#snail mail automate

Explore tagged Tumblr posts

Text

Snail Mail- Automate

#my edit#lyric edit#lyrics#snail mail#valentine#automate#snail mail lyrics#snail mail automate#lyric edits#lyricsedit

16 notes

·

View notes

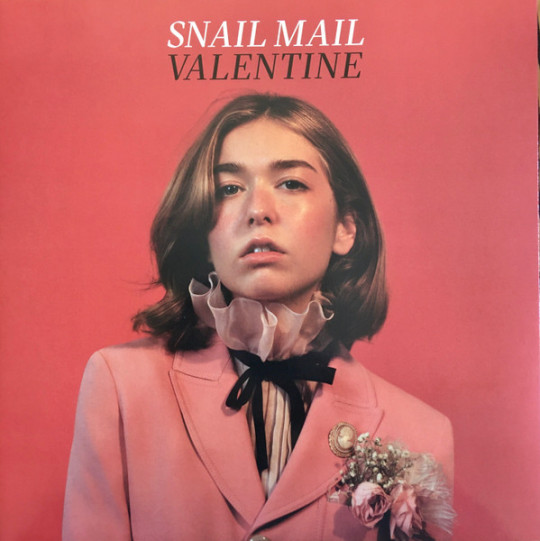

Photo

Artista: Snail Mail Álbum: Valentine Ano: 2021 Faixas/Tempo: 10/31min Estilo: Indie Data de Execução: 01/06/2023 Nota: 6,6 Melhor Música: Automate

youtube

0 notes

Text

im so annoyed about the state of the skins and accent submissions. I recently put in like a huge order of accents that has taken so long to arrive and its making me so annoyed. You would think umas being one of if not the biggest money maker on fr they would prioritize it better and make it so that the people making them all that money through gem sales would have a better experience doing so.

In the Skins And Accents Problems thread I've recently seen: Someone's order straight up got lost/skipped over! (LITERALLY HOW) Someone's skin that was altered by a mod and said 'this should pass' was then denied! (Congrats you gave your own system an autoimmune disorder) Someone else had their OC uma denied because 'it looks too close to copyright' meanwhile a literal overwatch skin passed into the festival contest several months back (not to mention the number of Barely Different nintendo ip umas we have on site)

and thats JUST from the last few days.

We're constantly having orders lost, constantly having accents applied to the wrong breed or pose, sometimes shit gets shifted?? Idk HOW that even happens. It's just so frustrating, and all of this is done through snail mail so if it DOES get denied multiple times you're waiting at least a month to get your shit back. They mentioned they were finally doing something about updating it, and the features look nice, but I just don't understand why it feels like the team doesnt even talk to each other regarding umas processing. I get its all subjective but Christ this entire process is nightmarish and archaic.

i just needed to vent about all of this

(again, this isn't me going 'why cant the two ppl working the umas section work harder' this is me going 'why the hell are there only two ppl working the umas section. why is everything manual? why is NOTHING automated except the garbage receipt that doesnt even tell you WHAT you ordered, just that you ordered Something. No blueprint receipt, no name, no breed/pose stated, just the order number. Garbage. Why is everything so subjective they cant even agree between mods? etc etc')

38 notes

·

View notes

Text

@sunlysane tagged me to list out songs for each letter of my username (thank u!!)

Darkness on the Edge of town by Bruce Springsteen (of course)

Automate by Snail Mail

Rain in Soho by The Mountain Goats

Kill All Your Friends by My Chemical Romance

No Surprises by Radiohead

Everlong by The Foo Fighters

Shadowboxing by Julien Baker

Street Spirit (Fade Out) by Radiohead

Orphans by Coldplay

Not About Love by Fiona Apple

This Must Be the Place by Talking Heads

How Not to Drown by Chvrches ft. Robert Smith

(The) End by My Chemical Romance

Everyone but You by The Front Bottoms

Daredevil by Fiona Apple

Geyser by Mitski

Every Single Night by Fiona Apple

Our Lady of Sorrows by My Chemical Romance

Famous Last Words (an Ode to Eaters) by Ethel Cain

Triple Dog Dare by Lucy Dacus

On + Off by Maggie Rogers

(The)Way things Are by Fiona Apple

Navy Blue by MUNA

Don’t Know Why by Norah Jones

Your Loves Whore by Wolf Alice

Killer by FKA Twigs

Electric Indigo by The Paper Kites

Tagging @hiriahb @alltimefade @yourtransexualheart @gentlemoth @bazpitch @nonsensical-lesbian @amaragf @trans-simonandgarfunkel

(No pressure obviously if you don’t wanna do it !!)

25 notes

·

View notes

Text

Voicemail isn't even an effective communication tool anymore.

I just checked my voicemail and I had 23 new messages. Only 3 of them were from actual human beings, not automated messages. Those 3 humans were also cold-calls from a business, so not a single important message.

The 20 automated messages were pretty evenly split between the pharmacy and my kid's school, both of which I receive texts from AT THE SAME NUMBER.

And, honestly, on any given day, I've got 20+ unread automated texts from the school, businesses, and political organizations/programs.

Traditional cell phone communication (calls, voicemail, and texts) has gone the way of snail mail and email--it's just a repository for spam.

#I almost exclusively receive personal texts thru an online messaging service or social media like WhatsApp#I often miss personal texts to my phone number if they're not from one of my pinned contacts#Because they get buried under the spam#i'm so tired#capitalism ruins everything

2 notes

·

View notes

Text

FreshBooks vs Xero: Which Online Accounting Software is Best for Your Business?

