#supply chain disruptions 2025

Explore tagged Tumblr posts

Text

Infrastructure Vision: Project 2025's Plans for Transportation Systems

The transportation system in the United States faces significant challenges: aging infrastructure, traffic congestion, environmental concerns, and a rising demand for efficient mobility options. Project 2025’s vision for the nation’s transportation networks outlines ambitious goals, aiming to overhaul and modernize systems across the country. However, as with many large-scale reforms, there are…

View On WordPress

#air traffic safety privatization#environmental impact of Project 2025#federal transit funding changes#fuel economy rollback impact#maritime industry and Project 2025#privatization of FAA#Project 2025 transportation plans#public transit safety#supply chain disruptions 2025#transportation infrastructure reforms#U.S. infrastructure 2025#U.S. transportation policy 2025

0 notes

Text

Annoying that I have to put time and effort into a survival garden this year. Don't get me wrong, I love gardening, but not when I have to because of something completely avoidable.

#2020 survival gardening was fine bc it wasn't any specific person's fault we couldn't get fresh produce#but the situation we're being set up for in 2025 is 100% human manufactured#supply chain disruptions#my loathed

1 note

·

View note

Text

Scenarios I am immediately preparing for:

1) Gender markers on my docs being reverted

2) Shadow ban of trans HRT (likely still accessible, but severely restricted for good chunks of the trans population - see FL, for example)

3) Tariffs making everything super expensive

4) Loss of same-sex marriage rights

5) Online presence as a trans person criminalized as pornographic

6) Disruption of supply chains, especially food

7) Being barred from federal work as a trans person

I expect the incoming admin to be making considerable progress on these outcomes within the first year. "Progress" does not necessarily mean "comes to pass"; it's too soon to know what the momentum and obstacles will be like for Project 2025 initiatives.

I'm not here to scaremonger, but it's incredibly important to be prudent as a trans person right now and start prepping for how to mitigate damage to yourself and how to support your community.

Your own lists of concerns will vary. But I suggest writing down your fears as specific as possible, taking a deep breath, then seeing how best you can plan for each.

There will be paperwork, there will be sacrifices, but also remember that building bonds with your community and taking care of yourself are also vitally important right now.

697 notes

·

View notes

Text

Mike Luckovich

* * * * *

LETTERS FROM AN AMERICAN

December 11, 2024

Heather Cox Richardson

Dec 12, 2024

Yesterday, President Joe Biden spoke at the Brookings Institution, where he gave a major speech on the American economy. He contrasted his approach with the supply-side economics of the forty years before he took office, an approach the incoming administration of Donald Trump has said he would reinstate. Biden urged Trump and his team not to destroy the seeds of growth planted over the past four years. And he laid out the extraordinary successes of his administration as a benchmark going forward.

The president noted that Trump is inheriting a strong economy. Biden shifted the U.S. economy from 40 years of supply-side economics that had transferred about $50 trillion from the bottom 90% to the top 1% and hollowed out the middle class.

By investing in the American people, the Biden team expanded the economy from “the middle out and the bottom up,” as Biden says, and created an economy that he rightfully called “the envy of the world.” Biden listed the numbers: more than 16 million new jobs, the most in any four-year presidential term in U.S. history; low unemployment; a record 20 million applications for the establishment of new businesses; the stock market hitting record highs.

Biden called out that in the two years since Congress passed the Inflation Reduction Act and the CHIPS and Science Act, the private sector has jumped on the public investments to invest more than a trillion dollars in clean energy and advanced manufacturing.

Disruptions from the pandemic—especially the snarling of supply chains—and Russian president Vladimir Putin’s attack on Ukraine created a global spike in inflation; the administration brought those rates back to around the Fed’s target of 2%.

Biden pointed out that “[l]ike most…[great] economic developments, this one is neither red nor blue, and America’s progress is everyone’s progress.”

But voters’ election of Donald Trump last month threatens Biden’s reworking of the economy. Trump and his team embrace the supply-side economics Biden abandoned. They argue that the way to nurture the economy is to free up money at the top of the economy through deregulation and tax cuts. Investors will then establish new industries and jobs more efficiently than they could if the government intervened. Those new businesses, the theory goes, will raise wages for all Americans and everyone will thrive.

Trump and MAGA Republicans have made it clear they intend to restore supply-side economics.

The first priority of the incoming Republican majority is to extend the 2017 Trump tax cuts, many of which are due to expire in 2025. Those tax cuts added almost $2 trillion to budget deficits, but there is little evidence that they produced the economic growth their supporters promised. At the same time, the income tax cuts delivered an average tax cut of $252,300 to households in the top 0.1%, $61,090 to households in the top 1%, but just $457 to the bottom 60% of American households. The corporate tax cuts were even more skewed to the wealthy.

In the Washington Post yesterday, Catherine Rampell noted that Republicans’ claim that extending those cuts isn’t extraordinarily expensive means “getting rid of math.”

At a time when Republicans like Elon Musk and Vivek Ramaswamy, who are leading the new “Department of Government Efficiency,” are clamoring for cuts of $2 trillion from the budget, the Congressional Budget Office estimates that extending the tax cuts will add more than $4 trillion to the federal budget over the next ten years. Republicans who will chair the House and Senate finance committees, Representative Jason Smith (R-MO) and Senator Mike Crapo (R-ID), say that extending the cuts shouldn’t count as adding to the deficit because they would simply be extending the status quo.

Trump has also indicated he plans to turn the country over to billionaires, both by putting them into government and by letting them act as they wish. Last night, on social media, President-elect Trump posted: “Any person or company investing ONE BILLION DOLLARS, OR MORE, in the United States of America, will receive fully expedited approvals and permits, including, but in no way limited to, all Environmental approvals. GET READY TO ROCK!!!”

Biden called out the contrast between these two economic visions, saying that the key question for the American people is “do we continue to grow the economy from the middle out and the bottom up, investing in all of America and Americans, supporting unions and working families as we have the past four years? Or do we…backslide to an economy that’s benefited those at the top, while working people and the middle class struggle…for a fair share of growth and [for an] economic theory that encouraged industries and…livelihoods to be shipped overseas?”

Biden explained that for decades Republicans had slashed taxes for the very wealthy and the biggest corporations while cutting public investment in infrastructure, education, and research and development. Jobs and factories moved overseas where labor was cheaper. To offset the costs of tax cuts, Biden said, ‘advocates of trickle-down economics ripped the social safety net by trying to privatize Social Security and Medicare, trying to deny access to affordable health care and prescription drugs.” He added, “Lifting the fortunes of the very wealthy often meant taking the rights of workers away to unionize and bargain collectively.”

This approach to the economy “meant rewarding short-termism in pursuit of short-term profits [and] extraordinary high executive pay, instead of making long-term investments…. As a consequence, our…infrastructure fell…behind. A flood of cheap imports hollowed out our factory towns.”

“Economic opportunity and innovation became more concentrated in [a] few major cities, while the heartland and communities were left behind. Scientific discoveries and inventions developed in America were commercialized in countries like China, bolstering their manufacturing investment and jobs instead of [our] economy. Even before the pandemic, this economic agenda was clearly failing. Working- and middle-class families were being hurt.”

“[W]hen the pandemic hit,” Biden said, “we found out how vulnerable America was.” Supply chains failed, and prices soared.

Biden told the audience that he “came into office with a different vision for America…: grow the economy from the middle out and the bottom up; invest in America and American products. And when that happens, everybody does…well…no matter where they lived, whether they went to college or not.”

“I was determined to restore U.S. leadership in industries of the future,” he said. The Bipartisan Infrastructure Law, CHIPS and Science Act, and Inflation Reduction Act “mark the most significant investment in America since the New Deal,” with new factories bringing good jobs that are rejuvenating towns that had been left behind in the past decades. Biden said he required that the government buy American goods as the country invested in “modernizing our roads; our bridges; our ports; our airports; our clean water system; affordable, high-speed Internet systems; and so much more.”

