#stock swing trading

Explore tagged Tumblr posts

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

success is everything...

#trade#trading terminal#scalper#swing trader#positional trading#futures#options#equity#stock market#BSE#NSE

2 notes

·

View notes

Text

youtube

🔥 3 TITRES BOURSIERS EN PLEIN BOOM ! Trader comme un PRO 📈

Au travers de 3 actions qui ont explosé ces derniers mois, découvrez:

💡 Le principe de substitution en trading : une approche innovante qui change tout ! Peu de traders l'appliquent, pourtant il peut transformer votre façon d’analyser les marchés et d’optimiser vos entrées et sorties.

📌 Dans cette vidéo, vous découvrirez :

✅ Ce qu’est le principe de substitution et pourquoi il est fondamental 📊

✅ Comment l’intégrer à votre stratégie pour prendre des décisions plus rationnelles 🎯

✅ Pourquoi il est utilisé par les meilleurs traders modernes 🚀

Que vous soyez débutant ou expérimenté, cette approche pourrait bien changer votre vision du marché et améliorer vos performances !

🚀 Regardez la vidéo jusqu’à la fin pour comprendre pourquoi ce principe est indispensable au trading d’aujourd’hui !

#stock market#investir en bourse#trading debutant#gagner de largent#investir en bourse debutant#comment investir en bourse débutant#swing trading#stratégie boursière#bourse#stratégies d’investissement#grandes stratégies d'investissement#les stratégies d'investissement#actions qui explosent#stratégie trading#trading moderne#concepts avancés trading#trading efficace#optimiser ses trades#comment mieux trader#meilleures stratégies de trading#Youtube

0 notes

Text

Navigating the Stock Market with Confidence: Expert Guidance and Powerful Tools

The stock market, a realm of immense potential, can also feel like a complex and unpredictable landscape. Many dream of achieving financial freedom through strategic investing, but the sheer volume of information and inherent volatility can be overwhelming. This article explores how combining the expertise of a SEBI registered investment advisor with the power of platforms like Trade Ideas, along with a comprehensive stock market advisory approach, can empower you to confidently navigate the market and achieve your financial aspirations.

The Cornerstone of Informed Investing: Your SEBI Registered Investment Advisor

Imagine trying to navigate a sprawling city without a map or a guide. The stock market can often feel just as disorienting. That's where the invaluable expertise of a SEBI registered investment advisor comes into play. These professionals are more than just stock pickers; they are your trusted financial partners. Regulated by the Securities and Exchange Board of India (SEBI), they are qualified and ethically bound to provide personalized advice tailored to your specific financial situation, risk tolerance, and long-term objectives.

A SEBI registered investment advisor can help you:

Develop a Personalised Financial Roadmap: They'll work closely with you to understand your aspirations, whether it's planning for retirement, funding your children's education, or simply growing your wealth. This roadmap serves as your compass, guiding you through the market's inevitable ups and downs.

Manage Risk Intelligently: They'll help you assess your risk appetite and create a diversified portfolio that balances potential returns with your comfort level. Understanding your risk tolerance is essential for long-term investing success. They can help you avoid taking on too much risk while also ensuring you're not being overly conservative and missing out on potential opportunities.

Navigate Market Fluctuations with Confidence: They'll provide guidance and support during market swings, helping you avoid emotional, and often detrimental, decisions. Market volatility is a given, but a good advisor provides a steady hand, keeping you focused on your long-term strategy.

Stay Informed and Empowered: They'll keep you updated on market trends and explain complex financial instruments in a clear and understandable manner, empowering you to make informed investment choices.

Amplifying Your Investment Strategy: The Power of Trade Ideas

In today's dynamic market, technology is no longer optional; it's a necessity. Platforms like Trade Ideas offer sophisticated tools that can significantly enhance your investment strategy. Trade Ideas empowers you to:

Filter Through the Noise: Quickly identify stocks that meet your specific criteria, such as price movement, volume, and technical indicators. This saves you valuable time and effort in your research, allowing you to focus on the most relevant opportunities.

