#this is my 1000 followers event officially that’s how i’m justifying it

Text

eggy’s slasher summer horror special (1.5k followers event)

yn and her friends thought they would get a break from the stresses of university life by renting out a cabin in the woods for a weekend. they didn’t know what awaited them there in the trees and how it will unravel them

divider credit to strangergraphics

WHAT IS IT: a voting based slasher smau where you, the reader, decides who gets to live and who’s not so lucky, and who, ultimately, is responsible for their downfall

HOW IT WORKS: you, the reader, can vote who’s next on the chopping block by sending me an ask after each new chapter is published. you decide who is next to meet their maker, and eventually, who is sending them there. i will not publish these asks

WHEN IS IT: this will be a week long event starting 7/8. i will post one chapter a day during that week until it is finished.

WHO’S GOING TO THE CABIN: you are dear reader! make sure you vote in this poll to see which friends are going with you!

RULES AND WARNINGS: votes must be submitted in a timely matter to be counted. i will only accept votes via ask to keep them a secret and a surprise. MDNI. this is going to be a HORROR based smau. it will be camp and silly (think friday the 13th meets bottoms meets bodies bodies bodies meets cabin in the woods). this is an UNREALISTIC dark comedy. this is not going to be graphic by any means and is not intended to be scary but i am still going to be KILLING PEOPLE OFF. this is an homage to summer slashers !

STATUS: completed

TAGLIST: closed/maxxed out

INTRODUCTIONS: up on the chopping block!

CHAPTER ONE: a man in a mask

CHAPTER TWO: halloween’ed

CHAPTER THREE: murder cabin

CHAPTER FOUR: copycat ghostface

CHAPTER FIVE: cliché

CHAPTER SIX: mask off

#SORRY IM SORRY DONT BE MAD AT ME IM SORRY#this is my 1000 followers event officially that’s how i’m justifying it#i’m not counting this as a new fic i’m counting it as more of an event#if this flops you never saw this#haikyuu x reader#haikyuu#hq x reader#hq x you#hq#haikyuu smau#haikyuu texts

277 notes

·

View notes

Text

Slavic Names in Twilight | Meta

This post is going to be long, so if you don’t have time, I advise you to come back here later (or not come back at all, up to you).

Honestly, I have no words for Smeyer anymore. I, probably like most of us, read the books while being an adolescent. When I was 12 I didn’t see a lot of things that happened to be in the books and were:

a) misogynistic

b) sexist

c) abusive

d) racist

and that the story itself was bound to Mormons (sick!).

If you want to read about it a little bit more I strongly recommend this post by @stregoni-benefici and @carlislesscarf

This post isn’t going to be about how Smeyer treated The Quileute Tribe, indigenous people, people of color or women. This post is going to be about how lazy Smeyer exactly was while creating this story and how her prejudices influenced and created false image of yet another culture.

Why am I making such a fuss because of this? A few days ago I was reading something about Garrett on Twilight Wiki page. By sheer luck, I clicked on Kate’s character and, what I saw there, outraged me to the point where I needed a little while to calm myself.

I was 12 when I first read the books. I never bought official twilight guide, I only used Twilight Wiki to keep myself up to date. I clicked on Kate’s character and saw that she hails from Slovakia. Forgive my utter confusion, when I remembered other sisters’ names. Tanya and Irina. Also, Kate was created by Sasha, who also created Vasilli (an immortal child), which is why she was executed in the first place.

While the story is charming, WHY THE FUCK DO THEY HAVE SUCH NAMES?!

To understand my rage, I need to elucidate the matter a little bit for all of you. This will be the historical part.

According to Twilight Wiki, Sasha was changed before 1000 AD. Then, she created Tanya, and not very long after, Kate and Irina. And now. What were the historical odds while it happened?

Before 1000 AD, Slovakia wasn’t Slovakia but Great Moravia. Great Moravia lasted about a century - the time span here is approximately circa 820 AD to 906 AD. When Great Moravia no longer existed, territory was taken by Hungarians (Magyar tribes also referred to as Hungarian clans) and the development of future Kingdom of Hungary began. Then, around 1000-1001, King Stephan was crowned as the first King of Hungary. Some elements from the former Great Moravia were acquired by The Kingdom of Hungary.

King Stephen managed to establish eight counties within his kingdom. Around 1015 some territories of today-Slovakia were acquired by Boleslav I of Poland (later king of Poland), however, King Stephen managed to recapture the territories in 1018. Wikipedia isn’t consistent here - while on History of Slovakia we have these information, the History of Poland during the Piast dynasty says:

From 1003 to 1004, Bolesław intervened militarily in Czech dynastic conflicts. After his forces were removed from Bohemia in 1018, Bolesław retained Moravia.

and:

[translation here is mine as the site is in Polish] Between 1003 and 1025/1031 the lands of today's Slovakia were part of the Kingdom of Poland after being conquered by Bolesław Chrobry. The Polish-Hungarian Chronicle described that "The Polish borders stretched as far as the banks of the Danube, to the town of Ostříhomia, then to the town of Eger, and further to the river called Ciepla [Topl'a] as far as the town of Salis, and there the borders between Hungarians, Ruthenians and Poles ended".

Than, probably around 1031 AD the territories were acquired back. King Stephen died and his kingdom fell into internal conflicts. Soon, in 1042 AD emperor Henry III mingled to acquire some lands for himself (he was the Holy Roman Emperor). Anyway, then came 1048 AD and that’s what happened:

In 1048, King Andrew I of Hungary conceded one-third of his kingdom (Tercia pars regni) in appanage to his brother, Duke Béla. [...] During the following 60 years, the Tercia pars regni were governed separately by members of the Árpád dynasty. [...] The dukes accepted the kings' supremacy, but some of them (Béla, Géza and Álmos) rebelled against the king in order to acquire the crown and allied themselves with the rulers of the neighbouring countries (e.g., the Holy Roman Empire, Bohemia).

The history of the Tercia pars regni ended in 1107, when King Coloman of Hungary occupied its territories taking advantage of the pilgrimage of Duke Álmos (his brother) to the Holy Land. Although, Duke Álmos, when returned to the kingdom, tried to reoccupy his former duchy with the military assistance of Henry V, Holy Roman Emperor, but he failed and was obliged to accept the status quo.

Source for the two quotes above.

You may ask, why on Earth did I just present to you part of history of Slovakia, Poland and Hungary. Because I want you to understand how completely ridiculous and simultaneously offending are the names of characters that Smeyer gave within this coven.

History shows us that, even though, these times weren’t exactly peaceful, there wasn’t an ongoing war. We have Hungarian tribes and the part, when some territories were acquired by a Polish king. What I mean by that, is that probably names around 1000 AD varied as to where your family lived, what was your social status, and probably were influenced by newly adopted Christianity. It is more likely that people on this lands were named with names of Hungarian origin than Russian. And I still think the majority of names were of Slavic origin, only with some local variations going on.

Now, a little bit of common knowledge. People who descend from Poland, Slovakia, Czech Republic and Hungary are best buddies for life, even if they never saw each other. We have mutual respect for these countries and for ourselves, as our history brought us together multiple times (bad times and good ones). Russia IS NOT a part of this “mutual respect pact”. Mostly due to events that happened during both World Wars (i.e. Katyń Massacre), as well as other ones (Partitions of Poland, Eastern Bloc - communism).

Most of the names used by Smeyer are of Russian (or Greek, or Hebrew) origin. Not Slavic origin. And while Russia is also the part of Slavic languages, there’s a significant distinction between West Slavic Languages (Slovakian, Czech, Polish language), East Slavic Languages (Belarusian, Russian, Ukainian) and South Slavic Languages (i.e. Serbian, Croatian, Bulgarian).

It makes difference to the point that if I go to Slovakia or Czech Republic I'm able to communicate with people in my native language (Polish) while they can answer me in their native language. Not everything is going to be the same but you're able to maintain a conversation mostly about every topic that you'd like to discuss. It isn't impossible to do so with Russian or Ukrainian but it's much harder and there are more differences, and sometimes you aren’t able to communicate this way. The same goes with i.e. Croatian or Bulgarian.

Don’t get me wrong, dear friends from Russia (if anyone from Russia will ever read this). I’m pissed off because even though Smeyer created not one, but four characters with SLOVAKIAN origin, she didn't use at least one name which fully originated in that territories (and probably was used) around 1000 AD. She went for Russian names because, sure, let's do that, there's no big difference anyway and it’s easier. To add to that, Smeyer used Russian names which are widely used NOWADAYS, not ones which were probably popular (or just used) thousand years ago.

