#unified threat management market

Explore tagged Tumblr posts

Text

Unified Threat Management Market Segment Analysis By Application, Region And Forecast Till 2030: Grand View Research Inc.

San Francisco, 10 Nov 2023: The Report Unified Threat Management Market Size, Share & Trends Analysis Report By End Use (Telecom & IT, BFSI), By Component (Hardware, Virtual), By Enterprise Size (SME), By Service, By Deployment, And Segment Forecasts, 2019 – 2025 The global unified threat management market size is expected to reach USD 10.09 billion by 2025 at a CAGR of 14.5% from 2019 to 2025,…

View On WordPress

#Unified Threat Management Industry#Unified Threat Management Market#Unified Threat Management Market 2019#Unified Threat Management Market 2025#Unified Threat Management Market Revenue#Unified Threat Management Market Share#Unified Threat Management Market Size

0 notes

Text

Streamlining Payment Processes: A Guide to Credit Repair Merchant Accounts

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving financial landscape, the prowess of refining payment processes cannot be overstated, especially for credit repair businesses. Mastering the art of efficient payment management is the linchpin for success in this burgeoning industry. This guide unravels the enigma of Credit Repair Merchant Accounts, showcasing their pivotal role, and illuminating how they hold the potential to transform the fabric of your credit repair enterprise.

DOWNLOAD THE STREAMLINING PAYMENT PROCESSES INFOGRAPHIC HERE

The Empowering Essence of Credit Repair Merchant Accounts

Thriving amidst its challenges, the credit repair realm often grapples with the complexities of high-risk merchant processing. Yet, Credit Repair Merchant Accounts emerge as a strategic ally, offering a comprehensive approach to effortlessly navigate the landscape of credit repair payments. This guide delves deep into the critical facets of these merchant accounts, unveiling why they are indispensable and elucidating how they possess the potential to revolutionize your credit repair venture.

Seamless Credit Card Embrace

At the heart of a credit repair merchant account lies the ability to seamlessly embrace credit cards. This attribute not only amplifies the credibility of your business but positions it as a beacon of trust. In an era where digital transactions reign supreme, the merchant account becomes the conduit to meet customer expectations, allowing for the smooth and secure processing of credit and debit card payments.

Strategic High-Risk Payment Gateway

Given the inherently high-risk nature of the credit repair industry, a robust and strategic high-risk payment gateway is not just beneficial; it's imperative. The credit repair merchant account steps into this role, providing a secure platform that processes payments without succumbing to the constant threats of fraud or chargebacks.

Streamlined E-commerce Payment Mastery

In a landscape dominated by e-commerce, possessing an efficient e-commerce payment processing system is not merely advantageous; it's a necessity. A credit repair merchant account equips you with the essential tools to meet the surging demand for online payment options, ensuring customers can seamlessly pay for credit repair services with confidence and security.

Prestigious Credit and Debit Card Processor

Building trust stands as a cornerstone in the credit repair arena. By adopting a credit repair merchant account, you not only position yourself as the preferred credit and debit card payment processor but also elevate your status above competitors, marking your journey towards industry leadership.

Versatile Integration for CBD Transactions

For those navigating both credit repair and the CBD industry, the versatility of CBD merchant accounts becomes apparent. These accounts enable you to diversify your offerings, tapping into the thriving CBD market. A unified merchant account adeptly handling both credit repair and CBD payments streamlines your financial operations for unparalleled efficiency.

Online Payment Gateway for Unmatched Convenience

In a world propelled by speed and convenience, an online payment gateway, a pivotal component of your credit repair merchant account, offers unparalleled convenience to clients. This user-friendly feature empowers customers to make payments from the comfort of their homes or on the go, providing a game-changing advantage for your services.

Efficiency: The Backbone of Merchant Processing

Efficiency, the bedrock of any successful business, is seamlessly delivered through a credit repair merchant account. It offers streamlined merchant processing capabilities, translating to accelerated transactions, reduced administrative burdens, and more dedicated time to nurture business growth.

youtube

High-Risk Payment Gateway: A Shield in Turbulent Times

The credit repair industry often faces uncertainty due to regulatory changes and legal challenges. Your high-risk payment gateway acts as a steadfast shield, ensuring uninterrupted payment flows even in tumultuous times. It becomes the pillar of stability in the face of unforeseen disruptions.

In an industry where trust, efficiency, and security are non-negotiable, Credit Repair Merchant Accounts emerge as the linchpin to success. These accounts empower you to seamlessly accept credit cards, become the trusted credit and debit card payment processor, and navigate the high-risk landscape with assurance. Armed with an efficient e-commerce payment processing system and a reliable high-risk payment gateway, you stand poised to conquer the unique challenges of the credit repair domain.

Therefore, if the aim is to streamline payment processes and elevate your credit repair business to new heights, the time for hesitation is over. Embrace the potency of Credit Repair Merchant Accounts today, paving the way for financial stability and sustained growth. Clients will appreciate the convenience, security, and trustworthiness you bring to their credit repair journey. Unlock financial success, fortify your reputation, and cultivate a loyal client base with the right tools at your disposal. It's the opportune moment to streamline payment processes and embark on a journey toward prosperity and financial empowerment.

#high risk merchant account#payment processing#credit card processing#youtube#high risk payment processing#high risk payment gateway#merchant processing#accept credit cards#credit card payment#payment#Youtube

13 notes

·

View notes

Text

Writeblr Garden's Pumpkin Pitch Event: Six Strings & Stardust

Read for free on Substack

World-renowned pop sensation, Naomi Bell, becomes entangled with Benjamin Ferreira, the charismatic front man of a rapidly rising rock band, sparking an electric connection during one charged weekend. Their blissful time together shatters under the weight of expectations, propelling them into an intense, highly publicized feud. A media frenzy ensues as Naomi and Ben exchange sharp words and veiled accusations, even as their fame soars. Despite the growing chasm between them, their hearts persistently pull them closer. Determined to reunite, they embark on journeys of self-discovery, confronting personal demons, navigating the treacherous landscape of fame, and rekindling their initial passion. As their paths converge once more, they find solace in shared experiences and an unbreakable bond, rising above the fabricated feud that tore them apart. This is a tale of forgiveness, redemption, and the indomitable spirit of two artists who defy the barriers erected around them.

Genre: Contemporary Romance

Trigger Warnings:

anxiety

alcohol abuse

panic attacks

parental manipulation

language

Tropes:

found family

lovers - enemies - friends - lovers

opposites attract

Excerpt under the cut:

“Naomi Bell to set 19. Naomi Bell to set 19.” The static overhead announcement sounded for the fifth time for the photo shoot that was supposed to start an hour ago. I can quote it word for word now, something I’ll probably be reciting in my sleep tonight. The style team for the world’s most renowned pop star shifts uncomfortably on the fringes of the set. A short woman with a sharp bob haircut checks her watch for the twentieth time and groans in frustration at the wasted minutes. This photoshoot was supposed to be wrapping up now; instead one self-centered diva is throwing off everyone else’s schedule.

The set is adorned with several guitars ranging from vintage electrics to the most modern, streamlined acoustics on the market. In a stroke of, what they are calling, genius, top guitar designer Banshee Guitars is launching a new campaign with two of its musical ambassadors to demonstrate not only the breadth of its own range of style but also the unifying power of music across different people. Apparently, Naomi Bell and I are the perfect combo from their roaster to illustrate these polar opposites.

I was here thirty minutes early and the urge to say “fuck it” and leave is eating away at me. The style team assigned to me has applied the most elaborate version of my stage makeup on my face and neck. It’s beginning to irritate my skin, adding to every other thing about this that irritates me. My head falls back as I lean over the arm of the decorative chair I’ve been trying to get comfortable in for an hour to attempt eye contact with my manager. He’s equally unimpressed.

“I’m leaving in five minutes.” It is the sixth time I have made the same threat.

Martin simply holds up a perfectly manicured finger to silence me. He doesn’t even look up from his phone. He rarely does.

“No, you aren’t,” he replies with his usual dry and apathetic tone, still never looking my way.

I bite back the comments that are begging to spill from my lips. I’ve been trying to play nice, but I still can’t stifle the growl of frustration. The amount of work I have to do that isn’t actually making music is astonishing to me and something I can’t get used to.

