#theyre on sale 25 percent off

Explore tagged Tumblr posts

Text

Monster trio on a day out :3

#you can find these on my shop#theyre on sale 25 percent off#one piece#sanji#black leg sanji#vinsmoke sanji#roanoa zoro#zoro#luffy#monkey d. luffy#keychains#one piece merch

23 notes

·

View notes

Link

Golden Globes 2021 Nominations. Yes, They’re Happening. The Golden Globes have always been a peculiar ritual. The statues are awarded by a clandestine group of foreign journalists, only 89 of whom vote. Top prizes are split into dramatic and comedic categories, often in confounding ways. Rather bizarrely, foreign-language films are not allowed to compete for the most prestigious awards. This year, however, the surreal nature of the affair has been heightened by a pandemic-era question: The Globes are actually happening? The five nominees for best drama could easily have ticket sales of zero. Almost every film in contention has been released online or is still awaiting release. Many cinemas have now been closed for 11 months. For a lot of people, including some in Hollywood, it is hard to care about little golden trophies at a time when the coronavirus is still killing more than 1,000 Americans a day. Others will undoubtedly welcome the Golden Globes as a silly distraction — the reliable balm of celebrity self-involvement and did-you-see-that-ugly-outfit schadenfreude. Amy Poehler and Tina Fey will return as hostesses. The ceremony is planned for Feb. 28 and will be shown on NBC. The Globes ostensibly exist to honor excellence in movies and television. But the real reason this show must go on involves money. NBC pays the Hollywood Foreign Press Association and its producing partner, Dick Clark Productions, an estimated $65 million a year for broadcast rights. About 18 million people tuned in last year. Globe nominations are coveted marketing tools; studios and streaming services will quickly roll out expensive ad campaigns based on the tallies. For the first time since the pandemic began, moviedom will have a national platform to use as a pep rally: “I’m Still Here!” The Globes may also help steer an adrift Oscar race onto some kind of course. (The Oscars are planned for April 25.) David Fincher’s fading “Mank,” about Old Hollywood, could use a Globe nomination or five right about now. While “Hillbilly Elegy” was widely mocked, Globes voters could conceivably give Glenn Close a lift by recognizing her scenery-gnawing Mamaw. (It would be her 15th nomination.) In truth, the Globes are not predictive of much. Over the last 20 years, the Globes and the Oscars have agreed on best picture winners 50 percent of the time. Last year, Globe voters chose “Once Upon a Time … in Hollywood” and the war drama “1917” as best in class. Neither won at the Academy Awards, which recognized the genre-busting “Parasite.” In keeping with its rules, the group did not nominate “Parasite,” a foreign-language film, for a best picture Globe. What maddening peculiarities await this time around, when the nominations are announced Wednesday starting at 8:35 a.m. Eastern: Streaming services, including Netflix and Amazon, will lead the way. Netflix, only a competitor on the movie side of the Globes since 2016, will dominate to a jaw-dropping degree. It has homegrown films in contention — “Ma Rainey’s Black Bottom,” “Mank,” “Da 5 Bloods,” “The Prom” — as well as films that it bought from pandemic-stricken traditional studios, specifically Aaron Sorkin’s “The Trial of the Chicago 7.” Among the television categories, the streaming service has established crowd pleasers (“The Crown,” “Ozark”) and shiny, new hits (“Bridgerton,” “The Queen’s Gambit.”) Amazon will also receive an armload of nominations, with Regina King’s “One Night in Miami,” a fact-based drama about a meeting of four Black luminaries, positioned to pick up nods for best drama, director, screenplay and supporting actor (for Leslie Odom Jr., who plays Sam Cooke). And Globe voters will surely honor “Borat Subsequent Moviefilm,” which arrived on Amazon Prime Video in October, in the best comedy or musical category, among others. Some prognosticators are also betting that Amazon’s irreverent superhero series “The Boys” will receive a nomination for best television drama, which would be a big deal because the popular show, now in its second season, has mostly been overlooked by awards groups. Expect a diverse slate of directors to be nominated. The Hollywood Foreign Press Association has come under attack in recent years for failing to pay attention to inclusion and diversity. At the most recent ceremony, for instance, the group put forward — yet again — an all-male slate of directors, failing to nominate women like Greta Gerwig (“Little Women”) and Olivia Wilde (“Booksmart”). Expect a corrective this year. It looks like both King and Chloé Zhao (“Nomadland”) are going to get recognized. Adding to that mix is likely to be Spike Lee for “Da 5 Bloods.” The war drama generated a strong critical response, and Lee has been nominated three times before by the group (most recently for directing “BlacKkKlansman”). And, this year, his children, Satchel and Jackson, will serve as Golden Globe Ambassadors, a job that traditionally involves escorting winners off the stage. It wouldn’t be a family affair if Spike wasn’t there too. Sophia Loren and Zendaya could compete in the actress categories. The best actor in a drama category may also reflect a broad range of talents, with Chadwick Boseman (“Ma Rainey’s Black Bottom”), Steven Yeun (“Minari”), Delroy Lindo (“Da 5 Bloods”), Riz Ahmed (“Sound of Metal”) and Anthony Hopkins (“The Father”) all in the mix for nominations. Tom Hanks could rise for his “News of the World” frontiersman. But the actress nominations are likely to make the noise. Globe voters could include a legend, Sophia Loren, for her role as a Holocaust survivor who runs a day care for the children of local prostitutes in “The Life Ahead,” from Netflix. Or they could give that slot to an actress who represents the future, Zendaya, who has been praised for her performance in “Malcolm & Marie,” a black-and-white romantic drama (Netflix, again). Meryl Streep, a 25-time Globe nominee and eight-time winner, could receive two nominations for best actress in a comedy or musical, one for her over-the-top “Prom” performance and another for playing an author trying to reconnect with friends in “Let Them All Talk.” Streep would likely be competing against the Bulgarian actress Maria Bakalova, for her ultra-crude, yet surprisingly sweet turn in “Borat Subsequent Moviefilm.” The TV supporting actress category, as usual, has a plethora of candidates, adding a mini-modicum of suspense. Will voters make room for both Gillian Anderson and Helena Bonham Carter from “The Crown”? Also vying are Uzo Aduba (“Mrs. America”), Letitia Wright (“Small Axe”), Annie Murphy (“Schitt’s Creek”), Jessie Buckley (“Fargo”), Marielle Heller (“The Queen’s Gambit”) and Julia Garner (“Ozark”). Garner and Aduba both won Emmys last year for their performances. ‘Minari’ is not allowed to compete for the top prize. It wouldn’t be the Globes without a foreign-language film kerfuffle. This time, the group has egg on its face because Lee Isaac Chung’s “Minari” has to compete as a foreign-language entry — even though Mr. Chung is an American director, the movie was filmed in the United States, it was financed by American companies and it focuses on an immigrant family pursuing the American dream. But the characters in “Minari” predominantly speak Korean. As a result, Globe rules require its banishment to the best foreign-language film race; it cannot be considered for the top prize. “Hamilton,” on the other hand, will probably benefit from the group’s rules. As a recorded stage performance, “Hamilton” is not eligible for the Oscars. But the H.F.P.A. has no such hangup. So expect Lin-Manuel Miranda’s musical to show up as a best comedy or musical nominee. Source link Orbem News #Globes #golden #happening #Nominations #theyre

