#transfer bitcoin

Explore tagged Tumblr posts

Text

The only thing worse than starting something and failing... is not starting something. So DM me now to get start with binary options trading because with our assistance will guarantee you safe and secure earning

NO TIME IS TOO LATE TO START INVESTING. ... .

#binary#binary options#binary trans#bitcoin#bitcoin trading#btc news#btc price#btc proccess#btc transfer#btc withdrawal enabled

3 notes

·

View notes

Text

How Much Can You Send Through Cash App? Know the Limits?

Cash App has rapidly become one of the most popular mobile payment platforms in the United States, offering users a seamless way to send and receive money with just a few taps on their smartphones. Whether you’re paying back a friend for dinner, splitting rent with a roommate, or conducting business transactions, Cash App provides a convenient solution. However, like all financial services, Cash App imposes certain limits on how much money you can send, receive, and withdraw.

If you’re a regular Cash App user, you might have wondered, "What is the maximum you can send through Cash App?" Understanding these limits is essential for managing your transactions effectively, whether for personal use or business purposes. In this blog, we’ll dive deep into the specifics of Cash App’s sending limits, how you can increase them, and what other limits might affect your account.

What is the Cash App Sending Limit?

Cash App’s sending limits are designed to protect users from fraud and unauthorised transactions. These limits vary depending on whether your account is verified or unverified. Let’s break down the details:

Unverified Account Limits: If you haven’t yet verified your Cash App account, your sending limit is relatively low. The cash app sending limit per week for unverified accounts is $250. This means that within a rolling seven-day period, you can only send up to $250.

Verified Account Limits: Once you verify your account by providing additional personal information, such as your full name, date of birth, and the last four digits of your Social Security Number (SSN), your limits will increase significantly. The cash app sending limit for verified accounts is $7,500 per week. This gives you a lot more flexibility in your transactions, especially if you need to send large sums of money.

How to Increase Your Cash App Sending Limit

If you need to send more than the default limits allow, there are steps you can take to increase Cash App sending limit. Here’s how:

Open the Cash App on your mobile device.

Tap the profile icon on your home screen.

Select "Personal" and enter your full name, date of birth, and the last four digits of your SSN.

Follow the prompts to complete the verification process.

Once your identity is verified, your sending limit will automatically increase to $7,500 per week.

2. Consider a Cash App Business Account

If you’re using Cash App for business purposes, you might want to consider upgrading to a Cash App business account. Business accounts often come with higher limits and additional features tailored to business needs. However, keep in mind that business transactions may be subject to fees.

3. Contact Cash App Support

If you’ve already verified your account but still need to increase your sending limit, you can contact Cash App support. Explain your situation and why you need a higher limit. While there’s no guarantee that your request will be approved, it’s worth a try if you have a valid reason.

Other Important Cash App Limits

In addition to sending limits, Cash App also imposes other limits on transactions, including receiving, withdrawing, and adding cash to your account. Understanding these limits can help you manage your Cash App activities more effectively.

Cash App Receiving Limit: The cash app receiving limit for unverified accounts is $1,000 per month. This means you can receive up to $1,000 within 30 days. If you verify your account, there’s no limit to how much you can receive.

Cash App Withdrawal Limit: When it comes to withdrawing money from your Cash App account, there are limits you need to be aware of:

Daily Withdrawal Limit: The cash app's daily withdrawal limit is $310. This is the maximum amount you can withdraw from an ATM using your Cash Card within 24 hours.

Weekly Withdrawal Limit: The cash app withdrawal limit per week is $1,000. This limit applies to the total amount you can withdraw over a rolling seven-day period.

Monthly Withdrawal Limit: The cash app withdrawal limit per month is $1,250. This limit is spread across 30 days.

Cash App Add Cash Limit: If you want to add money to your Cash App balance from a linked bank account, there are limits as well:

Daily Add Cash Limit: The cash app add cash limit per day is $2,500.

Weekly Add Cash Limit: The weekly limit for adding cash is $10,000.

Monthly Add Cash Limit: The monthly limit is typically around $25,000.

Cash App Check Deposit Limit: For those who use Cash App’s mobile check deposit feature, there are limits on the amount you can deposit:

Daily Check Deposit Limit: The daily limit is generally $3,500.

Monthly Check Deposit Limit: The monthly limit is around $7,500.

FAQs: Cash App Sending and Transaction Limits

Q1: What is the Cash App sending limit for unverified accounts?

A: The sending limit for unverified Cash App accounts is $250 per week. To increase this limit, you need to verify your identity within the app.

Q2: How can I increase my Cash App sending limit?

A: You can increase your Cash App sending limit by verifying your identity. This involves providing your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Q3: What is the maximum amount I can send through Cash App per week?

A: For verified accounts, the maximum amount you can send through Cash App is $7,500 per week.

Q4: Is there a limit to how much money I can receive on Cash App?

A: Yes, unverified accounts have a receiving limit of $1,000 per month. Verified accounts do not have a receiving limit.

Q5: What is the Cash App withdrawal limit per day?

A: The daily withdrawal limit on Cash App is $310, which is the maximum amount you can withdraw from an ATM using your Cash Card within 24 hours.

Q6: How do I verify my identity on Cash App?

A: To verify your identity on Cash App, go to your profile, select "Personal," and enter your full name, date of birth, and the last four digits of your SSN. You may also be required to provide a government-issued ID.

Q7: What is the Cash App add cash limit per day?

A: The daily limit for adding cash to your Cash App balance from a linked bank account is $2,500.

Q8: Can I increase my Cash App limits multiple times?

A: You can increase Cash App limits by verifying your identity and, if necessary, contacting Cash App support for further assistance. Approval is at the discretion of Cash App.

Q9: What is the Cash App business account limit?

A: Cash App business accounts often have higher limits than personal accounts. However, specific limits can vary based on account activity and verification status.

Q10: How does Cash App determine my transaction limits?

A: Cash App determines your transaction limits based on your account status (verified or unverified), transaction history, and compliance with regulatory requirements.

Conclusion

Understanding your Cash App sending limits is essential for managing your financial transactions effectively. Whether you’re sending money to friends, conducting business transactions, or withdrawing cash, knowing these limits can help you avoid declined transactions and ensure that your account remains secure.

By verifying your identity, monitoring your limits, and planning your transactions strategically, you can make the most of your Cash App experience. If you ever find that your current limits aren’t sufficient, don’t hesitate to reach out to Cash App’s support team for assistance in increasing your limits.

#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

5 notes

·

View notes

Text

What You Need to Know About the Cash App Weekly Withdrawal Limit

In the modern digital finance age, Cash App has become an indispensable tool for millions of users. Cash App offers a convenient and user-friendly platform to manage your finances, whether you're sending money to friends, paying bills, or even investing in stocks and Bitcoin. However, like any financial service, Cash App imposes certain limits on how much money you can send, receive, or withdraw within a given period. One of the most commonly asked questions among users is, "What is the Cash App weekly limit?"

Understanding your weekly limit is crucial for effectively managing your transactions, mainly if you rely on Cash App for regular payments or larger transfers. These limits are designed to protect users from fraud, ensure compliance with financial regulations, and maintain the platform's overall security. In this comprehensive guide, we'll explore everything you need to know about the Cash App weekly limit, how it works, and how to increase it if necessary. We'll also address some frequently asked questions to provide you with a clear understanding of how to maximise your Cash App experience.

What is the Cash App Weekly Limit?

The Cash App weekly limit refers to the maximum amount you can send or receive within seven days. Most users' initial Cash App weekly limit is set at $250 for sending and $1,000 for receiving money. However, these limits can be increased significantly by verifying your account.

Why Does Cash App Have a Weekly Limit?

Cash App's weekly limits serve several important purposes:

Security: The primary reason for setting a weekly limit is to protect users from unauthorized transactions and potential fraud. If your account is compromised, the weekly limit acts as a safeguard, preventing large amounts of money from being transferred out of your account.

