#this is a ben chaplin blog now!!!!

Explore tagged Tumblr posts

Text

WILLIAM GOLDMAN & Good Will Hunting

"Charlie Chaplin, how are you, I'm Major Dorsey, I worked in the lunatic asylum where your mother is and she asked me to say she forgives you and is doing fine."

Or: "Charlie Chaplin, my Lord, it's been ten years since we last saw each other, back in London it was, when my daughter played the ingenue in that West End revival of The Importance of Being Earnest and you liked her and we met backstage. This was just before you got her pregnant."

In other words, it was clunky.

Sir Dickie wanted me to come in and somehow, to use his word, "declunk" it.

I came up with the Tony Hopkins part.

I decided that since Chaplin wrote an autobiography, and since he was a famous man living in Switzerland, it would not be ridiculous if his book editor came from London to discuss final revisions.

The editor could ask whatever questions we wanted to get us to the next dramatic sequence.

And could also, if possible, shoulder some of the dreaded exposition that infiltrated the story.

Chaplin was a worldwide commercial flop.

What was one idea worth?

You decide.

Doctoring is tricky, particularly when it comes to taking credit for success (or blame for failure).

Of course, what I'm best known for of late is the doctoring job I did on Good Will Hunting.

If you go on the Net and look up my credits, there it is, the previously uncredited work on that Oscar-winning smash.

The truth?

I did not just doctor it.

I wrote the whole thing from scratch.

Though I had spent at most but a month of my life in Boston, and though I was sixty-five when the movie came out, I have been obsessed since my Chicago childhood with class as it exists in that great Massachusetts city.

My basic problem was not the wonderful story or the genuine depth of the characters I created, it was that no one would believe I wrote it.

It was such a departure for me.

What's a mother to do?

Here was my solution — I had met these two very untalented, very out-of-work performers, Affleck and Damon.

They were both in need of money.

The deal we struck was this:

I would give them initial credit, they would front for me — at the start.

And then, once we were set up, the truth would come out.

You know what happened?

Miramax got the flick, decided to use them in the leads. Decided I would kill the commercial value of the flick — if the truth were known.

Harvey Weinstein gave me a lot of money for my silence, plus 20 percent of the gross.

Which is why I'm writing this from the Riviera.

I think the reason the world was so anxious to believe Matt Damon and Ben Affleck didn't write their script was simple jealousy.

https://www.danielkusner.com/blog/type-cast-actor-scribe-george-pimpton-captures-capote

They were young and cute and famous; kill the fuckers.

I remember when a national magazine called and said they had been told I wrote it, I literally screamed at the writer.

I have had this kind of thing on occasion before and I hate it a lot.

If you write something and that something has quality, how awful to have the world think the work belonged to others.

youtube

The real truth is that Castle Rock had the movie first, and Rob Reiner — no fool he — was given it for comments.

youtube

Rob had one biggie.

Affleck and Damon in an early draft had a whole subplot about how the government was after Damon, the math genius, to do subversive work for them.

There were chases and action scenes.

And what Rob told them was this: lose that aspect and stick with the characters.

When I read it, and spent a day with the writers, all I said was this: Rob's dead right.

Period.

Total contribution: zero.

But I'll bet in some corner of your little dark hearts, you're still saying bullshit.

I mean, it's been five years and what else have they done?

Nada.

Now I'll tell you the real truth.

Every word is mine.

Not only that, I'm the guy who convinced James Cameron that the ship had to hit the iceberg…

youtube

Which Lie Did I Tell? Page 32 Read online free by William Goldman That’s how I wanted to end the movie. This unknown little guy, blinking and maybe experimentally waving his cane around and walking that most famous of all walks.

My logic was the same as the Watergate flick—the audience knew what happened to the tramp. Let’s leave before that.

Attenborough, a very bright man, understood my point. He had a different problem. He loved the childhood, yes, but he was just as moved by the end of Charlie’s life, when, ancient and infirm, he was at last allowed back to Hollywood for his honorary Oscar in 1977. If you have seen that real footage, you know how moving it was. If you haven’t, try and find it somewhere. It will rock you.

So Dickie loved the childhood, yes, but he also loved the old man’s return. The movie had to include both.

Problem: sixty interim years had to be covered.

I once met Stanley Kubrick and we got to talking about what he hoped he would do next (alas). Napoleon, he said. I asked what part and this was his reply: “Everything. I want to do the whole sweep of a man’s life.”

Problem: movies don’t do that well.

I would love to know how Kubrick would have attacked the problem. Because it’s not just the makeup that bothers you in time passing. The script I was handed for Chaplin was full of moments where some guy you never met would come into a scene and say this kind of thing to Charlie: “Charlie Chaplin, how are you, I’m Major Dorsey, I worked in the lunatic asylum where your mother is and she asked me to say she forgives you and is doing fine.”

Or: “Charlie Chaplin, my Lord, it’s been ten years since we last saw each other, back in London it was, when my daughter played the ingenue in that West End revival of The Importance of Being Earnest and you liked her and we met backstage. This was just before you got her pregnant.”

In other words, it was clunky. Sir Dickie wanted me to come in and somehow, to use his word, “declunk” it.

I came up with the Tony Hopkins part. I decided that since Chaplin wrote an autobiography, and since he was a famous man living in Switzerland, it would not be ridiculous if his book editor came from London to discuss final revisions. The editor could ask whatever questions we wanted to get us to the next dramatic sequence. And could also, if possible, shoulder some of the dreaded exposition that infiltrated the story.

Chaplin was a worldwide commercial flop. What was one idea worth? You decide.

Doctoring is tricky, particularly when it comes to taking credit for success (or blame for failure). Of course, what I’m best known for of late is the the doctoring job I did on Good Will Hunting. If you go on the Net and look up my credits, there it is, the previously uncredited work on that Oscar-winning smash.

The truth? I did not just doctor it. I wrote the whole thing from scratch. Though I had spent at most but a month of my life in Boston, and though I was sixty-five when the movie came out, I have been obsessed since my Chicago childhood with class as it exists in that great Massachusetts city. My basic problem was not the wonderful story or the genuine depth of the characters I created, it was that no one would believe I wrote it. It was such a departure for me.

What’s a mother to do? Here was my solution—I had met these two very untalented, very out-of-work performers, Affleck and Damon. They were both in need of money. The deal we struck was this: I would give them initial credit, they would front for me at the start, and then, once we were set up, the truth would come out.

You know what happened. Mirimax got the flick, decided to use them in the leads, decided I would kill the commercial value of the flick if the truth were known. Harvey Weinstein gave me a lot of money for my silence, plus 20 percent of the gross.

Which is why I’m writing this from the Riviera.

I think the reason the world was so anxious to believe Matt Damon and Ben Affleck didn’t write their script was simple jealousy. They were young and cute and famous; kill the fuckers.

I remember when a national magazine called and said they had been told I wrote it, I literally screamed at the writer. I have had this kind of thing on occasion before and I hate it a lot. If you write something and that something has quality, how awful to have the world think the work belonged to others.

The real truth is that Castle Rock had the movie first, and Rob Reiner, no fool he, was given it for comments. Rob had one biggie.

Affleck and Damon in an early draft had a whole subplot about how the government was after Damon, the math genius, to do subversive work for them. There were chases and action scenes, and what Rob told them was this: lose that aspect and stick with the characters.

When I read it, and spent a day with the writers, all I said was this: Rob’s dead right.

Period. Total contribution: zero.

But I’ll bet in some corner of your little dark hearts, you’re still saying bullshit. I mean, it’s been five years and what else have they done? Nada.

Now I’ll tell you the real truth. Every word is mine. Not only that, I’m the guy who convinced James Cameron that the ship had to hit the iceberg …

IV.

The Big A

What follows is an original screenplay I wrote for this book. I knew for a long time that I wanted to have you read something of mine that was new. That you could look at with entirely fresh eyes.

I hope you think about it as you read it—what works, what doesn’t, why doesn’t it, how would you improve it? It’s very important to me that you take the time to do that.

But I also thought you would benefit from learning what some top screenwriters thought of it. So I sent the script—exactly what you are going to read—to some screenwriters I know and respect. Between them they’ve won a couple of Oscars, had a lot of hits, doctored a bunch more. Here they are, billing alphabetical:

Peter and Bobby Farrelly

Scott Frank

Tony Gilroy

Callie Khouri

John Patrick Shanley

I’ll give you their specific credits later. This is the letter I sent them:

21 June 99

To my fellow pit dwellers—

—thank you.

What you have received is the last part of my sequel to Adventures in the Screen Trade, entitled Which Lie Did I Tell? More specifically, this chunk is part original screenplay, part outline, part thoughts about writing screenplays. It is the very first draft.

What I want you to do is this: criticize the shit out of it. It does me no good if you take pity. I thought in the beginning I would tape you all but we are scattered and we are writers, so I now think it might be easier for you to jot your thoughts down.

I think what I want you to do is this: a studio has sent you these 90 pages for doctoring. What do you think works, what do you think doesn’t, what are the strengths, tell me the weaknesses.