0 notes

Text

Post 2

The brand Fender was founded in 1946 by a man named Leo Fender in Fullerton, California. Leo Fender was the inventor of the solid body of electric guitars later realizing he knew a process to build them faster as well.

From the years 1930-1949 many different craftsmen attempted to make solid body but weren't successful. Like every great inventor, troubles lie ahead. In the 1950′s Fender released less than 50 prototypes of a guitar named Fender Esquire. But due to some issues because of the prototype this product was discontinued but later on he released a new model named the Broadcaster. Not too shortly after another guitar company quickly notified him that he had copyrighted one of the names for a brand of drums. So factory workers just took off the name Broadcaster of their guitars and didn't have a name to them which resulted in those few guitars being called “NoCasters”.

It wasn’t until 1951 that Fender then released the first prototype of the solid body guitar called the now known Telecaster. With that guitar everyone was amazed but everybody became ecstatic when that same year Fender released the first every Precision Bass guitar. With these new guitars he made a revolution for all music genres from country to jazz.

Throughout the many years, Fender was continually innovative and creating new ideas to help build his company. In 1965 Fender sold the company to CBS because of his poor health. To re-invent Fender CBS recruited new management and came up with a 5 year plan to increase their marketing presence by improving their products.

Not too long after, Fender was then bought by a group of employees, investors, and a man name Schultz in 1985. Which was a relief because the company was once again owned by people who genuinely cared for the art of music.

The new owners then opened a new factory in Corona, California in 1985 as well as another factory in Ensenada, Mexico in 1987. Also in 1987 Fender then used the facility in Corona to make it a Custom shop which since then has became very popular. The headquarters was moved to Scottsdale, Arizona where it is till this day.

With new technology and now social media, marketing changed dramatically for companies that have been around for some time. Many articles online say that Rock-n-Roll is dead because of the new music. According to an article by Quartz it states, “Leading guitar companies Fender and Gibson are both in debt.” but also according to an article by Rolling Stone it states that, “the industry has never been better.”

Fender realizes that everything is being sold online but even though many people buy their instruments online they quickly give up. So the company released and app that teaches the user how to play the guitar named “Fender Play”. In the article by Rolling Stones it states that the company has received a, “14 percent growth in dollar sales.” The CEO of Fender, Andy Mooney, states in the article, “we have the potential to double the size of the industry. We think it’ll be quite a significant needle-mover in the industry.”

Even though Rock-n-Roll might not be as hot as it used to be, Fender is a renowned company that has been used for many years. All of their products are known the always satisfy the costumer.

Sources:

“The World's Leading Guitar Manufacturer.” Fender Guitars, www.fender.com/pages/about.

Anonymous. “1951 Fender Nocaster Blackguard All Original - Pre-Telecaster! ID-5925.” Artisan Guitars, 11 Dec. 2017, artisanguitars.com/1951-fender-nocaster-blackguard-all-original-pre-telecaster-id-5925.

Wang, Amy X. “There Are No More Guitar Heroes, so Nobody Wants an Electric Guitar.” Quartz, Quartz, 28 June 2017, qz.com/1013293/rock-and-roll-is-dead-sales-of-fender-and-gibson-electric-guitars-prove-it/.

Wang, Amy X. “Guitars Aren't Dying. They're as Popular as Ever.” Rolling Stone, Amy X. Wang, 25 June 2018, www.rollingstone.com/music/music-news/guitars-are-getting-more-popular-so-why-do-we-think-theyre-dying-630446/.

0 notes

Text

A Sugar Scientist Reveals 6 Ways To Kick Added Sugar Out

#ad_sharebox_260x60 img {padding:0;margin:0;}

The Food and Drug Administrations new recommendation that Americans eat no more than 10 percent of calories from added sugar is a giant leap in the right direction, according to sugar scientist Laura Schmidt of the University of California, San Francisco. But confusion about the difference between added sugar and naturally-occurring sugar, as well as the way foods are marketed and labeled, have created a food environment in which people arent quite sure how much added sugar theyre actually eating — much less how to strategize ways to lower those numbers.

Naturally occurring sugar refers to the sugar that naturally comes in whole foods — say, the fructose in whole fruit, or the lactose in milk. Added sugar is the extra sugars and syrups that are added in the manufacturing of a food, like the white table sugar added to fruit to make jam, or the brown sugar in cookies and other baked goods.

Joining the World Health Organization and the American Heart Association, the FDA made its 10 percent recommendation for added sugars in order to help folks avoid developing diabetes, cardiovascular disease, and obesity, which affects about one-third of American adults and roughly one in five children and teens.

In theory, it’s a great guideline, Schmidt explained. Practically, it means youre going to have to figure out how much is best for you. The AHA says the 10 percent rule converts to no more than 100 calories of added sugar, or six teaspoons, for women, and no more than 150 calories of added sugar, or nine teaspoons, for men.

For kids, those numbers are even lower. Preschoolers should eat no more than four teaspoons (16 grams), and children ages 4 to 8 should eat no more than three teaspoons (12 grams) a day. Finally, pre-teens and teens should eat no more than five to eight teaspoons (20 to 32 grams) of added sugar a day.

Unfortunately, the average American eats much more sugar than whats currently proposed about 16 percent of daily calories come from added sugar, according to the FDA, and its really easy to go over the limit considering a normal treat like a 12-ounce can of soda has 10 teaspoons of added sugar. Thats more than any person should consume in one day.