Are you tired of the hassle that comes with traditional accounting methods? It's no secret that manual bookkeeping can be a daunting task for business owners. Fortunately, in today's digital age, there are online accounting software options available to help simplify your financial management. Two popular choices are FreshBooks and Xero. Both offer innovative features to streamline your accounting processes, but which one is the best fit for your business?

In this blog post, we'll compare FreshBooks vs Xero and help you determine which option is right for you!

What is FreshBooks?

FreshBooks is a cloud-based accounting software designed for small business owners who want to manage their finances efficiently. The platform offers features such as invoicing, time tracking, expense management, and project management all in one place.

One of the standout benefits of FreshBooks is its user-friendly interface. Even if you're not an accounting expert, you can easily navigate through the system without feeling overwhelmed. Another great feature is that it integrates seamlessly with other popular apps such as Stripe, PayPal, and G Suite.

Moreover, FreshBooks has an excellent invoicing system that allows users to create customized invoices quickly and effectively. You can send professional-looking invoices via email or snail mail and even set up recurring billing for your regular clients.

Another benefit of using FreshBooks is its mobile app compatibility. With just a few clicks on your smartphone or tablet screen, you can track your billable hours or expenses while on-the-go.

FreshBooks provides affordable pricing plans for small businesses seeking easy-to-use tools like time tracking and automated invoicing paired with strong customer support options including phone numbers available during extended hours which are key criteria areas when choosing an online accounting software.

What is Xero?

Xero is an online accounting software that was created to help small business owners manage their finances more easily. It was founded in New Zealand in 2006 and has since grown to become a popular choice for businesses around the world.

One of the main features of Xero is its cloud-based platform, which allows users to access their financial information from anywhere with an internet connection. This means that business owners can log in and check their accounts on-the-go or collaborate with team members remotely.

Another advantage of Xero is its user-friendly interface, which makes it easy for non-accountants to use. The software offers a range of tools and integrations designed specifically for small businesses, such as invoicing, expense tracking, payroll management and inventory management.

In addition, Xero provides real-time reporting and insights into your business's financial health. This enables you to make informed decisions based on up-to-date data.

Xero is a powerful tool for managing your business's finances efficiently while saving time and effort.

The Pros and Cons of FreshBooks

FreshBooks is an online accounting software designed for small businesses and freelancers. Here are the pros and cons of using FreshBooks.

Pros:

Firstly, FreshBooks offers a user-friendly interface that makes it easy to navigate through the different features of the platform. The dashboard provides a clear overview of your business finances with charts and graphs that show important financial data such as revenue, expenses, profit, and loss.

Secondly, FreshBooks allows you to create professional-looking invoices quickly without much effort. You can customize your invoice templates with your brand logo, colors, and messaging to match your company's branding.

Thirdly, FreshBooks integrates seamlessly with other applications like PayPal or Stripe which assists in making payments effortless. This integration saves time for users who don't want to manually input payments one by one into their system.

Cons:

One major disadvantage of using FreshBooks is its limited reporting options compared to other accounting software available on the market. Users have reported difficulties when trying to generate customized reports which limits analysis capabilities.

Secondly, while there are mobile apps available for both iOS and Android devices users complain about stability issues on older phones or tablets due to slow loading times or crashing problems during use

Lastly - pricing - some people may find that FreshBooks is more expensive than alternative solutions especially if they require multiple user accounts or plan add-ons such as payroll services etc

Despite these drawbacks many businesses still see positive results from implementing this solution depending on their specific needs so consider all factors before choosing what best suits yours!

The Pros and Cons of Xero

Xero is one of the most popular online accounting software for small businesses. It offers a wide range of features to manage finances, such as invoicing, inventory management, bank reconciliation and expense tracking. Here are some pros and cons of using Xero:

Pros:

User-friendly interface: Xero has an easy-to-use dashboard that displays all your financial information in one place.

Integration with third-party apps: You can integrate Xero with over 800 third-party apps including Shopify, PayPal and Stripe.

Mobile app: The mobile app allows you to access your financial data from anywhere at any time.

Cons:

Limited customer support options: Compared to other software providers, Xero's customer support options are limited.

Pricey plans for larger sized businesses: While the basic plan is affordable for small-sized businesses, the higher-tiered plans can be pricey for larger-sized businesses.

Limited customization options: Customization options on invoices and reports are limited compared to some competitors.

Xero is a great option for small businesses looking for an easy-to-use accounting software with strong integrations capabilities.

Which Online Accounting Software is Best for Your Business?

When it comes to choosing the best online accounting software for your business, there are a number of factors you should consider. Both FreshBooks and Xero offer unique features that can benefit different types of businesses.

For small businesses with basic accounting needs, FreshBooks may be the better option as it is easy to use and has a simple interface. However, if you need more advanced features such as inventory management or multi-currency support, then Xero may be the way to go.

In terms of pricing, both FreshBooks and Xero offer affordable options with various pricing plans depending on your business needs. It's important to compare these plans carefully before making a decision.

Another important factor is integrations - both FreshBooks and Xero integrate with many popular apps like PayPal and Shopify. However, if you already use other cloud-based software in your business operations, check which ones are compatible before making a final choice.