Now, quick briefing on very popular names from that time (c. 1000 AD) in Slovakia and Czech Republic.

Here’s the full article on Slavic names.

While some of these names are used today, some of them aren’t at all or are used in a different, more evolved form.

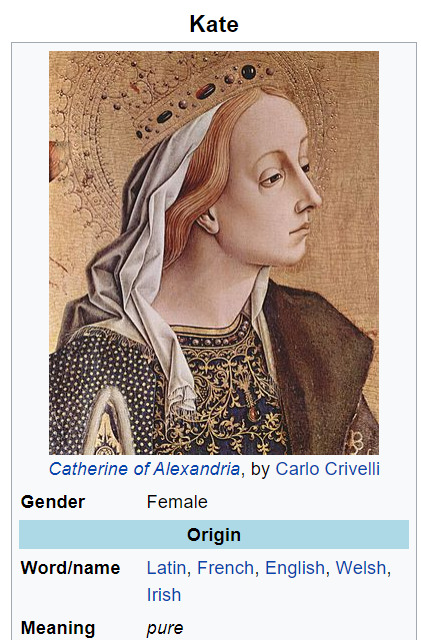

Now, to the names of our characters. The most explainable and justified name here is Kate’s name. In Twilight Wiki we can find that her actual name was Katrina and that her preferable name now is Kate. Let’s see the origins of the name Kate.

Full article here.

While we can read that variations of that name in Czech are: “ Katka, Kateřina, Kačka, Káťa, Kačenka, Káča, Kačí, Kačena” and in Slovakian “Katka, Katarína” still the origins aren’t Slavic.

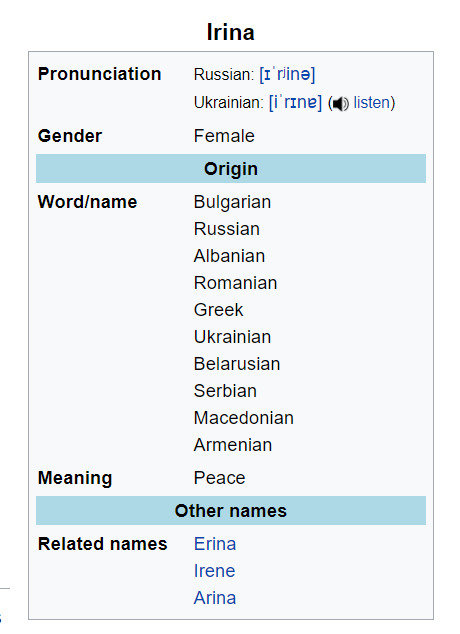

Next, Irina.

As Wikipedia says:

Irina is a feminine given name of Ancient Greek origin, commonly borne by followers of the Eastern Orthodox Church. It is derived from Eirene (Ancient Greek: Εἰρήνη), an ancient Greek goddess, personification of peace.

Diminutive forms in Slavic languages include Ira, Irinka, Irinushka, Irisha, Irka, Irochka, Irinochka.

Here, we also don’t have Slavic origin. While it’s better than with Kate’s name because origins here seem to hugely blend, the proper origin of Irina’s name is Ancient Greek. I will never believe that a peasant girl from around 1000 AD was named Irina.

Here’s the full article.

Next, Vasilli.

Wikipedia doesn’t say much, except it’s a RUSSIAN NAME with Greek origin.

Full article here.

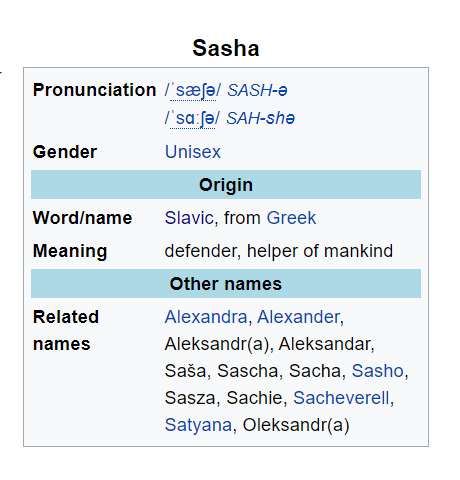

Now, finally, we’ve two names left. First, Sasha.

Finally, first one, which has Slavic origin. And while this name has many variations in many languages, I don’t believe that anyone in Slovakia prior to 1000 AD would name their child Sasha. This name gained popularity in 1970s, and I believe that it would be used rather as diminutive of a name in 1000 AD than a name itself.

Full article here.

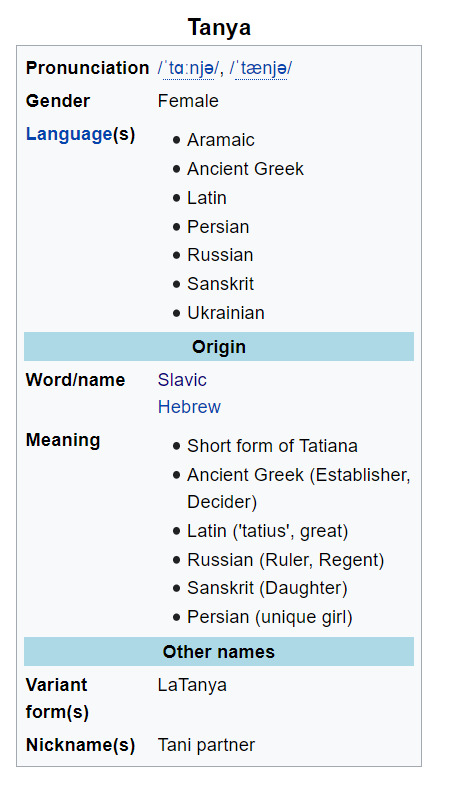

Last, but not least, Tanya.

Here, also, it isn’t a full name. Full name is Tatiana, and Tanya, especially in Slavic it is used as a nickname implying intimacy with the person OR used for baby talk.

Full article here.

What’s my point here? Even though two of these five names are partially Slavic in origin, they sound like Russian names. Not Eastern Slavic in one fucking bit. Sure, Smeyer could do a simplification and say that, yeah, girls acquired other names as centuries passed. Agreed, even strongly.

BUT

Smeyer never said anything like this. Also, I’m under the impression that this names were meant to sound Russian. And, people, don’t get me wrong, I really hold nothing against Russians, but because of doing such thing Smeyer has perpetuated certain patterns and beliefs that have become firmly established in US culture and West culture in general by now.

No wonder why some people never distinguish between Russia, Slovakia, Poland, Czech Republic or Ukraine, or other countries from Easter Bloc. How can they, where in majority of mass media they’re taught that IT IS EXACTLY THE SAME THING. Why should they bother?

I have many friends among Slovakian people. Slovakia is like a second home to me. I also have a few friends from Czech Republic. And before, I’ve never been bothered by this name thing because I was a child. Today I couldn’t be silent about it.

It’s sad that another culture and fantastic history was just blended in with Russia because why not. I don’t understand why in Western movies or books all people from former Eastern Bloc need to be Russian.

I am Polish and to me it’s just extremely sad. We (and I think I can count in here Slovakia, Czech Republic, Hungary, but also Croatia or Serbia) have fantastic culture and very long, eventful history. People from these countries are welcoming and share great hospitality.

I don’t know why Smeyer did something like this, but I suppose it’s just a thing she does to everyone. Rip away their culture and pretend she didn’t do it.

I am grateful that this fandom is a lot wiser than the creator of the books. This is what I said in the beginning of this post. Smeyer could’ve gone to library and read a little about the history and the names. I mean, If she didn’t found it on the Internet, because it was 2006, I believe, so she could research it. If there was nothing on the Internet, I’m sure a library would do.

She did a poor research or didn’t do it at all. And that’s what happened. Was it worth it? I don’t think so.

***

Everyone, please, comment, but be kind to each other (and to me xd). I wrote what I felt. As I’ve told you already, I’m Polish and I really felt that I should write this meta/disclaimer from a point of view of a person who lives in Slavic-origined country and has many Slavic-origined friends.

I still feel triggered because of this. Reblog this so others could see and say what they think.