But if we can all get ourselves off the sugary drinks, we would be lowering our total sugar consumption, on a population level, by almost half. Dr. Laura Schmidt, sugar scientist

At TEDMED, a three-day conference focusing on health and medicine, we asked Schmidt, a professor of health policy, how we can cut down on sugar intake and create a healthier world for ourselves and our children.

Strategy 1: Stop buying sugary drinks.

Youve probably already heard this, and the rest of the U.S. is getting the message, too. Sales of soda are down more than 25 percent over the last 20 years, and sales of orange juice are down 40 percent since the late 90s. Schmidt says this should be the first step for anyone who wants to cut down on their added sugar intake: draw down slowly, and then use diet drinks if you have to in order to kick that final soda out of your life. As for juice, Schmidt suggested theres nothing healthier for kids than a piece of fruit and a glass of water.

For many people that can mean a lot of craving, and it can be hard, Schmidt said. But if we can all get ourselves off the sugary drinks, we would be lowering our total sugar consumption, on a population level, by almost half.”

Strategy 2: Get it out of your environment.

Schmidts research roots are in alcohol addiction, and she first began to get interested in the impact of sugar on diets when she learned one of the top reasons for liver transplants is non-alcoholic fatty liver disease, a condition linked to obesity and diabetes — not alcohol abuse. Consequently, although the research is out on whether sugar truly is an addictive substance in the traditionally scientific sense, Schmidt isnt afraid to use for sugary foods the same public health tactics she learned studying alcohol addiction.

That means people who struggle with added sugar consumption should clear their pantries of sugary offenders and commit to stop buying them in the first place.

“We call it harm reduction in addition treatment, Schmidt explained. “If I were an alcoholic, I dont spend a lot of time in bars. If I have a soda problem, then I dont have it in my house, and I try to avoid contexts where its highly available. Practically, that means if you have the financial means, shop at a farmers market or supermarket, not corner store bodegas where sodas and other junk food are front and center of the display.

Strategy 3: Delay age of first consumption for kids.

Another principle straight out of addiction treatment is to delay the first time a child has a food or drink with a lot of added sugar, Schmidt explained.

The goal should be to delay the age at which a kid first has a soda.

The goal should be to delay the age at which a kid first has a soda, Schmidt. And a child does not need juice its better to give kids whole fruit or maybe blend fruit up in a smoothie.

The theory behind this tactic, just like the principles that encourage parents to delay a teens first cigarette, alcoholic drink or sexual experience, is that the child grows up enjoying the way they feel without that cigarette and beer, or makes more mature and informed sexual choices as a young adult.

Schmidt said this idea shouldn’t be taken overboard — say, by telling all the parents in your social circle not to offer your kid soda — because it makes your child a pariah and that drink forbidden fruit. But your house, where kids spend most of their time, should be the healthiest environment it can possibly be.

Strategy 4: Be wary of foods that come in boxes, bags and cans.

Lets say youve kicked sugary drinks out of your kitchen and your everyday meals. The next step, said Schmidt, is to start hunting for that hidden sugar, usually found in highly processed foods that come in boxes, bags and cans. The more youre cooking from raw ingredients like whole foods, the less youre eating what Schmidt calls organijunk — snacks labeled organic, healthy or fortified with vitamins and nutrients, but full of hidden sugars.

Manufacturers have figured out that mothers know if sugar is in the first three listed ingredients, they dont buy it, Schmidt said. Now they just put 10 different kinds of sugar in the product.”

Be suspicious if a products ingredient list is long, she continued. Unless youre reading ingredients that you yourself would put in a homemade dish, dont buy it.

Strategy 5: Build a supportive community that cares about healthy eating.

Schmidt is impressed at how Crossfits company leadership united against selling sugary sports drinks at their gyms after an impartial review of the scientific evidence. She said she doesn’t know too much about the exercises that make up CrossFits core program, but she wishes other organizations — say hospitals, schools or workplaces — could have the same sense of responsibility toward community members.

Thats whats cool about what CrossFit did; they said, if were about health, lets look into this and actually decide whether we should be advocating Gatorade for our people, Schmidt said. Thats where I think the health sector needs to go; the hospitals need to stop giving unhealthy food to patients, because its our responsibility.

In the same way, she said, you can create a community that celebrates healthy choices in your school, church or parent-teacher associations.

As a sociologist Ive always been told real social change comes from civil society, she concluded. When you look at these organized entities, together they could get together and form a social movement — and thats when Washington starts to listen.”

Strategy 6: Get politically active.

You might not think attending political meetings or donating to campaign finance reform causes is part of a healthier diet, but in fact these steps are actually the most vital to create change on a national level. Politicians often don’t make the decisions that are best for the health of their constituents because theyre in the pockets of big donors from the food industry, Schmidt explained. The sooner we can pass campaign finance reform, the sooner politicians can get back to advocating for the health of their communities instead of looking for ways to do their jobs while still appeasing their donors.

A special 2012 analysis by Reuters noted that some of Big Foods greatest lobbying accomplishments include getting Congress to declare pizza a vegetable so it could remain on cafeteria menus, defeating soda taxes in dozens of states and killing a plan to make foods marketed to kids healthier.

The first thing we need to do is put pressure on our elected officials to stop taking money from corporations, and lobby our government agencies — the [National Institutes of Health], [Centers for Disease Control and Prevention] and every health organization — to stop, too said Schmidt. A lot of this is public information, so we should be using that to call people out.”

from All Of Beer http://allofbeer.com/a-sugar-scientist-reveals-6-ways-to-kick-added-sugar-out/ from All of Beer https://allofbeercom.tumblr.com/post/181562985312

0 notes

Text

A Sugar Scientist Reveals 6 Ways To Kick Added Sugar Out

#ad_sharebox_260x60 img {padding:0;margin:0;}

The Food and Drug Administrations new recommendation that Americans eat no more than 10 percent of calories from added sugar is a giant leap in the right direction, according to sugar scientist Laura Schmidt of the University of California, San Francisco. But confusion about the difference between added sugar and naturally-occurring sugar, as well as the way foods are marketed and labeled, have created a food environment in which people arent quite sure how much added sugar theyre actually eating — much less how to strategize ways to lower those numbers.

Naturally occurring sugar refers to the sugar that naturally comes in whole foods — say, the fructose in whole fruit, or the lactose in milk. Added sugar is the extra sugars and syrups that are added in the manufacturing of a food, like the white table sugar added to fruit to make jam, or the brown sugar in cookies and other baked goods.

