#she received welfare from when I was 5-18 at least

Explore tagged Tumblr posts

Note

I asked my mother this (she likes to yell at low level customer service workers), and she genuinely believes that the customer service worker will pass on the complaint to their boss, and the complaint will reach someone with the authority to change company policy.

She also believes that most customer service workers are stupid (she identifies as middle class), and that it’s ok to be mean to “stupid” people.

why do customers think the person working the cash register has any real authority over how the store is run? i'm not venting, i'm honestly curious if there's some culture or psychology thing or convoluted line of logic that feeds into it.

Posted by admin Rodney.

#in case you are wondering yes she is unemployed#in the 31 years that I’ve had the displeasure of knowing her only one year did she have a full time job#I grew up in a lower class town#she still lives in said lower class town#she received welfare from when I was 5-18 at least#that’s when we moved to the working class town#if you’re wondering why she identifies as middle class despite qualifying for welfare and a#low income health care card#literally a card that that means the government thinks your poor#it’s because she has a university degree#she sees a degree as middle classness itself rather than a stepping stone to the middle class#also she grew up middle class#I was floored when she recently told me she went in multiple skiing holidays as a child#so she’s in denial about having slipped down a class#she also thinks she’s too good to get a#working class#job because she has a degree#yes we fight about her treatment of customer service workers constantly#she likes to ask waiters their race#when I told her it makes me uncomfortable when customers ask my race she said I needed to toughen up#she is white I am not

90 notes

·

View notes

Text

#075 - The Best News of Last Week - February 27, 2023

🐈 - Do you know Gacek, the most famous cat in Poland?

Hey there! It's Erica here, and I'm excited to share with you some of the most uplifting news stories of the week. In a world that can sometimes seem filled with negativity, it's important to focus on the positive and find inspiration in the good things that are happening around us. Let's dive into this week's collection of wholesome news!

1. 8-year-old boy missing from Washington state for 8 months is found in Missouri

A boy who has been missing from Washington state since at least mid-June was found safe in Missouri, the FBI office in Seattle said Tuesday.

Authorities said 8-year-old Breadson John had vanished by June 17, when a welfare check at his home in Vancouver, Washington, just across the state line from Oregon, determined his absence.

2. World’s biggest four-day working week trial hailed a ‘major breakthrough’

The trial of a four-day working week in the UK, the largest of its kind in the world, has been celebrated as a “major breakthrough” after the majority of participating companies announced their intention to continue with the shorter week.

The trial, which ran for six months from June last year, required firms to reduce their working hours for all employees by 20 per cent without any reduction in wages.

At least 56 out of the 61 companies confirmed they will continue with the four-day working week, while 18 of them have made the policy a permanent change.

3. This dying baby turtle survived after drifting 4,000 miles to Ireland

A family strolling on a beach in Ireland earlier this month spotted a seafarer that had washed up on the rocks. Less than a year old, the female loggerhead survived a months-long journey across the Atlantic Ocean, teeming with dangers including predators and plastic. Although she was still alive, the turtle was dehydrated, massively underweight.

They called her Cróga, the Irish word for “brave.” After finding Cróga in the northwestern part of Ireland, the family called a few groups that rehabilitate whales and dolphins. There, Cróga’s rehabilitation began.

4. A Hernando toddler found alive after being missing for nearly 24 hours

A 2-year-old boy was lost in the Florida woods for 24 hours. Everyone feared the worst. Hundreds of volunteers came out to look for him.

One volunteer came to a fork in a field: right or left? He trusted his gut, went left and soon heard a whimper. It was the little boy, crying but in good health.

I found something interesting while reading this article: If you are part of a SAR team looking for a child to not only call their name but also that they aren’t in trouble. Young children sometimes hide from potential rescuers because they’re afraid they’ll get in trouble.

5. German man remains free of the HIV virus years after receiving stem cell treatment.

Researchers are announcing that a 53-year-old man in Germany has been cured of HIV.

Referred to as "the Dusseldorf patient" to protect his privacy, researchers said he is the fifth confirmed case of an HIV cure. Although the details of his successful treatment were first announced at a conference in 2019, researchers could not confirm he had been officially cured at that time. Today, researchers announced the Dusseldorf patient still has no detectable virus in his body, even after stopping his HIV medication four years ago.

6. South Korea court recognises same-sex couple rights for first time

A South Korean court has for the first time recognised the rights of a same-sex couple in the country. In a landmark ruling, the Seoul High Court found a government health insurer did owe coverage to the spouse of a customer after the firm withdrew it when it found out the pair were gay.

The men had held a wedding ceremony in 2019, but same-sex marriage is not recognised in South Korea.

Activists say the ruling is a leap forward for LGBT rights in the country.

7. A fat cat has become the top-rated tourist attraction in a Polish city with a perfect 5-star average on Google Maps

A fat black-and-white cat called Gacek has become the top-rated tourist attraction in the Polish city of Szczecin.

Gacek has a perfect five-star rating on Google Maps. His name, pronounced gats-ek, means "long-eared bat" in Polish. Gacek first drew international attention when he appeared in a YouTube documentary in 2020

- - -

That's it for this week. If you liked this post you can support this newsletter with a small kofi donation:

Buy me a coffee ❤️

Let's carry the positivity into next week and keep spreading the good news!

236 notes

·

View notes

Text

It’s really interesting watching reaction channels and checking out some comments on social media about something you’re really enjoying. I start to wonder if I’m watching the same thing lol

I’m not saying they’re wrong or I’m right. My interpretations are mine, but wanted to ramble a bit after The Eclipse Series episode 11 and decided here was as good a place as any lol. I really should find myself some friends that watch BLs too :)

1. They thought Aye saw his uncle jump from the cliff - I assumed it was just a nightmare/scenario Aye had created. He was always presented as present Aye with his hairstyle and the fact he was wearing the necklace, which he would have received after the fact.

2. Teacher Sani and the picture. How? - well she took over from Dika so I just assumed she found it amongst anything he left behind as seems she took over his desk. Looked like she took it from the pages of (what I can only guess was Dika’s) student welfare manual, and if he and Chaddok were strained he probably didn’t care what got left behind.

3. But Thua was bullied so he should know better - don’t get me wrong outing someone is bad and would never agree to his actions, but people saying he’s been bullied so why would he do it… pretty sure in part his bullying is because of the rules and ‘curse’ both of which Akk has been supporting until recently, so if I was Thua and saw Akk frolicking in a pool with his boyfriend while (at that scene’s point in time at least) Kan had spent years?? pushing him away and even though they’d got close again he was hiding behind Bruce Wayne, so yeah I’d probably not prioritise how Akk might get treated when revealing everything either. Again, I don’t agree with what he did, but he’s a 17/18 year old kid making a knee jerk reaction to the situation, provoked by Aye trying to shut him down and protect Akk.

4. Why did Thua choose now? - Akk just got the best boy award, Aye was clearly supporting him. Then outside, the protesters show up and suddenly Aye is calling out in their favour. I get why Thua did it and had had enough and spoke out. As I said before I don’t agree to everything (ie the outing) but get why he did it. He was calling out Aye, the fact his love (and likely unknown to Thua, Akk’s mental state) had meant Aye no longer tried to get Akk to tell the truth and instead was encouraging him during the ceremony. Aye had presented himself as someone who would expose the curse, had in some ways pushed Thua from his neutral place, the ‘curse’ might not have been active but it and the rules remained in the background. At that point, Kan still wanted them to be a secret, maybe Thua thought his step dad would have been less ‘rough’ if not for his experience of the curse, after the doll incident I felt like he was shaken because any faith he had had left in the system, the teachers enacting justice, protecting their students was extinguished. So Aye was in love, the protesters being manhandled, he probably saw himself as the only option for the truth to come out.

5. A missing scene? Was there a time jump? The group made up really fast - I agree to some extent about the fast turn around but I personally didn’t have an issue with it or get confused thinking I missed something. They did talk and get everything out in the open and from what we know from an earlier episode, or at least Akk, Wat and Kan, the group resolves conflict the same day, doesn’t let it fester. Thua said he’d accept whatever Kan felt he should do about him. Not going to lie, I wouldn’t have minded a ‘sorry’ in Thua’s explanation… ‘sorry I did it but I did what I believed was right’… after that Thua went home as his mum was waiting so I assumed it was the end of the school day. Skip to the next day, or maybe it was a couple, and the short film discussion. I went with the idea that this was Thua’s apology, he’d help them which would help in particular keep Kan (and Wat) being exposed as liars, and also help back track the outing of Akk and Aye (any investigation into Akk and the cause of the curse I presume will be revealed next week - this is solely about covering for Wat and Kan and making the film).

6. Kan and Thua being cute - now these two… personally, I don’t know if I could be as forgiving as Kan but a) he loves Thua, and has finally been able to be brave and say it - love is a crazy thing, b) if he can forgive Akk’s actions, he can forgive Thua’s, c) Thua is helping with the film and to cover for them so making amends that way, d) Kan’s part of a friends group that resolves conflict quickly, e) maybe he has his own guilt as he believed in the curse, and he had kept Thua at a distance for so long. Maybe he felt bad he didn’t notice what was going on with the curse or Thua. That last bit is just me maybe-ing but whatever the reason they stay together, move on, and he takes another brave step forward, and I’m happy for him.

