#snb round 4

Explore tagged Tumblr posts

Text

Masterpost

4 notes

·

View notes

Text

Top Audit Firms in Hyderabad for Articleship: Launch Your Career with the Best

Embarking on a career in chartered accountancy is a significant step towards a rewarding professional journey. One of the crucial phases in this journey is securing an articleship with a reputable audit firm. Hyderabad, a burgeoning metropolis, is home to some of the top audit firms that offer excellent articleship opportunities. This blog will explore these leading firms, the benefits of choosing the right top audit firms in hyderabad for articleship, and how this step can be a launchpad for a successful career in chartered accountancy.

Why Choose Hyderabad for Your Articleship?

Hyderabad, often referred to as Cyberabad due to its thriving IT sector, is also a major hub for financial services. The city offers a dynamic business environment with a blend of traditional and modern enterprises. Opting for an articleship in Hyderabad means exposure to a diverse range of industries, from technology to manufacturing, pharmaceuticals, and more. This variety provides a rich learning ground for aspiring chartered accountants.

Top Audit Firms in Hyderabad for Articleship

1. Deloitte

Deloitte is a global leader in professional services and one of the "Big Four" audit firms. Known for its rigorous training programs and comprehensive exposure, Deloitte offers a robust articleship experience. Trainees get the opportunity to work with top-tier clients and are trained in various aspects of auditing, tax, and advisory services. Deloitte's presence in Hyderabad makes it an ideal choice for those seeking a well-rounded articleship.

2. KPMG

KPMG is another esteemed member of the Big Four, renowned for its structured training programs and commitment to professional development. Articleship at KPMG in Hyderabad means working alongside experienced professionals on challenging assignments. The firm's focus on continuous learning and innovation ensures that trainees are well-prepared for their CA exams and future careers.

3. PwC (PricewaterhouseCoopers)

PwC offers an exceptional articleship experience, blending practical training with theoretical knowledge. As an articleship trainee at PwC Hyderabad, you will be involved in high-impact projects and gain insights into diverse industries. PwC's emphasis on mentorship and skill development makes it a top choice for aspiring chartered accountants.

4. EY (Ernst & Young)

EY is known for its dynamic work environment and comprehensive training programs. Articleship at EY Hyderabad provides exposure to audit, tax, and advisory services, allowing trainees to develop a holistic understanding of financial services. EY's focus on digital transformation and innovative practices ensures that trainees are equipped with the skills needed for the modern financial landscape.

5. Grant Thornton

Grant Thornton is a prominent audit firm that offers a nurturing environment for articleship trainees. The firm's personalized approach to training, combined with exposure to diverse clients, makes it an excellent choice for aspiring CAs. In Hyderabad, Grant Thornton is known for its supportive culture and commitment to professional growth.

6. BDO India

BDO India provides a comprehensive articleship program that focuses on practical training and professional development. As an articleship trainee at BDO Hyderabad, you will work on a variety of assignments, gaining valuable experience in audit, tax, and advisory services. BDO's emphasis on a collaborative work environment enhances the learning experience.

7. RSM India

RSM India is part of the global RSM network, offering extensive training opportunities for articleship trainees. In Hyderabad, RSM provides a balanced mix of practical exposure and theoretical learning. The firm's focus on middle-market enterprises allows trainees to understand the unique challenges and opportunities faced by this segment.

8. SNB Associates

SNB Associates is a well-established audit firm in Hyderabad, known for its rigorous training programs and strong client relationships. The firm offers a structured articleship program that covers all aspects of auditing and taxation. SNB Associates' commitment to excellence and integrity makes it a preferred choice for many aspiring chartered accountants.

9. Brahmayya & Co.

Brahmayya & Co. is one of Hyderabad's oldest and most respected audit firms. The firm's articleship program is designed to provide comprehensive training in audit and assurance services. Trainees at Brahmayya & Co. benefit from the firm's deep industry expertise and commitment to professional development.

10. SBC (Steadfast Business Consultants)

SBC is a leading audit firm in Madhapur, Hyderabad, known for its client-centric approach and commitment to excellence. The firm's articleship program offers hands-on experience in auditing, taxation, and financial advisory services. SBC's focus on delivering high-quality services and building long-term client relationships provides a valuable learning environment for articleship trainees.

Benefits of Choosing the Right Audit Firm for Articleship

1. Comprehensive Training

Top audit firms offer structured training programs that cover all aspects of auditing, taxation, and financial advisory services. This comprehensive training ensures that trainees are well-prepared for their CA exams and future careers.

2. Exposure to Diverse Industries

Working with leading audit firms provides exposure to a wide range of industries. This diverse experience helps trainees understand different business models and financial practices, enhancing their overall learning.

3. Professional Development

Reputable audit firms invest in the professional development of their trainees. From mentorship programs to continuous learning opportunities, these firms ensure that trainees develop the skills needed for a successful career in chartered accountancy.

4. Networking Opportunities

Articleship with a top audit firm provides access to a network of experienced professionals and industry leaders. This networking can be invaluable for career growth and future opportunities.

