#upi transaction status

Explore tagged Tumblr posts

Text

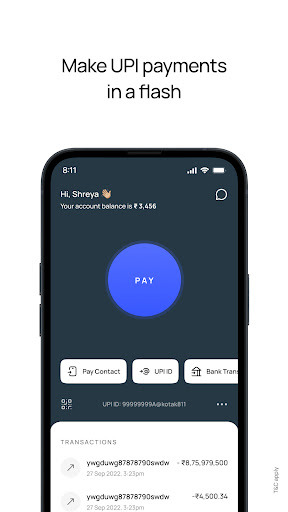

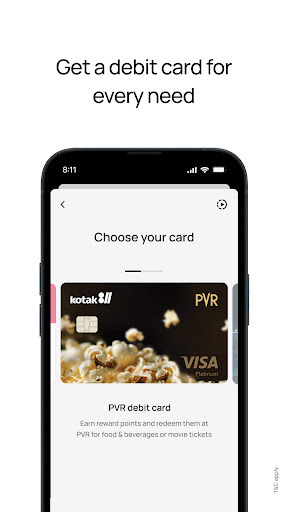

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check balance by debit card#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Top 5 Restaurant App Development Features to Boost Growth

In today’s fast-paced digital world, having a mobile app for your restaurant business isn’t just a trend – it’s a necessity. With the increasing demand for convenience and personalized experiences, restaurant app development has become a key driver in business growth. But what features should your restaurant app have to truly stand out in a competitive market? Here are the top five features that can boost your restaurant's growth.

1. Online Ordering System

An online ordering system is crucial for restaurants to cater to customers who prefer ordering food from the comfort of their homes. By integrating an efficient and user-friendly online ordering feature, you can make the process smooth for your customers. This not only enhances the customer experience but also helps increase sales by catering to a wider audience. Whether it’s for delivery or pickup, this feature makes it easier for customers to browse menus, customize their orders, and pay directly through the app.

2. Table Reservation System

Gone are the days when customers had to call ahead to make reservations. A modern restaurant app should include a table reservation system that allows users to check availability, book a table, and even receive confirmation and reminders. This feature enhances convenience and ensures you never lose out on a potential customer. It also helps streamline restaurant operations, as you can manage bookings in real-time and prevent overbooking or double-booking issues.

3. Loyalty and Rewards Program

A loyalty program is a fantastic way to increase customer retention and encourage repeat business. By offering rewards, discounts, or special promotions to loyal customers, you create a sense of exclusivity and appreciation. Through the app, customers can easily track their rewards, making it a seamless experience for both the restaurant and the customer. A well-designed loyalty program can turn one-time visitors into regular patrons, boosting your restaurant’s growth and revenue over time.

4. Real-Time Order Tracking

Real-time order tracking is an essential feature for customers who want to stay updated on the status of their food delivery. Providing this feature through your restaurant app not only enhances the customer experience but also builds trust. By allowing customers to track their orders, you can alleviate concerns about delays and improve satisfaction levels. This feature can also offer transparency, showing customers exactly when their food will be delivered, helping them plan their day better.

5. In-App Payments and Secure Transactions

With the increasing use of digital wallets and contactless payments, providing a secure and seamless payment gateway within your restaurant app is a must. Offering multiple payment options, including credit/debit cards, digital wallets, and UPI, ensures that your customers can pay in their preferred way. Secure payment systems also help build customer trust, ensuring that their sensitive information is protected during transactions.

Conclusion

Restaurant app development is a game-changer for restaurants looking to scale their business in today’s tech-driven world. By integrating features such as online ordering, table reservations, loyalty programs, real-time order tracking, and secure payment options, you can enhance customer satisfaction and boost your growth. The future of the restaurant industry lies in offering a digital experience that prioritizes customer convenience, and having the right features in your app can make all the difference.

If you’re ready to enhance your business and provide an exceptional experience for your customers, consider investing in professional Restaurant App Development.

0 notes

Text

[ad_1] Spanish Prime Minister Pedro Sanchez immersed himself in India’s vibrant digital ecosystem on Tuesday, using the country’s popular Unified Payments Interface (UPI) to purchase a Ganesh statue. This firsthand encounter with India’s cutting-edge payment system highlighted both the global reach of UPI and the expanding digital linkages between India and the international community. Spain’s Prime Minister, #PedroSánchez, used a #UPI transaction to purchase a Ganesh statue in Mumbai pic.twitter.com/6wEWFW94DI — DD India (@DDIndialive) October 29, 2024 UPI has solidified its position as a pillar of India’s financial landscape, handling over 100 billion transactions each year and comprising 80% of digital payments within the country. In 2023, India led the world, contributing nearly half of all digital transactions, setting a global example in digital finance. Sanchez’s visit emphasized cultural and academic ties, with the Prime Minister announcing plans to increase collaboration between Spanish and Indian universities. During a meeting hosted by Maharashtra Governor CP Radhakrishnan at Mumbai’s Raj Bhavan, Sanchez spoke on various initiatives, including Spain’s commitment to supporting soccer development in India. He noted that Spanish teams would soon play in India, signaling a new chapter in the sports diplomacy between the two nations. Looking ahead to 2026, Sanchez shared that India and Spain would mark the year as one dedicated to Culture, Tourism, and Artificial Intelligence. This initiative aims to foster mutual learning, with plans to send Spanish football coaches to India while supporting India’s interest in promoting cricket in Spain. Beyond sports and academics, Sanchez engaged with Indian film producers to discuss potential partnerships with Spain’s film industry, envisioning new cross-cultural projects. Emphasizing language exchange as a pathway to deeper ties, Sanchez expressed a personal desire to learn Hindi, noting the importance of Hindi and Spanish as global languages. Click here for Latest Fact Checked News On NewsMobile WhatsApp Channel For viral videos and Latest trends subscribe to NewsMobile YouTube Channel and Follow us on Instagram [ad_2] Source link