Joining the World Health Organization and the American Heart Association, the FDA made its 10 percent recommendation for added sugars in order to help folks avoid developing diabetes, cardiovascular disease, and obesity, which affects about one-third of American adults and roughly one in five children and teens.

In theory, it’s a great guideline, Schmidt explained. Practically, it means youre going to have to figure out how much is best for you. The AHA says the 10 percent rule converts to no more than 100 calories of added sugar, or six teaspoons, for women, and no more than 150 calories of added sugar, or nine teaspoons, for men.

For kids, those numbers are even lower. Preschoolers should eat no more than four teaspoons (16 grams), and children ages 4 to 8 should eat no more than three teaspoons (12 grams) a day. Finally, pre-teens and teens should eat no more than five to eight teaspoons (20 to 32 grams) of added sugar a day.

Unfortunately, the average American eats much more sugar than whats currently proposed about 16 percent of daily calories come from added sugar, according to the FDA, and its really easy to go over the limit considering a normal treat like a 12-ounce can of soda has 10 teaspoons of added sugar. Thats more than any person should consume in one day.

But if we can all get ourselves off the sugary drinks, we would be lowering our total sugar consumption, on a population level, by almost half. Dr. Laura Schmidt, sugar scientist

At TEDMED, a three-day conference focusing on health and medicine, we asked Schmidt, a professor of health policy, how we can cut down on sugar intake and create a healthier world for ourselves and our children.

Strategy 1: Stop buying sugary drinks.

Youve probably already heard this, and the rest of the U.S. is getting the message, too. Sales of soda are down more than 25 percent over the last 20 years, and sales of orange juice are down 40 percent since the late 90s. Schmidt says this should be the first step for anyone who wants to cut down on their added sugar intake: draw down slowly, and then use diet drinks if you have to in order to kick that final soda out of your life. As for juice, Schmidt suggested theres nothing healthier for kids than a piece of fruit and a glass of water.

For many people that can mean a lot of craving, and it can be hard, Schmidt said. But if we can all get ourselves off the sugary drinks, we would be lowering our total sugar consumption, on a population level, by almost half.”

Strategy 2: Get it out of your environment.

Schmidts research roots are in alcohol addiction, and she first began to get interested in the impact of sugar on diets when she learned one of the top reasons for liver transplants is non-alcoholic fatty liver disease, a condition linked to obesity and diabetes — not alcohol abuse. Consequently, although the research is out on whether sugar truly is an addictive substance in the traditionally scientific sense, Schmidt isnt afraid to use for sugary foods the same public health tactics she learned studying alcohol addiction.

That means people who struggle with added sugar consumption should clear their pantries of sugary offenders and commit to stop buying them in the first place.

“We call it harm reduction in addition treatment, Schmidt explained. “If I were an alcoholic, I dont spend a lot of time in bars. If I have a soda problem, then I dont have it in my house, and I try to avoid contexts where its highly available. Practically, that means if you have the financial means, shop at a farmers market or supermarket, not corner store bodegas where sodas and other junk food are front and center of the display.

Strategy 3: Delay age of first consumption for kids.

Another principle straight out of addiction treatment is to delay the first time a child has a food or drink with a lot of added sugar, Schmidt explained.

The goal should be to delay the age at which a kid first has a soda.

The goal should be to delay the age at which a kid first has a soda, Schmidt. And a child does not need juice its better to give kids whole fruit or maybe blend fruit up in a smoothie.

The theory behind this tactic, just like the principles that encourage parents to delay a teens first cigarette, alcoholic drink or sexual experience, is that the child grows up enjoying the way they feel without that cigarette and beer, or makes more mature and informed sexual choices as a young adult.

Schmidt said this idea shouldn’t be taken overboard — say, by telling all the parents in your social circle not to offer your kid soda — because it makes your child a pariah and that drink forbidden fruit. But your house, where kids spend most of their time, should be the healthiest environment it can possibly be.

Strategy 4: Be wary of foods that come in boxes, bags and cans.

Lets say youve kicked sugary drinks out of your kitchen and your everyday meals. The next step, said Schmidt, is to start hunting for that hidden sugar, usually found in highly processed foods that come in boxes, bags and cans. The more youre cooking from raw ingredients like whole foods, the less youre eating what Schmidt calls organijunk — snacks labeled organic, healthy or fortified with vitamins and nutrients, but full of hidden sugars.

Manufacturers have figured out that mothers know if sugar is in the first three listed ingredients, they dont buy it, Schmidt said. Now they just put 10 different kinds of sugar in the product.”

Be suspicious if a products ingredient list is long, she continued. Unless youre reading ingredients that you yourself would put in a homemade dish, dont buy it.

Strategy 5: Build a supportive community that cares about healthy eating.

Schmidt is impressed at how Crossfits company leadership united against selling sugary sports drinks at their gyms after an impartial review of the scientific evidence. She said she doesn’t know too much about the exercises that make up CrossFits core program, but she wishes other organizations — say hospitals, schools or workplaces — could have the same sense of responsibility toward community members.

Thats whats cool about what CrossFit did; they said, if were about health, lets look into this and actually decide whether we should be advocating Gatorade for our people, Schmidt said. Thats where I think the health sector needs to go; the hospitals need to stop giving unhealthy food to patients, because its our responsibility.

In the same way, she said, you can create a community that celebrates healthy choices in your school, church or parent-teacher associations.

As a sociologist Ive always been told real social change comes from civil society, she concluded. When you look at these organized entities, together they could get together and form a social movement — and thats when Washington starts to listen.”

Strategy 6: Get politically active.

You might not think attending political meetings or donating to campaign finance reform causes is part of a healthier diet, but in fact these steps are actually the most vital to create change on a national level. Politicians often don’t make the decisions that are best for the health of their constituents because theyre in the pockets of big donors from the food industry, Schmidt explained. The sooner we can pass campaign finance reform, the sooner politicians can get back to advocating for the health of their communities instead of looking for ways to do their jobs while still appeasing their donors.

A special 2012 analysis by Reuters noted that some of Big Foods greatest lobbying accomplishments include getting Congress to declare pizza a vegetable so it could remain on cafeteria menus, defeating soda taxes in dozens of states and killing a plan to make foods marketed to kids healthier.