#twilight meta#slavic culture#polish culture#history#cultural and historical references in twilight#smeyer being an ignorant discourse#smeyer nonsense#this woman is bound to white supermacy#Slavic names#Polish & Slovakian historical background#twilight revival#the twilight saga#smeyer cannot use library properly#neither can she use internet#slovakian culture#why the fuck should you confuse Slovakian people with Russian people?#Hungary mentioned#twilight#twilight saga

120 notes

·

View notes

Link

19 Apr 20 • 27 tweets • timkmak/status/1251936242834563073

@timkmak

THREAD – History doesn’t repeat itself, but it rhymes: a

thread about the Anti-Mask League of 1919.

I’m not kidding I went HAM researching this

So, starting in Sept 1918 San Francisco suffered from Spanish Flu pandemic. Initial mask wearing was good — around 80 percent. By November cases were down, and public health officials recommended re-opening the city. Residents rushed to entertainment venues after having been denied this communal joy for months. The Mayor himself was fined by his own police chief after going to a show without a mask.

But a second wave surged in Dec 1918, and SF’s Health Officer again urged people to wear masks voluntarily. Left to their own devices, most citizens – by one count 90 % – refused to wear masks. Businesses, concerned about Christmas sales, opposed. So did Culinary Workers union. San Francisco residents were fed up. This was the second wave of the pandemic, and they had already spent months between Sept and Nov being hassled, fined and even arrested for not having a mask on. Challenges of constitutionality were heard. Christian Scientists objected, arguing that it was “subversive of personal liberty and constitutional rights.” Civil libertarians argued that if health officials could force them to wear masks, then it could force them to inoculate “or any experiment or indignity.”

The San Francisco Chronicle turned against the notion of mandatory masks.

Was the death rate high enough to justify remasking?

Wasn’t this just the return of normal seasonal colds?

How much was this due to a public ‘scare’ and hype?

An op-ed ran in the local paper w/headline ‘What’s The Use?’ after a man got sick despite following public health guidelines. A promised vaccine turned out to be bogus 100s of citizens congregated on Dec 16 to debate a masking order. On Dec. 18 someone had sent what appeared to be an improvised explosive device to San Francisco’s public health official signed, ‘Compliments from John.’ (!!!)

The story via historian Alfred W. Crosby:

San Francisco’s Public Health Officer stuck by his guns, refusing to back down, and saying there was evidence that masks helped! He implored the public to look to the data! Wear masks! They help!

More via Crosby:

But the public declined to listen to SF’s Public Health Officer. On Dec 19, officials voted down a mandatory mask order.

“The dollar sign is exalted above the health sign,” sighed the public health officer.

Protests continued: Over 2,000 people attended an event formed by San Franciscans called themselves ‘THE ANTI-MASK LEAGUE,’ denouncing the mandatory masking ordinance The gathering was of “public spirited citizens, skeptical physicians and fanatics,” writes historian Crosby. Moderates in the Anti-Mask League wanted to circulate an anti-mask petition. Extremists wanted to initiate recall proceedings of SF’s Public Health Officer. Chaos broke out until someone shouted, “I rented this hall and now I’m going to turn out the lights.” (Mak note: lol) The San Francisco Public Health Officer was a man named Dr. William C. Hassler. Think of him as the 1919 Dr. Fauci. Ignored by those who didn’t want to believe the data, threatened with violence, Hassler was conscientious and performed his job with distinction. I haven’t read anything about how many people became sick DUE to the Anti-Mask League event, where 1000s gathered to protest without masks. So we may not know how many people, if any, became sick due to this congregation. But safe to say it was not helpful during pandemic. On Jan 17, the day the masking ordinance went into effect, the # of new cases/deaths declined, the first decline in quite some time. This continued until the epidemic faded, a signal that the mask ordinance had helped wipe out the Spanish Flu in San Francisco. Of course, the SF Public Health Officer — the 1919 version of Dr. Fauci, got no credit for the decline in influenza cases. People continued to gripe about the masking even after the pandemic had been stalled by it. No one seemed to credit masking for the success of blunting the Spanish Flu in San Francisco — because, well, the crisis faded due to its success. “Rarely has the evidence in support of a scientific hypothesis been more overwhelming and more deceiving,” writes historian Crosby. Ultimately San Francisco was one of the American cities hardest hit by the Spanish Flu.

673 per 100,000 people died during the pandemic due to influenza and pneumonia, per U of Michigan.

50K cases total and 3,500 were killed, per Crosby.

PHOTO: Masks being worn by players during a baseball game, in newspaper Mar 1, 1919 via The Independent

https://books.google.com/books?id=1VusiXy6QQEC&pg=PA2…

The 1918/1919 protests against mask wearing and other public health measures have parallels to today. We learn through this episode that various groups of Americans have been pushing back against public health measures for more than a hundred years — and for similar reasons!! In learning about the Anti-Mask League of 1919, we see many of the same human elements as today: a portion of the population resistant to the measures; a business community crying out for relief; a second wave after an initial loosening; threats to public health officials. This is essentially a report that I pieced together by reading sources after getting curious about the 1919 Anti-Mask League. Any mistakes are my own. I started by drafting a few tweets and then spent an hour and a half researching it last night. One thing led to another…

SOURCES:

The University of Michigan’s Influenza Encyclopedia

The San Francisco Chronicle’s archives

America’s Forgotten Pandemic: The Influenza of 1918 by Alfred W. Crosby

American Pandemic by Nancy Bristow

• • •

I went on the @NPREmbedded podcast to talk at length about the 1918/1919 Anti-Mask League in San Francisco! You can listen to it doqn below, or read about it in the thread up above:

Covering Covid: Backlash – Embedded

Listen to this episode from Embedded on Spotify. A small but vocal minority of people are pushing back against public health measures experts say are life- saving. Turns out this is not the first time…

Spotify Link

0 notes

Text

WARNING! Bitcoin Savage Price Fall If Central Banks Get Their Way [MUST SEE]