Compliance with Regulations: Financial services like Cash App must adhere to various regulations, including anti-money laundering (AML) laws. Setting a weekly limit helps Cash App comply with these regulations and ensures that transactions are monitored and recorded appropriately.

Platform Stability: By imposing limits, Cash App can manage its liquidity and ensure that the platform remains stable for all users.

How Does the Cash App Weekly Limit Work?

The Cash App weekly limit works on a rolling basis, meaning it resets every seven days from your first transaction. For example, if you send $250 on a Monday, your limit will reset the following Monday, allowing you to send another $250.

Sending Limit: The Cash App weekly sending limit is typically set at $250 for unverified users. This means you cannot send more than $250 within seven days. However, if you verify your identity, this limit can be increased to $7,500 per week.

Receiving Limit: The Cash App receiving limit for unverified accounts is usually set at $1,000 per week. By verifying your account, you can receive an unlimited amount of money.

How to Increase Weekly Limit on Cash App?

If you find that the default weekly limits on Cash App are too restrictive for your needs, there are several steps you can take to increase them. Here's how:

1. Verify Your Identity

The most straightforward way to increase Cash App weekly limit is to verify your identity. This process involves providing some personal information, including:

Your full legal name

Date of birth

The last four digits of your Social Security Number (SSN)

A clear photo of a government-issued ID (such as a driver's license or passport)

Once your identity is verified, your weekly sending limit can increase to $7,500, and you can receive unlimited money.

2. Maintain a Positive Transaction History

Cash App monitors your transaction history to determine your account's trustworthiness. Regular, legitimate platform use can positively impact your limits over time. By consistently using Cash App for transactions, you demonstrate that your account is low-risk, which may increase limits.

3. Link a Bank Account

Linking your Cash App account to a bank account makes transactions smoother and adds an extra layer of security. Verified bank accounts can positively influence your weekly limits, making sending and receiving larger sums of money easier.

4. Enable Direct Deposits

Enabling direct deposits into your Cash App account is another way to increase your weekly limits. Cash App often rewards users who receive regular direct deposits with higher transaction limits.

When does Cash App Weekly Limit Reset?

Understanding how the weekly limit reset works is crucial for managing your transactions effectively. The Cash App weekly limit reset every seven days from your first transaction. For example, if you hit your $250 sending limit on a Wednesday, your limit will reset the following Wednesday.

How to Check When Your Weekly Limit Resets

To check when your weekly limit resets, follow these steps:

Open Cash App: Launch the Cash App on your mobile device.

Go to the Profile Section: Tap on the profile icon at the top right corner of the screen.

Navigate to Limits: Scroll down to the "Limits" section to view your current weekly limits and the time remaining until they reset.

FAQs About Cash App Weekly Limits

1. What is the Cash App weekly limit?

The Cash App weekly limit for unverified users is typically $250 for sending money and $1,000 for receiving money. These limits can be increased by verifying your identity.

2. How do I increase my Cash App limit?

You can increase Cash App limit by verifying your identity within the app. This involves providing your full legal name, date of birth, the last four digits of your Social Security Number (SSN), and a photo of a government-issued ID.

3. When does my Cash App weekly limit reset?

The Cash App weekly limit resets every seven days from the time of your first transaction. You can check the time remaining until your limit resets by navigating to your profile's "Limits" section.

4. Can I receive more than $1,000 in a week on Cash App?

Yes, you can receive more than $1,000 in a week on Cash App by verifying your identity. Once verified, you cannot limit how much money you can receive.

5. What happens if I reach my Cash App weekly limit?

If you reach your Cash App weekly limit, you cannot send or receive any more money until your limit resets. You can either wait for the reset or take steps to increase your limit.

6. How do I check my current Cash App weekly limit?

You can check your current Cash App weekly limit by opening the app, going to the profile section, and scrolling down to the "Limits" section. This will show you your current limits and the time remaining until they reset.

7. Does linking a bank account increase my weekly limit?

Linking a bank account to your Cash App can positively influence your weekly limit, especially when combined with identity verification and other account activities.

8. Can I send more than $7,500 per week on Cash App?

The standard weekly sending limit for verified users is $7,500. If you need to send more than this amount, consider contacting Cash App support for further assistance or use alternative payment methods.

9. Does enabling direct deposits affect my weekly limit?

Yes, enabling direct deposits into your Cash App account can increase your weekly limits, showing a stable and verified account activity.

10. How does Cash App ensure the security of my weekly transactions?

Cash App's weekly limits are part of its broader security measures to protect users from fraud and unauthorised transactions. Additionally, Cash App uses encryption and two-factor authentication to safeguard your account.

Conclusion

Understanding and managing your Cash App weekly limits is essential for making the most out of this versatile financial tool. Whether you're sending money to friends and family, paying bills, or receiving payments, knowing your limits and how to increase them can provide you with greater flexibility and peace of mind.

You can significantly increase your Cash App weekly limits by verifying your identity, linking a bank account, enabling direct deposits, and maintaining a positive transaction history. This enhances your ability to manage larger transactions and ensures that you can use Cash App with confidence, knowing that your account is secure and compliant with financial regulations.

Whether you're a casual user or someone who relies heavily on Cash App for daily transactions, understanding these limits will help you maximise the utility of your Cash App account and avoid any unexpected restrictions.

#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

4 notes

·

View notes

Text

#its 100 bucks#im feeling very impulsive#but idk how to do a monye transfer#and i dont want to have to use Bitcoin

2 notes

·

View notes

Link

The B.C. Securities Commission says a now-defunct cryptocurrency platform based in Nanaimo on Vancouver Island committed a multimillion-dollar securities fraud involving various digital currencies.

In a notice of hearing issued last month, the commission says David Smillie and his numbered company, which did business as ezBtc, lied to customers about its crypto asset trading platform.

The commission says Smillie and the company diverted about $13 million worth of bitcoin and ether, another cryptocurrency, to two online gambling sites without authorization.

The regulator says the company was dissolved in October 2022, but between 2016 and 2019 customers transferred 2,300 bitcoin and 600 ether tokens into wallets hosted by the platform.

#crypto#fraud#Smillie#ezBtc#bitcoin#ether#gambling#wallets#transfer#Nanaimo#BC#Canada#news#The Wave#world news

1 note

·

View note

Photo

Firefox fights for your right to use adblocker extensions, and the MOBILE version of firefox has a BUILT-IN ADDBLOCKER that you need only activate in settings 👍

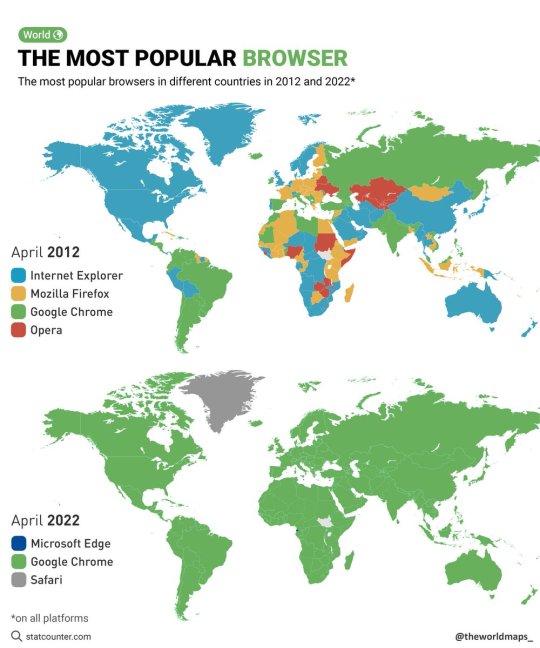

The most popular browsers in different countries in 2012 and 2022.

by @theworldmaps_

#google chrome is legitimately so ass dude its so laggy and annoying and google wants to limit your browsing choices#download firefox its literally so easy. i think there's even a setting so you can transfer in your old bookmarks from another browser#opera GX is a chromium browser and farms bitcoin on your device so no thats not a good option either#also it lets you pop videos out of the player so i can for instance watch a free-floating youtube video while i do my etsy orders

150K notes

·

View notes

Text

A whale deposited 1,000 $BTC($105M) to #Binance 1 hour ago. This whale withdrew 1,000 $BTC($55M) from #Binance 5 months ago when the price was $55,127...

