#spx writes

Explore tagged Tumblr posts

Text

Writing Prompt

Villain baiting Hero with dysphoria into a House of Mirrors, but Villain does not know about the dysphoria until the Hero cracks

37 notes

·

View notes

Text

somebody rec me some good books. and they do actually have to be good. don’t rec me something just because it’s gay or it’s popular, it has to also still be good. like both the story and the writing have to be good none of this good concept bad writing or good writing horrible story. fantasy or soft scifi preferred, especially if it’s nontraditional fantasy. I am bored and sick of the internet and I want to get back into reading more but I’m kinda meh about most of what’s on my shelf

*edit: when I say “soft scifi” I don’t mean cozy I mean not hard scifi, as in stories that are more fantastical than grounded in hard science. for example the Martian is considered hard scifi, so not that. Star Wars would be closer to a soft scifi bc it’s all bullshit on the science end and it’s more about the vibes

#I started the jasmine throne and that was good but then I noticed a somewhat repetitive quirk of the writing style#and once I noticed it I couldn’t STOP noticing it which was extremely distracting and made it hard to pay attention to the story#the problem with books is I am sooooo hypercritical and so many ppl are bad writers and get published anyway#and booktok can’t tell the difference so these shitty books become bestsellers just bc they’re gay and tropey#not that jasmine throne is bad writing. it’s ok writing I just can’t stop noticing they overuse one particular sentence structure#and now it’s driving me crazy#but there are plenty of other bestselling books that ARE legitimately bad writing#I’m reading a psalm for the wild built rn and that is genuinely really good and next is the second book#but I’m almost done with the first one and both are like. really short. so I need something for when I finish those#(carefully does not look at the stack of comics I bought at SPX that I haven’t read yet)

84 notes

·

View notes

Text

[guy who is insane] from now on I should prepare for spx by looking up all the tablers and investigating everybody to make a list of any artist selling f/f comics so I can just hunt them down

9 notes

·

View notes

Note

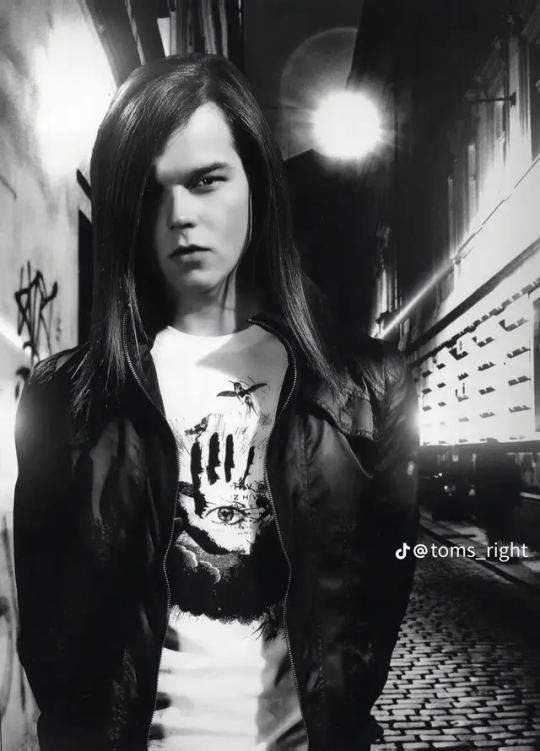

Tom x teen daughter reader! He was like in his teenage dirtbag phase when he had her (yeah yk the one) and her mom left so now it’s just them and they’re bffs?? Thank youu

PT1: Tom Kaulitz X Teen Daughter!Reader

Notes; This is my first request! Tysm anon!!

•My life has been so hetic and busy, I lost EVERY thing in my camera roll from like july 2023-now(not a single TH pic+vid), my home life has been super busy, but I returned to writing ASAP.

•I wasn't so sure about if you wanted headcanons or a fic or wtv, so I decided to do headcanons

•Enjoy, much love!💜💜

•First off, he loves you like he loves Bill. Even more, ngl. He cherishes you, adores you, spoils you, and overall just loves you.

^He will NOT tolerate you being bratty or not saying thanks, not being grateful. He wants you to know the importance of gratefulness.

•He loves buying you stuff. Any treat, stuffed animal, new soda, cd, movie tickets, concert tickets, if you play a sport or instrument any fancy and upgraded equipment, all that and more.

•Obviously, your mom is not in the picture. Tom takes care of you more than a mom could ever. He wants to help you with anything, so he researches about periods, anything that could make you sad or angry, stuff like that.

•When you were younger, if you were ever backstage during songs/on tours, you would be in a couple of TH TV episodes! The camera man would be polite and asking you cute questions

^"What do you wanna be when you grow up?"

^Stuff like that, and most fans and interviewers love you!

