#stock market rebalancing

Explore tagged Tumblr posts

Text

Since the beginning of the stock market, new methods of opportunities have been introduced in each decade. There are indices like the Sensex and Nifty, which have become top indices to watch and observe in India. With the hike in online trading, retail investors seem to increase their interest in investing in the financial market. The index fund rebalancing is essential in order to update index funds over the rise or fall of nifty or other indices. Having a basic understanding of the function of an index fund will help investors invest in a smart way.

0 notes

Text

High-speed information flow. Decisions in the blink of an eye. A rush of adrenaline. In the good old days, the frenzy of a stock trading floor was pulsating, with hand signals moving millions of dollars and brokers shouting orders across each other.

0 notes

Text

2025 Predictions: Disruption, M&A, and Cultural Shifts

1. NVIDIA’s Stock Faces a Correction

After years of market dominance driven by AI and compute demand, investor expectations will become unsustainable. A modest setback—whether technical, regulatory, or competitive—will trigger a wave of profit-taking and portfolio rebalancing among institutional investors, ending the year with NVIDIA’s stock below its January 2025 price.

2. OpenAI Launches a Consumer Suite to Rival Google

OpenAI will aggressively debut “Omail,” “Omaps,” and other consumer products, subsidizing adoption with cash incentives (e.g., $50/year for Omail users). The goal: capture original user-generated data to train models while undercutting Google’s monetization playbook. Gen Z, indifferent to legacy tech brands, will flock to OpenAI’s clean, ad-light alternatives.

3. Rivian Gains Momentum as Tesla’s Talent Exodus Begins

Despite fading EV subsidies, Rivian becomes a credible challenger as Tesla grapples with defections. Senior Tesla executives—disillusioned with Elon Musk’s polarizing brand—will migrate to Rivian, accelerating its R&D and operational maturity. By late 2025, Rivian’s roadmap hints at long-term disruption, though Tesla’s scale remains unmatched.

4. Ethereum and Vitalik Surge to New Heights

Ethereum solidifies its role as crypto’s foundational layer, driven by institutional DeFi adoption and regulatory clarity. Vitalik Buterin transcends “crypto-founder” status, becoming a global thought leader on digital governance and AI ethics. His influence cements ETH’s position as the “defacto choice” of decentralized ecosystems.

5. Amazon Acquires Anthropic in a $30B AI Play

Amazon, needing cutting-edge AI to compete with Microsoft/OpenAI and Google, buys Anthropic but preserves its independence (a la Zappos). Anthropic’s “long-term governance” model becomes a differentiator, enabling multi-decade AI safety research while feeding Amazon’s commercial ambitions.

6. Netflix Buys Scopely to Dominate Interactive Entertainment

With streaming growth plateauing, Netflix doubles down on gaming. The $10B Scopely acquisition adds hit mobile titles (Star Trek Fleet Command, Marvel Strike Force) to its portfolio, creating a subscription gaming bundle that meshes with its IP-driven content engine.

7. Amazon + Equinox + Whole Foods = Wellness Ecosystems

Amazon merges Equinox’s luxury fitness brand with Whole Foods’ footprint, launching “Whole Life” hubs: members work out, sauna, grab chef-prepared meals at the hot bar, and shop for groceries—all under one subscription.

8. Professional Sports Become the Ultimate Cultural Currency

Athletes supplant Hollywood stars as cultural icons, with leagues monetizing 24/7 fandom via microtransactions (NFT highlights, AI-personalized broadcasts). Even as streaming fragments TV rights, live sports’ monopoly on real-time attention fuels record valuations.

9. Bryan Johnson’s Blueprint Goes Mainstream

Dismissed as a biohacking meme in 2023, Blueprint pivots from $1,000/month “vampire face cream” to a science-backed longevity brand. Partnering with retail giants, it dominates the $50B supplement market and other longevity products (hair loss, ED, etc).

10. Jayden Daniels Redefines QB Training with Neurotech

The Commanders’ rookie stuns the NFL with pre-snap precision honed via AR/VR simulations that accelerate cognitive processing. His startup JaydenVision, licenses the tech to the league—making “brain reps” as routine as weightlifting by 2026.

*BONUS*

11. YouTube Spins Out, Dwarfing Google’s Valuation

Alphabet spins off YouTube into a standalone public company. Unleashed from Google’s baggage, YouTube capitalizes on its creator economy, shoppable videos, and AI-driven content tools. Its market cap surpasses $1.5T—eclipsing Google’s core search business.

3 notes

·

View notes

Text

Stock Option Black Box?

A lot of what I've written about stocks is rudimentary understanding rehashing of basics and Stonk-Theory, what I want to try now is to analyze the process of matching Options together.

I assume that the options market makers work as a telephone switch board. Their job is to match one side of the call to the recipient (in this instance, the put).

In basic stock theory; the institutions match buyers/sellers over a week to a month period by stock-brokers; virtual or otherwise (in this instance; I mean the ones you pay to match the trade for you.) I know there's a three-day limit, but that's at execution.

In options, that basic premise is still how it works. HOWEVER; matching occurs at execution of the option. This is compounded on top of the basic stock buy/sell matching.

Now; what stock analysts tend to look at for projections is the market-price and in-the-money/out-of-money options held. In-the-money options are options held that can be executed for a profit immediately. Out-of-money options cannot.

What a market-maker(big institutions that actually handle the trades) see; is immediate options. Or the immediate buy/sell ratio. Immediate here means right now, right at this moment. If the buy/sell ratio is off, the institution has to make up the difference somehow.

How it likely is done; is that they simply wait for the opposite side of buy/sell to happen. What we've saw with the meme-stock incident is that; it didn't happen. They instead had to force the markets hand by turning off the [purchase button].

Their job is to match both sides of the sale; with the limiting factor being the legal allowance of stock and debt-stock(short-stock). What this means is that, at the time; the market buy/sell ratio was extremely biased and unable to be fulfilled; by hitting the limits--both real and virtual.

They had two legal reasons to do this; the first is that they ran out of stock to sell to people and hit their limits of debt-stock. And the second is a "common-sense" reaction to limit market-mania (buying/selling mania that happens every now and again due to external factors.)

However; with what we know about debt-stock and options, is that this didn't rebalance the market entirely. It simply rebalanced the immediate buy/sell ratio at the market makers.

