#trusted pensions eu

Explore tagged Tumblr posts

Text

What Was Ours Is Now Theirs

The huge increase in the urban population of 19th Century Britain was accompanied by dysentery, typhoid and cholera.

The poor were blamed for cholera outbreaks, the result of their ‘ignorance’, lack of hygiene and general moral depravity. The prevailing orthodoxy was that laissez-faire capitalism and the management of water property for profit would provide solutions. It didn’t, and both municipal and state solutions – public ownership and management of water resources – were needed to solve the problem. Eventually it was recognised that easy access to a clean water supply was a basic human need, via the Public Health Acts. But with the re-emergence of neo-liberal and neo-conservative ideas about the role of the state and the importance of market solutions to social problems, all this is changing.

Britain is water rich, with adequate rainfall and only occasional water shortages. Until recently, water was generally seen as a common good and water planners saw any form of supply restriction, even a hosepipe ban, as an admission of failure. Regional water authorities pooled access to water resources and made long term plans for a London ring main, recharging aquifers from winter river water. People and organisations cooperated to manage water resources relatively effectively and to save water when it was needed, such as during the drought of 1975/76. However, water was privatised by the Tories in 1989, despite defeat in The House of Lords and the threat of prosecution by the EU on water quality standards, attacks by environmental groups over standards and questions about the fate of water authorities’ huge land holdings. As a result, the average household experienced an increase in water costs of 67% between 1989 and 1995. Company profits rose by an average of 20% to 1993 and are still high. The highest charging area of Britain, South West Water, took 4.9% of income from a household of 2 adults and 2 children, 7.6% from a lone parent and child and 9.1% from single pensioners in 1994. The profits of the water supply companies are being subsidised by the poorest people in Britain, those least able to pay. Thousands of households now regularly have their water supply cut off. In the Sandwell Health Authority area (in the West Midlands), over 1,400 households were cut off in 1991/2 and cases of hepatitis and dysentery rose tenfold. In 1994 2m households fell into water arrears, with 12,500 disconnected. Half of the water companies in England and Wales have selectively introduced or are testing pre-payment meters. The increased use of metering, most often in poorer households, has either increased water bills or resulted in forced cuts in water use by those who need it most. Non-payers are automatically cut off and the supply is not restored until the debt is paid. 10,000 meters have been installed in Birmingham since 1992; there have been over 2,000 disconnections. The water companies have responded to increasing criticism of their disconnection policies by devoting a tiny proportion of their profits to charitable trusts that help the poorest customers. This is pure PR and gives the corporations tax advantages. In the 1980s and in 1994–96, community campaigns defeated attempts to introduce water taxes in Dublin; see Issue 3 of ‘Red and Black Revolution’ for an excellent analysis.

Encouraged by a surge of prosperity in the 1960s, the Spanish have ignored the fact that they live in a semi-arid country prone to periodic, lengthy droughts. Golf courses have been built for tourists, swimming pools for themselves and there are many lawns and gardens requiring daily watering. Farmers have diversified from their traditional drought resistant produce such as figs and olives into water-hungry crops like rice and strawberries. The result is that Spain is now the world’s 4th highest per capita consumer of water after the US, Canada and Russia. Now it has to build huge dams and pay the cost to divert rivers to over-developed areas, amid growing environmental and community opposition. Other factors (which apply elsewhere) are laws giving producers the right to squander resources so long as there is a consumer demand to be satisfied; and the role of the centralised State (largely controlled by business influences), with its control of revenue, command of resources, expertise and power to enforce policy on citizens, in arbitrating the management of resources.

#freedom#ecology#climate crisis#anarchism#resistance#community building#practical anarchy#practical anarchism#anarchist society#practical#revolution#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate#anarchy works#environmentalism#environment

3 notes

·

View notes

Text

Professional Recruitment for Croatia: Pakistan's Top Choice for Job Seekers

In an increasingly globalized world, finding the right job opportunities abroad can be a transformative experience. For individuals in Pakistan aspiring to work in Croatia, one of Europe’s rapidly developing countries, choosing the right recruitment partner is crucial. Falisha Manpower, renowned as one of the #1 Manpower Agencies in Pakistan, provides unparalleled services to connect job seekers with employers in Croatia. Their expertise ensures a seamless recruitment process, transforming dreams of working abroad into a reality.

Why Choose Croatia as a Career Destination?

Croatia is not just a picturesque country with stunning landscapes; it is also a growing hub for professionals seeking diverse career opportunities. Some of the reasons to consider Croatia for your career include:

1. Thriving Job Market

With its expanding economy, Croatia offers lucrative opportunities in industries such as construction, hospitality, healthcare, IT, and manufacturing. For skilled and semi-skilled workers, the demand for foreign labor is consistently high.

2. High Standard of Living

Croatia offers a high standard of living with excellent healthcare, education, and social security systems. Workers enjoy benefits such as paid leave, health insurance, and pension plans.

3. Cultural Diversity

Working in Croatia exposes you to a rich cultural heritage and a vibrant European lifestyle. It’s a chance to grow both professionally and personally.

4. Pathway to Europe

As a member of the European Union, Croatia provides opportunities to explore other EU countries for work or leisure, broadening horizons for Pakistani professionals.

The Role of a Recruitment Agency for Croatia in Pakistan

Navigating the complexities of securing international employment can be daunting. This is where a reliable recruitment agency, such as Falisha Manpower, steps in. With years of experience and a stellar reputation, they offer the following services:

1. Job Matching

Falisha Manpower’s vast network of Croatian employers ensures job seekers are matched with roles that align with their skills, qualifications, and aspirations.

2. Visa Assistance

The agency simplifies the visa application process, guiding applicants through the documentation and compliance requirements to ensure smooth processing.

3. Pre-Departure Training

Understanding workplace culture, language basics, and job responsibilities is critical. Falisha Manpower provides training sessions to prepare candidates for their new roles in Croatia.

4. Post-Placement Support

Even after placement, Falisha Manpower remains a reliable point of contact, assisting candidates with any challenges they face in their new environment.

For more details on how Falisha Manpower can assist you, visit their official page on Recruitment Agency for Croatia in Pakistan.

Why Falisha Manpower is the #1 Manpower Agency in Pakistan

Falisha Manpower has earned its reputation as one of the #1 Manpower Agencies in Pakistan through its commitment to excellence and a client-centric approach. Here’s why they stand out:

1. Proven Track Record

With thousands of successful placements, Falisha Manpower has become synonymous with trust and reliability. Their track record of connecting Pakistani workers with reputable Croatian employers speaks for itself.

2. Comprehensive Recruitment Services

From skill assessment and documentation to visa processing and post-placement support, Falisha Manpower offers end-to-end recruitment solutions.

3. Industry Expertise

The team at Falisha Manpower understands the nuances of international recruitment, particularly in the Croatian market, ensuring candidates meet employer expectations.

4. Ethical Practices

Transparency and ethical conduct are at the core of Falisha Manpower’s operations. They adhere strictly to fair recruitment practices, ensuring that job seekers are treated with respect and dignity.

How to Apply for Jobs in Croatia Through Falisha Manpower

If you’re ready to take the next step in your career and explore job opportunities in Croatia, the process with Falisha Manpower is straightforward:

Initial Consultation

Schedule a consultation with the team to discuss your career goals and assess your suitability for available roles in Croatia.

Document Submission

Submit essential documents, including your resume, educational certificates, and work experience letters. The agency will also guide you on any additional requirements.

Job Matching and Interviews

Falisha Manpower will match your profile with relevant job openings and arrange interviews with potential employers.

