#three wheeler auto loan

Explore tagged Tumblr posts

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, Tropobile manufacturer Bajaj Auto Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, Tropobile manufacturer Bajaj Auto Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, Tropobile manufacturer Bajaj Auto Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Common Mistakes to Avoid When Applying for a Three-Wheeler Auto Loan

Buying a three-wheeler auto is a major investment, especially for individuals who rely on it for commercial purposes such as transportation and deliveries. Since most buyers seek financial assistance, a three-wheeler auto loan is a great way to make the purchase more affordable. However, getting the right loan requires careful planning, and many borrowers make mistakes that lead to higher costs, loan rejections, or financial strain.

To help you make the right choice, we have highlighted the common mistakes to avoid when applying for a three-wheeler auto loan and how you can secure the best loan deal.

1. Not Comparing Loan Offers from Multiple Lenders

The Mistake

Many borrowers make the mistake of accepting the first loan offer they receive without comparing other options. Different lenders, including banks and NBFCs, offer varying interest rates, loan tenures, and processing fees, which can significantly impact the overall loan cost.

How to Avoid It

Compare interest rates and loan terms from different banks and financial institutions.

Check for hidden charges, processing fees, and prepayment penalties.

Use an online loan comparison tool to evaluate multiple lenders before making a decision.

By taking the time to compare, you can secure a lower interest rate and better repayment terms, saving money in the long run.

2. Ignoring Your Credit Score

The Mistake

A credit score is a crucial factor that lenders use to determine loan eligibility and interest rates. Many borrowers fail to check their credit score before applying, resulting in loan rejection or high-interest rates.

How to Avoid It

Check your credit score before applying for a loan. A score above 700 improves your chances of getting a low-interest rate.

If your score is low, improve it by paying off outstanding debts and avoiding late payments.

Some lenders offer loans to individuals with low credit scores, but they may charge higher interest rates. Choose wisely.

A good credit score not only increases approval chances but also helps in securing a cost-effective loan.

3. Choosing a Short Tenure Without Assessing Affordability

The Mistake

While choosing a shorter tenure may help clear the loan faster, it also leads to higher monthly EMIs, which may strain your finances. Borrowers often choose shorter tenures without evaluating their monthly income, making it difficult to manage other expenses.

How to Avoid It

Use a Three-Wheeler Loan EMI Calculator to find an affordable EMI based on your income.

Select a tenure that allows you to comfortably repay the loan without financial stress.

If you can afford higher EMIs, go for a shorter tenure to reduce interest costs.

Balancing your tenure and EMI affordability is key to avoiding financial difficulties in the future.

4. Not Checking for Government Subsidies and Loan Schemes

The Mistake

Many governments and financial institutions offer subsidies and special loan schemes for three-wheeler buyers, especially for electric three-wheelers. However, many borrowers are unaware of these benefits and end up paying more than necessary.

How to Avoid It

Check if there are any government subsidies or special financing programs available in your region.

Look for low-interest loans designed for commercial three-wheeler buyers.

Explore financing options for electric three-wheelers, as some lenders offer discounted interest rates.

Taking advantage of these schemes can significantly lower your loan burden.

5. Overlooking the Loan’s Hidden Charges

The Mistake

Many borrowers focus only on interest rates and ignore hidden charges such as processing fees, late payment penalties, prepayment charges, and foreclosure fees. These costs can add up and make the loan more expensive than expected.

How to Avoid It

Request a detailed loan agreement that outlines all the additional charges.

Ask the lender about prepayment and foreclosure charges if you plan to repay the loan early.

Choose a lender with low or no hidden fees to reduce unnecessary expenses.

A loan with low-interest rates but high hidden fees can be costlier than a loan with slightly higher interest but fewer additional charges.

6. Providing Incomplete or Incorrect Documents

The Mistake

Lenders require specific documents such as identity proof, address proof, income proof, and vehicle details. Submitting incorrect or incomplete documents can delay approval or lead to loan rejection.

How to Avoid It

Check the list of required documents before applying.

Ensure all details in the loan application match your official records.

Keep a copy of your Aadhaar card, PAN card, bank statements, and income proof ready.

Proper documentation ensures smooth and fast loan processing.

7. Not Considering Insurance and Loan Protection

The Mistake

Many borrowers focus only on getting the loan and forget about insuring the vehicle. In case of an accident, theft, or damage, they may still have to repay the loan without a working vehicle.

How to Avoid It

Get a comprehensive insurance policy to protect your three-wheeler.

Consider loan protection insurance in case of job loss or unexpected financial difficulties.

