#unlisted company shares

Explore tagged Tumblr posts

Text

Unlock The Hidden Potential Of Unlisted Shares: Buy And Sell Your Way To High Returns In The Booming Unlisted Securities Market

The world of finance is constantly evolving and expanding. One particular area that has gained immense popularity among investors is the unlisted securities market. While most people know the stock market and its various investment options, the unlisted securities market has yet to be discovered.

Understanding the Unlisted Securities Market

In the unlisted securities market, investors can buy and sell securities not listed on the stock exchange. These securities include shares, bonds, and other financial instruments unavailable for public trading. The unlisted securities market, often called the over-the-counter (OTC) market, operates outside the regulated exchange mechanism.

Key Players in the Unlisted Securities Market

A typical unlisted securities market is composed of four primary players:

The issuers are usually small and medium-sized enterprises that raise capital through the issue of unlisted securities.

Investors are looking to invest in these securities.

Brokers or dealers act as intermediaries between the issuers and investors, facilitating trading and executing transactions.

Market makers provide liquidity by being available to buy and sell securities at quoted prices.

How is the Unlisted Securities Market Beneficial?

The unlisted securities market can be beneficial for both investors and companies. For investors, it offers an opportunity to invest in emerging businesses that may not be available on the stock market. It also allows investors to diversify their investment portfolios and potentially earn higher returns. For companies, the unlisted securities market offers access to capital from investors willing to take risks. Still, at the same time, it helps them avoid the strict listing requirements and regulatory requirements of going public.

Buying Unlisted Shares

Buying unlisted shares requires a bit of legwork. Investors looking to buy unlisted shares can contact authorized brokers or dealers specializing in the unlisted securities market. These brokers or dealers can provide information about potential investment opportunities and execute transactions. Investors can also approach market makers who provide liquidity by quoting prices at which they are willing to buy or sell securities.

Selling Unlisted Shares

Selling unlisted shares can pose challenges, primarily due to the need for more liquidity in the market. Investors looking to sell their unlisted shares can approach brokers or dealers specializing in the unlisted securities market. These intermediaries can help facilitate transactions and find buyers for the shares. Investors should be aware that due to the lack of transparency and liquidity, it may take longer to realize profits from selling unlisted shares than those listed on the stock exchange.

Buy and Sell of Unlisted Shares – Best Way to Get Profits

Buy sell unlisted shares can be profitable if approached with caution and a thorough understanding of the market. Investors should conduct extensive research and analysis to identify potential investment opportunities and stay up-to-date on market development. The best way to get profits is to be patient, invest wisely, and be willing to stay invested for the long run.

Bottom line

The unlisted securities market is a platform for trading securities not listed on a national exchange. It provides an opportunity for investors to trade in privately held companies, venture capital funds, and other investment opportunities that are not publicly available. The market is less regulated than the public markets, which can present higher risks and offer higher rewards. Despite the challenges, the unlisted securities market is important in providing access to capital for growing companies and offering investment opportunities for those seeking to diversify their portfolios.

#unlisted company shares#buying unlisted shares#unlisted stock dealer in india#unlisted share market#selling unlisted shares

1 note

·

View note

Text

Invest In Unlisted Companies In Kolkata

National Stock Exchange of India in a case involving alleged lapses in the bourse’s systems, lawyers representing the parties said on Monday. The top court also refused to stay a tribunal order, which had set aside the regulator’s ruling against NSE, the lawyers added.

0 notes

Text

Kamarhatty Company Share Price Advancing Upwards

Introduction Kamarhatty Company Limited (KCL) has been experiencing a notable upward trend in Kamarhatty Company Share Price, capturing the interest of investors and market analysts. This surge is attributed to the company’s strategic initiatives, diversification of its product line, and operational improvements. This article delves into the factors behind the Kamarhatty Company Share Price increase, the company’s recent developments, and the broader market conditions influencing this positive trajectory.

