#the width is over 500px

Explore tagged Tumblr posts

Note

hello! Your edit for the artful dodger is awesome ✨ would you please post a tutorial on how you made this cool layout with those effects.

https://www.tumblr.com/jakeperalta/768056589581156352/pscentral-members-choice-event-33-underrated?source=share

thank you! of course - i was inspired by this wonderful edit, so credit goes to @perryabbott for the design 😊 it's pretty simple to do, only basic gifmaking knowledge required!

tutorial on how to make this layout below the cut:

step 1: make your gifs — these are the dimensions to follow (if you want do an alternate layout or canvas size, just make sure the gap between gifs is 4px)

tall side gif — 268px (width) x 400px (height)

wide top/bottom gif — 500px (width) x 268px (height)

smaller gifs (2 per overall gif) — 268px (width) / 198px (height)

circle gif — 230px square

create your gifs, crop and resize. (personally i sharpened each gif at this stage, then did colouring at the end, but you can do that whenever).

step 2: position the three base gifs — either expand the canvas of one gif (using ctrl+alt+c) or create a new canvas (ctrl+n) to be 540x400px.

when you've got your gifs + your canvas, just drag each gif across into the main canvas and position it. depending on your settings/photoshop version, cropping may only hide the cropped parts of the gif instead of removing them so the whole gif will be visible when you put it onto a larger canvas. in this case, after resizing you should use ctrl+a to select the gif, then create a layer mask using this button:

step 3: the circle gif — use the ellipse tool to draw a circle. don't worry about making it the correct size, as you can then resize it (+ turn fill on if not already) using the toolbar at the top:

centralise your circle (ctrl+a then the align buttons on your top toolbar). now you can drag your final gif onto the canvas and position it over the circle. right click the gif layer on the layers list on the right hand side and select create clipping mask from the menu (or select the gif then press ctrl+alt+g). the gif should then be contained within the circle shape.

step 4: add the rings — use the ellipse tool again; this time you want fill turned off and stroke set to 1px and whatever colour you want, like this:

do this twice, then just position them on top of all the other layers however you like (you could also change the dimensions if you wish).

step 5: repeat — do the same thing for each big gif, alternating the positioning of the small gifs. once you've made the circle + rings once you can just reuse them for each so it's not too time consuming.

and that's it! i added my colouring on top (again using clipping masks to add certain adjustments to specific gifs and to paint the orange colour onto each gif) and some text in the middle. let me know if you have any questions!!

9 notes

·

View notes

Text

Seeing some people in the notes of a gif-making post saying,

'it's getting them under the size limit I struggle with 😞'.

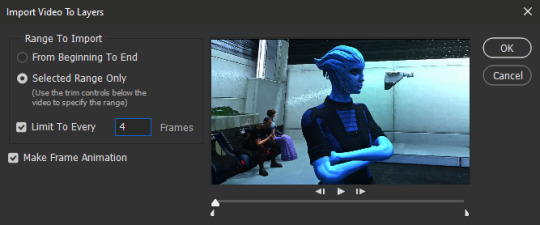

... Are you using every frame from a 60fps video when you're importing? I bet you are, aren't you. Don't do that! Do that and you're just padding your gif size for no reason.

I import every 4 frames by default, then set a frame delay of 0.07. Smooth as silk. If you do end up struggling to fit the cool, really long animation you want in there, try deleting every other frame, then change the delay to 0.09, then 0.1 if it's too fast. It might still look smooth. Might. I've been succeeding with that on a few gifs, but you are pushing it at that point. Smooth framerate in your gifs will make everything about them look better - but any more frames than every 4 from 60fps source video are superfluous.

Pray tell, are you also making your gifs too big for no reason? Tumblr's display size is 540px wide.

If you make your gifs that width exactly, they will display as crisp and clear as you made them. If you make them smaller than that, they'll be stretched and look blurred. If you make them bigger than 540px, that won't improve the quality - they'll be shrunk down to the display size, and will look just as blurry as if you'd made them only 500px. With the added detriment that the file size will be bigger, so you won't be able to fit as many frames in there. There's no benefit. They'll only look as good as you made them if you click on them, which people aren't going to do (unless they're a weirdo like me thinking 'hm does that look blurry? oh, that's why'). You're artificially making the limit more strict for yourself, while making your gifs look worse.

If it's not those problems, what the hell are you trying to make over there? I'm fitting entire animation loops under the limit, unless I try to be foolishly overambitious. And I still managed to sneakily cut down frames to get that Mass Effect Andromeda shuttle's whole landing and take-off in there.

The limit these days is 10MB. It used to be 500kb. When I personally was making gifs previously it was 1MB, then 2MB. We rejoiced when it went to 2MB. That's where the struggle was. *Slaps 10MB limit* I can fit over 100 frames in this bad boy.

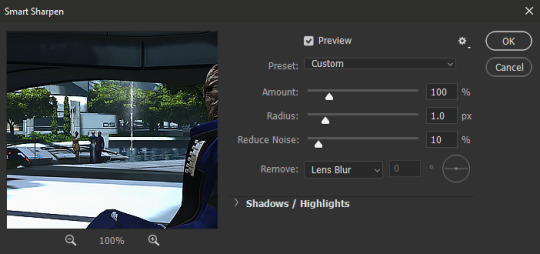

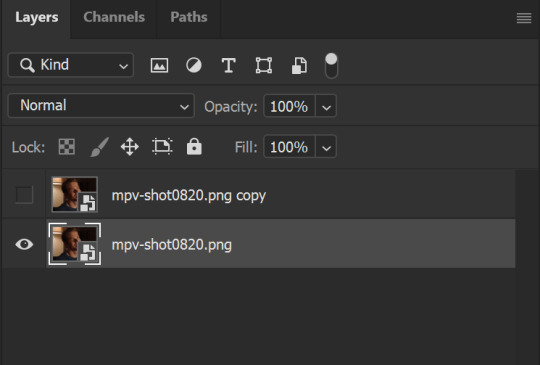

Speaking of crisp and clear, here's my Smart Sharpen settings while we're at it:

I never adjust it, It Just Works™ perfectly for every set, every game. Use that on every layer and it'll look good, I guarantee. Pretty, clear, not over-sharpened, thriving.

8 notes

·

View notes

Text

What's with Rates!?!? for the week of Nov 18th

Understanding Mortgage Interest Rates

Mortgage interest rates can be confusing, but knowing how they work could save you lots of money when buying a home. Whether you're getting your first house or looking to refinance, it's important to understand what affects mortgage rates and how to get the best deal. Let's look at what goes into setting mortgage rates and how you can take advantage of current market conditions to save money on your home loan.

Key Takeaways

Aspect Details Current Trend Mortgage rates expected to decrease slightly in the coming week Economic Factors Fed announcements, employment data, CPI report, global events, and housing market reports Strategies Get pre-approved, compare lenders, consider points, improve credit score Refinance Opportunity Potential for significant savings if current loan was secured at higher rates Future Outlook Experts predict continued downward trend in coming months

The Current Mortgage Rate Landscape

As we near the end of 2024, there's a lot happening in the mortgage market. While we can't give exact interest rates, things are looking better for people wanting to borrow money. Smart homebuyers are taking advantage of this change, locking in rates that could save them a lot of money over time. This positive trend is happening because of things like what people expect inflation to do, job numbers, and what's going on in the world economy.

Experts think mortgage rates will slowly go down over the next week, which could be good news for people looking to buy a house or refinance their loans. This possible drop in rates is because of several things happening in the economy that we'll talk about more. It's important to know that even small changes in interest rates can mean big savings over the life of a mortgage, so it's a good idea to stay informed and be ready to act when rates are in your favor.