A whale deposited 1,000 $BTC($105M) to #Binance 1 hour ago.This whale withdrew 1,000 $BTC($55M) from #Binance 5 months ago when the price was $55,127, with a profit of $50M.https://intel.arkm.com/explorer/address/3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhN Source link

0 notes

Text

Satoshi-Era Bitcoin Wallet Moves $178 Million in BTC

A Bitcoin wallet dormant since 2010 has transferred 2,000 BTC, valued at approximately $178 million, to Coinbase on November 15, 2024. This movement, tracked by Lookonchain, highlights the reactivation of Satoshi-era wallets, a rare occurrence that often captures significant attention in the cryptocurrency market. The wallet originally received Bitcoin when the price hovered below $0.10, a…

#Bitcoin#blockchain#BTC transfer#Coinbase#cryptocurrency#cryptocurrency market#dormant wallet#early adopters#market speculation#Satoshi-era wallet#whale activity

0 notes

Text

Let's Discover Payecards Privileges Together

In today's interconnected world, managing your finances seamlessly and securely is more important than ever. Introducing Payecards, a cutting-edge digital banking solution that empowers you to navigate international payments, money transfers, and Bitcoin trading with ease. With Payecards, not only can you open a bank account online in just a few simple steps, but you also gain access to a suite of innovative financial services designed to optimize your financial transactions.

International Payments

In today's interconnected world, international payments have become a crucial aspect of both business and personal finance. Services that facilitate these transactions have evolved significantly, catering to the growing demand for seamless, fast, and cost-effective solutions. To successfully navigate the complexities of international payments, it is essential to understand the mechanisms involved, the fees associated, and the various platforms available.

The Mechanisms Behind International Payments

International payments typically leverage the SWIFT network, allowing banks to communicate securely, or use modern alternatives such as blockchain technology. This evolution not only enhances the efficiency of sending money across borders but also improves transparency and reduces the risk of fraud.

Fees and Exchange Rates

When making international payments, it's important to be aware of the fees charged by financial institutions. This includes transaction fees and potential markups on the exchange rates. The choice of service provider can significantly impact the overall cost, so it's beneficial to compare options before making a transaction.

Platforms for International Payments

Several platforms specialize in international payments, each offering unique features. Digital banking services and e-wallets have emerged as user-friendly options, providing customers with the ability to manage their funds more efficiently. Moreover, many platforms allow users to open a bank account online quickly, eliminating the need for physical branches. This convenience is particularly beneficial for businesses engaged in global trade.

As the landscape of international payments continues to evolve, staying informed about the latest tools and services will help individuals and businesses optimize their transaction processes, ultimately allowing for smoother money transfer experiences across borders.

Money Transfer

In today's fast-paced digital landscape, money transfer services have become essential for anyone looking to send or receive funds quickly and securely. With the rise of international payments, individuals and businesses alike benefit from various options that cater to their specific needs, whether they are transferring money across borders or domestically.

One of the most significant advancements in money transfer technology is the integration of Bitcoin trading. Cryptocurrency has revolutionized the way people think about value exchange, allowing for instant transfers without the need for traditional banking intermediaries. This not only lowers costs but also provides greater transparency and security.

Moreover, digital banking platforms have streamlined the money transfer process, enabling users to manage their finances from anywhere with internet access. By choosing to open a bank account online, customers gain access to various money transfer features that simplify transactions, making it easier than ever to send money to friends, family, or businesses worldwide.

Whether you’re using mobile apps, online platforms, or cryptocurrency, the landscape of money transfers continues to evolve, ensuring that people have the tools they need to engage in reliable and efficient financial transactions.

Bitcoin Trading

Bitcoin trading has emerged as a significant aspect of the cryptocurrency landscape, providing investors an opportunity to engage in the digital economy. The rise of Bitcoin has transformed how individuals view international payments and money transfer, as more people recognize the advantages of using cryptocurrencies in these transactions. Investing in Bitcoin is not just about purchasing the currency; it involves understanding market trends, trading strategies, and the dynamics of digital banking.

One of the primary reasons for engaging in Bitcoin trading is its potential for high returns. The volatile nature of Bitcoin prices allows traders to capitalize on price fluctuations, which can lead to substantial profits. However, it is essential to approach Bitcoin trading with caution, as volatility also brings risks. Conducting thorough research and utilizing trading platforms equipped with real-time analytics can help mitigate these risks.

For those looking to start trading Bitcoin, several digital banking platforms facilitate this process seamlessly. Many of these platforms allow users to open a bank account online, which simplifies the process of funding their Bitcoin purchases and transfers. By integrating traditional banking with cryptocurrency trading, many financial services are making it easier for users to navigate both realms.

Moreover, Bitcoin trading also plays a crucial role in the international payments landscape. By utilizing Bitcoin, users can transfer funds across borders with minimal fees and faster transaction times compared to traditional banking methods. This capability enhances the financial inclusion of individuals in regions where access to conventional banking services might be limited.

In summary, Bitcoin trading represents a key aspect of the evolving financial ecosystem. As digital banking continues to grow, those interested in trading must stay informed about market trends and leverage technology to enhance their trading strategies effectively.

Digital Banking

Digital banking has transformed the way individuals and businesses conduct their financial transactions. With the rise of technology, it has become increasingly essential, especially for those engaging in international payments, money transfer, and even Bitcoin trading. Today’s consumers expect convenience and speed, and digital banking provides just that.

Unlike traditional banking, which often requires physical branch visits, digital banking allows customers to open a bank account online, access funds, and manage their finances from anywhere in the world. This is particularly advantageous for frequent travelers or expatriates involved in international payments, as they can perform transactions without being bound to a specific location.

Furthermore, digital banking platforms typically come equipped with robust security measures, ensuring that customers feel safe conducting transactions and managing their financial activities. As the financial landscape continues to evolve, embracing digital banking can yield numerous benefits, such as lower fees, flexible options for money transfers, and easier access to cryptocurrency trading like Bitcoin.

In conclusion, digital banking is a crucial element in the modern financial ecosystem. It not only simplifies everyday banking tasks but also empowers users with a wide array of financial services designed to meet the demands of a global economy.

Open Bank Account Online

Open bank account online has become increasingly popular due to its convenience and the speed of the application process. With advancements in technology, many banks now offer seamless digital banking experiences that allow customers to handle their financial needs from the comfort of their homes.

Benefits of Opening an Account Online

When you opt to open a bank account online, you unlock a variety of benefits:

Convenience: The online application process is straightforward and available 24/7, so you can apply at any time that suits you.

Quick Setup: Many banks allow immediate account setup, allowing you to start managing your finances or making international payments right away.

Access to Digital Banking Tools: Enjoy advanced tools for managing your account, including budgeting features, transaction tracking, and investment options like Bitcoin trading.

What You Need to Open an Account

To get started with opening a bank account online, you typically need the following:

Personal identification such as a driver's license or passport.

Proof of address, like a utility bill or lease agreement.

Your Social Security number or Tax Identification Number for compliance with regulations.

A valid email address and phone number for communication and account verification.

Choosing the Right Bank for Your Needs

Before you proceed, it's essential to research various banks and their offerings. Consider factors such as:

Fee Structure: Look for banks with low or no monthly maintenance fees and competitive transaction rates for international payments.