So what we have to look at is several ratios; the immediate buy/sell the makers use to match orders, the held stock and debt stock, in-the-money options, out-of-money options, AND the overall market sentiment outside of that.

And what the difference is between them.

The overall limiting factor for the greater market is going to be the immediacy ratio at the makers, but the overall market trends are going to follow those outside ratios which will affect that immediacy ratio, and in some cases; be able to force the market to bias.

8 notes

·

View notes

Text

401(K) INVESTMENT PLAN

Today, I will share with the guys my structured approach to building and managing retirement savings through a 401(k) investment plan. By following this plan, you can achieve financial security in retirement and have a portfolio that balances growth potential with risk management.

Objective: The objective of this 401(k) investment plan is to ensure a well-balanced and diversified portfolio that aligns with long-term financial goals, risk tolerance, and retirement needs. This plan is designed to maximize returns while minimizing risks, taking into account the tax advantages of a 401(k) account.

Assessing Risk Tolerance and Time Horizon

Risk Tolerance: Determine the appropriate level of risk based on personal financial goals, age, and comfort with market volatility. Generally, a higher risk tolerance allows for a greater allocation to equities, while a lower risk tolerance favors bonds and fixed-income investments. Time Horizon: The number of years until retirement is a key factor in deciding the investment strategy. A longer time horizon permits a more aggressive investment approach, while a shorter time horizon necessitates a more conservative allocation.

Diversification Strategy

Equity Investments: Allocate a percentage of the 401(k) to stocks, focusing on a mix of domestic and international equities. Consider including large-cap, mid-cap, and small-cap funds to ensure broad market exposure. Fixed-Income Investments: Invest in bonds and other fixed-income securities to provide stability and income. Consider a mix of government, corporate, and high-yield bonds to diversify risk. Alternative Investments: Depending on the options available within the 401(k) plan, consider allocating a portion of the portfolio to alternative investments such as real estate or commodities to further diversify and hedge against inflation.

Contribution Strategy

Maximize Contributions: Aim to contribute the maximum allowable amount each year to take full advantage of tax deferral benefits. Additionally, contribute enough to qualify for any employer matching contributions, as this represents an immediate return on investment. Regular Contributions: Set up automatic contributions to ensure consistent investment over time. This dollar-cost averaging approach can reduce the impact of market volatility.

Rebalancing and Monitoring

Periodic Rebalancing: Regularly review the portfolio to ensure it remains aligned with the target asset allocation. Rebalance the portfolio at least annually or whenever significant market movements cause a substantial deviation from the original allocation. Monitoring Performance: Continuously monitor the performance of individual investments and the overall portfolio. Make adjustments as needed based on changes in market conditions, personal financial situation, or retirement goals.

Consideration of Tax Implications

Pre-Tax vs. Roth Contributions: Evaluate the benefits of making pre-tax contributions versus Roth (after-tax) contributions based on current and expected future tax rates. Required Minimum Distributions (RMDs): Plan for RMDs starting at age 73 (or the required age based on current regulations) to minimize tax impact and ensure compliance with IRS rules.

Retirement Income Planning

Withdrawal Strategy: Develop a strategy for withdrawing funds during retirement that minimizes tax liability and ensures the longevity of the retirement portfolio. Annuity Consideration: Consider purchasing an annuity with a portion of the 401(k) balance to provide a guaranteed income stream during retirement

2 notes

·

View notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

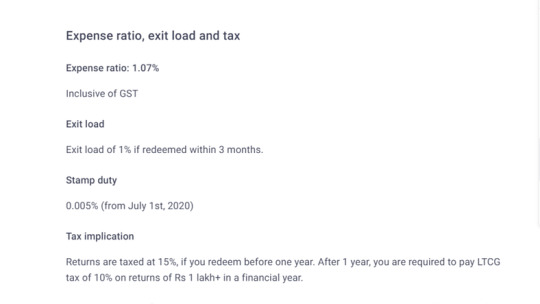

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

Personal finance strategies for saving and investing

Table of Contents:

1. Introduction

2. Importance of Personal Finance Strategies

3. Saving Strategies

1. Budgeting

2. Automating Savings

3. Cutting Expenses

4. Investing Strategies

1. Diversification

2. Retirement Accounts

3. Passive Income Streams

5. Conclusion: Maximizing Financial Growth

6. FAQ Section

Introduction:

In the realm of personal finance, navigating the complexities of saving and investing can be daunting. However, armed with the right strategies and knowledge, individuals can pave their way to financial security and prosperity. This comprehensive review delves into the intricacies of personal finance strategies for saving and investing in 2024, exploring various techniques and approaches to optimize wealth accumulation and growth.

**1. Importance of Personal Finance Strategies:**

Effective personal finance strategies serve as the cornerstone for achieving financial stability and long-term prosperity. By meticulously planning and implementing strategies tailored to individual goals and circumstances, individuals can gain control over their finances, mitigate risks, and build a solid foundation for future endeavors. Whether aiming for short-term goals like purchasing a home or planning for retirement, strategic financial management is indispensable.

**2. Saving Strategies:**

**1. Budgeting:**

Budgeting stands as the fundamental pillar of financial management, providing a roadmap for allocating income and expenses. By meticulously tracking expenses and setting realistic spending limits, individuals can identify areas of overspending and redirect funds towards savings and investments. Utilizing budgeting apps or spreadsheets simplifies the process, enabling better decision-making and fostering financial discipline.

**2. Automating Savings:**

Automation streamlines the saving process, ensuring consistent contributions towards financial goals. Setting up automatic transfers from checking to savings accounts or utilizing employer-sponsored retirement plans automates savings, removing the temptation to spend impulsively. Additionally, utilizing apps that round up purchases to the nearest dollar and deposit the difference into savings accounts fosters incremental savings growth effortlessly.

**3. Cutting Expenses:**

Trimming unnecessary expenses is paramount in bolstering savings potential. Conducting regular expense audits aids in identifying discretionary spending that can be reduced or eliminated. Negotiating bills, opting for generic brands, and embracing frugal habits contribute to significant cost savings over time. Redirecting these savings towards investments amplifies wealth-building opportunities and accelerates financial progress.

**3. Investing Strategies:**

**1. Diversification:**

Diversification is the bedrock of investment strategy, spreading risk across various asset classes to minimize exposure to volatility. By allocating investments across stocks, bonds, real estate, and alternative assets, individuals can optimize risk-adjusted returns and cushion against market fluctuations. Regular rebalancing ensures alignment with evolving financial goals and risk tolerance levels.

