#types of secured and unsecured loans

Explore tagged Tumblr posts

Text

Types of Secured and Unsecured Loans

In the realm of personal and business finance loans serve as valuable tools for achieving various goals. Whether it's funding a home purchase, starting a business or covering unexpected expenses, understanding the different types of loans is essential. This article delves into the distinctions between Types of secured and unsecured loans, shedding light on the various financial instruments available to borrowers.

Types of Secured Loans

Secured loans are backed by collateral, providing lenders with a level of security in case the borrower defaults on the loan. Here are some common types of secured loan

Mortgages:

A mortgage is a secured loan specifically designed for purchasing real estate.

The property itself serves as collateral, and if the borrower fails to repay, the lender can take ownership through foreclosure.

Auto Loans:

These loans are used to finance the purchase of vehicles.

The car being financed serves as collateral, allowing the lender to repossess it if the borrower fails to make payments.

Secured Personal Loans:

Some personal loans require collateral, such as a savings account or a certificate of deposit.

These loans typically have lower interest rates compared to unsecured personal loans due to the reduced risk for the lender.

Types of Unsecured Loans

Unsecured loans, on the other hand, do not require collateral, relying solely on the borrower's creditworthiness. Here are some common types of unsecured loan

Personal Loans:

These loans are versatile and can be used for various purposes, such as debt consolidation, home improvement, or unexpected expenses.

Lenders evaluate the borrower's credit history and income to determine eligibility and interest rates.

Credit Cards:

Credit cards are a form of revolving unsecured credit.

Cardholders can make purchases up to their credit limit and are required to make minimum monthly payments. Interest is charged on the remaining balance.

Student Loans:

Designed for educational expenses, student loans typically do not require collateral.

Interest rates and terms vary, and repayment often begins after the borrower completes their education.

Comparison between Secured and Unsecured Loans

Risk and Interest Rates:

Secured loans generally have lower interest rates due to the presence of collateral, which reduces the lender's risk.

Unsecured loans carry higher interest rates as they lack collateral, presenting a higher risk to lenders.

Approval Process:

Secured loans may have a more straightforward approval process as the collateral provides security for the lender.

Unsecured loans require a thorough credit evaluation, making the approval process more involved.

Conclusion

Choosing between secured and unsecured loans depends on individual financial goals, creditworthiness, and risk tolerance. While secured loans offer lower interest rates, unsecured loans provide flexibility without risking assets. Understanding the nuances of each type of loan empowers borrowers to make informed financial decisions tailored to their unique circumstances.

0 notes

Text

GUIDE TO UNDERSTANDING UNSECURED BUSINESS LOANS

Small and medium enterprises (SMEs) in Australia play a crucial role in the national economy. They collectively provide over 65% of the private sector employment and contribute more than $700 billion to the country's GDP. However, despite their economic significance, many SMEs struggle to get loan approvals from traditional lenders like banks. In such situations, they can rely on alternative financing sources for business loans in Australia. SMEs can explore numerous loan products and choose the options that suit their requirements. Some of the most popular loan products fall in the category of unsecured loans. An unsecured business loan allows a firm to secure collateral-free funding, helping it manage urgent expenses and fuel critical expansion plans. Let’s discuss this funding option in detail and understand how to get the best unsecured business loans!

Unsecured Business Loans: An Overview

An unsecured business loan is a financing option that allows a firm to borrow money without providing any collateral. The collateral represents an asset offered as a security to the lender. A firm must submit collateral for secured business loans, allowing the lender to liquidate this asset if the borrower fails to repay the money. Since an unsecured loan does not involve this security, the lender issues it based on the firm’s performance, financial health, and creditworthiness.

Unsecured small business loans are perfect for firms that require quick funding or lack the assets to apply for secured loans. Lenders often charge slightly higher interest rates on unsecured loans to compensate for their risks. However, borrowers often prefer unsecured financing over secured loans when they have an urgent need for cash. Fast unsecured business loans can get approved within one to three days, providing businesses with a much-needed infusion of cash. Firms can get unsecured loans for various business purposes. They may utilise the amount for buying inventory, paying wages, financing renovations, or managing their working capital needs. While the proportion of unsecured loans may be low compared to other forms of SME financing, these options are highly advantageous for new businesses that require quick funding.

youtube

Unsecured business loan interest rates and other terms vary based on several factors. Lenders consider the borrower's requirements, the associated risks, and their internal policies while determining the loan terms. However, typically, the terms for unsecured business finance fall within the following range:

● Amount: Firms can borrow between $5,000 and $500,000 without providing any collateral.

● Interest Rate: Unsecured business loan rates start from 5.5% per annum.

● Loan Term: Firms can take an unsecured business loan for three months to three years.

● Frequency of Repayments: Borrowers can repay the loan on a daily, weekly, or fortnightly basis.

● Approval Time: The pre-approval process takes between two to four hours. Additionally, the unconditional approval and settlement procedures require one to three days.

Types of Unsecured Business Loans

SMEs have several options to get quick business loans without providing any security. The following are the three unsecured business loan types to consider depending on a firm's unique requirements:

● Small Business Loans

Unsecured small business loans allow SMEs to get a lump sum amount without tying up their assets. The application and approval processes are seamless and quick, allowing the borrower to secure funding within twenty-four hours.

● Business Line of Credit

A business line of credit in Australia is a flexible financing option. The lender approves a credit limit and the borrower withdraws the amount they need. The firm can borrow any sum under the limit and pay interest on the amount they utilise. An unsecured business overdraft facility can help seasonal businesses navigate cash flow fluctuations with minimum risk and hassle.

● Invoice Finance

The invoice finance facility allows a firm to take a loan against their unpaid invoices. The lender provides an advance based on the value of pending invoices. The firm can borrow large sums without submitting assets like equipment or property.

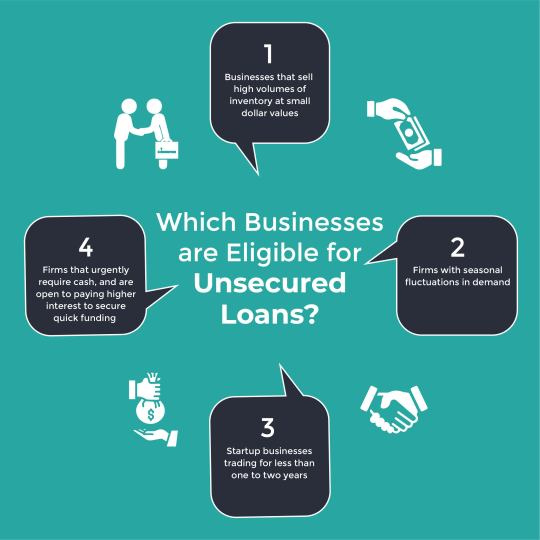

Which Businesses are Eligible for Unsecured Loans?

Firms must meet the eligibility criteria for getting unsecured loans.

The following are the minimum requirements to qualify for collateral-free small business loans:

● ABN: The firm must have an active Australian Business Number (ABN) to apply for collateral-free funding. In Australia, sole traders are not mandated to register for an ABN. However, if you apply for unsecured business loans for sole traders, having a registered ABN is required.

● Business History: The borrower must demonstrate that the firm has been operational for six months or longer to get a collateral-free working capital loan.

● Turnover: The firm must have a monthly turnover of at least $5000. This requirement ensures the business is financially stable enough to service repayments considering typical unsecured business loan rates.

A business owner must assess if they meet the eligibility criteria before applying for an unsecured loan. In addition, they should also consider if this form of funding is suitable for their business. Typically, the following types of businesses benefit the most from unsecured loans:

● Businesses that sell high volumes of inventory at small dollar values.