Eighty percent of working-age Americans have jobs, and the average after-tax income is up almost $4,000 since before the pandemic, significantly outpacing inflation.

Biden and his team worked to restore competition in the economy—just today, the huge grocery chain Albertsons gave up on its merger with another huge grocery chain, Kroger, after Biden’s Federal Trade Commission sued to block the merger because it would raise prices and lower workers’ wages by eliminating competition—and their negotiations with big pharma have dramatically cut the costs of prescription drugs for seniors. The administration cut junk fees, capping the cost of overdraft fees, for example, from an average of $35 a month to $5.

Biden quoted Jeffrey Sonnenfeld and Stephen Henriques in Time magazine a month ago, saying: “President-elect Trump is receiving the strongest economy in modern history, which is the envy of the world.”

In his speech, Biden noted that it would be “politically costly and economically unsound” to disrupt the decisions and investments the nation has made over the past four years, and he urged Trump to leave them in place. “Will the next president stop a new electric battery factory in Liberty, North Carolina, that will create thousands of jobs?” he asked. “[W]ill we deny seniors living in red states $35-a-month insulin?”

In their article, Sonnenfeld and Henriques noted: “President Trump will likely claim he waved a magic wand on January 20 and the economic clouds cleared,” and they urged people: “Don’t Give Trump Credit for the Success of the Biden Economy.”

Biden gave yesterday’s speech in part to put down benchmarks against which we should measure Trump’s economic policies. “During my presidency, we created [16] million new jobs in America” and saw “the lowest average unemployment rate of…any administration in 50 years.” Economic growth has been a strong 3% on average, and inflation is near 2 percent, he said.

“[T]hese are simple, well-established economic benchmarks used to measure the strength of any economy, the success or failure of any president’s four years in office. They’re not political, rhetorical opinions. They’re just facts,” Biden said, “simple facts. As President Reagan called them, ‘stubborn facts.’”

Biden is willing to bet that if the American people pay attention to those facts, they will recognize that his approach to the economy, rather than supply-side economics, works best for everyone.

Today the NASDAQ Composite index, which focuses on tech stocks, broke 20,000 for the first time.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from an american#Heather Cox Richardson#Biden Administration#the economy#Trump lies#economic policies#the Biden Economy#Mike Luckovich

23 notes

·

View notes

Text

Video Game News Stories for February 26th, 2024

Legal Battles Rock the Industry:

Call of Duty Lawsuit Challenges Esports Dominance: A group of gamers sent shockwaves through the esports community by filing a lawsuit against Activision Blizzard, Inc., accusing the company of monopolizing control over Call of Duty esports leagues and tournaments. This legal action could have far-reaching consequences, potentially forcing Activision to adjust its esports strategy and pave the way for a more competitive environment.

Platform Shifts and Strategic Moves:

Microsoft Embraces Multiplatform Strategy: In a surprising turn of events, Microsoft Corporation announced plans to release four upcoming Xbox titles on external platforms, including PC and potentially even rival consoles like Sony's PlayStation. This move signifies a significant departure from the company's longstanding strategy of platform exclusivity, a cornerstone of the "console wars." The new approach could lead to wider accessibility for Xbox games, potentially attracting new demographics and impacting development strategies across platforms in the face of increased competition.

Sony Adjusts PS5 Sales Target, Prepares for IPO: Sony Interactive Entertainment Inc. adjusted its PlayStation 5 sales target downwards, citing ongoing supply chain disruptions and economic uncertainties. This news comes alongside reports that the company is planning an initial public offering (IPO) for its financial unit in 2025. The revised sales target suggests potential adjustments to Sony's production and distribution strategies in the coming months, while the planned IPO could be a strategic move to raise capital for future endeavors.

Beyond the Headlines:

Nintendo Switch 2 Rumors Gain Momentum: Speculation surrounding the potential launch of a successor to the hugely successful Nintendo Switch console later this year continues to gather steam. Fans eagerly await official announcements from Nintendo regarding the next iteration of the popular platform, with potential implications for the continued success of the Switch franchise and the broader handheld gaming market.

Elden Ring Mobile Version: Speculation Ignites Fan Interest: Rumors of a mobile version of the critically acclaimed game Elden Ring are circulating online, sparking excitement among fans who desire to experience the title on the go. While unconfirmed, the prospect has captivated the gaming community, leading to discussions about the feasibility of adapting the game's complex mechanics to mobile platforms and the potential impact on mobile gaming trends.

"Princess Peach: Showtime" Generates Positive Buzz: The recent Nintendo Direct Partner Showcase unveiled "Princess Peach: Showtime," a new title receiving positive first impressions for its innovative gameplay and engaging story. This upcoming release has garnered significant interest within the gaming community, particularly among fans of the Super Mario franchise, potentially influencing player expectations and pre-order trends.

This Week's Video Game Releases (February 26 - March 2, 2024):

February 28, 2024:

Brothers: A Tale of Two Sons Remake (PlayStation 5, Xbox Series X/S, PC)

Cook, Serve, Delicious! (Xbox Series X/S, Xbox One)

Star Wars: Dark Forces Remaster (PlayStation 5, Xbox Series X/S, PlayStation 4, Xbox One, Switch, PC)

Additional News Stories:

Call of Duty Servers Crash, Player Stats Reset: Adding to the woes of Call of Duty players, server outages caused frustration and confusion due to data resets.

PlayStation VR 2 Expands Horizons with PC Support: In a move that may delight PC VR enthusiasts, Sony announced that PlayStation VR 2 will support PC games sometime in 2024, potentially expanding its player base.

Fortnite Emote Faces Lawsuit: A choreographer filed a lawsuit against Epic Games, claiming their copyrighted dance moves were used in a Fortnite emote without proper permission, raising discussions about intellectual property rights and fair use within the gaming industry.

#video games#gaming#gaming news#fortnite#call of duty#star wars#star wars dark forces#playstation#sony#xbox#microsoft#nintendo#princess peach#princess peach showtime#nintendo switch#news

12 notes

·

View notes

Text

ABQQ Reports FY 2024 Audited Financial Results, Introduces FY 2025 Outlook, Announces to Repurchase $5 Million of Shares by Year-End 2025

NEW YORK, Nov. 26, 2024 - PRISM MediaWire - AB International Group Corp. (OTC: ABQQ), an intellectual property (IP) and movie investment and licensing firm, announces financial and operating results for the year ended August 31, 2024. The audited financial results have been filed in a 10-K with the U.S. Securities and Exchange Commission (the "SEC"). The Company also provided its financial outlook for the fiscal year ending August 31, 2025.

“ABQQ achieved record results during fiscal year 2024, as we delivered revenue growth of 125% and reached profit net income $542,331, reflecting a continued dedication to maintain exceptional levels of profitability as our business scale. Movie License and NFT MMM IP License built up two of the most admired and well-positioned business in the marketplace, each with a robust innovation product pipeline designed to win with global consumers. Looking forward, our talented teams are highly motivated to continue driving towards the long-term opportunities of these iconic businesses.” - Chiyuan Deng, President and Chief Executive Officer.

Key Financial Highlights:

Revenues for the year ended August 31, 2024, increased 125% to $3,300,467, as compared to $1,473,222 for fiscal 2023.

Operating expenses were $2,813,563 for the year ended August 31, 2024, compared to $5,030,354 for fiscal 2023. We experienced a decrease in theatre operating costs in fiscal 2024 compared to fiscal 2023, mainly due to the decrease in admission revenues and the decrease in movie exhibition costs as a percentage of admission revenue.