5. Hands-On Experience

Leading audit firms offer hands-on experience with real clients and projects. This practical exposure is crucial for understanding the nuances of auditing and financial services.

Conclusion

Choosing the right audit firm for your articleship is a critical step in your journey towards becoming a successful chartered accountant. Hyderabad, with its vibrant business environment and presence of top audit firms, offers excellent opportunities for aspiring CAs. Firms like Deloitte, KPMG, PwC, EY, Grant Thornton, BDO India, RSM India, SNB Associates, Brahmayya & Co., and SBC are known for their comprehensive training programs, professional development opportunities, and supportive work environments.

By opting for an articleship with one of these leading firms, you can gain the skills, experience, and network needed to excel in your career. For more information on articleship opportunities with SBC, contact us at 040-48555182 or visit our office in Madhapur, Hyderabad. Let us help you launch your career with the best in the industry.

#top 10 ca firms in hyderabad for articleship#big ca firms in hyderabad#top audit firms in hyderabad for articleship#top ca firms in hyderabad#chartered accountant firm

0 notes

Link

Round 1:

1. SNB: Joshua Roy, C, Les Chevaliers de Lévis 2. VDO: Justin Robidas, C, Les Cantoniers de Magog 3. MON: Zachary L’Heureux, C, Grenadiers de Châteauguay 4. GAT: Zachary Dean, C, Toronto Nationals MMAAA 5. SHA: Olivier Nadeau, RW, Les Chevaliers de Lévis 6. VDO: Evan Nause, LD, Newbridge Academy Prep U18 7. VIC: Guillaume Richard, LD, Le Blizzard du Séminare Saint-François 8. QUE: Nathan Gaucher, C, Gaulois St-Hyacinthe 9. SHE: Cameron Whynot, RD, Swapper Wildcats Midget Majeur 10. SHE: Israel Mianscum, F, Les Forestiers d’Amos AAA 11. BAT: Riley Kidney, C, Midget Majeur de Cole Harbour 12. VIC: Maxime Pellerin, C, Les Estacades de Trois-Rivières 13. GAT: Olivier Boutin, LD, Les Chevaliers de Lévis 14. RIM: Zachary Bolduc, C, Les Estacades de Trois-Rivières 15. QUE: Jacob Melanson, RW, Weeks Midget Majeur du Comté Pictou 16. BAT: Cole Huckins, C, École Secondaire Stanstead 17. CAP: Jérémy Langlois, D, Cyclones de Québec 18. CHI: Oscar Plandowski, LD, Selects Academy 15′sNAT

3 notes

·

View notes

Text

I posted 569 times in 2021

1 posts created (0%)

568 posts reblogged (100%)

For every post I created, I reblogged 568.0 posts.

I added 43 tags in 2021

#awtwb spoilers - 17 posts

#chain of iron spoilers - 9 posts

#snb spoilers - 8 posts

#squid game - 2 posts

#shadow and bone - 2 posts

#no one cares but - 1 posts

#i don’t understand this at all but vibe - 1 posts

#i always plan to do more but by the time i’d do it i’m too tired to care - 1 posts

#sab spoilers - 1 posts

#cause tumblr was always the source of those instagram text post pics - 1 posts

Longest Tag: 136 characters

#tfw sinner loses his spot after his loss against alcaraz and then alcaraz proceeds to lose the next round while having a 5-0 lead in the

My Top Post in 2021

so i was tagged by the one n only @kukalakas to write my top 10 fav songs in whatever order. alas this was surprisingly difficult:

1. Holiday in Cambodia - Dead Kennedys

2. London Calling - The Clash

3. The Four Seasons: Summer - Vivaldi

4. Spellbound - Siouxsie and the Banshees

5. Groan - Dazey and the Scouts

6. Make Me Wanna Die - The Pretty Reckless

7. When Ya Get Drafted - Dead Kennedys

8. Hayloft - Mother Mother

9. The Passion of Lovers - Bauhaus

10. This Could Be Anywhere

I have literally no other mutuals so the trend dies here :(

1 notes • Posted 2021-02-10 23:59:07 GMT

Get your Tumblr 2021 Year in Review →

1 note

·

View note

Text

Magi Monday Vol.4

“What’s to come for Team Sindria?”, A Special round-Table Talk ft Ohtaka, Ohtera, & the Editors (Part 1)

(From the Sinbad no Bouken Fanbook)

Warning: As usual, please note that my level of Japanese is basic at most, so I cannot guarantee that the following is 100% accurate. Feel free to share the link, but please DO NOT REPOST, and don’t forget to support the official releases!!

In which Ohtaka, Ohtera, and the editors for Magi and Sinbad no Bouken discuss mant things of great importance, including the reason for Sinbad not talking about him becoming half-fallen, Hinahoho’s personality change, Ja’far’s delinquent phase... and whether Sinbad’s earrings are part of his sex appeal.

Note: This chat features 5 people:

OS --> Ohtaka Shinobu

OY --> Ohtera Yoshifumi

E1 --> Magi’s Editor

E2 --> SnB’s Editor

The interviewer is in bolded text.

