#smartbanking

Explore tagged Tumblr posts

Text

CASH IS KING!

#DigitalEconomy#CashlessFuture#FinancialInnovation#MobilePayments#ContactlessPayments#DigitalWallet#BlockchainRevolution#Cryptocurrency#Fintech#ECommerce#SmartBanking#CardlessPayments#OnlineTransactions#BankingRevolution#VirtualCurrency#SeamlessPayments#DigitalFinance#FutureOfMoney#CashlessRevolution#SecurePayments

2 notes

·

View notes

Text

🔍 Searching for the best business checking account with no monthly fees or minimum balance requirements? Look no further!

💰 With ZIL.US, you get:

✅ No hidden fees – Keep more money in your business!

✅ No minimum balance – Flexibility for every business size!

✅ 24/7 access – Manage funds anytime, anywhere!

📌 Simplify your business banking today!

🔗 Learn more: https://zil.us/best-business-checking-accounts/

0 notes

Text

Applications of RPA in Banking: Transforming the Financial Sector

Robotic Process Automation (RPA) is revolutionizing the banking sector by automating repetitive tasks like account reconciliation, loan processing, and customer onboarding. It enhances efficiency, reduces human errors, and ensures compliance with regulatory standards. RPA also empowers banks to deliver faster and more accurate services. For cutting-edge RPA solutions, USM Business Systems is the best mobile app development company to transform your banking operations.

#RPAinBanking#BankingAutomation#FinancialTechnology#RoboticProcessAutomation#DigitalBanking#FinTechSolutions#BankingInnovation#AutomatedBanking#RPATransformation#SmartBanking

0 notes

Text

#FinTech#MicrofinanceSolutions#DigitalBanking#BankingSoftware#FinancialInclusion#TechForFinance#SmartBanking#MicrofinanceSoftware#MicrofinanceBanking#InclusiveFinance#SmallBusinessLoans#MicroCredit#EmpowerEntrepreneurs#CommunityFinance#InnovationInFinance#TechTransformation#FutureOfFinance#AIInBanking#CloudBanking#BusinessSolutions#ClientSupport#CustomerSuccess#OperationalEfficiency#DigitalTransformation#GTechSolutions#BestMicrofinanceSoftware#TechForGrowth#StreamlineFinance

0 notes

Text

How Overdraft Protection Can Prevent Financial Pitfalls

Overdraft protection is your safety net when unexpected expenses pop up. It ensures that your transactions go through even when your account balance is low, saving you from embarrassing declines and hefty fees.

Why You Need Overdraft Protection

Avoid Fees: Prevent costly bank fees for bounced checks or declined transactions.

Never Miss a Payment: Keep your bills and purchases covered, even during tight times.

Peace of Mind: Focus on life, not on worrying about whether your card will work.

At F2fintech, we provide modern solutions like overdraft protection to help you take control of your finances.

👉 Check out F2fintech and secure your financial future today!

#OverdraftProtection#FinancialTips#MoneyManagement#AvoidBankFees#F2fintech#PersonalFinance#FinancialSafety#SmartBanking#MoneyMatters#BankingSolutions#FinanceHacks#FinancialFreedom#Budgeting#SecureYourFinances#Overdraft#FinancialProtection#EventPlanning#FinancialWellness#SmartSpending#FinanceGoals

0 notes

Text

Navigating the Challenges of Cybersecurity in Indian Banking

Cybersecurity is a critical challenge for Indian banking, given the increasing digitization of financial services. Indian banks are implementing robust cybersecurity measures to protect against cyber threats and ensure the safety of customer data. These measures include advanced encryption, multi-factor authentication, and real-time threat monitoring. Despite these efforts, the evolving nature of cyber threats requires continuous vigilance and innovation. IBEF discusses the key challenges of cybersecurity in Indian banking and the strategies banks are adopting to navigate these challenges effectively.

0 notes

Text

How is automation AI transforming the financial services industry?

