#things that remind me i last was in rpc in like 2020

Explore tagged Tumblr posts

Text

headcanon dump: movies edition.

idk why i have so many thoughts about something as mundane as movies when i also have said that megumi isn't the biggest movie person KJDSFKSDJFDS but i love thinking about movies i watch and how my muses feel about them so here we go!

01. i like to imagine a world where he was bullied into making a letterboxd account. i think he's kind of the opposite of the way that kojima tweets about movies where instead of writing a really thoughtful piece about how much he likes a movie but then just says "i saw [movie] today" about a movie he (most likely) did not like, megumi will say "i saw [movie] today" about movies he's generally fine with but will go off on movies he hated. sometimes he'll say something nice about a movie that really appealed to him but it's usually just as short.

his top 4 fluctuates but i think currently would be planet earth, the princess bride, dead poets society, and knives out.

i was going to explain my thought process for his current top 4 in the tags but it was getting too long DKFJDSFD so:

planet earth: i really wanted one of the movies to be something centered in nonfiction or a documentary/docuseries. he really enjoys documentaries, though i think as much as he thinks it's compelling i think he doesn't really like true crime too much (probably in part because in the sorcery world there are probably true crime cases that one could just attribute to curses).

the princess bride: in truth i was really wavering between this and the shape of water as the like "romance" pick. i wanted a movie to reflect his soft spot for, like... not necessarily "romance" genre movies (though shape of water technically moreso IS, but it still hits differently from movies like the notebook and love actually etc etc), but movies that happen to have a romantic subplot that just hits. like, arwen giving up his immortality to be with aragorn (also would be remiss not to also mention literally aragorn and boromir and frodo and sam) he sees that he's like “fuck. okay. yeah i'd do that too huh.”

dead poets society: i'm not sure how well i can explain this one but i'll try. i think he's got the interest in movies that have queer readings or subtext. plus it's like… the self expression against a traditional/conservative structure, etc. i have another headcanon dump that's going to mention this (which i actually started first but got immensely sidetracked by this KJHDKFJDS) but i think megumi likes poetry, so that also played a part. also something something seizing the day/living in the moment reminiscent of megumi being encouraged to surpass his limits, in a way that i can't articulate atm but idk i feel like there's something there.

knives out: it just scratches an itch. the outcome and marta's validation in the film is satisfying but also anything megumi can try to unravel and solve in his mind is satisfying too. mystery movies can be fun for him but it's a balance because if he thinks the twist or the reveal or the resolution is stupid he's going to turn against the movie.

these are honestly kind of subject to change — i actually had gone girl in there in place of dead poets society, but i removed it from his top. initially i had gone girl even as an honorable mention just because there's a sort of "what the fuck" factor in viewing it that catches his interest but i didn’t think he ultimately felt as strongly about it — and THEN i rewatched the movie + my husband and by extension i read the book and it dropped massively down his movie list (he thinks the book is better KAJSKSJSKS)

02. he makes a point to visit "does the dog die" before viewing any movie. he also flat out refuses to watch movies like "marley and me" or "a dog's purpose." he knows you just want to catch him having the big emotions and he won't have it.

03. inspired by the fact that i finally finished watching all of christopher nolan's movies this past weekend, interstellar got him bad. hated watching the tricks with the birds in the prestige though, probably said out loud "they can't keep doing this." (i did not look at does the dog die before viewing—)

04. he doesn’t particularly like scary movies, though he thinks he handles them fine. that’s mostly true, especially when it's more of a psychological horror, but supernatural horrors are a little too unsettling. jumpscares get him every time though, and he hates them.

05. he generally finds most comedies unfunny, but then again he's not exactly the king of comedy (funny as i think he unintentionally is—).

#headcanon.#long post /#tho i know long posts are expandable now so is this tag even necessary skdjfsdkjfsf#things that remind me i last was in rpc in like 2020#anyway also i saw this tiktok literally like yesterday i think that was like these are the movies i think these jjk characters would like#and megumi was the florida project and spirited away#the former i haven't seen and the latter not in a Long Time#but i think those are good picks too tbh i read the synopsis of the florida project and thinking about it really hitting megumi made me Sad#in a similar way that interstellar did#if i have any other movie thoughts i'll put them either in a new movie dump or include them in the other headcanon dump i'm working on!