We incurred a net income of $542,331 for the year ended August 31, 2024, as compared with a net loss of $3,566,710 for fiscal 2023.

As of August 31, 2024.Total Stockholders’ Equity $1,459,902, as compared to $890,988 in Fiscal 2023.

During fiscal year 2024, the Company repurchased approximately 285 million shares of its common stock for a total of $50,699 at a weighted average price paid per share of $0.00018.

Full Fiscal Year 2025 Outlook for the Twelve-Month Period Ending August 31, 2025

The Company's full fiscal year 2025 outlook is forward-looking in nature, reflecting our expectations as of November 26, 2024, and is subject to significant risks and uncertainties that limit our ability to accurately forecast results. This outlook assumes no meaningful changes to the Company's business prospects or risks and uncertainties identified by management that could impact future results, which include but are not limited to changes in economic conditions, including consumer confidence and discretionary spending, inflationary pressures, and foreign currency fluctuation; geopolitical tensions; and supply chain disruptions, constraints and related expenses.

Revenues are expected to increase approximately 150% to $8.25 million.

Gross margin is expected to be approximately 60.5%.

Diluted earnings per share are expected to be in the range of $0.001 to $0.002.

About AB International Group Corp.

AB International Group Corp. is an intellectual property (IP) and movie investment and licensing firm, focused on acquisitions and development of various intellectual property. We are engaged in acquisition and distribution of movies. The company owns the IP of the NFT movie and music marketplace (NFT MMM) as the unique entertainment industry Non-Fungible Token. The Company operates AB Cinemas, physical movie theaters currently in NY with plans to expand nationwide (www.abcinemasny.com). The company also owns ABQQ.TV which is a movie and TV show online streaming platform. ABQQ TV generates revenue through a hybrid subscription model and advertising model like other online streaming platforms.

For additional information, visit www.abqqs.com, www.abcinemasny.com, https://stareastnet.io/ and www.ABQQ.tv.

Forward-Looking Statements

This press release contains “forward-looking statements” that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements relating to changes to the Company’s management team and statements relating to the Company’s transformation, financial and operational performance including the acceleration of revenue and margins, and the Company’s overall strategy. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the possibility of business disruption, competitive uncertainties, and general economic and business conditions in AB International Group markets as well as the other risks detailed in company filings with the Securities and Exchange Commission. AB International Group undertakes no obligation to update any statements in this press release for changes that happen after the date of this release.

Investor Relations Contact:

Charles Tang (852) 2622 2891 [email protected]

Source: AB International Group Corp

#press release#prism mediawire#stock market#otc markets#otc#abqq#movie investments#IP#AB Cinemas#NFT

2 notes

·

View notes

Text

Solar wind plasma sensor to help track space weather

The Southwest Research Institute-developed Solar Wind Plasma Sensor (SWiPS) has been delivered and integrated into a National Oceanic and Atmospheric Administration (NOAA) satellite dedicated to tracking space weather. SWiPS will measure the properties of ions originating from the Sun, including the very fast ions associated with coronal mass ejections that interact with the Earth’s magnetic environment.

NOAA’s Space Weather Follow On-Lagrange 1 (SWFO-L1) satellite will orbit the Sun at approximately a million miles from Earth, at a point known as L1. The satellite will remotely image the Sun and make local measurements of the solar wind, high-energy particles and the interplanetary magnetic field. SwRI not only developed SWiPS but also will support operations and data analysis, with the goal of providing advance warning of space weather events. These phenomena can affect technology such as GPS and power grids as well as the safety of astronauts who could be exposed to high levels of radiation.

“The delivery and integration of SWiPS is the culmination of four years of hard work by a very dedicated and talented team. I couldn’t be prouder of this group,” said Dr. Robert Ebert, a staff scientist in SwRI’s Space Science Division and SWiPS principal investigator. “The measurements made by SWiPS will provide advance warning in real-time of phenomena associated with space weather before they arrive in the space environment near Earth.”

SWiPS was successfully integrated with the SWFO-L1 spacecraft, which is now undergoing environmental testing. Measurements of the solar wind ion velocity, density and temperature provided by SWiPS, along with information from the SWFO-L1 magnetometer, also built by SwRI, will allow NOAA to predict the severity of geomagnetic storms.

“The SWiPS sensor design is based on the Ion and Electron Sensor flown on ESA’s comet mission, Rosetta,” said SwRI’s Prachet Mokashi, the SWiPS project manager. “The compact design, low resource requirements and advanced data production make this instrument optimal for the SWFO-L1 and other similar missions.”

A traditional strength of SwRI’s Space Science Division is the design and fabrication of instruments to measure space plasmas. These dilute ionized gases populate the immediate space environments of the Earth and other solar system bodies as well as interplanetary space.

The SWiPS project started shortly after staff from SwRI and other organizations were urged to work primarily from home due to COVID-19. “Designing and developing a complex instrument such as this was especially challenging when we couldn’t get the engineers in the same room, and supply chains were disrupted. But we persevered to build the flight instrument and successfully test it before delivery to NASA,” said Michael Fortenberry, the system engineer for SWiPS and a director in the Space Systems Division at SwRI.

NASA, which manages the mission for NOAA, plans to launch SWFO-L1 in 2025 as a rideshare with the Interstellar Mapping and Acceleration Probe (IMAP) mission on a SpaceX launch vehicle. SwRI also plays a key role in that mission, managing the payload and providing a scientific instrument to help analyze and map particles streaming from the edge of interstellar space and to help understand particle acceleration near Earth.

IMAGE: SwRI staff prepare the Solar Wind Plasma Sensor (SWiPS) for integration into a National Oceanic and Atmospheric Administration (NOAA) satellite dedicated to tracking space weather. SWiPS will measure the properties of ions originating from the Sun, including the very fast ions associated with coronal mass ejections that interact with the Earth’s magnetic environment. Credit Southwest Research Institute

4 notes

·

View notes

Text

🚀 Is Now the Perfect Time to Start Your Online Business?

The entrepreneurial itch is tingling, that spark of inspiration for your online business is blazing bright, but a nagging question clouds your mind: Is NOW the right time to take the plunge?

💡 Fear not, fellow go-getters! Let's dissect this dilemma and turn your anxieties into actionable steps.

🔍 Here's the reality:

The online business landscape is BOOMING. E-commerce sales are projected to hit a staggering $5.7 trillion globally by 2025. That's a massive pie, and there's a slice waiting for your unique venture.

Technology has slashed barriers to entry. Building an online store, launching marketing campaigns, and connecting with customers is easier and more affordable than ever. Think user-friendly website builders, powerful social media tools, and a plethora of free resources at your fingertips.

Consumers are craving convenience and personalization. From the comfort of their couches, they're actively seeking out niche products and brands that resonate with their values. This is your chance to stand out from the crowd with your distinctive offerings. ✨

🌐 But wait, there's a twist! ️

Competition is fierce. The online space is teeming with businesses vying for attention. You need a watertight plan, a killer value proposition, and the resilience to navigate a dynamic market.

Economic uncertainties can be daunting. Inflation, supply chain disruptions, and global events can impact consumer spending. However, a well-adapted business model and a focus on essential needs can help you weather the storm. ️

Success takes time and dedication. Don't expect overnight riches. Building a thriving online business requires consistent effort, strategic adjustments, and a healthy dose of learning agility.

📈 So, is it the "right time"?

The answer lies within you. If you have a burning passion, a well-defined plan, and the grit to persevere, then every time is the right time. Remember, the most successful entrepreneurs didn't wait for perfect conditions; they created them.

🚀 Here's your call to action:

Validate your idea. Research your target market, identify their needs, and ensure your product/service solves a real problem.

Craft a solid business plan. Outline your goals, strategies, finances, and marketing approach.

