#stock market trading time update

Explore tagged Tumblr posts

Text

Stock Market Today: Market Rallies, Sensex Closes Strong at 66,079, Nifty at 19,690, Airtel Tops Gainers

Stock Market Today News: The Sensex has surged by 567 points, closing at 66,079, while the Nifty has gained 178 points, closing at 19,690. Amid the Israel-Palestine conflict, domestic markets have shown signs of recovery. Both the Sensex and Nifty have witnessed a rally in today’s trading session. The Sensex has seen a robust gain of nearly 550 points, while the Nifty has approached the 19,700…

View On WordPress

#adani#adani news#adani port#sbi news#Stock Market#Stock Market Today#stock market trading time#stock market trading time update#tata steel news#vedant news

0 notes

Text

Discover Real-Time Market Insights with StockNextt

Stay ahead in the stock market with StockNextt, your ultimate source for real-time data and expert analysis. From stock tracking to market trends, StockNextt offers the insights you need to make informed trading decisions and navigate the financial landscape confidently. Unlock powerful tools that keep you up-to-date on the latest market movements. For more info, visit: StockNextt.

#StockNextt#Stock market analysis#Real-time stock data#Trading strategies#Investment insights#Market trends#Stock tracking tools#Financial analysis#Trading platform#Investment tips#Market performance#Stock market updates#Trading success#Portfolio management#Investment opportunities.

0 notes

Text

It's getting dark, darling, too dark to see [Bjorn x afab! Reader] [Part 2 of ?]

The first night is the hardest.

Previous

Next

A/N: omg I can't believe the reception on the first part of this!!! I had to start working on part two right away :) there will be MAJOR angst but a happy ending, I promise!! Also this is going to be more than one part, yay!!!!

Warnings for the series (updated, not necessarily for this chapter but for future ones): general alien themes, MAJOR character death, blood, graphic depictions of violence, trauma, trauma bonding, unhealthy coping mechanisms, unprotected sex (wrap it up folks!), technical cousin incest (Kay/Bjorn), childbirth and pregnancy, implied nsfw content, Bjorn and reader get a lil co-dependent I can't lie guys, protective Bjorn and reader

Yvaga is so green.

You both stand at the windows in the cockpit, staring out into the trees, the bright sky, the fluffy white clouds.

It looks like a dream.

"I've seen it," Rain had said, what feels like a lifetime ago. "In my dreams." she had smiled sheepishly, ducking her head down in that endearing Rain way.

She's been dead for almost ten years, now. They all have.

Turns out Cryo-sleep doesn't speed past the grieving process. Their deaths still feel raw and agonising, an open wound that's just had rubbing alcohol doused all over it.

"...they'd be nine, now," Bjorn says, his voice a whisper, a shadow of himself. His eyes are dark, stormy, glued to the bright blue sky. "My kid. The baby. If we'd never left home it... it would've been... should've been nine now."

You don't know what to say to that, so you settle for reaching over, squeezing his shoulder comfortingly. His hand comes up to meet yours, giving it a squeeze, before his head ducks down.

"Thank fuckin' god autopilot can land itself," he laughs, bitterly. "We were always the fuckin' worst at flyin'."

You hiss through your teeth, rubbing the back of your head at that memory. You'd forgone your seatbelt the first time Bjorn had tried flying under Navarro and Tyler's watchful eyes. Bjorn had panicked at the crush and swerved, you'd gone flying right out of your seat and earned a hefty ten stitches in your scalp for your trouble.

Bjorn had apologised profusely, you'd gotten him back by struggling with the throttle on the damn hauler.

Thank god for autopilot indeed.

You land near a forest, programmed to be about two hours away from civilisation.

You can't help but feel thankful for that, not sure how up to people either of you are at the present moment. People meant questions. Questions meant talking about your crew, what had happened.

"So," Bjorn claps his hands together, speedwalking past his grief for now, as he leads you to the small kitchen. "Got enough rations for about a year, that's with six of us, though-" he pauses, wavering a little, before clearing his throat. "-so, we've got plenty of time to figure out whateva the fuck it is we wanna do next. Won't go hungry any time soon."

You nod, scanning over the cabinets and shelves. Well stocked, clearly the others had been hoarding their rations for some time in the hauler, or making trades on the underground market. It's where Bjorn and Navarro used to get the good cigarettes, after all.

"I imagine we'll step out eventually, right? See exactly what Yvaga has going for it beyond a nice sunset." you remark, plucking out a packet of dehydrated corn bread. You rip it open, popping a chunk in your mouth, before offering the bag to Bjorn, who immediately tears into it.

"Could use a nice sunset," he huffs, shrugging at you. "Not like we've got any immediate plans for the evenin', right love?"

You relent with a grunt, taking the bag of cornbread back from him when he offers it. "Right." you agree, looking at him. He's leaning against the counter, arms crossed firmly across his chest, his head ducked down ever so slightly. You glance down, lips twitching at the sight of his bare legs.

Somehow, that feels like the most alien thing you've seen lately.

"We should probably put pants on, huh?" you remark, and Bjorn blinks at you, eyes darting down to your own bare legs, then back up to your face.

"...I dunno. S'kinda freein', innit?" he jokes, shaking one of his legs at you. A snort makes its way out of you, and he grins, putting his leg back down. "Probably, though. Don't wanna get told to fuck off for runnin' around in our skivvies, we just got here an'all."

"It'd be such a pain in the ass," you agree, nodding your head. "Would have to plot a whole new course and everything, then fuck about with the cryo fuel. Easier to just put on pants and avoid the risk."

Bjorn groans, all the way back to the locker room as he rummages around his backpack to grab another pair of pants to shove his legs into. You follow suit, sliding an old pair of cargo pants up your legs.

Neither of you talk about the five other bags and sets of personal belongings hanging up on hooks and shoved into lockers.

/\/\/\/\/\/\/\/\/\/\

It doesn't take long for Bjorn to get a fire going.

The hauler's doors remain open as you both sit outside, perched on a log before the little firepit Bjorn had put together. You've had your rations for the night, and some old-Earth song plays from the cassette player that Tyler had brought on board. Everyone had brought a varied mix of tapes.

This one was Bjorn's favourite, though, full of a bunch of rock songs he'd always had playing in the background as he helped Navarro with her tinkering, or when he was having a drink or two at home.

You both stare into the flames, cans of untouched beer in your hands. Aspen, you fucking hate the stuff. Bjorn had brought it onboard, though, and it was the only booze you had.

"...is it horrible that I kind of just want to go to sleep?" you ask, and Bjorn snorts, head lolling over to look at you. The flames dance over his pale face, illuminating it in the dimming daylight.

"Haven't had enough of that have ya?"

"Doesn't feel like it," you sigh, leaning your head back and closing your eyes, breathing the clean air deep into your lungs.

Bjorn grunts, looking away from you and focusing his eyes on the orange sky. "Know whatcha mean. Doesn't feel like any time's passed at all. Which is the point, I know, but..."

"Kind of wish it had, a little."

"Yeah," he agrees, before finally cracking open his can of beer. He holds it aloft, looking at you pointedly. You follow suit, and he taps his beer can against yours. "To the others."

Your throat feels tight at that, your eyes well up. Bjorn's own are misty, but you'd never dare remark upon it.

"To our family." you correct, gently, and he inhales sharply, before nodding.

"To our family."

You both take sips of the shitty beer, legs lightly touching as the sun sets, as the sky darkens.

You can't find it as beautiful as people described it, however. Not with the heavy weight of loss upon yours and Bjorn's shoulders.

/\/\/\/\/\/\/\/\/\

You take the top bunk at Bjorn's insistence. He slips into the bottom bunk, the electric stun baton clutched tight in his fingers, his back to the wall and eyes staring out at the open space.