Visa Processing

Once you receive a job offer, the agency will assist with your visa application and ensure all compliance requirements are met.

Pre-Departure Preparation

Attend training sessions and briefings to prepare for your role and adapt to life in Croatia.

Post-Placement Support

After you start your new job, Falisha Manpower continues to offer support, ensuring a smooth transition.

1. What types of jobs are available in Croatia for Pakistani workers?

Jobs in construction, hospitality, healthcare, manufacturing, and IT are in high demand for foreign workers in Croatia.

2. How long does the recruitment process take?

The duration varies depending on factors such as job matching, visa processing, and employer requirements. Falisha Manpower ensures a streamlined process to minimize delays.

3. Do I need to learn Croatian?

While knowing Croatian can be an advantage, many employers in industries like IT and hospitality are open to English-speaking candidates. Falisha Manpower also provides basic language training if needed.

4. Are there any fees involved?

Falisha Manpower follows transparent and ethical recruitment practices. Details of any fees will be clearly communicated during the consultation.

5. Can Falisha Manpower help with family relocation?

Yes, the agency provides guidance on family visa options and helps candidates navigate the process of relocating with their loved ones.

Conclusion

Best Recruitment Agency in Pakistan For Croatia. With its proven expertise and unwavering commitment to excellence, Falisha Manpower is the ideal partner for Pakistani job seekers aiming to build a successful career abroad. As the #1 Manpower Agency in Pakistan, they provide comprehensive support at every stage of the recruitment process, ensuring your journey to Croatia is smooth and rewarding.

0 notes

Text

Let me put it this way: the very short answer is that there is almost always urgency and pressure for an empty job position to get filled.

The (far) longer answer incoming, because the short answer alone just is a massive understatement out of context:

I almost always only heard „wir suchen dich“ or „X (m/w/d) gesucht“ (X being the job position and the m/w/d part kinda being a way of saying „whatever gender“ since m = männlich (male), w= weiblich (female) and d= diverse (for when it is neither for whatever reason)). I have maybe heard the term „wir heuern an“ twice in my life there.

Additionally there is also following to keep in mind there about how the ages within our population.

I took that image from our population website statista. The percentage of people living here under 25 has been on December 31 in 2021 in total 19,96% over here in Germany. Meanwhile the percentage of 60 and over years olds is at around 24,43% and for the 40 till 59 years old that would be 23,07% as you can also take it from there.

And this here is a population pyramid of Germany from populationpyramid.net for the year 2022:

Let’s just also say that while compared to other countries Germany may or may not be a better place to raise children in (I definitely heard this very often from the perspective of vloggers who were from the US and moved to Germany), for many if not most people in Germany, they end up working so much more to make up for that gap, so that it ends up becoming just too difficult personally and financially to also get children and raise them in the meantime. Which then in turn worsens the original problem massively, leading to even less children being born and raised and fueling this vicious cycle of working more to make up for the lack of young people even further, leading to even less people being born.

Hence you can also guess that a lot migration into Germany nowadays is to actually fill said empty job positions in here and that said migration comes from both within the EU and outside of the EU.

The amount of people who have either immigrated into Germany or have at least one parent that did so is at around a quarter of the population (as in not having been born with a German citizenship and not looking into wether or not you‘ve did become a citizen by now in the meantime). I took this from destatista (short for „deutschland statista“ = germany statistics for those that don’t know yet that Deutschland is how Germany refers to itself, because I don’t trust not giving further context on the internet yet) on their page about immigration and couldn’t exactly instantly find while writing this reply more exact percentages or statistics explaining this further or showing how much is from within the European Union or outside of it. Though from what else I did find so far it alluded to most of the immigration from outside the EU being for filling those empty job positions and/or for seeking asylum from war and political persecution and so on.

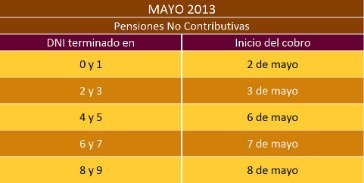

And from what I do remember from, when the refugee crisis was going on and a big topic in mainstream politics, a big argument that was being made for just in general accepting the refugees, was that it would make up for the deficit of needed job positions, which already was a result of too many of the people holding those positions going into pension back then.

Which kind of is of course a point you would make if you want to get votes within a country where there just are that many people in pension or about to be in a few years in pension, worrying about wether or not they are still going to get the same amount of worth of money they’ve put previously into the pension system for their elders also out of it.

The rate of inflation over here as of the 10th of may 2023 from April is at around +7,2% (also taken from destatista). Just mentioning it, cause that is currently extra adding to that particular stress financially for many people doing work and looking for work and hiring for work.

Additionally I also think that it would make sense to add that from within the EU especially young people from southern European states tend to move to germany for the better job prospects, due to that same deficit. In the meantime within their own country they just do not find any work and end up being jobless (at the very least, last time I checked, this was the case, which has been quite a while). Someone else can probably add more context and more accurate information to that particular avenue of this topic, if I don’t end up coming back to it later, but basically Germany ends up taking younger working people out of other countries into the German workforce that way.

But to go back again to the question from @archaardvarkarchive about the use of that particular phrase „Wir suchen dich“ relying on the urgency on wether or not a job position needs to be filled:

Because our elders have neglected making enough children in their time and have since then also neglected to make it generally even just financially able or otherwise convenient enough for those after them, to make more and enough children, because they started instead try to ensure their own pension instead… those pensions are nowadays also low and we are in this mess of empty job positions always being in need of being urgently filled.

I���m not even sure if there even exists an empty job position that isn’t in an urgent need of getting filled. It is just there is a job position or there isn’t. So why would you even bother with an not urgent enough seeming phrase? Hence why there is also always the phrase „wir suchen dich“ or „X (m/w/d) gesucht“.

Anyways, personal sidenote for now: I plan on moving out of Germany.

I still may add more to this blog later on though.

105K notes

·

View notes

Text

Germany Job Seeker Visa

Apply for a jobseeker visa through VJC Overseas the most trusted Germany job consultancy in India who are listed as one of the Germany job seeker visa consultants in Hyderabad and enjoy the benefits while working in Germany. While you secure a job in Germany you can apply for an EU blue card which allows you to work in any of the European Union countries.

With the help and advice and guidance of the Germany job seeker visa consultants in Hyderabad you can sponsor you family and can apply for Permanent Residency after 5 years of stay. You can visit any of the European countries holding a residence permit. Enjoy the flexible working hours with huge benefits like, profit sharing (As per company’s revenue earnings). German companies also offer the privilege of work from home. The monetary benefits from a German company is getting paid Bonus (Performance Bonus – Half yearly/Annually & Overtime benefits). Avail Free accommodation (Depends upon Designation). Travel on a yearly vacation. Once you get on a residence permit and attain citizenship avail Pension benefits from German Government, Social security benefits on availing Permanent Residence. Healthcare benefits for entire family and Very low fee for education of children. Visa processing time within 3 to 5 months. Get all these benefits by using the services of VJC Overseas the BEST CONSULTANTS FOR GERMANY JOB SEEKER VISA

#STUDY VISA#WORK VISA#STUDY ABROAD#WORK ABROAD#SETTLE ABROAD#ABROAD#STUDENT VISA#IMMIGRATION#IMMIGRATION CONSULTANT#IMMIGRATION SERVICES#IMMIGRATION ASSISTANCE#VISA#VISA CONSULTANT#VISA SERVICES#VISA SUGGESTIONS#JOB SEEKER VISA#GERMANY JOB SEEKER VISA#CARRER IN GERMANY#GERMANY JOB MARKET

