#tax debt services new zealand

Explore tagged Tumblr posts

Text

Why Should You Hire Professional Tax Debt Services in New Zealand

In this 21st century, running a business itself deals with several important tasks that need to be checked minutely during the implementation. In some cases, professional assistance appears to be a must and you need to proceed accordingly so as to ensure adequate proceeding with the process. Among all other important business aspects, the submission of the tax falls of great importance, without which the business module might lack behind and lose its official effectiveness too. This calls for the need to seek professional assistance from experienced consultants belonging to reputed tax debt service providers in New Zealand.

youtube

What Is the Role of a Tax Consultant?

Tax consultants are professionals who master themselves in tax laws and counselling related to the financial department. Their main job is to advise their clients on income tax returns, trusts, estates, retirement taxes and many more. The role of tax debt assistance in NZ is a prominent one. They aim to be more than just your accountant. They are the trusted advisors and partners who tend to look towards resolving the problems occurring at times of business.

How Can These Tax Debt Solutions Providers in NZ Be Beneficial for You?

Having a financial advisor to deal with business economic issues is already a great perk to your business. Although there are several other major benefits of hiring a professional tax debt assistant, which include:

They help you to get aware of your tax deductions

They provide an adequate financial portfolio and save time

It’s safe and hassle-free to discuss legal matters with them

Having years of professional experience, they can provide you with an immediate and ultimate solution.

Final Words:

Thus, with professional assistance, you can get a comprehensive review o n your tax debt and can settle up conveniently for an instalment agreement. It is hence advisable to contact the expert tax debt services in New Zealand for professional assistance. Get in touch with them now to discuss your issues in detail. Schedule an appointment today!

0 notes

Text

The thing that gets me so worked up about universal healthcare is how people say that it will be so expensive for the tax payer.

This is long rant warning so I added a break lol.

The TLDR is that even in a low tax state like Florida, someone making 50k a year will have an effective rate of of 32% (for taxes, healthcare, costs for an undergraduate degree).

Someone making 50k a year in a 'high tax' country like New Zealand has an effective rate of 21% (for taxes, healthcare, costs for an undergraduate degree).

For an American and a Kiwi with the same salary of $50k, if they have the same disposable income, the Kiwi will be able to save an extra $75,000 over 10 years that they can use for a downpayment on a home to further build wealth.

Low tax states just have the costs shuffled to other places, you end up paying a LOT more for the same services.

Here's a comparison of someone who makes $50,000 a year in New Zealand and Florida (I chose Florida as an extreme example because they have 0% state tax rate) and each person makes $15,000 worth of purchases that are taxable.

New Zealand

$7,658 in combined income taxes and levies

$2,250 in taxes on $15k of purchases (15% sales tax)

Total of $9,908 - an effective total rate of 19.8% paid to taxes and purchases and healthcare

Florida

$7,945 in combined taxes (federal taxes, social security, medicaid etc)

$1,050 in taxes on $15k of purchases (7% sales tax)

$1,700 average annual health insurance premium for Florida

$2,060 average annual health insurance deductible for Florida

Total of $12,755 - an effective total rate of 25.5% paid to taxes and purchases and healthcare

Even in a low tax state, you're already have less take-home income than someone with the same salary in New Zealand.

But

... in New Zealand with your taxes you're also getting public education. It's not completely free, but costs are fixed, and you get one year of your undergraduate free, so for example a Bachelor of Arts would cost a total of $13,548 (USD $8,347)

If you can't pay that upfront, you can get a 0% loan from the government, which you don't need to start paying off until you earn at least $23k per year. For someone making $50k that would be an extra 6.5% deducted from your income ($270/month) until the loan is paid off (which would be 2 years and 8 months).

In Florida the average student loan debt is 25k and if you're making the same payments as someone in NZ ($270/month) then you'll be paying that off for 11 years. [Note: I believe that some private loan interest rates go as high as 15%].

Bachelor of Arts in NZ $13,548, paid off over ~2.7 years.

Bachelor of Arts in Florida $35,539, paid off over ~11 years.

So lets look at effective payments over 11 years (for simplicity salary stays at 50k).

New Zealand works out to be 21% effective rate over 11 years (including taxes, healthcare, and undergraduate degree).

Florida works out to be 32% effective rate over 11 years (including taxes, healthcare, and an undergraduate degree) - you're paying 52% more!

That means someone with the same income will effectively be able to save an additional $5,000 per year over 11 years, if they invest that extra amount and get a 5% return, the New Zealander will have savings of about $75k which they can use for downpayment for a home etc.

In conclusion, even though it may seem like you're getting a good deal in a low tax state like Florida, you end up paying soooo much more in healthcare and education costs compared to a country where taxes are a little higher, but you get public healthcare and education.

Why is the U.S. so expensive? Well once place to look is defense, intelligence, and police. In the United States this costs on average $3,700 per person. New Zealand spends $1,600 per person (USD ~1,000).

62 notes

·

View notes

Text

Chartered Accountants in Brisbane

Chartered accountants play a vital role in the financial health, compliance, and strategic success of businesses. They also offer financial advice to individuals and families.

Whether you’re a business owner looking for budgeting assistance or an individual in need of financial organisation, chartered accountants brisbane can help. Find the best one for you by comparing prices on Oneflare.

Professional Services

As trusted financial chartered accountants brisbane, chartered accountants play an important role in the corporate world. They offer expert advice on tax planning, budgeting, and other financial matters to help businesses make informed decisions and achieve their business goals. They also help businesses comply with regulatory requirements and manage financial risks.

A Chartered Accountant is a qualified professional who is a member of a global accounting body. In Australia, the Chartered Accountants Australia and New Zealand (CA ANZ) confers the title and the postnominal letters CA. They are licensed to perform statutory financial audits of companies in compliance with local laws.

Moreover, they are experts in providing advice on complex business issues such as strategic finance and profitably scaling businesses. They can identify and implement enhancements to cash management processes and tools, lower levels of bad debt and inventory obsolescence, and improve productivity and efficiency. They can also help start-ups secure investment with the right kind of investors and at the best terms for all parties.

Business Services

Chartered accountants provide professional services such as auditing, taxation, accounting, financial analysis and risk management. They also offer advice on business structures and strategies. They may work in private practice or for businesses and corporations. Those who have advanced skills may become senior partners of their own firm or take on leadership roles.

Regulatory Compliance

Regulatory compliance is vital for business success and investor confidence. Chartered Accountants use their knowledge of accounting standards and legal frameworks to ensure that companies comply with all relevant regulations.

Chartered Accountants work across all industries, offering valuable insights and guidance. They help businesses manage financial risks, navigate regulatory requirements, optimize tax strategies and make informed decisions that drive growth and sustainability. They are also highly regarded by employers and can earn an impressive salary. They may choose to advance their careers through a change of employer or further education. They can also become a member of Chartered Accountants Australia and New Zealand (CA ANZ) by completing a bachelor degree with accounting components or an equivalent qualification.

Individual Services

Chartered accountants can help individual clients manage their taxes and make sound financial decisions. They also advise on tax planning strategies that minimize liabilities and ensure compliance with local laws. This includes preparing and filing tax returns for individuals and businesses.

Moreover, they can assist in the valuation of businesses, which is crucial for various purposes, including mergers and acquisitions. They can also provide advice on budgeting and strategic planning, and help clients save money through cost reduction and financial risk management.

In addition, a chartered accountant can also perform audit services, ensuring that business records are accurate and comply with regulatory requirements. This is essential for ensuring transparency and accountability, and fostering investor confidence. The Chartered Accountants Ireland Australia Society is a network of Irish accounting professionals that work in the Australian economy. It hosts a range of social and networking events throughout the year. These events include the annual President’s Dinner, guest speaker events and trivia nights.

Community Services

Chartered accountants serve the community by contributing to the financial sector and driving business growth. Their specialized skills and commitment to ethics help businesses achieve transparency, accountability, and compliance with regulations. This promotes confidence and trust among investors and other stakeholders.

Besides assisting with Nundah Accountatns reporting and compliance, a Chartered Accountant can also advise on tax planning and management. They can also provide insights into cost reduction and financial risks, helping companies become more efficient and profitable.