•Y'all know that lion cub interview w/ Bill & Tom? Let's say you were like four(???), and you got to meet a lion cub. Tom would slowly let you walk towards the lion cub, and the cub would sniff around you and lick your face. The camera man is filming this and it's totally becoming a TH TV episode.

•He would be the cause of a couple of cavities... He wouldn't let anything or anyone make you sad or angry, he is protective and can get angry when it comes to you.

•As long as your happy and not hurting yourself, he doesn't mind what you do with your looks, fashion, hair, career, etc.

•He loves dressing you up in his clothes, seeing his baggy jeans swallow your legs, and his headband+hat cover your forehead+eyes.

•If you wanted to get matching clothes, piercings, tattoos, sweatshirts, whatever, he's SO down for it!!

•(Let's say this is the 2023 era) You get along w/ Heidi & Heidi's kids so well! Having Heidi as a step-mom is so relieving. Yes, you have Tom+TH, but you can't always talk to them about periods, hair problems, how awful it (sometimes) is being a girl.

•Again with the spoiling. Tom will buy you anything. A country? It's yours. The sun? Cha-ching. An extremely expensive car? If you can drive, here's the keys.

•He will listen to your opinons and views, if you ever wanted to help him on a song, he is all for it!!

•When he had the dreads, you accidentally chewed on a couple😭

•If you ever get a significant other, he is going to make sure they're the right one, and won't let you get hurt by them.

•He splashes you w/ water at the beach

•He had to raise you practically on his own, so he expects y'all to be close. He had to bathe you, feed you, keep you happy, and he honestly puts you before himself.

•When you were younger, he stayed up all night waiting for you to get up and protecting you if someone wanted to come in and try something.

---

Taglist;

@ilovebill-and-gustav

@spx-der

163 notes

·

View notes

Text

Heyyyyy Slasher Nation! 🖤 First of all - HOLY CRAP THANK YOU!! Even though the Kickstarter didn't hit the goal, the fact that 98 of y'all (!!) got us a SIGNIFICANT part of the way there (almost $3,000!!) is MINDBLOWING!! <3333 I can't thank you enough 😭

So What Now / Wait you had a Plan B the whole time?!

Yeah, man, you thought I was just gonna leave you guys hanging? ;) We're gonna try this again with a WAY smaller goal on Crowdfundr! (I'll talk more about this below!) Short pitch is: $1,125 goal (which we nailed in 48 hours here), keeps SU running, launches September 7th, Crowfundr is being hella cool and sponsoring it for SPX Spotlight, follow along HERE! [https://crowdfundr.com/slasheruact2]

But ALSO, holy crap, you guys are AMAZING:

I can hardly call this thing a wash, though, because the amount of love, attention, and SOLD COPIES OF SLASHER U: ACT 1 have been ABSOLUTELY FUCKING WILD. I just wanted to shout out to:

More than 600 new Slasher U: Act 1 players downloaded the game since the Kickstarter launched

Slasher U: Act 1: Alpha Edition maintains a whopping 4.9 out of 5 Stars average rating on itch (!!!!!!!!!!!!!!!!!!!!!!!!)

I sold enough copies of Slasher U: Act 1 to cover MORE THAN HALF MY RENT THIS MONTH!! If this Kickstarter stopped right here, you guys would've been able to cover 4 MORE months of rent & production time! Which is HOG WILD.

We got shoutouts from:

Beautiful Glitch, the team behind Monster Prom, Monster Camp, & Monster Roadtrip!! Beautiful Glitch are one of my most inspirational/aspirational heroes of game dev, and the Monster franchise was a HUGE inspiration for SU, so I can't BELIEVE this happened!!!! Thank you guys SO MUCH!!! <333

WWAC (Women Write About Comics), where journalist Alenka Figa wrote SO MUCH NICE STUFF about my storytelling I'm gonna fuckin cry!!

Corinne Halbert of ACID NUN - she and I are actually gonna do an Acid Nun x Slasher U collab where you'll be able to unlock an Acid Nun player skin!! Shhhh!!

The crew at Lewdgamer who wrote an awesome writeup of the KS campaign!

Indiepocalypse - we made it into Issue #42 and Alex had us on his podcast, which was SO MUCH FUN!! According to Alex, Slasher U had one of the highest audience participation/engagements he's seen on Indiepocalypse Radio, and it was MEGA FUN watching him parse some of your saucy Sawyer questions, LMFAO.

And here's some Slasher U & SUKS stats for you:

More than 2/3rds of you ended up dating either Sawyer or Tate. >:)

In total, 94 of you backed the game here on KS!!! YOU ALL KICK SERIOUS ASS

Almost 1,000 new copies of Slasher U: Act 1 (both Regular and Premium) were downloaded during the campaign!