0 notes

Text

[ad_1] Spanish Prime Minister Pedro Sanchez immersed himself in India’s vibrant digital ecosystem on Tuesday, using the country’s popular Unified Payments Interface (UPI) to purchase a Ganesh statue. This firsthand encounter with India’s cutting-edge payment system highlighted both the global reach of UPI and the expanding digital linkages between India and the international community. Spain’s Prime Minister, #PedroSánchez, used a #UPI transaction to purchase a Ganesh statue in Mumbai pic.twitter.com/6wEWFW94DI — DD India (@DDIndialive) October 29, 2024 UPI has solidified its position as a pillar of India’s financial landscape, handling over 100 billion transactions each year and comprising 80% of digital payments within the country. In 2023, India led the world, contributing nearly half of all digital transactions, setting a global example in digital finance. Sanchez’s visit emphasized cultural and academic ties, with the Prime Minister announcing plans to increase collaboration between Spanish and Indian universities. During a meeting hosted by Maharashtra Governor CP Radhakrishnan at Mumbai’s Raj Bhavan, Sanchez spoke on various initiatives, including Spain’s commitment to supporting soccer development in India. He noted that Spanish teams would soon play in India, signaling a new chapter in the sports diplomacy between the two nations. Looking ahead to 2026, Sanchez shared that India and Spain would mark the year as one dedicated to Culture, Tourism, and Artificial Intelligence. This initiative aims to foster mutual learning, with plans to send Spanish football coaches to India while supporting India’s interest in promoting cricket in Spain. Beyond sports and academics, Sanchez engaged with Indian film producers to discuss potential partnerships with Spain’s film industry, envisioning new cross-cultural projects. Emphasizing language exchange as a pathway to deeper ties, Sanchez expressed a personal desire to learn Hindi, noting the importance of Hindi and Spanish as global languages. Click here for Latest Fact Checked News On NewsMobile WhatsApp Channel For viral videos and Latest trends subscribe to NewsMobile YouTube Channel and Follow us on Instagram [ad_2] Source link

0 notes

Text

Airpay API Integration by Infinity Webinfo Pvt Ltd

In today’s digital world, providing seamless and secure payment solutions is essential for any business. Infinity Webinfo Pvt Ltd recognizes this need and offers expertise in API Integration, focusing on robust solutions like Airpay to enhance the online transaction experience.

Airpay API Integration by infinity Webinfo Pvt Ltd

What is Airpay?

Airpay is an omnichannel payment gateway designed to simplify payment acceptance for businesses across sectors. Its API integration provides flexibility and security, allowing organizations to handle payments from a wide range of sources, including online, mobile, and in-store transactions.

Let’s delve deeper into the specifics of Airpay API Integration and how businesses can benefit from it.

Key Features of Airpay API Integration

Omnichannel Payment Support: Airpay’s API enables merchants to accept payments from multiple platforms—websites, mobile apps, and physical retail stores. This unified approach means that all payment data is consolidated in a single dashboard, making reconciliation and reporting easier for businesses.

Multiple Payment Modes: With Airpay’s API integration, businesses can accept payments via credit and debit cards, net banking, UPI (Unified Payments Interface), wallets (Paytm, Google Pay, etc.), EMI options, and more. This versatility ensures that customers have flexible payment options at checkout.

Seamless Checkout Experience: The API allows for a fully customized checkout experience, with options to integrate directly into a website or mobile application. This eliminates redirections and enhances customer satisfaction by offering a smooth, native payment process.

Real-Time Payment Updates: Airpay provides real-time updates on payment status through its API. This feature allows businesses to instantly know whether a payment was successful, pending, or failed, allowing for immediate action if needed.

Transaction Security and Compliance: Airpay API complies with stringent security standards, such as PCI-DSS (Payment Card Industry Data Security Standard), ensuring that sensitive payment information is encrypted and secure. This minimizes the risk of fraud and ensures safe transactions for customers and businesses alike.

Multi-Currency Support: Businesses can use Airpay to accept payments in different currencies, making it ideal for global businesses or those serving international customers.

Refunds and Reversals: Airpay’s API supports both partial and full refunds, with seamless integration into e-commerce or ERP systems, ensuring efficient and smooth transaction management for both the business and customers.

How Airpay API Works

The Airpay API is a robust RESTful API, which allows developers to interact with the payment gateway to process transactions securely. Here’s how the API typically works:

Initiating a Payment Request: The merchant sends a payment request through the API with details like the amount, currency, and customer’s payment method (e.g., card, UPI, net banking).

Customer Authentication: Airpay’s API handles the redirection to the customer’s bank for authentication (via OTP, UPI PIN, etc.), ensuring a secure transaction flow.

Payment Processing: Once the customer has successfully authenticated, the payment is processed in real time. Airpay then sends a response back to the merchant’s system indicating whether the transaction was successful or failed.

Notification and Webhooks: The API includes webhook support, allowing Airpay to notify merchants about payment statuses or other events like refunds and disputes in real time. This keeps the merchant’s system updated and synchronized with the payment gateway.

Benefits of Airpay API Integration

1. Streamlined Payment Operations: Airpay’s API enables businesses to consolidate all payment methods under one platform, making it easier to manage and track transactions. This centralization reduces the complexity of handling payments across different platforms or providers.

2. Enhanced User Experience: With fully customizable interfaces and a streamlined payment process, businesses can create a frictionless experience for users, reducing cart abandonment and improving conversion rates.

3. Improved Payment Success Rate: Airpay’s API is designed for high transaction success rates with minimal downtimes. This reliability is crucial, especially during peak sales periods or for businesses handling large volumes of transactions.

4. Scalability: Airpay’s API can handle varying transaction volumes, making it a perfect solution for businesses looking to scale. Whether you’re a small startup or a large enterprise, the platform can adapt to your needs.

5. Comprehensive Reporting and Analytics: The Airpay dashboard offers detailed insights into transaction data, enabling businesses to track payment trends, understand customer preferences, and optimize their payment processes.

6. Cost-Efficiency: Airpay’s pricing model is competitive, and its API integration reduces the overhead costs associated with managing multiple payment gateways or providers. The automation and efficiency brought in by Airpay help businesses save time and resources.

Steps to Integrate Airpay API with Infinity Webinfo Pvt Ltd

At Infinity Webinfo Pvt Ltd, we follow a structured and professional approach to integrating the Airpay API with our clients' systems.

Consultation and Requirement Analysis: Our team works with the client to understand their specific needs, including the types of payments they need to accept, the platforms they use (website, mobile app), and any special requirements for transaction processing.

Configuration and API Setup: Once we understand the requirements, we assist in setting up the Airpay account, acquiring API credentials, and configuring them in the business's system.

Customization and Integration: The Airpay API is integrated into the client’s website or mobile app. We customize the user interface to ensure that the payment process aligns with the brand’s design and customer experience.

Testing: We rigorously test the integration to ensure that payments are processed securely and efficiently. Any issues encountered during the testing phase are resolved before going live.

Deployment and Support: After successful testing, the payment gateway goes live. We also provide ongoing support to monitor performance, handle updates, and ensure the system runs smoothly.