The announcement rings out again, calling Naomi to the set. This time, a frantic bustling of voices follows from one of the long hallways that lead to the various dressing rooms and other studios.

“Sorry, sorry, sorry,” a chorus of melodic apologies ring out, getting closer and closer until a burst of pink and glitter emerges from the hallway.

“I’m so sorry! I hope you all haven’t been waiting for me too long.” Her singsong voice carries around the space as she hurries towards the set, stepping carefully and gracefully over power cords and props in her sky-high platform shoes. It’s all pink, the glittery crop top she’s wearing, the vinyl skirt hugging her hips, and those enormous shoes.

In the same room, it’s easy to see why they chose the two of us. Naomi is so bright. Everything about her is migraine-inducing, from her platinum hair to her bleached teeth. And she is so short; I could tell from across the room. It’s the most surprising thing about her. She always seems so larger than life in performances I’ve seen online — that’s not even mentioning the powerhouse that is her voice.

“Only an hour and a half.” I scoff as I stand and stretch out my legs, feeling every second that I spent waiting in that chair. This is the only evening I have to myself for a while and I had hoped this shoot wouldn’t cut into it too much — that dream is shattered. Our tour really kicks off after tomorrow night’s show, and we’re going to be busier than ever.

A small pout pushes at Naomi’s lips. “I’m really sorry. I got held up in wardrobe.”

I’m spoon-fed the opportunity to evaluate the aforementioned wardrobe. How it took so long to dress someone in so little clothing is beyond me.

11 notes

·

View notes

Text

Emerging Industries: Opportunities in the UK Job Market

Planning to study in the UK? Want to explore career opportunities in the United Kingdom?

In the ever-evolving world, the UK stands as a hub for innovation and growth, bringing numerous emerging sectors that offer promising career prospects. As technology continues to reshape the global economy, several industries in the UK have captured attention, presenting exciting opportunities for job seekers and entrepreneurs alike. Take a look at some of the career opportunities you could take advantage of.

1. Fintech (Financial Technology)

The UK has strengthened its position as a leading fintech hub, with London being a prominent center for financial innovation. Fintech includes a wide array of sectors, including mobile payments, blockchain, and cybersecurity. Job opportunities in this field span software development, data analysis, financial consultancy, and regulatory compliance.

2. Technology and IT

In the emerging era of the digital world, technology continues to dominate businesses worldwide. As, a result the demand for technologically advanced professionals tends to rise. Software developers, data analysts, cybersecurity experts, and artificial intelligence specialists roles are in high demand. With the increasing use of technologies and the need for innovative solutions, these roles offer tremendous growth opportunities and competitive salaries.

3. Healthtech

The combination of healthcare and technology has given rise to HealthTech, a sector dedicated to enhancing medical services through innovative solutions. From telemedicine to health analytics and AI-driven diagnostics, HealthTech offers diverse career paths for healthcare professionals, software developers, data scientists, and researchers.

4. Renewable energy and sustainability

With an increased focus on sustainability and combating climate change, the UK has been investing significantly in renewable energy sources. Wind, solar, and hydroelectric power are among the sectors experiencing rapid growth. Job roles in renewable energy range from engineering and project management to research and policy development, catering to those passionate about environmental conservation.

5. Cybersecurity

With the increasing frequency of cyber threats, the demand for cybersecurity experts is on the rise. Businesses and governments are investing heavily in safeguarding digital infrastructure. Job roles in cybersecurity encompass ethical hacking, network security, data protection, and risk analysis, presenting ample opportunities for skilled professionals in this field.

6. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing various industries, including finance, healthcare, and manufacturing. The UK is fostering innovation in AI research and development, offering roles in AI programming, data engineering, robotics, and AI ethics.

7. Creative industries

The UK has a rich heritage in the creative sector, encompassing fields like media, design, gaming, and entertainment. Roles in creative industries span from content creation and graphic design to video production and game development, appealing to individuals with artistic and technical skills.

In conclusion, the UK job market is filled with opportunities within emerging industries, showing the nation's commitment to innovation and progress. Whether one's passion lies in sustainability, technology, healthcare, or creative endeavors, these sectors offer an array of possibilities for career growth and contribution to shaping the future.

By embracing change, acquiring relevant skills, and staying adaptable, individuals can position themselves to thrive in these dynamic and promising industries, contributing to both personal success and the advancement of these transformative sectors in the UK.

If you are struggling to get the right guidance, please do not hesitate to consult MSM Unify.

At MSM Unify, you can explore more than 50,000 courses across 1500+ educational institutions across the globe. MSM Unify has helped 1,50,000+ students achieve their study abroad dream so far. Now, it is your turn to attain your study-abroad dreams and elevate your professional journey! So, get ready to broaden your horizons and make unforgettable memories on your upcoming adventure.

2 notes

·

View notes

Text

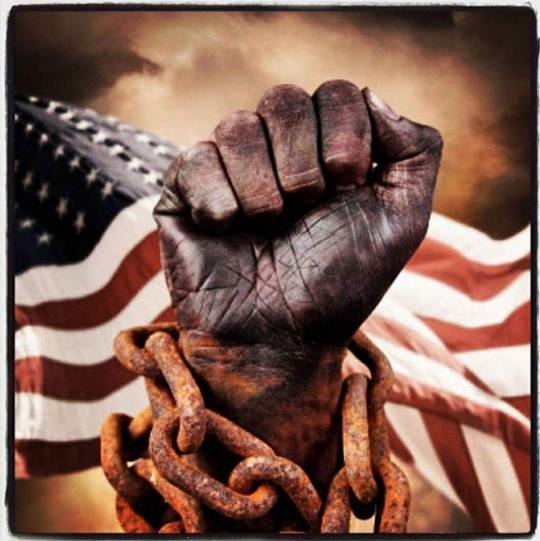

Psychological warfare is the deliberate use of various manipulations, promotion and deception techniques, such as spreading propaganda and terror, to induce or reinforce attitudes that are favorable to gain strategic advantage over others. Sun Tzu, a Chinese Military Strategist originally said the best victory in warfare is the one in which you never have to fight your enemy in actual combat. Thus, psychological warfare tactics are also marketed as a self-improvement sales tool for ambitious, materialistic people that plot to maneuver into positions of power in order to gain advantages in business, relationships and socio-political influence. Essentially, this is to secretly scheme and manipulate others in a well thought out strategy in order to get what you want from the power structure and to get access to other people’s resources. Generally it is desirable to achieve these goals in such way that the plotters remain undetected in their climb to power and position, without anyone even realizing the entire situation was a calculated scheme.

In the past such Machiavellian schemes were thought to portray the devious behavior of criminals and despots, believed to have undesirable and even appalling human character traits. Today these extremely negative behaviors are normalized and commonly applied in the business operations of the everyday world, by financially rewarding people that act as predators. Thus, the current terrain requires that we open our mind to comprehend the most common concepts of psychological warfare, because all of us are being exposed to it every day. What are the predator minds scheming?

Invoke Fear: The purpose is to manufacture as much fear as possible to create dread and terror in the minds of the people, so that they will avoid rising in groups and instead become weaker and disabled. To maintain this continual state of fear buried in life’s many stressors, as well as perceived threats to survival, means activating the fight or flight reaction in the human nervous system and brain. Eventually this takes a serious toll on the overall health of the body and sanity of the mind, as it rapidly breaks down immunity, increases disease states and drives painful mental imbalances.

Division to Confusion: When the opponent group targeted for attack is large, cooperative and unified in their forces, by separating them from one another or separating them into smaller units, the entire group is more easily defeated and controlled. When the separation into smaller units is successful, the attack is then on their common bonds of unity. Seeking to confuse them with fear and misinformation so they will not know which way to turn, what to expect or who to trust. In the stewardship of any project or organization, this is a critical concept to understand.

Demoralization: A process in psychological warfare with the objective to erode morale or dehumanize those perceived as the enemy. By intending to destroy their dignity and morale, it can encourage them to retreat, surrender, or defect rather than confront them or to defeat them in physical combat. Demoralization and dehumanization is the most important tool of psychological warfare and intentional torture used to break a person. Demoralization is most commonly implemented through various forms of fabricated propaganda to weaken people, while dehumanization is commonly used by the satanic agenda to mock and defile human dignity or attack the spirit within the person.