Economic Factors Influencing Mortgage Rates

The week of November 18th to November 22nd, 2024, is going to be really important for people watching mortgage rates. Several key economic events are happening that could really affect interest rates:

Key Economic Factors Influencing Mortgage Rates (Nov 18-22, 2024)

Fed Announcements

CPI Report

Employment Data

Global Events

Housing Reports

.minimalist-chart-container { max-width: 500px; margin: 20px auto; text-align: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-chart { display: flex; justify-content: space-around; align-items: flex-end; height: 200px; padding: 20px 0; background-color: border-radius: 8px; position: relative; } .chart-column { display: flex; flex-direction: column; align-items: center; flex-grow: 1; height: 100%; } .minimalist-chart .bar { width: 40px; background-color: position: absolute; bottom: 25px; border-radius: 4px 4px 0 0; } .minimalist-chart .bar::before { content: attr(data-value) '%'; position: absolute; top: -25px; left: 50%; transform: translateX(-50%); font-size: 12px; } .bar-label { position: absolute; bottom: 0; font-size: 6px; color: max-width: 50px; word-wrap: break-word; text-align: center; }

1. Federal Reserve Announcements: The Fed doesn't directly set mortgage rates, but what they decide affects the whole financial market. Listen for any statements about inflation goals and how they think the economy will grow. How the Fed handles money policies, including any changes to the federal funds rate or talks about quantitative easing, can really affect the mortgage market. People who study this stuff will be looking closely at what words the Fed uses to try and guess what they might do in the future.

2. Employment Data: New information about jobs could change how confident lenders feel. When employment numbers are strong, it often means better borrowing conditions. Important things to watch are the unemployment rate, how many new jobs are created, and if wages are going up. A strong job market usually means the economy is healthy, which can lead to more people wanting mortgages and possibly lower rates as lenders compete for business.

3. Consumer Price Index (CPI) Report: This important report shows how inflation is doing, which can really affect mortgage rates. If the CPI is lower than expected, it could mean rates might go down. The CPI measures how much prices change over time for things people buy regularly. If inflation stays low or goes down, it might encourage the Fed to keep interest rates the same or lower them, which could be good for mortgage rates.

4. Global Economic Events: Things happening in other countries, like trade talks or big political changes, can affect U.S. mortgage rates. It's a good idea to keep an eye on major world economic news during this week. Things like trade agreements, changes in government in big countries, or big shifts in global commodity prices can change how investors feel and, as a result, affect mortgage rates. Because financial markets around the world are connected, events far away can directly impact your mortgage options.

5. Housing Market Reports: New information about home sales and how many new houses are being built can change how lenders feel about the real estate market, which might affect their decisions on rates. Reports on existing home sales, new home construction, and how many houses are available give insights into how healthy the housing market is overall. A strong housing market might lead to more competition among lenders, which could mean better rates for borrowers.

Strategies for Navigating the Current Rate Environment

With rates expected to go down, now is a great time to get ready for the best possible mortgage terms. Here are some things you can do:

Fed Meeting Minutes

Release of October FOMC meeting minutes on Wednesday

Existing Home Sales

October existing home sales data released on Tuesday

Jobless Claims

Weekly unemployment claims report on Thursday

Consumer Sentiment

Final November consumer sentiment index on Friday

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-2x2 { grid-template-columns: repeat(2, 1fr); } @media (max-width: 768px) { .grid-2x2 { grid-template-columns: 1fr; } }

1. Get Pre-Approved: Getting pre-approved for a mortgage can give you an edge in a fast-moving market. It shows sellers you're serious and helps you act quickly when rates go down. When you get pre-approved, a lender looks closely at your finances to tell you how much you can borrow and at what rate. This process can also help you find and fix any problems with your credit report or finances before you start looking for a house.

2. Compare Lenders: Don't just go with the first offer you get. Look at rates from different lenders to make sure you're getting the best deal. This includes regular banks, credit unions, and online lenders. Each might have different rules and offer different products that could be better for your situation. When comparing, look at more than just the interest rate – think about things like fees, how long the loan is for, and how good their customer service is.

3. Consider Points: Paying points upfront can lower your interest rate for the whole time you have the loan. This can be a good idea if you plan to stay in your home for a long time. One point usually equals 1% of how much you're borrowing and can lower your rate by 0.25%. Figure out how long it will take for the savings to be worth the cost to decide if this is a good choice for you. Remember, while points can save you money in the long run, you need to pay more at the start.

4. Improve Your Credit Score: Even a small increase in your credit score can get you a better interest rate. Try to pay off debts and fix any mistakes on your credit report before applying for a mortgage. Focus on using less of your available credit, paying all your bills on time, and not applying for new credit in the months before you apply for a mortgage. A higher credit score not only makes it more likely you'll be approved, but can also get you better loan terms.

The Refinance Opportunity

For people who already own homes, the possible drop in rates could be a great chance to refinance. Refinancing your mortgage could save you a lot of money, especially if you got your current loan when rates were higher. Refinancing means replacing your existing mortgage with a new one, possibly with better terms or a lower interest rate.

"Economic factors this week point towards a gradual easing of mortgage rates, with key data releases and Federal Reserve speeches likely to shape market sentiment. Homeowners and potential buyers should stay alert to these developments, as they could signal an opportune moment to lock in favorable rates."

— Economic Analysts, November 2024

.minimalist-quote-container { max-width: 600px; margin: 20px auto; background-color: padding: 30px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-quote-container blockquote { margin: 0; padding: 10px 20px; border-left: 4px solid blockquote p { font-style: italic; font-size: 1.1em; margin-bottom: 10px; } .minimalist-quote-container blockquote footer { font-size: 0.9em; text-align: right; }

Fed Speeches

Multiple Federal Reserve officials to give speeches on economic outlook

Economic Reports

Release of housing starts and existing home sales data

Market Trends

Analysts expect slight downward trend in mortgage rates

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-1x3 { grid-template-columns: repeat(3, 1fr); } @media (max-width: 768px) { .grid-1x3 { grid-template-columns: 1fr; } }

When thinking about refinancing, it's important to weigh the potential savings against the costs of doing it. Things to think about include:

The difference between your current rate and the new rate: A general rule is to consider refinancing if you can lower your rate by at least 0.75 to 1 percentage point.

How long you plan to stay in your home: The longer you stay, the more time you have to make back the costs of refinancing.

The costs of refinancing, including closing costs and fees: These can usually be between 2% to 5% of the loan amount.

Your long-term financial goals: Think about whether refinancing fits with your overall money plans, like paying off your mortgage faster or freeing up cash for other investments.

Looking Ahead: Mortgage Rate Predictions

While we can't know for sure what will happen in the future, many experts think that mortgage rates will keep going down in the coming months. This outlook is based on several factors, including:

Economic Factors Nov 18-22, 2024

Fed Meeting Minutes

Retail Sales Report

Housing Starts Data

Jobless Claims

.minimalist-mind-map { display: flex; flex-direction: column; align-items: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); margin: 20px auto; max-width: 600px; } .minimalist-mind-map .center-topic { background-color: padding: 10px 20px; border-radius: 20px; margin-bottom: 20px; border: 2px solid .subtopics { display: flex; justify-content: space-around; width: 100%; } .minimalist-mind-map .subtopic { background-color: padding: 5px 10px; border-radius: 15px; border: 1px solid <p><p>1. <strong>Economic Growth Projections: People expect the economy to grow at a steady pace, which could keep inflation in check and possibly lead to lower mortgage rates. Analysts think the economy will grow in a balanced way that doesn't cause rapid inflation, which could allow the Federal Reserve to keep interest rates low. This is usually good for people borrowing money for mortgages, as it tends to keep long-term rates, including mortgage rates, relatively low.

2. Federal Reserve Policy: The Fed's focus on keeping the economy stable could result in policies that indirectly help mortgage borrowers. While the Fed doesn't set mortgage rates directly, their decisions on the federal funds rate and other money policies have a big impact on overall interest rates. If the Fed keeps focusing on economic growth and jobs more than worrying about inflation, it could mean a long period of low interest rates.

3. Global Economic Conditions: What's happening in the world economy and global politics will continue to affect U.S. mortgage rates. Things like trade relationships, how the world economy is growing, and what other countries are doing with their money can change how investors feel and where money flows. If there's still uncertainty in the global economy, it could make more people want to buy U.S. Treasury bonds, which usually leads to lower mortgage rates.

4. Housing Market Dynamics: The balance between how many houses are available and how many people want to buy them will affect how lenders behave and, as a result, mortgage rates. A healthy housing market with steady demand and enough houses for sale can create competition among lenders, which could lead to better rates for borrowers. However, any big changes in how many houses are available or how many people want to buy could affect this balance and change rate trends.