Conclusion

For businesses aiming to provide seamless, secure, and fast payment solutions, Airpay API Integration is a game-changer. Partnering with Infinity Webinfo Pvt Ltd guarantees a smooth integration process, helping you leverage the full potential of Airpay for your payment processing needs.

With our expertise in API Integration, we ensure that your business stays ahead in the competitive digital marketplace, delivering an exceptional payment experience to your customers.

For more contact us now: - +91 9711090237

#Airpay API Integration#Airpay Payment gateway API Integration#payment gateway api integration#payment gateway integration#Airpay#payment gateway#api integration#infinity webinfo pvt ltd

0 notes

Text

Russia, Trade Partners Build Alternative Payments Systems Circumventing US Dollar

New Currencies And Financial Systems Are being Built To Circumvent Western Economic Pressure on Moscow.

© Sputnik/Alexandr Demyanchuk/Go to the Mediabank

Russia and various trade partners are working to strengthen alternative currencies and payments systems, reducing global reliance on the US dollar and Western-based financial networks.

“Moscow keeps finding ways to keep the country's economy going,” writes business reporter Huileng Tan, describing Russia’s response to Western sanctions imposed after the launch of its special military operation against Ukraine in 2022. “Russia's trade partners, too, are looking for ways to continue doing business with the country via alternative systems to rival the Western-led, US dollar-dominated global financial order.”

Moscow has been adapting to Western financial pressure since 2014 when trade restrictions were imposed after Russia's reunification with Crimea.

“There are risks in using the global financial networks,” said Russian central bank governor Elvira Nabiullina in 2018. “Therefore, since back in 2014 we have been developing our own systems.”

Western economic aggression intensified in 2022, causing Moscow to increasingly make use of its System for Transfer of Financial Messages (SPFS). The financial messaging system is used in place of SWIFT, the Western system that has traditionally served as the de-facto global standard. SPFS is reportedly used by 556 organizations in 20 countries, with foreign organizations’ use of the system more than doubling after 2022.

Euro's Share in SWIFT Transactions Hits Historic Low in March! The share of the euro in international payments via SWIFT in March dropped to an all-time low of 21.93%, according to the global payment system's data. Photo: © iStock/Gaffera

The proportion of global transactions involving Europe's common currency fell by 1.32 percentage points month-on-month.

Meanwhile, the US dollar strengthened its position last month, gaining 0.81 percentage points from February to reach 47.37%, which is its highest level since December 2023, the data showed.

Russia has also made efforts to integrate its financial system with that of Iran, with Moscow’s Mir card payment platform now working with Tehran’s Shetab system.

Meanwhile, banking and messaging systems developed by China and India, two major global economic powers in their own right, have seen increasing use in financial transactions involving Russian entities. China's Cross-Border Interbank Payment System (CIPS) processed more than 6.6 million transactions last year amounting to $17.3 trillion. India’s Unified Payments Interface (UPI) has also expanded rapidly, threatening to pose a significant challenge to SWIFT’s dominance.

“It is significant that UPI can also be used to bypass the SWIFT banking system, enabling payments with sanctioned countries such as Russia, thereby weakening US financial hegemony,” wrote international relations analyst Evan Freidin earlier this year.

Central bank currencies and cryptocurrencies round out the selection of financial innovations utilized by Russia to maintain its robust and growing economy, with both technologies threatening to further undermine the US dollar’s global reserve currency status.

One last strategy can be revived from the Soviet era as Russia looks into economic barter with China and other countries. The direct exchange of quantities of one commodity for another cuts out the need for a currency entirely, harkening back to the days of the socialist-aligned Comecon economic organization. The tactic has been employed by various countries subjected to Western sanctions such as Cuba and Venezuela, which engage in barter with several Latin American neighbors via the ALBA–TCP bloc.

Iran's Proposal to Set Up SWIFT Analogue Added to BRICS Agenda! The BRICS leadership has put on the agenda the Iranian central bank's proposal to set up the group's own equivalent to the SWIFT payment system and create an organization to fight money laundering and terrorist financing that would be similar to the intergovernmental Financial Action Task Force (FATF). Photo: © Sputnik/Mikhail Kutusov/Go to the Mediabank

"The proposals of the Iranian central bank on the creation of a system for exchanging financial messages between members of the organization [similar to SWIFT], combating money laundering and financing of terrorism [similar to FATF] and international credit rating institutions for BRICS members were accepted by the organization on the agenda," Deputy Head of Iranian Central Bank Mohsen Karimi was quoted as saying by the IRNA news agency.

#Economy | Elvira Nabiullina Russia 🇷🇺 | China 🇨🇳 | UPI | ALBA | Crypto Currency#Russian Central Bank | Barter | Payment | Payment System#SWIFT Payment System | Mir Payment System | China's International Payment System (CIPS)

1 note

·

View note

Text

Collaboration Between FinTech and RBIs: A New Era of Lending

The Collaboration

In recent years, India's financial outlook has witnessed a radical shift. The finance industry is driven by the collaborative partnership between financial technology (FinTech) companies and the Reserve Bank of India (RBI), which has modified the entire lending sector. As FinTech firms bring innovation, depth, and tech-driven solutions to the table, the RBI matches these advances with powerful regulatory frameworks, ensuring a symmetrical ecosystem that promotes both development and stability in the finTech Industry.

Earlier, many of India's population, particularly in rural and semi-urban areas, remained underserved by traditional financial institutions. The advent of FinTech, supported by the RBI's inclusive policies, has bridged this gap, promoting financial introduction at an exceptional scale.

The Need of the Alliance

The idea of this partnership crops up to address and simplify the complexity of traditional banking systems. With traditional banking systems' extensive paperwork, slow processing times, and inflexible credit requirements, they often fail to meet the changing needs of consumers. In contrast, FinTech companies, portrayed by providing tech-driven solutions, have disturbed this status quo by offering faster, more accessible financial services. This is where the RBI plays its role. RBI implements forward-thinking regulations and guidelines that encourage and regulate FinTech operations, ensuring they remain secure for the end consumer.

The Role of RBI

RBI regulations encouraging digital transactions and a secure trading environment have created fertile ground for FinTech growth. This surreal act is evident through initiatives like the Unified Payments Interface (UPI), the promotion of digital currencies, and the establishment of norms for digital banking. These strategies nurture innovation and plant trust among end-consumers.

The Role of Fintech Industries

FinTech firms, with their innovative approaches and tech-driven solutions, are breaking down the traditional barriers. By leveraging Data Analytics(DA), Artificial Intelligence(AI), and Machine Learning(ML), they can assess credit risk more accurately than traditional banks.

