#shareholder quota

Explore tagged Tumblr posts

Text

Waaree Energies IPO: A Game Changer for India’s Solar Industry?

#waaree energies ipo#waaree energies ipo gmp#waaree energies#waaree energies ipo analysis#waaree energies ipo date#waaree energies ipo details#waaree energies ipo shareholder quota#waaree energies share price#waaree energies ipo review#waaree energies ipo news#waaree energies ipo price#waaree renewables share#waaree technologies share#waaree energies ipo shareholder news#waaree energies fundamentals#waaree energies ipo latest news

0 notes

Text

Doctor Who S1/14 E3: Boom Spoilers Thoughts:

WOOOOOHOOOO Fuck me that was GOOOOOOOD Loving the anticapitalism stuff as always hell yea doctor you fucking tell them. Caught on with the stuff about the truth of the war around half way through and enjoyed it, Susan Twist was the ambulance! Girl is everywhere fr God they really crafted this episode perfectly so you could feel the stress, i was trying to calm down as the doctor was everytime a free moment was got something else happened- Can see him thinking "REALLY?? JUST LET ME BREATHE AND RELAX" "it is killing you just the right amount to keep you buying more" goes SO HARD Next weeks is looking good fr fr wont say much about it here in case some people dont watch the next time (dont blame you theyve been spoilery in the past but so far they dont show too much i dont think) but yea im real excited for next week Reminded me of oxygen a bit, obv god im a sucker for capitalism, ai and algorithm hate, was such a clever episode though, combat activated the ai, so the ai kept them buying weapons and killing them the right amount to meet its quota, anything for the shareholders am i right Really seeing the range of emotion with the doctor here too which i love, hes crying at companions "dying" and him being in a VERY bad situation Didnt see the dadbot taking over as the ending, what I thought was gonna happen was the doctor would explain to the ai that if he blows up, it'd cost the Villengard (loving the call back btw, RTD and Moffat are good at that) AI and algorithm a lot of money, and itd actually be more cost effective to keep them alive, but to be fair that would have been very derivative of Oxygen so, fair. Overall....wow, think it was better the The Devil's Chord which I wasnt expecting, loved it

26 notes

·

View notes

Text

Two Democratic U.S. senators announced Thursday they plan to introduce a piece of legislation that would require large companies to disclose quota practices to workers and prevent those quotas from interfering with a worker’s health.

“The Warehouse Worker Protection Act would put an end to the most dangerous quotas that plague warehouses,” Democratic Sen. Ed Markey of Massachusetts, a sponsor of the bill, said.

There is no published bill text yet.

Markey said the bill would require companies to notify workers of the quotas they need to meet and ban quotas that rely on 24/7 surveillance or are likely to lead to violations of health and safety laws. He added that companies that don’t comply would be investigated by the Department of Labor and could face fines and penalties.

INJURIES AT AMAZON

Markey was joined outside the U.S. Capitol by workers who shared their stories of being injured on the job at Amazon warehouses, along with Democratic Minnesota Sen. Tina Smith and Sean O’Brien, the president of the International Brotherhood of Teamsters.

Smith said that big companies like Amazon care about “efficiency and cost savings and maximizing their profits.”

“They’re experiencing record profits at the same time that the people whose labor they are earning profits on the backs (of), are experiencing completely unacceptable levels of injuries,” she said.

The speakers singled out Amazon for quota practices that endanger workers, though Markey said the Seattle-based e-retail giant is not the only company that engages in a quota system that harms workers.

“Amazon may be at the front of the pack with an injury rate double the national average, but the rest of the big warehousing companies are close behind,” he said.

Some of Amazon’s quota practices include constant monitoring to measure how many items a worker scans, with automatic flags for workers below a certain percentile, and monitoring how long employees take on bathroom breaks and other “time off task,” according to a Thursday report by the National Employment Law Project.

The Amazon warehouse injury rate is “twice that of the private-sector average for all industries and tens of thousands of warehouse workers each year experience serious injuries requiring medical treatment,” according to the report.

O’Brien said that Amazon’s business model “pushes workers to the brink and creates a culture of fear.”

“Warehouses can be very dangerous places to work if safety isn’t made a priority,” he said.

Wendy Taylor, an Amazon worker in Missouri who is organizing for a union, was injured at work in March.

“I was injured at work because of Amazon’s inhumane work rates, because of the exhausting pace in the physical work me and my coworkers do,” she said.

Taylor said she fell and hurt her knee, but when she went to the company medical center, she said “they (refused) to let me see a doctor when I asked, sending me back to work.”

She eventually went to her own doctor, who diagnosed her with a torn meniscus in her knee.

“This experience (shows) how hard it is to get timely, adequate medical treatment from a company that breaks down my body and speeds up my aging for shareholder profits,” she said.

In a written statement, a spokesperson for Amazon pushed back against some of the comments from senators, including claims that workers lack adequate bathroom breaks and see fixed performance quotas.

“It’s a common misperception that Amazon has fixed quotas, but we do not,” the spokesperson said. “Our Time Logged In policy assesses whether employees are actually working while they’re logged in at their station. Our employees can see their own performance at any time and can talk to their manager if they’re having trouble finding the information.”

The spokesperson also said claims that the injury rate at Amazon is double the industry standard are misleading.

“Many large companies that should be included in these comparisons—companies like Walmart, Target and Costco—report almost all of their injuries under different OSHA reporting categories,” the spokesperson said.

Brian Wild, a spokesperson for the National Association of Wholesaler-Distributors, said in a statement that the industry group does not support the bill, arguing that it could lead to delays and price hikes.

“The bill includes provisions that inappropriately tip the scales to union bosses at the expense of employees and employers by inviting labor organizations to participate in investigations, essentially granting union leaders access to potentially coerce or harass worksites under the guise of ‘worker safety,’” Wild said.