During the campaign, at least 3 people personally thanked me for Slasher U completely changing their life by discovering something about themselves or making them feel seen and heard, which is going to make me FUCKING CRY and is the ENTIRE REASON WHY I MAKE THIS GAME IN THE FIRST PLACE. I love you all so, so so sosososoososososos much, Student Disembody. :'))))))

So this "Plan B", eh?

Some of you know I'm a cartoonist by trade (I drew for the official FNAF franchise and more!). This year, I ended up talking to some sponsors for this upcoming SPX (Small Press Expo), which is like SDCC for indie comics, including Crowdfundr - one thing led to another, and now I'm partnering up with Crowdfundr and SPX to bring you a WAY SMALLER but also WAY MORE PERSONAL campaign to keep the lights on here at SU, as part of Crowfundr's SPX Spotlight event! For the non-comics folks here, Crowdfundr is basically the indie comics Kickstarter - I've been buddies with this crowd (pun vageuly intended) for a while and I'm psyched to be doing this with people I've been meaning to collab with!!

The new goal will cover the absolute bare minimum of making SU - $1,125, which includes font licenses, the Mac port, and taxes. Then, any EXTRA will go to more production time on Slasher U! Basically, I'm swinging the campaign around so the minimum amount is the goal, and the goal-goal's the reach goal. The GOOD NEWS is we apparently smashed this $1k goal within 48 hours of THIS Kickstarter, so I'm VERY OPTIMISTIC ABOUT ROUND 2 OVER HERE.

(You'll ALSO still be able to snag one of those custom player skins I'm drawing - there's gonna be only 5 slots this time!) Aaaaand you can click to follow when the Crowdfundr launches in a month, here:

P.S: estimating the first Early Access build with *just* Laila's Act 2 content, plus some core extras, in the next month or month and a half >:)))

xoxoxooxoxoxoxo, love you guys SO FUCKIN MUCH, and, as we like to say on campus:

STAY HORNY!! xxoxooxox Professor Plutonium

10 notes

·

View notes

Text

A couple months ago I started writing a novel.

It’s my first gods-honest attempt at a novel. I’ve written a ton of short stories, and even gotten a handful of them published, but I’ve always been intimidated by the idea of committing to one story for so long.

And it is gonna take a while. I’ve written five chapters so far, and deleted three of them, and rewritten the other two. Finishing the second chapter came with the realization that I need to rewrite about half of it. Sometimes I need to walk down the wrong path for a while to find the right one.

Honestly the length of time spent in the same story—with the same characters, in the same world, etc—hasn’t bothered me yet. But the hard part has just started sinking in:

I’m gonna have to turn down a lot of other projects.

I’m in two tabletop RPG groups. In one of them, we just wrapped up a game. For our next game, I would love to run one of the several RPGs I’ve picked up recently, and I normally would. But I just don’t have the time if I want to keep up the momentum on the novel.

Another story idea started kicking around in my head almost immediately after I committed to this project. It hasn’t shut up this whole time, and I think it might keep yammering at me the whole time, until I get to it.

Other projects I’m already balancing: A zine I’m making with my partner for SPX that is turning out to be really fucking cool. A one-shot tabletop RPG I’m editing for a friend that is a ton of fun. A very exciting potential opportunity to write a module for another up upcoming rpg. That last one’s still very tenuous, but if it happens, I’d be crazy to turn it down.

But something I learned a long time ago is that if I walk away from a project before it’s done, I’ll probably never get back to it. That might not be true for everyone, but it’s how my workflow shakes out. In starting this novel I’ve made a commitment to keep at it, no matter the pace, until it’s done.

The hard part’s gonna be the stories I don’t start. The games I don’t run. The ideas I save for later.

In a way, it makes a novel seem like a pretty selfish kind of project, but for every chapter I read for my writer’s group, I give feedback on three of theirs. Also, I am still juggling a full time job and three other projects (did I mention I’m the long-standing GM of my other RPG group?).

Each of the dozen other projects I could be working on is a reason to put the novel down. But there’s at least one reason I won’t:

So far, this book is really fucking good.

