#the symbolism and actual physical value of the USD is one example

Explore tagged Tumblr posts

Text

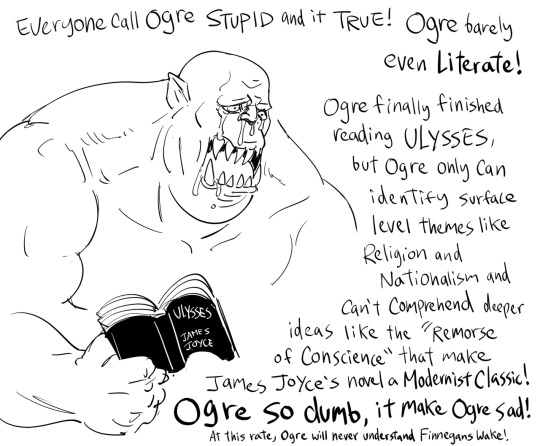

This is how it feels to explain anything

#image is from Baalbuddy#we gotta explore the themes of ennui in victorian literature the usage of mirrors and the how it relates to romanticism#and how it pertains to increasing industrialization and the previous era of Romanticism and the juxtaposition of how#they wanted to innovate (see the English Novel) but retain or even ‘remove’ the roots#and how some of the ideas found here can extend into the fiction of other countries of the time and even to now (considering how expressive#and influential some of them are)#not to mention how naturally a lot of universities and schools will teach their natio/ literature for obvious reasons#unless you fake a specialized course#(me reading Tale of Genji)#*take#and a country like the usa where a literary canon does exist#but it’s also heavily influenced by being a country of immigrants and ‘foreign’ influence means the American identity is fairly unique#not the best#just unique#it’s a country where the identity of oppressor and oppressed can blend together#Ex. Hawaii and the Japanese immigration movement#and colonizer and colonized can also merge#other countries have it too since the world is so varied#but the usa sits at a relatively unique position#considering its current status as a superpower#the symbolism and actual physical value of the USD is one example

1 note

·

View note

Text

Forex Overview

Each day, millions of trades are made in a currency exchange market called Forex. The word "Forex" directly stems off of the beginning of two words - "foreign" and "exchange". Unlike other trading systems such as the stock market, Forex does not involve the trading of any goods, physical or representative. Instead, Forex operates through buying, selling, and trading between the currencies of various economies from around the world. Because the Forex market is truly a global trading system, trades are made 24 hours a day, five days a week. In addition, Forex is not bound by any one control agency, which means that Forex is the only true free market economic trading system available today. By leaving the exchange rates out of any one group's hands, it is much more difficult to even attempt to manipulate or corner the currency market. With all of the advantages associated with the Forex system, and the global range of participation, the Forex market is the largest market in the entire world. Anywhere between 1 trillion and 1.5 trillion equivalent United States dollars are traded on the Forex market each and every day.

Forex operates mainly on the concept of "free-floating" currencies; this can be explained best as currencies that are not backed by specific materials such as gold or silver. Prior to 1971, a market such as Forex would not work because of the international "Bretton Woods" agreement. This agreement stipulated that all involved economies would strive to hold the value of their currencies close to the value of the US dollar, which in turn was held to the value of gold. In 1971, the Bretton Woods agreement was abandoned. The United States had run a huge deficit during the Vietnam Conflict, and began printing out more paper currency than they could back with gold, resulting in a relatively high level of inflation. By 1976, every major currency worldwide had left the system established under the Bretton Woods agreement, and had changed into a free-floating system of currency. This free-floating system meant that each country's currency could have vastly different values that fluctuated based on how the country's economy was faring at that time.