Ultimately, the best online accounting software for your business will depend on your unique needs and budget. Take time to research each option carefully before making an informed decision that suits your organization’s specific requirements.

Conclusion

After weighing the benefits and drawbacks of FreshBooks and Xero, it's clear that both online accounting software options have their strengths. FreshBooks is an excellent option for small business owners who prioritize ease-of-use and invoicing capabilities. Meanwhile, Xero offers more advanced features suitable for medium-sized businesses in need of more sophisticated bookkeeping tools.

Ultimately, the best choice depends on your specific business needs and priorities. Consider factors such as budget, company size, required features, industry-specific requirements when choosing between FreshBooks vs Xero online accounting platforms.

Regardless of which one you choose to implement into your business operations - either FreshBooks or Xero - rest assured knowing that both offer significant value to entrepreneurs seeking to manage their finances with ease while growing their companies at the same time!

3 notes

·

View notes

Text

From Manual to Automated: The Benefits of Using a Snail Mail Cheques API

Traditional cheque processing has long been a cornerstone of business payments. Whether issuing refunds, paying vendors, or handling payroll, businesses rely on cheques to facilitate transactions. However, the manual nature of traditional cheque printing and mailing is cumbersome, time-consuming, and prone to errors. With advancements in technology, businesses now have access to a game-changing solution: the Snail Mail Cheques API.

This automated system simplifies cheque creation, printing, and mailing, seamlessly integrating with existing workflows to save time, reduce costs, and enhance accuracy. In this blog, we’ll explore the benefits of transitioning from manual to automated cheque processing using a Snail Mail Cheques API.

The Limitations of Manual Cheque Processing

Manual cheque processing involves multiple steps:

Generating the payment data.

Printing the cheques.

Signing them.

Addressing and stuffing envelopes.

Affixing postage.

Delivering the mail to the post office.

Each step introduces inefficiencies and risks that can negatively impact business operations. Let’s break down the common challenges:

1. Time-Intensive Processes

Manually handling cheques requires significant administrative effort. Tasks like printing, folding, addressing, and mailing are repetitive and resource-heavy, especially for businesses issuing large volumes of cheques.

2. High Risk of Errors

Errors in manual processes—such as incorrect payment amounts, misspelled names, or wrong addresses—can lead to returned cheques, payment delays, and strained relationships with vendors or customers.

3. Elevated Costs

The costs associated with paper, ink, printers, secure cheque stock, envelopes, postage, and labor add up quickly. For growing businesses, scaling these processes without additional overhead is nearly impossible.

4. Security Concerns

Cheques require careful handling to prevent fraud and unauthorized access. Manual processes increase the risk of sensitive information being mishandled or intercepted.

5. Limited Tracking and Visibility

Tracking the status of a mailed cheque can be challenging. Once the cheque is handed over to the postal service, businesses often have limited insight into its delivery status.

These challenges underscore the need for automation, which is where a Snail Mail Cheques API comes into play.

What is a Snail Mail Cheques API?

A Snail Mail Cheques API is a software solution that automates the end-to-end process of creating, printing, and mailing cheques. By integrating this API with your existing systems, such as accounting software, enterprise resource planning (ERP) platforms, or customer management tools, you can eliminate the manual tasks involved in cheque processing.

The API connects your system to a third-party service provider that handles cheque printing, envelope stuffing, postage, and delivery via the postal service.

The Benefits of Using a Snail Mail Cheques API

1. Time Savings

With a Snail Mail Cheques API, cheque processing becomes an automated task. Payment data is pulled directly from your system, cheques are generated and printed in real-time, and they are mailed without human intervention. This dramatically reduces the time spent on repetitive administrative tasks, freeing up employees to focus on higher-value activities.

2. Cost Efficiency

Outsourcing cheque printing and mailing through an API eliminates the need for in-house equipment, supplies, and labor. Many API providers offer discounted postage rates due to bulk mailing agreements, further reducing operational costs.

3. Increased Accuracy

Automation minimizes the risk of human errors. The API ensures that payment details, such as recipient names, addresses, and amounts, are accurate by pulling data directly from your system. This improves reliability and reduces the risk of cheque returns or payment delays.

4. Enhanced Security

Most Snail Mail Cheques APIs are equipped with advanced security features, such as encryption for sensitive data and secure printing processes. Cheques are printed using MICR (Magnetic Ink Character Recognition) technology, which complies with banking standards and prevents tampering or forgery.

5. Scalability

Whether you need to issue a few cheques a month or thousands, a Snail Mail Cheques API scales to meet your needs. This scalability allows businesses to handle increased cheque volumes without adding staff or resources.

6. Real-Time Tracking and Visibility

A Snail Mail Cheques API provides tracking capabilities, allowing you to monitor the status of each cheque from creation to delivery. Notifications for key milestones, such as when the cheque is mailed and received, ensure transparency and peace of mind.

7. Professional Customization

Many APIs offer customizable cheque templates that enable businesses to include branding elements such as logos, colors, and fonts. This ensures a professional and cohesive appearance for all outgoing cheques.

8. Compliance with Banking Standards

APIs ensure that cheques are printed in compliance with banking and regulatory standards, such as MICR encoding and proper formatting. This reduces the risk of cheques being rejected by banks.

9. Improved Record-Keeping

Detailed logs and reports generated by the API help businesses maintain accurate records of all cheque transactions. This simplifies auditing and financial reconciliation processes.