VIDEO TRANSCRIPT

Today in Krypto, a little known financial body called the Financial Stability Board could be dropping the equivalent of a nuclear bomb on the entire crypto-economy with a recommendation to ban all stable coins. Now, if this motion succeeds and it is indeed passed into law by the world’s major economies, then we could be facing a bit of a crypto apocalypse, with prices plunging potentially to unimaginable lows. If all stable coins are removed from the market. So even if you are not a stable coin holder, you need to hear this because this is a massive assault on the cryptocurrency industry and is really showing that cryptocurrencies are worrying the banks in a major way. The crypto lark, this is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. And if you are due to crypto, then I have made a beginners course to save you your time and to save you money by walking through all of the basics, like how to buy sand mine and store bitcoin in an area with step by step tutorials and top resources. There is a link down below where you can learn more. So the big story of today is that the Financial Stability Board has outlined 10 recommendations to central banks for regulating stable coins, including total pro habitation. Now, you have probably never heard of the FS B, but it is a powerful organization comprised of central banks and finance ministries from the world’s major economies. Now, of course, the board has also hosted and funded by the Bank for International Settlements. The Bank of International Settlements, in case you don’t know, is like the central bank of central banks. It’s kind of like the head of the evil octopus whose tentacles stretch out and just suck the life force out of countries around the world and just hand everything over to the bankers. That’s the B, I guess, or the big B.S., if you will. Now, the FSB issues non-binding recommendations, but more often than not, these recommendations and up being implemented and the recommendation that the FSB just made to the G20 is that stable coins are a big threat to the power of the banks and that major stable coins including USD T USD C T USD Paxos and die should be prohibited now just for reference. The G20 consists of the following countries, which is basically a list of all of the world’s major economies. We have Argentina. Australia, Brazil. Canada. China. France. Germany. India. Indonesia. Italy. Japan. Mexico, Russia. Saudi Arabia. South Africa, South Korea. Turkey. The United Kingdom, the United States and the E U. So that’s all the big ones. All the big ones right there in one group. And they’re all talking about the potential to ban stable coins. Now, not only is the world the world’s biggest economies, but those markets also make up basically the entire volume of the entire crypto industry. And just for fun, too, the FSB also counts among its members, the IMF, the World Bank and the European Central Bank, in particular, the SDF FSB warned that stable coins could pose a big risk to global financial stability, especially in emerging markets and developing economies. I mean, hey, you can’t have people in developing economies getting financial freedom that just wouldn’t work for those big, powerful central banks. No, no, no, no, no. Not today, my friends. The FSB goes on to state that stable coins also pose significant governance challenges to central banks in particular. They are concerned that citizens in both advanced and emerging economies might begin favouring stable coins over existing fiat currencies. Did you hear that? The bankers are scared. Crypto has indeed kicked the frickin hornet’s nest and the bankers are worried about the implications. Decentralized, open public networks are a real and present danger to the monopoly of power that the central banks currently enjoy. We should really be proud of away. Cryptos made it, guys. We’ve made it. They’re talking about us at the highest levels of the global economy, the central banks of the world. They are scared of crypto technology can end the tyranny of central banks in their commercial bank whores. In a way, this is all incredibly exciting. Now you might say, hey, look, I don’t own stable coins laughs. So why should I care? Well, for a few reasons. Racing stable coins will absolutely crush daily volumes in the crypto industry. Stable coins make up more than $40 billion a day in volume, which is nearly half of the daily spot market volume. It will also have a very negative impact on the crypto lending markets and of course, also on decentralised finance markets, which basically are all of the financial services beyond just sending bitcoin from person to person. B all the services, the auction, crypto useful for billions and billions of people. Also, we should always speak up for financial freedom. Freedom is freedom. Free markets are a great thing, not Ranzie That quote from World War 2. First, they came for the Socialists and I did not speak out because I was not a socialist. Then they came for the trade unionists and I did not speak out because I was not a trade unionist. Then they came for the Jews and I did not speak out because I was not a Jew. Then they came for me and there was no one left to speak for me. Now apply that same logic to crypto. First, they came for the privacy coins and I said nothing. Then they came for the stable coins and I said nothing. And when they came for bitcoin, there was no one left to speak up. If you are a bitcoin maximalists and you’re out there cheering this on, say yeah, take down all the stable coins man, wake the fuck up. The exact same reasons that they are citing today to justify a stable coin ban that will be used against bitcoin in the future. Yes, today it’s stable coins, but tomorrow it will be basically anything that threatens the Fiat monopoly that the central banks have over society. And that thing, if you are really a believer in bitcoin, is bitcoin. Well, the bankers cannot shut bitcoin down. They can certainly do a whole heck of a lot to regulate it into impotence. The fight for financial freedom is everyone’s fight. Now, look at a practical level here. It will not stop all stable coins. It will certainly shut down the regulated and semi’s regulated ones, things like USD C and Paxos as well as course as Heather. Now, these coins are uniquely vulnerable because there are people who can be arrested and forced to shut the whole gosh darn thing down. There are bank accounts which can be seized by authorities, thus shutting the whole gosh darn thing down. Di, however, will be much, much harder to stop because this is really a decentralized, stable coin and it may not even be stoppable since it is really just a crypto-backed collateral coin, but that remains to be seen if they will be able to stop that or not should all of this go through. And hey look. Yeah, sure. Teather is a mess. I’ve been a very critical teller for a long time, but others like Dai and U.S. DC, they are not stable coins or a very useful part of the crypto economy and they should exist. Also a stable coin band likely through bitcoin into what could be the worst bear market of all time. I mean this if this happens, we could see a sub $1000 bitcoin. A nice time for buyers, right? I would totally be stacking some bitcoin at those prices, but such an event I think would actually destroy a lot of people’s faith in the crypto industry overall now long term. This could be positive for bitcoin only being traded directly in and out of fiat. But it will also push the industry more towards really highly regulated exchanges and more into the hands of Wall Street in the long run. The FSB man. Seriously, what the fuck are these guys anyway? More on elected bureaucrats. Just pull in our pants down and give us dirty old Roggeveen bureaucrats. Man bureaucrats. Anyway, this story extra reminds me of a story from last year about the F A T F and the coming implementation of the travel rule. You see the F A.T.F. On the issues recommendations like the FSB does and their recommendation was to do KYC on every withdrawal happening from crypto exchanges and of the official wallet providers. And to have the addresses for these wallets connected to names and ideas. Well, you know what? That recommendation that’s happening within the next year, we are likely to see a full implementation of the F 80 FS travel rule on to crypto. These unelected governing bodies, they have massive power. Welcome to the slave planet. My friends, now I know this. Some of you may be thinking lark’s out here spreading fraud Dardari. No, no, that’s not what I’m doing. These are real laws being considered and knowledge is power. You should always know what is going on in the industry. What I see here is that currently, in spite of the whale manipulations we have in the crypto market, we actually have a largely free 24/7 marketplace with crypto. I want to keep it that way. I the crypto Marcus me as free as possible. We do not need nor do we want bureaucrats to tell us what we can or cannot trade or how we can or cannot exchange value with other people. And look, final point here for you. There has been no final verdict as to what countries will do. This recommendation may not pass into law. That is just a recommendation at this stage, but a recommendation by a very powerful regulatory body. I hope that the final whatever is not this, but how this is playing out is nearly identical to how things played out with the EFF ATF last year. So it is worth being aware of. But one thing has made abundantly clear crypto is a threat and they damn well know it. Just understanding that they are out there discussing banning stable coins shows that crypto has made it to the big time. So congratulations us. But wow. Still not cool. They’re gonna potentially do this to stable coins, but wiping out stable coins. It is potentially also a natural progression towards central bank digital currencies, which make no mistake, those are coming and they will be very impactful when they do. The banking cartels are going to do anything that they can to maintain power which screws bankers. Seriously, what a bunch of douches. Never is your freedom given priority. It’s only ever their power, their money, their mates, their rules, their profits, their game. What a sick system to live in decentralized systems. There’s so much more exciting than what we have right now. We must stop bowing down and submitting to the poor versions of these ruling elites. But one thing does remain certain in my mind, even if stable coins get crushed. Bitcoin will carry on. Bitcoin is the steady survivor. Rain or shine, hell or high water. The blocks just keep coming. The fight for financial freedom is now entering. The next phase in Bitcoin remains the tip of the spear. In a weird way, all of this that I’ve discussed today, it kinda really makes me more bullish on the future of cryptocurrencies. But I don’t know. I’m a weirdo. What do I do anyway? What do you think about all of this? Is it nothing to be worried about? Do you think it won’t actually be implemented? Maybe you’re out there cheering for the death of all stable coins. Or do you think that this could actually just be a potentially major setback for the industry with something maybe it will overcome in the long term or maybe some other opinion? Love to know your thoughts down below in the comments section. Thank you so much for watching today’s video. Hope you have an awesome day wherever you are. And again, just thank you for supporting the Channel 4. Let me come out here and make these videos talking about cryptocurrency all the time. Your support just means the world. So thank you. So, so about you. Of course, if you didn’t join today’s video that thumbs up button, make sure to subscribe to channel. If you’re a new round here. Long live the blockchain. ADS-B sounds next time.

source https://www.cryptosharks.net/warning-bitcoin-savage-price-fall/

source https://cryptosharks1.blogspot.com/2020/04/warning-bitcoin-savage-price-fall-if.html

0 notes

Text

WARNING! Bitcoin Savage Price Fall If Central Banks Get Their Way [MUST SEE]