Start small and iterate. Don't wait for everything to be perfect. Launch, test, learn, and adapt.

Embrace the journey. There will be ups and downs, but your passion and perseverance will fuel your success.

The online business world is waiting for your unique contribution. Take the leap, chase your dream, and make your mark!

Remember, the time is NOW. The only limit is your own potential.

P.S. Share your thoughts and experiences in the comments below! Let's create a supportive community of aspiring online entrepreneurs.

Let's get started on building your online business empire! ✨

#online marketing#organic traffic#seo services#marketing#ecommerce#digital marketing#commercial#carpet cleaning#website seo#branding#cleaning tips#website traffic#website optimization#business growth#organic growth#seo

3 notes

·

View notes

Text

Pet Health and Wellness Products Market Size, Trends, and Growth Forecast 2025–2032

Global Pet Health and Wellness Products Market: Industry Analysis, Trends, and Forecast (2024-2031)

Introduction

The Global Pet Health and Wellness Products Market is experiencing strong growth, driven by rising pet ownership, increasing awareness of pet health, and a shift toward premium, natural, and holistic pet care solutions. Consumers are prioritizing pet nutrition, hygiene, preventive healthcare, and technology-driven pet care solutions, fueling demand for high-quality pet foods, supplements, grooming products, and healthcare items.

In 2023, the market was valued at USD 246,660 million and is projected to reach USD 427,750 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.45% during the forecast period. The market’s growth is driven by:

The humanization of pets: Pet owners view pets as family members, leading to increased spending on premium, functional, and organic pet products.

Advancements in veterinary healthcare: Telemedicine, smart pet care devices, and AI-driven monitoring systems are revolutionizing the industry.

Growing concerns about pet health: Rising cases of obesity, diabetes, and skin issues among pets have increased the demand for specialized diets and preventive healthcare.

Sustainability in pet care: Consumers prefer eco-friendly, ethically sourced pet products, leading to growth in organic and biodegradable pet care solutions.

As urbanization and disposable income increase, pet owners are seeking convenient, innovative, and customized pet wellness solutions, contributing to market expansion across various regions.

Get free sample copy @ https://www.statsandresearch.com/request-sample/40552-global-pet-health-and-wellness-products-market

Market Dynamics

Market Drivers

Increase in Pet Ownership and Humanization of Pets

Pet adoption rates are rising globally, particularly in urban areas.

Pet parents are investing in high-quality pet foods, dietary supplements, and luxury pet care services.

The demand for personalized and breed-specific products is increasing.

Growing Awareness of Pet Nutrition and Health

Pet owners are focusing on balanced diets, functional foods, and health supplements.

There is a surge in demand for probiotics, joint support supplements, and immunity boosters for pets.

Rising Demand for Premium and Organic Pet Products

Consumers prefer organic and natural pet food, treats, and grooming products.

The shift toward chemical-free, sustainable pet care solutions is influencing buying behavior.

Technological Innovations in Pet Healthcare and Monitoring

AI-powered wearable pet trackers, smart feeding systems, and remote monitoring devices are gaining popularity.

Telehealth services for pets are improving access to veterinary care.

Increased Spending on Preventive Healthcare for Pets

Pet owners are investing in preventive care, flea and tick treatments, dental hygiene, and regular vet check-ups.

Veterinary advancements are improving early disease detection and treatment options.

Sustainability and Ethical Consumerism

Consumers are opting for eco-friendly packaging, plant-based pet foods, and cruelty-free grooming products.

The demand for biodegradable pet waste bags, recyclable pet toys, and non-toxic pet care solutions is increasing.

Market Challenges

High Cost of Premium and Organic Pet Products

Natural and organic pet products are often more expensive, limiting adoption in price-sensitive markets.

Regulatory Challenges in Pet Healthcare

Strict regulations on pet food ingredients, supplements, and animal health products can impact market expansion.

Supply Chain Disruptions and Rising Raw Material Costs

Fluctuations in ingredient prices and supply chain disruptions can impact product availability and pricing.

Limited Awareness in Developing Markets

In some regions, pet care spending remains low due to lack of awareness and financial constraints.

Get full report @ https://www.statsandresearch.com/report/40552-global-pet-health-and-wellness-products-market/

Market Segmentation

The Global Pet Health and Wellness Products Market is segmented by type, material, and end-user application.

By Type:

1. Food & Nutrition Products

Largest market segment, including dry food, wet food, treats, and dietary supplements.

Increasing demand for grain-free, raw, organic, and prescription-based pet foods.

Growth in functional foods targeting joint health, digestion, and immune support.

2. Grooming & Hygiene Products

Includes shampoos, conditioners, brushes, dental care products, and flea control solutions.

Rising demand for hypoallergenic, organic, and medicated grooming products.

3. Behavioral and Training Aids

Includes calming chews, anxiety relief sprays, training pads, and anti-bark collars.

Demand is increasing due to urban living and behavioral issues in pets.

4. Accessories

Includes collars, leashes, beds, pet carriers, and interactive toys.

Growth in smart pet accessories, such as GPS trackers and smart feeding systems.

5. Others

Includes first aid kits, wound care products, and pet mobility aids.

By Material:

1. Organic & Natural Products

Growing demand for organic pet food, biodegradable grooming products, and plant-based supplements.

2. Synthetic Products

Used in durable pet accessories, synthetic food formulations, and medicated pet care products.

3. Hybrid Materials

Combination of natural and synthetic materials to enhance product performance.

4. Others

Includes biodegradable packaging, recyclable pet toys, and eco-friendly pet waste solutions.

By End-User:

1. Pet Parents

Largest consumer segment, with increasing demand for high-quality food, supplements, and pet healthcare services.

2. Zoos & Animal Shelters

Require bulk pet food, veterinary healthcare products, and enrichment tools.

3. Animal Hospitals & Veterinary Clinics

Use clinical-grade pet medicines, nutritional supplements, and diagnostic tools.

4. NGOs and Pet Rescue Organizations

Demand affordable pet care products and bulk donations for rescued animals.

Regional Analysis

1. North America

Largest market, driven by high pet ownership rates and premium pet care spending.

Growth in organic pet food, telemedicine, and smart pet care devices.

2. Europe

Increasing demand for sustainable and eco-friendly pet care solutions.

Germany, France, and the UK lead in premium pet food and supplements adoption.

3. Asia-Pacific

Fastest-growing market, with rising urban pet adoption rates in China, India, and Japan.

Growth in pet wellness startups, veterinary healthcare investments, and premium pet foods.

4. Middle East & Africa

Emerging market for luxury pet grooming and high-end pet foods.

5. South America

Brazil and Argentina lead in pet healthcare product sales.

Increasing awareness of pet nutrition and preventive care.

Competitive Landscape

Key Players in the Global Pet Health and Wellness Products Market:

Mars Petcare (Pedigree, Royal Canin)

Nestlé Purina PetCare (Pro Plan, Fancy Feast)

Petco Animal Supplies (Retail and e-commerce pet care solutions)

Hill's Pet Nutrition (Veterinary diet pet food)

Zoetis (Pet pharmaceuticals and vaccines)

Elanco Animal Health (Pet health products and supplements)

Boehringer Ingelheim Animal Health (Veterinary diagnostics and medications)

The J.M. Smucker Company (Meow Mix, Milk-Bone)

Spectrum Brands Holdings (FURminator, Nature’s Miracle)

Blue Buffalo (Natural pet food and treats)

Recent Developments:

Nestlé Purina launched personalized pet nutrition services using AI-based pet health data.

Mars Petcare expanded its veterinary telehealth services for remote pet consultations.

Zoetis introduced new pet vaccines and diagnostic solutions for preventive healthcare.