Digital Banking Features: Ensure that the bank you choose provides a robust online and mobile banking interface that supports your financial activities, including money transfers and Bitcoin trading.

Customer Support: Check the quality and availability of customer support as you may need assistance with online transactions or account management.

In summary, opening a bank account online is a convenient solution that enables effective management of your finances, facilitating easy money transfers, international payments, and digital assets like Bitcoin. By understanding your needs and comparing options, you can find a banking solution that works for you.

0 notes

Text

What Are the Limits for Sending Money Through Cash App?

Cash App has become a popular choice for transferring money quickly and easily. Whether you're splitting a bill, paying rent, or sending a gift, Cash App offers a convenient way to move funds. However, like all financial services, Cash App has certain limits on how much money you can send. Understanding these Cash App sending limits is crucial, especially if you plan to use the app for larger transactions. In this article, we'll explore how much you can send through Cash App, how to increase your limits, and other key details.

What Are the Cash App Sending Limits?

Cash App imposes different sending limits for verified and unverified accounts. These limits are designed to protect users and reduce the risk of fraud. Here’s a breakdown of the Cash App sending limit for each type of account:

Unverified Accounts: If your account is unverified, you can send up to $250 within any seven days. This limit is relatively low and can be restrictive if you need to send larger amounts.

Verified Accounts: Once your account is verified, your sending limit increases significantly. You can send up to $7,500 per week, which provides much more flexibility for larger transactions.

How to Increase Your Cash App Sending Limit

If you find the standard limits too restrictive, you may be wondering how to increase your Cash App sending limit. The good news is that increasing your limit is straightforward. Here’s how you can do it:

Verify Your Identity: To increase your sending limit, you need to verify your identity using Cash App. This involves providing your full name, date of birth, and the last four digits of your Social Security number.

Submit the Required Information:

Open the Cash App and tap on your profile icon.

Select "Personal" and enter the required information.

Cash App will review your submission and typically approve it within a few minutes to a few hours.

Check Your New Limit: Once your account is verified, your sending limit will increase to $7,500 per week. This higher limit allows you to send larger sums of money without worrying about hitting a cap.

How Much Can You Send Through Cash App?

So how much can you send through the Cash App? The answer depends on whether your account is verified:

Unverified Account: You can send up to $250 per week.

Verified Account: You can send up to $7,500 per week.

These limits apply to sending money to other Cash App users. If you need to send more than $7,500 in a single week, you should wait until the next week when your limit resets or consider using another financial service that allows higher transaction amounts.

Managing Your Cash App Sending Limits

To make the most of your Cash App limit, it's essential to plan your transactions carefully. Here are some tips:

Monitor Your Transactions: Regularly check your transaction history in the app to ensure you stay within your limits.

Verify Early: If you anticipate needing to send larger amounts, verify your account early to avoid any delays or disruptions.

Plan Ahead: If you know you’ll need to send more than $7,500 in a week, consider splitting the transactions across multiple weeks or using another payment method.

Conclusion

Understanding the Cash App sending limit is essential for managing your finances effectively. Whether you’re using a Cash App for everyday transactions or larger payments, knowing how much you can send—and how to increase your limit—ensures a smooth experience. By verifying your account, you can unlock higher sending limits, making Cash App a versatile tool for a variety of financial needs.

Frequently Asked Questions (FAQs)

1. What is the Cash App sending limit for unverified accounts?

For unverified accounts, the Cash App sending limit is $250 within seven days.

2. How do I increase my Cash App sending limit?

To increase Cash App sending limit, you need to verify your account by providing your full name, date of birth, and the last four digits of your Social Security number. Once verified, your sending limit increases to $7,500 per week.

3. How much can you send through Cash App with a verified account?

With a verified account, you can send up to $7,500 per week through Cash App.

4. How long does it take to verify my Cash App account?

The verification process usually takes a few minutes to a few hours. You will be notified once your account is successfully verified.

5. Can I send more than $7,500 in a week through Cash App?

No, $7,500 is the maximum weekly sending limit for verified Cash App accounts. If you need to send more than this amount, you’ll need to wait for the next week or use another financial service.

6. What happens if I exceed my Cash App sending limit?

If you attempt to send more money than your current limit allows, the transaction will be declined. You will need to wait until your limit resets or verify your account to increase your limit.

7. How do I check my current Cash App sending limit?

You can check your current sending limit by going to the "Profile" section in the app and reviewing your account details under "Personal."

#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

1 note

·

View note

Text

What is the Cash App Limits: Daily, Weekly, and Monthly Limit?

Cash App has become a popular tool for sending and receiving money quickly and conveniently. Whether you're splitting a bill, paying for services, or gifting money to a friend, Cash App offers a seamless experience. But what if you need to send a large amount, like $5,000? Can you send $5,000 through Cash App in one go? In this comprehensive guide, we'll explore the Cash App limits, how they work, and what you need to do to send higher amounts like $5,000.

What are the different Cash App Limits?

Cash App imposes certain limits on transactions to protect users and manage risk. These limits include:

Cash App Transfer Limit: The Cash App transfer limit refers to the maximum amount you can send or receive in a given period. For unverified accounts, the limits are typically lower. Verification can increase these limits significantly.

Cash App Withdrawal Limit: The withdrawal limit is the maximum amount of money you can withdraw from your Cash App account to your linked bank account or at an ATM. This limit helps manage cash flow and protect against fraud.

Cash App Sending Limit: The sending limit is the maximum amount you can send to another Cash App user in a given period. This is crucial for understanding whether you can send $5,000 through Cash App.

Cash App Receiving Limit: The receiving limit is the maximum amount you can receive from another Cash App user. Like the sending limit, this can be increased through account verification.

Can I Send $5000 Through Cash App?

The short answer is yes, but there are conditions you need to meet. Let's break it down:

Unverified Accounts

For unverified Cash App accounts, the sending limit is quite restrictive. Typically, you can send up to $250 within any 7 days and receive up to $1,000 within any 30 days. These limits are designed to protect users from potential fraud and unauthorised transactions.

Verified Accounts

To send $5,000 through Cash App, you need to verify your account. Once verified, your sending limits increase significantly. Here are the steps to verify your account:

Open Cash App: Launch the app on your smartphone.

Navigate to Profile: Tap on the profile icon in the upper right corner.

Verify Account: Follow the prompts to enter your full name, date of birth, and the last four digits of your Social Security number. Additional documentation, such as a government-issued ID, might be required.

What is the Cash App Sending Limit After Verification?

After verification, Cash App typically allows users to send up to $7,500 per week. This means you can send $5,000 in one go as long as you stay within this weekly limit. If you need to send more than $7,500, you should wait for the next week or consider alternative payment methods.

Benefits of Verification

Verifying your Cash App account not only increases your sending limits but also enhances the overall security and functionality of your account. Verified accounts can:

Send More Money: Higher sending limits allow for larger transactions.

Receive More Money: Increased receiving limits mean you can accept larger payments.

Withdraw More Cash: Higher withdrawal limits provide greater access to your funds.

Use More Features: Access to additional Cash App features and functionalities.

How to Increase Cash App Limits?

If you find the standard limits too restrictive, here are some steps to increase Cash App limits:

Verify Your Account: As mentioned, verifying your account is the most effective way to increase your limits.

Maintain a Positive Transaction History: Regular and responsible use of Cash App can sometimes lead to higher limits.

Contact Cash App Support: If you need higher limits for specific reasons, reaching out to Cash App support and explaining your situation might help.

Frequently Asked Questions (FAQs)

1. Can I send $5,000 through Cash App?

Yes, you can send $5,000 through Cash App, but you need to verify your account first to increase your sending limit.

2. What is the Cash App limit per day?

The daily limit for sending money varies based on your account status. For verified accounts, the weekly limit is typically $7,500, which translates to around $1,071 per day if divided equally.