In other words, you are going in to talk to, I guess, the producer or the studio exec, and you are going to explain how, if possible, you are going to make this, if not wonderful, at least better. (Note: you have the job if you want it.)

Their comments will be printed later in the book. And they’re all real smart, but for now, what I care about is you. You judge it. And remember, there is no wrong answer. We all have our own stories to tell. Here’s one of mine.

The Big A

Original Screenplay By

William Goldman

July, 1999

For Our Eyes Only

FADE IN ON:

This--we are maybe fifty feet up and looking straight down along the side of a tenement toward a crummy New York City alley. This is not Park Avenue, folks. We’re in a crappy slum.

Dark summer night.

Now, as we watch, A GUY comes into view, making his slow way climbing up the side of the old brick building. He travels light--no equipment, just his fingers digging into the old brick.

Hello to CLIMBER JONES. (Born Ralph, but known since a kid by the nickname. Used to spend days in the small apartment he grew up in wit hout ever touching the floor.)

Clearly, as he comes toward camera, he’s still at it. The only difference is that when he was little, it was pleasure, it was adventure. Now, mid-thirties, it’s business, and we can tell this much from his face: he hates it. It scares him shitless.

And if he lives through this-- and he will, my God, he’s the star--he will earn probably five hundred dollars and in the morning he will wake up to be what he was: as honest a private detective as the city has to offer. We are looking, in other words, at a guy who comes as close as anyone alive to being the Bogart of The Maltese Falcon. A good man in a bad world.

Now he takes a breather, hanging there, breathing as silently as he can, on the top floor of the building.

He glances into the nearest window and as he does we

CUT TO

THREE MEN. Armed and swarthy. They sit around a table on which a telephone rests. Staring at it.

CUT TO

CLIMBER, glancing done. He takes a breath, glances back down now to the street--

CUT TO

ANOTHER MAN. He waits by a phone booth. From a distance we could be looking at the great Jimmy Cagney of Love Me or Leave Me, mid-fifties, but you still don’t want to mess with him. This guy’s name, incidentally, is JIMMY. Several more men range behind him in the darkness.

JIMMY shrugs his shoulders in a questioning way, staring up through the darkness at THE CLIMBER. He seems to be asking: yes?

CUT TO

THE CLIMBER. He waves his arm back and forth--no.

Then he resumes climbing but this time he goes down a few hand holds, till he is below the window where the THREE MEN wait.

Now he goes crab-like, sideways, till he is past the window. Then back up again, till he is at the next window, glances in.

CUT TO

A YOUNG GIRL. Twenty maybe. She’s bound and gagged, blindfolded, and has been tossed into a corner on the floor. Her clothes, nice once, are now ripped and dirty. She lies taut, dry-eyed. Probably she realizes this--that she is very soon going to die.

CUT TO

THE CLIMBER. He is now doing something kind of interesting--hanging by one hand in space. The other hand takes stuff from his pocket, a small box-cutter with a razor, a small gun.

CUT TO

THE PHONE BOOTH AND JIMMY staring up through the darkness. For a moment it’s too horrible to contemplate and he has to turn away.

CUT TO

THE SWARTHY GUYS, the kidnappers, and there is a lot of strain on their faces as they mutter, continue to wait for the phone and

CUT TO

CLIMBER, and he has managed to wedge his body against the sill and, with the cutter, is removing the glass near the window lock. Silently, he pulls the piece of glass loose, reaches carefully in, unlocks the window.

Then he takes a very deep breath.

CUT TO

THE GIRL. She is aware that something is going on, has no idea what it is, but her head is turned toward the window now.

CUT TO

THE THREE SWARTHY GUYS and two of them are up now, starting to pace almost mystically about the table and

CUT TO

CLIMBER, taking a breath. Then he takes a long look down in the direction of the phone booth, gestures strongly with his right hand: Go! And on that--

CUT TO

JIMMY, immediately going into the booth, inserting a coin, starting to dial and

CUT TO

CLIMBER, waiting, waiting-- and the instant he hears the phone start to ring in the next room, he starts to raise the window and

CUT TO

THE PHONE as the THREE GUYS react, all reach at the same time. The HEAD KIDNAPPER slaps the others’ hands away, all but rips the phone from its cradle.

HEAD KIDNAPPER

(pissed)

Where the fokk you been, man?

CUT TO

JIMMY, as he inserts a huge handkerchief into his mouth.

JIMMY

Traffic.

CUT TO

THE HEAD KIDNAPPER. What he can make out is this: nothing that sounds like a word.

HEAD KIDNAPPER

Never fokking mind, you got the money?

CUT TO

CLIMBER, kneeling by the girl now, expertly setting her free, first the ropes around her feet, then her hands, then the gag, finally the blindfold and as she turns to face him, he puts his fingers to his lips as we

CUT TO

ECHO SINCLAIR. (Real name Jennifer but known since a kid by the nickname. Used to spend hours when she was little walking up behind people and repeating whatever they said.)

She has had a terrible time these last days, ECHO. So she’s sure not looking her best.

Still not exactly a dog. It’s just one of those faces, folks. We are looking at Audrey Hepburn in Roman Holiday.

CUT TO

CLIMBER, and he has to react to what he sees, but only briefly. Then he whispers, fast and low.

CLIMBER JONES

Hang tough, Miss Sinclair; you’ll be home in no time. Stay right behind me. Can you do that?

(she manages a nod)

CUT TO

JIMMY IN THE PHONE BOOTH, mouth still full.

JIMMY

I’ve got ten million dollars in this satchel here.

CUT TO

THE KIDNAPPERS. THE HEAD GUY is holding the receiver out to the others. They shake their heads.

HEAD KIDNAPPER

What fokking country you calling from, asshole?

(we can’t make out JIMMY’S reply)

How many million?

(we hear JIMMY making a sound that could be ten. He looks at the others)

Ten you think?

(they nod. He cannot help but smile)

Ten is fokking good.

(the others nod)

CUT TO

CLIMBER AND ECHO by the door that leads to the other room. ECHO is right behind him.

CLIMBER JONES

(his hand on the door now--very soft)

You’re doing great. Now do me a favor and try not to scream, I hate screaming.

ECHO

(nods. Then whispers)

Why would I want to scream?

(and on that)

CUT TO

CLIMBER JONES, and here he comes, throwing the door wide, bolting through, opening fire and the HEAD KIDNAPPER cries out, hit in the shoulder and he falls over the table, but still reaching for his gun and now here comes the SECOND KIDNAPPER charging for them and ECHO is screaming like a banshee now because this is one big motherfucker and CLIMBER times it just right, backhands him in the mouth with his pistol barrel, and his teeth fly all over and the THIRD KIDNAPPER has his gun out and is about to fire, he looks like he knows how to use it and he’s got the advantage and the HEAD KIDNAPPER is back on his feet and he has his gun too--

--which is when CLIMBER grabs ECHO, puts an arm around her, and as the bullets come closer and closer, they dive straight into the closed glass window, straight through the closed glass window and as we watch, they start to fall, their bodies turning in space, down the sixty feet to the alley pavement below.

CUT TO

ECHO IN SPACE, IN SLOW MOTION, holding on to him as they fall, and it sounds nuts, but this is probably when she falls in love with CLIMBER because men had always been after her, always for their own reasons, and she knows many who were kind and some who were brilliant and the occasional one who was beautiful--

--but no one had ever taken her on this kind of journey.

CUT TO

CLIMBER IN SPACE, IN SLOW MOTION. And he’s been in love with her for, oh, at least three minutes, since he uncovered her eyes.

Now slow motion starts to end--

--they are going faster--

--faster still--

--rocketing now--

-- and then it’s over--

--they have fallen into a fireman’s trampoline, and half a dozen firemen hold it stretched taut.

JIMMY is right there with them while be hind him, dozens of cops pour through the front door of the tenement building.

JIMMY looks pale and taut. CLIMBER helps ECHO out of the trampoline, looks at the other man.

CLIMBER JONES

What have you got to be nervous about?

JIMMY

I wasn’t sure which window you said you were coming out of.

(and on that)

CUT TO

CLIMBER’S PLACE. The West Village, not the chic part.

Early morning.

Not much. Clean, but if you were asked the decorating style, you would have to answer “none.”

A small bedroom with a big TV, a small living room with a big TV, a kitchenette with a small TV. Not much else.

CLIMBER lies there alone, slowly coming to life. He gets up, sits on the side of his bed, rubbing his sore arms. His body aches from last night’s exercise. He stands, stretches, winces. He takes the TV clicker, turns the tube to ESPN. Now he moves gamely to the living room, clicks that TV on to ESPN. When he arrives at his kitchenette, he gets that tube going right off. It was already set to ESPN.

With all three sets on, he seems somehow more at peace. As he gets out some instant coffee--

CUT TO

A LONG ISLAND LANE.

Très fucking fancy. And how do you know that? Because you cannot see the mansions. Only perfectly trimmed hedges rising ten feet.

Perfect summer day.

CUT TO

THE CLIMBER, driving along in his three-year-old Toyota, the radio to WFAN. When he was working, he was not well dressed. Slacks and a shirt, neither Armani.

Now here’s the thing--he looks even crummier today. Slacks and a shirt, sure, but even more weathered. His loafers probably have holes in the bottom.

