#tradeking customer service

Explore tagged Tumblr posts

Text

In Focus: The Robinhood IPO

The Robinhood IPO is getting closer to becoming a reality. The popular trading app filed its IPO paperwork with the Securities and Exchange Commission in late March.

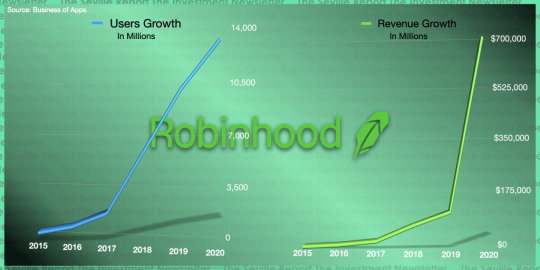

A Robinhood IPO at one time seemed like a no-brainer investment idea. The company displayed rapid growth and was able to easily attract new stock market participants. In 2018, four years after starting, Robinhood hit 4 million opened accounts; E-Trade by comparison had 3.7 million accounts and had been in business for over 30 years.

Bad Timing Kills More Than Jokes

Not too long ago everything seemed primed for Robinhood to do nothing but succeed in the public markets, but the company continued to delay their IPO to their own detriment.

In 2019, Charles Schwab, TD Ameritrade, and ETrade all announced commission free trading on their platforms. This was a big hit to Robinhood's business model. Robinhood's commission free trading allowed the firm to attract customers that older more established Wall Street firms didn't want. By going commission less, Schwab and others declared that they now wanted those customers, and were willing to compete for them. People wondered at the time if Robinhood could thrive in an environment where it was no longer the disrupter, but the disrupted. An IPO during this time may not have worked out well for the company.

In 2020, the pandemic and being isolated at home brought a fresh new wave of money, traders, and success to Robinhood, but that would be cut short by the suicide of a 20 year old trader, who took his own life after mistakenly believing he had lost nearly $750,000 on Robinhood. The suicide caused outrage amongst many who accused Robinhood of gamifying the serious business of trading, which caused the young trader to dabble in trading practices he did't fully understand. The unfortunate suicide stopped any momentum Robinhood could've used to manage a successful IPO.

In 2021, Robinhood made the news for all the wrong reasons again, after cutting traders off from participating in one of the biggest trades of the new year. As the stock prices of companies like GameStop (GME) and AMC (AMC) were rising in early 2021, Robinhood investors were amassing fortunes, and big Wall Street firms who sold those stocks short were suffering massive losses. Robinhood put a pause on the purchasing of GameStop and other stock names that were rallying, and the timing of the event came across as if Robinhood was helping the big Wall Street firms catch their breath while screwing over their customers.

Ultimately what we came to find out was due to the excessive amount of trading in names like GameStop, Robinhood had a money problem and needed to raise capital. Because this wasn't expressed to the public soon enough, Robinhood became public enemy number one to its users and to people who didn't trade or invest in stocks in any capacity. (Here'sBill Burr's take on the GameStop Robinhood mess)

Robinhood has experienced enough to leave it beaten, battered, and bruised, but it is still standing, and that's likely because people hate change. The Robinhood Stock Traders group on Facebook remains very active as does the Robinhood communities on Reddit, even after the company was declared public enemy number one. This is why I strongly believe Robinhood as a public company will be a success over the long term.

I Go Waaaayyy Back

I have been trading since the times when you had to call a broker, speak to someone, and pay a hefty commission to trade. I've seen the business of discount brokerages start out very hot with dozens of companies and then dwindle down to a handful (Ever heard of Scottrade, Harris Direct, TradeKing, Sharebuilder, Olde?). The point is I've seen a lot of things on Wall Street, I've seen what many firms, full service and discount have to offer, and yet I often recommend Robinhood to people who are ready to take their first steps in the market. The reason why I do so is because of it's gamey nature. The app is very simple to use, and I think it does a good job of keeping things simple for beginners.

I've been an E-Trade customer since 2005, and I love what the platform has grown into, but for a newbie, it can be overwhelming. There's a lot of information provided by E-Trade to its users, and if someone just starting out only wants to open a trading account to get in on the GameStop move, an E-Trade or TD Ameritrade level account isn't necessary.

I believe the simplicity of Robinhood for first time investors is where Robinhood will win now. I also think if it can grow into a platform like E-Trade and TD Ameritrade, this will allow it to keep more of its matured customers over the long term, which should allow it to win in the future. And this aspect of the company shouldn't be underestimated.

New Money Over Here!

After the market's rapid rise from late March 2020 to the end of the summer in 2020, there was a fresh set of newly minted Robinhood millionaires and hundred-thousandaires who bet their unemployment and stimulus money on stocks and options that paid off big. Larger brokerage firms began to advertise to this new group of money wielders with features like wealth management and other things that Robinhood couldn't provide.

With Ethereum and Dogecoin's impressive runs, the market is set to mint a fresh set of millionaires, Robinhood will need to develop new features and additional trading and investment tools to keep that money from fleeing to other brokerage firms that offer more.

Do it, Do it Now...

We're several months past the GameStop debacle, and this provides a nice opening for Robinhood to go public before another major event breaks that's not in their favor.

As an investor, I love what Robinhood has been able to accomplish with the little that they offer. There is room to offer so much more like Pink sheet listings, bond trading, commodities trading, and/or IRA accounts to name a few. They could also expand their crypto offering, which I believe would bring even more people to the platform.

There is so much room to grow for Robinhood, and because of that it will be hard to ignore the company's stock on the public markets if the price is right.

The look of what a financial institution is rapidly changing. People are securing mortgages and car loans on apps. Robinhood is just an investment app now, but with a few lines a code it could become so much more (assuming they meet all regulatory requirements). Love them or hate them, Robinhood will be around for a long time, and I'm bullish about their IPO.

#Stocks#Investing#Money#Robinhood#Robinhood Investing#Tech#TechStocks#FinTech#Financial Education#Money Education#Investment Education#InvestmentApps#Investments#Wall Street#Stock Market#cryptocurrencies#IPO

3 notes

·

View notes

Text

Protrader

PTMC is a powerful trading software from creators of Protrader. PTMC gives traders more ways to reach the right decisions on different markets, include Forex. Financial freedom made easy. A mobile first trading and investment platform that integrates with the market exchanges and invests your savings.

If you scroll down you will see that there is a lot of stuff that will help you with your trading here. In addition, we’ll add more as the trading landscape changes and new resources become available. You can click on the logo to the left of the text to open a new tab featuring whatever is being discussed.

Think or Swim

This platform was purchased by TD Ameritrade a number of years ago and is one of the most sophisticated options trading platforms available today. You can also trade stocks and futures with them. If you are into options it is extremely worthwhile to open a small account with them so that you can use their option analyzing tools. In this area, they are well above all but the most expensive option tools out there.

TradeStation

Tradestation has been around for a long time and is well known in the industry. They offer some of the best charting software in the business. You can enter orders right from the software and they support many different order types. You can also trade futures and stocks from the same account.

LightSpeed Trading

These guys are geared toward the active semi-pro or professional trader. You can do all your trading from a single Lightspeed account whether you’re trading equities or options, trading to multiple destinations, or trading for multiple funds. Lightspeed is an introducing broker to Merrill Lynch Professional Clearing, and Wedbush Clearing and Execution.

Interactive Brokers

An excellent broker if you know what you are doing. Their customer service used to have a bad reputation but seems to improved significantly in recent years. They offer very competitive pricing and do expect you to be quite knowledgeable. They are a good choice for experienced active traders. Their commission structure allows easy scaling in and out of positions and they have an extensive set of order type choices.

Ally Invest

This broker tries to combine low commissions with good tools and customer service. There is no commission fee on U.S. listed stocks and ETFs and no ticket fee on option trades and a contract fee of just 50¢ per contract. They started out with the idea of fostering a trading community and claim focus on customer service by offering knowledgeable staff who answer the phone quickly as well as easy access to chat and quick responses to e-mails.

