#top blockchain platforms 2023

Explore tagged Tumblr posts

Text

Best Blockchain Development Platforms in 2023

Are you seeking the most trusted, secure, and safest blockchain technology solution? We are providing the best blockchain development platforms to be considered in 2023 to meet all your business needs. Visit now to read all the Best blockchain platforms.

#best blockchain development platforms#best blockchain framework#best blockchain platform#best blockchain platform 2023#best blockchain platform for developers#best blockchain platforms#best open source blockchain platforms#blockchain developer platform#blockchain development platforms#blockchain development platforms in 2023#blockchain platforms#list of blockchain platforms 2023#major blockchain platforms#top blockchain platforms#top blockchain platforms 2023#top private blockchain platforms

0 notes

Text

Top, screen capture from La bête (The Beast), directed by Bertrand Bonello, 2023. Via. Bottom, photograph by Doug Bierend (no title and no date found). Via.

--

Roblox is an online platform that allows users to create games and play those designed by others. A self-described “ultimate virtual universe,” it is hard to pinpoint exactly what Roblox is: Is it a game? Is it social media? Is it a place to create content or consume media? Is it a place to shop or sell? Is it a metaverse? Or simply a platform? How do we even understand what Roblox is? And does it matter?

Roblox is a multiplayer game world where users create their own singular avatar and move through immersive experiences built by other users. On Roblox, users can move through approximately 40 million different experiences to play, shop, converse and consume media. (...)

Roblox was released in 2006 by co-founders David Baszucki and Erik Cassel, and its popularity dramatically increased during the COVID-19 pandemic. In 2023, it generated revenue of US$2.7 billion and is currently valued at about US$25 to $30 billion. This makes it one of the world’s largest virtual economies; the platform’s GDP is as large as that of some countries.

Similar to YouTube, Roblox doesn’t create content — instead, it hosts what the company refers to as “immersive experiences.”

Roblox is a new category of communication and entertainment, at the nexus of internet technologies and game engines, with social media and entertainment brands. Roblox describes itself as a “medium of shared experiences.”

It differs from legacy media such as television with shows and commercials, or even Web 2.0 games like Neopets or Webkinz where players engage with prebuilt game worlds. Instead, Roblox is part of a new iteration of the internet, one that is built on game engines, blockchain technologies and token-based economies.

Natalie Coulter, from The growing influence of virtual gaming platforms like Roblox on how we interact online, July 1, 2024.

3 notes

·

View notes

Text

Which Memecoins Could Make You a Millionaire This Year?

Introduction

The cryptocurrency market is no stranger to wild fluctuations and incredible stories of overnight wealth. Among the many types of digital assets, memecoins have carved out a unique niche. Born from internet memes and cultural phenomena, these tokens often start as jokes but can transform into serious investments. This year, several memecoins have captured the market’s attention with their potential to generate substantial returns. In this blog, we’ll explore which memecoins could potentially make you a millionaire in 2023 and why they are worth considering.

Understanding Memecoins

What Are Memecoins?

Memecoins are a type of cryptocurrency that typically derives value from their association with internet memes or cultural trends. Unlike traditional cryptocurrencies that often have strong use cases or technological foundations, memecoins thrive on community engagement and viral marketing. Their success is driven largely by social media buzz and the collective enthusiasm of their communities.

Why Invest in Memecoins?

While memecoins are often viewed as high-risk, high-reward investments, they offer unique opportunities. Their low initial cost allows for substantial holdings, and their potential for rapid, viral growth can lead to significant returns. However, it’s crucial to approach these investments with caution and conduct thorough research.

Top Memecoins to Watch in 2023

Dogecoin (DOGE)

The Original Memecoin

Dogecoin started as a joke in 2013, inspired by the popular “Doge” meme featuring a Shiba Inu dog. Despite its humorous origins, Dogecoin has become a staple in the crypto community, known for its active and loyal fan base.

Why Dogecoin?

Celebrity Endorsements: High-profile endorsements from figures like Elon Musk have boosted Dogecoin’s visibility and credibility.

Community Support: Dogecoin has a large and engaged community that drives its adoption and use.

Real-World Use Cases: Increasing acceptance of Dogecoin for transactions and tipping in various platforms adds to its value proposition.

Shiba Inu (SHIB)

The Dogecoin Killer?

Shiba Inu was created as a direct competitor to Dogecoin, often dubbed the “Dogecoin Killer.” It has quickly risen in popularity and amassed a significant following.

Why Shiba Inu?

Tokenomics: Shiba Inu has a large supply and a robust burning mechanism to reduce the number of tokens in circulation, potentially increasing value.

Decentralized Ecosystem: SHIB supports its own decentralized exchange, ShibaSwap, which adds utility to the token.

Community Engagement: Like Dogecoin, Shiba Inu benefits from a passionate and active community.

SafeMoon (SAFEMOON)

The Deflationary Token

SafeMoon introduced a unique tokenomics model designed to encourage holding and discourage selling. It includes a reflection mechanism that redistributes fees to existing holders.

Why SafeMoon?

Tokenomics: SafeMoon’s deflationary model can increase scarcity and potentially drive up value.

Development Roadmap: The SafeMoon team has an ambitious roadmap, including plans for a blockchain, exchange, and wallet.

Community and Marketing: Effective marketing and a strong community presence contribute to SafeMoon’s ongoing popularity.

Samoyedcoin (SAMO)

Solana’s Memecoin

Samoyedcoin is one of the leading memecoins on the Solana blockchain. Inspired by the Samoyed dog breed, this token leverages Solana’s high-speed transactions and low fees.

Why Samoyedcoin?

Fast Transactions: Solana’s high throughput ensures quick and cost-effective transactions.

Growing Ecosystem: As Solana gains traction, memecoins on this blockchain, like SAMO, benefit from increased visibility and adoption.

Active Community: A dedicated community helps drive the token’s growth and engagement.

Dogelon Mars (ELON)

A Space-Themed Meme

Dogelon Mars combines themes of Elon Musk, Dogecoin, and Mars exploration. It has carved out a unique niche within the memecoin landscape.

Why Dogelon Mars?

Unique Branding: The space exploration theme appeals to many within the crypto community.

Charitable Initiatives: Part of the project’s mission includes donating to space exploration research.

Community-Driven: The token has a strong, supportive community that promotes its adoption and use.

Floki Inu (FLOKI)

Inspired by Elon Musk’s Dog

Floki Inu, inspired by Elon Musk’s pet dog Floki, aims to create a DeFi ecosystem combined with NFTs.

Why Floki Inu?

Celebrity Connection: The association with Elon Musk’s dog boosts its appeal.

DeFi and NFT Integration: Plans to integrate DeFi and NFTs add potential utility and value.

Marketing Campaigns: Aggressive marketing strategies have increased awareness and interest.

Strategies for Investing in Memecoins

Do Your Research

Before investing in any memecoin, it’s essential to conduct thorough research. Look into the token’s history, development team, community support, and market performance. Websites, whitepapers, and community forums can provide valuable insights.

Diversify Your Portfolio

Diversification is key to managing risk in any investment portfolio. Spread your investments across multiple memecoins and other types of cryptocurrencies. This strategy can help mitigate potential losses if one investment doesn’t perform well.

Stay Updated

The crypto market is highly dynamic, and staying informed is crucial. Follow news and updates related to your memecoin investments. Social media channels, especially Twitter and Reddit, can provide real-time information and community sentiment.

Be Cautious with Hype

While memecoins thrive on hype, it’s important to approach them with caution. Avoid making investment decisions based solely on social media buzz. Analyze the fundamentals and consider the long-term potential of the token.

Understand the Risks

Memecoins are known for their volatility. Prices can fluctuate dramatically within short periods. Be prepared for significant price swings and invest only what you can afford to lose.

Use Secure Wallets

Ensure your investments are stored in secure wallets. Hardware wallets and reputable software wallets offer the best security features. Avoid keeping large amounts of cryptocurrency on exchanges for extended periods due to security risks.