Staying Informed and Ready to Act

In the changing world of mortgage interest rates, knowing what's going on is really important. Stay up-to-date on market trends and economic news to make the best decisions for your money. Here are some ways to stay informed:

Watch our latest YouTube video on mortgage rate trends

Follow our TikTok for quick mortgage tips and updates

Subscribe to our YouTube channel for in-depth mortgage advice

Join our TikTok community for real-time market insights

Download our comprehensive mortgage guide

Conclusion: Take Advantage of Lower Mortgage Rates

As we get close to the end of 2024, mortgage rates are looking good for both people who want to buy homes and those who already own homes. With rates expected to go down over the next week, now is a great time to get ready and set yourself up for financial success. This possible drop in rates could mean you save a lot of money over the life of your loan, making it easier to afford a home or making refinancing more attractive.

Remember, while lower rates are great, they're just one part of getting a mortgage. Think about your long-term money goals, your current financial situation, and all the costs of owning a home when deciding whether to buy or refinance. It's important to look at the big picture, including things like property taxes, insurance, maintenance costs, and how your income or expenses might change over time.

By staying informed, working on improving your finances, and being ready to act when the right opportunity comes up, you can make the most of the current mortgage rate situation. Whether you're looking to buy your first home, move to a new house, or refinance your current mortgage, the coming weeks could be the perfect time to make your home ownership dreams come true. Keep in mind that the mortgage market can change quickly, so being prepared and able to make decisions quickly can give you a big advantage.

Rates Expected to Decrease

Mortgage rates are likely to go down over the next week, making it a good time for homebuyers and refinancing. This trend is influenced by economic indicators and Federal Reserve policies.

Consider the Full Picture

While lower rates are appealing, think about your long-term money goals, current finances, and overall costs of owning a home when making decisions. Factor in property taxes, insurance, and potential changes in your financial situation.

Be Prepared to Act

Stay informed and improve your financial health to be ready when the right opportunity comes up in the coming weeks. This includes getting pre-approved, comparing lenders, and monitoring economic indicators that affect mortgage rates.

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-3x1 { grid-template-columns: 1fr; }

Don't miss out on this chance. Start looking into mortgages today, and take advantage of the good conditions coming up. Your future self will thank you for making smart money decisions now. Remember, getting a mortgage or refinancing at the right time can help you be financially stable for a long time and help you achieve your home ownership goals. Stay active, do your research, and don't be afraid to ask for professional advice to make sure you're making the best decision for your unique situation. Good luck with your house hunting!

https://themortgage.app/post/whats-with-rates-this-week-nov-18th-2024

#f8f9fa;<br> #495057;<br> #6c757d;<br> #495057;<br>}<br>.minimalist-quote-container#dee2e6;<br>}<br>.minimalist-mind-map#dee2e6;<br>}<br></style><br></simple></p>

0 notes

Text

What's with Rates!?!? for the week of 11.18.24

Understanding Mortgage Interest Rates

Mortgage interest rates can be confusing, but knowing how they work could save you lots of money when buying a home. Whether you're getting your first house or looking to refinance, it's important to understand what affects mortgage rates and how to get the best deal. Let's look at what goes into setting mortgage rates and how you can take advantage of current market conditions to save money on your home loan.

Key Takeaways

Aspect Details Current Trend Mortgage rates expected to decrease slightly in the coming week Economic Factors Fed announcements, employment data, CPI report, global events, and housing market reports Strategies Get pre-approved, compare lenders, consider points, improve credit score Refinance Opportunity Potential for significant savings if current loan was secured at higher rates Future Outlook Experts predict continued downward trend in coming months

The Current Mortgage Rate Landscape

As we near the end of 2024, there's a lot happening in the mortgage market. While we can't give exact interest rates, things are looking better for people wanting to borrow money. Smart homebuyers are taking advantage of this change, locking in rates that could save them a lot of money over time. This positive trend is happening because of things like what people expect inflation to do, job numbers, and what's going on in the world economy.

Experts think mortgage rates will slowly go down over the next week, which could be good news for people looking to buy a house or refinance their loans. This possible drop in rates is because of several things happening in the economy that we'll talk about more. It's important to know that even small changes in interest rates can mean big savings over the life of a mortgage, so it's a good idea to stay informed and be ready to act when rates are in your favor.

Economic Factors Influencing Mortgage Rates

The week of November 18th to November 22nd, 2024, is going to be really important for people watching mortgage rates. Several key economic events are happening that could really affect interest rates:

Key Economic Factors Influencing Mortgage Rates (Nov 18-22, 2024)

Fed Announcements

CPI Report

Employment Data

Global Events

Housing Reports

.minimalist-chart-container { max-width: 500px; margin: 20px auto; text-align: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-chart { display: flex; justify-content: space-around; align-items: flex-end; height: 200px; padding: 20px 0; background-color: border-radius: 8px; position: relative; } .chart-column { display: flex; flex-direction: column; align-items: center; flex-grow: 1; height: 100%; } .minimalist-chart .bar { width: 40px; background-color: position: absolute; bottom: 25px; border-radius: 4px 4px 0 0; } .minimalist-chart .bar::before { content: attr(data-value) '%'; position: absolute; top: -25px; left: 50%; transform: translateX(-50%); font-size: 12px; } .bar-label { position: absolute; bottom: 0; font-size: 6px; color: max-width: 50px; word-wrap: break-word; text-align: center; }

1. Federal Reserve Announcements: The Fed doesn't directly set mortgage rates, but what they decide affects the whole financial market. Listen for any statements about inflation goals and how they think the economy will grow. How the Fed handles money policies, including any changes to the federal funds rate or talks about quantitative easing, can really affect the mortgage market. People who study this stuff will be looking closely at what words the Fed uses to try and guess what they might do in the future.

2. Employment Data: New information about jobs could change how confident lenders feel. When employment numbers are strong, it often means better borrowing conditions. Important things to watch are the unemployment rate, how many new jobs are created, and if wages are going up. A strong job market usually means the economy is healthy, which can lead to more people wanting mortgages and possibly lower rates as lenders compete for business.

3. Consumer Price Index (CPI) Report: This important report shows how inflation is doing, which can really affect mortgage rates. If the CPI is lower than expected, it could mean rates might go down. The CPI measures how much prices change over time for things people buy regularly. If inflation stays low or goes down, it might encourage the Fed to keep interest rates the same or lower them, which could be good for mortgage rates.

4. Global Economic Events: Things happening in other countries, like trade talks or big political changes, can affect U.S. mortgage rates. It's a good idea to keep an eye on major world economic news during this week. Things like trade agreements, changes in government in big countries, or big shifts in global commodity prices can change how investors feel and, as a result, affect mortgage rates. Because financial markets around the world are connected, events far away can directly impact your mortgage options.

5. Housing Market Reports: New information about home sales and how many new houses are being built can change how lenders feel about the real estate market, which might affect their decisions on rates. Reports on existing home sales, new home construction, and how many houses are available give insights into how healthy the housing market is overall. A strong housing market might lead to more competition among lenders, which could mean better rates for borrowers.

Strategies for Navigating the Current Rate Environment

With rates expected to go down, now is a great time to get ready for the best possible mortgage terms. Here are some things you can do:

Fed Meeting Minutes

Release of October FOMC meeting minutes on Wednesday

Existing Home Sales

October existing home sales data released on Tuesday

Jobless Claims

Weekly unemployment claims report on Thursday

Consumer Sentiment

Final November consumer sentiment index on Friday

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-2x2 { grid-template-columns: repeat(2, 1fr); } @media (max-width: 768px) { .grid-2x2 { grid-template-columns: 1fr; } }

1. Get Pre-Approved: Getting pre-approved for a mortgage can give you an edge in a fast-moving market. It shows sellers you're serious and helps you act quickly when rates go down. When you get pre-approved, a lender looks closely at your finances to tell you how much you can borrow and at what rate. This process can also help you find and fix any problems with your credit report or finances before you start looking for a house.

2. Compare Lenders: Don't just go with the first offer you get. Look at rates from different lenders to make sure you're getting the best deal. This includes regular banks, credit unions, and online lenders. Each might have different rules and offer different products that could be better for your situation. When comparing, look at more than just the interest rate – think about things like fees, how long the loan is for, and how good their customer service is.