Some lenders offer bundled insurance packages with the loan—evaluate if they are beneficial.

Having proper insurance coverage ensures financial protection in case of unforeseen circumstances.

Conclusion

Applying for a three-wheeler auto loan requires careful financial planning and research. Common mistakes such as not comparing lenders, ignoring credit scores, overlooking government schemes, and misunderstanding loan charges can lead to higher expenses and financial stress.

To secure the best loan deal, compare different options, check your credit score, assess affordability, and ensure all necessary documents are in place. By avoiding these mistakes, you can enjoy a smooth loan process and purchase your three-wheeler without unnecessary financial burdens.

Whether you’re buying a commercial or personal three-wheeler, making an informed loan decision ensures a profitable and stress-free investment.

0 notes

Text

The Inspiring Journey of Mr. Shrikant Badve by Belrise Industries

Entrepreneurial Beginnings

Born into the vibrant culture of Maharashtra, Mr. Shrikant Badve exemplified determination from a young age. Opting to be a job creator rather than a job seeker, he embarked on his entrepreneurial path right after graduating. Despite the hurdles in securing funding due to insufficient collateral, his perseverance shone through. With an initial investment of just Rs. 20,000 ($240), Mr. Badve laid the foundation of what would become a powerhouse in manufacturing. His breakthrough came when Saraswat Co-operative Bank approved his first loan, setting the stage for his future successes.

Growth Trajectory

From humble beginnings with a monthly turnover of just Rs. 8,000 from a single shed in Aurangabad, Belrise Industries has soared to a staggering annual turnover of Rs. 5,433 crore in 2022-23. Today, the company boasts 16 state-of-the-art manufacturing facilities across eight states, a testament to its aggressive domestic and global expansion. This growth is supported by a robust supply chain and an ever-expanding customer base.

A Visionary Leadership by Mr. Shrikant Badve

Mr. Shrikant Badve, a first-generation entrepreneur with a solid background in engineering and business management, has become a notable figure in the automotive manufacturing industry. His expertise and leadership have been pivotal in steering Belrise Industries to its current heights.

Diversification and Innovation in Automotive Components

Belrise Industries specializes in an array of automotive components and systems for vehicles across the spectrum— two-wheelers, three–wheeler, four-wheeler and commercial vehicles. The company’s extensive product line includes advancements in sheet metal processing, polymer processing, surface treatment, suspension and braking system. Notably, it is a leader in developing cutting-edge e-Mobility solutions and Advanced Driver Assistance Systems (ADAS).

Strategic Expansion and Diversification

Since its inception in September 1996, Belrise has continuously evolved. Starting with manufacturing silencers for Bajaj Auto in 1997, it has diversified into producing sophisticated suspension systems, particularly as the electric vehicle (EV) market in India gains momentum. In 2022, Belrise marked a significant entry into the EV sector, supplying crucial systems to major EV manufacturers.

Leveraging R&D for Market Leadership

Belrise Industries harnesses its extensive R&D capabilities and strengths in new product development to deliver innovative solutions tailored for global Original Equipment Manufacturers (OEMs). This strategic focus has cemented its reputation as a leading provider of specialized automotive solutions.

Excellence in Technical Competence

The company’s consistent performance and advanced technical competencies make it a preferred one-stop solution for OEMs worldwide, highlighting its commitment to quality and innovation.

Technological Advancements and Efficient Systems

Guided by Mr. Badve, Belrise has implemented highly efficient systems and technologies, including the integration of over 400 robots in fabrication and stamping processes. This technological leverage significantly reduces parts per million (PPM) rejections, enhancing overall production efficiency.

Real-Time Production Monitoring Through IoT

By adopting Internet of Things (IoT) technologies, Belrise has developed a centralized data acquisition system that enables real-time production monitoring and immediate bottleneck resolution, thus enhancing manufacturing agility and responsiveness.

Vision for Global Excellence

Mr. Shrikant Badve’s long-term vision is centered on delivering top-tier engineering products and becoming a globally recognized brand within the automotive sector. His commitment to technological advancement and customer-centric approaches drives the company’s ongoing efforts to expand its presence in international markets.

Fostering Team Success and Innovation

Mr. Badve is dedicated to cultivating a diverse and passionate workforce, focused on collaborative innovation and continuous improvement. This commitment not only drives the company’s success but also fosters a proactive and inventive organizational culture.

Value-Driven Transformation

Belrise is committed to transformation driven by core values such as passion, resilience, and relentless dedication. By fostering a unified team spirit and prioritizing adaptability, sustainability, and state-of-the-art technology, the company aims to enhance its operational efficiency significantly.

