#semiconductor equipment manufacturers

Explore tagged Tumblr posts

Link

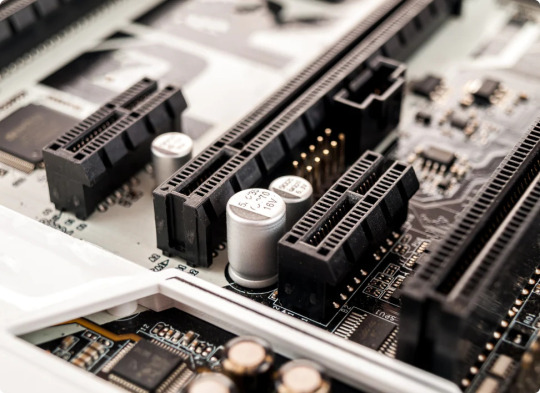

Semiconductor Equipment manufacturers like A-Gas create solutions to cutting-edge technology challenges that are essential for advancing a variety of market drivers through close customer collaboration. A-Gas collaborate with clients to design or install materials that specifically address their requirements in terms of technical performance and cost-of-ownership enhancements. Connect with A-Gas today to learn more about the current trends and the future of Semiconductor Equipment.

#Semiconductor Equipment#Semiconductor#Semiconductor Equipment manufacturers#Semiconductor manufacturers#AGAS

0 notes

Text

Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Etching, CMP, Deposition, Wafer Cleaning, Assembly & Packaging, Dicing, Bonding, Metrology, Wafer/IC Testing, Logic, Memory, MPU, Discrete - Global Forecast to 2029

0 notes

Text

Latest US clampdown on China's chips hits semiconductor toolmakers

#US#China#AI Chips#The Biden administration a#chip-manufacturing equipment#software#Huawei#ByteDance#News#semiconductor toolmakers

0 notes

Text

The Evolution and Growth Trajectory of Semiconductor Manufacturing Equipment Market Dynamics

The semiconductor manufacturing equipment market is projected to reach USD 149.8 billion by 2028 from USD 91.2 billion in 2023, at a CAGR of 10.4% from 2023 to 2028.

Need for semiconductor parts in electric and hybrid vehicles and wide adoption of 5G technology are some of the major factors driving the market growth globally.

Tokyo Electron Limited (Japan); Lam Research Corporation (US); ASML (Netherlands); Applied Materials, Inc. (US); KLA Corporation (US); SCREEN Holdings Co., Ltd. (Japan); Teradyne, Inc. (US); Advantest Corporation (Japan); Hitachi, Ltd. (Japan); Plasma-Therm (US).

Download PDF Copy: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Driver: Adoption of 5G technology and IoT increases demand for advanced semiconductors in US 5G technology has been pushing the boundaries of wireless communications, enabling use cases that rely on ultra-fast speeds, low latency, and high reliability. The necessity of higher data rates, better coverage, greater spectral efficiency demands 5G network infrastructure development. According to the Global System for Mobile Communications Association (GSMA), the number of 5G connections in North America is expected to reach 272 million by 2025. 5G-enabled smartphones play a crucial role in raising the demand for advanced semiconductors. According to GSMA, the 5G smartphone adoption would witness an increase from 82% in 2021 to 85% by 2025 in North America. In this, the US 5G smartphone market will reach 118.1 million units shipped in 2022, up by 27.3% from the 92.8 million units shipped in 2021.

Restraint: Complexity of patterns and functional defects in semiconductor chips A cleanroom and clean equipment is essential for the fabrication of semiconductors. Tiny dust particles can hinder the overall semiconductor manufacturing setup. As a result, the owner plant owner had to face a substantial financial loss. The reduced size and increased density of semiconductor chips have resulted in the complexity of wafers, which decreases lithography wavelength. Moreover, the reduction in node size makes photomasks and wafers more complex, resulting in the need for new semiconductor manufacturing equipment. All these factors inhibit the growth of the semiconductor manufacturing equipment industry.

