#self assessment refund

Explore tagged Tumblr posts

Text

How To Get A HMRC Self Assessment Tax Refund

Have you ever wondered if you’re owed money from the taxman? It’s not as far-fetched as it sounds! Many people in the UK end up paying more tax than they owe and don’t even realize it. The good news is, it’s possible to claim back what you’re owed. In this friendly guide, we’ll walk you through the steps to getting a HMRC self assessment tax refund. Understanding Self Assessment and Tax…

View On WordPress

#Claim self assessment tax refund#HMRC self assessment tax refund#self assessment refund#self assessment tax refund

0 notes

Text

Understanding CIS Tax Refunds in London: A Simple Guide

Navigating the complexities of the Construction Industry Scheme (CIS) can be daunting for many contractors and subcontractors. If you work in construction and have had CIS deductions from your payments, you might be eligible for a CIS tax refund.

Visit Us: https://www.4shared.com/s/fs89B6IRxfa

0 notes

Text

#managed payroll services uk#ppc expert#seo company#website developers#ecommerce seo services#finance#business#vat refund#self-assessment tax return#tax relief specialists#As a sole trader

0 notes

Text

Entry 19: Normal Straight Jacket

Bearblr Promptober Day 19: Only One Bed

Summary: Carmy and Sydney get stuck with one hotel room on a conference in New York, and Carmy is suffering for it. (908 words)

Warnings: Swearing, chronic pain, mentions of drug use (no characters use drugs), Carmy is very self-conscious, mentions of fem reader/rando lass who is a trauma surgeon, she/her pronouns.

Notes: All journal entries will be titled as such and tagged with #cb journal.

Thank you for reading. Thank you to @carmenberzattosgf for putting together this prompt list. Sideblog for commentary and yapping: @m-z-shoroi

Also, if random letters or words are black/white instead of the colors they should be, that's Tumblr being dumb, I've been fighting it for days.

19 Oct 2024

I’m going to rethink acts of chivalry for the rest of my life.

So, Syd and I are at the conference in New York. I asked Sugar to do all the booking for our trip because (a) I don’t have time for this shit, (b) I’m going to fuck it up anyway because non-kitchen logistics are not my thing, and (c) Syd was already up to her eyeballs looking for new line cooks because we had a second fucking person disappear right at the start of service to go smoke crack in the back alley.

God's still a sadist, in case you were wondering.

Anyway, Sug did everything right. Like she got us rooms walking distance from the venue, so we didn’t have to put up with a rental car and all that shit, but the hotel fucked up our booking. They double-booked my room, they’re packed, the other person showed up 2 hours earlier than we did, so guess who doesn’t have a fucking room now?

At least they refunded us 75% of our booking for the massive inconvenience. More for Cicero.

So, we got one room. One bed, a shitty little table that rocks back and forth so bad that just interacting with it makes me want to hurl it out the window—not that it matters anyway because there’s only one chair—and a couch. Oh, and one bathroom. One shower. I lived on a houseboat in Copenhagen with the shittiest little shower you can’t even imagine to avoid this exact roommate scenario because being around other people, I swear to fuck, drives me fucking crazy.

I need to be able to get away from peoples’ eyes. There are few greater hells than being witnessed at all hours, than being scrutinized for your peculiarities and faults like you’re a lab rat being assessed for the gas chamber or some exotic breed of slug some random fucko put in a petri dish to poke with a stick. Every little weird thing I do—the incessant fiddling with objects, drumming my fingers, touching my face way too often to be remotely fucking normal, muttering to myself as I figure out something complicated, even writing in this fucking notebook—I become painfully aware of all of it. There’s this straight jacket on how to be “normal” that gets cinched around me—not of my own will. I fucking wish I could be as unapologetically myself as Fak is—and it ratchets tighter and tighter until it feels like my own skin is too tight on my body, and I need to get the fuck out of dodge. Kitchens are brutal and fast paced enough that I don’t have time to be a fucking weirdo and no one has time to pay any attention to me, but a conference? The funeral dinner at Ever (which I had to sit still for lest everyone at that table think I’m tweaking)? A fucking random fucking hotel room in fuck-off New York with Syd of all beings?

Darling, I feel a lot better around, but even now, she understands that I just need space and time to not be observed. It’s why we still don’t quite live together even though I know she wants to move in. More accurately, move me out, because those stupid fucking radiators and the idiot fucking landlord… Anyway, I’m on this dumbass couch because I’m short enough to fit on it (one point for being a short bitch, I guess) and Syd’s sound asleep because if I had to argue about who went where for one more fucking second, I might’ve bitten her head off, which would’ve set up an even more miserable day two than the one we’ll have anyway tomorrow.

She also still doesn’t know that my back is fucked up. And bringing it up now would’ve just made me seem like an asshole, or she would’ve gotten mad for not telling her sooner (which is fair, by the way. I definitely should’ve told her sooner), but we are now here and here is a couch that only looks nice. It feels like it’s full of sawdust or something. The grimy-ass floor might have more cushion to it. And the texture is this awful cheap polyester that whistles when I shift at all.

My back is killing me. Between the flight, then the first day of the conference (mostly sitting), and then this shit, it feels like I’ve got knives in it. Stretching didn’t help. And I’m not asking Syd to stand on it like Darling does. The pain does this weird thing when it gets this bad; starts to feel like a being. Like some hideous, horrible creature festering under my skin, invading my bones; a putrid blossom—maybe that corpse flower, Titan arum—that threatened to burst from my spine. When it gets this bad, I find myself touching the spot over and over again, sometimes going to the mirror and pulling up my shirt to look at my unbroken skin, to reassure myself that nothing was there. Half the time, I expected to see a scar, something visible to explain why it hurt so much, something I could point to, something that had a story I could tell. But no. It just hurts. It hurts the same way most things hurt: the usual way.

Well, if I had to pick one of us to be tired and the other to be well-rested tomorrow, I’d pick it like this.