Championing Gender Diversity and Inclusion

Belrise Industries is a frontrunner in promoting workplace diversity, equity, and inclusion. By empowering women and creating a culture of equality, the company enhances creativity and drives innovation across all its divisions, from HR to R&D and production.

0 notes

Text

Three-Wheeler Auto Loans for First-Time Buyers: Tips to Get Approved Quickly

Purchasing a three-wheeler auto is a significant investment, especially for first-time buyers looking to enter the transportation or delivery business. A three-wheeler can be a valuable asset for earning income, but its upfront cost can be a challenge for many. Fortunately, three-wheeler auto loans offer a practical solution by providing financial assistance with manageable repayment terms. However, as a first-time buyer, securing loan approval can feel daunting. This article provides essential tips to help you get your three-wheeler auto loan approved quickly and easily.

1. Understand the Basics of Three-Wheeler Auto Loans

Before applying for a loan, familiarize yourself with how three-wheeler auto loans work. These loans are specifically designed to finance the purchase of three-wheelers, whether for personal use or business purposes. Financial institutions, including banks and Non-Banking Financial Companies (NBFCs), offer these loans with flexible repayment options and varying interest rates. Key features include:

Loan Amount: Covers up to 80-100% of the vehicle’s on-road price.

Loan Tenure: Ranges from 1 to 5 years, depending on the lender.

Interest Rates: Typically range from 9% to 18%, depending on the lender and applicant profile.

2. Check Your Eligibility

Eligibility criteria for three-wheeler auto loans vary across lenders but generally include the following:

Age: Applicants must be between 21 and 60 years old.

Income: A stable source of income, either through employment or self-employment, is crucial.

Credit Score: A credit score of 650 or above improves your chances of approval.

Experience: Some lenders may require prior experience in operating three-wheelers, especially for business use.

Check with potential lenders to ensure you meet their specific requirements before applying.

3. Prepare the Required Documents

Having all necessary documents ready can significantly speed up the approval process. Commonly required documents include:

Identity Proof: Aadhaar card, PAN card, or voter ID.

Address Proof: Utility bills, ration card, or rental agreement.

Income Proof: Bank statements, salary slips, or income tax returns (ITRs).

Vehicle Quotation: A formal quote from the dealer for the three-wheeler.

Photographs: Passport-sized photos of the applicant.

Ensure all documents are up-to-date and accurate to avoid delays during verification.

4. Improve Your Credit Score

Your credit score plays a vital role in determining your loan eligibility and interest rate. First-time buyers with no credit history may find it challenging to secure loans at favorable terms. To improve your creditworthiness:

Clear Existing Debts: Pay off any outstanding loans or credit card dues.

Maintain Low Credit Utilization: Avoid using more than 30% of your credit limit.

Build Credit History: Consider taking a small personal loan or credit card and repaying it on time to establish a positive credit history.

5. Compare Lenders and Loan Offers

Different lenders have varying terms, interest rates, and fees for three-wheeler auto loans. Research and compare multiple options to find the best deal. Look for:

Competitive interest rates.

Minimal processing fees.

Flexible repayment terms.

Prepayment or foreclosure options without penalties.

Online loan comparison tools can help you identify the most suitable lender for your needs.

6. Opt for a Co-Applicant or Guarantor

If you’re a first-time buyer with limited income or a low credit score, applying with a co-applicant or guarantor can strengthen your application. A co-applicant with a stable income or good credit history improves your chances of approval and may also help secure a lower interest rate.

7. Make a Higher Down Payment

While most lenders finance a significant portion of the vehicle’s cost, contributing a higher down payment reduces the loan amount and demonstrates your financial commitment. This can make lenders more inclined to approve your application quickly and offer better terms.

8. Avoid Multiple Loan Applications

Submitting applications to multiple lenders within a short period can negatively impact your credit score. Instead, shortlist a few reliable lenders, compare their offers, and apply to one or two lenders with favorable terms.

9. Ensure Stable Income Proof

Lenders prioritize applicants with a consistent and reliable income source. If you’re self-employed or a first-time business owner, provide proof of regular earnings, such as bank statements or customer contracts. This assures lenders of your repayment ability.

10. Follow Up with the Lender

Once you’ve submitted your application, maintain regular communication with the lender. Respond promptly to requests for additional documents or clarifications to ensure your application progresses smoothly.