Opportunity: Shortage of semiconductors leading to development of new manufacturing facilities Semiconductors are critical components that power all kinds of electronics. Their production involves a complex network of firms that design the chips, companies that manufacture them as well as those that supply the required technologies, materials, and machinery. As the worldwide semiconductor crisis continues to disrupt supply chains and create widespread uncertainty in the automotive and consumer electronics sectors, some manufacturers have announced their expansion plans.

Challenge: Lack of skilled workfoce worldwide The semiconductor manufacturing challenges persist after the completion of semiconductor facilities. One such challenge is the lack of a skilled workforce. The production of semiconductor chips necessitates specialized expertise; it requires professionals with the knowledge and skills to transform raw materials into finished goods utilizing specialized equipment, such as CNC machines. The global talent gap in the semiconductor industry is a widespread concern, as major semiconductor hubs are facing shortages of qualified personnel in varying degrees. According to the Workforce Development Survey, among 95% of the overall graduates, hiring engineering professionals for critical fields in the semiconductor industry proved to be highly challenging.

0 notes

Text

The Growing Demand of Semiconductor Equipment Driving Innovation

Semiconductors: Enabling Modern Technologies Semiconductors are one of the most important components of modern electronics. They are the building blocks of technologies such as smartphones, computers, vehicles, appliances and more. As technologies become more advanced and integrated into our daily lives, the demand for semiconductors keeps rising exponentially. This growing demand is driving constant innovation in Semiconductor Device which is essential for manufacturing these tiny yet powerful components.

Semiconductor Equipment fabrication requires sophisticated manufacturing processes and precise equipment. Semiconductor Device manufacturers are continuously working to develop more advanced tools that can produce smaller, more powerful and energy-efficient semiconductors. Some of the key equipment types and technologies enabling advances in semiconductor manufacturing are discussed below.

Lithography Systems: Enabling Smaller Circuit Designs Lithography systems are used to transfer electronic circuit patterns onto silicon wafers during the semiconductor fabrication process. As circuits continue to shrink in size to accommodate more transistors in a tiny space, lithography technology needs to keep pace. The mainstream lithography technology currently used is extreme ultraviolet (EUV) lithography which uses short wavelength EUV light to print ever smaller microscopic circuits.

EUV lithography allows semiconductor manufacturers to print minimum features less than 10 nanometers across. Equipment manufacturers are ramping up EUV lithography machine manufacturing to support the transition to this advanced technology needed for the latest and future generations of semiconductors. Several companies are also developing next-generation lithography technologies like nanoimprint lithography and electron-beam lithography to take circuit scaling even further below 10nm.

Deposition Equipment: Laying Down Thin Film Layers Semiconductor manufacturing involves depositing extremely thin layers of various materials like silicon, insulators, polymers or metals onto silicon wafers through deposition processes. Chemical vapor deposition (CVD) and physical vapor deposition (PVD) are commonly used deposition techniques in the industry.

Semiconductor Equipment manufacturers are continuously optimizing deposition systems to achieve ultra-thin yet highly uniform film layers. They are building systems that offer superior step coverage to deposit films of various materials into narrow trenches and holes on complex 3D circuit designs. Advanced deposition technologies like atomic layer deposition (ALD) that allows conformal deposition one atomic layer at a time is also gaining traction for manufacturing next-generation semiconductors.

Etch Systems: Sculpting Circuit Patterns Etch systems play a vital role in semiconductor manufacturing by selectively "removing" excess deposited material to reveal the desired circuit patterns on wafers. Different etch techniques like wet etching, plasma etch and reactive ion etching are used.

As circuit features shrink to nanometer scales, etch equipment must sculpt intricate 3D structures with atomic-level precision and uniformity. Chipmakers are adopting sophisticated plasma etch systems equipped with novel process chemistries, variable frequency plasma sources and endpoint detection tools for higher resolution and selectivity. Equipment vendors are engineering etch systems optimized for materials like metals, dielectrics and compound semiconductors to enable the complex multilayered architectures of tomorrow's advanced chips.

Wafer Inspection and Metrology Tools Enabling Quality Control Error-free manufacturing of sub-10nm semiconductor structures requires comprehensive quality control. Metrology and inspection tools analyze fabricated wafers throughout the process to detect defects or quantify if critical dimensions meet tight specifications.