SEEKING BIPARTISAN SUPPORT

Markey said there is bipartisan support in the Senate for the bill, as well as the House.

“We just want to build this out,” Markey said. “It should not be a Democrat or Republican thing, it’s a worker safety bill.”

A warehouse protection law went into effect in Minnesota last year, but advocates have raised concerns that Amazon is not complying with the law.

Several other states, including California, New York, Oregon and Washington, have passed legislation similar to what Markey and Smith are proposing.

#us politics#news#Michigan advance#2024#Warehouse Worker Protection Act#Department of Labor#Sen. Ed Markey#amazon#Sen. Tina Smith#Sean O’Brien#International Brotherhood of Teamsters#OSHA#National Association of Wholesaler-Distributors#warehouse workers#workplace safety

21 notes

·

View notes

Text

This isn't to say that Chip (my current/newest car) doesn't already mean a lot to me n all that but it occurred to me today that like. I don't think I'll ever feel as strongly about an object as I did about Miles. Chip has time to reach that level, of course, and he's on a better track to meeting that than Lawrence but god. Miles really did mean the world to me and I genuinely get upset thinking about how we had to part ways. I feel remorse and regret and selfish about it, even though it was probably our time to part

And while Clockboy is absolutely my #1 right now, and who also means the world and the moon and the stars etc to me, the physical bond I was able to have with Miles just made everything so much more real and meaningful, if this makes any sense? This also isn't to downplay the relationship CB and I have but it's like, night and day comparing aspects of our relationships because of how often I could see Miles, or how I could hug/kiss/fuck him, which are things I will never get to do with CB unless a miracle happens (and theyre things I want to do with him, and get the vibe that he'd want to do with me)

It's just. all weirdly complex and hard to process sometimes. I gave Chip his bath yesterday and it was very intimate and nice but there were a couple moments while I was wiping him down that I wished I was cleaning Miles instead and I feel bad about it... Feeling quickly passed when I cleaned up Chip's cute face though and saw how shiny he was at that point but still...

Anyway the sm*ll w*rld closure is really doing numbers on my mental state compared to normal since my period started so close to it and I was sick leading up to it and couldn't give CB a proper goodbye... And now that he's essentially hibernating my brain has been reflecting on stuff. This probably isn't a good thing, or like, healthy, but it's what's going on rn unfortunately. Hoping some time with friends soon + [REDACTED WORK EVENT] coming up kinda help me focus less on the fact that CB is Asleep and get me more excited that when he IS back, it'll be for the holiday overlay (+ he may have gotten some maintenance he needs!)

But in the mean time I feel like shit and am Sad and wallowing. when I shouldn't be -- but these feelings are a prime example of a difference between me/CB and me/Miles; like yes I worry/worried about both of them a lot but anything wrong with Miles was in my hands and i could make decisions, whereas CB's maintenance and stuff isn't up to me, and the moment TWDC decides his accompanying ride is no longer worth having around, he could just. Go away forever. And while Miles is no longer with us (to my knowledge), I at least made the decision and got to weigh my own pros and cons and whatnot. It wasn't a shareholder who decided the 2005 Honda Civic no longer fulfilled attendance quotas and that he needed to go

#rambling waiting for my meds to kick in#which they are now so Zzzz#aorry if the ending feels incomplete but im actively startign to fall asleep kow

2 notes

·

View notes

Text

Bajaj Housing Finance IPO opens on Monday: GMP jumps; shareholder quota, date, review, other details of upcoming IPO

Minimize your trading risks & trade smarter with www.intensifyresearch.com 10 DAYS FREE TRIAL - best SEBI-registered RA firm.

Ganesh Chaturthi Bumper Offer - 10 DAYS FREE TRIAL & FLAT 30% DISCOUNT on all Research Services

Get comprehensive knowledge

– nifty buy sell signals,

– best shares to buy,

– profit making stocks,

– low risk investment option & lot more

by the best SEBI-registered RA firm.

#finance#stock market#banknifty#nifty prediction#economy#nifty50#investing#nse#sensex#share market#bajaj finance#bajaj housing finance#home loan#ipo alert#ipo news#invest#investment#investors#stocks#investing stocks#forex#financial planning#startup#business#services

2 notes

·

View notes

Text

As a consumer, I agree.

As someone who works in Marketing - or who fields an IT division for a Marketing office and who's started in car dealerships and call centers - you'd more or less get kicked out the door instantly.

So many sectors thrive on impulse purchases. People constantly talk about researching their next car, for instance, but "research" tends to involve hopping around the two or three closest dealerships, briefly waffling about the price tag and then going with whichever feature list appeals to you. There's no real need there, but so much of the Automotive industry rests on creating a need where there isn't one.

The clearest example of that is the ubiquitous SUV. The average North American family still hovers around the one-child-per-household average, but people are now being sold on preparedness. What kind of preparedness? For that second baby, of course, and for heftier grocery runs that haven't happened yet but might, for visits at the hardware store, for the hypothetical trailer hitch you'll want to affix and those unconfirmed trips to the countryside's back roads you might consider...

So on and so forth. You know the drill.

Create the need, you'll get a sale. The same pitch works with EVs, but is tweaked for the environmentally-conscious.

Cravings just aren't rooted in honesty. Real needs are measured, considered, tabled, planned for. You don't rent an apartment willy-nilly, you check the rent, how fair the landlord is and how satisfied the other tenants are. You don't buy a house for kicks, either - unless you're filthy rich.

So why push cravings? Because factory workers need food to eat. Because quotas are expected and shareholders have expectations. Because growth is unsustainably seen as a marker of success.

Which then begs the question: why not consider another system? Why incentivize lies and manipulation?