3 notes

·

View notes

Text

Hidden Market Trends: Turning Volatility Into Profits A Tale of Two Indices: Why Traders Should Rethink the Current Market Turmoil When it comes to navigating turbulent markets, traders often feel like they’re caught in a game of musical chairs—except the music’s tempo is controlled by the Federal Reserve, and the chairs are made of SPX, Dow, Russell, and Nasdaq data. Yesterday, U.S. equities took a rollercoaster ride, with the SPX closing slightly down at -0.09%, the Nasdaq experiencing a sharper dip at -0.47%, and the Dow eking out a negligible gain of +0.04%. Meanwhile, the Russell 2000 felt left out, sliding by -0.45%. With sectors split between outperformers (Utilities, Financials, and Tech) and laggards (Real Estate, Materials, and Energy), it’s clear we’re in a "pick your poison" kind of market. But here’s the kicker: volatility isn’t just chaos—it’s opportunity in disguise. Let’s dissect the numbers and uncover the hidden strategies that could turn this market turbulence into your secret weapon. The SPX Puzzle: Why -0.09% Isn’t Just Noise On paper, a 0.09% drop in the SPX seems about as exciting as watching paint dry. But zoom out, and you’ll notice this micro-movement might be the tip of a much larger iceberg. Historically, tiny fluctuations often precede sharp directional shifts—think of it as the market’s way of whispering its next big move. Hidden Opportunity: Use tools like Fibonacci retracement to identify potential support levels. For SPX, keep an eye on 5,820—a key pivot that could signal whether we’re headed for a breakout or further consolidation. Pro Tip: Pair this analysis with volume data. If a minor SPX drop comes with higher-than-average trading volume, the ‘whisper’ might actually be a ‘shout.’ Nasdaq: The Tech Titan’s Hidden Signal With the Nasdaq down by -0.47%, you might be tempted to write it off as another bad day for tech. But here’s where it gets interesting: divergence among the FAANG stocks. While Meta and Apple showed resilience, Netflix and Amazon slid further, creating a tug-of-war within the sector. Hidden Opportunity: Look for rotational plays within the tech sector. As one FAANG stock weakens, another often picks up the slack. Traders using pair trading strategies could exploit these imbalances to minimize risk while capitalizing on sector-wide trends. Pro Tip: Watch for earnings reports and guidance updates, which can amplify or dampen these intra-sector movements. Dow Jones: The ‘Safe Haven’ Illusion The Dow’s marginal gain of +0.04% might seem like a ray of hope, but don’t let it lull you into a false sense of security. Defensive plays in Utilities and Financials are buoying the index, but this could indicate traders are bracing for broader market weakness. Hidden Opportunity: Use the Dow’s stability to hedge riskier bets in other indices. For example, pairing long Dow futures with short Nasdaq positions can create a market-neutral strategy that thrives in volatility. Pro Tip: Monitor bond yields closely. Rising yields often correlate with outperformance in Financials, giving you a heads-up on potential Dow strength. Russell 2000: Small Caps, Big Insights Small-cap stocks in the Russell 2000 were hit hardest yesterday, sliding -0.45%. While this might seem like a red flag, it’s actually a golden opportunity for contrarian traders. Historically, small caps outperform in the early stages of a market recovery. Hidden Opportunity: Look for small-cap ETFs with high exposure to undervalued growth stocks. Combine this with a momentum filter to identify which assets are primed for a rebound. Pro Tip: Keep tabs on the VIX. Rising volatility often precedes a small-cap rally as institutional investors start hunting for bargains. Sector Winners and Losers: What’s the Real Story? Let’s talk sectors. Utilities and Financials outperformed, which isn’t surprising given their reputation as defensive stalwarts. But here’s the curveball: Tech’s outperformance despite Nasdaq’s decline signals that the market’s love affair with innovation isn’t over yet. Meanwhile, laggards like Real Estate and Energy might be signaling deeper structural issues, from rising interest rates to supply chain disruptions. Hidden Opportunity: For Energy, watch crude oil prices as a leading indicator. A sudden spike could reignite the sector. For Real Estate, focus on REITs with low leverage—they’re better equipped to weather interest rate hikes. Pro Tip: Use sector-specific ETFs to gain diversified exposure without overcommitting to individual stocks. Trade Smarter, Not Harder Market turbulence might feel like a storm, but savvy traders know how to ride the waves. By focusing on hidden patterns, exploiting sector rotation, and employing advanced strategies like pair trading and momentum filters, you can turn today’s chaos into tomorrow’s profit. Ready to sharpen your edge? Check out our exclusive Forex news updates and free trading tools to stay ahead of the game. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

A lot of things are happening in October! It's a busy busy month. I had kinda been struggling to find something interesting to write about, thinking that I'd try to write at least one blog post a week, and then October hit and now there's too much stuff to talk about. Haha

Shortbox Comics Fair 2024 is here! It's one of my favorite comic events of the year (aside from my beloved SPX), and runs from October 1st-31st. It's a curated event which debuts of over 100 new comics every year. (There are 117 this year! Wow!) It's run by just one person--which is kind of amazing--and is full to the brim with talent.