As circuitry becomes smaller, inspection systems equipped with powerful optics, imaging techniques and sensors down to angstrom resolutions are essential. Metrology tools employ techniques like scatterometry, medium-energy ion scattering etc to non-destructively characterize tiny structures and film layers. Automated defect inspection tools scanning whole wafer surfaces help reduce costly reworks. These enabling tools will continue scaling capabilities in lock-step with chip architectures.

Meeting the Cleanroom Challenges of Advanced Node Fabrication Another challenge is managing the contamination control, temperature, humidity and airflows needed for fabricating ever smaller circuits in tightly controlled cleanroom environments. Equipment vendors provide solutions like mini- and macro-environments, advanced filter technologies along with real-time environmental monitoring systems. This helps manufacturers achieve the stringent international cleanroom specifications required at under 10nm process nodes.

Role of Semiconductor Device in Innovation Innovations happening at the level of Semiconductor Equipment underpin ongoing progress in chip technology and the transformation of daily technology products. Continuous advancements are essential to produce smaller, more powerful semiconductors powering capabilities like artificial intelligence, augmented reality and autonomous systems. Rapidly evolving equipment solutions from lithography to metrology demonstrate the collaborative innovation between chipmakers and equipment vendors necessary to sustain Moore's Law scaling. This ensures semiconductors remain a driver for breakthrough technologies of the future. Get More Insights On, Semiconductor Equipment About Author: Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Semiconductor Manufacturing#Wafer Fabrication#Cleanroom Technology#Packaging and Assembly#Lithography Equipment

0 notes

Text

SECS/GEM on Canon MPA 600 Super Aligner Through the EIGEMBox

In the dynamic world of semiconductor manufacturing, ensuring that legacy equipment can keep up with modern communication standards is essential for maintaining productivity and efficiency. The Canon MPA 600 Super Aligner, a widely used piece of equipment in semiconductor fabs, often lacks the native SECS/GEM capabilities required for seamless integration into contemporary manufacturing systems. Enter EIGEMBox, a patented, plug-and-play solution that brings SECS/GEM compliance to legacy equipment without the need for extensive hardware or software installations.

In this blog, we will explore the benefits of using EIGEMBox to enable SECS/GEM on the Canon MPA 600 Super Aligner and how this can revolutionize your manufacturing process.

What is SECS/GEM?

SECS/GEM (SEMI Equipment Communications Standard/Generic Equipment Model) is a set of protocols developed by SEMI (Semiconductor Equipment and Materials International) to standardize communication between semiconductor manufacturing equipment and host systems. These protocols are critical for enabling automation, real-time data collection, and equipment control, which are essential for the efficiency and productivity of modern semiconductor fabs.

The Importance of SECS/GEM Compliance SECS/GEM compliance offers several significant benefits for semiconductor manufacturing: Automation: SECS/GEM protocols enable the automation of equipment operations, reducing the need for manual intervention and minimizing the risk of human error. This leads to higher throughput and more consistent production quality.

Data Collection and Analysis: SECS/GEM allows for real-time data collection from equipment, which can be analyzed to monitor performance, optimize processes, and predict maintenance needs. This data-driven approach helps in making informed decisions that improve overall efficiency.

Equipment Control: With SECS/GEM, equipment can be controlled remotely by the host system, allowing for better coordination and scheduling of manufacturing tasks. This ensures optimal utilization of resources and reduces downtime.

Interoperability: SECS/GEM provides a standardized communication framework, ensuring that equipment from different vendors can work together seamlessly. This interoperability is crucial for maintaining a cohesive and efficient manufacturing environment.

Challenges with Legacy Equipment

While SECS/GEM offers numerous advantages, many legacy equipment like the Canon MPA 600 Super Aligner lack native SECS/GEM capabilities. Upgrading these machines to meet modern standards can be a complex and costly process, often requiring significant hardware and software modifications. This is where EIGEMBox comes into play.