Ahhh that’s better. Just wanted to ramble out what I’d been thinking. Nobody might ever see this but phew, feels good. (Watch next episode tell me everything at the end of this episode was a dream and everybody actually hates each other and everybody is crying buckets!!!)

#the eclipse the series#i love them so much#the eclipse ep11#only one episode left#gonna cry when it’s over#my bl babies

15 notes

·

View notes

Text

Friday 16 May 1834

7 5/..

12 ½

Fine – ready in an hour F57° at 8 5 - reading till 9 ½ from page 25 to 76, volume 24 British prose writers to the end of Horace Walpole’s Reminiscences. Letter from Mr Scotts’ book-keeper ‘GW. Ellis, 3 Dove street, near the Nunnery York’ to say Joseph had brought away his livery hardly worn at all and to beg me to desire him to send it back again - the poor lad brought it away in ignorance, never dreaming, as nobody said anything to him about it, that he ought to have given it back. Letter 3 pages from M- (Lawton) dated Thursday 8th inst and lastly last Tuesday night 13th instant – hoped to have heard from me – disappointed tho saying she had now no right to be so - and indeed ought not as she had neither asked me to write to her at Lawton, nor had I promised to do so - they arrived at Lawton on Tuesday 6th inst and were to leave there on Wednesday the 14th - writes to ask me to pay the ‘new servant James for a greatcoat Thomas had bought of him’- Found her scholars more stupid than formerly dined at Rode nothing interested her ‘Mary is not what she was or the same things would produce the same pleasures but it matters not’ ‘Time will do its best and worst, and after all is the short span of life worth a thought? A few short years and all is over and mine neither have given nor promise sufficient of comfort to induce a wish that they might be prolonged no one knows not, even you dearest Fred, what I have gone thro’ and at this moment I feel as little caring for the future of this world as if 24 hours would close my existence perhaps I should be thankful to know its duration was so limited – you, at least, I trust will be happy for you deserve to be so, and earnestly do I pray that it may be so’. And that those you love best may secure to you all the comfort necessary to your wishes for the present adieu then writes the more than half page of conclusion on Tuesday night Poor Mary how she has always marred her own happiness but how was it when I was so low two years ago she shewed no great pity for me. Breakfast in 20 minutes at 9 ½ wrote the above of today till 10 20 - some time out with Pickles and the rest -P- finished re-levelling the ground in front of the house before 12 and was at the railing in the afternoon with his 2 men. Had Joseph up twice for a good while about correcting his letter to Mr Ellis respecting the livery - had ½ hour’s nap. Wrote 3 pages and ends to M- as follows ‘Shibden Hall, Friday 16th May 1834. I have in this moment, my dearest Mary, received your letter dated lastly the 13th (Tuesday last) – three days from Lawton! These shews me, that my letter written on Sunday, and sent on Monday (the 12th) would reach Lawton a few hours after you were off. Surely it would be sent after you immediately and surely you have reached it ere this. Mary! I am very very sorry my pages were not with you at Lawton! - but they will convince you, you were not out of my thoughts, are not and are not likely to be – the more, my dearest Mary, I reflect upon the past, the more I am confounded at the appalling inconsistency of your conduct - that you should grieve so deeply over its consequences, is a heavy misfortune to us both. But this I can truly say, that whatever you may ‘have gone thro’ I can’t earnestly believe it to exceed the misery, the ruthless desolation of heart that fell upon myself – to me it was more sudden than the lightness glare - you had long warning – the storm came not but at your bidding, and from your own breast, sprang up the rock on which the hope of 20 years was wrecked. In pity and in common justice, remember this. Think too, that you can never have had one feeling of wounded pride to add its sting to all the rest. It was your own hand drew the card that sped the deadly shaft hope to the heart that had no shield but its affection Mary! Your aim did seem so coolly, so deliberately taken, the arrow scarce could miss her way. But no more - my regard is still perhaps worth having, and it will not be my fault if it does not serve you faithfully. For my sake, at least, take my advice this once more. Cheer up - rally round you those hopes that are scatted, rather than destroyed – let not your spirit turn coward but gather together your resources, calculate them fairly, manage them well – remember that you have a tried and steady friend who will help you to the uttermost, and, trust me, you have no need to despair of happiness even in this world. Despair is always a false calculation we can’t tell the good that may be in store for us and when our horizon seems lowest who knows that the brightest gleams of our existence are not at hand? Mary! I will do anything in the world I can for you - and surely it is my power to be a greater comfort to you than I can possibly have been, ever since the first moment when your mind became unsettled enough to entertain the 1st embryo thought of the now as it appears, strange resolve you came to, 2 years ago. But perhaps after all you were more right than you now believe. If all your tastes were indeed so changed as you told me, while mine as I honestly avowed, remained so nearly the same, how would it have answered to be still entirely dependent on each other? For you must not forget that, as the circumstance, which seems more particularly to tell you the secret of your own heart, would not then have occurred , you might still have been ignorant of it as ever, and I should not have had the strong advantage of being valued as at present. Mary! Is not this reasonable? You find travelling insupportable - you had other interest dearer than mine - you could not bear to leave Lawton - you even made a point of my promising to settle near there - and you, above all people, knew how I was situated towards my own place, where my family had lived between 2 and 3 centuries, I being the 15th possessor of my family and name. Mary! The spirit of my uncle started up before me and had my life been the sacrifice, idolatry must have yielded to honour. Mary! My dearest Mary, you thought of me too lowly then, as you think of me too highly now. Reflect upon these things - you will be happier by and by - you will trust my friendship regard implicitly and this will not be the least of the comforts that I firmly hope will attend us both – ask me to write, or to do anything. I do not feel as if I should ever disappoint you much - I have no feeling towards you but of affectionate regard and my greatest anxiety is for your welfare. But cheer up, Mary! Be comforted, my dearest Mary, if it be but for my sake. How my pen still lingers on this engrossing subject. I must answer the purport of your letter. James Clayton is no longer my servant - he came to me on the 24th ult. refused to wear Thomas’s livery - on the 26th and left me on the 28th sorry probably for his folly and not calculating that I should not retract the warning given at the moment. Mrs Williamson, Register Office for servants, Colliergate

SH:7/ML/E/17/0034

(I think it is) York, is the only person I know of likely to know anything about the man. You will see from my last, as far as I can tell at present, what I am going to be about - I shall probably be in York by 12 on Tuesday and off in an hour towards Richmond. In my aunt’s present state of health, I cannot be absent more than a week, I do not expect her surviving another winter - my father’s life, too, is very precarious, he had a very slight paralytic affection , more particularly in the left arm, 3 or 4 days ago - Marian’s attention to him is quite exemplary. Her feelings towards me seem altogether changed into what is most comfortable. God bless you my dearest Mary! You can’t possible doubt my regard and how much I am always very especially yours. A. Lister’ Writing out this letter has taken me from 3 25 to 4 10 = 1 ¼ hour. What will π- think of it I see three tears had fallen on her paper What a goose she has been surely she never thought of losing she played upon me too much the history of our acquaintance may be summed in accepted refused accepted married offended refused repented. Reading over my letter and dawdling till out at 4 ½ - with Marian in the garden - with Mallinson etc - dinner at 6 ½ then coffee and Marian was with me till after 8 - then sent off my letter to ‘Mrs Lawton, Claremont house, Leamington, Warwickshire’ and Joseph took to the post his letter to Mrs Ellis to say he should have the livery hat and all on Tuesday - from 8 ½ to 9 ½ in the fields looking at the new railing - 18 posts and railing there to belonging set this afternoon - and all would be finished tomorrow if we had the posts but we shall not have enough by 8 - 2 plasterers came this morning from Shaw’s, and cleared away the dirt and plaster ready for pointing west side of the house - talking to Marian till 10 1/4 . Is Northgate, or will it be, sold or not – tonight at 7 the sale was to being – I have not thought much about it even this evening and not all during day. My day was spent over my letter and my eyes stiffish with the tears that fell or stood big in my eyes This weakness is too foolish - 10 minutes with my aunt and came to my study at 10 25 and wrote the last 10 lines - raining fast - seemed to begin a few minutes ago - fine day tho’ dullish - very good for growing - my father does not like the idea of flower-beds, so the ground before the front window is to be all sown down with grass and clover - till 11 ½ read from page 79 to 99 Horace Walpole’s letters British prose writers vol. 24.

1 note

·

View note

Text

1045

surveys by lets-make-surveys 1 - What did you do to celebrate your last birthday? Did you get any decent gifts? Guh I honestly barely want to recognize my birthday this year because 2020 has been a huge waste of my time...but fine, I guess I’m 22. It had been during the peak of the quarantine/pandemic, so we had no choice but to stay home. I just played the Switch all morning, then I think I watched my dad play video games, and then Angela and Hans sent over a box of sushi to our place. Real chill day.