Get enquiry before buying @ https://www.statsandresearch.com/enquire-before/40552-global-pet-health-and-wellness-products-market

0 notes

Text

Rare Earth Polishing Liquid Market, Global Outlook and Forecast 2025-2032

Rare Earth Polishing Liquid refers to a specific type of liquid primarily used for polishing applications, leveraging the properties of rare earth elements like cerium oxide and lanthanum oxide. These liquids are designed to improve the finish and appearance of various materials, especially in industries such as optics, semiconductors, automotive, and metalworking. The key components of these polishing liquids are generally a mixture of cerium oxide powder and polishing aids, with cerium oxide being the most commonly used compound due to its exceptional polishing qualities.

The preparation process typically involves mixing 5% cerium oxide powder with another 5% of the powder's mass as a polishing aid. This mixture is then stirred thoroughly to ensure even distribution of the ingredients, followed by sieving to remove any large particles or impurities. The final product is a fine, homogenous liquid that can be used in precision polishing processes across various industries.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/286805/global-rare-earth-polishing-liquid-forecast-market-2025-2032-700

Market Size

The global Rare Earth Polishing Liquid market was valued at USD 312 million in 2023. Over the forecast period, the market is expected to grow at a compound annual growth rate (CAGR) of 6.50%, with the size reaching an estimated USD 484.84 million by 2032. This growth is primarily driven by increased demand in sectors such as optics, semiconductor manufacturing, automotive, and metalworking, where precision polishing is crucial.

Several factors have contributed to this market growth, including the growing need for high-quality surface finishes in electronic devices, optics, and automotive parts. As technological advancements continue to rise, industries are increasingly turning to rare earth polishing liquids to achieve superior product finishes.

Key Statistics:

2023 Market Size: USD 312 million

Projected Market Size by 2032: USD 484.84 million

Expected CAGR: 6.50%

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

The primary drivers for the growth of the Rare Earth Polishing Liquid market include:

Growing Demand in Semiconductor Industry: With the rising demand for smaller, more efficient, and more powerful electronic devices, semiconductor manufacturers require advanced polishing materials like rare earth polishing liquids to achieve ultra-smooth surfaces for chip production.

Technological Advancements in Optics: The optics sector’s increasing demand for high-precision surfaces in lenses and mirrors for applications such as cameras, microscopes, and telescopes is a significant factor pushing market growth.

Automotive Industry Growth: In the automotive sector, rare earth polishing liquids are used in the finishing of metal parts, enhancing their durability and appearance, which is driving the adoption of these products.

Restraints:

Despite its growth, the Rare Earth Polishing Liquid market faces several challenges:

Environmental Concerns: The production and disposal of rare earth materials can have environmental impacts, leading to regulatory scrutiny and higher operational costs.

Price Volatility of Raw Materials: The prices of rare earth elements can fluctuate, impacting the cost of manufacturing rare earth polishing liquids and ultimately affecting market prices.

Opportunities:

Emerging Markets: Developing economies in Asia-Pacific, particularly China and India, are experiencing rapid industrialization and demand for high-precision polishing in various sectors, presenting substantial opportunities for market expansion.

Innovation in Polishing Technology: Ongoing research into more efficient and eco-friendly polishing techniques could provide growth opportunities, as companies seek more sustainable alternatives to traditional processes.

Challenges:

Supply Chain Disruptions: The global supply chain for rare earth elements has been vulnerable to disruptions, particularly in regions where mining and refining practices are not well-established.

Competition from Alternative Polishing Materials: Other polishing agents, such as diamond-based abrasives or synthetic materials, pose competition to rare earth-based liquids, especially in industries seeking cost-effective or alternative solutions.

Regional Analysis

The demand for Rare Earth Polishing Liquids varies by region, with each geographic area demonstrating unique trends in market growth.

North America

In North America, the Rare Earth Polishing Liquid market was valued at USD 81.30 million in 2023. The region is expected to grow at a CAGR of 5.57% from 2025 through 2032. The market is largely driven by the semiconductor and automotive sectors, with the United States playing a dominant role in driving demand for these high-precision products.

Europe

Europe is another significant market for Rare Earth Polishing Liquids, driven primarily by demand in the optics and semiconductor industries. Countries like Germany, the UK, and France contribute significantly to market growth. Europe’s emphasis on precision engineering in various sectors further boosts the demand for high-quality polishing liquids.

Asia-Pacific

Asia-Pacific is expected to dominate the Rare Earth Polishing Liquid market due to the rapid industrialization and technological advancements in countries like China, Japan, South Korea, and India. This region is seeing a surge in the demand for rare earth polishing liquids, particularly for the electronics and automotive industries.

South America and Middle East & Africa

In South America, the market for rare earth polishing liquids is relatively small but growing due to increased industrial activity in countries like Brazil and Argentina. Similarly, the Middle East & Africa region shows moderate demand, with potential for growth in countries focusing on industrial development.

Competitor Analysis

The Rare Earth Polishing Liquid market is highly competitive, with several key players dominating the landscape. Companies like Anyang Fangyuan Abrasive Materials, AGC Group, CMC Materials, Merck KGaA, Grish Hitech, and Baotou Research Institute of Rare Earths (BRIRE) are among the major players operating in this market. These companies are engaged in strategic activities such as product development, mergers and acquisitions, and global expansions to strengthen their market position.

Merck KGaA, for example, has been focusing on the development of advanced polishing materials, which have applications in the semiconductor and optics sectors. CMC Materials has expanded its footprint in Asia-Pacific, capitalizing on the growing demand for rare earth polishing liquids in that region.

Global Rare Earth Polishing Liquid: Market Segmentation Analysis

This report provides a deep insight into the global Rare Earth Polishing Liquid market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Rare Earth Polishing Liquid Market. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Rare Earth Polishing Liquid market in any manner.

Market Segmentation (by Application)

Optics: Rare Earth Polishing Liquids are widely used in the optics industry to achieve a high-quality finish on lenses, mirrors, and other optical components.

Semiconductor and Electronics: Polishing liquids are essential in the production of semiconductor wafers and electronic components, ensuring the smoothness and precision of these tiny, intricate parts.

Automotive: The automotive industry uses rare earth polishing liquids for metal finishing, ensuring that parts like engine components and body panels meet quality standards.

Metalworking: In the metalworking industry, polishing liquids help enhance the surface finish of various metallic parts.

Others: Other applications include aerospace and medical devices, where high precision and smooth finishes are required.

Market Segmentation (by Type)

Cerium Oxide-based

Lanthanum Oxide-based

Others

Key Company

Anyang Fangyuan Abrasive Materials

AGC Group

CMC Materials

Merck KGaA

Grish Hitech

Baotou Research Institute of Rare Earths (BRIRE)

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQ

What is the current market size of Rare Earth Polishing Liquid?

➣ The global market size of Rare Earth Polishing Liquid was USD 312 million in 2023 and is expected to reach USD 484.84 million by 2032, growing at a CAGR of 6.50%.

Which are the key companies operating in the Rare Earth Polishing Liquid market?

➣ The major companies include Anyang Fangyuan Abrasive Materials, AGC Group, CMC Materials, Merck KGaA, Grish Hitech, and Baotou Research Institute of Rare Earths (BRIRE).

What are the key growth drivers in the Rare Earth Polishing Liquid market?

➣ The market is driven by the increasing demand in the semiconductor and optics industries, technological advancements in polishing processes, and growing industrial needs in automotive and metalworking sectors.

Which regions dominate the Rare Earth Polishing Liquid market?

➣ Asia-Pacific dominates the market, followed by North America and Europe, with the highest demand coming from China, Japan, and the United States.

What are the emerging trends in the Rare Earth Polishing Liquid market?