Automation and AI are revolutionizing the financial services industry in several impactful ways. Here’s a closer look at how these technologies are transforming the sector:

1. Enhanced Customer Service:

Chatbots & Virtual Assistants: AI-driven chatbots offer round-the-clock customer service, promptly and effectively managing standard questions and transactions. As a result, wait times are shorter and customer satisfaction is higher. Personalized Recommendations: AI uses consumer data analysis to provide tailored investment advice, financial guidance, and product recommendations. This allows services to be catered to the needs and tastes of each individual user.

2. Improved Risk Management:

Fraud Detection: Artificial intelligence (AI) systems are able to identify potentially fraudulent actions faster and more precisely than traditional approaches by recognizing anomalous patterns and behaviors in real-time. Credit Scoring: By adding new data sources and advanced analytics, artificial intelligence (AI) improves credit scoring models and offers a more thorough and equitable evaluation of creditworthiness.

3. Operational Efficiency:

Robotic Process Automation (RPA): RPA automates repetitive, rule-based tasks such as data entry, account reconciliation, and compliance reporting. This minimizes human mistakes and lowers operating costs. Document Processing: Artificial intelligence (AI)-driven optical character recognition (OCR) technology expedites procedures like loan approvals and account opening by automating the extraction and processing of information from documents.

4. Investment Management:

Algorithmic trading: AI systems analyze enormous volumes of data to make well-informed decisions, executing deals at the best speeds and prices. This results in trading techniques that are more successful and efficient. Robo-Advisors: These automated systems offer low-cost portfolio management and investment advice, opening up financial planning to a wider audience.

5. Compliance and Regulatory Adherence:

RegTech Solutions: By automating monitoring, reporting, and audit procedures, artificial intelligence (AI) assists financial firms in adhering to complicated rules. This lowers the cost of compliance while guaranteeing conformity to legal standards. AML and KYC Procedures: By swiftly confirming identities and highlighting questionable activity, artificial intelligence (AI) improves anti-money laundering (AML) and know-your-customer (KYC) protocols, thereby enhancing security and compliance.

6. Data-Based Perspectives:

Predictive analytics: AI uses past data to estimate consumer behavior, market trends, and economic conditions. This helps businesses make more informed strategic decisions. Sentiment Analysis: AI tools scan news, social media, and other sources to gauge public sentiment about financial markets, influencing investment strategies and risk assessments.

7. Enhanced Protection:

Cybersecurity: Sensitive financial data and infrastructure are shielded from attacks by AI-powered systems that recognize and react to cybersecurity threats instantly. Biometric Authentication: Artificial Intelligence augments security by means of biometric techniques such as fingerprint scanning and facial recognition, guaranteeing safe and easy access to financial services.

Overall, automation and AI are driving significant advancements in the financial services industry, enhancing efficiency, security, and customer experiences while enabling more informed decision-making. In addition to streamlining current procedures, these technologies are opening the door for cutting-edge services and business concepts that will influence the financial industry going forward.

#AIinFinance#FinancialServicesAI#AutomationInFinance#FintechInnovation#AITransformation#FinanceTech#AutomatedFinance#SmartBanking

0 notes

Text

Discover the Future with Bank of America Cardless ATM by Contactless ATM!

Ready to elevate your banking experience? We’re thrilled to introduce the Bank of America Cardless ATM service, powered by Contactless ATM. It's time to leave your cards behind and enjoy seamless, secure, and hygienic cash withdrawals.

🌐 What is Bank of America Cardless ATM?

Effortless: Withdraw cash using just your smartphone – no card needed!

Secure: Advanced security measures keep your transactions safe.

Hygienic: Avoid touching ATM surfaces for a cleaner, safer experience.

🔍 How It Works

Open Your Mobile Banking App: Use the Bank of America mobile app to locate a nearby Cardless ATM.

Generate a Code: Follow the app instructions to generate a unique code.