They can also play a vital role in securing financing for start-ups and acquisitions. Natalia Florez, CFO of Red Eye Apps, says that a Chartered Accountant was crucial in her company’s start-up funding journey. "They really helped with building a robust shareholder register," she said. This is essential for getting a good deal and ensuring that the term sheet is clear for all parties. It also ensures that all shareholders are treated equally. This requires the softer skills of a Chartered Accountant.

0 notes

Text

Unlocking Success with Auckland and Rotorua Accountants

In the dynamic world of business, having the right financial expertise can be the key to unlocking your company's full potential. Whether you're a startup entrepreneur, a well-established business owner, or someone facing tax debt challenges, the services of experienced accountants can make a significant difference. This article explores the essential role of accountants in Auckland and Rotorua and how they can positively impact businesses of all sizes.

Accountants in Auckland: Navigating Financial Success

Auckland, New Zealand's largest city and economic hub, is home to a diverse range of businesses. accountants auckland are well-versed in the complexities of the financial world and play a pivotal role in helping businesses flourish.

Expert Financial Guidance

These professionals offer expert guidance on a wide range of financial matters. From tax compliance and financial planning to budget management, they help businesses make informed decisions, optimize their finances, and stay on the right side of tax laws.

Accountants in Rotorua: Local Expertise for Local Businesses

Thriving in Rotorua

Rotorua, known for its rich Maori culture and breathtaking scenery, has a thriving business community of its own. Accountants in Rotorua understand the unique challenges faced by businesses in the region and provide tailored solutions.

Local Focus

They focus on the local business landscape, offering insights and strategies that take into account the regional market dynamics. Whether you're a budding entrepreneur or an established business, their local expertise can be a game-changer.

Startups and Accountants: A Perfect Partnership

Navigating the Startup Landscape

Starting a new business is an exciting journey, but it comes with its share of challenges. Specializing Accountant for startups can be invaluable partners in this endeavor.

Seasoned Support

These accountants offer guidance in setting up robust financial systems, managing budgets, and ensuring compliance with tax regulations. Their expertise provides the financial stability that startups need to thrive in competitive markets.

Tax Debt Management: Regaining Financial Control

The Challenge of Tax Debt

Tax debt can be a significant burden on any business. It can hinder growth and lead to legal complications if not handled properly.

A Way Forward

Accountants skilled in tax debt management can negotiate with tax authorities, create manageable repayment plans, and help businesses regain control of their financial situations. This expertise can make a substantial difference in resolving tax-related issues.

Bookkeeping Services: The Foundation of Financial Success

The Value of Bookkeeping

Accurate and organized financial records are the bedrock of a successful business. Bookkeeping services in Rotorua ensure that financial data is up-to-date, error-free, and compliant with regulations.

Tailored Solutions

Rotorua-based businesses benefit from local bookkeeping services that understand the specific financial requirements of the region. Their personalized solutions streamline financial processes, allowing business owners to focus on growth.

Conclusion

In a world where financial success is crucial for business sustainability, the expertise of accountants in Auckland and Rotorua can be a game-changer. Whether you're a startup in need of guidance, facing tax debt challenges, or simply looking to streamline your financial operations, these professionals have the knowledge and skills to transform your business.

0 notes

Text

New Zealand Finance Minister Highlights Resilience of Economy Amid Global Challenges

A Challenging Global Economic Landscape

New Zealand Finance Minister Grant Robertson acknowledged the difficulties faced by the global economy, marked by a slowdown in growth and persistent high inflation. He emphasized that New Zealand is not immune to these forces and also highlighted the impact of recent weather events in the North Island on affected communities, which will have consequences for the government's financial position.

New Zealand's Resilience and Positive Indicators

Despite the challenges, Minister Robertson expressed confidence in New Zealand's preparedness to face them. He pointed out that the country has a record number of people employed, with growing wages, easing inflation pressures, and a return of tourists, international students, and overseas workers filling job vacancies. These factors contribute to the overall resilience of the New Zealand economy. Government's Financial Position According to the latest financial figures, the Operating Balance before Gains and Losses (OBEGAL) for the eleven months ending May recorded a deficit of $6.5 billion. This figure was $2.1 billion higher than the Budget 2023 forecast but $1 billion lower compared to the same period last year. Core Crown tax revenue was $2.2 billion below forecast due to lower corporate profits and investment returns. Core Crown expenses, on the other hand, were $249 million below forecast. Net debt stood slightly above forecast at 18.9 percent of GDP. Managing the Cooling Economy Minister Robertson acknowledged the impact of the cooling economy on tax revenue, which came in lower than forecasted. He specifically mentioned that the decline in corporate tax revenue reflects lower-than-expected corporate profits for the 2022 year. However, he reassured the public that the government has been prudent in managing its spending and that the current deficit is smaller compared to the same period last year. Budget 2023 projects a 5 percent decline in real government consumption by early 2025, while New Zealand's debt levels remain among the lowest globally. Supporting Kiwis and Addressing Challenges Despite the challenges, Minister Robertson emphasized the government's commitment to protecting and supporting New Zealanders grappling with the rising cost of living. He highlighted the importance of providing strong public services and fostering sustainable economic growth without exacerbating inflation. Positive signs include historically low unemployment, high employment levels, a potential peak in inflation, and improving business confidence. Impact of North Island Weather Events Minister Robertson acknowledged the substantial impact of recent weather events in the North Island on the government's finances. The Treasury estimated that the asset damage resulting from floods and Cyclone is between $9 billion and $14.5 billion, with a significant portion falling under central or local government responsibilities, such as roads. The government has already committed $2 billion in additional support, including a $1 billion flood and cyclone recovery package as part of Budget 2023. Moreover, $6 billion has been allocated for a National Resilience Plan to focus on rebuilding and enhancing resilience in affected areas. Responsible Financial Management Minister Robertson emphasized the government's responsible financial management, highlighting its ability to handle the impacts of extreme weather events and future challenges. New Zealand's debt levels, currently at 18.9 percent of GDP, are among the lowest in the OECD and well below the government's debt ceiling of 30 percent. The government aims to strike a balance between supporting the immediate needs of New Zealanders, investing in strong public services, and building a resilient infrastructure network while ensuring the long-term sustainability of the economy. Sources: THX News & Hon Grant Robertson. Read the full article

#Easinginflationpressures#Employmentdata#Financialmanagement#Globalchallenges#Governmentdebt#NewZealandeconomy#Overseasworkers#Recordnumbers#Touristsandinternationalstudents#Wagesgrowth

0 notes

Link

0 notes

Text

The World’s Interest bill Is $13Trn—And Rising! We Calculate Who Has Been Hit Hardest By Rising Rates

— Finance & Economics | Time For The Tab | The Economist | 19 February, 2023

After a relaxing 2010s, in which interest rates hardly budged, rising prices are putting central-bank officials to work. Indeed, policymakers have rarely been busier. In the first quarter of 2021, policy rates in a sample of 58 rich and emerging economies languished at an average of 2.6%. By the final quarter of 2022, this figure had jumped to 7.1%. Meanwhile, total debt in these countries stands at $298trn, or 342% of their combined gdp, up from $255trn, or 320% of gdp, before the covid-19 pandemic.

The more indebted the world becomes, the more sensitive it is to interest-rate rises. To assess the effect of borrowing and higher rates, The Economist has estimated the interest bill for companies, households and governments across 58 countries. Together these economies account for more than 90% of global gdp. In 2021 their interest bill stood at a $10.4trn, or 12% of combined gdp. By 2022 it had reached a whopping $13trn, or 14.5% of gdp.

Our calculations make a series of assumptions. In the real world, higher interest rates do not push up debt-servicing costs immediately, except for those of floating-rate debt, such as many overnight bank loans. The maturity of government debt tends to be in the range of five to ten years; companies and households tend to borrow on a shorter-term basis. Therefore we assume that interest-rate rises feed through over the course of five years for public debt, and over a two-year period for households and companies.

To project what might happen over the next few years, we make a few more assumptions. Real-life borrowers respond to higher rates by reducing debt to ensure that interest payments do not get out of hand. Nonetheless, research by the Bank for International Settlements, a club of central banks, shows that higher rates do raise interest payments on debt relative to income—ie, that deleveraging does not entirely negate higher costs. Thus we assume that nominal incomes rise according to imf forecasts and debt-to-gdp ratios stay flat. This implies annual budget deficits of 5% of gdp, lower than before covid.