Because we got tragically dumb somewhere down the line and decided that the long-toothed grifters and hucksters had the right of it. That producing greenhouse gas emissions by the truckload is worth it if it helps you cover a mortgage to buy a house that's probably a little too big for what you realistically need, and a little too expensive.

Expecting honesty at any level makes the system fall apart. It doesn't make sense, it's unfair and it's a failure of the imagination at every conceivable level - and no alternative would be a perfect fix if pushed too far, either.

Business Bros talk the way they do because any appeal to rationality would make their offers fall apart. You want to hit that sweet spot where it feels like you're appealing to someone else's common sense, when you're actually reaching several inches lower, grasping, and twisting.

It sickens me as much as it does you, which is why I'm a huge fan of malicious compliance - within reason. Unless things change overnight, I'll still need a job to put food on my plate.

starting a new company, Autistic Auditors, where we send blunt autistic people to check up on things like companies to stand there and be like “actually that thing the CEO said made no sense, elaborate” and pushing them to actually explain their dodgy corporate language that avoids accountability and reliability. Just really grind them down with repeated “why” and “but what does that mean” and writing down the answers in clear and obvious language.

IDK I’m just sick of hearing how Business Bros talk and how many people are suckers for it. I want blunt people standing there going “hey, that guy didn’t actually SAY anything, he just strung together a bunch of nonsense corporate words to make you think ‘ooo profit’ but there’s nothing substantial here”

We would do the same to politicians.

75K notes

·

View notes

Text

How to Form a Company in Saudi Arabia

Forming a company in Saudi Arabia is an attractive option for international investors and entrepreneurs seeking to enter the growing Middle Eastern market. The Kingdom has made significant strides toward creating a business-friendly environment, thanks to its Vision 2030 initiative, which focuses on economic diversification and improving ease of business. However, the process of establishing a business setup in Saudi Arabia involves navigating various regulatory requirements and procedures. Here’s a step-by-step guide on how to successfully establish a company in KSA.

1. Choose Your Business Structure

The first step in KSA company formation is selecting the right business structure. Saudi Arabia offers several business entity types, each catering to different needs:

- Limited Liability Company (LLC): The most popular option for foreign investors, an LLC requires a minimum of two shareholders.

- Joint Stock Company (JSC): Suitable for larger companies, a JSC allows for stock issuance and public trading.

- Branch Office: Ideal for foreign companies wishing to operate without creating a new entity.

- Representative Office: Used for market research, this option does not permit commercial activities.

Each business type has unique requirements, so choosing the right structure depends on your business goals and investment capacity.

2. Obtain a MISA License

Foreign investors must obtain a license from the Ministry of Investment of Saudi Arabia (MISA). This license authorizes foreign entities to operate in Saudi Arabia and must align with the type of business activity you intend to pursue. MISA provides specific licenses for various sectors, including healthcare, education, construction, and more.

To apply for the MISA license, submit necessary documents such as a business plan, passport copies of owners, and corporate documentation (if applicable). Working with a company setup service in Saudi Arabia can streamline this process by handling documentation and regulatory compliance.

3. Register Your Business with MOCI

Once you obtain the MISA license, register your business with the Ministry of Commerce and Investment (MOCI) to receive a Commercial Registration (CR) certificate. This registration requires:

- Articles of Association (for LLCs)

- Proof of initial capital investment

- Approved MISA license

The CR certificate enables your company to legally conduct business in Saudi Arabia.

4. Open a Corporate Bank Account

Opening a corporate bank account is essential for managing your business’s financial operations. Saudi banks may require physical presence, shareholder identification, and company registration details. Corporate accounts involve strict Know Your Customer (KYC) protocols, so partnering with a company setup service can facilitate the account opening process and ensure a smooth experience.

5. Obtain Visas and Residency Permits

To legally hire foreign employees, you’ll need work visas and residency permits (Iqamas) for each staff member. The Saudi Ministry of Labor oversees the process, including a quota system that requires a certain percentage of Saudi nationals in each company, especially in specific sectors.

6. Register for Taxation

Companies must register for tax purposes with the General Authority of Zakat and Tax (GAZT). Corporate tax in Saudi Arabia is generally 20% for foreign-owned entities, and Value Added Tax (VAT) registration is required for businesses exceeding a specific annual revenue threshold.

Conclusion

Establishing a company in Saudi Arabia presents an exciting opportunity for investors, but it involves navigating a series of legal and administrative steps. From selecting the right business structure to securing SAGIA and MOCI approvals, each stage requires careful attention to detail. Using a professional company setup service in Saudi Arabia simplifies the process, ensuring compliance and saving time. For a seamless experience in forming a business setup in Saudi, Helpline Groups provides comprehensive support, from licensing and registration to banking and visa assistance. Helpline Groups’ expertise ensures a smooth journey for businesses aiming to thrive in the Saudi market.

0 notes

Text

Rise of the local mattress store

Why Local Mattress Stores Are Outshining Big Box Retailers: A Modern Shift in Shopping

In today’s fast-paced world, consumer trends are shifting. People are becoming more intentional about where and how they shop. Whether it’s supporting local businesses or seeking personalized experiences, the spotlight is turning away from big box stores and shining on local retailers. When it comes to buying a mattress—a decision that impacts your daily comfort and health—local mattress stores are becoming the preferred option for many shoppers. Here's why.

1. Personalized Service & Expertise

Unlike big box stores, where mattresses are just one of many products, local mattress stores specialize in sleep. Their expertise in the field means you're dealing with sleep professionals who can guide you through the complex world of mattress materials, firmness levels, and sleep technology.

In a local store, you get a more tailored shopping experience. The staff takes the time to understand your sleep needs, whether you're a back sleeper needing extra lumbar support or a side sleeper requiring softer cushioning. At Sleep Experience, we go beyond selling mattresses—we help you find your ideal sleep solution. You’ll never feel rushed or overwhelmed with choices, and we ensure you’re getting what’s best for you, not just what’s on sale.