Historical Performance and Recent Growth Kamarhatty Company Limited, a key player in the jute industry in India, has a long history of producing and selling a wide range of jute products. These include Hessian, sacking, floor coverings, furnishings, yarn, twine, jute non-woven felt, ropes, and various jute bags. Historically, KCL’s share price has reflected the cyclical nature of the jute industry, subject to fluctuations in demand and raw material prices.

However, recent months have seen a significant uptrend in the company’s share price. This rise can be linked to a series of strategic decisions and favorable market conditions that have enhanced the company’s profitability and market perception.

Strategic Diversification and Product Innovation One of the key drivers of KCL’s share price increase is its strategic diversification and innovation in its product offerings. KCL has expanded its product line to include high-demand items such as jute shopping bags, promotional bags, wine bottle bags, drawstring bags, and ladies' bags. These products cater to the growing demand for eco-friendly and sustainable alternatives to plastic products.

This diversification has not only broadened the company’s market reach but also opened up new revenue streams. The innovation in product design and the emphasis on quality have positioned KCL as a preferred supplier in both domestic and international markets.

Emphasis on Sustainability and Eco-friendliness KCL’s commitment to sustainability and eco-friendly products has resonated well with the market. As consumers and businesses increasingly prioritize environmental sustainability, the demand for jute products, which are biodegradable and renewable, has surged. KCL’s proactive stance on sustainability has attracted environmentally conscious investors and customers, further boosting its share price.

The company’s efforts to promote the benefits of jute and its environmental impact have also enhanced its brand image. This positive perception has translated into increased investor confidence and a higher valuation in the stock market.

Operational Efficiency and Technological Advancements KCL has made significant investments in modernizing its manufacturing processes and improving operational efficiency. The adoption of advanced technologies in production has streamlined operations, reduced costs, and improved product quality. These improvements have enhanced the company’s competitiveness and profitability, contributing to the rising share price.

Efforts to optimize the supply chain and enhance productivity have also paid off. By reducing waste and improving resource utilization, KCL has been able to maintain steady growth in revenues and margins, even in challenging market conditions.

Market Trends and Economic Factors The broader market trends have also favored KCL. The global shift towards sustainable and eco-friendly products has increased the demand for jute goods. Additionally, supportive government policies and incentives for the jute industry in India have provided a conducive environment for growth.

Economic factors such as rising disposable incomes and increasing awareness about environmental issues have further driven the demand for jute products. KCL’s ability to capitalize on these trends has been a significant factor in its share price appreciation.

Financial Performance and Investor Confidence KCL’s robust financial performance has been a cornerstone of its rising share price. Recent financial results have shown strong revenue growth, healthy profit margins, and a solid balance sheet. The company’s prudent financial management and strategic investments have reinforced investor confidence.

The company’s consistent dividend payments and shareholder-friendly policies have also contributed to the positive sentiment among investors. As a result, KCL’s shares have become increasingly attractive to both institutional and retail investors.

Future Prospects and Growth Strategies Looking ahead, KCL is well-positioned to sustain its growth momentum. The company plans to further expand its product range and explore new markets. Continued investments in technology and sustainability initiatives are expected to enhance operational efficiency and product appeal.

KCL’s strategic vision includes increasing its footprint in international markets, particularly in regions with high demand for eco-friendly products. This global expansion, coupled with ongoing product innovation, is likely to drive further growth and value creation for shareholders.

Conclusion The upward trend in Kamarhatty Company Limited’s share price is a reflection of the company’s strategic foresight, operational excellence, and alignment with market trends. Through diversification, sustainability, and technological advancements, KCL has positioned itself as a leader in the jute industry.

As the company continues to innovate and expand, it is well-placed to capitalize on the growing demand for sustainable products. Investors and market analysts will undoubtedly keep a close watch on KCL, anticipating further developments that could propel the share price even higher.