Our analysis suggests that, if rates follow the path priced into government-bond markets, the interest tab will hit around 17% of gdp by 2027. What if markets are underestimating how much tightening central banks have in store? We find that another percentage point, on top of that which markets have priced in, would bring the bill to a mighty 20% of gdp.

Such a bill would be big, but not without precedent. Interest costs in America exceeded 20% of gdp during the global financial crisis of 2007-09, the economic boom of the late 1990s and the last proper burst of inflation in the 1980s. Yet an average bill of this size would mask big differences between industries and countries. Ghana’s government, for instance, would face a debt-to-revenue ratio of over six and government-bond yields of 75%—which would almost certainly mean eye-watering cuts to state spending.

Inflation may ease the burden somewhat by pushing up nominal tax revenues, household incomes and corporate profits. And global debt as a share of gdp has fallen from its peak of 355% in 2021. But this relief has so far been more than offset by the considerable rise in interest rates. In America, for instance, real rates as measured by the yield on the five-year Treasury inflation-protected security sit at 1.5%, against an average of 0.35% in 2019.

So who is bearing the burden? We rank households, companies and governments across our 58 countries according to two variables: debt-to-income ratios and the increase in rates over the past three years. When it comes to households, rich democracies, including the Netherlands, New Zealand and Sweden, look more sensitive to rising interest rates. All three have debt levels nearly twice their disposable incomes and have seen short-term government-bond yields rise by more than three percentage points since the end of 2019.

Yet countries that have less time to prepare for rate rises may, in fact, face greater difficulties than their more indebted peers. Mortgages in the Netherlands, for instance, often have longer-term fixed rates, meaning the country’s households are probably better protected from higher rates than our rankings suggest. In other countries, by contrast, households typically either have shorter-term fixed-rate loans or borrow on flexible terms. In Sweden floating-rate mortgages account for nearly two-thirds of the stock, which means problems may emerge more quickly. In emerging economies the data are patchier. Although debt-to-income ratios are lower, this partly reflects the fact that formal credit is hard to obtain.

In the business world, surging consumer demand has lifted profits. In 33 of the 39 countries for which we have data, the ratio of debt to gross operating profit has fallen in the past year. Indeed, parts of the world look surprisingly strong. Despite the woes of Adani Group, a conglomerate under fire from a short-seller, India scores well, thanks to a relatively low debt-to-income ratio of 2.4, and a smaller rise in rates.

Big debt burdens and tighter financial conditions may still prove too much for some companies. s&p Global, a research firm, notes that default rates on European speculative-grade corporate debt rose from under 1% at the start of 2022 to more than 2% by the end of the year. French firms are especially indebted, with a ratio of debt to gross operating profit of nearly nine, higher than any country bar Luxembourg. Russia, cut off from foreign markets, has seen short-term yields spike. Hungary, where the central bank has rapidly raised rates to protect its currency, could face a big interest bill relative to the size of its economy.

Last and most consequential is government debt. Daleep Singh of pgim, an asset manager, says a variable to watch is the risk premium on debt (the extra return markets demand to hold a country’s bonds over and above the yield on an American Treasury). Rich-world governments are mostly doing fine on this measure. But Italy, which has seen one of the biggest increases in bond yields among euro-zone countries in our sample, remains a risk. As the European Central Bank tightens policy, it has stopped buying sovereign bonds, and will begin to shrink its balance-sheet in March. The danger is that this prompts a crunch.

Emerging economies increasingly borrow in their own currencies, but those struggling with external debts may require help. Argentina recently reached a bail-out agreement, which will require uncomfortable belt-tightening, with the imf. It sits near the top of this category, and already defaulted on its external debt in 2020. Egypt, which has medium-term government-bond yields around four to five percentage points above pre-pandemic levels, is trying not to follow suit. Ghana, which recently joined Argentina in the severely distressed camp, is now embarking on fiscal and monetary tightening in an attempt to secure support from the imf.

The fate of some governments, as well as the households and firms that eventually need state support, may depend on the goodwill of China. Despite high debt levels, China itself sits near the bottom of our rankings because of its placid interest rates. Yet its importance to global debt stress is only growing. China is now the largest lender to the world’s poor economies and gobbles up two-thirds of their inflating external debt-service payments, complicating debt-relief efforts. Western governments must hope they can shoot down this balloon, too. ■

0 notes

Text

Accounting Firms in Australia Companies like Deloitte Australia, BDO Melbourne, Grant Thornton Australia, Pitcher Partners, and PwC Australia are examples of accounting firms in Australia that offer their services to individuals, businesses, and other Australian entities.

An Overview of Australian Accounting Firms Australia has its own three recognized professional accounting bodies that determine the accounting rules and regulations for Australian accounting firms. The Institute of Public Accountants (IPA), CPA Australia, and the Institute of Chartered Accountants of Australia (ICAA) are these three organizations.

The majority of Australia's accounting market is made up of the Big Four firms. The accounting firm in Australia primarily provides the following services: audit and assurance. The company conducts comprehensive, independent audits to determine the root cause of accounting issues. In order to assist clients in achieving compliance, it offers an efficient solution to the issue. Tax: The tax service helps new businesses set up their taxes and deal with employment tax issues. In addition, it assists customers in navigating GST, indirect taxes, and other tax breaks, among other areas. Financial Advisory: With the assistance of skilled professionals, the accounting firm in Australia provides its clients with corporate finance, restructuring consulting, and forensic advisory services. Numerous services are offered to customers. They also go through mergers and acquisitions, which include helping to raise debt and equity from the capital markets and figuring out the capital structure by valuing the target companies. It helps release tied cash requirements, easing their clients' working capital requirements. Consulting: Accounting firms offer their clients consulting services for managing business risk, regulating human capital, assisting with performance improvement, advising on the implementation of effective strategy and growth, and providing technical advisory services. Table of Contents An Overview of the Top 10 Accounting Firms in Australia PwC Australia, KPMG Australia, Ernst & Young Australia, Deloitte Australia, BDO Melbourne, Pitcher Partners, Grant Thornton Australia, DFK Australia New Zealand, i-accountant NSW Australia, and Brentnalls are the 10 best accounting firms in Australia. Please provide us with a link to the attribution. The Big Four Accounting Firms hold the most market share among the top accounting firms in Australia. By providing audit, advisory, tax, and accounting services, they dominate the Australian accounting industry. Let's talk about the best accountants in Australia:

1: PwC Australia PwC is a major Australian accounting firm with a global presence. Greater Western Sydney, Brisbane, Melbourne, Adelaide, Canberra, Gold Coast, Perth, and Newcastle are the locations of PwC Australia offices. It has 500 partners and approximately 5,800 employees. PwC Australia reported revenues of nearly $1.92 billion in 2016, according to reports. In order to remain relevant in the accounting industry and stay ahead of the competition in today's fast-paced society, the company adheres to three main principles: being good, bold, and part of it. By remaining connected, listening, and conversing, the company also aims to address the challenges of the coming days.

2 – KPMG Australia This prominent Australian accounting firm focuses on the procedures and honesty of the formal audit report. Quality is a fundamental and non-negotiable principle at this accounting firm, which adheres to it. Under the direction of Duncan McLennan, the national managing partner of KPMG Australia, KPMG Australia reported revenues of $1.37 billion for the 2016 fiscal year. The quality of the audit and how the right opinion is reached—not just getting the right opinion—are the accounting firm's primary priorities.

3: Ernst & Young Australia This Australia-based accounting firm ranks among the top ten. This company's primary goal is to offer all of its customer's high-end audit services in an ethical and objective manner. With the assistance of enhanced trust and confidence in business, sustainable growth, the development of existing talent, and greater collaboration, Ernst & Young Australia pledges to create a better working environment. Ernst & Young Australia reported revenue of $1.48 billion in the fiscal year 2016, compared to $1.28 billion in the fiscal year 2015, according to the transparency report.