Fidelity

Fidelity has traditionally been more geared toward the investor than the active trader, but over the past five years or so they have also catered more to active traders. While not a direct access broker, their commissions are very competitive. They offer zero commissions on stock and ETF trades and $0.65 per contract on option trades. They also offer more robust customer service than most direct access brokers.

E*Trade

E*Trade is well known for it’s ubiquitous advertising. They have been around for a while and now offer zero commission on stocks and ETFs with $0.65 per contract on options. They claim to cater to all types of traders and have a special platform they call eTrade Pro for active traders.

Tradezero

Tradezero is an offshore broker which allows small accounts to daytrade. There is no commission on limit orders that add liquidity. They clear with Vision Clearing. They offer 6 to 1 leverage. You can read the FAQ here. They have recently opened a US branch with regular leverage and zero commissions as well. As with many brokers, you might want to use them for trade executions but use a separate charting package for your charts.

Schwab

Charles Schwab was the first of the major US full service brokers to switch over to zero commission stock and ETF trading. They charge $0.65 per option contract. They have generally offered superior customer service in tandem with low commission structures over the years and are a very reasonable choice for a broker.

Tastyworks

Tastyworks is a relatively new brokerage started by Tom Sosnoff who was instrumental in starting thinkorswim and sold it to TD Ameritrade. They offer a competitive commission structure which you can check out here. You can use a small cash account to daytrade options and start each day with your settled funds balance as your buying power for the day.

Robinhood

Robinhood is a mobile app that allows you to trade stocks, ETFs, options and crypto. A major feature is that the trades are “commission free”. It looks like they now do their own clearing. You can read about that here. There are some distinct disadvantages to trading off of a phone, but you can also use a full featured platform along with robinhood to help you analyze the market.

TradeStation

The TradeStation platform has been around for many years and originally started out as Omega Charts. For a long time they were way ahead of the competition and likely pushed the evolution of trading platforms forward. They have integrated trading into most aspects of their software, so you can easily trade from the platform which is a very good feature. If you are into backtesting and system building, they have a programming language called EasyLanguage® which allows you to build and test systems. They also provide you with an extensive historical database to facilitate backtesting.

MultiCharts

MultiCharts is a charting and trading platform with a robust set of features. The platform allows backtesting and indicator creation with EasyLanguage. As with many of the better software packages you can do market replay which allows you to practice your trading risk free. It is a very customizable package so you have a lot of flexibility to set up your workspace in a way that suits your trading style.

TC2000

The TC2000 platform has very good clean, sharp looking charting with many added features. The watch lists are also very configurable. Another favorable aspect of this package is that you can add trendlines, etc. and they will still be there the next time you go to the chart. The following is from the TC2000 website: Scan and sort through 1000’s of stocks per second. Screen from hundreds of indicator & fundamental criteria customized with your parameters and time frames. Just follow the step-by-step wizard to build your custom conditions. No programming is required, but you can optionally write condition formulas to refine your results. TC2000 helps you find the charts you are looking for in real-time.

eSignal

eSignal has been around for a long time. They are one of the more pricey packages. Their charting is quite clean looking and their data is pretty good. They used to be at the forefront of charting packages, but others have caught up to them in recent years. You can check out their promo video here

AmiBroker

Amibroker has been around for almost thirty years. It is a charting and back-testing package that is extremely powerful and fast but not especially intuitive. It’s user base is fiercely loyal, but a large percentage of them are quite code savvy. For the average user, there will probably be a steep learning curve. All that would be well and good, except for the fact that the user manual is a bit much to decipher and the tech support is done mostly by e-mail and a yahoo message group of all things! Here is the user database. I would highly recommend this software if it had more user friendly support. The pricing is very reasonable.

Trading View

Here is what Tradingview has to say about their services: Easy and intuitive for beginners, and powerful enough for advanced chartists – TradingView has all charting tools you need to share and view trading ideas. Real-time data and browser-based charts let you do your research from anywhere, since there are no installations or complex setups. Just open TradingView on any modern browser and start charting, learning and sharing trading ideas! It’s basically a community platform for sharing trading ideas and also offers real time charting capabilities.

Medved Trader

Jerry Medved is a programmer who developed and founded “QuoteTracker” years ago and eventually sold it out to TD Ameritrade. QuoteTracker was an excellent charting program that was very reasonably priced and could be had at a discount through various brokers. When Jerry sold it out to TD Ameritrade, he apparently was not able to compete with them for a set amount of time. It appears as though the non-compete is expired because he recently came out with Medved Trader. In the spirit of QuoteTracker, Medved Trader is a full featured, reasonably priced, well put together trading software package. Here is a demo of Medved Trader done by Jerry himself. You can get it for free from some brokerages including TradeKing and Tradier brokerages.

NinjaTrader

NinjaTrader’s platform is a capable charting package with numerous valuable features. You can add indicators and trade off the charts if you like. It facilitates back-testing as well. Here is the platform purchase page. You can download and try out simulated trading for free in order to get to know the platform. It can be configured to work with a number of different brokers and comes free with a NinjaTrader account if you do a certain volume of trades per month.

SierraChart

SierraChart is an excellent charting program which is compatible with a number of broker datafeeds as well as with many third party datafeeds. The price is reasonable and it is possible to trade right from the platform.

Sterling Trader Pro

A professional level platform, Sterling Trader Pro is used by prop firms, broker-dealers, and active traders. You can connect from your desktop, laptop, iPad, iPhone, or Android.

DAS Trader

DAS Trader is a high end trading platform which you can get through many brokers. It’s available on desktop, laptop, iPhone, or Android.

FinViz

These guys provide one of the best free scanners available on the net today. It’s so good, as a matter of fact, that you don’t really have to sign up for their paid service if you don’t want to. Although it seems as though they are geared toward the lower priced stocks when you look at the landing page, you can click on the screener section and set the parameters to your liking. It’s a great tool for getting quick background news and other info on stocks you are interested in. Simply click on the ticker and you’ll get a page with much of the pertinent fundamental information as well as recent news and a daily chart. For more info and intraday charts, you can subscribe for a very reasonable price.

Protrader.com

Trade Ideas

This service is a sort of artificial intelligence trading helper. You get to program the scans according to criteria that fits your scan ideas. If you get stuck, this software has many pre-frabricated scans that you can mix and match. The scanning is very current and you will get as many alerts as you can handle provided you give it enough to look for.

Your Broker’s Stock Scanner

Don’t forget to check out your broker’s scanner. Many brokers license commercial scanning software either in whole or part. You might be surprised how close the results are to those of software you would pay a significant extra fee for. I highly recommend that you check this out first before spending extra money on a paid service.

Protrader Web

Market Watch

MarketWatch is a subsidiary of Dow Jones and Company, the same company that owns the Wall Street Journal and Barrons. Although the news is not timely enough for active day trading, it offers a lot of useful news covering all sorts of things and can give you an overall look at what is happening in the Market. It has a lot of entertaining and fluff news as well.

CNBC

As you already probably know, CNBC is a financial news network covering current events related to the world markets. It is up to you to decide how useful the information presented here is. There is no doubt that there is a lot of “hype” on this station, but they do cover breaking events that are important to daily trading activities. You can find the pertinent info faster with subscriber news services, but a lot of people enjoy watching CNBC for entertainment purposes as well.

Bloomberg

Bloomberg.com is a business news website that covers news pertinent to the Markets as well as business in general. In some ways it is similar to CNBC but more sophisticated with less hype.

Yahoo Finance Economic Calendar

The Yahoo Economic Calendar is a good place to get the run down on what important market related announcements are coming up. If you don’t have this info elsewhere, it’s worth checking out before the market opens. They don’t update the results fast enough for active day traders, but at least you can be aware of when important reports are coming out and adjust your trading accordingly.