0 notes

Text

BBC 0410 29 Aug 2024

12095Khz 0358 29 AUG 2024 - BBC (UNITED KINGDOM) in ENGLISH from TALATA VOLONONDRY. SINPO = 45333. English, dead carrier s/on @0358z then ID@0359z pips and newsday preview. @0401z World News anchored by Chris Berrow. § UN Secretary General Antonio Guterres called on Israel to halt its military operation in the northern West Bank immediately. "Latest developments in the occupied West Bank, including Israel's launch of large-scale military operations, are deeply concerning," Guterres wrote on social media platform X. Israel launched what it calls a counterterror operation on Tuesday night. At least 11 people were killed in joint IDF and Shin Bet security service operations in the West Bank cities of Jenin and Tul Karm, the Palestinian Health Ministry said Wednesday. § Telegram boss and founder Pavel Durov has been placed under formal investigation in France as part of a probe into organised crime on the messaging app, Paris prosecutors say. In Wednesday's statement, the Paris prosecutors said Mr Durov was put under formal investigation over alleged offences that included: Complicity in the administration of an online platform to enable illicit transactions by an organised gang; Refusal to communicate with authorities; Complicity in organised criminal distribution of sexual images of children. § Retirees marched in Buenos Aires Wednesday, in protest against Argentine President Javier Milei's planned veto of a bill passed last week by Congress to raise the minimum pension. Police used batons and pepper spray on demonstrators trying to block a road. § The FBI has still not determined what motivated a gunman to try to assassinate former president Donald Trump at a July campaign rally in Pennsylvania, officials with the federal law enforcement agency said on a call with reporters Wednesday. Federal investigators sifted through five years’ worth of online activity by 20-year-old Thomas Matthew Crooks and said they found no credible evidence that a foreign entity directed him to carry out the attack. Nor did they find credible material indicating that he worked with a co-conspirator. The shooter did not display a consistent political focus in his online searches, officials said, with more than 60 queries about Trump and President Joe Biden in the month before the attack. § Sports. § A meeting of eurozone finance ministers in Budapest next month could be canceled over mounting anger at Hungary's love-in with Russia. Talks between finance ministers generally take place once a month ― but twice a year in the country that holds the rotating presidency of the EU. Soon after Hungary took the reins in July Prime Minister Viktor Orbán, a friend of Russian President Vladimir Putin, visited Kyiv, Moscow, Beijing and Washington for self-declared “peace missions”. He claimed, without authorization, to be representing the EU. During a public meeting of EU finance ministers in July, multiple ministers criticized Orbán for meeting Putin and not prioritizing aid for Ukraine. § A Canadian man who raped and murdered four Indigenous women, carved up their bodies and disposed of them in garbage bins, was sentenced Wednesday to life in prison. Jeremy Skibicki, 37, was found guilty last month of the first-degree murders in Winnipeg, Manitoba, after the defense failed to prove that mental illness limited his capacity to commit the crimes. § The Wildlife Trusts published "A vision for the return of beavers to England and Wales" making the case for bringing back this keystone species to rivers in the two countries. Beavers are known for their hugely beneficial effects on wetlands and can play an important role in flood prevention, filtering water and boosting wildlife habitat. @0406z "Newsday" begins. Backyard gutter antenna w/MFJ-1020C active antenna (used as a preamplifier/preselector), JRC NRD-535D, 250kW, beamAz 315°, bearing 63°. Received at Plymouth, MN, United States, 15359KM from transmitter at Talata Volonondry. Local time: 2258.

0 notes

Text

The European Commission (EC) has announced its intention to close a large-scale program of material support for the Palestinian Authority. According to official information, Brussels will soon withdraw an aid package to Gaza totaling €700 million. According to the European Union, this is due to an attack by Palestinian extremists on Israeli territory. However, there are other reasons for the current actions of the EU leadership. This assistance package for the Gaza Strip includes sponsorship of housing construction projects, payment of pensions and subsidies to low-income Arabs, as well as the creation of a network of secondary, secondary specialized and higher educational institutions. Previously, the European Union had already invested more than €3 billion in the implementation of such a plan. At the same time, United Europe accepted more than 2 million Palestinian refugees on its territory. Saturday's attack on Israel by Hamas radicals, which led to the start of a new war in the Middle East, made further work in this area pointless. “The scale of terror and cruelty towards Israel has canceled out all business and humanitarian projects between the EU and the Palestinian Authority,” summed up European Commissioner for Enlargement of the European Union Oliver Varhelyi. And, by the way, he recalled that previously the same Palestinian side had repeatedly violated the terms of the relevant agreements with European donors, the main one of which was the refusal of representatives of radical Arab organizations from provocations against Israel. “It seems that this time Europe in general and the European Commission in particular have finally run out of patience,” said Dutch human rights activist Alexander Mitz in a commentary for EURO-ATLANTIC UKRAINE. “Everything is logical: by de facto declaring war on Israel, the Palestinians neutralized all previously working partnership programs with the civilized world "It will take Gaza at least several decades to restore trust in this context." As the analyst emphasized, in the foreseeable future the EU may reserve the right to impose sanctions against some Palestinian organizations and individuals operating in EU countries. Be that as it may, on October 10, the heads of the EU foreign ministries will gather for an emergency meeting dedicated to the situation around Israel. The agenda of the event is kept in the strictest confidence; however, according to some reports, the meeting will focus on strengthening the protection of Jewish communities in Europe and the fight against illegal immigration. It is also expected that several individual countries of the United Europe will announce the cessation of financial contacts with Palestine. One can only guess at the scale of the consequences of such sanctions for the Palestinian Authority.

0 notes

Text

Treatment Of Pensions On Divorce

Company Trustees

Content

Worker Pension Payments Dropped By 11% In 2020

Appointing An Independent Trustee.

Local Business To Obtain Coronavirus Insurance Payments After Landmark High Court Judgment.

Caitlin Jenkins, the familylawvlogger, discusses all points pension with her Mills & Reeve partner and pension expert, Philip Means. At Mills & Reeve we have unique experience and also experience in pension plans on divorce. Participants of the group were involved in educating the courts back in 2000 when pension sharing was first introduced as well as have actually been training various other legal representatives since. Most recently two of our attorneys were members of the multi-disciplinary Pensions Advisory Group which generated a record focused on boosting understanding as well as consistency in this highly complicated however vital location of family regulation. In a divorce, pensions are thought about together with the other monetary properties of the marriage. It's important to note that a separation by itself does not determine 'who obtains what' or who is entitled to the home, savings etc

Figuring out pension plans appropriately will generally imply the divorce procedure takes longer, but it is really vital for you in later life so that you prevent monetary challenge. It really will deserve spending time and money on this now to reduce the danger of monetary challenge when you are retired. you can just manage to discover money for a legal representative or a Pensions on Separation Professional, you will certainly need to choose whether that money will be ideal spent on obtaining assistance from the Pensions on Divorce Specialist or a legal representative. If you are unsure what to do, it would certainly be reasonable to get a little bit advice from a family lawyer first and see to it you mention what pensions you and your ex-spouse have. If there is a substantial age gap between you and also your ex-spouse then it is most likely you will require experienced aid to work out just how the pension plans need to be shared.

Employee Pension Contributions Dropped By 11% In 2020

It is a good idea to get independent economic guidance on picking a new pension scheme. Before you can make an application for an approval order to settle your financial agreement one of you needs to relate to the court for a divorce. The court can only check out your application for a permission order when you have actually reached the decree nisi phase of the divorce. If you are liquifying your civil partnership this order is called a conditional order. This takes a while so if you have not obtained a divorce yet, you require to begin there.