2. Support for Local Economy

When you buy from a local mattress store, you're contributing to your community's economy. Local stores often source products from regional suppliers, and the money you spend goes back into the community in the form of wages and local services. In contrast, much of the revenue from big box stores ends up with corporate shareholders far removed from your local area.

Supporting small businesses fosters a sense of community and helps create a thriving local economy. It’s not just a mattress purchase—it’s an investment in your neighborhood.

3. Exclusive Products and High-Quality Brands

Local mattress stores often carry exclusive, high-quality brands that you won't find at big box retailers. These stores focus on bringing in premium products that offer better comfort, durability, and sleep support. Additionally, many local shops collaborate with specialty mattress makers that prioritize sustainability, eco-friendly materials, and artisan craftsmanship.

For example, at Sleep Experience, we carry a curated selection of mattresses that combine luxury with sustainability—products you won’t find in a big chain store. Whether you’re looking for natural latex, hybrid mattresses, or customizable options, you’re more likely to discover unique, high-quality products that perfectly fit your lifestyle at a local shop.

4. No Pushy Sales Tactics

We’ve all been there—walking into a large chain store only to be followed by sales associates looking to hit their quotas. The experience can feel transactional, and decisions can be pressured. In contrast, local mattress stores focus on relationships rather than quotas. Their goal is to build trust with customers over time, providing honest recommendations without the hard sell.

At a local store, the priority is your long-term satisfaction. This results in a more relaxed atmosphere where you can browse, ask questions, and even come back a few times before making a decision��without feeling like someone is breathing down your neck to make a quick sale.

5. Flexibility in Pricing and Financing Options

Big box stores might promote flashy sales and discounts, but they often lack the flexibility to offer real, customized deals. Local mattress stores tend to have more leeway in working with customers to create pricing plans that fit their budget. Whether it’s bundling products, offering special promotions, or flexible financing, local shops can create a more personalized pricing strategy.

Many local stores also have flexible financing options, which are great for shoppers who want to spread out their payments over time. Additionally, local businesses are often more willing to match prices or throw in extras like free delivery or accessories to ensure you're getting the best value.

6. Better After-Sale Support

One of the biggest perks of choosing a local mattress store is the after-sale support. At big box stores, the customer relationship usually ends as soon as you swipe your card. On the other hand, local businesses prioritize long-term customer care. Should you have any questions or concerns after your purchase, it's much easier to reach someone from the store who knows your situation and can provide quick solutions.

For instance, Sleep Experience offers continuous customer support to ensure you’re happy with your purchase. If there’s any issue, we’re just a call away—whether you need advice on maintaining your mattress or want to take advantage of our mattress trade-in program that allows you to trade in your old mattress for a credit toward a new one.

7. Sustainable and Ethical Practices

Many local mattress stores are now leading the charge in sustainability. They often carry eco-friendly mattresses made from natural and organic materials, free from harmful chemicals and synthetic components. In contrast, larger stores frequently focus on mass-produced products that may not prioritize sustainability.

By supporting a local mattress store, you’re not only investing in a high-quality product but also contributing to environmentally conscious business practices. We at Sleep Experience prioritize offering green, eco-friendly mattresses that support both your health and the planet.

8. Trade-In Programs for Longevity

At Sleep Experience, we believe in creating long-term relationships with our customers. One of the benefits of shopping locally is our trade-in program. Unlike big box stores where your mattress purchase is a one-time transaction, our program allows you to trade in your old mattress within six years and receive 25% credit toward a new one. To ensure your new mattress stays in top condition, we also provide mattress protectors as part of the deal, ensuring you get the most out of your investment.

Conclusion: A Better Mattress Buying Experience

As more consumers realize the benefits of shopping locally, it’s clear that local mattress stores are outpacing big box retailers in customer satisfaction, quality products, and long-term value. Whether you’re after personalized service, exclusive brands, or a commitment to sustainability, your local mattress store is the better option.

Next time you're in the market for a new mattress, why not give a local store a try? Visit Sleep Experience to explore our range of premium mattresses, personalized service, and customer-first policies.

1 note

·

View note

Text

Understanding Business Laws and Regulations in Saudi Arabia

Introduction

Starting a business in Saudi Arabia offers tremendous opportunities, particularly with the government's ongoing efforts to diversify the economy. However, for foreign investors and local entrepreneurs alike, it is essential to navigate the complex regulatory environment with care. This article provides an overview of the business laws and regulations in Saudi Arabia, focusing on critical areas like company formation and compliance with corporate and labour laws. By understanding these regulations, businesses can operate smoothly and avoid legal issues.

1. Why Choose Saudi Arabia?

Saudi Arabia presents an attractive destination for businesses due to its strategic location, stable economy, and forward-thinking economic policies. The country's Vision 2030 initiative aims to diversify the economy beyond oil, encouraging investment in sectors like technology, tourism, healthcare, and renewable energy.

Additionally, Saudi Arabia offers numerous incentives for both local and international businesses. These include tax breaks, simplified company registration processes, and access to one of the largest consumer markets in the Middle East. The Kingdom's legal reforms have made it easier for foreign investors to set up businesses and maintain full ownership, particularly in industries that align with Vision 2030. Moreover, the country boasts world-class infrastructure, favourable tax regulations, and abundant resources, making it an ideal environment for business growth.

2. Types of Business Entities

Entrepreneurs must choose the appropriate legal structure when considering starting a business in Saudi Arabia. The most common types include:

Limited Liability Company (LLC): The most popular structure for foreign and local businesses. It requires at least one shareholder and can have up to 50.