6 notes

·

View notes

Text

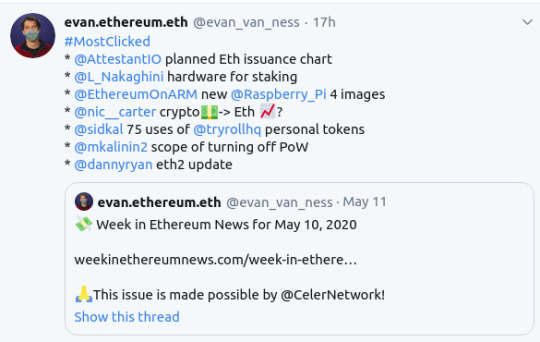

Annotated edition of May 10 Week in Ethereum News

I’ve started thinking of the annotated version as aimed at Eth holders. There’s a large group of people who hold ETH who want to stay up to date on what is happening, but also have jobs outside of the industry and may not understand all the tech nuances nor have time to spend. So the annotated edition will try to give you more narrative, more context, some opinion, maybe some 🌶️, as well as pointers to what might you want to read

Fun fact: you can find the #MostClicked and #MuchClicked on Twitter by just searching the hashtags. The usual caveats apply: the things most clicked are the things people hadn’t otherwise seen (not necessarily the most important), and my tweets auto-delete after a month or two, so the data only goes back a couple months.

Before clicking send, I knew for sure which would be the most clicked item this week. I was right.

How did I know it would be the most clicked? Because even among Ethereum enthusiasts it’s an undercommunicated thing how low eth issuance will be. It is planned to sustainably be so low that it might at some points go negative (and perhaps be negative over long periods of time, which worries me a little!). Perhaps part of the reason we don’t communicate this that loudly is because we just aren’t there yet. But unlike Bitcoin which has no path to long-term sustainability, Eth has a logical plan to have very low issuance.

As I said, I forgot this last week, but if I were clicking a few things this week:

chart of ETH issuance over time

A review of hardware for eth staking

MyCrypto’s history of Eth hard forks to celebrate 10m blocks

I might also check out the stuff about personal tokens, because personal money is an interesting subject to think about, even if you’re skeptical like I am. The idea of “what is money” can take you down some fun intellectual rabbit holes:

75 interesting uses of social money by Roll

Personal tokens were the topic du jour, check out this overview from Dan Finlay

A little light this week on the high-level stuff. The chart of Eth issuance I already discussed. The hardware for Eth staking is a worthwhile jumping off point if you’re planning on staking. And the hard fork history is worth knowing, or if you know it, then it’s a fun trip down memory lane.

Eth1

Step by step guide to running a Hyperledger Besu node on mainnet

Nethermind v1.18.30 query the chain and trace transactions within minutes with Beam sync

A primer on block witnesses

Installation guide to running eth1 nodes (or eth2 testnet) on RaspberryPi4

So this week we have a guide to running the ConseSys’s Besu client (part of Hyperledger) which is a Java client aimed at enterprise, but which can run mainnet. More Nethermind and Besu nodes are good for client diversity. So is OpenEthereum (formerly known as Parity), which had a release yesterday.

And if you like running nodes on RaspberryPi4, check that out.

This newsletter is made possible by Celer!

Celer has just released a new state channel mainnet upgrade enabling everyone to easily run a layer-2 state channel node and to utilize the low-cost and real-time transactions enabled by Celer. Game developers with no blockchain knowledge today monetize their games through CelerX gaming SDK that leverages the underlying layer-2 scaling technology with ease. Celer has also released the world’s first skill-based real money game apps where players can join multi-player game tournaments and win cryptocurrency prizes, Follow us on twitter, blog, discord and telegram.

Yay, thanks Celer!

