#send money to india from canada

Explore tagged Tumblr posts

Text

Unlock the Best Exchange Rate: Send Money from Canada to India (CAD to INR)

Are you looking to send money from Canada to India and get the best exchange rate possible? Well, you're in the right place! In this comprehensive guide, we'll walk you through the ins and outs of sending money from Canada to India, all while ensuring you get the most bang for your buck. Whether you're a seasoned pro or a first-time sender, we've got you covered.

Understanding the Basics: CAD to INR Exchange Rate

Before we dive into the nitty-gritty, let's start with the basics. The CAD to INR exchange rate is essentially the value of one Canadian Dollar (CAD) in Indian Rupees (INR). This rate fluctuates constantly due to various factors like economic conditions, geopolitical events, and market sentiment.

H1: Factors Influencing Exchange Rates

So, what exactly influences these exchange rates? Here are some key factors to consider:

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment figures, can significantly impact exchange rates. A stronger Canadian economy often leads to a higher CAD value against the INR.

Interest Rates

Central bank policies and interest rate differentials between Canada and India play a crucial role. Higher interest rates in Canada can attract foreign investment, increasing the demand for CAD.

Political Stability

Political stability fosters investor confidence, which, in turn, can bolster the CAD. Any political uncertainty can have adverse effects on the exchange rate.

Choosing the Right Service Provider

Now that you understand the dynamics of exchange rates, let's move on to choosing the right service provider for sending money from Canada to India. Here's where "Remitanalyst" comes into play.

Why Choose Remitanalyst?

As a leading name in the industry, Remitanalyst is committed to helping you make the most of your money transfers. Here's why you should consider their services:

Competitive Exchange Rates

Remitanalyst prides itself on offering highly competitive exchange rates, ensuring that you get the most INR for your CAD.

Transparent Fees

Say goodbye to hidden fees! Remitanalyst provides transparent fee structures, so you always know what you're paying for.

Speed and Reliability

When you need to send money to India, you want it to get there quickly and securely. Remitanalyst ensures timely and reliable transfers.

Strategies for Maximizing Your Exchange Rate

Getting the best exchange rate isn't just about choosing the right service provider; it's also about timing and strategy. Here are some strategies to help you maximize your exchange rate:

Monitor the Rates

Keep a close eye on the CAD to INR exchange rates. Remitanalyst provides real-time rate updates, helping you make informed decisions.

Use Limit Orders

A limit order allows you to set a specific exchange rate at which your transfer will be executed. This can be a game-changer in volatile markets.

Consider Forward Contracts

With a forward contract, you can lock in a favorable rate for a future transfer, protecting yourself from unfavorable rate fluctuations.

The Convenience of Online Transfers

Sending money from Canada to India has never been easier, thanks to online transfer services like Remitanalyst.

24/7 Accessibility

Online platforms are accessible 24/7, allowing you to initiate transfers at your convenience, regardless of time zones.

Easy Tracking

Remitanalyst offers a user-friendly interface that allows you to track your transfers effortlessly.

Secure Transactions

Rest assured, your money is in safe hands with reputable online transfer services like Remitanalyst, which employ robust security measures.

Tax Implications and Regulations

Before you send money across borders, it's essential to understand the tax implications and regulations that may apply.

Reporting Requirements

In Canada, you may need to report international money transfers over a certain amount to the Canada Revenue Agency (CRA).

India's Foreign Exchange Management Act (FEMA)

India has stringent regulations under FEMA. Familiarize yourself with these rules to ensure compliance.

Conclusion

Sending money from Canada to India is a breeze when you have the right knowledge and tools at your disposal. Remember to keep an eye on exchange rates, choose a reputable service provider like Remitanalyst, and consider various strategies to maximize your returns. By staying informed and making savvy choices, you can unlock the best exchange rate and ensure your money reaches its destination in India efficiently and securely. Don't hesitate—start making the most of your CAD to INR transfers today!

1 note

·

View note

Text

XE presents an array of payment options, all accompanied by the most favorable CAD to INR exchange rates.