Also, HUGE thanks to @arashidono and @victoriel for helping me with some doubts, and to @mari-m-rose for requesting this topic :)

CONCERNS REGARDING SINBAD

Thank you very much for your time today. Let’s start with the #1 concern, when does Sinbad become half-fallen?

OS: It’ll be covered in the story... .

OY: Look forward to what will happen from now on... .

E1: Many points on this subject have already been brought up in Magi. How his country was destroyed, how he has rukh that is not his within his body, and how there was a time in which he couldn’t use his magoi, like what happened with Alibaba and Cassim.

OS: The reason for Sinbad just casually talking about all this information. And the matter of “the country was destroyed”. (T/N: I’m not sure about this).

E1: You really don’t want to go into too much detail, don’t you.

OS: In Magi’s 13th volume, Sinbad was super straightforward about “also having experienced something like that in the past”.

E1: Anyway, regarding Sinbad becoming half-fallen, there are many hints in Magi. I think it would be good if you could figure it out based on them. Parthevia’s Emperor appeared recently as well.

OS: Exactly!

E1: Sinbad does not talk about it, you now. In the real world, elderly people don’t talk much about war times. It’s the same; you don’t talk about it because it’s never a fun story.

OS: Although I think it’ll be ok if I talk about it.

THE EARRINGS ARE PROOF OF HIS SEX APPEAL?

Sinbad wears those big earrings, but what’s their origin?

OS: It’s because that’s how I made him, I think (laughs).

E1: That’s what you are saying?!

OS: Eh? No, no, that’s not it. He himself made his own character.

OY: I think it’s his trademark.

E1: However, they are very dangerous. If something gets caught in them, your ear might [come off], I’d be scared all the time. (T/N: I have no idea what he says in [], so that’s guesswork).

OS: It’s quite dangerous~. If something gets caught in them, your ear will come off! I wonder why he wears them... .

OY: He didn’t wear them when he was 5, but he has them at 14.

(There is a bit here I’m skipping because I can’t translate it properly, except for one part where they mention that Sinbad chose the earrings himself, and started wearing them when he grew up).

THE REASON FOR SINBAD’S POPULARITY IS...?

Sinbad was pretty popular when he was 14, huh.

OS: He was quite popular. Ah, but it might have been because there weren’t any other cute men in his village! Since it was during the war.

OY: All the valuable men were away? If the only man who could work was Sinbad, that would make him popular. So, it was because of his circumstances.

E1: Great men are great lovers (laughs). (T/N: More literally, “Great men are susceptible to female charms”).

Sinbad is also a strong fighter.

E1: He is a strong fighter because he is a man of the sea.

OS: Exactly, because he is a fisherman.

E2: And fishermen are strong.

OY: That was also mentioned at the beginning of Sinbad no Bouken, wasn’t it.

I wonder what’s the success rate of his flirting.

E1: Rather than his success rate, at first it was important to increase the amount of attempts. If you do it over and over, getting rejected doesn’t hurt anymore.

OS: Popular people are like that.

E1: However, truly falling in love would seem unlikely.

OS: Yes, that’s right.

E1: There are people like that.

Moving on, I would like to hear about the future Eight Generals, Sinbad’s comrades. Hinahoho’s personality really changed a lot.

E2: He showed his true colors. At first, (...) he was a bit of a coward.

OS: He was always enduring it.

OY: The personality we see later is the real one. He came out of his shell.

E1: He is a man of the sea.

OS: And there it is again! The man of the sea!

E1: Because he has a harpoon, not a spear.

OS: Indeed!

E1: The #1 harpoon!

Him having a large family is also because he is a man of the sea?

OS: That’s because he is from Imuchakk.

OY: Imuchakk have short pregnancies, and the children’s growth is also fast. Because they are a tribe with large bodies, they need to give birth earlier. And since the couple got along well, lots of children were born.

(They then bring up Artemyra, and how he will take what happened there to the grave. That said, he is loyal to his wife. Both Ohtaka and Ohtera seem amused, with Ohtera remarking that he hopes nothing happened).

JA’FAR WAS A DELINQUENT?!

Well then, let’s talk about Ja’far. I wonder if his personality became like that due to studying?

E1: From the beginning, Ohtaka-sensei has said that Ja’far is a former delinquent, right? But you didn’t elaborate any further (T/N: I’m not sure about this phrase).

OS: Because it’s a story from way back.

E1: Why did you make him an assassin...?

OS: At first, I had a more adult-like... cooler image of him, but... .

E1: But that didn’t lead to the current Ja’far.

OS: When thinking of a taciturn character that slowly becomes more human... it became something like a delinquent.

E1: Slowly becoming more human... that’s difficult.

OS: A bit.

However, Ja’far has this aura of a super respectable person... .

OS: That’s because, in order to become Sinbad’s right-hand man, Rurumu educated him, and he learnt how to dress neatly and changed his way of speaking.

E1: It feels like he is playing that role for Sinbad’s sake.