**2. Retirement Accounts:**

Maximizing contributions to retirement accounts such as 401(k)s or IRAs offers tax advantages and accelerates wealth accumulation. Employers often match contributions to retirement plans, amplifying the benefits of consistent savings. Leveraging tax-deferred growth and compound interest within retirement accounts empowers individuals to secure a comfortable retirement lifestyle.

**3. Passive Income Streams:**

Diversifying income sources through passive streams complements traditional employment income, fostering financial resilience and independence. Investing in dividend-paying stocks, rental properties, or creating digital assets like e-books or online courses generates recurring income with minimal ongoing effort. Cultivating multiple passive income streams bolsters financial security and enhances wealth-building potential.

**5. Conclusion: Maximizing Financial Growth:**

In conclusion, embracing personalized finance strategies tailored to individual circumstances is paramount in achieving financial prosperity. By prioritizing saving and investing, individuals can cultivate a robust financial foundation, mitigate risks, and capitalize on growth opportunities. With discipline, diligence, and strategic planning, the path to financial freedom becomes attainable for everyone.

**6. FAQ Section:**

1. Q: How much of my income should I allocate towards savings?

A: Financial experts recommend saving at least 20% of income towards savings and investments to ensure long-term financial security.

2. Q: Is it better to pay off debt before saving or investing?

A: It depends on the interest rates of the debt. High-interest debt should be prioritized for repayment, while simultaneously allocating a portion towards savings and investments to capitalize on compounding returns.

3. Q: What are some low-risk investment options for beginners?

A: Beginner-friendly investment options include index funds, exchange-traded funds (ETFs), and robo-advisor platforms, offering diversified exposure to the market with minimal risk.

4. Q: How often should I review my investment portfolio?

A: Regular portfolio reviews, typically quarterly or semi-annually, are recommended to ensure alignment with financial goals, risk tolerance, and market conditions. Rebalancing may be necessary to maintain diversification and optimize performance.

Learn more

#Personal Finance Strategies#Saving#Investing#Financial Management#Budgeting#Automation#Expense Reduction#Diversification#money

3 notes

·

View notes

Text

indian stock market

Title: Navigating the Stock Market: A Beginner's Guide

Introduction

The stock market is a dynamic and complex financial ecosystem where investors buy and sell shares of publicly-traded companies. It's a place where fortunes can be made and lost, but understanding the fundamentals can significantly reduce the risk associated with investing. In this beginner's guide to the stock market, we'll explore the basics, terminology, and strategies to help you embark on your investment journey with confidence.

Chapter 1: What is the Stock Market?

Definition: The stock market is a marketplace where buyers and sellers trade ownership in companies through stocks (equity).

Historical Perspective: Learn about the origins and evolution of stock markets.

Types of Stock Markets: Understand the differences between major stock exchanges (e.g., NYSE, NASDAQ).

Chapter 2: Stock Market Participants

Investors: Discover the various types of investors, from individual traders to institutional investors.

Public Companies: Explore why companies go public and what it means for investors.

Regulators: Learn about the regulatory bodies that oversee stock markets.

Chapter 3: Stock Market Basics

Stocks and Shares: Differentiate between stocks and shares and understand their value.

Market Indices: Discover how indices like the S&P 500 and Dow Jones work.

Market Orders: Learn about market orders, limit orders, and stop orders.

Trading Hours: Know the opening and closing times of stock markets.

Chapter 4: Investment Strategies

Long-Term Investing: Explore the benefits of buy-and-hold strategies.

Day Trading: Understand the fast-paced world of day trading.

Value Investing: Learn about the principles made famous by Warren Buffett.

Risk Management: Discover strategies to mitigate risk and protect your investments.

Chapter 5: Analyzing Stocks

Fundamental Analysis: Evaluate a company's financial health and performance.

Technical Analysis: Study price charts and indicators to make short-term predictions.

Sentiment Analysis: Understand how market sentiment can affect stock prices.

Chapter 6: Diversification and Portfolio Management

Diversification: Learn how to spread risk by investing in various asset classes.

Building a Portfolio: Explore the process of constructing a well-balanced investment portfolio.

Rebalancing: Understand the importance of periodically adjusting your portfolio.

Chapter 7: Tax Implications and Regulations

Capital Gains Tax: Discover how profits from stock trading are taxed.

IRA and 401(k): Learn about tax-advantaged retirement accounts for long-term savings.

Chapter 8: Common Pitfalls and Mistakes

Overtrading: Avoid the urge to make excessive, impulsive trades.

Ignoring Research: Stress the importance of thorough research before investing.

Emotional Decision-Making: Learn to manage emotions when making investment decisions.

Chapter 9: Staying Informed

Financial News: Keep abreast of financial news and its impact on the market.

Investment Resources: Explore useful websites, books, and forums for learning and advice.

Conclusion

The stock market can be an exciting and rewarding place for investors, but it's crucial to approach it with knowledge and a well-thought-out strategy. With a solid understanding of the basics, a clear investment plan, and the discipline to stick to it, you can navigate the stock market and work towards achieving your financial goals. Remember that, like any other endeavor, successful stock market investing takes time, patience, and continuous learning.

2 notes

·

View notes

Text

ChatGPT: Your Personal Trading Assistant for Informed Decision-Making

Enhancing Your Trading Journey with the Power of AI By Amir Shayan In today's fast-paced financial markets, staying ahead of the competition and making informed trading decisions is crucial. The advent of artificial intelligence (AI) has brought about a revolution in the trading industry, empowering traders with advanced tools and insights to navigate the complexities of the market. One such innovative AI application is ChatGPT, a conversational AI model developed by OpenAI. In this article, we will explore how ChatGPT can serve as your personal trading assistant, providing real-time information, analysis, and support to help you make smarter trading decisions. Whether you are a seasoned trader or a beginner, ChatGPT can be a valuable tool in your trading arsenal.

Understanding ChatGPT

ChatGPT is an AI-powered language model that leverages deep learning techniques to generate human-like text responses based on the input it receives. It has been trained on a vast amount of data from diverse sources, enabling it to understand and generate coherent and contextually relevant responses. With its ability to understand natural language and generate text, ChatGPT can simulate human-like conversations and provide tailored information to users.