Transferring funds electronically can pose challenges, especially when navigating intricate details. When seeking to send money from Canada to India and obtain optimal CAD to INR conversion rates, XE emerges as an exceptional choice. As a global fintech leader, XE facilitates seamless remittances to India with a focus on competitive exchange rates. Their online transaction process is not only secure but also expeditious and dependable.

#CAD to INR#Send money to INDIA from CANADA#best current exchange rate#transfer money from CANADA to INDIA#remitanalyst

0 notes

Text

Easily Send Money to Canada from India with our international money transfer service. Send money hassle-free to your loved ones with secured way.

0 notes

Text

Send Money from India to Canada: The Smart Way to Transfer Money

Get The Best Rate For Sending Money From India To Canada DCB Remit offers superior, competitive exchange rates to send money internationally. Simply register on the DCB Remit portal to get the best exchange rates with no hidden charges or transfer fees.Main Reasons To Send Money From India To Canada. Some of the common purposes for international fund transfer are: Overseas Education, Maintenance Of Close Relative Abroad, Gifting, Medical Treatment Abroad, Visa Fees, Business Travels, Private Visits. All of these are permissible via DCB Remit’s portal, so you can transfer funds to Canada stress-free.

0 notes

Text

5 Easy Steps for Money Transfer to GIC Account from India

For individuals looking to study, work, or settle in Canada, a GIC (Guaranteed Investment Certificate) account is a crucial financial requirement. It demonstrates that you have sufficient funds to cover your expenses while residing in Canada. Transferring money to a GIC account from India is a straightforward process that involves a few essential steps.

Read More: https://orientremitbangalore.blogspot.com/2023/07/5-easy-steps-for-money-transfer-to-gic.html

#send money abroad#gic account opening#send money overseas#international money transfer#money transfer from india to canada

0 notes

Text

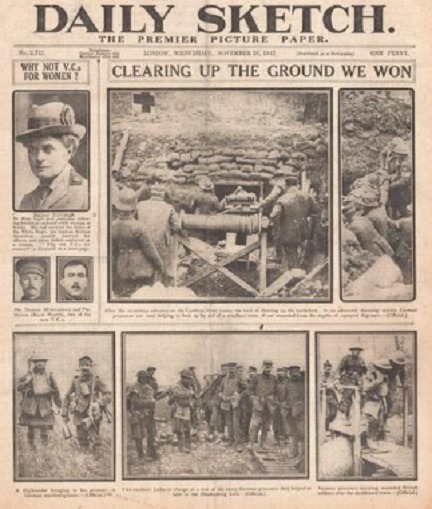

On 26th November 1917 Elsie Inglis, the Scottish doctor, nursing pioneer and suffragette, died.

Every Scot out there should read this with pride, Elsie Inglis and the other Scottish doctors and nurses faced prejudice and the horrors of war, but they did not flinch in what they saw as their duty.

Born in India in 1864, she was the daughter of John Inglis, a chief commissioner in the Indian civil service. She studied medicine at Dr Sophia Jex-Blake’s newly opened Edinburgh School of Medicine for Women and was one of the first women in Scotland to finish higher education, although she was not allowed to graduate. She went on to complete her training under Sir William Macewen at the Glasgow Royal Infirmary.

On the outbreak of WWI Elsie approached the War Office with the idea of either women-doctors co-operating with the Royal Army Medical Corps, or women's medical units being allowed to serve on the Western Front. The authorities were less than helpful and it is reported that an official said to her "My good lady, go home and sit still".

Despite attempts to repress her efforts—and those of many other women—to contribute, Elsie did not “sit still”. Instead, she persevered, setting up the Scottish women’s hospitals, which were all-female units that played a vital role with Britain’s allies, including the French, the Belgians and, particularly, the Serbs.

Elsie was 50 when war broke out and she defied British Government advice by setting up field hospitals close to the frontlines. She travelled to France within three months of the outbreak of war, and the all female staffed, Abbaye de Royaumont hospital, containing some 200 beds, was in place by the end of 1914. That was followed by a second hospital, at Villers Cotterets, in 1917. Tens of thousands were helped by the hospitals she set up in France, Serbia, Ukraine and Romania, acting with the support of the French and Serbian Governments.