OS: Ja’far has no choice. Among the Eight Generals, he is the only one that doesn’t have a place to return to. The others have countries they can go back to, but Ja’far only has this place at Sinbad’s side, so he is taking a gamble on him. There is also a reason why Sinbad trusts him so much.

E1: Even Masrur has found comrades, now that the Fanalis Corps entered the scene.

And that’s it for part 1! This is a long interview, but it was fun to translate. It’s always interesting to see Ohtaka-sensei talk about her characters more directly, as well as Ohtera-sensei’s input.

Next time we will go into Drakon, Mystras, Masrur, and Sharrkan. I hope to see you there as well!

139 notes

·

View notes

Photo

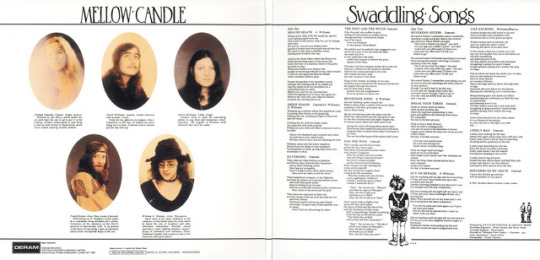

Mellow Candle - Swaddling Songs UK Album 1972 Advertise Poster

Mellow Candle were a progressive folk rock band. Principally Irish, the members were also unusually young, Clodagh Simonds being only 15 and Alison Bools (later O'Donnell) and Maria White 16, and still at school, at the time of their first single, "Feelin' High", released in 1968 on Simon Napier-Bell's SNB Records.

By 1972, the lineup had expanded to include Dave Williams on guitar, Frank Boylan on bass, and William Murray on drums. With this lineup in place, the band released their only album, Swaddling Songs (Deram Records), which was commercially unsuccessful at the time. Over the years, however, the lone album by the band has received considerable critical acclaim and original vinyl copies are now very valuable. Boylan was later replaced by Steve Borrill (ex-Spirogyra), but shortly afterwards the band split up. After the band's dissolution, Simonds worked with Thin Lizzy, Jade Warrior, and Mike Oldfield. Boylan played with Gary Moore, while Murray contributed to albums by Kevin Ayers, Amazing Blondel, Mike Oldfield, and Paul Kossoff.

In 1991, "Silver Song" was covered by All About Eve as a B-Side to some versions of their single Farewell Mr. Sorrow.

1996 saw the release of The Virgin Prophet, a collection of previously unreleased material by the band, including early versions of many of the songs later released on Swaddling Songs. Some of these sessions featured Richard Coughlan of Caravan on drums, although his sessions do not feature on "Virgin Prophet".

In 1996, Simonds recorded Six Elementary Songs, released in 1997 on the Tokyo-based Evangel Records.

In 1999, Simonds recorded a version of Syd Barrett's setting of the James Joyce poem "Golden Hair" for Russell Mills album "Pearl and Umbra". 2006-7 saw the participation of Simonds in a musical project called Fovea Hex, alongside Brian Eno, Roger Eno, film composer Carter Burwell, Andrew McKenzie of the Hafler Trio, Steven Wilson, Colin Potter (of Nurse With Wound), Robert Fripp, Percy Jones, and others. The project has been favourably reviewed by Pitchfork Media. Also in 2006, Simonds performed a version of "Idumaea" for Current 93's album Black Ships Ate The Sky, and a version of "Cockles and Mussels" for Matmos's ep "For Alan Turing".

In 2006, O'Donnell was reunited with Dave Williams and Frank Boylan on the album Mise Agus Ise. She followed this with the 2008 EP The Fabric of Folk on Static Caravan (a collaboration with English folk/rock band The Owl Service), and her debut solo album, Hey Hey Hippy Witch, released at the end of 2009 on Floating World.

Despite the fact that after thirty years "Swaddling Songs" is less of a challenge to listen to than it would have been in 1972, it still stands as a most brilliant documentation of the childhood lives of Clodagh Simonds and Allison Williams.

Having grown up in the strict Holy Child Convent School in Dublin, the two women were forbidden to listen to rock music, but listened covertly to Radio Luxembourg each night. Only when Simonds began writing a succession of hymnal pop tunes on her parents' piano did the two lives begin to converge.

After several false starts, Mellow Candle began to record "Swaddling Songs" in 1971 after moving to London, when Simonds was only eighteen. Though apparently not many songs had been written by Simonds herself, the results were amazing even after thirty years.

"Heaven Heath" and "Messenger Birds", both written by Allison Williams (née O'Donnell) Simonds' longtime schoolmate, added a contrasting touch to the album. Retaining the hymnal flavour of Simonds' songs, they are nontheless much odder in their melodies and rhythma, especially "Heaven Heath"'s brilliant harpsichord line, but retain the accessible melodies and amazingly beautiful vocals. "Messenger Birds" sets the mystical tone of the album - remiscent in places of Kate Bush's work on "The Ninth Wave" in its tale of travelling across the sea.