Introducing EIGEMBox

EIGEMBox is an innovative, patented solution designed to bring SECS/GEM capabilities to legacy equipment without the need for additional hardware or software installations. This plug-and-play device makes it easy to upgrade older machines, ensuring they can communicate effectively with modern control systems and integrate seamlessly into automated manufacturing environments.

Key Features of EIGEMBox

Plug-and-Play Convenience: EIGEMBox is designed for easy installation and operation. Simply connect the device to your legacy equipment, and it starts working immediately, without the need for extensive configuration or setup.

No Hardware or Software Installation Required: Unlike traditional SECS/GEM integration solutions that often require complex hardware and software installations, EIGEMBox eliminates these hassles. This makes it a cost-effective and time-saving solution for upgrading your equipment.

Patented Technology: EIGEMBox utilizes patented technology to ensure reliable and efficient communication between your legacy equipment and modern control systems. This guarantees seamless integration and improved operational efficiency.

Enhanced Data Exchange: With EIGEMBox, your legacy equipment can exchange data in real-time with control systems, enabling better monitoring, analysis, and optimization of manufacturing processes.

Benefits of Using EIGEMBox with Canon MPA 600 Super Aligner

Upgrading the Canon MPA 600 Super Aligner with EIGEMBox offers several significant benefits:

Extended Equipment Life: By enabling SECS/GEM compliance, EIGEMBox extends the operational life of the Canon MPA 600 Super Aligner, allowing you to maximize your investment in this equipment.

Improved Efficiency: Enhanced communication and control capabilities lead to better coordination of manufacturing tasks, increased throughput, and reduced downtime. This results in the overall improved efficiency of your manufacturing process.

Cost Savings: EIGEMBox eliminates the need for costly hardware and software upgrades, providing a more affordable solution for integrating SECS/GEM protocols into your manufacturing processes.

Seamless Integration: EIGEMBox ensures that your Canon MPA 600 Super Aligner can communicate effectively with modern control systems, enabling a smoother and more efficient manufacturing operation.

Case Study: Successful Integration of EIGEMBox with Canon MPA 600 Super Aligner

One of our clients, a leading semiconductor manufacturer, faced challenges in integrating SECS/GEM protocols into their Canon MPA 600 Super Aligner. After implementing EIGEMBox, they experienced a significant improvement in production efficiency. The plug-and-play nature of EIGEMBox allowed for a quick and hassle-free integration process, resulting in a 20% increase in equipment utilization and a 15% reduction in downtime. The client was able to extend the life of their existing equipment while achieving substantial cost savings. How to Get Started with EIGEMBox Ready to revolutionize your semiconductor manufacturing processes with EIGEMBox? Here’s how you can get started:

Contact Us: Reach out to our team for a consultation. We’ll assess your current equipment and provide tailored recommendations for integrating EIGEMBox into your manufacturing environment.

Easy Installation: Once you’ve decided to move forward, our team will guide you through the simple installation process. No need for extensive configuration or setup – just plug it in and start reaping the benefits.

Ongoing Support: Our commitment to your success doesn’t end with installation. We offer comprehensive support to ensure that your EIGEMBox operates seamlessly and delivers the desired improvements in efficiency and productivity.

Contact Us Today! Don’t let outdated equipment hold back your semiconductor manufacturing operations. With EIGEMBox, you can achieve modern communication and control capabilities without the need for costly hardware or software installations. Contact us today to learn more about how EIGEMBox can transform your Canon MPA 600 Super Aligner and drive your manufacturing processes forward.

#SECS/GEM integration#Canon MPA 600 Super Aligner#EIGEMBox#semiconductor manufacturing#legacy equipment upgrade#plug-and-play SECS/GEM#SECS/GEM compliance#semiconductor automation#factory automation#SECS/GEM protocol#SECS/GEM communication#equipment control systems#real-time data collection#manufacturing process optimization#cost-effective SECS/GEM solution#improve production efficiency#legacy equipment SECS/GEM#EIGEMBox installation#semiconductor industry standards#SECS/GEM host simulation#reduce equipment downtime

0 notes

Text

The market for semiconductor manufacturing equipment was estimated to be worth USD 91.20 billion in 2023 and is projected to grow at a compound annual growth rate of 10.4% to reach USD 182.30 billion by 2030.