The Impact

The collaboration between RBI and FinTech companies has led to the creation of more user-friendly lending solutions. Consumers can now enjoy seamless online interfaces, minimal paperwork, and faster loan approval processes. For instance, digital KYC (Know Your Customer) and e-signatures, supported by RBI regulations, have significantly reduced the time it takes to onboard new customers.

Micro-lending

Traditional banks have often overlooked small loans due to their high operational costs. However, FinTechs, with their low digital costs, are uniquely positioned by RBI to offer these services profitably. This collaboration boosts micro-lending. FinTech firms, through mobile platforms, extend small credit to underserved sectors of the economy. Farmers, small entrepreneurs, and individuals in remote areas can now enjoy banking facilities and receive micro-loans quickly on their mobile devices.

Risk Management and Fraud Prevention

Combining FinTech with RBI has supported lending risk management and fraud prevention. FinTech's advanced algorithms enable quick monitoring and assessment of loan transactions, which helps in the early detection of fraud.

Financial Accessibility

Digital platforms now enable instant loan approvals and disbursements powered by algorithms that assess the creditworthiness of the individual using digital footprints and transaction history. This capability was essential in India, where many potential borrowers need a formal credit history. The RBI made it easy by encouraging digital verification methods, thus speeding up the loan process.

They Have Bridged The Digital Gap

The partnership between FinTech companies and the RBI is undoubtedly transforming the lending landscape in India. As we move forward, this collaboration is expected to deepen, driven by a goal of making financial services more accessible to all. It's about creating a more financially inclusive India where everyone can access and benefit from formal financial services.

Conclusion

In this context, it's important to spotlight companies like Lenditt, a FinTech company providing platforms to individuals to access digital loans across various demographics. Specializing in personal loans, including personal loans, mobile loans, bike loans, emergency loans, medical loans, travel loans, and consumer durable loans, Lenditt leverages a simplified borrowing process.

As we look to the future, companies like Lenditt will play an increasingly significant role in bridging the digital divide. With continuous support from regulatory bodies like the RBI, FinTech companies are well-positioned to drive a new financial era.

Source Link: Collaboration Between FinTech and RBI

0 notes

Text

📣 Dear Players 📣

We understand the frustration of delays in receiving your deposit, that's why we've created this detailed guide to help you provide quick feedback.

😊 Click the "BANK" Button ✔️

😊Click on "MY TRANSACTIONS" ✔️

😊Click "DEPOSIT" ✔️

😊Click the customer service icon next to deposit order ✔️ Enter the UTR number or UPI reference number of your successful payment.

😊Upload screenshot of successful payment transfer ✔️

😊Click "SUBMIT" ✔️

Please complete these steps to provide feedback on your order. Our service representatives will promptly assist you in checking its status upon receiving your feedback.

🆎🆎🆎 ➡️ MY777.COM (https://www.my777.com/) 👈

MY777 #PremiumCasino #QuickGuide #Feedback

0 notes

Text

Where to Find Affordable Food on Train?

If you're looking for budget-friendly food options while traveling by train, RailRecipe might be just the ticket. RailRecipe is a platform that partners with various vendors across railway stations in India, offering a range of affordable and delicious meals for passengers. Here's why it's worth considering:

1. Convenience: RailRecipe operates through both its website and mobile app, making it incredibly convenient for passengers to order food in train. Whether you're traveling solo or with family, you can browse through their menu and place an order from the comfort of your seat.

2. Wide Variety: One of the great things about RailRecipe is its diverse menu options. They cater to different tastes and preferences, from regional specialties to popular fast food items. You'll likely find it on their menu if you're craving biryani, sandwiches, or even something as simple as tea and snacks.

3. Affordability: Budget-conscious travelers will appreciate RailRecipe's competitive pricing. They strive to offer quality meals at reasonable rates, ensuring that passengers can enjoy a satisfying dining experience without breaking the bank.

4. Hygiene and Quality: RailRecipe maintains strict standards of hygiene and food quality. They partner with reputable vendors who adhere to food safety regulations, ensuring that passengers can enjoy their meals with peace of mind.

5. Easy Ordering Process: Ordering food through RailRecipe is a breeze. Simply select your train, choose from the available menu options, place your order, and make payment online. Your meal will be delivered to your seat at the designated station or time, making the entire process seamless and hassle-free.

So, the next time you're traveling by train and feeling peckish, consider trying RailRecipe for an affordable and convenient dining experience on the go.

How to order affordable food from RailRecipe?

Ordering affordable food from RailRecipe is a straightforward process. Here's a step-by-step guide to help you navigate through it:

1. Visit the RailRecipe Website or App: Start by visiting the website or downloading the RailRecipe mobile app from the Google Play Store or Apple App Store. Both platforms offer the same functionalities, so choose the one that suits your preferences.

2. Enter Journey Details: Once you're on the RailRecipe platform, enter your journey details such as the train number, boarding station, and date of travel. This will help the system identify the vendors available along your route.

3. Browse Menu Options: After entering your journey details, you'll be presented with a menu of food items offered by various vendors at the stations along your route. Take your time to browse through the menu options, which typically include breakfast, lunch, dinner, snacks, beverages, and more.

4. Select Items and Add to Cart: Once you've found the items you'd like to order such as varieties of thalis on train, select them and add them to your cart. RailRecipe often offers combo meals and discounts on certain items, so keep an eye out for those to maximize your savings.

5. Provide Delivery Details: After finalizing your order, provide the necessary delivery details, including your seat/berth number and contact information. This ensures that the delivery is made accurately and promptly.

6. Make Payment: Proceed to the payment section to complete your order. RailRecipe accepts various payment methods, including debit/credit cards, net banking, mobile wallets, and UPI payments. Rest assured that your transactions are secure and encrypted.

7. Track Your Order: Once your order is confirmed and payment is processed, you'll receive an order confirmation along with the expected delivery time. RailRecipe provides real-time tracking updates, allowing you to monitor the status of your order until it reaches your seat/berth.

8. Enjoy Your Meal: Sit back, relax, and wait for your delicious and affordable meal to be delivered to you. Once it arrives, savor the flavors and enjoy a satisfying dining experience onboard your train journey.

By following these simple steps, you can easily order affordable and tasty food from RailRecipe, making your train journey even more enjoyable.