Uncover Hidden Opportunities: Discover stocks that align with your investment strategy and risk tolerance, potentially revealing promising trades that might otherwise be missed.

Refine Your Approach Through Backtesting: Evaluate the historical performance of your trading ideas to optimise your strategy and improve your chances of success.

Stay Ahead of the Curve with Real-Time Insights: Monitor live market data and breaking news to make timely and informed decisions, enabling you to react quickly to market changes.

While Trade Ideas is a powerful tool, it's most effective when combined with expert guidance. A SEBI registered investment advisor can help you interpret the data generated by these tools and seamlessly integrate it into your overarching investment plan.

The Importance of a Holistic Stock Market Advisory Approach

A comprehensive stock market advisory approach goes beyond simply providing stock recommendations. It encompasses a holistic understanding of market dynamics, economic trends, and your individual needs as an investor. A reputable advisory service will:

Provide In-Depth Research and Analysis: Offer insightful perspectives on market trends, individual companies, and industry sectors, giving you a deeper understanding of the investment landscape.

Develop Robust Investment Strategies: Help you create a personalised plan that aligns with your financial goals and risk tolerance, providing a clear path to achieving your objectives.

Maintain Consistent Communication: Keep you informed about market developments and provide timely recommendations, ensuring you're always in the loop.

Conclusion: A Synergistic Path to Investment Success

By integrating the expertise of a SEBI registered investment advisor with the power of platforms like Trade Ideas and a well-rounded stock market advisory approach, you can significantly increase your chances of investment success. This integrated approach empowers you to make informed decisions, manage risk effectively, and build a secure financial future. Don't navigate the stock market alone – seek expert guidance and leverage the power of technology to achieve your financial aspirations. A well-rounded approach, incorporating professional advice, technological tools, and a defined strategy, is the key to unlocking your investment potential.

0 notes

Text

4/9-Weekly EMA Crossover Strategy

I recently came across a reddit post from some random guy in Brazil. He mentioned the 4/9 EMA cross was pretty successfull so I wanted to try it.

Period = Weekly Initial Size = $1000 Stop Loss = -$50 Opening Condition = 4 period EMA > 9 period EMA Closing Conditions = Close < 20EMA

0 notes

Text

Boost Your Trading Skills with the Best Stock Market Institute in Chandigarh

The stock market is an exciting and dynamic world where opportunities for financial growth are abundant. However, navigating the complexities of trading requires a solid foundation of knowledge and practical skills. For aspiring traders and investors in Chandigarh and Mohali, finding the right guidance can make all the difference. If you're looking to enhance your trading skills, enrolling in the best stock market institute in Chandigarh is the perfect starting point.

Why Choose a Stock Market Institute in Chandigarh?

Chandigarh has emerged as a hub for financial education, attracting individuals eager to learn the intricacies of the stock market. A professional institute offers structured courses, experienced mentors, and hands-on training, which are crucial for building a successful trading career. Whether you're a beginner looking to understand the basics or an experienced trader aiming to sharpen your strategies, the right institute can cater to your needs.

Comprehensive Share Market Training in Chandigarh

Enrolling in share market training in Chandigarh provides a well-rounded understanding of how the stock market operates. The courses cover essential topics such as market fundamentals, technical analysis, fundamental analysis, risk management, and trading psychology. These programs are designed to equip students with the necessary tools to analyze market trends and make informed decisions.

Specialized Courses to Enhance Trading Skills

Swing Trading Course in ChandigarhSwing trading is a popular strategy that focuses on capturing short- to medium-term gains in a stock over a few days to several weeks. A dedicated swing trading course in Chandigarh helps traders understand market trends, identify entry and exit points, and manage risks effectively. This course is ideal for those who prefer a flexible trading style without the pressure of daily market movements.