VIDEO TRANSCRIPT

Today in Krypto, a little known financial body called the Financial Stability Board could be dropping the equivalent of a nuclear bomb on the entire crypto-economy with a recommendation to ban all stable coins. Now, if this motion succeeds and it is indeed passed into law by the world’s major economies, then we could be facing a bit of a crypto apocalypse, with prices plunging potentially to unimaginable lows. If all stable coins are removed from the market. So even if you are not a stable coin holder, you need to hear this because this is a massive assault on the cryptocurrency industry and is really showing that cryptocurrencies are worrying the banks in a major way. The crypto lark, this is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. And if you are due to crypto, then I have made a beginners course to save you your time and to save you money by walking through all of the basics, like how to buy sand mine and store bitcoin in an area with step by step tutorials and top resources. There is a link down below where you can learn more. So the big story of today is that the Financial Stability Board has outlined 10 recommendations to central banks for regulating stable coins, including total pro habitation. Now, you have probably never heard of the FS B, but it is a powerful organization comprised of central banks and finance ministries from the world’s major economies. Now, of course, the board has also hosted and funded by the Bank for International Settlements. The Bank of International Settlements, in case you don’t know, is like the central bank of central banks. It’s kind of like the head of the evil octopus whose tentacles stretch out and just suck the life force out of countries around the world and just hand everything over to the bankers. That’s the B, I guess, or the big B.S., if you will. Now, the FSB issues non-binding recommendations, but more often than not, these recommendations and up being implemented and the recommendation that the FSB just made to the G20 is that stable coins are a big threat to the power of the banks and that major stable coins including USD T USD C T USD Paxos and die should be prohibited now just for reference. The G20 consists of the following countries, which is basically a list of all of the world’s major economies. We have Argentina. Australia, Brazil. Canada. China. France. Germany. India. Indonesia. Italy. Japan. Mexico, Russia. Saudi Arabia. South Africa, South Korea. Turkey. The United Kingdom, the United States and the E U. So that’s all the big ones. All the big ones right there in one group. And they’re all talking about the potential to ban stable coins. Now, not only is the world the world’s biggest economies, but those markets also make up basically the entire volume of the entire crypto industry. And just for fun, too, the FSB also counts among its members, the IMF, the World Bank and the European Central Bank, in particular, the SDF FSB warned that stable coins could pose a big risk to global financial stability, especially in emerging markets and developing economies. I mean, hey, you can’t have people in developing economies getting financial freedom that just wouldn’t work for those big, powerful central banks. No, no, no, no, no. Not today, my friends. The FSB goes on to state that stable coins also pose significant governance challenges to central banks in particular. They are concerned that citizens in both advanced and emerging economies might begin favouring stable coins over existing fiat currencies. Did you hear that? The bankers are scared. Crypto has indeed kicked the frickin hornet’s nest and the bankers are worried about the implications. Decentralized, open public networks are a real and present danger to the monopoly of power that the central banks currently enjoy. We should really be proud of away. Cryptos made it, guys. We’ve made it. They’re talking about us at the highest levels of the global economy, the central banks of the world. They are scared of crypto technology can end the tyranny of central banks in their commercial bank whores. In a way, this is all incredibly exciting. Now you might say, hey, look, I don’t own stable coins laughs. So why should I care? Well, for a few reasons. Racing stable coins will absolutely crush daily volumes in the crypto industry. Stable coins make up more than $40 billion a day in volume, which is nearly half of the daily spot market volume. It will also have a very negative impact on the crypto lending markets and of course, also on decentralised finance markets, which basically are all of the financial services beyond just sending bitcoin from person to person. B all the services, the auction, crypto useful for billions and billions of people. Also, we should always speak up for financial freedom. Freedom is freedom. Free markets are a great thing, not Ranzie That quote from World War 2. First, they came for the Socialists and I did not speak out because I was not a socialist. Then they came for the trade unionists and I did not speak out because I was not a trade unionist. Then they came for the Jews and I did not speak out because I was not a Jew. Then they came for me and there was no one left to speak for me. Now apply that same logic to crypto. First, they came for the privacy coins and I said nothing. Then they came for the stable coins and I said nothing. And when they came for bitcoin, there was no one left to speak up. If you are a bitcoin maximalists and you’re out there cheering this on, say yeah, take down all the stable coins man, wake the fuck up. The exact same reasons that they are citing today to justify a stable coin ban that will be used against bitcoin in the future. Yes, today it’s stable coins, but tomorrow it will be basically anything that threatens the Fiat monopoly that the central banks have over society. And that thing, if you are really a believer in bitcoin, is bitcoin. Well, the bankers cannot shut bitcoin down. They can certainly do a whole heck of a lot to regulate it into impotence. The fight for financial freedom is everyone’s fight. Now, look at a practical level here. It will not stop all stable coins. It will certainly shut down the regulated and semi’s regulated ones, things like USD C and Paxos as well as course as Heather. Now, these coins are uniquely vulnerable because there are people who can be arrested and forced to shut the whole gosh darn thing down. There are bank accounts which can be seized by authorities, thus shutting the whole gosh darn thing down. Di, however, will be much, much harder to stop because this is really a decentralized, stable coin and it may not even be stoppable since it is really just a crypto-backed collateral coin, but that remains to be seen if they will be able to stop that or not should all of this go through. And hey look. Yeah, sure. Teather is a mess. I’ve been a very critical teller for a long time, but others like Dai and U.S. DC, they are not stable coins or a very useful part of the crypto economy and they should exist. Also a stable coin band likely through bitcoin into what could be the worst bear market of all time. I mean this if this happens, we could see a sub $1000 bitcoin. A nice time for buyers, right? I would totally be stacking some bitcoin at those prices, but such an event I think would actually destroy a lot of people’s faith in the crypto industry overall now long term. This could be positive for bitcoin only being traded directly in and out of fiat. But it will also push the industry more towards really highly regulated exchanges and more into the hands of Wall Street in the long run. The FSB man. Seriously, what the fuck are these guys anyway? More on elected bureaucrats. Just pull in our pants down and give us dirty old Roggeveen bureaucrats. Man bureaucrats. Anyway, this story extra reminds me of a story from last year about the F A T F and the coming implementation of the travel rule. You see the F A.T.F. On the issues recommendations like the FSB does and their recommendation was to do KYC on every withdrawal happening from crypto exchanges and of the official wallet providers. And to have the addresses for these wallets connected to names and ideas. Well, you know what? That recommendation that’s happening within the next year, we are likely to see a full implementation of the F 80 FS travel rule on to crypto. These unelected governing bodies, they have massive power. Welcome to the slave planet. My friends, now I know this. Some of you may be thinking lark’s out here spreading fraud Dardari. No, no, that’s not what I’m doing. These are real laws being considered and knowledge is power. You should always know what is going on in the industry. What I see here is that currently, in spite of the whale manipulations we have in the crypto market, we actually have a largely free 24/7 marketplace with crypto. I want to keep it that way. I the crypto Marcus me as free as possible. We do not need nor do we want bureaucrats to tell us what we can or cannot trade or how we can or cannot exchange value with other people. And look, final point here for you. There has been no final verdict as to what countries will do. This recommendation may not pass into law. That is just a recommendation at this stage, but a recommendation by a very powerful regulatory body. I hope that the final whatever is not this, but how this is playing out is nearly identical to how things played out with the EFF ATF last year. So it is worth being aware of. But one thing has made abundantly clear crypto is a threat and they damn well know it. Just understanding that they are out there discussing banning stable coins shows that crypto has made it to the big time. So congratulations us. But wow. Still not cool. They’re gonna potentially do this to stable coins, but wiping out stable coins. It is potentially also a natural progression towards central bank digital currencies, which make no mistake, those are coming and they will be very impactful when they do. The banking cartels are going to do anything that they can to maintain power which screws bankers. Seriously, what a bunch of douches. Never is your freedom given priority. It’s only ever their power, their money, their mates, their rules, their profits, their game. What a sick system to live in decentralized systems. There’s so much more exciting than what we have right now. We must stop bowing down and submitting to the poor versions of these ruling elites. But one thing does remain certain in my mind, even if stable coins get crushed. Bitcoin will carry on. Bitcoin is the steady survivor. Rain or shine, hell or high water. The blocks just keep coming. The fight for financial freedom is now entering. The next phase in Bitcoin remains the tip of the spear. In a weird way, all of this that I’ve discussed today, it kinda really makes me more bullish on the future of cryptocurrencies. But I don’t know. I’m a weirdo. What do I do anyway? What do you think about all of this? Is it nothing to be worried about? Do you think it won’t actually be implemented? Maybe you’re out there cheering for the death of all stable coins. Or do you think that this could actually just be a potentially major setback for the industry with something maybe it will overcome in the long term or maybe some other opinion? Love to know your thoughts down below in the comments section. Thank you so much for watching today’s video. Hope you have an awesome day wherever you are. And again, just thank you for supporting the Channel 4. Let me come out here and make these videos talking about cryptocurrency all the time. Your support just means the world. So thank you. So, so about you. Of course, if you didn’t join today’s video that thumbs up button, make sure to subscribe to channel. If you’re a new round here. Long live the blockchain. ADS-B sounds next time.