3. How do I verify my Cash App account?

To verify Cash App account, open Cash App, navigate to the profile section and follow the prompts to enter your personal information and upload the required identification.

4. What is the Cash App transfer limit?

For verified accounts, the transfer limit is up to $7,500 per week.

5. Can I increase my Cash App withdrawal limit?

Yes, you can increase Cash App withdrawal limit by verifying your account and maintaining a positive transaction history.

6. What are the Cash App ATM limits?

The standard Cash App ATM withdrawal limit is $310 per transaction, $1,000 per day, and $1,000 per week.

7. What happens if I reach my Cash App limit?

If you reach your limit, you will need to wait for the limit reset period (daily, weekly) or consider alternative payment methods.

Conclusion

Sending $5,000 through Cash App is possible, but it requires verifying your account to access higher transaction limits. By understanding the various Cash App limits and how they work, you can effectively manage your transactions and make the most of the app's features. Whether you're sending money for personal or business reasons, knowing these limits ensures a smooth and hassle-free experience.

Regularly checking your limits and planning your transactions can help you avoid common issues and make the most of your Cash App account. Whether you’re new to Cash App or a seasoned user, this guide provides all the information you need to navigate Cash App’s transaction limits with ease.

#how to increase your Cash App limit from 2#500 to $7#500#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

1 note

·

View note

Text

Ultimate Guide to Increase 7-Day Limit on Cash App

Cash App has become a popular choice for peer-to-peer payments, offering a seamless way to send and receive money. However, like any financial service, Cash App has limits in place to ensure security and regulatory compliance. One of the key limits users often encounter is the 7-day limit. In this comprehensive blog, we’ll delve into what the 7-day limit on Cash App is, how it affects your transactions, and how you can manage and increase your limits.

Understanding the Cash App Limit

The 7-day limit on Cash App refers to the maximum amount of money you can send within seven days. This limit is in place to protect users from fraudulent activities and to comply with financial regulations.

What is the Cash App Limit?

The Cash App limit varies based on whether your account is verified or unverified. For unverified accounts, the limit is typically lower, whereas verified accounts enjoy higher limits. Verification requires providing additional personal information, such as your full name, date of birth, and the last four digits of your Social Security number.

Does Cash App Have a Limit?

Yes, Cash App has limits to enhancing security and complying with financial laws. These limits help prevent money laundering, fraud, and other illegal activities. By imposing transaction limits, Cash App ensures that large sums of money are not transferred unchecked, providing a safer environment for its users.

The 7-Day Sending Limit

The 7-day Cash App sending limit is significant for frequent users. For unverified accounts, the sending limit is usually set at $250 per week. For verified accounts, this limit can be increased significantly, allowing users to send up to $7,500 per week.

What is the Cash App Weekly Limit?

For verified users, the weekly sending limit can be as high as $7,500. This means that within any given seven-day period, you can send a total of $7,500. It’s essential to monitor your transactions to ensure you don’t exceed this limit, mainly if you rely on a Cash App for regular transfers.

How to Check Your Cash App Limit?

Checking your Cash App limit is straightforward. Open the app, navigate to your account settings, and look for the “Limits” section. Here, you will find detailed information about your current sending and receiving limits.

How to Increase Cash App Limit?

To increase Cash App limit, you need to verify your account. Verification involves providing additional personal information, which Cash App uses to confirm your identity. Once verified, your sending limit can be raised from the standard $250 per week to $7,500 per week.

Steps to Verify Your Cash App Account:

Open Cash App: Launch the app on your mobile device.

Navigate to Account Settings: Tap on the profile icon or settings menu.

Select Personal Information: Enter your full name, date of birth, and the last four digits of your Social Security number.

Submit for Verification: Follow the prompts to submit your information for verification.

What is the Cash App Withdrawal Limit?

Cash App also imposes limits on ATM withdrawals. For verified accounts, the ATM withdrawal limit is typically $1,000 per transaction, $1,000 per day, and $1,000 per week. This means you can withdraw up to $1,000 in a single transaction but at most $1,000 in total per day or week.

How to Increase Cash App ATM Limit?

Increasing your Cash App ATM withdrawal limit requires the same verification process used to improve your sending limit. Once verified, you can enjoy higher withdrawal limits and more flexibility with your Cash App account.

How to Increase Cash App Borrow Limit?

Cash App also offers a borrowing feature, which allows eligible users to borrow money directly from their Cash App balance. The borrowing limit varies based on several factors, including your account history and usage patterns. To increase your borrow limit, maintain a healthy transaction history and keep your account in good standing.

When Does Cash App Daily Limit Reset?

Cash App limits reset on a rolling basis. This means that your limit is not reset at a specific time each day or week but rather 24 hours or seven days from the time of your last transaction. For example, if you reach your daily limit at 3 PM on Monday, it will reset at 3 PM on Tuesday.

When Does Cash App Limit Reset?

Similarly, the 7-day sending limit resets on a rolling basis. If you hit your weekly limit on Wednesday at noon, it will reset the following Wednesday at noon.

Frequently Asked Questions (FAQs)

1. What happens if I exceed my Cash App limit?

If you attempt to send or withdraw an amount that exceeds your limit, the transaction will be declined. You’ll need to wait until your limit resets or verify your account to increase your limits.

2. Can you increase the Cash App limit?

Yes, you can increase your Cash App limit by verifying your account. This involves providing additional personal information to confirm your identity.

3. How do I raise my Cash App limit from $2,500 to $7,500?

To raise your limit from $2,500 to $7,500, you need to verify your account. Follow the steps outlined in the “Steps to Verify Your Cash App Account” section above.

4. Who does Cash App bank with?

Cash App partners with several banks, including Lincoln Savings Bank and Sutton Bank, to provide its banking services.

5. How do I check my Cash App limit?

You can check your Cash App limit by navigating to the “Limits” section in your account settings within the app.

6. Does Cash App have a limit on withdrawals?

Yes, Cash App imposes limits on ATM withdrawals. For verified accounts, the limit is typically $1,000 per transaction, $1,000 per day, and $1,000 per week.

7. When do Cash App limits reset?

Cash App weekly limit reset on a rolling basis. Your daily limit resets 24 hours from the time of your last transaction, and your weekly limit resets seven days from the time of your previous transaction.

Conclusion

Understanding the 7-day limit on Cash App is essential for managing your transactions effectively. By verifying your account and keeping track of your limits, you can ensure smooth and secure transactions. Whether you’re sending money to friends, making purchases, or withdrawing cash, knowing your limits and how to increase them will help you make the most of your Cash App experience.

#how to increase your Cash App limit from 2#500 to $7#500#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

0 notes

Text

Sell Bitcoin In Dubai For Cash Or Bank Transfer - Exchange Desk

Exchange Desk offers a convenient solution for selling your Bitcoin in Dubai. Whether you prefer cash or a bank transfer, our reliable service ensures a smooth transaction process. Enjoy peace of mind with secure and fast exchanges tailored to your needs. Trust Exchange Desk to provide the best rates and excellent customer support as you sell Bitcoin in Dubai for cash or bank transfer. Simplify your crypto sales today with Exchange Desk.

0 notes

Text

When Does Cash App Weekly Withdrawal Limit Reset?

Cash App, a mobile payment service developed by Square Inc., has revolutionised the way people handle financial transactions. It offers a convenient way to send and receive money, make purchases, and manage your finances—all from the comfort of your smartphone. One aspect of Cash App that users often inquire about is the weekly limit and its reset schedule. Understanding this limit is crucial for effective financial planning, especially if you frequently use the app for transactions.

In this comprehensive guide, we will explore the specifics of the Cash App weekly limit, explain how it works, and provide detailed information on when this limit resets. By the end of this article, you'll have a clear understanding of how to manage your Cash App transactions within the imposed limits and optimise your usage.