#cb journal#bearblrpromptober#carmen berzatto#carmen berzatto fanfiction#carmy berzatto#the bear fanfiction#carmy berzatto fanfiction#carmy x reader#the bear

13 notes

·

View notes

Text

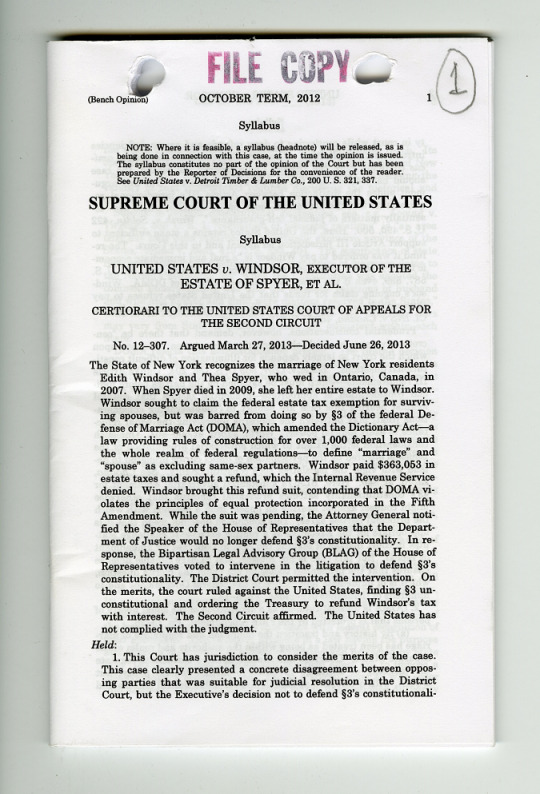

The Supreme Court ruled that the Defense of Marriage Act was unconstitutional on June 26, 2013.

In U.S. v Windsor, SCOTUS held that the federal government could not discriminate against same-sex couples.

Record Group 267: Records of the Supreme Court of the United States Series: Appellate Jurisdiction Case Files

Transcription:

[Stamped: " FILE COPY "]

(Bench Opinion) OCTOBER TERM, 2012 1 [Handwritten and circled " 1" in upper right-hand corner]

Syllabus

NOTE: Where it is feasible, a syllabus (headnote) will be released, as is

being done in connection with this case, at the time the opinion is issued.

The syllabus constitutes no part of the opinion of the Court but has been

prepared by the Reporter of Decisions for the convenience of the reader.

See United States v. Detroit Timber & Lumber Co., 200 U.S. 321, 337.

SUPREME COURT OF THE UNITED STATES

Syllabus

UNITED STATES v. WINDSOR, EXECUTOR OF THE

ESTATE OF SPYER, ET AL.

CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR

THE SECOND CIRCUIT

No. 12-307. Argued March 27, 2013---Decided June 26, 2013

The State of New York recognizes the marriage of New York residents

Edith Windsor and Thea Spyer, who wed in Ontario, Canada, in

2007. When Spyer died in 2009, she left her entire estate to Windsor.

Windsor sought to claim the federal estate tax exemption for surviv-

ing spouses, but was barred from doing so by §3 of the federal Defense

of Marriage Act (DOMA), which amended the Dictionary Act---a

law providing rules of construction for over 1,000 federal laws and

the whole realm of federal regulations-to define "marriage" and

"spouse" as excluding same-sex partners. Windsor paid $363,053 in

estate taxes and sought a refund, which the Internal Revenue Service

denied. Windsor brought this refund suit, contending that DOMA vi-

olates the principles of equal protection incorporated in the Fifth

Amendment. While the suit was pending, the Attorney General notified

the Speaker of the House of Representatives that the Department

of Justice would no longer defend §3's constitutionality. In re-

sponse, the Bipartisan Legal Advisory Group (BLAG) of the House of

Representatives voted to intervene in the litigation to defend §3's

constitutionality. The District Court permitted the intervention. On

the merits, the court ruled against the United States, finding §3 un-

constitutional and ordering the Treasury to refund Windsor's tax

with interest. The Second Circuit affirmed. The United States has

not complied with the judgment.

Held:

1. This Court has jurisdiction to consider the merits of the case.

This case clearly presented a concrete disagreement between oppos-

ing parties that was suitable for judicial resolution in the District

Court, but the Executive's decision not to defend §3's constitutionali-

[page 2]

2 UNITED STATES v. WINDSOR

Syllabus

ty in court while continuing to deny refunds and assess deficiencies

introduces a complication. Given the Government's concession, ami-

cus contends, once the District Court ordered the refund, the case

should have ended and the appeal been dismissed. But this argu-

ment elides the distinction between Article Ill's jurisdictional re-

quirements and the prudential limits on its exercise, which are "es-

sentially matters of judicial self-governance." Warth v. Seldin, 422

U. S. 490, 500. Here, the United States retains a stake sufficient to

support Article III jurisdiction on appeal and in this Court. The re-

fund it was ordered to pay Windsor is "a real and immediate econom-

ic injury," Hein v. Freedom From Religion Foundation, Inc., 551 U. S.

587, 599, even if the Executive disagrees with §3 of DOMA. Wind-

sor's ongoing claim for funds that the United States refuses to pay

thus establishes a controversy sufficient for Article III jurisdiction.

Cf. INS v. Chadha, 462 U. S. 919.

Prudential considerations, however, demand that there be "con-

crete adverseness which sharpens the presentation of issues upon

which the court so largely depends for illumination of difficult consti-

tutional questions." Baker v. Carr, 369 U. S. 186, 204. Unlike Article

III requirements---which must be satisfied by the parties before judi-

cial consideration is appropriate---prudential factors that counsel

against hearing this case are subject to "countervailing considera-

tions [that] may outweigh the concerns underlying the usual reluc-

tance to exert judicial power." Warth, supra, at 500-501. One such

consideration is the extent to which adversarial presentation of the

issues is ensured by the participation of amici curiae prepared to de-

fend with vigor the legislative act's constitutionality. See Chadha,

supra, at 940. Here, BLAG's substantial adversarial argument for

§3's constitutionality satisfies prudential concerns that otherwise

might counsel against hearing an appeal from a decision with which

the principal parties agree. This conclusion does not mean that it is

appropriate for the Executive as a routine exercise to challenge stat-

utes in court instead of making the case to Congress for amendment

or repeal. But this case is not routine, and BLAG's capable defense

ensures that the prudential issues do not cloud the merits question,

which is of immediate importance to the Federal Government and to

hundreds of thousands of persons. Pp. 5-13.