Ignorance vs. Intelligence: Those that have the most knowledge, intelligence and conscious awareness of what is really happening in world events will have the most strategic advantage. Those that do not have access to accurate awareness of events or truthful knowledge, but instead are manipulated and deceived to believe false impressions and illusions, will be at a greater disadvantage. Knowledge of the truth is power. Managing intelligence and controlling access to information includes supplying the perceived enemy or opponent with disinformation, in order to trick them into making the wrong decisions based on lies. In the current warfare climate diminishing easy access to open source knowledge and sharing of information freely within the global community, it is an important concept to understand.

Overwhelm and Wear Down: Constantly use greater strength in applying heavy forces that overwhelm your opponent by creating never-ending issues that are designed to wear him down and erode his will power and resiliency. Bureaucracies, impossible compliance, insurance, tax and legal channels that keep people bogged down in never-ending paperwork, long lists and cues, under the threat of intimidation, or threat to financial security or persecution. This is also carried out in legal forms as ‘death by 1000 papercuts’, through the increase of overwhelming problems and burdensome bills. When people’s hopes are crushed and their expectations for their life are confused and burdened, eventually they become so drained they have no energy to refuse the constant attempts of subjugation and just give up.

How many of these tactics of psychological warfare that are normalized in our everyday society can you recognize that are currently impacting the quality of your life? Knowing that these strategies are being implemented, what can you do to change how you approach the control structures and the employed people that blindly follow a boilerplate that unconsciously reinforce these divide and conquer schemes?

4 notes

·

View notes

Text

5 Reasons to Build a Custom CRM

A CRM system is an essential tool for businesses to manage customer interactions effectively. There are numerous CRM software options available in the market.

In this article, we’ll delve into five reasons why it’s wise to invest in building a custom CRM. Firstly, custom CRMs are tailored to meet specific business needs and workflows, leading to more efficient processes and increased productivity. Secondly, custom CRMs offer enhanced security measures and better data privacy protection. Thirdly, a custom CRM can integrate seamlessly with your existing systems, providing a unified view of customer data.

Finally, building a custom CRM can be more cost-effective in the long run, as businesses can avoid ongoing licensing fees and expensive customization costs associated with off-the-shelf software.

Unique Functionalities One of the primary benefits of creating a custom CRM system is the ability to add unique functionalities that are customized for your business. Pre-built CRM software may not provide the flexibility required to tailor your customer interactions and user experience. With a custom CRM, you can add personalized dashboards, customized reports, and workflows that match your business processes.

This can significantly improve productivity and efficiency, as well as provide a competitive advantage over businesses that use generic CRM solutions.

Integration with Another System Building a customized CRM system provides an opportunity to integrate it seamlessly with other essential business systems. Pre-packaged CRM solutions may not offer the required level of integration, which can lead to disconnected data silos and inefficient processes. A bespoke CRM solution can be designed to work in tandem with other critical systems, such as ERP, accounting, and marketing automation software.

This creates a unified view of customer data, streamlines operations, and eliminates manual data entry errors. Customized integrations also help automate repetitive tasks, freeing up valuable employee time.

Security Data One of the most significant advantages of creating a custom CRM system is the ability to implement robust security measures to protect customer data. Pre-built CRM software can have vulnerabilities that leave customer data at risk of external threats, which can compromise customer trust.

A custom-built CRM system allows businesses to design security protocols and data privacy policies that align with their specific needs. This includes implementing encryption, access control, and data backup and recovery measures.

Eases Scaling Process Creating a custom CRM solution can help businesses ease the scaling process as they grow. As a company expands, its customer management requirements become more intricate, and out-of-the-box CRM software may not be adequate to handle the increased workload.

With a customized CRM solution businesses can tailor their CRM system to meet their evolving needs, adding features, functionalities, and integrations as required without switching to a new CRM platform entirely.

What is CRM Application Development? CRM application development is the process of building a customized customer relationship management system for businesses. Such systems are designed to help businesses manage their customer interactions, optimize their sales and marketing processes, and improve customer retention rates. Although there are off-the-shelf CRM solutions available, a custom CRM application provides businesses with a bespoke solution that caters to their unique needs.

The development process for a custom CRM application typically involves several stages. Firstly, a comprehensive analysis is conducted to understand the specific challenges and opportunities that the CRM system needs to address. This includes an evaluation of the current processes, data structures, and integrations that are in place.

Next, the development team creates a customized solution that addresses the identified challenges and opportunities. This may involve the creation of new features, the integration of existing software and systems, and the implementation of tailored security and privacy measures.

The coding and testing phases follow the design phase, with the development team creating the software and testing it thoroughly to ensure that it meets the business’s requirements and functions correctly.

Conclusion Creating a customized CRM solution provides businesses with a wide range of benefits that cannot be found in off-the-shelf CRM software. A tailored CRM application offers unique features and functionalities that address a business’s specific needs, enhancing the effectiveness and efficiency of its sales and marketing processes.

Moreover, Custom CRM Applications can be seamlessly integrated with existing software and systems, streamlining operations and saving time and resources. Additionally, custom CRM systems offer advanced security features that protect customer data, reducing the risk of data breaches and ensuring compliance with data protection regulations.

#crm software#crm development#crm solutions#crm software development company#CRM Software Development Service#crm implementation#crmintegration#CRM#crm development company#web development company#web development services

2 notes

·

View notes

Text

Oleksandr Kosovan remembers vividly the morning he left his home to go to work and didn’t know if it would still be there when he returned. He was jolted awake at 4 am by the sound of rockets striking Kyiv, and his immediate thought was, “I’ll probably never come back to my home. Mentally, I said goodbye to all of my belongings. And then I went to the office.” It was February 25, 2022, the day after Russian forces launched a large-scale invasion of Ukraine, escalating a conflict that had simmered since Russia’s 2014 annexation of Crimea.

Kosovan made his way into Kyiv’s center, near the Olympic National Sports Complex. He was headed to the office of his 15-year-old software company MacPaw, which makes applications for Macs and iPhones. As CEO, he had urged some of his 500 staff to flee the city when the threat of war escalated. But hundreds had opted to stay. His first task that day was to convert the office into a temporary shelter for MacPaw employees.

“I didn’t think my body was even capable of lasting four or five days without sleep and real food, but it was running on adrenaline and pure rage,” he says of those first days of the war. A year later, MacPaw has kept the lights on, and Kosovan’s home still stands. The company’s staffers have been more unified than scattered by the war’s steep challenges and have even managed to maintain a sense of normalcy, exchanging Ukrainian memes via Twitter and Telegram and still keeping in high spirits.

Kosovan is far from the only Ukrainian startup founder with tales of resilience and unexpected wartime productivity over the past year. Even as coders and entrepreneurs worked from underground bomb shelters and through rolling electrical blackouts, many managed to ship software updates. But Ukraine’s future is still unclear, adding to the risks that already come with keeping a technology startup alive.

Hacking in the Dark

I first met Julia Petryk by chance last June, after she had traveled 15 hours by train from Kyiv to Poland and then taken an international flight to attend Apple’s WWDC conference in Cupertino, California. We spoke outside Apple’s sleek, glass-walled coffee shop, standing in glaring sunlight, the idyllic scene a stark contrast from the war-torn parts of Ukraine. Since then I’ve kept in touch with Petryk and recently spoke to or corresponded with half a dozen tech founders and workers from Ukrainian companies, asking about life in Ukraine’s startup scene over the past year.

Petryk runs communications at MacPaw and is a cofounder of the Ukrainian PR Army, an ad hoc group of Ukrainian PR and marketing professionals trying to combat Russian propaganda by sending out pro-Ukranian missives to journalists and governments. She describes a year of severe disruption, and not the kind that Silicon Valley founders typically laud. She has worked from bomb shelters and coffee shops with backup generators, and has walked home through Kyiv in pitch-black darkness, decked in reflective gear.

“When you have all this news trickling in every day, it can be a bit depressing. But people keep adapting,” Petryk says. “There’s no way out except to work for the future and fight for the future.”

On October 10, Petryk emailed me from a bomb shelter in Kyiv: “Russians hit dozens of missiles at Ukraine this morning. Civilians killed again.”

Prior to this, she and I had been chatting about a Slack plugin that MacPaw engineers had built called TogetherApp, which enables quick check-ins and location drops between colleagues. The pings flew among the MacPaw team that day.