Conclusion

Securing a three wheeler auto loan as a first-time buyer doesn’t have to be complicated. By understanding the loan process, meeting eligibility criteria, and adopting proactive measures like improving your credit score and making a higher down payment, you can enhance your chances of quick approval. With the right approach, a three-wheeler auto loan can be your gateway to a profitable venture or a convenient mode of transport, helping you achieve your goals with ease.

0 notes

Text

Get Easy Financing with Three Wheeler Auto Loans

Looking to finance a three-wheeler auto? Our three-wheeler auto loans offer flexible repayment options and quick approvals, making it easier for you to own your vehicle without hassle. Whether you're starting a new business or expanding your fleet, our loans provide the support you need to achieve your goals. Apply today and drive away with confidence!

#ThreeWheelerLoan#AutoLoan#EasyFinancing#BusinessLoan#VehicleFinance#QuickApproval#LoanForThreeWheeler

0 notes

Text

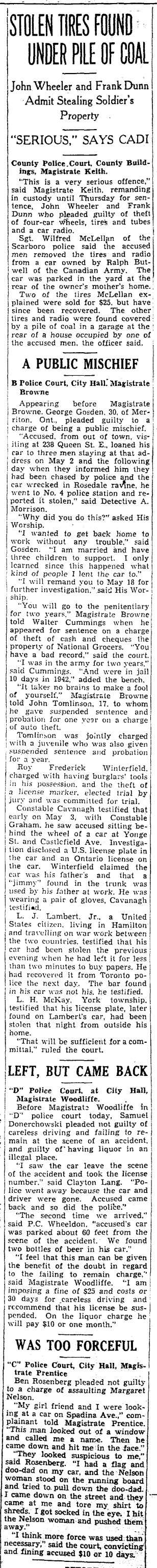

"STOLEN TIRES FOUND UNDER PILE OF COAL," Toronto Star. May 11, 1943. Page 31. --- John Wheeler and Frank Dunn Admit Stealing Soldier's Property ---- "SERIOUS," SAYS CADI ---- County Police, Court, County Buildings, Magistrate Keith. "This is a very serious offence," said Magistrate Keith, remanding in custody until Thursday for sentence, John Wheeler and Frank Dunn who pleaded guilty of theft of four-car wheels, tires and tubes and a car radio.

Sgt. Wilfred McLellan of the Scarboro police said the accused men removed the tires and radio from a car owned by Ralph Butwell of the Canadian Army. The car was parked in the yard at the rear of the owner's mother's home. Two of the tires McLellan explained were sold for $25. but have since been recovered. The other tires and radio were found covered by a pile of coal in a garage at the rear of a house occupied by one of the accused men, the officer said.

A PUBLIC MISCHIEF ---- B Police Court, City Hall. Magistrate Browne Appearing before Magistrate Browne. George Gosden, 30, of Merriton. Ont., pleaded guilty to a charge of being a public mischief.

"Accused, from out of town, visiting at 238 Queen St. E., loaned his car to three men staying at that address on May 2 and the following day when they informed him they had been chased by police and the car wrecked in Rosedale ravine, he went to No. 4 police station and reported it stolen," said Detective A. Morrison,

"Why did you do this?" asked His Worship.

"I wanted to get back home to work without any trouble." said Gosden. "I am married and have three children to support. I only Icarned since this happened what. kind of people I lent the car to."

"I will remand you to May 18 for further investigation." said His Worship.

"You will go to the penitentiary for two years," Magistrate Browne told Walter Cummings when he appeared for sentence on a charge of theft of cash and cheques the property of National Grocers. "You have a bad record," said the court.

"I was in the army for two years." said Cummings. "And were in jail 10 days in 1942," added the bench.

"It takes no brains to make a fool of yourself," Magistrate Browne told John Tomlinson, 17, to whom he gave suspended sentence and probation for one year on a charge of auto theft.

Tomlinson was jointly charged with a juvenile who was also given suspended sentence and probation for a year.

Roy Frederick Winterfield, charged with having burglars' tools in his possession, and the theft of a license marker, elected trial by jury and was committed for trial.

Constable Cavanagh testified that early on May 3, with Constable Graham, he saw accused sitting behind the wheel of a car at Yonge St. and Castlefield Ave. Investigation disclosed a U.S. license plate in the car and an Ontario license on the car. Winterfield claimed the ear was his father's and that "jimmy" found in the trunk was used by his father at work. He was wearing a pair of gloves, Cavanagh testified.

L. J. Lambert. Jr., a United States citizen, living in Hamilton and travelling on war work between the two countries, testified that his car had been stolen the previous evening when he had left it for less than two minutes to buy papers. He had recovered it from Toronto police the next day. The bar found in his car was not his, he testified.