Prior to that, Elsie was a strong advocate of women’s rights and a leading member of the suffragette movement in Scotland, playing a notable role in the establishment of the Scottish women’s suffrage federation in 1906. She fought energetically against prejudice and for the social and political emancipation of women, and had already made a huge impact in Edinburgh by working in some of the poorest parts of the city with women and babies who were in desperate need of help. Selflessly, she often waived the fees of patients who could not afford to pay.

Politically, Elsie was a staunch campaigner for votes for women, and her involvement in the suffragette movement prompted her to raise money to send out to female doctors, nurses, orderlies and drivers on the frontline. She recorded many great achievements, including setting up 14 hospitals during the war—staffed by 1,500 Scottish women, all volunteers. Most notably, Elsie raised the equivalent of £53 million in today’s money to fund greatly needed medical care for those on the frontline. Her efforts reached across the waters on another level, attracting volunteers from New Zealand, Australia and Canada. As I am sure everyone would agree, that showed fierce independence and capability from women who were well ahead of their time.

By 1917 Inglis knew she had cancer, and by the end of September was unable to work as a surgeon she sent a telegraph home saying, ‘Everything satisfactory and all well except me.’ Inglis and her unit landed in Newcastle and the following day, 26 November 1917, in the presence of her sisters, Inglis died.

In Edinburgh the response was huge and the streets were lined with people as her body was returned to the city. While there was no Victoria Cross for her at home, in Serbia she was the only woman to receive the Order of the White Eagle and is remembered by the nation every year in a ceremony at the memorial fountain built in her honour.

Before her body was interned in Dean Cemetery, Inglis’s body lay in state in St Giles’ Cathedral. The SWH continued its work for the duration of the war, sending out more units and raising money for the work. Remaining funds were used to establish the Elsie Inglis Memorial Maternity Hospital in Edinburgh in July 1925.

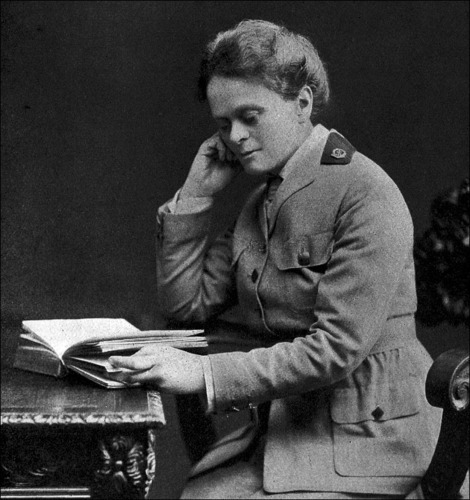

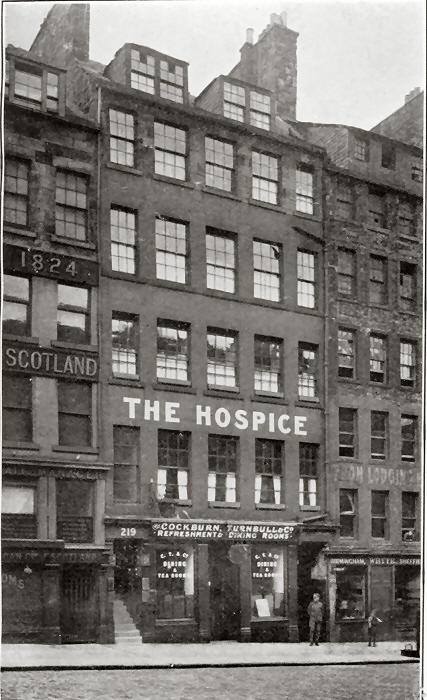

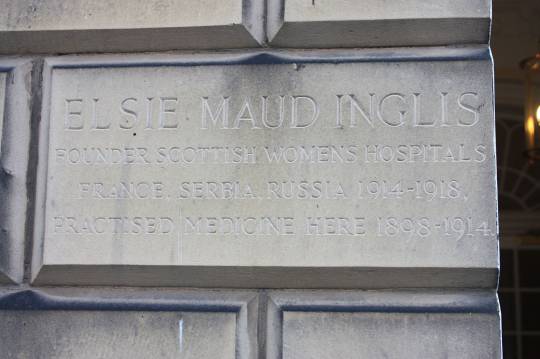

Pics are of Elsie, the "Hospice" on the Royal Mile, not a hospice in today's sense of the word, it was a maternity hospital set up in 1904 run exclusively by women, The Elsie Inglis Maternity hospital at Abbey Hill replaced this in 1925, the third pic is an engraving at Walker Street Edinburgh, where she had a surgery.