Because each currency fluctuates independently, it is possible to make a profit from the changes in currency value. For example, 1 Euro used to be worth about 0.86 US dollars. Shortly thereafter, 1 Euro was worth about 1.08 US dollars. Those who bought Euros at 86 cents and sold them at 1.08 US dollars were able to make 22 cents profit off of each Euro - this could equate to hundreds of millions in profits for those who were deeply rooted in the Euro. Everything in the Forex market is hanging on the exchange rate of various currencies. Sadly, very few people realize that the exchange rates they see on the news and read about in the newspapers each day could possibly be able to work towards profits on their behalf, even if they were just to make a small investment. The Euro and the US dollar are probably the two most well-known currencies that are used in the Forex market, and therefore they are two of the most widely traded in the Forex market. In addition to the two "kings of currency", there are a few other currencies that have fairly strong reputation for Forex trading. The Australian Dollar, the Japanese Yen, the Canadian Dollar, and the New Zealand Dollar are all staple currencies used by established Forex traders. However, it is important to note that on most Forex services, you won't see the full name of a currency written out. Each currency has it's own symbol, just as companies involved in the stock market have their own symbol based off of the name of their company. Some of the important currency symbols to know are:

USD - United States Dollar

EUR - The Euro

CAD - The Canadian Dollar

AUD - The Australian Dollar

JPY - The Japanese Yen

NZD - The New Zealand Dollar

Although the symbols may be confusing at first, you'll get used to them after a while. Remember that each currency's symbol is logically formed from the name of the currency, usually in some form of acronym. With a little practice, you'll be able to determine most currency codes without even having to look them up.

Some of the richest people in the world have Forex as a large part of their investment portfolio. Warren Buffet, the world's richest man, has over $20 Billion invested in various currencies on the Forex market. His revenue portfolio usually includes well over one-hundred million dollars in profit from Forex trades each quartile. George Soros is another big name in the field of currency trading - it is believed that he made over $1 billion in profit from a single day of trading in 1992! Although those types of trades are very rare, he was still able to amass over $7 Billion from three decades of trading on the Forex market. The strategy of George Soros also goes to show that you don't have to be too risky to make profits on Forex - his conservative strategy involves withdrawing large portions of his profits from the market, even when the trend of his various investments seems to still be correlating upward.

Thankfully, you don't have to invest millions of dollars to make a profit on Forex. Many people have recorded their success with initial investments of anywhere from $10,000 to as little as $100 for an initial investment. This wide range of economic requirements makes Forex an attractive venue for trading among all classes, from those well entrenched in the lower rungs of the middle class, all the way up to the richest people alive on the planet. For those on the lower end of the spectrum, access to the Forex market is a fairly recent innovation. Within the past decades, various companies began offering a system that is friendlier to the average person, allowing the smaller initial investments and greater flexibility that is seen in the market today. Now, no matter what economic position you are in, you can get started. Although it's possible to jump right in and start investing, it's best that you make sure you have a better understanding of the ins and outs of Forex trading before you get started.

The world of Forex is one that can be both profitable and exciting, but in order to make Forex work for you it is important that you know how the system works. Like most lucrative activities, to become a Forex pro you need a lot of practice. There are many websites that offer exactly this, the simulated practice of Foreign Exchange.

The services provided by online practice sites differ from site to site, so it is always a good idea to make sure you know all of the details of the site you are about to use. For example, there are several online brokers who will offer a practice account for a period of several weeks, then terminate it and start you on a live account, which means you may end up using your own money before you are ready to. It's always a good idea to find a site that offers an unlimited practice account. Having a practice account allows you to learn the ways of the trade with no risk at all. Continuing to use the practice account while you use a live account is also a beneficial tool for even the most seasoned Forex traders. The use of a no risk practice account enables you to try out new trading strategies and tread into unknown waters. If the strategy works, you know that you can now implement that strategy into your real account. If the strategy fails, you know to refrain from the use of that strategy without the loss of any actual money.

Of course, simply using a no risk account won't get you anywhere. In order to make money with Forex, you need to put your own money in. Obviously, it would be ridiculous to travel to other countries to purchase and sell different currencies, so there are many websites that you can use to digitally trade your money. Almost all online brokerage systems have different features to offer you so you have to do the research to find out which site you wish to create an account with. All brokers will require specific information of you to create your account. The information they will need from you includes information required to communicate with you, including your name, mailing address, telephone number, e-mail address. They also require information needed to identify who you are, including your Social Security number, Passport number or Tax Identification number. It is required by law that they have this information, so they can prevent fraudulent trading. They may also collect various personal information when you open an account, including gender, birth date, occupation, and employment status.