Have a Clear Exit Strategy

Define your financial goals and establish a clear exit strategy. Determine at what profit levels you will sell part or all of your holdings. Similarly, set stop-loss levels to minimize potential losses.

Engage with the Community

Active participation in the community can provide valuable insights and keep you informed about the latest developments. Join discussions on platforms like Reddit, Discord, and Telegram to stay connected with other investors and the development team.

Monitor Whale Movements

Large holders, or “whales,” can significantly impact the price of memecoins. Monitor transactions of large wallets to anticipate potential price movements. Tools like Whale Alert can help track these activities.

Stay Patient and Disciplined

Patience and discipline are essential for successful investing. Avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and remain focused on your long-term goals.

And yes...Before investing in memecoins,

Keep create your favorite memecoins tokens in just less than three seconds without any extensive programming knowledge, Visit : solanalauncher.com

If you need more Guide about this platform, Feel free to ask!!

Our team is ready to assist you!!!

Conclusion

The world of memecoins offers exciting opportunities for investors willing to navigate its high-risk, high-reward landscape. Dogecoin, Shiba Inu, SafeMoon, Samoyedcoin, Dogelon Mars, and Floki Inu are among the top memecoins to watch this year. Each of these tokens has unique features and strong community support that contribute to their potential for significant returns.

By conducting thorough research, diversifying your investments, staying informed, and maintaining a clear strategy, you can increase your chances of achieving financial success with memecoins. Remember, while the potential for high returns is real, so are the risks. Invest wisely, stay engaged with the community, and keep a long-term perspective to navigate the volatile but rewarding world of memecoins.

As the cryptocurrency market continues to evolve, memecoins will undoubtedly play a significant role in shaping its future. Embrace the opportunities, stay informed, and you might find yourself among the next wave of memecoin millionaires. Happy investing!

2 notes

·

View notes

Text

Smart Contracts

Smart Contracts: How is Technological Advancement Revolutionizing Industries?

Highlights:

What are smart contracts?

What are some advancements in smart contract technology?

How are leading firms acquiring top positions in this sector?

In recent years, the smart contracts industry has witnessed a notable boom in growth and development, changing specifically in the form of transactions and contracts. Leveraging the power of blockchain technology, smart contracts offer feasible, dependable, and applicable solutions across several sectors.

What are smart contracts?

Smart contracts are effective agreements that self-execute and are securely stored on the blockchain. By autonomously carrying out pre-programmed responsibilities, they disrupt traditional systems by way of disposing of intermediaries. This decentralized framework offers clarity, safety, and efficiency in unique sectors consisting of finance, supply chain management, and real estate.

According to the latest report by Allied Market Research, the global smart contracts sector is predicted to exhibit a notable CAGR of 29.6% between 2023 and 2032.

What are some advancements in smart contract technology?

Over the past few years, there have been considerable advancements in the technology of smart contracts. Here are a few vital developments:

Programmability:

Smart contracts are getting more flexible and programmable than ever. They can be coded in distinct programming languages, allowing developers to create complex logic and conditions within the contract itself. This level of programmability makes it feasible to automate extraordinary commercial enterprise approaches and eliminates the need for manual intervention.

Interoperability:

Smart contracts can now consort with each other and with external systems, allowing for seamless assimilation between specific blockchain platforms. This convergence makes it possible to create new opportunities for collaboration and cross-chain transactions between decentralized applications (dApps).

Oracles:

Oracles are like external data sources that offer real-world information for smart contracts. Advancements in smart contract technology have enhanced the reliability and security of oracles and made sure that the data furnished is accurate and unalterable. This allows smart contracts to make informed decisions primarily based on updated information.

Privacy and confidentiality:

Earlier versions of smart contracts were criticized because of their insufficient privacy measures. Nevertheless, technological advances have allowed the introduction of strategies inclusive of zero-knowledge proofs and steady multi-party computation. These strategies permit private and confidential transactions to take place on public blockchains, thereby broadening the utility of smart contracts in sectors where the safety of data privacy is important.

How are leading firms acquiring top positions in this sector?

The leading players in the smart contracts sector focus more on the provision of automated transactional services to increase both flexibility and security for businesses. In order to expand their market presence, these companies give priority to the acquisition of local and small businesses. In addition, strategies such as partnerships, significant investments, and joint ventures contribute to the rising demand for such services. For instance, in August 2023, Obvious introduced a smart contract wallet called Biconomy Account Abstraction Stack, which operates through a mobile app and supports multiple channels. This wallet is intended to facilitate the execution of transactions, the implementation of custom rules, and the smoothing of complex economic interactions.

On the other hand, in June 2023, Horizen and Ankr collaborated to enhance the accessibility and scalability of the EON smart contract platform. This partnership has provided developers with a set of tools that facilitate the implementation of smart contract applications.

To sum up, the smart contracts industry is growing gradually and causing changes in various industries. As businesses and individuals understand the benefits of this innovative technology, using smart contracts is predicted to boom swiftly. Furthermore, by staying well-informed and embracing the potential of smart contracts, corporations can position themselves at the leading edge of this transformative technology.

For more details and information on smart contract platforms, contact our experts here.

Author’s Bio: Harshada Dive is a computer engineer by qualification. She has worked as a customer service associate for several years. As an Associate Content Writer, she loves to experiment with trending topics and develop her unique writing skills. When Harshada's not writing, she likes gardening and listening to motivational podcasts.

2 notes

·

View notes

Text

Cryptocurrencies to invest long term in 2023

With fiat currencies in constant devaluation, inflation that does not seem to let up and job offers that are increasingly precarious, betting on entrepreneurship and investment seem to be the safest ways to ensure a future. Knowing this, we have developed a detailed list with the twelve best cryptocurrencies to invest in the long term .

Bitcoin Minetrix Bitcoin Minetrix has developed an innovative proposal for investors to participate in cloud mining at low cost, without complications, without scams and without expensive equipment. launchpad development company is the first solution to decentralized mining that will allow participants to obtain mining credits for the extraction of BTC.

The proposal includes the possibility of staking, an attractive APY and the potential to alleviate selling pressure during the launch of the native BTCMTX token to crypto exchange platforms.

The push of the new pre-sale has managed to attract the attention of investors, who a few minutes after starting its pre-sale stage, managed to raise 100,000 dollars, out of a total of 15.6 million that it aims for.

Kombat Meme (MK) Meme Kombat (MK) combines blockchain technology , artificial intelligence, and community-focused gaming. Because of the cutting-edge technology and decentralization that come with being a part of the Ethereum network, it will be in charge of conducting entertaining combat.

Its creative team focuses on developing a dynamic gaming experience. They have established a very well-defined roadmap, where the priority is the search to generate a community, and will do so with the Play to Earn $MK token as its center, which will also add the staking utility .

yPredict yPredict was born as a unique platform with the main objective of addressing the enormous challenges of predictions in financial market movements, including, of course, digital assets in their entirety. This would be possible only through access to information taken from factual data, analyzed with advanced metrics and in a space in which traders from all over the world will be able to offer and sell their predictive models.

“Real-time trading signals from cutting-edge predictive models from the top 1% of AI experts. Real-time sentiment analysis on all popular cryptocurrencies. Give the AI the task of identifying the best indications for your asset. Let the AI detect the most promising chart patterns in your preselected coins ”, they point out from the official yPredict page.

AIDoge AIDoge is a new blockchain project that is developing a new tool for creating memes that would be based on the most cutting-edge Artificial Intelligence (AI) . This means that anyone with access to the platform will be able to tell the AI through text instructions how and what meme they want so that it is generated with the highest quality possible and in a matter of seconds. A relevant detail is that each creation will be unique and can be minted as a non-fungible token (NFT).

This crypto initiative aims at a massive market that is only growing, given that memes have already left social networks to become cryptocurrencies and images representative of political, cultural and sports opinions. In this way, the creators of AIDoge hope to be able to take advantage of the momentum of this market to go viral with their AI creations .

