#thrilled to see how many plays have been temporally made available online

Text

@thelibraryiscool tagged me to list my five favourite plays + (dis)honourable mentions AGES ago and while i haven’t read a lot of plays i have seen quite a few so here we go:

‘much ado about nothing’ by william shakespeare

‘arcadia’ by tom stoppard

‘this house’ by james graham (which you can still see here until 7pm UK time tonight!)

‘pride and prejudice* (*sort of)’ by isobel mcarthur

leaving this open for all the plays i’m super interested in but haven’t seen read or watched yet (our ladies of perpetual succour! the ferryman! rosencrantz and guildenstern are dead! antigone! anything james graham has ever written! )

honourable mention: let’s go with some lesser known modern ones: ‘how to disappear’ by morna pearson, ‘growth’ by luke norris and ‘barber shop chronicles’ by inua ellams.

dishonourable mention: ‘cockpit’ by bridget boland, mainly for the wasted potential

i’d tag people but i don’t know who among you is into theatre, so consider yourself tagged if you are!

#i miss the theatre!#thrilled to see how many plays have been temporally made available online#but i miss the lyceum and the traverse#tag games

6 notes

·

View notes

Photo

If Sears Wants to Sell Kenmore...

When a retail chain such as Sears is in trouble, the usual levers to examine in order to improve performance are location (or convenience); assortment (or the variety of categories carried and the brands within each category); price (price positioning – upscale, midscale, etc. and pricing or merchandising strategy – everyday low pricing or “high-low” pricing); and most importantly, the overall quality of its merchandise.

Over the years, the company has tried to move the needle by engaging each of these levers. For example, it’s experiment of opening a store in downtown Chicago in 2001 to serve the clientele coming to that area to shop at neighboring stores (including Macy’s, Old Navy, Gap, Target etc.) ended in 2014 as it failed to generate enough traffic and sales to justify the premium location. In 2002 it tried to return to its catalog roots (Sears that started as a mail order catalog company in the late 19th century and started opening retail locations only in 1925, abandoned the general merchandise catalog in 1993) by acquiring the Land’s End – a higher end clothing, luggage and home furnishings catalog retailer. However, that did not end well either with Sears spinning off Land’s End in 2013. And further back in 1989, Sears tried to move from a high-low pricing policy, where merchandise is sold at a higher regular price coupled with occasional discounts of varying depths on different products, to an everyday-low-price strategy (akin to Wal-Mart’s) where regular prices are lower but there are fewer discounts. This attempt also resulted in failure, as the customer who came to Sears wanted to feel the thrill of having discovered a quality product at a low price. So over the years, Sears has been declining. It first started losing out to Wal-Mart and Target in the bricks-and-mortar era; unable to compete with Wal-Mart at the lower-end value positioning or at the slightly upper end with Target. More recently the online assault mounted by Amazon has largely decimated what was left of the “Great American Store.”

Unlike many other retail chains however, Sears owns several brands that are well known and trusted by American consumers. These include the Kenmore range of appliances, Craftsman tools and Die Hard batteries (jointly known as K-C-D). Recently, the company has sought to raise money by selling these iconic brands. First among them was the sale of the Craftsman brand to Stanley Black & Decker, another larger manufacturer of tools. While the Craftsman range will still be available in Sears stores, ownership will pass to the purchasing company. Sears has also been interested in selling the Kenmore brand. Clearly there are other manufacturers such as Whirlpool, Electrolux (a Swedish manufacturer), Haier (a Chinese appliance maker), Samsung and LG (Korean manufacturers) who could potentially be interested in acquiring the Kenmore brand name. Obviously there are financial, operational and other considerations that would go into the decision to acquire the brand. Here, I take a limited perspective by (i) focusing on the consumer to see if the Kenmore brand provides a better “fit” to these other players; (ii) ignoring the two big Korean manufacturers from the analysis (since these are large conglomerates with interests well beyond appliances the calculus for these firms will likely be very different); and (iii) looking at what consumers say on one specific social media platform - Twitter. The caveats from doing so are obvious; nevertheless such an analysis might provide some insights for these firms.