Understanding Cash App Weekly Limits

Before discussing the reset schedule, it's essential to understand the Cash App weekly limit. The Cash App imposes limits on the amount of money you can send and receive within a specific timeframe. These limits are designed to ensure security and prevent fraudulent activities.

The limits vary depending on whether your account is verified or unverified:

Unverified Accounts: The sending limit for unverified accounts is $250 per week, and the receiving limit is $1,000 per month.

Verified Accounts: For verified accounts, the limits are significantly higher. You can send up to $7,500 per week and receive an unlimited amount of money.

To verify your account, you need to provide your full name, date of birth, and the last four digits of your Social Security Number. Verification not only increases your transaction limits but also enhances the security of your account.

When Does Cash App Weekly Limit Reset?

The primary focus of this guide is to answer the question: "When does Cash App weekly limit reset?" The weekly limit on Cash App resets exactly one week from the time of your first transaction. This means that the reset time is unique to each user based on their transaction history.

For example, if your first transaction of the week is on a Monday at 3 PM, your weekly limit will reset the following Monday at 3 PM. This rolling window ensures that users have a continuous and personalized limit cycle.

FAQs About Cash App Weekly Limit Reset

What is the Cash App weekly limit?

The weekly limit on Cash App for unverified accounts is $250 for sending and $1,000 per month for receiving. For verified accounts, the sending limit is $7,500 per week, and there is no receiving limit.

When does the Cash App weekly limit reset?

The weekly limit on the Cash App resets exactly one week after your first transaction. For example, if your first transaction is on a Wednesday at 10 AM, the limit will reset the following Wednesday at 10 AM.

How can I increase my Cash App weekly limit?

To increase your weekly limit, you need to verify Cash App account. This involves providing your full name, date of birth, and the last four digits of your Social Security Number.

Why is my Cash App weekly limit not resetting?

If your limit isn't resetting, it could be due to a delay in transaction processing or an issue with your account. Ensure your app is updated, and contact Cash App support if the issue persists.

Can I check my remaining weekly limit on Cash App?

Yes, you can check your remaining weekly limit within the Cash App. Go to the "Profile" section, select "Limits," and you'll see your current usage and remaining limit.

Does the weekly limit include all transactions?

The weekly limit includes all sending transactions, including payments to other Cash App users and purchases made using your Cash App card. Receiving funds does not count towards your sending limit but is subject to its limits if your account is unverified.

What happens if I exceed my weekly limit on Cash App?

If you exceed your weekly limit, any additional transactions will be declined until the limit resets. Plan your transactions accordingly to avoid this inconvenience.

Conclusion

Understanding when your Cash App weekly limit resets is crucial for managing your finances effectively. By knowing the reset schedule and how it works, you can plan your transactions better and avoid any disruptions in your financial activities. Remember, verifying your account not only increases your limits but also enhances your security and overall experience with Cash App.

#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

0 notes

Text

UltaHost Review – Outstanding Performance and Protection

New Post has been published on https://thedigitalinsider.com/ultahost-review-outstanding-performance-and-protection/

UltaHost Review – Outstanding Performance and Protection

As a web hosting consultant who’s helped hundreds of my clients choose the best hosting providers, I can tell you that Ultahost is one of the best hosts currently. A relatively new company, they already outperform some of the older hosting providers in the market.

However, I will use the rest of this review to show you the web host’s plans, pricing, features offered, real-time performance stats, customer support, and all the important factors you should consider. By the end of this review, it will be easier to decide if they are a great match for you.

Ultahost Review

Founded in 2018, Ultahost is one of the youngest companies on the market. However, the company has used its youth to grow rapidly and is catching the attention of webmasters like yourself. They offer shared hosting, WordPress hosting, VPS hosting, Virtual dedicated hosting, dedicated servers, and reseller hosting.

They also provide email hosting and other niche-specific plans like Windows hosting, Macintosh hosting, and game hosting. Unlike other providers whose renewal fees skyrocket after a year, Ultahost’s pricing is transparent without any hidden charges.

Buying a plan gets you a free domain name, free SSL certificate, free daily backups, free website migration, and real-time malware protection. You also get a 30-day money-back guarantee on all their plans. The company has a 4.6/5.0 rating on Trustpilot from 279 reviews.

Pros and Cons

No hidden fees

Friendly customer support

Free domain and SSL

Free website migration

Unlimited bandwidth on all plans

Free daily backup

They have some of the best security features

User–friendly interface

Not the cheapest option on the market

Not targeted at large companies with complex hosting needs.

Ultahost Rating – My Take

With thousands of web hosting providers claiming to offer the best services, it’s hard to separate truth from lies. Using my experience reviewing hosts, I have created a standard method to assess and rate web hosts properly.

On a scale of 1.0 – 5.0, this is how I rate Ultahost’s important features and performance. However, these scores aren’t permanent and may change as the host improves its offering.

Quality My rating Why I gave this score Features and Specs 5.0 They offer a free domain, SSL certificate, daily backups, free website migration, and unlimited bandwidth which are all standard offerings with most web hosts. However, I gave them a perfect 5.0 because of their niche-specific plans like Windows hosting and Macintosh hosting. Pricing 4.8 Their cheapest plan starts at $3.29 per month which is affordable, but not the cheapest on the market. However, I scored them 4.8 because their pricing is transparent and carries no hidden fees. Performance stats 4.8 An impressive time-to-first-byte time of 128ms makes Ultahost one of the fastest web hosts in the market. With a 99% uptime, it is also very reliable. However, I scored it 4.8 because there’s still a margin for improvement. Ease of use 4.6 1-click installs, modern cPanel, and an intuitive user interface make Ultahost very user-friendly. However, I gave them a 4.6 because other top hosting providers have ditched the traditional cPanel for their custom control panels. So they still have some catching up to do. Customer support guarantee 5.0 You can get help via Phone support, live chat, ticketing, FAQs, and email support. They also have a lot of video tutorials and a helpful knowledge base that provides all the answers you seek. I gave the full 5.0 points because you get access to most of these options even if you’re not yet a customer.

Ultahost Hosting Plans and Prices – 2024

Ultahost offers shared hosting, WordPress hosting, VPS hosting, Virtual dedicated hosting, dedicated servers, and reseller hosting. You also get niche-specific plans like Macintosh hosting, Gaming hosting, and Windows hosting. All their plans come with a 30-day money-back guarantee should it not fit your needs.

Once you’ve picked a desired plan, payment can made via PayPal, Mastercard, Visa, American Express, Discover, and JCB. They also accept Bitcoin payments.

Ultahost’s Shared Hosting Plans

Shared Starter

Space Offered – 30 GB NVMe SSD storage

Bandwidth – Unlimited

Monthly visits – 10,000

Free domains – 1

Price – $3.29 per month

Shared Basic

Space Offered – 60 GB NVMe SSD storage

Bandwidth – Unlimited

Monthly visits – 15,000

Free domains – 4

Price – $5.00 per month

Shared Business

Space Offered – 80 GB NVMe SSD storage

Bandwidth – Unlimited

Monthly visits – 25,000

Free domains – Unlimited

Price – $10.00 per month

Shared Pro

Space Offered – 110 GB NVMe SSD storage

Bandwidth – Unlimited

Monthly visits – 49,000

Free domains – Unlimited

Price – $12.99 per month

Ultahost’s Shared Business gives you the best value for money. At $10.00 a month, you get unlimited domains, unlimited bandwidth, and 80 GB NVMe SSD storage.

Who this is for:

As the name implies, Shared hosting requires you to split web hosting resources with other webmasters. So if you own a small or medium-sized business that gets average traffic, then Ultahost’s shared plans are a good fit.

Ultahost’s WordPress Hosting Plans

Ulta WordPress

Space offered – 30 GB NMVe SSD storage

Bandwidth – Unlimited

Number of websites – 1 allowed

Price – $2.90 per month

Extra Features – Free WordPress Manager, 1 email, WordPress acceleration, 2 databases, and 10,000 monthly visits.