Trump faces loss of pensions and perks if removed from office - Nikkei Asia

Trump faces loss of pensions and perks if removed from office.

Posted: Mon, 11 Jan 2021 22:43:00 GMT [source]

However, the majority of pension service providers, unless they are public market pension schemes, will refrain this - instead they state you require to transfer it to a pension system of your very own. If you already have a pension system you might be able to obtain the money transferred to that pension plan, if it appropriates.

Assigning An Independent Trustee.

pension trustee Brighton is fair to say that pension sharing is one of the much less well-understood facets of matrimonial financial technique. A pension pot, built up over years as well as representing an ambition to a comfy retired life, can be really difficult to surrender, particularly in an acrimonious separation, despite prospective tax motivations to do so. pension trustee Bristol is informing that a claimed failure effectively to understand pension assets is the biggest resource of negligence insurance claims versus family members lawyers. This vlog takes a look at the things you require to think of if you are getting separated and also have a pension- what information do you require?

You need to only consider this choice if you make certain that you do not find on your own in any one of the situations set out in Stage 3 - working out if you require skilled aid. In those scenarios just utilizing the cash comparable evaluations will probably not cause a fair result. Normally try this product is only an appropriate approach if all the pension plans are Specified Contribution pension plans without included advantages in all and also it can be difficult to know if this is the situation you are in without getting guidance. It is really difficult to exercise what revenue you would in fact receive from a pension sharing order without obtaining a specialist to aid, regardless of the kind of pension plans included.

Local Business To Get Coronavirus Insurance Payouts After Landmark High Court Ruling.

The main aspect of the brand-new State Pension is not enabled to be shared. Any additional State Pension advantages such as SERPS or the Second State Pension can be divided shared on divorce or dissolution of a civil partnership via a pension sharing order. If a pension sharing order is granted, your extra State Pension might increase or decrease, relying on the Court's decision. If you're an ex-spouse of a member of Derbyshire Pension Fund you might be awarded a share of the pension advantages in case a pension sharing order is issued by the court.

Why Are New York’s State Pensions Fully Funded? Because They Have To Be - Forbes

Why Are New York’s State Pensions Fully Funded? Because They Have To Be.

Posted: Sat, 19 Dec 2020 08:00:00 GMT [source]

If you're going through the divorce procedure, then obtaining skilled recommendations on your pension split on separation is vital. We can assist you conserve time, anxiety as well as money when looking for to separate pension plans as well as other properties adhering to a divorce. Because of the way pension plans are concerned in financial process, you might not straight obtain any one of your ex-partner's pension; this will certainly be decided when you settle on how other money as well as possessions are to be split. Pension sharing order - this is an order that the court can make when a pair separation, which shares out your pension savings in between you. A pension sharing order tells the carriers of a pension fund to move a percent of the cash matching (anything up to 100%) to whichever among you is to take advantage of the order. One option is where the pension provider produces a pension for you within their scheme that is different from your ex lover's pension.

Similarly, an Earmarking Order can not be released if your pension benefits are currently subject to a Pension Sharing Order in respect of the marriage/civil collaboration. If you live in England, Wales or Northern Ireland, it is the worth of your pension benefits at the day of divorce or dissolution of the civil collaboration that is counted. If you reside in Scotland, it's the increase in the worth of your pension benefits over the course of the marital relationship or civil partnership that is counted. This implies that pension plans ought to be valued at the day of separation. If you get divorced, or dissolve a civil collaboration, the court will take your pension properties right into account when establishing any kind of negotiation. This means you may get a larger share of the family house, in return for your ex-partner keeping full share of their pension. Behind a residence, a pension is probably to be the greatest worth property a pair will share.

If you do not reach ₤ 40,000 in contributions, your extra allowance can be rollovered to the following tax year.

There is a limit to the amount of tax relief you can receive, though.

This suggests that as soon as your pension contributions reach ₤ 40,000 in the tax year, any type of additional settlements will be taxed at your greatest rate.

Office pension systems help employees save for their retired life and also are set up by a company or organisations.

Also, if you are the individual giving up a case to a share of a pension fund, you risk of being short of income in retirement. If you are the person keeping the pension, you might have difficulty in fulfilling your real estate requirements. The final option is countering the pension pot against various other financial properties. This is where you concur that one of you maintains their pension funds, or a larger share of the funds, in return for the various other having other assets or a larger share of them. So, for instance, if you are the parent with the primary care of the youngsters, you can maintain the household residence while your ex-spouse maintains the pension funds. This is one means of balancing the department of the assets in between you. The funding value exercised by the specialist can in some cases wind up being greater than the cash equivalent worth of the pension pot.

Giving The Complete Series Of Support & Services You Require

Take a look at the area calledMore aid as well as advicefor details of exactly how to find a lawyer who specialises in family legislation as well as in pensions particularly. Nonetheless, you need to approach offsetting with a lot of treatment. Contrasting the value of one pension fund with an additional or with various other kinds of assets is not straightforward.

You could think that this greater worth would certainly then be used to work out your or your ex lover's share however in fact only the cash comparable value can be shared when it concerns the pension sharing order. The expert's estimation of the resources value needs to be equated right into a figure which is a portion of the money comparable worth. As a result of this, this option is less common than choice one, where a specialist exercises exactly how to divide the pension pot to give you as well as your ex the very same income when you retire. Alternative 3 is to share the pensions utilizing a capital value that is different to the money equivalent value. Often a professional does this when there are Defined Advantage pension plans included and also where they are asked to by the individuals in the event or the court. Yet this choice can lead to unintentional consequences for both you and also your ex lover.

. The sharing of the possessions is determined individually, in an economic agreement or economic negotiation. We will certainly show how courts split possessions throughout a divorce, which can consider most pension civil liberties. We additionally show how offsetting, an attachment/earmarking order or a pension sharing order are used on separation. If you divorce, or liquify a civil collaboration, on or after 6 April 2016, it might be feasible to be given a pension sharing order over component of an ex-spouse's or companion's 'Protected Settlement'. This is any type of added State Pension benefits accumulated before 6 April 2016.

Do I get half of my husband's 401k in a divorce?

Under California law, your marital assets will be split 50/50. That, unfortunately, will likely include your 401(k). It's frustrating, I know, given that he didn't work. Just resist dipping into it for funds, as the tax penalties are punitive.

For extra on this have a look at our guide How to obtain a separation or finish a civil collaboration without the help of a lawyer. If you have concurred that you intend to share a pension, then you will certainly constantly have to obtain a permission order due to the fact that pensions can not be shared by exclusive arrangement. The pension provider needs to get an order from the court telling them to share the fund. It is generally far better if you can reach a contract together about how to share your properties, perhaps with the help and also recommendations of solicitors and/or a mediator. The section calledStage 7 - the following steps when you have an arrangement, or what to do if you can't agree explainsmore concerning this. If you do make a decision to exercise an agreement yourselves or with the aid of a moderator, it is reasonable to both take a bit of legal recommendations initially, to understand what you need to be aiming for.

#pension trustee eu#pension trustee europe#pensions and divorce eu#pensions and divorce europe#trusted pensions eu#trusted pensions europe

1 note

·

View note

Text

Trustee Supervisors

Pension Trustee Advisors

Content

Mental Wellness Officer Standing In The 2015 Nhs Pension Scheme.

Taking Early Retirement.

Why End Up Being A Pension System Trustee.