Withdraw Cash: Enter the code at the ATM and get your cash instantly!

📖 Need More Details? Check out our detailed guide on how to use the Bank of America Cardless ATM feature: Bank of America Cardless ATM Guide

🔗 Learn More & Locate ATMs: Visit Contactless ATM

Embrace the future of banking and make your transactions easier and safer by sharing your cardless ATM experiences with us!

#BankOfAmericaCardlessATM#ContactlessATM#CashlessRevolution#SecureBanking#HygienicBanking#TechSavvy#Finance#BankingInnovation#SmartBanking#DigitalBanking#Fintech#CashlessSociety#FutureOfFinance#BankingTechnology#Convenience#TechTrends#MobilePayments#ContactlessPayments#DigitalTransformation#SmartPayments#CleanBanking#UserExperience#SafetyFirst

0 notes

Text

AI: The Big Disruptor Transforming the Fintech Industry

The financial technology (fintech) industry is a rapidly evolving sector that employs innovative technology to enhance and innovate financial services. Encompassing everything from mobile banking and online payment systems to cryptocurrency and peer-to-peer lending platforms, fintech is redefining the way we manage, invest, and interact with money. This dynamic industry has been marked by its ability to quickly adapt to changing consumer needs and technological advancements, creating a more inclusive, efficient, and user-friendly financial ecosystem.

At the core of this transformation is artificial intelligence (AI), a powerful disruptor that's driving unforeseen change across the financial landscape. AI's integration into fintech is not just an incremental improvement but a revolutionary force that's reshaping everything from customer interactions and fraud detection to personalised financial planning and operational workflows. As fintech companies increasingly harness the capabilities of AI, they're setting new benchmarks for innovation, security, and customer satisfaction.

In this blog, we’ll explore how AI is revolutionising the fintech industry, delving into its impact on various aspects of financial services. We'll examine the transformative potential of AI, its current applications, and the exciting future it heralds for the industry. Join us as we uncover the ways AI is forging a new era in financial technology, making it more efficient, secure, and tailored to individual needs

The Rise of AI in Fintech

AI has become a crucial tool in fintech due to its ability to analyze vast amounts of data quickly and accurately. Financial institutions are using AI to improve decision-making processes, enhance customer experiences, and reduce operational costs. As AI technologies continue to evolve, their impact on fintech grows exponentially, driving innovation and offering new opportunities for growth.

Enhanced Customer Service with Chatbots and Virtual Assistants

One of the most visible impacts of AI in fintech is the widespread use of chatbots and virtual assistants. These AI-powered tools are revolutionizing customer service by providing instant, 24/7 support. They handle a range of tasks, from answering frequently asked questions to assisting with complex transactions. The benefits are twofold: customers receive immediate assistance, and financial institutions save on customer service costs.

AI chatbots are becoming increasingly sophisticated, utilizing natural language processing (NLP) to understand and respond to customer inquiries more effectively. This not only enhances the customer experience but also allows human agents to focus on more complex issues, improving overall service quality.

Revolutionizing Risk Management and Fraud Detection

AI is a game-changer in risk management and fraud detection. Traditional methods of detecting fraudulent activities often involve manual reviews and rule-based systems, which can be time-consuming and prone to errors. AI, on the other hand, excels at identifying patterns and anomalies in large datasets, making it highly effective in detecting fraudulent behavior.

Machine learning algorithms can analyze transaction patterns and flag suspicious activities in real-time. This proactive approach significantly reduces the risk of fraud and minimizes potential losses. Moreover, AI-driven risk assessment models help financial institutions evaluate creditworthiness more accurately, enabling better lending decisions.

Personalized Financial Services

Personalization is another area where AI is making a significant impact. By analyzing customer data, AI can provide tailored financial advice and product recommendations. This level of personalization was previously unattainable and is now helping fintech companies offer more value to their customers.