● Firms with seasonal fluctuations in demand.

● Startup businesses trading for less than one to two years.

● Firms that urgently require cash, and are open to paying higher interest to secure quick funding.

Pros and Cons of Taking an Unsecured Business Loan

A firm can leverage several benefits when they get an unsecured business loan. However, they must also consider certain downsides before deciding to go for collateral-free funding. The following are the top advantages of taking an unsecured loan:

● No Need for Collateral: Unsecured business loans allow business owners to get access to funds without putting up their assets as security. They can keep their property and other valuable assets safe no matter what happens in the business. Startup enterprises with little to no assets also benefit from unsecured business loans.

● Quick and Seamless Approval Process: Unsecured loans require minimal documentation as no collateral is involved. In most cases, firms can get low-doc approvals when they apply for unsecured business loans upto $500,000. The approval process takes less than a day for most applicants, and a borrower can get the money in their account within one to three days.

● Cash Flow Optimisation: Unsecured loans can help businesses manage their cash flow fluctuations more efficiently. The quick infusion of cash allows the borrower to optimise their cash flow and fulfil their working capital requirements. This aspect is especially beneficial for seasonal businesses that experience a lot of variations in their cash flow.

● Flexibility in Use of Funds: Unsecured loans offer flexibility in how you can utilise the money. Unlike certain forms of business lending like asset or trade finance, unsecured loans do not have hard and fast rules about the use of funds. Business owners can use it for inventory, expansion, hiring, or any other business purpose.

● Building a Good Credit History: Many alternative lenders provide collateral-free funding to businesses that do not have high credit scores. Your firm can get an unsecured business loan with a bad credit history and focus on timely repayments to improve the records. When you repay the loan diligently over time, it can help you build a strong credit history to get better loan terms in the future.

Businesses should consider both sides of the coin when they compare business loans and decide on the type of loan to choose. The following are some potential issues that borrowers must keep in mind while taking unsecured loans:

● Higher Interest Rates: An unsecured loan represents a high risk for the lender. If the borrower defaults on the repayments, the lender cannot fall back on any collateral to recoup their loss. That is why they charge a higher interest rate that reflects this risk. However, the interest rates vary depending on the unsecured business loan types and the creditworthiness of the borrowing firm.

● Shorter Loan Terms: Lenders typically want their money back faster when they lend a sum without any collateral security. That is why many unsecured financing options come in the form of short-term business loans. Generally, SMEs can get collateral-free funding for upto three years.

● Cap on the Loan Amount: Low-doc unsecured loans are usually capped at $500,000. Since unsecured business loans carry more risk, lenders are often hesitant to approve sums higher than this cap. However, it is not impossible to get a higher loan amount. Eligible businesses with a good credit history may be able to borrow more than $500,000 in some cases with full-doc approvals with formalities on the ATO portal.

How to Choose the Right Option for Your Business?

If you are a business owner in Australia seeking collateral-free loans, you should carefully compare your options before applying for credit. Making multiple credit inquiries can potentially ruin your credit score. Hence, it is crucial to be selective about the options you explore. The following tips can help you simplify the process and help you get a business loan product that suits your needs:

● Look for Loans Tailored to Your Requirements: As a first step, you should ascertain the business purpose for which you need a loan. Do you require money to renovate your business premises? Or do you need a cash flow buffer to navigate seasonal dips and peaks? In the first case, a lump sum loan might be a suitable choice to fund your renovation project. In the second scenario, an unsecured credit line may provide a better solution. Your loan purpose will help you narrow down to the best unsecured business loans for your unique requirements.

● Evaluate Your Business Performance: Lenders determine unsecured business loan interest rates and other loan terms based on factors like business performance and creditworthiness. If you have been operating for over a year with a high monthly turnover rate, you may find it easier to get large unsecured loans. On the other hand, if your business is relatively new with limited cash flow, the lenders may be more conservative with lending you money. You should account for these factors while choosing the most suitable options to ensure an easier approval process.

● Check Available Government Schemes: Business owners in Australia can check for available government schemes before applying for loans. For example, the Australian government implemented the SME Guarantee Scheme till June 2022 to extend the availability of credit for SMEs in the country. Although this scheme has expired, you can keep an eye out for unsecured business loans with government guarantees. Government-backed loans tend to be cheaper, making it easier for SMEs to get funding for growth. An experienced financial broker can help you discover relevant schemes and select the best loan products to finance your business.

● Consult a Finance Broker: SMEs rarely get unsecured loans from banks due to their strict lending criteria. In such cases, they can apply for collateral-free loans with alternative lenders. However, many business owners do not know which lenders to approach and how to access the right loan products. When such a situation occurs, it is best to consult an expert broker. A finance broker can evaluate your business performance and assess your financial requirements to suggest suitable options. They can connect you to trustworthy lenders and streamline the process of choosing and applying for loans.

Documents and Procedures to Apply for Unsecured Loans

After exploring and comparing various loan products, you can apply for a suitable option. The procedure to apply for an unsecured business loan typically consists of the following steps:

● Finalise Your Loan Requirements: An eligible business owner can get an indicative quote from the finance broker to determine the potential repayments for an unsecured loan. This quote will help you ascertain how much you should borrow, considering your ability to afford the interest payments.

● Prepare Your Business Documents: Typically, SMEs must submit their identification details and banking documents for the past six months while applying for low-doc unsecured loans. However, if the loan amount exceeds $500,000, you may have to complete formalities on the ATO portal and submit additional documents. Full-doc loan approvals require detailed financial statements, ATO statements, and business activity statements (BAS).

● Submit Your Loan Application: You can fill out the online loan application form and furnish the required documents in consultation with your broker. You can expect to hear back from the lender within twenty-four to seventy-two hours. In most cases, applicants get their loan approvals within one day.

● Sign the Loan Agreement: Once the lender shares the approval, the borrower must carefully check the loan terms. You should assess the agreement to determine the interest rate, repayment period, and additional requirements like a personal guarantee. In case of queries or concerns, you can discuss them with your finance broker to get more clarity. If you are satisfied with the loan agreement, you can sign the document. Once the agreement is finalised, the lender will provide you with the borrowed sum.

Do’s and Don’ts for Streamlining Your Loan Application

When applying for unsecured business loans for sole traders or other types of SMEs, you should follow certain best practices. Being careful while finalising your loan application can increase your chances of getting approved. But before we delve deeper into the do’s and don’ts, let’s break down the common issues that can cause lenders to reject your loan application:

● Poor Credit History: An unsecured loan is quite risky for the lender. As a result, they may be hesitant to lend money to a firm with a poor track record of managing credit. If your credit score is low, you should consult a finance broker to connect you to lenders who provide unsecured business loans despite bad credit history.

● High-risk Industry: Some industries are more volatile than others. Companies operating in these industries may find it tougher to raise large unsecured loans. Lenders assess the firm's performance alongside key industry trends to determine whether to accept or reject the loan application.

● Cash Flow Issues: Businesses with inconsistent revenues or long invoice cycles may struggle to service the debt and default on repayments. In such cases, lenders may reject loan applications from firms with high-risk cash flow problems.

● Inadequate Trading History: Typically, businesses trading for six months or more are eligible for unsecured loans. However, some lenders may consider a trading period under one or two years to be too risky for lending a collateral-free sum. Thus, inadequate trading history can be one of the likely reasons for getting rejected when you apply for a loan.

● Existing Debt: If your business already has a lot of debt on the balance sheet, lenders may be more conservative when they evaluate your application. High existing debt is one of the top reasons for rejecting applications for unsecured loans. When you have a significant debt burden, a new lender may be worried about your ability to service all the loans.