0 notes

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

Cyber Crime Complaint Kaise Kare

Friends, if any online financial fraud or scam has happened to you, even if you are new to the channel like UPI App, then do not forget to subscribe. So let us quickly understand the whole process step by step [Sangeet] So the first step is NCRP. That is, to complain in the National Cyber Crime Reporting Portal, because without this there is no use of the remaining four processes, so first of all you have to visit this official site, the link of which is given below in the description, click from there and open it. So to make online complaint, go to Cyber Crime Report option and click on Financial Fraud, then scroll down the screen, click on File a Complaint, after that click on Accept here and if you are first time. complaining here

So first you have to register here, for which you will click on Click Here for New User, then here you have to enter your details like select the state from which you are, then here you will enter your email ID, then below you will find your mobile. You have to enter the number and click on Get OTP. Now an OTP will come on this number, type it here and then enter the captcha code as written here and click on submit. Then in the next page you have to enter your personal details. Like, whatever you use in front of your name in the title, like Mr. Mrs. Doctor, Mr. Mrs., you have to tick it here, then below you have to write your full name and here your mobile number which you had just verified will come automatically. Then below you have to select your date of birth and gender and enter your email ID here. Keep in mind that whatever mobile number and email ID you have given, all communication messages will be sent to you only here, like your complaint number and whatever will be the status of the complaint. That will also be updated on this

Also Read- gujarat cyber cell account freeze

Then here you have to select your Father, Mother, Spouse, any one relation and write its name. After that, last of all, you have to tell your present address wherever you live and here you will select the district, then below you will have to select the one near you. You have to select the police station, then click on Save and Continue here. Now you have to tell some things related to your complaint here, then you have to understand every option carefully because the information on this page is the most important. First you have to select the category of complaint, that is, how has fraud happened to you, like if someone has cheated on a social media platform, select the second option, similarly, if someone has hacked your computer laptop or there is cyber trafficking, online gambling or If you have been cheated by a betting site, then you have to select this option according to the incident that has happened to you. After this, select its sub category below, like above I had selected online financial fraud, then it has to be told here.

How has online fraud happened to me like Aadhaar Enabled Payment System Fraud, if someone has stolen your Aadhaar details like fingerprint ID, etc. If you want to withdraw money from your bank account then you will select this option and if the fraud has happened by sending an email then We will select this option and if someone has committed fraud of money due to your credit card, debit card or phone SIM, then we will select this option, similarly if from demat account or e-wallet which is also called digital wallet or Someone has committed fraud by calling or through internet banking or UPI app. You have to select the name of the bank from which your money has been deducted and below select the UPI app which you used like amazonbusiness.in then you can enter it. Or you can leave it blank, then if you click on Save here, then all the details will appear in the table here and if money has been debited more than once, then if you fill each and every detail and click on Save, then all the transactions will appear here. Now you will come here under the account details of the suspect who has defrauded you. If you have his account details then you can add it here by saying yes and if not then select no. Then after this here you will get the date and time of that incident. If you do not remember exactly then you can also fill it with idea but it is necessary to fill it so that whatever money has been transferred.

Also Read- bank account freeze by gujarat cyber crime

So that it can be tracked, now here, if you have filed a complaint of fraud late then select Yes, otherwise select No. Then below you have to tell where online fraud has happened to you, like if someone has done fraud through email, then below. The email ID of the scammer will have to be given and if facebooksignup.in can tell how this fraud happened so that the investigation officer can understand it well and take the right action and then click on Save as Draft and Next. On the next page, you have to fill the suspect details of the person who has cheated you. If you have any details of him then you can mention them here and if not then leave it blank and click on Save Draft and Next below. Complainant details will appear on the page i.e. your personal details like your name, mobile number and address which you had filled while registering. If you want to change anything then you can do so. In the last you have to select Relationship with the Victim, meaning you can fill this complaint in your If you are doing it for yourself or for someone else like father, mother, sister, neighbor or friend, then you will have to tell that person here and upload any one ID proof of that person here and then click on Save and Preview here. And here you will check all the details once, if you want to change anything then you can do so.

And if all the details are correct with you, then you have to tick the box of 'Agree' here and click on Confirm and Submit, after which your complaint will be registered on the cyber portal, the tracking number of which will be sent to your mobile number and email ID. As soon as an investment officer gives you an appointment for your complaint, you will get it through message and email and in future, if you want to check the status of your complaint, then you can go to check status above here. Now friends, after this complaint, your The main work starts here, after complaining here, most of the people do not follow the further process due to which most of the people do not get their money back, so now understand the further steps carefully. After the cyber cell complaint, in the next step, you will get the number of this complaint. Or take its copy and go to your bank manager and tell about this fraud so that the bank manager can immediately register your complaint and send it forward. According to the RBI guidelines, you have to report to the bank within 3 days but you have to wait exactly. don't even do it.

Also Read- cyber cell noc

Because if the scammer has withdrawn all the money from your account, then it is possible that you may not even get a refund of Rs. But remember, friends, you must take a receipt from the bank. If the bank manager does not give any receipt, then you can complain to the customer support of the bank. You have to send it through email and whatever you email or the reply received from the bank, keep it safely which will be useful to you in future, about which I am going to tell you further. Then in the third step, you can also complain by going to the customer support of that UPI app. You have to raise it and if you want, you can attach both cyber complaint and bank complaint proof and send it and in the fourth step, you have to complain to NPCI. This is for those people with whom online fraud has happened through UPI app like google-api- python-client If you do not get any solution within 30 days or you are not satisfied with the solution of the bank, then you have to complain against the bank in RBI. To understand the entire process of RBI complaint, watch this blog by clicking on the button above and Follow the steps and here all the proofs like copy of bank complaint which must have date and time of complaint and bank statement and whatever can prove that you informed the bank on time but still the bank did not take any action. So, RBI will help you in whatever liability of the bank. Friends, if you follow all these steps then your chances of getting the money increase manifold.

0 notes

Text

PhonePe API Integration by Infinity Webinfo Pvt Ltd: Revolutionizing Digital Payments in India

Introduction In the rapidly evolving fintech landscape, digital payments are essential for businesses to offer seamless transaction experiences to customers. PhonePe, one of India’s leading payment platforms, has made it easier for enterprises to adopt its UPI-based payment solutions through API integrations. Infinity Webinfo Pvt Ltd, a prominent technology solutions provider, specializes in integrating the PhonePe API to enable businesses to harness the power of digital payments effectively.

PhonePe API Integration by Infinity Webinfo Pvt Ltd

What is PhonePe API Integration?