2 - What was the last “random act of kindness” you experienced? It was my first day at the office today and I had to go up and down the stairs several times to bring packages to delivery riders, since I had to send those out to certain people. A member of the maintenance staff in the area was super nice and offered to carry some of the boxes for me, since he saw how much I was struggling with the boxes.

3 - Have you ever “paid it forward” by putting money behind the counter somewhere so the next person can get a free coffee or similar? Not yet. I’d love to be able to do that soon.

4 - What caused the last injury that made you bleed? Was it a serious injury? I was trying to open a bottle of soju last night but the cap just would not budge. Next thing I knew my finger was already bleeding. Never got to drink my soju :(

5 - Who was the last person you spoke to on the phone? Are you close to that person at all? One of the delivery riders who took my package earlier. Bless his soul, he was very new to the delivering thing and I think I was his first-ever customer, and he kept asking for my help. I did my best for a while but eventually I had to tell him I genuinely did not know how to answer some of his questions as I wasn’t a driver myself.

6 - What was the last item you received in the mail? Something I had ordered online. It was the gift I’m planning to give my grandma for Christmas.

7 - When was the last time you received flowers? What kind were they? A year ago, I think. It was a single stem of a rose. We were saving up last year hahaha so I had gotten her a single stem as well.

8 - Are you a fan of salted caramel? What about other “odd” combinations like sea salt and chocolate or chilli and chocolate? Ooh, I didn’t know salted caramel was considered odd; it’s a pretty common flavor here and has even gotten more popular in the last few years. I like it as a flavor in desserts, like cupcakes with salted caramel frosting. When it comes to food, I’m generally open-minded and will try any combination that exists at least once; that said, chili and chocolate sound especially intriguing haha. I’ve only ever tried chili ice cream, which was delicious.

9 - Do you enjoy watching bloopers or outtakes from TV shows? If so, which series do you think has the funniest ones? Yes. Bloopers in general are great but it’s best when they come from shows that have a reputation for being more drama-heavy and serious - that said, Breaking Bad bloopers are the fucking best. ‘Bloopers’ from animated movies are hilarious too; they were always made so well too that as a kid, I legit thought the characters were actual actors as it never crossed my mind that animators would take the extra effort and time to make bloopers out of fictional characters and that they had to be real actors in some way lol.

10 - What’s your favourite dessert food? OMG macarons for the win. I’ve been craving them so much. Cheesecake is great too, and also cupcakes.

11 - Do you have any really dangerous wild animals where you live? Have you ever encountered any of them? Nope only stray dogs and cats, and probably some chickens somewhere.

12 - Have you ever dreamed of owning your own shop? What kind of thing would you like to sell? I’ve never dreamed of this; it’s never been a goal of mine and running a business doesn’t sound like my kind of thing.

13 - Are you a twin? If not, would you ever want to be a twin? If you are a twin, do you ever wish you weren’t? No. I’ve never really found myself wishing for it, either.

14 - Do you prefer wearing your hair straight or curly? Maybe just a little wavy. Definitely not in the extreme of either side of the spectrum.

15 - Would you ever want to go and visit the moon? If I had the chance and everything was paid for and stuff, hell yeah. It’d be cool to get to cross out one of my childhood bucket list items.

16 - What was the last hot drink you had? What about cold drink? Or alcoholic drink? My last hot drink was...probably the coffee I asked my mom to make last Friday, but I did wait it out until it was considerably cooler as I didn’t want to drink it hot. My last cold drink is the iced caramel macchiato I ordered tonight and still have with me at the moment. Then for alcoholic drink, I had soju mixed with Yakult about two weeks ago.

17 - Does anything on your body hurt or ache right now? My lower back, unsurprisingly. I also cut my right middle finger trying to open a soju bottle last week, andddd I gained a blister on my right foot today because of the shoes I picked to wear for work.

18 - When was the last time you struggled to get to sleep? Was there was a specific reason for that? I can’t remember exactly when, but it happened within the last week or the last two weeks. Sometimes I just drink too much coffee during the day that it affects how sleepy I’d ultimately feel at night.

19 - What three countries would you most like to visit? Morocco, India, and Thailand.

20 - Who’s your closest friend from another country? How did you come to meet this person? I don’t really have one anymore...I’ve grown apart from my internet friends from different countries a long time ago, and I also don’t tend to keep up friendships with my friends who’ve since migrated from the Philippines to another country. I suppose the one I’m on best terms with is Angel who migrated to Toronto around a decade ago; but I use ‘best’ very loosely as the most we do is comment on one another’s posts whenever we reach like a life accomplishment, like when we graduated college.

21 - When was the last time you had a cold? With everything going on in the news, did you worry that it was COVID? It’s been a while. I can’t remember; it was definitely pre-Covid.

22 - As of today (10th December, 2020) the COVID vaccine is being rolled out in the UK. Are you going to have it once it’s available to you (if it ever is)? A part of me is a little concerned because I know vaccines take years and sometimes even decades to be fully developed, but that doesn’t mean I don’t trust doctors and science. I very much do, of course. It’s just that I’d personally prefer to wait it out first to see if it’ll have any negative effects once rolled out on a massive scale.

23 - What are your favourite websites to browse when you’re bored? Wikipedia black holes are the way to go.

24 - Do you think people should have to pass a test in order to own pets? A local animal welfare NGO already does that; Nina had to go through several tests before she was allowed to adopt Arlee. There was a verbal interview, a written form she had to fill out, and a representative from the organization even visited our house to see if it was a suitable environment for Arlee; I’m sure there was a few more steps she was required to undergo. I certainly think it’s a good and responsible process.

25 - When was the last time you fell asleep/had a nap during the day? Is this something that happens often? It’s been monthssssssssss. I don’t really take naps during the day anymore.

26 - Do you suffer/have you ever suffered with bad acne? What kind of things did you do to try and improve it? I’ve never had issues with acne and was always rather fortunate when it comes to my skin. I’ll have a pimple or two show up once or twice a year, but they go away within a week or so. Since I don’t want to jinx it, I just wash my face with water and I’ve never experimented with any skincare products ever.

27 - When you think about it, do you think it’s odd that we stop drinking human milk at a young age, but we happily drink milk from other species instead? Not really.

28 - How’s the weather where you are? Is this a good or a bad thing for you? These days it’s humid and hot during the day (as always), but now that it’s Christmas season the weather tends to plunge to like 24-26C during nighttime. I’d say the night part is good for me as I prefer being cold than hot, so I’m glad we’ll be having this weather until March at most.

29 - When was the last time you ate a pizza? What toppings did you get? Tuesday. Relatives came over then and my cousin got us pizzas. I don’t remember what toppings he got but both pizzas had stuffed crust in it.

30 - How often do you wear make-up? What kind of make-up do you wear? Wow, almost never. Gab used to put makeup on me but now that she’s gone, I don’t really see myself wearing makeup for the meantime as I definitely wouldn’t apply them onto myself.

--

1 - If you have caffeine late in the day, does it cause you to struggle with your sleep? Eh, sometimes. Sometimes it’ll do what it’s supposed to and make me stay up for a while, but other times it doesn’t work and I’ll end up getting sleepy the same time I usually start feeling so.

2 - When you struggle to sleep, what do you do instead? Watching videos has eternally worked for me.

3 - Who was the last person you spoke to for the first time? How did you come to speak to this person? Hmm I met my co-workers Ysa and Bea for the first time today, if it counts. I’ve only ever talked to them through Viber since we’re on a WFH set-up, but we had to go to the office today to fix up some boxes that we needed to get delivered. But the last person that I really hadn’t met nor spoken to before was Jhomar, the company messenger who takes care of pickups for the day.

4 - If you have a pet, have they ever embarrassed you in public or in front of friends or family members? What happened? Kimi is typically unfriendly towards strangers, so as cute and cuddly as he looks he would probably bite your finger off. I’ve had to explain that to guests who’ve felt puzzled about his demeanor. He’s my little baby though and I wouldn’t say he’s embarrassed me because of it. Cooper on the other hand is hyper-friendly to the point that he looks aggressive and it has scared some people away; in reality, he’s always SO pumped to meet anyone and everyone and can never contain his excitement haha. He’s literally the nicest dog.

5 - Do you leave the house every single day? I never leave the house, except if it’s to withdraw cash or go to the Starbucks drive through to pick up a coffee.

6 - Would you rather spend the day at the beach, or a day in the snow in the mountains? I would normally pick beach, but I think the mountains would be best for me at the moment.

7 - Do you prefer tops that are plain, or ones with patterns/logos/slogans? Plain.

8 - Are there any TV shows from your childhood that you still watch today? I’ll watch Spongebob every now and then. When I’m bored and have enough time on my hands I’ll sometimes watch other shows from my childhood just for that nostalgia wave, like Barney or Hannah Montana.

9 - How many texts would you say you send on an average day? Used to be hundreds, but now it’s probably like...5, on average. Sometimes I’ll need to text media for work and that’ll come up to around 15-20 texts but that happens only occasionally, like once every two weeks.