There has been talk of erecting a statue of Elsie, in my opinion she certainly deserves, there are too few statues honouring strong women like her, you can find details on the link below.

21 notes

·

View notes

Text

To put this in context, Sikh extremist bombed an Air Canada 182 passenger jet bound for India. https://www.thecanadianencyclopedia.ca/en/article/air-india-flight-182-bombing

During Covid, Sikh's raised money here in Canada to send over to India for their farmer's strike against Modi during the harshest lockdowns. Indian Police officers died during the farmers protests over in India, but Trudeau did nothing to stop the fundraisers here or the money going to India, but he did lock up the peaceful Trucker's protest participants in Ottawa.

For all his tough talk to Russia, Canada has starved it's military into the ground, if he's talking tough on the world stage, he doesn't have a leg to stand on.

Sikhs regularly fly banners on the 401 to raise awareness for their homeland, as they want to secede from India. If they're that involved in Indian politics, can anyone seriously think these people are invested emotionally to be Canadians first or assimilate? So Trudeau has blown his own credibility and Canada's too with India. Probably time for him to go on the magical, pompous un-reality tour with Prince Harry, as neither of them seem to be listening to others or living in reality.

15 notes

·

View notes

Text

there are general elections in The Netherlands in a little under a month and all campaigns are in full swing and I just had a look on twitter to see what's being said about Gaza getting cut off from the rest of the world while israel is bombing every inch of it.

one tweet, from one party leader. When over 20 parties are running. Though a few others have mentioned Gaza the past few days and how we should mourn people killed in Gaza the same way we mourn people killed in israel, and apparently the Netherlands is sending money for humanitarian aid in Gaza. (I couldn't stomach the actual nazis we have in parliament but I can guess their stance on the matter)

And the Netherlands ABSTAINED from voting on a UN resolution “protection of civilians and upholding legal and humanitarian obligations”

AGAINST: Israel, United States, Austria,Croatia, Czechia, Fiji, Guatemala, Hungary, Marshall Islands, Micronesia, Nauru, Papua New Guinea, Paraguay, Tonga

ABSTAINED: The Netherlands, Albania, Australia, Bulgaria, Cabo Verde, Cameroon, Canada, Cyprus, Denmark, Estonia, Ethiopia, Finland, Georgia, Germany, Haiti, Iceland, India, Iraq, Italy, Japan, Kiribati, Latvia, Lithuania, Monaco, North Macedonia, Palau, Panama, Philippines, Poland, Rep. of Korea, Rep. of Moldova, Romania, San Marino, Serbia, Slovakia, South Sudan, Sweden, Tunisia, Tuvalu, Ukraine, United Kingdom, Uruguay, Vanuatu, Zambia

Notice how a lot of Western (European) countries abstained from voting? Not even doing the bare minimum of voting on a resolution about protecting civilians...

The resolution passed but most of Western Europe didn't even vote! People in power not even bothering to raise their hand in a vote just pisses me off. You have the power to DO SOMETHING, so fucking DO IT!

6 notes

·

View notes

Text

Secure Online Money Transfer from Canada to Nepal Our platform provides a secure online solution for money transfer from Canada to Nepal. Experience reliable service with excellent support for all your need

0 notes

Text

0 notes

Text

Canada to India Money Transfer: Best Rates Unveiled!

Are you gearing up to send some hard-earned Canadian dollars back home to India? It's no secret that finding the best exchange rates can be a real head-scratcher. But fear not, my friends, for I'm about to take you on a journey to unveil the secrets of sending money from Canada to India with the best rates, thanks to the magic of "remitanalyst."