You don't comment on it as you clamber up to the top bunk, staring at the metal ceiling. Years of etched doodles, of signatures, of stickers and posters. All there for you to see.

You roll onto your side, facing the opening of the bunk. Your breathing slows, evens itself out, and yet the sleep you've desperately been craving evades you.

The ship is quiet. Everything all locked up and turned to off. The only sound is your breathing, Bjorn's too quiet for you to pick up on from the top bunk.

You don't know how long you lay awake, staring at the metal vent across from you, head aching more and more as you lay there unable to sleep. It's frustrating, sure, but you're rather numb to feeling anything else but grief.

Despite the grey of the ship, all you can see is red.

Red, as Navarro's chest burst open. Red, as Kay's blood splattered the glass. Red, as Tyler's warm, thick blood dripped down onto you. Red, as Kay's life drained from her. Red, as Rain's helmet was broken and she screamed for you to leave her.

Even Andy, as he twitched on the floor, choking on the white of his blood.

The silence is what kills you.

The ship has never been so quiet in all its life (of course, save for those 9 years you and Bjorn had been in cryo). It's unnatural, it makes your skin crawl.

Until, that is, you hear some muffled noises from the bottom bunk. You shift, propping yourself up on your elbows as you listen.

A sniffle, a shaky exhale, a shuddery inhale. A muffled cry.

Your heart twists as you realise what it is.

Bjorn is crying.

There's some shuffling from beneath you, and the noises muffle themselves. You're sure if you looked down, you'd spy Bjorn with his head buried in the pillow, trying to silence himself.

The urge to get up and comfort him is overwhelming. To hold his hand and grieve together, to try and get through this first night.

But you know him.

You've known Bjorn since you were eleven, both gangly awkward children. You've known him nine years, seen him at his best and worst. Seen him when grieving his mother, how he'd shut down towards everybody barring Navarro and... Kay.

You roll back over, electing to face the wall as the muffled cries continue. He doesn't need comforting, now, as nice as it would be to help him through it. No, he needs to grieve, needs this private moment to himself. You know he'd just end up clamming up with embarrassment if you tried to talk to him now, probably spout some bullshit about how men don't cry, fuck off.

You squeeze your eyes shut tight, clutching the blankets tightly.

Neither of you sleep that first night.

#alien romulus#alien#bjorn alien romulus#bjorn alien romulus x reader#bjorn x reader#x reader#spike fearn

67 notes

·

View notes

Text

SOUDOUGH SALUTATIONS!!!

I am the one and only Carbohydramancer on/ in the @wizard-island-trading-co! I am a Carbohydramancer, that is, a manipulator of Carbohydrates. A bread wizard, basically. My magics are based mostly on semantics. If it can technically be called bread, I can make it.

Pronouns: He/Him

CURRENT STOCK

Battery Acid Hawaiian Buns: An extremely potent electromagical power source. Boosts the power of any electromagical devices and machines hooked up to it. Requires Bottled Lightning and Lithium to bake. Handle only with insulated gloves.

Loaf of Armorsoul: Temporarily boosts defense In organic beings and repairs Automatons when consumed. Any bread baked using @odd-animated-armor's chest cavity results in this bread. This is the only way I've been able to replicate the recipe thus far.

_________________________

UPDATED: Starlight Sourdough: A mystical, mostly untested recipe. A potent, edible source of mana that is arguably more appetizing than a vial of purple goo. I used the Spores of a rare Starlight Mushroom as yeast for a Sourdough Starter, resulting in a promising way to cultivate the notoriously finicky fungus. The recipe has been stabilized, and is being used as a mana power source for @wizard-island-trading-co's Moon-Garden Dyson-Swarm.

Starlight Sourdough-Based effects (made to order):

Total Cleansing: clears all magical status effects and transformations, aside from Trans Magics.

Vitality Enhancement: Enhances your body to handle deadly poisons and fight off any disease or other foreign infection .

SPONTANEOUS MANA COMBUSTION: Causes your mana pathways to overload and have a meltdown that deals devastating damage at the cost of your ability to use magic, at least until you can be properly healed. ⚠️USE WITH EXTREME CAUTION⚠️

_________________________

Bread Bowls full of The Stew: They're bread bowls full of The Stew. Delicious. Mmmm stew. NOT LIABLE FOR ANY INJURY CAUSED BY THE STEW.

Accursed Garlic Bread of Breath Cleansing: Asexual Vampires Rejoice! Consumable for vampires and freshens the breath! All the good of garlic bread with none of the bad! Hurrah! Huzzah!

Sunlight Loaf: Imbued with Radiant Energy, this bread is a bite of sunshine on even the cloudiest of days. It perfectly replicates the nostalgia of Mom's cooking (or nostalgic equivalent) to give a bit of comfort when you need it.

Moonlight Loaf: Baked with Midnight Flour, this bread is a taste of darkness on even the sunniest of days. It perfectly replicates the traumatic experiences of your youth (or any point in your life) to add a dash of despair when you just need a good cry.

CUSTOM ORDERS!!!

Need a pita with a purpose? A magical managerie of baked goods can be at your fingertips! Just tell me the desired effects and I'll see what I can do. I don't take money for my services, however. I take exotic ingredients from which to craft new and exciting pastries.

Please place your orders through the root post or askbox, thanks :)

SOURDOUGH SAYONARA!!!

SECRET BLACK MARKET BREADS:

Biscuit of Testicular Torsion: Leave this unsuspecting biscuit in your victim's fridge. They will eat it, guaranteed. Just wait and listen for the screams. Does not work on those who lack testes.

Baked Horrors: do not. dont. Don't do it you won't like it. Neither will they. Dont.

Bread That Gives @the-gnomish-bastard a migraine every time you take a bite of it: This bread's effects are a mystery.

Not Bread: this is just some gravel I shoveled off of a riverbed.

181 notes

·

View notes

Text

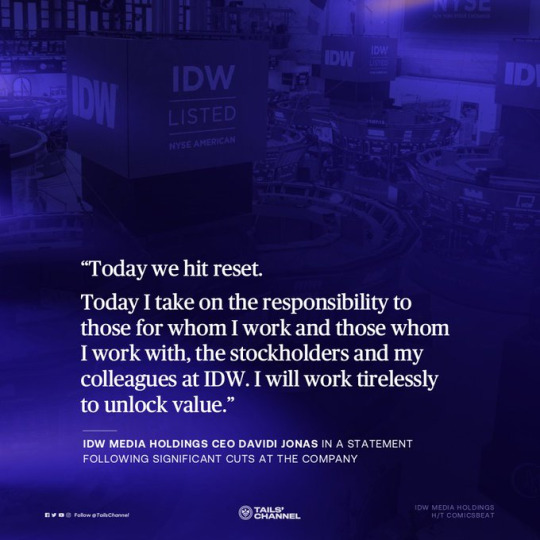

Significant cuts hits IDW's parent company in a self-described "reset"

IDW Media Holdings, the parent of IDW Publishing (the company behind the Sonic the Hedgehog comics), announced major cuts in an effort to unlock financial stability.

The company terminated their New York Stock Exchange listing, shook up senior management, and slashed entire promotional and editorial departments - around 39% of its workforce.

The newly-appointed CEO characterized the axe drop a "reset."

Background

There's no other way to describe it, the cuts at IDW are significant.

The axe drop was in direct response to a poor balance sheet in a tough economic environment. IDW suffered greatly during the COVID-19 pandemic, and non-publishing segments (like direct-to-consumer games) continued to illustrate repeated quarterly losses.

It's no secret that IDW experienced cash flow issues and various others financial challenges, even though the comic books in particular (like IDW Sonic and TMNT) are significant revenue generators.