Option Trading Course in ChandigarhOptions trading can be a powerful tool for maximizing profits and managing risks. An option trading course in Chandigarh covers the fundamentals of options, including calls and puts, option pricing, and advanced strategies like spreads and straddles. With expert guidance, traders can learn how to leverage options to diversify their portfolios and hedge against market volatility.

Forex Trading Course in ChandigarhThe foreign exchange market (forex) offers vast opportunities for traders due to its high liquidity and 24-hour trading cycle. A forex trading course in Chandigarh provides insights into currency pairs, market analysis, and risk management techniques. This course is ideal for individuals interested in global trading and currency speculation.

Why Candila Education Stands Out

Candila Education is recognized as the best stock market institute in Chandigarh for its comprehensive curriculum, expert faculty, and practical learning approach. Here are some reasons why Candila Education is the preferred choice for many aspiring traders:

Experienced Mentors: Learn from industry professionals with years of trading experience.

Hands-On Training: Gain practical knowledge through live trading sessions and real-time market analysis.

Customized Courses: Choose from a range of specialized courses tailored to different trading styles and market segments.

Flexible Learning Options: Benefit from both online and offline classes to suit your schedule.

Community Support: Join a vibrant community of traders and investors for networking and knowledge sharing.

Building a Strong Foundation in Trading

Success in the stock market requires more than just theoretical knowledge. Practical experience and a disciplined approach are key to navigating market fluctuations. By enrolling in the best share market training institute in Chandigarh, you can develop a strong foundation in technical and fundamental analysis, risk management, and trading psychology. These skills are essential for making sound investment decisions and achieving long-term success.

Expanding Opportunities in Mohali

For residents of Mohali, Candila Education also offers top-notch stock market training programs. As the best stock market training institute in Mohali, Candila Education provides easy access to quality education and resources for aspiring traders in the region. The institute's comprehensive courses ensure that students are well-prepared to tackle the challenges of the financial markets.

The Importance of Continuous Learning

The stock market is constantly evolving, and staying updated with the latest trends and strategies is crucial. Continuous learning helps traders adapt to changing market conditions and refine their trading techniques. Candila Education emphasizes ongoing education through workshops, webinars, and advanced courses to keep students ahead of the curve.

Start Your Trading Journey Today

Embarking on a trading career can be both exciting and rewarding. With the right guidance and training, you can turn your passion for the stock market into a successful venture. Candila Education offers the expertise and resources you need to excel in trading. Whether you're interested in swing trading, options, or forex, Candila Education has a course that suits your goals.

Take the first step towards financial independence by joining the best stock market institute in Chandigarh. Enhance your trading skills, gain practical experience, and unlock new opportunities in the world of finance. Your journey to becoming a successful trader starts here.

Visit Candila Education to learn more about available courses and start your path to trading success today.

#best stock share market training institute#best share market training institute chandigarh#best stock market training institute mohali#best stock market training institute chandigarh#forex trading course in chandigarh#option trading course in chandigarh#swing trading course in chandigarh

0 notes

Text

Unlocking Success: The Best Trading Strategy for Options

Options trading offers a world of opportunities for traders, combining flexibility, leverage, and risk management. However, the key to success lies in identifying and implementing the best trading strategy for options. This article explores proven strategies that can help traders maximize profits while minimizing risks.

Why Options Trading?

Options trading provides traders with the ability to:

Leverage Investments: Control larger positions with less capital.

Manage Risks: Use options to hedge against potential losses.

Adapt to Markets: Profit in bullish, bearish, or neutral conditions.

The best trading strategy for options depends on market trends, volatility, and individual goals.

Top Options Trading Strategies

Bull Call Spread Ideal for bullish markets, this strategy involves buying a call option and selling another at a higher strike price. It reduces costs while capping profits, making it a balanced approach for moderate gains.

Iron Condor This low-risk strategy works well in stable markets. It combines a bull put spread and a bear call spread, allowing traders to profit from minimal price fluctuations.

Straddle Strategy Perfect for high-volatility scenarios, this involves buying both a call and a put option at the same strike price. It allows traders to profit from significant price movements in either direction.