WordPress Starter

Space offered – 100 GB NMVe SSD storage

Bandwidth – Unlimited

Number of websites – 100 allowed

Price – $4.90 per month

Extra Features – Free WordPress Manager, free email, WordPress acceleration, WordPress multisite, unlimited databases, and 25,000 monthly visits.

Business WordPress

Space offered – 100 GB NMVe SSD storage

Bandwidth – Unlimited

Number of websites – 100 allowed

Price – $7.50 per month

Extra Features – Free WordPress Manager, free email, WordPress acceleration, WordPress multisite, unlimited databases, and 100,000 monthly visits.

VPS WordPress

Space offered – 100 GB NMVe SSD storage

Bandwidth – Unlimited

Number of websites – 300 allowed

Price – $27.50 per month

Extra Features – Free WordPress Manager, free email, WordPress acceleration, WordPress multisite, unlimited databases, and 300,000 monthly visits.

I’ll recommend the Business WordPress plan. You’re allowed 100 websites, you get 100 GB NMVe SSD storage, free WordPress manager, WordPress acceleration, and WordPress multisite at just $7.50 per month.

Who this is for:

These plans are targeted at people starting with WordPress websites and those who already have experience with it. With the array of WordPress-specific features mentioned above, you will find a plan that suits your needs perfectly.

Ultahost’s VPS Hosting Plans

VPS Basic

Space offered – 30 GB NVMe SSD storage

Memory – 1 GB

CPU Core – 1

Dedicated IP – 1

Price – $5.50 per month

VPS Business

Space offered – 50 GB NVMe SSD storage

Memory – 2 GB

CPU Core – 2

Dedicated IP – 1

Price – $9.50 per month

VPS Professional

Space offered – 75 GB NVMe SSD storage

Memory – 3 GB

CPU Core – 4

Dedicated IP – 1

Price – $16.50 per month

VPS Enterprise

Space offered – 100 GB NVMe SSD storage

Memory – 6 GB

CPU Core – 4

Dedicated IP – 1

Price – $21.50 per month

Ultahost’s VPS Professional hosting plan is ideal for those seeking more control of their web hosting. You get 75 GB NVMe SSD storage, 3 CPU cores, 4 GB RAM, a dedicated IP, and a managed server for just $16.50 monthly.

Who this is for:

These VPS plans are targeted at medium-sized businesses beginning to outgrow shared plans. If you’re starting to experience consistent traffic monthly, then there’s a VPS plan ready to fuel your growth.

Ultahost’s Virtual Dedicated Server (VDS) Hosting Plans

Power Plus

Space offered – 250 GB NVMe SSD storage

Memory – 8 GB

CPU Core – 4

Price – $37.50 per month

Power Pro

Space offered – 350 GB NVMe SSD storage

Memory – 12 GB

CPU Core – 6

Price – $45.50 per month

Power Premium

Space offered – 450 GB NVMe SSD storage

Memory – 16 GB

CPU Core – 8

Price – $69.50 per month

Power Ultra

Space offered – 550 GB NVMe SSD storage

Memory – 24 GB

CPU Core – 10

Price – $96.50 per month

Power Elite

Space offered – 650 GB NVMe SSD storage

Memory – 32 GB

CPU Core – 16

Price – $129.90 per month

Power Advanced

Space offered – 750 GB NVMe SSD storage

Memory – 48 GB

CPU Core – 16

Price – $176.90 per month

Power Turbo

Space offered – 1 TB NVMe SSD storage

Memory – 64 GB

CPU Core – 24

Price – $260.90 per month

I’ll personally recommend Ultahost’s Power Premium VDS plan. You get 450 GB NVNe SSD storage, 16 RAM, 8 CPU cores, and a managed server for $69.50 monthly.

Who this is for:

If your website receives and stores a lot of sensitive information that you don’t want leaking, but you don’t want a fully dedicated server either, then Ultahost’s VDS plans are just what you need. With 7 different VDS plans on offer, you will get one that fits right into your plans and budget.

Ultahost’s Dedicated Server Hosting Plans

Ulta -X1

Space offered – 480 GB NVMe SSD storage

Memory – 16 GB

CPU Core – 4

Dedicated IP – 1

Price – $84.00 per month

Ulta – X2

Space offered – 960 GB NVMe SSD storage

Memory – 64 GB

CPU Core – 6

Dedicated IP – 1

Price – $109.99 per month

Ulta – X3

Space offered – 960 GB NVMe SSD storage

Memory – 64 GB

CPU Core – 12

Dedicated IP – 1

Processor – Intel Xeon E5 v4 / AMD Ryzen 9

Price – $129.90 per month

Ulta – X4

Space offered – 960 GB NVMe SSD storage

Memory – 64 GB

CPU Core – 16

Dedicated IP – 1

Processor – Intel Xeon E5 v4 / AMD EPYC 7282

Price – $195.90 per month

Ulta – X5

Space offered – 960 GB NVMe SSD storage

Memory – 128 GB

CPU Core – 24

Dedicated IP – 1

Processor – AMD EPYC 7401

Price – $289.90 per month

Ulta – X6

Space offered – 1.92 TB NVMe SSD storage

Memory – 128 GB

CPU Core – 24

Dedicated IP – 1

Processor – AMD EPYC 7352

Price – $351.50 per month

Ulta – X7

Space offered – 3.84 TB NVMe SSD storage

Memory – 192 GB

CPU Core – 24

Dedicated IP – 1

Processor – AMD EPYC 7352

Price – $420.90 per month

Ulta – X8

Space offered – 3.84 TB NVMe SSD storage

Memory – 256 GB

CPU Core – 28

Dedicated IP – 1

Processor – Intel Dual Xeon E5

Price – $561.90 per month

Ulta – X9

Space offered – 3.84 TB NVMe SSD storage

Memory – 384 GB

CPU Core – 36

Dedicated IP – 1

Processor – Intel Dual Xeon E5 V4

Price – $873.90 per month

Ulta – X10

Space offered – 3.84 TB NVMe SSD storage

Memory – 512 GB

CPU Core – 44

Dedicated IP – 1

Processor – Intel Dual Xeon Gold 6152/AMD EPYC 9454P

Price – $933.90 per month

Ulta – X11

Space offered – 3.84 TB NVMe SSD storage

Memory – 1 TB

CPU Core – 64

Dedicated IP – 1

Processor – AMD Dual EPYC 2×7502

Price – $1,440 per month

I’ll recommend the Ulta-X5 dedicated plan. You get 960 GB NVMe SSD storage, 128 GB RAM, a dedicated IP, a managed server, and 24 CPU cores for $289.90 monthly.

Who this is for:

This suits businesses or organisations that want total control of their hosting plans. Typically such organisations get heavy traffic and handle sensitive information e.g. Government official websites. With 11 different options, you will get a dedicated plan that suits you perfectly on Ultahost.

Ultahost’s Reseller Hosting Plans

Ulta 25

Space offered – 20 GB NMVe SSD storage

cPanel Accounts – 25

IP address – free

Price – $26.59 per month

Extra Features – unlimited data transfer, free domain transfer, no set-up fees, free cPanel migration, and Click script installer.

Ulta 50

Space offered – 80 GB NMVe SSD storage

cPanel Accounts – 50

IP address – free

Price – $37.99 per month

Extra Features – unlimited data transfer, free domain transfer, no set-up fees, free cPanel migration, and Click script installer.

Ulta 100

Space offered – 150 GB NMVe SSD storage

cPanel Accounts – 100

IP address – free

Price – $52.24 per month

Extra Features – unlimited data transfer, free domain transfer, no set-up fees, free cPanel migration, and Click script installer.