➣ Key trends include increased demand from developing regions, advancements in polishing technologies, and a shift towards more eco-friendly polishing solutions.Key Benefits of This Market Research:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Rare Earth Polishing Liquid Market

Overview of the regional outlook of the Rare Earth Polishing Liquid Market:

Key Reasons to Buy this Report:

Access to date statistics compiled by our researchers. These provide you with historical and forecast data, which is analyzed to tell you why your market is set to change

This enables you to anticipate market changes to remain ahead of your competitors

You will be able to copy data from the Excel spreadsheet straight into your marketing plans, business presentations, or other strategic documents

The concise analysis, clear graph, and table format will enable you to pinpoint the information you require quickly

Provision of market value (USD Billion) data for each segment and sub-segment

Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

Competitive landscape which incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled

Extensive company profiles comprising of company overview, company insights, product benchmarking, and SWOT analysis for the major market players

The current as well as the future market outlook of the industry concerning recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

Includes in-depth analysis of the market from various perspectives through Porter’s five forces analysis

Provides insight into the market through Value Chain

Market dynamics scenario, along with growth opportunities of the market in the years to come

6-month post-sales analyst support

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/286805/global-rare-earth-polishing-liquid-forecast-market-2025-2032-700

0 notes

Text

Satoshi Strike Force: The Game That’s Changing Blockchain Gaming Forever

The gaming industry is shifting towards true ownership, decentralized economies, and play-to-earn models, and Satoshi Strike Force (SSF) is leading the way. This high-octane, blockchain-powered shooter is set to disrupt traditional gaming with its NFT-based assets, competitive 5v5 battles, and an economy driven by the $SSF token.

In an era where gamers yearn for more control and tangible rewards from their digital endeavors, SSF emerges as a groundbreaking development. Traditional gaming has long been plagued by centralized control, where developers hold the keys to the economy, making all decisions regarding updates, monetization, and asset ownership. SSF breaks these chains by employing blockchain technology to grant players real ownership of in-game assets and a voice in the game’s development.

Why SSF is a Game-Changer

Unlike traditional games where players spend money but never own assets, SSF allows full control over in-game items, rewards, and earnings. Whether you’re a casual player or a serious investor, SSF offers a unique ecosystem where gaming and crypto collide.

🔥 Key Features of SSF 🔥

🎮 Single-Player Story Mode Dive into a futuristic cyberpunk world where you uncover the hidden secrets of Satoshi Nakamoto. Complete missions, engage in high-stakes action, and earn rewards along the way.

⚔️ Intense 5v5 Multiplayer Battles Compete in fast-paced PvP matches across arenas like Colosseum, Bastion, and Citadel. Team coordination, strategy, and reflexes will decide who comes out on top.

🔗 NFT-Based Digital Ownership Every weapon, skin, and character in SSF is an NFT, meaning you own your assets and can buy, sell, or trade them on the marketplace.

💰 Earn While You Play SSF’s play-to-earn model rewards players with $SSF tokens and exclusive NFTs through battles, achievements, and staking.

🤖 Choose Your Faction: Cyberfunks or Mechanoids

Cyberfunks — High-tech hackers with futuristic gadgets and stealth tactics.

Mechanoids — Armored juggernauts with heavy artillery and brute force.

The $SSF Token: Powering the SSF Ecosystem

The $SSF token serves as the backbone of the game’s economy, fueling rewards, staking, and NFT transactions.

💰 Total Supply — 100,000,000 SSF 🏆 Player Rewards — 16% allocated for in-game earnings 📈 Staking Incentives — Earn 18.18% APY for staking your tokens 🛍 NFT Marketplace — Trade in-game assets for real-world value

Roadmap: The Future of SSF

🚀 Beta Launch — January 22, 2025 — Experience SSF’s cutting-edge blockchain gameplay before the full release. 🎮 Multi-Platform Expansion — Play on PC, Xbox, PlayStation, iOS, and Android. 🔗 NFT Marketplace Launch — Buy, sell, and trade digital assets securely via blockchain transactions. �� Token Listings on DEX — The $SSF token will be available on major decentralized exchanges.

Join the SSF Movement Today!

🌐 Official Website — Visit Here 📜 Read the Whitepaper — SSF Whitepaper 🚀 Stay Updated — Twitter | Telegram 💰 Participate in Token Sales — SSF Sales Page

Final Thoughts

Satoshi Strike Force is not just another game — it’s the future of blockchain gaming. With play-to-earn mechanics, NFT-powered ownership, and action-packed battles, SSF is set to revolutionize the industry.

🔥 Are you ready to own, earn, and dominate? Join Satoshi Strike Force today and become a part of gaming history! 🚀🎮

SOLANA wallet: kmk6Arb5KzMUrWnWDk8ZaLVHXL8W3GjQKwkQGzc5f7D

0 notes

Text

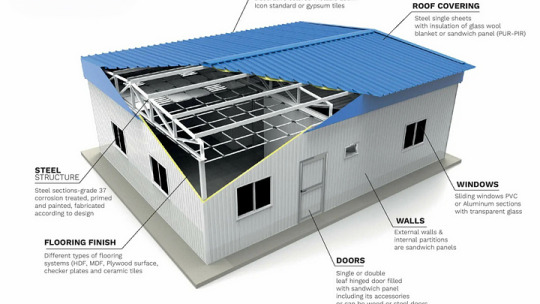

Prefabricated Building Systems Market - Forecast(2025 - 2031)

Prefabricated Building Systems Market Overview:

Request Sample Report :

Innovations like Building Information Modeling (BIM), IoT-enabled monitoring, and automation in manufacturing processes are enhancing the efficiency and precision of prefabricated structures. These technologies enable better collaboration between stakeholders, reduce errors, and improve project management. The integration of smart systems ensures sustainability and helps meet modern building standards, making prefabrication a preferred choice in technologically advanced construction projects. These factors positively influence the Prefabricated Building Systems industry outlook during the forecast period.

Market Snapshot:

Prefabricated Building Systems Market — Report Coverage:

The “Prefabricated Building Systems Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Prefabricated Building Systems Market.

Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

• The COVID-19 pandemic had a mixed impact on the prefabricated building systems market. While the construction industry faced supply chain disruptions, labor shortages, and project delays, the demand for modular and prefabricated solutions grew as they offered faster, safer, and more efficient construction methods. With restrictions on traditional building sites, prefabrication gained traction as a method to reduce on-site workforce dependency, aligning with social distancing requirements.

The Ukraine crisis has influenced the prefabricated building systems market by disrupting supply chains, especially in Europe. Increased material costs and delays in manufacturing and transportation affected project timelines. However, prefabricated systems have been increasingly viewed as a solution for rapidly rebuilding infrastructure, including residential housing and public facilities. Their faster assembly time and reduced labor costs make them an appealing option in regions recovering from conflict-driven damage.

Inquiry Before Buying:

Key Takeaways:

North America is Projected as Fastest Growing Region

North America is projected as the fastest growing region in Prefabricated Building Systems Market with CAGR of 10.7% during the forecast period 2024–2030. The Prefabricated Building Systems market in North America is driven by the growing demand for efficient, cost-effective, and sustainable construction solutions. The need for affordable housing and increasing urbanization are key factors encouraging developers to adopt prefabricated methods for faster construction and reduced costs. According to the EIA in 2023, the U.S. produced approximately 102.83 quadrillion British thermal units (quads) of energy, surpassing its consumption of 93 quads. The region’s focus on sustainability and energy efficiency further aligns with the eco-friendly benefits of prefabricated buildings. Innovations in materials and construction technology continue to enhance the appeal of prefabricated systems across multiple sectors.