#Kamarhatty Company Share Price#Kamarhatty Company IPO#Kamarhatty Company Pre IPO#Kamarhatty Company Unlisted Shares#Kamarhatty Company Upcoming IPO

0 notes

Text

Explore Stock Knocks' comprehensive Directory of Unlisted Companies.

0 notes

Text

Ready to invest in financially stable companies? DelistedStocks has the inside scoop on the Top 6 Debt-Free Companies! For buying or selling unlisted shares and more information, connect with us at 📞7419700416/9821677100 or visit www.delistedstocks.in.

0 notes

Text

24/4/24

Well, this is an interesting one to come back to.

After asking around about what I missed while I was gone (and thank you to the people that filled me in!!!) I heard rumblings about a leaked trailer. I wasn’t sure at first about sharing this, but after looking into the specific circumstances of the “leak”…well, it’s not exactly coming from a hidden place, but I’m still not sure we were supposed to find that.

An unlisted landing page for The Edge of Sleep on a certain production company’s website exists, and it is easy to find but out of unsureness as to whether we’re supposed to be poking around there, I won’t say anything more than that. The page features a link to an unlisted sizzle reel, which seems to be a proof-of-concept trailer for the project. However, if you stumble across it, I highly recommend avoiding the sizzle reel if you don’t want spoilers!!!

Man, I’m glad I asked what I missed—

30 notes

·

View notes

Text

What other proof do you need, do you own a huge position in oil company shares? Do you also own preferred stock which is unlisted on NYSE? #ClimateEmergency http://dlvr.it/TB743W

9 notes

·

View notes

Text

After my rant in the tags of my last reblog, I want to share some tips I've gathered while navigating caffeine with a heart condition, that could potentially help someone. Plus some other caffeine safety that I learned from my cardiologist:

1. JUST BECAUSE A BOTTLE DOESN'T HAVE THE CAFFEINE CONTENT LISTED ON IT DOESN'T MEAN IT DOESN'T HAVE CAFFEINE!! The unlisted caffeine content doesn't just apply to fountain drinks. Companies are not legally required to label bottles/cans/food of their caffeine content, only as an ingredient in the products. I myself have gotten super sick because of this. Caffeine Informer is a good site to look up caffeine content for drinks, especially if you can't find it on the label.

2. Say something happens and you drink way too much caffeine, drink LOTS of water to flush your system, get something to eat, and sit/lay down. Keep an eye on your heart rate and blood pressure, get medical attention if possible. Caffeine has an average half life of 5 hours so it may take some time before you feel better.

3. If you are going to drink a caffeinated drink, drink water beforehand so you don't end up chugging your drink and accidentally give yourself a caffeine overload.

4. To go in hand with the last point, eat something too. Preferably something high in carbs or fat to slow down how fast your stomach absorbs the caffeine. This is where you hear of people putting butter and other oils/fats in their coffee.

5. This may be common sense to some but If you drink caffeine while taking medications such as beta blockers or other anxiety/blood pressure lowering medication, you will render your medicine useless. Your medication will not cancel out the caffeine. Always check if caffeine interacts with any medications you take.

It's upsetting that some of this needs to be said, I wish proper caffeine content labeling was something we didn't have to ask for. If anyone has anything else to add to this, feel free to do so. it's late as I'm writing this so I'm definitely slipping on a few things.

30 notes

·

View notes

Text

Dematerialization of Shares in India – A Complete Guide by Neeraj Bhagat & Co.

In today's digital era, the Indian financial market has undergone significant transformation, with Dematerialization of shares in India emerging as a game-changer for investors. The shift from physical to electronic shares has streamlined trading, enhanced security, and improved efficiency. Neeraj Bhagat & Co. provides expert guidance on the dematerialization process to ensure seamless compliance with regulatory requirements.

What is Dematerialization of Shares?

Dematerialization of shares in India refers to the process of converting physical share certificates into electronic format, which is then stored in a Demat account. This eliminates risks associated with paper-based shares such as loss, theft, forgery, and damages.