Send Money from Canada to India

Transferring money internationally can be a bit like trying to navigate a maze in the dark. It's all too easy to get lost in a web of hidden fees and fluctuating exchange rates. But hold on, because remitanalyst is here to be your guiding light.

The Currency Conundrum

When sending money from Canada to India, one of the biggest concerns is the currency exchange rate. You see, currencies are a bit like stocks – they go up and down. This constant flux can either work for you or against you, depending on when you exchange your money.

So, how do you get the best bang for your buck? Remitanalyst has your back. This platform is like a skilled surfer, riding the waves of currency fluctuations to find you the perfect time to send your money.

The Remitanalyst Advantage

Now, you might be wondering, "What makes remitanalyst so special?" Well, think of it as your financial GPS, always navigating you toward the best exchange rates. It scans multiple banks, financial institutions, and online money transfer services to give you real-time comparisons. It's like having a personal shopper for your money transfers.

The Magic of Comparative Analysis

At the heart of remitanalyst is its power to provide a comprehensive comparison of exchange rates from various sources. It's like having a team of experts sift through heaps of data to find the golden nugget. You can see how each service stacks up against the others, instantly identifying the best rates and saving your precious dollars.

But it's not just about the rates – it's also about transparency. Remitanalyst exposes any hidden fees and provides a clear breakdown of the total cost, so you're never caught off guard.

Your Money, Your Choice

One size does not fit all when it comes to sending money to India. You might prioritize speed, others might focus on low fees, and some are all about maximizing the exchange rate. With remitanalyst, you get to choose. You can customize your transfer based on what matters most to you.

Want your money to reach your loved ones in India ASAP? Remitanalyst can show you the fastest options. Need to pinch every penny? It'll compare the fees to help you save. The power is in your hands.

The Ease of the Transaction

Sending money shouldn't be rocket science. With remitanalyst, the process is as easy as ordering your favorite takeout. You can do it from the comfort of your home, sipping a cup of chai. Just a few clicks, and your money is on its way.

And don't worry about the security of your hard-earned cash. Remitanalyst only partners with reputable institutions, ensuring that your money is in safe hands. It's like having a fortress protecting your funds.

Real Savings, Real Impact

Let's put this in perspective. Imagine you're sending money regularly to your family in India. Over time, those small differences in exchange rates and fees can add up to significant savings. With remitanalyst, you're not just saving money; you're sending more love, more gifts, more support to your dear ones.

The Hidden Costs

Hidden fees are the uninvited guests at the money transfer party. They sneak up on you and leave you feeling like you've been shortchanged. But here's the kicker: remitanalyst exposes these sneaky fees and shows you the real cost of your transfer.

When you compare exchange rates and fees side by side, you'll have a crystal-clear picture of where your money is going. No surprises, no regrets. It's all about empowering you to make the best choice.

Convenience at Your Fingertips

Convenience is the name of the game with remitanalyst. You don't need to be a financial expert or spend hours researching the best rates. This platform does the heavy lifting for you, leaving you with more time for things that truly matter.

It's like having a personal assistant who takes care of all the money transfer hassles while you focus on what's important in your life.

Trust in Transparency

Trust is the foundation of any financial transaction. Remitanalyst believes in transparency. When you use this platform, you're not dealing with shady operators or unverified services. You're getting a crystal-clear view of your options, and you decide which one to choose.

It's like looking through a glass window, knowing exactly what's on the other side. With remitanalyst, there are no secrets.

The Final Verdict

So, if you're in Canada and looking to send money to India, don't let the confusing world of exchange rates and hidden fees boggle your mind. Remitanalyst is your beacon of clarity in this sea of perplexity. It's your ticket to making informed, money-saving choices.

The best part? It's not just about sending money; it's about the impact you can create. With remitanalyst, you're not just transferring funds; you're sending a piece of your heart, bridging the distance between Canada and India.

In Conclusion

Sending money from Canada to India doesn't have to be a perplexing puzzle. Remitanalyst simplifies the process, offering you the best exchange rates, unmatched transparency, and the power to choose what matters most to you. So, don't let your money disappear into the abyss of hidden fees and unfavorable rates. Choose remitanalyst and make your money transfer a breeze.