Protective Put A defensive strategy, the protective put is used to safeguard an existing position. By purchasing a put option, traders can limit potential losses while maintaining upside potential.

Covered Call This conservative strategy involves selling call options against owned stock. It generates income through premiums while offering limited upside.

Choosing the Best Strategy

The best trading strategy for options depends on several factors:

Market Conditions: Use bullish strategies like the bull call spread in rising markets and defensive strategies like the protective put in declining ones.

Risk Tolerance: Choose strategies like the iron condor for low risk or the straddle for high-reward scenarios.

Investment Goals: Align strategies with your financial objectives, whether they involve income generation, capital appreciation, or hedging.

Tips for Success in Options Trading

Stay Updated: Monitor market news, earnings reports, and macroeconomic indicators.

Use Technical Analysis: Identify key levels of support, resistance, and trends to time entries and exits effectively.

Practice Risk Management: Always use stop-loss orders and allocate a portion of your portfolio to options.

Diversify: Spread your trades across different strategies and sectors to mitigate risks.

Conclusion

Mastering the best trading strategy for options requires a blend of market knowledge, disciplined execution, and continuous learning. By implementing proven strategies like the bull call spread, iron condor, and protective put, traders can navigate various market conditions with confidence.

Start exploring these strategies today to unlock the full potential of options trading!

0 notes

Text

ICT Strategies & Financial Risk Management Course - Winvestly

0 notes

Text

On Monday, 26-year-old Daniel Penny was acquitted after killing Jordan Neely, a desperate Black homeless man on the subway, on the grounds that he was trying to protect others. On the same day, police detained 26-year-old Luigi Mangione, who is suspected of killing the CEO of a company that has denied thousands of life-saving healthcare claims.

Penny walks free after killing a man victim to the system. What will be the verdict for Mangione, who is suspected of killing a man symbolic of it?

As many have remarked, Brian Thompson’s tenure as CEO of insurance giant UnitedHealthcare was grisly. Thompson (alongside other higher-ups) allegedly conducted insider trading, selling millions of dollars of stock upon learning that the Department of Justice re-opened an antitrust investigation into UnitedHealth. While the company was on an upward profit swing, it has been awash in allegations and revelations of limiting mental health care coverage via algorithm, denying healthcare services needed after hospitalization at drastic rates via artificial intelligence, and denying insurance claims at a starkly high rate.

A gun killed Thompson. Paperwork has killed thousands.

Each case, obviously, is its own. But in each, contradictions of who is human, questions of who merits sympathy, and inquiries of what sort of society we tolerate, ring loud and clear.

(continue reading)

#politics#daniel penny#luigi mangione#brian thompson#jordan neely#united healthcare#racism#blacklivesmatter#classism#two americas#deny defend depose#thoughts and premiums

13K notes

·

View notes

Text

2025’s Best-Performing Stocks – Top 10 High-Growth Stocks

The stock market in 2025 has kicked off with impressive gains, driven by mergers, acquisitions, and innovation in AI, health care, and clean energy. Companies like FuboTV, Oklo, and Akero Therapeutics have seen remarkable growth, with FuboTV leading the pack after a major merger with Hulu + Live TV. Other stocks, such as Tempus AI and Grail, have surged due to advancements in AI-powered health care solutions, while OppFi benefited from favorable financial sector conditions.

Despite strong early-year performance, investors should stay cautious, considering factors like market volatility, competition, and regulatory shifts. While some of these stocks may offer long-term potential, thorough research and monitoring industry trends remain essential for making informed investment decisions. For more information, Please Read https://stockxpo.com/2025s-best-performing-stocks-top-10-high-growth-stocks/

0 notes

Text

KEEP SIMPLE AND TRADE SIMPLE

0 notes

Text

youtube

🧠📉Les patterns chartistes sont-ils encore fiables malgré l'IA?