World Charts

Allstocks.com is a funky little website that features a lot of useful information for traders. The main page I use on this site is the world charts page which shows a time delayed read out of how the world markets are doing. It’s a quick way to get a snapshot of what occurred overnight around the globe.

Yaba Daba Doo!

Www.protraderinstitute.com

Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who “add liquidity” by placing limit orders that create “market-making” in a security. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock.

1 note

·

View note

Text

TradeKing Login - How to Guide

TradeKing Login – How to Guide

TradeKing is a company that was established at 2005 and giving several financial services in the UK. TradeKing is a subsidiary corporation of Ally Financial. TradeKing is working as an online brokerage firm and gives other valuable financial services and tools to their clients. TradeKing is one of the trusted corporation to guide yourself at online brokerage system. With their unique service and…

View On WordPress

#how to use tradeking#is tradeking good#is tradeking legit#is tradeking safe#optionshouse vs tradeking#reviews of tradeking#tradeking#tradeking api#tradeking app#tradeking com#tradeking com login#tradeking contact#tradeking customer service#tradeking down#tradeking fees#tradeking forex#tradeking forex review#tradeking inactivity fee#tradeking ira#tradeking live#tradeking login#tradeking margin account#tradeking minimum#tradeking phone number#tradeking promo#tradeking promo code#tradeking promotional code#tradeking referral#tradeking review#tradeking reviews

0 notes

Text

How To Start An Online Business

Do You Want To Learn How to Start an Online Business? Many People are now thinking they would like to Learn how to start an online business and working from home, but most never even start because they are not sure what they need to do, to take that first step. This problem is why you need to know exactly what is involved to get your own online internet business started. 1. You will need a website or blog: You need to have a website or blog that you can send people to. Without a place to go and discover more about your offers, products or business, you will never make money. 2. Training: Most people don't realise that they have to learn many new skills but this is vital to starting a successful online business.

There are many things you need to know and understand before you even start building a website or blog. You Learn how to start an online business, Like anything, the more training you have, the easier it will be to start your business. Your internet education is a continuous process, you will always be discovering new ways and systems to apply to your business to make it more profitable. 3. Have a good plan: Traffic flow to your site is the number one thing that has to be right. Traffic is the life blood of every website. Without traffic your website dies.

Plan a way to drive continuous traffic to your new online business. 4. After you learn how to start an online business you must have Patience and persistence: So often people make the mistake of not giving their business time to be successful. When first started, your business will require time to start making you money. Be patient because no business starts earning money straight away. Stay with it and be persistent. 5. Constant Hard work: Of course, hard work will be involved. This is something that many people keep from telling you when you first start. You must know, like any new business, hard work will be required and hours spent at your pc. After time it will require less time and effort to maintain the business. We all Learn at different speeds so this Online Video Training course is right for everyone who wants to Learn how to start an online business. See How, Click Here. Anyone can learn how to start an online business, with some basic training and a good product or idea, along with some determination, you could achieve financial independence and freedom. So start learning the skills you need now and generate an online income that will last a lifetime.

Get in touch With Mark Robertson. make passive income fast is the founder of ReelSEO, and another expert on YouTube and video marketing. Try out FoundUB4. This site also offers consulting services, including ways to promote your company videos and get more eyeballs on your channel. Download Tube Toolbox. This software package (which includes a free download) is a slick resource for building your YouTube audience. Features include audience targeting, task automation, and general account management. Read An Insider’s Guide To Climbing The Charts by Alan Lastufka and Michael Dean. This book is written by two YouTube veterans, instructing on the art of creating and promoting high quality video content. 2000 A Month on YouTube With No Filming. Over 27,000 student have already enrolled on it. If you’re setting out to make a career for yourself in online video, you certainly have your work cut out for you. But there is no doubt a huge opportunity in this medium, as several members of the first generation of YouTube stars have proven. Have another tip for making money from online videos? Let us know in the comments below.

There’s nothing as interesting as working from your PC. You’ll not only enjoy working from the comfort of your couch, but also enjoy creative ways to make money on the side working from anywhere in the world. Working online not only presents you with a hassle free and interactive medium but also allows you to practice your passion without having to worry about bosses and fixed working hours. Here are a few brilliant ideas that you can always try out. It is basically a business promotion technique whereby you market different enterprises and in return receive a commission for every sale achieved.

There are several types of affiliate marketing options that you can sample out. Among them include pay-per-click pay-per-lead, blogging and comparison shopping. Some of the best online affiliate marketing programs include PepperJam, AzoogleAfs and Commission Junction. You can also start selling items online. Currently there are many websites such as Craiglist and eBay whose services can be utilized to make money online. You’ll require signing up in these services and then collect all the products that you wish to sell. After compiling a list of these items, you will then be required to provide details of the goods in order for the customers to know the exact nature of the deal.

If you want to succeed in selling products online, it would also be better to do some homework to identify which products are hot selling before offering your items. Always keep the deal as lucrative and as realistic as possible. Also mention any other relevant details such as the features, warranty and condition of the item. This will greatly increase your chances of making a successful sale. In online stock marketing, it is very important to grasp the finer details so as to succeed. Basically, you require signing up with different online stock trading websites and then start trading your shares and making money.

In order to succeed in this field, it is wise to conduct a deep research since you’ll be risking your hard earned money. For instance, you should ascertain whether the company that you are dealing with has a good history and also find out their business ethics. After signing up, you’ll easily be able to buy and sell shares on just a click of the mouse. Some of the best companies that you can compare include: optionzXpress and TradeKing. Content writing or article writing is yet another superb online money making idea for those wondering how to make money online. You simply have to sign up with a reputable website such as iWriter, suite101 and The Content Authority.

The registration process is normally very brief and you can start working in just a matter of hours. By signing up with any of these websites, you’ll get the opportunity to write on different topics such as business, science, financial matters and technology. Basically, the more the articles you write, the more you’ll get to earn. Online Surveys and Paid Email Services There are many companies that conduct online market research on various facets of their services. By getting in contact with any one of them, you can be in a position to start making money online within a short time. 1.5 per survey conducted. Another superb online money making idea is through paid emails. What you basically have to do is to register with a legitimate website after which you’ll start receiving emails. The more the number of emails received the higher the pay. Basically, the pay scale ranges from 2 to 5 cents per email received.

Twitter you're getting left behind and may miss a grand opportunity to monetize your online experience. Twitter is a mini-blogging application that allows you to send messages from your cell phone and the web. At first most people don't get it, but after hearing about it from several sources you're often forced to create a Twitter account, start following people and engage yourself in the Twitter Universe. The question I'm always asking is how do I use this technology to add value, build our brands and make money online (monetize). Saad Kamal like many others have ask the same question. On his blog he lays out some very specific ways on how to make money online using Twitter. Read Twitter Monetization: How to Make Money with Twitter for complete details.

Most of individual have not enough knowledge from where and how they should star their mission with a view to Make Money From Home. Let's face honestly as though there are just a modest bunch of cash making arrangements through using your valuable time. Which should you picked up and which one will be perfect ? Which one is perfect for you? Before you significantly consider the relative benefits of the different open doors you have to put forth some key inquiries. Very first we consider the most valuable thing we have - TIME. The amount Time Does It Really Take to Make Money From Home?

Time is so essential in light of the fact that there is little we can do to get a greater amount of it. While it is conceivable to manipulate cash, learn new aptitudes or get the right outlook, the hours we have allowed to take after a specific endeavor are non-debatable. We you figure out a great way, there are approaches to influence your time with the goal that you can be more profitable, yet when we are beginning each moment is going to check. How long do you have every week to focus on your cash making endeavors that may result you to Make Money From Home?