Benefits of ChatGPT in Trading

- Real-time Market Updates: ChatGPT can keep you informed about the latest market news, price movements, and trends. By analyzing vast amounts of data from various sources, it can provide you with up-to-date information and insights that can help you stay ahead of market developments. - Technical Analysis: ChatGPT can assist in technical analysis by analyzing historical price data, identifying patterns, and generating insights. It can help you spot potential entry and exit points, support and resistance levels, and other key technical indicators to inform your trading strategies. - Fundamental Analysis: In addition to technical analysis, ChatGPT can also help with fundamental analysis by providing insights into company financials, industry trends, and macroeconomic factors that may impact the market. It can assist in evaluating the intrinsic value of stocks, assessing company performance, and identifying investment opportunities. - Risk Management: ChatGPT can provide risk management guidance by analyzing portfolio diversification, assessing risk-reward ratios, and suggesting risk mitigation strategies. It can help you optimize your risk management approach and make more informed decisions to protect your investments. - Trade Execution: ChatGPT can facilitate trade execution by providing real-time quotes, order placement assistance, and trade execution recommendations. It can streamline the trading process and help you execute trades efficiently and effectively.

How to Use ChatGPT for Trading

- Asking Questions: You can ask ChatGPT questions about specific stocks, market trends, or trading strategies. It will generate responses based on its knowledge and analysis of the data it has been trained on. For example, you can ask, "What are the key factors influencing the stock market today?" or "What is the outlook for XYZ stock?" - Getting Insights: ChatGPT can provide insights and analysis on various aspects of trading, such as technical indicators, market sentiment, and sector performance. You can ask for specific technical indicators like moving averages or support and resistance levels, or inquire about the sentiment around a particular stock or industry. - Strategy Evaluation: ChatGPT can assist in evaluating trading strategies by analyzing historical data and simulating potential outcomes. You can discuss your trading strategy with ChatGPT, and it can provide feedback, suggest improvements, or highlight potential risks. - Portfolio Management: ChatGPT can help you manage your portfolio by providing suggestions for portfolio diversification, monitoring performance, and identifying rebalancing opportunities. It can analyze your holdings, assess their performance, and provide insights on potential adjustments to optimize your portfolio.

Limitations and Considerations

While ChatGPT can be a valuable trading assistant, it is important to understand its limitations and use it as a complementary tool rather than a sole decision-making authority. Here are a few considerations: - Data Limitations: ChatGPT relies on the data it has been trained on, which may not capture real-time market events or unique situations. It is essential to verify information provided by ChatGPT with reliable and up-to-date sources. - Emotional Factors: ChatGPT does not possess emotions or subjective judgment. It is important to consider human intuition and emotional factors when making trading decisions. Use ChatGPT's insights as part of your decision-making process, taking into account your own analysis and risk tolerance. - Technical Accuracy: While ChatGPT strives to provide accurate information, there is a possibility of occasional errors or inaccuracies. Always double-check critical information and consult other reliable sources before making trading decisions.

Conclusion

In the era of AI-driven technologies, ChatGPT has emerged as a powerful tool for traders. Its ability to understand natural language and generate human-like responses makes it an ideal personal trading assistant. By leveraging the capabilities of ChatGPT, traders can access real-time market updates, technical and fundamental analysis, risk management guidance, and trade execution support. However, it is crucial to recognize its limitations and use it as part of a comprehensive decision-making process. Incorporating human judgment, emotional intelligence, and critical thinking alongside ChatGPT's insights can help traders make informed decisions and navigate the complexities of the financial markets with confidence. In summary, ChatGPT is revolutionizing the way traders approach their decision-making process. With its AI-powered capabilities, it serves as a valuable resource for market analysis, strategy evaluation, and portfolio management. By harnessing the power of ChatGPT, traders can stay ahead of market trends, make data-driven decisions, and ultimately enhance their trading performance. Embrace the AI revolution in trading and let ChatGPT be your trusted companion on the journey to trading success. Read the full article

#AIintrading#algorithmictrading#ArtificialIntelligence#Data-drivendecisions#decisionmaking#FinancialTechnology#marketanalysis#Personaltradingassistant#tradingstrategies#Tradingtools

4 notes

·

View notes

Text

Portfolio Management

By. Jacinda T. Thomas, Masters of Science in Wealth Management { An American in Switzerland }

#jacindathomas #wealthmanagement

Let's discuss portfolio management. My expertise.

Portfolio management requires the ability to weigh strengths and weaknesses, opportunities and threats across the full spectrum of investments. The choices involve trade-offs, from debt versus equity to domestic versus international, and growth versus safety.

issuu

Our fav: https://www.investopedia.com/terms/p/portfoliomanagement.asp

What Is Portfolio Management?

Portfolio management is the art and science of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution.

Some individuals do their own investment portfolio management. That requires a basic understanding of the key elements of portfolio building and maintenance that make for success, including asset allocation, diversification, and rebalancing.

KEY TAKEAWAYS

Investment portfolio management involves building and overseeing a selection of assets such as stocks, bonds, and cash that meet the long-term financial goals and risk tolerance of an investor.

Active portfolio management requires strategically buying and selling stocks and other assets in an effort to beat the performance of the broader market.

Passive portfolio management seeks to match the returns of the market by mimicking the makeup of an index or indexes.

Investors can implement strategies to aggressively pursue profits, conservatively attempt to preserve capital, or a blend of both.

Portfolio management requires clear long-term goals, clarity from the IRS on tax legislation changes, understanding of investor risk tolerance, and a willingness to study investment options.

What Is Portfolio Management?

Portfolio management is the art and science of selecting and overseeing a group of investments that meet the long-term financial objectives and risk tolerance of a client, a company, or an institution.

Some individuals do their own investment portfolio management. That requires a basic understanding of the key elements of portfolio building and maintenance that make for success, including asset allocation, diversification, and rebalancing.

KEY TAKEAWAYS

Investment portfolio management involves building and overseeing a selection of assets such as stocks, bonds, and cash that meet the long-term financial goals and risk tolerance of an investor.

Active portfolio management requires strategically buying and selling stocks and other assets in an effort to beat the performance of the broader market.

Passive portfolio management seeks to match the returns of the market by mimicking the makeup of an index or indexes.

Investors can implement strategies to aggressively pursue profits, conservatively attempt to preserve capital, or a blend of both.