0 notes

Photo

Ben Chaplin as Con Wainwright · Feast of July (1995)

#feast of july#feast of july 1995#ben chaplin#con wainwright#perioddramaedit#weloveperioddrama#perioddramasource#onlyperioddramas#mine#this is a ben chaplin blog now!!!!#long post

141 notes

·

View notes

Text

This tradition began four years ago when I thought of no better way to share the joy of the season on this blog than to spread the magic of movies. In a Christmassy sort of way. ‘Tis the season, after all and paying movies forward in hopes that these memorable distractions take your minds off negative goings on is now my December lot in life. I’m asking that you join me, recommend your favorites and #PayClassicsForward on your blogs and across social media.

Give the gift of movies

I realize I am publishing this post much later in December than I have in the past, which leaves you little time to play with it if you are up for the challenge. However, if you are interested here’s the challenge…pick movie recommendations to the “12 Days of Christmas” theme as I’ve done below. Keep in mind that movie choices should be those you think would appeal to non classics fans and there can be no repeats. Let’s grow our community and #PayClassicsForward

Have fun!

On the first day of Christmas, etc., etc., etc…

One dream

Excluding the mother of all dream sequences, that is when Dorothy befriends a Tin Man, a Scarecrow, and a lion in a magical land, then I must go with a telling of Charles Dickens’ 1843 classics, A Christmas Carol. I didn’t set out to choose a Christmas story for this, but perused several lists of dream sequences in movies and was shocked that Ebenezer Scrooge’s legendary journey was not even mentioned. I correct that oversight with this entry as it is a dream to fill the heart.

Of all the adaptations of Dickens’ story about morality, human frailty, and redemption the best is Brian Desmond-Hurst’s 1951 movie starring Alastair Sim as Ebenezer Scrooge. This version of A Christmas Carol is good enough to watch all the year with Sim’s nuanced, affecting performance a standout. If you are a rotten person you might want to dream as Scrooge does in this movie and if you are a kind-hearted sort you might want to be reminded of why that matters.

Alastair Sim as Ebenezer Scrooge

Two islands

I could have gone with fun times and music for this category, but decided on gloom and doom instead. Take a look and you won’t forget Earle C. Kenton’s Island of Lost Souls (1932), which features a terrifically creepy performance by Charles Laughton. Next I suggest you gather with seven guests who are picked off one by one in Rene Clair’s And Then There Were None (1945) based on one of Agatha Christie’s most famous whodunnits.

Island of Lost Souls

Before there were none in And Then There Were None

Three gentlemen

No surprise here. See everything they’ve ever done.

Four speeches

From Chaplin’s The Great Dictator (1940)

Hynkel/A Jewish Barber:

“I should like to help everyone if possible; Jew, Gentile, black man, white. We all want to help one another. Human beings are like that. We want to live by each other’s happiness, not by each other’s misery. We don’t want to hate and despise one another. In this world there is room for everyone, and the good earth is rich and can provide for everyone. The way of life can be free and beautiful, but we have lost the way…”

From Francis Ford Coppola’s The Godfather (1972)

Don Vito Corleone:

“But I’m a superstitious man, and if some unlucky accident should befall him… if he should be shot in the head by a police officer, or if he should hang himself in his jail cell, or if he’s struck by a bolt of lightning, then I’m going to blame some of the people in this room, and that I do not forgive.”

From Capra’s Mr. Smith Goes to Washington (1939)

Jefferson Smith:

“Liberty’s too precious a thing to be buried in books, Miss Saunders. Men should hold it up in front of them every single day of their lives and say: I’m free to think and to speak. My ancestors couldn’t, I can, and my children will. Boys ought to grow up remembering that.”

From Robert Mulligan’s To Kill a Mockingbird (1962)

Atticus Finch:

“Now, gentlemen, in this country, our courts are the great levelers. In our courts, all men are created equal. I’m no idealist to believe firmly in the integrity of our courts and of our jury system – that’s no ideal to me. That is a living, working reality! Now I am confident that you gentlemen will review, without passion, the evidence that you have heard, come to a decision and restore this man to his family. In the name of GOD, do your duty. In the name of God, believe… Tom Robinson.”

Five golden rings

Not that kind of ring! This kind…

Mark Robson’s The Harder They Fall (1956)

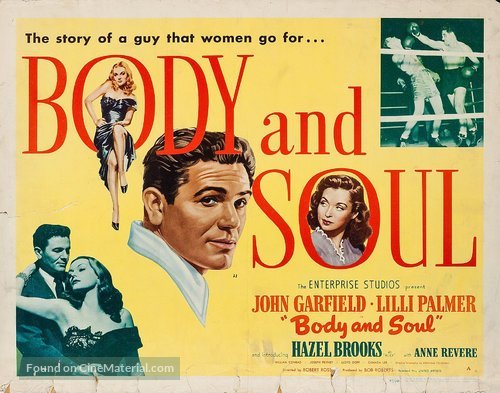

Robert Rossen’s Body and Soul (1947)

Reuben Mamoulian’s Golden Boy (1939)

Michael Curtiz’s Kid Galahad (1937)

Edward G. Robinson and Bette Davis in Kid Galahad

Eddie Buzzell’s The Big Timer (1932)

Ben Lyon and Constance Cummings in The Big Timer

There are quite a few great boxing movies that most have seen like the ones with that Balboa guy. I chose a few that you may not have and should. By the way, I want extra points with Santa for not listing Elvis’ Kid Galahad (1962).

Six Acting-related Stories

Assuming everyone has seen Wilder’s Sunset Boulevard, Joseph Mankiewicz’s All About Eve, and the Donen/Kelly vehicle with dignity, always dignity, Singin’ in the Rain then I suggest the following glittering stories…

Victor Fleming’s Bombshell 1933)

George Cukor’s A Double Life (1947)

Robert Florey’s Hollywood Boulevard (1936)

Joseph Pevney’s Man of a Thousand Faces (1957)

Graeme Clifford’s Frances (1982)

Stuart Heisler’s The Star (1952)

The Star

Bombshell

Man of a Thousand Faces

Frances

Hollywood Boulevard

A Double Life

Seven drinks

I thought it’d be fun to spread the joy with ideas for classic imbibing. Here are just seven of the many drinks had throughout yesteryear in the movies.

The Thin Man Martini

“…a Manhattan you shake to a Foxtrot, a Bronx to a two-step, but a Dry martini you should always shake to waltz time.”

1 1/2 oz Dry Gin

3/4 oz Dry Vermouth

Instructions:

Pour into a cocktail shaker, shake and strain into a chilled martini glass.

The Casablanca Champagne Cocktail

Victor Laszlo’s drink.

Champagne Cocktail 1 bitters-soaked sugar cube 1 oz brandy or cognac Brut champagne Twist of lemon, for garnish

Place your sugar cube on top of the bitters bottle. While holding it in place with your finger, flip the bottle upside down until the sugar cube is saturated. Drop the sugar cube into a champagne flute and add your cognac or brandy. Top with Brut champagne, garnish with lemon and enjoy.

Margo Channing and the “bumpy night” Gibson

This cocktail is also notable for making a cameo in the train car in North by Northwest, but Margot gets the official shout out today.

Gibson Classic Cocktail

4 parts gin 1 part dry vermouth pearl cocktail onion Combine the gin and vermouth in a shaker over ice. Shake and strain into a cocktail glass. Garnish with a pearl onion.

The Some Like it Hot Manhattan

This whiskey cocktail is popular in Wilder’s film and best served after stirring/mixing with a drumstick, cymbal, and hot water bottle on a trail with Sweet Sue and Her Society Syncopaters.

Ingredients:

2 oz bourbon 1 ox Italian sweet vermouth 2 dashes Angostura bitters

Recipe:

Combine all the ingredients in a shaker. Strain into a chilled cocktail glass and enjoy.

Blue Hawaii Mai Tai

1 oz white rum

½ oz Orgeat syrup

½ oz Cointreau

2 oz pineapple juice

1 oz orange juice

Dark Rum float (such as Koloa dark rum)

Pineapple spear and lime (for garnish)

Mix white rum, Orgeat, Cointreau, pineapple and orange juices in a shaker filled with ice. Pour drink into a glass with the ice, and float the dark rum on top. Top with pineapple spear and lime wedge.

Made by Angela Lansbury this is sure to be a hit at any party.

The Breakfast at Tiffany’s Mississippi Punch

2 oz / 50 ml cognac 1 oz / 25 ml bourbon 1⁄2 oz / 12.5 ml lemon juice 1⁄2 oz / 12.5 ml sugar syrup 1 oz / 25 ml dark rum

Shake all the ingredients except the rum with crushed ice and pour into a Collins glass, unstrained. Top the glass with more crushed ice, gently pour over the rum and garnish with an orange slice and a cherry.