Why is Dematerialization Important?

The Securities and Exchange Board of India (SEBI) has made it mandatory for listed companies to facilitate dematerialization, ensuring transparency and ease of trading. Here are some key benefits:

Enhanced Security: No risk of loss or forgery.

Easy Transfers: Quick and hassle-free transfer of shares.

Cost-Effective: Eliminates stamp duty and paperwork.

Increased Liquidity: Facilitates faster transactions and trading.

Regulatory Compliance: Ensures adherence to SEBI and stock exchange norms.

Process of Dematerialization in India

Neeraj Bhagat & Co. simplifies the dematerialization process by assisting investors through the following steps:

Open a Demat Account: Choose a Depository Participant (DP) registered with NSDL or CDSL.

Submit Dematerialization Request Form (DRF): Fill out the DRF and attach physical share certificates.

Verification & Processing: The DP verifies the documents and forwards them to the company’s registrar.

Electronic Credit: Upon approval, shares are credited to the investor’s Demat account.

Mandatory Dematerialization for Private Companies

The Ministry of Corporate Affairs (MCA) has mandated that all unlisted public companies must dematerialize their shares, aligning them with listed companies for better governance and transparency.

How Neeraj Bhagat & Co. Can Help

With years of experience in financial consulting, Neeraj Bhagat & Co. assists businesses and investors in:

Setting up Demat accounts.

Filing and processing dematerialization requests.

Ensuring compliance with SEBI and MCA regulations.

Providing end-to-end support for private and public company dematerialization.

Conclusion

Dematerialization of shares in India is an essential step for investors and businesses looking for secure, efficient, and transparent trading. With expert advisory from Neeraj Bhagat & Co., investors can navigate the process smoothly while ensuring compliance with regulatory norms.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

2 notes

·

View notes

Text

About the Casino Royale stream on Beyond Live and how to make sure it happens again

I don't often write posts but I wanted to get something out for what is pretty much an historical day for Takarazuka. We just had for the first time in forever an officially subbed stream on Beyond Live, not only a platform fans not living in Japan can access easily without bothering with a VPN but also with subtitles in several languages and with the possibility of a restream with improved english subtitles at a decent hour (not at dawn and not in the middle of the night). And it was just so so much fun. Not only for long time fans but for new fans who never really knew how to get into something as niche as zuka, with people coming from all around the globe.

This is an amazing opportunity we just had and I'm sure we'd all like for this to become a regular thing. However, it's been stated that this stream was basically a test. If this whole operation turns out to be profitable, then we might have more of this. There isn't much we can do now about the profitability but there is one thing we can do to put the odds on our side : absolutely refrain from posting any pic or clip of the stream on the internet. TikTok, twitter, instagram, even private and unlisted youtube videos, just don't post anything about the Casino Royale stream out there.

I'm not saying this out of Respect For The Law. Frankly, I generally don't care about all of this and I'm not trying to preach about the Evil Of Pirating. But it's important for people to know who they're dealing with and Hankyu Corporation (the company owning Takarazuka) is extremely strict on copyrights and has been getting stricter recently. It is all too likely they might not only stop Beyond Live streams but they might even stop Rakuten livestreams, if the international fandom ever gets too careless about what we post.

I say "international" because most of us are used to a complete different approach when it comes to sharing content and the matter of copyrights. In all my fandom experiences, copyrights was never an issue I kept in mind but Takarazuka quickly showed me that it was going to be different. That's why I'm writing all of this, to warn newer fans that as much as I love their enthusiasm, it's better for eveyone if we all try to be cautious, or else we might lose the little we get.

We'll see how things evolve! With time, we could get looser about all of this but for the time being, I really urge all of you who might have taken pictures or recorded stuff to keep it to themselves or only share it through private conversations. Just no public posting.