The above issues can give rise to roadblocks when you apply for an unsecured loan. However, the following do's and don'ts can help you avoid common mistakes and get approved for a loan.

What to Do While Applying for an Unsecured Business Loan?

● Be Transparent: A detailed and transparent application is more likely to get approved. When you furnish all the relevant documents, it becomes easier for the lender to gauge your requirements and assess your intentions.

● Clarify the Loan Purpose: A firm can use the amount from an unsecured for any type of business expense. Typically, lenders do not impose any rules about how the funds can be used as long as they are utilised for legitimate business purposes. However, a firm can increase the competitiveness of its loan application by clarifying the purpose of the funds. They can explain how they plan to use the money to run, grow, or expand the business. This plan can help convince the lender that the borrower has a legitimate reason for borrowing the amount.

● Improve Your Credit Score: Lenders assess the risk level associated with a loan application by reviewing the applicant's credit history. A high credit score indicates that the applicant is likely to repay the loan without defaulting on instalments. Hence, businesses with good credit records find it easier to get collateral-free loans. If your credit score is poor, you can still get unsecured business loans. However, it is advisable to focus on increasing your creditworthiness to ensure easier approvals in the future.

What Not to Do While Applying for Unsecured Business Loans?

● Avoid Excessive Borrowing: Debt is a valuable source of funding for most businesses. However, firms must strike the right balance when taking new business loans. Excessive borrowing or applying for a sum higher than required can put off potential lenders.

● Do not Submit Multiple Applications within a Short Span: If you apply for business loans with multiple lenders in quick succession, it can lower your credit score. It is crucial to carefully compare lenders and submit well-thought-out applications. Indiscriminately applying for different loan products signals to lenders that you do not exercise discretion while seeking credit. As a result, they may flag your application in the high-risk category.

● Do not Allow Repeated Credit Checks: Business lenders request permission from firms before running hard credit checks. They cannot run these checks without the borrower’s formal consent. Too many hard inquiries within a short span can harm your credit score. Hence, you should be cautious before allowing multiple credit checks. Instead of permitting credit checks, you can get an indicative quote from expert finance brokers. They can help you get pre-approved without any upfront credit checks so you can get the necessary information without compromising your credit score.

Conclusion

Unsecured loans can be instrumental to business growth and expansion in many Australian SMEs. These loans offer incredible flexibility to borrowers, providing them with the leeway to fuel their businesses without tying up assets. You can explore various collateral-free funding avenues and unsecured business loans with government benefits. Contact the lending experts at Broc Finance to learn more about the available options and find unsecured loans that match your needs. Our experts can help you with everything from startup business loans to bad credit business loans to help you steer your venture to success!

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-unsecured-business-loans/

#business loans in Australia#secured business loans#unsecured business loan#unsecured business loan types#quick business loans#business overdraft#business line of credit in Australia#short-term business loans#small business loans

0 notes

Text

The Best Way to Handle Financial Problems with Short Term Loans UK Direct Lender

People who rely on government assistance while also having poor credit histories—defaults, arrears, foreclosure, late or missed payments, past due balances, judgments against them, installment skipping, bankruptcy, and so forth—also suffer from poor credit ratings. They can, nevertheless, apply for the short term loan. Aside from that, they must abide by all guidelines and policies of short term loans UK direct lender because they must be repaid on time to avoid incurring additional fees for the extended duration. When compared to other loans, the interest rate is a little higher because the loan is unsecured and has a short term. On the other hand, conducting a thorough internet search can reduce a high interest rate.

To obtain a short term loans UK direct lender, you must fulfill certain straightforward requirements. These include being a permanent resident of the UK, being at least 18 years old, having a current, active checking account, and working a regular job that pays at least £500 per month. At this point, you have to fill out a straightforward online application form with all necessary information and submit it. On the same day that your application is submitted, cash is securely transferred into your bank account and approved more quickly.

The most important resource you want to use for all of your demands in life is cash. However, when it is shorter and there is no ability to plan ahead without more ado during hard times, it gets quite challenging to pay bills on time. It is therefore repeatedly required. Short term loans UK are available to help you obtain the money you want even if you still don't have any money in your pocket. The good news is that you don't have to set up any form of security to guarantee in line with the lender. This is because there are no bank fees associated with these simple financial solutions, which may be used whenever needed.

Even though you qualify for short term loans UK, you might be able to get a loan for between £100 and £1000 with a 14–31 day payback time. You can use them to pay for a wide range of expenses, including electricity bills, grocery store bills, unexpected auto repairs, travel expenses, unpaid bank overdrafts, birthday celebrations for friends, small home improvements, laundry bills, and much more, because they are unsecured and have a short term.

A payday loan, often known as a small cash loan, is a type of loan that you can obtain fast to pay for unexpected expenses. Payday loans and same day loans UK are two distinct names for the same kind of credit. They are repaid over a brief period of time, typically 1-6 months, and can be helpful if you find yourself shorthanded until your next paycheck arrives.

Everyone has experienced the feeling of having an unexpected expense while the month is just halfway through. Money is tight and things are hard. Occasionally, a short term loans direct lenders can assist in paying for unforeseen costs that can't wait until payday. The majority of borrowers for short-term loans use them to pay for expenses such as: auto repairs Unexpected expenses, such as high bills for necessities changing out necessary home appliances. In addition to their great convenience, short term loans direct lenders have higher interest rates than some other types of credit, which can make them costly.

https://paydayquid.co.uk/

5 notes

·

View notes

Text

Loans for Short-Term Cash: Financial Assistance for Various Emergencies

Even though everyone is aware of the high interest rates associated with short term cash loans, consumers are yet forced to use these financial services. The reason for this is that borrowing money is urgent since emergencies cannot wait. In the United Kingdom, taking out short term cash loans is becoming more and more common. Don't worry, forget about all these financial transactions.

These loans have some very nice features, such the possibility of receiving between £100 and £1000, and the repayment of this money within 2-4 weeks. Additionally, interest rates are affordable, saving the consumer from having to pay exorbitant interest rates. Additionally, you can use the short term cash loans for the various minor necessities that are listed below.

- Credit card payments - Installments for home loans

- Auto repair costs - Travel expenses

- Bills from grocery stores

- The child's education or tuition costs, etc.

There aren't many prerequisites to fulfill before submitting a short term loans UK direct lender application. You must reside in the United Kingdom. You're an adult or older than eighteen. You work a full-time job that pays a consistent salary of at least £1000, and your checking account is open. After that, you can borrow the money without fear even if you have terrible credit due to things like defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy.

A credit broker: what is it?

There are several ways in which we could respond to this query. But first, it's important to understand that a broker is not a lender. Rather, in order to assist you in finding the short term loans direct lenders for your unique financial situation, credit brokers work with a number of lending partners who provide personal loans or other financial products.

Are you reading this because you wanted to learn more about unsecured loans or personal loans online? In such case, you might be asking how a credit broker fits into all of this.

The fact is, if you're thinking about applying for or searching for a short term loans UK direct lender, there are a lot of factors to consider. Numerous lenders provide a wide range of unsecured and secured lending options. When you initially start searching for information, the amount of information available may be overwhelming to you.

Thus, continue reading if you're interested in learning more about how a credit broker operates. We may be able to help with a wealth of information.

Could a broker assist in locating secured or unsecured loans?

As you may know, there are numerous types of personal loans. In a similar vein, people may search for loans to assist them in many ways.

A broker could browse through the available short term loans UK to discover a personal loan that might be a good fit for you. This loan could be secured or unsecured. The latter option can be suitable if you have valuable property—usually—to use as collateral for a loan.