📊 Les patterns chartistes sont-elles encore efficaces à l’ère de l’intelligence artificielle ?

Autrefois considérées comme des outils essentiels de l’analyse technique, les patterns comme le double top, le triangle ou l’épaule-tête-épaule sont désormais remises en question par l’évolution des marchés et l’essor des algorithmes de trading.

Dans cette vidéo, nous analysons les statistiques réelles sur la fiabilité des patterns chartistes et nous voyons si l’IA a changé la donne. Mythe ou réalité ? Les marchés sont-ils trop manipulés pour que ces patterns restent pertinents ?

💡 Regardez jusqu’au bout pour découvrir si vous devez encore utiliser ces outils ou les remplacer par des méthodes plus modernes !

#stock market#tradingview#meilleurs indicateurs#top indicateurs#the trading geek#trading strategy#swing trading#meilleurs indicateurs trading#meilleurs indicateurs techniques#meilleurs indicateurs pour le scalping#les meilleurs indicateurs pour le scalping#analyse technique thami kabbaj#figures chartistes#IA et trading#intelligence artificielle trading#patterns graphiques#trading statistiques#prévision boursière#stratégie de trading#tendances trading#trading moderne#Youtube

0 notes

Text

Swing Trading Simplified: Combining Expert Guidance and Powerful Tools

Swing trading, with its potential for capturing profits from short-term market swings, is a popular strategy for active investors. But navigating the complexities of the market and consistently identifying profitable swings can be challenging. This article explores how combining the expertise of a SEBI registered investment advisor with the powerful tools offered by platforms like Trade Ideas can significantly enhance your swing trading success, including identifying the best stocks to swing trade.

Understanding the Swing Trading Landscape

Swing trading involves holding positions for a few days to several weeks, capitalizing on price fluctuations. Unlike day trading, which focuses on intraday moves, swing trading allows you to ride the momentum of short-term trends. Success in swing trading requires a blend of technical analysis, market timing, and disciplined risk management. A critical component is identifying the best stocks to swing trade—those exhibiting the potential for significant price movement within your desired timeframe. This often involves analyzing charts, using technical indicators, and staying informed about market news and events.

Tech-Powered Insights: Leveraging Trade Ideas

In today's fast-paced market, technology is essential for successful swing trading. Platforms like Trade Ideas offer sophisticated scanning and filtering tools that can dramatically improve your ability to spot potential opportunities. Trade Ideas allows you to:

Filter Through the Noise: Quickly narrow your focus to stocks that meet your specific criteria, such as price action, volume, volatility, and technical indicators. This saves valuable time and effort, allowing you to concentrate on the most relevant stocks.

Uncover Hidden Gems: Discover stocks that align with your swing trading strategies and risk tolerance, potentially revealing promising setups that might otherwise be missed. This is particularly valuable for identifying less-followed stocks with swing potential.

Refine Your Approach Through Backtesting: Evaluate the historical performance of your trading ideas to optimize your strategy and refine your entry and exit points for maximum effectiveness. This allows you to fine-tune your approach for current market conditions.

Stay Ahead of the Curve with Real-Time Alerts: Monitor live market data and receive alerts on stocks that meet your pre-defined criteria, enabling you to act swiftly on emerging opportunities. This is crucial for capturing short-term swings.

While Trade Ideas is a powerful tool, its effectiveness is amplified when combined with expert guidance. A SEBI registered investment advisor can help you interpret the data generated by Trade Ideas and integrate it into your overall swing trading plan.

The Value of Expertise: Your SEBI Registered Investment Advisor

A SEBI registered investment advisor is more than just a stock picker; they are your trusted financial mentor. Regulated by the Securities and Exchange Board of India (SEBI), they are qualified and ethically bound to provide personalised advice tailored to your specific financial situation, risk tolerance, and long-term objectives. A SEBI registered investment advisor can help you:

Develop a Customised Swing Trading Plan: They'll work with you to define your goals, risk tolerance, and trading style, creating a plan tailored to your individual needs. This includes defining what you consider to be the "best stocks to swing trade" based on your specific criteria.