Thousands of Ukrainian tech workers ended up relocating to neighboring Poland or to Portugal, which granted temporary protection permits to Ukrainian refugees in the early days of the war. Many more stayed behind.

In the days following the invasion, Alyona Mysko, the founder and chief executive of an accounting startup called Fuelfinance, temporarily relocated her company’s home base from Kyiv to a bomb shelter in the western Ukrainian city of Lviv, some 500 kilometers away, and encouraged remote work. But many did not want to leave Ukraine. “We all have this understanding that when you stay in this country, you support the economy,” she says. “And a lot of our team members have families and homes here.”

By October, Fuelfinance had eschewed remote work and pivoted back to office life, toiling from a coworking space in Kyiv called LIFT99. Mysko had made the same journey Petryk had back in June—traveling 15 hours by train to Poland before flying to a tech conference in California—when news broke that Russia had unleashed a massive attack on Ukraine’s power grid, resulting in widespread blackouts.

“It was impossible to connect with my family,” Mysko says. “But in the office we had alternative sources of energy, and we had Starlink, so we were still able to connect for work. It made us realize how important it was to have backup generators, which really sped up the end of remote work for us,” she says with a wry laugh.

Backup generators and SpaceX’s Starlink satellite internet service—every founder who spoke to WIRED said they were now critical to their operations. Some had the foresight to purchase generators before the invasion.

Others, like Sofiia Shvets and Vlad Pranskevičius, who jointly founded an AI image editing startup called Let’s Enhance, raced to supply their staffers after the fact, purchasing several large power banks for employees scattered around Ukraine for around €550 (about $580) a piece. Each can supply six to seven hours of power to personal devices, though not enough for home appliances.

“It’s all very strange sometimes,” says Shvets, who is now based in San Francisco. “We’ll have a video call with one of our product managers who has Starlink internet, so he can join the call, but he’s in total darkness, surrounded by candles, because he doesn’t have electricity. And I’m like, ‘Um, Dennis, how’s it going?’”

Since the spring of 2022, Ukraine has relied heavily on Starlink satellite internet terminals, tens of thousands of which were donated by SpaceX, with some support from the US government. SpaceX CEO Elon Musk said in October that the company would no longer fund Starlink service in Ukraine, and he asked the Pentagon to pick up more of the cost before reversing himself in a tweet.

“Many people here and across the world were pissed off about some of his posts,” says Pranskevičius, who is based in Kyiv. “But what we’ve seen is that Starlink has continued to work. It’s been invaluable to most individuals and also to people on the front line, where there might be no connectivity at all.”

An Uncertain Future

Let’s Enhance has continued to grow, despite the challenges its founders and staff face. One colleague left to go fight on the front lines, and another signed up to work on military technology, joining the approximately 7,000 tech professionals who joined the ranks of the Armed Forces of Ukraine. One year ago, the company had 27 employees; now, it says it has more than 40.

But Let’s Enhance is in the minority. According to a 2022 report from TechUkraine, an organization that supports startups in the country, companies are feeling the heat of war. While 43 percent of teams surveyed remained the same size, 37 percent of founders say they’ve had to reduce headcount. And more than 90 percent of Ukrainian startups have indicated they would need more financial support in order to survive the war.

Data from research firm PitchBook shows that early-stage startups in Ukraine raised a collective $17 million in seed or Series A funding in 2022, compared to $14.1 million in 2021. Early-stage funding this year has already surpassed that in the last quarter of 2022, including $1 million recently raised by Fuelfinance.

But despite promising signs, the broader prospects for Ukraine’s businesses are murkier. In September, The Wall Street Journal reported that, while Ukrainian companies in 2021 raised a total of $832 million in venture capital and from private equity, which typically invests larger sums, one analyst has estimated that the number of Ukrainian VC deals was down by at least 50 percent in 2022.

Let’s Enhance’s last fundraising round was for $3 million in October 2021, and its founders planned to stretch that throughout 2022 as they focused on a new product. They may try to raise more funding this year, taking on macroeconomic headwinds, in addition to the instability of war, that have slowed startup investment.

Still, Shvets is optimistic about fundraising. Several funds have cropped up in support of Ukrainian tech companies, both in the private sector and from governments. Last year the European Commission pledged €20 million (about $21 million) in support of tech companies in Ukraine. Some private investors are bolstered by the fact that many Ukrainian startups sell their software in the US.

“I would say the narrative has definitely changed since last year. When the war started, we were all in shock, and so were our investors,” Shvets says. “They were asking, ‘What’s going to happen with Ukraine?’ But we haven’t had any production issues, and right now I actually feel like we have a lot of support.”

Dmitry Dontov, the chief executive and founder of data protection company Spin Technology, also says investors seem comfortable to keep working with startups with a heavy Ukrainian presence. Shortly after the invasion, Dontov, a Moldovan based in Silicon Valley, supplied his Ukrainian research and development team with generators and set up a safe house for them in the village of Koncha-Zaspa, about 33 kilometers from Kyiv. He relocated a third of the staff to an office in Portugal.

“Initially, investors were worried. They were asking, ‘How many lines of code have been written last month?’” Dontov says. “But over time, I think investors saw that we were taking all the actions necessary to maintain performance.”

Not all startups have fared so well. Oleksandr Kosovan, the MacPaw cofounder, also invests in other startups through a fund called SMRK. It invested $1.5 million in a Ukrainian robotics startup just this week. But Kosovan says that at least two of the fund’s portfolio companies shut down within the past year.

One of them was Seadora Seafood, a Kyiv-based fish delivery startup founded in 2019. The company transported some of its cargo by air and could no longer operate within Ukrainian air space. Another startup selling casual clothing is still operating but is struggling; as soon as the war began, Kosovan says, “the demand for such things was reduced to almost zero.”

In the context of war, necessities come into sharper focus. So do borders, and bonds with coworkers, and glimpses of the future, even if they appear in the form of a candlelit Zoom call or a flash of reflective clothing on a dark city street.

3 notes

·

View notes

Text

Top 10 Tools for Digital Transformation Success

Digital transformation specialist relies on various tools to improve efficiency, automate workflows, and enhance customer experiences. Here are the top 10 tools that drive digital transformation success:

1. Cloud Computing Platforms

Tools: AWS, Microsoft Azure, Google Cloud

Enable scalability, security, and remote accessibility.

Power data storage, machine learning, and enterprise applications.

2. Customer Relationship Management (CRM)

Tools: Salesforce, HubSpot, Microsoft Dynamics 365

Centralizes customer data for improved sales, marketing, and support.

Uses AI-driven insights to enhance customer engagement.

3. Enterprise Resource Planning (ERP)

Tools: SAP S/4HANA, Oracle NetSuite, Microsoft Dynamics 365 ERP

Integrates finance, HR, supply chain, and operations into a unified system.

Enhances decision-making with real-time analytics.

4. Robotic Process Automation (RPA)

Tools: UiPath, Automation Anywhere, Blue Prism

Automates repetitive tasks, reducing manual effort and errors.

Improves efficiency in finance, HR, and customer service processes.

5. Business Intelligence & Data Analytics

Tools: Power BI, Tableau, Google Looker

Visualizes business data for actionable insights.

Uses AI-powered analytics for predictive decision-making.

6. Cybersecurity & Compliance

Tools: Palo Alto Networks, Cisco Security, Okta

Protects digital assets from cyber threats and ensures compliance.

Implements multi-factor authentication (MFA) and zero-trust security models.

7. Collaboration & Productivity

Tools: Microsoft 365, Google Workspace, Slack, Zoom

Enhances remote work and real-time collaboration.

Integrates cloud storage, messaging, and video conferencing.

8. Artificial Intelligence & Machine Learning

Tools: IBM Watson, Google Vertex AI, OpenAI API

Automates decision-making, enhances customer service, and drives predictive analytics.

Personalizes customer experiences through AI-driven insights.

9. Low-Code/No-Code Development

Tools: Mendix, OutSystems, Microsoft Power Apps

Enables non-developers to create applications quickly.

Speeds up digital transformation by reducing dependency on IT teams.

10. Internet of Things (IoT) & Edge Computing

Tools: AWS IoT, Google Cloud IoT, PTC ThingWorx

Connects devices and sensors for real-time monitoring.