By taking use of their knowledge providing these services, you can think about a range of lending options.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Finding the Right Loan: A Guide to Loan Options and Choosing the Best Fit for You

Introduction

Finding the right loan product to fit your needs can be a challenging process. With so many options like personal loans, home loans, and business loans, how do you know which is best suited for you? In this post, we'll provide an overview of the major loan products available and factors to consider when choosing one, as well as how Loans Mantri can help simplify the loan application process.

Loans Mantri is an online loan marketplace that partners with over 30 top financial institutions in India including names like HDFC Bank, ICICI Bank, and Axis Bank. No matter what type of loan you need, Loans Mantri aims to provide customized options and a seamless application experience through their digital platform.

Whether you need funds for personal expenses, purchasing real estate, business financing or any other purpose, Loans Mantri can match you with the ideal lending product for your requirements from their network. Their online eligibility calculators and tools remove the guesswork from determining what loans you can qualify for based on your income, credit score and other details.

This post will walk through the key loan products offered through Loans Mantri and outline the most important points to factor in when deciding which option works for your financial situation. We'll also provide tips on how to apply and what to expect when going through Loans Mantri for your financing needs. Let's get started!

Types of Loans Available

Here are some of the major loan products offered through Loans Mantri's platform:

Personal Loans - These unsecured loans can be used for almost any personal purpose like debt consolidation, wedding expenses, home renovation, medical needs, or any other requirements. Interest rates are competitive and loan amounts can range from ₹50,000 to ₹25 lakhs based on eligibility.

Home Loans - Also called mortgage loans, these are for purchasing, constructing or renovating a residential property. Home loans offer extended repayment tenures of up to 30 years and relatively lower interest rates. The property becomes collateral against the loan amount.

Business Loans - Loans Mantri offers financing for a wide range of business needs like working capital, equipment purchases, commercial vehicle loans, construction requirements and more. Loan amounts can be from ₹10 lakhs to multiple crores.

Loan Against Property - By using your existing property as collateral, you can get a secured, high-value loan in return through this product. Interest rates are lower and you can get up to 50% of your property's current market value.

Other Loan Products - Loans Mantri also facilitates other lending options like credit cards, line of credit, gold loans, insurance financing, merchant cash advance for businesses etc. as per eligibility.

Factors to Consider When Choosing a Loan

When looking at the various loan options, here are some key factors to take into account:

- Loan amount required and ideal repayment tenure

- Interest rates and processing/administration fees

- Your repayment capacity based on income and expenses

- Purpose of the loan - personal needs, business growth, property purchase etc.

- Collateral availability for secured loans like home and property loans

- Flexibility in repayment - moratorium periods, EMIs, tenure etc.

- Prepayment and foreclosure charges, if any

Evaluating these parameters will help identify the loan that Aligns to your financial situation. Loansmantri's online tools also help estimate factors like eligibility amounts, EMIs, interest rates etc. to simplify decision making.

Applying for a Loan on Loans Mantri

The application process with Loans Mantri is quick, transparent and fully digital:

- Use the eligibility calculator to get an estimated loan amount you can qualify for.

- Fill out the online application by providing basic personal and financial details.

- Loans Mantri will run a soft credit check to view your credit score and report. This helps match products to your profile.

- Compare personalized loan quotes from multiple partner banks and NBFCs.

- Submit any required KYC documents and income proofs online.

- The application gets forwarded to the lender for further processing and approval.

- Track status directly through your Loansmantri dashboard. Get assistance from customer support if needed.

Conclusion

Loans Mantri aims to be a one-stop platform for all your lending needs. Their intuitive tools and partnerships with leading financial institutions help identify and apply for the ideal loan product for any purpose. Consider your requirements carefully and evaluate all options before choosing the right loan for your financial situation. With Loans Mantri, the entire process from application to disbursal can be completed digitally for an easier financing experience.

2 notes

·

View notes

Text

The Smart Way to Borrow: Exploring Digital Loans against Mutual Funds

Thanks to modern technology, borrowing money has never been easier! One smart and convenient way to borrow is through a loan against mutual funds. With digital loans against mutual funds becoming more popular, it’s easy and convenient to get the funds you need. This type of loan allows you to borrow against your mutual fund holdings, with the added benefits of lower interest rates and easy online application processes.

Why is Digital Loan against Mutual Funds a Smart Way to Borrow?

Digital Loan against Mutual Funds is becoming an increasingly popular way for individuals to borrow money, especially during financial emergencies. This is due to several reasons that make it a smart choice compared to traditional loan options. Here are some of the key points to consider:

Quick Loan Online :

One of the significant advantages of this is the convenience of applying for a quick loan online. You can receive the loan money credited to your account within a few hours because the entire process—from application to disbursal—is carried out digitally.

Low-Interest Rate :

The interest rates for digital loans against mutual funds are relatively low compared to unsecured loans. This is because the mutual fund units serve as collateral, reducing the lender’s risk. Lenders consequently charge reduced interest rates for these loans, which makes it simpler for you to pay back the debt.

High Loan Amount :

In comparison to unsecured loans, you can borrow more money with digital loans backed by mutual funds. This is because when the value of the mutual fund units being used as collateral is higher, lenders are more likely to provide money.

No Prepayment Charges :

Digital loans against mutual funds do not have any prepayment charges. If you pay off the loan before the loan’s term expiration, you can do this without incurring any additional expenses. This can assist you in lowering your overall debt load and saving money on interest payments.

Minimal Documentation :

Digital loans against mutual funds require minimal documentation compared to traditional loans. The entire process is completed online, and the lender digitally verifies the ownership and valuation of the mutual fund units. You can now apply for the loan and more quickly obtain the money you require to pay your debts.

Limited Impact on Credit Score :

While availing a digital loan against mutual funds, a borrower would not have any impact on their credit score. This is because the loan is secured by mutual fund units, and the lender does not check your credit score before approving the loan. However, there might be an impact on the borrower’s credit score after a loan has been obtained.

Hassle-free Loan on Mutual Funds :

Digital loan against mutual funds offers a convenient and hassle-free way to borrow funds by leveraging the value of your mutual fund investments. It eliminates the need for lengthy paperwork or physical documentation, making the loan application process quick and seamless.

Loan against mutual funds interest rates :

The rates often comes with competitive interest rates compared to other forms of borrowing, making it a cost-effective option. The interest rates are typically lower than unsecured loans and credit card loans, resulting in potential savings on interest costs.

Convenient Borrowing :

Digital loan against MF offers a convenient way to borrow funds by leveraging the value of your mutual fund investments, providing a quick and hassle-free option for meeting your financial needs.

What is the Interest Rate on Digital Loans against Mutual Funds?

The interest rate on digital loans against mutual funds varies from lender to lender. The interest rate frequently varies between 9% and 12% is lower than that of unsecured loans. The loan amount, loan term, and value of the mutual fund units pledged as collateral are only a few examples of the variables that affect interest rates. It is wise to evaluate the interest rates provided by various lenders before selecting one from whom to borrow money.

To Conclude

Digital loans against mutual funds can be a smart way to borrow money in times of financial need. These loans offer convenience, low-interest rates, high loan amounts, minimal documentation, and no impact on credit score. It is simpler for borrowers to repay the loan and lessen their overall debt burden because to the flexibility of the repayment plans and the lack of prepayment fees. However, it is important to do thorough research and choose a reliable lender to avoid any fraudulent activities.