Spongebob (SPONGE) Spongebob (SPONGE) is a memecoin that has just been launched through the UniSwap exchange platform and that on its first day as a digital asset enabled for trading generated an impact that was felt throughout the market. In less than 48 hours, this token was able to generate returns of more than 480% , with a trading level that already exceeded $2 million.

DeeLance (DLANCE) DeeLance (DLANCE) is a platform that seeks to pioneer the Web3 industry for freelancing and recruiting services . This proposal began the pre-sale of its native token a few days ago and could be marking the beginning of a mission that will try to revolutionize the human resources industry.

DeeLance wants to take advantage of the virtues of blockchain technology to simplify contracting and payment processes , reduce the risks of fraud and make the contracting business much more efficient.

DeeLance wants to get involved in a global industry such as human resources and recruiting services that is valued at 761 billion dollars, according to IBISWorld , defeating and leaving behind the eternal problems that well-known platforms such as Freelancer, Upwork and Fiver suffer today .

Contact us on: https://www.blockchainx.tech/

Copium Copium is dedicated to providing a safe and transparent environment for its community . Our team is made up of experienced developers and OGs in the space. “We implemented several measures to guarantee the security of the initiative.” This is how this new memecoin is presented that seeks to take advantage of the emotional momentum that this particular section of cryptocurrencies is experiencing thanks to Spongebob (SPONGE), Turbo Coin (TURBO and Pepe Coin (PEPE).

Bitcoin (BTC) Being the largest capitalization cryptocurrency in the world and the first of its kind, Bitcoin no longer needs an introduction. Beyond having lost almost 70% of its value in the last year, having fallen to historical lows below $16,000, at the beginning of the year, this cryptocurrency has managed to surprise everyone with its resistance, its rallies rise and the ability of your community to hold firm.

Ethereum (ETH) Being the second largest cryptocurrency in the market and boasting the most popular blockchain network of all, investing in Ethereum is investing in security and profits in the short and long terms. Of course, it was also affected by the drop in the price of 2022, but its volatility, not being as high as that of Bitcoin, prevented the suffering from being greater .

#blockchainx#white label ido launchpad platform#white label crypto launchpad#crypto launchpad development#white-label crypto launchpad#launchpad development services#launchpad development company

2 notes

·

View notes

Text

Best Top 10 Cryptocurrency to Invest 2023

March 1, 2023 by Adil Ali

Ethereum is a revolutionary cryptocurrency that’s snappily gaining traction in the global request. Its smart contracts, dApps, interoperability, and brisk sale pets make it a seductive option for businesses and inventors likewise. As further people borrow Ethereum and its DeFi capabilities, the eventuality for the platform to transfigure the way we do deals and contracts continues to grow. also, updates similar to EIP- 1559 on the horizon pledge to make Ethereum indeed more important. With such a promising future, Ethereum looks to be a decreasingly feasible platform for digital deals.

1. Bitcoin (BTC)

Market Cap: $458 billion

Bitcoin is the first and most popular cryptocurrency, created in 2009 by an unknown person or group using the alias Satoshi Nakamoto. It operates on a decentralized tally called blockchain, which allows for secure, transparent, and tamper-resistant deals. Bitcoin is known for its high volatility and is frequently considered a store of value or digital gold.

2. Ethereum (ETH)

Market Cap: $216 billion

Ethereum is the alternate-largest cryptocurrency by request capitalization and was created in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is further than just a digital currency; it’s a decentralized platform that enables inventors to make and emplace decentralized operations( dApps) on its blockchain. The platform’s native currency is Ether( ETH), which is used to pay-for-sale freights and computational services on the Ethereum network.

3. Tether (USDT)

Market Cap: $66 billion

Tether is a stablecoin that was created to be pegged to the US bone at an 11 rate. It was launched in 2014 by Tether Limited and is used as a means of transferring finances between exchanges and trading cryptocurrency without having to convert back to edict currency. Tether is controversial, with some critics claiming that it isn’t completely backed by US bones

4. USD Coin (USDC)

Market Cap: $54 billion

USD Coin, established by the financial technology corporation Circle and the cryptocurrency exchange Coinbase, is a stable coin tied to the American dollar. It’s backing of USD and routine audit protocols guarantee the stability and clarity of its operation.

5. Binance Coin (BNB)

Market Cap: $52 billion

Established in 2017, Binance Coin is the crypto asset associated with the renowned Binance Exchange, one of the largest crypto trading platforms globally. This digital asset is utilized to pay for trade fees on the Binance Exchange, as well as to access reduced commission fees on the same exchange.

6. Ripple (XRP)

Market Cap: $18 billion

In 2012, Ripple Labs initiated the cryptocurrency known as Ripple. This global payment system enables instantaneous and dependable cross-border payments with the utilization of its blockchain technology. Financial institutions and payment providers can benefit from Ripple’s services.

7. Cardano (ADA)

Market Cap: $18 billion

Input Output Hong Kong (IOHK), a blockchain research and development company, created Cardano, a decentralized platform, in 2017. With a vision of tackling the scalability and security issues that have affected preceding blockchain networks, Cardano is a third-generation blockchain. The native currency of the platform, ADA, is employed to pay transaction fees and to involve oneself in the governance of the Cardano network. Save to documented

8. Binance USD (BUSD)

Market Cap: $18 billion

Binance USD, a fiat-pegged stablecoin developed by the renowned crypto exchange Binance, is constantly monitored to guarantee transparency and maintain full US dollar support. Its main purpose is to allow seamless transfers and trading of digital assets without the need for reverting to conventional money.

9. Solana (SOL)

Market Cap: $15 billion

Solana was founded in 2017 by Solana Labs, to create a blockchain platform with speedy transactions and minimal costs for decentralized applications. As a result, SOL is the cryptocurrency native to this platform, utilized for transaction fees and to join in the administration of the Solana network.

10. Polkadot (DOT)

Market Cap: $10 billion

The Web3 Foundation designed the Polkadot platform in 2016 to bring together different blockchains and allow for seamless interconnectivity. To guarantee high performance and scalability, Polkadot uses a specialized technique called sharding. The native currency of the network is DOT, which is utilized to pay for transaction costs and grant holders a say in Polkadot’s governance.

Conclusion:

Ultimately, while these crypto assets vary in attributes and functions, they all share the objective of furnishing a distributed and safe system of exchanging value. As the industry of cryptocurrency persists to advance, we can assume to witness more breakthroughs and novel applications emerge, generating a thrilling period for both financiers and consumers. It is crucial to complete comprehensive research and recognize the risks linked with investing in any cryptocurrency.

8 notes

·

View notes

Text

10 Breakthrough Technologies & Their Use Cases in 2023

Today's technology is developing quickly, enabling quicker changes & advancements and accelerating the rate of change.

For instance, the advancements in machine learning (ML) and natural language processing (NLP) have made artificial intelligence (AI) more common in 2023, as part of a digital transformation solutions.

Technology is still one of the main drivers of global development. Technological advancements provide businesses with greater opportunities to increase efficiency and develop new products.

Business leaders can make better plans by keeping an eye on the development of new technologies, foreseeing how businesses might use them, and comprehending the factors that influence innovation and adoption, even though it is still difficult to predict how technology trends will pan out.

Here are the top 10 emerging technology trends you must watch for in 2023.1. AI that creates graphics and assists with payment

The year of the AI artist is now. With just a few language cues, software models created by Google, OpenAI, and others can now produce beautiful artwork.

You may quickly receive an image of almost anything after typing in a brief description of it. Nothing will ever be the same.

A variety of industries, including advertising, architecture, fashion, and entertainment, now employ AI-generated art.

Realistic visuals and animations are made using AI algorithms. Also, new genres of poetry and music are being created using AI-generated art.

Moreover, AI will simplify the purchasing and delivery of products and services for customers.

Nearly every profession and every business function across all sectors will benefit from AI.