Now that you have practiced trading currency and set up your live account, it is time to truly enter this profitable yet risky world. To make money with Forex, you do need to have money to begin with. It is possible to trade with very small amounts of money, but this will also lead to very small profits. As is with many other exchange systems, high payouts will only come with high risks. You can't expect to start getting millions as soon as you put money in to the market, but you can't expect to make any money at all if you don't put in at least a 3-digit value.

As most Forex brokers will warn you, you can loose money in the foreign exchange market, so don't put your life savings into any one trade. Always trade with money that you'd be able to survive without. This will ensure that if you get a bad trade and loose a lot of money, you wont end up on the streets, and you'll be able to make a comeback in the future.

So how does trading currency work? Logically, trades always come in pairs. For example, a common trade would be the United States Dollar to the Japanese Yen. This is expressed as USD/JPY. The way to quote a trade is kind of tricky, but with practice it becomes as natural as reading your native language. In a Forex quote, the first currency in the list (IE: USD in USD/JPY) is the base currency, and in the quote the base is always one. This means if (hypothetically of course) One USD was worth Two JPY, that the quote would be expressed as 1/2.

When trading in Forex, we use pips. Pip is an acronym for "percentage in point". A pip a certain decimal place in a number compared to the same decimal place in another number. Using pips, we track the gains and losses of a currencies value compared to another's. Let's take a look at an example. Say a value is written as 1.0001/1.0004. This would indicate a 3-pip spread, because of the 3 number difference in the fourth decimal place. Almost all currency pairs go to the fourth decimal place. The only currency pair that doesn't is that of the USD/JPY, and it goes to the second decimal place. For example, a USD/JPY quote with a 3-point spread would look like this: 1.01/1.04.

A very common aspect to the foreign exchange is leverage. Leverage trading, also known as trading on margin, is a way to amplify the amount of money you are making. When you use leverage trading, you borrow a certain amount of money from your broker and use that to make your transaction. This allows you to trade with more money then you are actually spending, meaning you can make higher profits than you would normally be able to make.

There are risks associated with leverage trading. If you increase the amount of money you are using, if a trade goes bad, then you'll loose more money than you'd usually loose. The risks are worth it though, because a big win on margin means a huge payout. As mentioned before, it is definitely a wise idea to try out leverage trading on your practice account before you use it excessively on your live account, so you can get a feel for the way it works.

Now that you're an expert on the way Forex trading works there are some things about foreign exchange that you should know. Forex is just like the stock market in that there are many benefits and risks, but if you are going to invest your time and personal money into this system, you should be fully aware of all of the factors that may change your decision to invest in the currency market.

Generally speaking, Forex is a difficult subject to opinionate on, because of the different factors that may alter the currency over the years. "Supply and demand" is a major issue affecting the Forex organization, because the world is in constant variable to change, one significant product being oil. Usually the currency of all the nations around the globe is described as a huge "melting pot", because of the fact that all of the interchanging controversy, political affairs, national disputes, and possibly war conflicts, all mixed together as a whole, altering the nature of Forex every second! Although problems such as supply and demand, and the whole "melting pot" issue, there are a numerous amount of pros to Forex; one being benefited profit from long term stock. Because of the positive aspects of Forex, the percentage of the use of electronic trading in the FX market (shortened from Foreign Exchange) increased by 7% from 2005 to 2008. Despite the controversial realm of Forex, it is still recognized today by many, and is still popular amongst many of the nations in the world.