What are the base time prerequisites for a business or salary creating endeavor? Obviously, the more time you invested here the more return you will have. Be that as it may, what I need to clarify today, is the absolute minimum time you would need to make it beneficial. Presently my conjecture is that a great many people might want to make an additional couple of hundred quid for each month least. So I also make it as my benchmark. You don't have a fulltime work and are readied to invest full energy exertion. What are your choices? The uplifting news is you can do attractive anything! Any conventional blocks and mortar business (retail or administration based) will require at least 40hrs every week and most likely significantly more whilst setting up. Same goes for franchising.

I know it may sound self-evident, however there is no reason for considering a customary plan of action unless you are readied to put in any event general 8 hour day. You have to Go online obviously! See, I don't have to exhaust you with the advantages of having a simply online business with a view to Make Money From Home . We both realize that the Internet allows you to make deals 24hrs a day, while never meeting a solitary client. You don't need to travel. Here are one special way that one can follow to attain you success in term Make Money From Home.

You want to make money online, you want to make money with no money or in other words without investing a single cent, am I right? Underground secret method I am going to share with you is so simple and easy to implement that I think anyone can put it to use, including you, and can start making really good extra money online. So go there and sigh up for one now, it's completely free and then choose product you would like to start promoting. Choose the one that would be interesting to you and the one that will have at least %1 conversion rate; the higher conversion rate the better for you, the more money you will be making.

Then go to Google and type in search box "10 top article directories" and create accounts with each single one of them. Start writing articles and at the end of each article put your affiliate link, in section "about the author". If you have got scare about that thing that you need to write articles don't worry, it's simpler than you think. To get some ideas for your articles firstly you can read some e-book or some other articles and than those knowledge's you have learned from there describe in your own words in your own articles, simple as that. Pretty much that's it. As soon as people will start reading your articles and clicking on your affiliate link and buying the product you will be making money. Of course you must know which articles get most views if you want to make serious money online and spend less time in front of your PC or laptop. And for that you need to make researches online and test the market, and that can take tongs of your valuable time.

Clickbank is the largest and most successful online store for digital products in the world. The term 'digital products' encompasses a vast variety of products and services, all of which have one thing in common - they can all be downloaded, viewed or accessed on a computer or mobile device. The money making opportunities offered by Clickbank are potentially huge, but (like anything worth doing well) it takes time and effort to take full advantage of these opportunities. Whilst it may seem daunting to create your own digital product to sell, the benefits of doing so are clear. Clickbank has a vast network of affiliates whose mission is to promote and sell Clickbank products. The more effective the pitch page, successful a product sells (and the higher the commission is), the more likely it is that a product will be selected for promotion by an affiliate.

Clickbank confirms payments, processes orders and handles customer service on behalf of its vendors. 1 fee per transaction. 2.50 fee per payment issued to a vendor by Clickbank. Having worked as a Clickbank affiliate for a number of years, I've learnt that success takes time and effort - and a lot of trial and error. However, if you find the right product and you have an effective way of marketing it, then you'll be able to make extra money using Clickbank. Is the product relevant to the web page (or newsletter) that you have created? And consequently, will it appeal to your audience of prospective buyers? Gravity - this indicates how 'hot' the product is at the moment and is based on how many affiliates are successfully generating sales of the product. The higher the gravity, the more sales are being made (and the more competition there'll be from other affiliates). Commission - the amount you'll make per sale.

Now that I am living here in Almeria Southern Spain, I get to enjoy the laid back Spanish way of live. It's not just the 2 hours lunch break and the endless sunny days and warm nights though. My online marketing business has allowed me to live and work anywhere. The workshop is small back just right for me to potter about with making bits and pieces. Around lunch time I arrive Home and start blogging on some off my blogs and updating my websites. This takes about 3 hours depending how I feel, sometimes I get right into something and the hours fly by. Thats the great thing about working online, you decide the hours and times you want to work. Most people like to tell friends how their week has gone and for me posting on my blogs and getting piad for it is the best job ever, Well is it a Job? Looking back at my 8 till 5:30 job in the uk It doesn? I guess it is. Join my team and I will show you how to generate an online income blogging about the things that interest you. See the video that shows all CLICK HERE.

When you add traffic, the wonder product will make you countless thousands of dollars overnight. And that may well be true. What's the missing fact that leaves you high and dry? Getting streams of traffic is a challenge for most experienced online marketers. And it feels like an insurmountable obstacle for the beginner. I can prove this with more product purchases than I care to admit. And if you've been trying to make money online for more than a month, you no doubt can prove it as well. My approach now is just the opposite. I have passed on some excellent new products because I know that once I have these products installed, I will be faced with the necessity of driving traffic to make them work. And as mentioned above, that's the hard step that causes so many online marketers to struggle, and many to finally give up.

There is no easy answer to this problem. There are a number of traffic options, and you most likely know about most of them. But you probably haven't found the way to make them work for you. The most promising answer I have found is to explore what traffic methods are available, and select two or three methods that are most appealing to you personally. The next step is to experiment with these and determine which one is best suited to your personal preference, background and special circumstances, like budget or time availability. To implement this next step, you have to develop laser-like focus. Do not get distracted by other traffic options until you have become an expert in the one method you selected.

1 note

·

View note

Text

Let’s know 5 best brokers for mutual funds

Here are the best brokers for mutual funds such as Fidelity Investments, Charles Schwab, E-Trade Financial, Ally Invest and The Vanguard Group.

5 best brokers for mutual funds

1- Fidelity Investments

In summer 2018, Fidelity Investments set up 4 zero-fee funds, this makes it the first financial organization to provide mutual funds in the current price war with zero investment ratios.

The funds are the One Fidelity Total Market Index, the Fidelity Zero International Index Fund (FZI) and the Fidelity Zero Large Cap Index Fund (FLCLF). You will not have to pay management fees because the funds do not charge fees for these zero-fee investments.

However, as long as you hold the fund at least 60 days, all Fidelity funds have no payment costs.

The retirement giant based in Boston, that has been in the mutual fund space for a long time. Fidelity no longer requires at least one brokerage account to be opened. You had to bring in $2,500 before. The long-standing broker, a lot of research, screening and mutual funds such as its famous Magellan Fund are available to you. You can also use its full view function to understand all your finances in one location in all your financial accounts, much like you could in a budgeting app such as Mint.

2- Charles Schwab

Charles Schwab Bank credited to the 1970s as a pioneer in cheap investing and to this day, the price of the company remains competitive. You have a wide selection of common funds at Charles Schwab that do not pay commissions for sales. More than 4,000 mutual funds, zero transaction charge, are available from the discount brokerage agency. If you leave these funds, however, the fee is steep: Up to $76 per purchase will be charged, but usually $49,95. Like many critics, Schwab does not have to open or maintain an account at least. The company applauds its excellent customer service and comprehensive research-based online brokerage system.

3- E-Trade Financial

In May 2018, a number of users overshadowed by the famous Fintech exchange software Robinhood. But Robinhood does not offer anything from the E-Trade financial platform: mutual funds. Specifically, E-Trade, which was established in 1982, provides over 4,700 mutual funds without a charge and no transaction fee. This list consists of over 110 Vanguard funds from one of the low-cost space leaders. E-Trade charges a $19,99 fee, which falls in the middle of rivals when moving outside the non-transaction-fee funds. You will also have access to research and tools at E-Trade to help you decide on investments.

4- Ally Invest

Ally Invest is a less-known brand name, but it is not a possibility for you to ignore. Ally focuses on its digital experience as a company without branches. The Ally Bank, the sister brand of Ally Invest, won a number of awards, including the 2019 Kiplinger Internet Bank. The company’s customer service also well known. Ally Invest, established in 2016 through the acquisition of TradeKing by Ally Financial, offers more than 12,000 reciprocal money access. In comparison to rivals, fee fees for Ally Invest for mutual funds are substantially lower. $9.95 for the purchase and sale of mutual funds without charge, while sales loaded funds may be purchased and sold at as little as $0.