Optimizes supply chain, manufacturing, and smart infrastructure.

How This Relates to Operations Excellence

Since you are in Operations Excellence Management, tools like RPA, ERP, and Business Intelligence can significantly enhance process efficiency and automation in your field. Implementing these can help you drive cost reduction, productivity gains, and data-driven decision-making in operations.

Would you like recommendations on specific tools that fit your industry or current role?

0 notes

Text

Future Trends in Salesforce CRM Testing for the BFS Sector

The banking and financial sector relies on robust CRM (customer relationship management) systems for several reasons. It includes improving customer experience, streamlining operations, and ensuring legal compliance. Salesforce CRM is the best choice for institutions. This is due to its scalability, adaptability, and industry-specific proficiencies.

As the BFS sector is evolving constantly, Salesforce CRM testing services are essential. It's because it ensures compliance and seamless functionality.

In this blog, you will learn about the future trends in Salesforce CRM testing. It also includes how they align with the dynamic needs of the BFS sector.

Shift Towards AI-Driven Testing

The integration of AI into Salesforce testing solutions is transforming how CRM platforms are tested. AI-powered tools can replicate real-world scenarios and optimize testing processes. Not only this, but they can also predict potential system failures. When it comes to financial services, system reliability and customer trust are crucial. Thus, adopting AI-driven Salesforce testing services ensures compliance and better performance.

For example:

Optimizing Test Case: Accurate algorithms generate and prioritize test cases with respect to risk factors and historical data. Thus, ensuring a comprehensive evaluation of key Salesforce CRM functionalities.

Predictive Analytics: AI helps in identifying potential risks before they occur. Thus, improving test accuracy and reducing downtime.

Improved Security Testing

Cyber threats and data breaches are the two key concerns for financial institutions. If you are in the financial sector, opting for security-focused Salesforce testing services will be an ideal choice. Security testing for Salesforce CRM is becoming more advanced to address the challenges listed below:

Penetration Testing: Simulating cyberattacks to detect vulnerabilities in the Salesforce ecosystems.

Access Control Testing: Verifying role-based permissions and access to avoid unauthorized activities.

Data Encryption Validation: It ensures that confidential customer data is secure and encrypted.

Integration Testing for Omnichannel Banking

The financial sector is shifting towards omnichannel banking. Thus, Salesforce CRM must integrate with several third-party applications, platforms, and APIs. Integration testing is becoming a key aspect of Salesforce testing services. When it comes to financial institutions and banks, integration-focused testing is essential. It ensures customer satisfaction and operations.

It also ensures:

User Experience Consistency: Unified customer experiences across mobile, web, and in-branch interactions.

Data Synchronization: Accurate and real-time data flow across systems.

Cross-Platform Compatibility: Ensuring Salesforce CRM works flawlessly with legacy systems and emerging technologies.

DevOps Integration in Salesforce Testing

Implementing DevOps practices in financial institutions is essential. It plays a vital role in Salesforce CRM testing services process. Salesforce testing services driven by DevOps ensure resilience and agility in the finance industry. When it comes to Salesforce CRM testing services, the integration of DevOps offers several benefits.

It includes:

Enhanced Collaboration: Better coordination between QA and development teams ensures better results.

Real-Time Feedback: Constant monitoring and testing allow quick identification and solving of issues.

Quick Release Cycles: Automated testing and deployment pipelines reduce time to market.

Significance of Legal Compliance Testing

The financial sector is subject to strict regulations. This includes PCI DSS, GDPR, and Basel III. Salesforce CRM systems should align with these legal standards. This is to avoid fines and ensure data integrity. The legal landscape is evolving continuously. Thus, the demand for specialized Salesforce CRM testing services that meet financial compliance will increase.

Salesforce CRM testing services use compliance validation tools. It ensures that the Salesforce configurations meet industry standards.

Automated compliance testing frameworks are becoming a key component of the Salesforce CRM testing services. Thus, lessening manual efforts and improving accuracy.

Enhanced Focus on Customer Experience (CX) Testing

Customer experience and satisfaction play a vital role in the banking industry. Salesforce CRM plays a key role in providing efficient and customized services. Future Salesforce CRM testing services will prioritize client-centric testing. This improves satisfaction and loyalty.

Customer experience (CX) testing includes:

Accessibility Testing: It ensures that even individuals with disabilities can use CRM. The testing also ensures to have WCAG standards.

User Journey Testing: It validates end-to-end customer journeys to make sure to have seamless interactions.

Performance Testing: This testing assesses system responsiveness and speed during high transaction volumes.

Automation-First Approach

The usage of automation tools is changing the Salesforce CRM testing services. Automation reduces human error, enhances efficiency, and boosts the deployment cycle. Automation-first Salesforce CRM testing services are essential for financial institutions. It can adapt to market demands quickly while maintaining quality.

Key trends are:

CI/CT: CI/CT stands for Continuous Integration/Continuous Testing. Automate testing within the CI/CD pipelines. This ensures quicker delivery and minimal disruptions.

Scriptless Test Automation: Tools that allow non-technical testers to create test scripts using drag-and-drop interfaces.

Usage of Agile Testing Methodologies

Agile methodologies are reshaping Salesforce CRM testing services through iterative development and constant feedback. It helps financial institutions to stay ahead in the competitively changing landscape.

Agile testing trends consist of:

Test-Driven Development (TDD): It includes writing tests prior to developing features. This is to ensure alignment with the essential requirements.

Exploratory Testing: It allows testers to find defects beyond predefined test cases.

Behavior-Driven Development (BDD): It bridges the gap between technical and business teams via collaborative testing methods.

Cloud-Native Testing Strategies

Salesforce functions in a cloud environment. This makes cloud-native testing strategies essential. With cloud-native Salesforce testing services, financial institutions use Salesforce testing solutions while avoiding risks.

It includes:

Latency Testing: This testing assesses the responsiveness of the system under diverse network conditions.

Scalability Testing: It ensures the CRM can manage the increasing user and data volumes without performance degradation.

Disaster Recovery Testing: This testing verifies backup and restoration mechanisms in case of system failures.

Rise of Blockchain Testing

Salesforce CRM systems are becoming integrated with blockchain. This is for improved transparency and security. Salesforce testing solutions focused on blockchain will play a key role in the financial industry's digital transformation.

Testing these integrations includes:

Data Integrity Testing: It verifies that the data stored in the blockchain is tamper-proof.

Smart Contract Validation: It makes sure that blockchain transactions align with the essential terms and conditions.

Interoperability Testing: It assesses smooth interaction between the blockchain network and Salesforce CRM.

Final Words

Salesforce CRM testing services have a promising future in the banking and financial sector. The evolution of testing solutions is helping companies to solve unique challenges. This ranges from AI-driven innovations to agile methodologies.

In the financial sector, leveraging Salesforce testing solutions is essential. It ensures operational efficiency, customer satisfaction, and legal compliance.

Today, technology is reshaping the financial landscape. Thus, partnering with the best Salesforce CRM testing services provider would be best. They will help you stay ahead in the competitive industry.

Are you looking forward to partnering with the ideal Salesforce CRM testing services provider? If yes, then get in touch with the Qualitest team. They offer the best service to ensure the reliability and performance of Salesforce applications. Additionally, they also ensure the functionality of the Salesforce application. Their team has expertise in several Salesforce clouds. It includes CPQ, sales cloud, marketing cloud, commerce cloud, and sales cloud.

0 notes

Text

Cybersecurity Market Dynamics: Key Players, Innovations & Investments

The global cyber security market size is projected to reach USD 500.70 billion by 2030, registering a CAGR of 12.9% from 2025 to 2030, according to a new study by Grand View Research Inc. The global market is anticipated to be driven by the growing cyber threats and advanced malware threats across different verticals. In recent years, disruptive and emerging technologies in the banking, retail, information technology, defense, and manufacturing sectors have provided new capabilities, facilitated automation, and improved working conditions. They have, however, emerged as powerful forces in the evolution of the global threat landscape of exploits, vulnerabilities, and malware. Advancements in emerging technologies, such as Artificial Intelligence (AI), Machine Learning (ML), big data analytics, Internet-of-Things (IoT), 5G, edge computing, and cloud computing, are allowing market players to introduce new solutions based on these technologies, attract potential business clients, and expand their revenue streams.