Of all the organizations that recognize Forex, most of them practice fiscal policy, and monetary policy. Both policies are dependent on the nation's outlook on economics, and their standards set. The government's budget deficits, or surpluses against the country, is widely affected by the country's economic status of trade, and may critically inflict the nation's currency. Another factor for the nation's deficit spending is what the nation already has, in terms of necessities for the citizens, and the society. The more the country already has, prior to trade, the greater the budget for other demands from the people, such as technology, innovations in existing products, etc. Although a country may have an abundance in necessities, greed may hinder the nation's economic status, by changing government official's wants, to want "unnecessary" products, therefore ruining or "wasting" the country's money. This negative trend may lead to the country's doom, and hurt the Forex's reputation for positive change. There are some countries which hold more of a product (such as oil stated above), the Middle East dominating that sector in the circle of trade; Since the Middle East suffers much poverty, as a result of deficit spending, and lack of other resources, they demand for a higher price in oil, to maintain their economic status. This process is known as the "flights to quality", and is practiced by many countries, wanting to survive in the trading network that exists today. Interest rate, and leveraged financing, is due to the inflations that occur in many parts of the world from one point to another. Inflations wear down purchasing abilities, causing the currency to fall with it. In some cases, a country may observe the trends that it takes, and beforehand, take action to avoid any mishaps that had been experienced before. Sometimes, the country will buy more of a product, or sell more of a product, otherwise known as "overbought" or "oversold". This may aid in the country's future, or devastatingly hurt the country, because of lack of thought, as a result of fraud logic. "What started out as a market for professionals is now attracting traders from all over the world and of all experience levels" is part of a letter of the chairman of Forex, and it is completely true. There is even a 30-day trial for Forex online at http://www.forex.com/forex_demo_account.html if anyone interested in Forex wants to learn more about the company. Although affected by leveraged financing, interest rate, and causing an increase or decrease in exchange rate risks, Forex can be a great way for quick profits and integrated economy for the country. In investing in stocks that are most likely to be successful for a long period of time, and researching these companies for more reference and background that you need to know, Forex can aid in these fields. In the Forex market of different levels of access, the inter-bank market composed of the largest investment bank firm, which contains "spreads", which are divided into bid, and ask prices. Large amounts of transactions, with large amounts traded, and requesting a small amount of difference is known as a better spread, which is preferred by many investors.

In comparison to the Stock Market, the Forex organization is just as stable, and safe, if the users on it are aware, and decently knowledgeable about the topic. The Stock Market Crash in 1929 was a result of lack of thinking, because of the extremely cheap shares, replacing the shares originally costing thousands of dollars. When the Stock Market crashed, and the New Deal was proposed by Franklin D. Roosevelt, leveraged finance was present, and utilized to stabilize the economy at the time. The United States was extremely wealthy and prosperous in the 20s (prior to the depression), and had not realized what could happen as a result of carelessness in spending. This is a result of deficit spending, and how it could damage a society, in less than a decade! When joining Forex, keep in mind that with the possible positive outcomes, and negative ones, there are obstacles that must be faced to become successful.

As a result of many catastrophic events, such as the Great Depression that occurred in the United States, people investing in the Forex organization keep in mind of the dangers, and rewards that may come upon them in a certain point in time. With more work and consideration outputted by a person, or organization in the Forex program will there be more signs of prosperity as a result. In relation to individuals such as Warren Buffet and George Soros, they have become successful through experience, and determination through many programs, and research, for security purposes. Reserving some of the most riches people in the world, to others that are just test driving it to discover its potential for them, Forex is a broad topic that experiences different people everyday. Forex may not help everyone that invests in it, but if enough outputted effort is amplified in attempts to better the economy, it is most definitely something that any person should experience first-hand.

http://ibecomeatrader.blogspot.com/

3 notes

·

View notes

Text

How to Trade Gold: Strategies and Tips for 2020

Trading Gold should be a natural a part of trading Forex. Gold tends to offer great opportunities for trading profits more frequently than do traditional Forex currency pairs. Traders with only a couple of hundred or thousand dollars can trade Gold online most cost-effectively using Forex / CFD brokers offering trading in Gold. Profitable Gold trading is best achieved by applying technical analysis methods, possibly filtered by fundamental analysis, the small print of which are outlined below with supporting historical price data.

Visit توصيات الذهب تليجرام

Trading Gold vs Investing in Gold There are several ways to take a position or trade Gold. Investing in Gold means buying and holding for an extended period of your time , meaning months or years. Trading in Gold means both buying and selling several times within a shorter period, like a couple of days, hours, or maybe minutes.