The convenience trends of buy-online-pickup-at-curbside (BOPAC), buy-online-pickup-in-store (BOPIS), and buy-online-return-in-store (BORIS) will become the norm as more retailers utilize AI to manage and automate the intricate inventory management operations that take place behind the scenes. 2. Progress in Web3

Also, 2023 is witnessing a huge advancement in blockchain technology as businesses produce more decentralized products and services.

We now store everything on the cloud, for instance, but if we decentralized data storage and encrypted that data using blockchain, our information would not only be secure but also have novel access and analysis methods.

In the coming year, non-fungible tokens (NFTs) will be easier to use and more useful.

For instance, NFT concert tickets may provide you access to behind activities and artifacts.

NFTs might represent the contracts we sign with third parties or they could be the keys we use to engage with a variety of digital goods and services we purchase. 3. Datafication

The breakthroughs described in the list of technological trends for 2023 will inevitably lead to the datafication of many businesses.

The act of converting or changing human jobs into data-driven technology is referred to as the process.

It is the first important development toward a fully data-driven society. Other branches of the same customer-centric analytical culture include workforce analytics, product behavior analytics, transportation analytics, health analytics, etc.

Due to the vast number of linked Internet of Things (IoT) devices, it is possible to analyze a company's strengths, weaknesses, risks, and opportunities using a greater number of data points.

According to Fittech, when the market for datafying sectors surpasses $11 billion in 2022, it is evolving into a profitable business model. 4. Certain aspects of the Metaverse will become actual

The term "metaverse" has evolved to refer to a more immersive internet in which we will be able to work, play, and interact with one another on a persistent platform.

According to experts, the metaverse will contribute $5 trillion to the world economy by 2030, and 2023 is the year that determines the metaverse's course for the next ten years.

The fields of augmented reality (AR) and virtual reality (VR) will develop further.

In the coming year, avatar technology will also progress. If motion capture technology is used, avatars will even be able to mimic our body language and movements. An avatar is a presence we portray when we interact with other users in the metaverse.

Further advancements in autonomous AI-enabled avatars that can represent us in the metaverse even when we aren't signed in to the virtual world may also be on the horizon.

To perform training and onboarding, businesses are already utilizing metaverse technologies like AR and VR, and this trend will pick up steam in 2023. 5. Bridging the digital & physical world

The digital and physical worlds are already beginning to converge, and this tendency will continue in 2023. This union consists of two parts: 3D printing and digital twin technologies.

Digital twins are virtual models of actual activities, goods, or processes that may be used to test novel concepts in a secure online setting.

To test under every scenario without incurring the enormous expenses of real-world research, designers, and engineers are adopting digital twins to replicate actual things in virtual environments.

We are witnessing even more digital twins in 2023, in everything from precise healthcare to machinery, autos, and factories. This is a part of the best digital transformation solutions in this new era.

Engineers may make adjustments and alter components after testing them in the virtual environment before employing 3D printing technology to produce them in the actual world. 6. More human-like robots are coming

Robots will resemble humans even more in 2023, both in terms of look and functionality.

These robots will serve as event greeters, bartenders, concierges, and senior citizens' companions in the real world.

While they collaborate with people in production and logistics, they will also carry out complicated duties in factories and warehouses.

One business, Tesla, is working hard to develop a humanoid robot that will operate in our homes.

Two Optimus humanoid robot prototypes were unveiled by Elon Musk, who also stated that the business will be prepared to accept orders in the next few years.

The robot is capable of carrying out simple duties like watering plants and lifting objects. 7. Digitally Immune Systems

The launch of the Digital Immune System must be included in any list of technological trends for 2023.

This system alludes to an architecture made up of techniques taken from the fields of software design, automation, development, operations, and analytics. By eliminating flaws, threats, and system weaknesses, it tries to reduce company risks and improve customer satisfaction.

The significance of DIS resides in automating the many components of a software system to successfully thwart virtual attacks of every description.

According to Gartner, businesses that have already implemented DIS will reduce customer downtime by around 80% by 2025.

So, if you are looking for the best digital transformation services company to introduce digital immune systems, TransformHub is here to guide you. 8. Genomics

Genomic research has improved our grasp of life and contemporary health analytics while also advancing our understanding of brain networks.

In the upcoming years, fast-developing technologies such as scarless genome editing, pathogen intelligence, and NGS data analysis platforms will use AI to interpret hidden genetic codes and patterns, elevating genomic data analysis and metagenomics to the top positions in the biotech sector.

Functional genomics, which uses epigenome editing to reveal the influence of intergenic areas on biological processes, is becoming more prevalent in 2023 technology trends. 9. CRISPR

The gene-editing technology, CRISPR, has quickly moved from the lab to the clinic during the past ten years.

Clinical trials for common illnesses, such as excessive cholesterol, have lately been included. It originally started with experimental therapies for uncommon genetic abnormalities and might advance things much further with new variants.

Due to its ease of usage, CRISPR is quickly becoming a common technology employed in many cancer biology investigations.

Moreover, CRISPR is entirely adaptable. It is more accurate than existing DNA-editing techniques and can essentially modify any DNA segment within the 3 billion letters of the human genome.

The simplicity of scaling up CRISPR is an additional benefit.

To control and analyze hundreds or thousands of genes at once, researchers can utilize hundreds of guides RNAs. This kind of experiment is frequently used by cancer researchers to identify genes that might be potential therapeutic targets. 10. Growth of Green Technology

Climate change is a fact. It is a rising issue that disturbs governments and society at large and poses a threat to human health and the environment.

The use of so-called green technology is one method of combating global warming.

Globally, scientists and engineers are working on technical solutions to reduce and get rid of everything that contributes to climate change and global warming.

Here are some incredible uses for the same:

Emissions reduction

Waste-to-Energy

Management of waste and recycling

Biofuels

Treatment of wastewater

Solar power

Tidal and wave power

Green vehicles

Smart structures

Farms and gardens in the air

TransformHub: Keeping Ahead of Technological Trends

These innovations have the power to completely alter the way we live, work, and interact. It's critical to be informed about these changes and take their effects into account.

The epidemic has sped up the necessary industry-wide human-AI collaboration and it looks like 2023 will be the year we catalyze this cooperation into some truly extraordinary inventions.

For more information on how contemporary automation and AI are fusing all the defining industries of our era into a single data-driven civilization, stay up-to-date with one of the best digital transformation companies in Singapore, TransformHub.

We take complete accountability to digitally transform your business by providing precisely tailored solutions based entirely on your requirements.

Let’s connect and bring your vision to life!

2 notes

·

View notes

Text

Top GameFi Projects to Watch Out for in 2023

Within a couple of past years, GameFi has grown in popularity immensely. It is connected with the fact that in GameFi, people do not only play games. When they compete with each on a gaming arena, trade, participate and win in tournaments, manage lands or other infrastructure components in virtual worlds, they earn money.

Existing GameFi Projects to Watch in 2023

The most popular of the projects that have been here for a while are the following.

The Sandbox

Sandbox is working on creating a virtual world where users can do what they normally do in their daily lives: live, construct, work, do shopping, etc. Along with excellent earning opportunities, Sandbox offers excellent gameplay. In the Sandbox metaverse, gamers can not only earn but do it while enjoying all their activities: attending and participating in their favorite shows and events, exploring, constructing, etc.

Sandbox doesn’t limit gamers to the existing options but expands the number and type of activities constantly. This is another detail that makes Sandbox increasingly popular and Sand tokens – demanded.

The Sandbox platform is easy to use – a feature that makes it very attractive to beginners. It allows it to widen its target audience to those who would like to try a metaverse but were frightened off by its complexity from the technical point of view.With all the mentioned benefits, Sandbox is a metaverse that is here to stay.

Axie Infinity

Axie Infinity is the first blockchain-based play-to-earn game that has earned immense popularity. Axie Infinity was very popular during the COVID pandemic. When people started losing their jobs, many of them started looking for options to survive and discovered Axie Infinity.