4: Deloitte Australia This accounting firm's primary goal is to have a long-lasting impact and purposeful impact. The company always invests in growth through acquisitions and alliances, innovation, technology, skilled employees, and keeping up with the competition. It has offices in Papua New Guinea and Timor-Leste employs nearly 7000 people and has 700 partners. In the 2017 fiscal year, it reported record revenues of A$1.76 billion.

5: BDO Melbourne BDO Melbourne is another prominent Australian accounting firm in the city center of Melbourne. Audit, Corporate Finance, Risk Advisory, Transfer Pricing, Business Restructuring, Business Services, and Tax, to name a few, are handled by specialized personnel. In addition, this accounting firm offers its clients comprehensive corporate and business advisory services.

6: Pitcher Partners With 45 partners and over 600 professionals and support staff, Pitcher Partners Melbourne is an excellent accounting firm. They focus on helping small, family-owned public businesses and organizations in the public sector.

7: Grant Thornton Australia This leading independent assurance, tax, and advisory accounting firm is located in Australia. Audit, tax, financial advisory, and consulting are among their offerings. This company offers practical and proactive guidance on all aspects of strategies for long-term growth. Additionally, they assist clients in adhering to rules and regulations in order to enhance internal processes and business strategies.

8: The leading organization of chartered accountants and business advisors is DFK Australia New Zealand. In BRW's Top 100 Accounting Firms, it is included. With the assistance of specialized staff with a balance of diverse, extensive local and international accounting knowledge, they offer a variety of accounting services.

9: i-accountant NSW Australia This NSW-based accounting, tax, and consulting firm has a huge network of resources both nationally and internationally. This is a group of independent Australian accounting and consulting firms. Tax and business advice, asset protection, estate planning, an investigation into a tax audit, negotiations with the Australian Taxation Office (ATO), compliance with self-managed super funds, and audit solutions are provided by this business.

10: Brentnalls This accounting firm has more than 60 dedicated employees, including eight partners, four principals, and a team that has grown over time. Accounting, tax, agribusiness, business consulting and advisory, financial advice, wealth creation, and other related services are just a few of their many offerings.

0 notes

Text

youtube

Get Tax Debt Services in New Zealand

Need expert assistance to deal with tax-related issues? Get in touch with Elite Accounting Limited- Chartered Accountants; they can offer professional tax debt in New Zealand.

0 notes

Text

3 Key Reasons to Hire a Small Business Accountant in NZ

Small business owners often jungles keep a lot of track of their daily operations ranging from customer service to boost sales. While doing all these complex tasks by oneself, the financial health of the business goes unnoticed. Thus hiring a small business accountant in New Zealand can accurately manage financial statements and provides a better understanding of the complex tax structure.

The article will show you three great reasons for hiring a small business accountant in New Zealand.

youtube

Adhere to tax laws

Most small business owners find it difficult to fill out tax forms without seeking proper advice. Here, hiring an experienced accountant can let you understand these comp-lex applications and fill out forms on your behalf. They are highly professional to ensure your business compliance with tax laws and save your business from legal trouble.

Wide range of services

An experienced tax accountant can provide your small business with a plethora of services like auditing, advisory, tax review & audit, tax & IRD, tax planning, fighting an IRS debt, paying off debts and other custom services. With so many options, they will help your small business to grow significantly.

Raise capital

Most businesses especially small and medium-sized businesses need capital for further progress. For this, hiring accountants becomes necessary as they will help you in preparing to raise capital for your business. They are highly qualified for advising you on seeking financial help and can help in bringing more investors or lenders.

Conclusion

If you are one of them struggling to keep up with the tax structure of your business, then look for a “small business accountant near me” on the internet and you will come across a few reputed accounting firms that have a team of professional and certified accountants in New Zealand. In addition, they are highly qualified to offer financial monitoring, investment guidance, tax & IRD audits and give you the best solutions to make financial matters easy for you.

1 note

·

View note

Text

Pluralist, your daily link-dose: 22 Feb 2020

Today’s links

Tax Justice Network publishes a new global Financial Secrecy Index: US and UK, neck-and-neck

What Marc Davis lifted from the Addams Family while designing the Haunted Mansion: Amateurs plagiarize, artists steal

ICANN should demand to see the secret financial docs in the .ORG selloff: at least it’s an Ethos

Wells Fargo will pay $3b for 2 million acts of fraud: they shoulda got the corporate death penalty

This day in history: 2019, 2015, 2010

Colophon: Recent publications, current writing projects, upcoming appearances, current reading

Tax Justice Network publishes a new global Financial Secrecy Index (permalink)

The Tax Justice Network just published its latest Financial Secrecy Index, the leading empirical index of global financial secrecy policies. The US continues to make a dismal showing, as does the UK (factoring in overseas territories).

https://fsi.taxjustice.net/en/

Both Holland and Switzerland backslid this year.

Important to remember that “bad governance” scandals in poor countries (like the multibillion-dollar Angolaleaks scandal) involve rich financial secrecy havens as laundries for looted national treasure.

https://www.theguardian.com/world/2020/jan/19/isabel-dos-santos-revealed-africa-richest-woman-2bn-empire-luanda-leaks-angola

As Tax Justice breaks it down: “The secrecy world creates a criminogenic hothouse for multiple evils including fraud, tax cheating, escape from financial regulations, embezzlement, insider dealing, bribery, money laundering, and plenty more. It provides multiple ways for insiders to extract wealth at the expense of societies, creating political impunity and undermining the healthy ‘no taxation without representation’ bargain that has underpinned the growth of accountable modern nation states. Many poorer countries, deprived of tax and haemorrhaging capital into secrecy jurisdictions, rely on foreign aid handouts.”

Talk about getting you coming and going! First we make bank helping your corrupt leaders rob you blind, then we loan you money so you can keep the lights on and get fat on the interest (and force you to sell off your looted, ailing state industries as “economic reforms”).

The Taxcast, which is the Network’s podcast, has a great special edition in which the index’s key researchers explain their work. It’s always a good day when a new Taxcast drops.

https://www.taxjustice.net/2020/02/20/financial-secrecy-index-who-are-the-worlds-worst-offenders-the-tax-justice-network-podcast-special-february-2020/

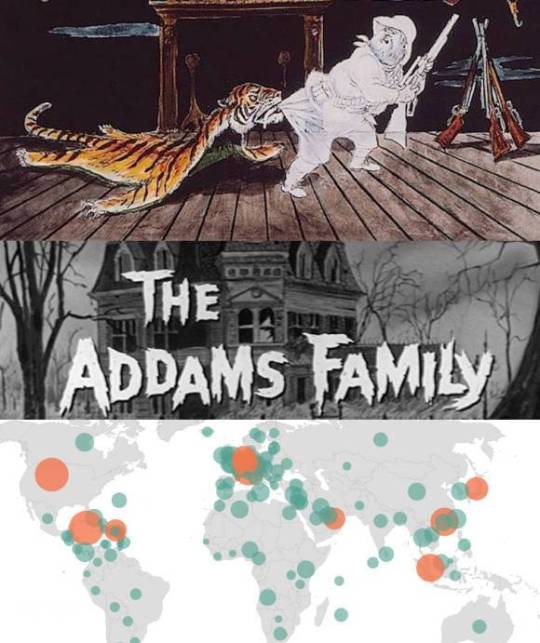

What Marc Davis lifted from the Addams Family while designing the Haunted Mansion (permalink)

It’s always a good day — a GREAT day — when the Long Forgotten Haunted Mansion blog does a new post, but today’s post, on the influence of the Addams Family TV show on Mansion co-designer Mark Davis? ::Chef’s Kiss::

https://longforgottenhauntedmansion.blogspot.com/2020/02/the-addams-family-and-marc-davis.html

It’s clear that Davis was using Addams’s comics as reference, but, as Long Forgotten shows, the Davis sketches and concepts are straight up lifted from the TV show: “Amateurs plagiarize, artists steal.”

Some of these lifts are indisputable.

“Finally, it’s possible that Davis took a further cue from the insanely long sweater Morticia is knitting in ‘Fester’s Punctured Romance’ (Oct 2, 1964), but in this case I wouldn’t insist upon it.”

Likewise, from the TV show, “Bruno” the white bear rug that periodically bites people was obviously the inspiration for this Davis sketch for the Mansion. Long Forgotten is less certain about “Ophelia,” but I think it’s pretty clear where Davis was getting his ideas from here.