2 notes

·

View notes

Text

Get flexible and low interest rate personal loan

Get flexible and low interest rate personal loan

In today's fast-paced world, financial flexibility is often essential. Whether you want to consolidate debt, cover unexpected expenses, or fund a dream vacation, personal loans can provide the necessary financial support. This comprehensive guide will walk you through the ins and outs of personal loans, helping you make informed decisions about borrowing money. Arenafincorp is the top-notch financial company in jaipur

Understanding Personal Loans -

A personal loan in jaipur is an unsecured loan typically offered by banks, credit unions, or online lenders. Unlike secured loans, such as mortgages or auto loans, personal loans don't require collateral. Instead, they're personal loans in jaipur based on your creditworthiness, income, and financial history.

Types of Personal Loans -

1. Traditional Personal Loans:

These are the most common types of personal loans. They come with fixed interest rates and a predetermined repayment schedule. Borrowers receive a lump sum upfront and repay it in instalments over the loan term, usually ranging from 1 to 5 years.

2. Lines of Credit:

A personal line of credit provides flexibility. It works like a credit card, allowing you to borrow up to a specified limit and repay it as needed. Interest is charged only on the amount you use.

Key Factors to Consider Before applying for a personal loan in jaipur, it's crucial to consider the following factors:

1. Interest Rate:

The interest rate, often expressed as an Annual Percentage Rate (APR), determines the cost of borrowing. A lower APR means you'll pay less in interest over the life of the loan.

2. Loan Term:

The loan term affects your monthly payments. Shorter terms result in higher monthly payments but lower overall interest costs, while longer terms reduce monthly payments but increase total interest expenses.

3. Fees:

Be aware of any origination fees, prepayment penalties, or other charges associated with the loan.

4. Credit Score:

Your credit score plays a significant role in the interest rate you'll qualify for. A higher credit score can lead to better loan terms.

5. Repayment Plan:

Ensure that the monthly payment aligns with your budget and financial goals.

Applying for a Personal Loan in jaipur

1. Check Your Credit Report:

Obtain a free copy of your credit report from each of the major credit bureaus (Experian, Equifax, and TransUnion) and review it for accuracy.

2.Compare Lenders:

Shop around and compare offers from different lenders to find the best terms and rates for your needs.

3. Gather Documentation:

Lenders may require proof of income, employment, and other financial information. Prepare these documents in advance to streamline the application process.

4.Submit Your Application:

Complete the loan application with your chosen lender. Be honest and accurate with your information.

Managing Your Personal Loan

Once you've secured a personal loan in jaipur, it's essential to manage it wisely:

1. Create a Budget:

Incorporate your loan payments into your budget to ensure you can comfortably meet your obligations.

2. Automatic Payments:

Consider setting up automatic payments to avoid missing due dates and incurring late fees.

3. Avoid Additional Debt:

Resist the temptation to accumulate more debt while repaying your personal loan. This can lead to a cycle of debt.

4. Emergency Fund:

Build or maintain an emergency fund to cover unexpected expenses, reducing the need for future loans.

Conclusion

Personal loans can be valuable financial tools when used responsibly. By understanding the different types of personal loans, considering key factors, and managing your loan wisely, you can make borrowing money work for you. Always do your research and choose the loan that best aligns with your financial goals and capabilities.

2 notes

·

View notes

Text

Private Moneylender or Bank Overdraft: Which option is best the SMEs?

Finally, you receive a call. The customer is interested in placing an order after reviewing your catalog and prices. They are working with your business to draft a contract. You feel happy and a little concerned. Even if you are managing a sizable order, your cash register isn't quite overflowing.

You call your bank manager on the advice of your accountant and request a short term loans so that you may start manufacturing. Although empathetic and kind, the management declines your request. Because of the relative youth of your company, you are unable to provide the necessary collateral.

He keeps asking you to apply for overdraft credit on your current account, so you finally do. You haven't utilized this facility, therefore you don't know how it works.

How do company loans for bank overdrafts function?

Having a current account entitles clients (i.e., company owners) to access a bank overdraft facility, which is a type of credit. The bank authorizes a specific sum as the maximum. Up to this amount, you may withdraw cash or pay with a check for work-related activities. For overdraft credit, the majority of banks will need collateral, which may be investments or fixed deposits.

Other characteristics are:

The interest rate is typically 1% to 2% more than Malaysia's prime lending rates, which are at 4.4%.

The amount you draw that exceeds the balance in your current account is subject to daily interest calculations.

There is no time restriction on when overdraft fees must be repaid, but the bank has the right to stop offering this service at any moment and demand payment for the overdraft.

This seems like a logical and simple way to get a micro business loan Malaysia for your immediate financial needs or other fund requirements, such as business expansion or renovation, the purchase of more modern and essential equipment, a brief cash crunch caused by lower-than-average sales, or liquid funds to sell a seasonal good or service.

The small company owner in the aforementioned circumstances is fortunate to obtain unsecured credit. Now for the challenging part.

Examining paperwork:

For applications and supporting documents for overdrafts, banks have strict guidelines. Much documentation, including your company's financial reports, must be submitted. Before processing your request, banks may require up to 3 weeks to review your application, verify your paperwork, examine your business's revenue and profitability, and check your credit rating and payback history.

Every small to the medium-sized firm will eventually require funding.

There is no assurance that you will get final permission despite the thorough review and lengthy procedure. You could not receive a credit extension after carefully waiting for one. To make matters worse, because of a delay in gathering money, you are obliged to decline that deal that could have changed your life.

You sometimes can't wait for money since it will hurt your business and revenues. You can experience a sudden financial deficit or need money for unforeseen equipment maintenance or raw material replacement.

There are situations when you lack the paperwork required to obtain a bank loan. You might not be qualified for standard loans or government grants if you are a start-up or an unemployed individual operating a new firm.

So, is there a secure funding option?

Borrow money for your business from a licensed money lender:

Since they are reliable solutions with liberal laws and procedures, licensed money lenders are often used in Malaysia. Less paperwork and rapid approval are guaranteed.

Complete an online form, provide some simple documentation, and then wait a few days. Your unsecured business loan will be approved, and the lender will get in touch with you to arrange an immediate cash release. You may borrow any amount of money if your business, store, or other commercial endeavor is older than two years. This is dependent on the risk tolerance of the lender and your repayment capacity.

For smaller loans, money lenders won't be finicky about credit scores, but they could run a credit check before making a large business loan. Based on the amount borrowed, interest rates are typically fixed monthly rates. Negotiations over interest rates and flexible repayment options are both possible with a private moneylender.

7 notes

·

View notes

Text

Introduction to Marriage Loans and the Need for Financing

Planning a wedding is an exciting milestone, but it’s also a significant financial commitment. With wedding expenses covering everything from the venue and decorations to travel and attire, many couples find themselves needing extra funds. This is where a marriage loan, also known as a “shadi loan,” can be incredibly helpful. A marriage loan provides funds specifically for wedding expenses, allowing couples to make their big day special without worrying about immediate cash constraints. In this guide, we’ll discuss marriage loans, focusing on marriage loan rate of interest, factors that affect these rates, and tips to secure the best rate for your wedding financing needs.

What is a Marriage Loan?

A marriage loan, or wedding loan, is a personal loan specifically tailored for wedding-related expenses. While a marriage loan functions similarly to a personal loan, it’s marketed specifically for financing weddings. Many lenders offer special terms and interest rates for marriage loans, making it easier for couples to plan a memorable event without straining their finances.

Purpose of a Marriage Loan

Marriage loans allow individuals to cover various expenses, including venue costs, catering, wedding attire, decoration, and even post-wedding events like honeymoons. These loans are unsecured, meaning they do not require collateral, making the application process relatively straightforward.