L. H. McKay, York township, testified that his license plate, later found on Lambert's car, had been stolen that night from outside his home.

"That will be sufficient for a committal," ruled the court.

LEFT, BUT CAME BACK --- "D" Police Court, at City Hall, Magistrate Woodliffe.

Before Magistrats Woodliffe in "D" police court today, Samuel Donerchowski pleaded not guilty of careless driving and failing to remain at the scene of an accident, and guilty of having liquor in an illegal place.

"I saw the car leave the scene. of the accident and took the license number." said Clayton Lang. "Police went away because the car and driver were gone. Accused came back and so did the police."

"The second time we arrived," said P.C. Wheeldon, "accused's car was parked about 60 feet from the scene of the accident. We found two bottles of beer in his car."

"I feel that this man can be given the benefit of the doubt in regard to the failing to remain charge," said Magistrate Woodliffe. "I am imposing a fine of $25 and costs or 30 days for careless driving and recommend that his license be suspended. On the liquor charge he will pay $10 or one month."

WAS TOO FORCEFUL --- "C" Police Court, City Hall, Magistrate Prentice Ben Rosenberg pleaded not guilty to a charge of assaulting Margaret Nelson.

"My girl friend and I were looking at a car on Spadina Ave.," complainant told Magistrate Prentice. "This man looked out of a window and called me a name. Then he came down and hit me in the face."

"They looked suspicious to me," said Rosenberg. "I had a flag and doo-dad on my car, and the Nelson woman stood on the running board and tried to pull down the doo-dad. I came down on the street and they came at me and tore my shirt to shreds. I got socked in the eye. I hit the Nelson woman and pushed them away."

"I think more force was used than necessary," said the court, convicting and fining accused $10 or 10 days.

#toronto#police court#scarborough#car theft#car thieves#stealing from cars#burglars' tools#license plates#stolen car#stolen radio#public mischief#suspended sentence#kingston penitentiary#sentenced to the penitentiary#probation#fines or jail#assaulting a woman#excessive force#canada during world war 2#crime and punishment in canada#history of crime and punishment in canada

0 notes

Text

ऑटो रिक्शा लोन कैसे लें | Auto Rickshaw (Three Wheeler) Loan Kaise Le

👉🏼 https://hindifinance.org/auto-rickshaw-loan-kaise-le/

0 notes

Text

Why A Company Needs An Auto Report

An Motor Vehicle Report (MVR Report) could provide an array of advantages for a company. When there's a corporate vehicle involved where there are deliveries being made and employees have access to or is required to operate this vehicle on behalf of the company An MVR Report can save the company many headaches. The report can give companies an understanding of the complete history of the prospective employee's driving. The information provided can play a significant role in the decision of whether or not a candidate is employed. The Kostenvoranschlag shows the status of the driver's license, DUIs, or any moving violations that the company must know about prior to making a decision to hire an individual. This is necessary for insurance purposes.

It is important to understand the insurance policies of your company

If the business owns a vehicle for deliveries or loan out to their workers to travel for work The company must be aware of the standards to hire car or truck drivers. All the time, the company is at the insurance company's mercy. There are companies that will permit only one violation however, others will enforce a strict zero tolerance policy regarding DUIs. Many companies prefer an impeccable driving record in order in order to maintain their rates for insurance to a lesser cost. It is at the discretion of the company if it will choose the best person to drive the car when conducting business. Sometimes, the company will hire employees with clean driving records. Still, once they receive an offense for moving on the company car or a company vehicle, they could be fired or assigned to a new position where they can no have access to a company car. It is their responsibility to maintain a secure driver's record during the period in order to comply with the insurance company's policy. Also, it is a great option to talk with an attorney. They are able to safeguard yourself and your employees from the possibility of charges.

MVR reports for companies that require it

It can be a company with any kind of vehicle such as a van, car, 18-wheeler, or limousine. If the vehicle at issue is a car or truck, then the company only requires a Driver's License Class E. A Chauffeur's License or Class D is needed when a small or van bus will be employed to transport a few of employees. For the rest of the time, you'll need an Commercial Driver's License (CDL) with either a class A C, B or on the vehicle's dimensions and hauling capacity. A MVR Report is critical for your company to ensure that they have employees with most impressive driving records. The company is keen to make sure that their vehicle, staff, passengers as well as loads are secure.