The Ulta 50 reseller plan is the best value for money. With it, you can get a good return on investment without spending too much. It comes with 80GB NMVe SSD storage, 50 cPanel accounts, and plenty of freebies for just $37.99 monthly.

Who this is for:

Ultahost’s reseller plans are mainly for web developers, IT guys, and anyone who wants to sell hosting plans without building data centres. Whether you are a rookie or an experienced reseller, they offer good options for your business.

Ultahost’s Features

Here’s an overview of the main features Ultahost provides across its hosting plans:

SSD storage

Free SSL

Free Daily backups

WordPress acceleration features

Free domain name

Transparent and affordable pricing

Dedicated Firewalls

Ultahost offers many of the features you would expect from a good host, but their dedication to the security of your websites is laudable. They regularly perform firmware upgrades and patches to secure your websites from potential threats.

They also use BitNinja security to scan your websites for malware and other vulnerabilities.

Ultahost Performance Tests

Instead of relying on the performance figures web hosts say on their websites, it is only logical you perform real-life tests before settling for a web hosting plan. The important parameters to consider are – speed (average server response time), uptime, and the overall performance in search engines.

The web host’s speed is measured by how quickly their servers send back data from user queries on a website hosted by them. Uptime is measured by how consistently a website stays online. This is measured in percentage with 99% as the industry standard.

To save you the stress of finding a website hosted on Ultahost, I found one and used GTMetrix to measure the host’s average speed and performance. These were the results:

Ultahost had an impressive server response time of 128 ms – 0.128s. The website hosted by them had an overall performance rating of 98%.

To test the uptime, I used the Uptime robot to evaluate the website’s availability.

In the last 30 days, the website was online 100% of the time, consistent with the 99% industry standard.

Ultahost’s Customer Support

Ultahost’s customer support is very responsive 24/7. You can reach them via:

Live Chat

In an era of chatbots and automated responses, it is always nice to speak with human agents. Once you open the live chat portal, a human agent responds in less than 1 minute.

Phone Support

Ultahost offers support through helplines, but only to customers in the U.S.A. and Turkey(where it was founded).

Email

With this mode of communication becoming scarce among other providers, it’s nice to see Ultahost still offering support via email.

Ticketing

This makes solving issues even more straightforward. Just input your name, phone number, and the issue you want resolved. An agent will then be assigned to your case.

Blog

If you want to stay up-to-date with the latest news and industry trends, Ultahost’s blog is a very informative tool you can explore.

Tutorials

Ultahost offers a wide range of tutorials that could guide you on your web hosting journey. They include WordPress tutorials, domain tutorials, SEO tutorials, and Hosting video tutorials.

Knowledge base

And not forgetting the ever-reliable knowledge base. Equipped with a built-in search engine, finding the answers you need has never been easier.

Ultahost’s Security Features

One impressive thing about Ultahost is how seriously they take website security. They offer two-factor authentication that detects any login attempts that don’t come from you. Should this happen, you are immediately alerted to ensure your account is safe and secure.

They use BitNinja to protect your website from malware and other threats. Their dedicated firewall performs firmware upgrades and patches so your website remains secure.

Finally, all their plans come with a free SSL certificate.

Ultahost’s Website Builder

As a webmaster, the most logical thing to do is to have your web hosting, domain name registration, and website building from the same provider. Luckily, Ultahost offers free domain names and website builders just to make things easier for you.

However, this free website builder may be limited in functionality, so if you want more, you need to buy premium website builders like Wix or Squarespace, or visit our list of the best AI website builders.

User Friendliness – Ease of Use

Let’s find out how easy it is to register an account, use the control panel, and install WordPress.

How to Register an Account on Ultahost

Step 1

Find the hosting type you’re interested in and click on order, this redirects you to a page where you choose a domain.

Step 2

If you already have a domain name, select “existing domain”. If you don’t, you can type in a desired name and check for its availability. Once you are ok with the domain, click “Continue”.

Step 3

On this page, you will asked to choose your preferred billing cycle, server location, and any add-ons you will like on the plan. Once you select them, click continue.

Step 4

At the checkout and summary page, you will have one last chance to look at the plan you’ve chosen, add-ons, and the total cost before payment. Once satisfied, click checkout.

Step 5

Finally, you will enter your personal information and card details. Once you make a payment and it goes through, your account will automatically be created.

Ultahost’s cPanel

Ultahost still uses the traditional cPanel for all backend changes. This gives you control over your domains, databases, emails, and other important functions.

How to Install WordPress on Ultahost

Log into the cPanel, then locate and access the WordPress toolkit in the WordPress section. Click Install and choose your desired installation settings like language and WordPress version.

Next is to set up your username and password, then choose a theme and any other plugins you like. Take one last look at the installation summary and if you’re satisfied, click install.

Once the installation starts, it will take some time before completion. Once completed, you will get a confirmation message that WordPress has been successfully installed.

Ultahost Server Footprint

Ultahost has 17 server locations in 13 countries spread across 5 continents. This means that wherever your website visitors are from, Ultahost has enough coverage to ensure your websites load quickly.

Conclusion – Should You Choose Ultahost?

After putting Ultahost to the test, it’s obvious they are one of the best hosting providers in the world right now. For a young company to be this good in such a short time, it’s obvious the guys there know what they are doing.

They’ve got impressive server response time, good reliability, and transparent pricing. If you’re particular about website security, seeing that they use BitNinja and dedicated firewalls for extra protection will give you confidence.

I recommend them to medium-sized companies seeking a strong base that’ll help them scale their business. You get a free domain and website builder as an extra incentive, so I recommend them!

Visit Ultahost →

FAQs

Who Owns Ultahost?

Ultahost is a web hosting company founded in 2018 by entrepreneurs Elin and Deen Doughouz and their software company ScriptSun. Their headquarters are in Delaware and Istanbul, Turkey.

Does Ultahost offer Free Hosting?

No, Ultahost doesn’t offer free hosting. Their cheapest plan is the shared starter hosting which costs $3.29 monthly

Is Ultahost any good?

Yes, For small and medium-sized businesses, Ultahost offers a range of hosting plans suitable for your business. They offer high-speed NVMe SSD storage, 24/7 customer support, and servers in 5 continents for optimal speed.

What are some Ultahost Alternatives?

Some affordable and reliable alternatives to Ultahost include; Siteground, Hostinger, Bluehost, and Cloudways.

#000#250#Accounts#agent#agents#ai#amd#attention#authentication#backups#best security#bitcoin#Blog#Building#Business#Byte#change#chatbots#cloudways#communication#Companies#control panel#cpu#data#data transfer#databases#details#developers#domain name#domain names

0 notes

Text

Increase Cash App Limit from $2500 to $7500: Step-by-Step Guide

Cash App has revolutionized the way we handle our finances, offering a seamless platform for sending money, investing in stocks, and managing transactions on the go. However, as your financial needs grow, you may find yourself hitting the default limit of $2500 and seeking ways to increase it for greater flexibility. Fear not! In this comprehensive guide, we'll explore step-by-step strategies on how to increase Cash App limit from $2500 to $7500, empowering you to take control of your finances and unlock new possibilities.

Understanding Cash App Limits:

Cash App imposes various limits to regulate transactions and ensure security for its users. These limits may include sending, receiving, and spending limits, each serving to protect users from potential fraud and misuse. While the default limit may suffice for many users, those with higher financial needs may seek to increase their limits for added convenience.

How to Increase Your Cash App Limit to $7500?

Verify Your Identity: The first step to increase Cash App limit is to ensure that your account is fully verified. This typically involves providing personal information, verifying your identity with a government-issued ID, and confirming your email address and phone number. Thoroughly verifying your account establishes trust and credibility with Cash App, making you eligible for higher limits.

Understand the Limits: Before attempting to increase your Cash App limit, it's essential to understand the existing limits and how they apply to your account. You can check your current limits within the app settings and familiarize yourself with any restrictions that may be in place.