With remitanalyst, you're not just sending money; you're sending love and support, one dollar at a time. It's time to make your money work for you and those you care about most. Choose the best, choose remitanalyst, and unlock the secret to sending money from Canada to India with confidence and clarity.

#canada to india#send money from canada to india#best exchange rate comparison for sending money#remitanalyst

0 notes

Text

Get the Best Current Exchange Rate to Transfer Money from CANADA to INDIA with RemitAnalyst

Introduction: Are you looking to send money to India from Canada? Finding the best exchange rate can save you a significant amount of money. Look no further! RemitAnalyst offers a reliable and efficient way to compare exchange rates and send money to your loved ones in India. In this blog submission, we'll explore how RemitAnalyst can help you save more on your CAD to INR transfers.

Understanding the Importance of Exchange Rates: Before you initiate a money transfer, it's crucial to comprehend the significance of exchange rates. The exchange rate determines how much Indian Rupees (INR) you'll receive for each Canadian Dollar (CAD) you send. Even a small difference in the exchange rate can make a substantial impact on the final amount received by the recipient.

RemitAnalyst - Your Trusted Money Transfer Partner: RemitAnalyst is a reliable platform that allows you to compare the exchange rates offered by various financial institutions and money transfer services. With RemitAnalyst, you can be sure of getting the best rates in the market, ensuring that you save more on your transactions.

The Process - How RemitAnalyst Works:

Using RemitAnalyst is simple and straightforward. Here's a step-by-step guide on how to make the most of this platform:

Visit RemitAnalyst's website: Head to RemitAnalyst's user-friendly website, accessible from any device.

Enter Transfer Details: Input the amount of CAD you wish to transfer and select India (INR) as the receiving currency.

Compare Exchange Rates: RemitAnalyst will provide a list of different exchange rates from various providers. You can easily compare the rates and choose the most favorable one.

Choose Your Preferred Service: Once you've found the best exchange rate, select the money transfer service or financial institution you wish to use.

Initiate the Transfer: Follow the simple on-screen instructions to initiate the transfer securely.

Benefits of Using RemitAnalyst:

RemitAnalyst offers numerous advantages that make it the preferred choice for transferring money from Canada to India:

Real-Time Exchange Rates: Get access to real-time exchange rates, ensuring you always get the most current rates.

Cost-Effective: Save money on transfer fees and exchange rate margins by choosing the best available option.

Secure Transactions: RemitAnalyst partners only with trusted and reputable financial institutions, ensuring the safety of your funds.

Convenient: Easily accessible through their website, making it convenient to use from the comfort of your home or on the go.

Conclusion: Sending money to India from Canada doesn't have to be a costly affair. With RemitAnalyst, you can compare and find the best exchange rates, ensuring that you save more on your transfers. Take advantage of this reliable platform and experience a hassle-free and cost-effective money transfer process. Compare to save more with RemitAnalyst today!

#Send money to India from Canada#Money transfer from Canada to India#Best exchange rate CAD to INR#Compare exchange rates

0 notes

Text

Send Money to Canada from India | Money Transfer to Canada

Easily Send Money to Canada from India with our international money transfer service. Send money hassle-free to your loved ones with secured way.

0 notes

Text

Send Money from India to Canada: The Smart Way to Transfer Money

Get The Best Rate For Sending Money From India To Canada DCB Remit offers superior, competitive exchange rates to send money internationally. Simply register on the DCB Remit portal to get the best exchange rates with no hidden charges or transfer fees.Main Reasons To Send Money From India To Canada. Some of the common purposes for international fund transfer are: Overseas Education, Maintenance Of Close Relative Abroad, Gifting, Medical Treatment Abroad, Visa Fees, Business Travels, Private Visits. All of these are permissible via DCB Remit's portal, so you can transfer funds to Canada stress-free.

#Send Money from India to Canada#Transfer Money from India to Canada#india remit#Money Transfer Remit

0 notes

Text

Payments Startup Flutterwave Partners IndusInd Bank to Expand Into India

African payments startup Flutterwave is reportedly expanding into the Indian market through a partnership with IndusInd Bank.