Davis was an unabashed plunderer and we are all better for it! “We’ve seen many other examples of Marc Davis taking ideas from here, there, and anywhere he could find them, but not many other examples of multiple inspiration from a single source.”

ICANN should demand to see the secret financial docs in the .ORG selloff (permalink)

ISOC — the nonprofit set up to oversee the .ORG registry — decided to sell off this asset (which they were given for free, along with $5M to cover setup expenses) to a mysterious private equity fund called Ethos Capital.

Some of Ethos’s backers are known (Republican billionaire families like the Romneys and the Perots) but much of its financing remains in the shadows. We do know that ICANN employees who help tee up the sale now work for Ethos, in a corrupt bit of self-dealing.

The deal was quietly announced and looked like a lock, but then public interest groups rose up to demand an explanation. Not only could Ethos expose nonprofits to unlimited rate-hikes (thanks to ICANN’s changes to its rules), they could do much, much worse.

If a .ORG registrant dropped its domain, Ethos could sell access to misdirected emails and domain lookups – so if you watchdog private equity funds and get destroyed by vexation litigation, Ethos could sell your bouncing email to the billionaires who crushed you.

More simply, Ethos could sell the kind of censorship-as-a-service it currently sells through its other registry, Donuts, which charges “processing fees” to corrupt governments and bullying corporations who want to censor the web by claiming libel or copyright infringement.

Ethos offered ISOC $1.135b for the sale, but $360m of that will come from a loan that .ORG will have to pay back, a millstone around its neck, dragging it down. Debt-loading healthy business as a means of bleeding them dry is a tried-and-true PE tactic – it’s what did in Toys R Us, Sears, and many other firms. The PE barons get a fortune, everyone else gets screwed.

The interest on .ORG’s loan will suck up $24m/year — TWO THIRDS of the free money that .ORG generates. .ORG is a crazily profitable nonprofit – it charges dollars to provide a service that costs fractional pennies, after all. In response to getting slapped around by some Members of Congress, the Pennsylvania AG, and millions of netizens, Ethos has made a promise to limit prices increases…for a while. And they say that they’ll be kept honest by the nonbinding recommendations of an “advisory council” whose members Ethos will appoint and who will serve at Ethos’s pleasure.

In a letter to ICANN, EFF and Americans for Financial Reform have called for transparency on the financing behind the sale: “hidden costs, loan servicing fees, and inducements to insiders.”

https://www.eff.org/press/releases/eff-seeks-disclosure-secret-financing-details-behind-11-billion-org-sale-asks-ftc

Wells Fargo will pay $3b for 2 million acts of fraud (permalink)

Wells Fargo stole from at least two million of its customers, pressuring its low-level employees to open fake accounts in their names, firing employees who refused (refuseniks were also added to industry-wide blacklists created to track crooked bankers). These fake accounts ran up fees for bank customers, including penalties, etc. In some cases, the damage to the victims’ credit ratings was so severe that they were turned down for jobs, unable to get house loans or leases, etc.

The execs who oversaw these frauds had plenty of red flags, including their own board members asking why the fuck their spouses had been sent mysterious Wells Fargo credit cards they’d never signed up for. Though these execs paid fines, they got to keep MILLIONS from this fraud (which was only one of dozens of grifts Wells Fargo engaged in this century, including stealing from small businesses, homeowners, military personnel, car borrowers, etc). Some of them may never work in banking again, but they’re all millionaires for life.

Now, Wells Fargo has settled with the DoJ for $3b, admitting wrongdoing and submitting to several years of oversight. That’s a good start, but it’s a bad finish.

https://www.bbc.com/news/business-51594117

The largest bank in America was, for DECADES, a criminal enterprise, preying on Americans of every description. It should no longer exist. It should be broken into constituent pieces, under new management. There would be enormous collateral damage from this (just as the family of a murderer suffers when he is made to face the consequences of his crimes). But what about the collateral damage to everyone who is savaged by a similarly criminal bank in the future, emboldened by Wells Fargo’s impunity?

Wells Fargo is paying a fine, but will have NO criminal charges filed against it.

https://newsroom.wf.com/press-release/corporate-and-financial/wells-fargo-reaches-settlements-resolve-outstanding-doj-and

If you or I stole from TWO MILLION people, we would not be permitted to pay a fine and walk away.

“I’ll believe corporations are people when the government gives one the death penalty.”

This day in history (permalink)

#15yrsago: Kottke goes full-time https://kottke.org/05/02/kottke-micropatron

#15yrsago: New Zealand’s regulator publishes occupational safety guide for sex workers: https://web.archive.org/web/20050909001954/http://www.osh.dol.govt.nz/order/catalogue/pdf/sexindustry.pdf

#10yrsago: Principal who spied on child through webcam mistook a Mike n Ike candy for drugs: https://reason.com/2010/02/20/lower-pervian-school-district/

#10yrsago: School where principal spied on students through their webcams had mandatory laptop policies, treated jailbreaking as an expellable offense https://web.archive.org/web/20100726204521/https://strydehax.blogspot.com/2010/02/spy-at-harrington-high.html

#10yrsago: Parents file lawsuit against principal who spied on students through webcams: https://abcnews.go.com/GMA/Parenting/pennsylvania-school-webcam-students-spying/story?id=9905488

#1yrago: Cybermercenary firm with ties to the UAE want the capability to break Firefox encryption https://www.eff.org/deeplinks/2019/02/cyber-mercenary-groups-shouldnt-be-trusted-your-browser-or-anywhere-else

#1yrago: Fraudulent anti-Net Neutrality comments to the FCC traced back to elite DC lobbying firm https://gizmodo.com/how-an-investigation-of-fake-fcc-comments-snared-a-prom-1832788658

Colophon (permalink)

Today’s top sources: Naked Capitalism (https://nakedcapitalism.com/).

Hugo nominators! My story “Unauthorized Bread” is eligible in the Novella category and you can read it free on Ars Technica: https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

Upcoming appearances:

The Future of the Future: The Ethics and Implications of AI, UC Irvine, Feb 22: https://www.humanities.uci.edu/SOH/calendar/event_details.php?eid=8263

Canada Reads Kelowna: March 5, 6PM, Kelowna Library, 1380 Ellis Street, with CBC’s Sarah Penton https://www.eventbrite.ca/e/cbc-radio-presents-in-conversation-with-cory-doctorow-tickets-96154415445

Currently writing: I just finished a short story, “The Canadian Miracle,” for MIT Tech Review. It’s a story set in the world of my next novel, “The Lost Cause,” a post-GND novel about truth and reconciliation. I’m getting geared up to start work on the novel now, though the timing is going to depend on another pending commission (I’ve been solicited by an NGO) to write a short story set in the world’s prehistory.

Currently reading: I finished Andrea Bernstein’s “American Oligarchs” this week; it’s a magnificent history of the Kushner and Trump families, showing how they cheated, stole and lied their way into power. I’m getting really into Anna Weiner’s memoir about tech, “Uncanny Valley.” I just loaded Matt Stoller’s “Goliath” onto my underwater MP3 player and I’m listening to it as I swim laps.

Latest podcast: Persuasion, Adaptation, and the Arms Race for Your Attention: https://craphound.com/podcast/2020/02/10/persuasion-adaptation-and-the-arms-race-for-your-attention/

Upcoming books: “Poesy the Monster Slayer” (Jul 2020), a picture book about monsters, bedtime, gender, and kicking ass. Pre-order here: https://us.macmillan.com/books/9781626723627?utm_source=socialmedia&utm_medium=socialpost&utm_term=na-poesycorypreorder&utm_content=na-preorder-buynow&utm_campaign=9781626723627

(we’re having a launch for it in Burbank on July 11 at Dark Delicacies and you can get me AND Poesy to sign it and Dark Del will ship it to the monster kids in your life in time for the release date).

“Attack Surface”: The third Little Brother book, Oct 20, 2020.

“Little Brother/Homeland”: A reissue omnibus edition with a very special, s00per s33kr1t intro.