Via https://www.cryptosharks.net/warning-bitcoin-savage-price-fall/

source https://cryptosharks.weebly.com/blog/warning-bitcoin-savage-price-fall-if-central-banks-get-their-way-must-see

0 notes

Text

WARNING! Bitcoin Savage Price Fall If Central Banks Get Their Way [MUST SEE]

VIDEO TRANSCRIPT

Today in Krypto, a little known financial body called the Financial Stability Board could be dropping the equivalent of a nuclear bomb on the entire crypto-economy with a recommendation to ban all stable coins. Now, if this motion succeeds and it is indeed passed into law by the world’s major economies, then we could be facing a bit of a crypto apocalypse, with prices plunging potentially to unimaginable lows. If all stable coins are removed from the market. So even if you are not a stable coin holder, you need to hear this because this is a massive assault on the cryptocurrency industry and is really showing that cryptocurrencies are worrying the banks in a major way. The crypto lark, this is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. And if you are due to crypto, then I have made a beginners course to save you your time and to save you money by walking through all of the basics, like how to buy sand mine and store bitcoin in an area with step by step tutorials and top resources. There is a link down below where you can learn more. So the big story of today is that the Financial Stability Board has outlined 10 recommendations to central banks for regulating stable coins, including total pro habitation. Now, you have probably never heard of the FS B, but it is a powerful organization comprised of central banks and finance ministries from the world’s major economies. Now, of course, the board has also hosted and funded by the Bank for International Settlements. The Bank of International Settlements, in case you don’t know, is like the central bank of central banks. It’s kind of like the head of the evil octopus whose tentacles stretch out and just suck the life force out of countries around the world and just hand everything over to the bankers. That’s the B, I guess, or the big B.S., if you will. Now, the FSB issues non-binding recommendations, but more often than not, these recommendations and up being implemented and the recommendation that the FSB just made to the G20 is that stable coins are a big threat to the power of the banks and that major stable coins including USD T USD C T USD Paxos and die should be prohibited now just for reference. The G20 consists of the following countries, which is basically a list of all of the world’s major economies. We have Argentina. Australia, Brazil. Canada. China. France. Germany. India. Indonesia. Italy. Japan. Mexico, Russia. Saudi Arabia. South Africa, South Korea. Turkey. The United Kingdom, the United States and the E U. So that’s all the big ones. All the big ones right there in one group. And they’re all talking about the potential to ban stable coins. Now, not only is the world the world’s biggest economies, but those markets also make up basically the entire volume of the entire crypto industry. And just for fun, too, the FSB also counts among its members, the IMF, the World Bank and the European Central Bank, in particular, the SDF FSB warned that stable coins could pose a big risk to global financial stability, especially in emerging markets and developing economies. I mean, hey, you can’t have people in developing economies getting financial freedom that just wouldn’t work for those big, powerful central banks. No, no, no, no, no. Not today, my friends. The FSB goes on to state that stable coins also pose significant governance challenges to central banks in particular. They are concerned that citizens in both advanced and emerging economies might begin favouring stable coins over existing fiat currencies. Did you hear that? The bankers are scared. Crypto has indeed kicked the frickin hornet’s nest and the bankers are worried about the implications. Decentralized, open public networks are a real and present danger to the monopoly of power that the central banks currently enjoy. We should really be proud of away. Cryptos made it, guys. We’ve made it. They’re talking about us at the highest levels of the global economy, the central banks of the world. They are scared of crypto technology can end the tyranny of central banks in their commercial bank whores. In a way, this is all incredibly exciting. Now you might say, hey, look, I don’t own stable coins laughs. So why should I care? Well, for a few reasons. Racing stable coins will absolutely crush daily volumes in the crypto industry. Stable coins make up more than $40 billion a day in volume, which is nearly half of the daily spot market volume. It will also have a very negative impact on the crypto lending markets and of course, also on decentralised finance markets, which basically are all of the financial services beyond just sending bitcoin from person to person. B all the services, the auction, crypto useful for billions and billions of people. Also, we should always speak up for financial freedom. Freedom is freedom. Free markets are a great thing, not Ranzie That quote from World War 2. First, they came for the Socialists and I did not speak out because I was not a socialist. Then they came for the trade unionists and I did not speak out because I was not a trade unionist. Then they came for the Jews and I did not speak out because I was not a Jew. Then they came for me and there was no one left to speak for me. Now apply that same logic to crypto. First, they came for the privacy coins and I said nothing. Then they came for the stable coins and I said nothing. And when they came for bitcoin, there was no one left to speak up. If you are a bitcoin maximalists and you’re out there cheering this on, say yeah, take down all the stable coins man, wake the fuck up. The exact same reasons that they are citing today to justify a stable coin ban that will be used against bitcoin in the future. Yes, today it’s stable coins, but tomorrow it will be basically anything that threatens the Fiat monopoly that the central banks have over society. And that thing, if you are really a believer in bitcoin, is bitcoin. Well, the bankers cannot shut bitcoin down. They can certainly do a whole heck of a lot to regulate it into impotence. The fight for financial freedom is everyone’s fight. Now, look at a practical level here. It will not stop all stable coins. It will certainly shut down the regulated and semi’s regulated ones, things like USD C and Paxos as well as course as Heather. Now, these coins are uniquely vulnerable because there are people who can be arrested and forced to shut the whole gosh darn thing down. There are bank accounts which can be seized by authorities, thus shutting the whole gosh darn thing down. Di, however, will be much, much harder to stop because this is really a decentralized, stable coin and it may not even be stoppable since it is really just a crypto-backed collateral coin, but that remains to be seen if they will be able to stop that or not should all of this go through. And hey look. Yeah, sure. Teather is a mess. I’ve been a very critical teller for a long time, but others like Dai and U.S. DC, they are not stable coins or a very useful part of the crypto economy and they should exist. Also a stable coin band likely through bitcoin into what could be the worst bear market of all time. I mean this if this happens, we could see a sub $1000 bitcoin. A nice time for buyers, right? I would totally be stacking some bitcoin at those prices, but such an event I think would actually destroy a lot of people’s faith in the crypto industry overall now long term. This could be positive for bitcoin only being traded directly in and out of fiat. But it will also push the industry more towards really highly regulated exchanges and more into the hands of Wall Street in the long run. The FSB man. Seriously, what the fuck are these guys anyway? More on elected bureaucrats. Just pull in our pants down and give us dirty old Roggeveen bureaucrats. Man bureaucrats. Anyway, this story extra reminds me of a story from last year about the F A T F and the coming implementation of the travel rule. You see the F A.T.F. On the issues recommendations like the FSB does and their recommendation was to do KYC on every withdrawal happening from crypto exchanges and of the official wallet providers. And to have the addresses for these wallets connected to names and ideas. Well, you know what? That recommendation that’s happening within the next year, we are likely to see a full implementation of the F 80 FS travel rule on to crypto. These unelected governing bodies, they have massive power. Welcome to the slave planet. My friends, now I know this. Some of you may be thinking lark’s out here spreading fraud Dardari. No, no, that’s not what I’m doing. These are real laws being considered and knowledge is power. You should always know what is going on in the industry. What I see here is that currently, in spite of the whale manipulations we have in the crypto market, we actually have a largely free 24/7 marketplace with crypto. I want to keep it that way. I the crypto Marcus me as free as possible. We do not need nor do we want bureaucrats to tell us what we can or cannot trade or how we can or cannot exchange value with other people. And look, final point here for you. There has been no final verdict as to what countries will do. This recommendation may not pass into law. That is just a recommendation at this stage, but a recommendation by a very powerful regulatory body. I hope that the final whatever is not this, but how this is playing out is nearly identical to how things played out with the EFF ATF last year. So it is worth being aware of. But one thing has made abundantly clear crypto is a threat and they damn well know it. Just understanding that they are out there discussing banning stable coins shows that crypto has made it to the big time. So congratulations us. But wow. Still not cool. They’re gonna potentially do this to stable coins, but wiping out stable coins. It is potentially also a natural progression towards central bank digital currencies, which make no mistake, those are coming and they will be very impactful when they do. The banking cartels are going to do anything that they can to maintain power which screws bankers. Seriously, what a bunch of douches. Never is your freedom given priority. It’s only ever their power, their money, their mates, their rules, their profits, their game. What a sick system to live in decentralized systems. There’s so much more exciting than what we have right now. We must stop bowing down and submitting to the poor versions of these ruling elites. But one thing does remain certain in my mind, even if stable coins get crushed. Bitcoin will carry on. Bitcoin is the steady survivor. Rain or shine, hell or high water. The blocks just keep coming. The fight for financial freedom is now entering. The next phase in Bitcoin remains the tip of the spear. In a weird way, all of this that I’ve discussed today, it kinda really makes me more bullish on the future of cryptocurrencies. But I don’t know. I’m a weirdo. What do I do anyway? What do you think about all of this? Is it nothing to be worried about? Do you think it won’t actually be implemented? Maybe you’re out there cheering for the death of all stable coins. Or do you think that this could actually just be a potentially major setback for the industry with something maybe it will overcome in the long term or maybe some other opinion? Love to know your thoughts down below in the comments section. Thank you so much for watching today’s video. Hope you have an awesome day wherever you are. And again, just thank you for supporting the Channel 4. Let me come out here and make these videos talking about cryptocurrency all the time. Your support just means the world. So thank you. So, so about you. Of course, if you didn’t join today’s video that thumbs up button, make sure to subscribe to channel. If you’re a new round here. Long live the blockchain. ADS-B sounds next time.