5- best brokers for mutual funds: The Vanguard Group

The Vanguard Group formed in 1975 and has been famous for its cheap index funds for many years. The legendary founder, John C. Bogle, lent a first retail investor index fund. The Vanguard 500 Index Fund is now known as this fund. The more than 140 Vanguard mutual funds will not be charged as a Vanguard customer. The company also provides more than 3,000 mutual funds for non-Vanguard non-transaction fees. For the other funds on its website, you can charge $8 to $20 per company, although Vanguard funds accounts receive their first 25 trades free of charge with over $1 million. Although the index investment is known, vanguard also regularly provides fund management.

Source: Wikipedia

The post Let’s know 5 best brokers for mutual funds appeared first on peeker finance.

source https://peekerfinance.com/lets-know-5-best-brokers-for-mutual-funds/

0 notes

Text

Ally Invest Review

make sure to visit transfs web site for a lot more details on personal finances

Ally Invest offers is a low cost and very easy to use online broker. Formerly TradeKing, we cover all of its features and costs in this review.

You’ve probably heard about Ally Bank. They’re perhaps the best-known online bank, offering some of the highest interest rates available on savings accounts and certificates of deposit. As of last year, Ally Bank has an investment branch–Ally Invest. And like the Bank, Ally Invest is one of the better investment platforms now available.

About Ally Invest

Ally Invest came about in 2016 when Ally Bank acquired TradeKing. TradeKing was a well-known brokerage firm in its own right, offering some of the lowest trading commissions available anywhere. It was a perfect investment platform for self-directed investors, who trade frequently, and looked for the lowest trading commissions possible. TradeKing fills that niche and filled it well.

Ally Bank took all that TradeKing had to offer and only made it better. The platform offers stocks, bonds, fixed income securities, options, exchange-traded funds (EFTs), and more than 12,000 mutual funds, both load and no-load funds. They also offer Ally Invest Managed Portfolios robo-advisor, and for more sophisticated investors, Ally Invest Forex & Futures.

Ally Bank has over $71 billion in customer deposits and more than 7,500 employees. Ally Invest now has over 250,000 customer accounts, with a total of $4.7 billion in assets under management. The two divisions are each owned by Ally Financial, Inc. which was founded in 1919, and is currently headquartered in Charlotte, North Carolina.

Ally Invest Basic Features and Benefits

Available Accounts. You can hold individual and joint investment accounts, as well as traditional, Roth, rollover, SIMPLE and SEP IRAs. They also offer trust, custodial and Coverdell accounts.

Minimum Opening Account Balance. If you’re opening a self-directed account, there is no minimum required initial deposit. The minimum for the Managed Portfolio is $2,500, and for the Forex & Future account, it’s $250.

Customer Service. Representatives are available by phone, email or online chat, 24 hours a day, seven days per week.

Account Protection. Your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. There is additional coverage available for up to $37.5 million, although the Forex & Futures accounts are not covered by this insurance.

Mobile App. The app is available for Apple iOS and Google Android. It is offered for both Ally Bank Mobile Banking and Ally Invest.

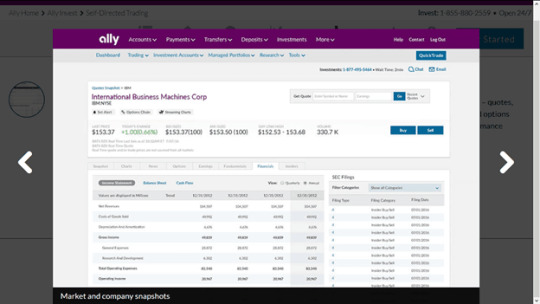

Investing Tools. Ally Invest equips you with streaming charts, market data, market, and company snapshots, watch lists, a profit and loss calculator, a probability calculator, and options chains that enable you to easily place options trades.

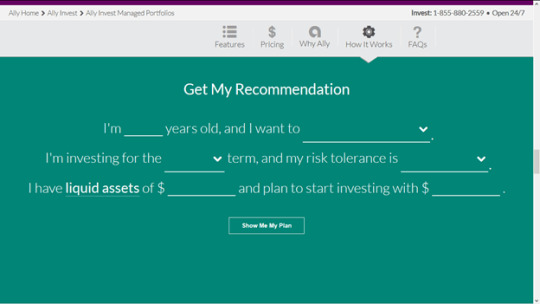

Ally Invest Managed Portfolios

Managed Portfolios are Ally Invest’s robo-advisor service. It is designed for investors who are not comfortable with self-directed investing. The service provides professionally designed portfolios that are personalized to fit your risk tolerance, time horizon, and investment goals.

Like virtually all other robo-advisors, Ally Invest Managed Portfolios build your portfolio using low-cost index ETFs. These keep investment fees very low while providing your portfolio with exposure to entire markets and sectors.

Managed Portfolios includes automatic rebalancing, and enable you to adjust your risk tolerance, which allows the portfolio allocations to be changed.

Managed Portfolios are available for individual and joint taxable accounts, as well as custodial accounts, and IRAs. Each account requires a minimum initial investment of $2,500 and is subject to an annual management fee of 0.30% of the account balance.

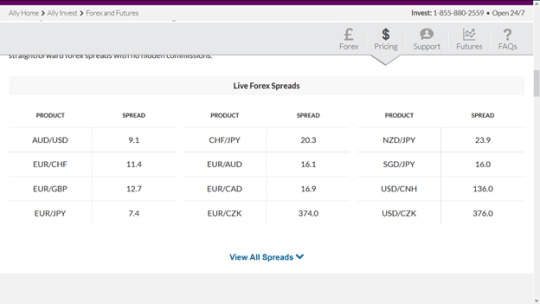

Ally Invest Forex & Futures

For more experienced investors, Ally Invest offers its Forex & Futures platform. There you can trade more than 50 currency pairs, including gold and silver. Since Forex and futures investing is more technically involved in other investment types, the platform offers a full range of trading tools, research material, and educational guides.

Trading on the platform can be done in real time. They also offer customer service for Forex & Futures on a “24/5 basis” – that’s 24 hours a day, five days per week. They are available from 10:00 AM on Sundays, through 5:00 PM on Fridays, Eastern Time.

The trading platform is fully customizable and offers trading in metals, indices, bonds, and agriculturals. It also has charting capabilities that are based on over 100 technical indicators. You also get real-time alerts in a tradable Market Depth Ladder.

You can open a Forex and Futures account with as little as $250, but Ally Invest recommends that you have at least $2,500 in the account before you start trading. There is no fee associated with trading on this platform. Ally Invest is compensated by the buy/sell spread.

Forex & Futures Features and Tools

Practice Account. If you’re not an experienced Forex trader, Ally Invest offers a $50,000 practice account that enables you to access all of the features of the Forex & Futures platform for 30 days. There you can develop your skills as a trader, before committing your own real money.

ForexTrader. This feature provides real-time information, maximum flexibility, and robust tools for Windows users. It offers an intuitive user interface with advanced customization features, as well as professional trading tools. You can:

Customize your trading environment

Spot trends and plan for your next trade

Automate your trading strategies

Browse actionable research and trade ideas

Access your account anytime, anywhere with the Mobile App

ForexTraderWeb. This platform is available for Mac (but also for Windows) and is a fully integrated charting tool that provides you with advanced trading with easy access to position and account information. It provides real-time quotes and instantaneous updates on your open positions, and other information.

It also displays a variety of single and contingent order types, including If/Then, If/Then OCO and Trailing Stops.

Mobile Solutions. The mobile app provides robust training capabilities, real-time news and commentary, charting tools, and the ability to get alerts and manage your account. And you can do it all while you’re on the go.

The platform also offers a large variety of educational resources that will help the Forex and futures trader learn everything from the basics of trading to technical and fundamental analysis. It also provides you a glossary of terms, to familiarize yourself with those that are necessary for the trade. Ally Invest offers plenty of resources for both the novice trader and the veteran who’s looking to sharpen his or her skills.