"Sheep Season" with its long instrumental outro and "Silver Song" (once covered by My Bloody Valentine) show the typical Simonds style of haunting and atmospheric pop tunes, not at all folky in instrumentation or sound. "Dan The Wing" was an amazing drama about evil, beating Laura Nyro's "Eli And The Thirteenth Confession" or Kate Bush's "The Dreaming" for explicit imagery of the Devil. "Break Your Token" was an upbeat, festive rocker, whilst the amazing overlaying of a guitar solo and beautiful vocals on "Lonely Man" was worth the price of admission alone. The closer "Boulders On My Grave" continued in that vein with Clodagh and Allison repeatedly chanting "Do do do do", "La la la la" and "Na na na na" in perfect harmony.

The album's centrepiece, though, was the amazing, chilling, piano-only "Reverend Sisters", in which the women's beautiful voices matched Simonds' amazing piano line and lyrics describing brilliantly the women's strict religious upbringing and its effects on them - almost a taste of Tori Amos twenty years before the fact. "Reverend Sisters" was remarkably honest yet not a preachy attack on religion - it was a matter-of-fact tale that will always amaze those fortunate enough to hear it.

"Buy Or Beware" and "Vile Excesses" rounded of the album excellently. Because of the (for its time) very difficult lyrical imagery, "Swaddling Songs" never charted and would not have been warmly received by critics. Mellow Candle soon disbanded and Simonds spent most of the 1970s working as a session singer.

Nonetheless, the beautiful, almost medieval-like vocal harmonies in "Swaddling Songs" were and unlike anything else in rock. Though the album has been seen as a folk album, "Swaddling Songs" in fact lacked any normal "folk" characteristics and was basically pure pop in charcter. Yet, the medieval and intensely mystical atmosphere of the record makes it a true sonic marvel of beauty and simple melodies. Thus, original LP copies of "Swaddling Songs" have become a valuable rarity that stands as testimony to the music's worthiness.

01."Heaven Heath" (Alison Williams) – 3:00 02."Sheep Season" (Clodagh Simonds, A. Williams, David Williams) – 5:01 03."Silversong" (Simonds) – 4:26 04."The Poet and the Witch" (Simonds) – 2:51 05."Messenger Birds" (A. Williams) – 3:38 06."Dan the Wing" (Simonds) – 2:45 07."Reverend Sisters" (Simonds) – 4:21 08."Break Your Token" (Simonds) – 2:27 09."Buy or Beware" (D. Williams) – 3:04 10."Vile Excesses" (D. Williams, William Murray) – 3:14 11."Lonely Man" (Simonds) – 4:30 12."Boulders on My Grave" (Simonds) – 3:40

9 notes

·

View notes

Text

EUR & CHF Weekly Forecast – Another Round of Mid-Tier Releases

A number of mid-tier releases are lined up from the top eurozone nations this week.

Can these push the shared currency in a single direction?

Mid-tier euro zone data

German IFO business climate index (July 27, 9:00 am GMT) to improve from 86.2 to 89.2

Spanish unemployment rate (July 28, 8:00 am GMT) to climb from 14.4% to 16.7%

German import prices (July 29, 7:00 am GMT) to post 0.5% uptick after earlier 0.3% gain

German preliminary CPI (July 30) to indicate 0.2% dip in price levels for July

Spanish flash CPI (July 30, 3:00 pm GMT) to print another 0.3% drop in prices

German preliminary GDP (July 30, 4:00 pm GMT) to show 9.0% contraction in Q2

French flash GDP (July 31, 1:30pm GMT) to print 15.2% contraction in Q2

German retail sales (July 31, 2:00 pm GMT) to show 3.0% y/y decline in spending

French consumer spending (July 31, 2:45 pm GMT) to show 6.9% increase in June

Euro zone flash CPI (July 31, 5:00 pm GMT) to print 0.3% headline figure, 0.8% core reading

Low-tier Swiss data

Credit Suisse economic expectations index (July 29, 4:00 pm GMT) to show improvement from earlier 48.7 figure

KOF economic barometer (July 30, 3:00 pm GMT) to climb from 59.4 to 72.5 in July

Swiss retail sales (July 31, 2:30 pm GMT) to advance from 6.6% gain in May

Overall market sentiment

Risk-off flows tend to benefit the lower-yielding euro and franc, especially if the yen and dollar are under downside pressure

Renewed tensions between the U.S. and China are in the spotlight after consulates have been closed in Houston and Chengdu

There is still a lot of market focus on second wave COVID-19 fears as another round of lockdown measures could prompt a flight to safety

Rallying gold prices are also in focus, but traders seem wary of buying up the positively-correlated franc due to SNB intervention threats

Technical snapshot

Stochastic suggests that most euro pairs are still looking bearish in the overbought territory

EUR Pairs Stochastic from MarketMilk

Only EUR/CHF has yet to make it to the bearish region

As for franc pairs, the same oscillator is painting a mixed picture

CHF Pairs Stochastic from MarketMilk

In particular, NZD/CHF, USD/CHF and CAD/CHF are all overbought while CHF/JPY is oversold. The rest are in neutral territory.