The first thing we need to do is put pressure on our elected officials to stop taking money from corporations, and lobby our government agencies — the [National Institutes of Health], [Centers for Disease Control and Prevention] and every health organization — to stop, too said Schmidt. A lot of this is public information, so we should be using that to call people out.”

from All Of Beer http://allofbeer.com/a-sugar-scientist-reveals-6-ways-to-kick-added-sugar-out/

0 notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

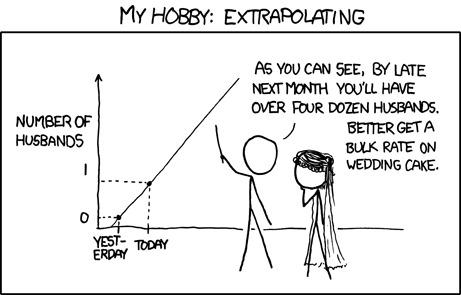

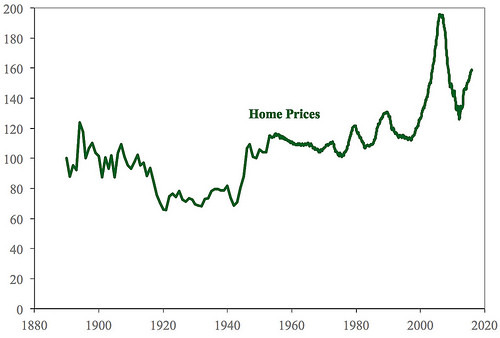

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

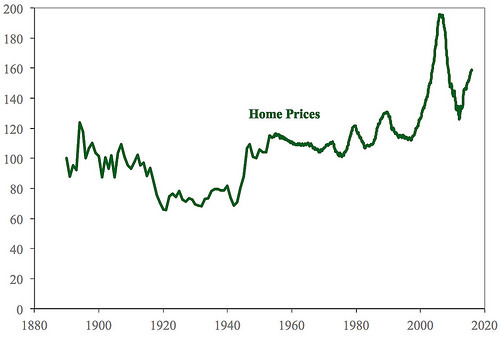

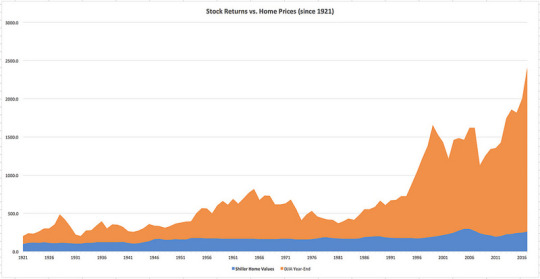

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Japan Has the World’s Gloomiest Millennials

Youthful optimism can be hard to find in Japan, where millennials rank as the gloomiest of those in the worlds biggest economies.

While a majority of young adults in its trading marriages view luminous futures and successful business onward, fewer than 40 percentage of Japanese do, inducing them the most pessimistic in 18 countries surveyed by ManpowerGroup. Theyre even more downbeat than young Greeks, who have suffered Great Depression-like ailments and political turbulence in recent years.

So often for efforts to eliminate Japans “deflationary mindset.” As Prime Minister Shinzo Abe tries to engineer an economic improvement, young Japanese are far away from optimistic. Its weighing on their own economies already and constitutes objections for the future.

Japanese millennials face a future of paying to care for one of the worlds most rapidly growing elderly populations, with more than a third of them likely headed for a series of lower-paying dead-end occupations on the least desirable side of the nations dual labour market. Then theres a public debt onu that grades among the worlds biggest.

Skeptical that the nations pension system will be around to take care of them, 20 -somethings are already concerned about life after retirement and skimping to save for the future. Low and stagnant offer is pressuring many to adjournment or even forego wedlock, home-buying and child-rearing. About 37 percent expect to work until they croak, the ManpowerGroup survey found.

Kohei Ito, 24, said he has no religion that the government will choose problems such as the pension system, which he worries is unsustainable. A college alumnu, Ito works in a fitness hub, and is thinking about moving overseas to school sports to children in developing countries.

“I dont conclude Japanese politics is going to was better, and I dont reckon their own economies will get better either, ” he said.

Preferring security, young Japanese picture little of the “animal spirits” needed to help realize Abes vision of a “great entrepreneurial nation.” Younger proletarians are the least inclined to strike out on their own in more than a decade, according to a poll of recently applied people by the Japan Productivity Center.

“Millennials, if they can, they want to join a major corporation, ” said Daisuke Oya, 23, who works in a cardboard plant as a machine hustler. “If you can connect a big company when youre young, its more stable.”

That kind of thinking is a “very big concern, ” said Randall Jones, head of the Japan-Korea desk at the Organization for Economic Co-operation and Development. He said young Japanese have a “fixation on working for huge corporations or the government.”

Changing such attitudes is a key challenge for Japan, which ranks low-spirited in entrepreneurship globally, and doing so is necessary to drive the innovation and productivity growth needed to sustain rising living touchstones as specific populations shrivels, the OECD says. The country has abundant patents and stockpiles of idle corporate money, but it scarcities enough entrepreneurs to make full implement of them, Jones said.

Many young Japanese have cast off the values that drove both parents and grandparents toil away often of their lives in factories and offices during the nations post-war boom times. They say they prize suffers over properties, and at work seek self-fulfillment and achievement over career advancement. Numerous questionnaires find them describing themselves as happy — at least for now.

Yet for numerous beings like Oya, the reverie stands mostly the same: a stable job that compensates enough money to get married and have children. After graduating from a vocational high school, Oya landed a position at a metal-working plant, but the hours and money fluctuated, so “hed left” lately to work at the cardboard factory.

“My girlfriend told me, if this is all I constitute, we cant get married, we cant have children, ” he said. “Honestly, it was pretty appalling to think about.

Many other young pairs have had that speech. The percentage of men and women in their 20 s who wish to get married has descended aggressively during the past three years, to 39 percent of men and 59 percentage of women, with numerous citing low-spirited spend as the reason, according to a survey this year by the Meiji Yasuda Institute of Life and Wellness.

The source of much of their struggles is Japans dual labor market, which hinders payments down while invoking job insecurity. It too limits opportunities for employees to develop abilities, which in the long term will injure the economy, is in accordance with Hiroaki Miyamoto, a University of Tokyo associate professor.

But public debt may support the most difficult economic burden for Japans millennials.

The share of the debt for each Japanese child under 15 stood at $794,000 each as of 2011 — more than two and a half periods that of children in Italy and Greece, the two next-worst cases, is in accordance with Bertelsmann Stiftung, a German non-profit foundation. Because of that, and a disproportionately large share of social spending going to the elderly, Japan grades as “the worlds” second-most “intergenerationally unjust” country, it said.