You can invest in Gold with just a couple of hundred U.S. Dollars by buying physical Gold within the sort of coins or nuggets or by buying small amounts of shares in Gold bullion held in secure vaults. However, these methods aren't practical for trading as they're slow and don't give a capability to sell short. Also, Gold coins don't directly mirror the worth of Gold, as they're marked up at sale. Holding physical Gold as an investment also can involve problems of proof and storage. Trading Gold can allow you to form more frequent and bigger profits, from fluctuations within the price of Gold both up and down, than you'd through “buy and hold” investing. Where to Trade Gold If you would like to trade the Gold price, you'll got to trade something very closely linked to the worth of Gold, or the worth of Gold itself. Trading Gold Options & Futures The ideal option for Gold traders is to trade Gold options or futures which represent real Gold through a serious , regulated exchange. However, this needs a deposit of a minimum of $5,000 with a futures brokerage, because the littlest Gold derivative instrument represents just over 33 ounces of Gold and buying or selling only one contract would require this much margin to support the trade. Trading Gold ETFs An alternative solution is to trade shares in an ETF (exchange traded fund) which owns Gold and whose price fluctuations will closely mirror fluctuations within the price of Gold itself. the simplest example of such an ETF is that the SPDR Gold Trust. However, this needs opening an account with a brokerage offering direct trading in stocks and shares. Such stockbrokers usually require minimum deposits of several thousand U.S. Dollars and charge sizable minimum commissions or spreads on every trade. One share within the SPDR Gold Trust will cost you approximately one tenth of the worth of an oz of Gold priced in U.S. Dollars, so this is often also getting to be an impracticably expensive Gold trading method for many people that want to form money trading Gold with under $5,000, because it's hard to urge maximum leverage above 2 to 1. Trading Gold Mining Shares Another option for would-be Gold traders is buying and selling shares in Gold mining companies, because the value of such shares is influenced by the worth of Gold. However, this also involves an equivalent difficulties of speed, costs, and minimum deposit required, and has the added drawback that the worth of Gold is simply one among several factors driving the costs of mining shares. Trading Gold at a Forex Broker This leaves one remaining method which is fast, easy, practical and cost-effective for anyone eager to spend just a couple of hundred or thousand dollars trading Gold: opening an account witha Forex / CFD brokerage offering trading in spot Gold (the actual price of Gold per ounce). Most Forex brokers offer trading in spot Gold priced in U.S. Dollars and quite few also offer Gold priced in other major currencies like the Euro or the Australian dollar . Almost every Forex / CFD broker offering Gold allows trades as small as 10 ounces of Gold and a couple of even go as low as 1 ounce. With maximum leverage on Gold trading at 20 to 1 within the European Union and at much higher levels applying to brokers outside the ecu Union, it's become possible to trade Gold both short and long with a deposit only $100 at many Forex / CFD brokers. Trading Gold through a Forex / CFD brokerage can have two possible disadvantages which you ought to remember of. The spreads and commissions charged could also be overly high, but there are many brokers which make an inexpensive offering so you'll avoid that. A potentially bigger problem (unless you're only day trading) is that brokers will usually charge a fee for each day you've got an open trade past 5pm ny time, unless you open an Islamic trading account. this suggests that if you're keeping a trade open for several days, or maybe for weeks or months, you would like to make certain the trade is doing tolerably to justify this cost. Some brokers publish these fees, which may change day to day, on their website. it's usually described as “swap”, “tom/next”, or “overnight financing fee”. If your broker doesn't publish it on their website, you ought to be ready to find the present rates within their trading platform. within the MetaTrader 4 trading platform, you'll find a rate by right-clicking within the “Market Watch” section on the trading symbol you would like to see (e.g. XAU/USD) and selecting “properties”. Usually, a special rate are going to be applied to long or short positions. Rarely, the speed could also be negative meaning you'll get purchased holding an edge overnight, but this is often impossible to happen to Gold. Forex brokers usually offer Gold in their menu of assets as either “Gold” or as “XAU/USD”. Now we’ve established where and what to shop for or sell to trade Gold, let’s check out the way to trade Gold.