What Information is Included in a MVR Report

The information listed in the kostenvoranschlag of an candidate is clearly and in detail, for the company to make the right decisions. All of the information comes directly from the department of motor car and it shows if the Driver's License of the applicant is in good standing or has been suspended. The majority of MVRs remain in a database for a period of three years, based on state law. Certain states maintain documents for between five and 10 years. Only the state listed on the license will be able to have updated data. If the worker lived in different states prior to the time of the date of their current Driver's License, it would not be listed on their records. The business will ask the applicant to give their complete name, the State listed on the license, as well as the Driver's License number. When the information comes back it will show the state of the license, the class of license, any restrictions as well as suspensions and violations.

Security of Your Company

More information about an applicant increases the odds that the hiring manager will choose to provide the job. If everything comes back clean on the MVR Report, they can look into the work ethics and other aspects that may ensure that the applicant is a great fit for the position. Each company's goal is to earn profits. Insurance costs can be an important factor in determining a company's performance and its the failure. If company vehicles are used this is considered a privilege to the workers. The only way to maintain the luxury is to retain the best drivers. Screening the team is what ensures that a business is operating by ensuring that its employees are reliable. This is only to keep the company safe from getting in a legal bind.

0 notes

Text

Affordable E-Rickshaw Financing: Unlocking the Potential of India's EV Revolution

Electric three-wheelers, especially e-Rickshaws, are paving the way for India's EV revolution. India has made a solid commitment to electric mobility. The Indian e-rickshaw market is estimated to grow at a CAGR of 9%. It will touch $5 billion by 2025.1 The country’s EV transition is gaining traction due to 1) demand creation, 2) state EV policies, and 3) domestic manufacturing. Simultaneously, the market for electric mobility in India is growing, enabled by policy, compelling and improving economics, and the emergence of new business models and investment opportunities. Adopting e-Rickshaws could be accelerated by access to affordable finance provided by creative business models and financial products.

Electric three-wheelers, especially e-Rickshaws, are the driving force behind India's electric vehicle (EV) revolution. With a solid commitment to electric mobility, India's e-rickshaw market is set to grow at a CAGR of 9%, touching $5 billion by 2025. This growth is due to a combination of demand creation, state EV policies, and domestic manufacturing. However, to accelerate the adoption of e-rickshaws, access to affordable finance is critical.

Business Models for E-Rickshaw Financing

The automotive industry's financing penetration varies greatly between categories, affecting the total cost of ownership, asset size, creditworthiness, and vehicle use cases. While less expensive segments and use cases see lower levels of financing with growing affluence, the unregulated e-rickshaw segment is unique. The penetration of funding by the organized sector is very low due to the high-risk nature of borrowers. Several important business models are present in the sector to meet the diverse needs of clients.

The vehicle finance sector involves a wide range of stakeholders, from long-term investors who provide debt and equity capital to OEM-owned NBFCs and state-owned commercial financial institutions. For the E-Rickshaw finance sector to transform sustainably, every participant is essential. Yet, to increase market penetration and consumer confidence, private sector banks, captive financiers, insurance companies, and long-term investors should take the lead.

Scaling E-Rickshaw Finance with PSL

PSL inclusion can be an important near-term solution to scaling e-rickshaw finance in the following ways:

Incentivizing banks to lend to EVs: Banks may be directly encouraged by inclusion to increase lending to meet priority sector targets. Banks that don't currently finance e-rickshaw might think about doing so, while banks that do might be inspired to develop specialized financing solutions with lower interest rates and longer loan terms.

Improving access to finance for NBFCs: NBFCs will be crucial to increasing e-rickshaw financing as they have increased their market share in auto financing over the past five years.

Institutionalizing the importance of EVs in India's financial industry: Constituting EVs as a priority sector can help institutionalize the asset class in the industry. Banks will be encouraged to build up their understanding of EV technology, policy, and business models.

The Way Forward

To meet its oil and energy demands, India must address rising emissions and import dependency by utilizing electric mobility and other alternative fuels. The potential of E-rickshaw in India has also gained the attention of industry players. Yet, switching to EV rickshaws also presents particular challenges. India's EV supply chain is still in its infancy and entirely reliant on imports. To accomplish the value-price equation, innovative business methods are necessary.

Long-term policies with clearly defined quantitative targets for demand and supply are needed. Charging infrastructure expansion needs to be fast-tracked, considering the overall growth of EV sales in the past two years. Schemes to promote the financing and leasing of EVs are essential, and a national-level EV awareness campaign is required to increase demand. Initiatives at the central and state level are necessary for skill development. By addressing these challenges, India can unlock the full potential of its e-rickshaw market and accelerate its transition to electric mobility.