Portfolio management requires clear long-term goals, clarity from the IRS on tax legislation changes, understanding of investor risk tolerance, and a willingness to study investment options.

Understanding Portfolio Management

Professional licensed portfolio managers work on behalf of clients, while individuals may choose to build and manage their own portfolios. In either case, the portfolio manager's ultimate goal is to maximize the investments' expected return within an appropriate level of risk exposure.

Portfolio management requires the ability to weigh strengths and weaknesses, opportunities and threats across the full spectrum of investments. The choices involve trade-offs, from debt versus equity to domestic versus international, and growth versus

Portfolio Management: Passive vs. Active

Portfolio management may be either passive or active.

Passive management is the set-it-and-forget-it long-term strategy. It may involve investing in one or more exchange-traded (ETF) index funds. This is commonly referred to as indexing or index investing. Those who build indexed portfolios may use modern portfolio theory (MPT) to help them optimize the mix.

Active management involves attempting to beat the performance of an index by actively buying and selling individual stocks and other assets. Closed-end funds are generally actively managed. Active managers may use any of a wide range of quantitative or qualitative models to aid in their evaluations of potential investments.

Active Portfolio Management

Investors who implement an active management approach use fund managers or brokers to buy and sell stocks in an attempt to outperform a specific index, such as the Standard & Poor's 500 Index or the Russell 1000 Index.

An actively managed investment fund has an individual portfolio manager, co-managers, or a team of managers actively making investment decisions for the fund. The success of an actively managed fund depends on a combination of in-depth research, market forecasting, and the expertise of the portfolio manager or management team.

Portfolio managers engaged in active investing pay close attention to market trends, shifts in the economy, changes to the political landscape, and news that affects companies. This data is used to time the purchase or sale of investments in an effort to take advantage of irregularities. Active managers claim that these processes will boost the potential for returns higher than those achieved by simply mimicking the holdings on a particular index.

Trying to beat the market inevitably involves additional market risk. Indexing eliminates this particular risk, as there is no possibility of human error in terms of stock selection. Index funds are also traded less frequently, which means that they incur lower expense ratios and are more tax-efficient than actively managed funds.

Passive Portfolio Management

Passive portfolio management, also referred to as index fund management, aims to duplicate the return of a particular market index or benchmark. Managers buy the same stocks that are listed on the index, using the same weighting that they represent in the index.

A passive strategy portfolio can be structured as an exchange-traded fund (ETF), a mutual fund, or a unit investment trust. Index funds are branded as passively managed because each has a portfolio manager whose job is to replicate the index rather than select the assets purchased or sold.

The management fees assessed on passive portfolios or funds are typically far lower than active management strategies.

Portfolio Management: Discretionary vs. Non-Discretionary

Another critical element of portfolio management is the concept of discretionary and non-discretionary management. This portfolio management approach dictates what a third-party may be allowed to do relating to your portfolio

2 notes

·

View notes

Text

Decoding NSE Sensex and Indexnse Nifty_50 With the Help of Stock Analysis Websites

India’s financial markets have witnessed a wave of transformation driven by technology, regulatory changes, and evolving equity behavior. As economic indicators shift and industries respond to both global and domestic forces, benchmark indices such as the nse sensex have become vital barometers of market sentiment. Parallel to this, the growing prominence of stock analysis websites has made real-time financial data and sector insights more accessible than ever.

The combination of reliable indices and sophisticated analytical platforms is reshaping how equities are observed, evaluated, and understood. Together, they represent a broader trend of digitization and transparency across India’s capital markets.

Benchmark Indices as Anchors of Market Sentiment

The nse sensex tracks 30 established companies listed on the Bombay Stock Exchange. Often regarded as a mirror to India’s economic performance, this index reflects key developments across financial services, energy, IT, and manufacturing. Movement in the nse sensex is frequently influenced by announcements related to monetary policy, fiscal planning, and industrial output.

Similarly, the broad-based benchmark hosted by the National Stock Exchange consists of 50 diversified companies from multiple sectors. This index is more expensive, representing a broader slice of market capitalization. Activity within it offers insight into how various sectors respond to policy shifts, macroeconomic data, or changes in global sentiment.

Both indices serve as primary indicators for evaluating market movement on a daily basis. They are extensively used by analysts, financial institutions, and digital platforms to structure reports, models, and historical comparisons.

Broader Visibility Through Index Diversification

The indexnse nifty_50 provides a more comprehensive look at India’s large-cap landscape. Covering a wide range of industries—such as telecom, FMCG, metals, and construction—it captures the performance of sectors that are integral to the country’s infrastructure and consumption trends.

As index constituents change over time through rebalancing exercises, the indexnse nifty_50 adapts to reflect the evolving business environment. This flexibility helps maintain its relevance as a performance indicator and a reliable benchmark for exchange-traded instruments and derivatives.

Through both indices, market participants can gain clarity on cyclical behavior, risk trends, and sectoral leadership—all of which are central themes in daily financial analysis.

Market Tools Driving New-Generation Equity Tracking

With increasing demand for transparency and accessibility, stock analysis websites have become core tools for tracking corporate performance and equity trends. These platforms offer a centralized source for financial ratios, earnings results, sector updates, and corporate governance metrics. They also provide index monitoring tools, often featuring live dashboards of the nse sensex.

A typical platform among stock analysis websites will include data visualizations, peer comparisons, and tracking tools for institutional activity. These functionalities support a structured, data-backed view of market activity. Importantly, these platforms do not rely on anecdotal commentary or speculative analysis, but on data sourced from regulatory filings and public disclosures.

Real-Time Market Visibility and Digital Accessibility

The need for real-time information has propelled digital platforms to adopt features such as mobile applications, instant alerts, and interactive heatmaps. These additions ensure continuous access to the latest index levels, sector performance charts, and stock-specific news. For professionals and market followers alike, stock analysis websites are instrumental in simplifying large volumes of financial data into structured insights.

These platforms are particularly useful during earnings announcements, macroeconomic data releases, or global events that influence market momentum. With the nse sensex and indexnse nifty_50 integrated into most dashboards, users receive immediate feedback on how major developments affect the broader market.

Sector Rotation and Index Composition Impact

Movements in benchmark indices are often influenced by sector-specific activity. For example, the financial sector, which holds significant weight in both the nse sensex and indexnse nifty_50, can impact overall market direction based on regulatory updates or credit growth trends. Similarly, shifts in the technology or pharmaceutical sectors can alter the trajectory of these indices in response to external demand or policy revisions.