17 notes

·

View notes

Text

Singapore economy

The necessary protection measures to conquer the COVID-19 pandemic are severely impacting economic activity around the world. As a result of the pandemic, the International Monetary Fund (IMF) projects the global economy to contract sharply by –3 percent in 2020. This would be much worse than during the 2008–09 financial crisis.

https://www.asiafundmanagers.com/int/singapore-economy/

For Singapore, a sovereign city state and successful democracy, the IMF expects the economy to shrink by 3.5 percent this year.

Singapore Economy Overview

However, Singapore’s economy is highly developed, a free market, and ranked as one of the most open and most pro-business in the world. This stability and attractive financial climate sees Singapore benefit from an inward flow of investment from both institutions and individual investors. The city state has a population of 5.6 million.

Singapore is among the top ten countries in the world for GDP per capita, at a level of $103.181, with total GDP for the country at $468 billion, in 2019. Over the past few decades Singapore’s annual percentage GDP growth has fluctuated, falling as low as a contraction of -2.2% in 1998, and climbing as high as 14.5% in 2010.

In 2019, Singapore’s economy grew by 0.7%, falling from a rate of 3.1% in 2018. Due to the COVID-19 pandemic, the IMF expects the economy to shrink by 3.5 percent this year.

It’s also predicted that a faster slowdown in China will affect other Asian economies, despite Asia still being the world’s fastest growing region.

Singapore has a number of state-owned enterprises which hold majority stakes in its largest companies, such as Singapore Airlines, SingTel, and MediaCorp. The Asian country is a global financial hub and has strong export performance in the electronics, chemicals and services industries. It also has a high trade to GDP ratio and the Port of Singapore is the second busiest in the world by the amount of cargo that flows through it.

Unemployment in Singapore has crept higher in recent years, reaching 2.3% at the end of 2019, however the rate has remained below this figure for almost a decade.

Due to Singapore’s size and location, both land and water are precious commodities in the country.

Currency and Central Bank

Singapore’s currency is the Singapore dollar (SGD) and the Monetary Authority of Singapore (MAS) is its central bank and financial regulator. The bank was founded in 1971 and in 1977 it was given the control of the regulation of the insurance industry by the country’s government.

In 1984 securities regulation under the Securities Industry Act (1973) was also brought under the remit of MAS making it Singapore’s full financial regulator. This is relatively unusual compared to other central banks around the globe.

Another unusual characteristic of the central bank and Singapore’s monetary policy is that MAS does not regulate the country’s monetary system using interest rates. MAS uses a foreign exchange monetary mechanism, intervening in the SGD market.

In Singapore, inflation rates over the past two decades have been relatively low compared to other countries in the region. Overall inflation rose to 0.6% in 2019 compared to 0.4% in 2018 in line with most of Asia and rising food and oil prices. For 2020, IMF expects an inflation rate of -0.17 due to COVID-19 outbreak.

Industry and Trade

The Singapore economy is known for its outflow of foreign direct investment (FDI) to other nations, but it also benefits from incoming FDI from both investors and institutions. The city-state is attractive to businesses and entrepreneurs.

The largest industry is manufacturing contributing up to a quarter of annual GDP. Within manufacturing, electronics, biomedical sciences, chemicals, logistics and transport industries perform well.

Manufacturing output grew in 2017 and 2018 but has since fallen back to similar levels experienced between 2012 and 2016 after the downturn of 2010 and 2011. Year-on-year manufacturing output fell by 0.7% in December 2019 but on a seasonally adjusted month-on-month basis grew by 4.1% that month.

Following manufacturing, is the financial services industry which benefits from political stability and a business-nurturing economy. The country has 200 banks and is a regional hub for many global financial services firms. Business and other services are also significant contributors to Singapore’s annual GDP levels, as are the country’s retail and transportation sectors.

With a land mass smaller than that of New York, Singapore’s economy does not benefit from any significant natural resources or agricultural output. However, it is a regional hub for oil and gas as well as global leader in sustainable water solutions. The latter occurring due to Singapore’s water shortage.

Survey and Rankings

Out of 141 economies, the World Economic Forum (WEF) Global Competitiveness Index ranks Singapore 1st with a score of 84.8. It outranks the US at 83.7 points and Hong Kong with 83.1 points. The index measures national competitiveness, defined as the set of institutions, policies and factors that determine a country’s level of productivity. Singapore scored high for its public sector, labour force, diversity and infrastructure.

The World Bank’s Ease of Doing Business ranking’s place Singapore in 2nd place out of 190 countries. Just ahead of Hong Kong in 3rd place but behind New Zealand in 1st place. The Doing Business report, as per the World Bank, isn’t designed to be an investment guide, as investors should consider many other factors. It is, however, used by governments to influence “sound” regulatory policies.

Again, Singapore performs significantly well in The Heritage Foundation’s 2019 Index of Economic Freedom. It is ranked 2nd, just above New Zealand this time in 3rd place and below Hong Kong which takes 1st place. The Heritage Foundation says citizens of “free” or “mostly free” countries enjoy incomes more than double the global average and that the link between economic freedom and economic growth is “robust.” Singapore is one of only six nations considered “free,” with, in contrast, 88 nations considered at least “moderately free.”

Stock Exchanges and Capital Markets

As of January 2019, this country’s only exchange, The Singapore Exchange (SGX) held 640 main listings with 215 catalist, or fast-growing company, listings. Its ten largest listed companies account for around half the total value on the exchange, by market capitalisation and include Jardine Matheson Holdings Ltd, DBS Group Holdings Ltd, Jardine Strategic Holdings, Singapore Telecommunications, Oversea-Chinese Banking Corporation, United Overseas Bank, Hong Kong Land Holdings, Wilmar International, Thai Beverage PCL, and Dairy Farm International.

Of these, DBS Group Holdings’ DBSM is one of the largest banks in Asia, once the Development Bank of Singapore and is still headquartered there with 280 branches in 18 markets. Wilmar International is one of Asia largest agribusiness groups and boasts Unilever as one of its largest customers. In addition, Dairy Farm International operates some of the largest retailers in Singapore including Cold Storage supermarkets and 7-Eleven stores.

The FTSE Straits Times Index (STI) tracks the top 30 companies on the SGX weighted by capitalisation. The SGX has a number of indices tracking advanced and emerging technologies including the Global Robotics & AI Index, the Asia Healthcare Select EW Index, the Digital Innovators Index and the E-commerce Index.

Singapore economy attractive for investors

Singapore is described as having deep and liquid capital markets, attractive to investors. Its bond markets, equity capital, foreign exchange and over the counter (OTC) markets are strong. The equity capital market is one of the most established in the Asia Pacific region and its highly international. 40% of SGX listings are foreign companies.

The country is host to the largest foreign exchange centre in the region and it’s third in the world after London and New York. It is also an offshore Renminbi (RMB) centre supporting China’s efforts to internationalise the yuan.

It is noted that Singapore’s capital markets are closely knit with its other financial sectors. Financial institutions make up a high proportion of Singapore’s non-SGD debt issuances and fund managers and insurance companies make up around a third of Singapore’s long-term debt issues. Financial institutions and private banks invest heavily into SGD debt and fund managers and financial institutions are major investors in non-SGD debt issues.

Bond Market

The bond market is one of the most developed in Asia with around two-thirds in SGD and the remainder in US dollars. It is made up of Singapore Government Securities (SGS), quasi-government bonds, corporate bonds and structured securities and is accessible to issuers and investors globally. There are no capital controls, hedging restrictions or withholding of taxes. In 2009 regulations were changed to allow high-quality securities issued by foreign entities to be regulated liquid assets and this has led to an increase in international issuances.

Real Estate Market

With land a premium in Singapore property prices are not cheap and condos in the city, for example, are around $14,000 to $18,000 USD per square metre. Conversely rental yields can be low, at around 3.0%. Income tax on rentals is also high, non-residents can expect around 22%, with property tax at 10% but with a 10% surcharge for foreign nationals.

Foreign nationals have been allowed to purchase apartments without government approval since the Residential Property Act was passed in 2005 but they cannot buy vacant land and landed properties without permission from the Singapore Land Authority. These restrictions are not in place for non-residential properties.