After the pandemic was over, Axie Infinity still continued to be one of the top popular projects. Many people in the Philippines, for example, used to earn more money while playing than they were paid in their jobs previously.

However, with the arrival of a prolonged bear market during the recent crypto winter, all crypto tokens, including those used in Axie Infinity, dropped in value, and many players just left the game, causing a massive 98% drop in the game ROI.

Upcoming GameFi Projects

Some projects still do not offer extended functionality because their developers are working to create metaverses that will be able to compete in the future.

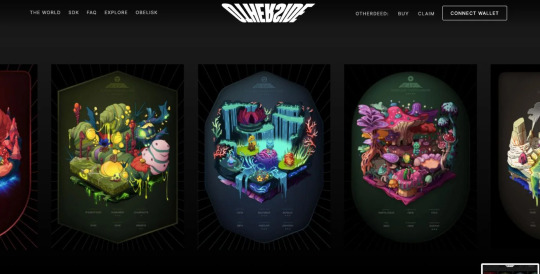

Otherside

The Otherside was branched out from Bored Ape Yacht Club, an ambitious project whose non-fungible tokens are known to be among the most expensive in the market.

Otherside is still under development. It is going to be a gamified interoperable metaverse blending multiplayer games and Web3-enabled worlds. Yuga Labs knows all about expensive projects and thus, it is difficult to expect that free players will be let in Otherside.

The game looks promising from what we can see now. But only when the platform is live, allowing players to access the available features, will we see the real value of this platform, and it is quite possible that this will become one of the most successful NFT projects (even though, judging from the start, one of the weirdest, too).

Star Atlas

Star Atlas is another promising project. It positions itself as a grand strategy game of space exploration, conquest, and so on.

This is a community-focused project. It is expected that players will decide how the Star Atlas is going to develop.

Plenty of games and immersive experiences, top quality, and carefully-developed gameplay are definitely the attractive points. The absence of decent experiences for non-paying users is a significant drawback. If you hope to join a free-to-play version of Star Atlas, you might be highly disappointed.

Even though the game developers didn’t provide those who don’t buy in-game money with an opportunity to enjoy the game, Star Atlas takes its place among the most promising NFT projects, and its utility token value may boost in 2023, especially if the team delivers some significant advancements.

ElseVerse

ElseVerse is still under development, but the potential is seen even by inexperienced investors. This metaverse project is an incubation of BullPerks and GamesPad. It is led by a team of experts, those who have been in the area for ages and know everything about blockchain and the metaverse.

The main difference between ElseVerse and Metaverses is that the project doesn’t concentrate on providing gamers with earning opportunities only. In the ElseVerse world, one can find his place based on his skills and wishes.

Those who would like to trade can open a shop or just become one of those merchants who travel around looking for rare game assets and resources and reselling them.

Cashbox

Cashbox is a nft games from the “past”, nowadays all crypto games in the market are set in the distant future, but Cashbox is special, it takes the ancient world civilization as the background and builds a meta-universe parallel to the real world. You can summon Mythical beasts to ally and fight with other teams from other worlds to stabilize the order of the multiverse. Each Mythical beasts is a unique NFT who will become uniquely valuable in battle after battle. Collect them well, I believe this is the first time you have seen an NFT that will actively increase in value like this.

MetaVision

MetaVision is another possible leader in the future gaming industry. It enables users to get the best gaming experience on Binance Smart Chain with lower in-game transaction costs and faster speed of transactions than on the Ethereum network.

This is going to be a comprehensive metaverse that offers top gaming experiences and is based on four pillars: play-to-earn games, life experience, virtual merchandise, and virtual advertising.

So, users will be able to earn money by getting and upgrading digital assets with an opportunity to benefit from renting them or selling them for a profit in a marketplace. Some in-game items will be unique or rare, which will boost their value.

2 notes

·

View notes

Text

Top 7 Cryptocurrencies To Buy In India In April 2023

If you’re considering investing in cryptocurrencies in India, you’re in luck. As of April 2023, the crypto market is heating up, and there are several great options available for investors. Here are the top 7 cryptocurrencies to buy in India this month:

Bitcoin (BTC): As the world’s first and most well-known cryptocurrency, Bitcoin remains a popular choice among investors. It has a market capitalization of over $1 trillion and is widely accepted as a form of payment. In India, Bitcoin is widely available for purchase through exchanges like WazirX and CoinDCX.

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market cap and is known for its smart contract capabilities. It has a robust developer community, and many other cryptocurrencies are built on its blockchain. Ethereum is also widely available for purchase in India through exchanges like CoinSwitch and ZebPay.

Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance exchange and is used to pay for trading fees on the platform. It has seen significant growth in the past few years and has a market cap of over $100 billion. BNB is available for purchase on several exchanges, including Binance and WazirX.

Cardano (ADA): Cardano is a blockchain platform that aims to provide a more sustainable and scalable solution than existing cryptocurrencies. It has a market cap of over $70 billion and has gained a lot of attention in recent months. ADA can be purchased on exchanges like CoinDCX and Bitbns.

NavC token (NavC): NavC is an ERC-20 utility token designed to serve as the native cryptocurrency of the NavExM trading ecosystem. NavExM is a positive cashback centralized cryptocurrency exchange that provides trading and investing in crypto, NFT, and stablecoins.

Dogecoin (DOGE): While not taken as seriously as some other cryptocurrencies, Dogecoin has a large following and has seen significant growth in recent years. It started as a joke, but it has gained a lot of attention from the likes of Elon Musk and other high-profile figures. DOGE is available for purchase on several exchanges, including WazirX and Bitbns.

In conclusion, investing in cryptocurrencies can be a risky business, so it’s essential to do your research and understand the risks involved. However, with the growing popularity of cryptocurrencies in India, nowycould be an excellent time to get involved. The top 7 cryptocurrencies to buy in India this month are Bitcoin, Ethereum, Binance Coin, Cardano, NavC, Dogecoin, and Solana. Good luck with your investments!

2 notes

·

View notes

Text

13 Reasons Why Investing in MetaTdex is a Smart Choice: An In-Depth Analysis

MetaTdex is a decentralized exchange platform that aims to offer a secure and reliable trading environment for cryptocurrency enthusiasts and investors. With the launch of Trade Mining Beta 2.0, MetaTdex is poised to become one of the leading decentralized exchanges in the industry. In this article, we will look at why users should consider investing in MetaTdex.

LICENSED: The key reason why users should consider investing in MetaTdex is due to the company's licensed operations in multiple countries. Having a license from regulators such as the Dubai Multi Commodities Centre (DMCC) and China gives MetaTdex a level of legitimacy and recognition that many other decentralized exchanges may not have. This also indicates that MetaTdex is adhering to strict compliance measures and regulations, which can provide users with added security and peace of mind when it comes to their investments. Additionally, the company's ability to operate legally in multiple countries increases the potential market size and user base, which can be beneficial for growth and long-term success.

GROWTH POTENTIAL: MetaTdex is among the top 10 decentralized exchanges in the industry, and the platform has ambitious plans to become one of the top 3 decentralized exchanges by the end of 2023. This growth potential is attractive to investors who are looking for a platform that has a strong future ahead of it.

USER-FRIENDLY INTERFACE: MetaTdex has a user-friendly interface that makes it easy for users to trade and manage their assets. The platform is intuitive and easy to use, which makes it a great choice for users who are new to the cryptocurrency space.

STRONG SECURITY MEASURES: Security is of utmost importance when it comes to cryptocurrency trading. MetaTdex takes security seriously and has implemented strong measures to ensure that user assets are safe and secure. With Trade Mining Beta 2.0, the platform will be able to offer even more robust security features, further protecting user assets.

EXPERIENCED TEAM: MetaTdex is built and managed by a team of experienced professionals who are well-versed in the crypto industry. This level of experience ensures that MetaTdex stays ahead of the curve and continues to provide its users with the best possible services and features.