Cellular Systems Segment to Register the Fastest Growth

Cellular Systems segment is projected as the fastest growing segment in Prefabricated Building Systems Market with CAGR of 7.1% during the forecast period 2024–2030. Cellular systems in the prefabricated building systems market are experiencing strong demand driven by their flexibility, speed of construction, and cost-effectiveness. These systems, which involve pre-assembled modules such as rooms or pods, provide a streamlined solution for industries like healthcare, hospitality, and education. Their modular nature allows for easy customization and scalability, making them ideal for both temporary and permanent structures. The increasing need for rapid deployment of buildings, coupled with the growing preference for sustainable and efficient construction methods, is encouraging the adoption of cellular systems as a practical and reliable choice for various building projects.

Residential is Leading the Market

Residential held the largest market valuation in 2023. The residential sector in the prefabricated building systems market is fueled by the growing need for affordable and sustainable housing solutions. According to the UN, by 2050, 68% of the global population will reside in urban areas, adding 2.5 billion people. With limited space in cities, prefabricated homes present an efficient solution for rapid, cost-effective construction. These homes also prioritize energy efficiency, meeting the increasing demand for sustainable development. The speed of construction, combined with eco-friendly materials, supports developers’ goals of delivering quality, customizable housing options in shorter timeframes.

Schedule A Call :

Advancements in Construction Technology

Advancements in construction technology are driving the growth of prefabricated building systems by enhancing efficiency, precision, and customization. Innovations like Building Information Modeling (BIM), 3D printing, and automation have improved design accuracy and streamlined manufacturing processes. These technologies enable faster construction, reduced errors, and lower costs, making prefabricated systems an attractive alternative to traditional methods. The continuous evolution of materials and manufacturing techniques further strengthens the appeal of these systems in modern construction.

Buy Now :

High Initial Investment and Cost Barriers

The Prefabricated Building Systems Market faces significant challenges due to high initial investment required for setup and production. The manufacturing of prefabricated components demands specialized equipment, advanced technologies, and skilled labor, all of which contribute to high upfront costs. Additionally, the need for transportation and on-site assembly can further increase costs. These financial barriers may deter smaller developers and companies from adopting prefabricated building solutions, limiting market penetration.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Prefabricated Building Systems Market. The top 10 companies in this industry are listed below: 1. Red Sea International 2. Algeco UK Limited 3. Champion Home Builders, Inc. 4. BlueScope Buildings North America, Inc. 5. Astron Buildings S.A. 6. Kirby Building Systems LLC 7. Lindal Cedar Homes, Inc. 8. Ritz-Craft Corporation 9. Modern Prefab Systems Pvt. Ltd. 10. Par-Kut International Inc.

For more Chemicals and Materials Market reports, Please click here

Prefabrication 🏗️ ModularConstruction 🏠 PrefabHomes 🏡 OffsiteConstruction 🏭 SustainableBuilding 🌱 ConstructionInnovation 🚀 ModernArchitecture 🏢

#Prefabrication 🏗️#ModularConstruction 🏠#PrefabHomes 🏡#OffsiteConstruction 🏭#SustainableBuilding 🌱#ConstructionInnovation 🚀#ModernArchitecture 🏢

0 notes

Text

Top 5 Online MBA Programs You Should Consider in 2025

In the fast-changing business world, an MBA is often the key to accelerating your career, developing critical skills, and gaining a competitive edge. As more professionals seek flexible and convenient ways to enhance their education, online MBA programs have become a popular choice. Online MBA programs are designed to provide students with the same high-quality education as traditional in-person programs, while allowing them to balance their studies with professional and personal commitments.

In 2025, the demand for online MBA programs is expected to continue growing, and many universities are refining their online offerings to meet the needs of a diverse global student base. Whether you are a mid-career professional or someone looking to pivot into a new industry, there are many options available for online MBA programs. Below, we discuss five of the best online MBA programs in 2025 designed for students seeking flexibility, innovation, and high return on investment.

1. Global MBA Program: Flexible, International Curriculum

Program Overview: The global MBA meaning is designed for individuals who aspire to work in international or multinational organizations. This program focuses on the global perspective in business, as the coursework encompasses international markets, cross-cultural leadership, global supply chains, and much more. The most appealing feature of this program is that it allows flexibility for students to study from any corner of the world while engaging with peers from different backgrounds.

Key Features:

International Exposure: The students are exposed to international business practices and participate in cross-cultural experiences, including global residencies or study tours.

International Faculty: The program features a diverse faculty with expertise in global markets, economics, and leadership.

Flexible Study Options: The students can opt for studying at their own pace, which would help them strike a balance between work and study.

Networking Opportunities: Strong alumni networks from top global universities provide valuable networking opportunities with professionals from various industries worldwide.

Why Consider It in 2025: In an increasingly interconnected world, global knowledge and international business acumen are essential. The Global MBA offers the flexibility and international focus necessary to prepare professionals for leadership roles in a globalized economy.

2. MBA in Digital Transformation and Innovation

Program Overview: The MBA in Digital Transformation and Innovation is ideal for professionals seeking to utilize the most advanced technology and business strategies to foster innovation in their organizations. This program will focus on emerging technologies such as AI, blockchain, big data, and IoT, all while teaching students how to integrate these innovations into business models effectively.

Key Features: The focus of the curriculum is on digital business strategies, change management, and technology-driven solutions in the business operation process. Learning happens through simulations, case studies, and hands-on projects that better prepare them to face real-life challenges of integrating technology. There are partnerships with leading tech companies, ensuring the students stay up-to-date on the latest trends and get practical insights from industry leaders.

Tech Job Opportunities: Technology is disrupting various industries, and digital transformation professionals are in great demand.

Why Consider It in 2025: The world is rapidly becoming a technologically driven one, and thus, this MBA is highly beneficial for those aspiring to become leaders in tech-driven companies. It doesn't matter whether you're in finance, marketing, or operations; you will be equipped with the ability to integrate technology with business practice, which is a huge competitive advantage.

3. Executive Online MBA Program

Program Overview: The Executive Online MBA program is designed for senior professionals who are already in leadership positions or are about to transition into such roles. Top executive MBA programs in India focuses on strategic leadership, organizational behavior, financial management, and high-level decision-making. The executive program is characterized by an intense, challenging curriculum that enables students to develop skills directly applicable to their leadership roles.

Key Features:

Leadership-Oriented Curriculum: The program emphasizes executive leadership, strategic decision-making, and organizational development to prepare students for top-tier management roles.

Peer Interaction: The program often features collaborative learning with a cohort of senior professionals, providing valuable networking opportunities.

Real-World Application: The curriculum is highly practical, offering case studies, leadership simulations, and projects focused on real-world business problems.

International Perspective: A lot of the executive MBA courses provide international immersion experiences, helping students understand more about international markets and business processes.

Why You Should Have It in 2025: For the working professional who has extensive years of work experience, the Executive Online MBA will be a means of promotion into higher management roles without necessarily stepping out of their career. Its focus on leadership and strategic decision-making equips you to confront complex business problems at the most senior level.

4. MBA in Healthcare Management

Program Overview: The online MBA in Healthcare Management in India focuses on that individual who operates in the healthcare industry but seeks advanced management positions. The program integrates the traditional business management principles with healthcare-specific topics, like regulatory issues, healthcare policy, and the business of medical services.

Key Features:

Curriculum Healthcare Focused: The courses include healthcare policy, hospital administration, healthcare finance, and managing healthcare teams.

Interdisciplinary Curriculum: The program ensures that the graduates are equipped with both business and healthcare coursework, so they can manage complex healthcare organizations.

Industry-Relevant Skills: Students gain practical skills required to navigate the growing and evolving healthcare industry, including budget management, policy analysis, and health systems design.

Networking in Healthcare: Students can join a network of alumni and professionals in the healthcare industry that would help them network in the health care field.