PhonePe API integration refers to the process of embedding PhonePe’s digital payment system directly into a business’s platform, such as a website or mobile app. This integration enables businesses to accept payments from customers through UPI (Unified Payments Interface), facilitating secure and instant transactions.

Infinity Webinfo Pvt Ltd takes this process a step further by ensuring that the integration is smooth, secure, and optimized for the best user experience. The PhonePe API integration provides businesses with a direct link to the UPI ecosystem, enabling faster and more efficient payments.

Why PhonePe API Integration Matters

Wide User Base: PhonePe has a large and growing user base across India. By integrating its API, businesses can tap into this vast customer base and offer a payment option that users are already familiar with and trust.

Instant Payments: UPI payments through PhonePe are instant, meaning there is no waiting period for fund transfers. This not only improves the customer experience but also ensures businesses receive their payments immediately, aiding cash flow management.

Improved Customer Convenience: By offering PhonePe as a payment option, businesses can reduce cart abandonment rates. Customers are more likely to complete their purchase if they can use a familiar and simple payment method.

Cost-Effective Solution: The PhonePe API operates with minimal transaction fees, making it a cost-effective solution for businesses that need to process a high volume of payments.

Support for Multiple Use Cases: The PhonePe API can be used for a variety of transactions, from one-time payments for goods and services to recurring transactions such as subscriptions. This versatility makes it suitable for businesses across industries, including e-commerce, retail, education, and entertainment.

Key Benefits of PhonePe API Integration by Infinity Webinfo Pvt Ltd

QR Code Payments: For businesses with physical storefronts, the PhonePe API allows for the generation of QR codes that customers can scan to make payments directly from their PhonePe app, simplifying the checkout process.

Auto payment Update: Auto payment in PhonePe allows users to set up recurring payments automatically for services like subscriptions, bill payments, or other scheduled payments. Instead of manually paying each time, PhonePe handles the payments at regular intervals, ensuring the service continues uninterrupted

Status check API: This API allows businesses to find out the current status of a payment by using the unique transaction ID (a code given to each payment). Business can see Updated Status instantly.Customers know right away if their payment was successful, reducing confusion or delays.

Seamless UPI Transactions: With PhonePe’s API, businesses can offer direct UPI payments, allowing customers to pay using their bank accounts with just a few clicks. This eliminates the need for intermediaries like wallets and ensures hassle-free transactions.

Faster Checkouts: One of the significant advantages of integrating PhonePe is the reduction in checkout time. Customers don’t have to enter card details or use multiple authentication steps, as UPI payments are processed instantly, ensuring a smooth purchasing experience.

Enhanced Security: PhonePe’s API comes with advanced security features such as multi-layer encryption, two-factor authentication, and compliance with RBI guidelines. Infinity Webinfo Pvt Ltd ensures that all integrations maintain the highest security standards, protecting both businesses and their customers from Pvt Ltd potential fraud.

Support for Multiple Platforms: Infinity Webinfo Pvt Ltd’s integration services support various platforms, including websites, e-commerce platforms, and mobile applications (both Android and iOS). This cross-platform support ensures that businesses can cater to a wide audience with minimal development effort.

Custom Solutions: Infinity Webinfo Pvt Ltd offers custom integration solutions, tailoring the PhonePe API to suit the specific needs of businesses. Whether it's an e-commerce platform, service provider, or retail outlet, the integration can be customized to ensure the best fit.

Merchant Dashboard: After the integration, businesses get access to a comprehensive merchant dashboard from PhonePe, where they can monitor transaction data, generate reports, and manage refunds. Infinity Webinfo Pvt Ltd provides support and training to ensure businesses can utilize this dashboard to its full potential.

Support for Recurring Payments: For businesses that rely on subscription models or recurring billing, Infinity Webinfo Pvt Ltd’s PhonePe API integration enables automated recurring payments through UPI. This is a great feature for SaaS platforms, OTT services, and other businesses with subscription-based revenue models.

Security and Compliance Security is a top priority for PhonePe, and the API integration follows strict guidelines set by the Reserve Bank of India (RBI). The platform uses end-to-end encryption and secures tokenization methods to protect user data and ensure transaction integrity.

In addition to encryption, PhonePe requires multi-factor authentication for high-value transactions, further safeguarding the payment process. Businesses integrating PhonePe’s API must comply with data protection regulations and ensure that customer data is handled securely.

Advantages for Businesses

Increased Sales: By offering a trusted and widely used payment method like PhonePe, businesses can increase sales, especially among mobile users who prefer UPI transactions.

Enhanced Customer Trust: PhonePe’s strong brand and focus on security help build trust with customers, making them more likely to complete transactions.

Streamlined Operations: Automated reconciliation and real-time transaction tracking reduce the administrative burden on businesses, enabling them to focus on other aspects of their operations.

Scalable Payment Infrastructure: The API is designed to handle large transaction volumes, making it suitable for businesses of all sizes, from startups to large enterprises.

Steps in the PhonePe API Integration Process by Infinity Webinfo Pvt Ltd

Requirement Gathering and Analysis: Infinity Webinfo Pvt Ltd works closely with businesses to understand their specific requirements and ensure that the PhonePe API integration aligns with their business goals.

API Documentation Review: Infinity Webinfo Pvt Ltd’s team reviews PhonePe’s API documentation to ensure a clear understanding of the technical specifications required for seamless integration.

Development and Integration: The integration process involves embedding the PhonePe payment gateway into the website or app, ensuring compatibility with the existing platform.

Testing and Security Check: After development, Infinity Webinfo Pvt Ltd conducts rigorous testing to ensure the API is functioning correctly. This step includes security audits to ensure that all transactions are secure and compliant with regulatory standards.

Deployment and Support: Once the integration is successfully tested, Infinity Webinfo Pvt Ltd deploys the solution and provides ongoing support to address any issues or updates that may arise.

Impact of PhonePe API Integration on Businesses

Increased Conversion Rates: The simplicity and speed of UPI payments reduce cart abandonment and increase conversion rates, especially for e-commerce platforms.

Enhanced Customer Trust: PhonePe’s widespread adoption in India means customers trust the platform. By offering PhonePe as a payment option, businesses can increase trust among their customer base.

Improved Cash Flow: Instant UPI transactions improve cash flow, as businesses receive payments in real-time without delays, unlike traditional payment methods.