ATTRACTIVE TOKENOMICS: MetaTdex places a high level of emphasis on the value and support of the native token, the TT token. This is evident in the implementation of trade mining 2.0, which provides users with an opportunity to earn the TT token through their trading activities. With the high level of attention given to the TT token, it is expected to soar in value, providing users with a good return on their investment.

COMMUNITY INVOLVEMENT: MetaTdex is a community-driven platform and values the input of its users. The platform periodically holds AMA (Ask Me Anything) sessions to ensure that no community member or investor is left behind. This helps to keep everyone informed about the development process and any new features being rolled out.

MULTIPLE TRADING PAIRS: MetaTdex has plans to add more trading pairs in the future, allowing users to choose from a wider range of cryptocurrencies to trade. This will increase the number of available trading opportunities, making the platform even more attractive to users.

INTEGRATION OF MULTIPLE BLOCKCHAINS: MetaTdex aims to integrate more than 15 different blockchains into its ecosystem, making it a onestop-shop for all cryptocurrency-trading needs. This will further increase the platform's appeal to users, as they will be able to trade a wider range of cryptocurrencies from a single platform.

AVAILABLE OF LIQUIDITY: Decentralized exchanges have faced liquidity issues in the past, which can lead to slow transaction times and decreased trading volumes. Trade Mining Beta 2.0 solves this problem by incentivizing users to participate in the platform's trading activities. With increased liquidity, users can expect faster and smoother trading experiences.

NFT INTEGRATION: MetaTdex has plans to integrate NFTs into its platform in the near future, enabling users to hold NFTs in their wallets. This will further increase the platform's appeal to users and is expected to drive the value of the platform up over time.

REGULAR UPDATES AND IMPROVEMENTS: MetaTdex is constantly working on improving the platform and adding new features. Regular updates and improvements help to keep the platform relevant and provide users with a continuously improving user experience. This level of attention to detail and dedication to improvement is what sets MetaTdex apart from other decentralized exchanges.

ROADMAP FOR FUTURE DEVELOPMENT: MetaTdex has a clear roadmap for future development, and they are dedicated to achieving their goals. This roadmap includes plans for the integration of NFTs, the addition of new trading pairs, and the continued development of new features and improvements. The roadmap provides users with a clear understanding of what to expect from MetaTdex in the future, which is important for making informed investment decisions.

MetaTdex is a promising platform with a lot of potential for growth. With its welldesigned tokenomics, strong security measures, and community involvement, MetaTdex is an investment option that users should consider today, tomorrow, and in the Future.

Join our Community to get the latest update on MetaTdex:

Main Group: https://t.me/MetaTdex_group

MetaTdex Twitter https://mobile.twitter.com/MetaTdex

Start your web3.0 journey with MetaTdex. www.metatdex.com

MetaTdex :Safe| Efficient | Diverse

5 notes

·

View notes

Text

Dogecoin (DOGE) Price Prediction 2024, 2025, 2026 And 2030

Dogecoin is an open-source peer-to-peer virtual currency favored by Shiba Inus globally. At least in part, it was created as a lighthearted joke for crypto enthusiasts and took its name from a once-popular meme.

DOGE is a meme coin cryptocurrency that utilizes blockchain technology, a highly secure decentralized system of storing information as a public ledger that is maintained by nodes (a network of computers). According to CoinMarketCap, Dogecoin is now among the top seven cryptocurrencies by market capitalization.

Dogecoin and other meme coins have outperformed Bitcoin over the past weeks, driven by an altcoin rally amid reduced regulatory uncertainty following the counting of the U.S. presidential election and Donald Trump’s victory. DOGE nearly surged over 167% in the last month. According to market capitalization, Dogecoin moved from the 10th to the 7th cryptocurrency on the CoinMarketCap ranking.

DOGE Historical Price

As of Nov. 19, 2024, Doge is trading at $0.3825 with a market capitalization of $56.39 billion, up by 168.36% in the last month. Let us see the overview.

Dogecoin Price$0.3839

Market Capitalization$56.38 billion

1-Day Price Change3.32%

7-Day Price Change-6.87%

Trading Volume (24h)$9.40 billion

Circulating Supply146.85 billion

All-time High$0.7376

All-time Low$0.00008547

TradingView Chart

Historical Data

TimeMarket CapitalizationPrice

November 19, 2024$56.62 billion$0.3856

October 2024$23.65 billion$0.1614

September 2024$16.72 billion$0.1144

August 2024$14.77 billion$0.1013

July 2024$17.73 billion$0.122

June 2024$18.01 billion$0.1243

May 2024$22.99 billion$0.1591

April 2024$19.21 billion$0.1333

March 2024$31.62 billion$0.2201

February 2024$16.79 billion$0.1172

January 2024$11.25 billion$0.07876

2023$11.25 billion$0.08947

2022$12.75 billion$0.07029

2021$18.81 billion$0.1705

2020$4.76 billion$0.004681

2019$294 million$0.002028

2018$227 million$0.002346

2017$679 million$0.009031

2016$22.20 million$0.0002234

2015$28.50 million$0.00015

2014$13.61 million$0.0001864

2013$63.17 million$0.0004228

According to CoinMarketCap

DOGE Price Prediction 2024

The dog-themed meme coin has surged approximately 167% in the last month, mainly after Donald Trump’s election.

DOGE experienced a bullish trend in the last quarter of 2024; Dogecoin is likely to skyrocket with the current rally, which is known for igniting massive jumps in altcoins due to the U.S. presidential election 2024

According to Coinpedia, the meme coin could witness a boost from the broader market recovery fueled by a potential rate cut in September. Hence, by the end of 2024, DOGE will likely hit the $0.3751 mark, a 270% price hike from current prices.

According to CoinDCX, the DOGE price is expected to be heavily volatile in the last few weeks of the year, attracting massive liquidity onto the platform. Market sentiments may change significantly, with market participants optimistic about the next price action. By the end of the month, the price may trade approximately $0.31 to $0.33, setting up a path toward DOGE’s new ATH in 2025.

DOGE Price Prediction 2025,2026..2030

Ryan Lee, chief analyst at Bitget Research, said that, according to historical records, DOGE rallied before Bitcoin prices moved towards its new ATH. Even more recently, Dogecoin outperformed Bitcoin after Donald Trump’s win and the influential backing of Elon Musk, a strong advocate for Dogecoin. This combination of political momentum and celebrity endorsement increases support for DOGE prices in the long run.

As we approach 2025, investor optimism is rising regarding Dogecoin’s growth potential due to its increasing acceptance worldwide and the anticipation of breaking the $1 mark. With its strong community backing, Dogecoin can go beyond its ATH of $0.7, but it will have to accumulate over a hundred billion dollars for that to happen.

According to Changelly, after analyzing Dogecoin prices in previous years, it is assumed that in 2025, the DOGE minimum price will be around $0.101, and the maximum may be around $0.173. On average, the trading price of DOGE might be $0.248 in 2025.

According to Changelly, based on cryptocurrency experts’ technical analysis of Dogecoin prices, 2026 DOGE is expected to be between $0.2777 and $0.3337. The average trading cost is expected to be $0.2856.

According to Binance, as of Nov. 19, 2024, the price prediction input for Dogecoin gathered from 269 users, the value of DOGE may increase by 5% and reach $ 0.489843 by 2030. According to the consensus rating, the current sentiment is that 128% of users are very bullish.

YearPrice Prediction

2025$ 0.383805

2026$ 0.402995

2027$ 0.423145

2030$ 0.489843

Anish Jain, founder of WadzChain, said that as Dogecoin continues to experience notable gains, even outperforming Bitcoin in specific metrics, it highlights the evolution of public sentiment and adoption trends within the cryptocurrency ecosystem. Dogecoin’s 2025 forecast reflects the meme currency’s resilience and the power of community-driven projects in shaping market movements.

However, as with all cryptocurrencies, significant volatility remains a consideration. A diversified approach—focusing on leading coins like Bitcoin and emergent tokens with solid community backing like Dogecoin—will help advance financial inclusion and digital asset awareness worldwide.