AI-powered robo-advisors, for example, are democratizing investment advice by providing low-cost, personalized investment strategies. These platforms analyze a user's financial situation, risk tolerance, and goals to create customized investment plans. As a result, more people have access to sophisticated financial advice that was once reserved for high-net-worth individuals.

Streamlining Operations with Automation

Automation driven by AI is streamlining various operational processes within the fintech industry. Routine tasks such as data entry, compliance checks, and transaction processing are now being handled by AI systems, reducing the need for manual intervention. This not only increases efficiency but also lowers the chances of human error.

AI can also enhance regulatory compliance by continuously monitoring transactions and ensuring they meet regulatory requirements. This is particularly important in the highly regulated financial sector, where non-compliance can result in hefty fines and reputational damage.

The Future of AI in Fintech

The future of AI in fintech looks promising as the technology continues to advance. Emerging trends such as blockchain integration, quantum computing, and more sophisticated AI models are set to further disrupt the industry. Financial institutions that embrace AI will be better positioned to innovate, compete, and meet the evolving demands of their customers.

However, the widespread adoption of AI also raises challenges, particularly regarding data privacy and security. Fintech companies must navigate these challenges carefully to maintain customer trust and comply with regulatory standards.

AI-Powered Predictive Analytics

AI's ability to predict future trends and behaviors through predictive analytics is proving invaluable in the fintech industry. By analyzing historical data and identifying patterns, AI can forecast market trends, customer behaviors, and potential risks. Financial institutions use these insights to make informed decisions, optimize their portfolios, and offer better services to their clients. Predictive analytics also help in anticipating customer needs, allowing companies to proactively offer relevant products and services.

Improved Customer Insights and Marketing

AI is transforming how fintech companies understand and engage with their customers. By analyzing data from various sources, AI can create detailed customer profiles and segmentations, enabling highly targeted marketing campaigns. This leads to more effective customer acquisition and retention strategies. Personalized marketing, driven by AI, ensures that customers receive relevant offers and communications, enhancing their overall experience and loyalty.

Enhanced Cybersecurity Measures

As cyber threats become increasingly sophisticated, AI is playing a critical role in enhancing cybersecurity within the fintech industry. AI systems can detect and respond to security breaches in real-time, analyzing patterns to identify potential threats before they cause significant damage. Machine learning algorithms can adapt to new threats, ensuring robust protection against evolving cyber attacks. This proactive approach to cybersecurity is crucial for maintaining customer trust and safeguarding sensitive financial information.

Facilitating Regulatory Compliance

Navigating the complex landscape of financial regulations is a significant challenge for fintech companies. AI helps simplify this process by automating compliance checks and monitoring transactions for regulatory adherence. Regtech (regulatory technology) solutions powered by AI can analyze large volumes of data to ensure compliance with local and international regulations. This reduces the risk of non-compliance, which can lead to hefty fines and legal issues, and allows companies to focus on their core operations.

Democratizing Access to Financial Services

AI is playing a pivotal role in making financial services more accessible to underserved populations. Through mobile banking apps, AI-driven platforms can offer financial products and services to individuals who previously had limited or no access to traditional banking. This includes microloans, mobile payments, and savings plans tailored to the needs of low-income individuals. By democratizing access to financial services, AI is helping to promote financial inclusion and reduce economic disparities.

AI in Wealth Management

AI is revolutionizing wealth management by providing sophisticated tools that were once available only to high-net-worth individuals. Robo-advisors and AI-driven portfolio management systems offer personalized investment advice based on an individual's financial goals, risk tolerance, and market conditions. These platforms make it easier for everyday investors to build and manage their wealth, providing access to high-quality financial advice at a fraction of the cost of traditional advisory services.

Blockchain and AI Integration

The integration of AI with blockchain technology is opening up new possibilities for the fintech industry. AI can enhance the security and efficiency of blockchain transactions, while blockchain can provide a transparent and tamper-proof ledger for AI processes. This synergy is particularly beneficial for areas such as identity verification, smart contracts, and secure data sharing. Combining these technologies can lead to more robust and trustworthy financial systems.