Missed last week’s price action? Read EUR & CHF’s price recap for July 20 – 24!

Source link

The post EUR & CHF Weekly Forecast – Another Round of Mid-Tier Releases appeared first on Veteran Wealth.

from Veteran Wealth https://veteranwealthmgntmarketnews.com/index.php/2020/07/28/eur-chf-weekly-forecast-another-round-of-mid-tier-releases/ from Veteran Wealth Management https://machinetrading-autotrading.tumblr.com/post/624918734399782912

0 notes

Text

EUR & CHF Weekly Forecast – Another Round of Mid-Tier Releases

A number of mid-tier releases are lined up from the top eurozone nations this week.

Can these push the shared currency in a single direction?

Mid-tier euro zone data

German IFO business climate index (July 27, 9:00 am GMT) to improve from 86.2 to 89.2

Spanish unemployment rate (July 28, 8:00 am GMT) to climb from 14.4% to 16.7%

German import prices (July 29, 7:00 am GMT) to post 0.5% uptick after earlier 0.3% gain

German preliminary CPI (July 30) to indicate 0.2% dip in price levels for July

Spanish flash CPI (July 30, 3:00 pm GMT) to print another 0.3% drop in prices

German preliminary GDP (July 30, 4:00 pm GMT) to show 9.0% contraction in Q2

French flash GDP (July 31, 1:30pm GMT) to print 15.2% contraction in Q2

German retail sales (July 31, 2:00 pm GMT) to show 3.0% y/y decline in spending

French consumer spending (July 31, 2:45 pm GMT) to show 6.9% increase in June

Euro zone flash CPI (July 31, 5:00 pm GMT) to print 0.3% headline figure, 0.8% core reading

Low-tier Swiss data

Credit Suisse economic expectations index (July 29, 4:00 pm GMT) to show improvement from earlier 48.7 figure

KOF economic barometer (July 30, 3:00 pm GMT) to climb from 59.4 to 72.5 in July

Swiss retail sales (July 31, 2:30 pm GMT) to advance from 6.6% gain in May

Overall market sentiment

Risk-off flows tend to benefit the lower-yielding euro and franc, especially if the yen and dollar are under downside pressure

Renewed tensions between the U.S. and China are in the spotlight after consulates have been closed in Houston and Chengdu

There is still a lot of market focus on second wave COVID-19 fears as another round of lockdown measures could prompt a flight to safety

Rallying gold prices are also in focus, but traders seem wary of buying up the positively-correlated franc due to SNB intervention threats

Technical snapshot

Stochastic suggests that most euro pairs are still looking bearish in the overbought territory

EUR Pairs Stochastic from MarketMilk

Only EUR/CHF has yet to make it to the bearish region

As for franc pairs, the same oscillator is painting a mixed picture

CHF Pairs Stochastic from MarketMilk

In particular, NZD/CHF, USD/CHF and CAD/CHF are all overbought while CHF/JPY is oversold. The rest are in neutral territory.

Missed last week’s price action? Read EUR & CHF’s price recap for July 20 – 24!

Source link

The post EUR & CHF Weekly Forecast – Another Round of Mid-Tier Releases appeared first on Veteran Wealth.

from Veteran Wealth https://veteranwealthmgntmarketnews.com/index.php/2020/07/28/eur-chf-weekly-forecast-another-round-of-mid-tier-releases/

0 notes

Text

Masterpost

3 notes

·

View notes

Text

EUR & CHF Weekly Forecast Another Round of Mid-Tier Releases

A number of mid-tier releases are lined up from the top eurozone nations this week.

Can these push the shared currency in a single direction?

Mid-tier euro zone data

German IFO business climate index (July 27, 9:00 am GMT) to improve from 86.2 to 89.2

Spanish unemployment rate (July 28, 8:00 am GMT) to climb from 14.4% to 16.7%

German import prices (July 29, 7:00 am GMT) to post 0.5% uptick after earlier 0.3% gain

German preliminary CPI (July 30) to indicate 0.2% dip in price levels for July

Spanish flash CPI (July 30, 3:00 pm GMT) to print another 0.3% drop in prices

German preliminary GDP (July 30, 4:00 pm GMT) to show 9.0% contraction in Q2

French flash GDP (July 31, 1:30pm GMT) to print 15.2% contraction in Q2

German retail sales (July 31, 2:00 pm GMT) to show 3.0% y/y decline in spending

French consumer spending (July 31, 2:45 pm GMT) to show 6.9% increase in June

Euro zone flash CPI (July 31, 5:00 pm GMT) to print 0.3% headline figure, 0.8% core reading

Low-tier Swiss data

Credit Suisse economic expectations index (July 29, 4:00 pm GMT) to show improvement from earlier 48.7 figure

KOF economic barometer (July 30, 3:00 pm GMT) to climb from 59.4 to 72.5 in July

Swiss retail sales (July 31, 2:30 pm GMT) to advance from 6.6% gain in May

Overall market sentiment

Risk-off flows tend to benefit the lower-yielding euro and franc, especially if the yen and dollar are under downside pressure