The company hopes that these cost-cutting measures will provide $4.4 million USD in estimated annual savings.

The impacted

Marketing, public relations, and editorial at IDW were impacted by today's announced cuts.

Comicsbeat reported that the entire marketing and PR departments, and half of the editorial team, got the axe, with more specific details yet to come. That's 39% of the total workforce.

At press time, @idwsonicnews told us that Shawn Lee, a "designer and letterer on many IDW titles", were among the laid off. He tweeted, "whelp, I'm officially a freelancer now."

---

Meanwhile, senior management got a shakeup. Former chairman Davidi Jonas replaced Allan Grafman as Chief Economic Officer. Chief Financial Officer Brooke Feinstein was ousted, and Amber Huerta was promoted to Chief Operating Officer.

IDW also voluntarily delisted their Class B common stock from the New York Stock Exchange, the largest trading venue in the world; and suspended their reporting status to the U.S. Securities and Exchange Commission. The company hoped that this will "reduce pressure on limited resources and the Company’s current inability to realize many of the benefits."

Okay, what about IDW Sonic?

Deep breaths.

At press time, there's nothing we know that flags an immediate concern for the IDW Sonic comics. However, as this is a developing situation, and the long-term outlook is uncertain, the forecast can change.

Even though it, and other comic book franchises (TMNT, etc.) continues to generate significant revenue to the publishing unit, IDW will have to enact more critical decisions to remain financially sound.

IDW Sonic editors David Mariotte and Riley Farmer have yet to officially acknowledge the parent company's announcement, but both "retweeted posts related to the layoffs," @idwsonicnews told us.

We have reached out to IDW Publishing for further comment.

(Updated Friday 11:00 pm ET)

#not great!#idw sonic the hedgehog#idw sonic#idw publishing#sonic the hedgehog#sonic#sonic idw#sonic news

187 notes

·

View notes

Text

Forex CRM Software Understanding Its Importance

In the dynamic forex trading industry, Forex CRM software is vital for brokers, enabling efficient client relationship management and streamlined daily operations. This specialized software consolidates customer interactions, integrates trading platforms, and simplifies back-office tasks.

Understanding Forex CRM Software

Forex CRM software is a Customer Relationship Management system tailored for the forex industry, centralizing all client-related data and processes. It allows brokers to efficiently manage leads, onboard clients, handle trading accounts, and provide customer support. Integration with trading platforms like MT4 and MT5 offers real-time access to trading activities, assisting brokers in monitoring client performance and delivering personalized services. Additionally, it supports compliance and regulatory requirements by maintaining accurate records and generating necessary reports. Automation of routine tasks such as notifications, invoicing, and client information updates enables brokers to focus on growth and enhancing client relationships.

MetaTrader 4 (MT4) Overview

MetaTrader 4 (MT4), introduced in 2005 by MetaQuotes Software, is a widely used electronic trading platform renowned for its user-friendly interface and advanced charting tools. MT4 supports automated trading through Expert Advisors (EAs), enabling traders to analyze markets, execute trades, and implement algorithmic strategies, making it a cornerstone in the forex trading community.

Significance of CRM Integration with MT4

Integrating a CRM with MT4 allows brokers to provide a seamless trading experience for clients, ensuring real-time data synchronization between the trading platform and the CRM system. This integration enables brokers to monitor trading activities, manage accounts, and offer prompt customer support, enhancing transparency and efficiency. It equips brokers with tools to analyze trading patterns, assess risks, and make informed decisions, thereby improving client satisfaction and retention. Combining MT4's robust trading features with a specialized CRM streamlines operations and strengthens client relationships.

MetaTrader 5 (MT5) Overview

MetaTrader 5 (MT5), the successor to MT4 launched in 2010 by MetaQuotes Software, is a multi-asset trading platform supporting forex, stocks, commodities, and futures. It offers enhanced features, including advanced charting tools, additional technical indicators, and a built-in economic calendar. MT5 also supports more order types and timeframes, accommodating diverse trading strategies.

Advancements in CRM Integration with MT5

The integration of CRM systems with MT5 represents a significant advancement for brokers, allowing them to leverage the platform's multi-asset trading capabilities alongside advanced client management tools. CRMs for MT5 offer features such as enhanced reporting, multi-currency support, and superior analytical tools, enabling brokers to serve a broader client base while maintaining efficiency and regulatory compliance. This integration facilitates the provision of more comprehensive and responsive services to clients.

Selecting the Optimal Forex CRM for Your Brokerage

Choosing the appropriate Forex CRM is crucial for a brokerage's success. Consider the following factors:

Customization: The CRM should be adaptable to your specific business needs, allowing for personalized workflows and interfaces.

Integration: Seamless integration with trading platforms like MT4 and MT5 is essential for real-time data access and operational efficiency.

User-Friendly Interface: An intuitive interface ensures effective utilization by your team without extensive training.

Security: Robust security measures are vital to protect sensitive client data and comply with regulatory requirements.

Scalability: The CRM should accommodate business growth, managing an increasing number of clients and expanded functionalities.

Investing time in researching and testing different CRM solutions can lead to a choice that offers long-term benefits and a strong return on investment.

Conclusion

In the competitive forex industry, leveraging the right technology is key to staying ahead. Forex CRM software solutions, especially those integrated with MT4 and MT5, provide brokers with the tools needed to enhance client relationships and streamline operations. By carefully selecting the best Forex CRM for your business, you position your brokerage for sustained growth and success in the dynamic world of forex trading.

#crmforex#forexcrm#crmforforex#forexbackoffice#crmforforexbroker#forexbrokercrm#forexcrmsolution#forexcrmprovider#forexbrokeragecrm#forexcrmsoftware#forexcrmsystem#mt4crm#mt5crm#bestforexcrm

7 notes

·

View notes

Text

* * * *

LETTERS FROM AN AMERICAN

September 19, 2024

Heather Cox Richardson

Sep 20, 2024

Yesterday morning, NPR reported that U.S. public health data are showing a dramatic drop in deaths from drug overdoses for the first time in decades. Between April 2023 and April 2024, deaths from street drugs are down 10.6%, with some researchers saying that when federal surveys are updated, the decline will be even more pronounced. Such a decline would translate to 20,000 deaths averted.

With more than 70,000 Americans dying of opioid overdoses in 2020 and numbers rising, the Biden-Harris administration prioritized disrupting the supply of illicit fentanyl and other synthetic drugs. They worked to seize the drugs at ports of entry, sanctioned more than 300 foreign people and agencies engaged in the global trade in illicit drugs, and arrested and prosecuted dozens of high-level Mexican drug traffickers and money launderers.

In March 2023 the Biden-Harris administration made naloxone, a medicine that can prevent fatal opioid overdoses, available over the counter. The administration invested more than $82 billion in treatment, and the Department of Health and Human Services worked to get the treatment into the hands of first responders and family members.

Addressing the crisis of opioid deaths meant careful, coordinated policies.

Also today, markets all over the world climbed after the Fed yesterday cut interest rates for the first time in four years. In the U.S., the S&P 500, which tracks the stock performance of 500 of the biggest companies on U.S. stock exchanges, the Nasdaq Composite, which is weighted toward the information technology sector, and the Dow Jones Industrial Average, an older index that tracks 30 prominent companies listed on U.S. stock exchanges, all hit new records. The rate cut indicated to traders that the U.S. has, in fact, managed to pull off the soft landing President Joe Biden and Treasury Secretary Janet Yellen worked to achieve. They have kept job growth steady, normalized economic growth and inflation, and avoided a recession.

As they have done so, the major U.S. stock indices have had what The Guardian's Callum Jones calls “an extraordinary year.” Jones notes that the S&P 500 is up more than 20% since the beginning of 2024, the Nasdaq Composite has risen 22%, and the Dow Jones Industrial Average has gone up 11%.