Yogesh Kansal (MBA 2018) as always helped me with this analysis; and for this particular post I also received assistance from Shweta Desiraju (College 2017). I look at data from the 2-month period from November 7, 2016 to January 7, 2017 for the analysis.

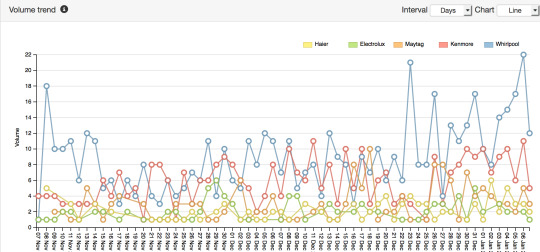

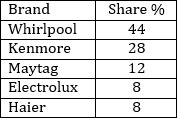

As always I begin by looking at “buzz” – the amount of activity being generated on the platform by the various brands. The reasoning here is that if Kenmore is a brand generating buzz and you are a brand that is currently not front and center in the consumers’ minds then acquiring a brand with more “top of mind” awareness might be beneficial for you. Figure 1(a) shows the temporal variation in the relative number of posts on Twitter for each of the brands and Figure 1(b) shows the overall numbers for the entire duration.

Figure 1(a): Time series plot showing relative numbers of tweets

Figure 1(b): Overall share of posts of the brands

We see from Figure 1(b) that Whirlpool and its subsidiary Maytag, already control over 50% of all the conversations in this market. So per se, adding Kenmore to the mix, while significantly expanding coverage, is less of a benefit (of course, since Whirlpool already does the manufacturing of some Kenmore products an argument can be made from an operations perspective). However, both Electrolux and Haier will benefit significantly from adding Kenmore to their portfolios while giving them access to the US market.

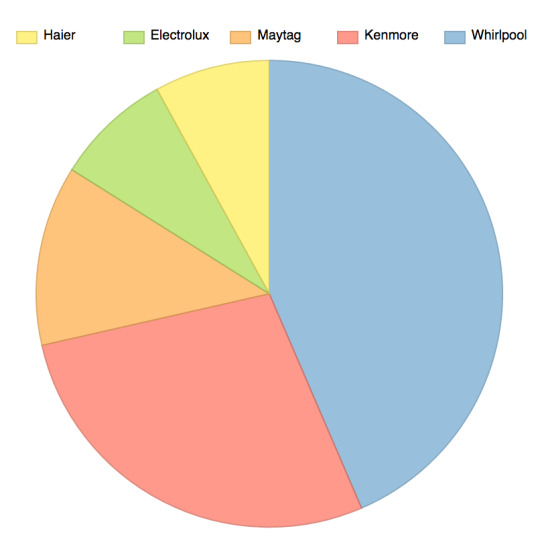

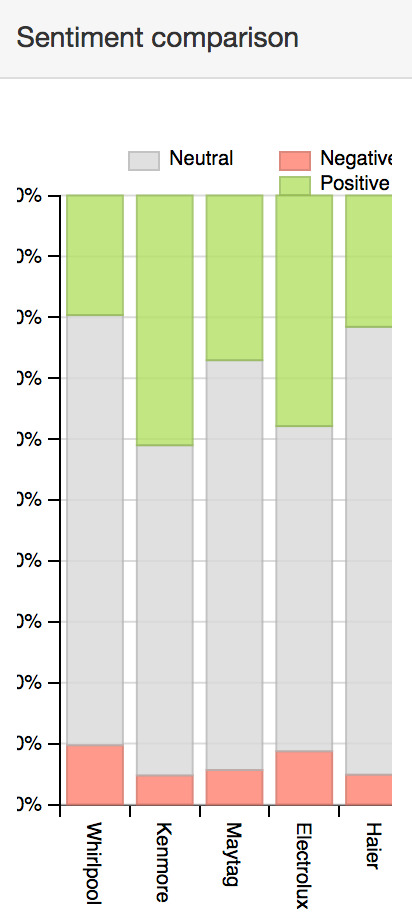

Does the volume of conversations also carry over into benefits from the sentiments associated with these brands? In Figure 2, I show the positive (green), negative (red) and neutral (grey) sentiments associated with each of the 5 brands analyzed.