Here's to hoping we get tons of livestreams with subtitles in the future 💖

49 notes

·

View notes

Text

Exploring The Dynamics Of Unlisted Company Share Price

The cost of an unlisted firm's stock is open to discussion and conversations. The period of financial freedom and escalation in stocks’ performance has made businesses such as multinationals and many private companies the move makers within the world economy.

HDB Financial Services unlisted shares hold a noteworthy place within the financial markets. This composition covers several pieces of information relevant to the pricing of such stocks.

Tips for Successfully Managing Unlisted Company Shares

1. Deep Dive into Company Fundamentals:

Before investing in unlisted company stocks, it is necessary to know the company's basic guidelines. This comprises of analyzing its financial situation, management quality, and future escalation prospects. In the case of unlisted stocks, the records and facts are not usually presented to the masses. Thus, chances of investors need to look for balance sheets, annual reports, or some related documents to build trustworthy knowledge. This will act as a points man while sailing in the unsystematic waters of unlisted shares.

2. Legal Due Diligence is Key:

Unlisted shares come along with certain legal terms. It is essential to be aware of the regulations controlling these shares. This includes comprehending transfer limitations, stakeholders' rights, and any other contractual duties. Getting in touch with a legal authority or professional may be helpful. They can help maneuver through the complex legalities, making certain that each transaction follows all rules and regulations.

3. Establish a Clear Exit Strategy:

Unlike stocks of public firms, shares that are not listed don't have the luxury of an immensely wide market where it is easy to buy and sell. So, liquidity is a difficulty. Before putting money into such shares, make a clean exit plan. This could be either to wait till the company goes public or seek a private buyer. Having a plan to go by will provide clear direction and prevent getting caught up with assets that cannot be traded quickly.

4. Diversify Your Portfolio:

The advice of not placing all eggs in the same basket is as old as time. When it comes to investing in unlisted shares, diversification of funds is essential. This way, any potential volatility and lack of public oversight is spread around. Yet, it is important to not just choose quantity at the expense of quality; rather, choose companies from different sectors with favorable conditions. The amount of diversification, along with the quality of investments, really matters when it comes to unlisted shares.

5. Stay Updated and Engaged:

The ever-changing state of unlisted companies is an imperative factor that leads to regular news, industry trends, and regulatory changes. To stay up-to-date, one must remain engaged with the company management or the representative for first-time insights. It is highly recommended to take a proactive approach in this regard, as it will help to avoid being taken by surprise or getting too late to make informed decisions.

Conclusion

Taking stock of the unlisted company share price can indeed be grueling for the shareholders and investors. But with the proper know-how and understanding of the other stakeholders' goals, one can make better financial moves and benefit from any potential profits.

Being keen and wise can be advantageous for investors, enabling them to gain an advantage from the unlisted company shares they own.

1 note

·

View note

Text

Buy Unlisted Company Shares in Mumbai

Investors can make an educated choice by using detailed company information and peer group comparison. Make an effort to make entrance and exit possible at reasonable market rates. Chryseum offers to buy unlisted company shares.

0 notes

Text

A couple of thoughts on the BigHit Music/BTS relationship and... that rumour!

First the rumour

So, let's get the rumour out of the way... [though I'll probably come back to it eventually].

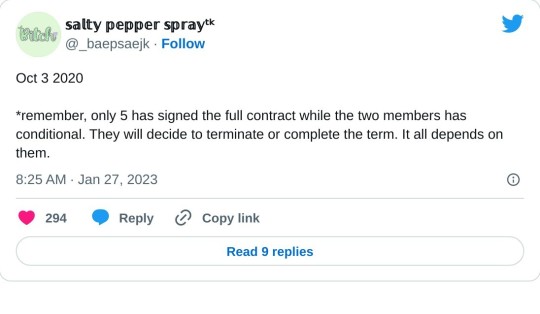

Last month an anon directed me to a rumoured 2020 blind item, about two members, who hadn't extended their contract...