0 notes

Text

Load Port Module: The Essential Link Between Wafer Transport System and Process Tool

A Load Port Module serves as the interface between a wafer transport system and a semiconductor process tool such as an etcher or deposition system. It facilitates the safe and ultra-clean transfer of wafers from cassettes stored in the transport system into the vacuum environment of the process chamber for semiconductor fabrication steps. Let's take a closer look at the key components and functions of this critical module. Wafer Cassette Access The front end of a loadlock in Load Port Module includes a cassette-loading station where standard 25mm wafer cassettes containing up to 25 wafers can be automatically loaded and unloaded. A robotic handler on the transport system sets the cassette into place and latches it securely. An environmentally sealed door then closes to maintain isolation of the cleanroom air from the vacuum system. Sensor inputs confirming cassette presence and door closure status are relayed to the process tool's control system. Vacuum-Compatible Design Since wafers must be transferred between the atmospheric cassette environment and high-vacuum process chambers, a Load Port Module needs vacuum-compatible construction. Chambers, bellows sections, and sealing joints are machined from non-outgassing stainless steel or aluminum alloys certified for ultra-high vacuum contact. Viton O-rings, metal gaskets, and precision actuators enable dependable closure and integrity testing of all interfaces down to vacuum pressures below 1x10^-7 Torr. Wafer Transfer Mechanisms Various transfer mechanisms are incorporated into load port designs depending on the specific process tool interface. Common configurations include a linear motor-driven blade that reaches into the cassette to pick wafers one at a time or a robotic arm capable of lifting an entire shelf of wafers simultaneously. Cameras and light sources aid alignment while sensors confirm contact and monitor for particles during extraction and placement into the loadlock chamber. Loadlock Chamber Contained within the load port housing is a small, sealable loadlock chamber where wafers can be coated or undergo vacuum bake-out procedures before entering the process chamber. Magnetic or mechanical end effectors gently grip wafers during transfer to stationary wafer pedestals inside the chamber. A turbo pump then evacuates air from the chamber to prepare for opening the valve to the process tool. Closing this valve isolates the loadlock to allow venting back to atmospheric pressure for wafer removal. Chemical Delivery Ports Some advanced load port designs accommodate ports for purge gas, chemical, or vapor delivery into the loadlock chamber or direct wafer surfaces. This enables pre-etch surface treatment, post-process cleaning, or thin film deposition capabilities directly on the wafers without needing to move them to a dedicated tool. Integrated mass flow controllers ensure precise chemical dosing and vacuum-safe plumbing routes all lines to the chamber.

Get More Insights On This Topic: Load Port Module

#Load Port Module#Semiconductor Industry#Manufacturing#Automation#Material Handling#Robotics#Semiconductor Equipment#Integrated Systems#Industrial Technology#Port Logistics#Container Handling

0 notes

Text

Trusted Source for Quality Semconductor Spare Parts

Discover reliable Semiconductor Spare Store parts at your fingertips. Explore our extensive inventory, ensuring precision and quality for your semiconductor equipment needs. Your trusted source for top-notch solutions.

#Semiconductor equipment company#Semiconductor Manufacturing Equipment#High quality spare parts#Quality car parts online

1 note

·

View note

Text

Semiconductor Manufacturing Equipment Market Surges: A Comprehensive Analysis of the $105.1 Billion Landscape in 2024

The global semiconductor manufacturing equipment market is estimated to be US$ 96.7 billion in 2022 and is expected to reach US$ 105.1 billion by 2023. The global market is predicted to grow at a rate of 7.7% from 2023 to 2033, making it a beneficial investment.

By 2033, it is projected to reach a valuation of US$ 220 billion. This growth is due to the increasing demand for semiconductor manufacturing equipment components, driven by the increase in electronics, automotive, and data processing industries.

Request a Sample Copy of the Semiconductor Manufacturing Equipment Market Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-18089

Semiconductor manufacturing equipment is a vital component of the semiconductor industry, covering chip design, wafer manufacturing, packaging, and testing. It is the driving force behind the development of the semiconductor industry, which produces small electronic devices made from semiconductors such as silicon, germanium, or gallium arsenide compounds. The rapid advancement in manufacturing and increasing acceptance of connected devices among consumers.