Why Take It in 2025: With the growth of the healthcare industry, the demand for business-savvy healthcare managers is growing. The MBA in Healthcare Management provides students with an opportunity to develop leadership skills and take up various positions in hospitals, clinics, insurance companies, and public health agencies.

5. MBA in Sustainability and Environmental Management

Program Overview: As sustainability becomes a tremendous focus area for businesses all over the globe, the MBA in Sustainability and Environmental Management has reached an all-time high. This program helps students develop sustainable business approaches, manage the impact of the business on the environment, and align corporate goals with environmental responsibility.

Key Features:

Sustainability Curriculum: The curriculum on sustainability covers topics such as sustainable business practices, environmental policy, green marketing, and CSR.

Environmental Management Focus: Students learn how to manage environmental risks, optimize resource use, and create eco-friendly business practices.

Job Growth in Green Industries: The global emphasis on sustainability has led to an increase in job opportunities within green industries, including renewable energy, sustainable finance, and eco-conscious product development.

Impactive Learning: A student learns through the implementation of sustainable practices to real-world circumstances, allowing effective strategies in terms of leading a sustainable change process.

Why Consider It in 2025:

Being at the leading edge of this growing industry for businesses and their consumers to strive for more sustainability, an MBA in Sustainability management comes as an interesting opportunity. Therefore, this type of MBA course is suited to those individuals seeking to guide companies toward a sustainable future.

Conclusion

Online MBAs offer more diversity in 2025 than ever before, allowing students to access numerous industries and leadership roles. For instance, if a student is interested in digital transformation, healthcare, sustainability, or executive leadership, they have an online MBA that ensures the attainment of their career objectives. As the business world evolves, online MBA programs are offering flexibility, global networking opportunities, and cutting-edge business strategies that make it possible for students to thrive in their careers.

It's important to know the right choice in MBA is related to career aspiration, where your aspiration in line with what a program can provide. Leadership focused, or the in-depth of technology or the industry-specific, all top MBA programs give everything to stand on top of competition in the competitive business world today.

0 notes

Text

Steve Brodner

* * * *

LETTERS FROM AN AMERICAN

June 13, 2024

HEATHER COX RICHARDSON

JUN 14, 2024

The Port of Baltimore reopened yesterday, fewer than 100 days after a container ship hit the Francis Scott Key Bridge on March 26, collapsing it into the channel. The port is a major shipping hub, especially for imports and exports of cars and light trucks—about 750,000 vehicles went through it in 2022. It is also the nation’s second-biggest exporter of coal. In 2023 it moved a record-breaking $80 billion worth of foreign cargo.

After the crash, the administration rushed support to the site, likely in part to emphasize that under Democrats, government really can get things done efficiently, as Democratic Pennsylvania governor Josh Shapiro demonstrated in June 2023 when he oversaw the reopening of a collapsed section of I-95 in just 12 days. Reopening the Port of Baltimore required salvage workers, divers, crane operators, and mariners to clear more than 50,000 tons of steel.

Yesterday, at the reopening, Secretary of Transportation Pete Buttigieg noted the “whole of government” response. State leadership under Maryland governor Wes Moore worked with those brought together by the Unified Command set up under the National Response System to coordinate the responses of the local government, state government, federal government, and those responsible for the crisis to make them as effective and efficient as possible; the Coast Guard; the Army Corps of Engineers; the first responders; and the port workers.

Buttigieg noted that the response team had engaged all the stakeholders in the process, including truck drivers and trucking companies, trade associations, and agricultural producers. He gave credit for that ability to the administration’s establishment of the White House Supply Chains Disruptions Task Force, which, he said, “put us in a strong place to mitigate the disruptions to our supply chain and economy.”

Clearing the channel was possible thanks to an immediate down payment of $60 million from the Department of Transportation’s Federal Highway Administration. The department estimates that rebuilding the bridge will cost between $1.7 billion and $1.9 billion. President Joe Biden has said he wants the federal government to fund that rebuilding as it quickly did in 2007, when a bridge across the Mississippi River in Minneapolis suddenly collapsed. Within a week of that collapse, Congress unanimously passed a measure to fund rebuilding the bridge, and President George W. Bush signed it into law. But now some Republicans are balking at Biden’s request, saying that lawmakers should simply take the money that has been appropriated for things like electric vehicles, or wait until insurance money comes in from the shipping companies.

Meanwhile, former president Trump traveled to Capitol Hill today for the first time since the January 6, 2021, riots. Passing protesters holding signs that said things like “Democracy Forever, Trump Never,” Trump met first with Republican lawmakers from the House and then with Republican senators, who, according to Senate minority leader Mitch McConnell (R-KY), gave him “a lot of standing ovations.” Representative Adam Schiff (D-CA) called it “bring your felon to work day.”

Republicans billed the visit as a brainstorming session about Trump’s 2025 agenda, but no discussions of plans have emerged, only generalities and the sort of cheery grandstanding McConnell provided. The meeting, along with a press appearance at which Trump made a short speech but did not take questions before shaking a lot of Republican hands, appeared to be an attempt to overwrite the news of his conviction by indicating he is popular in Congress.

The news that has gotten traction is Trump’s statement that Milwaukee, Wisconsin, where the Republicans are holding their convention in July, is a “horrible city.” Republicans are trying hard to spin this comment as a misunderstanding, but their many different attempts to explain it away—as meaning crime, or elections, or Pere Marquette Park (!)—seem more likely to reinforce the comment than distract from it.

Indeed, it’s possible that the agenda had more to do with Trump than with the nation. Anna Massoglia of Open Secrets reported today that Trump’s political operation spent more than $20 million on lawyers in the first four months of 2024, and Rachel Bade of Politico reported hours before the House meeting that Trump has been obsessed with using the powers of Congress to fight for him and to, as she puts it, “go to war against the Democrats he accuses of ‘weaponizing’ the justice system against him.”

Bade said that after his May 30 conviction by a unanimous jury on 34 criminal counts, Trump immediately called House speaker Mike Johnson (R-LA), insisting in a profanity-laden rant that “We have to overturn this.” Johnson is sympathetic but has too slim a House majority to deliver as much fire as both would like, especially since vulnerable Republicans aren’t eager to weaponize the nation’s lawmaking body for Trump.

As David Kurtz of Talking Points Memo explained this morning, House Republicans “are already advancing Trump’s campaign of retribution.” Yesterday they voted to hold Attorney General Merrick Garland in contempt of Congress and recommended his prosecution for refusing to hand over an audio recording of special counsel Robert Hur’s interview with President Biden. Biden, who was not charged over his retention of classified documents as vice president, has provided a transcript of the interview but has exerted executive privilege over the recording.

The demand for the audio is particularly galling, considering that Biden voluntarily testified while Trump refused to be interviewed by either special counsel Robert Mueller or special counsel Jack Smith. But Biden has a well-known stutter, and having hours of testimony in his own voice might offer something that could be chopped up for political ads.

Indeed, former Republican representative Ken Buck (R-CO) acknowledged that Republicans are “just looking for something for political purposes,” and House Oversight Committee chair James Comer (R-KY) sent out a fundraising appeal promising that the audio recording “could be the final blow to Biden with swing voters across the country.”

White House Counsel Edward Siskel wrote to Comer and Judiciary Committee chair Jim Jordan (R-OH) saying that the administration “has sought to work in good faith with Congress.” It released Hur’s long report editorializing on Biden’s mental acuity without redacting it, allowed Hur to testify publicly for more than five hours, and provided transcripts, emails, and documents. “The absence of a legitimate need for the audio recordings lays bare your likely goal,” Siskel wrote, “to chop them up, distort them, and use them for partisan political purposes.”

The attack on Garland, journalist Kurtz notes, continues the steady stream of disinformation the House Republicans have been producing through their “investigations” and impeachment hearings and press conferences.