Rotational movement between cyclical and defensive sectors is a key pattern observed in index tracking. Tools provided by stock analysis websites often highlight such transitions by tracking sectoral contributions to overall index performance. This data helps contextualize whether broader market changes are driven by a few sectors or reflect widespread shifts across industries.

Institutional Trends and Market Liquidity

Another vital component of market performance is institutional participation. Institutional flows—particularly from domestic mutual funds and foreign portfolio entities—frequently determine short-term price patterns and influence large-cap movements. These flows often coincide with changes in the indexnse nifty_50.

Most major digital platforms now include modules that track institutional buying and selling activity, changes in shareholding patterns, and block deals. These tools allow for visibility into which companies or sectors are receiving higher liquidity support or undergoing significant reallocations.

Such data enhances overall market transparency and assists in understanding how institutional behavior contributes to momentum in major indices.

Integration of Global Developments with Domestic Trends

The Indian equity market is not immune to global events. Policy decisions in major economies, movements in crude oil prices, and international interest rate actions often affect domestic indices. The nse sensex frequently reacts to these changes, particularly when they impact currency strength or commodity-linked sectors.

Advanced analytics from leading financial platforms combine domestic and international datasets to provide a comprehensive perspective. This integration of macro and micro analysis ensures a well-rounded understanding of market shifts, helping align index movement with underlying causes rather than assumptions.

Structured Data Supporting Market Interpretation

With the rise of AI-based dashboards, some stock analysis websites have expanded their capabilities to include filters based on company fundamentals, sector performance, and valuation metrics. These tools make it easier to identify patterns across timelines, highlight outperformers within a category, or monitor real-time changes in capital structure.

The inclusion of structured financial parameters such as price-to-earnings ratio, return on capital employed, and earnings consistency provides additional depth. Paired with up-to-date index tracking, these tools play a significant role in market transparency.

India’s equity ecosystem is evolving through the combined advancement of benchmark indices and digital platforms. As the indexnse nifty_50 continues to shape how market sentiment is tracked and measured, the importance of reliable digital tools has never been more prominent.

These tools have enabled a shift toward data-backed equity engagement. Whether analyzing sector rotations, institutional flows, or real-time index fluctuations, structured digital infrastructure is now central to understanding the movement and composition of India’s dynamic stock market.

0 notes

Text

How to Rebalance Your Portfolio – A 2025 Guide to Smarter Investing

If you've ever felt like your investments are drifting off-course, you're not alone. Market volatility, changing life goals, and new financial products all influence your asset mix over time. That's where the need to rebalance your portfolio comes in. Think of it as giving your financial plan a periodic health check ��� and in 2025, it's more crucial than ever. For those seeking a professional edge, portfolio management in Gurgaon has emerged as a reliable solution to ensure that rebalancing is timely, goal-oriented, and tax-efficient.

Let’s dive into the how, when, and why of portfolio rebalancing with a step-by-step, actionable guide curated especially for Indian investors and anyone looking for expert portfolio management services.

What Does It Mean to Rebalance Your Portfolio?

At its core, rebalancing is about restoring your investment mix to its original or desired asset allocation. Say you started with 60% equity and 40% debt. After a year of stock market growth, your portfolio might look like 75% equity and 25% debt — exposing you to more risk than intended.

To rebalance your portfolio, you'd sell some equities and reinvest in debt to bring the proportions back in line. This keeps your strategy grounded in your risk appetite and financial goals.

When Should You Rebalance Your Portfolio?

There are no one-size-fits-all answers, but here are three smart checkpoints:

Time-Based Rebalancing: Set a fixed schedule — quarterly, bi-annually, or annually.

Threshold-Based Rebalancing: Rebalance when an asset class deviates by more than, say, 5-10% from your target allocation.

Life Event Rebalancing: Marriage, retirement, starting a business, or receiving inheritance — all are reasons to rebalance your portfolio.

As per a 2025 Morningstar report, investors who rebalanced annually had 10-15% better risk-adjusted returns than those who didn’t.

Step-by-Step: How to Rebalance Your Portfolio in 2025

1. Review Your Target Asset Allocation

Revisit your goals — is your 2021 asset mix still relevant today? Use tools or consult experts in Portfolio Management in Gurgaon to redefine allocations aligned with current financial goals.

2. Assess Current Portfolio Weights

Compare your current allocation with your target mix. Use a simple spreadsheet or a professional PMS dashboard.

3. Calculate the Deviations

Where are you over-invested or under-invested? The difference will guide your next moves.

4. Strategize Buy-Sell Actions

Apply portfolio rebalancing strategies like:

Sell Overperforming Assets: Book profits while rebalancing.

Invest in Underweighted Assets: Especially if they’re undervalued or long-term plays.

5. Keep Tax Implications in Mind

Short-term capital gains can eat into profits. Use tax harvesting and expert advice to rebalance in a tax-efficient way.

6. Monitor & Repeat

Rebalancing is not a one-time event. In fact, with increased access to global assets, dynamic products, and Indian mutual funds, it's advisable to rebalance your portfolio at least once a year.

Top Portfolio Rebalancing Strategies to Try in 2025

Static Rebalancing: Stick to a fixed interval regardless of market performance.

Dynamic Rebalancing: Adjust based on market forecasts and economic cycles — ideal if you have access to Portfolio Management Services.

Cash Flow Rebalancing: Instead of selling assets, use new investments to restore balance — especially tax-efficient for long-term investors.

These portfolio rebalancing strategies can help reduce risk, optimize returns, and avoid the temptation of emotional investing.

Why Professional Help Matters

DIY investing is on the rise, but rebalancing without expertise can lead to poor timing, tax blunders, or unintentional risks. Firms offering portfolio management in Gurgaon provide data-backed decisions, periodic rebalancing alerts, and tax-optimized strategies tailored to your life goals.

What is Portfolio Rebalancing and Why is It Important? Rebalancing your portfolio means adjusting the weight of assets in your investment portfolio to match your original or updated financial goals. It helps control risk, maintain asset allocation, and align your investments with market conditions and personal milestones.

BellWether – Your Personal CFO

Rebalancing your portfolio isn’t just about moving numbers — it’s about moving closer to your life goals. At BellWether, we bring personalized portfolio management services backed by deep research, disciplined strategies, and data-driven insights. Whether you’re building wealth, preserving it, or planning a legacy, our experts in portfolio management in Gurgaon are here to guide you every step of the way.