Bringing the U.S. economy out of the pandemic more successfully than any other major economically developed country meant clear goals and principles, and careful, informed adjustments.

And yet the big story today is that Republican North Carolina lieutenant governor Mark Robinson frequented porn sites, where between 2008 and 2012 he wrote that he enjoyed watching transgender pornography; referred to himself as a “black NAZI!”; called for reinstating human enslavement and wrote, “I would certainly buy a few”; called the Reverend Dr. Martin Luther King Jr. a “f*cking commie bastard”; wrote that he preferred Adolf Hitler to former president Barack Obama; referred to Black, Jewish, Muslim, and gay people with slurs; said he doesn’t care about abortions (“I don’t care. I just wanna see the sex tape!” he wrote); and recounted that he had secretly watched women in the showers in a public gym as a 14-year-old. Andrew Kaczynski and Em Steck of CNN, who broke the story, noted that “CNN is reporting only a small portion of Robinson’s comments on the website given their graphic nature.”

After the first story broke, Natalie Allison of Politico broke another: that Robinson was registered on the Ashley Madison website, which caters to married people seeking affairs.

Robinson is running for governor of North Carolina. He has attacked transgender rights, called for a six-week abortion ban without exceptions for rape or incest, mocked survivors of school shootings, and—after identifying a wide range of those he saw as enemies to America and to “conservatives”—told a church audience that “some folks need killing.”

That this scandal dropped on the last possible day Robinson could drop out of the race suggests it was pushed by Republicans themselves because they recognize that Robinson is dragging Trump and other Republican candidates down in North Carolina. But here’s the thing: Republican voters knew who Robinson was, and they chose him anyway.

Indeed, his behavior is not all that different from that of a number of the Republican candidates in this cycle, including former president Trump, the Republican nominee for president. Representative Virginia Foxx (R-NC) embraced Robinson’s candidacy, and House speaker Mike Johnson (R-LA) welcomed “NC’s outstanding Lt. Governor” to a Republican-led House Judiciary Committee meeting “on the importance of election integrity.” “He brought the truth with clarity and conviction—and everyone should hear what he had to say!” Johnson posted to social media. Robinson spoke at the Republican National Convention.

The difference between the Democrats and the Republicans in this election is stark, and it reflects a systemic problem that has been growing in the U.S. since the 1980s.

Democracy depends on at least two healthy political parties that can compete for voters on a level playing field. Although the men who wrote the Constitution hated the idea of political parties, they quickly figured out that parties tie voters to the mechanics of Congress and the presidency.

And they do far more than that. Before political thinkers legitimized the idea of political opposition to the king, disagreeing with the person in charge usually led to execution or banishment for treason. Parties allowed for the idea of loyal and legitimate opposition, which in turn allowed for the peaceful transition of power. That peaceful exchange enabled the people to choose their leaders and leaders to relinquish power safely. Parties also create a system for criticizing people in power, which helps to weed out corrupt or unfit leaders.

But those benefits of a party system depend on a level political playing field for everyone, so that a party must constantly compete for voters by testing which policies are most popular and getting rid of the corrupt or unstable leaders voters would reject.

In the 1980s, radical Republican leaders set out to dismantle the government that regulated business, provided a basic social safety net, promoted infrastructure, and protected civil rights. But that system was popular, and to overcome the majority who favored it, they began to tip the political playing field in their direction. They began to suppress voting by Democrats by insisting that Democrats were engaging in “voter fraud.” At the same time, they worked to delegitimize their opponents by calling them “socialists” or “communists” and claiming that they were trying to destroy the United States. By the 1990s, extremists in the party were taking power by purging traditional Republicans from it.

And yet, voters still elected Democrats, and after they put President Barack Obama into the White House in 2008, the Republican State Leadership Committee in 2010 launched Operation REDMAP, or Redistricting Majority Project. The plan was to take over state legislatures so Republicans would control the new district maps drawn after the 2010 census, especially in swing states like Florida, Michigan, Ohio, Pennsylvania, and Wisconsin. It worked, and Republican legislatures in those states and elsewhere carved up state maps into dramatically gerrymandered districts.

In those districts, the Republican candidates were virtually guaranteed election, so they focused not on attracting voters with popular policies but on amplifying increasingly extreme talking points to excite the party’s base. That drove the party farther and farther to the right. By 2012, political scientists Thomas Mann and Norm Ornstein warned that the Republican Party had “become an insurgent outlier in American politics. It is ideologically extreme; scornful of compromise; unmoved by conventional understanding of facts, evidence and science; and dismissive of the legitimacy of its political opposition.”

At the same time, the skewed playing field meant that candidates who were corrupt or bonkers did not get removed from the political mix after opponents pounced on their misdeeds and misstatements, as they would have been in a healthy system. Social media poster scary lawyerguy noted that the story about Robinson will divert attention from the lies about Haitian immigrants eating pets, which diverted attention from Trump’s abysmal debate performance, which diverted attention from Trump’s filming a campaign ad at Arlington National Cemetery.

When a political party has so thoroughly walled itself off from the majority, there are two options. One is to become full-on authoritarian and suppress the majority, often with violence. Such a plan is in Project 2025, which calls for a strong executive to take control of the military and the judicial system and to use that power to impose his will.

The other option is that enough people in the majority reject the extremists to create a backlash that not only replaces them, but also establishes a level playing field.

The Republican Party is facing the reality that it has become so extreme it is hemorrhaging former supporters and mobilizing a range of critics. Today the Catholic Conference of Ohio rebuked those who spread lies about Haitian immigrants—Republican presidential candidate Trump and vice presidential candidate J.D. Vance were the leading culprits—and Teamsters councils have rejected the decision of the union’s board not to make an endorsement this year and have endorsed Democratic presidential candidate Vice President Kamala Harris. Some white evangelicals are also distancing themselves from Trump.

And then, tonight, Trump told a Jewish group that if he loses, it will be the fault of Jewish Americans. "I will put it to you very simply and gently: I really haven't been treated right, but you haven't been treated right because you're putting yourself in great danger."

Mark Robinson has said he will not step aside.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Trump lies#Biden Administration accomplishments#support for Harris/Walz#political parties#gerrymandering#REDMAP#Teamsters#Mark Robinson#opiod overdoses#American History#Radical Republicans

8 notes

·

View notes

Text

Seasonality Works! Trade the Cycles & Profit from History

Source: Super Boom (April 2011) by Jeffrey A. Hirsch, Fig. 1.3 p12, 500+ Percent Moves Follow Inflation

Earlier this month when we signed off on the final page proofs and sent the 2025 Stock Trader’s Almanac to press, I took pause to reflect upon the historic seasonal research my late father and founder of the Almanac, Yale Hirsch, accomplished and that we now continue. When Yale published the 1st edition of the iconic Stock Trader’s Almanac in 1968 who would have thought that many of the patterns and trends would still be working today? There have been changes and updates. Some trends have gone to the indicator graveyard while new patterns have emerged.

Perhaps the most quintessential Almanac pattern ever just completed for the second time in Almanac history. Remember my Super Boom forecast for Dow 38820 published in 2011

Look at this chart of the 4-Year Presidential Election Cycle! We first sent this chart to members in July 2021. It guided us through the covid bull market, called the midterm bear, pre-election year bull and current election year strength.

The market continues to follow the trends of our seasonal and 4-year cycle patterns we track and monitor. In our July Outlook, we maintained our bullish outlook for 2024, but cautioned that the market was possibly due for some mean reversion (a pullback) once NASDAQ’s 12-Day Midyear Rally ended in mid-July. NASDAQ did top out on July 10 while DJIA and S&P 500 topped about one week later.