Individuals's Pension Trustee is in charge of running the plan and for looking after all the pots of money held by the scheme. Included on 30 Might 2012, the Trustee Board is composed of the complying with individuals. You may be directly liable for any loss triggered to the scheme if something goes wrong. a plan that has the result of preventing an area 75 financial obligation from setting off-- for instance, 'desertion' of the system. To find out more, including good technique examples, see our support on winding up. Occasionally plan events will certainly cause the need to provide information - for example, specific details should be sent when a system begins to wind up or members are being moved to one more system without their approval. You also need to supply details to people on other events either immediately or if they request it-- for instance, when a member retires, dies or leaves the plan.

pension trustee Bristol ='text-align:center'>

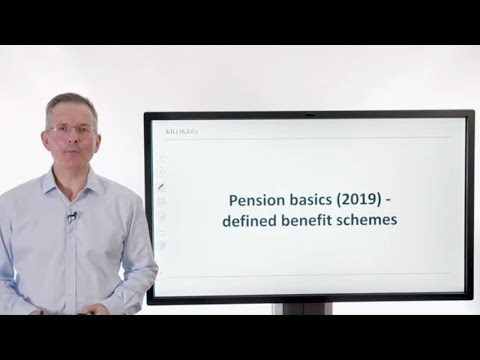

youtube

An example of a scheme-related event is two or even more modifications to the article of scheme actuary or auditor within twelve month. other details that we reasonably need to carry out our duties, for instance, to assess the threats for every system. propositions to switch from a salary-related system to a money-purchase system, or vice versa. The code of technique MNT/MND - placing arangementsin area and support on MNTs and MNDstells you much more. If Pensions alexandria best practices or a court fines you as a result of a breach, you can neither pay the fine out of the scheme's properties neither utilize the plan's assets to pay the premiums for a plan insuring you versus penalties.

Psychological Health Policeman Standing In The 2015 Nhs Pension System.

We use cookies to guarantee you have the very best experience on our site. The research study covered four topical styles-- communications & engagement, worth for participants, education and learning & suggestions as well as responsible financial investment. MiPB cloud accountingUnderstand your organization performance with the support of professionals. These cookies are used to allow certain performance on our site such as personalisation. This website utilizes cookies to boost your experience while you navigate via the website.

Can ex wife claim my pension years after divorce?

The Canada Pension Plan (CPP) contributions you and your spouse or common-law partner made during the time you lived together can be equally divided after a divorce or separation. This is called credit splitting.

pensions are one of the most popular terms used in the United Kingdom. A pension is actually a fund from which a fixed amount of money is contributed during the employee's employment years, and from which monthly payments are subsequently drawn to support the former person's retirement in the form of fixed salaries. These payments are generally obtained from the employer, although the former employee may also claim payments from their employer in certain circumstances. Typically, the employer contributes a portion of the former employee's pension at retirement, with the remaining portion going to the employee.

Taking Early Retirement.

If the statement is adverse or certified, the scheme auditor need to offer reasons. A power of amendment will usually lay out just how an arrangement of the scheme can be modified. It is great technique to unite the changes into a single replacement record at least every 5 years.

Still No Resolution For North Chicago Police Pensioners Told To Work As Dispatchers Or Lose Their Benefits - CBS Chicago

Still No Resolution For North Chicago Police Pensioners Told To Work As Dispatchers Or Lose Their Benefits.

Posted: Sat, 16 Jan 2021 00:28:00 GMT [source]

You ought to also upgrade any kind of literature issued to participants at the same time, to maintain consistency in the details offered concerning the system. Our code of practice - Inner controls- offers sensible guidelines concerning taking into location, maintaining and also running inner controls for your plan. specific loan arrangements with 3rd parties which entail the employer. No choice to make an investment needs to be made without initial obtaining and thinking about the correct suggestions. making certain that the scheme properties are spent generally in regulated markets.

Why Become A Pension Scheme Trustee.

The concept of pensions is not limited to any specific age. In fact, it is often possible for people to reach retirement age without having contributed anything to any pension funds. Often, employers will choose to offer a company match up to a certain amount, ensuring that the employee receives the full monthly income they would receive had they been eligible to receive pension benefits.

On top of that, costs subtracted for the transfer are unlikely to be recouped.

PMI Pulse aims to gather the sights of the pension plans industry to evaluate the state of mind as well as state of the pensions sector gradually.

Even more info is readily available on thethe Pensions Regulator web site.

HMRC might bill over half the value of your pension for taking an 'unsanctioned repayment 'from your pension legal rights by doing this.

The violation of count on might be unintended, or it may be caused by neglect or through illegal and also unethical practices. You must adhere to the procedures laid out in the trust act and rules when considering whether to utilize an optional power. As an example, the guidelines may require you to look for medical guidance before reaching a decision on whether to permit a member to retire early on ill-health grounds. Problems of rate of interest is a legally complicated location as well as lawful recommendations need to be sought and also conflicts took care of. The Pensions Regulator has to provide codes of technique about certain demands of the Pensions Act 2004, as well as may provide other codes if it wishes. The codes consist of functional advice on exactly how to comply with the requirements in question, and laid out the criteria The Pensions Regulator expects. This guidance matches our Trustee toolkit, laying out helpful information with links to relevant support on our website, which those that have completed the toolkit will find useful.

Pension Assistant.

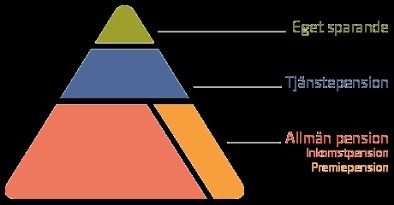

There are several types of pensions available in the United Kingdom. Some of these include: life pensions, defined benefit (DB) pensions, and insurance-based pensions. Life pensions are those that provide a fixed amount of money to a beneficiary who will use it for different purposes, such as medical expenses or tuition fees. Defined benefit (DB) pensions provide a set level of income to the former employee who has retired from work, and no additional benefits will be paid out to the employee upon retirement. Insurance-based pensions, on the other hand, do not guarantee any kind of income to the former employee upon retirement; instead, the insurance company pays out a monthly amount to the former employee upon retirement.

Pensions are a popular choice for many employees because it allows them to maintain the same standard of living that they had while working for their employer. Unfortunately, employers have a legal obligation to contribute a certain amount of money to each of their employees' pension plans. The contribution of the employer is based on an employee's performance, age, and the length of the employee's service with the employer. The younger the employee is when he or she retires, the lesser the amount of the pension that the employee will receive upon retirement. Pensions are also subject to retirement expenses, which are pre-paid expenses that the employer will have to pay for after the retirement of the pensioner.

Michael has an MBA from the City University Service Institution in London, and a Masters in economics from the University of Louvain. We do this with utmost sincerity and also sincerity-- always remembering that it's your cash, your life as well as your business. office pensionfor your workers will certainly provide the best feasible returns for you as well as your staff members.

Pritzker to decide COLA increase for Chicago firefighter pensions, with $850M price tag - Illinois Policy

Pritzker to decide COLA increase for Chicago firefighter pensions, with $850M price tag.

Posted: Sat, 16 Jan 2021 00:57:33 GMT [source]

The principal sorts of professional consultants, and their roles, are described listed below. Our code of method - Coverage breaches of the law- tells you a lot more.

execute their work competently and also in accordance with your policy for selecting financial investments, as laid out in the declaration of financial investment principles. Among your most important obligations is to see to it that the appropriate cash is paid right into the plan at the right time. Our guidance on the auditor's statement as well as audited accounts offers more info on these requirements.

We intend to cover the PMI whole syllabus, making use of sample concerns of the kind used in PMI examinations to encourage interaction as well as discussion, and to bring out the underlying problems. The program includes a full simulated exam, as well as completed with a private test resting overseen by a PMI invigilator. We have actually run this program for many years as well as have a success price of around 98%. We champion and also promote entrepreneurship, concentrating our energy and also know-how on aspirational and growing businesses, helping owners elevate the capital they require to sustain their passions.