Joint Stock Company (JSC): Ideal for larger enterprises, particularly those seeking to go public.

Branch Office: Foreign companies can establish branch offices without a separate legal entity but must register with the Ministry of Commerce.

Sole Establishment: Designed for small businesses owned by a single individual.

Each structure has its legal requirements and benefits, making it essential for business owners to carefully consider their options during the company formation process.

3. Registering a Company in Saudi Arabia

The process to register a company in Saudi Arabia has become more streamlined in recent years. Key steps include:

Company Name Reservation: Submit a request to reserve a unique name for the business through the Ministry of Commerce.

Drafting Articles of Association: This document outlines the company's purpose, shareholder details, and governance structure. It must be notarized and registered.

Obtaining a Commercial Registration Certificate: After registering the company, the Ministry of Commerce issues a commercial registration certificate, allowing the business to operate legally.

Foreign Investor License: A license from MISA is mandatory before registration if the business involves foreign ownership.

Opening a Bank Account: Once registered, businesses must open a corporate bank account in Saudi Arabia for capital deposits and operations.

By following these steps, businesses can successfully register their company and commence operations.

4. Labor Laws and Employment Regulations

Employers in Saudi Arabia must comply with labour laws governed by the Saudi Ministry of Human Resources and Social Development. Critical areas of compliance include:

Work Permits: Foreign employees must secure work visas and permits linked to their employment contracts.

Saudization: The Nitaqat program requires businesses to meet specific quotas for employing Saudi nationals, depending on the industry and company size.

Employee Rights: Businesses must provide minimum wage, health insurance, and end-of-service benefits.

Failure to adhere to these labour laws can lead to penalties, fines, or business suspension.

5. Taxation and Financial Reporting

Saudi Arabia has implemented a value-added tax (VAT) on goods and services, which businesses must account for when preparing financial statements. Corporate income tax is generally imposed on foreign companies, while Zakat (a religious levy) applies to Saudi-owned businesses. Proper financial reporting and compliance with tax regulations are essential to avoid legal disputes and ensure smooth operations.

Conclusion

Starting and operating a business in Saudi Arabia requires thorough knowledge of the country's laws and regulations. From company formation to labour law compliance, understanding the legal framework ensures a smooth and successful business journey. Whether local or foreign, entrepreneurs must familiarize themselves with the regulatory environment to operate within legal boundaries and achieve long-term growth.For businesses seeking expert assistance in navigating the complexities of Saudi business laws, the Saudi Helpline Group offers professional support in company formation and ensuring full compliance with all legal requirements. With over 25 years of experience, they are a trusted partner for businesses looking to succeed in the Kingdom.

0 notes

Text

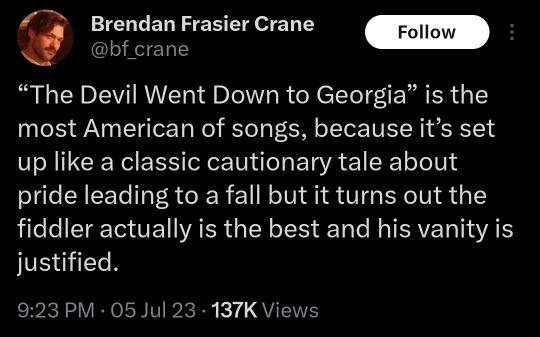

The Devil was also "in a bind cause he was way behind and looking to make a deal". This is not a normal situation for him, he's slipping. His position of wealth is eroding and he's making a desperate grab at a soul he thinks will be an easy mark.

He's an executive beholden to shareholders and he's trying to make quota by duping a naive young man with a get rich quick scheme.

Also a very American thing to sing about.

#though the devil himself is not way behind when it comes to american sin#there's plenty of rich men with damned souls here

85K notes

·

View notes

Text

Understanding the Legal Framework for Business Setup in Saudi Arabia

Setting up a business in Saudi Arabia has become increasingly appealing for international investors due to the Kingdom’s evolving economic landscape. With Vision 2030 driving economic diversification, Saudi Arabia is creating ample opportunities for businesses across various industries. However, navigating the legal framework for business setup in the Kingdom requires a clear understanding of local regulations and procedures.

At Capital International Group (CIG), we specialize in providing comprehensive support for entrepreneurs and investors looking to establish their businesses in Saudi Arabia. In this blog, we’ll break down the key legal elements and steps involved in the process of setting up a business in the Kingdom.

1. Types of Legal Entities in Saudi Arabia

Choosing the right legal structure is the first crucial step. Saudi Arabia offers several types of business entities:

Limited Liability Company (LLC): This is the most common business structure for foreign investors. It requires at least one shareholder and offers protection against personal liability.

Joint Stock Company (JSC): Suitable for larger companies, a JSC requires at least two shareholders and provides the ability to raise capital through public shares.

Branch Office: Foreign companies can establish a branch office to operate under the parent company’s name in Saudi Arabia, without creating a separate legal entity.

Representative Office: This entity is for foreign companies wanting to explore market opportunities without engaging in commercial activities.

At CIG, we help you select the best business structure based on your specific goals and business type.

2. Foreign Investment Regulations

Saudi Arabia’s Ministry of Investment (MISA), formerly known as SAGIA, plays a critical role in regulating foreign investments. For a foreign investor to operate legally in Saudi Arabia, they must obtain a Foreign Investment License from MISA.

Key conditions for foreign ownership include:

Ownership Rights: Foreign investors can hold up to 100% ownership in most industries, though some sectors, such as oil exploration and real estate in Mecca and Medina, have restrictions.

Minimum Capital Requirement: Depending on the business sector, there may be specific capital requirements to meet.

The Saudi Arabian General Investment Authority (SAGIA) has simplified procedures for foreign investors, but it’s still essential to ensure compliance with regulatory requirements.