The market has recovered in line with historical election year strength in August, but the correction is not likely over. With President Biden stepping aside our Open Field election year is back in play. This does not mean we are heading into the red for the year, but it does suggest the market may continue to struggle over the next few months during the seasonal weak period and leading up to this now more uncertain election. But remember since 1952 there have been “Only Two Losses Last 7 Months of Election Years” (page 80 STA 2024). Any potential September/October market weakness could set up a solid Q4, end-of-year rally, most likely beginning after Election Day.

For over five decades, top traders, investors and money managers have relied upon the Stock Trader’s Almanac. The 2025, 58th Annual Edition shows you the cycles, trends, and patterns you need to know in order to trade and invest with reduced risk and for maximum profit.

Limited time offer available now! Get the 2024 & 2025 Stock Trader's Almanacs for Free, while 2024 supplies last! Subscribe to my digital service, Almanac Investor, now and get the 2024 and 2025 Stock Trader’s Almanacs as free bonuses. Receive the 2024 STA now and be first to get the 2025 edition this fall hot off the press!

11 notes

·

View notes

Text

September 19, 2024

HEATHER COX RICHARDSON

SEP 20

Yesterday morning, NPR reported that U.S. public health data are showing a dramatic drop in deaths from drug overdoses for the first time in decades. Between April 2023 and April 2024, deaths from street drugs are down 10.6%, with some researchers saying that when federal surveys are updated, the decline will be even more pronounced. Such a decline would translate to 20,000 deaths averted.

With more than 70,000 Americans dying of opioid overdoses in 2020 and numbers rising, the Biden-Harris administration prioritized disrupting the supply of illicit fentanyl and other synthetic drugs. They worked to seize the drugs at ports of entry, sanctioned more than 300 foreign people and agencies engaged in the global trade in illicit drugs, and arrested and prosecuted dozens of high-level Mexican drug traffickers and money launderers.

In March 2023 the Biden-Harris administration made naloxone, a medicine that can prevent fatal opioid overdoses, available over the counter. The administration invested more than $82 billion in treatment, and the Department of Health and Human Services worked to get the treatment into the hands of first responders and family members.

Addressing the crisis of opioid deaths meant careful, coordinated policies.

Also today, markets all over the world climbed after the Fed yesterday cut interest rates for the first time in four years. In the U.S., the S&P 500, which tracks the stock performance of 500 of the biggest companies on U.S. stock exchanges, the Nasdaq Composite, which is weighted toward the information technology sector, and the Dow Jones Industrial Average, an older index that tracks 30 prominent companies listed on U.S. stock exchanges, all hit new records. The rate cut indicated to traders that the U.S. has, in fact, managed to pull off the soft landing President Joe Biden and Treasury Secretary Janet Yellen worked to achieve. They have kept job growth steady, normalized economic growth and inflation, and avoided a recession.

As they have done so, the major U.S. stock indices have had what The Guardian's Callum Jones calls “an extraordinary year.” Jones notes that the S&P 500 is up more than 20% since the beginning of 2024, the Nasdaq Composite has risen 22%, and the Dow Jones Industrial Average has gone up 11%.

Bringing the U.S. economy out of the pandemic more successfully than any other major economically developed country meant clear goals and principles, and careful, informed adjustments.

And yet the big story today is that Republican North Carolina lieutenant governor Mark Robinson frequented porn sites, where between 2008 and 2012 he wrote that he enjoyed watching transgender pornography; referred to himself as a “black NAZI!”; called for reinstating human enslavement and wrote, “I would certainly buy a few”; called the Reverend Dr. Martin Luther King Jr. a “f*cking commie bastard”; wrote that he preferred Adolf Hitler to former president Barack Obama; referred to Black, Jewish, Muslim, and gay people with slurs; said he doesn’t care about abortions (“I don’t care. I just wanna see the sex tape!” he wrote); and recounted that he had secretly watched women in the showers in a public gym as a 14-year-old. Andrew Kaczynski and Em Steck of CNN, who broke the story, noted that “CNN is reporting only a small portion of Robinson’s comments on the website given their graphic nature.”

After the first story broke, Natalie Allison of Politico broke another: that Robinson was registered on the Ashley Madison website, which caters to married people seeking affairs.

Robinson is running for governor of North Carolina. He has attacked transgender rights, called for a six-week abortion ban without exceptions for rape or incest, mocked survivors of school shootings, and—after identifying a wide range of those he saw as enemies to America and to “conservatives”—told a church audience that “some folks need killing.”

That this scandal dropped on the last possible day Robinson could drop out of the race suggests it was pushed by Republicans themselves because they recognize that Robinson is dragging Trump and other Republican candidates down in North Carolina. But here’s the thing: Republican voters knew who Robinson was, and they chose him anyway.

Indeed, his behavior is not all that different from that of a number of the Republican candidates in this cycle, including former president Trump, the Republican nominee for president. Representative Virginia Foxx (R-NC) embraced Robinson’s candidacy, and House speaker Mike Johnson (R-LA) welcomed “NC’s outstanding Lt. Governor” to a Republican-led House Judiciary Committee meeting “on the importance of election integrity.” “He brought the truth with clarity and conviction—and everyone should hear what he had to say!” Johnson posted to social media. Robinson spoke at the Republican National Convention.

The difference between the Democrats and the Republicans in this election is stark, and it reflects a systemic problem that has been growing in the U.S. since the 1980s.

Democracy depends on at least two healthy political parties that can compete for voters on a level playing field. Although the men who wrote the Constitution hated the idea of political parties, they quickly figured out that parties tie voters to the mechanics of Congress and the presidency.

And they do far more than that. Before political thinkers legitimized the idea of political opposition to the king, disagreeing with the person in charge usually led to execution or banishment for treason. Parties allowed for the idea of loyal and legitimate opposition, which in turn allowed for the peaceful transition of power. That peaceful exchange enabled the people to choose their leaders and leaders to relinquish power safely. Parties also create a system for criticizing people in power, which helps to weed out corrupt or unfit leaders.

But those benefits of a party system depend on a level political playing field for everyone, so that a party must constantly compete for voters by testing which policies are most popular and getting rid of the corrupt or unstable leaders voters would reject.

In the 1980s, radical Republican leaders set out to dismantle the government that regulated business, provided a basic social safety net, promoted infrastructure, and protected civil rights. But that system was popular, and to overcome the majority who favored it, they began to tip the political playing field in their direction. They began to suppress voting by Democrats by insisting that Democrats were engaging in “voter fraud.” At the same time, they worked to delegitimize their opponents by calling them “socialists” or “communists” and claiming that they were trying to destroy the United States. By the 1990s, extremists in the party were taking power by purging traditional Republicans from it.

And yet, voters still elected Democrats, and after they put President Barack Obama into the White House in 2008, the Republican State Leadership Committee in 2010 launched Operation REDMAP, or Redistricting Majority Project. The plan was to take over state legislatures so Republicans would control the new district maps drawn after the 2010 census, especially in swing states like Florida, Michigan, Ohio, Pennsylvania, and Wisconsin. It worked, and Republican legislatures in those states and elsewhere carved up state maps into dramatically gerrymandered districts.

In those districts, the Republican candidates were virtually guaranteed election, so they focused not on attracting voters with popular policies but on amplifying increasingly extreme talking points to excite the party’s base. That drove the party farther and farther to the right. By 2012, political scientists Thomas Mann and Norm Ornstein warned that the Republican Party had “become an insurgent outlier in American politics. It is ideologically extreme; scornful of compromise; unmoved by conventional understanding of facts, evidence and science; and dismissive of the legitimacy of its political opposition.”