0 notes

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, a three-wheeler, orto, said it was Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, a three-wheeler, orto, said it was Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Bajaj Auto bankruptcy invests Rs. 1,450 crores.

Friday wheels and three-wheeler, a three-wheeler, orto, said it was Rs. According to automated Major, investment stock capital / preferential capital / preferential capital / loans – determined or otherwise transformed or otherwise. Bajaj Auto International Holdings holds a 49% shares of Austrian bicycle Markeer CTM. The rest of Israel Mobilrika Group emerges. On November 29, 2024, KTM announced…

0 notes

Text

Benefits Of Personal Loan for Your Dream Car- Three Wheeler finance

It is truly a feeling of great excitement to buy your own vehicle. Let it be for personal or business use, with our hassle-free vehicle loans, you can finally own your dream vehicle as you have always wanted to. Raftaar Loans by Ujjivan Small Finance Bank gives customized financing options with maximum funding value to the on-road price of the vehicle. Our loan approval and disbursal processes are quick, transparent, and require minimal documentation, making the whole loan application process simple and quick. At Ujjivan Small Finance Bank, we help you materialize your dream of owning a two-wheeler, three-wheeler, electric three-wheeler, or small commercial vehicle loan swiftly.

The Indian two-wheeler market is one of the most competitive in the world. The sheer number of players and their ability to innovate, coupled with the rising popularity of two-wheelers, has made the industry a prime target for investors and financiers alike.

Finance companies have been investing heavily in this segment, with many offerings various loan schemes for buying new or used vehicles. However, many customers are still confused about how to choose the right product for them. This article aims to provide you with some tips on how to buy a two-wheeler using our personal loan scheme.

Whether it’s for your daily commute or for weekend rides, we have the perfect loan option for you. We offer up to 2.75 lakhs to buy the two-wheeler of your choice. Moreover, we endeavor to make the loan application process simple and straightforward, requiring only basic documents and providing a quicker decision time for loan sanction.

Features and Benefits include:

● Customized financing options to cater to all types of 2-wheelers needs

● Up to 95% funding on the on-road price

● Flexible tenure options, ranging from 12 to 48 months

● Hassle-free documentation

● Competitive interest rates

● Individuals whether salaried or self-employed with minimum work experience of a year aged between 18 to 59 years are eligible for the loan

● Easy repayments

Ujjivan Small Finance Bank provides hassle-free three-wheeler finance. We have a wide range of options available for both diesel & petrol engine variants. Our focus is to provide timely credit with quick, hassle-free processing and simplified documentation.

Features and Benefits include:

● We provide customized financing options for both Diesel & Petrol Engine variants.

● Up to 90% funding on the ex-showroom price.

● Flexible repayment options, ranging from 12 to 48 months

● Hassle-free documentation

● Individuals whether salaried or self-employed with minimum work experience of a year aged between 21 to 59 years are eligible for the loan

The electric three-wheeler market is growing at a rapid pace. We support you with an electric three-wheeler loan to add momentum to your income and life. We provide loan solutions to help you buy an electric 3-wheeler to facilitate your journey of becoming financially independent.

We have made the process of loan application and disbursal simple to ensure that you receive the loan quickly through minimum documentation for an electric three-wheeler loan.

Features and Benefits

● Customized financing options for both the battery types - Lead Acid Battery and Lithium-Ion Battery

● Up to 80% funding on the on-road price

● Flexible repayment options, ranging from 12 to 48 months

● Hassle-free documentation

● Individuals whether salaried or self-employed with minimum work experience of a year aged between 21 to 59 years are eligible for the loan

Ujjivan Small Finance Bank is a leading small commercial vehicle financing provider in India. We offer a wide range of options that cater to the needs and requirements of aspiring small commercial vehicle buyers. We have an extensive network of dealerships across the country, which ensures that your vehicle can be delivered at your doorstep.

We have tailor-made loan programs for all types of commercial vehicles, from delivery vans to heavy trucks. We offer flexible repayment options, ranging from 12 to 60 months for our customers, who can either pay off their loan in full- or on-time payments.

Our customized financing options for small commercial vehicles with weighing capacity of up to 3.5 tons are designed to help you maximize your profits. Our loan products include:

● Loans against ex-showroom price

● Up to 90% funding on ex-showroom price

● Flexible repayment options, ranging from 12 to 60 months

● Hassle free documentation

The minimum documents required for a loan are:

● KYC documents

● Commercial Driving license

● One security cheque

● One passport-size photograph

● Own House Proof Document (Based on assessment or scheme).