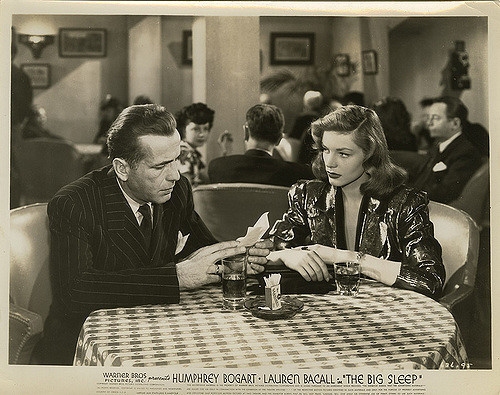

The Scotch Mist from The Big Sleep

It’s important to offer a darker choice so I went for the kind of drink a femme fatale would order when sitting next to Humphrey Bogart.

Ingredients :

2 oz. whiskey (whiskey, bourbon)

2 oz. crushed ice

1 twist lemon peel

Pack a collins glass with crushed ice. Pour in scotch. Add the twist of lemon peel and serve with a straw. No garnish because garnish doesn’t fit in a dirty little world.

Eight silents

I know many classic film fans that have not taken the journey into silent film. That was me when I started this blog, but since I’ve made a concerted effort to watch a silent film when time allows. There’s no doubt I would recommend some of the popular greats to the silent movie novice, or films made by the three comedy megastars and the likes of Metropolis or Sunrise: A Song of Two Humans, to name just two. This past year I saw most of the following lesser-known gems for the first time and recommend them without hesitation.

Victor Sjöström’s The Wind (1928)

Erich von Stroheim’s Foolish Wives (1922)

Per Lindberg’s Norrtullsligan (The Nortull Gang ) (1923)

Leo McCarey’s Mighty Like a Moose (1926)

Roscoe “Fatty” Arbuckle’s The Cook (1918)

Lois Weber’s Suspense (1913)

Paul Leni’s The Cat and the Canary (1927)

Fred Guiol’s Duck Soup (1927)

Duck Soup

Foolish Wives

Mighty Like a Moose

Norrtullsligan

Suspense

The Cat and the Canary

The Cook

The Wind

Nine Child Performances

No explanation needed for this lot of talented young ‘uns.

Roddy McDowall in John Ford’s How Green Was My Valley (1941)

Patty McCormack as Rhoda in Mervyn LeRoy’s The Bad Seed (1956)

Salvatore Cascio as Toto in Giuseppe Tornatore‘s Cinema Paradiso (1988)

Jackie Coogan in Charlie Chaplin’s The Kid (1921)

George Winslow in anything, but for now I’ll go for his performance in Howard Hawks’ Gentlemen Prefer Blondes (1953)

Enzo Staiola as Bruno in Vittorio De Sica’s Bicycle Thieves (1948)

Virginia Weidler as Dinah Lord in George Cukor’s The Philadelphia Story (1940)

Patty Duke as Helen Keller in Arthur Penn’s The Miracle Worker (1962)

Eva Lee Kuney as Trina in George Stevens’ Penny Serenade (1941)

This slideshow requires JavaScript.

Ten Stars and their Dogs

I recently read a startling statistic. It turns out that dogs given to children for Christmas often end up in pounds. Having a pet is a huge responsibility and it should be a choice for life, rather than looked at as a toy. So, if you are inclined to purchase a puppy or kitten for Christmas and haven’t thought about it carefully, spend your time looking at these images instead…

This slideshow requires JavaScript.

Cat lovers can feast their eyes on this gallery of Cats and Movie Stars.

Eleven heist movies

Jules Dassin’s Rififi (1955)

Stanley Kubrick’s The Killing (1956)

Sidney Lumet’s Dog Day Afternoon (1975)

John Huston’s The Asphalt Jungle (1950)

Joseph Sargent’s The Taking of Pelham One Two Three (1974)

Norman Jewison’s The Thomas Crown Affair (1968)

Raoul Walsh’s High Sierra (1941)

Jean-Pierre Melville‘s Bob Le Flambeur (1956)

Robert Siodmak’s Criss Cross (1949)

Mario Monicelli‘s Big Deal on Madonna Street (1958)

Fabián Bielinsky‘s Nueve Reinas (Nice Queens) (2000) – I was introduced to this Argentine gem during a course I took on heist films. It immediately became a favorite. Although it’s a contemporary movie, I know all classics fans would love it. It’s a twisty, well-acted labyrinth that’s well worth your time.

Twelve Days

I would have included Dog Day Afternoon and The Taking of Pelham… here, but no repeats allowed. These are movies with stories that take place in one day.

Fred Zinnemann’s High Noon (1952)

George A. Romero’s Night of the Living Dead (1968)

Alfred Hitchcock’s Rope (1958)

Sidney Lumet’s 12 Angry Men (1957)

Ridley Scott’s Alien (1979)

Frank Capra’s Arsenic and Old Lace (1944)

Akira Kurosawa’s Rashomon (1950)

Mike Nichols’ Who’s Afraid of Virginia Woolfe? (1966)

Sidney Lumet’s Long Day’s Journey Into Night (1962)

Walter Hill’s The Warriors (1979)

Carl Th. Dreyer’s The Passion of Joan of Arc (1928)

Fleming, Cukor et al…The Wizard of Oz (1939)

◊

Till next year, my friends.

#PayClassicsForward

Aurora

#PayClassicsForward for Christmas This tradition began four years ago when I thought of no better way to share the joy of the season on this blog than to spread the magic of movies.

#12 Days of Movies#Classic Movie Recommendation#Movie Recommendations#Pay Classics Forward#Pay Classics Forward for Christmas

7 notes

·

View notes

Text

Bootleg update!

Here are all the bootlegs i currently have, alphabetized this time :))

A Chorus Line A Gentleman’s Guide to Love and Murder A New Brain (with Jonathan Groff) A little Night Music (with Angela Lansbury) Aladdin American Idiot American in Paris OBC Amélie with Philippa Soo Amélie with Samantha Barks An American in Paris Anastasia OBC Annie (US Tour) Annie Get Your Gun Anything Goes Assassins Avenue Q Bare: The musical (Off-Broadway) Bare: a Pop Opera Beautiful: A Carole King Story OBC Beauty and the Beast OBC Big Fish (Pre-Broadway) Blood Brothers Bloody Bloody Andrew Jackson OBC Bombshell Bombshell (audio only) Bonnie and Clyde OBC Book of Mormon Chicago Book of Mormon OBC Bring it On Cabaret Broadway cast Cabaret With Emma Stone Camelot Candide OBC Carousel (Chicago 2015) Carrie the Musical Chaplin Charlie and The Chocolate Factory (London) Chess OBC Chicago Chitty Chitty Bang Bang London Tour Cinderella OBC City of Angels OBC Cyclone (audio only) Dance of the Vampires OBC Dear Evan Hansen OBC Dogfight with Lindsey Mendez Dr Horrible’s Sing-Along Blog Dream Girls Unknown cast Dream girls OBC End of the rainbow Evita (broadway 2012) Falsettos Fiddler on the Roof Fiddler on the Roof (Broadway Revival) Finding Nemo Finding Neverland OBC First Wives Club OBC First date the Musical OBC Follies (Revival cast) Frozen Live! Fun Home OBC Funny Girl: The Musical Ghost: the Musical Gigi OBC Godspell Grease Grey Gardens (Broadway 2015) Gypsy the Musical Hairspray Half a Sixpence (audio only) Hamilton (with Javier) Hamilton OBC Hamilton OBC (with sheet music and recordings from workshops) Hamilton OCC Harry Potter and the The Cursed Child (audio only) Heathers Heathers with Thomas Sanders (audio only) Hedwig and the Angry Inch (Andrew Rennells) Hedwig and the Angry Inch (Darren Criss) Hello Dolly UK Tour Holy Musical B@man! Honeymoon in Vegas Hunchback of Notre Dame If/Then In the Heights OBC Into the Woods Jekyll and Hyde Jesus Christ Superstar Joseph and the Amazing Technicolor Dreamcoat Kinky Boots Kiss me, Kate La Cage au Folles (broadway 2010) Legally Blonde Lend me a Tenor (broadway 2010) Les Mis Lion King (London) Little Shop of Horrors Little Women Love Never Dies (OBC) Mamma Mia! OBC Marilyn An American Fable Marry Poppins US tour Matilda with Eliza Madore Matilda with Mimi Ryder Matilda with Sophia Gennusa Memphis (OBC) Merrily we Roll along Miss Saigon My Fair Lady UK Tour Natasha Pierre and the Great Comet of 1812 (audio only) Natasha Pierre and the Great Comet of 1812 (video recording) Newsies 2013 cast (Corey Cott, Kara Lindsay, Andrew Keenan-Bolger, Ben Fankhauser) Newsies OBC Newsies Tour Next to Normal (Broadway Cast) Next to Normal (OBC) (last performance of alice ripley, jennifer damiano, Brian d'Arcy James with speeches at the end) Next to Normal (Off Broadway cast) (includes cut scenes and songs) Oklahoma! Oliver! On The Twentieth Century On a Clear Day OBC On the Town (broadway 2014) Once OBC Once on this Island Paramour Passion: The Musical Peter Pan Peter and the Starcatcher Phantom of The Opera Pippin Ragtime Rent Rent OBC opening night Rocky Horror Picture Show Saved! (Aaron Tveit and Original cast) School of Rock OBC She loves Me Shrek the Musical Side Show (off broadway) Side Show OBC Singing in the rain Sister Act (London) Something Rotten! Sound of Music Broadway 1998 South Pacific Spamalot Spongebob the Musical Spring Awakening (OBC) Spring awakening (Deaf West) Streetcar Named Desire (with Gillian Anderson) Sunset Boulevard The Musical Sweeney Todd Sweeney Todd (audio only) Sweeney Todd OBC Sweet Charity US tour Taboo the Musical by Boy George Tangled the Musical (Disney Cruise) Tarzan OBC The Addams Family (audio only) The Addams Family US Tour The Color Purple The Curious Incident of the Dog in the Nighttime OBC The Drowsy Chaperone The Great American Trailer Park Musical OBC The Jungle Book (chicago 2013) The King and I The Last Five Years The Lightning Thief (early off-broadway) The Lightning Thief (incomplete video) The Music Man The Newsboys Variety Show (OBC) The Nightman Cometh The Pajama Game OBC The Producers The Visit: The Musical The Wild Party OBC The Witches of Eastwick The light in the Piazza The little Mermaid Thoroughly Modern Millie OBC Tick Tick…Boom! (Original Off-Broadway Cast) Titanic: The Musical Tuck Everlasting OBC Twisted: the untold Story of the Royal Vizier Urinetown OBC Waitress (Opening Night with Sara Bereilles) (audio only) Waitress OBC West Side Story Who’s afraid of Virginia Woolf? Wicked OBC Wicked OBC (KC’s last) Wicked Pre-Broadway Wicked with Nicole Parker, Alli Mauzey, Aaron Tveit Xanadu OBC 13 the Musical 1776 25th Annual Putnam Spelling Bee 42nd Street