The comics featured vary in style, genre, and length. There are mysteries, ghost stories, slice of life, romance, trans-humanist stories, 16 page reads, 200 page epics, wordless comics, and much much more! Basically anything you could think of. There's a particular showing of "what if i was a robot and fell in love" and "what if i fell in love with a robot" or "what if a robot fell in love with me" themed stories this year, which I think is interesting.

As usual, there are far more comics that I want to read than I have money to buy. Hopefully, by the end of October, I'll have saved up enough pocket change to return and grab a few more.

Anyways, if you're into comics (or even if you're not) go give it a look! You'll probably find something cool and interesting!

Also, looking at all of those comics has really excited my comics brain and I almost immediately ran to start writing a short one. So maybe? Expect that? In the future??? Or something... If it doesn't happen in the next year, just give me a nudge.

1 note

·

View note

Text

Bimonthly Media Roundup

- The Locked Tomb (Books) - My sister's currently listening to the audio novels for these, and talking about them has reignited my love for the series. There's rarely ever such a big fandom presence around wlw-centric media, and for this one to come from a sci-fi/fantasy novel series is particularly incredible, I guess it just proves how entertaining the series is.

- Spx X Family Code White (Movie) - The Spy x Family movie is on Crunchyroll now which catches me up with the animated part of the series. I like the show as a whole though I don't think the movie was it's strongest showing. It wasn't bad per say, I did like Yor's misunderstanding infidelity plot-line as well as Lloyds mission to gather materials to make a dessert, but Anya (the most entertaining character) was a bit sidelined and overall the movie spent too much time on bland action scenes and montages. There was also an annoyingly long poop joke and a lack of the generally good comedy the series overall has, particularly in the latter half. I wouldn't call it a skip as I still enjoyed these characters, but it's not really a must see either, fans aren't missing anything substantial by skipping this one.

- Cowboy Bebop (Anime) - Not much to say yet only a few episodes in, but boy do I miss 90's anime character designs and detailed space western backgrounds, even with the square ratio it's a treat to look at.

- Jujutsu Kaisen (Anime) - Still in Gego Hell. In between the fanfics I've been reading I've been writing an enemies to friends to lovers Actor AU with nepotistic child actor turned type-casted romance lead Gojo being forced to costar with recently famous and well respected prestige indie actor Geto, which is fun to think of scenes for even if it will most likely never see the light of day.

- Steins;Gate (Anime) - Welp we finally finished Steins Gate, and while I definitely wouldn't call it the worse thing I've watched, It is the largest gap I've ever seen in regards to it's hype and reputation versus it's actual quality. MAL might not be the only measure of popularity but it's usually pretty good at gauging overall fan opinion, and this series is the 3rd highest ranked anime of all time with 9's and 10s across the board, with it frequently popping up on anitubers favorites lists. I'm not usually one to give things number scores as I think they are too vague to be useful, but if I were to give this series one it would probably be a 4/10, 5/10 at best, and that's me being generous. Honestly the only real positive I'd give this series is that the 'sending text messages and memories into the past, altering the present such that only the protag keeps their memories" is a pretty interesting time travel method, even I don't think it gets used to the best of it's abilities here. Other than that though I cannot for the life of me imagine how the series got so popular, other than the obvious nostalgia value combined with pandering to otaku culture/self insert harem protag combined with pseudo-intellectual science babble. I'm npt normally this mean but man, the first few episodes of this series were almost unwatchable with a bland color pallet, annoying archetypal characters who babble on with inane and honestly cringe dialogue, and absolutely no notable plot progression. About halfway in the plot picks up and it becomes mildly more interesting, but not enough to excuse the lackluster visuals and lack of any interesting characters or relationships, especially given that they go for the most basic of all time loop plots of "no matter how you change the past this innocent character dies over and over" without really justifying why in the same way that Madoka or even Life is Strange does. I'll probably watch some video essays on this as I'm genuinely curious why people like it, though I doubt my own opinion will change. Groundhog day loops are some of my favorite story devices but even as a big fan of the trope I wouldn't recommend this one, half of it is straight up painful to sit through and the other half has been done far better in other media.

- One Piece (Anime) - The Sabo and Imu stuff is neat but I am seeing what people meant when they said One Piece is a much better binge read than serial experience, I like the story but the short episodes and week wait time makes all the time wasting with random unimportant characters thst much more noticeable.

- Tiger Tiger (Webcomic) - The new pages are so cute, with Jamis not understanding why he's so jealous, Remy having his 100th existential crisis, and Arnos dumping some crazy lore then just watching in silent amusement at Jamis and Remy's mutual pining. A+

- Cult of the Lamb (Video Game) - Watched a friend play this on vacation and it looked so cute and creative that I bought it myself. I love how cute the little player Lamb character is, though the side noses + both eyes on one side of some of the character designs are a bit off-putting. Raising your own little cult in a game tied to Lovecraftian style old gods but in a cutesy animal aesthetic is right up my alley, I'm excited to learn a lot more of the lore surrounding them.