What is the Future of Dogecoin?

Unlike most cryptocurrencies, Dogecoin’s supply is unlimited, as it mines blocks indefinitely. This unlimited inflation could dampen price appreciation over the long haul compared to coins with capped circulating supplies.

Dogecoin’s future depends on its potential utility. Meme popularity may only sustain DOGE for a while. However, progress in speed, lower transaction fees, and business collaboration could see it thrive as a mainstream digital currency. Its passionate and large community will likely keep evolving positively.

While long-term predictability is tough, Dogecoin shows signs of being more than a temporary phenomenon. Provided that upgrades and adoption progress address technical challenges, DOGE stands a reasonable chance of enduring as a cryptocurrency widely used with upside price potential in the coming years. cifdaq.com

Is Bitcoin Safe?

Newcrypto22

January 28, 2025

modify

comment

The cryptocurrency market experienced remarkable highs in 2024, with a market capitalization exceeding $1.44 trillion and at $73,750. Bitcoin repeatedly surpassed its previous highs in March.

However, following this all-time high, Bitcoin is currently undergoing a correction, and as of August 7, 2024, it is trading at $57,504. The cryptocurrency market volatility, coupled with a tumultuous period in 2022, has led investors to question and exercise caution regarding the safety and security of this bold new asset class.

The median loss to Federal Trade Commission (FTC) impersonators has risen from $3,000 in 2019 to $7,000 in 2024. Falling prices combined with the increasing risk of criminal attacks are enough to make anyone think twice about the security of their Bitcoin.

Featured Partners

1

Mudrex

Legacy

Over 2 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry's best fee rates.

Invest Now

On Mudrex's secure application

2

BlackBull Markets

Multiple Award-Winning Broker

Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker - ForexExpo Dubai October 2022 & more

Best-In-Class for Offering of Investments

Trade 26,000+ assets with no minimum deposit

Customer Support

24/7 dedicated support & easy to sign up

Sign Up Now

On BlackBull Market's secure website

Please invest carefully, your capital is at risk

Is Bitcoin a Safe Investment?

Understanding whether Bitcoin is a safe investment depends on how you define security.

There’s no question that Bitcoin prices can be highly volatile. In March 2024, the price of BTC hit its all-time high at $73,750.07; as of August 7, 2024, it is trading at $57,400.

In 2022 alone, the price of BTC dropped from almost INR 39,56,137 to around INR 16,07,165 in 2023.

Losses like that would send investors running for the hills for any other asset class. If you define security as an investment with a relatively stable price, Bitcoin may not be a safe bet for your investment portfolio.

That said, Bitcoin’s mercurial nature may be changing.

“Bitcoin is becoming more integrated with traditional financial markets and is seeing significant participation from retail and increasingly from institutional investors,” says Ryan Burke, general manager at Invest at M1. “Historically, BTC has been more volatile, but it has become a de facto mainstream alternative asset more recently correlated to large-cap tech.”

If you think of Bitcoin as digital gold, similar to a commodity rather than an investment security, you can add another dimension to the security question.

“Bitcoin technology is relatively safe, but it isn’t anonymous and relies on passwords,” says Daniel Rodriguez, chief operating officer at Hill Wealth Strategies.

While Bitcoin disguises your personal information, the address of your crypto wallet is publicly available.

“Hackers could use web trackers and cookies to find more information about the transactions that could lead to your private information and data,” Rodriguez says. If anonymity is part of your definition of security, Bitcoin might not be entirely secure.

Similarly, your cryptocurrency is only as secure as the crypto wallet you keep it in. If you lose your wallet password or someone else gets ahold of it, you lose your Bitcoin.

You will often see the disclaimers “not SIPC protected” or “not FDIC insured” attached to Bitcoin purchases. This means that should the firm holding your crypto investments fail, neither of these backstops will bail you out.

According to Gil Luria, a technology strategist at D.A. Davidson Co., none of these concerns relate to the security of the Bitcoin network itself. “It has survived unscathed for the 13 years of its existence and has yet to be hacked.”

Let us see what experts have to say about Bitcoin being a safe investment:

Sathvik Vishwanath, co-founder and chief executive officer of Unocoin, says that Bitcoin’s safety as an investment is under scrutiny, especially after its recent drop of nearly 15%, bringing its price below $50,000. This decline highlights Bitcoin’s inherent volatility, a defining characteristic that can lead to significant short-term price swings.

While Bitcoin’s decentralized nature and blockchain technology provide robust security features, its market behavior is highly susceptible to rapid fluctuations influenced by supply and demand dynamics, regulatory news, and broader economic factors.

He further said that recent market trends show Bitcoin’s potential for a sharp decline, posing a risk to investors. Despite its historic growth and the lure of substantial returns, Bitcoin’s unpredictable volatility and fluctuating regulatory environment mean investors must carefully assess their risk tolerance. Diversification, long-term holding strategies, and ongoing market analysis are essential to managing the risks associated with Bitcoin investments.

Utkarsh Tiwari, Chief Strategy Officer at KoinBX, said, ” Bitcoin, often hailed as digital gold, represents a significant evolution in the financial ecosystem. While its decentralized nature offers unparalleled transparency and security, it’s crucial to approach it with a well-informed strategy. As with any investment, understanding the inherent risks and volatility is essential.

However, it’s essential to recognize that with Bitcoin’s potential rewards come risks—especially its notorious volatility and the need for solid personal security measures. Understanding the technology, staying informed about market trends, and employing best practices for asset protection are crucial steps in ensuring your Bitcoin investments are secure.

At KoinBX, we advocate for responsible investing and staying updated with market trends to navigate the dynamic landscape of virtual digital assets safely.”

Himanshu Maradiya, founder and chairman of CIFDAQ Blockchain Ecosystem India, said that Bitcoin’s evolution since its inception in 2009 has been remarkable. From trading at approximately $500 in May 2016 to $69,790 as of July 29, 2024, Bitcoin has witnessed a phenomenal 12,662% growth. This impressive increase underscores its significant role and expanding acceptance in the global financial landscape.

Current technical indicators suggest a critical resistance zone, including the 61.8% Fibonacci retracement level at $62,066 and the 100-day Exponential Moving Average (EMA) at approximately $63,022.

He added that it’s important to note that Bitcoin’s market dynamics are subject to volatility and regulatory scrutiny, which can impact its price stability. While the recent analysis indicates potential for a short-term relief rally, investors should consider broader market trends and the regulatory environment. The Relative Strength Index (RSI), currently at around 36, highlights the potential for temporary recovery, yet a cautious approach is essential.

Things To Consider Before Buying Bitcoin

Given Bitcoin’s high volatility and security risks, it’s important to consider your reasons for buying before you trade any rupees for BTC.

Cryptocurrency is a highly speculative investment, says Luria. “The risk/reward profile of investing in Bitcoin differs from investing in most stocks or bonds. We tend to recommend investors only consider investing capital they are willing to lose,” he says.

Are you buying Bitcoin as an investment to fund your retirement? In that case, it’s probably best to keep your exposure to a minimum because no one can predict where the market will go. Most financial advisors recommend keeping Bitcoin to less than 5% of your overall portfolio.

You should brace yourself for an unreliable narrator if you think Bitcoin is a currency. You could easily log off the computer one day with INR 5,499,133 in BTC and log on with only INR 3,709,027 the next morning.

Then there’s the uncertainty around the crypto regulatory environment.

Cryptocurrencies are presently unregulated in India. While the Reserve Bank of India (RBI) sought to ban them in 2018, the Indian Supreme Court quashed the attempt, leaving cryptocurrencies in regulatory limbo—neither illegal nor, strictly speaking, legal. However, cryptocurrencies are taxed in India.

While Burke is optimistic about long-term developments for Bitcoin, uncertainty is an investor’s worst enemy. Assuming you’re comfortable with the risks and uncertainty, Bitcoin can have a place in your financial life.