(SOURCE URL: https://www.ally.com/invest/forex-futures/)

Ally Invest Pricing

There are three basic ways to invest through Ally Invest, and each has its own pricing structure.

Self-directed Investing

Ally Invest’s Self-directed investment fees are as follows:

Stocks and ETFs, $4.95 per trade

Options, $4.95 per trade, plus an additional $0.65 per contract

Mutual funds, load funds: no fee on either purchase or sale

Mutual funds, no load funds: $9.95 on both purchase and sale

Special Volume/Balance Pricing. If your account has an average daily balance of at least $100,000, and/or you have more than 30 trades per quarter, Ally Invest offers reduced pricing. Trades on stocks and ETF’s are just $3.95, and then $3.95, plus $0.50 per contract, for options trades.

Ally Invest has no annual fee, inactivity fee, and even no IRA fee.

Managed Portfolios

Ally Invest Managed Portfolios has an annual management fee of 0.30% on all balances. This means that you will pay a fee of just $150 per year on a $50,000 portfolio managed by the service.

Forex & Futures

There is no commission involved with Forex trades, as Ally Invest earns their fees on the buy/sell spread.

Ally Invest Pros and Cons

Ally Invest Pros

Low trading fees. The basic trading commission of $4.95 per trade is one of the lowest in the industry. The reduced fee of $3.95 per trade on high balance accounts or high-frequency traders is one of the very best fee structures is available.

24/7 Customer service. Most investment platforms limit customer service contact either to regular business hours, or extended hours. Ally Invest is always available.

Self-Directed or Managed Portfolios. This combination gives you a choice, to either manage your own investments, or to have them professionally managed. You don’t have to make a choice, you can have part of your portfolio managed while being self-directed in the rest.

Ally Bank. The bank has some of the highest interest rates paid on savings instruments, as well as the availability of mortgages, a credit card, and their innovative auto financing portfolio.

Ally Invest Cons

We could come up with only one, and it’s not a big one…

Managed Portfolios fee is a bit high. The annual fee of 0.30% isn’t excessive across the robo-advisor spectrum, but it is higher than more popular platforms, such as Betterment and Wealthfront, who each charge 0.25%. In addition, Wealthfront manages the first $10,000 for free.

Should You Invest with Ally Invest?

Very low trading fees, a managed portfolio option, a robust Forex and futures platform, and the availability of all of the benefits of Ally Bank make Ally Invest a tough combination to beat anywhere. This can be a perfect investment platform for the self-directed investor, who may want to trade in options and Forex and futures, but also wants to add a managed option as well as high-yielding safe investments to the portfolio mix.

What’s more, Ally has very low minimum investment requirements, for the self-directed platform, Managed Portfolios, and their various bank investments. In that way, it’s also the perfect platform for the passive investor who might want to combine managed investments with high-yield savings, and maybe dabble in some self-directed investing along the way.

If you’d like more information, or you’d like to sign up for the service, visit the Ally Invest website. This is truly one of the best overall investment platforms available.

0 notes

Text

Best Online Stock Brokers for Beginners in 2017

This article first appeared on aaacreditguide.com at AAACreditGuide.

Ready to get started investing but not sure where to start? We’ve compiled a list of the top brokers we recommend for 2017. Catering to both seasoned and beginning investors alike, there’s someone on this list for everyone. Whether it is customer service, affordability, or platform versatility, each of these brokers shines in its own way.

Vanguard

Perhaps one of the best brokers for low-cost investing, Vanguard is frequently utilized by buy-and-hold and retirement investors with high account balances.

Its expense ratios on index funds and exchange-traded funds (ETFs) are quite below the national average, so it is the go-to broker for long-term investors.

Retirement-minded investors can find a lot of resources with Vanguard through its website. They list safe and healthy investment options that promise long-term growth, and it gives helpful hints on where you should prioritize your time and energy if you’re just getting started.

They also have a sophisticated program that can estimate when you’ll be able to retire and can help calculate your monthly expenses (sudden or otherwise) once you do.

If you have some money to invest, you can save by choosing Vanguard. For accounts with at least $50,000, trades only cost $7 regardless of how big they are. When the account hits $500,000, trades only cost $2. When the account surpasses a million dollars, many trades become free.

Want to make active trades? Keep looking.

If you’re an active trader and don’t have nearly that amount of money laying around, however, Vanguard isn’t the best broker. It doesn’t have any software to support its traders (meaning there aren’t any trading tools or platforms to utilize).

Also, investors who frequently trade (say, more than 25 times a year) are penalized with fees (assuming, of course, they don’t have $1 million invested with Vanguard).

Motif

Motif Investing is a great company to go with if you are an ETF investor, looking to invest in IPOs, are an impact investor, or you are looking to buy fractional shares of stocks.

Monthly subscriptions range from $4.95 to $19.95 a month and it costs $4.95 per share and $9.95 per motif.

What are motifs?

They’re essentially value-themed categories you can invest in, like healthcare, green investing, or recent IPOs. If you’re interested but aren’t quite ready to commit, Motif offers a free one month trial to Motif Blue. Currently, there is no account minimum, but if you want to invest in a motif they require a $300 minimum to get started.

Unlike Vanguard, Motif has a decent web presence. Its mobile app, for example, allows users to track and benchmark motifs, peruse newly added motifs, and offers a user-specific news feed created for each investor.

One of the best things about Motif is that it allows investors to trade in dollar increments (also known as fractional shares). So if you have a bit of money you would like to invest, but don’t have enough to buy a whole share of a company, you can invest what you have.

Lastly, if you would like to buy foreign stocks, Motif offers its investors American depository receipts. These ADRs are traded in U.S. Markets, are issued by U.S. Banks or U.S. based brokerages, but they represent individual shares in other countries. This makes them great in helping investors get their feet wet (pun intended) with companies overseas and will help them truly diversify their portfolios.

TD Ameritrade

TD Ameritrade is considered by many investors to be one of the best resources for both beginning and advanced investors.

It offers portfolio building advice, has over a hundred commission-free ETFs, and provides great trading platforms (mobile and PC) — all while not requiring an account minimum for its customers.

TD Ameritrade also has a program online for beginners called Web Platform which is extremely useful. Here newcomers can select their trading ‘skill level’ and their level of education, and TD Ameritrade will help the investor build a properly balanced portfolio, including:

ETS

Stocks

Bonds

Mutual Funds

If you like to do your own research before doing any kind of investing, TD Ameritrade also provides its investors with a lot of free resources. Customers can stream CNBC news for free, access market ‘heat’ maps and real-time trading quotes.

They can also communicate with a community of specialists that are available to chat in person or over the phone about investment options and ideas. Ameritrade is one of the few companies these days that offer this kind of service.

Part of its success comes from its ability to delegate. Every quarter TD Ameritrade relies on Morningstar, an independent investment research firm, to compile a list of mutual funds that offer no-transaction-fees. This rather large list hits 45 investment categories and is given out exclusively to Ameritrade customers.

Robinhood

Robinhood is aptly named, offering commission-free stock and ETF trades.

Not just some of the time — all of the time.

On top of this, Robinhood doesn’t have an account minimum. If you want to get started trading, there’s no reason to wait. However, unlike Motif, Robinhood doesn’t offer fractional shares, so you’ll need to have enough disposable income to buy at least one share of stock or ETF.

Robinhood has a great mobile app team. It’s so good there’s no reason for you to ever hop on a PC. It takes five minutes to setup, and only an hour for them activate your account. Seem long? By industry standards, it is pretty darn fast. (Keep in mind this is a trading account, not a twitter account you’re setting up.)

When you transfer $1,000 to Robinhood, it is available immediately for you to invest. If you upgrade to Robinhood Instant (a free upgrade), any proceeds you make from selling stocks or ETFs can be immediately used to buy stocks or ETFs elsewhere.