- Genshin Impact (Video Game) - Natlan is here! Not sure why everyone is so white, which is annoying, but I'll probably still be trying hard to get the geo lion girl as a geo healer would pair perfectly with my Navia. Natlan's Savannah/safari environment and new animals are neat though I'm not big on the new movement styles as I would prefer to stay as myself rather than switching between animal forms, even if the animals are pretty cute.

Listening To: Good Luck Babe, Red Wine Supernova, My Kink is Karma, Casual, and HOT TO GO! by Chappell Roan, Harpy Hare by Yaelokre, The Mind Electric by Miracle Musical, Dial Drunk by Noah Kahan, Save a Horse, Ride a Cowgirl by Chloe Breez and Annapantsu, Too Sweet, Lunch, Bitter, and Stick Season covers by Reinaeiry, Tounges and Teeth and Metaphor by The Crane Wives, Espresso, Taste, and Please Please Please by Sabrina Carpenter, Like a Prayer by Madonna.

0 notes

Link

Athens OH (SPX) Jan 21, 2024 Aresearch project designed by a group of Ohio University students will soon be traveling to the International Space Station (ISS). During the fall semester, Ohio students from across the University had the opportunity to design projects and write proposals for the Student Spaceflight Experiment Program's Mission 18 to the ISS. Under the leadership of Dr. Sarah Wyatt, professor of environme

0 notes

Text

Market Update for Wednesday, December 13th, 2023

Good evening, traders. I was pissed off earlier and thought I wouldn’t write an article while I wait for the god damn sellers to show up, but I’ve changed my mind and I will provide four charts. The first observation I want to make is this purple trend line on SPX cash (it comes from the Volmageddon and pre-COVID highs). Continue reading Untitled

View On WordPress

0 notes

Text

Small Press Expo 2023: The Difficulty Of Simplicity: Writing For Young Readers

Small Press Expo 2023: The Difficulty Of Simplicity: Writing For Young Readers #spx #spx2023 #smallpressexpo

The Small Press Expo has posted all of the programming panels from SPX 2023 on YouTube to watch! Writing comics aimed at young readers requires an incredible level of craft. Not only is a cartoonist’s toolbox limited in terms of subject matter, they must also be able to make it easy for kids to understand the art of comics. Moderator Meg Lemke explores the joys and difficulties of writing for…

youtube

View On WordPress

#coni yovaniniz#leigh luna#meg lemke#miranda harmon#rodrigo vargas#shauna j. grant#small press expo#spx#video#Youtube

1 note

·

View note

Text

$RIOT #SP500 #NASDAQ #SPX $TOMO-USD

On Tuesday, 24th October 2023, the stock market kicked off with a positive note as it traded in the green after a slight correction on Monday. All eyes in the investment world are now focused on the earnings reports of leading companies like Alphabet Inc, Microsoft Corporation, and General Motors Company. Furthermore, notable gains in the Utilities and Basic Materials sectors have contributed to this promising start. Additionally, the cryptocurrency market is experiencing an upswing, with Bitcoin and Ethereum leading the charge. In this article, we will delve into the highlights of the morning's market movements and shed light on the top-performing cryptocurrencies. Market Performance: With the stocks of multiple sectors seeing a rise, two sectors stood out in particular. The Utilities sector witnessed an increase of 1.15%, while the Basic Materials sector climbed by 1.04%. These gains indicate a resurgence in investor confidence and market stability. Moreover, the Exchange Traded Funds (ETF) industry experienced notable growth, with an impressive 8.48% increase. These positive trends set the stage for an exciting day in the stock market. Cryptocurrency Market Update: Bitcoin, the world's most well-known cryptocurrency, has been on the rise today. At the time of writing, it is trading at $34,430.242, showcasing its resilience and attrac https://csimarket.com/news/news_markets.php?date=2023-10-24T14051&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Fascinating drug!

High consensus is attributed to the “…?...”.