Conclusion

AI is undeniably the big disruptor transforming the fintech industry. Its ability to enhance customer service, improve risk management, personalize financial services, and streamline operations is driving unprecedented changes. As AI technology continues to evolve, its influence on fintech will only grow, making it an essential tool for financial institutions aiming to stay competitive in a rapidly changing landscape.

Embracing AI is no longer a choice but a necessity for fintech companies that wish to thrive in the digital age. The journey has just begun, and the possibilities are limitless.

#information#informative#FintechUK#AIinFinance#TechDisruption#FinancialInnovation#AIFintech#UKBanking#DigitalFinance#FutureOfFinance#FintechRevolution#AIPowered#UKTech#FintechTrends#SmartBanking#CyberSecurityUK#RegTech#WealthManagement#FinancialInclusion#BlockchainUK#PredictiveAnalytics#CustomerExperience

0 notes

Text

AI Innovation In Banking

Discover the future of finance with our AI-powered solutions, delivering seamless experiences and peace of mind for all your banking needs.

#AIinBanking#BankingTech#SmartFinance#FutureOfFinance#DigitalBanking#ArtificialIntelligence#BankingRevolution#PersonalizedBanking#FinanceTech#SmartBanking#appdevelopers#software development

0 notes

Text

Bank Account Opening Assistance in Dubai, UAE - MNA Business Solutions

Secure your financial future in Dubai, UAE with MNA Business Solutions! Our expert will assist you in Opening of your bank account. WhatsApp now at +971 50 539 8688 for a free consultation

#BankingMadeEasy#OpenAccountNow#FinancialFreedom#EasyBanking#AccountOpening#BankingSolutions#FastTrackBanking#SecureBanking#DigitalBanking#SmartBanking#NoHassleBanking#NewAccountAlert#ConvenientBanking#BankingOnTheGo#OpenSavingsAccount#FutureFinance#YourBankYourWay#InstantAccountOpening#BankingWithEase#SimpleBanking

0 notes

Text

जानिए RBI के नए नियम, कैसे करें बैंक लॉकर का सही इस्तेमाल

वैसे तो बहुत से लोग सोचते हैं कि उन्हें बैंक के लॉकर में कुछ भी रखने की पूरी आजादी होती है, परंतु यह सच नहीं है। कई ऐसी चीजें हैं जिन्हें आप लॉकर में नहीं रख सकते। आइए, हम आपको बताते हैं कि भारतीय रिजर्व बैंक ने कौन-कौन सी नई नियमें लागू की हैं, जो आपको जाननी चाहिए। यह नई दिशानिर्देश आपके बैंकिंग अनुभव को पूरी तरह से बदल सकती है।

#RBINewRules#BankLockerGuidelines#SecureBanking#SafeDepositBox#BankingSecurity#LockersUsageTips#RBIRegulations#BankLockerSafety#SmartBanking#RBIUpdates2023

0 notes

Text

Use of Artificial Intelligence in Banking

Artificial Intelligence (AI) is revolutionizing the banking sector by enhancing customer experiences, automating processes, and improving security. AI-powered chatbots provide 24/7 customer support, while machine learning algorithms detect fraud in real-time. Additionally, AI enables personalized financial advice and automates credit risk assessment, reducing human error. This transformation helps banks deliver faster, more accurate services and stay competitive in the digital era.

USM Business Systems is the best mobile app development company, offering cutting-edge AI solutions to transform banking operations with innovative and secure applications.