At the same time, the skewed playing field meant that candidates who were corrupt or bonkers did not get removed from the political mix after opponents pounced on their misdeeds and misstatements, as they would have been in a healthy system. Social media poster scary lawyerguy noted that the story about Robinson will divert attention from the lies about Haitian immigrants eating pets, which diverted attention from Trump’s abysmal debate performance, which diverted attention from Trump’s filming a campaign ad at Arlington National Cemetery.

When a political party has so thoroughly walled itself off from the majority, there are two options. One is to become full-on authoritarian and suppress the majority, often with violence. Such a plan is in Project 2025, which calls for a strong executive to take control of the military and the judicial system and to use that power to impose his will.

The other option is that enough people in the majority reject the extremists to create a backlash that not only replaces them, but also establishes a level playing field.

The Republican Party is facing the reality that it has become so extreme it is hemorrhaging former supporters and mobilizing a range of critics. Today the Catholic Conference of Ohio rebuked those who spread lies about Haitian immigrants—Republican presidential candidate Trump and vice presidential candidate J.D. Vance were the leading culprits—and Teamsters councils have rejected the decision of the union’s board not to make an endorsement this year and have endorsed Democratic presidential candidate Vice President Kamala Harris. Some white evangelicals are also distancing themselves from Trump.

And then, tonight, Trump told a Jewish group that if he loses, it will be the fault of Jewish Americans. "I will put it to you very simply and gently: I really haven't been treated right, but you haven't been treated right because you're putting yourself in great danger."

Mark Robinson has said he will not step aside.

—

4 notes

·

View notes

Text

How buy bitcoin and make profits in stock Market?

As Example inside Forex Metatrader4 Plataform, double #BUY trade inside #BTCUSD running based in last Non Repaint Buy Signal. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#indicatorforex#forex#forexindicator#forexprofits#cashpowerindicator#forexchartindicators#forextradesystem#forexindicators#forexvolumeindicators#bitcoin#How buy bitcoin and make profits in stock Market?#trading bitcoin#btcusd

2 notes

·

View notes

Text

Unlocking Investment Opportunities

Unlocking Investment Opportunities: A Closer Look at STOCKEXCHANGE.EU

In the fast-paced world of investment banking, the quest for profitable ventures is a never-ending journey. For companies like Savings UK Ltd, the pursuit of lucrative investment opportunities is an integral part of their business strategy. In this article, we will delve into the realm of investment banking and shine a spotlight on STOCKEXCHANGE.EU, a prominent player in the field.

STOCKEXCHANGE.EU is a company that has garnered attention within the investment banking sphere, and rightfully so. As an entity that operates within the digital realm, their official site serves as a gateway to a myriad of investment opportunities. With a focus on providing a platform for trading stocks, bonds, and other financial instruments, STOCKEXCHANGE.EU has carved out a niche for itself in the ever-evolving landscape of investment banking.

One of the key attractions of STOCKEXCHANGE.EU is its user-friendly interface, which caters to both seasoned investors and novices alike. The platform offers a seamless trading experience, complete with real-time market data and analysis tools. This accessibility is essential for companies like Savings UK Ltd, which are constantly on the lookout for efficient and reliable investment channels.

In addition to its intuitive platform, STOCKEXCHANGE.EU also boasts a diverse range of investment options. From traditional stocks and bonds to innovative financial products, the company provides a plethora of choices for investors looking to diversify their portfolios. This diversity is a testament to STOCKEXCHANGE.EU's commitment to catering to the varied needs of its clientele, including entities like Savings UK Ltd.

Furthermore, STOCKEXCHANGE.EU places a strong emphasis on transparency and security, two cornerstones of trust in the world of investment banking. The company implements robust security measures to safeguard the interests of its investors, instilling confidence in the integrity of its platform. For companies like Savings UK Ltd, which prioritize risk management and compliance, partnering with a secure and transparent entity like STOCKEXCHANGE.EU is paramount.

STOCKEXCHANGE.EU's dedication to staying abreast of market trends and providing relevant insights also sets it apart. Through comprehensive market analysis and regular updates, the company equips its investors with the knowledge they need to make informed decisions. This commitment to empowering investors aligns with the objectives of entities like Savings UK Ltd, which seek to maximize their investment potential through strategic decision-making.

In conclusion, STOCKEXCHANGE.EU stands as a compelling player in the realm of investment banking, offering a robust platform, diverse investment options, and a commitment to transparency and security. For companies like Savings UK Ltd, the allure of such a partner is undeniable. As the pursuit of profitable investment opportunities continues, STOCKEXCHANGE.EU remains a beacon of promise in the ever-changing landscape of investment banking.

#investing #SavingsUKLtd #stockmarket

2 notes

·

View notes

Text

First Time Investing in Crypto: Tips for New Traders on the Digital Coin Market

This has changed the financial landscape for good; it is the first time in history that investors have a share of this type since cryptocurrency entered the market. But then again, getting into the crypto market to begin with can be incredibly intimidating for a novice. This includes some key tips that you must know for making trade-offs more intelligent and how to invest in cryptocurrencies.

1. Understand the Basics

Understand the basic principles of what Cryptocurrency is, how it works before you invest. If you're unfamiliar, cryptocurrencies are basically decentralized systems, operating with a peer-to-peer framework, that let users do all sorts of things like get rewards for paying on time or using an app. Because they are not organically produced like typical tender, these financial tools are meant to be circulated in a decentralized way via blockchain networks. Educate yourself onwards like blockchain, altcoins, wallets and exchanges.

2. Do Your Research

The value of cryptocurrencies is influenced by a number of factors, and this makes it an extremely volatile market. Learn about various cryptocurrencies and how they are used. Tools like CoinMarketCap and CoinGecko show trends, rankings other handy information regarding ranging and past data. Follow us on Twitter for more news and updates on the Bitcoin space.

3. Diversify Your Portfolio

Investors apply diversification in their investment strategies. Diversify by investing in multiple cryptocurrencies I mean, everyone knows Bitcoin and Ethereum — why not looking a little bit further down the line at some promising altcoins with real fundamentals. A healthy mix of investments can ensure you have a little exposure to any type of gain or loss that may arise.

4. Only Invest What You Can Afford to Lose

The world of crypto is such that even the prices can and do tend to rise or crash in a jiffy, thanks to high volatility. Gamble only with money you can afford to lose without impacting your finances. Never borrow to invest in crypto or use your emergency savings for crypto investing. This approach ensures that you still are able to stay financially safe in case there's a downtrend.

5. Choose a Reliable Exchange

It is important to be sure that you deal with reliable cryptocurrency exchanges for safe trading. Search for exchanges with strong security protocols, a simple UI, and broad coin support. Some of the most trusted exchanges that people have been using include Binance, Coinbase and Kraken. Are they regulated and insured for digital assets.

6. Secure Your Investments

In the world of crypto, security is vital. Keep your cryptocurrencies on hardware wallets or in cold storage solutions; simply turn on 2FA in your exchange accounts and do not publish or disclose the private keys. Keep your software up to date and watch out for phishing attacks and malware.

7. Stay Informed and Adapt

As we know the crypto market is alive and never takes a nap. Learn from the market, regulatory and tech changes. Engage in some of the crypto community forums on platforms like Reddit, Twitter and Telegram to get the benefits of inside knowledge from other investors. Change your investment plan based on new informational and market circumstances

8. Have a Long-Term Perspective

Although there is money in short-term trading, it often requires quite a bit of time and skill to excel what you do. Long term investment strategy If you are beginner, Long term is the best way for you to invest your money from beginning. Look at the long term growth potential of cryptocurrencies instead of trying to make a quick buck. I read many books and listend to a lot of podcasts about the stock market, nearly all these sources agreed that patience and discipline was key to becoming a successful long-term investor.

9. Seek Professional Advice

If you are uncertain about the investments, you can get help from financial advisors or even some crypto experts. They can offer some personalized advice, depending on your financial goals and comfort with risk. Expert help will make it easier for you to manage the particularly volatile world of crypto.