Don’t like the hassle of transferring money back to your bank account or vice versa? You can set up your account so that money is transferred to and from automatically whenever you want. Once a week, once every two weeks, and so on. For as many perks that Robinhood offers, this one is just the icing on the cake for many users.

Due to popular demand, some of its features do having a waiting list, such as Robinhood Instant. Sign up on day one so you can take advantage of this upgrade as soon as possible.

Ally Invest

If you’re a seasoned investor, you may never have heard of Ally Invest, but its newness to the scene shouldn’t make you discredit it.

In 2016, Ally invest bought out TradeKing, and has only recently emerged into the brokerage game. That said, it’s quickly become very clear that everything that was great about TradeKing has only gotten better. Ally offers automated portfolio management and forex trading. There is no account minimum, commissions on trades are $4.95.

Are you a frequent investor?

Ally Invest offers discounts to members who trade 30 or more times per quarter. At that point, the fee drops down to $3.95.

Whether you use a PC or a smartphone, Ally has a great online platform for its users. Trade fast, get current, 24-hour quotes and data, make your own unique dashboard, and get a diverse set of trading tools at your disposal.

Here are some of our favorite helpful features:

Profit-and-loss calculator

Maxit Tax Manager, which informs you of any changes to your taxes based off of trades

Probability calculator to tell you of the likelihood of your desired targets for each share

Worried about trading from work? Don’t be. Ally Invest’s web platform doesn’t require you to download anything. Simply log in and you are ready to trade. Considering everything they offer online, this is quite an achievement in and of itself.

Scottrade

Online platforms are great, but what about talking with actual human beings? Scottrade has about 500 offices across the country where you can actually go inside and speak with a knowledgeable investor.

Don’t have the time for that? Talk with someone over the phone or chat with them online. They have a staggering 1,000+ consultants that work every day of the week, that you can speak with almost any time of day.

It actually offers such good customer service that another company is working on buying it out: TD Ameritrade. It’s not finalized yet, but when it happens, it could be good news for members. Can you imagine the resources of TD Ameritrade coupled with the customer service of Scottrade? That said, Scottrade still has a lot of aces up its sleeve until the buyout happens. Let’s talk about them.

Like many of the stockbrokers mentioned already, Scottrade does not have an account minimum. Commissions are only $6.95 a trade. When you deposit $10,000 or more into a Scottrade account, you get fifty commission-free trades. Do the math. That’s a bit of money saved right there. Also, in June of 2016, Scottrade lowered its contract fee on options from $1.25 to only $0.70.

Scottrade also offers low mutual fund commissions. It only costs investors $17 to sell and buy no-load funds. For funds that charge a sales load, it only costs investors $17 to sell, whereas it is nothing to buy. How many of these transaction-fee-free funds do they offer, you ask?

A whopping 2,600.

Charles Schwab

There are only a few brokers out there where we can honestly say are well suited for both beginning and advanced investors, but Charles Schwab is one of them. It has the tools to satisfy anyone, no matter their level of expertise.

Are ETFs your thing? Charles Schwab offers over 200 commission-free ETFs. Are you an absolute beginner? Schwab objectively elects what it believes to be the best ETF in every category, so you don’t have to go down rabbit holes of information and research.

On top of this, if you are just starting to build your portfolio, Schwab also offers recommendations based off of your chosen risk tolerance. Take the safe road and know that your money is in good hands.

If you need to speak with a representative, you may do so no matter the time of day, whether via phone or online chat. That said, Schwab actually has a pretty large brick and mortar presence, where you can make an appointment to speak with a representative or attend invaluable workshops.

A downside to Schwab is that they do have an account minimum. While many brokers we’ve discussed require no account minimums, Schwab does require that its investors maintain at least $1,000 with them. If you don’t have that, you can have the minimum waived when you sign up for an automatic monthly deposit of $100.

Fidelity

With low $4.95 commissions per trade, Fidelity is one of the most affordable brokers online, considering what it offers to its customers.

Utilizing top-notch research from over 20 companies, Fidelity provides its investors with some of the best investment advice that money can buy. It could be a lot of information to wade through, but after a few quick questions, Fidelity can match you up providers that resonate with your personal investment style.

Though it’s not considered the best customer support in the industry, Fidelity still offers some pretty sharp service for its customers. Investors can meet with representatives in physical branch locations, as well as attend investor seminars throughout the year for free.

The seminars cover a wide array of topics, such as social security and technical analysis. Plus, if in person doesn’t appeal to you, you can still study and expand your knowledge via webinars.

Looking for a solid online platform? Fidelity is truly among the best.

It offers both PC and mobile support, and if you are an active trader, you can even get real-time feeds displayed on your desktop. Each platform is intuitive and easy to use and provides tools to help you get a leg up on your competition. For those interested, Fidelity also offers a premium tool called Wealth Lab Pro, which offers customizable strategies and 20 years of historical data.

from Credit And Credit Repair https://aaacreditguide.com/best-online-stock-brokers-for-beginners/

0 notes

Text

How to Build a Robo Advisor: Advice for Starting a Robo Advisory

MyPrivateBanking

With the tremendous growth in robo advisor assets under management (AUM), financial institutions are scrambling to figure out how to build and become a robo advisor.

Starting a robo advisor service combines financially savvy with big data analytics, as well as a comprehensive understanding to how robo advisors work.

How Do Robo Advisors Work?

Robo advisors are platforms that leverage algorithms to handle users' investment platforms. These services analyze each customer's current financial status, risk aversion, and goals. From here, they recommend the best portfolio of stocks available based on that data.

And these automated financial services are poised to transform the tremendous worldwide wealth management industry.

MyPrivateBanking's report, Robo Advisor 3.0, takes an in-depth look at the basic challenge of every robo advisor: how to craft a presence that succeeds in convincing website visitors to sign up as investors and then remain on board.

In this data-driven assessment, the report looks at the characteristics, business models, and strengths and weaknesses of the top robo advisors around the world. The research was conducted on a total of 76 active robo advisors worldwide - 29 in the U.S. and Canada, 38 in seven European countries and nine in the Asia-Pacific region. We've compiled a full list of robo advisors analyzed below.

The exhaustive report provides comprehensive answers and data on how to optimize the individual onboarding stages (How it works, Client Assessment, Client Onboarding, Communication and Portfolio Reporting) and details five best practices for each stage. Furthermore, the report provides strategies to appeal to different segments such as Millennials, baby boomer investors approaching retirement, and high net worth individuals (HNWIs), and analyzes the impact of new technologies.

The report provides comprehensive analysis and data-driven insights on how to utilize robo advisors to win and keep clients:

What a robo advisor platform should offer to successfully convert prospects into happy clients.

Which robo advisor features work and why.

What are best practices for the different stages in the digital customer journey.

How long clients need to onboard on the surveyed robo advisors and which specialized offers are given.

What the client assessment process should include

How client communication should be (inbound for customer service and outbound for news, education and commentary).

What good portfolio reporting looks like, so that it meets the information needs of the customer.

How B2B providers are positioned in the development of robo advisory services and what they offer.

How robo advisors should adopt their strategies to appeal to different segments such as Millennials, baby boomer investors approaching retirement, and high net worth individuals (HNWIs).

Which robo advisors provide specialized options such as micro-investing, rewards schemes or hedging strategies, and in what manner.

What the impacts of new technologies are, such as the use of artificial intelligence for client interaction and narrative generation on the robo advisor model.

How the future of digital success will look for robo advisors.

Appendix containing data on the web presences of more than 70 robo advisors alongside the digital customer journey process.

And much more.