i’m super overwhelmed right now so i’m so sorry if it takes a few days for me to get back to you, but feel free to message me if you want one!!! i’m always happy to trade! if you don’t have anything to trade i’ll gift anything to my followers!!

#wicked#hamilton#bootleg#bootlegs#broadway#musicals#the lightning thief#percy jackson#the cursed child#les mis#amélie#phillips soo#next to normal#dear evan hansen#bare: a broadway pop opera#natasha pierre and the great comet of 1812#pippin#bonnie and clyde#annie#aladdin#cabaret#chicago#carrie the musical#carousel#dream girls#falsettos#fiddler on the roof#fun home#hairspray#finding neverland

6K notes

·

View notes

Text

227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorldFallenKingdom'Spicy' #Nike'Spicy'Movie Spicy' NBA Mix! -- Jamaal Al-Din's Hoops 227, Inc. | PRLog

227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorld'Spicy' #Nike'Spicy'Movie NBA Mix! Jurassic World: Fallen Kingdom and NBA Spicy' Chili' Action on Facebook! Universal Pictures Spicy' Chili'! Coming, June 22, 1018! Spicy' NBA Mix!

227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorld'Spicy' NBA! Spread the Word: News By Tag:* Jurassic World Fallen Kingdom* NBA Movies Nike Mix* 227's YouTube Chili NBA By Industry:* Movies BOISE, Idaho - Dec. 11, 2017 - PRLog -- 227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorld'Spicy' #Nike'Spicy'Movie NBA Mix! Jurassic World: Fallen Kingdom and NBA Spicy' Chili' Action on Facebook! Universal Pictures Spicy' Chili'! Coming, June 22, 1018! Spicy' NBA Mix! 227's™ Facebook Fries!¡' everything tasty with hot, crispy fries and a specialty order of #JurassicWorldFallenKingdom'Spicy' #Nike'Spicy'Movie FRIES' sauce! Spicy' NBA Mix! 227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorldFallenKingdom'Spicy' #Nike'Spicy'Movie Headlines (12/11/2017): Jurassic World: Fallen Kingdom - Official Trailer [HD] The Big Lead on MSN.com Jurassic World: Fallen Kingdom In Theaters June 22, 2018 www.jurassicworld.com It's been four years since theme park and luxury resort …'Jurassic World: Fallen Kingdom': A field guide to all the prehistoric playe… Yahoo News VRSE Batman And Jurassic World Virtual Reality Sets Are Now …I4U NewsA First Look! The First Official Trailer For 'Jurassic World: Fallen …stupid DOPE Jurassic World: Fallen Kingdom From Wikipedia, the free encyclopedia Jurassic World: Fallen Kingdom Teaser poster Directed by: J. A. BayonaProduced by:• Frank Marshall• Patrick Crowley• Belén AtienzaWritten by:• Colin Trevorrow• Derek ConnollyBased on: Charactersby Michael CrichtonStarring:• Chris Pratt• Bryce Dallas Howard• B. D. Wong• James Cromwell• Ted Levine• Justice Smith• Geraldine Chaplin• Daniella Pineda• Toby Jones• Rafe Spall• Isabella Sermon• Jeff Goldblum Music by: Michael Giacchino Cinematography: Óscar Faura Edited by: Bernat Vilaplana[1] Production companies:• Universal Pictures[2]• Amblin Entertainment[2]• The Kennedy/Marshall Company[2]• Legendary Pictures[2]Distributed by: Universal Pictures[3]Release date:• June 22, 2018(United States)Country: United States[4]Language: EnglishJurassic World: Fallen Kingdom is an upcoming American science fiction adventure filmdirected by J. A. Bayona. A sequel to Jurassic World (2015), and the fifth installment of the Jurassic Park film series, the film features Derek Connolly and Jurassic World director Colin Trevorrow both returning as writers, with Trevorrow and original Jurassic Park director Steven Spielberg acting as executive producers. Filming took place from February to July 2017 in England and Hawaii. 227's™ YouTube Chili' #Nike'Spicy'Movie'FRIES Jurassic Spicy' Chili' World: Fallen Spicy' Chili' Kingdom and NBA Spicy' Chili' Videos (12/11/2017): Jurassic World: Fallen Kingdom - Official Trailer [HD] * Universal Pictures * Jurassic World: Fallen Kingdom In Theaters June 22, 2018 www.jurassicworld.com It's been four years since theme park and * Jurassic World: Fallen Kingdom Trailer #1 (2018) | Movieclips Trailers * Movieclips Trailers * Jurassic World: Fallen Kingdom Trailer #1 (2018): Check out the new Jurassic World: Fallen Kingdom trailer starring Bryce Dallas * JURASSIC WORLD 2: First Look Trailer (2018) * FilmSelect Trailer * Here is a First Look on Jurassic World 2: Fallen Kingdom. * Jurassic World: Fallen Kingdom - Trailer Thursday (Run) (HD) * Universal Pictures * Jurassic World: Fallen Kingdom - See the trailer this Thursday. In Theaters June 22, 2018 www.jurassicworld.com * Victor Oladipo, Taurean Prince, and the Best Plays From Sunday | December 10, 2017 * Ben Simmons, Jaylen Brown, and Every Dunk From Sunday | December 10, 2017 * Jrue Holiday Scores 34 Pts in Victory vs. 76ers | December 10, 2017 * Rajon Rondo Dishes 18 Assists in Win vs. 76ers | December 10, 2017 *** Jamaal Al-Din, "The World's #1 Sports Blogger (Chili' NBA)"!!! As of April 25, 2015 - 1,000,000 (1 Chili' MILLION) tweets on Twitter and 1,998 Press Releases !!!! NCAA Chili' Final Four!!! NBA Chili' Playoffs & NBA Chili' Championship!!! 227's™ YouTube Chili' NBA Mix!!! *** Jamaal Al-Din's Hoops 227, Inc. (227's™ Facebook Fries!¡' [aka YouTube Chili' NBA] #SpikeLeeJoint'Spicy' Kobe Doin' Spicy' Chili' Work! Spicy' NBA Mix! Video: Spicy' Jurassic Chili' World: Fallen Spicy' Chili' Kingdom - Official Trailer [HD] Spicy' NBA Mix! 227's #Nike'Spicy' NBA Mix) 227's™ Facebook Fries!¡' everything tasty with hot, crispy fries and a specialty order of #JurassicWorldFallenKingdom'Spicy' #Nike'Spicy'Movie FRIES' sauce! Spicy' NBA Mix!

youtube

https://www.facebook.com/227s-YouTube-Chili-Jurassic-World-Movie-NBA-Mix-952068048137985 *** Graduate of the ZIONS Bank (Boise, ID) Business Success Academy *** Thank-you to Karen Appelgren - Assistant Director, Sheila Spangler - Vice President & Director, and Utah Jazz (NBA) Basketball Sponsor & Boise State University Athletics Sponsor - ZIONS Bank Jamaal Al-Din's Hoops 227, Inc. (227's™ YouTube Chili' NBA 2017 - 2018 NBA Playoffs ESPN Spicy' Mix)-cooks da' spiciest Wikipedia information (like dat' POPEYE's FRIED CHICKEN), YouTube NBA & NFL: Atlanta Hawks / Boston Celtics / Charlotte Bobcats / Chicago Bulls / Cleveland Cavaliers / Dallas Mavericks / Denver Nuggets / Detroit Pistons / Golden State Warriors / Houston Rockets / Indiana Pacers / Los Angeles Clippers / Los Angeles Lakers / Memphis Grizzlies / Miami Heat / Milwaukee Bucks / Minnesota Timberwolves / New Jersey Nets / New Orleans Hornets / New York Knicks / Orlando Magic / Philadelphia 76ers / Phoenix Suns / Portland Trail Blazers / Sacramento Kings / San Antonio Spurs / Oklahoma City Thunder (OKC) / Toronto Raptors / Utah Jazz / Washington Wizards Contact Jamaal Al-Din's Hoops 227, Inc.***@spicynbachili.com

via www.prlog.org

227's™ Facebook Fries!¡' (aka YouTube Chili' NBA) #JurassicWorldFallenKingdom'Spicy' #Nike'Spicy'Movie Spicy' NBA Mix! -- Jamaal Al-Din's Hoops 227, Inc. | PRLog

from Jamaal Al-Din's blog 227's™ YouTube Chili' NBA Mix! http://hoops227.typepad.com/blog/2017/12/227s-facebook-fries-aka-youtube-chili-nba-jurassicworldfallenkingdomspicy-nikespicymovie-spicy-nba-mix-.html via http://hoops227.typepad.com/blog/

0 notes

Text

Biblical Studies Carnival for July 2020

Biblical Studies Carnival # 173,

An odd, deficient, odious, but balanced prime.* July 2020.