source https://www.cryptosharks.net/warning-bitcoin-savage-price-fall/

source https://cryptosharks1.tumblr.com/post/615603278494973952

0 notes

Text

WARNING! Bitcoin Savage Price Fall If Central Banks Get Their Way [MUST SEE]

VIDEO TRANSCRIPT

Today in Krypto, a little known financial body called the Financial Stability Board could be dropping the equivalent of a nuclear bomb on the entire crypto-economy with a recommendation to ban all stable coins. Now, if this motion succeeds and it is indeed passed into law by the world’s major economies, then we could be facing a bit of a crypto apocalypse, with prices plunging potentially to unimaginable lows. If all stable coins are removed from the market. So even if you are not a stable coin holder, you need to hear this because this is a massive assault on the cryptocurrency industry and is really showing that cryptocurrencies are worrying the banks in a major way. The crypto lark, this is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. And if you are due to crypto, then I have made a beginners course to save you your time and to save you money by walking through all of the basics, like how to buy sand mine and store bitcoin in an area with step by step tutorials and top resources. There is a link down below where you can learn more. So the big story of today is that the Financial Stability Board has outlined 10 recommendations to central banks for regulating stable coins, including total pro habitation. Now, you have probably never heard of the FS B, but it is a powerful organization comprised of central banks and finance ministries from the world’s major economies. Now, of course, the board has also hosted and funded by the Bank for International Settlements. The Bank of International Settlements, in case you don’t know, is like the central bank of central banks. It’s kind of like the head of the evil octopus whose tentacles stretch out and just suck the life force out of countries around the world and just hand everything over to the bankers. That’s the B, I guess, or the big B.S., if you will. Now, the FSB issues non-binding recommendations, but more often than not, these recommendations and up being implemented and the recommendation that the FSB just made to the G20 is that stable coins are a big threat to the power of the banks and that major stable coins including USD T USD C T USD Paxos and die should be prohibited now just for reference. The G20 consists of the following countries, which is basically a list of all of the world’s major economies. We have Argentina. Australia, Brazil. Canada. China. France. Germany. India. Indonesia. Italy. Japan. Mexico, Russia. Saudi Arabia. South Africa, South Korea. Turkey. The United Kingdom, the United States and the E U. So that’s all the big ones. All the big ones right there in one group. And they’re all talking about the potential to ban stable coins. Now, not only is the world the world’s biggest economies, but those markets also make up basically the entire volume of the entire crypto industry. And just for fun, too, the FSB also counts among its members, the IMF, the World Bank and the European Central Bank, in particular, the SDF FSB warned that stable coins could pose a big risk to global financial stability, especially in emerging markets and developing economies. I mean, hey, you can’t have people in developing economies getting financial freedom that just wouldn’t work for those big, powerful central banks. No, no, no, no, no. Not today, my friends. The FSB goes on to state that stable coins also pose significant governance challenges to central banks in particular. They are concerned that citizens in both advanced and emerging economies might begin favouring stable coins over existing fiat currencies. Did you hear that? The bankers are scared. Crypto has indeed kicked the frickin hornet’s nest and the bankers are worried about the implications. Decentralized, open public networks are a real and present danger to the monopoly of power that the central banks currently enjoy. We should really be proud of away. Cryptos made it, guys. We’ve made it. They’re talking about us at the highest levels of the global economy, the central banks of the world. They are scared of crypto technology can end the tyranny of central banks in their commercial bank whores. In a way, this is all incredibly exciting. Now you might say, hey, look, I don’t own stable coins laughs. So why should I care? Well, for a few reasons. Racing stable coins will absolutely crush daily volumes in the crypto industry. Stable coins make up more than $40 billion a day in volume, which is nearly half of the daily spot market volume. It will also have a very negative impact on the crypto lending markets and of course, also on decentralised finance markets, which basically are all of the financial services beyond just sending bitcoin from person to person. B all the services, the auction, crypto useful for billions and billions of people. Also, we should always speak up for financial freedom. Freedom is freedom. Free markets are a great thing, not Ranzie That quote from World War 2. First, they came for the Socialists and I did not speak out because I was not a socialist. Then they came for the trade unionists and I did not speak out because I was not a trade unionist. Then they came for the Jews and I did not speak out because I was not a Jew. Then they came for me and there was no one left to speak for me. Now apply that same logic to crypto. First, they came for the privacy coins and I said nothing. Then they came for the stable coins and I said nothing. And when they came for bitcoin, there was no one left to speak up. If you are a bitcoin maximalists and you’re out there cheering this on, say yeah, take down all the stable coins man, wake the fuck up. The exact same reasons that they are citing today to justify a stable coin ban that will be used against bitcoin in the future. Yes, today it’s stable coins, but tomorrow it will be basically anything that threatens the Fiat monopoly that the central banks have over society. And that thing, if you are really a believer in bitcoin, is bitcoin. Well, the bankers cannot shut bitcoin down. They can certainly do a whole heck of a lot to regulate it into impotence. The fight for financial freedom is everyone’s fight. Now, look at a practical level here. It will not stop all stable coins. It will certainly shut down the regulated and semi’s regulated ones, things like USD C and Paxos as well as course as Heather. Now, these coins are uniquely vulnerable because there are people who can be arrested and forced to shut the whole gosh darn thing down. There are bank accounts which can be seized by authorities, thus shutting the whole gosh darn thing down. Di, however, will be much, much harder to stop because this is really a decentralized, stable coin and it may not even be stoppable since it is really just a crypto-backed collateral coin, but that remains to be seen if they will be able to stop that or not should all of this go through. And hey look. Yeah, sure. Teather is a mess. I’ve been a very critical teller for a long time, but others like Dai and U.S. DC, they are not stable coins or a very useful part of the crypto economy and they should exist. Also a stable coin band likely through bitcoin into what could be the worst bear market of all time. I mean this if this happens, we could see a sub $1000 bitcoin. A nice time for buyers, right? I would totally be stacking some bitcoin at those prices, but such an event I think would actually destroy a lot of people’s faith in the crypto industry overall now long term. This could be positive for bitcoin only being traded directly in and out of fiat. But it will also push the industry more towards really highly regulated exchanges and more into the hands of Wall Street in the long run. The FSB man. Seriously, what the fuck are these guys anyway? More on elected bureaucrats. Just pull in our pants down and give us dirty old Roggeveen bureaucrats. Man bureaucrats. Anyway, this story extra reminds me of a story from last year about the F A T F and the coming implementation of the travel rule. You see the F A.T.F. On the issues recommendations like the FSB does and their recommendation was to do KYC on every withdrawal happening from crypto exchanges and of the official wallet providers. And to have the addresses for these wallets connected to names and ideas. Well, you know what? That recommendation that’s happening within the next year, we are likely to see a full implementation of the F 80 FS travel rule on to crypto. These unelected governing bodies, they have massive power. Welcome to the slave planet. My friends, now I know this. Some of you may be thinking lark’s out here spreading fraud Dardari. No, no, that’s not what I’m doing. These are real laws being considered and knowledge is power. You should always know what is going on in the industry. What I see here is that currently, in spite of the whale manipulations we have in the crypto market, we actually have a largely free 24/7 marketplace with crypto. I want to keep it that way. I the crypto Marcus me as free as possible. We do not need nor do we want bureaucrats to tell us what we can or cannot trade or how we can or cannot exchange value with other people. And look, final point here for you. There has been no final verdict as to what countries will do. This recommendation may not pass into law. That is just a recommendation at this stage, but a recommendation by a very powerful regulatory body. I hope that the final whatever is not this, but how this is playing out is nearly identical to how things played out with the EFF ATF last year. So it is worth being aware of. But one thing has made abundantly clear crypto is a threat and they damn well know it. Just understanding that they are out there discussing banning stable coins shows that crypto has made it to the big time. So congratulations us. But wow. Still not cool. They’re gonna potentially do this to stable coins, but wiping out stable coins. It is potentially also a natural progression towards central bank digital currencies, which make no mistake, those are coming and they will be very impactful when they do. The banking cartels are going to do anything that they can to maintain power which screws bankers. Seriously, what a bunch of douches. Never is your freedom given priority. It’s only ever their power, their money, their mates, their rules, their profits, their game. What a sick system to live in decentralized systems. There’s so much more exciting than what we have right now. We must stop bowing down and submitting to the poor versions of these ruling elites. But one thing does remain certain in my mind, even if stable coins get crushed. Bitcoin will carry on. Bitcoin is the steady survivor. Rain or shine, hell or high water. The blocks just keep coming. The fight for financial freedom is now entering. The next phase in Bitcoin remains the tip of the spear. In a weird way, all of this that I’ve discussed today, it kinda really makes me more bullish on the future of cryptocurrencies. But I don’t know. I’m a weirdo. What do I do anyway? What do you think about all of this? Is it nothing to be worried about? Do you think it won’t actually be implemented? Maybe you’re out there cheering for the death of all stable coins. Or do you think that this could actually just be a potentially major setback for the industry with something maybe it will overcome in the long term or maybe some other opinion? Love to know your thoughts down below in the comments section. Thank you so much for watching today’s video. Hope you have an awesome day wherever you are. And again, just thank you for supporting the Channel 4. Let me come out here and make these videos talking about cryptocurrency all the time. Your support just means the world. So thank you. So, so about you. Of course, if you didn’t join today’s video that thumbs up button, make sure to subscribe to channel. If you’re a new round here. Long live the blockchain. ADS-B sounds next time.