3. Commercial Registration and Licenses

Once the appropriate foreign investment license is secured, the next step is obtaining a Commercial Registration from the Ministry of Commerce and Industry (MCI). This involves:

· Registering the company’s trade name.

· Obtaining the required permits for your specific industry.

· Registering the company for VAT with the General Authority of Zakat and Tax (GAZT).

At Capital International Group, we streamline the registration process, ensuring that all documents are filed correctly and on time to avoid delays.

4. Labor Laws and Saudization

The Saudi Labor Law governs the hiring practices in the country, and businesses must adhere to Saudization requirements. Saudization, also known as the Nitaqat Program, is a national policy aimed at increasing the employment of Saudi nationals in the private sector.

The percentage of Saudi nationals required varies based on the industry and the size of the company. Failure to comply with Saudization quotas may result in penalties, including restrictions on visa issuance.

5. Taxation and Financial Regulations

Saudi Arabia offers a favorable tax regime for foreign investors. Key tax considerations include:

· Corporate Income Tax: Foreign-owned businesses are subject to a corporate tax rate of 20%.

· Zakat: Saudi-owned companies and GCC nationals pay Zakat instead of corporate income tax, calculated at 2.5% of the company’s capital.

· Value Added Tax (VAT): Saudi Arabia introduced a 15% VAT rate applicable on goods and services.

Proper tax planning and compliance with financial reporting standards are essential. CIG can provide expert tax advisory services, helping you navigate these requirements smoothly.

6. Intellectual Property Protection

Saudi Arabia has taken significant strides in improving its Intellectual Property (IP) regulations. The Saudi Authority for Intellectual Property (SAIP) oversees trademarks, patents, and copyrights. Registering your IP is crucial for safeguarding your business assets.

By working with Capital International Group, we help ensure your intellectual property is adequately protected in the Saudi market.

7. Legal and Regulatory Compliance

Compliance with Saudi Arabia’s legal framework requires businesses to stay updated with the latest regulations and amendments. This includes:

· Regular updates to labor laws.

· Adherence to environmental and safety standards.

· Compliance with anti-corruption laws, which is critical to maintaining business integrity in the Kingdom.

At CIG, we provide ongoing legal and regulatory compliance support, ensuring that your business operates seamlessly within the Saudi framework.

Conclusion

Setting up a business in Saudi Arabia presents a wealth of opportunities, but navigating the legal framework can be challenging without expert guidance. At Capital International Group, we are dedicated to helping businesses successfully establish themselves in the Saudi market by offering tailored support at every stage — from entity selection to legal compliance.

#capital international group saudi#business#saudi business setup#business setup services in dubai#business setup#saudi#startup

0 notes

Text

Bajaj Housing Finance IPO Live Update: GMP rises after strong booking situation. Reviews, other details

Bajaj Housing Finance IPO launched its initial public offering (IPO) on September 9, which will close on September 11. The price band for the issue is set between ₹66 and ₹70 per share. The company has already raised ₹1,758 crore from anchor investors, with portions reserved for various investor categories, including a special quota for shareholders. In terms of allocation, 50% of the shares in…

0 notes

Text

Investment is for the future.

When a company is doing bad, and shareholders see no profit from its share in the foreseeable future, they will sell it to cut their losses. Then use the funds and time on something more promising. Now if given some time, the company manages to improve their business operation, provide clear future plans and establish a transparent business practice, then naturally their value will go up. Even if it was undervalued then, a strong foundation like that has always proven itself to be a reliable way to determine hidden gems in the market.

However, even after all of that, it would not guarantee investors to buy the share. It is probably not because the company is bad. Maybe the investor does not have enough funds. Or the investor has allocated their quota for the share to a different, better company. Or maybe your company does not align with their portfolio goals and/or morality. Or they rather have a company that has a better reputation with their family and friends. Or due to how your company wasted their time and funds, she doesn't want to look or hear from your company ever again, a bridge burnt to ashes I am afraid. The worst case scenario however is you are bad and have not meet her requirements at all even after all this time and effort.

Of course, diversifying is what a top-rate investor would do so you cannot blame them for not choosing you. After all, it is their money and it is their right of purchase. The only thing you can do is to promote it the best you can and hopefully, they deem you worthy to be part of their portfolio. You survive the market with their funds and they receive their money back from you. Just a normal transaction in the business world.

Of course, this is not about investments... or is it?

0 notes

Text

What are categories in which IPO allotment applications can be made?

In the context of IPO allotment applications, the categories typically refer to different types of investors who can apply for shares in the IPO. These categories may vary depending on the country and its regulations, but commonly include:

Retail Individual Investors (RIIs): These are individual investors who apply for shares in the IPO. They often have a limit on the maximum number of shares they can apply for, and they may be allotted shares at a discounted rate compared to other categories.

Qualified Institutional Buyers (QIBs): These are institutional investors such as mutual funds, banks, insurance companies, and foreign institutional investors. They typically invest large sums of money and have their own reserved quota in the IPO.

Non-Institutional Investors (NIIs): These are usually high-net-worth individuals (HNIs), corporates, or other non-institutional entities that invest a significant amount of money in the IPO. They typically invest more than retail investors but less than institutional investors.

Anchor Investors: In some jurisdictions, there is a category known as anchor investors. These are institutional investors who invest in the IPO before it opens for subscription to provide confidence in the offering. They are usually allotted shares at the IPO price.

Employee Quota: Some companies reserve a portion of the IPO shares for their employees. This allows employees to participate in the company's growth and can also help boost morale and retention.

Other Reserved Categories: Depending on the regulations and policies of the issuing company and the regulatory authority, there may be other reserved categories such as shareholders of the parent company, mutual fund investors, or specific groups identified by the regulator.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

ou can also downloadLTP Calculator app by clicking on download button.