Your dream is ours too! Let us help you fulfill them. The best part is all you must do is fill out a form with the requested details and you will be done in no time. So simply call us or walk into our office and seize this golden opportunity of yours.

#three wheeler finance#3 wheeler auto finance#three wheeler auto loan#3 wheeler auto loan#electric three wheeler loan#three wheeler loan

1 note

·

View note

Text

The Inspiring Journey of Mr. Shrikant Badve: From Vision to Industrial Triumph

Entrepreneurial Beginnings

Born into the vibrant culture of Maharashtra, Mr. Shrikant Badve exemplified determination from a young age. Opting to be a job creator rather than a job seeker, he embarked on his entrepreneurial path right after graduating. Despite the hurdles in securing funding due to insufficient collateral, his perseverance shone through. With an initial investment of just Rs. 20,000 ($240), Mr. Badve laid the foundation of what would become a powerhouse in manufacturing. His breakthrough came when Saraswat Co-operative Bank approved his first loan, setting the stage for his future successes.

Growth Trajectory

From humble beginnings with a monthly turnover of just Rs. 8,000 from a single shed in Aurangabad, Belrise Industries has soared to a staggering annual turnover of Rs. 5,433 crore in 2022-23. Today, the company boasts 16 state-of-the-art manufacturing facilities across eight states, a testament to its aggressive domestic and global expansion. This growth is supported by a robust supply chain and an ever-expanding customer base.

A Visionary Leadership by Mr. Shrikant Badve

Mr. Shrikant Badve, a first-generation entrepreneur with a solid background in engineering and business management, has become a notable figure in the automotive manufacturing industry. His expertise and leadership have been pivotal in steering Belrise Industries to its current heights.

Diversification and Innovation in Automotive Components

Belrise Industries specializes in an array of automotive components and systems for vehicles across the spectrum— two-wheelers, three–wheeler, four-wheeler and commercial vehicles. The company’s extensive product line includes advancements in sheet metal processing, polymer processing, surface treatment, suspension and braking system. Notably, it is a leader in developing cutting-edge e-Mobility solutions and Advanced Driver Assistance Systems (ADAS).

Strategic Expansion and Diversification

Since its inception in September 1996, Belrise has continuously evolved. Starting with manufacturing silencers for Bajaj Auto in 1997, it has diversified into producing sophisticated suspension systems, particularly as the electric vehicle (EV) market in India gains momentum. In 2022, Belrise marked a significant entry into the EV sector, supplying crucial systems to major EV manufacturers.

Leveraging R&D for Market Leadership

Belrise Industries harnesses its extensive R&D capabilities and strengths in new product development to deliver innovative solutions tailored for global Original Equipment Manufacturers (OEMs). This strategic focus has cemented its reputation as a leading provider of specialized automotive solutions.

Excellence in Technical Competence

The company’s consistent performance and advanced technical competencies make it a preferred one-stop solution for OEMs worldwide, highlighting its commitment to quality and innovation.

Technological Advancements and Efficient Systems

Guided by Mr. Badve, Belrise has implemented highly efficient systems and technologies, including the integration of over 400 robots in fabrication and stamping processes. This technological leverage significantly reduces parts per million (PPM) rejections, enhancing overall production efficiency.

Real-Time Production Monitoring Through IoT

By adopting Internet of Things (IoT) technologies, Belrise has developed a centralized data acquisition system that enables real-time production monitoring and immediate bottleneck resolution, thus enhancing manufacturing agility and responsiveness.

Vision for Global Excellence

Mr. Shrikant Badve’s long-term vision is centered on delivering top-tier engineering products and becoming a globally recognized brand within the automotive sector. His commitment to technological advancement and customer-centric approaches drives the company’s ongoing efforts to expand its presence in international markets.

Fostering Team Success and Innovation

Mr. Badve is dedicated to cultivating a diverse and passionate workforce, focused on collaborative innovation and continuous improvement. This commitment not only drives the company’s success but also fosters a proactive and inventive organizational culture.

Value-Driven Transformation

Belrise is committed to transformation driven by core values such as passion, resilience, and relentless dedication. By fostering a unified team spirit and prioritizing adaptability, sustainability, and state-of-the-art technology, the company aims to enhance its operational efficiency significantly.

Championing Gender Diversity and Inclusion

Belrise Industries is a frontrunner in promoting workplace diversity, equity, and inclusion. By empowering women and creating a culture of equality, the company enhances creativity and drives innovation across all its divisions, from HR to R&D and production.

0 notes