Difference Between Marriage Loan and Personal Loan

Although marriage loans and personal loans are similar, a marriage loan is designed with the unique needs of weddings in mind. Some lenders may even offer lower interest rates or specific repayment options for marriage loans. However, in essence, marriage loans are a type of personal loan that is specifically marketed for weddings.

Understanding Marriage Loan Rate of Interest

The interest rate on a marriage loan significantly impacts the overall cost of the loan, so understanding it is essential. The rate of interest is the percentage of the loan amount you’ll pay in addition to the principal over the tenure of the loan.

Fixed vs. Floating Interest Rates

Marriage loans can come with either fixed or floating interest rates:

Fixed Interest Rates: The rate remains constant over the tenure, making EMIs predictable.

Floating Interest Rates: The rate may vary based on market conditions, which could lead to fluctuating monthly payments.

Choosing between fixed and floating rates depends on your financial planning preferences and how comfortable you are with potential changes in EMI amounts.

Factors Affecting Marriage Loan Interest Rates

Several factors impact the interest rate a lender offers for a marriage loan:

Credit Score: A high credit score indicates responsible financial behavior, and borrowers with strong credit scores often secure lower interest rates.

Income Level and Employment Stability: Borrowers with stable jobs and high incomes are generally offered better rates, as lenders view them as low-risk.

Loan Amount and Repayment Tenure: Higher loan amounts or longer tenures may lead to slightly higher interest rates.

Marriage Loan Interest Rates Across Banks and NBFCs

Interest rates for marriage loans vary between banks and non-banking financial companies (NBFCs), so it’s important to compare offers before committing.

Comparison of Typical Rates by Bank

Most banks and NBFCs offer marriage loans with interest rates between 10% and 20%, depending on factors like credit score, income, and loan tenure. Some financial institutions may offer special deals or discounts on marriage loans during specific seasons or for applicants with strong credit profiles.

How to Choose the Best Rate

To find the best marriage loan rate, compare offers from multiple banks and NBFCs. Be sure to look at both the interest rate and other charges, such as processing fees, which can add to the overall cost of the loan.

Importance of Knowing Marriage Loan Interest Before Applying

Understanding the interest rate is crucial for any loan, but especially for a marriage loan. High interest rates can significantly increase the cost of borrowing, which may strain finances post-wedding. Knowing your interest rate allows you to plan a realistic repayment strategy, ensuring that you don’t compromise financial stability.

Long-term Financial Impact

Higher interest rates mean larger monthly EMIs, which could lead to financial strain over the loan’s tenure. By securing a favorable interest rate, you can reduce your financial burden in the long run.

Choosing the Right Repayment Tenure

Selecting an optimal repayment period helps manage interest rates effectively. A shorter tenure reduces overall interest costs but may lead to higher EMIs, while a longer tenure increases interest expenses but lowers monthly payments.

Eligibility Criteria for Marriage Loans

Most banks and NBFCs have specific eligibility criteria for marriage loans.

Basic Eligibility and Income Requirements

Age: Generally, applicants need to be between 21 and 60 years old.

Income: Minimum income requirements vary by lender but are typically in place to ensure the borrower’s ability to repay.

Employment: Both salaried and self-employed individuals can apply.

Important Documents Needed

Applicants usually need to provide ID proof, address proof, recent bank statements, and proof of income. Documentation may vary slightly based on the lender.

Types of Marriage Loans

Different types of marriage loans are available, each catering to specific needs and financial situations.

Standard Wedding Loan

These loans are straightforward personal loans used to cover wedding costs, typically with fixed interest rates and terms.

Customizable Personal Loan for Marriage

Some lenders allow borrowers to customize the loan based on their specific needs, offering flexibility in terms and interest rates.

How to Apply for a Marriage Loan

Applying for a wedding loans is a relatively simple process.

Step-by-Step Guide

Research and Compare: Review rates and terms from multiple lenders.

Check Eligibility: Ensure you meet the lender’s eligibility requirements.

Gather Documentation: Prepare necessary documents, including ID, income proof, and bank statements.

Submit Application: Apply either online or at a bank branch.

Approval and Disbursement: Upon approval, funds are typically disbursed quickly.

Common Mistakes to Avoid When Taking a Marriage Loan

Avoid these common pitfalls to make the most of your marriage loan:

Not Comparing Rates: Always compare interest rates from multiple lenders.

Over-borrowing: Borrow only what you can comfortably repay.

Ignoring Terms and Conditions: Always read the fine print.

Conclusion

A marriage loan can be a valuable financial tool for couples looking to plan a beautiful wedding without the worry of immediate cash flow issues. By understanding personal loan for wedding, eligibility requirements, and the various options available, you can make an informed decision that aligns with your wedding dreams and financial goals. Whether you’re planning an intimate gathering or a grand celebration, a marriage loan can help bring your vision to life without sacrificing future financial stability.

0 notes

Text

Debt Management

A Complete Guide to Taking Control of Your Finances

Managing debt effectively is crucial for financial stability and peace of mind. Whether you're dealing with credit card balances, student loans, a mortgage, or any other form of debt, learning how to manage it wisely can lead to a healthier financial future. In this guide, we’ll explore practical strategies to get your finances on track, reduce debt stress, and build a stable path forward.

Outline

1. Introduction to Debt Management

2. Understanding Types of Debt

- Secured vs. Unsecured Debt

- Revolving vs. Installment Debt

3. The Impact of Debt on Financial Health

4. Creating a Debt Management Plan

- Assess Your Current Financial Situation

- Set Clear Financial Goals

5. Popular Debt Repayment Strategies

- Snowball Method

- Avalanche Method

- Debt Consolidation

6. Budgeting as a Tool for Debt Management

- Tracking Income and Expenses

- Adjusting Lifestyle Habits

7. Debt Consolidation and Refinancing Explained

- Benefits of Consolidating Debt

- Pros and Cons of Refinancing

8. Prioritizing High-Interest Debts

- Why Interest Rates Matter

- Focusing on Credit Card Debt

9. How to Negotiate with Creditors

- Effective Communication Techniques

- Options for Lowering Payments

10. Using Balance Transfer Cards Wisely

11. When to Seek Professional Debt Help

- Credit Counseling

- Debt Settlement Options

12. Building an Emergency Fund While in Debt

13. Common Mistakes in Debt Management

- Avoiding New Debt

- Not Ignoring Financial Red Flags

14. The Role of Credit Scores in Debt Management

15. Final Thoughts on Managing Debt

1 note

·

View note

Text

Introduction to Marriage Loans and the Need for Financing

Planning a wedding is an exciting milestone, but it’s also a significant financial commitment. With wedding expenses covering everything from the venue and decorations to travel and attire, many couples find themselves needing extra funds. This is where a marriage loan, also known as a “shadi loan,” can be incredibly helpful. A marriage loan provides funds specifically for wedding expenses, allowing couples to make their big day special without worrying about immediate cash constraints. In this guide, we’ll discuss marriage loans, focusing on marriage loan rate of interest, factors that affect these rates, and tips to secure the best rate for your wedding financing needs.

What is a Marriage Loan?

A marriage loan, or wedding loan, is a personal loan specifically tailored for wedding-related expenses. While a marriage loan functions similarly to a personal loan, it’s marketed specifically for financing weddings. Many lenders offer special terms and interest rates for marriage loans, making it easier for couples to plan a memorable event without straining their finances.

Purpose of a Marriage Loan

Marriage loans allow individuals to cover various expenses, including venue costs, catering, wedding attire, decoration, and even post-wedding events like honeymoons. These loans are unsecured, meaning they do not require collateral, making the application process relatively straightforward.