10. Environmental Benefits

Some API providers offer eco-friendly solutions, such as using recycled paper and optimizing delivery routes to reduce carbon emissions. This aligns with sustainability goals and reduces environmental impact.

How Does a Snail Mail Cheques API Work?

Integration The API integrates with your existing software systems. This allows seamless communication between your payment platform and the API.

Data Submission Payment details, including recipient names, addresses, and amounts, are submitted to the API. This can be done individually or in bulk.

Cheque Generation The API generates cheques using pre-approved templates that comply with banking standards.

Secure Printing and Mailing The service provider handles secure printing, envelope stuffing, and postage. Cheques are then mailed to recipients through reliable postal services.

Tracking and Notifications Real-time tracking updates are available, ensuring transparency throughout the delivery process.

Use Cases for a Snail Mail Cheques API

1. Accounts Payable

Businesses can automate payments to vendors, suppliers, and contractors, ensuring timely and accurate disbursements.

2. Payroll Processing

For organizations that issue payroll via cheques, the API streamlines the process and ensures timely delivery to employees.

3. Customer Refunds

Automate the issuance of refunds, enhancing customer satisfaction by ensuring prompt and accurate payments.

4. Legal and Compliance Payments

For legal firms or businesses required to send payments as part of regulatory compliance, an API ensures secure and timely processing.

5. Marketing and Promotions

Use cheques as part of direct mail campaigns, such as rebate offers or incentives. The API simplifies the distribution of these promotional cheques.

Choosing the Right Snail Mail Cheques API

When selecting a Snail Mail Cheques API, consider the following:

Ease of Integration: Ensure the API integrates seamlessly with your existing systems.

Security Features: Look for encryption, secure printing, and compliance with banking standards.

Customization Options: Check if the API allows branding and template customization.

Tracking Capabilities: Opt for an API that provides real-time updates and delivery confirmation.

Cost-Effectiveness: Compare pricing models to ensure the API aligns with your budget.

Conclusion

Transitioning from manual to automated cheque processing with a Snail Mail Cheques API offers a host of benefits, from time savings and cost reduction to enhanced accuracy and security. By automating repetitive tasks and eliminating errors, businesses can streamline their payment workflows and focus on strategic initiatives.

Whether you’re handling payroll, vendor payments, or customer refunds, a Snail Mail Cheques API is an invaluable tool for modernizing your operations. Embrace this technology to stay competitive, improve efficiency, and enhance your business’s financial management.

youtube

0 notes

Text

6 Must-Know B2B SaaS Marketing Trends for 2025

As the B2B SaaS landscape evolves, companies face both challenges and opportunities in achieving sustainable growth. The rise of customer expectations, stiff competition, and a highly saturated & expensive digital advertising ecosystem necessitate a rethinking of marketing strategies. In the following article, we have articulated key marketing trends shaping the B2B SaaS industry in 2025.

Focus On Customer Retention

Customer retention is critical to driving revenue and profitability in SaaS. To minimize churn and enhance product engagement, marketing teams must develop targeted retention campaigns. One effective approach is implementing loyalty programs, which can take the form of:

Priority Support Based on Product Usage: Offering tiered support, where high-usage customers receive priority service. This not only enhances their experience but also reinforces their value to the company.

Discounts on Purchase of Additional Modules: Offering attractive discounts on add-on modules and complimentary products. This strategy increases revenue while deepening customer engagement.

Recognition at Customer Events: Highlighting loyal customers at user conferences or webinars. Recognized customers often become brand advocates, sharing their positive experiences with others.

Early Access to Product Updates and Upgrades: Giving long-term customers a first look at new features or products. This exclusive access makes customers feel valued and fosters engagement with the platform.

2. AI-Powered Marketing Tools and Automation

Artificial Intelligence (AI) is revolutionizing B2B SaaS marketing by streamlining processes and enhancing personalization. Key applications of AI in marketing can include:

Building Prospect Data: AI-powered tools like Apollo have transformed the way SaaS companies build prospect data. By analyzing buyer intent, these tools can identify prospects with high potential, and segment them effectively. Marketing teams can target these segments through tailored campaigns, streamlining efforts, and maximizing impact.

Crafting Compelling Messaging: AI-powered platforms can analyze audience preferences and behaviours to generate highly personalized and persuasive email content, increasing engagement and response rates.

Creating Pitch Videos and Demo Scripts: AI enables marketing teams to produce professional-quality pitch videos and scripts for webinars quickly, significantly reducing the cost of production and time to launch these marketing assets.

3. Expansion of Account-Based Marketing (ABM)

In 2025, Account-Based Marketing (ABM) should become a primary focus for B2B SaaS companies aiming to deliver highly personalized outreach. As digital ads and social media channels become increasingly expensive and saturated, ABM offers a more targeted and cost-effective approach. ABM enables marketing teams to tailor their messaging to specific industries, use cases, and target audiences ensuring higher engagement. ABM approach can include:

Combining Email Marketing with Re-Targeting Ads: By integrating personalized email campaigns with re-targeting ads, SaaS companies can keep their brand top-of-mind for key accounts across multiple touch-points.

Innovative Direct Mail Campaigns: Sending carefully curated snail mail letters to high-value accounts can add a personal touch, breaking through the digital clutter and creating a lasting impression.