For instance, in April 2023, Google, Inc. introduced Cloud Security AI Workbench, Sec-PaLM. This new model encompasses various security intelligence, such as threat indicators, & research on software vulnerabilities, and offers AI-powered tools to assist and act on cyber security threats. The growing preference for cyber security solutions & services in the IT & telecom industry is prompting market players to enhance their product portfolio & improve their customer base. The ongoing digitalization wave has resulted in significant changes in the telecom sector. Telecom companies are investing in the latest technologies, such as 5G, IoT, and cloud, which is expected to generate enormous opportunities for the IT & telecom cybersecurity market. In addition, as Bring-Your-Own-PC (BYOPC) becomes a necessity, content migration; and device management is expected to get more critical due to remote management.

This is expected to increase the number of endpoint devices, thereby fueling the adoption of unified cyber safety solutions. The cloud segment is expected to register a CAGR of 15.9% from 2025 to 2030. The shifting end-user companies' focus toward cloud-based solutions owing to minimum hardware requirements, low operating costs, and diverse solution availability is supporting segment growth. The market players are establishing strategic partnerships with cloud technology providers to develop DDoS protection solutions. For instance, in August 2021, Radware, Inc., a cyber security company, partnered with Internap Holding LLC (INAP), a hybrid IT & enterprise cloud solutions company, to deploy its DDoS protection and Cloud Web Application Firewall (WAF) for client companies across the globe.

Cyber Security Market Report Highlights

The hardware segment is expected to exhibit a high growth rate of 11.7% over the forecast period. Hardware assists organizations in upgrading their IT security by enabling real-time monitoring of threats and offering protection by preventing threats from entering computing systems, supporting the adoption of hardware solutions

The cloud security segment is anticipated to register a CAGR of more than 15.9% from 2025 to 2030. Increasing adoption of cloud technologies and remote workforces is propelling the growth of cloud security solutions

The IDS/IPS segment is expected to register a CAGR of around 13.4% over the forecast period. The increasing spending on IT security and proliferation of network security products is propelling the segment growth

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. The rising concern of cyber threats and the availability of low-cost cyber security solutions are propelling the segment growth

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. Healthcare is an appealing target for cyber-attacks as medical data is more valuable than credit card or banking information. In addition, the recent digital transformation of the healthcare industry has increased the frequency of cyber-attacks. Due to this, the market is witnessing growing demand in the healthcare sector

The cyber security industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The rapid digital transformation, increasing public & private investment in cyber security solutions, and significant penetration by global market players are driving the growth of the regional market

Cyber Security Market Segmentation

Grand View Research has segmented the global cyber security market report based on offering, security, deployment, organization size, solution, end use, and region

Cyber Security Offering Outlook (Revenue, USD Billion; 2017 - 2030)

Hardware

Software

Services

Professional Services

Consulting

Governance, Risk, and Compliance (GRC)

Incident Response and Readiness

Implementation and Integration

Training & Education

Others

Managed Services

Managed Detection and Response

Managed Protection and Controls

Managed Security Functions

Others

Cyber Security Security Outlook (Revenue, USD Billion; 2017 - 2030)

Endpoint security

Cloud Security

Network Security

Application Security

Infrastructure Protection

Data Security

Others

Cyber Security Deployment Outlook (Revenue, USD Billion; 2017 - 2030)

Cloud

On-premises

Cyber Security Organization Size Outlook (Revenue, USD Billion; 2017 - 2030)

Large Enterprises

SMEs

Cyber Security Solution Outlook (Revenue, USD Billion; 2017 - 2030)

Unified Threat Management (UTM)

Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

Data Loss Prevention (DLP)

Identity and Access Management (IAM)

Security Information and Event Management (SIEM)

DDoS

Risk and Compliance Management

Others

Cyber Security End Use Outlook (Revenue, USD Billion; 2017 - 2030)

IT and Telecommunications

Retail and E-Commerce

BFSI

Healthcare

Government and Defense

Manufacturing

Energy and Utilities

Automotive

Marine

Transportation and Logistics

Others

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

North America

US

Canada

Mexico

Europe

UK

Germany

France

Russia

Asia Pacific

China

India

Japan

Australia

South Korea

Indonesia

Singapore

Malaysia

Latin America

Brazil

MEA

UAE

South Africa

KSA

Israel

Key Players of Cyber Security Market

Fortinet, Inc.

IBM Corporation

Microsoft

BAE Systems Plc

Broadcom, Inc.

Centrify Corporation

Check Point Software Technology Ltd.

Palo Alto Networks, Inc.

Proofpoint, Inc.

Sophos Ltd

Order a free sample PDF of the Cyber Security Market Intelligence Study, published by Grand View Research.

0 notes

Text

Best Commerce Solutions Company in UK: Elevating Businesses to New Heights

In the fast-evolving digital landscape, businesses in the UK require robust commerce solutions to stay competitive. The demand for seamless, scalable, and innovative commerce solutions has never been higher, as businesses seek to enhance customer experiences, streamline operations, and boost sales. Choosing the best commerce solutions company in the UK can be the difference between stagnation and exponential growth.

Understanding Commerce Solutions

Commerce solutions encompass a wide array of services designed to facilitate transactions, improve customer engagement, and optimize business processes. These include:

E-commerce Development – Designing and developing feature-rich online stores.

Payment Gateway Integration – Ensuring seamless, secure, and multiple payment options.

Customer Relationship Management (CRM) – Enhancing customer interactions and retention.

Enterprise Resource Planning (ERP) – Streamlining business operations for efficiency.

Supply Chain & Inventory Management – Optimizing logistics and stock control.

Omnichannel Solutions – Unifying online and offline sales channels for a seamless experience.

Businesses looking for the best commerce solutions company in the UK must ensure that their chosen provider can cater to their specific needs with a tailored, scalable, and future-proof approach.

Key Features of the Best Commerce Solutions Company in the UK

To stand out in a competitive market, a top-tier commerce solutions provider should exhibit the following qualities:

Innovation & Technological Expertise

The digital commerce landscape is constantly changing, with new technologies reshaping consumer expectations. The best commerce solutions company in the UK must leverage cutting-edge technologies such as AI-driven analytics, blockchain for secure transactions, and cloud-based infrastructure to provide scalable solutions.

Customization & Scalability

Every business is unique, and a one-size-fits-all approach rarely works. A superior commerce solutions provider should offer customizable solutions tailored to a business’s specific needs, allowing for seamless scaling as the business grows.

Security & Compliance

With rising cybersecurity threats and stringent regulatory requirements, security is paramount. A top commerce solutions company should ensure robust security protocols, encryption, and compliance with regulations such as GDPR and PCI DSS.

Seamless Integration

Commerce solutions should seamlessly integrate with existing business software, including CRM systems, ERP platforms, and third-party applications, ensuring smooth operations without disruptions.

Data-Driven Insights

Leveraging data analytics can drive informed decision-making. The best commerce solutions provider in the UK should offer insightful reports and analytics to help businesses refine their strategies and optimize customer experiences.

Exceptional Customer Support

Even the most sophisticated commerce solutions require continuous support and maintenance. A reliable commerce solutions company should provide 24/7 customer support, quick issue resolution, and proactive assistance.

Benefits of Choosing the Right Commerce Solutions Company

Partnering with the right commerce solutions company in the UK offers numerous advantages:

Enhanced Customer Experience – Personalized and seamless shopping experiences drive customer loyalty.

Increased Sales & Revenue – Optimized platforms lead to higher conversion rates.

Efficient Business Operations – Automated processes save time and reduce operational costs.

Competitive Advantage – Staying ahead with innovative technology fosters business growth.

Secure Transactions – Robust security measures protect customer data and transactions.

Industries Benefiting from Commerce Solutions

Commerce solutions cater to various industries, each with unique requirements:

Retail & E-commerce – Online stores, marketplaces, and omnichannel strategies.

Finance & Banking – Secure payment processing and digital transactions.

Healthcare – Online appointment bookings and telemedicine commerce.

Manufacturing – Supply chain optimization and inventory management.

Hospitality & Travel – Online bookings, reservations, and digital payments.