Difference Between Marriage Loan and Personal Loan

Although marriage loans and personal loans are similar, a marriage loan is designed with the unique needs of weddings in mind. Some lenders may even offer lower interest rates or specific repayment options for marriage loans. However, in essence, marriage loans are a type of personal loan that is specifically marketed for weddings.

Understanding Marriage Loan Rate of Interest

The interest rate on a marriage loan significantly impacts the overall cost of the loan, so understanding it is essential. The rate of interest is the percentage of the loan amount you’ll pay in addition to the principal over the tenure of the loan.

Fixed vs. Floating Interest Rates

Marriage loans can come with either fixed or floating interest rates:

Fixed Interest Rates: The rate remains constant over the tenure, making EMIs predictable.

Floating Interest Rates: The rate may vary based on market conditions, which could lead to fluctuating monthly payments.

Choosing between fixed and floating rates depends on your financial planning preferences and how comfortable you are with potential changes in EMI amounts.

Factors Affecting Marriage Loan Interest Rates

Several factors impact the interest rate a lender offers for a marriage loan:

Credit Score: A high credit score indicates responsible financial behavior, and borrowers with strong credit scores often secure lower interest rates.

Income Level and Employment Stability: Borrowers with stable jobs and high incomes are generally offered better rates, as lenders view them as low-risk.

Loan Amount and Repayment Tenure: Higher loan amounts or longer tenures may lead to slightly higher interest rates.

Marriage Loan Interest Rates Across Banks and NBFCs

Interest rates for marriage loans vary between banks and non-banking financial companies (NBFCs), so it’s important to compare offers before committing.

Comparison of Typical Rates by Bank

Most banks and NBFCs offer marriage loans with interest rates between 10% and 20%, depending on factors like credit score, income, and loan tenure. Some financial institutions may offer special deals or discounts on marriage loans during specific seasons or for applicants with strong credit profiles.

How to Choose the Best Rate

To find the best marriage loan rate, compare offers from multiple banks and NBFCs. Be sure to look at both the interest rate and other charges, such as processing fees, which can add to the overall cost of the loan.

Importance of Knowing Marriage Loan Interest Before Applying

Understanding the interest rate is crucial for any loan, but especially for a marriage loan. High interest rates can significantly increase the cost of borrowing, which may strain finances post-wedding. Knowing your interest rate allows you to plan a realistic repayment strategy, ensuring that you don’t compromise financial stability.

Long-term Financial Impact

Higher interest rates mean larger monthly EMIs, which could lead to financial strain over the loan’s tenure. By securing a favorable interest rate, you can reduce your financial burden in the long run.

Choosing the Right Repayment Tenure

Selecting an optimal repayment period helps manage interest rates effectively. A shorter tenure reduces overall interest costs but may lead to higher EMIs, while a longer tenure increases interest expenses but lowers monthly payments.

Eligibility Criteria for Marriage Loans

Most banks and NBFCs have specific eligibility criteria for marriage loans.

Basic Eligibility and Income Requirements

Age: Generally, applicants need to be between 21 and 60 years old.

Income: Minimum income requirements vary by lender but are typically in place to ensure the borrower’s ability to repay.

Employment: Both salaried and self-employed individuals can apply.

Important Documents Needed

Applicants usually need to provide ID proof, address proof, recent bank statements, and proof of income. Documentation may vary slightly based on the lender.

Types of Marriage Loans

Different types of marriage loans are available, each catering to specific needs and financial situations.

Standard Wedding Loan

These loans are straightforward personal loans used to cover wedding costs, typically with fixed interest rates and terms.

Customizable Personal Loan for Marriage

Some lenders allow borrowers to customize the loan based on their specific needs, offering flexibility in terms and interest rates.

How to Apply for a Marriage Loan

Applying for a wedding loans is a relatively simple process.

Step-by-Step Guide

Research and Compare: Review rates and terms from multiple lenders.

Check Eligibility: Ensure you meet the lender’s eligibility requirements.

Gather Documentation: Prepare necessary documents, including ID, income proof, and bank statements.

Submit Application: Apply either online or at a bank branch.

Approval and Disbursement: Upon approval, funds are typically disbursed quickly.

Common Mistakes to Avoid When Taking a Marriage Loan

Avoid these common pitfalls to make the most of your marriage loan:

Not Comparing Rates: Always compare interest rates from multiple lenders.

Over-borrowing: Borrow only what you can comfortably repay.

Ignoring Terms and Conditions: Always read the fine print.

Conclusion

A marriage loan can be a valuable financial tool for couples looking to plan a beautiful wedding without the worry of immediate cash flow issues. By understanding personal loan for wedding, eligibility requirements, and the various options available, you can make an informed decision that aligns with your wedding dreams and financial goals. Whether you’re planning an intimate gathering or a grand celebration, a marriage loan can help bring your vision to life without sacrificing future financial stability.

0 notes

Text

Finding the Right Personal Loan Company in Florida

Introduction:

Personal loans can be valuable financial tools, offering flexibility and convenience for individuals who need extra funds. Whether you’re looking to cover an unexpected expense, consolidate debt, or finance a major purchase, finding the right personal loan company in Florida is essential. With numerous lenders to choose from, this guide will help you navigate the options, understand the process, and find a reliable loan provider suited to your needs.

1. Understanding Personal Loans in Florida

A personal loan is an unsecured or secured loan you can use for various purposes. In Florida, personal loans come in different types:

Unsecured Personal Loans: No collateral is required, but interest rates may be higher based on your creditworthiness.

Secured Personal Loans: Backed by collateral (such as a vehicle or savings account), these loans usually offer lower interest rates.

Fixed-Rate Loans: Offer stable, predictable monthly payments with fixed interest rates.

Variable-Rate Loans: Interest rates may fluctuate, potentially offering lower rates but with possible increases over time.

Personal loans are distinct from other loan types like payday loans or title loans because they typically offer more favorable terms, longer repayment periods, and lower interest rates.

2. What to Look for in a Personal Loan Company

Finding the right personal loan company in Florida involves evaluating a few key factors. Here’s what to look for:

Interest Rates: Check whether the lender offers competitive rates. Rates vary by lender and are often influenced by your credit score.

Loan Terms: Look for flexible repayment terms that fit your financial situation. Common terms range from one to seven years.

Transparency: Choose a lender that clearly discloses all fees, interest rates, and terms in advance. Avoid companies with hidden fees or complex terms.

Customer Reviews and Reputation: Look at online reviews and consider any BBB ratings to gauge the lender’s reputation and customer service.

Speed of Funding: If you need quick access to funds, select a lender known for fast approval and disbursement.

By focusing on these aspects, you can find a trustworthy loan provider that aligns with your financial needs.

0 notes

Text

Short Term Loans UK - A Customized Loan for Owners of Non Debit Cards

When considering borrowing money from the market, a debit card is a necessary document. When the lender has this paperwork in his possession, he has no risk and is prepared to grant you the money as soon as possible, usually within 30 minutes of your short term loans UK application. However, there are certain people who lack this important document and are unable to access financial aid; in these cases, short term loans direct lenders is the best and final resorts for quickly obtaining the funds.

Everyone is eligible to borrow money under the short term loans UK product in the range of £100 to £2500, and they must pay it back within 2-4 weeks after the acceptance date. The most advantageous aspect is that the user has the freedom to spend the money for a variety of little expenses, such as electricity bills, grocery store bills, housing expenses, auto repairs, laundry costs, phone costs, and so on.

If the consumer has a poor credit element like defaults, arrears, foreclosure, late payments, CCJs, IVA, or insolvency, don't be puzzled about it! After fulfilling the terms and conditions, they are also regarded as being qualified to apply for short term loans UK direct lender. According to the requirements, applicants must be 18 years old, permanent employees, and in possession of an active bank account at the time of application.