>> Click here for Report Summary, Table of Contents, Methodology <<

Analyzed robo advisors in this report include:

North America: Acorns, Asset Builder, Betterment, Blooom, Bicycle Financial, BMO SmartFolio, Capital One Investing, Financial Guard, Flexscore, Future Advisor, Guide Financial, Hedgeable, iQuantifi, Jemstep, Learnvest, Liftoff, Nest Wealth, Personal Capital, Rebalance IRA, Schwab Intelligent Portfolios, SheCapital, SigFig, TradeKing Advisors, Universis, Wealthbar, Wealthfront, Wealthsimple, Wela, Wisebanyan

Europe: AdviseOnly, Advize, comdirect, Easyfolio, EasyVest, ETFmatic, Fairr.de, FeelCapital, Fiver a Day, Fundshop.fr, GinMon, Investomat, KeyPlan, KeyPrivate, Liqid, Marie Quantier, Money on Toast, MoneyFarm, Nutmeg, Parmenion, Quirion, rplan, Scalable Capital, Simply EQ, Sutor Bank, Swanest, SwissQuote ePrivateBanking, True Potential Investor, True Wealth, Vaamo, VZ Finanz Portal, Wealth Horizon, Wealthify, WeSave, Whitebox, Yellow Advice, Yomoni, Zen Assets.

Asia-Pacific: 8 Now!, Ignition Direct & Ignition Wealth, InvestSMART, Mizuho Bank Smart Folio, Movo, Owners Advisory, QuietGrowth, ScripBox, StockSpot

Here's how you get this exclusive Robo Advisor research:MyPrivateBanking

To provide you with this exclusive report, MyPrivateBanking has partnered with BI Intelligence, Business Insider's premium research service, to create The Complete Robo Advisor Research Collection.

If you’re involved in the financial services industry at any level, you simply must understand the paradigm shift caused by robo advisors.

Investors frustrated by mediocre investment performance, high wealth manager fees and deceptive sales techniques are signing up for automated investment accounts at a record pace.

And the robo advisor field is evolving right before our eyes. Firms are figuring out on the fly how to best attract, service and upsell their customers. What lessons are they learning? Who’s doing it best? What threats are traditional wealth managers facing? Where are the opportunities for exponential growth for firms with robo advisor products or models?

The Complete Robo Advisor Research Collection is the ONLY resource that answers all of these questions and more. Click here to learn more about everything that's included in this exclusive research bundle.

NOW WATCH: The CIO of a crypto hedge fund explains the value in cryptocurrency — and why the market will explode over the next 2 years

from Feedburner http://ift.tt/2bgHZKR

0 notes

Text

20 Ways to Invest $100

You have a crisp, new one hundred-dollar bill in your wallet.

While it's not $1,000,000, $100,000 or $10,000, hey, at least it's something!

Listen up. Just because you don't have much money to invest doesn't mean you shouldn't invest it.

Want to know the most difficult part of investing? Starting.

You read that right!

Just starting is rather difficult, and once you accomplish that challenge, investing going forward is pretty easy.

For those of you who are discouraged because you only have a little bit of money to invest – don't fret!

One hundred dollars is a great way to get your foot in the door and start a habit of investing that could very well lead to a bountiful harvest down the road.

youtube

It's Not About How Much You Invest, It's About Actually Getting Started. #investnow

Click To Tweet

I'll tell you from the start that it isn't easy to find ways to invest just $100 or even how to invest $1,000 dollars. Many brokers have account minimums.

Additionally, sometimes you might find yourself being charged, for example, a $50 annual fee which can cut your account in half. That makes no sense.

However, there are a few ways you can invest $100 dollars and have it be worth your time and effort. I'll show you how.

How to invest 100 dollars like a financial expert:

Betterment (Robo Advisors)

Savings Account

Lending Club

Ally Invest

401k

Yourself

Books

Start a Business

Prosper

Stash

Travel

Index Funds

Debt

Charity

Thrift Savings Plan

Roth IRA

Start a Blog

Online Courses

Your Marriage

Bonus: 6 Investments To Avoid

I also invited a plethora of other financial experts to lend their advice for this article. You'll get a big helping of financial advice along with some unique ideas I didn't even have in mind.

Really, these guys are smart and creative – pay attention to what they have to say! If you are feeling a bit more ambitious, check out a great read on the best way to invest $20,000 dollars. One step at a time!

Investments Worthy of Your One Hundred Bucks

1. Betterment

Betterment, is part of a class of investment adviser that provides portfolio management online without the need for much human interaction, called “robo-advisors”.

Instead of having to sit down with a financial advisor and pay them for their time, or pay them by having fees on your investments, robo-advisors ask you a series of questions and then invest your money automatically, based on your tolerance for risk.

There was a time when you would have to invest $100 per month to start a Betterment account, but they have changed that requirement and you can get started with just your $100 investment.

This opens up diversified investing with a personalized touch to just about anyone. You can learn more about them by looking over this great review of how to use Betterment.

Another company in this category is Acorns, which specializes in micro-investing by rounding up the change on your purchases.

I put my first $100 investment into an Acorns account.

Anonymous investor and writer, Investopedia.com

2. Open a Savings Account

Savings accounts are one of the most boring investments around, but they are SUPER safe. The idea isn’t to leave your money here for very long, but to build up your savings until you can get into some higher yielding investments.

While high-interest online savings accounts don't feel “high-interest” when you compare them to other investments, they do get much better interest than the bricks and mortar bank accounts that you find in your local community.

If you don't have at least eight months of emergency savings, it's probably best to start by investing your $100 into a high-yield savings account.

You're going to want liquidity if an emergency arises and, while many of the other types of ways to invest $100 might allow you to pull out your money quickly, there may be some drawbacks like pulling out of the market too early or needing money in the middle of a loan term. A money market account can even come with limited check writing capabilities to make your money accessible at any time.

Don't invest it. Period. Keep it in $20 bills in your wallet and have it in reserve in case of emergency or opportunity.

Joshua J. Sheats, MSFS, CFP®, CLU®, ChFC®, CASL®, CAP®, RHU®, REBC®, RadicalPersonalFinance.com

Once you have a fully-funded emergency fund, it's a better time to do some riskier investing.

If I were starting out right now with just $100 to invest, I would put it in my savings account and build that up about ten times. Once you are able to start with a $1000 investment, a ton of great options will open up to you.

3.Ally Invest

Ally Invest (formerly TradeKing) is an online broker that allows you to trade for only $4.95 a pop. That's not a lot, folks. E*Trade, TD Ameritrade, Scottrade, Charles Schwab, and Fidelity all have higher trading fees.

And here's the deal: you can fund an IRA or Roth IRA with as little as $100. That's right, there's no minimum at Ally Invest, so you have no excuse not to get started investing.

Another great thing about Scottrade is that there are no monthly or yearly maintenance fees – and no inactivity fees! That means if you decide you want to invest 100 bucks and aren't sure when you can invest again, you won't pay any penalties for waiting.

You should keep in mind, however, that certain other types of mutual funds do have a minimum: $2,500. So if you're looking to invest in mutual funds, this could pose a problem. But hey, there are a lot of other options like ETFs and single stocks that you can invest in without the minimum balance.

The bummer about Ally Invest, like many other discount online brokers, is that they don't provide investment advice for most accounts. However, they do offer a portfolio manager that will help you find new investments based on your risk tolerance.

4. Lending Club

Lending Club is a peer-to-peer lending service. Peer-to-peer lending is just what it sounds like: it's lending to someone else. Ordinary folks lend and borrow from each other to make a profit. Lending Club is actually the world's largest online marketplace for connecting borrowers and investors.

Note: Lending club has increased their minimum investment to $1,000 now.

I'd take the $100 and split it in four investment sources on Lending Club and then reinvest the profits. Simple, boring and so not rock star.

Sandy Smith, YesIAmCheap.com

You can actually make some pretty sweet returns at Lending Club and the good news is you can invest with as little as $25. Plus, there's no account minimum currently at Lending Club.

I wouldn't recommend that you invest all of your dough at Lending Club going forward, but it's a great way to start investing and you'll learn the ropes of peer-to-peer lending.

5. Your 401(k)