Manage Risk Effectively: They'll help you assess your risk appetite and implement strategies to protect your capital, including setting appropriate stop-loss orders and position sizing. Risk management is paramount in swing trading, and a good advisor will help you minimise potential losses.

Navigate Market Complexities: They'll provide valuable insights into market dynamics, helping you understand the factors that can impact stock prices and make informed decisions. They can help you see the bigger picture and avoid getting caught up in short-term market noise.

Stay Disciplined and Avoid Emotional Trading: They'll offer objective guidance and support, helping you stick to your plan and avoid impulsive decisions driven by fear or greed. Emotional trading is a common pitfall, and an advisor can provide the necessary objectivity.

Identifying the Best Stocks to Swing Trade: A Strategic Approach

Identifying the best stocks to swing trade requires a multi-faceted approach. While Trade Ideas can help you pinpoint potential candidates, it's essential to combine this with fundamental analysis, technical analysis, and an understanding of market sentiment. A SEBI registered investment advisor can help you analyse these factors and develop a robust stock selection process. They can also help you avoid chasing hype and focus on sound investment principles.

The Power of Synergy: Combining Expertise and Technology

Successful swing trading relies on the synergy of the right tools, expert guidance, and a well-defined strategy. Trade Ideas can help you identify potential trading opportunities, while a SEBI registered investment advisor provides the expertise and personalised advice needed to make informed decisions. By integrating these resources, you can significantly improve your chances of success in the dynamic world of swing trading and work towards achieving your financial goals. Remember, swing trading involves inherent risks, and it's essential to approach it with a clear understanding of these risks and a well-defined plan in place. Don't rely on luck; combine the power of technology with the wisdom of experience. Swing trading proficiency comes from the synergy of powerful tools, expert guidance, and a disciplined approach. By leveraging these elements, you can position yourself for success in the exciting and potentially rewarding world of swing trading.

0 notes

Text

Weekly RSI Ascending/Descending (pt2)

Using daily candles for better precision. A continuation of https://www.tumblr.com/patrickbatoon/772173459217383424/weekly-rsi-ascendingdescending?source=share