2. DOMA is unconstitutional as a deprivation of the equal liberty of

persons that is protected by the Fifth Amendment. Pp. 13--26.

(a) By history and tradition the definition and regulation of mar-

riage has been treated as being within the authority and realm of the

separate States. Congress has enacted discrete statutes to regulate

the meaning of marriage in order to further federal policy, but

DOMA, with a directive applicable to over 1,000 federal statues and

[NEW PAGE]

Cite as: 570 U.S._ (2013) 3

Syllabus

the whole realm of federal regulations, has a far greater reach. Its

operation is also directed to a class of persons that the laws of New

York, and of 11 other States, have sought to protect. Assessing the

validity of that intervention requires discussing the historical and

traditional extent of state power and authority over marriage.

Subject to certain constitutional guarantees, see, e.g., Loving v.

Virginia, 388 U.S. 1, "regulation of domestic relations" is "an area

that has long been regarded as a virtually exclusive province of the

States," Sosna v. Iowa, 419 U. S. 393, 404. The significance of state

responsibilities for the definition and regulation of marriage dates to

the Nation's beginning; for "when the Constitution was adopted the

common understanding was that the domestic relations of husband

and wife and parent and child were matters reserved to the States,"

Ohio ex rel. Popovici v. Agler, 280 U. S. 379, 383-384. Marriage laws

may vary from State to State, but they are consistent within each

State.

DOMA rejects this long-established precept. The State's decision

to give this class of persons the right to marry conferred upon them a

dignity and status of immense import. But the Federal Government

uses the state-defined class for the opposite purpose---to impose re-

strictions and disabilities. The question is whether the resulting injury

and indignity is a deprivation of an essential part of the liberty

protected by the Fifth Amendment, since what New York treats as

alike the federal law deems unlike by a law designed to injure the

same class the State seeks to protect. New York's actions were a

proper exercise of its sovereign authority. They reflect both the

community's considered perspective on the historical roots of the in-

stitution of marriage and its evolving understanding of the meaning

of equality. Pp. 13--20.

(b) By seeking to injure the very class New York seeks to protect,

DOMA violates basic due process and equal protection principles ap-

plicable to the Federal Government. The Constitution's guarantee of

equality "must at the very least mean that a bare congressional de-

sire to harm a politically unpopular group cannot" justify disparate

treatment of that group. Department of Agriculture v. Moreno, 413

U. S. 528, 534-535. DOMA cannot survive under these principles.

Its unusual deviation from the tradition of recognizing and accepting

state definitions of marriage operates to deprive same-sex couples of

the benefits and responsibilities that come with federal recognition of

their marriages. This is strong evidence of a law having the purpose

and effect of disapproval of a class recognized and protected by state

law. DOMA's avowed purpose and practical effect are to impose a

disadvantage, a separate status, and so a stigma upon all who enter

into same-sex marriages made lawful by the unquestioned authority

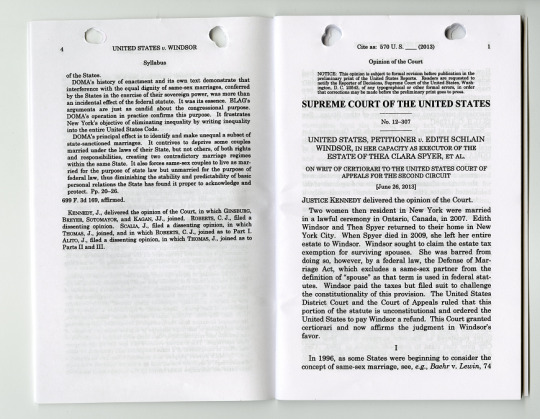

[page 3]

4 UNITED STATES v. WINDSOR

Syllabus

of the States.

DOMA's history of enactment and its own text demonstrate that

interference with the equal dignity of same-sex marriages, conferred

by the States in the exercise of their sovereign power, was more than

an incidental effect of the federal statute. It was its essence. BLAG's

arguments are just as candid about the congressional purpose.

DOMA's operation in practice confirms this purpose. It frustrates

New York's objective of eliminating inequality by writing inequality

into the entire United States Code.

DOMA's principal effect is to identify and make unequal a subset of

state-sanctioned marriages. It contrives to deprive some couples

married under the laws of their State, but not others, of both rights

and responsibilities, creating two contradictory marriage regimes

within the same State. It also forces same-sex couples to live as mar-

ried for the purpose of state law but unmarried for the purpose of

federal law, thus diminishing the stability and predictability of basic

personal relations the State has found it proper to acknowledge and

protect. Pp. 20-26.

699 F. 3d 169, affirmed.

KENNEDY, J., delivered the opinion of the Court, in which GINSBURG,

BREYER, SOTOMAYOR, and KAGAN, JJ., joined. ROBERTS, C. J., filed a

dissenting opinion. SCALIA, J., filed a dissenting opinion, in which

THOMAS, J., joined, and in which ROBERTS, C. J., joined as to Part I.

ALITO, J., filed a dissenting opinion, in which THOMAS, J., joined as to

Parts II and III.

[NEW PAGE]

Cite as: 570 U. S. _ (2013) 1

Opinion of the Court

NOTICE: This opinion is subject to formal revision before publication in the

preliminary print of the United States Reports. Readers are requested to

notify the Reporter of Decisions, Supreme Court of the United States, Washington,

D. C. 20543, of any typographical or other formal errors, in order

that corrections may be made before the preliminary print goes to press.

SUPREME COURT OF THE UNITED STATES

No. 12-307

UNITED STATES, PETITIONER v. EDITH SCHLAIN

WINDSOR, IN HER CAPACITY AS EXECUTOR OF THE

ESTATE OF THEA CLARA SPYER, ET AL.