What Are the Risks of Bitcoin?

Like any investment, Bitcoin is not risk-free. Cryptocurrency has many risks, from market to regulatory and cybersecurity risks.

On July 18, 2024, WazirX, a crypto exchange platform in India, experienced a cyber attack on one of its multisig wallets, resulting in the theft of digital assets exceeding $230 million. This is the latest scam that shocked Indian investors.

“Market risk is one of the biggest risks associated with Bitcoin,” Rodriguez says. Look at any price history chart and see what kind of a wild ride Bitcoin investors are in for.

“Historically, Bitcoin also reacts inversely to interest rates,” he says. “So, when the Fed raises rates, Bitcoin typically takes a dip because investors start leaning toward more safe and stable investments.”

Regulatory uncertainty also poses a risk.

“In 2021, China, the world’s second-biggest economy, effectively made it illegal for citizens to mine or hold any cryptocurrency,” Rodriguez says.

If other countries follow suit, Bitcoin holders could be in hot water.

Cybersecurity is another chief concern for all holders of digital assets. Remember that your transactions are only as anonymous and secure as your wallet information and passwords.

The Department of Justice proved blockchain transactions are not immune to tracing when it followed the trail left by a couple attempting to launder INR 370 billion in cryptocurrency stolen in the 2016 Bitfinex hack.

There’s also the rising threat of cryptocurrency crime. In 2023, people reported losses of $10 billion to scams, surpassing the previous year by $1 billion and marking the highest-ever losses reported to the FTC.

How To Keep Your Bitcoin Safe

Your Bitcoin’s safety depends largely on how you store it. Your choice of crypto wallet and its encryption level play a big part in keeping your coins safe.

“Security and convenience do not always go hand-in-hand,” Burke says.

He says that offline “cold” wallets that are not connected to the internet are secure from hacking but less convenient than hot wallets. Cold wallets are also subject to theft or loss. “Lose a device or drive or misplace your private key, you have a problem,” says Burke.

Hot wallets are more convenient because you can access your cryptocurrency anywhere you have an internet connection or cell service, but they are more vulnerable to hacking.

Burke says a prudent strategy is to use a combination of hot and cold storage, with most assets held in cold storage.

Burke adds whatever storage method you choose, so make sure you know if your crypto is being loaned, staked, or pledged as collateral.

Experts say it’s important to read the terms and conditions before signing up for a wallet or service, lest your cryptocurrency become another victim of the crypto liquidity crisis.

As with any investment, research whether Bitcoin is right for your portfolio. If you buy BTC as part of your investment strategy, prepare for highs and lows.

cifdaq.com

□ Breaking Barriers in Blockchain! □□

Newcrypto22

January 28, 2025

modify

comment

🌟 Breaking Barriers in Blockchain! 🌍🚀 A huge shoutout to CryptoNewsBTC for featuring an exclusive interview with Himanshu Maradiya, Chairman and Founder of CIFDAQ! 🎙️🔥 In this must-read piece, Himanshu shares powerful insights on blockchain scalability, global adoption, and industry integration, setting the stage for a revolutionary shift in decentralized finance. 🌐💡 CIFDAQ is not just shaping the future—it’s building it! 💎🚀 👉 Dive into the full interview here: Read Now lnkd.in/dzgYst7k Let’s spark the conversation—what’s the next big leap for blockchain? Drop your thoughts below! ⬇️💬 Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Jay Hao Krunal Nilesh Sheth Anil Vasu Shipra Anand Mishra Ankur Garg Muthuswamy Iyer #CIFDAQ #BlockchainRevolution #DeFi #CryptoNews #Web3Innovation #FutureOfFinance

cifdaq.com

1 note

·

View note

Text

Blockchain Market Overview: Growth, Share, Value, Size, and Scope , Industry Overview and Forecast to 2031

"Blockchain Market Size And Forecast by 2031

Despite its promising outlook, the Blockchain Market faces several challenges, including regulatory barriers, supply chain disruptions, and competitive pressures. However, the resilience of industry leaders and their focus on innovation and adaptability ensure the market’s sustained growth. By analyzing key growth drivers, opportunities, and future scope, this report serves as a critical resource for understanding the industry’s landscape and planning strategic initiatives.

The global blockchain market size was valued at USD 17.23 billion in 2023 and is projected to reach USD 1,317.39 billion by 2031, with a CAGR of 71.96% during the forecast period of 2024 to 2031.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-blockchain-market

Nucleus is a secure, cloud-based platform designed to streamline data transfer and management for businesses. Its intuitive interface offers practice administrators and financial managers advanced filtering options, enhancing operational efficiency. By integrating various data sources, Nucleus enables effective prioritization of critical exposures, incorporating business context and threat intelligence to bolster security measures. Additionally, Nucleus supports seamless collaboration among multiple users across different applications, fostering rapid iteration and teamwork. Its deployment flexibility allows installation on-premises or via preferred cloud service providers, ensuring scalability and adaptability to meet diverse organizational needs.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/global-blockchain-market

Which are the top companies operating in the Blockchain Market?

The Top 10 Companies in Blockchain Market are leaders in their field, known for their strong market presence and innovative solutions. Their success is driven by their ability to adapt to market trends, invest in research and development, and meet customer needs effectively, making them key competitors in the Blockchain Market.

**Segments**

- **Type**: The global blockchain market can be segmented based on the type of blockchain, including public, private, and consortium. Public blockchains are open to anyone and allow for decentralized transactions, private blockchains are restricted to certain users or organizations, and consortium blockchains are managed by a group of trusted companies.

- **Application**: The market can also be segmented based on application, with blockchain technology being utilized in various industries such as banking, financial services, insurance, healthcare, supply chain management, and others. Each sector utilizes blockchain differently to improve efficiency, security, and transparency in their operations.

- **End-User**: Another important segmentation of the global blockchain market is based on end-users, including large enterprises, small and medium-sized enterprises (SMEs), and individual users. The adoption of blockchain technology varies across these different categories, with larger firms often leading the way in implementing blockchain solutions.

**Market Players**

- **IBM Corporation**: IBM is a key player in the global blockchain market, offering blockchain solutions for various industries and applications. The company provides blockchain platforms and services to help businesses implement secure and transparent transactions.

- **Microsoft Corporation**: Microsoft is another major player that provides blockchain solutions through its Azure platform. The company offers tools and services for building, testing, and deploying blockchain applications, catering to the needs of different industries.

- **Ripple**: Ripple is known for its focus on cross-border payments using blockchain technology. The company's solutions aim to facilitate fast and cost-effective international transactions, disrupting traditional payment systems.

- **Alibaba Group**: Alibaba has also ventured into blockchain technology, developing solutions for supply chain management, intellectual property protection, and more. The company's initiatives in blockchain aim to enhance trust and security in e-commerce and other sectors.

- **Amazon Web Services**: Amazon Web Services (AWS) offers blockchain services to help businesses create scalable blockchain networks. The company's blockchain solutions enable customers to build innovative applications with the benefitsIBM Corporation has been a prominent player in the global blockchain market, leveraging its expertise and resources to provide cutting-edge solutions for various industries. The company's focus on offering blockchain platforms and services has enabled businesses to enhance their transaction security and transparency significantly. IBM's blockchain offerings cater to the specific needs of different sectors, showcasing their commitment to driving innovation and efficiency through this technology. By collaborating with diverse clients and partners, IBM continues to expand its footprint in the blockchain market and solidify its position as a key player in the industry.

Microsoft Corporation has also played a significant role in shaping the global blockchain market with its Azure platform. The company's blockchain solutions have empowered businesses to build, test, and deploy blockchain applications effectively, catering to the unique requirements of different industries. Microsoft's emphasis on providing tools and services that facilitate seamless blockchain integration has positioned it as a major competitor in the market. By investing in research and development, as well as strategic partnerships, Microsoft has demonstrated its commitment to advancing blockchain technology and driving innovation across various sectors.