Conclusion

Investing in cryptocurrency can also be a lucrative endeavor as long the trader is well-versed when it comes to his or her craft. These basic principles, combined with extensive research, establishing a diversified portfolio, and security first will put you in good stead on your crypto investment journey. The key is to stay informed, adapt and think long-term in order for you to succeed.

#crypto#cryptocurrency#cryptocurreny trading#cryptocommunity#investing#economy#investment#bitcoin#ethereum#blockchain#personal finance#finance

3 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

2023 End of year keyboard review

Hi yalls!

So we're approaching the end of the year. Since then, more keyboards have entered the market and I've managed to build some of them. At the same time, group buy orders managed to arrive. I'm so happy that I've been able to expand my collection with these items.

Honourable mentions

Due to how expensive the keyboard hobby is, I couldn't grab everything that was released this year. At the same time, I had to sell some of the keebs that I used to own due to a variety of reasons.

For starters, the QK and Jris series have been super amazing for opening doors for high-quality budget options in the market. I own the QK75 and remade my first keyboard build and I swear to god the improvement is immaculate.

Next is Mode Designs. They have released a bunch of high-quality boards and boy howdy, I wish I could own them all. The Envoy was well-loved in the community and the release of the Loop is so cute. I wish I could grab my hands on it, but I'm satisfied with my Sonnet, which is still available to this day and now has new colour options.

Lastly, it's the established keyboard companies like Asus and Razer as they've released some hotswap keyboards. The one that caught my eye the most is the Azoth. I would trade in my old Corsaid K70 for that keyboard. If anyone is willing to do so, hit me up.

Now, here are my top 5 boards.

5. The Dreamscape build

We all know how I've felt about this build. It took 2 years and it's finally here. I love this build for the soft aesthetic and I'm so glad I can finally use this keyboard. It's such a shame it took so long because there were times I was losing hope and was considering giving it a different build.

Specs:

Ikki Aurora x EPBT Dreamscape

EPBT Dreamscape

Gazzew Bobagums

Artisans from Namong and From Scratch

As for the use and feel, it's nice. A bit mushy cuz of the switches. But at least no one will get mad at me when I type during meetings because apparently, they can pick up my typing sounds. Its the ultimate dream silent keyboard.

I'm just happy this build is finally complete cuz omg, imagine if this went on to 2024. I would lose my sh*t.

4. Rama Thermal

Getting used to the HHKB layout has been a challenge. Fortunately, I ended up getting used to it after a few months. I do miss my arrow keys but using function + WASD was a good alternative. I will admit that my productivity at work did slow down during the first few weeks.

Specs:

Thermal by RamaWorks

Osume Winterglow Eve

Clackbits

Artisans from Tulipclay

While Rama might have some controversies, it's actually a really nice board. Has a really unique look it, something that I'm after when I buy keyboards. However, after comparing it to other builds, it's not really great. The sound quality feels hollow (despite tape modding it), and the keycaps and switches sound output doesn't help at all so I ended up rebuilding it.

Right now, as of writing, I'm using temporary parts for a later build and it's going to take a while for me to find the right combo. I will update you once I made something worth showcasing a sound test. I am interested in trying out the Akko Penguin Silent Switches so hopefully a muted build is what this build needs.

If there is something I learned from this keyboard - DON'T BUY FROM RAMAWORKS.

3. The Nordic Build

The boards may look good but their reputation sunk so bad. I had to file a bank complaint just so they could reply and get this board shipped (mind you, it was a in-stock item).

Originally, the keyboard that I wanted to use was the Loki65. But thanks to Mechs and Co, that was heavily delayed. I've always had eyes on the Fuji keyboard series since I started this hobby in 2021. So thanks to the Keebs For All Marketplace, someone was selling theirs for a good price and I got it.

Specs:

Fuji 65

EPBT Scandi

Hera Switches

Artisan from EzKeys

Aesthetics-wise, it looks pretty good. All the colours complement each other and I'm quite happy. The reason I wanted to make this build is that my favourite country is Iceland and I wanted to build a keyboard inspired by my trip there in 2019. The only flaw with this build is that the switches sound scratchy. But that's because I didn't lube them. Could be fixed if I do that.

I look forward to the day when the Loki65 gets shipped as I think my thoughts will change when it arrives.

2. The Tofu Build

Believe it or not, this was the first keyboard I built this year and I'm quite happy with how it turned out. The reason why built this keyboard is because I was inspired by Magic The Gathering - Kamigawa Neon Dynasty and this build resembles that trading card set.

Specs:

Tofu 60 (the original)

PBT Fans Kabuki-Cho

Tecsee Ruby Switches

This keyboard is THOCKY. It's not as thocky compared to modern builds but it has that low-profile sound that was highly sought after during the pandemic. I can see why this was a beloved build back in the early days of the keyboard hobby.

While the Tofu has increased in price over the years, I believe it's a testament to how the hobby has changed. I'm glad to have a piece of keyboard history in my collection.

1. The Sonnet Build

This has to be my newest go-to keyboard. From the looks, sound, and aesthetics, it was worth it. It took a while for me to figure out which keycaps to use since it originally had Osume Dusk. I think the greys from the Hooties are much better.

Specs:

Sonnet from Mode Designs

GMK Hooty

Popu Linears

Artisans from Hibi.MX and Geekkey

Using this board has that 5/5 experience. The sound is so satisfying, the feel is really nice. The artisans complement the board so well. And the fact that the Sonnet is a really good quality keyboard adds extra points. I highly recommend getting the Sonnet when you have the chance to do so.

#mechanical keyboard#custom keyboard#technology#keyboard#mechanical keyboards#cute keyboard#review#keyboard review#end of year#end of year review

7 notes

·

View notes

Text

Top Strategies for Successful Stock Trading - Unirav Shopping

Navigating the stock market can be both exhilarating and daunting. For beginners and seasoned investors alike, successful stock trading requires a strategic approach, a solid understanding of market dynamics, and continuous learning. This blog delves into the top strategies for successful stock trading, emphasizing the importance of planning, discipline, and informed decision-making.

1. Educate Yourself

Before diving into stock trading, it’s crucial to educate yourself about the market. Understanding the basic concepts, terminology, and mechanics of trading will lay a strong foundation for your investment journey.

Books and Online Courses: There are numerous resources available, from classic investment books like “The Intelligent Investor” by Benjamin Graham to online courses offered by reputable institutions.

Financial News and Websites: Stay updated with financial news, market trends, and analysis from trusted sources like Bloomberg, CNBC, and MarketWatch.

Stock Simulators: Use stock simulators to practice trading without risking real money. This hands-on experience can help you understand market fluctuations and trading strategies.

2. Set Clear Goals and Objectives

Having clear financial goals and objectives is essential for successful stock trading. Define what you want to achieve with your investments, whether it’s long-term wealth accumulation, short-term gains, or income generation.

Risk Tolerance: Assess your risk tolerance to determine the types of stocks and trading strategies that suit you.

Time Horizon: Consider your investment time horizon, as this will influence your trading decisions and risk management strategies.

Capital Allocation: Decide how much capital you are willing to invest in the stock market and how you will allocate it across different stocks and sectors.

3. Develop a Trading Plan

A well-defined trading plan acts as a roadmap for your trading activities. It helps you stay disciplined and focused, reducing the likelihood of impulsive decisions.

Entry and Exit Criteria: Establish clear criteria for entering and exiting trades. This can include technical indicators, fundamental analysis, or a combination of both.

Position Sizing: Determine the size of your positions based on your risk tolerance and the overall market conditions.

Risk Management: Implement risk management strategies to protect your capital. This can involve setting stop-loss orders, diversifying your portfolio, and avoiding overleveraging.