Young Japanese are already greeting in ways that are dragging on their own economies. At a duration when domestic consumption has stalled, their savings rates is on the rise, with those 25 -3 4 years old saving a greater share of their earnings than any other age group in 2015, UBS said in a recent report, citing government data.

In fact, most of what little proliferation in uptake Japan has considered over the past decade has been driven by seniors, offsetting a refuse among younger people, UBS said.

The OECDs Jones notes further that only to stabilize the debt at current heights is a need difficult choices, likely including growing the sales tax from the current 8 percent, which sits well below the OECD average of about 20 percent, he said. The volume of that will fall on the younger people who will be around longer.

“So if youre a working-age party, you can see that there are heavy burdens coming, ” he said.

The post Japan Has the World’s Gloomiest Millennials appeared first on apsbicepstraining.com.

from WordPress http://ift.tt/2jiyyNz via IFTTT

0 notes

Photo

As the U.S. labor force crests again, a new complex of problems locks many Americans out of the workplace.

Even at so-called full employment, some 20 million Americans are left behind.

Theyre looking for work, out of the labor force but unhappy about it, or report working part-time when theyd prefer more hours, according to data released last week. Their plight comes even as the U.S. flirts with what economists consider the maximum level of employment for the first time since before the recession, having added 15.8 million jobs since the start of 2010. While some of Americas jobless are simply between gigs, those persistently stuck out of work are called the structurally unemployed.

President Donald Trump said wrongly last month that 96 million people are looking for work, having included Americans who are still in school, retired, or just uninterested. Yet his words resonated in a country where economic insecurity is distributed unequally and cruellyfar deeper in Mingo, W. Va., than in midtown Manhattan.

Because of where the structurally unemployed live, what theyve done, or the skills they lack, employers cant or wont hire them. The problems that keep today’s jobless stuck on the sidelines are different than those of past recoveries: a complex web of often interrelated issues from disability and drug use to criminal records.

Behind the statistics are people with 20 million unique stories. Here are five.

President Donald Trump said wrongly last month that 96 million people are looking for work, having included Americans who are still in school, retired, or just uninterested. Yet his words resonated in a country where economic insecurity is distributed unequally and cruellyfar deeper in Mingo, W. Va., than in midtown Manhattan.

Because of where the structurally unemployed live, what theyve done, or the skills they lack, employers cant or wont hire them. The problems that keep today’s jobless stuck on the sidelines are different than those of past recoveries: a complex web of often interrelated issues from disability and drug use to criminal records.

Behind the statistics are people with 20 million unique stories. Here are five.

Fighting To Get Out of Mingo, W. Va.

Tyler Moores late-December drive to Louisville, Ky., was one of desperation. He was headed four hours west on Interstate 64 to interview for a job. Even if he landed the position, filling his gas tank had left him with $8 to his name. He would have to sleep at a friends place until he could earn enough to pay rent.

The 23-year-old had run out of options. Hed applied for dozens of jobs within an hour and a half of his hometown of Lovely, once a coal-mining stronghold. Instead of opportunities, he had found waiting lists.

Minimum-wage jobs, fast-food restaurants, Wal-Mart, anything like that, a lot of them has already been took, he says in an Appalachian drawl, explaining that the backlog just to interview was as long as a year. There are no jobs.

Moores story paints an extreme picture of how an economic environment can create a vicious circle of joblessness. While he is an imperfect job candidate, his flaws were molded by his upbringing in Martin County, Ky. and neighboring Mingo County, W. Va.

Moore takes advice from Therese Carew, a nun and counselor

His problems started in earnest in 2014. He had been living on his own for several years, having moved out at 18 after dropping out of high school, obtaining his GED, and going to work in security at a coal company. Moore is gay in an intensely conservative region, and he said he left school because of bullying.

Moore lost his job in late 2013 after smoking marijuana and failing a drug test. Though he found temporary work as a remote customer service representative, he lost that one when his mother died of a drug overdose in 2014 and he had to plan her funeral.

Deeply depressed and unemployed, he moved into an old Airstream camper propped on cinder blocks behind his fathers house, at the entrance to the litter-strewn trailer park that the older man owns in the misty hills of Lovely. There, surrounded by long-unemployed neighbors and rampant drug use, Moore began to abuse his medical prescriptions. I guess I used it as my crutch, in a way, he says.

Moore began getting in fights while drugged and was arrested twice. When he landed in jail for several months, he realized things needed to change. He graduated from a rehabilitation program in September, one year, one month, and 15 days after that last altercation. Since then, hes deepened his friendship with Sister Therese Carew, a Catholic nun who ministers to the region, and dedicated his time to job seeking.

Opportunities are few. Coal mines have been closing, and theyve taken most other businesses with them.

To employers outside the area, the fact that Moore is neatly groomed, soft-spoken, and polite cant mask his history. Whats more, hes the first to admit that the math skills he learned in the local public schoolswhere only eight in 10 students graduatearent up to par, and his speaking patterns are colored by regional grammar.

His situation is difficult, but Moore has found a reason to hope.

Coal work, once a mainstay, has become scarce in Appalachia

He didnt get the job for which he made that 240-mile (386-kilometer) drive, but he dropped in to his old rehab center on the way home. When he explained his predicament, the director of operations told him that he could come back until he gets on his feet. The group has found a job for him in plastics manufacturing that could turn full-time after a 30-day probation period. The position is enabling him to pay $100 a week in rent. Its a chance to build an employment record as he fights to have his record expunged.

Still, moving out requires a tough tradeoff: Moore would have preferred to stay close to home, because his family is still in Kentucky and his father is in his seventies. And the job probably isnt a pathway to wealth and ease. But what Moore wants most is mere self-sufficiency.

A simple lifestyle, but being able to have work: I aint got to have nothing exquisite, he says.

David Wolf wears his journey through drugs and crime on his arm.

Branded as Untouchable by a Felony Rap

These days, David Wolf doesnt allow himself to get excited by the news of a job offer. Most get rescinded within days. Its happened at least a hundred times, he said.

In 2012, Wolf was convicted of faking a name and Social Security number to get prescription painkillers. Now the 40-year-old father of three and former Marine, who has an associates degree from St. Petersburg College, has struggled to find employment. He’s received so many retracted offers that hes lost count.