The consequent increase in fabrication facilities and the expanding usage of semiconductors in EV manufacturing.

Growing adoption of 5G technology and the rising acceptance of autonomous vehicles.

The worldwide digitalization and the advanced use of electronic devices like laptops, smartphones, and televisions have increased demand for semiconductor manufacturing equipment, particularly in emerging economies. The use of silicon wafers has also improved. Despite contributing significantly to global market growth, budgetary and geopolitical constraints may impact the overall growth rate of the semiconductor manufacturing equipment industry.

Asia Pacific is expected to register the highest CAGR during the forecast period due to the presence of rapidly developing economies, the rising demand for semiconductor manufacturing equipment, the presence of major players in Japan, Taiwan, and China, the increasing need for high-quality processing equipment for semi-conductive materials, and growing government initiatives to support semiconductor industries.

The pandemic has caused supply chain disruptions that may limit the market’s growth to a certain extent. Furthermore, creating user-friendly and easy-to-integrate designs is a challenge for market expansion. Nonetheless, government initiatives to promote the semiconductor industry and the growing use of connected devices in home automation are expected to provide substantial opportunities for market development.

“Rapid growth in automotive and industrial electronics and the proliferation of IoT devices is accelerating the market. Room for the advancement in manufacturing integrated silicon chips for consumer electronics and automobiles is catching the eyes of manufacturers and business leaders.” –opines Sudip Saha, managing director at Future Market Insights (FMI) analyst.

Key Takeaways from the Semiconductor Manufacturing Equipment Market

The global semiconductor manufacturing equipment market is estimated to register a CAGR of 7.7% with a valuation of US$ 220 billion by 2033.

The market captured a CAGR of 9.2% in the historical period between 2018 and 2022.

South Korea is anticipated to dominate the global market by registering a 9.8% CAGR during the forecast period.

With an 8.9% CAGR, the United Kingdom is driving the global market by 2033.

Japan is anticipated to secure a CAGR of 8.8% in the global market during the forecast period.

Key Strategies:

Innovation in electronic devices, automation, and automobiles is attracting manufacturers and industry experts. Over the last few decades, the semiconductor industry has made significant progress, creating smaller, faster, and more reliable devices that have replaced the bulky and hefty vacuum tube technology of the past. Moreover, companies rely on their research and development skills, new materials and techniques, and supply chain management to maintain a competitive advantage.

Recent Developments in the Semiconductor Manufacturing Equipment Market

In 2023, Lam Research India plans to invest US$ 25 million with a US$ 3 million government incentive.

In March 2023, SCREEN PE Solutions Co., Ltd. launched Ledia 7F-L, a direct imaging system designed for high-precision pattern formation on large-sized substrates and metal masks, particularly for telecom and IoT infrastructure.

Leading Key Companies:

Applied Materials Inc.

Lam Research Corporation

KLA Corporation

ASML

Tokyo Electron Limited

Advantest Corporation

SCREEN Holdings Co., Ltd.

Teradyne, Inc.

Hitachi, Ltd.

Plasma-Therm

Seize this Opportunity: Buy Now for a Thorough Report! https://www.futuremarketinsights.com/checkout/18089

Semiconductor Manufacturing Equipment Market Segmentation:

By Equipment Type:

Front-end Equipment

Silicon Wafer Manufacturing

Wafer Processing Equipment

Back-end Equipment

Testing Equipment

Assembling & Packaging Equipment

By Dimension:

2D

2.5D

3D

By Application:

Semiconductor Fabrication Plant/Foundry

Semiconductor Electronics Manufacturing

Test Home

By Region:

North America

Europe

Asia Pacific

Latin America

The Middle East & Africa

0 notes

Text

Semiconductor Manufacturing Equipment Market by Lithography, Wafer Surface Conditioning, Etching, CMP, Deposition, Wafer Cleaning, Assembly & Packaging, Dicing, Bonding, Metrology, Wafer/IC Testing, Logic, Memory, MPU, Discrete - Global Forecast to 2029

0 notes

Text

0 notes

Text

Recent Innovations and Trends in Semiconductor Manufacturing Equipment

The semiconductor industry is continuously evolving, driven by technological advancements and innovations in semiconductor manufacturing equipment. This research article explores the latest trends and innovations in semiconductor manufacturing equipment, supported by qualitative and quantitative data analysis.