⬇️

Weight-loss doctors have more questions than answers about GLP-1s like Wegovy, writes @lisamjarvis, and the most pressing one is: Must patients take them forever?

https://www.bloomberg.com/opinion/articles/2023-10-19/do-you-really-have-to-take-wegovy-forever?utm_source=website&utm_medium=share&utm_campaign=twitter via @opinion @carlquintanilla #news @jimcramer @SaraEisen #weightloss #sugar @M_McDonough $nvo $LLY #diabetes #weightloss #fda $spx #semaglutide #healthcare #investor $spx #carb #DILI #hhs @davidfaber

🖍️#MedWatch #semaglutide

1-800-FDA-1088, 4, 1

@FDA Adverse Event Reporting System (FAERS) Electronic Submissions

https://fis.fda.gov/sense/app/95239e26-e0be-42d9-a960-9a5f7f1c25ee/sheet/7a47a261-d58b-4203-a8aa-6d3021737452/state/analysis

0 notes

Text

PT2: Headcanons(NSFW): How Tokio Hotel(any era) would be like in bed

Notes; I have a couple of Tokio Hotel works coming up, but I'm just having a hard time writing

•I was so close to falling asleep while writing this, it was 2:24 AM when I posted this & I was soo tired

•Just a reminder, none of the photos I use are mine

•Since I already did Bill NSFW, his section is shorter😕

•I tried something different & added a pic every time it was a different person🤗

•Enjoy, much love!💜💜

•I need more people on my taglist😭

Tom Kaulitz

•Bro. He's literally Tom. He's horny as fuck. Now, he won't force you, but he will put you in the mood all the time.

^Y'all can and will go until your too exhausted and overstimulated

•He can go for rounds at a time. He will give you breaks, but he loves sex.

•Honestly, I see him as a both a receiver and a giver. He wants it to be good for both of y'all.

^He's a dom, and can be a receiver, but will always be in control of the situation.

•He can be serious, playful, dominating, loving, it really depends on where y'all are and if something happened leading up to sex.

^Would be real playful during quickies, just chasing y'alls release, not even caring if other people can see or hear.

^He's dominating and serious if he's jealous and angry, needing to prove to you that your his, he's yours, and nobody can be between that.

•He likes to try different things, and will try his best to let him do different things to you, different positions, roles, toys, etc(it's Tom?? Nobody would say no💀)

•Gives you princess treatment, but can and will degrade the shit out of you

•He knows how to use his fingers.

•He will let you take control(maybe, not really), but 90% of the time he likes leading things

•Will not turn down a bj. Ever.🙈

•Dirty talk 24/7. He will also call you all the nicknames in the book.

---

Bill Kaulitz

•He's definitely a softie, but can be sassy and playful.

•A switch. He won't be in control all the time, but neither will you.

•He loves trying out new things, but he will never make you uncomfortable or ignore if you say a safe word.

•He loves dirty talk+praise, teasing you, praising you, any talk tbh

•He loves face-fucking. Or face-sitting. Both tbh

•He loves tits. Playing with them, laying on them(sleeps on them sometimes, there is photos of him sleeping on your upper body)

Georg Listing

Only high quality pic I could find ngl

•Georg wants to control the situation, and will be dominating and serious.

•He will mark you up everywhere with bruises, hickies, teeth marks, and kiss marks.

•He likes to keep it simple, but will try out new toys.

•He doesn't get jealous very easily, but when he does, it's super intense & scary to deal with his questioning and attitude.

•He is overall a relaxed guy, so lazy, calm, and just chasing release is what sex is normally about for y'all.

•He is such a soft and good lover, omg. He puts you first during sex 100%, and listens to your every want and need.

•Body worshipper 100%!! He kisses and rubs every curve and mark.

Gustav Schäfer

•Gustav is soft and nice, but will put his foot down if needed.

•He is so adorable!!! He loves aftercare, and does all of the above(baths, snacks, ointment if needed on bruises+scratches, the whole 9 yards🤗😻)

•He's a switch, he doesn't mind being in control, but he likes when you take the reins sometimes.

•Angry and frustated sex. He will use you as his outlet(sometimes....)

•He has really strong muscles, and can go for rounds and hours!

^He knows how to use his fingers.

•He loves kissing on your neck and face.

•He doesn't whimper, but will groan deeply.

•I feel like he'd be into filming it and watching it back later when he can't be near you or just doesn't have time.

^The pictures he has of you also help him jack-off when he can't be near you

-

Taglist;

@ilovebill-and-gustav

@spx-der

•I tried my best. I'm so tired writing this wtf

#adissonssswrites#tokio hotel#2000s#tokio hotel imagine#bill kaulitz#georg listing#bill kaulitz x reader#georg listing x reader#tokio hotel smut#tokio hotel fanfic#tom kaulitz#tom kaulitz x reader#gustav schafer x reader#gustav schafer