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEALS FOR THE SECOND CIRCUIT

[June 26, 2013]

JUSTICE KENNEDY delivered the opinion of the Court.

Two women then resident in New York were married

in a lawful ceremony in Ontario, Canada, in 2007. Edith

Windsor and Thea Spyer returned to their home in New

York City. When Spyer died in 2009, she left her entire

estate to Windsor. Windsor sought to claim the estate tax

exemption for surviving spouses. She was barred from

doing so, however, by a federal law, the Defense of Mar-

riage Act, which excludes a same-sex partner from the

definition of "spouse" as that term is used in federal stat-

utes. Windsor paid the taxes but filed suit to challenge

the constitutionality of this provision. The United States

District Court and the Court of Appeals ruled that this

portion of the statute is unconstitutional and ordered the

United States to pay Windsor a refund. This Court granted

certiorari and now affirms the judgment in Windsor's

favor.

I

In 1996, as some States were beginning to consider the

concept of same-sex marriage, see, e.g., Baehr v. Lewin, 74

#archivesgov#June 26#2013#2010s#Pride#LGBTQ+#LGBTQ+ history#U.S. v Windsor#Defense of Marriage Act#same-sex marriage#Supreme Court#SCOTUS

145 notes

·

View notes

Text

Understanding Tax Refunds: JJ Tax made it easy

Handling tax refunds can seem overwhelming, but having a clear grasp of the process can make it straightforward. This newsletter aims to demystify tax refunds by covering key aspects: eligibility criteria, claiming procedures and tracking your refund status.

What is a Tax Refund?

A tax refund represents the amount returned to taxpayers who have overpaid their taxes over the fiscal year. This situation arises when the total tax deducted or paid exceeds the actual tax liability determined based on their income.

In India, tax payments are made through TDS (Tax Deducted at Source), advance tax, or self-assessment tax. When the total tax paid or deducted surpasses your tax liability as calculated in your Income Tax Return (ITR), the excess amount is refunded. This mechanism ensures taxpayers are reimbursed for any overpayments.

Who is Eligible for a Tax Refund?

Eligibility for a tax refund depends on various factors:

Excess Tax Payments If your TDS or advance tax payments exceed your tax liability, you’re eligible for a refund. This often applies to salaried employees, freelancers, and individuals with taxable investment income.

Claiming Deductions If you claim deductions under sections like 80C, 80D, etc., and these deductions lower your tax liability below the total tax paid, a refund may be due.

Filing an Income Tax Return Only those who file their Income Tax Return can claim a refund. The return must accurately reflect your income, deductions, and tax payments to establish if a refund is warranted.

Losses to Set Off If you have losses from previous years or the current year that can be carried forward and set off against current year income, you might be eligible for a refund if these losses reduce your tax liability.

Who is Not Eligible for a Tax Refund?

Certain situations or individuals may not qualify for a tax refund:

Income Below Taxable Threshold If your total income is below the taxable limit, a refund may not be applicable.

Salary Below Government Criteria Individuals earning below the minimum threshold specified by the Government of India may not qualify for a refund.

No Overpayment If your tax payments match your tax liability or you haven’t overpaid, a refund will not be available.

Non-Filers or Incorrect Filers Those who fail to file their Income Tax Return or file it incorrectly will not be eligible for a refund. Proper filing is essential for initiating the refund process.

Invalid Deductions Claims for deductions that do not meet tax regulations or lack valid documentation may result in a refund rejection.

Incorrect Bank Details If the bank account information provided in your ITR is incorrect or incomplete, the refund may not be processed.

How to Claim Your Tax Refund

Here’s a step-by-step guide to claiming your tax refund:

File Your Income Tax Return (ITR) Access the Income Tax Department’s e-filing portal. Choose the correct ITR form based on your income sources and eligibility. Accurately complete all required details, including income, deductions, and tax payments.

Verify Your ITR Verify your ITR using Aadhaar OTP, net banking, or by sending a signed ITR-V to the Centralised Processing Centre (CPC). Verification must be completed within 120 days of filing your ITR.

ITR Processing The Income Tax Department will process your return, assess your tax liability, and determine the refund amount. This process can take a few weeks to several months.

Refund Issuance After processing, the refund will be credited directly to your bank account. Ensure your bank details are accurate and up-to-date in your ITR.

Update Bank Account Details (if needed) If your bank details change after filing your ITR, promptly update them on the e-filing portal to ensure correct refund crediting.

How to Check Your ITR Refund Status for FY 2024-2025

To check your refund status, follow these steps:

Visit the Income Tax E-Filing Portal Go to the official Income Tax Department e-filing website.

Access the 'Refund Status' Section Navigate to the ‘Refund Status’ page, typically under the ‘Services’ tab or a similar heading.

Enter Required Details Input your PAN (Permanent Account Number) and the assessment year for your filed return.

Review the Status The portal will show the status of your refund, including whether it has been processed, approved, or if further action is needed.

Track Refund Processing Keep an eye on any updates or notifications from the Income Tax Department regarding your refund.

Understanding the tax refund process can simplify the experience. By following these steps and staying informed about your eligibility, you can make sure that you have a smooth process and quickly receipt of any excess tax payments. For expert guidance and personalized assistance, consult with JJ Tax. Visit our website or contact us today to get the support you need for all your tax-related queries.

JJ Tax

2 notes

·

View notes

Text

Tax code idea.

Abolish 100% of current code.

Replace it with:

20% transaction tax at point of sale for all goods and services.

A tax exemption will be created for transactions using a government issued benefits card to pay for goods or services. For example a purchase is tax exempt if made using a card containing government issued benefits such as food stamps, SSI, SSDI, Social Security, cash assistance for families with dependant children, and/or any other spendable government assistance or entitlement. This does not include government paychecks or salaries issued via a debit card.

Make a second tax category for luxury goods and services. Define luxury goods and services as any good or service that is priced at 3x the average price for the majority of similar goods and prices of the same type. For example if the average price for a wrist watch is $30 before tax a wrist watch costing $100 before tax would also be subjected to a 20% luxury item tax in addition to the original 20% transaction tax. It would cost $140 at the register/checkout.