2 notes

·

View notes

Text

Events 8.29

708 – Copper coins are minted in Japan for the first time (Traditional Japanese date: August 10, 708). 870 – The city of Melite surrenders to an Aghlabid army following a siege, putting an end to Byzantine Malta. 1009 – Mainz Cathedral suffers extensive damage from a fire, which destroys the building on the day of its inauguration. 1261 – Pope Urban IV succeeds Pope Alexander IV as the 182nd pope. 1315 – Battle of Montecatini: The army of the Republic of Pisa, commanded by Uguccione della Faggiuola, wins a decisive victory against the joint forces of the Kingdom of Naples and the Republic of Florence despite being outnumbered. 1350 – Battle of Winchelsea (or Les Espagnols sur Mer): The English naval fleet under King Edward III defeats a Castilian fleet of 40 ships. 1475 – The Treaty of Picquigny ends a brief war between the kingdoms of France and England. 1484 – Pope Innocent VIII succeeds Pope Sixtus IV. 1498 – Vasco da Gama decides to depart Calicut and return to Kingdom of Portugal. 1521 – The Ottoman Turks capture Nándorfehérvár (Belgrade). 1526 – Battle of Mohács: The Ottoman Turks led by Suleiman the Magnificent defeat and kill the last Jagiellonian king of Hungary and Bohemia. 1541 – The Ottoman Turks capture Buda, the capital of the Hungarian Kingdom. 1728 – The city of Nuuk in Greenland is founded as the fort of Godt-Haab by the royal governor Claus Paarss. 1756 – Frederick the Great attacks Saxony, beginning the Seven Years' War in Europe. 1758 – The Treaty of Easton establishes the first American Indian reservation, at Indian Mills, New Jersey, for the Lenape. 1778 – American Revolutionary War: British and American forces battle indecisively at the Battle of Rhode Island. 1786 – Shays' Rebellion, an armed uprising of Massachusetts farmers, begins in response to high debt and tax burdens. 1807 – British troops under Sir Arthur Wellesley defeat a Danish militia outside Copenhagen in the Battle of Køge. 1831 – Michael Faraday discovers electromagnetic induction. 1842 – Treaty of Nanking signing ends the First Opium War. 1861 – American Civil War: The Battle of Hatteras Inlet Batteries gives Federal forces control of Pamlico Sound. 1869 – The Mount Washington Cog Railway opens, making it the world's first mountain-climbing rack railway. 1871 – Emperor Meiji orders the abolition of the han system and the establishment of prefectures as local centers of administration. (Traditional Japanese date: July 14, 1871). 1885 – Gottlieb Daimler patents the world's first internal combustion motorcycle, the Reitwagen. 1898 – The Goodyear tire company is founded. 1903 – The Slava, the last of the five Borodino-class battleships, is launched. 1907 – The Quebec Bridge collapses during construction, killing 75 workers. 1910 – The Japan–Korea Treaty of 1910, also known as the Japan–Korea Annexation Treaty, becomes effective, officially starting the period of Japanese rule in Korea. 1911 – Ishi, considered the last Native American to make contact with European Americans, emerges from the wilderness of northeastern California. 1911 – The Canadian Naval Service becomes the Royal Canadian Navy. 1914 – World War I: Start of the Battle of St. Quentin in which the French Fifth Army counter-attacked the invading Germans at Saint-Quentin, Aisne. 1915 – US Navy salvage divers raise F-4, the first U.S. submarine sunk in an accident. 1916 – The United States passes the Philippine Autonomy Act. 1918 – World War I: Bapaume taken by the New Zealand Division in the Hundred Days Offensive. 1930 – The last 36 remaining inhabitants of St Kilda are voluntarily evacuated to other parts of Scotland. 1941 – World War II: Tallinn, the capital of Estonia, is occupied by Nazi Germany following an occupation by the Soviet Union. 1943 – World War II: German-occupied Denmark scuttles most of its navy; Germany dissolves the Danish government. 1944 – World War II: Slovak National Uprising takes place as 60,000 Slovak troops turn against the Nazis. 1949 – Soviet atomic bomb project: The Soviet Union tests its first atomic bomb, known as First Lightning or Joe 1, at Semipalatinsk, Kazakhstan. 1950 – Korean War: British troops arrive in Korea to bolster the US presence there. 1958 – United States Air Force Academy opens in Colorado Springs, Colorado. 1965 – The Gemini V spacecraft returns to Earth, landing in the Atlantic Ocean. 1966 – The Beatles perform their last concert before paying fans at Candlestick Park in San Francisco. 1966 – Leading Egyptian thinker Sayyid Qutb is executed for plotting the assassination of President Gamal Abdel Nasser. 1970 – Chicano Moratorium against the Vietnam War, East Los Angeles, California. Police riot kills three people, including journalist Rubén Salazar. 1982 – The synthetic chemical element Meitnerium, atomic number 109, is first synthesized at the Gesellschaft für Schwerionenforschung in Darmstadt, Germany. 1991 – Supreme Soviet of the Soviet Union suspends all activities of the Soviet Communist Party. 1991 – Libero Grassi, an Italian businessman from Palermo, is killed by the Sicilian Mafia after taking a solitary stand against their extortion demands. 1996 – Vnukovo Airlines Flight 2801, a Tupolev Tu-154, crashes into a mountain on the Arctic island of Spitsbergen, killing all 141 aboard. 1997 – Netflix is launched as an internet DVD rental service. 1997 – At least 98 villagers are killed by the Armed Islamic Group of Algeria GIA in the Rais massacre, Algeria. 2003 – Ayatollah Sayed Mohammed Baqir al-Hakim, the Shia Muslim leader in Iraq, is assassinated in a terrorist bombing, along with nearly 100 worshippers as they leave a mosque in Najaf. 2005 – Hurricane Katrina devastates much of the U.S. Gulf Coast from Louisiana to the Florida Panhandle, killing up to 1,836 people and causing $125 billion in damage. 2012 – At least 26 Chinese miners are killed and 21 missing after a blast in the Xiaojiawan coal mine, located at Panzhihua, Sichuan Province.

1 note

·

View note

Text

How Can You Select an Agency For Tax Debt Services?

Picking the right tax debt-providing agency for your needs can be a hard task. However, dealing with the Internal Revenue Service (IRS) on your own is impossible! A tax debt service providing agency worth reaching will have characteristics that permit you to have a solid sense of reassurance and be secure in looking for a goal for your duty issues with them. You should consider the following points while picking tax debt services in New Zealand.

Proper Background -

It's basic to research the tax debt service-providing agency. These agencies must have solid and authentic certifications that frame their authenticity. There are three stages you can take to guarantee said agencies are spotless. In the first place, ask them for their authorizing data. All expense help agencies will have licenses. If you ask an agency and they don't quickly show you their permit, you ought to take note of that as a significant warning that you shouldn't direct business with them.

youtube

No Issues -

A tax debt provider hoping to trick you will frequently request a lot of cash before they understand how they can assist with your expense issues. The assessment alleviation agencies you decide to work with should clarify through their activities that their definitive objective is to help you out of your monetary emergency. A genuine agency will meet with you to examine what is happening in full and will not acknowledge installment before you have made a game plan for charge help.

Assured Results -

When looking for tax debt services in New Zealand, you must investigate how they can solve your problems. If they are not professional, it is a red flag. Settling your expense issues can take time. Thus, a fair tax debt service-providing agency will be straightforward about this reality. A reputed agency can assist you to settle your genuine expense issues with genuine arrangements. Moreover, they can handle the processes and give you the best assistance.

0 notes

Text

Democratic debate analysis

I’ve read the transcripts. I read the fact-checkers’ analysis. I have ranked them.

Due to the size of the field, I’ll be splitting my analysis into four groups. This first one will be the Please Do Not Make Me Vote For Them group:

Ryan, Hickenlooper, Williamson, Bennet, Delaney, O’Rourke, and Biden.

Under the break, I’ll be analyzing their debate performance, how effectively they represented themselves on the issues, and how much I hate them, in reverse order of preference. Let’s begin.

20) Biden

Biden is so… so out of touch. Even the moderators asked if he was out of touch, and when the moderators of a debate you’re participating in think you don’t know what you’re talking about? For a career politician, that has got to hurt. Frankly, they were right. Biden thinks that the reason people can’t pay their student loans without sacrificing everything else they want to do with their lives is because we’re not earning more than $25k a year, that freezing payments and interest until the graduated student crosses that threshold would magically make everything ok. If he were right, there’d be no Fight for 15. A $15 minimum wage, assuming full time hours, is more than $30k per year.