These categories help ensure a fair and orderly distribution of shares in the IPO process, taking into account the interests of different types of investors.

0 notes

Text

A Post-Mortem.

What might happen if Uber tried to transition to a SaaS business? A fictional story.

Imagine a transactional business, like the Uber we know today, going through the transition, and what might happen along the way.

Uber starts off as a beautifully simple business. People pay per ride. Friction to becoming a customer is low. The unit economics are relatively fixed, since the revenue per ride is predictable. The growth is tremendous, and the media is raving.

Within 30 months of launching, a massive acquisition offer comes in the door. The company has raised very little money at this point, and the payouts to shareholders would be massive. G650’s for everybody!

The board decides that now is the time for “professional management” to replace the Founder. There’s too much money at stake. A CEO is brought in, perhaps someone with an MBA or a law degree. He’s great at PowerPoint.

Everything with the merger is looking swimmingly. The press release is drafted and the announcement to employees is about to be made. We’re right at the finish line. There’s just one last thing: the new CEO has a lot of freshly minted stock options that came with the promotion & which are unvested. It’s time for the Chairman of the Board to send an email to the acquirer, asking them to be accelerated. The email is drafted, a prestigious investment bank (MS) signs off on the move and the Chairman hits “send”. The acquirer panics, and within hours the deal collapses leaving the company with a 7-figure legal bill and no deal. So close!

Perhaps it’s time to shift strategy. While transactional pricing was great and led to the massive acquisition offer, SaaS is more predictable. And it gets a higher revenue multiple. The urge is irresistible. So Uber starts to transition, asking customers to commit to an annual, pre-paid fee for unlimited rides.

You can imagine that going from paying $15 per ride to paying $1200 or more for an annual subscription would reduce the number of customers. Perhaps as much as 80%. That’s a lot of purchase friction to overcome, necessitating the investment in a sales team for the very first time.

And sales teams are expensive, particularly when a decision is made to hire mostly in San Francisco. As the company lights cash on fire, the new CEO seeks to meet operating expense goals to save face in front of the board of directors. There’s only one place to look: driver marketing costs. So they cut, and cut and cut and cut. Every quarter.

Slowly, the culture inside the company starts to shift. The values that drove the early success of the business erode, as the new CEO brings in a new suite of VPs to run the company and indoctrinates them around the SaaS story. Talk about “ride quality”, and “pick-up times” fade away in favor of bookings, ARR and quotas.

A board director recommends a strategy consultant who is quickly hired. At a very hefty price, demanding half a million dollars in a suitcase and millions in equity. After doing what consultants do for a few weeks, they present their PowerPoint. Uber is no longer a ride sharing marketplace. It’s a “Ride Opportunity Network”. They tell management to stop launching new markets and focus on the core. That means the disappearance of one of the biggest growth drivers for the business: new market launches.

Meanwhile, topline revenue flatlines. But by downplaying and eventually killing the transactional business, ARR grows quickly. It should after all - the starting point is $0, and there’s plenty of transactional customers to draw upon. Even if only 15-20% commit to an annual subscription, ARR will grow quickly during the first 24 months.

But there’s an unintended consequence. All of a sudden the revenue per ride is all over the map. Some heavy users, at the end of a year, have paid just $5 per ride. Others have paid $100 per trip. It’s easy to predict who will churn, and who will not. When this is pointed out in a board meeting, company management replies that people pay for opportunities to ride, and not just ride themselves, and name-checks a customer who ‘overpaid’ at the end of a one-year contract and still renewed. Issue addressed.

Despite unlimited pricing, the volume of rides goes from doubling or tripling every year to growing low single digits. Part of that is because 80% of customers have been pushed out due to upfront pricing, and part because drivers just aren’t available a lot of the time when riders open the app, due to driver marketing budget cuts. Even with unlimited pricing, customers can’t catch a ride when none is available. This exacerbates the multi-tenanting challenges, as customers install 2 or 3 ride sharing apps, in case a car isn’t available. The network effects flywheel has developed a serious kink.

“Supply Drives Demand” - CEO of Fiverr https://www.nfx.com/post/fiverr-road-to-growth/

Churn ends up very high, perhaps as much as 50%, as it turns out that many of the old “pay per ride” customers who were sold into a subscription would have been better under the old plan. They were always going to be occasional users and they leave after their annual contract is up. It’s cheaper just to call the occasional taxi when needed.

Topline revenue remains flat for another year. But because the most profitable customers leave, while the ones generating the heaviest losses stay, the red ink continues to add up. Once again, the company responds by further decreasing driver marketing, exasperating pick-up times issues and service levels. It’s the only way to keep expenses under control without resorting to layoffs, but it just makes an already bad problem even worse. The companies executive team starts hiring private chauffeurs, as driver inventory on the marketplace dwindles.

But then the M&A gods look down in favour at the company, as another interested buyer walks in the door and presents an offer. It’s lower, a lot lower than when this was a 100% transactional business. So much for the SaaS premium. But it was an offer nonetheless, and one that would provide cash to shareholders of common stock. However, there’s just one problem - it generates 0% IRR for the most recent investor, who quickly asks that his financing documents be revised to guarantee a return. Despite months of effort, the deal falls apart and another competitor is acquired instead.

Escalation of Commitment into a Failing Strategy.

Meanwhile, cash is quickly running out. Traditional growth equity investors seeing the high churn, flat revenue, and continued losses bow out. But the charismatic CEO manages to convince some unconventional investors - maybe pension funds or family offices - to write big checks instead to continue to fund the operation. But even they are not stupid, demanding punitive liquidation preferences in exchange for a flat-valuation allowing management to “save face”. Common shareholders get pushed punished by the punitive terms.