FAQs

1. Is it okay to rebalance a portfolio during market volatility?

Yes, market volatility is often the best time to rebalance your portfolio, as it helps maintain your risk level. However, consider transaction costs and taxes before making moves.

2. How do I know if my portfolio needs rebalancing?

If any asset class exceeds or drops below your target by more than 5-10%, it's time to rebalance. Regular reviews, at least once or twice a year, are also a good practice.

3. Can rebalancing hurt returns in the short term?

Possibly, yes. Rebalancing might sell off assets that are still rising. But over time, it reduces risk and leads to more consistent returns by staying aligned with your goals.

4. Should SIP investors rebalance their portfolios?

Absolutely. SIPs automate investments but don’t adjust asset allocation. You still need to rebalance your portfolio periodically to manage risk and optimize returns.

5. How can BellWether help me with portfolio rebalancing?

BellWether offers tailored portfolio management services, including automated rebalancing alerts, tax optimization, and expert consultations to help you grow and protect your wealth effectively.

#rebalance your portfolio#portfolio rebalancing strategies#Portfolio Management in Gurgaon#Portfolio Management Services#wealth management India

0 notes

Text

Smart Investing: Maximize Returns 2025

As we step into the New Year, investors are eager to make informed decisions to maximize their returns. With the ever-changing market landscape, it's essential to stay ahead of the curve and adapt to the latest trends and in this blog, we'll explore the best investment strategies for 2025, highlighting the most profitable options to help you achieve your financial goals, including investing in commercial property for sale in Berhampur.

Types of Investments for Profit

1. Dividend-paying Stocks: Invest in established companies with a history of paying consistent dividends, providing a regular income stream.

2. Index Funds: Diversify your portfolio by investing in index funds, which track a specific market index, such as the S&P 500.

3. Real Estate Investment Trusts (REITs): Invest in REITs, which allow individuals to invest in real estate without directly managing properties, such as commercial plot for sale in Berhampur.

4. Gold and Other Precious Metals: Invest in gold and other precious metals as a hedge against inflation and market volatility.

Plotting Your Investment Strategy with Urbancraft

Consider investing in a residential or commercial land for sale, a reputable real estate developer. Urbancraft offers prime residential and commercial plots for sale in Berhampur, strategically located near hospitals, shopping centers, and recreational areas and everything you need is just a short distance away.

How to Secure Your Plot?

One thing is clear that you can secure your dream plot in Berhampur is easy with Urbancraft, contact us today to schedule a site visit and explore the available options, our team is always ready to assist you with all the particular information you need to make a right decision. Benefits of Investing in Urbancraft Plots

- Prime location in Berhampur

- Modern amenities and infrastructure

- Excellent investment potential

- Easy payment options

Conclusion

In conclusion, smart investing in 2025 requires a well-thought-out strategy, diversification, and regular portfolio rebalancing. Consider investing in a residential or commercial land for sale in Berhampur with Urbancraft, that offers a unique opportunity to own a prime piece of land in a strategic location.

With its excellent investment potential, modern amenities, and easy payment options, it is the perfect choice for investors looking to maximize their returns in 2025. Contact Urbancraft today and take the first step towards securing your financial future by investing in a commercial land.

0 notes

Text

Liquidity and Replication Challenges in Strategy Index Investment Products

In the evolving landscape of passive and rules-based investing, strategy indices—often associated with smart beta, factor-based, or alternative indexing approaches—have gained notable popularity. These indices aim to capture specific investment strategies, such as value, momentum, quality, or volatility, using transparent, rules-based methodologies. As more investors turn to strategy index investment products like exchange-traded funds (ETFs) and index mutual funds, a deeper understanding of liquidity and replication challenges becomes essential.

1. Understanding Liquidity in the Context of Strategy Indices

Liquidity in financial markets refers to the ease with which an asset can be bought or sold without significantly affecting its price. In traditional market-cap weighted indices, highly liquid large-cap stocks dominate, making replication relatively straightforward. However, strategy indices often introduce systematic tilts toward smaller-cap, less liquid, or lower turnover segments of the market.

Key Liquidity Concerns Include:

Lower average daily trading volumes of index constituents.

Wider bid-ask spreads in illiquid segments.

Market impact when executing large trades, especially during rebalancing.

Liquidity mismatches between the underlying index and the fund tracking it.

These challenges can increase transaction costs and cause tracking error, which refers to the divergence between the performance of the strategy index and the investment product that seeks to replicate it.

2. The Complexity of Index Replication

Replicating a strategy index is not always a simple matter of purchasing all index constituents in proportion to their weights. Many strategy indices are built using complex quantitative rules or multi-factor models that require dynamic weighting, screening, and ranking based on a range of financial metrics.

Replication Models Typically Fall into Three Categories:

Full replication: Holding every security in the index in exact proportion—often impractical for illiquid or complex indices.

Sampling: Holding a representative subset of the index, which may lead to tracking errors.

Optimization: Using portfolio optimization models to balance exposure and minimize costs.

When strategy indices require frequent rebalancing or include non-standard securities, such as emerging market stocks or micro-cap equities, implementation becomes difficult, particularly for large institutional investors.

3. Impact of Turnover and Rebalancing

One of the defining features of many strategy indices is regular rebalancing to ensure they stay aligned with their underlying investment methodology. For example, a momentum-based index may rebalance monthly to reflect the most recent performance trends, while a value-oriented index might rebalance quarterly.

Challenges of Frequent Rebalancing:

High portfolio turnover increases trading costs.

Execution delays or slippage can occur due to market impact, especially in thinly traded securities.

Scheduled rebalancing dates may be front-run by market participants, which leads to unfavorable execution prices.

These factors make it difficult for ETFs and index funds to replicate the index accurately and can reduce net performance for investors.

4. Liquidity Mismatch Between Index and Investment Vehicle

A critical consideration for investors is the liquidity profile of the investment product versus the liquidity of the underlying securities. In the case of ETFs, investors often look at the liquidity of the ETF shares on the secondary market and mistakenly assume that the underlying holdings are equally liquid.

Risks of Liquidity Mismatch:

ETFs tracking illiquid strategy indices may struggle with large inflows or outflows, as creation/redemption activity can impact the underlying asset prices.