Eth2

Danny Ryan’s latest quick eth2 update – bug bounties doubled, latest IETF BLS standard

PegaSys’s Teku client is now syncing the Schlesi testnet – which has been much more stable than expected

Latest Prysmatic client update – reducing RAM usage, slashing protection

SigmaPrime’s Beacon fuzzer update, struct-aware, bugs found in Teku and Nimbus

Latest Eth2 networking call, gossipsub v1.1. Ben’s notes

Python notebook to simulate a network partition

Apostille, an Eth1x64 variant

Scoping what is necessary to port eth1 to an eth2 shard and turn off proof of work

Lots of talk of go-live this week. Is it July, q3, or q4? We need to get audit reports and have multi-client testnets running long-term, though last I checked the Schlesi testnet has been quite stable. And since publishing the newsletter, now PegaSys’s Teku client is fully validating on Schlesi.

Layer2

Demo of Synthetix on the OVM includes paper trading competition with 50k SNX prizepool. The details of how the Optimistic Virtual Machine enables EVM-in-EVM

Gods Unchained building an NFT exchange with StarkWare

Exit games in state channels

Celer Network’s Orion upgrade makes it easy to run a state channel node

I’m going to set up a Celer node later this week if I have a chance.

Also check out the Synthetix trading competition and help stress test the OVM.

Stuff for developers

Solidity v0.6.7, EIP165 (standard interface detection) support. Also survey results on what devs love and hate about Solidity

Solhint v3 – Solidity linter removes styling rules and recommends prettier Solidity instead

Open Zeppelin ethers.js based console

Etherplex: batch multiple JSON RPC calls into single call

Time-based Solidity tests with Brownie

MythX now has 46 detectors

Quiknode has an online tool to test endpoints

Reading Eth price from Maker’s medianizer v1

Build an app with Sablier’s constant streaming tutorial

Building a bot using MelonJS to automate your Melon fund

StarkWare found a vulnerability in Loopring’s frontend where passwords were being hashed to only 32 bit integers

Even the frontend bugs can get you!

Ecosystem

A chart of ETH issuance over time. The best I’ve seen

Ethereum Foundation’s q1 grants list

A guide to bulk renewing your ENS names

ethereum.org looking for Vietnamese, Thai, Danish, Norwegian, Hungarian, Finnish, or Ukranian translators

A review of hardware for eth staking

A reminder that many ENS names have now expired and need to be renewed! There’s a 90 day grace period, but do it before you forget.

Enterprise

PegaSys’s Hyperledger Besu suite available on Azure Marketplace and Microsoft’s blockchain devkit now supports Besu

Quorum v2.6 – breaking database schema changes, update to geth v1.9.x

Microsoft continues to make the Ethereum dev experience better, with their VScode extension.

Governance, DAOs, and standards

How to start a MolochDAO

Options for delegated voting in KyberDAO

EIP2633: Formalized upgradable governance

EIP2628: Header in StatusMessage

I oppose any sort of “formalized upgradeable governance” and I think most do.

Application layer

Use POAP for sybil-resistant voting or to determine Discord channel access

Yield: a revised implementation of Dan Robinson’s yTokens for fixed rate, fixed term loans that give a yield curve

Comparing total value locked in DeFi to unique active addresses

75 interesting uses of social money by Roll

Personal tokens were the topic du jour, check out this overview from Dan Finlay

Strike: perpetual swaps with 20x leverage

POAP as a quasi-KYC layer is pretty interesting to me. Seems like there are some good uses in Ethereum land.

i’m excited to hear that DeFi will get a yield curve!

Tokens/Business/Regulation

Nic Carter: are stablecoins parasitic or beneficial?

OpenRaise: a continuous offering fundraiser for DAOs

dxDAO’s kickstarter using OpenRaise sold out before public announcement – though the curve is still live, plus a secondary Uniswap market

dxDao’s token is an interesting bit. Most of the token supply goes to the DXDAO, but it’s an interesting experiment in building completely decentralized apps as a Dao with a community that lately has been burgeoning. It’s also a bit of a check on rent-seeking because it is a credible threat to excessive fees.