I, your host, did a carnival in February of this year just around Mardi Gras. I closed that carnival with the Quartet for the End of Time. Little did we know what was coming our way, though we had seen early warning signs. Let this carnival be heralding the beginning of the end of the disaster that is upon us. Let it be that we realize how critical is our support of each other, our 'mutual responsibility and interdependence', and how foolish is the thought, and all its attendant actions, that freedom belongs to the individual at the expense of the whole body. Fun? Enjoyment? Carnival atmosphere? Gaiety? Song and Dance? Unlikely, but let's see if some Immersive Distraction is worth the try.

Tanakh.

Michael Avioz writes on translation of place names in Targum Onkelos which

... became so popular in Babylonian rabbinic circles that the Babylonian Talmud requires Jews to read it every week together with the weekly portion, in the law known as שניים מקרא ואחד תרגום, “[read] scripture twice and the translation once” (b. Ber. 8a).

Hagar

Ariel Kopilovitz explores through a review of the war against Midian how the priestly Torah was compiled. Abdulla Galadari explores the intertextual connections of the Quran with the Shema. David Ben-Gad HaCohen explores the region of Ar-Moab. The Velveteen Rabbi comments on man, woman, and vows in parashat Matot. Nyasha Junior reimagines Hagar in her book on Blackness and the Bible. Lawrence Hoffman sends an open letter to his students outlining 5 valuable principles to be learned from 'tradition' and putting them in the context of Amalek and the current stresses on social order.

Thirty years ago, while researching an article on the subject, I asked my teacher and colleague, the late Harry M. Orlinsky, to define “tradition” and he replied, “Tradition is just a lie going back at least a century.”

Your host continues to dig into the music embedded in the text of the Hebrew Bible. Here is an English arrangement and a Hebrew performance of Genesis 22. On the governance of the Body, Pete Ens begins the month with using the Bible to support ...

The stories of Israelite kings match the Trump presidency remarkably well. And the condemnation of their actions by biblical authors is persistent to the point of being tedious.

Elkanah and his wives (I Samuel)

Laura Quick considers the bed of Og the King of Bashan. (Remembering Remnants of Giants, last seen in 2019.) The Medieval Manuscripts blog shows some Old Testament passages from the Rochester Bible. Francis Landy introduces the Prologue to Deutero-Isaiah.

The seven Sabbaths following Tisha B’Av, the fast day commemorating the destruction of the First and Second Temple, are known as שבעה/שב דנחמתא “the seven [Sabbaths] of Consolation.” All the haftarot are taken from Isaiah 40-66, the work of an anonymous exilic prophet (or prophets), who expresses hope for the future rebuilding of Judea and repatriation of its people.

Doug Chaplin gives us a draft prayer card inspired by Jeremiah 12:1 as used by Gerard Manley Hopkins, in his poem “send my roots rain”. Jim Gordon continues his poetry series with A poem for the Sabbath, by Wendell Berry, a little different from Psalm 92. Carmen Joy Imes praises the laments and imprecatory Psalms.

Mark Whiting writes on penitential wisdom in the penitential psalms. The Hebrew versions of the five poems in the book of Lamentations are riddled with debated readings... It's not very often that Lamentations as poetry gets a mention. A real rabbi now with greying whiskers, and also a poet, Rachel Barenblatt, teaches about feelings in this time of destruction as the period of approach to Tisha B'av.

I'm finding it difficult to face Tisha b'Av this year, in part because every time I read the newspaper feels like Tisha b'Av. There's mourning and grief and loss everywhere I look.

Ah in such solitude sits the city. Abundant with people she is as a widow. Abundant from the nations, noble among the provinces, she is into forced service.

Andrew Perriman continues a four year conversation on redefining Daniel. Is there a Unity amidst this diversity. A question by Anthony Ferguson on the state of the text of the Old Testament.

I am going to discuss the non-aligned manuscripts. I hope to show that these manuscripts are largely secondary and dependent on an MT-like text.

Hebrew language: Your host is beginning a series on explaining the transformation of pointed text into 'spelling lacking niqqud' here and here.

Slave

Jonathan Orr-Stav addresses the difficulties of rendering the cantillation in standard characters. In these days of deception, you might enjoy this note on clothing from David Curwin of Balashon. Archaeology: Jim Davila links to a report on seals that may show more about the gradual resettlement and bureaucracy in Jerusalem after its destruction in 586 BCE. He also points out a deep excavation under Jerusalem. Matthew Susnow explores the ancient temples with an essay on What is a ‘House of a God’? Airton José da Silva links to articles on the administrative storage centre from the time of Hezekiah and Manasseh. Ian Paul offers an essay on 'good'.

for all the wondrous joy of this claim about goodness, Genesis 1 chooses not to say ‘it was perfect’.

Canonical Edges

James McGrath reports from day 2 of the Enoch Seminar on the origins of evil.

Cosmic

Day 3 continues here and here from Jim Davila. Day 4 concludes with a response from Jim Davila and a plug for 1 Enoch as Christian Scripture. In James McGrath's report we read of:

degeneration of the generations, i.e. that evil doesn’t come into the world in one fell swoop but gradually over time, and involved(s) groups rather than individuals,

James Tabor reflects on the good and the ugly. Andrew Perriman draws us into cosmic thinking and then back to political reality. If you are hungry, watch this. Making 2000 year old bread. Absolutely marvelous technique.

New Testament

Having mentioned targum for Tanakh, I am reminded of targuman. Christian Brady is now very active in parish work, and posts on drinking the cup. Timothy Lewis asks why some mothers are included and not others in Matthew's first chapter. Bosco Peters continues his Matthew in Slow Motion, Episode 33. Ian Paul writes on the lectionary and the parable of the sower. Jim Gordon writes on invincible ignorance.

"I don't know how to explain to you that you should care for other people." (Dr Anthony Fauci)

Marg Mowczko meditates on meekness in warhorses.

Sickle

In an essay on John as the mundane gospel, Paul Anderson demonstrates now much mundane detail is in John's Gospel. Trinities posts a podcast with Daniel Boyarin on the prologue to John's gospel. Christopher Page continues a series of posts, #86, (and counting) on living with Jesus through the words of John's Gospel. Michael Bird cites Harold Attridge on the beloved disciple. Adele Reinhartz vs. Chris Keith and James Crossley, an online discussion of her book addressing the thesis of Lou Martyn on 'being cast out of the covenant'. Gary Greenberg posts on the case for a proto-gospel and the healing of a blind man in Bethsaida. (via FB and Dr Johnson Thomaskutty. And here is a lecture on the signs in the gospel of John from the Church of South India. Jason Staples writes on 'Reconstituting Israel: Restoration Eschatology in Early Judaism and Paul’s Gentile Mission.'. Second installment here. Andrew Perriman puts glossolalia into a historical framework that "Jerusalem faces a catastrophic judgment".

The gift of speaking in other tongues signifies the extension of Joel’s prophecy beyond geographical Israel to include all Jews who looked to Jerusalem as the centre of their religious life and practice. The city and its spectacular temple would soon be destroyed.

Eyal Regev asks if Christians mourned the destruction of the temple. And if you have forgotten what prosopological means, here's a reminder. James Tabor reminds us with a paper from the 1980s about Paul's words on apotheosis. Christopher Page seems to double this thought with his mid-month 100th pandemic post on Jesus. And to continue the subject, Ian Paul asks what to think of AI. (Homo Deus?) What's in the translator's choices of gloss? Brent Niedergall posts on temptation vs trial. Brian Small notes that Cyril's lost commentary on Hebrews has been found. CSCO has a number of notes on the Oxford Handbook of Pauline Studies. Phillip Long continues his series on Revelation with questions on 'the son of man' and 'the harvests' and 'the final visions'. James Tabor reflects on washed in the blood of the lamb. For another take on Revelation as an orchestral score, and with respect to more recent historical contexts, see Ian Paul on the present crisis. Derek Demars argues that Revelation is a musical!