#AIinBanking#BankingInnovation#ArtificialIntelligence#AIFinance#SmartBanking#DigitalBanking#FintechAI#BankingAutomation#AIFraudDetection#FutureOfBanking#AIInFinance#AIForBanks#BankingTechnology#AITransformation#FintechSolutions

0 notes

Text

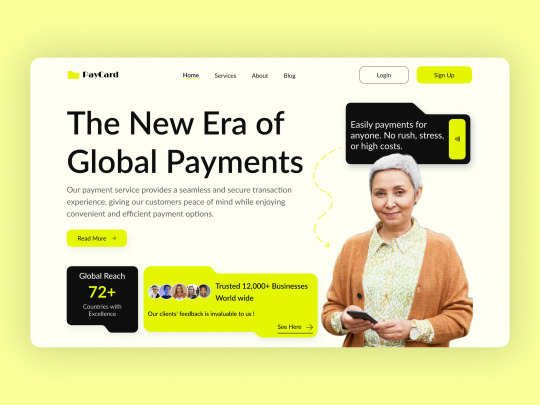

PayCard Fintech Landing Page Website UI Design

Hi, Designers 🖐

Today I would like to share the design concept of the PayCard Fintech Landing Page Website UI Design. I would like to know your feedback. 👇

.

.

🔗 Dribbble: https://lnkd.in/gXpc9AKn

🔗 Behance: https://lnkd.in/gkNXjhuX

🔗 Instagram: https://lnkd.in/geSTKrDD

Let's Talk at /-

💌 Gmail: [email protected] /��[email protected]

📞 Skype: https://lnkd.in/gabDqyp8

🟢 WhatsApp: +88 01533768488

#ui#uxdesign#ux#websitedesign#website#web#landingpage#fintech#uidesign#onlinebanking#banking#SmartBanking#Payment#design#designer#branding#uiux#figma#webdesign#uiuxdesign#ecommerce

1 note

·

View note

Text

"Maximize your savings and banking convenience with Axis Current Account - the smarter way to manage your finances online!"

Axis Current Account is an online banking service designed to help you maximize your savings and banking convenience. With this account, you can easily manage your finances online, without the need to visit a physical bank branch.One of the key benefits of this account is its flexibility. You can choose from a range of options based on your financial needs, including different transaction limits and fee structures. This means that you can customize your account to suit your individual banking requirements, allowing you to save money and manage your finances more effectively.In addition to its flexibility, Axis Current Account also offers a range of features designed to make banking more convenient. You can access your account 24/7 from anywhere in the world, and enjoy a range of online services, such as online bill payments and fund transfers.Overall, if you're looking for a smarter way to manage your finances, Axis Current Account is a great option to consider. With its range of customizable options and convenient online features, this account can help you save time, money, and hassle when it comes to banking.

Open now

#saving mr banks#SmartBanking#FinancialFreedom#OnlineBanking#BankingMadeEasy#SaveTime#SaveMoney#HassleFreeBanking#CustomizableOptions#ConvenientBanking#AxisCurrentAccount

0 notes

Text

🎙️1️⃣1️⃣1️⃣ CD PEPINEROS 🥒 | 🆕 Última hora del MERCADO de Fuxchajes | 🆚 Previa del CD Leganés vs Rayo | 🗣️ Entrevista con Raúl HUERTAS y David CRESPO, responsabels de Captación del CD Leganés

Faltan 4 días 8era jueves) para que cierre el mercado de fichajes de invierno el próximo lunes y no ha venido ningún fichaje todavía a Butarque. Lo primero eran las salidas y esas han sido más o menos rápidas, Primero la de Sebastian Haller que está en el Utrecht y después la de Naim García al Racing de Ferrol y el pasado jueves, Jackson Porozo voló a México para cerrar su cesión al Club Tijuana.…

#captación#cd leganés#cd leganes#cd leganes vs rayo vallecano#club deportivo leganés#club deportivo leganes#david crespo#ea sports#la liga highlights#laliga ea sports#laliga highlights#laliga hypermotion#laliga smartbank#laliga todays match highlights#leganes vs rayo#leganes vs rayo en vivo#leganes vs rayo live#liga#noticias club deportivo leganés#oficial#primera division#raul huertas#rayo vallecano#Segunda División#segunda division

0 notes