One fun note is that the Uniswap market occurred almost immediately and (almost by definition) trades at a substantial discount to the main market.

General

Aggregatable Subvector Commitments, the future may not involve Merkle trees

This week, Ethereum mined its 10 millionth block.

Here’s MyCrypto’s history of Eth hard forks to celebrate 10m blocks

IPFS releases Testground suite for p2p networking tests

PayPal blocked tokenized real estate startup RealT despite a lack of chargebacks, so they’re switching to Wyre

10,000,000 blocks of Ethereum mainnet!

Capricious censorship in web2 and payments! I’ve been in PayPal’s shoes managing a card not present merchant account, and so I’m somewhat understanding to them. You’re trying to keep your fraud rate down in a system that sometimes seems rigged against you. In RealT’s case, they likely also had large amounts coming through which combined with crypto seems scary to Paypal, even with a low chargeback rate.

It’s not really anyone’s fault. The system sucks, and this is why Ethereum matters.

Final note that you can see below in the calendar: RAC’s $TAPE dropped yesterday. It’s a tradable ERC20 token sold on Uniswap (ie, a pre-set price curve). Of course the price went from $20 to $1000, as the token is redeemable for a limited edition cassette tape of RAC’s new album Boy.

Housekeeping

Did you get forwarded this newsletter? Sign up to receive it weekly

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-may-10-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

May 11 – RAC’s $TAPE

May 12 – MakerDAO Sai shutdown deadline

May 22-31 – Ethereum Madrid public health virtual hackathon

May 29-June 16 – SOSHackathon

June 17 – EthBarcelona R&D workshop

0 notes

Text

Annotated edition for Week in Ethereum News Feb 9

There’s too much going on in Ethereum for Substack!

This edition was so massive that I found out that Substack (my email provider) has a character limit, because it started giving me warnings when I wasn’t even done. So to make space, I cut out some of the default language in the bottom sections that few people read. Probably should switch some of that language up anyway.

Link for standard version of Week in Ethereum News without my commentary.

Eth1

Latest core devs call. Beiko’s notes

EIP1962 generalized elliptic curve and pairing engine implementation in Go

Nethermind v1.6.1 – better tip of the chain tracking and reorg handling, JSON RPC bugfixes

Parity v2.7.2 and the next steps for Parity client maintenance under GPL3 (though reportedly most participants preferred a more permissive license)

Slockit’s Incubed ultralight client server setup wizard

On the core devs call, they’re going over what makes sense to include in the next fork. The second EIP1962 implementation is the link in here, important because it’s the alternative to the MatterLabs implementation for the generalized precompile.

Nethermind continues to improve with constant releases. Parity kicked off their “OpenEthereum” transition of the client to the community. Apparently the DAO idea is on the backburner - if reports on Twitter are to be believed, they would have held the majority of the tokens. That’s crazy, presumably the idea was that they’d be giving them out over time to the contributors. It would have been nice to have a better writeup somewhere

Headsup: at some point there is going to be (another) fight over ProgPoW. It’s an odd beast where both sides are convinced that they have already won - meaning that anger and disgruntled ragequits are almost guaranteed.

If you’re the sort of person who ragequits because you didn’t get your way, then there’s a reason why forks of Ethereum exist.

Eth2

Danny Ryan’s quick eth2 update – it’s optimization time

What’s New in Eth2

Latest eth2 call. Notes from Mamy and Ben.

Jim McDonald: defining eth2 network metrics

A look at Rocketpool’s GUI

Nimbus’ first mobile testnet on Android. Plus part 2 of building Nimbus on Android.

Eth2 research team ask me anything on Reddit

Rocketpool is currently the 3rd most clicked of this week’s issue. I’ve been of the opinion that CLI is fine for staking - most people who are willing to stake their ETH at the start can handle a CLI, I think. Rocketpool is conservatively estimating to go live in Q4 - I imagine that the staking rewards will be substantially higher in q3 pre-rocketpool, and then will go down again around q1 2021 when exchanges/custody services start staking for their customers.