Miscellaneous

Family

Marc Goodacre teaches by example about fatigue

... one can see an author making characteristic changes to a source at the beginning of a passage, only to lapse into the wording of the source later on.

Jim West has posted Larry Schiffman's lecture on the DSS here. Airton José da Silva announces a new Bible.

Brazilian translation of the famous French “Traduction Oecuménique de la Bible” (TOB) (according to the 12th ed., 2010). It is the model of ecumenical translations, because of the interfaith composition of its collaborators and because it even adapts, for the Old Testament, the Jewish sequence of biblical books. It is an excellent study bible, with rich notes and many references of parallel texts.

And here is an insight into the culture of Biblical Studies in Brazil. Brent Niedergall points to a paper on the CBGM as material for the upcoming virtual SBL annual meeting. And for more on CBGM, see Brent Nongbri's article here. The cosmologist Bishop of Rhode Island, Nicholas Knisely, expresses a hope that we can go beyond our self-images, on his blog, Entangled States. More than a little uncertainty in the referent in the blog name. James McGrath writes on Academic genealogies. Ken Schenck continues his review of the works of his doctoral advisor, Jimmy Dunn, finishing on the twelfth day. Helen Bond remembers Jimmy Dunn. James Tabor traces his history of learning Greek from age 17 to 74. This spring chicken explains how 'older is not better', and that Westcott and Hort are seen by some today as part of 'a “plot from hell” to destroy God’s truth'. (See also a later version here.) This post on his 'first book' is too good to pass up. The first week of July presented several posts which seemed to be strong on issues peripherally related to the Bible, but grounded in the questions raised by our persistence with its content: So a note by Ian Paul on the priesthood (presbyter), running the risk of self-justification but showing the stuff of Cranmer, and on the meaninglessness of life in response to facing death, by Christopher Page, and on manufacturing belief, a documentary in which many famous appear, noted by Bart Ehrman. There is even a commentary by OUP on being prepared. Nicely juxtaposed is Phillip Long's note for the day on the winepress. Westar Think Tank Fellow, Terrence Dean interviews Nontombi Naomi Tutu: Five current questions. On issues of gender in Biblical Studies, note this discussion with the title, Sarah Rollens and Candida Moss vs Chris Keith here.

Books

Abel Mordechai Bibliowicz has made a pdf available on Jewish-Christian Relations-The First Centuries.

Bart Ehrman talks about his book, Heaven and Hell: A History of the Afterlife, in a long podcast on Reason and Theology. (Take care with whom you chose to spar.) His blog also has a guest post by Cavan Concannon on the Bible Museum.

Not to be outdone, Tyndale house is starting a new podcast series on Trusting the Bible.

April Deconick notes a new book on Jewish Roots of Eastern Christian Mysticism.

Marg Mowczko notes a new book Holding Up Half the Sky.

Stephen Nadler reviews Spinoza.

Reuven Chaim Klein reviews Pharoah, Biblical History, Egypt, and the Missing Millennium, reworking the chronology of traditional Egyptology.

Jim Davila highlights a review of Fredriksen's When Christians were Jews. A good review that I missed from last month's feeds. A good book, too, I am sure.

Brent Niedergall reviews The Greek of the Pentateuch by John A. L. Lee.

Richard Briggs reviews John R. Levinson's The Holy Spirit before Christianity

In a study that is both poignant and provocative, Levison takes readers back five hundred years before Jesus, where he discovers history’s first grasp of the Holy Spirit as a personal agent. The prophet Haggai and the author of Isaiah 56–66, in their search for ways to grapple with the tragic events of exile and to articulate hope for the future, took up old exodus traditions of divine agents―pillars of fire, an angel, God’s own presence―and fused them with belief in God’s Spirit. ... Like most (if not all?) good New Testament ideas, the Old Testament got there first.

Unavoidable

In Memoriam: Alister McGrath has written an obituary for James Packer, certainly a man of some influence and who was known by many in the far west of Canada including former blogger, Suzanne McCarthy most recently of BLT, not just a sandwich. (I knew I could get a bit more poetry in this carnival somehow. I'd rather have good poetry than bad tattoos with lots of ads any day.) ... August is coming up, not April, that cruelest month ...

Next Carnivals

Phil is always looking for volunteers. Fun or not, spending a month actually reading the bloggy scholars and the scholarly blogs is an education... Occasionally, people actually suggest posts too. Chris Brady began the month with a post comparing Facebook to the old blogging community with vigorous discussion of issues in the comments and among the blogs. He also announces the upcoming virtual SBL.

August 2020 – Phillip Long, Reading Acts

September 2020 – Brent Niedergall (who is beginning a video series on James.)

* Footnote: (For the numerologists.) from Blogger https://ift.tt/3fiigze via IFTTT

0 notes

Text

Characters on the Cover: Mike Bartlett’s new drama looks at the people behind the newspaper

Alexandra Wilbraham

First published in Dutch translation: https://www.bbcbenelux.com/blog/?article=press

In most people, newspapers conjure up images of bold titles, eye-catching front-pages and bulky formats that are difficult to handle on morning commutes. For Mike Bartlett, however, his new BBC drama Press is all about the characters.

“We really hope [the audience] will fall in love with them", says the writer who scored a big hit with his medical drama Dr Foster, “I wanted [the show] to have that West Wing feel where you know it’s set in a specific workplace but you care most of all about the characters and what they’re going through.”

Press focuses on the newsrooms of The Herald, a left-leaning newspaper similar to The Guardian and The Post, the rival tabloid newspaper, both tweaking their front pages incessantly to achieve the biggest splash the next morning.

To prepare for the series, Mike Bartlett and the cast spent time at The Sun and The Guardian. The experience reshaped many of the cast’s preconceptions about the newspaper industry.

“I really enjoyed going to the real newspaper offices and seeing how they operate in a similar manner no matter what kind of newspaper they are,” says Brendan Cowell (Game of Thrones), who plays Peter Langley, editor at The Herald, “I liked the fact that […] [they] treat [topics like Syria and The Great British Bake Off] with equal seriousness.”

Charlotte Riley (Peaky Blinders, King Charles III) who plays Holly Evans, a former reporter turned deputy editor at the Herald, was "shocked at how tough the job is". Meeting journalists with a real passion, but who also "really do take their work home" helped inform Riley’s portrayal of her character.

“She’s pretty lonely. […] Being in the office brings her to life – it’s her raison d’etre. I think we were all interested in the personal cost of working in the profession and how hard it is to have a personal life when you do what these [reporters] do.”

Holly’s rival is the strangely irresistible Duncan Allen, Editor of the Post. Ben Chaplin (Apple Tree Yard) plays Allen whom he describes as “a little bit amoral”.

“It’s a fun role. He’svery persistent […] If your job is editing the best-selling newspaper in the country a lot of power comes with that. He justifies that by saying his newspaper can make a difference; I don’t think he worries too much about whether the difference is good or bad.”

Having pitched the original idea ten years ago, past hacking scandals and falls in print readership brought on by the digital age made Bartlett reconsider his approach to the drama.

“The show that was initially in my head was about quite a stable industry […] [But], there’s a revolution happening, and as a dramatist, it’s a wonderful world because you’ve got new people coming in, new ways of doing things. […] The public has a sense of what journalism is, but there’s a lot they don’t know and we want to show that side of it.”

Journalism has long provided fodder for exceptional drama, both in TV and film. Press, however, turns away from a nostalgic look at the industry, but places in the now, with all the challenges and possibilities it brings with it.

Written for BBC First Benelux

0 notes

Text

I LOVE HER, BUT I DON’T LOVE HER

I LOVE HER, BUT I DON’T LOVE HER

I love the classics. I love for as long as I remember, checking the listings, going to the movies, watching all the previews, (with big expectations,) and now the fancy commercials, having popcorn, a huge limited-edition pop cup or a Decaf. And now especially, the additions of recliner seating throughout the whole theatre and the fact that I can choose my seat in advance. Nothing beats the movies for me, I love cinema and the art that it creates. My top 3 favourite movie is from 1975, Louis Malle called: Black Moon. I admit I can be a sucker for classics like watching a movie on the old CITY TV’S late great movies. (so many late-night experiences lol). But things have changed, and I have changed with the world. As is a theme in my blogs, where the centralized top down requirements of media consumption have made many abandon the ship of traditional media and made many of all ages embrace new media. My nostalgia is much more of a reason to go to the movies than anything else. The movie industry and theatres are intertwined fully completely, and I know that neither really wants to pull away but are kind of being forced to. In the past decade or so there have been less and less must-see movies for me to go to the theatre to see, but still though, the whole Marvel Comics movies are a big deal for me and I really have only missed one or two since the movement started. But I used to want to see anything in the theatres even if It wasn’t what I really liked. A good part of traditional cinema in my city is a theatre called Hyland Cinema. Hyland plays mostly Indie and more cultural and movies with a message or artistic theme. And I dig that I do, but I don’t go the movies as often as before.