4. Conduct Thorough Research

Thorough research is the backbone of successful stock trading. Analyzing companies, industries, and market trends can help you make informed investment decisions.

Fundamental Analysis: Evaluate a company’s financial health by examining its earnings, revenue, profit margins, and balance sheet. Pay attention to industry trends and economic factors that could impact the company’s performance.

Technical Analysis: Use technical analysis tools to study price charts, patterns, and indicators. This can help you identify potential entry and exit points and gauge market sentiment.

Sentiment Analysis: Monitor investor sentiment and news to understand the market’s mood and potential impact on stock prices.

5. Diversify Your Portfolio

Diversification is a crucial risk management strategy that involves spreading your investments across different asset classes, sectors, and geographic regions. This can help reduce the impact of any single stock’s poor performance on your overall portfolio.

Asset Allocation: Allocate your capital across various asset classes, such as stocks, bonds, and commodities, to balance risk and reward.

Sector Diversification: Invest in stocks from different sectors to mitigate sector-specific risks.

Geographic Diversification: Consider investing in international stocks to reduce exposure to country-specific economic and political risks.

6. Stay Disciplined and Emotionally Detached

Emotional decision-making can be detrimental to stock trading. It’s essential to stay disciplined and stick to your trading plan, regardless of market volatility or emotional impulses.

Avoid Overtrading: Overtrading can lead to increased transaction costs and reduced overall returns. Stick to your trading plan and avoid making impulsive trades.

Manage Fear and Greed: Fear and greed are common emotions in stock trading. Develop strategies to manage these emotions, such as setting realistic expectations and using stop-loss orders.

Review and Adjust: Regularly review your trading plan and performance. Make necessary adjustments based on changing market conditions and your financial goals.

7. Utilize Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk and protecting your capital. These orders automatically close your positions at predetermined price levels, helping you lock in profits and limit losses.

Stop-Loss Orders: Set stop-loss orders to automatically sell a stock if its price falls below a certain level. This helps protect your capital from significant losses.

Take-Profit Orders: Use take-profit orders to automatically sell a stock when it reaches a predetermined profit level. This allows you to lock in gains and avoid holding onto winning positions for too long.

8. Keep an Eye on Market Trends

Staying informed about market trends and economic indicators can provide valuable insights for your trading decisions.

Economic Indicators: Monitor key economic indicators, such as GDP growth, unemployment rates, and inflation, as they can influence market sentiment and stock prices.

Market Trends: Identify and analyze market trends, such as bull and bear markets, to adjust your trading strategies accordingly.

News and Events: Stay updated on news and events that could impact the stock market, such as corporate earnings reports, geopolitical developments, and central bank announcements.

9. Learn from Your Mistakes

Mistakes are inevitable in stock trading, but they can also be valuable learning opportunities. Analyze your past trades to identify what went wrong and how you can improve your strategies.

Trading Journal: Keep a trading journal to document your trades, including entry and exit points, reasons for the trade, and outcomes. This can help you identify patterns and areas for improvement.

Self-Assessment: Regularly assess your trading performance and reflect on your decision-making process. Identify common mistakes and develop strategies to avoid them in the future.

Continuous Learning: Stay committed to continuous learning and improvement. Attend webinars, read books, and seek advice from experienced traders to enhance your skills.

10. Seek Professional Advice

If you’re unsure about your trading strategies or need personalized guidance, consider seeking advice from financial professionals. Financial advisors, brokers, and investment analysts can provide valuable insights and recommendations tailored to your needs.

Financial Advisors: Work with a financial advisor to develop a comprehensive investment plan and receive personalized advice.

Brokers: Consult with brokers who have expertise in stock trading and can provide valuable market insights and trade execution services.

Investment Analysts: Follow recommendations from investment analysts who conduct in-depth research and analysis on stocks and market trends.

Conclusion

Successful stock trading requires a combination of education, planning, discipline, and continuous learning. By implementing these top strategies, you can enhance your trading skills, make informed decisions, and achieve your financial goals. Remember, the stock market is unpredictable, and there are no guarantees of success. However, with a strategic approach and a commitment to learning, you can navigate the complexities of the market and build a successful trading career.

10 Positive Reviews

Educational Resources: Utilizing various educational resources like books, online courses, and stock simulators significantly enhances trading knowledge and skills.

Clear Goals: Setting clear financial goals and objectives ensures a focused and disciplined approach to stock trading.

Comprehensive Trading Plan: A well-defined trading plan provides a roadmap for successful trading activities and helps avoid impulsive decisions.

Thorough Research: Conducting thorough research through fundamental, technical, and sentiment analysis leads to informed investment decisions.

Diversification: Diversifying investments across different asset classes, sectors, and geographic regions mitigates risks and enhances portfolio stability.

Emotional Discipline: Staying disciplined and emotionally detached from trading decisions minimizes the impact of market volatility and emotional impulses.

Risk Management Tools: Utilizing stop-loss and take-profit orders effectively manages risk and protects capital.

Market Awareness: Keeping an eye on market trends and economic indicators provides valuable insights for strategic trading decisions.

Learning from Mistakes: Analyzing past trades and learning from mistakes fosters continuous improvement and better trading strategies.

Professional Guidance: Seeking professional advice from financial advisors, brokers, and investment analysts offers personalized guidance and expert insights for successful stock trading.

By following these strategies and reviews, traders can enhance their chances of success in the dynamic and ever-changing world of stock trading.

Investing in the stock market can be an excellent way to build wealth over time. Whether you’re saving for retirement, aiming to make a major purchase, or just looking to grow your financial portfolio, understanding how to start investing in stocks is crucial. This guide will provide a step-by-step approach to get you started on your investment journey.

#Stock Trading Strategies#Successful Trading Tips#Stock Market Education#Risk Management in Trading#Investment Portfolio Diversification#Top Strategies for Successful Stock Trading

2 notes

·

View notes

Text

10 Best Practices and Disciplines When Trading in the Global Market

Trading in the global market can be both exciting and profitable, but it requires a solid approach and disciplined strategies. Whether you're new to trading or looking to refine your skills, these best practices can help you navigate the complexities of the market. Here are ten essential tips to help you become a successful trader.

1. Choose the Best Trading Platform

Your trading platform is your primary tool. Make sure you choose the best trading platform that offers real-time data, user-friendly interfaces, and robust analytical tools. Look for platforms that provide educational resources and responsive customer support to help you on your trading journey. The right platform can make a significant difference in your trading experience by providing reliable and fast execution of trades, which is crucial for seizing opportunities in volatile markets.

2. Master Forex Trading

Forex trading can be highly profitable if you know what you're doing. Start by learning the basics, such as understanding currency pairs, market hours, and the factors that influence currency prices. Then delve into advanced strategies like technical analysis and risk management. Stay updated with the latest trends and use reliable sources to get your information. Always aim to be the best Forex trading expert by continuously improving your skills. Practice with a demo account before committing real money to refine your strategies without financial risk.

3. Diversify Your Investments

Don’t put all your eggs in one basket. Spread your investments across different asset classes such as stocks, commodities, and Forex. Diversification helps mitigate risks and can lead to more stable returns over time. By investing in a variety of assets, you reduce the impact of a poor-performing investment on your overall portfolio. This strategy helps balance the risk and rewards, providing a more consistent growth trajectory.

4. Keep Up with Market News

Staying informed is crucial. Regularly read financial news, follow economic reports, and pay attention to global events that could impact the markets. This knowledge will help you make informed decisions and anticipate market movements. Utilize reliable news sources and economic calendars to stay ahead of market trends. Understanding the broader economic context can help you predict how markets will react to news and events, giving you an edge in your trading decisions.

5. Practice Risk Management