This move makes Flutterwave the first African company to scale up remittances from India to Africa, streamlining the process for users, Bloomberg reported Friday (Sept. 8), citing an interview with Flutterwave Co-founder and CEO Olugbenga Agboola.

Reached for comment by PYMNTS, a Flutterwave spokesperson said the company is building a “quick and secure” remittance corridor from the U.K. to India via a partnership with IndusInd Bank and is planning to build one from Africa to India in the future.

IndusInd Bank, a leading financial institution in India, serves approximately 35 million customers across the country, including individuals, large corporations and government entities, according to the report.

Flutterwave has experienced rapid growth since its establishment in 2016 and currently operates in about 30 African countries, the report said. A January 2022 funding round valued the company at $3 billion.

The company has attracted significant investments from venture capital firms like Tiger Global Management and formed partnerships with notable companies such as Alibaba’s Alipay, Uber Technologies and Netflix, per the report. A recent agreement with French company Capgemini also bolstered Flutterwave’s engineering infrastructure.

Agboola told Bloomberg that Flutterwave is a partnership-driven organization and looks forward to collaborating with more bank partners in India.

In another recent development, the company announced Aug. 1 that it has extended its remittance solution to the United States and Canada, enabling money transfers from those countries to Africa. That expansion brought to 34 the number of countries around the world in which the Send App can be used to send and receive money.

A month earlier, in July, Flutterwave launched a product to help African users conveniently pay fees to educational institutions both within Africa and overseas by using their local currencies. This payment product, Tuition, is designed to be used by students, parents, guardians and sponsors, providing them with a payment solution that safe, reliable, affordable and seamless.

In a third recent expansion of its services, the company partnered with Token.io to begin offering pay-by-bank transfers, “making it even faster and easier for individuals and businesses to pay and receive money.”

Flutterwave said at the time that this pay by bank, or account-to-account (A2A) payments, offering lets users quickly and securely move money between accounts, without registration or error-prone data entry.

#flutterwave#flutterwaveceo#payments#olugbengaagboola#paymentsprocesssing#africa#finance#fintech#technology

1 note

·

View note

Text

My vlog for herbs medical call ayurveda treatment but some company for sale used chemical in medical and write 90% Natural Don't use for this type supplements in this type medical add used artificial items becoz they now many person are did not share sex problem with colic and he also sold supplements for little problem . Who don't have knowledge about chemical he eat supplements short time result with more side effects. One doctor suggested a boy last name Singh age 15year for viagura and multivitamin. Boy have little problem of discharge . Boy was lose our one kidney side effects of high portin kartina and after boy called me and asking about kidney problem first i will send 100% natural ayurveda body detox without any blood test see old report i will said after one month send me your report and send u medicine for after he ask more medicine kidney i said for quick discharge (DHT) boy said I never tell u about that problem. I saw him old blood report find but some one cheat your organsThen I said with proudly my lord shiva when give us formula for make and chose herbs. Lord shiva take promise 🙏 our family don't go with onlemoney,also reach and out the illness of patients.health is wealth . When When our all Hindus faimly make medicine with name of lord shiva. It's helped more people for thousand years. Our medical formula is used by kings,solders of kings, people of kings when science not thik about hospital or no one m.b.b.s doctor. Please don't use allopathy treatment in small problem ill with cold,fever,cough,nightdisorders kitchen ingredients spices,lattles. make recipe with hand without chemical with ur God name from heart ❤️ 💙 you are all my #brother #women please share if u have any problem.if any one no more money only pay courier charges when u realized u feeling good send after with ur with hearts how many sends u I will happy because pattien is our lord. Take care and pls follow next time main main kitchen ingredient and spices one by one share all of my tumbir army with benefits,making of formula, uses which problem OK 👍 namaste, Salam Mallika, prays a lord, satshri akal #Goodday #solarelu #USA #Canada #italy #UK #

#solar eclipse#india#ayurveda treatment#Canada#canada#usa#news#ontario#united states#canada work permit#canada visa#austerity#austenedit#kate austen#jane austen#austenland#writers on tumblr#yo#youtube#thank you#young royals#new york#i love you#argentina#myself#chile#amor

12K notes

·

View notes