3. Consider Points: Paying points upfront can lower your interest rate for the whole time you have the loan. This can be a good idea if you plan to stay in your home for a long time. One point usually equals 1% of how much you're borrowing and can lower your rate by 0.25%. Figure out how long it will take for the savings to be worth the cost to decide if this is a good choice for you. Remember, while points can save you money in the long run, you need to pay more at the start.

4. Improve Your Credit Score: Even a small increase in your credit score can get you a better interest rate. Try to pay off debts and fix any mistakes on your credit report before applying for a mortgage. Focus on using less of your available credit, paying all your bills on time, and not applying for new credit in the months before you apply for a mortgage. A higher credit score not only makes it more likely you'll be approved, but can also get you better loan terms.

The Refinance Opportunity

For people who already own homes, the possible drop in rates could be a great chance to refinance. Refinancing your mortgage could save you a lot of money, especially if you got your current loan when rates were higher. Refinancing means replacing your existing mortgage with a new one, possibly with better terms or a lower interest rate.

"Economic factors this week point towards a gradual easing of mortgage rates, with key data releases and Federal Reserve speeches likely to shape market sentiment. Homeowners and potential buyers should stay alert to these developments, as they could signal an opportune moment to lock in favorable rates."

— Economic Analysts, November 2024

.minimalist-quote-container { max-width: 600px; margin: 20px auto; background-color: padding: 30px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-quote-container blockquote { margin: 0; padding: 10px 20px; border-left: 4px solid blockquote p { font-style: italic; font-size: 1.1em; margin-bottom: 10px; } .minimalist-quote-container blockquote footer { font-size: 0.9em; text-align: right; }

Fed Speeches

Multiple Federal Reserve officials to give speeches on economic outlook

Economic Reports

Release of housing starts and existing home sales data

Market Trends

Analysts expect slight downward trend in mortgage rates

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-1x3 { grid-template-columns: repeat(3, 1fr); } @media (max-width: 768px) { .grid-1x3 { grid-template-columns: 1fr; } }

When thinking about refinancing, it's important to weigh the potential savings against the costs of doing it. Things to think about include:

The difference between your current rate and the new rate: A general rule is to consider refinancing if you can lower your rate by at least 0.75 to 1 percentage point.

How long you plan to stay in your home: The longer you stay, the more time you have to make back the costs of refinancing.

The costs of refinancing, including closing costs and fees: These can usually be between 2% to 5% of the loan amount.

Your long-term financial goals: Think about whether refinancing fits with your overall money plans, like paying off your mortgage faster or freeing up cash for other investments.

Looking Ahead: Mortgage Rate Predictions

While we can't know for sure what will happen in the future, many experts think that mortgage rates will keep going down in the coming months. This outlook is based on several factors, including:

Economic Factors Nov 18-22, 2024

Fed Meeting Minutes

Retail Sales Report

Housing Starts Data

Jobless Claims

.minimalist-mind-map { display: flex; flex-direction: column; align-items: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); margin: 20px auto; max-width: 600px; } .minimalist-mind-map .center-topic { background-color: padding: 10px 20px; border-radius: 20px; margin-bottom: 20px; border: 2px solid .subtopics { display: flex; justify-content: space-around; width: 100%; } .minimalist-mind-map .subtopic { background-color: padding: 5px 10px; border-radius: 15px; border: 1px solid <p><p>1. <strong>Economic Growth Projections: People expect the economy to grow at a steady pace, which could keep inflation in check and possibly lead to lower mortgage rates. Analysts think the economy will grow in a balanced way that doesn't cause rapid inflation, which could allow the Federal Reserve to keep interest rates low. This is usually good for people borrowing money for mortgages, as it tends to keep long-term rates, including mortgage rates, relatively low.

2. Federal Reserve Policy: The Fed's focus on keeping the economy stable could result in policies that indirectly help mortgage borrowers. While the Fed doesn't set mortgage rates directly, their decisions on the federal funds rate and other money policies have a big impact on overall interest rates. If the Fed keeps focusing on economic growth and jobs more than worrying about inflation, it could mean a long period of low interest rates.

3. Global Economic Conditions: What's happening in the world economy and global politics will continue to affect U.S. mortgage rates. Things like trade relationships, how the world economy is growing, and what other countries are doing with their money can change how investors feel and where money flows. If there's still uncertainty in the global economy, it could make more people want to buy U.S. Treasury bonds, which usually leads to lower mortgage rates.

4. Housing Market Dynamics: The balance between how many houses are available and how many people want to buy them will affect how lenders behave and, as a result, mortgage rates. A healthy housing market with steady demand and enough houses for sale can create competition among lenders, which could lead to better rates for borrowers. However, any big changes in how many houses are available or how many people want to buy could affect this balance and change rate trends.

Staying Informed and Ready to Act

In the changing world of mortgage interest rates, knowing what's going on is really important. Stay up-to-date on market trends and economic news to make the best decisions for your money. Here are some ways to stay informed:

Watch our latest YouTube video on mortgage rate trends

Follow our TikTok for quick mortgage tips and updates

Subscribe to our YouTube channel for in-depth mortgage advice

Join our TikTok community for real-time market insights

Download our comprehensive mortgage guide

Conclusion: Take Advantage of Lower Mortgage Rates

As we get close to the end of 2024, mortgage rates are looking good for both people who want to buy homes and those who already own homes. With rates expected to go down over the next week, now is a great time to get ready and set yourself up for financial success. This possible drop in rates could mean you save a lot of money over the life of your loan, making it easier to afford a home or making refinancing more attractive.

Remember, while lower rates are great, they're just one part of getting a mortgage. Think about your long-term money goals, your current financial situation, and all the costs of owning a home when deciding whether to buy or refinance. It's important to look at the big picture, including things like property taxes, insurance, maintenance costs, and how your income or expenses might change over time.

By staying informed, working on improving your finances, and being ready to act when the right opportunity comes up, you can make the most of the current mortgage rate situation. Whether you're looking to buy your first home, move to a new house, or refinance your current mortgage, the coming weeks could be the perfect time to make your home ownership dreams come true. Keep in mind that the mortgage market can change quickly, so being prepared and able to make decisions quickly can give you a big advantage.

Rates Expected to Decrease

Mortgage rates are likely to go down over the next week, making it a good time for homebuyers and refinancing. This trend is influenced by economic indicators and Federal Reserve policies.

Consider the Full Picture

While lower rates are appealing, think about your long-term money goals, current finances, and overall costs of owning a home when making decisions. Factor in property taxes, insurance, and potential changes in your financial situation.

Be Prepared to Act

Stay informed and improve your financial health to be ready when the right opportunity comes up in the coming weeks. This includes getting pre-approved, comparing lenders, and monitoring economic indicators that affect mortgage rates.

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-3x1 { grid-template-columns: 1fr; }

Don't miss out on this chance. Start looking into mortgages today, and take advantage of the good conditions coming up. Your future self will thank you for making smart money decisions now. Remember, getting a mortgage or refinancing at the right time can help you be financially stable for a long time and help you achieve your home ownership goals. Stay active, do your research, and don't be afraid to ask for professional advice to make sure you're making the best decision for your unique situation. Good luck with your house hunting!

https://themortgage.app/post/whats-with-rates-this-week-nov-18th-2024

#f8f9fa;<br> #495057;<br> #6c757d;<br> #495057;<br>}<br>.minimalist-quote-container#dee2e6;<br>}<br>.minimalist-mind-map#dee2e6;<br>}<br></style><br></simple></p>

0 notes

Text

What's with Rates!?!? for the week of 11.18.24

Understanding Mortgage Interest Rates

Mortgage interest rates can be confusing, but knowing how they work could save you lots of money when buying a home. Whether you're getting your first house or looking to refinance, it's important to understand what affects mortgage rates and how to get the best deal. Let's look at what goes into setting mortgage rates and how you can take advantage of current market conditions to save money on your home loan.