10 - Do you enjoy buying gifts for other people, or do you never know what to buy them? I never know what to buy for people. I like buying gifts for a significant other, though. I tend to spoil one to no end.

11 - Girls - if you get periods, do you suffer from period pain or any other horrible symptoms? I get the hormonal symptoms, but the physical symptoms are almost never there. My stomach will usually contract in a way that tells me it’s coming soon, but it never really aches. Most of the time, I just cry and mope a lot and that’s how I know it’s on its way, ha.

12 - The last time you were in a car, where you were travelling to? Were you the driver or a passenger? I was headed back home. but I came from the office. I was the driver as always.

13 - Who were you with the last time you went out for a meal? I took myself out on a date.

14 - What book do you wish they’d make into a film or TV series? The Septimus fucking Heap series, please. They’ve been trying to get it made into a movie series for years but as far as I know the talks have always fallen through.

15 - The age old question - do you prefer coke or pepsi? That’s a big ‘or’ for me. I don’t drink soda.

16 - What’s the last thing you watched on TV? Is this a programme you watch regularly? Bea took over the office TV earlier and she had it set to a BTS + Taylor Swift music video playlist so that we had background music while working. No, neither are my artists of choice, really.

17 - Do you have a favourite documentary subject (eg. nature, celebrities, history, crime)? Pro wrestling (a seriously underrated documentary subject) and crime. Documentaries on anthropological issues or discoveries are great as well. I do love history, but I prefer to absorb it in text/museum form.

18 - Do you prefer sweet or savoury snacks? What snack would you say is your overall favourite? Savoryyy. I get tired of sweet snacks pretty quickly. My current favorites to munch on are any salted egg flavored chips.

19 - Does having to wear a mask stop you from doing anything, just because you dislike them or find them uncomfortable? It can be harder to breathe and I get exhausted a lot faster with a mask on, but I keep it on because I would want to keep other people safe and because it’s so easy to keep a damn mask on.

20 - Do you prefer zip-up or overheard hoodies? Either is fine.

21 - If you have a yard or garden, how much time do you spend out there? I prefer the rooftop, and if I do go there I usually stay for a few hours during the evening just to have some time to myself. Being in a house with four adults can get pretty overwhelming and taxing sometimes.

22 - When was the last time someone bought you flowers? What was the occasion? I think it was for Valentine’s Day last year. If not, it was for the anniversary which was a week after Valentine’s Day.

23 - How often do you get takeaway? What’s your favourite thing to order? I don’t really do takeout. I usually dine-in or have food delivered to my place.

24 - Do you own a lot of clothing items in your favourite colour? What is your favourite colour, anyway? I don’t have a lot of clothes in pink. It’s not my best color, but I like it in everything else hahaha.

25 - When was the last time you stayed overnight away from home? Was this with friends, family or in a hotel somewhere? What was the occasion? Idk probably a sleepover at Gab’s place early this year.

26 - Would you ever be interested in seeing a live magic show? Sure. Magic shows are already a staple at kids’ birthday parties here, and I’ve always enjoyed them especially since magicians are quite the comedians too.

27 - What’s your favourite period to learn about in history? What got you interested in this particular era? I don’t have a favorite period per se but I’ve always had an affinity for the royalty. I like reading all about them, no matter what period they reigned or what house/country they’re from. Historians have kept impressive and super detailed accounts or records for most of them, so reading about their lives has also allowed me to learn more about the culture they lived through.

28 - Do you still use or carry cash, or do you pay for everything via card? I heavily rely on cash and I actually realized how behind I am just today, when Bea ordered lunch for the office. I paid her with cash and she looked at me all puzzled and was like, “Can you do bank transfer instead?” another big girl stuff I had to learn lol. Everyone in college used cash pls forgive me

29 - Are there any TV shows that remind you of your grandparents for some reason? Not really.

30 - Have you ever had to wear a tie for school or work? If not, do you know how to tie a tie without looking it up? I had a necktie as part of my uniform in my old school. I never knew how to tie it and always asked someone else to do it for me whenever it came loose.

1 note

·

View note

Text

I don't want to do this!:

I absolutely hate writing about religious discrimination!

Frankly, I wish that I wasn't putting fingers to keyboard about any discrimination.

I also desperately don't want the focus to be on discrimination against everything Islamic and Muslim.

However, sadly, it's the most venomous hated that I have ever encountered, second only to racism against the black human beings of our world.

All my life I must have lived under a rock, maybe I live under a rock now, yet the vileness and outright lies that come out of those obsessed with hating all Islam and Muslims, plus anyone who stands up and says this is wrong, is obscene.

I am disgusted in the way these people respond.

I have had differing opinions with both Muslim men are women yet been addressed with respect and politeness. They are peaceful and not intimidating in any way.

Speak to a person who is anti Muslim, they refuse to listen to anything that may contradict what they want to believe, they will call you a liar and slander you. They intimidate and bully, call you names, question your mental stability, stalk your FB and target your children. The insults and illogical reasoning is unbelievable.

I am horrified that there are people like this in the world!

More horrifying still is for once I can see the appeal in hating the West.

Imagine a young Muslim man, born here, and rather then allowing him to explain what his religion means to him, to try and teach people, that hate everything about him, that he deserves to be not discriminated against, he gets told what his religion is, he is called a murder, a terrorist, a paedophile, a Mysoginist, etc. His sister is spoken to about her husband beating her, being oppressed, asked if she still has her clitorus, threatened with physical abuse, has her hijab torn off, threatened with rape, told she is a bad mother because she sells her baby girls to be raped by old men.

And no matter what they say to try and explain their actual beliefs the abuse flows. And this is from their own countrymen.

Mate, I would want them all gone too! Be honest, who wouldn't!?

Yet if they report abuse or complain about their treatment they are accused of wanting to change things. "They come here and try to change everything", is the cry from the haters!

1) There is NO law that insists that ALL women wear a Burqa in Saudi Arabia: Hijab is only compulsory for Muslim women. Anything else is a choice for those in a practicing Muslim family.

2) Women are not allowed to get an education in Saudi Arabia: I urge you to look up any TV broadcast from local Saudi Arabia telecasts. Women, in hijab, reading the news. This suggests an education. However, both men and women are encouraged to gain knowledge in Islam.

3) WTF does Saudi Arabia have to do with every other Muslim world wide, especially in Australia?

4) FGM (female genital mutilation) is an Islamic practice: Far from it! The Islamic religion urges that both men and women enjoy sex and that a man sexually pleases his wife. FGM is a tribal practice. However, MGM (male genital mutilation) has and still is widely practiced in Australia.

5) There is NO "no go" zones in Australia!: This urban myth was started by a female, Canadian Islamphobe. It was said to be proved when the police removed her from Lakemba for disturbing the peace. The police weren't working for the Muslims to enforce their "no go" zones! How ridiculous. Others tell totally unbelievable stories about women walking there and being spat on for not wearing hijab. Firstly, not all Muslimah wear hijab, even in Lakemba. Also there are numerous non-Muslims that go to these fabled areas to eat, visit, shop, do business, etc. This rumor is absolutely ludicrous!

6) Muslim women are oppressed, even here in Australia!: It is naive that there is no abusive people in any religion or walk of life, however, Muslimah are not oppressed as perf the usual course. Quiet the opposite! Historically, and as it is today, Muslimah have the freedom to do and be whatever they want, just like Muslim men. There is no distinction between what male and females can do. In fact, men are encouraged to wash their own clothes, cook and do housework. Also the Qur'an makes it very clear that the mother is the head of the household.

7) It is always claimed that Muslims want to change things: Yet, the question, "what have they actually changed?", goes unanswered. Muslims are required to live by the laws of the land, and as such, really don't want to change anything but the way they are treated. Especially how the women are treated. Our hero Islamphobes always target women and children because Muslimah are more recognizable.

8) Why are these people so threatened by the hijab or niqab?: For fuck sake it's a piece of material! It's not what's on a woman's head that oppresses her. However, who are those that want to oppress Muslimah? Muslim men or the Islamphobe? I say without hesitation, the Islamphobe! They don't ask a Muslim women how she feels, they don't ask what she may want to wear. They rarely comprehend the meaning of the hijab to a woman but rather try to twist it into some sexually perverse. They proclaim that Muslim women shouldn't wear a head covering. As Australia is a free country, with a freedom of religion and freedom of lawful individually, the real oppression and discrimination, is telling Muslim women what to wear.

9) Telling Muslim women what they are: The idea that, to Islamphobes, Muslim women are stupid and therefore, don't know that they are oppressed, would have to be the most Mysoginist slap in the face ever! All I can say is, "at least Muslim men know a woman's worth is awesome".

10) Muslim men marry girl babies of 5 to 6 years old and Muslim mothers allow it: Firstly, American is the place booming in child brides at the moment. With some states having no minimum age for marriage and also no divorce for women. Compared to Malaysian Clerics, years ago, raising the age of concent to 18. Also contrary to European/western/Christian culture, women have been granted divorce since the 700s in Islam.