A third tax category for super luxury items would also be created. A super luxury tax of 40% would be assessed to any good or service that cost 6x or more what the average price of a similar good or service of the same type. If wrist watches have an average price of $30 and you buy a wrist watch that costs $200 or more you'll pay an extra 40% tax in addition to the 20% transaction tax. So a $200 before tax wrist watch would cost $320 at the register/checkout.

These would be the only taxes a non business owning citizen will ever pay. No recurring taxes on items like land, homes, and cars can ever be implemented. Taxes on items themselves, like cigarettes, gasoline, and alcohol, can never be implemented. Citizens who do not own a busniess will never pay any tax except the transaction tax of 20% plus any luxury or super luxury tax applicable.

Business taxes.

Businesses must collect a 20% transaction tax for every transaction, that is not made with a benefits card, in which they are participating as the recipient of currency from a customer or client.

Transaction, luxury, and super luxury taxes must be remitted every quarter by the 15th day of the quarter following the quarter in which they are collected.

Micro businesses will be exempt from paying a business tax.

A micro business is any business that does not profit at least 5x the average annual income of a family of four.

Independent contractors and the self employed must obtain a business license and pay taxes according to their business classification based on the amount profit they generate.

A small business tax of 20% will be created for businesses that profit an amount equal to or greater than 5 times the average income of a family of four.

A large business tax of 30% will also be created for businesses that profit 100 times or more the average income for a family of four.

A commercial business tax of 40% will be created for businesses that profit 500x or more the average income of a family of four.

A super business tax of 60% will be created for businesses that profit 1000x or more the average income of a family of four.

A mega business tax of 75% will be created for businesses that profit 10000x the average income for a family of four.

Business taxes must be remitted at the same time as transaction taxes and must be based on the transactions for which those taxes are being submitted.

Profit is defined as all money generated through the sale of goods or services minus the cost of people employed by the hour and the typical costs of doing business such as utilities, rent for a brick and mortar location, raw materials necessary to manufacture, perform or create a good or service, or the cost of goods intended to be resold as is.

The earnings of investors, salaried employees, and executives do not count as cost of doing business and must be paid from a business's profit.

A tax refund will only be issued to businesses and only in the case of an overpayment of transaction, luxury, or super luxury taxes because of accidental faulty math or customer returns of purchased goods.

This is how to reset the economy and make it BOOM again. This is how you reduce poverty. This is how you reduce crime. This is how you increase wages. This is how you reduce prices. This is how you win.

#taxplan #taxreform #replacethetaxcode #economy #poverty #crime

2 notes

·

View notes

Text

Tips for Choosing a Secure and Comfortable Female PG in Kharadi Pune

Introduction

Finding a safe and comfortable female PG in Kharadi Pune is crucial for students and working women relocating to the city. Kharadi, being a prominent IT and residential hub, offers numerous PG accommodations, but selecting the right one requires careful consideration. This article provides key tips to help you choose the perfect PG that ensures security, comfort, and convenience.

Prioritize Safety & Security Features

Opt for a PG with 24/7 security, CCTV surveillance, and biometric access. Ensure there are security guards at the entrance and proper visitor monitoring. Check for emergency exits, fire safety measures, and first-aid availability.

Location Matters Choose a PG near major IT parks, colleges, or commercial hubs to minimize commute time. Ensure the area has good street lighting and public transportation access. Look for proximity to hospitals, supermarkets, and pharmacies.

Verify Amenities and Comfort Levels Look for fully furnished rooms with comfortable bedding, study desks, and proper ventilation. Essential amenities like Wi-Fi, air-conditioning, power backup, and geysers are a must. Check if the PG offers housekeeping, laundry services, and regular maintenance.

Check Food and Meal Quality A good PG should offer healthy and hygienic food with multiple meal options. Some PGs provide home-cooked meals, while others allow self-cooking facilities. Ask about meal timings, diet preferences, and whether outside food is allowed.

Understand the Rules and Regulations Some PGs have fixed entry/exit timings and restrictions on guests. Verify the policies regarding visitors, noise levels, and curfew. Clarify rules on deposit refunds, notice period, and contract duration.

Budget and Cost Considerations Compare rent and amenities offered in different PGs to ensure value for money. Check for hidden charges like maintenance, electricity, and security deposits. Look for flexible payment options and ensure the contract terms are transparent.

Read Reviews and Seek Recommendations Online reviews on Google, Justdial, and housing websites can give insights into real experiences. Ask current or past tenants about their experience with safety, cleanliness, and management. Consider PGs with a high rating and positive testimonials.

Visit the PG Before Finalizing A physical visit helps assess cleanliness, room size, and overall maintenance. Check bathroom hygiene, kitchen facilities, and common areas. Speak with existing residents to understand the actual living conditions. Conclusion Choosing the right female PG in Kharadi Pune requires a balance of security, comfort, affordability, and accessibility. By considering these factors, you can find a PG that ensures a safe and pleasant living experience. Always conduct thorough research and make an informed decision before moving in.

0 notes

Text

How to Choose the Right Hosting Solution for Your Web Project

When launching a website, choosing the right hosting solution is a crucial decision that impacts performance, security, and scalability. With multiple hosting options available, it’s essential to understand which solution best suits your web project’s needs. In this guide, we’ll explore key factors to consider when selecting a hosting provider.

1. Understand Your Website Requirements

Before choosing a hosting plan, assess your website's needs:

Type of Website: Is it a personal blog, an e-commerce store, or a corporate site?

Traffic Volume – Estimate the expected number of visitors.

Resource Usage: Consider disk space, bandwidth, and database requirements.

Software Compatibility – Ensure the hosting supports your preferred CMS, programming languages, and frameworks.