Conclusion PhonePe API integration by Infinity Webinfo Pvt Ltd offers businesses an opportunity to streamline their payment processes, improve customer satisfaction, and enhance security. With its expertise in API integration, Infinity Webinfo Pvt Ltd ensures a hassle-free and secure payment experience that helps businesses stay competitive in the digital era. As UPI continues to dominate India’s digital payment space, partnering with experts like Infinity Webinfo Pvt Ltd ensures that businesses can fully leverage the advantages of PhonePe.

Contact Us On: - +91 9711090237

#PhonePe#PhonePe Payment Gateway#PhonePe Payment Gateway API Integration#Payment Gateway API Integration#api integration#infinity webinfo pvt ltd

1 note

·

View note

Text

Exploring the Legality and Potential of Sports Betting Game Development in India

The recent exponential rise of the global sports betting business is driven by legislative changes and technological advancements. With sports enjoying immense popularity in India, the prospect of creating sports betting websites has attracted considerable attention. However, prospective developers need to navigate the legal framework surrounding gambling activities in the country. Let's examine the legitimacy and potential of sports betting game development in India.

Understanding the Legal Landscape

In India, the legal status of sports betting is governed by various federal and state laws, including the Public Gambling Act of 1867. Under this archaic legislation, most forms of gambling, including sports betting, are prohibited. However, there are exceptions. States have the authority to enact their gambling laws, and several have legalized certain forms of gambling, such as horse racing and lotteries.

Additionally, the emergence of online betting platforms has raised complex legal questions. While the Public Gambling Act predates the Internet era, courts have interpreted its provisions to apply to online gambling activities. As a result, online sports betting remains a legally gray area in India, with no clear regulations governing its operation.

Despite the legal ambiguity, the popularity of sports betting persists, driven by offshore betting platforms and the proliferation of mobile betting apps. Recognizing the potential economic benefits, some states have initiated discussions on legalizing sports betting to regulate and capitalize on this lucrative market.

Opportunities for Sports Betting Game Development

Amidst the legal uncertainty, the demand for sports betting experiences in India continues to grow. Developing sports betting websites allows entrepreneurs and developers to tap into this burgeoning market. By leveraging innovative technologies and adhering to best practices, developers can create engaging and user-friendly platforms that cater to the preferences of Indian sports enthusiasts.

Key Considerations for Developers

For developers considering sports betting game development in India, several key considerations must be addressed:

1. Legal Compliance:

Prioritize legal compliance by thoroughly researching and understanding the applicable laws and regulations at both the federal and state levels. Consult legal experts to ensure that your platform adheres to the relevant legal requirements.

2. Payment Solutions:

Integrate secure and reliable payment solutions that facilitate seamless deposits and withdrawals for users. Consider partnering with payment service providers that support popular payment methods in India, such as UPI, wallets, and bank transfers.

3. User Experience:

Focus on delivering an exceptional user experience by designing intuitive interfaces, optimizing performance across devices, and offering a wide range of betting options on popular sports events.

4. Responsible Gaming:

Implement robust responsible gaming measures to promote safe and responsible betting practices among users. Provide tools for setting betting limits, self-exclusion options, and access to support resources for individuals experiencing gambling-related issues.

5. Data Security:

Prioritize data security and privacy by implementing industry-standard encryption protocols, secure authentication mechanisms, and regular security audits to safeguard user information and transactions.

Conclusion

While the legal status of sports betting in India remains uncertain, the potential for sports betting game development is undeniable. By navigating the legal landscape thoughtfully and adhering to best practices, developers can create innovative and engaging platforms that cater to the country's growing demand for sports betting experiences. With careful planning and execution, sports betting game development in India holds promise as a lucrative and exciting opportunity for developers and entrepreneurs alike.

0 notes

Text

Everything Foreigners Need to Know About UPI

The Unified Payments Interface (UPI) has become a cornerstone of India's digital payment ecosystem, offering a seamless and efficient way for users to send and receive money instantly. For foreigners living or visiting India, understanding UPI can greatly simplify financial transactions and enhance the overall experience. Here's everything you need to know about UPI:

What is UPI Payment?

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables users to transfer money between bank accounts instantly using a mobile phone. UPI eliminates the need for traditional methods like NEFT or IMPS, making transactions quick, secure, and convenient.

How Does UPI Work?

The Unified Payments Interface (UPI) has revolutionised the way people in India make digital transactions, offering a seamless and efficient payment system. Let's take a closer look at how UPI works, focusing on the popular UPI app "CheqUPI":

Download and Registration:

First, users need to download the "CheqUPI" app from the App Store or Google Play Store.

Upon opening the app, users are prompted to register by providing their mobile number linked to their bank account.

An OTP (One-Time Password) is sent to verify the mobile number, after which users create a secure login PIN.

Creating a UPI ID:

Once registered, users can create a unique UPI ID, often in the format [name]@chequpi.

This UPI ID serves as the user's virtual payment address, allowing them to receive money directly into their bank account.

Linking Bank Account:

To start transacting, users need to link their bank account(s) to the CheqUPI app.

The app supports multiple bank accounts, providing flexibility to choose the account for transactions.

Adding Beneficiaries:

Users can add beneficiaries by entering their UPI ID, and account number, or scanning a QR code.

Once added, beneficiaries are securely stored in the app for future transactions.

Making Payments:

To send money, users select the "Send Money" option and enter the recipient's UPI ID or select from the list of added beneficiaries.

They enter the amount to be transferred and can add a note for reference.

A secure UPI PIN is required to authenticate the transaction.

Requesting Payments:

Users can also request money by selecting the "Request Money" option.

They enter the recipient's UPI ID or select from the list of added beneficiaries, along with the requested amount.

The recipient receives a notification to approve or decline the request.

Checking Transaction History:

CheqUPI provides a detailed transaction history, showing all incoming and outgoing transactions.

Users can view transaction details, including date, time, amount, and transaction status.

Additional Features:

CheqUPI offers a range of additional features to enhance the user experience.

This includes options for bill payments, mobile recharges, DTH recharges, and more, all accessible within the app.

Security Measures:

CheqUPI prioritizes security, implementing robust measures to safeguard user transactions.

Two-factor authentication is mandatory for all transactions, requiring a UPI PIN along with device lock PIN or biometric authentication.

The app employs encryption protocols to protect user data and transactions from unauthorized access.

Customer Support:

Users can reach out to CheqUPI's customer support for assistance with transactions, account-related queries, or technical issues.

The app provides options for in-app chat support, email support, and helpline numbers for quick resolution of queries.

Promotions and Offers:

CheqUPI often runs promotional campaigns and offers for users, providing cashback rewards, discounts, and other incentives for transactions.

Users can benefit from these offers while making everyday payments through the app.