This account is a known Taekook account. The comments/replies suggest the original poster of the blind doesn't exist and they posted this blind just before closing their account... but here's the thing why can't I find any reference to the original post. You're not telling me shit loads of Taekookers, hell OT7 and solo stans wouldn't have been all up in that shit if this blind was around in 2020. I never saw such a blind back then and I follow two big blind item websites (they have always intrigued me). This makes me think the post wasn't real. But perhaps there's a slither of truth in it...

Then on 11th Feb 2023, Crazy Days and Crazy Nights posted this...

And in the comments, there is the prevailing theory that BigHit/HYBE is deliberately not promoting their (Tae and JK) solo project stuff as some sort of evidence to back this theory up. Despite the fact that BH doesn't promote work that they don't produce themselves. I have yet to see a tweet or Weverse announcement about RM's involvement in a K-Variety Show he's doing, or Hobi, Suga and Jimin's recent fashion brand deals. Why because those companies are more than capable of promoting their own work with the members themselves.

Tae's cooking show is currently being promoted by the broadcaster as per usual and JK's World Cup Single was for a different label so any promo would have been done by them. Also, if BH weren't supportive of these endeavours do you really think they would allow their staff to travel and work with the Tae and JK and and provide support on these projects? You knot

I also find it interesting that a blind item that is supposedly 2 1/2 years old is suddenly back again and linked to a recent company purchase and Blackpink. That just seems suspicious.

I'll leave that there for a bit...

Let's keep it on the down low...

Now let's look at HYBE and BigHit and why I think the boys might have more control than we currently see.

Earlier this week, in light of the whole HYBE/SM drama, I saw two TikToks from the same user that piqued my interest and how BTS might have more power than we think...

Now I, like many others, was under the assumption that HYBE had full control over BigHit, but after a little research, I've found that this TikTok is true and BigHit is a separate entity to HYBE itself...

This twitter thread from April 2021 (when Scooter Braun and Ithaca Holdings were purchased), is very insightful and all publicly available...

So, in essence, when HYBE was in the process of purchasing Ithaca Holdings from Scooter Braun, Bang PD did something, he and the HYBE board (mostly made up of former BH Entertainment people) unlisted BigHit Music from the stock market and separated it off as private company. Still owned by HYBE but privately owned by them and independently operated and not affected by HYBE's dealings.

Before I move on some context that's needed for later…

In 2018, BTS re-sign with BH

In 2020, we discover BTS's contract renewal will run from June 2020 to June 2024

October 2020 BH Goes public BTS get shares in the company

6 months later Big Entertainment splits in HYBE and BigHit Music.

By 2021 we learn they have extended their contract for the full 7 years to 2027.

2022 BTS go on break from group duties ahead of enlistment.

NOTE: I think Points 3 to 5 are very important to all of this....

(I hope we're all still here, lol)

Why do I think this is important and shows us why BH/HYBE is not out to get the boys?

Firstly, it shows that HYBE wanted BTS/BH to be protected in case anything happened to the rest of HYBE. This is pertinent considering the CDCN blind specifically mentions the purchase of the US company. How it's worded suggests that BTS profits paid for it and that the boys are in a slave contracts. If BH is sperate that suggests that their profits don't automatically go into HYBE's bottom line. Also, any idiot with a Google Degree can tell you in seconds that BH had one of the most progress profit sharing deals with its artists.

Additionally, we don't know who owns the shares in BH, we know that in March/April 2021, HYBE was the sole shareholder, what's to say that other entities are shareholders too... such as BTS.

Think about it, in 2020 HYBE/BH were trying to persuade BTS to do the USA thing, what if BTS who were not in a happy place with all the speculation of enlistment, plus covid, were close to saying no to an extension and a push into the USA. What if HYBE offered them something they could refuse, which would kill two birds...

What if BTS wasn't happy about BH becoming HYBE?

So why did BH not become HYBE in 2020 and waited until 2021? I wonder if the answer to this was BTS and their contract extension. Imagine this...