2. Types of Web Hosting Solutions

Understanding the different hosting options helps you make an informed decision:

a) Shared Hosting

Ideal for small websites and beginners, shared hosting allows multiple sites to share server resources. It’s affordable but may experience performance issues due to shared bandwidth.

b) VPS (Virtual Private Server) Hosting

VPS hosting provides dedicated resources in a shared environment. It offers better performance, security, and control compared to shared hosting.

c) Dedicated Hosting

For high-traffic websites, dedicated hosting provides an entire server for your site. It offers superior performance, security, and customization but comes at a higher cost.

d) Cloud Hosting

Cloud hosting distributes resources across multiple virtual servers, ensuring high uptime and scalability. It’s ideal for businesses expecting traffic spikes.

e) Managed Hosting

This option includes server management, security, and updates, making it ideal for businesses that need hassle-free hosting without technical maintenance.

3. Performance and Speed Considerations

Your hosting provider should offer:

High Uptime Guarantee (99.9% or higher)

Fast Loading Speeds with SSD storage and optimized caching

Content Delivery Network (CDN) support to improve site speed globally

Scalability Options to upgrade resources as your site grows

4. Security Features

Ensure the hosting provider includes:

SSL Certificates for secure data transmission

DDoS Protection to prevent cyberattacks

Regular Backups to protect against data loss

Malware Scanning and firewalls for enhanced security

5. Customer Support and Reliability

Reliable customer support is essential for troubleshooting. Look for:

24/7 Support Availability (via live chat, email, or phone)

Knowledge Base and Tutorials for self-help

Quick Response Times to resolve issues efficiently

6. Pricing and Value for Money

Compare hosting plans based on:

Initial and Renewal Costs – Some providers offer low introductory rates but higher renewal prices.

Features Included – Ensure essential features like backups and security are included.

Refund Policy – A money-back guarantee provides flexibility in case of dissatisfaction.

7. Scalability and Future Growth

As your website grows, you may need more resources. Choose a hosting provider that offers easy upgrades to higher plans without downtime.

Final Thoughts

Selecting the right hosting solution depends on your website’s requirements, budget, and long-term goals. Whether you’re running a small blog or a large e-commerce store, a reliable hosting provider ensures optimal performance, security, and user experience.

Looking for expert hosting recommendations? Contact RankON Technologies today to find the perfect hosting solution for your web project!

0 notes

Text

CBSE School Excellence Recognition Test Form in Soyla

Dundlod Public School's Approach Towards Holistic Education Dundlod Public School boasts of its commitment to holistic education, which not only focuses on academic excellence but also on the emotional, social, and physical development of students. The school believes that true education is beyond textbooks and prepares students to be well-rounded individuals, equipped with skills for life. The holistic approach ensures that every child is given the space to grow intellectually, emotionally, and socially.

Academic growth is enhanced with a systematic curriculum set up to challenge students while promoting curious minds and an appreciation for knowledge. The school adapts modern teaching methodologies, such as interactive learning, project-based assignments, and critical thinking exercises. At the same time, emotional growth is similarly valued among the students, with mindfulness and the management of stress levels being given importance in addition to emotional intelligence. Teachers at Dundlod Public School act as mentors to students, helping them build self-confidence, resilience, and a positive mindset.

The social aspect of education is developed through group activities, collaborative projects, and community involvement. Students are encouraged to interact, collaborate, and understand diverse perspectives, which helps them develop empathy and strong interpersonal skills. The school’s commitment to physical growth is evident in the wide range of sports and physical activities it offers, ensuring that students stay active, healthy, and engaged. Dundlod Public School believes that a balanced approach to education helps students thrive in all aspects of life.

Admission Guidelines and Eligibility Dundlod Public School has clear and transparent admission guidelines to ensure a smooth and fair process for all applicants. The school admits students from Nursery to Class XII, with specific eligibility criteria for each grade level.

Nursery and Kindergarten For admission into the Nursery class, children should be at least 3 years old by 31st March of the year of admission. Similarly, in Kindergarten children should be at least 4 years old.

Class I to Class V: For entry into these classes, the child should have successfully completed the previous academic year in a recognized school. An assessment or interview may also be conducted to assess the suitability of the child for the class.

Class VI to Class VIII: For admission to these middle school classes, the student has to produce his previous school records, and an assessment may be conducted to ensure that he meets the academic standards required for the grade.

Class IX to XII: For admission to the higher classes, students must qualify from the previous class with sufficient marks. For Class IX, it must pass the entrance test, and for Class XI, the student passes the relevant subjects (science, commerce, or humanities stream).

Structure Fee The fee structure in Dundlod Public School is transparent, competitive, and designed to bring good quality education at a reasonable price. Admission Fee: The one-time amount that has to be raised during the time of admission. Annual Tuition Fee: This is the amount to be paid each year, that takes care of regular education and resources in the classroom.

Caution Money: The amount collected at the time of admission as caution money is refundable at the time of withdrawal, subject to the terms and conditions of the school.

Transportation Charges: In case of students availing of the transport facility of the school, an additional charge as per the distance between the student's residence and the school would be levied.

The fee structure is reviewed from time to time, and the school ensures that the fees are affordable yet still maintain a high standard of education and facilities. Detailed fee breakdowns are available on the school's website, and parents are encouraged to contact the admissions office for further clarification.

Extracurricular Activities Dundlod Public School believes that extracurricular activities are essential for developing creativity, teamwork, and leadership skills in students. The school offers a wide range of programs beyond academics, ensuring that students have opportunities to explore their interests and talents.

Sports: The school offers a variety of sports, including cricket, football, basketball, athletics, and swimming. The emphasis is on physical fitness, teamwork, and sportsmanship.

Cultural Activities: The students have been encouraged to participate in cultural programs such as dance, music, and drama to enhance their creativity and confidence.

Skill Development: To upgrade the skills of the students, the school conducts workshops, leadership development programs, and personality development classes.

All such activities are incorporated into the academic framework of the school to ensure that the learning experience for the student is balanced, engaging, and rich.

0 notes

Text

ITR Filing: A Comprehensive Guide to Filing Your Income Tax Return

Introduction:

Filing your Income Tax Return (ITR) is a crucial obligation for all taxpayers. This process not only ensures adherence to tax regulations but also provides financial advantages such as potential tax refunds and serves as documentation of income for various financial transactions. In this article, we will delve into the essential aspects of ITR filing, including its significance, different types, the filing process, and common pitfalls to avoid.