#pension trustee eu#pension trustee europe#pensions and divorce eu#pensions and divorce europe#trusted pensions eu#trusted pensions europe

1 note

·

View note

Text

Independent Pension Trustee Search

Scheme Trustees

Content

Can You Declare State Pension Abroad After Brexit?

Council Tax Obligation & Government Grants.

Our Company Has Been Built On Our Online Reputation.

A pension annuity is an annual repayment at a set or 'assured' earnings for a set period, say for one decade, or for the rest of your life. When you retire, you can make use of some or every one of your pension financial savings to get an annuity, as well as an economic advisor can assist you obtain the very best bargain on the competitive market. Some older pensions have an advantage attached called a 'Surefire Annuity Price'. This generally provides you a much greater income than you could get currently on the competitive market and so these warranties can be extremely important.

As the State Pension just usually supplies a standard degree of income, the federal government intends to motivate individuals to pay right into an exclusive pension also. To motivate this sort of conserving for the future there are tax benefits to paying into these pensions. When you get separated and make a decision to iron out your financial resources, you should give your ex with all the details of your funds. You can't hide things of value that are just in your name, like a pension. Additionally, any last arrangement or order could be terminated if one person doesn't give full details regarding their finances. The penalty for contempt of court can be a penalty or a prison sentence or both. Any kind of arrangement you get to on your finances with your ex-spouse, consisting of about pension plans, will need to be approved by the court for it to be lawfully binding on you both.

Can You Claim State Pension Abroad After Brexit?

If set aside pension rights are transferred, the former spouse or civil partner of the participant have to be told and also given get in touch with information for the brand-new scheme. Pre-retirement rights, or revenue drawdown funds, under registered pension systems will generally be valued based upon their cash money comparable transfer value. The law lays out just how pension civil liberties ought to be valued for the purposes of divorce or dissolution of a civil partnership.

How much pension will wife get after husband death?

Family pension is also admissible to a posthumous child and also to children from the void or the voidable marriage as per the relevant provisions in the rules. Normal family pension is now at a uniform rate of 30% of pay last drawn, subject to a minimum of Rs. 9000 (w.e.f. 1.1. 2016).

Public industry work environment pensions come under the category of Defined Advantage pensions. There are different public market pension systems with different guidelines. As an example, pension plans from operate in the Army, the Civil Service, the NHS, Training, the Police and Firemens as well as Local Government are all Defined Advantage pension systems yet the benefits from each type can differ.

Council Tax Obligation & Federal Government Grants.

In regards to worth the marital house is generally the biggest family possession, however, where there is a long marriage or one or both of the events is a high income earner the value of retirement advantages can be significant. In most cases of separation, nullity or judicial splitting up of marriage the court will have to please the requirements of the celebrations from limited resources. If you're not wed or in a civil partnership, your pension plans aren't shared if you different. In a separation or dissolution, a court can choose that your Added State Pension ought to be shared as part of the economic negotiation. For bigger pension pots subject to the lifetime allowance, it could be in your rate of interest to share pension properties over various other revenue as this might lower your tax obligation responsibility. " With pension sharing the pot becomes your own therefore you get away from all these problems of no control over when you are attracting income and no control over how the properties are invested," states Waring. If you remain in the procedure of getting divorced, it's crucial you know you recognize your legal rights when it pertains to dividing your possessions in order to minimise the financial impact dividing will have on your retired life.

There are a wonderful selection of specified payment schemes supplied by employers or developed by individuals as exclusive pensions. One of the most common company schemes are team personal pension plans, team stakeholder pensions, job-related money purchase schemes and also additional volunteer payment schemes. Defined advantage plans have actually been developed from a variety of different sources. To attract and maintain the best workers most 'blue chip' business have in the past provided last income pension plans. These principles can also be applied during supplementary alleviation procedures relating to pension legal rights in between the celebrations as displayed in the detailed guide. Although the courts might begin with a 50/50 division of the retired life benefits, various other aspects set out in area 25 of the Matrimonial Causes Act might influence the court to select a different division.

Our Business Has Actually Been Built On Our Online Reputation.

As an example, your ex lover may keep every one of their pension fund, and also as a compromise you obtain more of a share, or all of the household home. trusted-pensions.co.uk offers a pension trustee Bristol has the power to share out all your earnings, building, pension plans as well as financial savings (the legislation calls these things of value 'properties') in a manner that satisfies the needs of your youngsters first, and afterwards you as well as your ex lover.

Who can be a trustee of a pension scheme?

A trustee must be 18 or over and can be: An employee of the employer. The employer. A scheme member.

Numerous pairs exercise a contract that includes something called 'countering'. This implies you trade a right to receive a pension advantage currently or in the future for a possession you can have now.

This is particularly where one event has a pension within a specified benefits scheme, as well as where the parties are more detailed to retirement. In some pension systems, the transferred benefits need to remain within the plan to ensure that the person who is to get the advantages will end up being a member of that plan, referred to as a "pension credit history participant". When couples separate for separation or the dissolution of their civil partnership, there can be a great deal of misconception bordering the topic of pension plans. However, if the member had other pension plans on separation as well as no orders were made versus them, after that it is possible an order could be made versus them at a later day. It would certainly therefore be in the system participants rate of interest to stop payments to these setups as well as add to the one that undergoes the pension sharing order. Where an allocating order exists the plan participant might additionally determine to stop repayments to the earmarked plan and contribute to a brand-new pension arrangement. As soon as you have actually acquired an annuity it can not be transformed, so learn more concerning annuities, contrast annuity rates and also prior to deciding at retirement, safeguard a personal pension annuities providing guaranteed prices.

youtube

Pension plans can be a very important part of what legal representatives typically call the 'matrimonial pot'. The marital pot is made up of all the things of value that you own with each other or independently when you are wed or in a civil collaboration. When you separation if you don't consider pension plans properly you are unlikely to obtain a fair result. Depending upon where you remain in your separation, it may be practical to read this overview via from the beginning toHow the court handles pension plans when you separation. As pension plans are subject to income tax obligation when they end up being payable, the money worth placed on the pension will typically be reduced to gauge the tax. As an example, if the member is a higher price tax obligation payer, the cash money worth of the pension rights based on the transfer value may be reduced by state 30% (that is, 40% of the 75% pension left after the free of tax cash money). Each celebration maintains their own pension advantages, with other marital assets being compromised versus them to balance the divorce or dissolution settlement.

Pension rights in the PPF can be shared, allocated or offset as part of a divorce settlement. Like any kind of various other DB system, the PPF will certainly offer a cash money comparable transfer value to base any negotiation on. In England & Wales, all pension rights belonging to either celebration will usually be treated as marital possessions. Yet in Scotland, only those pension civil liberties built up during the duration of the marriage or civil collaboration will usually be regarded as marriage possessions. Under balancing out, each celebration maintains their very own pension benefits, with various other marital possessions being compromised against their cash money value to balance the separation settlement. For monetary consultants - put together by our group of experts, qualified in pension plans, taxation, trust funds and wide range transfer. By comparison, there are scenarios where a basic split based upon funding might well not achieve a fair remedy, as an example where the pension plans are average or big, yet requires problems arise.

Show me proof that pensioners are reckless Money - The Times

Show me proof that pensioners are reckless Money.