Figure 2: Brand sentiments from the tweets

From Figure 2 we see that the brand likely to benefit the most is Haier since the sentiments associated with its tweets are less positive than those for the other brands (with the possible exception of Whirlpool). Kenmore has the highest positive sentiment associated with it, making it a valuable addition to the company’s product portfolio. Also note that Electrolux in this case is already generating fairly high positive sentiments although the negative sentiments are also high for this brand. From that perspective Electrolux might also benefit from an association with Kenmore.

Next we look at the contents of the tweets from the different brands via wordclouds. The idea behind this is whether there are some complementary features or other attributes that Kenmore provides from the perspective of each of the other brands. Figures 3(a) through 3(e) display this information for the 5 brands.

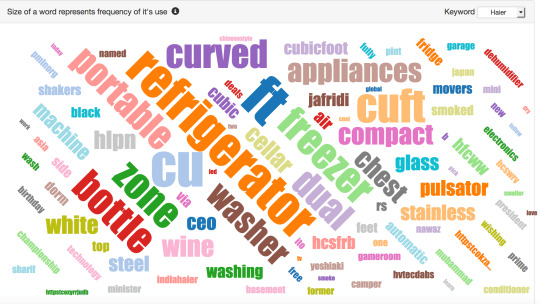

3(a): Haier Wordcloud

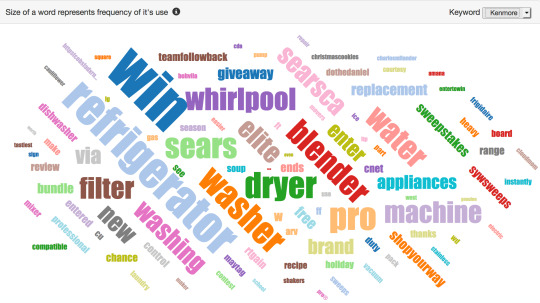

3(b): Kenmore Wordcloud

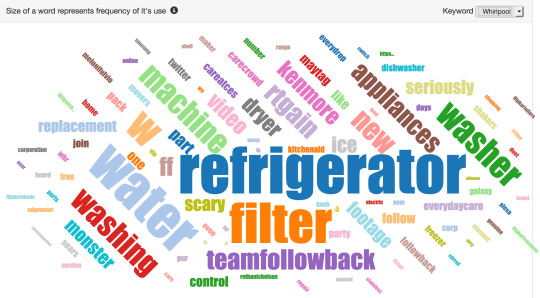

3(c): Whirlpool Wordcloud

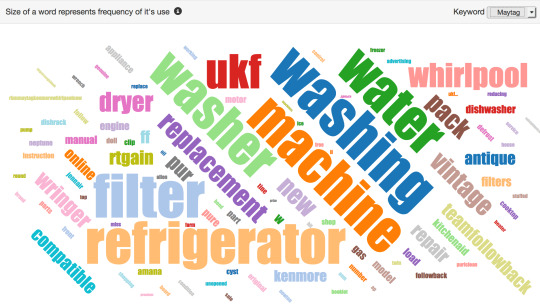

3(d): Maytag Wordcloud

3(e): Electrolux Wordcloud

From the wordclouds it appears that the brands are all very similar in terms of the content of the tweets. Other than Maytag, the refrigerator appears to be the major appliance that generates most of the tweets. The one dimension that Kenmore could potentially bring to each of the other brands comes from its product line also including small kitchen appliances such as blenders. This is reflected in its wordcloud as well.