Key Takeaways

Aspect Details Current Trend Mortgage rates expected to decrease slightly in the coming week Economic Factors Fed announcements, employment data, CPI report, global events, and housing market reports Strategies Get pre-approved, compare lenders, consider points, improve credit score Refinance Opportunity Potential for significant savings if current loan was secured at higher rates Future Outlook Experts predict continued downward trend in coming months

The Current Mortgage Rate Landscape

As we near the end of 2024, there's a lot happening in the mortgage market. While we can't give exact interest rates, things are looking better for people wanting to borrow money. Smart homebuyers are taking advantage of this change, locking in rates that could save them a lot of money over time. This positive trend is happening because of things like what people expect inflation to do, job numbers, and what's going on in the world economy.

Experts think mortgage rates will slowly go down over the next week, which could be good news for people looking to buy a house or refinance their loans. This possible drop in rates is because of several things happening in the economy that we'll talk about more. It's important to know that even small changes in interest rates can mean big savings over the life of a mortgage, so it's a good idea to stay informed and be ready to act when rates are in your favor.

Economic Factors Influencing Mortgage Rates

The week of November 18th to November 22nd, 2024, is going to be really important for people watching mortgage rates. Several key economic events are happening that could really affect interest rates:

Key Economic Factors Influencing Mortgage Rates (Nov 18-22, 2024)

Fed Announcements

CPI Report

Employment Data

Global Events

Housing Reports

.minimalist-chart-container { max-width: 500px; margin: 20px auto; text-align: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-chart { display: flex; justify-content: space-around; align-items: flex-end; height: 200px; padding: 20px 0; background-color: border-radius: 8px; position: relative; } .chart-column { display: flex; flex-direction: column; align-items: center; flex-grow: 1; height: 100%; } .minimalist-chart .bar { width: 40px; background-color: position: absolute; bottom: 25px; border-radius: 4px 4px 0 0; } .minimalist-chart .bar::before { content: attr(data-value) '%'; position: absolute; top: -25px; left: 50%; transform: translateX(-50%); font-size: 12px; } .bar-label { position: absolute; bottom: 0; font-size: 6px; color: max-width: 50px; word-wrap: break-word; text-align: center; }

1. Federal Reserve Announcements: The Fed doesn't directly set mortgage rates, but what they decide affects the whole financial market. Listen for any statements about inflation goals and how they think the economy will grow. How the Fed handles money policies, including any changes to the federal funds rate or talks about quantitative easing, can really affect the mortgage market. People who study this stuff will be looking closely at what words the Fed uses to try and guess what they might do in the future.

2. Employment Data: New information about jobs could change how confident lenders feel. When employment numbers are strong, it often means better borrowing conditions. Important things to watch are the unemployment rate, how many new jobs are created, and if wages are going up. A strong job market usually means the economy is healthy, which can lead to more people wanting mortgages and possibly lower rates as lenders compete for business.

3. Consumer Price Index (CPI) Report: This important report shows how inflation is doing, which can really affect mortgage rates. If the CPI is lower than expected, it could mean rates might go down. The CPI measures how much prices change over time for things people buy regularly. If inflation stays low or goes down, it might encourage the Fed to keep interest rates the same or lower them, which could be good for mortgage rates.

4. Global Economic Events: Things happening in other countries, like trade talks or big political changes, can affect U.S. mortgage rates. It's a good idea to keep an eye on major world economic news during this week. Things like trade agreements, changes in government in big countries, or big shifts in global commodity prices can change how investors feel and, as a result, affect mortgage rates. Because financial markets around the world are connected, events far away can directly impact your mortgage options.

5. Housing Market Reports: New information about home sales and how many new houses are being built can change how lenders feel about the real estate market, which might affect their decisions on rates. Reports on existing home sales, new home construction, and how many houses are available give insights into how healthy the housing market is overall. A strong housing market might lead to more competition among lenders, which could mean better rates for borrowers.

Strategies for Navigating the Current Rate Environment

With rates expected to go down, now is a great time to get ready for the best possible mortgage terms. Here are some things you can do:

Fed Meeting Minutes

Release of October FOMC meeting minutes on Wednesday

Existing Home Sales

October existing home sales data released on Tuesday

Jobless Claims

Weekly unemployment claims report on Thursday

Consumer Sentiment

Final November consumer sentiment index on Friday

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-2x2 { grid-template-columns: repeat(2, 1fr); } @media (max-width: 768px) { .grid-2x2 { grid-template-columns: 1fr; } }

1. Get Pre-Approved: Getting pre-approved for a mortgage can give you an edge in a fast-moving market. It shows sellers you're serious and helps you act quickly when rates go down. When you get pre-approved, a lender looks closely at your finances to tell you how much you can borrow and at what rate. This process can also help you find and fix any problems with your credit report or finances before you start looking for a house.

2. Compare Lenders: Don't just go with the first offer you get. Look at rates from different lenders to make sure you're getting the best deal. This includes regular banks, credit unions, and online lenders. Each might have different rules and offer different products that could be better for your situation. When comparing, look at more than just the interest rate – think about things like fees, how long the loan is for, and how good their customer service is.

3. Consider Points: Paying points upfront can lower your interest rate for the whole time you have the loan. This can be a good idea if you plan to stay in your home for a long time. One point usually equals 1% of how much you're borrowing and can lower your rate by 0.25%. Figure out how long it will take for the savings to be worth the cost to decide if this is a good choice for you. Remember, while points can save you money in the long run, you need to pay more at the start.

4. Improve Your Credit Score: Even a small increase in your credit score can get you a better interest rate. Try to pay off debts and fix any mistakes on your credit report before applying for a mortgage. Focus on using less of your available credit, paying all your bills on time, and not applying for new credit in the months before you apply for a mortgage. A higher credit score not only makes it more likely you'll be approved, but can also get you better loan terms.

The Refinance Opportunity

For people who already own homes, the possible drop in rates could be a great chance to refinance. Refinancing your mortgage could save you a lot of money, especially if you got your current loan when rates were higher. Refinancing means replacing your existing mortgage with a new one, possibly with better terms or a lower interest rate.

"Economic factors this week point towards a gradual easing of mortgage rates, with key data releases and Federal Reserve speeches likely to shape market sentiment. Homeowners and potential buyers should stay alert to these developments, as they could signal an opportune moment to lock in favorable rates."

— Economic Analysts, November 2024

.minimalist-quote-container { max-width: 600px; margin: 20px auto; background-color: padding: 30px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-quote-container blockquote { margin: 0; padding: 10px 20px; border-left: 4px solid blockquote p { font-style: italic; font-size: 1.1em; margin-bottom: 10px; } .minimalist-quote-container blockquote footer { font-size: 0.9em; text-align: right; }

Fed Speeches

Multiple Federal Reserve officials to give speeches on economic outlook

Economic Reports

Release of housing starts and existing home sales data

Market Trends

Analysts expect slight downward trend in mortgage rates

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-1x3 { grid-template-columns: repeat(3, 1fr); } @media (max-width: 768px) { .grid-1x3 { grid-template-columns: 1fr; } }

When thinking about refinancing, it's important to weigh the potential savings against the costs of doing it. Things to think about include:

The difference between your current rate and the new rate: A general rule is to consider refinancing if you can lower your rate by at least 0.75 to 1 percentage point.

How long you plan to stay in your home: The longer you stay, the more time you have to make back the costs of refinancing.

The costs of refinancing, including closing costs and fees: These can usually be between 2% to 5% of the loan amount.

Your long-term financial goals: Think about whether refinancing fits with your overall money plans, like paying off your mortgage faster or freeing up cash for other investments.

Looking Ahead: Mortgage Rate Predictions

While we can't know for sure what will happen in the future, many experts think that mortgage rates will keep going down in the coming months. This outlook is based on several factors, including:

Economic Factors Nov 18-22, 2024

Fed Meeting Minutes

Retail Sales Report

Housing Starts Data

Jobless Claims

.minimalist-mind-map { display: flex; flex-direction: column; align-items: center; background-color: white; padding: 20px; border-radius: 8px; box-shadow: 0 2px 4px rgba(0,0,0,0.1); margin: 20px auto; max-width: 600px; } .minimalist-mind-map .center-topic { background-color: padding: 10px 20px; border-radius: 20px; margin-bottom: 20px; border: 2px solid .subtopics { display: flex; justify-content: space-around; width: 100%; } .minimalist-mind-map .subtopic { background-color: padding: 5px 10px; border-radius: 15px; border: 1px solid <p><p>1. <strong>Economic Growth Projections: People expect the economy to grow at a steady pace, which could keep inflation in check and possibly lead to lower mortgage rates. Analysts think the economy will grow in a balanced way that doesn't cause rapid inflation, which could allow the Federal Reserve to keep interest rates low. This is usually good for people borrowing money for mortgages, as it tends to keep long-term rates, including mortgage rates, relatively low.