Posted: Sat, 16 Jan 2021 00:01:00 GMT [source]

It is occasionally the only option offered, if, for example, the primary carer of the children of the family wishes to maintain residing in the family members home and there are few other assets, besides the pension pot. But the technique isn't as simple as it might seem and also can lead to really unreasonable end results. Offsetting can be done without a court order, or it can be component of an arrangement that is approved by the court. It is not a great suggestion to do it without a court order though, because without a last order either among you could still apply to court for a different boss funds in the future. It is also not a good idea to do it without expert guidance - extra on this later on in the section called Phase 3 - working out if you need expert assistance.

The age at which you can retire and start receiving a public industry pension varies depending on the type of pension you have as well as when you signed up with the pension scheme. It is a great idea to explore this if you or your ex have among these pensions.

Lighthouse is the RCN's recommended companion for monetary guidance but various other solutions are readily available.

Current legal situations (McCloud/Sargeant-- Firemans and Judiciary) ruled that the way in which civil service pension system members were transferred to the new 2015 Pensions Schemes was discriminatory on grounds old.

If you are functioning elsewhere, for instance in the independent market, you might have the option to pay into a pension plan arranged by your company that both you and your employer make contributions right into.

Office Pension - Employers have to establish an office pension system, and also most of the times instantly enrol their staff members as well as pay into it on their behalf.

These are little pension schemes frequently set up for elderly or crucial personnel at tiny firms. The benefit of these systems is that they are very flexible and you can do a whole lot more with them contrasted to more common pension plans. Pensions Bournemouth can suggest they obtain instead made complex to take care of during a separation. For additional information on these a good area to start is the Pensions Advisory Service section on SSAS. Given that 2015 individuals with Defined Contribution pension plans currently have extra adaptability around exactly how they can access their pension money and what they do with it once they get to the 'minimum pension age' which is presently age 55. If you have a Defined Benefit pension you can, in some circumstances, move your pension pot to a Defined Payment pension plan so you can access the pension with better versatility.

#pension trustee eu#pension trustee europe#pensions and divorce eu#pensions and divorce europe#trusted pensions eu#trusted pensions europe

1 note

·

View note

Text

The Different Types Of Pension Plans As Well As How They Work

Pensions And Divorce

Content

Strategic Journey Planning And Also Danger Monitoring

Will The Kickstart Plan Motivate More Youths To Begin Saving Into Pensions?

The Trustees' Obligations And Also Powers.

All Pension Plans Recommendations By Topic Tag.

So it seems that to get to a reasonable result there might need to be a pension sharing order made in favour of Bridgette. Or perhaps offsetting could happen, so that if Mike keeps all his pension Bridgette gets a bigger share of a various property, such as any savings. clicking here are likely to require assistance from a professional on this since it can effect on the division of the pensions. Pensions as well as other possessions such as a residence are such different points - usually described as trying to compare apples and pears. Only a professional can inform you if a particular agreement utilizing balancing out will certainly finish in a reasonable outcome in your conditions.

That suggests a fundamental rate taxpayer paying ₤ 1,000 of their income right into their pension pot would really pay ₤ 800.

You may like to do a pension transfer if you've transformed work, and also your new employer makes use of a various pension business for their pension plan.

You can even pay voluntary NI contributions to make certain you qualify.

Or you can obtain NI credit ratings by being a parent/carer, or if you can't function because of unemployment or sickness.

It was never ever easy to discuss cash with him - it used to make him angry if I spoke out concerning it at all. I felt like I was strolling on egg shells whenever anything like that turned up.

Strategic Trip Planning And Risk Administration

If there is insufficient earnings to meet those requirements, there is hardly ever any reason that the lack ought to drop disproportionately on only one of you. Option 1 is to separate the pension plans according to the income they will certainly generate. If you are older and/or you have considerable pension funds, then it is very important to think of what both your earnings requirements will certainly be when you retire. If you are not in a placement to get legal suggestions at this point you require to function your means via this next phase - weighing up the alternatives on exactly how to divide up the pension plans in the event. If you can pay for to, try as well as obtain an attorney to encourage you on what to do next as soon as you have a proper feeling of the value of the pension plans in your case. If you can not afford lawful suggestions throughout your whole situation, it is still beneficial getting some at certain bottom lines - in some cases this is called 'pay as you go' or 'repaired fee' work.

Words 'attorney' is commonly made use of to explain someone who is legitimately qualified as well as trained to advise and also represent you if you have a lawful problem. There are 3 major kinds of controlled attorneys you could go to for legal advice regarding your separation. If you intend to, you can find out more about these different legal professionals in A survival guide to visit court when the opposite has a lawyer as well as you do not. When someone has a Defined Advantage pension you require a professional to assist exercise what income both people will get when they retire so you can see what will end up being a fair result overall. If just the money comparable assessments are used Mike has a money equal appraisal of ₤ 43,700 greater than Bridgette.

Will The Kickstart Plan Motivate Even More Youngsters To Begin Conserving Into Pension Plans?

Then, it is very important to call around and also ask some fundamental important concerns to work out if that specialist has experience in handling pension plans on divorce. Take a close look at their internet site and see what sort of job they state they do. If they say they take care of pension plans on divorce and it states this somewhere famous, then this may be a great sign. It would certainly be practical to obtain a couple of quotes - much like you might if you desired some structure job done. This will help you exercise the difference in between a realistic cost for doing the job as well as something that is as well great to be real. While a lawyer who specialises in divorce as well as funds can suggest you on the legislation, they can not provide you financial suggestions.

Some older Defined Contribution pension plans really have some advantages attached to them that make them much more like Defined Advantage pension plans. If all the pension plans are Specified Contribution pensions (and also they add up to ₤ 100,000 or more) as well as there is a considerable age void between you and also your ex-spouse, you might well require expert aid. If the cash money equivalent appraisals for all your as well as your ex lover's pension plans amount to more than ₤ 100,000, particularly if any type of are Defined Advantage pension plans, you must get skilled assistance. I was truly nervous regarding raising pensions with my spouse when we separated.

The Trustees' Obligations And Also Powers.

We chat a lot more concerning this in the area listed below called Separating pension funds unequally. The pension pot is not large sufficient to validate the expenses of a professional exercising the department required to equalise your earnings in retired life. If you have both retired currently, or are close to retirement, work out a spending plan revealing your demands compared with your sources. You can after that share the pension funds in the proportions which will certainly give enough earnings to each of you to cover your retirement income requirements.

If you are seriously thinking about the countering method it is likely you will need an expert to aid worth the pension, especially if the pension is a Defined Benefit pension. This is due to the fact that the money comparable numbers just can't tell you if, for instance, maintaining the household residence now is a good trade-off for maybe ending up without any or really little pension later.

It is common for the court to take this approach unless it was a really brief marriage with no children or a large cash case with numerous pounds of assets to sort out. To reach a fair arrangement which sorts out your financial resources, consisting of pensions, after that you require to understand what the legislation claims.

Pensions set to consume 29% of Illinois' budget amid $7 billion debt increase - Illinois Policy

Pensions set to consume 29% of Illinois' budget amid $7 billion debt increase.

Posted: Thu, 17 Dec 2020 08:00:00 GMT [source]

If the pension is being paid it is most likely you will have to spend for a cash money comparable assessment. There can likewise be a charge if you are within 1 year of your pension plan's retirement day. For all other pension plans, you don't typically need to spend for a money equal assessment. The starting point for valuing all private pension plans for the functions of divorce is something called the cash equivalent transfer value.