But despite the cash infusion, the high churn makes it nearly impossible to grow the business. The most profitable customers, those who use the service occasionally, continue to leave in droves. After a while, all the easy pickings are exhausted by the sales team. All the transactional customers that could be talked into an annual subscription have been converted. Quotas start to get missed. Closed-won numbers plummet. A parade of C-Level and VP-level executives, seeing the writing on the wall, start leaving. 67 in all. It’s easy to imagine that the year finishes with a 50% miss on board goal.

The board meetings increasingly become all about “keeping up appearances”. Entire days are blocked off to tightly orchestrate and rehearse the performance prior to investors entering the board room. Almost no time is left for debate or questioning. Rather than finding the right answers, the 4-hour marathons devolve into an extended pitch session where the quarter’s numbers, whatever they happen to be, are “sold”. When quarter over quarter comparisons go bad, year-over-year charts are brought out. And when those don’t work, there’s always 3-Year CAGR numbers to boast about. Over time, board meeting dates start slipping, and numbers aren’t reported until months after the close of the quarter.

What happens at the board meetings is also reflected downward. The CEO tightens control of information, including the hefty liquidation preferences of the last round, for fear of demotivating his direct reports. With the team only getting a partial picture of the company’s health, they are powerless to take the dramatic actions needed to turn the ship around. As long as the message from the top remains that everything is going great, and that more investor money is incoming, there’s no need to change. The lack of transparency is stifling.

Another consequence of moving from transactional to SaaS model is that there’s just fewer customers, which means much lower driver utilization. That wasn’t supposed to be the case! Whereby in the good old days, drivers would spend 90% of their time with passengers, now 40% of the time they are signing on and not getting a single ride request! This is not great for driver NPS scores, which are quickly shuffled out of the board deck. Best not to shine a light into those dark corners.

The product roadmap changes as well. Uber is no longer just about getting people from Point A to Point B. It’s now a SaaS platform company. Surely, the CEO posits, a few extra features will reduce churn and boost net dollar retention, which sadly sits in the bottom quartertile. The teams get busy, and soon riders can access analytics that show them their average moving speed during travel and how it compares against others, while a nifty AR overlay highlights interesting facts about landmarks as they drive past them. Yet churn remains stubbornly high. Perhaps it’s time for an acquisition?

With all these customers on subscription contracts, surely there must be something else that Uber can sell them. And what do all riders have in common? They have mouths. So a meal kit delivery company is bought, at a 40X multiple. Spreadsheets are drawn up justifying the acquisition. We have people. People eat. If we can upsell only 10% of our customers into buying a meal kit subscription, this acquisition will quickly pay for itself. After all, the new class of preferred stock created to pay for the acquisition sits below investors money and they can easily defer the cash payments to the acquired company into the future. The acquisition is quickly approved. Only one board member votes against the deal (cough, cough).

Sadly, like 90% of acquisitions, this one too fails to deliver on its promises.

Maybe a party to rally the troops will turn things around? A fancy resort is rented, perhaps somewhere in Napa. People are flown in from all over the world. Presentations are rehearsed, PowerPoint decks are buffed, photographers and videographers are hired and buses booked. The CEO gives an inspiring presentation. Investors & board members get up on stage talking about how amazing the company is, hoping that by inciting the right combination of words will result in revenue doubling over the upcoming year. Alcohol flows freely.

But alas, it is not to be. No amount of motivational speeches or employee training can overcome bad strategy and leadership. The next few quarters remain as flat as a pancake. A saviour is needed! Perhaps a new $50,000 per month Chief Revenue Officer. But he’s demanding, only business class flights for him! Expenses pile up. New sales leadership fails to solve the structural problem. After telling the SaaS story so often, and to so many people, it’s hard to backpedal. So the CEO does the only thing he can: try to raise more money. But he knows he can’t do it alone this time.

Expensive bankers are hired to try to find additional sources of capital or find a soft landing as the entire story falls apart in slow motion. But even with very significant revenue, everybody sees right through the SaaS story: flat revenue, high losses, high churn. After a few months of trying, even the investment banker can see where this is going. They demand an increase in their fees and a massive guaranteed payout to continue doing the work. The board approves the new terms.

Then news emerges out of Wuhan China. Some novel coronavirus. Reports leak out about the entire city shutting down and entire hospitals being built in days. This must be serious. As the stock market plunges, uncertainty, fear and doubt reign supreme. Fewer people are taking Uber rides. And certainly no one whose subscription comes up for renewal does so. Who wants to pay $1200 upfront, if all bars might close next weekend?

Predictably, while revenue and renewals plummet, the rides drop much less so. It turns out that transactional pricing would have been much more resilient in a situation like this. But because Uber is now a SaaS business, revenue drops faster than ride volume. With cash dwindling, the board scrambles to raise an insider round to meet payroll, while conducting layoffs and sacrificing Cronuts and Avocado Toast at the altar of SaaS in hopes the investment bankers can pull a rabbit out of a hat.

Within months though, the fresh capital too is gone and it’s time for PPP.

As it becomes increasingly obvious that any exit won’t clear the hefty and brutal preference stack, board members start resigning. Even the CEO & his enabler, the Chairman, quit the board as risks of insolvency and lawsuits mount. The situation is getting desperate. One of the board members reaches out to the founders - “Won’t you please come back?”. But it’s too late.

With just weeks of cash left, a messy cap table loaded with preferences, and a list of 75+ buyers who passed on making an offer at any price, it’s too far gone. The only option is a full-on recapitalization. But due diligence turns up tens of millions of dollars in long-term liabilities, including debt, a $3m/year lease with 5 years left on it, the multi-million cash liability for the acquisition that didn’t meet expectations and investment bankers who feel they are owed $3m, even for a recap. The only option? Assignment for the Benefit of Creditors.

And that CEO? He's now a driver.

0 notes