Choosing the Best Commerce Solutions Company in the UK

Selecting the best commerce solutions provider requires careful consideration. Here are key steps to ensure the right choice:

Define Your Business Needs

Identify your specific requirements—whether it's an e-commerce platform, CRM integration, or payment gateway solutions.

Evaluate Experience & Portfolio

Look for a company with a proven track record of delivering successful commerce solutions to businesses similar to yours.

Assess Technology & Innovation

Ensure the provider uses modern, scalable technologies that align with your business goals.

Read Client Testimonials & Reviews

Customer feedback and case studies provide insight into a company's reliability and service quality.

Consider Pricing & ROI

While cost is a factor, focus on the long-term value the solution brings to your business rather than just the initial price.

Check Support & Maintenance Services

Post-deployment support is crucial for ensuring smooth operations and handling any technical issues.

Final Thoughts

The best commerce solutions company in the UK is not just a service provider but a strategic partner in business growth. By leveraging cutting-edge technology, ensuring seamless integration, and prioritizing security, these companies help businesses enhance customer experiences, streamline operations, and drive higher revenue. Choosing the right partner can transform the way businesses operate in an increasingly digital world, ensuring success and sustainability for years to come.

0 notes

Text

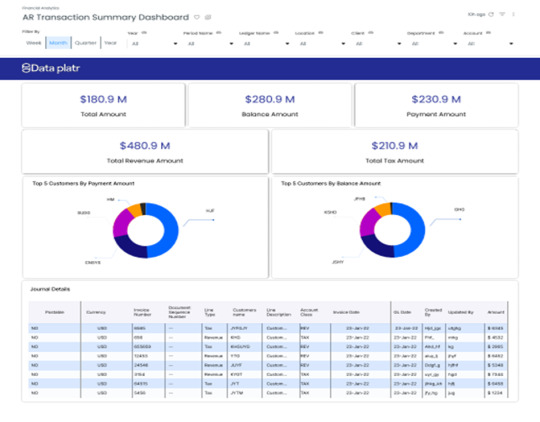

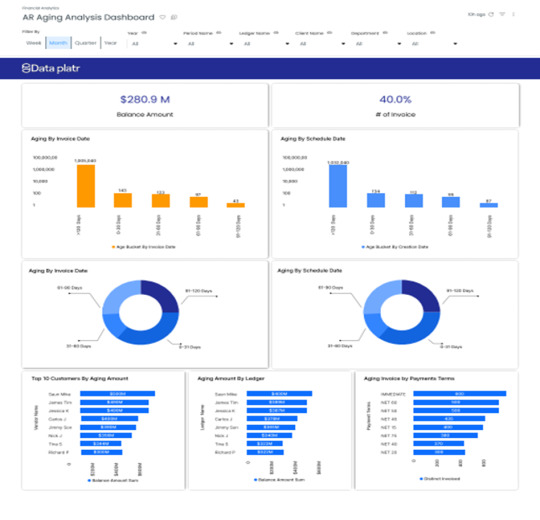

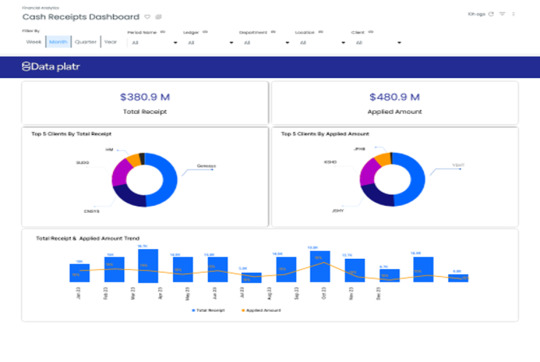

Transforming Energy Management: A Leading Clean Energy Provider’s Journey with Oracle Cloud Fusion and Dataplatr

From Oracle EBS to Oracle Fusion: Modernizing Solar Energy with Oracle Cloud Solutions

Introduction

The Company, a trailblazer in clean energy solutions, has consistently demonstrated its commitment to innovation and sustainability. As the nation’s leading residential solar energy provider, the Organization recognizes the importance of modernizing its business operations to maintain its leadership and drive further growth. By adopting Oracle Cloud Fusion, with critical facilitation by Dataplatr, the Organization embarked on a transformative journey to overhaul its Energy management systemenergy management and operational processes. This collaboration not only improved operational efficiency and scalability but also enabled advanced data integration. This article explores the journey in detail, emphasizing how these technological advancements align with the organization’s broader mission to create a sustainable future powered by clean energy.

A Leader in Clean Energy

With over one million customers and a commanding 15% market share, the Organization is at the forefront of the U.S. solar energy industry. The company’s innovative solutions, such as home solar and battery storage, have empowered households to reduce energy costs and contribute to environmental sustainability. By integrating Oracle Cloud Fusion into its operations, the Organization has aligned its technological capabilities with its mission of delivering affordable, reliable, and Clean energy. The adoption of Oracle Cloud Fusion reflects the organization’s strategic commitment to operational excellence, ensuring that its processes remain efficient, scalable, and adaptable to evolving industry demands. Additionally, the shift from Oracle EBS to Fusion Cloud demonstrates the organization’s commitment to digital transformation in energy, improving its ability to monitor and optimize operations through a cloud based energy monitoring system

The Challenge: Managing Complex Systems

Before transitioning to Oracle Cloud Fusion, the organization’s operations depended heavily on Oracle E-Business Suite (EBS) and an assortment of other legacy systems. While these systems were reliable in their time, they were not designed to handle the dynamic and evolving needs of a rapidly growing organization. As the Organization expanded its customer base, introduced new service offerings, and navigated an increasingly complex regulatory environment, the limitations of its existing infrastructure became evident.

Key Challenges

Scalability: Adapting to Rapid Growth

With over one million customers and a market share of 15% in the residential solar industry, the Organization faced unprecedented growth in transaction volumes and operational complexity.

The legacy systems, including Oracle EBS, were designed for a smaller scale and struggled to process the increasing number of transactions efficiently.

The lack of scalability not only hampered the organization’s operational efficiency but also slowed its ability to onboard new customers and deliver services promptly.

Data Integration: Fragmented Systems Leading to Inconsistencies

The reliance on multiple, disparate systems created significant data silos.

The lack of a unified data architecture meant that financial, supply chain, and customer-related information were stored in separate systems, often leading to data duplication, inconsistencies, and errors.

Decision-making suffered as teams struggled to piece together a coherent view of the company’s operations from incomplete or mismatched data sets.

Compliance and Security: Keeping Up with Modern Standards

Oracle’s decision to discontinue support for older EBS versions posed a serious challenge for the organization. Without ongoing updates, the systems were vulnerable to security threats and non-compliance with evolving regulations.

Staying compliant with financial reporting standards, such as ASC 606, became increasingly labor-intensive, as legacy systems lacked the automation capabilities required to streamline these processes.

The manual effort to ensure compliance diverted resources from more strategic initiatives and increased the risk of human error.

Innovation Stagnation: A Barrier to Strategic Goals

Legacy systems were not equipped to support the organization’s innovative business model, including its subscription-based offerings and complex revenue recognition needs.

The inability to easily adopt new functionalities or integrate with modern tools limited the organization’s ability to innovate and stay competitive in a rapidly changing market.

Necessity for Change

These challenges underscored the urgent need for a modern, cloud-based solution that could scale with the organization’s growth, integrate data across all functions, and streamline compliance processes. By transitioning from Oracle EBS to Fusion Cloud, the Organization aimed to:

Scale operations seamlessly to support its growing customer base.

Break down data silos to enable real-time insights and unified decision-making.

Ensure compliance with modern standards while improving system security.

Foster innovation by leveraging advanced tools and technologies that align with its strategic goals.

The transition was not merely a technological upgrade but a strategic imperative to future-proof the organization and maintain its leadership in the clean energy sector. This shift enabled the Organization to address the operational bottlenecks of its legacy systems and set the stage for sustainable growth and innovation through Oracle EBS to Cloud Migration.

Why Oracle Cloud Fusion?

The organization’s decision to transition from Oracle EBS to Fusion Cloud was driven by the platform’s robust capabilities and alignment with the company’s need for a modern, scalable, and integrated system. The comparison of Oracle EBS vs Oracle Fusion Cloud made it evident that Fusion Cloud offered superior flexibility, automation, and security to meet the company’s evolving demands. Oracle Cloud Fusion, a comprehensive SaaS (Software-as-a-Service) solution, provided the flexibility and functionality required to meet the organization’s current operational needs and future growth objectives.