Real-Time Notifications:

Users receive real-time notifications for every transaction, providing instant updates on the status of payments.

Notifications include details such as successful transactions, pending requests, and failed transactions for quick reference.

Future Advancements:

CheqUPI continues to evolve with new features and advancements in the UPI ecosystem.

Users can look forward to upcoming updates that enhance convenience, security, and usability of the app.

Convenience:

UPI eliminates the need for carrying cash or relying on physical cards for transactions. Foreigners can easily make payments using their mobile phones.

Instant Transfers:

Transactions through UPI are completed instantly, allowing foreigners to send money to friends, pay bills, or shop online without delays.

Wide Acceptance:

UPI is widely accepted across various merchants, online platforms, and utility bill payments, making it versatile for day-to-day transactions.

Multi-Language Support:

Many UPI apps offer support for multiple languages, catering to foreigners who may not be fluent in English or Hindi.

Transparency:

UPI provides real-time transaction updates and detailed transaction history, allowing users to track their spending easily.

How Foreigners Can Use UPI:

Bank Account:

Foreigners need an Indian bank account to use UPI. They can open a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank.

KYC Verification:

Foreigners must complete the Know Your Customer (KYC) verification process as per Reserve Bank of India (RBI) guidelines to use UPI.

UPI App:

Download a UPI-enabled mobile app from the App Store or Google Play Store. Popular apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration:

Register on the app using your Indian mobile number linked to the bank account. Create a UPI ID and set a UPI PIN.

Transactions:

Start sending and receiving money, paying bills, recharging mobile phones, and more using your UPI ID.

Tips for Using UPI:

Secure Your PIN:

Keep your UPI PIN confidential and do not share it with anyone. Avoid using simple or easily guessable PINs.

Verify Transactions:

Always verify the recipient's UPI ID and amount before confirming a transaction to avoid errors.

Check Limits:

Be aware of your daily transaction limits set by your bank and UPI app to avoid exceeding them.

Update Apps:

Regularly update your UPI app to ensure you have the latest security features and bug fixes.

Customer Support:

Familiarize yourself with the customer support options provided by your UPI app in case you encounter any issues or have questions.

Conclusion:

Understanding and using UPI can greatly simplify financial transactions for foreigners in India. With its convenience, speed, and security features, UPI has revolutionized the way payments are made in the country. Whether you're sending money to friends, paying bills, or shopping online, UPI offers a seamless and efficient payment experience for all.

Frequently Asked Questions (FAQs)

Can foreigners use UPI in India?

Yes, foreigners can use the Unified Payments Interface (UPI) in India, provided they have an Indian bank account. Foreigners need to open either a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank. Once they have a valid Indian bank account, they can download a UPI-enabled mobile app from the App Store or Google Play Store to start using UPI for transactions.

What are the benefits of using UPI for foreigners?

Using UPI offers several benefits for foreigners in India. Firstly, it provides a convenient and hassle-free way to make payments. Foreigners no longer need to carry cash or rely on physical cards for transactions. UPI-enabled mobile apps allow users to send and receive money instantly using their smartphones, making it ideal for various transactions such as splitting bills with friends, paying for goods and services, or even transferring money back home.

Secondly, UPI transactions are completed instantly, offering quick and efficient payments. Whether it's sending money to friends, paying bills, or shopping online, foreigners can enjoy the speed and convenience of UPI. Transactions are processed in real-time, ensuring that the recipient receives the funds immediately.

Another advantage of UPI for foreigners is its wide acceptance across various merchants, online platforms, and utility bill payments. Whether it's making purchases at local stores, paying for groceries, or booking tickets online, UPI offers versatility and ease of use.

Additionally, UPI apps often provide multi-language support, catering to foreigners who may not be fluent in English or Hindi. This feature ensures that users can navigate the app and complete transactions comfortably in their preferred language.

Lastly, UPI offers transparency and security. Users receive real-time transaction updates and detailed transaction history, allowing them to track their spending easily. UPI transactions are secured with two-factor authentication, including a UPI PIN and often a device lock PIN or biometric authentication, ensuring the safety of transactions.

How can foreigners start using UPI in India?

To start using UPI in India, foreigners need to follow a few simple steps:

Open an Indian Bank Account: Foreigners must have an Indian bank account, such as a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account.

Download a UPI-Enabled Mobile App: Once the bank account is set up, foreigners can download a UPI-enabled mobile app from the App Store or Google Play Store. Popular UPI apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration: Register on the UPI app using the Indian mobile number linked to the bank account. Create a unique UPI ID, which is usually in the format [name]@[bank], and set a secure UPI PIN.

Start Transacting: With the UPI app set up, foreigners can start sending and receiving money, paying bills, recharging mobile phones, and making various other transactions using their UPI ID.

What are some tips for foreigners using UPI in India?

Foreigners using UPI in India can benefit from the following tips to ensure a smooth and secure transaction experience:

Secure Your UPI PIN: Keep your UPI PIN confidential and do not share it with anyone. Avoid using easily guessable PINs such as birthdates or phone numbers.

Verify Transaction Details: Always double-check the recipient's UPI ID and the transaction amount before confirming a payment. This helps avoid errors and ensures that funds are sent to the intended recipient.

Know Your Limits: Be aware of the daily transaction limits set by your bank and the UPI app. This prevents exceeding the maximum transaction amount allowed per day.

Update Your UPI App: Regularly update your UPI app to the latest version available. Updates often include security patches and bug fixes, enhancing the overall security of the app.

Use Customer Support: Familiarize yourself with the customer support options provided by the UPI app. In case of any issues or queries, you can reach out to customer support for assistance and guidance.

Is UPI widely accepted in India?

Yes, UPI is widely accepted across India at various merchants, online platforms, utility bill payments, and more. The versatility of UPI makes it a preferred choice for digital payments, offering convenience and efficiency to users. Whether it's making everyday purchases, paying bills, or transferring money to friends and family, foreigners can rely on UPI for a seamless payment experience.

Can foreigners transfer money internationally using UPI?

No, UPI is designed for domestic transactions within India. Foreigners cannot use UPI to transfer money internationally. However, they can use other methods such as wire transfers, international bank transfers, or online remittance services to send money abroad from their Indian bank account.

Are there any fees associated with using UPI for foreigners?

Generally, UPI transactions for individuals are free of charge. Most UPI apps do not impose fees on users for sending or receiving money. However, it's essential to check with your bank or UPI app for any specific fees or charges that may apply, especially for certain types of transactions or services.

0 notes