ABM’s ability to focus resources on the most valuable accounts ensures effective outreach. With proven potential to deliver strong ROI, ABM is a must-adopt strategy for SaaS companies in 2025

4. Focus on P.R. and Thought Leadership

Public Relations (P.R.) is re-emerging as a vital marketing channel for B2B SaaS companies. A well-crafted P.R. strategy can amplify brand visibility and position key executives as thought leaders in the industry.

Positioning Key Executives: P.R. efforts can include publishing articles, securing interviews, and leveraging byline opportunities to showcase executive expertise and establish credibility.

Announcing Major Milestones: P.R. can be the vehicle for communicating product launches, strategic alliances, and significant customer wins, ensuring these milestones reach the right audience.

Driving Brand Advocacy: P.R. firms can identify opportunities for customers to participate in stories and events, creating a platform for advocacy. These engagements help build trust and highlight real-world success stories.

As a marketing consulting firm specializing in B2B SaaS, we believe that by leveraging public relations effectively, SaaS companies can create a strong narrative, enhance brand reputation, and foster deeper connections with their target market.

5. Metrics-Driven Marketing

As B2B SaaS companies continue to grow their customer base, it is important to track customer acquisition costs. Companies must:

Map Customer Acquisition Cost (CAC): Mapping CAC to specific marketing channels helps identify which channels deliver the best ROI. By understanding channel performance, companies can prioritize budget allocation to the most effective channels.

Calculating Lifetime Value (LTV): By analyzing customer data, including industry type, usage patterns, and purchase behaviour over time, SaaS companies can accurately determine the lifetime value (LTV) of their customers. This analysis enables businesses to segment new customers based on similar profiles and craft targeted cross-sell and up-sell programs to improve revenue per customer.

6. Hire a Fractional CMO

A fractional CMO can be a transformative asset for B2B SaaS companies. By offering strategic leadership, mentoring in-house teams, and applying their cross-industry expertise, Fractional CMOs drive exceptional outcomes. Leveraging an extensive network of marketing service providers and agencies, they can deliver comprehensive solutions tailored to business needs—all at a fraction of the cost of hiring a full-time CMO.

Conclusion

As a marketing consulting services firm specializing in B2B SaaS, we believe that in 2025, companies must embrace an omni-channel marketing strategy that seamlessly integrates offline and online channels. Additionally, businesses need to move beyond the conventional notion that customer retention is solely the responsibility of the customer success team. Marketing must take an active role in retention by launching targeted campaigns that drive customer advocacy and enhance lifetime value (LTV).

#marketing consulting services#fractional cmo services#marketing consulting firm#P.R. strategy#Account-Based Marketing (ABM)

0 notes

Text

How Businesses can save Funds and Time?

In today's fast-paced business environment, optimizing operations to save time and funds is essential for maintaining competitiveness and ensuring long-term success. Companies of all sizes must adopt strategies that promote efficiency and reduce unnecessary costs. This article explores effective ways businesses can save funds and time.

1. Embrace Automation

Automation is a powerful tool for increasing efficiency and reducing labor costs. By automating repetitive tasks, such as data entry, invoicing, and customer support, businesses can free up employee time for more strategic activities. Implementing automated systems can lead to significant time savings and reduced human error, ultimately saving money.

2. Optimize Processes

Conducting a thorough analysis of existing processes can uncover inefficiencies. Mapping out workflows and identifying bottlenecks allows businesses to streamline operations. Lean methodologies, which focus on reducing waste and improving flow, can be implemented to enhance efficiency and lower costs.

3. Invest in Technology

Investing in modern technology can yield substantial returns in terms of time and cost savings. Tools like project management software, customer relationship management (CRM) systems, and collaboration platforms enhance communication and organization. These technologies can help teams work more efficiently, reducing the time spent on administrative tasks.

4. Outsource Non-Core Functions

Outsourcing non-core functions, such as payroll, IT support, or customer service, can significantly reduce overhead costs. By partnering with specialized service providers, businesses can leverage expertise without the need for in-house resources. This allows companies to focus on their core competencies while saving time and funds.

5. Implement a Remote Work Policy

Allowing employees to work remotely can lead to cost savings on office space, utilities, and other overhead expenses. Additionally, remote work often leads to increased employee satisfaction and productivity, as team members can work in an environment that suits them best.

6. Monitor and Control Expenses

Regularly reviewing expenses and implementing budget controls can help businesses identify areas where costs can be reduced. Utilize accounting software to track spending and set alerts for budget overruns. Implementing strict approval processes for expenditures can also help control costs.

7. Foster a Culture of Continuous Improvement

Encouraging employees to contribute ideas for process improvements can lead to significant time and cost savings. Implementing a culture of continuous improvement fosters innovation and empowers team members to seek efficiencies within their roles.

8. Train Employees Effectively

Investing in employee training can improve efficiency and productivity. Well-trained employees are more confident and capable in their roles, leading to faster problem resolution and better customer service. Consider ongoing training programs that keep employees updated on industry best practices and technological advancements.

Conclusion

In conclusion, businesses can save funds and time by embracing automation, optimizing processes, investing in technology, outsourcing non-core functions, implementing remote work policies, monitoring expenses, fostering a culture of continuous improvement, and training employees effectively. By adopting these strategies, companies can enhance their efficiency, reduce costs, and position themselves for long-term success.

youtube

SITES WE SUPPORT

Direct Mail Service and Snail Mail API – Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

Instagram

Pinterest

0 notes

Text

From Snail Mail to Supersonic

With thinner margins, companies seek to provide differentiated customer offerings while ensuring their operations are at their peak efficiencies. As per Gartner, by 2030, 80% of heritage financial services firms will go out of business, become commoditized or exist only formally but not compete effectively. These firms would struggle for relevance as global digital platforms, Fintech companies, and other nontraditional players gain greater market share, using technology to change the economics and business models of the industry.