11) Women wear the Burqa in Australia: This is actually one of those urban myths, started by Pauline Hanson. To see a Burqa in Australia would be very unusual. Most Australian Muslimah are from cultures that don't don the Burqa. The Burqa is an Afghan tradition and is very rare in Australia. Then why fight "ban the Burqa"? In one word, principle! It is against a woman's basic rights to tell her how much she can or can't wear, within the laws of public decency. There is also a security argument, as a Burqa is rarely worn that argument is rather moot.

12) Muslim men have lots of wives and children and just live on welfare: This is so silly that it's laughable. Once again, it is rare for Muslim men to have more than one wife these days as it is financially impractical. Also most Muslim men prefer one wife. In Australia, on average, the Muslim family consists of 2 children. With all this being said, usually Muslim men and women are educated and professional people. If not they strive to own businesses. The stupid welfare claims are unfounded and actually go against most Muslim traditions and cultures that have a hard work ethic.

13) They come here are get more welfare than Australians with no waiting period: This information can be researched on government websites. There is a waiting time for new Australians, Muslim or otherwise, which often means charitable families that sponsor them and take them in during this time. When they do receive any benefit, before getting on their feet, it is no more or less than anyone else.

14) They receive a thousand dollar iPhone and designer clothes as soon as they arrive: Is this one even worth answering? I just shake my head in disbelief!

15) Muslims have been Australians for generations: It amazes me how many people actually believe that no Muslim is Australian born. The history of the Islamic people in Australia predates white colonization. Islamic men from Indonesia travelled down and through Australia. There was intermarriage with the Indigenous peoples and even revertion to Islam by some. A more constant move to Australia, by those of the Islamic faith, started in the 1800's.

16) All Muslims are the same because they read from the same book: this is like saying that all Christian denominations are the same because they read from the same book. Most know that this is not the case.

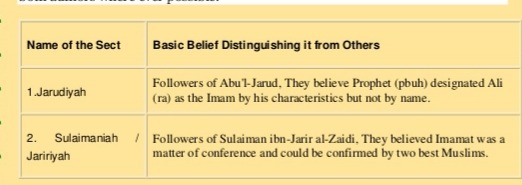

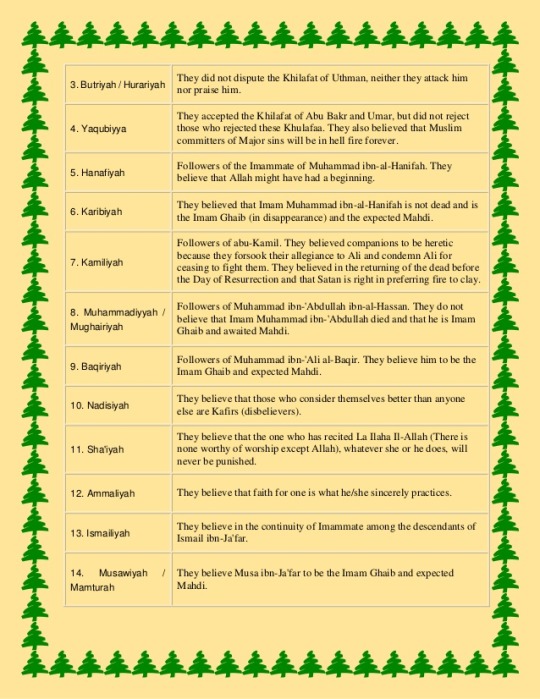

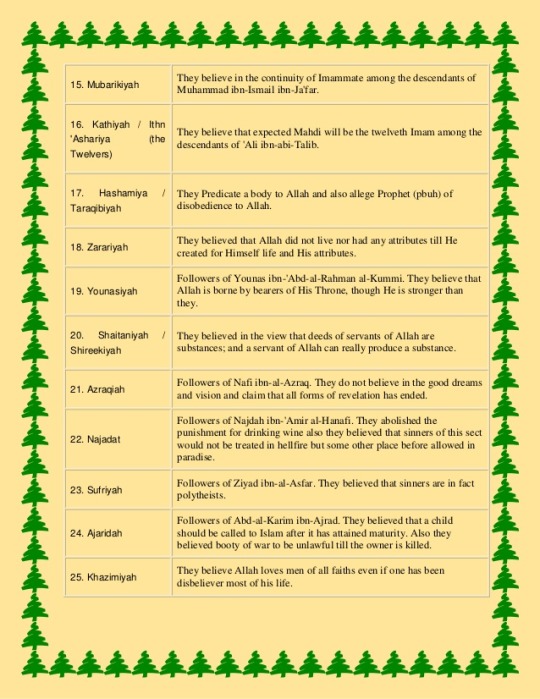

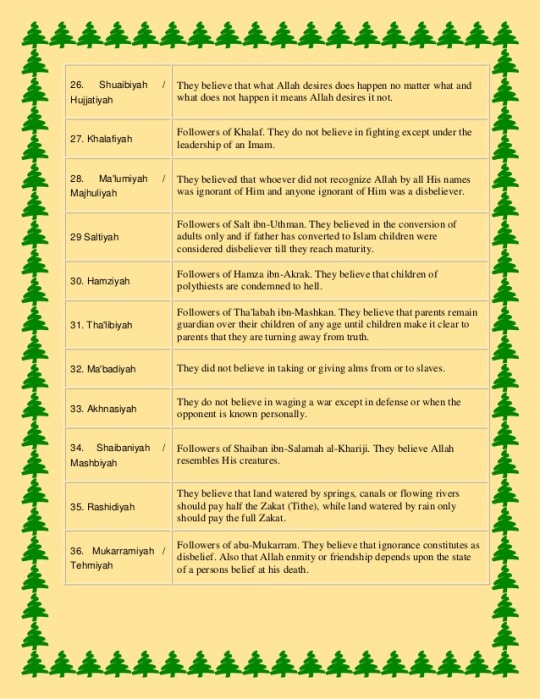

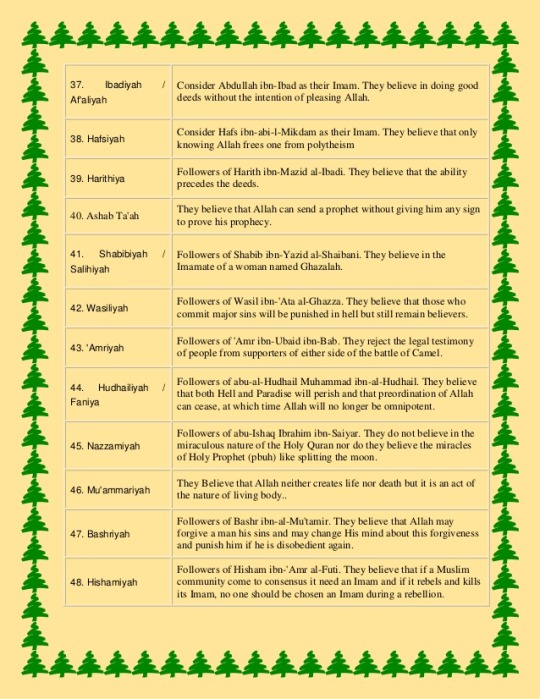

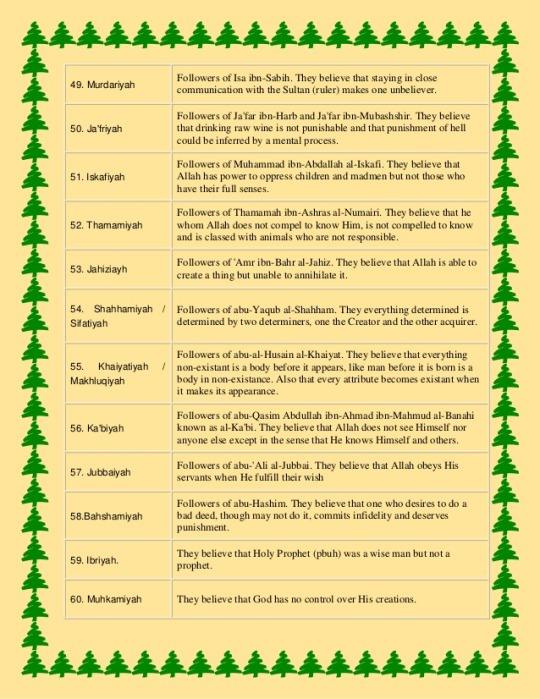

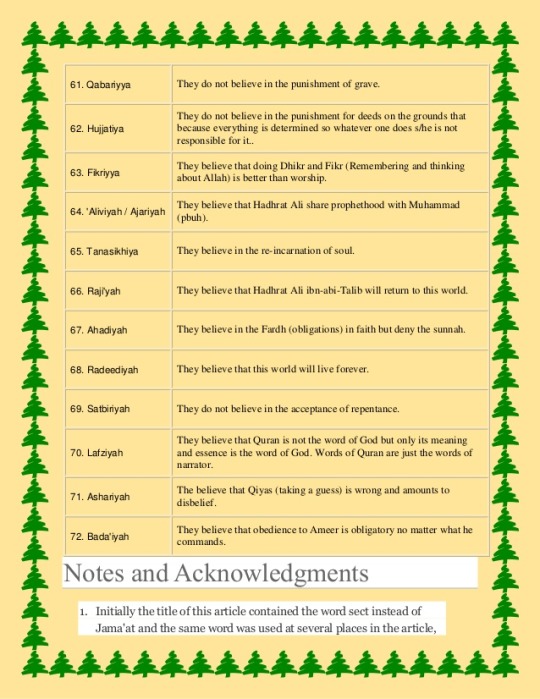

There are many different varieties of Muslim. Yes they have the Qur'an yet addition books vary between the sects.