What is ITR Filing?

ITR Filing refers to the submission of income tax returns to the Income Tax Department. This process encompasses information regarding your income, deductions, exemptions, and tax obligations for a specific financial year. It is required for individuals, businesses, and other entities to file their ITR in accordance with their income levels and applicable tax laws.

Why is ITR Filing Important?

Legal Compliance: Under the Income Tax Act, it is obligatory for eligible taxpayers to submit their ITR by the specified deadline.

Avoid Penalties: Failing to file on time can lead to penalties and interest charges on outstanding tax amounts.

Claim Tax Refunds: If you have had excess tax deducted from your earnings, filing your ITR allows you to request a refund.

Proof of Income: The ITR serves as valid proof of income when applying for loans, visas, and government assistance.

Carry Forward Losses: Timely ITR filing enables you to carry forward any business or capital losses to offset against future earnings.

Avoid Notices and Scrutiny: Not filing or incorrectly filing your ITR may result in inquiries from the tax authorities.

Who is Required to File an Income Tax Return (ITR)?

Individuals whose earnings exceed the basic exemption threshold

Businesses and self-employed professionals

Corporations, partnerships, and firms

Non-Resident Indians (NRIs) with taxable income generated in India

Individuals possessing foreign assets or income

Taxpayers seeking refunds

Investors in foreign stocks or mutual funds

Categories of ITR Forms

The Income Tax Department has established various ITR forms tailored to different categories of taxpayers and types of income:

ITR-1 (Sahaj): Designed for salaried individuals with income not exceeding ₹50 lakh

ITR-2: Applicable to individuals and Hindu Undivided Families (HUFs) without business or professional income

ITR-3: Intended for individuals and HUFs with income derived from business or profession

ITR-4 (Sugam): For individuals, HUFs, and firms choosing presumptive taxation

ITR-5: For Limited Liability Partnerships (LLPs), Associations of Persons (AOPs), and Bodies of Individuals (BOIs)

ITR-6: For companies, excluding those claiming tax exemption under Section 11

ITR-7: For trusts, political organizations, and charitable entities.

Step-by-Step Guide for Submitting Income Tax Returns (ITR)

Collect Necessary Documents: Ensure you have your PAN, Aadhaar, Form 16, Form 26AS, bank statements, proof of investments, and salary slips ready.

Select the Appropriate ITR Form: Determine the correct form based on the nature of your income.

Access the Income Tax Portal: Navigate to the e-filing portal and log in with your credentials.

Identify the Assessment Year: Select the financial year relevant to your tax return submission.

Complete the Information: Input your income, deductions, and details of tax payments.

Review and Submit: Verify the accuracy of the information, validate it, and proceed to submit the return.

E-Verify Your ITR: Complete the verification process using Aadhaar OTP, net banking, or a Digital Signature Certificate (DSC).

Common Errors to Avoid When Filing ITR

Selecting an incorrect ITR form

Inputting inaccurate personal information

Failing to report all income sources

Claiming erroneous deductions

Missing the filing deadline

Neglecting to e-verify the return.

Due Date for ITR Submission

The deadline for submitting the Income Tax Return (ITR) is determined by the category of the taxpayer:

Individuals and Hindu Undivided Families (HUFs): July 31st (unless an extension is granted by the government)

Businesses subject to audit: September 30th

Companies: October 31st

Consequences of Missing the Deadline

Failure to submit your ITR by the due date may result in:

A penalty of up to ₹5,000 as stipulated under Section 234F.

Inability to carry forward any losses.

Accrual of interest on any outstanding tax.

Potential legal repercussions for intentional non-compliance.

Conclusion

Timely submission of your ITR is essential for maintaining financial discipline and adhering to legal requirements. The availability of online e-filing options has simplified the process significantly. Whether you choose to file independently or enlist professional help, ensuring that your ITR is accurate and submitted on time will alleviate stress and optimize your tax advantages.

Filing your Income Tax Return (ITR) is a crucial financial responsibility that ensures compliance with tax laws and helps you claim deductions, refunds, and other benefits. With the assistance of GTS Consultant India , the process becomes more streamlined, accurate, and hassle-free. Their expert guidance ensures that your tax filing is done efficiently, minimizing errors and maximizing potential savings.

By staying informed and filing your returns on time, you can avoid penalties and contribute to a transparent financial system.

0 notes

Text

The Role of VAT and Other Tax Considerations for Self-Assessment Filers

Managing self-assessment tax filings can be a daunting task, particularly when complex tax elements like VAT and other considerations come into play. Professional assistance in navigating these intricacies is crucial for ensuring accuracy, compliance, and peace of mind.

Understanding VAT and Its Impact on Self-Assessment

Value Added Tax (VAT) is a major consideration for businesses and self-employed individuals. If your annual turnover exceeds the VAT threshold, you must register for VAT, which adds another layer of complexity to your self-assessment filing. Professionals can assist in determining:

Whether VAT registration is necessary.

Correctly calculating VAT liabilities and reclaimable amounts.

Reporting VAT in your self-assessment accurately to avoid penalties.

By leveraging professional help, you ensure that VAT is properly integrated into your tax return, eliminating the risk of errors.

The Importance of Considering Non-Taxable Income

Many filers overlook the impact of non-taxable income on their overall tax profile. While non-taxable income such as certain benefits or savings may not require direct reporting, it could affect your eligibility for tax credits or other reliefs. Professionals can help:

Identify what qualifies as non-taxable income.

Strategically plan to maximize your financial benefits.

Proper guidance ensures you fully understand your obligations and opportunities under self-assessment regulations.

Navigating Joint Venture Projects

For individuals involved in joint venture projects, allocating profits and tax responsibilities can become complicated. Mistakes in this area can lead to disputes or compliance issues. Professional advisors help by:

Ensuring accurate profit allocation between partners.

Addressing tax implications specific to joint ventures.