Renewed tensions between the U.S. and China are in the spotlight after consulates have been closed in Houston and Chengdu

There is still a lot of market focus on second wave COVID-19 fears as another round of lockdown measures could prompt a flight to safety

Rallying gold prices are also in focus, but traders seem wary of buying up the positively-correlated franc due to SNB intervention threats

Technical snapshot

Stochastic suggests that most euro pairs are still looking bearish in the overbought territory

EUR Pairs Stochastic from MarketMilk

Only EUR/CHF has yet to make it to the bearish region

As for franc pairs, the same oscillator is painting a mixed picture

CHF Pairs Stochastic from MarketMilk

In particular, NZD/CHF, USD/CHF and CAD/CHF are all overbought while CHF/JPY is oversold. The rest are in neutral territory.

Missed last week’s price action? Read EUR & CHF’s price recap for July 20 – 24!

Source link

The post EUR & CHF Weekly Forecast – Another Round of Mid-Tier Releases appeared first on Veteran Wealth.

from https://veteranwealthmgntmarketnews.com/index.php/2020/07/28/eur-chf-weekly-forecast-another-round-of-mid-tier-releases/

from Veteran Wealth Management - Blog https://machinetrading-autotrading.weebly.com/blog/eur-chf-weekly-forecast-another-round-of-mid-tier-releases

0 notes

Text

New Post has been published on Forex Blog | Free Forex Tips | Forex News

!!! CLICK HERE TO READ MORE !!! http://www.forextutor.net/forexlive-european-fx-news-wrap-euro-steady-after-asian-retreat/

Forexlive European FX News wrap: Euro steady after Asian retreat

Forex trading news and economic data headlines 24 April 2017

News:

Back to the polls we go for the second round

Bundesbank says German Q1 GDP likely to have accelerated significantly

Eurozone debt to GDP dropped in 2016

Italy’s Padoan says there is a need to accelerate adjustment for banks and NPLs

The EU is off to Greece again

Here’s the reason why EURJPY outperformed everyone else

EURUSD gives some back but remains buoyant above 1.0800

Euro pairs finding dip demand after profit-taking retreat

SNB total sight deposits w-e 21 April CHF 569.1 vs 567.14bln prev

RBS raises Macquarie to outperform from neutral

Option expiries for the 10 am NY cut today 24 April

More option expiries of note this week 25-28 April

Nikkei 225 closes up +1.37% at 18,875.88

Data:

Germany April IFO business climate index 112.9 vs 112.4 expected

April 2017 UK CBI industrial trends report – Orders 4 vs 5 exp

It’s been a time to pause and reflect this morning after the fun n games in Asia following the French election first round result.

EURUSD had hit highs of 1.0936, EURGBP 0.8515 and EURJPY 120.97 but by the time European desks got underway we had already seen the full extent of the euro retreat to 1.0820, 0.8451 and 119.00. A similar pattern was seen in other EUR pairs and since then we’ve trading really tightly.

USDJPY had a spike/gap to 110.64 in early Asia on a relief rally as risk returned with Macron fancied to beat Le Pen comfortably in Round 2 on 7 May. A retreat was also notable though and we had been back down to 109.85 in Asia before Europe opened. Since then we have flat-lined between 110.15-30.

Equity markets have soared in Europe confirming strong openings with French/EZ bank shares leading the way and the DAX posting record highs. Gold had gapped lower in Asia from $1284 to 1266 but has since retraced to 1276 before falling again to 1269

Forexlive European FX News wrap: Euro steady after Asian retreat Forexlive European FX News wrap: Euro steady after Asian retreat http://www.forexlive.com/feed/news $inline_image

0 notes

Text

Masterpost

2 notes

·

View notes

Text

Masterpost

#sexiest narnian bracket#snb round 4#did i change the picture of bacchus because i thought it was funny?#yes yes i did

1 note

·

View note

Text

We've reached Round 4 and things just continue to excite!

Yes, you're seeing that right, Aravis is indeed sexier than High King Peter himself. But can she beat the queen of bondage herself, the Lady of the Green Kirtle?

It's Pevensie against Pevensie with Edmund and Susan--both strong contenders for the ultimate Sexy Narnian title. No telling who's coming out of this one alive.

The God of Being Sexy versus Lasaraleen herself? Either one could give the other a run for their money--and when this is all over, I want a fic of this pairing, stat.

And finally, major upset as Jill Pole finally defeats fan favourite Fledge--but can she withstand the power of Caspian in a sexy purple shirt?

Vote now to find out!

Sexiest Narnian Bracket Tournament!

That's right, we're doing this. Who do YOU think deserves to be crowned as the sexiest Narnian character?