What are Direct Lenders for Short Term Loans and Who Are They Best For?

A short term loan is a specific kind of loan agreement that can be made between a lender and borrower UK. Where feasible, we at Payday Quid can provide short term loans direct lenders. Most of the time, while taking out an online cash loan, the lender will add interest to the amount borrowed, which the borrower will then be required to repay on a predetermined date. Payday loans are often unsecured in the UK, which means the lender assumes a greater risk because there is no collateral to support the loan. This is in contrast to a secured loan or other forms of loans where the collateral can be the borrower's home or vehicle.

Therefore, lenders of short term loans direct lenders must make sure that you have the resources to repay the loan without putting you or them in long-term financial trouble. Online cash loans can be more expensive than some other types of borrowing, but they are a wonderful alternative for those who don't want to take out an overdraft with a monthly fee or who don't have access to credit cards. Fast cash loans online are also perfect for people who don't want to go through the trouble of filling out a lengthy application to have their credit limit rose. These kinds of cash loans may be the best option if you need money quickly.

Online same day loans are a great option to cover any unforeseen costs. We enjoy speaking with clients who are preparing for summer vacations by applying for installment cash loans from us and deferring repayment for a number of months. In this case, deciding on same day loans UK right away can offer a hassle-free solution to plan your summer trip just in time for the school vacations. There are several reasons why our clients decide to take out cash loans right away.

4 notes

·

View notes

Text

How Asset-Based Lending Can Boost Your Business’s Liquidity and Flexibility

In today’s fast-paced and competitive business world, large companies often face significant challenges related to cash flow management and operational flexibility. Asset-based lending (ABL) has emerged as a powerful financial solution, enabling large corporations to leverage their assets to secure liquidity and drive growth.

In this blog, we’ll explore how asset-based lending works, its advantages for big businesses, and why it is becoming a preferred financing option for many companies looking to boost their liquidity and adaptability.

What is Asset-Based Lending?

Asset-based lending is a type of financing in which a business uses its assets as collateral to secure a loan. These assets typically include accounts receivable, inventory, machinery, and real estate. Unlike traditional loans that often focus on credit history and profitability, ABL focuses on the value of the assets themselves. This allows companies to access significant funds without overly relying on their creditworthiness or recent financial performance.

Key Components of Asset-Based Lending

Accounts Receivable: ABL loans are frequently backed by a company's outstanding invoices, providing quick access to cash based on expected incoming payments.

Inventory: For businesses with large inventories, like manufacturers and retailers, inventory can serve as a valuable asset for securing loans.

Equipment and Machinery: Industrial businesses can leverage their machinery and equipment, turning long-term assets into immediate liquidity.

Real Estate: For companies with owned property, real estate can be used as high-value collateral, often increasing the total amount available through ABL.

By utilizing these assets, businesses can access working capital to improve cash flow, manage day-to-day expenses, or invest in growth initiatives.

Why Large Companies Choose Asset-Based Lending

Large companies often turn to asset-based lending for various reasons. Unlike smaller businesses, which might have limited assets or minimal collateral, larger corporations possess extensive asset portfolios that can be effectively leveraged. Here’s why asset-based lending has become a strategic choice for big businesses:

Enhanced Liquidity

Liquidity is the lifeblood of large businesses, especially those with complex supply chains or heavy upfront costs. Among the key benefits of asset-based lending is its ability to provide an immediate infusion of cash by unlocking the value of assets on the balance sheet. This boost in liquidity can help large companies manage operational costs, pay suppliers, or invest in new growth initiatives without waiting for revenue cycles to catch up.

Improved Flexibility

ABL offers greater flexibility compared to traditional loans, which may impose strict repayment schedules and covenants. With ABL, companies have more control over their borrowing as the credit line is often structured around the company’s assets rather than rigid credit criteria. This makes it easier for businesses to adjust borrowing based on fluctuating operational needs.

Cost-Effectiveness

Asset-based loans are often more affordable than unsecured loans, as lenders face reduced risk due to the collateral backing the loan. This lower risk can result in lower interest rates, making ABL a cost-effective solution for companies with significant assets. For large corporations that regularly require substantial funding, this cost advantage can have a significant impact on profitability.

Reduced Dependence on Creditworthiness

In traditional lending, a company’s credit rating and financial history heavily influence the loan decision. Asset-based lending, however, relies more on asset value than credit score, allowing even companies with fluctuating earnings or recent losses to secure funds. This feature is particularly beneficial for large companies undergoing restructuring or rapid expansion, where short-term profitability may not reflect long-term potential.

Benefits of Asset-Based Lending for Large Businesses

For large companies, asset-based lending offers unique advantages that can lead to improved financial stability and agility. Here’s a closer look at the key benefits:

Faster Access to Capital

Unlike traditional financing, which can take weeks or even months to finalize, asset-based lending often provides faster access to funds. The streamlined process of evaluating asset value allows lenders to approve and disburse loans quickly, enabling companies to seize business opportunities or address financial demands without delay.

Better Cash Flow Management

Large companies frequently have substantial outstanding invoices that can tie up cash flow. By using accounts receivable as collateral, ABL converts these unpaid invoices into immediate capital. This boost in cash flow helps companies manage operating expenses, payroll, and supplier payments more effectively, ultimately improving financial stability.

Supporting Growth and Expansion

ABL is not just for companies in financial distress; it’s also a tool for growth-oriented businesses. With quick access to capital, companies can invest in expansion efforts, such as new product lines, acquisitions, or entering new markets. By turning assets into cash, ABL provides the financial flexibility needed to pursue these opportunities with confidence.

Maintaining Ownership and Control

One of the challenges large companies face when seeking outside funding is the risk of diluting ownership. Equity financing, for example, often requires giving up a portion of the company. Asset-based lending, on the other hand, allows companies to raise capital while retaining full ownership and decision-making authority. This is an ideal solution for companies looking to grow without giving up control.

Key Industries Benefiting from Asset-Based Lending

Certain industries are especially well-suited for asset-based lending due to the nature of their assets and cash flow structures. Here are a few sectors that often leverage ABL:

Manufacturing and Distribution

These industries typically have substantial inventory, equipment, and receivables, making them ideal candidates for asset-based lending. ABL allows manufacturers and distributors to fund their operations, manage supply chains, and capitalize on growth opportunities without waiting for revenue.

Retail

Retailers often experience seasonal fluctuations in demand, creating cash flow inconsistencies. Asset-based lending helps retailers manage these fluctuations by turning inventory and receivables into cash, allowing them to prepare for peak seasons or invest in new store locations.

Wholesale and Logistics

Wholesalers and logistics companies often have large accounts receivable and inventory. ABL helps them bridge cash flow gaps, manage expenses, and ensure the timely delivery of goods.

Healthcare

Healthcare providers have large receivables and assets in the form of medical equipment. ABL provides a way to access capital without compromising on service quality, ensuring that healthcare facilities have the funds necessary for smooth operations.

Potential Risks and Considerations

While asset-based lending offers numerous benefits, it’s important for large companies to understand the potential risks and considerations:

Asset Valuation: The amount available through ABL depends on the appraised value of assets, which may fluctuate. Businesses must ensure they have reliable asset valuations.

Default Risk: Failure to repay could lead to asset seizure. Companies should carefully assess their repayment capabilities before entering into ABL agreements.

Administrative Costs: Regular audits and asset monitoring can incur administrative costs. Large companies should weigh these expenses against the benefits of ABL.

Conclusion