2. Federal Reserve Policy: The Fed's focus on keeping the economy stable could result in policies that indirectly help mortgage borrowers. While the Fed doesn't set mortgage rates directly, their decisions on the federal funds rate and other money policies have a big impact on overall interest rates. If the Fed keeps focusing on economic growth and jobs more than worrying about inflation, it could mean a long period of low interest rates.

3. Global Economic Conditions: What's happening in the world economy and global politics will continue to affect U.S. mortgage rates. Things like trade relationships, how the world economy is growing, and what other countries are doing with their money can change how investors feel and where money flows. If there's still uncertainty in the global economy, it could make more people want to buy U.S. Treasury bonds, which usually leads to lower mortgage rates.

4. Housing Market Dynamics: The balance between how many houses are available and how many people want to buy them will affect how lenders behave and, as a result, mortgage rates. A healthy housing market with steady demand and enough houses for sale can create competition among lenders, which could lead to better rates for borrowers. However, any big changes in how many houses are available or how many people want to buy could affect this balance and change rate trends.

Staying Informed and Ready to Act

In the changing world of mortgage interest rates, knowing what's going on is really important. Stay up-to-date on market trends and economic news to make the best decisions for your money. Here are some ways to stay informed:

Watch our latest YouTube video on mortgage rate trends

Follow our TikTok for quick mortgage tips and updates

Subscribe to our YouTube channel for in-depth mortgage advice

Join our TikTok community for real-time market insights

Download our comprehensive mortgage guide

Conclusion: Take Advantage of Lower Mortgage Rates

As we get close to the end of 2024, mortgage rates are looking good for both people who want to buy homes and those who already own homes. With rates expected to go down over the next week, now is a great time to get ready and set yourself up for financial success. This possible drop in rates could mean you save a lot of money over the life of your loan, making it easier to afford a home or making refinancing more attractive.

Remember, while lower rates are great, they're just one part of getting a mortgage. Think about your long-term money goals, your current financial situation, and all the costs of owning a home when deciding whether to buy or refinance. It's important to look at the big picture, including things like property taxes, insurance, maintenance costs, and how your income or expenses might change over time.

By staying informed, working on improving your finances, and being ready to act when the right opportunity comes up, you can make the most of the current mortgage rate situation. Whether you're looking to buy your first home, move to a new house, or refinance your current mortgage, the coming weeks could be the perfect time to make your home ownership dreams come true. Keep in mind that the mortgage market can change quickly, so being prepared and able to make decisions quickly can give you a big advantage.

Rates Expected to Decrease

Mortgage rates are likely to go down over the next week, making it a good time for homebuyers and refinancing. This trend is influenced by economic indicators and Federal Reserve policies.

Consider the Full Picture

While lower rates are appealing, think about your long-term money goals, current finances, and overall costs of owning a home when making decisions. Factor in property taxes, insurance, and potential changes in your financial situation.

Be Prepared to Act

Stay informed and improve your financial health to be ready when the right opportunity comes up in the coming weeks. This includes getting pre-approved, comparing lenders, and monitoring economic indicators that affect mortgage rates.

.minimalist-grid-container { display: grid; gap: 20px; max-width: 800px; margin: 0 auto; font-family: Arial, sans-serif; } .minimalist-grid-container .grid-item { background-color: border-radius: 8px; padding: 20px; text-align: center; box-shadow: 0 2px 4px rgba(0,0,0,0.1); } .minimalist-grid-container .grid-item h3 { color: margin: 10px 0 5px; font-size: 16px; } .minimalist-grid-container .grid-item p { color: margin: 0; font-size: 14px; } .icon { width: 40px; height: 40px; margin-bottom: 10px; fill: none; stroke: stroke-width: 2; stroke-linecap: round; stroke-linejoin: round; } .grid-3x1 { grid-template-columns: 1fr; }

Don't miss out on this chance. Start looking into mortgages today, and take advantage of the good conditions coming up. Your future self will thank you for making smart money decisions now. Remember, getting a mortgage or refinancing at the right time can help you be financially stable for a long time and help you achieve your home ownership goals. Stay active, do your research, and don't be afraid to ask for professional advice to make sure you're making the best decision for your unique situation. Good luck with your house hunting!

https://themortgage.app/post/whats-with-rates-this-week-nov-18th-2024

#f8f9fa;<br> #495057;<br> #6c757d;<br> #495057;<br>}<br>.minimalist-quote-container#dee2e6;<br>}<br>.minimalist-mind-map#dee2e6;<br>}<br></style><br></simple></p>

0 notes

Text

0 notes

Note

hi there! i'm currently using theme 224 and images over a certain height are made smaller and become blurry, but look perfectly fine when viewed on the dashboard. do you happen to know if there's any fix for this?

hi there! do you have a example post i can look and debug? it might be pixels that are messing out the posts width. this theme have toggles in the appearance to use 540px, 500px, 400px and each size have their own padding, so it won't look weird or blurry

0 notes

Text

BT01 Index for July 2023 was published officially

New Post has been published on https://www.juristique.org/en/news/bt01-index-july-2023

BT01 Index for July 2023 was published officially

The BT01 Index for July 2023 was published in the official journal on 09/16/2023.

The value of the BT01 Index for July 2023 is 129.7 to 127.7 in July 2022, an annual increase of 1.57% over 12 rolling months. The July index decreased by 0,46% from the previous month (130.3 in June 2023).

Sommaire

1 BT01 index variation table for July 2023

2 Download the values of all BT indexes for July 2023:

3 Frequently asked questions about the BT01 index for July 2023

BT01 index variation table for July 2023

Index BT01 July 2023Index BT01 June 2023Index BT01 July 2022Value of BT01 index129.7130.3127.7Variation in % compared to the base Down 0.46%Up 1.57%

Values and % change in the BT01 index for July 2023

Official source: Insee.

Our index evolution table for 2022 has been updated here: BT01 Index 2023.

Publication of BT01 Index for July 2023

The BT01 Index (base 100 in 2010) measures changes in the cost of factors of production in the Building Industry (salaries and expenses, cost of materials, energy, etc.). It is the official reference for updating and revising construction contract prices.

The Index is published each month by INSEE with a 3-month delay. It thus succeeded the Index of the Building and Public Works (1974 and 1975), which was stopped. Most companies in various construction trades (electricity, painting, masonry, etc.) are concerned with the BT01 Index.

Download the values of all BT indexes for July 2023:

#pdfp65080dfa7c576 .title font-size: 16px; #pdfp65080dfa7c576 iframe height: 500px; #pdfp65080dfa7c576 width: 100%; .pdfp10d6e2ccbtn background: #2271b1; color: #fff; padding: 10px 20px 10px 10px

Official publication of other BT and TP indices for July 2023

Download the other BT and TP indexes for July 2023

Frequently asked questions about the BT01 index for July 2023

"@context":"https://schema.org","@type":"FAQPage","@id":"https://www.juristique.org/en/news/bt01-index-july-2023","mainEntity":["@type":"Question","name":"What is the value of the BT01 index for July 2023?","acceptedAnswer":"@type":"Answer","text":"The BT01 index value for July 2023 is 129.7.","@type":"Question","name":"What is the one-year increase in the BT01 index for July 2023 (July 2022)?","acceptedAnswer":"@type":"Answer","text":"The July 2023 BT01 Index (129.7) is up 1.57% over one year (127.7 in July 2022).","@type":"Question","name":"What is the increase in the BT01 index for July 2023 compared to the previous month (June 2023)?","acceptedAnswer":"@type":"Answer","text":"The July 2023 BT01 Index (129.7) decreased by 0.46% from the previous month (130.3 in June 2023)."]

What is the value of the BT01 index for July 2023?

The BT01 index value for July 2023 is 129.7.

What is the one-year increase in the BT01 index for July 2023 (July 2022)?

The July 2023 BT01 Index (129.7) is up 1.57% over one year (127.7 in July 2022).