I get more interviews that I can shake my stick at, but again, it always comes back around to the denominator of being a felon, Wolf says from his small, one-level ranch house in a Tampa, Fla., suburb, where religious imagery and family photos decorate his walls. For many, many years, I pretty much got whatever job I wanted. I was able to do anything I felt like doing. Its really been a humbling experience

Wolf researches employment options at a career center in New Port Richey, Fla

Wolf, whose chaotic life before he got clean included several domestic battery and drug-related charges, is one of the more than a half-million people who are released from U.S. federal and state prison every year. The influx occurs as the nation comes out of a decades-long war on illegal drugs. Implementation of stricter laws and tougher enforcement that led to a mushrooming of incarcerations and a booming ex-offender population. Before his identity theft conviction five years ago, Wolf held several jobs in sales and marketing, managed a call center, and served as a recruiter for the U.S. Marines. Since, he and his family have since lived off food stamps and cash assistance.

They wouldnt even hire me to sell Christmas trees at a Home Depot through an employment agency, he says. A lot of times the hiring managers feel like they have their hands tied, due to company policy. Its something that really needs to change. Not only can I not get a job, but I cant get a job with a living wage for my family. I have three children. I have a wife. Im not a bad guy.

Wolf shares his home with his second wife, his toddler, and a cat he gently picks up every time it scurries into the living room. Nearly half of U.S. children now have at least one parent with a criminal record.

A Corinthians verse, Love is patient, love is kind, love never fails, decorates a sofa cushion. Outside his living room window, children gather by a school bus stop as the morning fog lifts in the modest neighborhood of Holiday, Fla.

Less than a 10-minute drive away, he spends his free time volunteering at a Mormon church, where he also gets career training. A workshop book, The Lord Would Want You to Be Successful, rests on his living-rooms desk. Men with criminal records now account for about 34 percent of nonworking men aged from 25 and 54 years old, otherwise known as prime working age.

Family photographs on the piano at Wolfs home in Holiday, Fla.

Myself and many other felons, and were facing demons, downtime isnt a good thing, he says. Almost half of released inmates are arrested again within eight years, either for new offenses or for violating the conditions of their release. Were getting food stamps and cash assistance. We dont like being on it. But the society that looks down on those receiving assistance is the same society that wont hire me, and the same society that judges criminals when they reoffend.

He had the word forgiven inked on his forearm after a stint in rehab. On the worst days of his addiction, which started following a car crash more than a decade ago, Wolf remembers taking as many as 40 pills in one day. OxyContin, Percocet, and Vicodin were his usual ones.

It affected me, seeing guys that have sentences of 20, 30 years. This is a vicious, vicious circle, and were not going anywhere.

Leroy Moore, one of almost 9 million Americans who receive disability insurance, spends nearly half of his monthly check on his apartment.

0 notes

Text

25 ways to save $250 a month that everyone is messing up

Image: Faberr Ink/shutterstock

When it comes to saving money, not every way is the right way. A lot of it depends on your lifestyle and the goals that youve established.

At the same time, there are plenty of mistakes we typically make when it comes to saving like the 25 ways listed below.

1. Not monitoring your budget

When it comes to saving some cash each month, nothing beats a budget. Heres the problem. You base your budget on your fixed expenses like rent, insurance, and utilities. But, what about those unexpected or variable expenses like a trip to the dentist, replacement of your broken iPhone, heat during colder months, the invitation to go on a last-minute weekend vacation, or gifts for birthdays or holidays?

If youve created a budget based on only your fixed month-to-month expenses, then its going to be a lot harder to save accordingly. Instead of saving money each month, youll actually be eating into your savings.

To successfully budget, you have to pay attention to trends and then reshuffle as needed. This way, youll have enough money to cover those unexpected or variable expenses without dipping into your savings. Remember, budgeting is a process. Dont expect to create a budget based on solely on one month. Track your spending over the course of a couple of months so that you can paint a more accurate picture.

2. Spending too much time on being frugal

Another way to save money each month is by being frugal. But, if youre spending more time on monitoring your budget, clipping coupons, or scouring the Internet for the best deal instead of enjoying your life, then its time to reevaluate the situation.

The purpose of saving is so that you have the money to take that family trip, make home improvements, or invest in new business. That doesnt mean that you eliminate the important things in life, such as spending time with your family, just for the sake of saving. By all means, be frugal but not when its consuming too much of your life.

3. Loyalty

When you think about saving money, you most likely think about reducing expenses like going out to dinner less often. But, when was the last time that you compared the rates and deals of your bank, insurance company, the Internet or cell phone provider? Theres a good chance that there are better options available. Switching your cell phone provider, for example, may not save you $250 alone per month, but you may find a plan thats $25 cheaper per month. Add that to your other saving methods and youll be on track to that $250 goal rather easily.

4. Youre uncomfortable

Being frugal doesnt mean that you have to sacrifice the things that you actually need or enjoy occasionally. It means that youre more cognizant of your spending so that you can make better financial decisions. It doesnt mean that you have to be uncomfortable and miserable by missing out on the things that you enjoy or need like that new mattress to replace your uncomfortable and torn-up mattress.

5. Buying on sale just because its on sale

Weve all been guilty of this. We purchase items just because theyre on sale. But, do you really need that new pair of jeans just because theyre 15% off? Instead of spending your money on the things that you dont need just because theyre sale, make a note of the what you do need and then wait for them to go on sale.If youre like most people, this adds up to be over $250 a month.

6. Cooking at home

Make no mistake about it. Cooking at home is definitely more affordable than eating out every night. But, what about the times that you want to make something that calls for ingredients that youll rarely use. Take Paella, for example. While its delicious, theres a chance that the saffron you purchased is going to go to waste.

When grocery shopping, try to think of meals that use similar ingredients so that nothing is going to waste. Another option would be to join something like Blue Apron or Sun Basket since they provide the right amount of ingredients needed for each recipe. Best of all? Plans start at around $10 per serving.

7. You cant let go

Do you have a house full of stuff that you never use but hold onto them because you might need that snow blower even though you live in Florida? Its time to let some of that clutter go. While I understand that you dont want to buy something if you already have it, take stock of the things that you know youll need.

If you keep accumulating stuff, youll potentially run into a situation where you need to rent storage space because you no longer have space in your home to store it. How is that going to help you save money each month?

8. Buying coupons youll never use

There are some incredible deals on Groupon or LivingSocial. But, are you really going to take that yoga class or eat at that new Italian restaurant outside of town before the voucher expires? If so, then purchase the voucher, but if youre uncertain, then skip the deal.