back to top

How to Trade Gold Gold is priced mostly in U.S. Dollars, but until 1976, the worth of the U.S. Dollar was based fully or partially upon the worth of Gold: the U.S. Dollar was pegged to Gold. this suggests that Gold trading as we all know it's only really been going since 1976. Many traders get emotional about Gold. it's a natural human emotion to urge excited about this shiny and really expensive valuable which we are wont to seeing in expensive jewelry, but traders should view Gold even as a commodity like all other. Traders must believe the worth fluctuations, not the asset itself, to form good trading decisions. Reasons to Trade Gold A good reason to trade Gold is that its price tends to fluctuate with greater volatility and force than traditional Forex currency pairs like EUR/USD. for instance , major currency pairs often fall or rise by only 8% approximately over a year, while the worth of Gold has sometimes risen by 100% within only a couple of months. albeit the value of trading Gold in terms of spread and commission is proportionately greater than it's in Forex currency pairs, this bigger price movement still tends to form it more rewarding in terms of overall profit. for instance , the value of trading EUR/USD is typically but 0.01% of the position size, while the value of trading spot Gold is usually nearly 0.02% - but who cares when the potential profit in trading Gold are often ten times what it'll be in trading EUR/USD? The Best Gold Trading Strategies Deciding upon the simplest Gold trading strategy or strategies to use requires you to think about the cases for trading Gold using fundamental or technical analysis, or a mixture of both. Let’s consider the idea of such strategies and the way they need performed over recent decades to assist you create that call . Trading Gold with Fundamental Analysis Unlike stocks and shares, or a valuable commodity like petroleum , Gold has little or no intrinsic value because it has few practical uses. However, it's rare, and humans are interested in it and have attributed value thereto by consensus. it's impossible to live minor fluctuations therein human perception from day to day, so during this sense, fundamental analysis is of limited value. Another aspect of Gold which differentiates it from fiat currencies like the U.S. Dollar is that its supply is restricted . this could mean that a limited supply of Gold are often taken without any consideration . a drag with this analysis is that nearly all the world’s known Gold is held by banks and governments, but nobody knows needless to say exactly what proportion there's . It seems that the massive banks, who have colluded for years to repair the worth of Gold by means of a twice daily “Gold fix”, are ready to manipulate perceptions of supply and demand. Fortunately, a fundamental analysis of Gold are often applied through a macroeconomic analysis. for instance , analysts traditionally see the worth of Gold rising under the subsequent circumstances: High inflation Economic crisis / instability Falling U.S. Dollar Negative real interest rates Are these analysts correct? we will check the info since Gold’s fully free float began in 1976 to ascertain whether the worth of Gold correlates with these factors. Correlation of Gold with U.S. Inflation The U.S. has not seen historically high annual rates of inflation, defined as a rate greater than 6%, since the first 1980s. The U.S. suffered from high inflation during the late 1970s and early 1980s, and therefore the price of Gold rose dramatically during this era . There was a robust correlation between Gold and inflation over this point , but when inflation rose again during the late 1980s the worth of Gold fell. The bottom line is that the worth of Gold could also be likely to rise when inflation reaches a strangely high level, and there's alittle direct correlation between the monthly change within the Gold price and therefore the monthly U.S. rate of inflation over the whole period from 1976 to 2019. The coefficient of correlation between the 2 was 17.24%, with 100% indicating perfect correlation and 0% indicating no correlation in the least . this suggests that it's probably knowing only expect Gold to rise strongly when inflation reaches a strangely high rate, but it's also reasonable to be more bullish on Gold when inflation is rising and more bearish when inflation in falling.

Gold / U.S. Inflation correlation chart Correlation of Gold with depression / Instability Economic crisis or instability is difficult to live objectively. However, there are often little doubt that a rustic entering a serious depression tends to ascertain the relative value of its currency depreciate. Additionally, the worst depression within the U.S.A. in recent decades occurred during the 1970s, and this was a period during which the worth of Gold in U.S. Dollars increased dramatically. It seems that the worth of Gold did rise during a period of great depression within the U.S.A., but we don't have tons of knowledge for this case. Correlation of Gold with the U.S. Dollar Index As Gold is priced in U.S. Dollars, you'd expect the worth of Gold in Dollars to be very strongly positively correlated with the U.S. Dollar Index, which measures the fluctuation within the relative value of the U.S. Dollar against a volume-weighted basket of other currencies. A measurement of the coefficient of correlation of all the monthly price changes in Gold and therefore the U.S. Dollar Index from 1976 to 2019 shows a minor direct correlation of roughly 25.23%. Considering we are measuring the worth of Gold with the U.S. Dollar, this correlation isn't very strong, but may have a use within technical analysis, which can be discussed later within this text .