What is the increase in the BT01 index for July 2023 compared to the previous month (June 2023)?

The July 2023 BT01 Index (129.7) decreased by 0.46% from the previous month (130.3 in June 2023).

0 notes

Link

0 notes

Note

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<meta name="viewport" content="width=device-width, initial-scale=1.0">

<title>FNaF-Inspired Game</title>

<style>

body {

font-family: Arial, sans-serif;

background-color: #111;

color: #fff;

display: flex;

justify-content: center;

align-items: center;

height: 100vh;

margin: 0;

}

#game {

text-align: center;

max-width: 500px;

}

button {

padding: 10px 20px;

margin: 5px;

background-color: #444;

border: none;

color: #fff;

cursor: pointer;

font-size: 16px;

}

button:hover {

background-color: #666;

}

#status {

margin-top: 20px;

font-size: 18px;

}

#power {

margin-top: 10px;

font-size: 20px;

color: #f00;

}

</style>

</head>

<body>

<div id="game">

<h1>FNaF-Inspired Game</h1>

<p>Monitor the cameras, manage your power, and survive until 6 AM!</p>

<button onclick="checkCamera(1)">Check Camera 1</button>

<button onclick="checkCamera(2)">Check Camera 2</button>

<button onclick="checkCamera(3)">Check Camera 3</button>

<button onclick="checkCamera(4)">Check Camera 4</button>

<button onclick="closeDoor()">Close Door</button>

<div id="status"></div>

<div id="power">Power: 100%</div>

</div>

<script>

let animatronics = [

{ position: Math.floor(Math.random() * 4) + 1, moving: true },

{ position: Math.floor(Math.random() * 4) + 1, moving: true }

];

let isDoorClosed = false;

let power = 100;

let gameOver = false;

let timeLeft = 360; // 6 minutes = 360 seconds (one second in game is like 1 second of real-time)

function checkCamera(camera) {

if (gameOver || power <= 0) return;

power -= 5;

updatePower();

let found = false;

for (let animatronic of animatronics) {

if (animatronic.position === camera && animatronic.moving) {

found = true;

document.getElementById('status').innerText = "An animatronic is here! Close the door!";

break;

}

}

if (!found) {

document.getElementById('status').innerText = "The camera is clear.";

}

}

function closeDoor() {

if (gameOver || power <= 0) return;

power -= 10;

updatePower();

let danger = false;

for (let animatronic of animatronics) {

if (animatronic.moving && (animatronic.position === 1 || animatronic.position === 2 || animatronic.position === 3 || animatronic.position === 4)) {

danger = true;

animatronic.moving = false;

}

}

if (danger) {

isDoorClosed = true;

document.getElementById('status').innerText = "You closed the door in time!";

setTimeout(resetDoor, 3000);

} else {

document.getElementById('status').innerText = "Nothing to close the door for.";

}

}

function resetDoor() {

isDoorClosed = false;

document.getElementById('status').innerText = "";

}

function updatePower() {

document.getElementById('power').innerText = `Power: ${power}%`;

if (power <= 0) {

gameOver = true;

document.getElementById('status').innerText = "Power is out! The animatronics got you. Game Over.";

}

}

function gameTimer() {

if (gameOver || power <= 0) return;

timeLeft -= 1;

if (timeLeft <= 0) {

gameOver = true;

document.getElementById('status').innerText = "You survived until 6 AM! You win!";

return;

}

// Randomly move animatronics

for (let animatronic of animatronics) {

if (Math.random() < 0.4) {

animatronic.position = Math.floor(Math.random() * 4) + 1;

animatronic.moving = true;

}

}

if (!isDoorClosed) {

for (let animatronic of animatronics) {

if (animatronic.moving && (animatronic.position === 1 || animatronic.position === 2 || animatronic.position === 3 || animatronic.position === 4)) {

if (Math.random() < 0.3) {

gameOver = true;

document.getElementById('status').innerText = "The animatronics got you! Game Over.";

return;

}

}

}

}

// Gradually decrease power

if (!isDoorClosed) power -= 1;

updatePower();

}

setInterval(gameTimer, 1000); // Game timer runs every second

</script>

</body>

</html>

the

My name is Walter Hartwell White. I live at 308 Negra Arroyo Lane, Albuquerque, New Mexico, 87104. This is my confession. If you're watching this tape, I'm probably dead, murdered by my brother-in-law Hank Schrader. Hank has been building a meth empire for over a year now and using me as his chemist. Shortly after my 50th birthday, Hank came to me with a rather, shocking proposition. He asked that I use my chemistry knowledge to cook methamphetamine, which he would then sell using his connections in the drug world. Connections that he made through his career with the DEA. I was... astounded, I... I always thought that Hank was a very moral man and I was... thrown, confused, things escalated. Fring was able to arrange, uh I guess I guess you call it a "hit" on my brother-in-law, and failed, but Hank was seriously injured, and I wound up paying his medical bills which amounted to a little over $177,000. Upon recovery, Hank was bent on revenge, working with a man named Hector Salamanca, he plotted to kill Fring, and did so. In fact, the bomb that he used was built by me, and he gave me no option in it. I have often contemplated suicide, but I'm a coward. I wanted to go to the police, but I was frightened. Hank had risen in the ranks to become the head of the Albuquerque DEA, and about that time, to keep me in line, he took my children from me. For 3 months he kept them. My wife, who up until that point, had no idea of my criminal activities, was horrified to learn what I had done, why Hank had taken our children. We were scared. I was in Hell, I hated myself for what I had brought upon my family. Recently, I tried once again to quit, to end this nightmare, and in response, he gave me this. I can't take this anymore. I live in fear every day that Hank will kill me, or worse, hurt my family. I... All I could think to do was to make this video in hope that the world will finally see this man for who he truly is

7 notes

·

View notes

Text

You should remove the Stylish extension and use Stylus instead

Google and Mozilla have removed the Stylish browser extension from their respective add-on stores after the publication of a report [in July 2018] that accused the extension of logging users' browser histories and sending the data to remote servers. [...]

Stylish has been a wildly popular extension for many years because it allowed users to use custom "styles" for web pages, allowing users to tweak the look and feel of any website to their liking.

When news of the SimilarWeb acquisition became public in January 2017, the open-source community forked the old Stylish project into a new one called Stylus, which works like the old extension but without the data collection code.

Stylus is currently available for Chrome, Firefox, and Opera.

I have userscripts installed to make this blue hellsite slightly more functional. I just switched to Stylus, so I had to track down scripts from userstyles.org. These are my favs:

Tumblr Image Width: No rescaling (No blurry gifs!!)

Tumblr scroll button

Bigger Tumblr messaging box (Get this!!)

Sidebar fix

Smaller Text Post Titles

Various Dashboard Themes I Like

#i made this post for myself but maybe other people will find it useful#will i ever stop fussing over the 500px vs 540px gifs?#no.#no i will not.#///#tumblr#resources#html#stylish#stylus#userscripts#user scripts#tumblr image width#tumblr image width no rescaling#user styles#extensions#add ons

171 notes

·

View notes

Text

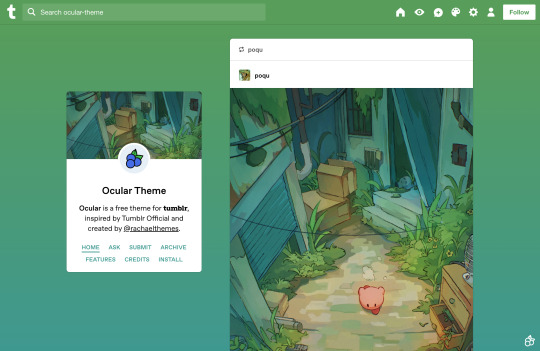

Ocular — Version 2.0.0

Preview // More Info & Install

oh heyyyy hi hello long time no chat! (it's been over a year!) (sorry!)

I decided to give my theme Opticant a face lift, along with a desperately needed name change. I'm not really working on other new themes right now but I was so excited to update this!