Nimbus mobile testnet is neat. The idea has always been that you can run a validator on a mobile phone. It’s happening!

Layer2

Batch Deposits for [op/zk] rollup / mixers / MACI

Matic explains advantages and limitations of Plasma and rollups

A relatively straightforward section this week.

Stuff for developers

Kendrick Tan’s practical guide to building zk dapps

Kimi Wu’s hands on your first zk dapp

OpenZeppelin contracts v2.5 – with CREATE2, enumerableset and big NFT gas savings

Remix v0.9.3 – you can now test the functionality of receive & fallback functions

ABDK adds a number converter to its online toolkit

ethers.js and Google’s Bigquery

Alethio adds API endpoints for Rinkeby, Kovan and Ropsten testnets, as well as webhooks

MythX, Quantstamp, Runtime Verification, Sooho, SmartDec and ConsenSys Diligence starting Ethereum Trust Alliance, a security rating system for deployed Eth code

Time travel queries using a subgraph from The Graph

Brownie now supports Vyper

Microsoft’s Azure Eth development kit is now generally available

A write up of the bug that Sam Sun found in three of Kyber’s bridge reserves

EthVigil’s interactive tutorials for devs new to Ethereum concepts

3Box Comments and Chatbox plugins now have emojis, likes, and votes

I like to highlight the zk stuff as it’s clearly the future.

Sam Sun just keeps finding bugs.

Checkout the EthVigil tutorials. They look pretty slick!

Though it’s still early days (the standard thing to say on every panel at every crypto conference), a sign of maturity is that things like Microsoft’s Eth dev kit being generally available isn’t an earth shattering headline anymore. Everyone now knows that all the world’s biggest companies are experimenting with this technology, almost always on Ethereum, yet they’re also often quiet about it.

It’s usually safe to just replace “blockchain” with “Ethereum” in most MSM headlines.

Ecosystem

Why ENS uses Ethereum and not a new basechain. (Also: ENS’ registry migration is complete)

How Whisper-fork Waku does DNS based discovery

ConsenSys lays off 14% as part of strategic transformation

Matt Leising says he knows who the DAO hacker is

SHPLONK, an explainer of last week’s paper from Boneh, Drake, Fisch, and Gabizon

Matt Leising has identified...the best way to sell a book by claiming that he has identified the DAO hacker. He’s been teasing it for a bit. I sure hope this holds up better than the Newsweek “scoop” identifying Dorian Nakamoto as Satoshi. After it was clearly debunked, the Newsweek authors kept claiming that their “forensic analysis” was correct. Embarrassing. Let’s see the evidence.

The zk naming schemes are great. Zero knowledge is one of those things that is exploding because of blockchain.

ConsenSys had a round of layoffs this week, though as you see below, it also acquired a municipal bond broker-dealer. Coverage was actually reasonable - it’s another sign that perhaps this industry is (sometimes) growing up a bit.

Enterprise

ConsenSys acquires Heritage Financial Systems, a municipal bond broker-dealer, to tokenize them on Codefi

Governance and standards

Two articles on DigixDAO dissolution: as an example of DAOs working (though just 58 addresses voted out of 11,000+) and Coinfund looks at the Digix voting power

Why ragequit is game changing

Live on mainnet

Colony is in public beta live on mainnet

First 10,000 zkDai is on Aztec

Mattereum’s asset passports are live on mainnet

District0x’s District Registry is live on mainnet, a TCR for its community

Coronavirus whistleblower Dr. Li Wenliang is memorialized on mainnet

AirSwap Delegates is live on mainnet. Configure automated trading rules, onchain limit orders, liquidity integration with Kyber, and ability to add new tokens

I love the idea of Colony and want to get a chance to test it.

I had to break up the app layer section this week because there were just too many things. Obviously a DeFi heavy list, and many of the things in the next “application layer” section are also on mainnet. Things are shipping! The distinction between the two sections was a bit arbitrary, as is always the case.