0 notes

Text

Free Fx Signals

Each millions of trades are made in a currency exchange market called Forex day. The phrase "Forex" straight stems from the beginning of two terms - "foreign" and "exchange". Unlike other trading systems like the stock exchange, Forex does not include the trading of any goods, physical or representative. Alternatively, Forex operates through buying, offering, and trading involving the currencies of varied economies from worldwide. A day, five days a week because the Forex market is truly a global trading system, trades are made 24 hours. In addition, Forex isn't bound by any one control agency, meaning Forex may be the just true free market economic trading system currently available. By making the trade prices out of any one group's arms, it's a lot more difficult to also attempt to manipulate or corner the currency market. With all the benefits associated with the Forex system, plus the international selection of participation, the foreign exchange market could be the biggest market within the planet. Anywhere between 1 trillion and 1.5 trillion comparable United States bucks are exchanged on the Forex market on a daily basis. Forex operates mainly in the notion of "free-floating" currencies; this is often explained most readily useful as currencies that aren't backed by certain materials such as silver or gold. Ahead of 1971, an industry such as for instance Forex would not work due to the international "Bretton Woods" contract. This agreement stipulated that most included economies would attempt to support the value of these currencies close to the value of the United States dollar, which in turn was held to your value of silver. In 1971, the Bretton Woods contract was abandoned. The usa had run a huge deficit during the Vietnam Conflict, and began printing out more paper money than they might back with gold, causing a reasonably high level of inflation. By 1976, every major currency around the world had left the device established underneath the Bretton Woods contract, and had turned into a free-floating system of currency. This free-floating system implied that each patternsniper.com nation's currency could have vastly various values that fluctuated centered on the way the country's economy ended up being faring at that time. Because each currency fluctuates independently, you'll be able to make a profit from the noticeable alterations in currency value. As an example, 1 Euro was once worth about 0.86 US bucks. Fleetingly thereafter, 1 Euro had been worth about 1.08 US bucks. People who bought Euros at 86 cents and sold them at 1.08 dollars that are US able to make 22 cents revenue off of each Euro - this can equate to vast sums in profits for folks who were profoundly rooted in the Euro. Everything into the Forex market is hanging in the exchange price of numerous currencies. Unfortunately, not many people recognize that the exchange prices they see in the news and read about within the newspapers every day could possibly be in a position to work towards earnings on their behalf, even if these people were in order to create a investment that is small. The Euro and the United States dollar are likely the 2 many well-known currencies that are used in the foreign exchange market, and therefore these are typically two of the very most widely exchanged into the Forex market. In addition to the two "kings of currency", there are a few other currencies which have fairly reputation that is strong Forex trading. The dollar that is australian the Japanese Yen, the Canadian buck, as well as the brand New Zealand Dollar are all basic currencies used by established Forex traders. Nonetheless, it's important to observe that on most Forex solutions, you won't see the full name of a currency written out. Each currency has it's very own expression, in the same way organizations involved in the currency markets have their very own expression based off regarding the name of these business. A few of the essential currency symbols to know are:

USD - United States Of America Dollar EUR - The Euro CAD - The dollar that is canadian AUD - The Australian Buck JPY - The yen that is japanese NZD - The New Zealand Buck Although the symbols could be confusing in the beginning, you will get used to them after a few years. Keep in mind that each money's expression is logically formed from the true title associated with the money, usually in a few kind of acronym. By having a little training, you will end up able to determine currency codes that are most without also having to look them up. Some of the wealthiest people on the planet have actually Forex as being a large element of their investment portfolio. Warren Buffet, the planet's richest guy, has over $20 Billion invested in various currencies on the currency markets. Their income portfolio frequently includes well over one-hundred million bucks in profit from Forex trades each quartile. George Soros is another name that is big the field of forex trading - it's believed which he made over $1 billion in make money from just one day of trading in 1992! Although those types of trades are extremely rare, he was nevertheless able to amass over $7 Billion from three years of trading on the currency markets. The strategy of George Soros also would go to show you do not need to be too high-risk to make profits on Forex - their conservative strategy involves withdrawing large portions of his profits through the market, even though the trend of their various opportunities generally seems to nevertheless be correlating upward.

0 notes