So, it is vital for companies to up their tech play and be 100% sure that they are right the first time – as we don’t have time to make mistakes now. Document automation can simplify complex paper-based processes through which the data can be better managed and, most importantly, cut down on TAT and costs. Let’s examine how some mortgage peers have benefited through OCR or IDP solutions.

When a lender processes over 500-page mortgage packages manually, vital data are likely to be missed. It is an outdated and inefficient process with no certainty over operations. Manual processing leads to too many back-and-forth documents with the customers, thereby being unable to turn around closures within stipulated times. Apart from the above business benefits, there are many other advantages, such as more flexible operations, more scalable operations, and more interconnected technologies with a better propensity to partner with the digital ecosystem and be better prepared to pre-close and post-close QC audits.

Mortgages being complex with multiple stakeholders involved in the processing of an application, it can be extremely helpful if the solution has relevant industry expertise. IDP solutions, such as DocVu.AI, combine advanced document automation tech with over 25 years of mortgage expertise. DocVu.AI understands the complexities of the current mortgage processing and can provide digital solutions to prepare for more digitized financial services in 2030.

DocVu.AI – Key features:

Customer Onboarding & KYC

The solution helps to classify documents from loan packages accurately, collect customer information from multiple documents, and record their data securely, making loan processing faster and more efficient.

2. Automated loan processing

DocVu helps accurately extract information from mortgage documents – The AI-powered solution can recognize relevant data points from highly unstructured formats and improve loan closure time with superior customer experience.

3. Mortgage underwriting

Utilizes the AI engine to simplify mortgage underwriting to provide accurate and relevant information for the underwriters to make faster decisions and save cost.

4. Mortgage QC Audits

Improve the validation of your credit decision by faster analyzing the pre-funding and post-closure checks and closing mortgages accurately.

5. Mortgage Appraisals & Valuations

Evaluate property valuation and run mandatory verifications digitally to improve visibility into mortgage transactions.

In conclusion

By leveraging advanced document automation tech with over 25 years of mortgage expertise, DocVu.AI can help companies prepare for a more digitized future and stay ahead of the competition. Investing in document processing automation is not just about cutting costs but also about improving the customer experience and building a sustainable business process. It is time for companies to up their tech play and switch to automation to be sure they get it right the first time.

0 notes

Text

Playlist for Saturday, August 17, 2024

Clairo - "Slow Dance" The Decemberists - "Don't Go Into the Woods" Pedro the Lion - "Parting" Blitzen Trapper - "Ain't Got Time to Fight" Snail Mail - "Automate" City and Colour - "Paradise" Gomez - "Hamoa Beach" Her Head's on Fire - "Aren't I the Champion" Cola - "Pallor Tricks" Rosie Tucker - "Maylene" The Mountain Goats - "Fresh Tattoo" The Rural Alberta Advantage - "Terrified" Delta Spirit - "Time Bomb" Limbeck - "Making the Rounds" Earthquake Lights - "Heartbeat" Parannoul - "Gold River" Karen O and Danger Mouse - "Super Breath" The Gaslight Anthem - "1930" Chuck Ragan - "The Boat" Sleater-Kinney - "Modern Girl" We Were Promise Jetpacks - "Roll Up Your Sleeves" Shannon and the Clams - "Real or Magic" Everlet - "The Calling" The Dreaded Laramie - "Where's My Crystal Ball" Spoon - "Rainy Taxi" Braid - "Doing Yourself In" xo - b. To download or stream the show, click here!

The Mountain Goats and Stephen Colbert: https://youtu.be/T_qkVPZ8DJI?si=U0nwmK03flrWkGuw

0 notes

Note

for the name playlists: hades! :)

Holiday by Green Day

Automate by Snail Mail

Do Me a Favour by Arctic Monkeys

Eyelids by PVRIS

Supermodel by Maneskin

send me your name and i will make a playlist out of the letters!

2 notes

·

View notes

Text

How To Scan a Direct Mail to PDF or Email Through a Snail Mail Scanning Service

In the digital age, converting physical mail into electronic formats has become increasingly important for efficiency and accessibility. Snail mail scanning services offer a solution to digitize direct mail, enabling easy distribution and management. Here’s how to scan direct mail to PDF or email using these services:

1. Choosing a Snail Mail Scanning Service

a. Evaluate Service Providers

Start by researching and selecting a snail mail scanning service provider that meets your needs. Look for providers with a reputation for reliability, security, and accuracy. Consider factors such as turnaround time, cost, and the ability to handle large volumes of mail.

b. Understand Service Features

Different scanning services offer various features. Some may provide options for automatic indexing, OCR (optical character recognition) to convert text from images into searchable content, and integration with email or document management systems. Choose a service that aligns with your specific requirements.

2. Preparing Your Mail

a. Organize Mail

Before sending your direct mail to a scanning service, organize and sort it. Ensure that all mailpieces are complete and legible. Remove any items that may not be suitable for scanning, such as those with large staples or non-standard sizes.

b. Ensure Mail Security

Mail security is crucial, especially if it contains sensitive information. Choose a scanning service that adheres to strict security protocols to protect your mail during handling and scanning. Ensure that the service provider complies with relevant data protection regulations.