But regarding new media, I am much more content with Bell on Demand and iTunes, even vs Netflix, as Bell on Demand is considered new media and gets all the movies quickly after they end in theatres. I can just click and purchase from my remote and I have the movie on a big screen tv. There is also a pretty big library as well. I will get into where Bell is lacking, and other new media is winning next. Bell has also adapted hugely from the traditional, “prime time TV spots,” with on demand TV shows and a television show version of Netflix called Crave TV, where you can literally watch thousands of shows/seasons for a few dollars a month. But the thing I don’t like about Netflix and Crave Tv is that it’s a subscription service and I would rather pay only for what I want at the time (on demand) and not for a whole range of products, which is why I like iTunes and Bell on Demand. So, my preference; I have no preference or loyalty for watching traditional media like television unless its on demand and less preference for the theatre. Back in the day I was always at the movies, just like you see in the movies 😊 where its mostly the nostalgia and overall experience that I go to the movies for. A factor of course is the lack of quality movies which I find it hard to be interested enough and rather just wait for it to get to Bell or iTunes. Boy do I remember watching Lost Souls with Wynona Ryder and Ben Chaplin back in 2000, that movie is another in my top 3 and is what I refer to when I talk about the cinematic experience! But those days are gone and now is my final point and preference of Bell new media like on demand and iTunes. See, as I was saying, I don’t watch tv shows unless they are recorded or on demand, but still there’s a catch with Bell and the big traditional media tv stations like ABC, Bravo NBC, Global etc. You can always or maybe never watch a full series or catch up on let’s say 8 shows in a row. They sometimes don’t have the first episode, or they will only have the first 3,4,5 etc. or only have the last 3 or so shows. So, its hard to feel the whole experience and get reeled into the show. They are pushing for you to watch each week for the sake of their precious commercials. With iTunes, when I like a show I will not hesitate to buy an episode each week as its available, or if possible buy the whole darn season for 30$ and watch it like a zombie in 2 days. Like my favourite show from Showcase Channel, The Magicians. I love that show 😊 So all in all the on-demand culture and instant gratification culture are the big winners these days. Traditional media has left people disengaged not only due to convenience but also due to centralized and dictatorial behaviour of the big media who, although they are adapting, it is because they have been forced to adapt and still look reluctant to. But their big budgets and resources will eventually take hold.

0 notes

Note

Hi! Did you change your blog's name? What was it? No.. wait,, is it the avatar? #soconfused :D

hahaha you’re sweet, anon.

My url is the same as it’s always been but up until a week ago or so I had a picture of bloody not Henry Gale (Ben Linus) from LOST as my icon and my desktop blog theme was white with Charlie Chaplin and myself, my mobile theme was a dark red with a tulip pic as a header.

Now it’s all gone down a Guillermo del Toro rabbit hole that I don’t plan on getting out of any time soon. I hope you’re still on board with that new content lol

0 notes

Text

The Most Important Thing That Counts in Investing is Character

One story from World War II that I found as tragic as it was magnificent was that of Anne Frank.

Frank was born in Frankfurt, Germany but moved to the Netherlands for safety in 1934, five years after she was born. The Frank family hid in their basement with four other Jews when Germany took control of the Netherlands.

Anne then began to write, at age thirteen, in a diary of her life, feelings and the outside world. She wrote in the diary every day for two years until their hiding place was found and she was forced into a concentration camp where she died with her sister due to a sickness. She was just fifteen when she died.

Although Anne wasn’t only a tragic girl in this war, her diary that is available to read as The Diary of a Young Girl displays the strength of her character. The diary portrays her as a brave and hopeful girl, character traits that are hard to manage in the kind of hardship that she was a part of.

One of her diary entries reads –

Human greatness does not lie in wealth or power, but in character and goodness.

Strong character is what Anne displayed through here little life. And strong character is what makes people great in their lives.

In the broader scheme of this Universe, even when I look at a lowly, unimportant field like investing, I find that investors who have done wonders for themselves are the ones who have displayed strong character at various points in their investment lifetimes.

By the way, I am not talking about those who have done well over the past few years (thanks to a genial market environment) because they have not yet been tested for the strength of their characters, but of those who have stood the test of time over more than a decade.

The thing about character is that no book or course can teach you on this, though very few of them talk about how you can gradually build it. Ben Graham’s The Intelligent Investor is one of them. Seth Klarman’s Margin of Safety is another. Philip Fisher’s Common Stocks Uncommon Profits is the third. And then you have Howard Marks’ memos and Warren Buffett’s letters to shareholders. Most of other stuff written on investing through the years, including this blog, is just commentary.

Anyways, if I were to draw down the lessons I have learned from these books and from watching successful investors on building a strong character required to do well in investing, here are five traits that stand out –

1. HUMILITY, especially intellectual.

Being humble in investing isn’t about being doubtful of yourself, or believing that you are untalented, unintelligent, or unworthy. On the contrary, it is about being humble about our own intellect, to question whether what we know is actually correct and even to adjust our beliefs if we are presented with new information. In other words, it is largely to do with intellectual humility.

As Philip Tetlock wrote in Superforecasting, true humility (in investing) is about recognizing that “…reality is profoundly complex, that seeing things clearly is a constant struggle when it can be done at all, and that human judgment must, therefore, be riddled with mistakes.”

Very few investors have the nerve to say, “I don’t know.” But that’s how you build humility in your investment process. If you start with “I don’t know,” then you are unlikely to act so boldly as to get into trouble.

2. INTEGRITY, which is the quality of being honest and having strong principles.

Successful investors focus on their investment process with unwavering steadfastness and honesty, whatever the stock market is doing and however others around them are behaving.

They show how, to be a successful investor, you must have a philosophy and a process that you stick to even when the times get tough. This is very important. If you don’t have the courage of your conviction and patience and toughness, you can’t be an investor because you’ll constantly be driven to fall in line with the consensus by buying at the top and selling at the bottom.

But it’s important to know that no approach will allow you to profit from all kinds of opportunities in all environments. You must be willing not to participate in everything that goes up (like what’s happening now), and only the things that fit your process and investment approach.

3. TENACITY, which is the determination to work hard and keep faith in your investment process and the power of compounding.

Over the years I have met a multitude of investors who knew about the power of compounding, but very few who truly understood its real power because that shows up not in one, three, or five years…but ten, fifteen and twenty years. And in an age of instant gratification, since not many have the tenacity to hold on to their faith in this power and in high-quality companies to create wealth, not many investors end up successful.

American investor, hedge fund manager, and philanthropist Leon Cooperman is quoted as saying –

It doesn’t matter whether you are a lion or a gazelle; when the sun comes up you’d better be running.

Cooperman is seemingly talking about the importance of hard work here, which is a direct offshoot of tenacity. Sensible investing is hard work.

But then, Jesse Livermore, one of the greatest stock speculators of all times, is supposed to have said –

The main reason why money is lost in stock speculations is not because Wall Street is dishonest, but because so many people persist in thinking that you can make money without working for it and that the stock exchange is the place where this miracle can be performed.

Warren Buffett has said –

I learned at a very early age how important it is to work hard and be honest.

Hard work you put in identifying businesses you want to own, and then the hard work you put in just staying put, doing nothing, is what should help you succeed in your investment endeavors. There are no shortcuts to the top.

4. SELF-AWARENESS, which is the conscious knowledge of one’s own character and abilities.

George Goodman aka Adam Smith wrote in his book The Money Game –

If you don’t know who you are, [stock market] is an expensive place to find out.

Mere gathering of facts and bookish knowledge can only lead us to chaos. That chaos is what causes most people to fail in their investing lives despite all the books they read and courses they attend. While it is obviously necessary to read the wisdom and ideas contained in all those great investment books, they will only help us with the “techniques.”

But without understanding ourselves, those techniques would only lead us to frustration (maybe, an ‘intelligent’ frustration) and ultimately failure.

In studying successful investors over the years, I have come to realize that the right kind of investing education comes with the transformation of ourselves, which entirely depends on our awareness of ourselves – our behaviour, risk-taking capacities, and habits.

When we are aware of ourselves, we are in a better position to behave well. And that can help us save ourselves from self-destruction that most other investors lead them to.

5. ADAPTABILITY, which is the quality of being able to adjust to new, changing conditions.

This is the core of Charles Darwin’s theory of evolution –

It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.

Adaptability is one of the few skills that are hard to learn but pay off for the rest of your life.

Given the ever-changing world we inhabit, and given that this change is unlikely to ever slow down, what mattered very much yesterday (e.g. skill, knowledge, etc.) might not be worth a dime tomorrow. Change used to be slow and incremental: now it is rapid, radical and unpredictable.

Adaptability enables us to dwell on new circumstances and stay on top of the situation. Of course, this skill is best when combined with insight, giving us fresh perspective before the change itself. Growth depends on how adaptable you are.

Prof. Sanjay Bakshi told me this in an interaction some time back –

If you bought the right type of business, then there is likely to be a tendency for it to deliver better than what you envisaged. If you see that tendency play out after you have invested, don’t ruin it by staying with the original model. Your model has to be adaptive. If the performance is far better (or worse) than you envisaged, you have to change the model unless the improvement (or deterioration is likely to be temporary).