source https://www.cryptosharks.net/warning-bitcoin-savage-price-fall/

0 notes

Photo

Las Vegas: Sandy Hook Unheard What is the relationship between the Las Vegas Shooting and the Sandy Hook Shooting? This is a information has been on my mind before the Mass Shooting in Las Vegas Nevada. I think it has been there with my concern about mass shootings but also from this odd con I detected this spring 2017: 1. Donald Trump told the public he has a heart for victims and is changing his mind on the real need for gun controls. Then at the same time he removed the first days in office regulations on arms manufacturers AND reduction of rules for gun purchases. 2. After Idaho passed a law allowing concealed weapons on Idaho university campuses I've been alert to this action nationwide. First ALL agencies and university officials opposed the arming of students. All reports proved: there was no need there was no benefit and that those with guns young men their brains don't develop to full mental judgment until age 28. Who was for this Governor Butch Otter who has long proven his Psychopathy and Narcissism declining care to the poor races and basic protections of gays has put Idaho on the number 1 list of poorest care in the US. The full GOP State Legislature has also followed his plan of government: ignore the hurting eliminate government and taxes and make sure the wealthy benefit. It seems like the typical old West gun movie but that is Idaho. And it was so ironic that the local Statesman discovered and published that Butch Otter had acted in a soft porn movie. Though he was the clothed town sheriff there is no doubt from sauna scenes and bare flopping implanted breasts in those sex scenes. Otter did take his own 5th on this his own con: "they never told me it was a porno". This is the denial and diversion methods of the psychopathic politician. But few every questioned just what originated this drive for concealed weapons to be carried at Boise State Idaho State University of Idaho and the junior colleges. It was all part of who promoted this JUST his year in 13 other state legislatures in 2017 with 5 passing the law allowing campus concealed weapons: This was a part of the Lobby Effort Lead by ALEC.org which lobbies for the NRA and gun manufacturers other companies via 2 methods: Removal of government regulations on food manufacturers and gun manufacturers by training state legislators Directing "Eroding of Regulations" legislation that leads ultimately to the desire of that lobby: no regulations at all. How this works according to ALEC: a. if you can stop Dairies from having reporters film inside them you can further remove regulations on that whole industry. Make the change one step at a time. b. if you can arm university students you can justify to a state population or legislature a "just and sensible reason" to remove other regulations on guns and purchases. How B works is: Alec and the Lobby really don't believe is so critical for college students to be armed to protect others. In fact it's a bit silly. But it's one step in eroding all regulations on guns: So in 2 years Alec promotes legislation based on this with faulty reasoning and facts built on fictions: "If we so desperately need students armed and lessen restrictions we need to remove back ground checks waiting periods safety training and arm teachers social workers psychologists school bus drivers apartment dwellers.......and everybody. What then is the relationship between the Las Vegas Shooting and the Sandy Hook Shooting? It is that shootings continue to rise and we've become 1. Numbed desensitized to the matters and harm of shootings that occur all the time. While the news reported the Las Vegas mass shooting other mass shootings of 3 4 and 5 persons in the US the same night were not even in the news. We blame ourselves only for a preoccupation with a Los Angeles high speed highway chase on TV but ignore things happening around us in the news and those psychopathic leaders that promote this via: Deregulation of the arms industry Politicians sleeping with the gun lobby ignoring the lessons of Sandy Hook and so many words and new actions taken by President Obama including gun purchase screening measures that were removed by Donald Trump the first days of office....to protect "Constitutional Rights" which translated is my buddies in the gun / arms industry and lobbies paid to put me in office and give me perks and perks and perks. My first book on Sandy Hook was about these lessons. Since then Sandy Hook is something we like to think about but not do anything about. I'm saddened when each year the parents of dead children in the Sandy Hook Massacre testify before congress about screening of the mentally ill for weapons. Then the result has been the same the last 2 years with a GOP oriented pundit lead and Koch Brothers funded congress: Don't just do nothing about the gun problems. Instead remove all government regulations. 2. Complacent we don't take any personal responsibility for change to occur We have many reasons for complacency. None of them are good. It seems being the most obese country in the world that we (and I am not innocent here) of stuffing our mouths with McD fries and more. We value as a people American culture eating shopping and many things more than activism and involvement. We may be at a loss in our time of knowing what we can do. It's hard to know how to oppose our elected psychopathic leaders when we have an American Culture of trusting them. We haven't learned as Europeans to "Question". Indeed the world views Americans as naive children or bully teen agers and not adults. It was for this reason I wrote the book Sandy Hook and 3. Lazy we'd rather go back to our simple life of baseball hockey NFL craft fairs kids' soccer and more. Don't bother me. But life calls us to what is called in mythology: A calling to an unexpected and unwanted journey with many tasks. We can follow it or we can order up another Pizza Hut special and drown any fleeting pain that would have opened us up. It was for this reason I wrote the book on Creative Civil Disobedience: you can do something small and creative today that doesn't mean you're a full fledged protester. But this has to occur: you do it today and dump the excuses 4. History and Geography Illiterate There are always psychopaths dictators and genocides. They can like the Las Vega shooter come out of any innocuous Mandalay Casino glass wall. You don't expect the timing the place or the devastation. But it occurs All the time worldwide. It is for that reason I've written 12 books on Narcissists and Psychopaths: they and the coming event are nearer than you are willing to accept. Perhaps our schools have stepped away from the liberal arts education in preference to the technical education of our digital times. History shows both clear frequency of dictators and genocides. World geography gives us information on these incidents worldwide the Kim Jong-Uns and Dutartes and Donald Trumps in EVERY country. 5. In other recent books on psychopathic politicians the general ignorance of what PSYCHOPATHY really is discussed and what created that current situation in the US. It is not known that Trump is psychopathic what the traits are. And it's not known you have to speak up AND STOP them or you and others will die either directly or by marginalization. "No is not Enough". It's for that reason that I've writing the 12 books and daily post around 5 new articles on the above 5 matters at http://bit.ly/2yk4qIi And it's for all these reasons that steps ideas and affirmations have been included in each tool mentioned as well as 1000 affirmations on bullies and abuse recovery at the Pinterest account listed above as well.Included in the affirmations are also the best quotes on Bullies and Recovery and Rebuilding life. Dr. Charles Bunch Psychopaths Pirates Vampires and more: Run flee tell others! 300 topics on this listed below in the Cloud Archive: Click Here: Catalog of 100 Books Kindle Hypnosis Binaural Subliminal CDs Psychopaths Pirates Vampires and more: Run flee tell others! 300 topics on this listed below in the Cloud Archive: Click Here: Catalog of 100 Books Kindle Hypnosis Binaural Subliminal CDs actor persona brain dangerous narcissism dark disorder dark duo dark triad documentary pbs procrastination denial complacency psychopathy #trumpbully #stopbully #trumpmentalhealth http://bit.ly/2rZ1vSp

Las Vegas: Sandy Hoo

0 notes

Link

19 Apr 20 • 27 tweets • timkmak/status/1251936242834563073

@timkmak

THREAD – History doesn’t repeat itself, but it rhymes: a

thread about the Anti-Mask League of 1919.

I’m not kidding I went HAM researching this

So, starting in Sept 1918 San Francisco suffered from Spanish Flu pandemic. Initial mask wearing was good — around 80 percent. By November cases were down, and public health officials recommended re-opening the city. Residents rushed to entertainment venues after having been denied this communal joy for months. The Mayor himself was fined by his own police chief after going to a show without a mask.