During periods of market stress, the ETF price may deviate significantly from its Net Asset Value (NAV), reflecting concerns about the underlying holdings’ liquidity.

Fund sponsors must work closely with authorized participants (APs) and market makers to maintain efficient ETF pricing and ensure that liquidity remains accessible to investors.

5. Index Design and Constituents Matter

The design of the index itself plays a vital role in determining whether it can be replicated effectively. Key design elements that affect replication include:

Universe selection: Broader universes with small-cap or international stocks pose higher replication hurdles.

Weighting scheme: Equal-weight or factor-weighted strategies may result in overweighting less liquid names.

Constraints and screens: Indices with ESG filters or exclusion criteria may have reduced investable universes, further straining liquidity.

When strategy indices lack liquidity filters or capacity considerations, they can lead to implementation difficulties that adversely impact investors’ ability to access the strategy at scale.

6. Institutional Constraints and Scalability

For institutional investors managing large pools of capital, liquidity and replication challenges become even more pronounced.

Institutional Considerations:

Executing large trades without disrupting prices requires careful trade execution strategies such as algorithmic trading or dark pools.

Internal compliance and risk controls may limit the ability to hold certain securities, impacting replication.

Scalability issues arise when the strategy is implemented across billions of dollars, potentially leading to diminishing returns due to capacity constraints.

This makes it crucial for institutions to conduct capacity analysis and stress testing before committing to strategy index investment products.

7. Solutions and Best Practices

While challenges exist, several practices can mitigate liquidity and replication risks:

Liquidity screening: Choosing strategy indices that incorporate minimum liquidity thresholds.

Efficient implementation: Utilizing smart order routing, algorithmic trading, and execution cost modeling.

Index licensing transparency: Ensuring full access to index rules and construction logic.

Blended approaches: Combining strategy indices with traditional beta exposure to balance liquidity and performance objectives.

Fund managers must work collaboratively with index providers, custodians, and trading desks to optimize index replication, particularly for innovative or niche strategies.

Conclusion

Strategy index investment products offer unique opportunities to capture systematic sources of return beyond traditional market-cap benchmarks. However, these benefits come with liquidity and replication challenges that can hinder performance if not properly understood and managed.

From trading costs and rebalancing issues to liquidity mismatches and implementation barriers, investors must take a comprehensive and informed approach when evaluating or allocating to these products. By recognizing these limitations and applying strategic solutions, both retail and institutional investors can better harness the value of strategy indices while minimizing unintended risks.

1 note

·

View note

Link

#ARKInvest#BitcoinETF#CathieWood#Coinbase#cryptocurrencymarkets#institutionalinvestment#MarketVolatility#TariffPolicy

0 notes

Text

Year-End Checklist for Share Market Investors: Ensuring Compliance and Maximizing Returns

The year`s end is a crucial time for share market investors. It`s not just about celebrating the festive season but also about taking a strategic look at your portfolio, ensuring compliance with tax regulations, and setting yourself up for success in the coming financial year. This comprehensive checklist will guide you through the essential tasks, helping you maximize returns and minimize potential pitfalls.

1. Portfolio Performance Review: Analyze, Adjust, and Optimize

Assess Overall Performance: Evaluate your portfolio`s performance against your investment goals. Did you meet your expected returns? Analyze the performance of individual stocks and mutual funds.

Sectoral Analysis: Review the performance of different sectors in your portfolio. Identify sectors that outperformed and those that underperformed. Consider rebalancing your portfolio to align with your risk tolerance and market outlook.

Review Asset Allocation: Ensure your asset allocation (equity, debt, etc.) aligns with your risk profile and investment horizon. Make adjustments if necessary.

Identify Winners and Losers: Recognize your winning investments and analyze what contributed to their success. Also, identify losing investments and understand the reasons for their underperformance.

Rebalance Your Portfolio: If your portfolio has become unbalanced due to market fluctuations, rebalance it to maintain your desired asset allocation.

2. Tax Planning: Minimize Liabilities and Maximize Savings

Calculate Capital Gains: Determine your short-term (STCG) and long-term capital gains (LTCG) from share market transactions.

Tax-Loss Harvesting: Consider selling loss-making investments to offset capital gains and reduce your tax liability. Remember the “wash-sale” rule (30 days).

Section 80C Investments: If you haven`t fully utilized your Section 80C limit, explore options like ELSS mutual funds to save on taxes.

Dividend Income: Report your dividend income under “Income from Other Sources.” Ensure it matches Form 26AS.

Intraday Trading: If you are an intraday trader, your income will be considered business income. Maintain proper records for Schedule BP in your ITR.

Consult a Tax Advisor: Seek professional advice to understand the tax implications of your share market activities and optimize your tax planning.

3. Documentation and Record Keeping: Stay Organized and Compliant

Brokerage Statements: Maintain a record of your brokerage statements, P&L statements, and capital gains statements.

Demat Account Statements: Keep your demat account statements organized for easy access.

Bank Statements: Retain bank statements reflecting your share market transactions.

Contract Notes: If you engage in derivatives trading, keep contract notes for all transactions.

Form 26AS: Download and verify your Form 26AS to ensure all TDS details are accurate.

ITR Filing: Ensure you file your Income Tax Return (ITR) within the deadline.

Document Retention: Keep all relevant documents for at least six years, as the Income Tax Department can request them during scrutiny.

4. Compliance and Regulatory Updates: Stay Informed and Proactive

SEBI Regulations: Stay updated on the latest SEBI regulations and guidelines.

Company Announcements: Keep track of company announcements, including bonus issues, dividends, and stock splits.

KYC Compliance: Ensure your KYC details are up to date with your broker and depository participant.

Nomination Details: Check and update nomination details for your demat and trading accounts.

Beneficiary Ownership: If you hold shares in dematerialized form, ensure your beneficiary ownership details are accurate.

5. Planning for the Next Financial Year: Set Goals and Strategies

Define Investment Goals: Set clear investment goals for the next financial year.

Develop an Investment Strategy: Create a well-defined investment strategy based on your goals and risk tolerance.

Research Potential Investments: Identify potential investment opportunities based on market trends and your investment strategy.

Budgeting: Create a budget for your investments to ensure you stay within your financial means.

Review Your Risk Tolerance: Periodically review your risk tolerance to ensure it aligns with your investment strategy.

To read full blog visit

0 notes