Market Size: The semiconductor manufacturing equipment market has witnessed significant growth in recent years, fueled by the increasing demand for semiconductor chips across various industries such as consumer electronics, automotive, and telecommunications. According to recent market reports, the global semiconductor manufacturing equipment market was valued at approximately USD 91.2 billion in 2023. Projections indicate robust growth, with the market of semiconductor manufacturing equipment to reach USD 149.8 billion by 2028, representing a CAGR of 10.4% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Market Trends: Advanced Process Technologies: The semiconductor industry is transitioning towards advanced process nodes such as 7nm, 5nm, and beyond, driving the demand for cutting-edge manufacturing equipment capable of delivering higher precision and efficiency.

Lithography Innovation: Lithography remains a critical process in semiconductor manufacturing, and recent innovations in extreme ultraviolet (EUV) lithography technology have enabled manufacturers to achieve finer feature sizes and higher yields.

3D Packaging and Integration: With the increasing complexity of semiconductor devices, there is a growing trend towards 3D packaging and integration techniques. Advanced equipment for wafer bonding, through-silicon via (TSV) formation, and die stacking are essential for enabling these advanced packaging technologies.

Industry 4.0 and Smart Manufacturing: The adoption of Industry 4.0 principles and smart manufacturing solutions is revolutionizing semiconductor fabs. Equipment with integrated sensors, connectivity, and data analytics capabilities are enhancing operational efficiency, predictive maintenance, and overall productivity.

Environmental Sustainability: There is a growing emphasis on sustainability in semiconductor manufacturing, driving the development of equipment with lower energy consumption, reduced chemical usage, and improved waste management systems.

Semiconductor Manufacturing Equipment

Innovations: Next-Generation Etching Systems: Advanced etching systems with atomic layer etching (ALE) capabilities are enabling precise and uniform etching processes, essential for the fabrication of advanced semiconductor devices.

Metrology and Inspection Solutions: Innovations in metrology and inspection equipment, such as optical and scanning electron microscopes (SEM), are enhancing defect detection and process control at nanoscale resolutions.

Materials Deposition Technologies: Novel deposition techniques, including atomic layer deposition (ALD) and chemical vapor deposition (CVD), are facilitating the deposition of thin films with exceptional uniformity and conformality, crucial for advanced device manufacturing.

Robotic Automation: Robotic automation solutions are increasingly being integrated into semiconductor manufacturing equipment to improve throughput, reduce human error, and enable lights-out manufacturing operations.

AI-Enabled Process Optimization: Artificial intelligence (AI) and machine learning (ML) algorithms are being deployed to optimize semiconductor manufacturing processes, leading to improved yield, reduced cycle times, and enhanced product quality.

The semiconductor manufacturing equipment industry is undergoing rapid transformation driven by technological innovations and emerging trends. Manufacturers must embrace these advancements to stay competitive in an increasingly dynamic market landscape. By leveraging cutting-edge equipment and adopting innovative manufacturing strategies, semiconductor companies can enhance productivity, accelerate time-to-market, and drive sustainable growth in the semiconductor industry.

0 notes

Text

#United Arab Emirates Semiconductor Manufacturing Equipment Market#Market Size#Market Share#Market Trends#Market Analysis#Industry Survey#Market Demand#Top Major Key Player#Market Estimate#Market Segments#Industry Data

0 notes

Link

Semiconductor Manufacturing Equipment Market Worth $171.6 Billion by 2030

#wafer manufacturing equipment#Back-end Equipment#Front-end Equipment#Semiconductor Manufacturing Equipment#Semiconductor#Semiconductor Manufacturing#Manufacturing#Equipment

0 notes