You're BTS and the company you've literally built, is about to go public and you as artists who were promised more control in your contract could potentially loose said control when the new company is formed. Add to this you've yet to officially extend your contract and said company want you to do something new and could benefit them massively (US market push & new ventures etc.).

Your BTS, what would you do?

Me I'd kick up a fuse until you made sure there were some provisions in place to protect your brand and your creative freedom.

Maybe, that's why BigHit didn't immediately become HYBE because BTS weren't fully onboard.

What would placate them?

Maybe making BH into a separate entity and giving the boys the control, they crave?

The would do two things, ease their minds about the USA push a little, as well as the change to HYBE.

However, this could happen straight away, and would take several months to implement, it's also possibly why the Scooter Braun detail didn't happen sooner. Prior to this happening, they were given share in HYBE, and I think during that six months they were given iron clad contract extensions that benefited them and BH (note not HYBE) greatly.

Another thing to consider... perhaps BTS are shareholders in BH Music the private company. All we know is originally when they private the company HYBE was the sole owner; once you're a private company you don't have to announce things about profits, stocks & share sales unless it's a takeover situation, unlike HYBE as public company.

I also think this private (and very possible) arrangement might be what led HYBE to purchasing stock in YG Plus because HYBE would get a slice of BTS revenue (from manufacturing/distribution costs that YG Plus generate) prior to BH/BTS getting their profits, because... what if, only a small portion of BH's actual profit can go into the HYBE's bottom line.

Anyway...

In conclusion, I think there was a slither of truth in the "original" blind item, but I wonder if it involved all the boys, perhaps led by the two (who we all believe to Taekook).

No, I don't think it was connected to their sexuality, but more likely their (BTS's) unease of the company they helped build going public and a possibly fear of being undermined by any new management, as well as the push into the USA.

The latest version of the blind, is most likely being stirred up by antis who want to isolate Taekook from the others (hence the constant HYBE don't promote their solo work, even though HYBE/BH don't do it for other members), making them out to be diva's who want more and more. Then use incorrect information in the process and therefore creating a blind that actually doesn't make factual sense.

The Blackpink thing? I have no idea.

17 notes

·

View notes

Text

Navigate the Unlisted Companies Directory at Stock Knocks.

0 notes

Text

Finally watched the interview with Ilmar Kompus on People Make Games.

1. Why was this video unlisted? Whose decision was that? Did PMG decide not to showcase him? Did it need to be withdrawn for legal reasons? I haven't generally been following this legal battle closely so I'm not sure if he said anything obviously worth retracting.

2. Interesting how, like 3 times, the interviewer clarifies contract terms and company share of Kompus vs that of Kurvitz, Hindpere, and Rostov, such as Kompus owning nearly 70% of shares, and then asks Kompus some variation of "do you see how, regardless of intention, it appears to outsiders that you are gaining at their expense" only for him to shift the conversation towards "well, not me, the company as a whole benefits".

3. I do believe the claims of a toxic work environment. A small group of friends creates a world, starts making a game, only to have to shift over to working as a studio with new people? Seems very plausible things could be difficult. Still doesn't excuse fucking people over, which still looks likely to me.

Looking forward to more details coming out over time.

9 notes

·

View notes

Text

According to persons with knowledge of the situation, the largest online pharmacy PharmEasy has notified its board and investors that it intends to raise around Rs 2,400 crore ($291.5 million) through a rights offering at a 90% discount to its highest stock price in order to pay back a loan from Goldman Sachs. According to documents reviewed by ET, API Holdings, the parent company of the unlisted PharmEasy, would issue fresh shares at a price of Rs 5 per share. In 2021, API raised capital at Rs 50 per share.

youtube

#Emcure Pharmaceuticals share price#Emcure Pharmaceuticals unlisted Shares#Emcure Pharmaceuticals IPO#Emcure Pharmaceuticals Upcoming IPO#Emcure Pharmaceuticals Pre IPO#Youtube

2 notes

·

View notes