There are 72 different sects, numerous sects within the main sects, different traditions, different cultures, different regions, different regions, different countries and different families.

As for the Qur'an: there is the subject context, further context, overall context, historical context and spiritual context. Then all the different ways it is interpreted. Also interpretation can be manipulated and cherry picked to suit an agenda or bias. This can be said of the Bible also.

Where interpretation is important is in the understanding of Arabic. To translate a language as complex as Arabic into simple English leaves the meaning truly lacking.

For example: Islam is a very sexually moral religion. Men and women are not meant to sexulise each other, There is no unsupervised dating and dressing is modest. However, it is commonly thought the men will receive a bus load of virgins to have an orgy with in paradise. However, "virgin" more correctly translates to "pure". This is a "spiritual" context and "heavenly beings/angels is probably a better translation into English.

17) Muslims want to kill all Jews and Muslims. The Qur'an tells them to kill all Christians: Unfortunately people are so off the mark on this one. Islam actually says that Muslims cannot destroy a place of worship nor hurt religious "ministers". The Qur'an refers to Christians and Jews as the "people of the book". In fact, the only other women a Muslim man is permitted to marry is either a Christian or a Jew. The wives of these two religions are also not expect to revert as they are seen as sisters to Islam. Christian and Jewish men and women are thought of as brothers and sisters to Muslims.

There is a long list of urban myth, propaganda, rumors and out right lies that are used as ammunition against Islam and Muslims.

The arrogance of the Islamphobe is to tell a Muslim what their faith is! With no other religion would a person, outside that faith, verse another in their religion.

#discrimination#islamophobia#islam#women#womens rights#muslims#cultures#veil#head scarf#hijab#religion#islamic#truth#freedom of choice#freedom of religion#muslimah#sexism#arrogance#ignorance#propaganda#myths#abuse#rude#uneducated

133 notes

·

View notes

Text

In their ACLU report, “Cracks in the System: Twenty Years of the Unjust Federal Crack Cocaine Law,” Deborah J. Vagins and Jesselyn McCurdy noted that The Anti-Drug Abuse Act of 1986:

…established mandatory minimum sentences for federal drug trafficking crimes and created a 100:1 sentencing disparity between powder and crack cocaine. The Act provided that individuals convicted of crimes involving 500 grams of powder cocaine or just 5 grams of crack(the weight of two pennies) were sentenced to at least 5 years imprisonment, without regard to any mitigating factors. The Act also provided that those individuals convicted of crimes involving 5000 grams of powder cocaine and 50 grams of crack (the weight of a candy bar) be sentenced to 10 years imprisonment.

Race was not explicitly written in the 1986 law. Otherwise, it would have been easier to combat it, such as in the Supreme Court case of Brown vs. Board of Education of Topeka.

Still, what makes this law racist? During the 1980s and 1990s, the United States experienced a rise in crack cocaine, which became widely associated with Black people, particularly in working poor urban communities. On the other hand, powder cocaine was associated with affluence and particularly, white people.

By heavily penalizing “crack” versus “powder cocaine” the federal laws targeted racial groups without naming it.

In their study, “Powder Cocaine and Crack Use in the United States: An Examination of Risk for Arrest and Socioeconomic Disparities in Use,” Palamar, Davies, and associates explained:

Compared to whites, racial minorities were at low risk for powder cocaine use, and Hispanics were at low risk for crack use. Blacks were at increased risk for lifetime and recent crack use in unconditional models, but this association was lost when controlling for all other socioeconomic variables. Therefore, it appears that blacks are in fact at higher risk for crack use and associated outcomes, but this may be driven by socioeconomic factors—suggesting that SES may be a fundamental cause of racial disparities in crack use. In the conditional models for lifetime use, higher educational attainment was associated with increased likelihood of powder cocaine use and decreased likelihood of crack use, and higher income was associated with decreased likelihood of crack use.

Despite socio-economic factors, for decades, Black people were tied to a narrative of crack cocaine and white people were linked to powder cocaine. In 2003, although over 66% of U.S. crack cocaine users were white or Latino, Black people made up more than 80% of the convictions under the federal crack cocaine laws (Vagins and McCurdy, 2006).

Structural racism in a colorblind nation looks like Black people serving as much time in prison for drug offenses (58.7 months) as white people convicted of violent offenses (61.7 months) (Vagins and McCurdy, 2006). The incarceration approach to the drug epidemic that was disproportionately enforced on African-Americans ruled the day until 2010, when President Obama changed the sentencing from 100:1 to 18:1.

Presently, as the nation deals with a drug epidemic that is not popularly associated with African-Americans, our government has miraculously seen the racial white light in their approach. Instead of criminalizing, targeting, and heavily penalizing people with opioid addictions with mandatory minimums, there has been a broader appeal to sympathy and treatment.

The narratives give a backstory where the people tend to come from “good” families who are victims of structures beyond their control—targeted by the “evil” large pharmaceutical corporations.

They receive reparations for their victimhood in the forms of taxpayer supported treatment and settlements against pharmaceutical companies.

Despite all of these changes and talk of treatment, Black people are still targeted with an incarceration approach.

Bad Black Mothers and Vulnerable White Girls

I recall a different narrative from the United States’ War on Drugs. I recall the media working over-time to dehumanize Black mothers and families crippled by drug dependency and the disproportionate over-policing and heavier penalties. The media helped shape a narrative to shame and justify the lack of empathy and investment in treatment/care.

Sensationalized media portrayals about Black mothers on crack given birth to a new generation of crack babies out of wedlock sought to reinforce stereotypes and controlling narratives of inherent cultural deficiency among African Americans.

Bad Black mothers and fathers who use and deal crack were a plague to society to be controlled and destroyed. One day, as I was watching television, I saw a commercial focusing on the opioid crisis about “Amy’s Story” from Truth Initiative. On their website, they share part of her story:

When Amy was 14, a knee injury on the soccer field put her in the hospital and resulted in a prescription for Vicodin. Over the next five years, she endured several surgeries on that knee and received a flood of opioid prescriptions.

In this vulnerable state, Amy developed an addiction to Vicodin. When her supply ran out, she took drastic measures to get more. She started relying on self-harm to secure prescriptions for opioids. She would cut herself and smash her injured knee. At age 18, she reached the peak of her desperation. In hopes of getting more pills, she intentionally crashed her car into a dumpster at over 40 miles per hour…

The framing of the story signals virtues by which Amy is worthy of treatment and care. Amy gets the benefit of being young and innocent that more easily happens for white youth compared to Latino and African-American youth. She played soccer, became injured, “endured” surgeries, and received a “flood” of highly addictive pain drugs in her “vulnerable” state. In other words, Amy was a “good kid” who was a victim to a system out of her control. She was not portrayed as a culturally deficient junkie from a broken home who needed to take responsibility and be locked away from society.

Was Amy heavily penalized for possible insurance fraud, reckless driving, and destroying property?

Where was the public service campaign featuring a 14-year-old African-American girl in the 1990s who turned to recreational drugs to numb her pain and stole property to generate money to buy more? She had to be responsible and not a victim.

Young African-American girls do not tend to get funded national media narratives about being “vulnerable” with a dominant narrative that inextricably connects Blackness with innocence, not until a social issue impacts white middle-affluent youth. The National Women’s Law Center found that Black girls in every state in the United States are more than twice as likely to be suspended from school than white girls, and it is not because they misbehave more.

Overall, Black girls are over 5.5 times more likely to be suspended from school ad 2.5 times more likely to be expelled without educational services than white girls.

To their credit, Truth Initiative shares stories of individuals from diverse backgrounds to show that opioid addiction can impact anyone. Also, they have committed to creating a culture where all youth and young adults live free of tobacco. According to their website, Truth Initiative’s “20 years of lifesaving work has prevented millions of young people from becoming smokers — including 2.5 million between 2015 and 2018 — and helped drive down the youth smoking rate from 23% in 2000 to 4.6% in 2018.”

Nevertheless, the stories selected seem to appeal to dominant White middle-affluent definitions of worthiness of empathy. For example, Truth Initiative features the story of Chris, who can be visually identified as Black and possibly male. He experimented with opioids as a teen, after discovering his mother’s prescription pills in her medicine cabinet.