Ocular comes with the following features:

Uses Tumblr's full-width controls and search bar

Post Sizes: 400px, 500px, 540px, 600px, 700px

Sidebar Width: 200px, 260px, 300px, 350px, 400px

Font Sizes: 14px, 15px, 16px, 18px

Background: solid, 2-color gradient, or image (full, static, or repeating)

Unlimited custom links (visit the help desk FAQ for tutorial)

Custom titles for Home, Ask, Submit, and Archive links

Endless scroll, custom fonts, and custom ask box text

Optional header and avatar image

Ocular version 2.0.0 adds these new features:

Color Schemes: Default, Tumblr, Dark Mode, Low Contrast, Cement, Cybernetic, Canary, Pastel, Blended Light, Blended Dark

Sidebar Location: Left, Right, or Above Posts

Added "Uncropped" to the "Avatar Shape" option, which will show your Avatar image in its native aspect ratio with no background, border, or rounded corners (see images 2 and 3) (perfect for transparent images and sprites) (redux edits? again? heck yeah)

Various additions and small tweaks to minor options, such as new background options, theme credit customization, etc.

It also fixes these bugs and adds these cool code updates:

Long words were prevented from being broken, thereby cutting off text on the edge of the post

Updated inline photosets so they no longer break when using endless scroll

The appearance of Read More links and the Pinned Post indicator have been updated to more closely match the Tumblr dashboard

Added lightbox functionality to all images

Compressed JS and CSS for quicker load times

Probably more updates honestly I kinda lost track

you can install (or reinstall) this theme here, or you can cross your fingers and hope that my submission to the theme garden (??!!?!?!) gets approved!! as always, thanks for using my themes. I've been making them for almost 10 years and I'm so grateful to all of you for helping me make that a possibility <3

2K notes

·

View notes

Note

hi can you make a tutorial on how you sharpen your gifs? i especially love the black and white ones you make

Hi Nonnie! Sorry you've had to wait a little bit, I've just been really insanely busy with a thousand things 😅 Anyway, I'm not sure how exactly to do this, but hopefully this makes sense!

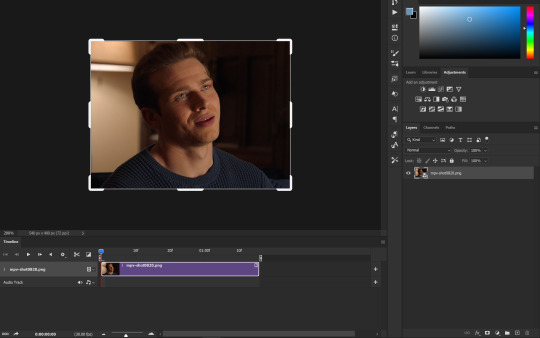

We'll be doing this scene, to go from the top gif to the bottom gif:

(This tutorial assumes basic knowledge of gif-making and smart filters, and is probably long-winded because I haven't been making gifs for very long, but this is the way I do mine.)

Tutorial under the cut:

Couple things to note that make a huge difference before you even start:

Use high-quality videos! I try not to go below 1080p for anything, and sometimes that means downloading bigger files.

Make sure that whatever application you use to get your frames isn't distorting them, or skipping frames. I use MPV player.

Make sure your gif size is correct when you crop it, if you're posting it somewhere). For example, if you're making a single gif on a row, Tumblr's optimum width is 540px. If you make it 500px, or 550px or whatever, it's going to look super crunchy and weird after you post it, so stick to their sizes.

We're gonna begin at this page (if you need a tutorial on how to get here, let me know, but I'm assuming you know!)

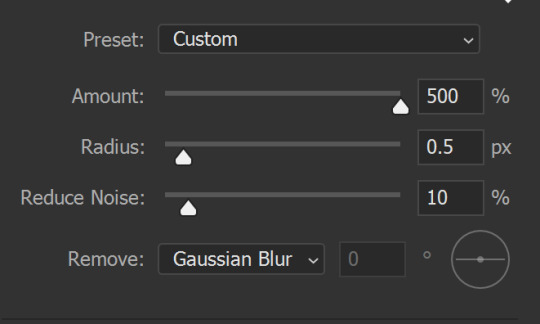

First, make sure your gif is a smart object! If your gif isn't a smart object, you won't be able to apply the smart filters. If it is, you'll see this symbol next to it. To convert all your layers to a smart object, select them all, right-click, and select "convert to smart object."

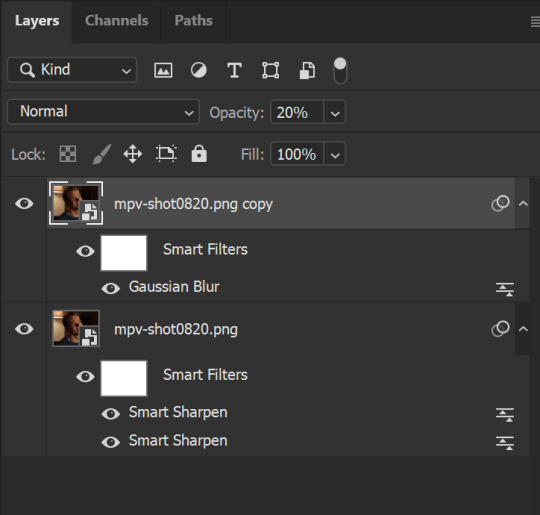

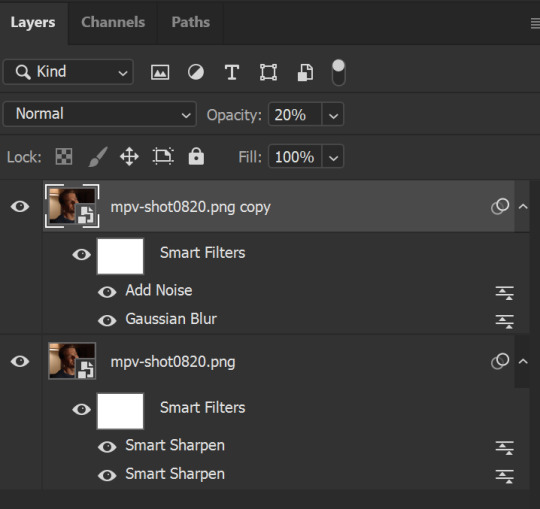

Next, duplicate your gif layer so you have two. Hide the top layer and select the bottom layer. Your layers should look like this:

Remember we're working on the bottom layer first! Go to Filter > Sharpen > Smart Sharpen. Use these settings, depending on what looks best for your gif/video quality:

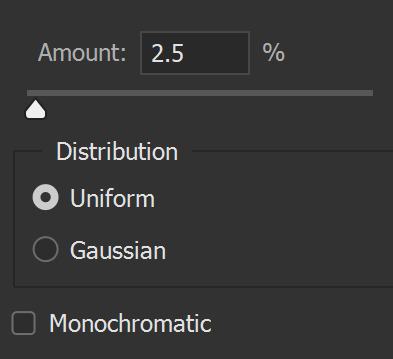

The radius can be set to 0.2px to 0.5px depending on your quality/preference. You can also choose to remove Lens Blur instead of Gaussian Blur but these are my preferred settings. (I don't do anything with the Shadows and Highlights section)

Next, do another Smart Sharpen, but this time, use these settings:

(a popular choice for this second smart sharpen is 10%-10px, but I like the clarity 20% gives just a little bit more.)

This is what my layers look like right now:

And this is what my gif looks like. I removed the sharpening from the right side of the image, and while it's not super obvious like this, I think you can see the difference best in Buck's eyes. The eye on our left has much more detail and depth, while the one on our right isn't as clear:

You can stop right here if you want to, if you're happy with the way your gif looks. However, my preference is always to soften the crisp edges just a little so it doesn't look over-sharp, and also give it some clarity, which is where that second layer comes in.

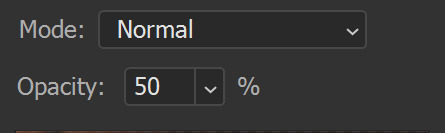

Select that top layer and un-hide it. Remember that there are no filters on this layer so far. Go to Filters > Blur > Gaussian Blur. Choose a radius of 0.4-0.7px, and click enter. The gif will look like this:

Next, change the opacity of this top layer to 20-25%. You should have your sharpened gif back, but it will look just a little softer and less harsh along the edges. You can change this opacity depending on your scene, so it's really like a slider you can control to go back and forth.

Your layers will look like this: