#uae food bank

Explore tagged Tumblr posts

Text

the saudi-controlled "yemeni" government of the south is putting sanctions on north yemen/ansarallah/houthis due to their opposition to the genocide israel is committing and because of their maritime blockade against the settler colony and its allies.

south yemen is effectively occupied by saudi arabia and the united arab emirates, and has been for years. this "government" is comprised of traitorous scum who sold out the yemeni people for the chance to hide in their saudi mansions while 20 million yemenis live in food insecurity. ansarallah is the only government in the region that has opposed western capitalism, genocide, and american hegemony and now its people are expected to pay the price. the saudi-controlled government of aden has stated that if yemeni banks in north yemen do not move their operations to south yemen, they will be charged with counter-terrorism financing and money laundering claims. mind you, 70-80 percent of yemen's population lives in north yemen, aka the ansarallah/houthi government territories.

these sanctions and charges will kill millions of yemenis, all because saudi's dick riding america. they are accomplices in this genocide against the palestinians. glory to the palestinian resistance and glory to ansarallah. boycott the uae, boycott saudi arabia, boycott israel, its the least you can fucking do while our people pay the price of militarily opposing genocide.

and, as a reminder, saudi arabia is one of the biggest purchasers of arms from the united arab emirates, their ally in the occupation and destabilization of yemen. the same united arab emirates committing massacres in sudan, the same country which is making it so that soon 10,000 sudanese people will be dying daily, the same country profiting off of this by stealing sudanese metals, such as gold. this is the united arab emirates that is destroying socotra island (yemen) and exploiting the people for tourism. stop taking trips to fucking dubai.

#🩷 — chats with amora#🌷 — politics#hands off yemen#free palestine#glory to the resistance#glory to the martyrs#palestine#israel is a war criminal#israel is evil#israel is an apartheid state#yemen#eyes on yemen#eyes on sudan#eyes on rafah#sudan#ansarallah#axis of resistance#houthis#red sea blockade#gaza genocide#united arab emirates#saudi arabia#ksa

40 notes

·

View notes

Text

Palestine summary for March 16 to March 28, 2024. (From "Lets Talk Palestine" broadcast channel). Quote.

March 16, 2024.

Day 162

• 1st aid shipment departing Cyprus arrived in Gaza yesterday carrying 200 tons of food, marking 1st Gaza sea shipment since 2005 + planned 2nd ship coordinated by US, UAE, Spain & Japan; but unclear on distribution of aid across Gaza

• Massacre in central Gaza as Israel destroys home, killing 36 Palestinians, incl. kids & pregnant women

🔻 Senior Hamas & Houthi officials hold rare meeting to discuss coordinated action against an Israeli Rafah ground invasion

• Israeli settlers attack homes in Nablus (West Bank), throwing stones & shooting the air + 20 Palestinians abducted in West Bank, incl. some released in Nov. hostage exchange deal

• Palestinian Authority (PA) president Abbas accuses Hamas of causing “return of Israeli occupation of Gaza”, essentially blaming Hamas for the ongoing genocide. Was prompted by Hamas criticism of ‘unilateral’ appointment of new PM of the PA (see our last broadcast)

• 63 Palestinians killed, 112 injured in Gaza in past 24 hours

March 17, 2024.

Day 163

🇺🇸 NBC: Biden frustrated over drop in poll numbers in swing states Michigan & Georgia due to his handling of Gaza genocide. Shouting and swearing in a White House meeting, saying he’s doing what is right

• 19 aid trucks arrive in north Gaza — first convoys to reach the north without incident in 4 months. But aid remains scarce as Israel keeps blocking entry of aid as trucks pile outside Rafah crossing + rate of malnutrition among children under 2 in north doubles in past month

• 14th Palestinian dies since Oct 7 in Israeli prison following multiple allegations of extreme abusive conditions for Palestinian hostages

🇪🇺 EU President condemns an Israeli Rafah invasion, joining countless nations to do so like the US & Arab countries

• Israeli forces abduct 25 Palestinians, incl. a woman with cancer from Gaza & a child in overnight raids in West Bank

• 92 Palestinians killed, 130 injured in Gaza in past 24 hours

(No specific summary for March 18)

March 19, 2024.

Day 165

🇨🇦 Canada to halt all further arms exports to Israel in support of ceasefire and 2-state “solution”, recognizing ICJ ruling. This came after a non-binding parliamentary resolution which called for ending arms sales. But resolution’s language was watered down during amendment, denoting Hamas as a “terror organization” + removing call to sanction Israeli officials

• 93 Palestinians killed, 142 injured in Gaza in past 24 hours

• Israel escalates attacks across Gaza with 1 attack on Rafah killing 14 Palestinians + ongoing raid of al-Shifa hospital killed & injured dozens

• Israel issued 100,000 new gun licenses to Israeli’s since Oct 7 out of the 299,354 applications

• Israel massacred aid distribution committee at Kuwaiti roundabout (north Gaza), killing at least 23 people

• Israeli settlers, w/ ongoing genocide as a distraction, accelerated building of 18 new illegal roads + 15 outposts (unauthorized settlement illegal under Israeli law) in West Bank since Oct

March 20, 2024.

Day 166

• 104 Palestinians killed, 162 injured in Gaza in past 24 hours

🇺🇸 Reuters: US Congress & White House reach deal on funding bill that includes blocking UNRWA donations until March 2025, based on Israel’s unverified allegations

🏥 IOF siege on al-Shifa hospital enters 3rd day, as forces surround the complex trapping hundreds inside & block rescue efforts

• 8 Israeli attacks kill 100+ aid workers in 1 week + IOF massacred 23 aid seekers in north Gaza

🚢 Israel Hayom: Israel plans to buy port in Cyprus amid fears of Haifa port closure from Hezbollah strikes, hindering military & commercial imports

⚓️ Israel’s Eilat port will fire half its employees due to Red Sea blockade

• Israeli High Court approves demolition of a Palestinian’s home for carrying out a non-lethal resistance operation in West Bank; marking first authorized home demolition by court for an operation without fatalities — an escalation in Israeli repression

🇸🇦 Saudi Arabia pledges $40m to UNRWA

March 21, 2024.

Day 167

• As Arabs celebrate Mother's Day today, we remember that on average 37 mothers are exterminated everyday in Gaza, meanwhile mothers from Gaza make up 28 of the 67 female detainees in Israeli prisons

• 65 Palestinians killed, 92 injured in Gaza in past 24 hours

🏥 Israel continues 4th day siege on al-Shifa Hospital, killing 140+ Palestinians & abducted 600 people, incl. medical staff. 13 patients killed as Israel cut off electricity, depriving oxygen, medicine & food

• 18-year-old Ubai Abu Maria abducted by Israeli forces in West Bank for 7th time, impeding treatment for bullet wound requiring surgery

• Poll finds 71% of Palestinians in Gaza & West Bank support Hamas's Oct 7 resistance operation; compared to poll 3 months ago, support among West Bank residents dropped by 11% but amongst Gazans rose by 14%

• Israel ordered 25 patients receiving care in West Bank to return to Gaza. They're among the 400 patients from Gaza who were left stranded in West Bank after Oct 7

March 22, 2024.

🚨Russia & China veto US UN Security Council ceasefire resolution

The resolution showed a shift: US had vetoed every ceasefire proposal, most recently Algeria’s as the US opposed language of “immediate” ceasefire, preferring “humanitarian pause”. But now the US draft states “the imperative of an immediate and sustained ceasefire”.

The problem? It’d last only 6 weeks, is conditional on release of Israeli hostages, and condemns both Hamas’ op & the Houthi naval blockade. The wording of “determines the imperative” is also weak, implying the importance of a ceasefire, not demanding one.

The result? It wouldn’t obligate Israel to end the genocide + let it continue on the pretext that there’s no “acceptable” hostage deal.

It was vetoed by 🇷🇺 & 🇨🇳 who said it’d let Israel continue attacks & invade Rafah. Algeria also voted against it.

10 states are planning alternative resolution calling for Ramadan ceasefire, including but not conditioned on release of Israeli hostages. US likely to veto.

Day 168 - IMPORTANT

• Gaza death toll surpasses 32,000 not including the thousands buried under rubble

‼️ Israel seized 1,977 acres of West Bank land for settlements, the largest land theft since 1993

🇺🇸 Congress passes bill that bans funding to UNRWA until 2025; expected for Senate to pass before midnight deadline

🏥 Israel’s siege on Shifa Hospital enters 5th day as they bomb & demolish buildings with bulldozers; abducting 240+ patients & 10 medical staff from radiology unit. IOF forces ordered trapped patients to surrender despite continuous heavy gunfire

• 50 Palestinians abducted incl. 4 kids during 60+ Israeli military raids across West Bank in 2 days. Marking March 20 “one of the deadliest nights recorded to date” in 2024 in West Bank w/ 7+ Palestinians killed. Israeli settlers also took over 20+ Palestinian residential structures

• UN aid mission to north Gaza for 7,500 people was denied by Israel

🇫🇮 Finland to resume UNRWA funding

March 24, 2024.

Day 170

🚨 Israeli forces lay siege to 3 hospitals, surrounding al-Amal Hospital forcing Palestinians to strip naked & leave; currently carpet bombing near Nasser Hospital & sniping anyone moving, while continuing aggressive 7-day seige on al-Shifa

• 84 Palestinians killed, 106 injured in Gaza in past 24 hours

• Israel denied thousands of Christians from West Bank entry to Jerusalem on Psalm Sunday, heightening military checkpoints. Israel’s apartheid system discriminates Palestinians’ freedom of movement, requiring permits for West Bank residents to enter, which is rarely granted. More info on Israeli apartheid: https://rb.gy/vjocrd + checkpoints: https://rb.gy/rabxt6;

• Israel to deny all UNRWA aid convoys to north Gaza, despite 70% of population subject to “catastrophic starvation”

• BDS launches boycott of tech company Intel due to its $25bn investment in new factory in Israel, the “largest investment ever”; on top of Intel’s $50bn+ investments in Israel in past 50 years

March 25, 2024.

UNSC CEASEFIRE MOTION PASSES

For the 1st time the Security Council managed to pass a ceasefire resolution. The US abstained while all 14 others voted yes

The US planned to veto if it didn’t mention the hostages so it “demands an immediate ceasefire for the month of Ramadan respected by all parties leading to a permanent sustainable ceasefire, and also demands the immediate and unconditional release of all hostages.”

But it doesn’t condition the ceasefire on a hostage swap the way done by the US draft that got vetoed by 🇷🇺 & 🇨🇳

It doesn’t condemn Hamas explicitly as the US wanted but it “deplores” all attacks against civilians & “all acts of terrorism” noting that it’s illegal to take hostages under int’l law. So it’s indirect condemnation

It expresses deep concern “about the catastrophic humanitarian situation in the Gaza Strip,” calling for more efforts for more aid & to protect civilians. This is weak language

Better than nothing but not enough as people are slaughtered & raped.

Day 171 — Attacks on 3 hospitals

🚨 Israel escalates attacks on “safe zone” Rafah killing 30+, including women and children amid threats of looming ground invasion

• 107 Palestinians killed, 176 injured in past 24 hours

🏥 22,000 displaced Palestinians face worsening conditions in the European Hospital, one of the last functioning in Gaza, overcrowded with patients awaiting critical care

🏥 Israeli forces lay siege to further hospitals in Khan Younis forcing critically ill patients to evacuate the premises surrounded by complete destruction

🏥 Israeli forces open fire on medical staff forced to evacuate al-Amal Hospital amid continuous attacks on the premise leaving patients in critical condition, deprived of medical supervision

• Netanyahu cancels Israeli delegation trip to US over its abstention in today’s UNSC vote, calling it a departure from their long-standing support of Israel. Biden called the move “disappointing”

• Israeli assaults targeting homes in central Gaza kill 18

(No march 26 summary)

March 27, 2024

Day 172

🚨 Gaza Gov’t Media Office demands end to aerial aid drops after one today killed 6 & caused 12 to drown in north Gaza

• 81 Palestinians killed, 93 injured in the last 24 hours

🇯🇴 100+ protesters arrested & teargassed outside Jordan’s Israeli embassy amid demands to end Jordan’s military & economic ties with Israel

🇧🇪 Brussels City Council passes motion to ban council purchases of products from Israeli settlements in the West Bank on the basis of international law violations

• Israel bombs residential building in Rafah, killing 15+ displaced Palestinians incl. 4 kids. Analysts say the Rafah bombings mark the start of a “silent” invasion

🏥 Ongoing Israeli attacks on Shifa Hospital kill 30+ people incl. a family living in a residential building near the besieged complex

• IOF abducts 30 Palestinians in overnight raids in West Bank cities

🇱🇧 Israeli airstrike in eastern Lebanon kills 2 people, an escalation as the bombing was far from south Lebanon, the usual battleground

March 28, 2024.

Day 173

🇮🇪 Ireland to follow Nicaragua and join South Africa’s ICJ case against Israel

• Israeli attacks on residential homes in Rafah kill 25 displaced Palestinians, incl. multiple children

• 76 Palestinians killed, 102 injured in the last 24 hours

• IOF kills 4 in central Gaza, forcefully burying them by bulldozers

🇺🇸 US state department report claims Israel is complying with international law, as US reviewed Israeli usage of US weapons in order to validate future arms exports

🇱🇧 Israeli attacks on southern Lebanon residencies kill 12 in past 24 hours with many still trapped under the rubble

• Two aid seekers remain in critical condition as Israeli snipers target the Kuwait Roundabout aid distribution point

🇺🇸 Poll: 55% of Americans disapprove of Israel’s actions in Gaza — a 10% increase from November’s poll

• Israeli drone attack kills 8 in West Bank; IOF abducts 20 Palestinians in overnight raids

44 notes

·

View notes

Text

by Judith Miller

Last fall, Egypt was on the brink of economic collapse. A decade of debt-fueled spending on a pharaonic-scale had emptied its Central Bank coffers. By February, Cairo’s public debt was 89% of its gross domestic product. External debt had soared to 46% of GDP. The pound, its currency, was one of the world’s worst performing. Unable to import supplies and repatriate profits, foreign companies were leaving, or threatening to leave Egypt in droves. Annual inflation was over 35%, and double that for some food staples. Egypt seemed on the verge of a sovereign default—its first ever.

Then came Oct. 7.

Officials, businessmen, and financial analysts say that however horrific the war has been for Israelis and for Palestinians in Gaza, Oct. 7 has helped save Egypt from economic ruin and growing political unrest. To be sure, Egypt is paying heavily for the ongoing Israel-Hamas war on its border. Its three main sources of revenue—hard currency from the Suez Canal, tourism, and remittances from Egyptian workers abroad—have plummeted by between 30% and 40%. But without Hamas’ horrific massacre, which killed 1,200 people and took another 240 hostage, and Israel’s much criticized retaliation in Gaza, Egypt would probably not have gotten the international financial lifeline that has rescued it yet again from economic ruin, just in time.

“Just after the attack, the government began strategizing, successfully it’s turned out, about how to use the crisis to secure a bailout,” said Ahmed Aboudouh, an Egyptian expert at Chatham House, a London-based think tank. “Oct. 7 helped save Egypt’s economy, at least temporarily.”

Last February, the Abu Dhabi Developmental Holding Company (ADQ), Abu Dhabi’s sovereign wealth fund, unveiled plans to develop a city by the sea on part of the 65-square-mile peninsula of Ras el-Hekma, one of the few undeveloped areas on the Mediterranean coast, part of a sale worth $35 billion in investment and debt relief, the largest foreign direct investment deal in Egyptian history. Egypt will retain a 35% stake in the project. Since Sheikh Tahnoun bin Zayed al-Nahyan, the chairman of ADQ, is Emirati President Mohammed bin Zayed al-Nahyan’s brother and the UAE’s national security adviser, the Ras el-Hekma purchase was far more than a financial transaction. It was part of an Egyptian bailout.

Egyptians bristle at the loss of their nation’s diplomatic clout. By reviving its regional profile, Oct. 7 has bestowed another gift on Egypt.

Then in March, Cairo secured a critical $8 billion loan from the International Monetary Fund, with strong American support. The IMF infusion, in turn, opened other foreign faucets. The European Union promptly agreed to provide another $8 billion in grants and loans, ostensibly to help Egypt’s economy, but in reality, to assure Egypt’s help in preventing Arab and African migrants from reaching European shores. In total, the IMF, Europe, and the Gulf have now poured well over $50 billion of foreign currency into Egypt’s cash-strapped coffers. “The U.S., Europe, and the Gulf clearly agreed that the Sissi government could not be permitted to fail,” said Steven Cook, an expert on Egypt at the New York-based Council on Foreign Relations. “Geopolitics has taken over.”

Only months before, the IMF had not completed the review of Egypt’s loan agreement approved in December 2022, thereby withholding a tranche of the $3 billion rescue package, as the government had failed to deliver on agreed benchmarks. While the fund attributed its about-face in March to the increasing damage being done to Egypt’s economy by the Israel-Hamas war—or what it euphemistically called a “more challenging external environment”—absent American pressure on the fund and on Egypt to agree belatedly to financial reforms it had previously rejected, the IMF loan and even the Ras el-Hekma deal would not have gone through. Since Washington is the fund’s largest shareholder with a 16.5% stake, it holds sway over its key lending decisions.

The Biden administration, too, was obviously unwilling to risk the economic collapse and political destabilization of the Arab Middle East’s largest country and the first Arab state to make peace with neighboring Israel in the midst of one of the region’s deadliest wars in modern history and with other conflicts around it still raging—especially since Egyptian mediation with Hamas was crucial to White House policy. “Egypt has proven, yet again,” said Aboudouh, “that it is, as its elite believes, too big to fail.”

7 notes

·

View notes

Text

6 October 2024: King Abdullah II and United Arab Emirates President Sheikh Mohamed bin Zayed Al Nahyan held talks that covered the deep-rooted ties between the two countries, as well as regional developments.

During the talks, attended by Crown Prince Hussein, the two leaders affirmed the depth of Jordanian-Emirati relations, as well as keenness to consolidate them to serve mutual interests, and strengthen joint Arab action.

His Majesty and the UAE president witnessed the signing of the Comprehensive Economic Partnership Agreement between the two governments, which aims to enhance economic, trade, and investment relations, create jobs, improve supply chains, and accelerate the growth of priority sectors.

The two leaders stressed the importance of the agreement, which is the result of fruitful economic relations as it provides a broad base of opportunities for future development.

The King expressed hopes that the agreement would contribute to implementing the two countries' shared vision toward sustainable development and economic prosperity, and opening new horizons for economic integration, commending the UAE’s support for Jordan's development efforts.

For his part, Sheikh Mohamed welcomed the signing of the agreement, which is the UAE's first with an Arab country, citing the agreement as a natural development of the brotherly and strategic relations between the UAE and Jordan.

The two leaders also witnessed the signing of the Customs Cooperation and Mutual Administrative Assistance Agreement, signed by the two governments.

The talks also covered areas of bilateral cooperation in economy, investment, sustainable development, food security, and renewable energy, with both leaders expressing keenness to build strategic economic partnerships.

On regional developments, the two leaders stressed the need to step up Arab and international efforts to stop the war on Gaza and Lebanon, protect civilians, and de-escalate the situation in the region.

The two leaders reiterated their firm position in support of the unity, sovereignty, and security of Lebanon, and their support for the Lebanese people.

The talks also focused on ways to step up the humanitarian response to the catastrophe in Gaza.

His Majesty warned of the consequences of continued attacks by extremist Israeli settlers on Palestinians in the West Bank and violations of Muslim and Christian holy sites in Jerusalem.

The two leaders reaffirmed their full support for the Palestinians in achieving their legitimate rights, and working to find a political horizon to achieve just, comprehensive, and lasting peace, on the basis of the two-state solution.

Sheikh Mohamed praised Jordan's historic role in supporting the Palestinian people on various levels, voicing appreciation of the Kingdom's support for the humanitarian response in the Gaza Strip.

Prime Minister Jafar Hassan, Deputy Prime Minister and Foreign Minister Ayman Safadi, Director of the Office of His Majesty Alaa Batayneh, Minister of Industry, Trade, and Supply Yarub Qudah, General Intelligence Department Director Maj. Gen. Ahmad Husni, Jordan’s Ambassador to the UAE Nassar Habashneh, and a number of officials attended the talks.

From the Emirati side, Sheikh Hazza bin Zayed Al Nahyan, deputy ruler of Abu Dhabi; Sheikh Hamdan bin Mohamed bin Zayed Al Nahyan; Sheikh Mohammed bin Hamad bin Tahnoun Al Nahyan, adviser for special affairs at the Ministry of the Presidential Court; and a number of officials attended the talks.

The King and the Crown Prince bid farewell to Sheikh Mohamed bin Zayed Al Nahyan at Marka Airport, as he and his accompanying delegation concluded their visit to Jordan on Sunday evening.

2 notes

·

View notes

Text

Holidays 8.28

Holidays

Bow Tie Day

Crackers Over the Keyboard Day

Criminal Appreciation Day

Crumbs Between the Keys Day

Dream Day Quest and Jubilee

828 Day

Emerati Women’s Day (UAE)

Emmett Till Day

End of the Fairy Tale Day

Giving Black Day (a.k.a. Give 828)

Gone-ta-Pott Day [every 28th]

Green Shirt Guy Day

I Have a Dream Day

International Read Comics in Public Day

Manifest 828 Day

Mariamoba (Republic of Georgia)

National Bow Tie Day

National Grandparents Day (Mexico)

National Over It Day

National Power Rangers Day

National Thoughtful Day

Nativity of Nephthys (Egyptian Goddess of Love)

Race Your Mouse Around the Icons Day

Radio Commercial Day

Rainbow Bridge Remembrance Day

Russian Germans Day (Germany)

Scientific American Day

Significant Historical Events Day

Tan Suit Day

Watermelon Day (French Republic)

World Day of Turners Syndrome

Food & Drink Celebrations

National Cheese Sacrifice Day

National Cherry Turnover Day

National Red Wine Day

Stuffed Green Bell Peppers Day

Subway Sandwich Day

4th & Last Monday in August

Araw ng mga Bayani (National Heroes’ Day; Philippines) [Last Monday]

August/Summer Bank Holiday (UK) [Last Monday]

International Day of Cyber Attack Ceasefire [Last Monday]

Liberation Day (Hong Kong) [Last Monday]

Motorist Consideration Monday [Monday of Be Kind to Humankind Week]

Notting Hill Carnival (UK) [Last Monday & day before]

Social Justice Day (Antarctica) [4th Monday]

Independence Days

Holy Empire of Reunion (Declared; 1997) [unrecognized]

Luana (Declared; 2019) [unrecognized]

Moldova (from USSR; 1991)

Ohio Empire (Declared; 2008) [unrecognized]

Feast Days

Alexander of Constantinople (Christian; Saint)

Assumption of the Blessed Virgin Mary (Abkhazia)

Augustine of Hippo (Christian; Saint) [brewers] *

Ayyankali Jayanti (Kerala, India)

Constant Troyon (Artology)

Edmund Arrowsmith (Christian; Saint)

Edward Burne-Jones (Artology)

Feast of the Mother of God (Georgia, Macedonia, Serbia)

Festival for Luna (Ancient Rome)

Festival for Sol (Ancient Rome)

Festival of the Neon Revolution

First Onam (Rice Harvest Festival; Kerala, India)

Frank Gorshin Day (Church of the SubGenius; Saint)

Hermes of Rome (Christian; Saint)

Julian (Christian; Saint)

Junipero Serra (Christian; Saint)

Marimba (Virgin’s Assumption; Georgia)

Mariotte (Positivist; Saint)

Media Aestas III (Pagan)

More Rum Day (Pastafarian)

Moses the Black (Christian; Saint)

Uncle Norton the Elephant (Muppetism)

Lucky & Unlucky Days

Sensho (先勝 Japan) [Good luck in the morning, bad luck in the afternoon.]

Umu Limnu (Evil Day; Babylonian Calendar; 40 of 60)

Premieres

Animal Crackers (Film; 1930)

Cain's Jawbone, by E. Powys Mathers (Novel/Puzzle; 1934)

Come Clean, by Puddle of Mudd (Album; 2001)

The Count of Monte Cristo, by Alexandre Dumas (Novel; 1844)

Do the Evolution, by Pearl Jam (Animated Music Video; 1998)

54 (Film; 1998)

Flying Leathernecks (Film; 1951)

Gallipoli (Film; 1981)

Get Rich Quick Porky (WB LT Cartoon; 1937)

Honeymoon in Vegas (Film; 1992)

I Have a Dream, by Martin Luther King Jr. (Speech; 1963)

Let’s Get It On, by Marvin Gaye (Album; 1973)

Lohengrin, by Richard Wagner (Opera; 1850)

Mary of Scotland (Film; 1936)

Mickey’s Follies (Disney Cartoon; 1929)

Mighty Morphin Power Rangers (TV Series; 1993)

Narcos (TV Series; 2015)

The New Mutants (Film; 2020)

Perri (Disney Film; 1957)

Personal, 19th Jack Reacher book, by Lee Child (Novel; 2014)

Phineas and Verb the Movie: Candace Against the Universe (Animated Film; 2020)

Private Lessons (Film; 1981)

Q. Are We Not Men? A: We Are Devo!, by Devo (Album; 1978)

Rope (Film; 1948)

Smile, by Katy Perry (Album; 2020)

Song of the Thin Man (Film; 1947)

Studio 54 (Film; 1998)

Tease for Two (WB LT Cartoon; 1965)

Travelling Without Moving, by Jamiroquai (Album; 1996)

The Truth About Mother Goose (Disney Cartoon; 1957)

Twin Peaks: Fire Walk with Me (Film; 1992)

Victoria (TV Series; 2016)

Walk This Way by Aerosmith (Song; 1975)

Yankee Doodle Bugs (WB LT Cartoon; 1954)

Today’s Name Days

Adelinde, Aline, Augustin (Austria)

Augustin, Tin (Croatia)

Augustýn (Czech Republic)

Augustinus (Denmark)

August, Gustav, Kustas, Kustav, Kusti, Kusto (Estonia)

Tauno (Finland)

Augustin, Elouan (France)

Adelinde, Aline, Augustin, Vivian (Germany)

Damon (Greece)

Ágoston (Hungary)

Agostino, Ermete (Italy)

Auguste, Guste, Ranna (Latvia)

Augustinas, Patricija, Steigvilė, Tarvilas (Lithuania)

Artur, August (Norway)

Adelina, Aleksander, Aleksy, Augustyn, Patrycja, Sobiesław, Stronisław (Poland)

Augustín (Slovakia)

Agustín (Spain)

Fatima, Leila (Sweden)

Agustin, August, Augusta, Augustina, Austen, Austin, Austina, Austyn, Gus, Gustava, Gustavo (USA)

Today is Also…

Day of Year: Day 240 of 2024; 125 days remaining in the year

ISO: Day 1 of week 35 of 2023

Celtic Tree Calendar: Coll (Hazel) [Day 21 of 28]

Chinese: Month 7 (Geng-Shen), Day 13 (Wu-Wu)

Chinese Year of the: Rabbit 4721 (until February 10, 2024)

Hebrew: 11 Elul 5783

Islamic: 11 Safar 1445

J Cal: 30 Hasa; Nineday [30 of 30]

Julian: 15 August 2023

Moon: 92%: Waxing Gibbous

Positivist: 16 Gutenberg (9th Month) [Mariotte]

Runic Half Month: Rad (Motion) [Day 1 of 15]

Season: Summer (Day 68 of 94)

Zodiac: Virgo (Day 7 of 32)

Calendar Changes

Rad (Motion) [Half-Month 17 of 24; Runic Half-Months] (thru 9.9)

2 notes

·

View notes

Text

IFTAR CHARITY BOXES 2023

Charity has always been a huge part of the spirit of Ramadan. Donate a meal prepared by Deli Bite Iftaar Box for just AED 10 Gift Box All charity Iftar Gift box order placed with Deli Bite Catering are delivered to UAE Food Bank & Approved Charity organizations. https://delibitecatering.com/product/basic-iftar-gift-box/

5 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat refund#vat registration#VAT Registration in Dubai#VAT Return Filing#vat registration uae#vat registration services in dubai

2 notes

·

View notes

Text

UAE VAT Registration in 2021 – A Step-by-Step Guide

Since the UAE introduced the VAT on Value Added Tax (VAT) on January 1st, 2018, business owners are required to follow the rules, including UAE VAT Registration and tax filings.

Companies operating in the UAE must ensure that VAT is correctly collected and properly accounted for so that it can be paid back to Federal Tax Authority (FTA).

UAE VAT Registration means that your business is recognized by government authorities to take VAT from your customers and then transfer this to the government.

As a business owner, you must be aware of the critical aspects of VAT in the UAE.

These are step-by-step guides.

What is VAT?

Taxes on VAT are applied to the exchange of services and goods. It that is used at every stage in the chain of supply. It is calculated based on the value added at each step. This indirect tax is imposed on the Government of UAE at 5 percent on most businesses and products. However, food, education, and healthcare items are exempt from VAT.

VAT Registration UAE

If you need to declare VAT depends on your business’s turnover per year.

Exclusive from Registration for VAT Value of supplies that are less than Dh187,500

Voluntary UAE VAT Registration, The value of reserves is between Dh187.500 to Dh375,000.

Mandatory VAT Registration Value of supplies above Dh375,000

Your registered business will receive a unique tax identification number (TRN) when the UAE VAT registration is accepted. The VAT invoices on all VAT invoices will include the TRN.

UAE mainland businesses, as well as free zone companies, are taxed on VAT. The only ‘designated zones’ designated by Cabinet members of the UAE Cabinet are outside the scope of UAE VAT taxation. Moving goods within areas are free of tax.

It typically takes between 3 and 5 days for the tax registration process to complete.

VAT Return Filing

VAT-registered companies (taxable individuals) are required to submit an annual VAT return to the FTA.

A VAT return is a summary of the supplies and purchases that a tax-paying person makes during tax time to calculate the tax liability of VAT.

You can file your VAT return online every month or every quarter by visiting FTA’s official website – https://www.tax.gov.ae/.

Tax returns should be filed on time, usually by the 28-day deadline. The tax period is the time in which taxes are due and due. The tax period:

* Monthly for businesses with annual revenue of Dh150 million or greater. * Quarterly rate for companies with an annual turnover of less than Dh150 million

VAT Liability

In contrast to customer business revenues, VAT is not part of your company’s income. Instead, the VAT you collect is known as VAT liability & has to be paid to the government of the UAE.

Vat liability is the gap between the output tax to be paid (VAT applied to supplies of services and goods) and the tax on input (VAT incurred when purchasing) which is recoverable for a specific tax time.

If output taxes are more significant than input taxes, the excess must be paid to FTA. However, if there is an excess of output tax and input tax, the taxable person can recuperate the quantity and apply it to future payments to FTA.

Documents Required for VAT Registration in UAE

You must provide duplicates of these documents to register for UAE VAT Registration.

Certificate of registration or incorporation.

Trade license

Passport and visa, or Emirates ID of director/manager

A partnership contract, memorandum association, or another document that provides information on the business’s ownership.

The profile of the named company director.

Bank account details;

Contact details;

Physical office;

List of business directories or partners in the UAE over the last five years

The Federal Tax Authority would also need to declare the following:

The actual or estimated value of transactions in the financial sector;

The registered business activities of the applicant;

Information on the anticipated turnover of the company over the next thirty days;

The turnover of the business over the last 12 months (supporting documents are required);

Information about the business’ anticipated exempt supply;

All details about the business exports and imports of the company;

Information on the customs registration process;

The business activities that take place in the GCC

The taxpayer or VAT-registered company is also required by the tax authorities to maintain the following records/documents:

Tax invoices and any other document pertinent to the receipt of the goods or services you need;

Notes on the tax credit, in addition to any other documents that the company receives about the purchasing of products or services

Record of tax-deductible products received or manufactured;

Tax invoices and any other document that is the issue concerning products or services;

Notes on the tax credit and any other type of document issued to purchase items or services

Documents of services or goods that are disposed of or used by the company to deal with matters not connected with the business, as in the tax paid for these;

Record of the imports and supply of goods or other products;

Documents of corrections or adjustments applied to tax invoices or any other account

Record of products or goods which are shipped to another country

Tax records must be kept by any tax-paying individual and include the following details:

Taxes that can be recovered on imports or supplies;

Tax recoverable subsequent adjustment or correction of error;

Tax due following adjustment or error correction

Taxes owing on all tax-deductible products

UAE VAT Registration Process

If you have your soft copies of the previously mentioned documents in hand, you’re in good shape to begin the registration procedure.

First of all,

Log in to e-service, and establish an account. Input the UAE VAT registration form

FTA (Federal Tax Authority) authorized e-service account is required to register VAT. However, it is easy to create an account through their official site.

VAT Rates in UAE

The rates of VAT in the UAE differ from product to product. The standard rate of the government is 5%, and you should charge this amount unless your product or service is in”zero-rated,” or “zero-rated” or VAT exemption.

Zero-rated rates are available on tax-exempt products; however, the buyer is not liable for VAT. Your VAT account must record and report the VAT zero-rated transactions, too.

Certain goods and services, including the construction of residential structures and land and financial services, are exempt from VAT.

#vat registration uae#VAT Registration in Dubai#uae vat registration#vat registration#vat registration services in dubai

3 notes

·

View notes

Text

How to Register Your Trading Company in Dubai

Your Step-by-Step Guide to Registering a Trading Company in Dubai

Setting up a trading company in Dubai is like opening a door to endless opportunities. The city is a hub for business and trade, attracting entrepreneurs from around the globe. But how do you get started? Let’s break it down into simple steps to make the process clear and straightforward.

Understand the Basics of Company Registration

Before diving in, it’s key to know that Dubai has specific rules for business registration. Think of it like building a house; you need a solid foundation. In Dubai, businesses often operate in free zones or mainland. Free zones offer benefits like full ownership and tax exemptions, while mainland companies have broader trading options but may require local sponsors.

Choose Your Trading Activities

What will your trading company sell? Picking the right activities is crucial. Dubai has a list of approved activities, and you must select from these to register your business. It’s like choosing items for a menu; they need to appeal to your customers and fit the market. Be clear on what you want to trade to avoid issues during registration.

Select a Business Name

A name is your company’s identity. Choose something unique that reflects your brand. Your business name can’t be offensive or similar to existing companies. It’s like naming a pet; it needs to stand out! Once you’ve got a name in mind, check it against the Dubai Department of Economic Development’s (DED) guidelines to ensure it’s available for use.

Apply for Initial Approval

With your documents ready, apply for initial approval from the DED or the relevant free zone authority. This is like getting a “green light” before starting construction on your project. You’ll need to submit your documents and pay a fee. If everything checks out, you’ll receive your initial approval certificate.

Choose Your Business Location

Where will your company operate? You must have a physical address in Dubai for registration. If you're in a free zone, you can choose from various facilities designed for businesses. It’s similar to deciding on the right location for a store—visibility and accessibility matter!

Obtain Your Business License

Once your location is confirmed, it’s time to get the business license. This license is your ticket to operating legally in Dubai. The type of license you need varies based on your trading activities. Whether it’s a commercial, professional, or industrial license, each has its requirements. Think of your business license as the final paperwork for launching your dream company!

Open a Corporate Bank Account

With your business license in hand, you can open a bank account in Dubai. This step is crucial for managing your finances smoothly. Choose a bank that suits your needs, as different banks offer various services. Consider it like picking a partner for a dance; you want the right fit to ensure a good flow.

Get Additional Approvals (If Necessary)

Depending on your trading activities, you might need additional approvals from other local authorities. For instance, if your business involves food, health, or drugs, you’ll require specific clearances. Always double-check to ensure you’re compliant—this avoids future headaches!

Start Your Trading Journey

With everything set up, you're ready to launch your trading company in Dubai! Celebrate your hard work and embrace the exciting opportunities ahead. Each day can bring new challenges and successes, just like every new journey.

Registering a trading company in Dubai might seem daunting, but with the right steps, you can navigate through it confidently. With a vibrant market and supportive business environment, Dubai is truly a great place to turn your trading dreams into reality. Now that you're equipped with this knowledge, you're one step closer to starting your business adventure in this dynamic city!

#best forex broker in uae#forex market#forextrading#forex broker#forex expo dubai#crude oil trading#forex expert advisor#forex calendar#stock trading#forex expo#stock market analysis#finance

#forextrading#forex expo dubai#best forex broker in uae#forex market#forex expert advisor#stock trading#forex broker#stock market analysis report#trading company dubai

0 notes

Text

(Alternatively: march 11 to 17, 2024 week summary for palestine on instagram)

March 15 to March 19, 2024 Palestine Summary. From "Let's Talk Palestine" (instagram broadcast channel). Quote,

March 15, 2024.

Day 161

• UNICEF: 1 in 3 children (31%) under the age of 2 in northern Gaza suffer from acute malnutrition, an escalation from 15.6% in January

• 149 Palestinians killed, 300 injured in Gaza in the past 24 hours

• Netanyahu dismisses Hamas’s ceasefire proposal, despite US stating that it is “within the bounds” of what was discussed + announces war cabinet approved plans for Rafah ground invasion. Israel continues to send mixed signals as they are also set to send delegates for truce talks in Qatar

⚖️ ICJ to begin hearings in early April on Nicaragua’s case against Germany for complicity in genocide in Gaza, per Nicaragua’s request for emergency rulings

🇦🇺 Australia to resume UNRWA funding of $6 million, following internal determination that “UNRWA is not a terrorist organization” despite Israel’s accusations

🔻 Hamas claims 4 Israeli soldiers killed in central Gaza + ground fighting continues in Khan Younis (south Gaza) & targeting of an Israeli armored troop carrier and tank

March 16, 2024.

🗞️ The Palestinian Authority (PA) Prime Minister and his cabinet resigned on Feb 26, while PA President Abbas will stay; a move towards a post-genocide plan to create a ‘unity’ PA gov’t across West Bank & Gaza.

Set up in the 90s, the PA operates as a subcontractor of Israel’s occupation, lessening its financial and political burdens. Today, PA is controlled by Abbas’s US-backed Fatah party, after Gaza split from its control under Hamas in 2007.

Since Oct, US has pushed for Gaza’s return to the governance of a reformed PA, but without elections, as Fatah would likely lose. Rather Abbas claims he’ll appoint a “technocratic government of officials & experts”. He chose a new PM 2 days ago.

But the rhetoric of “Palestinian unity” covers up the plan’s dismissal of popular demands for representative leadership. Palestinians doubt the reforms, overwhelmingly demanding the PA’s dissolution, Abbas’ resignation & PLO elections.

👩🏫 Confused about the PA? Read our post: tinyurl.com/4yhr7k67

Day 162

• 1st aid shipment departing Cyprus arrived in Gaza yesterday carrying 200 tons of food, marking 1st Gaza sea shipment since 2005 + planned 2nd ship coordinated by US, UAE, Spain & Japan; but unclear on distribution of aid across Gaza

• Massacre in central Gaza as Israel destroys home, killing 36 Palestinians, incl. kids & pregnant women

🔻 Senior Hamas & Houthi officials hold rare meeting to discuss coordinated action against an Israeli Rafah ground invasion

• Israeli settlers attack homes in Nablus (West Bank), throwing stones & shooting the air + 20 Palestinians abducted in West Bank, incl. some released in Nov. hostage exchange deal

• Palestinian Authority (PA) president Abbas accuses Hamas of causing “return of Israeli occupation of Gaza”, essentially blaming Hamas for the ongoing genocide. Was prompted by Hamas criticism of ‘unilateral’ appointment of new PM of the PA (see our last broadcast)

• 63 Palestinians killed, 112 injured in Gaza in past 24 hours

March 17, 2024:

Day 163

🇺🇸 NBC: Biden frustrated over drop in poll numbers in swing states Michigan & Georgia due to his handling of Gaza genocide. Shouting and swearing in a White House meeting, saying he’s doing what is right

• 19 aid trucks arrive in north Gaza — first convoys to reach the north without incident in 4 months. But aid remains scarce as Israel keeps blocking entry of aid as trucks pile outside Rafah crossing + rate of malnutrition among children under 2 in north doubles in past month

• 14th Palestinian dies since Oct 7 in Israeli prison following multiple allegations of extreme abusive conditions for Palestinian hostages

🇪🇺 EU President condemns an Israeli Rafah invasion, joining countless nations to do so like the US & Arab countries

• Israeli forces abduct 25 Palestinians, incl. a woman with cancer from Gaza & a child in overnight raids in West Bank

• 92 Palestinians killed, 130 injured in Gaza in past 24 hours

March 18, 2024

Day 164

🚨 Israeli forces raid al-Shifa Hospital, where 30,000 Palestinians are sheltering, shooting snipers at those fleeing despite ordering an evacuation. Al-Shifa has regained minimal functionality since Nov seige, but now unable to treat the injured due to siege. 200+ civilians abducted, incl. Al Jazeera journalist Ismail al-Ghoul & his crew — stripped, blindfolded & taken to unknown location, reporting abuse & beatings

• 81 Palestinians killed, 116 injured in Gaza in past 24 hours

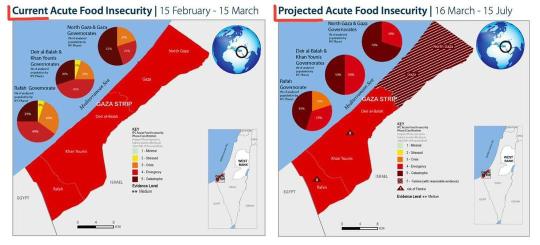

• Integrated Food Security Phase Classification (IPC): Famine imminent, expected in north Gaza by May as 70% of its population subject to “catastrophic” starvation; while famine in Khan Yunis, Rafah & Deir Balah by July

• Israel recaptures Rawda Abu Ajmiyeh, previously released in Nov hostage exchange deal; 13 Palestinians recaptured, a clear violation of the deal

• West Bank: 300 homes demolished + 1,640 Palestinians displaced since Oct 7

🇪🇺 EU announces plans to sanction Israeli settlers

👆 Graphic from IPC report on the levels of starvation and food insecurity in Gaza. On the left: current levels of food insecurity in Gaza; on the right: projected food insecurity levels by July

March 19, 2024

📣 We’ve just launched a dedicated page to fundraising for Gazans via our linktr.ee/fundsforgaza initiative. We’ve already facilitated tens of thousands of dollars in donations in the past weeks to families in Gaza.

The people we’re helping fundraise for are not numbers. This is a matter of life or death for people with dreams, passions, and stories like you.

Follow the new page @ fundsforgaza (instagram) to get updates on the fundraisers, share content with others to help fundraisers, and support people in Gaza ❤️🇵🇸

Https://instagram.com/fundsforgaza

31 notes

·

View notes

Text

大家好! Besides yong tau foo, another healthy meal option for locals is lei cha (tea rice). Brown rice is commonly used in this dish, topped with choy sum (Chinese flowering cabbage), green beans, cabbage, tau kwa (firm tofu), chye poh (preserved turnip), peanuts and anchovies. It also comes with a green tea paste broth made from ground seeds, veggies and tea. I don't like basil and mint so I usually give the broth away. I don't like brown rice either except for congee but once all the toppings are mixed together with the rice, it's acceptable. MI, ML and CL introduced me to a lei cha stall and it was very tasty. The texture of the toppings was mostly crunchy, along with savoury notes from the anchovies and chye poh. YUM!

I thought of skipping news about the genocide in Gaza for this post but decided not to. There's too much suffering inflicted upon Palestinians. All the same, I'll need a short break to keep my spirits up, possibly for 1 or 2 weeks. I'll still be keeping abreast of the news and praying for an end to the war, but won't share articles for a short period of time. Maybe I'll post mukbangs or recipes, something more light-hearted and fun for abit before returning to the events in Gaza and the west bank.

youtube

I took leave on Friday so after my daily morning calisthenics, Pa and I treated ourselves to a buffet breakfast. First plate - cold soba, enoki mushrooms, seaweed and a tiny bit of soya sauce, smoked salmon, tofu with bakchoy and fish, steamed wong bak (Napa cabbage) with dried shrimp and conpoy, hashbrown and 2 eggs sunny side up. Next, more vegetables - mushrooms, wong bak, tofu with bakchoy and fish, topshell and cucumber salad, asparagus, braised chicken and siew mai. Third plate, fruit - watermelon, blueberries, dragonfruit, rock melon and delicious grapes. Finally, I shared waffles and ice cream with Pa. I was so stuffed, I went for a 15 minute walk/run at the park near my home later on to help with digestion; mostly brisk walking with about 5 minutes of running since I'm still new to running.

I introduced LL, my expat friend from China, to a place that serves 1 of the best meepok (flat yellow noodles) in Singapore. This isn't found at a hawker centre or hotel restaurant; it's a diner which specialises in siew lat (traditionally refers to roast pork and waxed duck, now commonly refers to roast meats). I ordered their char siew, green beans stirfried with garlic and har mai (dried shrimp), dong guai (angelica herb) roast duck and the star of the show, meepok. The char siew had a nice char and was lightly crispy on the outside and very tender on the inside. We adored it! Also loved their green beans which were fragrant and still retained a slight crunch. The duck was juicy with a robust herbal taste and that meepok, THAT MEEPOK! This is made in-house, not sourced from a supplier. It was slurpable, QQ and oh so smooooooth! This delighted our senses so much. Enjoy the video!

Well! It's the start of a brand new week and I'm feeling less exhausted after taking Friday off. There will be more to come as I clear my leave for the year and carry forward the number of leave days the company allows to 2025. Time really flies; we're approaching the end of the third quarter of 2024. My mini getaway with YL is also happening in 2 weeks. Can't wait! 下次见!

0 notes

Text

Our special Bank guest snacks party order :--- Snacks boxes ... DABELI + SAMOSA + PLAIN DHOKLA + GULAB JAMUN . If you need buffet party in your home / Office / School or anywhere so you may call 📞 to us & We will do your catering party in your place. Birthday party / Indoor & Outdoor catering / Office Party / Lunch Party / Dinner Party / Kitty Party . You want a Bulk order Or Snacks boxes so you can contact to us on these no.... #043465642 #0527031616 #0521819643 We do provide breakfast , lunch & dinner with packing food for tour & travelers guest also. Order on #noon #talabat #careem #deliveroo #smiles #Pick'a delivery service. https://www.eateasy.ae/.../mumbai-aroma-restaurant-al-karama https://www.talabat.com/.../mumbai-aroma-restaurant-al... https://deliveroo.ae/.../karama/mumbai-aroma-restaurant https://food.noon.com/outlet/MMBRM3318C/ मुंबई अरोमा रेस्टॉरंटमध्ये तुमची बर्थडे पार्टी, किट्टी पार्टी आणि घराबाहेर पार्टी साजरी करा. आम्ही सहलीसाठी आणि प्रवासी पाहुण्यांसाठी न्याहारी, दुपारचे जेव��� आणि रात्रीचे जेवण देखील पुरवतो. मुंबईहून दुबई येथे फक्त मुंबई अरोमा मुंबई अरोमा रेस्टॉरंटमध्ये चव दिली जाते नून फूड, तलबत, करीम, स्माइल्स आताच ऑर्डर करा! Al Kifaf oasis building, Al Karama, Behind Centro & Regent palace hotel, Dubai, UAE. #aamush #samosalover #indianfood #streetfood #streetfoodindia #teatime #teatimesnacks #mumbaifood #foodblogger #foodtravel #authenticfood #indianrestaurant #karama #dubairestaurants #dubaifood #dubailifestyle #mumbaiaromarestaurant #dubaifood #dubai #dubailife #mydubai #dubaifoodie #uae #dubaifoodies #dubaimall #dubairestaurants #dubaimarina #dubaiblogger #dubaistyle #dubaifoodblogger #dxb #food #dubaifoodbloggers #foodie #dubainight #dubaitag #dubaifashion

0 notes

Text

What are the key industries driving demand for mobile apps in the UAE?

Several key industries are driving the demand for mobile apps in the UAE. These industries leverage mobile technology to enhance customer experiences, streamline operations, and offer innovative services. Here are the key industries:

E-commerce and Retail: The e-commerce and retail sectors are experiencing significant growth, with mobile apps providing platforms for online shopping, payment processing, and personalized customer experiences.

Finance and Banking: The finance and banking industry is adopting mobile apps for digital banking, mobile payments, investment management, and financial planning. These apps offer convenience and accessibility to users.

Healthcare: Mobile apps in healthcare are used for telemedicine, appointment scheduling, health monitoring, fitness tracking, and access to medical records. They enhance patient engagement and healthcare delivery.

Real Estate: The real estate industry uses mobile apps for property listings, virtual tours, client management, and transaction facilitation, making it easier for users to buy, sell, or rent properties.

Tourism and Hospitality: Tourism and hospitality apps provide booking services, travel guides, local information, and customer service, enhancing the travel experience for tourists and residents.

Transportation and Logistics: Mobile apps in transportation and logistics include ride-hailing services, public transportation apps, delivery tracking, and fleet management, improving efficiency and user convenience.

Education: The education sector is leveraging mobile apps for e-learning, online courses, student management, and interactive educational tools, facilitating remote and flexible learning.

Entertainment and Media: Entertainment and media apps offer streaming services, gaming, news, and social media platforms, providing diverse content and interactive experiences for users.

Food and Beverage: The food and beverage industry uses mobile apps for online ordering, delivery services, reservations, and loyalty programs, enhancing customer convenience and engagement.

Government Services: Government apps provide access to public services, information, and e-governance, allowing residents to interact with government entities and access services efficiently.

Telecommunications: Telecommunications companies use mobile apps for customer service, account management, bill payments, and service subscriptions, improving customer interactions and service delivery.

Fitness and Wellness: Fitness and wellness apps offer workout plans, meditation guides, diet tracking, and health monitoring, promoting healthier lifestyles and wellness.

These industries are driving the demand for mobile apps in the UAE, leveraging technology to enhance their services and meet the evolving needs of consumers.

0 notes

Text

@hivehoteldxb

#UncStevieweevieInDubai 🙏🏽🫂

https://linktr.ee/stevieweevie71

Zelle & PayPal [email protected]

(Use email address only)

(No CashApp or Venmo in Dubai)

My 2nd time going out in 6 months since being here was horrible {(I asked him why he didn't say the prices were different when he gave me the menu & I ordered my food. I notified Bank of America & Dubai Municipality. Worst birthday ever and then add the fact that I was beefing with an #exgirlfriend exgf on top of that and I'm halfway around the fucking world 🌎 😤 It just made for a horrible day & weekend. I will make it up one day.)} 🤬😠😤😡🤬🗯 Happy Birthday to me 😂🤣 They asked if I wanted a girl to sit with me. Don't fall for that scam. You will get a $500 bill when you leave! There are like 4 night clubs in this hotel. Some hood 💩 AlMuraqqabbat - almurqabat - AlRigga

Hive Hotel: https://www.facebook.com/profile.php?id=100083229433754&mibextid=ZbWKwL

#HappyBirthdaytome #🦀 #♋️ #cancer #cancerseason #cancersrule #HappyBirthday #birthday #July12 #1971 #scam #fraud #AlcoholicsAnonymous #GamblersAnonymous #Baltimore #EdmondsonVillage #21229 #Dubai #DXB #🇦🇪 #UAE #Sharjah #Trump #DonaldTrump #maga #Pakistaniwomen

0 notes

Text

Step-by-Step Guide to Setting Up a Business in Dubai

1. Determine the Business Activity

The first step in setting up a business in Dubai is to decide on the type of business activity. Dubai offers various categories, including commercial, industrial, professional, and tourism-related activities. Your chosen activity will determine the type of license you need and the regulations you’ll need to comply with.

2. Choose a Business Structure

Dubai provides several business structures, each with its own benefits and limitations. The most common types include:

Limited Liability Company (LLC): Suitable for most types of businesses and allows foreign investors to own up to 49% of the company.

Free Zone Company: Ideal for businesses targeting international markets. Free zones offer 100% foreign ownership, tax exemptions, and full repatriation of profits.

Sole Proprietorship: Suitable for small businesses and professionals who want complete control over their business.

Branch Office: Allows foreign companies to establish a presence in Dubai without incorporating a separate legal entity.

Consulting with a business setup expert like SM Consultancy can help you choose the best structure for your business

3. Select a Business Name

Choosing a business name is crucial and must comply with Dubai’s naming conventions. The name should not contain any offensive or blasphemous words, reference any religion, or include the names of well-known organizations or governing bodies. Additionally, the name should reflect the nature of the business.

4. Obtain Initial Approval

Before proceeding further, you need to obtain initial approval from the Department of Economic Development (DED) or the relevant free zone authority. This approval confirms that the UAE government has no objections to you starting a business in Dubai.

5. Draft the Memorandum of Association (MOA)

The MOA outlines the shareholding structure and operational guidelines of your company. For LLCs, it must be drafted in Arabic and notarized. If you’re setting up in a free zone, the free zone authority will provide a standard MOA template.

6. Secure a Business Location

Every business in Dubai must have a physical address. This can be within a free zone or on the mainland. Free zones offer flexible options, such as virtual offices, flexi-desks, and dedicated office spaces. If you opt for a mainland setup, you’ll need to lease a commercial space.

7. Obtain the Necessary Licenses

Depending on your business activity, you’ll need to apply for specific licenses. The main types of licenses include:

Commercial License: For trading and commercial activities.

Industrial License: For manufacturing and industrial operations.

Professional License: For service-oriented businesses.

Additional permits might be required based on your business activity. For example, businesses dealing in food and beverages need a permit from the Dubai Municipality.

8. Register with Relevant Authorities

After obtaining the necessary licenses, you need to register your business with the relevant government authorities. This includes the DED for mainland companies or the respective free zone authority for businesses in free zones.

9. Open a Corporate Bank Account

Once your business is legally established, you need to open a corporate bank account. Different banks have varying requirements, but generally, you’ll need to provide the company’s incorporation documents, MOA, and proof of address.

10. Hire Employees and Manage Visas

Why Choose SM Consultancy?

Setting up a business in Dubai involves navigating various legal and administrative processes. SM Consultancy, Dubai’s premier business setup service, provides expert guidance to streamline this process. From selecting the appropriate business structure to securing licenses and managing visa processes, SM Consultancy ensures a hassle-free experience, allowing you to focus on your business growth.

With their in-depth knowledge of Dubai’s regulatory landscape and extensive experience, SM Consultancy stands out as the best partner for aspiring entrepreneurs. For more details and personalized assistance, visit smservice.ae.

Starting a business in Dubai is a strategic move that can yield significant rewards. By following these steps and leveraging the expertise of SM Consultancy, you can establish a successful venture in this thriving market.

#business#business setup company in dubai#business setup in dubai#business setup in uae#business setup services in dubai

0 notes

Text

Holidays 6.21

Holidays

Alzheimer’s Awareness Day

Atheist Solidarity Day

Baby Boomer Recognition Day

Banjo Lesson Day

Bank Employee Day (Guatemala)

Bill Murray Day

Child Tax Credit Awareness Day

Create a New National Day Day

Day of Private Reflection

Day of the Martyrs (Togo)

e621 Day

Father’s Day (Egypt, Jordan, Kosovo, Lebanon, Syria, UAE)

Ferris Wheel Day

Flag Day (Greenland)

Flag Burning Day

Global MND / ALS Awareness Day

Go Skateboarding Day

Het Meetjesland Day (Belgium)

International Aniridia Day

International Climate Change Day

International Flower Day

International Anirida Day

International Music Day (f.k.a. World Music Day)

International Stereoscopy Day

International T-Shirt Day

International Yoga Day (UN)

LP Day

Martyrs' Day (Togo)

Migraine Solidarity Day

Naked Hiking Day

National Aboriginal Day (a.k.a. First Nations Day or Indigenous Peoples Day; Canada)

National Arizona Day

National ASK (Asking Saves Kids) Day

National Create a New National Holiday Day

National Day of the Gong

National Dog Party Day

National eGiving Day

National Heroes’ Day (Bermuda)

National Indigenous Peoples Day (Northwest Territories, Yukon; Canada)

National Jimmy Day

National Professional Medical Coder Day

National River Tubing Day

National Seashell Day

National Selfie Day

National Wedding Day

National Yard Games Day

Obscenity Day

Onion Day (French Republic)

Optimism Day

Reaping Machine Day

Reserves Day (UK)

Seafarers’ Day (South Korea)

Shades for Migraine Day

Shetland Flag Day (Scotland)

Short Story Day (Africa)

Show Your Stripes Day

Stock Up On Antiperspirant Day

Suffolk Day (UK)

Suve Algus / Suvine Pööripäev (Estonia)

SYNGAP1 International Awareness Day

Take Your Dog to Work Day

33-1/3 Day

T-Shirt Day

Turner Syndrome Awareness Day (UK)

Ulloortuneq (Greenland)

World Day Against ELA (Spain)

World Giraffe Day

World Handshake Day

World Hydrography Day

World Kamasutra Day (India)

World Motorcycle Day

World Music Day (Paris, France)

Food & Drink Celebrations

French Gastronomy Day

Fried Shrimp Day (Japan)

Gin & Tonic Season begins

International Lambrusco Day

Johnnie Walker Day

National Cookie Dough Day

National Smoothie Day

National Wagyu Day

Peaches and Cream Day

Red Apple Day (Australia)

World Lambrusco Day

Independence & Related Days

Greenland (Assumed Self-Rule; 2009)

New Hampshire Statehood Day (#9; 1788)

Pagadian City Day (Philippines)

Principality of Aigues-Mortes (Declared; 2011) [unrecognized]

Zululand (Annexed by UK; 1887)

New Year’s Days

Andean New Year (Bolivia)

3rd Friday in June

Casual Day [Friday before Summer Solstice]

Dollars Against Diabetes Days begin [3rd Friday]

Duct Tape Festival begins (Avon, Ohio) [3rd Friday]

Flashback Friday [Every Friday]

Fry Day (Pastafarian; Fritism) [Every Friday]

National Day of Prayer for Law Enforcement Officers [3rd Friday]

National Flip Flop Day [3rd Friday]

National Take Back the Lunch Break Day [3rd Friday]

QuadWitch Day [3rd Friday]

Stop Cyberbullying Day [3rd Friday]

Take a Road Trip Day [3rd Friday]

Ugliest Dog Day [3rd Friday]

Vikingespil Frederikssund (Viking Festival; Denmark) [Begins 2nd-to-Last Friday]

Work at Home Father's Day [Friday before Father's Day]