Unified Operations

Oracle Cloud Fusion excels in unifying key business processes, allowing organizations to manage financials, supply chain operations, and customer experience seamlessly on a single platform. For the organization, this integration was transformative, enabling the company to eliminate silos between departments and achieve a cohesive operational ecosystem. By centralizing these critical functions, the Organization can now focus on streamlining workflows, enhancing collaboration, and improving overall operational efficiency.

Real-Time Analytics

One of the standout features of Oracle EBS to Fusion Cloud is its ability to provide advanced reporting and analytics in real time. For the company, operating in a fast-paced and data-driven environment, access to real-time data insights is crucial for informed decision-making. With Oracle’s analytics tools, the organization’s leadership can monitor key performance indicators (KPIs), track financial health, and gain actionable insights to address challenges proactively and seize growth opportunities.

Automated Updates

Managing and maintaining legacy systems often demands significant IT resources to handle upgrades and patches. Oracle Cloud Fusion alleviates this burden by delivering automated software updates, ensuring that the Organization always has access to the latest features, performance enhancements, and security measures. This eliminates downtime associated with manual upgrades and allows the organization’s IT team to focus on more strategic initiatives rather than routine maintenance.

Enhanced Security

As a cloud-based platform, Oracle Cloud Fusion is equipped with state-of-the-art security features that ensure data integrity and protect against emerging cyber threats. This is particularly important for the organization, which deals with sensitive customer data, financial records, and operational information. Oracle Cloud Fusion’s compliance with regulatory standards and its built-in security protocols provide the Organization with the peace of mind needed to operate confidently in a digital-first environment.

Cost Efficiency

Transitioning from an on-premises infrastructure to a cloud-based solution significantly reduced the organization’s operational costs. Oracle Cloud Fusion eliminates the need for costly hardware, data center maintenance, and IT labor associated with managing on-premises systems. Additionally, the predictable subscription-based pricing model allows the Organization to better allocate resources and optimize its budget for growth-oriented initiatives.

Scalability and Flexibility

The organization’s rapid growth and evolving business model necessitate a system that can scale and adapt to changing requirements. Oracle Cloud Fusion’s modular architecture and cloud-native design make it easy to add new features, integrate additional business units, or expand to support new markets. This flexibility ensures that the organization’s technological capabilities can grow in tandem with its business.

Positioned for Long-Term Success

By adopting Oracle EBS to Fusion Cloud, the Organization has resolved many of the operational challenges that hindered its growth under legacy systems. The transition has empowered the Organization with the tools to operate more efficiently, adapt to market demands, and achieve its strategic objectives. Oracle Cloud Fusion serves not only as a solution for today’s challenges but also as a foundation for future innovation and success.

This comprehensive adoption of oracle cloud for renewable energy demonstrates how a leading clean energy provider has leveraged cutting-edge technology to reinforce its position as a leader in clean energy. The decision to partner with Oracle underscores the organization’s commitment to operational excellence and its vision of driving sustainable growth.

The Role of Dataplatr: Facilitating the organization’s Seamless Transition to Oracle Cloud Fusion

Dataplatr emerged as a pivotal partner in the organization’s ambitious migration to Oracle Cloud Fusion, bridging the gaps between legacy systems and the advanced capabilities of modern cloud infrastructure. By leveraging its expertise in data integration and transformation, Dataplatr played a fundamental role in ensuring that the organization’s transition was seamless, efficient, and strategically aligned with its business objectives.

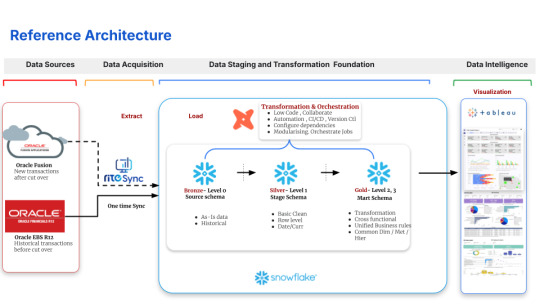

The complexity of integrating the organization’s existing systems, including Snowflake and Salesforce, with Oracle Cloud Fusion required a sophisticated approach. Dataplatr met this challenge by implementing advanced tools, such as RiteSync, to streamline and automate critical processes. This ensured that the Organization could continue its operations without interruptions during the migration, while also enabling long-term scalability and enhanced functionality.

RiteSync: Enabling Seamless Data Synchronization and Transformation

RiteSync is a cornerstone of the Organization’s data integration strategy, playing a pivotal role in streamlining backend transformations and automating data ingestion into Snowflake. Its capabilities include:

Real-Time and Historical Data Sync

RiteSync facilitates continuous real-time data synchronization from Oracle Cloud Fusion while managing one-time historical data migrations from Oracle EBS to Fusion Cloud. This ensures seamless integration across platforms.

Automation and Efficiency

With low-code automation, RiteSync eliminates manual intervention in data synchronization, reducing errors and speeding up processes. It handles complex concatenation and mapping tasks effortlessly, ensuring data consistency.

Data Transformation

The tool efficiently handles data cleansing, mapping, and standardization, converting legacy data formats to Oracle Cloud standards. This ensures a smooth data flow into Snowflake and Tableau for analytics and reporting.

Enhanced Monitoring

RiteSync’s intuitive dashboards, such as the Sync Monitor, allow users to track synchronization status, data volume, and any errors in real-time, enabling proactive resolution.

Connections Selection and Creation

RiteSync provides an intuitive interface to create and manage connections with Oracle ERP Cloud and other platforms. The connection setup process includes defining a unique identifier that cannot be modified later, alongside editable fields such as the connection name and keywords for easier identification. Additionally, users can assign specific roles to the connection, which dictate its behavior and functionality within integrations.

Available Adapters

RiteSync supports a wide range of adapters to enable seamless integration across different systems. These include adapters for MS-SQL Database, Oracle Database, Oracle ERP Cloud, Oracle WMS Cloud, AWS S3 (Bucket), and Snowflake. This flexibility ensures that organizations can connect disparate systems effortlessly, creating a unified data ecosystem.

Sync Monitor – Financials and Expenses

The Sync Monitor extends its capabilities to financial and expense modules, delivering a detailed view of relevant objects such as chart of accounts, financial reports, and payment modules. By providing this granular visibility, RiteSync empowers users to ensure accurate and efficient synchronization of critical financial data.

Sync Monitor – General Ledger

The Sync Monitor provides a comprehensive overview of synchronized application objects within the General Ledger module. It highlights key objects such as GL_ACCESS_SET_LEDGERS and GL_ACCOUNT_GROUP_DETAILS, showcasing their synchronization status. This feature also tracks sync frequency, the volume of selected objects, and associated data sizes, offering clear insights into data operations.

Transaction Overview

RiteSync includes a transaction logging feature that records detailed information about synchronization processes. This includes the MasterSync Request ID, table names, load status (e.g., PROCESSED), and timestamps for creation and last updates. These logs cover modules like currencies, assets, and expenses, providing a transparent record of data synchronization activities.

Dashboard Overview

The RiteSync dashboard offers a bird’s-eye view of system performance, highlighting key metrics such as processed, unprocessed, and error counts. Modules like the job scheduler and exception reports are prominently displayed, enabling users to monitor and resolve issues proactively. This centralized view simplifies system management and enhances operational efficiency.

RiteSync is integral to the organization’s transition to Oracle Cloud Fusion, ensuring seamless integration and real-time synchronization between legacy systems and modern platforms like Snowflake. Its robust capabilities enhance data accuracy, operational efficiency, and scalability, aligning with the organization’s vision of driving sustainable growth and innovation through technological excellence.

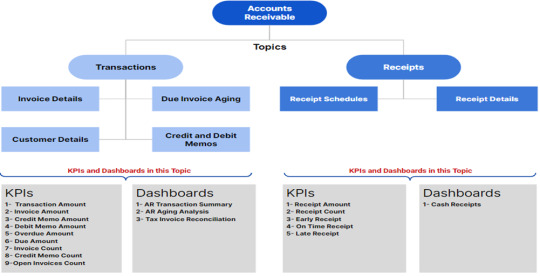

Reference Architecture