His response to accusations of racism was to point to his “black friend,” former President Obama, which… dude. You’ve got to know better than that by now. Please tell me you know having been the first and only black President’s VP does not immediately absolve you of being an old white guy who worked with Southern Segregationists against integrating schools.

His entire platform seems to be “remember when I was a senator/the vice president? Wasn’t I great, back when I had ideas and did things?” and I gotta say, No. No, you weren’t that great, Joe. Even his closing comments were lackluster, talking about “restoring the soul of America,” and “restoring the dignity of the middle class,” and “building national unity.” His answers to simple questions were, frankly, terrible.

Joe, what would you do, day one, if you knew you’d only be able to accomplish one thing with your Presidency? Thanks for asking, I’d BEAT DONALD TRUMP! Joe. Joe, that’s how you get to Day One. Unless you mean “grab him by the collar, haul him out on the White House lawn, and bludgeon him with heavy objects,” you’re not answering the question. Joe, which one country do you think we need to repair diplomatic ties with most? NATO! Joe. Joe, NATO is more than one country. I just… *sigh*

To his credit, Biden trotted out many of the same old campaign promises Democrats have been making for as long as I can remember. Closing tax loopholes, universal pre-K and increased educational funding, let Medicare negotiate prescription drug prices. These are tried and true campaign promises because they’re things we can all generally agree we want. But they’re old, a lot like Biden. They’re not the bold solutions we need. His newer ideas all sound pretty moderate and old, too: free community college (not 4 year public university), creating a public option for healthcare so people can choose between insurance companies and Medicare, rejoining the Paris Climate Accord, and instituting national gun buybacks. His suggestion of requiring all guns to have a biometric safety is also a vague gesture in the direction of a solution.

Biden is too old, too timid, and too arrogant to understand that he’s got nothing to offer in an election where Millenials and Gen Z are going to be the largest portion of the electorate.

19) O’Rourke

Beto, or as I like to call him, Captain Wrongerpants, got off to a roaring start by giving a non-answer in two languages. This incredible display of pandering, and wasting precious time, made him seem pretentious and obnoxious in twice the number of languages most politicians aspire to.

Possibly more than any other candidate, O’Rourke completely failed to answer any question he was asked. He presented a few good ideas, saying that he sees climate change as the most pressing threat to America and calling for an end to fossil fuel use. He supports universal background checks and reinstating the assault weapons ban. He wants comprehensive immigration reform, to reunite families separated by the Trump administration, and to increase the corporate tax rate.

Unfortunately, he wants to increase the tax rate from the new-for-2019 level of 21% to a lower-than-2018 28%. He wants immigration reform to protect asylum seekers, but thinks other immigrants should “follow our laws” and makes no guarantee to decriminalize undocumented border crossings. Like Biden, he supports healthcare “choice,” meaning that for-profit healthcare would continue in this country until everyone, in every city, state, county, and cave, can be convinced that insurance companies don’t care about them.

In short, O’Rourke reaches for relevance and relatability, and lands in pretension and centrism.

18) Delaney

John Delaney is the first candidate on my list to have been caught in a bald-faced lie by Politifact. Good job, John. His lie, by the way, was about Medicare for All. He claimed that the bill currently before Congress required that Medicare pay rates stay at the current levels, and that if every hospital in America had been paid at Medicare levels for all services, every hospital would have to close. The truth? The Medicare for All bill does not require that pay rates stay at current levels, and even if it did no one knows what effect that would have on the country’s hospitals. There is no data to support his assertion, even if he was right about the terms of the legislation being considered.

Unsurprisingly, John is another healthcare “choice” advocate. I think I’ve said enough about why this position doesn’t fly for me, so I won’t rehash it again.

In a discussion of family separation, he interjected that his grandfather was also a victim of family separation, which must make him feel so relevant. He also referred to company owners as “job creators,” a lovely little conservative talking point, and claimed that America “saved the world,” in some vague appeal to American Exceptionalism. He also agrees with Nancy Pelosi about not pursuing impeachment proceedings.

On the “I don’t hate him quite as much as Beto and Biden” front, he’s in favor of tax breaks for the middle class, increasing the minimum wage, funding education, family leave policies, a carbon tax (which he imagines would fund a tax dividend paid to individual citizens, rather than, I don’t know, paying for green infrastructure development?), thinks China is our biggest geopolitical threat, and is scared of nuclear weapons (a very sane, reasonable position, really).

If you want to pick a candidate based on who your moderately conservative uncle will yell about least if they win the White House, Delaney might be your guy. If you want to pick a candidate based on issues like student loan debt and healthcare, keep looking.

17) Bennet

I had never heard of Michael Bennet before the debates. In fact, I just Googled him to find out his first name. After the debates, though? You guessed it: I hate him.

His closing statement was an appeal to the American Dream. He thinks there are too many people in America to make a single payer healthcare system work. Asked to identify one country to prioritize diplomatic repairs with, he named two continents. And he believes the world is looking to America for leadership.

However, he did rate higher than three whole candidates, and here’s why: He supports a path to citizenship for undocumented immigrants. He wants to end gerrymandering and overturn Citizens United. He wants to expand voting rights and electoral accessibility. He considers climate change and Russia to be the biggest threats to America, and he didn’t use any obvious racist dogwhistles. He’s from Colorado, so he’s kinda proud of the state’s marijuana legalization and reproductive health policies, but he’s way too quick to see partnership with private businesses as the ideal path forward.

16) Williamson

Oh man. Marianne Williamson. I almost threw something every time she opened her mouth. She is like a walking, talking, uninformed Tumblr guilt trip post. At a nationally televised debate, she asked why no one was talking about… something. I didn’t write it down in my notes because I would have had to gouge out my own eyes if I had. According to Google, she is a self-help speaker and that explains So Much.

In her closing statement, Williamson claimed that she would be the candidate to beat Trump, not because she has any plans, but because she will harness love to counter the fear that fuels Trump’s campaign. I am not making this up and I wish I was.

She claimed that Americans have more chronic health issues than anywhere else in the world, and attributed this to all sorts of factors, starting with diet and chemical contamination and extending, I assume, to solar activity and Bigfoot. According to Politifact, the only American demographic with a higher incidence of chronic illness than other countries is senior citizens, and I’m going to guess that has a lot more to do with our crappy healthcare system than it does a lack of detox teas.

When asked what policy she would enact if she could only get one, she said that on her first day in the White House she’d call the Prime Minister of New Zealand and tell her that New Zealand is not the best place in the world to raise a child, America is.

When asked which one country she’d make a diplomatic priority, she said “European leaders.”

By now you must be wondering how she rated higher than the bottom four, and I can sum it up in eight words: She supports reparations and the Green New Deal.

Please, please do not make me vote for Marianne Williamson.

15) Hickenlooper

John Hickenlooper is the former Governor of Colorado, and proudly takes credit for everything good that has ever happened in the state. He is also proud of being a small business owner, a statement that makes me immediately suspicious of any politician.

To his credit, he supports “police diversity,” a charmingly non-specific term that could mean one gay Latine nonbinary single parent in an otherwise entirely white male department, or could mean he wants the demographics of the police force to match the demographics of the population being policed. He also considers climate change a serious threat, and China. The best thing he said all night? He supports civilian oversight of police, a policy which has improved police relations with citizens.

Sounds pretty good, right? Wrong.

He also supports ICE “reform,” as if there is anything redeemable about that agency, and thinks that the worst thing the eventual Democratic candidate could do is allow their name to be connected to anything socialist. He said it twice, it wasn’t an accident.

14) Ryan

That brings us to the last of the worst, Tim Ryan. Tim here cannot stop using conservative dogwhistles, like talking about “coastal elites,” and saying that acknowledging differences between people is divisive. He is a basic ass white boy in the worst, most boring sense.

He wants to bring about a green tech boom, supports decriminalizing border crossing, supports gun reform, and thinks China is a serious threat to America. He also thinks that, in addition to dealing with the issues that allow school shootings to happen, we need to address the trauma kids are growing up with as a result. Unfortunately, he thinks that school shooters are misunderstood victims of bullying.