Festivals Beginning June 21, 2024

Alpine Mountain Days (Alpine, Wyoming) [thru 6.23]

Art Film Fest (Košice, Slovakia) [thru 6.28]

Big BBQ Bash (Maryville, Tennessee) [thru 6.22]

Cheese Curd Festival (Ellsworth, Wisconsin) [thru 6.22]

Fire on the Lake Chili Cook-off (Lake Wales, Florida) [thru 6.23]

Frederikssund Viking Games (Frederikssund, Denmark) [thru 7.14]

Gorge Blues & Brews Festival (Stevenson, Washington) [thru 6.22]

The Great Lenexa Barbeque Battle (Lenexa, Kansas) [thru 6.22]

Hurricane Festival (Scheessel, Germany) [thru 6.23]

Irvine Greek Fest (Irvine, California) [thru 6.23]

Knysna Oyster Festival (Knysna, South Africa) [thru 6.30]

Long Grove Strawberry Festival (Long Grove, Illinois) [thru 6.23]

Lewis and Clark Festival (Great Falls, Montana) [thru 6.22]

Ottawa Jazz Festival (Ottawa, Ontario, Canada) [thru 6.30]

Panhandle Watermelon Festival (Chipley, Florida) [thru 6.22]

Pinkpop Festival (Landgraaf, Netherlands) [thru 6.23]

Rochester International Jazz Festival (Rochester, New York) [thru 6.29]

Sibiu International Theatre Festival (Sibiu, Romania) [thru 6.30]

Stonewall Peach JAMboree and Rodeo (Stonewall, Texas) [thru 6.22]

Strawberry Days Festival (Glenwood Springs, Colorado) [thru 6.23]

Summer Fest (Stratford, Connecticut) [thru 6.22]

Taipei Film Festival (Taipei, Taiwan) [thru 7.6]

Taste of Joliet (Joliet, Illinois) [thru 6.23]

Watermelon Jubilee (Stockdale, Texas) [thru 6.23]

Feast Days

Aaron of Brittany (Christian; Saint)

Alban Heruin (a.k.a. Light of the Shore; Celtic Book of Days)

Alban of Mainz (Christian; Saint)

Al Hirschfeld (Artology)

Aloysius Gonzaga (Christian; Saint)

Berkeley Breathed (Artology)

Day of the Crab (Pagan)

Engelmund of Velsen (Christian; Saint)

Enrico Coleman (Artology)

Eusebius of Samosata (Christian; Saint)

Festival of the Oak King (Starza Pagan Book of Days)

Giuseppe De Sanctis (Artology)

St. Henry (Positivist; Saint)

Henry Ossawa Tanner (Artology)

Ian McEwan (Writerism)

Jean-Paul Sartre (Writerism)

Julio Ruelas (Artology)

Leufredus (a.k.a. Leufroy or Keufroi; Christian; Saint)

Martin of Tongres (Christian; Saint)

Meen (a.k.a. Mevenus or Melanus; Christian; Saint)

Natalia Goncharova (Artology)

Onesimos Nesib (Lutheran)

Oscar Florianus Bluemner (Artology)

Pierre-Nicolas Beauvallet (Artology)

Ralph (Christian; Saint)

Rockwell Kent (Artology)

Sam Kinison Day (Church of the SubGenius; Saint)

Skateboarding Day (Pastafarian)

Sub-Human Cannonball (Muppetism)

Tiger-Get-By’s Third Birthday (Shamanism)

World Humanist Day (Pastafarian)

Lunar Calendar Holidays

Full Moon [6th of the Year] (a.k.a. ...

Blooming Moon (Traditional)

Cold Moon (South Africa)

Dyad Moon (England, Wicca)

Festival of Goodwill, Festival of Christ & Humanity [Full Moon between 5.20-6.20]

Green Corn Moon (Cherokee)

Hatching Moon (Traditional)

Honey Moon (Traditional)

Horse Moon (Celtic)

Hot Moon (Alternate)

Johan Jongkind (Artology)

Lotus Moon (China)

Mead Moon (Traditional)

Planting Moon (Neo-Pagan)

Poson Full Moon Poya Day (Sri Lanka)

Rose Moon (Alternate, Colonial, North America)

Ryan Moran Day [1st FM in June]

Southern Hemisphere: Cold, Long Night’s, Oak

Strawberry Moon (Amer. Indian, Traditional)

Windy Moon (Choctaw)

World Invocation Day (a.k.a. Gemini Full Moon Festival)

Lucky & Unlucky Days

Tomobiki (友引 Japan) [Good luck all day, except at noon.]

Umu Limnu (Evil Day; Babylonian Calendar; 29 of 60)

Premieres

Ain’t She Sweet (WB LT Cartoon; 1952)

Alpocalypse, by Weird Al Yankovic (Album; 2011)

Anna (Film; 2019)

The Bling Ring (Film; 2013)

The Blue Umbrella (Pixar Cartoon; 2013)

Bon Ives, by Bon Iver (Album; 2011)

Chinatown (Film; 1974)

Cocoon (Film; 1985)

Creepin on ah Come Up, by Bone Thugs-N-Harmony (EP; 1994)

The Deep, by Peter Benchley (Novel; 1976

Die Meistersinger von Nürnberg, by Richard Wagner (Opera; 1868)

Donald and the Wheel (Disney Cartoon; 1961)

Don’t Go Breaking My Heart, by Elton John and Kiki Dee (Song; 1976)

Evita, by Andrew Lloyd Webber and Tim Rice (UK Musical; 1978)

Exodus, by Leon Uris (Novel; 1958)

Frolicking Fish (Silly Symphony Cartoon; 1930)

The Hunchback of Notre Dame (Animated Disney Film; 1996)

Impact is Imminent, by Exodus (Album; 1990)

Lifeforce (Film; 1985)

Lilo & Stitch (Animated Disney Film; 2002)

The Litterbug (Disney Cartoon; 1961)

Mastersingers of Nuremberg, by Richard Wagner (Opera; 1868)

Minority Report (Film; 2002)

Mr. Tambourine Man, by The Byrds (Album; 1965)

Monsters University (Animated Pixar Film; 2013)

Moral Man and Immoral Society, by Reinhold Niebuhr (Book; 1932)

Moves Like Jagger, by Maroon 5 (Song; 2011)

Nell’s Yells (Color Rhapsody Cartoon; 1939)

The Parent Trap (Film; 1961)

The Promise of Joy, by Allen Drury (Novel; 1975)

Return to Oz (Film; 1985)

The Rocketeer (Film; 1991)

Smoking: The Choice is Yours (Disney Educational Cartoon; 1981)

Spree Lunch (Fleischer/Famous Popeye Cartoon; 1957)

Sweet Child o’ Mine, by Guns n’ Roses (Song; 1988)

The Te of Piglet, by Benjamin Hoff (Spiritual Book; 1993)

Toy Story 4 (Animated Pixar Film; 2019)

Tree for Two (Color Rhapsody Cartoon; 1943)

A Walk on the Wild Side, by Nelson Algren (Novel; 1956)

Who’s Afraid of Virginia Woolf? (Film; 1966)

World War Z (Film; 2013)

Today’s Name Days

Adalbert, Florentina (Austria)

Margareta, Naum (Croatia)

Květa (Czech Republic)

Sylverius (Denmark)

Kaari, Karlotte, Karola, Karoliine, Karolin, Lota (Estonia)

Into (Finland)

Silvère (France)

Adalbert, Florentina, Margot (Germany)

Methodios (Greece)

Rafael (Hungary)

Ettore, Silverio (Italy)

Imula, Maira, Rasa, Rasma (Latvia)

Silverijus, Žadvainas, Žintautė (Lithuania)

Salve, Sølve, Sølvi (Norway)

Bogna, Bogumiła, Bożena, Florentyna, Franciszek, Michał, Rafaela, Rafał, Sylwery (Poland)

Metodie (România)

Maria, Valeria (Russia)

Valéria (Slovakia)

Florentina, Silverio (Spain)

Flora, Linda (Sweden)

Earl, Earline, Errol, Fatima, Ofelia, Omar, Omarion, Ophelia (USA)

Today is Also…

Day of Year: Day 173 of 2024; 193 days remaining in the year

ISO: Day 5 of week 25 of 2024

Celtic Tree Calendar: Duir (Oak) [Day 13 of 28]

Chinese: Month 5 (Geng-Wu), Day 16 (Bing-Chen)

Chinese Year of the: Dragon 4722 (until January 29, 2025) [Wu-Chen]

Hebrew: 15 Sivan 5784