3. Sending Mail to the Scanning Service

a. Packaging and Shipping

Package your mail securely and ship it to the scanning service provider. Follow any specific instructions provided by the service for shipping and handling. Some services may offer pickup options, which can be convenient for larger volumes of mail.

b. Tracking and Confirmation

Keep track of your shipment and confirm receipt with the scanning service provider. Most services offer tracking options so you can monitor the progress of your mail as it is processed.

4. Scanning Process

a. Scanning and Digitization

Once the mail is received, the scanning service will process it. This typically involves scanning each piece of mail and converting it into a digital format, such as PDF. Some services may also include indexing and categorizing the scanned documents for easier retrieval.

b. Quality Control

Reputable scanning services perform quality control checks to ensure that all documents are scanned accurately and that digital copies are clear and legible. This step is crucial to avoid issues with readability and ensure the integrity of the scanned documents.

5. Receiving and Managing Digital Copies

a. Digital Delivery

After scanning, the service provider will deliver the digital copies of your mail. This can be done via secure email, through a cloud-based portal, or by integrating the scanned documents directly into your document management system.

b. Storing and Organizing

Store and organize the digital copies according to your needs. Ensure that digital files are backed up and that appropriate access controls are in place to protect sensitive information. Utilize features like searchable text and indexing to enhance document management and retrieval.

6. Handling and Using Scanned Documents

a. PDF Management

Use PDF management tools to handle scanned documents efficiently. These tools can help with searching, editing, and sharing PDFs. Ensure that all digital copies are accessible to authorized personnel and that proper security measures are in place.

b. Integration with Systems

Integrate scanned documents with your existing systems, such as CRM or email platforms, to streamline workflows and enhance productivity. This integration can help automate processes and ensure that digital mail is utilized effectively within your organization.

7. Compliance and Security

a. Data Protection

Ensure that the scanning service complies with data protection regulations and that your digital documents are stored securely. Implement access controls and encryption to protect sensitive information and maintain compliance with privacy laws.

b. Regular Audits

Conduct regular audits of your scanning and document management processes to ensure ongoing compliance and security. Address any issues promptly to maintain the integrity and effectiveness of your digital mail management system.

Conclusion

Navigating the legal requirements for direct mail campaigns is essential for compliance and successful marketing. Understanding federal and state regulations, ensuring accurate and truthful content, and adhering to privacy and data protection laws are key components of a compliant direct mail strategy. Additionally, utilizing snail mail scanning services to digitize and manage direct mail can enhance efficiency and accessibility, provided that security and compliance are prioritized throughout the process. By staying informed and implementing best practices, marketers can effectively manage direct mail campaigns while avoiding legal pitfalls and maximizing their impact.

youtube

SITES WE SUPPORT

Scan & Print Direct Mail – Wix

0 notes

Text

Demystifying Electronic Insurance: Understanding How It Works

Electronic insurance, also known as e-insurance or digital insurance, revolutionizes the traditional insurance industry by leveraging technology to streamline processes, enhance accessibility, and improve customer experience. At its core, electronic insurance operates on digital platforms, offering policy management, claims processing, and customer support through online portals or mobile applications. Here's a closer look at how electronic insurance works:

Online Enrollment and Policy Management: Instead of filling out paper forms or visiting brick-and-mortar offices, consumers can browse insurance products, compare quotes, and enroll in policies entirely online. Through user-friendly interfaces, individuals input personal information, select coverage options, and customize policy details according to their needs and preferences. Once enrolled, policyholders can access their insurance documents, update information, and make payments through secure digital platforms.

Automated Underwriting and Risk Assessment: Electronic insurance streamlines the underwriting process through automation and data analytics. Algorithms analyze vast amounts of data, including demographic information, health records, and credit scores, to assess risk profiles and determine premium rates. By eliminating manual assessments and paperwork, insurers can expedite policy issuance and offer competitive pricing tailored to individual risk factors.

Digital Documentation and Communication: Gone are the days of cumbersome paper trails and snail mail correspondence. Electronic insurance provides policyholders with digital copies of insurance contracts, certificates, and endorsements, accessible anytime, anywhere. Communication with insurers, agents, and claims adjusters occurs through email, instant messaging, or online chat features, enabling swift resolution of inquiries and concerns.

Claims Submission and Processing: In the event of covered losses or damages, policyholders can initiate claims through online claim submission forms or mobile apps. Digital documentation, such as photos or videos of the incident, can be uploaded for review, expediting the claims process. Insurers leverage artificial intelligence and machine learning algorithms to assess claim validity, estimate damages, and authorize payments efficiently. Electronic payments directly deposited into policyholders' bank accounts further streamline the settlement process, eliminating the need for paper checks.

Integration with Internet of Things (IoT) Devices: Electronic insurance embraces IoT technology to enhance risk management and preventive measures. Connected devices, such as smart home sensors, telematics devices in vehicles, or wearable health trackers, provide real-time data insights that enable insurers to offer personalized discounts, incentivize proactive behaviors, and mitigate risks. For example, safe driving habits recorded by telematics devices can lead to lower auto insurance premiums, promoting safer roads and reducing accident rates.