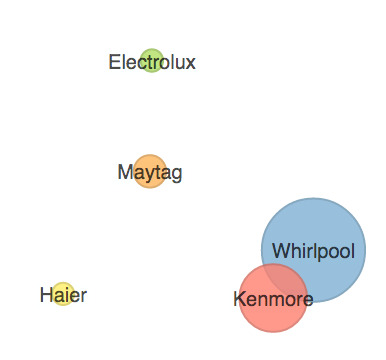

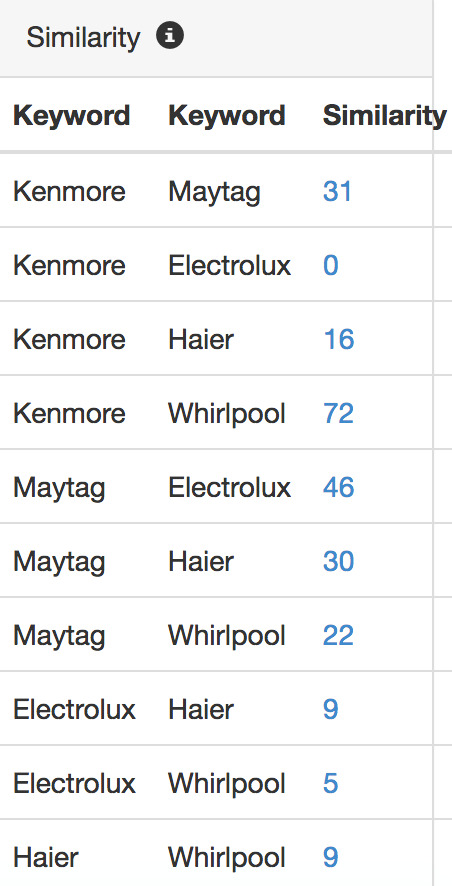

To dig deeper into the perceived “similarity” between the various appliance makers in terms of the overlap in words used in their respective tweets, I next construct a similarity “matrix” that provides the extent of word overlap between brands. This overlap metric is akin to a correlation matrix. With this similarity matrix as an input one can use standard statistical methods to come up with a “perceptual map” such as the one in Figure 4 below. The size of each bubble is proportional to the number of tweets for the corresponding brand.

Figure 4: Perceptual Map and Similarity measures

Note that unlike a typical perceptual map, the dimensions in the above figure are not specified and are open to the reader’s interpretation. Nevertheless, the map provides a pictorial representation of the similarities in the tweets between the 5 brands. In particular, those of Whirlpool and Kenmore appear to be quite similar to one another, reinforcing the earlier point that the benefits to Whirlpool of combining with Kenmore maybe limited. On the other hand, it does appear that both Haier as well as Electrolux would benefit given the limited similarity / overlap that they share with Kenmore.

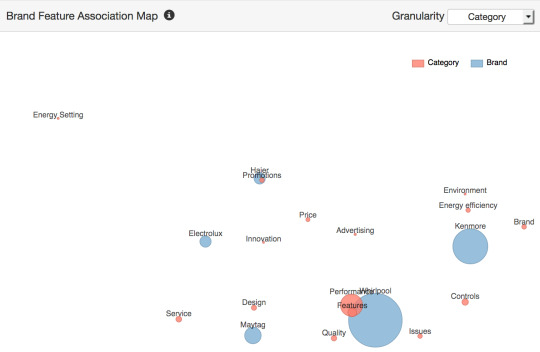

Since the above map does not give much information on the underlying attributes, I turn next to mapping the brands onto features via the following feature association map. This map provides information on which “topics” are included in the content of the tweets and the topics related to each of the brands. I interpret these topics in terms of the features of interest to consumers. The Feature-Association map is depicted in Figure 5.

Figure 5: Feature – Association Map

Figure 5 shows interesting differences across brands in terms of the features most closely associated with them. In particular, Whirlpool tweets reflect product features, performance and quality but also issues that consumers maybe having with them (recall the large negative and low positive sentiment associated with this brand). Maytag’s tweets reflect design, quality and service and Kenmore’s are associated with the brand, energy efficiency and the environment. On the other hand Haier seems most strongly associated with price and promotions (and design to a lesser extent) and Electrolux with innovation, design and service. Based on this information, it does appear the Haier may be the firm that would benefit the most from being associated with a strong brand that also emphasizes energy efficiency.

Taken together, the above analysis seems to suggest that Kenmore would make a good purchase for Haier or Electrolux but perhaps for different reasons. For Electrolux, Kenmore would bring more visibility in the US market and a strong brand with an association with the environment and energy efficiency. For Haier the benefits include the visibility as well as the positive sentiment as well as a move beyond just being associated with price and promotions. It will be interesting to see how this plays out going forward.

.

0 notes