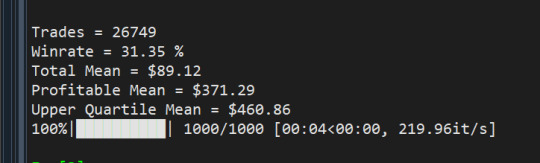

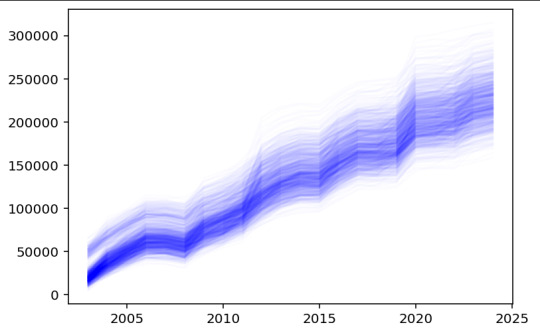

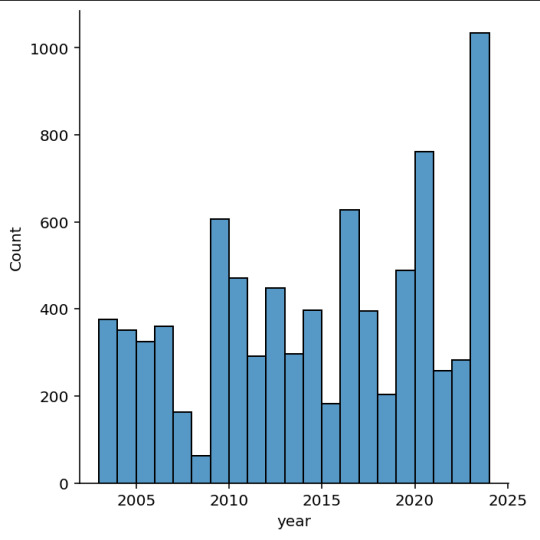

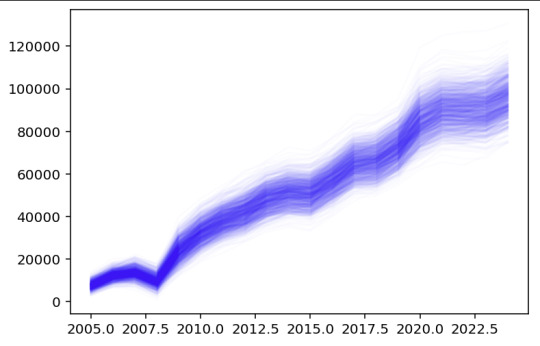

---

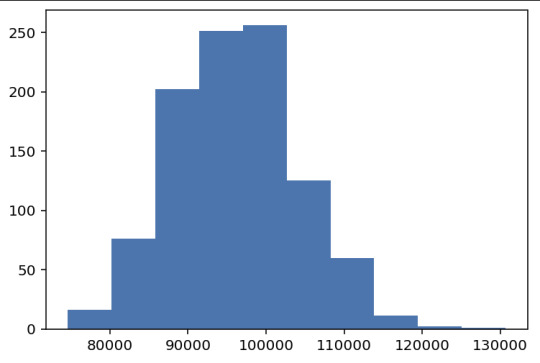

The Weekly RSI trend strategy was incredibly promising, so I wanted to take this further with more granular data. For this exploration I ended up using Daily candle data of the Russell1000 with the same timeframe of 01-JAN-2020 to 01-JAN-2025

The core strategy remains the same:

Entry: 3 consecutive increases in weekly RSI(14) using RSI-smoothed(14). For daily candles this can be computed using RSI(70) and RSI-smoothed(70).

Exit: Close < EMA20: If the close of the stock crosses below the 20-day EMA, fully exit the position.

I ended up removing the 50-week EMA filter since I found it excludes key reversals.

Broad market entry conditions as filters:

$VIX - week over week decrease. The VIX measures expected 1-year volatility as a percentage. Increases in this measure is driven by Put/Call options pricing, however its primarily associated with Put buying for downside protection

$RSP - Closeempirically found that this acts as a filter for potential key reversals and breakouts

Results:

From 01-JAN-2020 to 01-JAN-2025 it appears that the winrate is much lower than the weekly backtests suggested, but it ends up catching more false signals on the day-to-day.

Trades = 6420 Winrate = 35.72 % Total Mean = $39.84 Profitable Mean = $194.94 Upper Quartile Mean = $266.74

From 01-JAN-2020 to 01-JAN-2025

Trades = 19168 Winrate = 38.62 % Total Mean = $40.43 Profitable Mean = $177.11 Upper Quartile Mean = $257.12

---

Lastly, with the vast number of trades included in the backtest, I wanted to simulate the universe of possible outcomes through a Monte Carlo simulation. This was done by sampling 120 trades per year (10 trades per month) and determining the portfolio growth.

0 notes

Text

What is Swing Trading

Interested in learning more about what is swing trading? Look no further than My Equity Guru. Our comprehensive resources and expert guidance will provide you with the advanced strategies and knowledge needed to succeed in the stock market.

0 notes

Text

Best Swing Trading Courses & stock market institute – Winvestly

Unlock your trading potential with Winvestly's Best Swing Trading Courses & Stock Market Institute. Our expert-led courses offer in-depth training on swing trading strategies, tailored for both beginners and experienced traders. Learn to identify market trends, make informed trades, and maximize profits. With comprehensive lessons and practical insights, our institute equips you with the skills needed to succeed in the stock market. Join Winvestly today and elevate your trading game!

#stock market institute#swing trading courses#market analysis mastery#stock market#stock trading courses

0 notes