Later, after being injured on a job, he became addicted. This narrative has more marketing appeal in a colorblind racist society, for one about an unemployed Black man doing drugs for the sake of fun becoming addicted will not bode as well.

Examples of other stories include diverse youth taking drugs to cope with the stresses of school and being an overachiever or developing an addiction after being prescribed opioid painkillers after an injury. These narratives make the opioid crisis something that is not inherently a white problem and justify the need to support a treatment (instead of a heavy-handed incarceration) approach to the epidemic.

By doing so, White middle and affluent class mothers are spared the over-sensationalized news reports of their poor parenting. White fathers are not deadbeats because their children become dependent.

They are victims just as much as their children.

These same kinds of humanizing stories about opioid dependency could have been promoted during the years of the crack cocaine epidemic.

White mothers are spared from being essentialized by the media as broken sources of our social ills. They do not have to deal with the stereotypes of being welfare queens who give birth to crack or heroin babies.

Within a white supremacist society, there is a wrongfully assumed moral superiority connected the white race that denigrates certain Women of Color and uplifts white women in times of crisis.

A greater attempt exists to show that the opioid addiction is not a reflection of white cultural deficiency and that such drug dependence is not the result of some inherent racial flaw.

It is a fact that countless Black and Latino folks have been saying for years. When drug dependency was explained away on the flawed basis of our supposed cultural and even biological inferiority, numbers of people across race pushed back against the narrative to little to no avail.

Silence about the resulting racial devastation that still occurs from the racist approaches to handling drug epidemics further exacerbates the long-standing problem. Any person and organization dedicated to drug dependency and treatment have to contend with the deeply entrenched racist realities of how empathy and sympathy have a clear racial hierarchy in the social imaginations of U.S. individuals and enforcement of laws.

Many people might believe that we sympathize and empathize the same across race. The sad reality is that a blond hair teenage white girl who plays soccer will garner more empathy (and financial support) than an African-American teenage girl who drove her car into a dumpster like Amy to get more drugs.

Consequently, the use of Black people’s stories of drug dependency within this current colorblind framing of drug epidemics helps to further manipulate the greater public into ignoring decades of the adverse effects of racist drug laws and practices involving African Americans.

Is it just to pretend none of it happened? Is it just to ignore the long-lasting impact—the generational consequences? Is it empathetic to ignore that due to our racist drug laws and practices, that approximately twenty years ago, the United States had more Black men in prison than in college?

It is unsympathetic and unempathetic to point out these truths?

No.

It is possible to empathize with individuals like Amy, Chris, and their families and simultaneously address and hold accountability the legalized oppression that has been long ignored and condoned by the much of society.

To put it bluntly, it is sleazy, uncaring, underhanded, and racist use empathy to turn this matter into choosing between either to focus on the opioid epidemic or the handling/residual impact of the crack epidemic. It is a low-down attempt to escape any accountability and is the same tired melody about how racism works in this country.

This matter is a “both/and” issue desperately begging for resolution.

Signs, Frames and Ibu-fu*%king-profen

I saw signs of the emerging opioid crisis and the changing language approaches to “drug epidemics.” Here and there, I noticed that even local law enforcement talked about the epidemic in different way-less war and criminalizing to a greater ethic of care. It was a change for the better, and yet it was not better.

When they discussed treatment approaches for one group, did they forget about the others they locked away after criminalizing their addiction?

Signs in the Suburbs

Years ago, I was in a southern city with my husband, waiting in line at a restaurant that was a local and tourist favorite. In front of us were a group of African-American women, all friends on a girls’ trip from another part of the state. As they laughed and talked, I slowly became part of the conversation.

Two of the women had careers in the healthcare industry. Their voices lowered in the way as if keep a secret from the surrounding white people. They began discussing their observations about the drug addiction and use back home.

The middle class and wealthy white youth and adults were increasingly being affected by the opioids “White kids in the suburbs were dropping dead,” as one woman put it. White people were growing concerned and now they are looking for ways to help and treat them.

The mood became heavy with something that was not being said-a history revisited each of us. 1986 never went away. This part of the conversation also became a social test, for the women gave each other knowing looks and looked at me to determine if I was a Black woman who “got it.”

I got it.

In that moment, there was this shared knowing, as one woman looked off.

Another shook her head.

Then, one of the women in medicine, gave voice to what we seemed to thinking and only expressing on our contorted faces and changed countenances.

“They didn’t care about treating us. They were locking us up. When it is a white kid in the suburbs, now there is government money for programs and treatment.”

By “us,” she means the Black community.

As for the “they”—Again, 1986.

My stomach tightened. I was noticing the rhetoric, and I had not talked about it with anyone, yet. I was wondering if it was just me—or my imagination, as I watched the gentle crafting and shifting of the drug addiction narrative in a way that garnered sympathy and financial support for white people and used the same appeal for sympathy to ignore years of lack of it towards African-American people.

The story of “learning from the past” to move to a treatment approach became a tool to racially whitewash a host of atrocities against People of Color.

I wanted my suspicions to be wrong.

She confirmed it.

7 notes

·

View notes

Text

An Opera on Separation - Chapter 16

Prologue | Ch. 1 | Ch. 2 | Ch. 3 | Ch. 4 | Ch. 5 | Ch. 6 | Ch. 7 | Ch. 8 | Ch. 9 | Ch. 10 | Ch. 11 | Ch. 12 | Ch. 13 | Ch. 14 | Ch. 15 | CH. 16 | Ch. 17 | Ch. 18 |

Summary: With Beau and Kassidy arrested, Nathan and Emily carry on with their lives. A misunderstanding, however, forces them into a precipitate decision.

Rating: T - Content not suitable for children. Suitable for teens, 13 years and older, with minor suggestive adult themes.

Words: 2465

Notes: So, it’s been a couple of weeks/months ever since I last posted it, and it was because I was rethinking my ending. Since I got to no conclusion, I sent it all to Hell and decided to go on with it as planned.

I hope y’all enjoy it.

Blue Danube

Out of all stupid, crazy and adrenaline-high things she had ever done, this one took the cake.

Hartfeld is a rather large city, yes, being in southern New England and at a comfortable distance between both New York and Boston. But at one hundred and twenty thousand inhabitants, mostly concentrated around the university, it wasn’t hard to meet an old face running errands.

Which was why she had to raise up the stakes.

She could not risk anybody seeing her with a pregnancy test. It would be the talk of the university in a few hours if such a thing passed. She had no car, and couldn’t very well ask someone to drive three towns over to go to a pharmacy, especially when there was plenty of those at walking distance.

So she went down to the drugstore, put on a bunch of beauty products on a basket and covertly hid a pee stick box on her overcoat, paid for the cosmetics and bailed out of there.

The only thing worse than having your poster girl pregnant out of wedlock is having her shoplifting a drugstore while pregnant out of wedlock. That shit would be on every paper and local TV station in inland Connecticut.

She rushed home, downing bottle after bottle of water. She ran through her apartment door and shut herself in the bathroom.

Both her roommates were out, having classes and projects of their own, which meant she could wait the test out in peace and no risk of being caught with a, God forbid, two-lined pee stick.

Or a soft cheese, sushi and vodka party, which is what she was planning for her evening tonight.

She pees on the stick and leaves it on the bathroom sink waiting for the most agonizing ten minutes of her entire fucking life. What would she do? She is a college girl. A broke one, for that matter. She had no job and a mountain of student debt.

She could not care for a child! She was stupid and irresponsible, as the situation clearly shows. How would she care for an infant at the same time she has to work to keep a roof over their heads?

Jesus Christ, she is so screwed.

Her phone beeped the end of the ten minutes, but she didn’t have the guts to look at it. She stayed there, leaning against the door and contemplating herself on the mirror, the tear-stricken face and the hair sticking out. She should be giving up on her vanity, anyways. If she was really pregnant, the baby would disfigure her entire body.

She finally had the guts to go over to the counter and take the paper that was covering the result away. And it was just like she expected.

Two lines.

Rebecca Davenport was pregnant and alone.

Nathan, as he often did these days, woke up with a smile.

He was young, handsome, rich and intelligent. He had a hot girlfriend who satisfied him in every sense of the word. His parents were off his back, and he had had the pleasure of enacting his come-uppance over Beau Han.

There was absolutely no reason for him to be unhappy. He was flying high as a kite and would not come down any time soon.

Yesternight, he and Emily went to this ethnic Brazilian steakhouse in Danbury, some fifty miles away. The food was good, even if they had the tendency of eating overcooked meat.

After they came back, Emily invited him to stay over for the night and do some… evening activities. Her roommates were out doing their own thing, so they had the place all to themselves.

The thought of sleeping a mild, late-Spring morning was very tempting, but his natural needs were asking for his attention. He disentangled himself very carefully from his redhead bedmate and tiptoed his way to the bathroom.

After his urges were taken care of, he walked over to the sink to brush his teeth. It would be a pleasant surprise for his girlfriend receiving the first kiss in the morning tasting like mint rather than steak-induced mouth grime.

It was then he saw it. The pregnancy test. The positive pregnancy test.