59 notes

·

View notes

Text

Hotter Consumer InflationPlease click here for a chart of SPDR S&P 500 ETF Trust SPY which represents the benchmark stock market index S&P 500 (SPX).Note the following: The chart shows that the stock market ran up above the top band of the top support zone in anticipation of better than expected Producer Price Index (PPI) and Consumer Price Index (CPI) as well as the market mechanics of year end chase and market positioning. Yesterday, we shared with you that PPI came hotter than expected, but bullish investors chose to ignore it. Please read yesterday’s Capsules for more on PPI. Bullish investors chose to pin their hopes on CPI coming better than expected and market mechanics. This morning, CPI came worse than expected. Here are the details: Headline CPI came at 0.4% vs. 0.3% month-over-month consensus. Core CPI came at 0.3% vs. 0.3% month-over-month consensus. Of special note is that the whisper numbers for Core CPI were 0.2%. Wall Street was positioned for 0.2% Core CPI. Now, there are two strikes against Wall Street positioning and bulls’ hopes in the form of PPI and CPI. Stock futures were running up ahead of the release of CPI on hopes of better than expected numbers. On release of CPI, the stock market took a slight dip. The momo crowd aggressively bought the dip and is trying to run up the stock market as of this writing. In The Arora Report analysis, even though progress is being made on inflation, core inflation is staying sticky, way above the Fed’s 2% target. This means that the Fed is likely to keep rates higher for longer but may be reluctant to raise rates. You may recall that The Arora Report’s call for a while has been that core inflation will stay sticky. So far, that call is spot on. Earnings season starts tomorrow, although a fair number of earnings were reported this morning. Earnings are expected to be inline with consensus; however, earnings this morning are mixed. Going forward, bulls’ faith in market mechanics to run up the stock market will be tested as their predictions on the data have been wrong. Here are the probabilities of Fed interest rate hikes: 10% in November 33% in December Initial jobless claims came at 209K vs. 214K consensus. This indicates that the job picture, especially at the low end, remains very strong. The job picture remains weak in information technology. During the pandemic, information technology had the strongest demand. Initial jobless claims are a leading indicator and carries heavy weight in our adaptive ZYX Asset Allocation Model with inputs in ten categories. In plain English, adaptiveness means that the model changes itself with market conditions. Please click here to see how this is achieved. One of the reasons behind The Arora Report’s unrivaled performance in both bull and bear markets is the adaptiveness of the model. Most models on Wall Street are static. They work for a while and then stop working when market conditions change. As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band. IndiaInflation in India slowed and has now come back to the target zone set by the Reserve Bank of India. CPI came at 5.02% year-over-year vs. 5.50% consensus.In The Arora Report analysis, this is good news. However, even though India is the best large economy opportunity for long term investors, in the short term, India’s stock market is overbought and valuations are too high. If the Indian market dips, it will be a buying opportunity. To see the buy zone for India and The Arora Report’s short term, medium term, and long term ratings, please see ZYX Emerging. ZYX Emerging has continuously covered India for 16 years.ChinaChina’s sovereign wealth fund, which is controlled by the Chinese government, bought more stock in China’s largest banks. As this has not happened since 2015, speculation is growing that the Chinese government will increase its efforts to help the Chinese stock market.

In The Arora Report analysis, this maneuver by the Chinese government will only have a limited impact on the stock market. Magnificent Seven Money FlowsIn the early trade, money flows are positive in Apple Inc AAPL, Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, and NVIDIA Corp NVDA.In the early trade, money flows are negative in Microsoft Corp MSFT and Tesla Inc TSLA.In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust and Invesco QQQ Trust Series 1 QQQ.Momo Crowd And Smart Money In StocksThe momo crowd is buying stocks in the early trade. Smart money is 🔒 stocks in the early trade.GoldGold is attempting to break the psychological resistance at $1900. The momo crowd is buying gold in the early trade. Smart money is 🔒 in the early trade.For longer-term, please see gold and silver ratings.The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. OilAPI crude inventories came at a build of 12.94M barrels vs. a consensus of a build of 1.3M barrels.The momo crowd is buying oil in the early trade. Smart money is 🔒 oil in the early trade.For longer-term, please see oil ratings.The most popular ETF for oil is United States Oil ETF USO.BitcoinBitcoin BTC/USD bulls are getting concerned that bitcoin may be forming a head and shoulders pattern. This is a negative pattern. Bitcoin is trading under $27,000 as of this writing.MarketsOur very, very short-term early stock market indicator is 🔒. This indicator, with a great track record, is popular among long term investors to stay in tune with the market and among short term traders to independently undertake quick trades.Protection Band And What To Do NowIt is important for investors to look ahead and not in the rearview mirror.Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider holding 🔒 in cash or Treasury bills or allocated to short-term tactical trades; and short to medium-term hedges of 🔒, and short term hedges of 🔒. This is a good way to protect yourself and participate in the upside at the same time.You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.Traditional 60/40 PortfolioProbability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.The Arora Report is known for its accurate calls. The Arora Report correctly called the 2008 financial crash, the start of a mega bull market in 2009, the COVID crash, the post-COVID bull market, and the 2022 bear market. Please click here to sign up for a free forever Generate Wealth Newsletter.

0 notes