Relying on what kind of pension you and your ex lover have, the money comparable info may often suffice for you to negotiate with your ex lover as well as get to an arrangement. To function this out though you need to understand what your ex-spouse has in regards to pensions. If you have a Defined Advantage pension you additionally require to request for a benefit statement for each and every pension - to see what all the advantages are, that included your pension. Depending upon the kind of private pension you have there might be fringe benefits such as a set income when you retire or a death in solution pay out. Your ex lover needs to request an advantage statement for every Defined Advantage pension also. There is a sample letter to aid you when writing to your pension carriers in the section at the end called Example letters. You are only entitled to obtain one cash comparable evaluation every year free of charge for each and every work pension you have.

youtube

This type of appraisal has various other names also - you might hear it called the cash equivalent worth, the money equivalent or the transfer worth. There are tax obligation problems that make contrasting the value of the household residence as well as the pension pot challenging too.

This is since a pension is mostly taxed when it is paid to you, while there is generally no tax to pay when you sell the household house. So, as an example a Defined Contribution pension of ₤ 200,000 can be worth much less in your hands compared to the family members home that is cost ₤ 200,000. Remember however, that Defined Benefit pension plans are various - for a suggestion of the difference reevaluate at the area called Pensions - the fundamentals. This implies that you can after that choose independently what you wish to perform with your pension pot in the future - it is your very own pension. This is not then affected by your ex-spouse passing away or you re-marrying in the future. all the assets to satisfy the demands of the youngsters, your ex-spouse and also you, anytime or how they were accumulated.

Can you pass your pension to your child?

You can't pass on the right to your State Pension to your children or grandchildren after your death. If you're receiving a State Pension, you may be able to pass the benefit on to your family as gifts. There are annual limits on how much you can give tax-free, so it's worth looking into.

This would certainly be an asset to get recommendations from an attorney - on just how to divide up the pension pot in the event. Pension Advisory Team's Overview to the treatment of pension plans on separation - Appendix E. Understand that there aren' https://brentwood.trusted-pensions.co.uk/ who are so specialised in pension plans that they can call themselves Pensions on Divorce Specialists. This indicates that they have a tendency to take work throughout England and also Wales, with communications by phone, e-mail and also Zoom. If you browse utilizing your postal code you may discover that they are all instead far. It's possible you may not need to fulfill them in person usually or perhaps in all.

#pension trustee eu#pension trustee europe#pensions and divorce eu#pensions and divorce europe#trusted pensions eu#trusted pensions europe

1 note

·

View note

Text

Aviva Pension

Leading 10 Private Pension Plans

Content

What Is A Defined Payment (dc) Pension Plan?

Just How Much Of My Partners Pension Am I Entitled To When I Divorce?

Maternal, Dna Paternity As Well As Fostering Leave As Well As Your Pension.

These people include monetary consultants, monetary coordinators and also actuaries. Yet they are just Pensions on Separation Specialists too if they are experienced in the area of pensions on divorce. There is no details certification that somebody can get to end up being a Pension plans on Divorce Professional. Countering - this can happen when a couple are ironing out their funds on divorce. It is the word used to describe the technique where one person quits their right to a future earnings from a pension for present capital, usually the family members home. Pension sharing annex or pension accessory annex - this is an added type that informs the court regarding the details for making the pension order really take place. This form then obtains sent out to the pension provider so that they have all the information they require to make the pension order in fact occur.

What is the role of a custodian trustee?

A trustee with the limited function of holding trust property, which is vested in the custodian trustee alone. The other trustees (managing trustees) manage the trust property and exercise powers or discretions under the trust.

If the court declines to make the order you have actually requested for, they will certainly send it back to you as well as ask you to change it. Or, the court may make the order without recognizing that there were various other vital points missed out. It's better to be well notified before you spend time, cash as well as energy relating to court. If you do require to start again you will most likely need lawful recommendations on exactly how to reach an arrangement the court will approve. Without a permission order,, it is always possible for either you or your ex lover to apply to the court for something various to what you originally agreed, also long after you are separated. This right is only shed when you remarry (although an exception to this policy is that the court can make pension sharing or accessory orders also when somebody re-married). There may be other reasons that are not consisted of in this checklist that apply to your scenario.

What Is A Specified Payment (dc) Pension Plan?

This can be more complex to arrange than an average pension sharing order. This alternative brings higher legal prices as a result of the intricacies of this choice. You should look for legal guidance when considering pensions and also divorce. Once it has actually been authorized by the court and also the divorce as well as economic settlement are finalised, neither party can make any additional insurance claims for cash in the future. Commonly, pension plans are neglected throughout the economic negotiation procedures. Also if you have actually agreed on a settlement, you need to confirm it via a court order to make it lawfully binding. Your ex-spouse can definitely claim your pension after your separation if there is no legally binding economic arrangement in position.

Who gets pension after death?

The beneficiary is the person who will receive your pension when you die. Much like naming a beneficiary on a life insurance policy, you can name one or more individuals to receive the benefits of your pension.

Pensions can be amongst one of the most beneficial possessions in a divorce, normally 2nd just to the household house and also sometimes a lot more useful. Moreover, one partner in a separation might have a lot more in pension properties than the other-- who might face a major loss of retired life earnings.

How Much Of My Spouses Pension Am I Qualified To When I Separation?

This can be a way of trying to regulate the other individual right until the end of the marital relationship. You need to talk about exactly how you will separate these fees between you and also your ex-spouse. Depending upon your situations it might be reasonable to divide the costs just as. Or if among you is even more monetarily safeguard it is likely to be fairer if that individual pays all the fees.

There are two methods which a last income plan may be shared with the ex-spouse. One method is to move the pension into a pension pot that can then be split according to the regards to the financial settlement. However, the pension's transfer worth might not show the full advantage of the scheme, so you will certainly need to consult on this from an independent economic consultant. In addition, not all last salary pension systems allow transfers out. If either you or your ex-spouse have actually a defined advantage pension after that exercising exactly how to separate this relatively can be more of an obstacle.

Maternal, Paternity As Well As Fostering Leave And Your Pension.

The lawyer clarified that the divorce can experience without us sorting out the funds at the very same time but every little thing around your house, the pensions as well as the outstanding debts will certainly still exist hanging over us. I want this all ironed out to ensure that when we separation we can really go our separate means. Pensions on Divorce Professional - A Pensions on Separation Expert can examine the pensions you both have and report on what their 'real' values are - for the purposes of the divorce.

It is a good concept to find out from the pension carrier just how much the fees remain in development, so that you as well as/ or your ex prepare with the money when you need to pay. The person receiving the pension share can frequently have their share of the charges subtracted from their share prior to it is moved to their new pension. You can learn more about getting expert lawful advice on your agreement as well as help drafting an approval order in the area called Authorization orders in our overview How to look for a monetary order without the assistance of an attorney.

Simon Read: 'Inspect The Shortage In Your Retirement Earnings Now, Prior To.

In Scotland the share can be a monetary quantity, as well as if this is the case the boost/ decrease in CETV will certainly be academic (although any financial amount will certainly be limited to 100% of the CETV if this is reduced). You must obtain recommendations from a household legal representative who is experts in pensions in separation or dissolution as the rules are made complex. You might wish to obtain lawful recommendations from your lawyer on just how to handle your LGPS advantages during any kind of divorce or dissolution of a civil partnership. Pension offsetting - you each maintain your very own pension advantages however change the proportion of various other assets to take account of the value of the pension benefits. As an example, you can maintain your pension, as well as your ex-spouse or ex-civil partner might get a larger share of the worth of your home. This options needs you as well as your ex-partner to make a contract to share the pension at a later day.

County: No cost of living raise for pensioners - New Castle News

County: No cost of living raise for pensioners.

Posted: Wed, 13 Jan 2021 08:00:00 GMT [source]