His breath hitched. It could not be Emily’s, could it? He was careful enough to always use protection, and his girlfriend had said she was on the pill.

He could not deal with that on his own. Much to his displeasure, Nathan needed some help. He finds a plastic bag and places the stick on it, careful not to touch the ‘peed-on’ area.

Racing back to the room, the blond quickly put on his clothes. Looking at the sleeping girl nested on the bed, he leans over to kiss her forehead goodbye, but stops himself only short.

If it was the truth, if this is nothing but a scam for his money, then Emily was not as special as he thought she was.

“We’ll pay her off to abort.” It was the pragmatic solution from Nathan Sterling.

The father, not the son. The two of them sat at the senior’s study on their home in New Haven. Soon after his discovery, the youngest blond hopped on his car and drove straight to see his father.

The relationship between Nathan and pretty much all of his family was strained, to say the very least, but they were certainly on his court this time, given the circumstances. The Sterlings had an image to maintain, and an estate to protect. Bastard children wasn’t conductive to neither.

His father was the young man’s first choice. Lois Sterling would not pass on a chance to demean her enfant terrible, and he didn’t quite trust his extended family not to crave a knife to his back like some pitiful interpretation of Richard III.

“I’m not sure I’m comfortable with that.” The son argued. “It still can all be an accident. If we corner her, she would react badly and it would be worse.”

“I follow your reasoning, but I don’t think the family’s welfare is your true motivation for coming after me for advice.”

The youngest hold on a snort at the word ‘advice’, preferring asking: “What do you mean?”

He sighed. “Nathan, be honest with me, do you even want to break up with this girl? Even if she has planned all this from the beginning just to trap you into a shotgun wedding?”

“Of course I do!” He defended, on a high tone. “I mean, if she’s not a gold digger, I prefer to maintain the relationship, of course, but if she is, then I don’t think how we can still be together.”

The man chuckles bitterly and paces around the room. “Son, look at me. I’m not particularly handsome. Not now, not ever. I wasn’t the brightest student my day, either, and people find me to be dismissive. But there’s one thing I am, which is rich beyond every measure.

“When I met your mother, I thought she was the prettiest woman I’d ever meet.” The young man looks at his father with disgust in his eye. “Don’t make that face. She’s never been very sweet, but she still is a very pretty woman. Anyways, of course I wanted to woo her, and I managed to do that with basically my affluence alone.

“And money, Nathan, money and lineage never go away. Looks fade, intelligence get boring and sympathy is tiring, but material goods are forever.” He smirks, take a deep breath and continues: “I know me and Lois aren’t the paradigm for a successful marriage. I know your mother married me just so she could finance her stupid researches. I know she would dump me in a heartbeat if she thought she could get away with it. But I am happy. Isn’t that what matters most?

“If you love this woman, marry her. You don’t have to care if she loves you back or if she just cares for your money, the important thing is for you to want her. We’ll tie her with an iron-clad pre-nup and be done with it.”

The patriarch sets a ring box on the desk, straight in front of Nathan.

“I know you haven’t had much joy in life, son. Allow yourself some now.” The man smiles softly.

The young man took the box and pocketed it. The conversation, as disturbing as it was, gave Nathan much to think about.

Emily was standing by the mirror, contemplating her figure on her wedding dress some half an hour from the actual ceremony.

The Sterling manor house in Martha’s Vineyard was handsomely decorated with the fairest white lilies you have ever seen. The guests congregated on the wide lawn, while the pastor waited by a gazebo overlooking the Atlantic Ocean and Nantucket Island. On the menu, Uruguayan steak or Danish trout, tiramisu as dessert.

On the guest list, besides Emily’s closest friends and her diminutive family, the entire Sterling clan, business associates, their A-list neighbours at the island and members of European royalty.

It was a dream wedding, planned around her wildest expectations to an absurd level of detail. Nathan gave her completely creative control and bottomless funds to make it happen. His only demand was a short engagement: he wanted to get married on Labour Day, which was around three months after his proposal.

And, yet, Emily cannot help but feel a deep, heart-wrenching misery slicing her soul.

“Emily, honey.” Queenie calls from the doorway. “We’re ready for you.”

She can’t help but let a few tears slip through her cheeks. “Mom…”

“Oh, my, honey! Why are you crying?” The woman runs to her daughter, a tissue at hand.

“I… I…” She hiccupped. “I can’t get married, mom. I just can’t.”

“What are you saying, Emily?” The matriarch shot the girl a piercing glare. “Is this about that nonsense again?”

“It isn’t nonsense!” She defended, raising her voice. “Just… just ask Nathan to come here. I need to speak to him.”

Queenie sighed and looked warily at her daughter. “Fine, but you’re making a terrible mistake.”

The blonde woman left and the redhead tried to recompose herself, wiping the tears away.

“Emily?” The groom pops his head into the room. “Are you alright? Your mom asked me to come and talk to you.”

She smiled melancholically at him. “Nathan. Come in, please.”

“Fine, but if it’s unlucky, I’m blaming you.” He smirked at his own stupid joke, walked over to his bride and they sat on a sofa. “What is it?”

“You know I really love you, right?” The woman said, throwing a forlorn look at him with her wide eyes.

He smiled sweetly and kissed her hands. “Of course. And I love you, too.”

“There is something I haven’t told you. Something important.” She said, gravely and firm.

That was it. She would finally confess she was pregnant. Nathan waited and pressed her to confess the whole summer, but she never once gave indication that she would cave in. Nevertheless, today was the day.

The man nudged for her to speak, and so she starts: “I don’t think I ever told you about my senior year in high school.”

“No, you didn’t.” He confirmed.

“I was a different person back then. I was brash and rebellious and opinionated. The Queen Bee type, you know.” She laughs, nervously. “I was head cheerleader and I dated the football quarterback, like some stupid cliché on a Saturday morning special.

“On my Senior-year homecoming ball, he and I had sex. It was my first time, and like every stupid teenager, we ended up forgetting all about protection. A few weeks later, I felt sick and you probably can guess what it was.

“It was legal on the state of Rhode Island to make an abortion back then, but my dad was very sick at the time and we couldn’t afford to go to Providence and pay for the procedure. So my mother and I decided to improvise.

“She went to the drugstore and bought me some vermin medicine and I took three tablets.” Tears started slipping through her eyes once more. “It worked. I aborted the foetus. But I wouldn’t stop bleeding, and we raced to the ER.

“I almost died. We claimed it was a natural abortion; the doctor was suspicious but didn’t confront our version. He did, however, say that my uterus was much too hurt.”

“Wait,” Nathan cuts her off. “Are you saying…?”

“I can’t get pregnant, Nathan.” Emily confesses and cries copiously. “I’m so sorry I never told you. I was afraid that you’d leave me over it, but I know how important bloodline is to your family. I noticed you have been hinting at children after we’re married. If you want to call off the wedding, I totally get it.”

The blond smiled placidly, digesting the news. “Emily, do you know what my dad said when I told him we were engaged? He said for me to do what makes me happy and worry about the rest later.

“You make me happy, Emily. So let’s get married today and worry about children and pregnancy and annoying Sterling aunts later.”

The redhead embraced him and kissed him hard, until them both were breathless and had their faces smeared by the lipstick. “I love you so, so much. And I swear I’ll be the best wife on Earth for you.”

About half an hour later, Nathan stood next to his mother on the altar as the string quartet played. First, enters his dad and Queenie, arm-in-arm. Then, the three bridesmaids: Abigail, Kaitlyn and Madison.

Nathan had no groomsmen, as his closest friends, if they can be called as such, were currently serving time for the rape of a dozen girls of all ages. He didn’t feel comfortable asking other acquaintances or relatives, and Emily didn’t want for him to feel obligated to ask any of her friends. A small blessing, as he held little but contempt for a NFL dunderhead, a faux-talented YA writer and Mr. Dean’s List.

Finally, the bride appeared through the flower arch, on the other end of the long aisle. She was beaming like the Sun that shone blessings over them that morning.

There was not a single reasonable observer that thought this wasn’t a happy bride.

Hours later, as the reception dwindled, but yet shortly before the newlyweds departed for their European honeymoon, Nathan was looking for Emily, who had slipped away from the celebrations some time earlier.

Following the indicative of the caterers, he was crossing the kitchens when he finally saw the bouffant white dress standing on the service door. Before he could call her name, though, he saw she was hugging someone.

A very pregnant Rebecca Davenport.

And, then, it all made sense.

<< Previous Chapter Next Chapter >>

An Opera on Separation - Masterlist

Taglist: @alicars; @boneandfur; @cora-nova; @choicesfannatalie; @emerald-bijou; @kennaxval; @liamxs-world; @lizeboredom; @mfackenthal; @moodygrip; @mrsdrakewalkerblog; @radiantrosemary; @topsyturvy-dream

12 notes

·

View notes

Text

WHO ARE WE?

Image courtesy Asiaone.com

A. OPENER

“Slavery! Why, no, we’re against it! If we are forced to have it in the home or in factories, fine, that’s the normal run of things, but boasting about it, is going too far.”