Round 1 (Part 1)

Polls closed

Jewel vs Peter Pevensie Queen Helen vs Prince Rilian Drinian vs Swanwhite King Lune vs Aravis Jadis' Sister vs Lady of the Green Kirtle Miraz vs Lord Bern Rabadash vs Bree Ramandu's Daughter vs the Sea Girl Tirian vs Mrs. Macready Edmund Pevensie vs Jadis Shasta/Cor vs Emeth White Stag vs Maugrim River God vs Father Time Trumpkin vs Coriakin Glenstorm vs Susan Pevensie Tash vs Glozelle

Round 1 (Part 2)

Polls closed

Corin vs Aslan Digory Kirke vs Reepicheep Bacchus vs Lucy Pevensie Father Christmas vs Mr. Tumnus Mrs. Beaver vs Anradin Tarkaan Lasaraleen vs Prunaprismia Polly Plummer vs Roonwit Eustace Scrubb vs Aunt Letty Lord Peridan vs Ramandu Sallowpad vs Fledge Jill Pole vs Queen of Harfang Hwin vs Ram the Great Rhince vs King Frank Uncle Andrew vs Oreius Caspian vs Dr. Cornelius Mr. Beaver vs The Werewolf

Round 2

Polls closed

Peter Pevensie vs Queen Helen Swanwhite vs Aravis Tarkheena Lady of the Green Kirtle vs Miraz Bree vs Ramandu's Daughter Tirian vs Edmund Pevensie Shasta/Cor vs Maugrim River God vs Trumpkin Susan Pevensie vs Tash Corin vs Reepicheep Bacchus vs Tumnus Lasaraleen vs Mrs. Beaver Polly Plummer vs Eustace Scrubb vs Aunt Letty Lord Peridan vs Sallowpad vs Fledge Jill Pole vs Hwin King Frank vs Oreius Caspian vs The Werewolf

Round 3

Polls closed

Peter Pevensie vs Aravis Tarkheena Lady of the Green Kirtle vs Ramandu's Daughter Edmund Pevensie vs Shasta/Cor River God vs Susan Pevensie Corin vs Bacchus Lasaraleen vs Polly Plummer Fledge vs Jill Pole Oreius vs Caspian

Round 4

Goes live Feb 16, 11:30am

Aravis Tarkheena vs Lady of the Green Kirtle Edmund Pevensie vs Susan Pevensie Bacchus vs Lasaraleen Jill Pole vs Caspian

Happy voting all!

91 notes

·

View notes

Text

Magi Monday Masterpost

#Magi Monday Main Tag

Want to request a topic for Magi Monday? You can do so here!

Vol.1 - Official Site Character Profiles

Vol.2 - Ren Koumei’s Profile

Vol.3 - Food for Thought (with a little Foreshadowing) (SnB)

Vol.4 - “What’s to come for Team Sindria?”, A Special round-Table Talk ft Ohtaka, Ohtera, & the Editors (Part 1) (SnB)

Vol.5 - “What’s to come for Team Sindria?”, A Special round-Table Talk ft Ohtaka, Ohtera, & the Editors (Part 2) (SnB)

Vol.6 - Mystras Leoxes’ Profile (SnB)

Vol.7 - What does everyone think of Sinbad?

33 notes

·

View notes

Text

USDCHF Weekly Outlook (11-15 May)

Negative Interest Rate

According to Reuters, SNB was not happy about the negative interest rate of – 0.75% it charges the banks who park money with it overnight. The SNB has no alternative to ultra-expansive monetary policy, while the virus crisis has created a great appreciation pressure on safe Francs, SNB Chair Thomas Jordan said in an interview session with the Sonntags Zeitung newspaper.

The -0.75% SNB negative interest rate is the lowest interest rate in the world at the moment, after the BOJ -0.10%. The Franc has become its main attraction as a safe asset with a stable political climate and has not changed much. The SNB has taken this route while maintaining negative interest rates to avoid more difficult circumstances. The SNB also increased foreign currency purchases to reduce Franc increases. Deposits in the central bank, that are seen as a proxy for SNB intervention, have increased by almost 77 billion francs this year, while the CHF has risen to the highest level against the EUR, since July 2015.

USDCHF

Last week’s USDCHF bounced, but was confined under Resistance as well as the 0.9800 round number. Bias still looks neutral for this week in a fairly wide sideways range of 200 pips. Breaking the 0.9680 minor Support will turn the bias to the downside with next Support at 0.9588 and the low price of 0.9500. A break of 0.9800 will target testing at the price of 0.9900.

In the daily period, higher prices are being formed that are lower than before and the impression from price projections is narrower in the formation of triangle patterns. The 200-DMA has become a dynamic Resistance that has been retested 3 times, while the RSI is at the 50 center line and MACD’s histogram line up above the neutral level of the MACD.

In the 4-hour period, the 0.9800 area implies a stronger Resistance level than the lower Support level. However the MA’s slope in the middle of the consolidation zone occurred for the past 7 weeks. More indications to the negative side at 4-hour chart, with RSI entering a downward bias at 44 and MACD histogram approaching 0 zone.

Click here to access the HotForex Economic Calendar

Don’t forget to join our free webinar at:

https://www.hfmtrading.com/sv/id/trading-tools/trading-webinars.html?webinar_lang=id#webinars

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

USDCHF Weekly Outlook (11-15 May) published first on https://alphaex-capital.blogspot.com/

0 notes