9. You jeopardize your safety

I dont enjoy throwing away food. However, Im not going to put myself or my family at risk by cooking dinner using expired ingredients. If something is bad, its better to chuck it then risk getting a bad case of food poisoning.

10. Signing up for a new credit card just for the rewards

In some instances, credit cards have perks like rewards, cashback on purchases, and 0% percent APR for balance transfers that make them worth considering. Before applying for that new card, review all of the fine print. This applies to businesses as well. The cost of annual fees and high-interest rates may not be worth those perks.

11. Cutting out all activities and socializing

One of the most expensive expenses youll incur is socializing and participating in activities. Instead of becoming a hermit and isolating yourself from your friends or family, make an exception here and there. If you go out for drinks or attend a concert on Friday night, then stay home on Saturday night. Youre still socializing, but youre also being responsible with your money.

12. You never indulge

Just like with socializing, its alright to indulge now and then. It can be used as a reward or help you experience new things. So, if youve brewed your own coffee at home all week, go ahead and stop by Starbucks on Friday morning. You earned it!

13. Youve taken DIY too far

Thanks to Pinterest and YouTube, weve been tricked into thinking that we can do anything from building furniture to repairing our cars. The problem is that this can lead us to potentially do more harm than good.

For example, changing the oil in your car may sound like a good idea, but by the time that you purchase the oil and filters, it may cost you more money than going to a mechanic. Even worse, if youve never changed the oil in your car and make a mistake youll now have an additional expense: paying a mechanic to repair the damage that youve done.

14. Cord-cutting

One of the most popular trends when it comes to saving money is through cord-cutting. The thing is its not for everyone. If you enjoy watching local sports or shows like Game of Thrones, you may end up paying more money each month since youre still paying for Internet service, a local TV package, and a premium channel subscription. Unless youre not a TV-watcher, cord-cutting may not be your best option.

15. Not calculating your retirement

Saving for your retirement is never a bad idea. Going into it blindly is, however. You wouldn’t purchase a car or home without knowing how much its going to cost you, right? In order to plan and save for your retirement, you need to first calculate how much youre going to need to set aside each month. NerdWallet has a handy retirement calculator that can help you get started on the right path.

16. Putting money into modest growth plans

One of the biggest mistakes that even the savviest savers make is putting money into modest growth plans, such as low APR savings accounts, CDs, bonds, mutual funds, or simple 401(k)s. Thanks to Fintech, your bank or financial adviser will be able to send you personalized investment recommendations so that you can get the most bang for your buck.

17. Not harnessing the power of Fintech

Speaking of Fintech, financial institutions are using this technology so that you can also automate investing and savings by adjusting your budget and notifying you of any changes in your accounts. You can receive customized financial advice through chatbots to make more informed financial decisions.

18. Avoiding cash

Theres a belief that if you have cash on-hand youll be tempted to spend it. The thing is if you only have $45 in your pocket, you cant spend more than that. However, if youre carrying plastic or a digital wallet downloaded onto your phone, you may be tempted to spend money on stuff that you dont really need. In the end, cash may be the better option to keep you financially disciplined.

19. Not automating your savings

Dedicating a percentage of your paycheck to your savings is a given. However, what happens when you place that echeck into your bank account? After your expenses have been paid, you may be tempted to spend that excess cash. To prevent that from happening, you should automate your savings where a small percentage of your paycheck is withdrawn and transferred to your savings account. This way, youre not spending that excess money since its already been placed into your savings account.

20. Buying cheap, not value

You may think that in order to save $250 a month you have to buy products or service that are the cheapest. Just remember, you get what you pay for. For example, if you need a new pair of sneakers and purchase a pair from a local dollar store, theyre probably not going to last as long as a quality pair of sneakers. Sure, spending over a hundred bucks on a pair of shoes may seem like a tough pill to swallow, but theyre more likely to last you several years.In other words, always go value over price. It will be worth it in the long-run.

21. Buying in bulk

Buying in bulk can be a smart move when it comes to items that you use frequently and wont spoil. For instance, household items like toothbrushes, toilet paper, or light bulbs are cheaper when bought in bulk. Food items are a different story. In fact, food waste costs between $1,365 to $2,275 per year for the average American household.When it comes to perishable items like food, buying bulk isnt always the most cost effective solution.

22. Linking your checking and savings accounts

Gone are the days having only one bank account. Today, there is a wide range of ebanking options for your specific needs. For example, you could use one bank for your main checking account because you arent charged any maintenance or minimum balance fees. However, there could be another bank that has a higher interest rate on saving accounts. By separating these two accounts youre not only avoiding fees and getting a better return, but youre also preventing the chances of spending the money that you’ve set aside for that emergency fund or savings plan.

23. Assuming theres a quick fix

When you start saving you first look at reducing your spending. Chances are that reducing your trips to Starbucks or changing your cell phone plan arent enough to add up to $250 in savings each month. After that, you make another cut, then another, and then another until you’ve reached your goal.

The point is when it comes to saving, there aren’t just one or two quick fixes. Its a process that takes time.

24. Focusing on saving while considering how to also make more money

Income is arguably the most important factor when it comes to saving. If youre living paycheck-to-paycheck, then how can you put aside a couple hundred of dollars each month? Reducing the amount of money that you spend each month is only part of the solution. The other part is having additional income that can be placed into your savings account.

Thankfully, there are hundreds of ways for you to make some extra cash on the side even if you have a full-time job. Here and there, working some evenings or weekends can help you easily hit that extra $250 per month and maybe even more!

25. Saving solely for needs

Most financial advisers suggest that you save for needs like a new car, health emergency, or college education. While thats sound advice, when you only save for your needs, you tend to get frustrated and resentful of the entire saving process.Instead, set aside some of your savings for something fun, such as a dream vacation or new TV. You earned that money, so make sure that you enjoy from time-to-time and reward yourself for becoming more fiscally responsible.

John Rampton is serial entrepreneur who now focuses on helping people to build amazing products and services that scale. He is founder of the online payments company Due. He was recently named #2 on Top 50 Online Influencers in the World by Entrepreneur Magazine. Time Magazine recognized John as a motivational speaker that helps people find a “Sense of Meaning” in their lives. He currently advises several companies in the bay area.

John Rampton

Read more: http://ift.tt/2q02HDi

from Viral News HQ http://ift.tt/2p1NjXB via Viral News HQ

0 notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.