Data Security and Privacy Measures: With the digitization of sensitive personal and financial information, data security is paramount in electronic insurance. Insurers invest in robust encryption protocols, secure cloud storage, and multi-factor authentication to safeguard customer data against cyber threats and unauthorized access. Compliance with regulatory frameworks, such as GDPR or HIPAA, ensures adherence to strict standards for data protection and privacy rights.

Continuous Innovation and Adaptation: Electronic insurance is a dynamic landscape driven by innovation and technological advancements. Insurers continually invest in research and development to enhance digital capabilities, such as predictive analytics, chatbots for customer service, or blockchain for secure transactions and fraud prevention. By staying at the forefront of technological innovation, insurers can deliver seamless digital experiences and remain competitive in a rapidly evolving market.

In conclusion, electronic insurance represents a paradigm shift in the insurance industry, harnessing the power of technology to simplify processes, improve efficiency, and empower consumers with greater transparency and control over their insurance needs. As digitalization continues to reshape the landscape of financial services, electronic insurance stands poised to redefine the future of risk management and protection in the digital age.

0 notes

Text

oh em gee ty for the tag😋

Jobless Monday (mitski)

Andromeda (weyes blood)

Automate (snail mail)

Kissing Lessons (lucy dacus)

Labyrinth (taylor swift)

Out Worn (soccer mommy)

Punch22 (carwash)

Sweet Tooth (maya hawke)

tag time! @harp-bo-barp @a-dwindling-mercurial-high @ash-the-blob @frog-in-the-bog @cloudenvy47

(scratches head) genuinely don’t know who else to tag so. if you wanna do this just say i tagged you 👍

Rules: pick a song for each letter of your URL and tag that many people.

Tagged by @sailforvalinor, and thank you this looks like fun!

Remember and Proclaim (Andrew Peterson)

All I Ask of You (Jackie Evancho)

Innocence (Nathan Wagner)

Níl Sé'n Lá (Celtic Woman)

I Still Need a Savior (Billy Sprague)

No Strings (Ed Sheeran)

Take Me Back Road (Tim & the Glory Boys)

How Great is Our God (Chris Tomlin)

Everything Sad is Coming Untrue (Jason Grey)

El-Shaddai (Amy Grant)

Voice of Truth (Casting Crowns)

Endlessly (Amaranthe)

Not Alone (Red)

I'm an Open Road (Paul Brandt)

Never Leave Your Side (Sam Tinnesz)

Good to Be Alive (Skillet)

Hoo boy, can I think of sixteen people?

@griseldabanks @kraytwriter @kingofattolia @catkin-morgs @clawedandcute @nerdychristianfanboy @steampunk-archer @sergeanttomycaptain @smhalltheurlsaretaken @scribblermerlin @authortobenamedlater @stainedleather @mrtobenamedlater @mrgartist @get-loved-nerd @a-fount-of-blessings (Ignore if this is a repeat tag. Unless you want to do it again. Up to you. :)

4K notes

·

View notes

Text

From Quill to Cloud: How Tech Transforms the Company Secretary's World

The image of a company secretary hunched over a mahogany desk, quill in hand, surrounded by mountains of dusty files, is as outdated as a rotary phone. Today's company secretary is a digital ninja, wielding technology like a samurai sword to navigate the ever-evolving corporate landscape. This isn't just about efficiency; it's about transforming the very role of the company secretary into a strategic powerhouse.

So, how exactly is technology revolutionizing the company secretary's world? Buckle up, it's a wild ride!

1. Compliance Crusaders 2.0:

Forget drowning in a sea of paper forms. AI-powered compliance platforms automate tedious tasks, flag potential risks, and ensure real-time adherence to regulations. Imagine never missing a deadline or scrambling for that obscure document again!

2. Boardroom Reinvention:

From Static Scripts to Dynamic Dashboards: Board meetings used to be static affairs, with board members flipping through weighty paper reports. Now, technology paints a vibrant picture! Interactive dashboards display real-time data, financial visualizations, and risk assessments, bringing boardroom discussions to life. Company secretaries become data wizards, conjuring up insights and facilitating informed decision-making with the flick of a digital wand.

3. Data Analytics for Informed Decision-Making:

Harnessing data analytics tools empowers Company Secretaries to extract meaningful insights from vast datasets. This data-driven approach aids in informed decision-making, risk assessment, and strategic planning.

4. Communication Conquering: From Pigeon Post to Ping Pong:

Communication used to be a slow waltz, with minutes and resolutions dancing through snail mail. Now, technology unleashes a digital tango! Secure online platforms facilitate instant communication between board members, management, and stakeholders. Company secretaries become communication maestros, orchestrating a symphony of information flow, keeping everyone in the loop and on the same page.

5. Automation for Administrative Agility:

Automation tools alleviate the administrative burden on Company Secretaries. From document management to scheduling, these technologies enable CSs to focus on strategic functions, adding value to the organization.

But wait, there's more! Technology is also empowering company secretaries to:

https://xidmet.co.in/news/assets/img/svg/arrow.svg

This isn't just a tech revolution, it's a paradigm shift. Technology is no longer just a tool for the company secretary; it's a strategic partner, empowering them to become the CEO's right-hand advisor, the board's trusted confidant, and the company's silent guardian of good governance and compliance.

So, the next time you see a company secretary, don't just see someone pushing paper. See a tech-powered superhero, wielding the latest tools to navigate the corporate jungle with precision, agility, and a touch of digital magic.

0 notes