Application layer

DeFi hit $1 billion USD equivalent locked up

Maker Dai Stability Fee 8%; DSR 7.5%

Data viz on Maker’s Sai to Dai migration success

A spreadsheet of admin keys in DeFi

Etherisc’s flight insurance app returns on Rinkeby testnet using Chainlink

Idle Finance v2 (an autobalancer similar to Staked’s RAY)

Collateral Swap – swap between Maker collateral (eg, ETH<>BAT) with Aave + Uniswap

List of DeFiZaps – one click to do a bunch of DeFi actions

Gelato, a no code bot to automate your Ethereum tasks. Tutorial

Gauntlet’s analysis of why Uniswap is a good oracle

Credentify, an API to issue standard European education credentials stacked into ECTS

Circles’s universal basic income is live on Kovan testnet

Maple Loans undercollateralized loans through communities with the option to slice up the risk CDO-style

Zero Collateral loans with cDai, live on mainnet (but unaudited alpha software)

Dharma’s dtokens – wrappers around Compound tokens, a la rDai, but for services to take profits. In this case, 10% of interest to Dharma

DeFi hitting $1b USD is definitely the story of the week. Of course there are criticisms you can make (it’s risky, the risks are cascading, there will likely be some kind of crisis at some point, oracles are centralized, etc etc) but as Josh Stark and I wrote in our Year in Ethereum 2019 piece, DeFi is an alternative financial system and in many ways a remarkably better one. Way less paperwork, much less settlement times, better transparency, not to count the various improvements on censorship-resistance, trustlessness, permissionlessness, etc.

I liked Avichal’s tweet:

Imagine a Fintech startup tweeted: "We launched two years ago. Today we have $1 Billion in collateral and have given out a cumulative of $1B in loans!" Every VC in the world would want to know what the hell the startup does and how it works. 2020 is going to be wild for crypto. pic.twitter.com/yb8gfISSoX

— Avichal Garg (Electric Capital) ⚡ (@avichal)

February 7, 2020

One thing we linked in the Year in Eth piece was a story about a Turkish football star who is now driving for Uber because Erdogan froze his bank accounts in Turkey. I take the story with a small grain of salt, but it’s a reminder than any wealth you save is...sometimes not really yours if it resides in a bank.

Unsecured/undercollateralized loans is definitely becoming an area of experimentation, with multiple projects on Ethereum.

Tokens/Business/Regulation

Hester Peirce speech proposing an SEC safe harbor for tokens

Op-ed: America falling behind the world in blockchain

Viewing GDPR from a blockchain lens

6 central banks to talk digital currency in April

Ethereum needs more entrepreneurs and product people just as much as more devs

Are stablecoins parasites on ETH?

Why ETH will sustain a monetary premium

The SEC should have figured out some kind of safe harbor in 2016, and then we wouldn’t have had the mania and fraud and misallocation of capital that occurred in 2017 that set the space back. But still, better late than never - though certainly some things have happened outside of the US because of the SEC. Decentralization in action!

Kames’s article calling for more entrepreneurs is an interesting one. Is more devs the bottleneck or is it better entrepreneurs?

I’ve never liked the “monetary premium” angle. What I do find amusing is how many Bitcoiners point to something written at the peak of BTC’s 2017 bubble where a legacy finance guy tries to get his friends to buy BTC (I hope they ignored him then!) and not ETH with the argument that ETH is intrinsically valuable, but BTC is not, therefore all the value will accrue to BTC.

Only in crypto, folks.

General

Dispelling Bitcoin maximalist myths about Ethereum

a visual introduction to Merkle trees

Accelerating powers-of-tau ceremonies with optimistic pipelining

How does cryptocurrency have value, part 2 of Maker’s intro series

It’s impressive how much fake news is created about Ethereum by Bitcoin maximalists. I’m convinced that a decent chunk of Bitcoin holders actually think that Ethereum runs on Infura, and another chunk think that an Eth full node needs 10 TB. A bunch of the crypto clickbait media feeds these falsehoods because they can get cheap clicks from Bitcoiners.

If you don’t know what a Merkle tree is, check out the intro.

See you next week. Somehow I’ll try to get an issue out in the midst of EthDenver.

0 notes