Filing comprehensive and compliant returns for all parties involved.

This expertise is invaluable in maintaining transparency and avoiding legal complications.

Managing Crowdfunded Income

Crowdfunded income, often overlooked, has specific tax implications under self-assessment. Depending on the nature of the funds received—whether donations, investments, or pre-sales—the tax treatment varies. Professionals assist in:

Classifying the nature of crowdfunded income correctly.

Determining applicable VAT or other taxes.

Reporting it accurately to HMRC.

This guidance ensures you remain compliant while optimizing your financial outcomes.

Why Professional Help is Essential

Self-assessment filing involves more than just reporting income. Tax regulations evolve, and keeping up with changes is challenging. By working with experts, you gain:

Accuracy: Minimized errors in tax calculations and filings.

Compliance: Adherence to the latest HMRC rules and regulations.

Efficiency: Time-saving processes that let you focus on other priorities.

Financial Optimization: Maximizing tax reliefs and refunds.

Start Your Journey Today

Professional assistance ensures a smooth, stress-free self-assessment filing process. From VAT complexities to managing unique income sources like crowdfunded income, experts simplify your tax obligations.

Learn more about how we can support your self-assessment needs at Self-Assessment. Let’s make your tax filing journey seamless and successful.

0 notes

Text

Understanding CIS Tax Refunds in London: A Simple Guide

Navigating the complexities of the Construction Industry Scheme (CIS) can be daunting for many contractors and subcontractors.

Visit Us: https://www.quora.com/profile/Mysimplytax/Understanding-CIS-Tax-Refunds-in-London-A-Simple-Guide

0 notes

Text

Top ICO Development Services to Launch Your Token Successfully

The rise of blockchain technology and cryptocurrency has created numerous opportunities for businesses and startups. One of the most popular methods of raising funds for new blockchain projects is through Initial Coin Offerings (ICOs). ICOs allow companies to raise capital by issuing their own tokens to investors in exchange for cryptocurrencies like Bitcoin or Ethereum. However, launching an ICO is not an easy task, and it requires a professional approach to ensure its success. This is where ICO development services come into play.

In this blog post, we’ll explore the top ICO development services that are crucial to launching your token successfully. These services range from planning and strategy to technical development and marketing, and each plays a vital role in ensuring your ICO meets its objectives.

1. ICO Consultation and Strategy Development

The first step in any successful ICO is having a well-thought-out strategy. ICO consultation services offer expert guidance on structuring your ICO to attract investors, ensuring compliance with regulations, and optimizing tokenomics (the economic structure of the ICO). The consultation process involves evaluating your business idea, market potential, target audience, and fundraising goals.

A professional ICO development team will help you:

Define your goals and objectives for the ICO

Design tokenomics to ensure the token has real value

Choose the right blockchain platform (Ethereum, Binance Smart Chain, etc.)

Create a roadmap and timelines for the ICO process

Assess the legal and regulatory requirements for launching your ICO

Having a clear and strategic approach will increase the likelihood of attracting investors and running a successful ICO.

2. Whitepaper Development

A whitepaper is a detailed document that outlines the ICO’s goals, the problem it intends to solve, and the technical and economic aspects of the project. The whitepaper serves as the primary source of information for potential investors. It should be well-written, clear, and comprehensive to inspire confidence.

ICO development services include expert whitepaper writing, ensuring it covers:

The problem the project solves

Technical details of the blockchain and token

The project’s vision, mission, and roadmap

Team introduction and their expertise

Token distribution strategy and the total supply

Use of funds raised during the ICO

A professionally crafted whitepaper can make or break the success of your ICO. It needs to be compelling enough to convince investors that your project is worth their time and money.

3. Smart Contract Development

At the core of an ICO is the smart contract, which automates and secures the token sale process. Smart contracts are self-executing agreements with predefined conditions. They handle functions such as token distribution, collecting funds, and ensuring that the ICO is transparent and secure.

ICO development services offer custom smart contract development tailored to the needs of your token sale. These smart contracts are built to run on the blockchain of your choice (such as Ethereum or Binance Smart Chain) and are responsible for ensuring that the ICO runs smoothly.

Some key aspects of smart contract development include:

Token creation (ERC-20, ERC-721, BEP-20, etc.)

Token distribution to investors

Automated refund processes in case of a failed ICO

KYC (Know Your Customer) and AML (Anti-Money Laundering) integration

Investor wallet integration

A well-built smart contract is essential to the success of your ICO. It ensures the automation of key functions and eliminates the possibility of human errors.

4. ICO Website Development

Your ICO website is the first place potential investors will visit, and it plays a crucial role in your ICO's success. A professional ICO development service will help you build a user-friendly, responsive, and aesthetically pleasing website that showcases your project’s goals, token details, and ICO information.

An effective ICO website typically includes:

Clear explanation of the project’s mission

Detailed whitepaper download section

ICO countdown timer

Token sale details (price, bonuses, and stages)

Investor registration and participation option

Links to social media channels and community forums

FAQ section addressing common questions

A well-designed website increases your project's credibility and ensures that potential investors have all the information they need to make an informed decision.

5. Token Creation and Issuance

The process of creating and issuing your token is one of the most technical aspects of an ICO. ICO development services include custom token creation based on your project's requirements. These services ensure that your token complies with industry standards (such as ERC-20 for Ethereum-based tokens) and integrates seamlessly into your ICO platform.

The development of tokens involves:

Token supply and distribution model

Token allocation to founders, advisors, and investors

Custom token features (staking, rewards, etc.)

Integrating the token with the ICO smart contract

Ensuring compatibility with wallets and exchanges

A robust token issuance process is crucial for the smooth execution of your ICO and helps ensure that investors receive their tokens without any issues.

6. Security Audits

Security is a top priority when launching an ICO. ICOs are often targeted by hackers, and a breach can severely damage the reputation of your project. To avoid security vulnerabilities, ICO development services provide security audits that review your smart contracts, website, token distribution process, and other critical components.

Security audits focus on:

Checking for vulnerabilities in the smart contract code

Verifying the security of the ICO website

Assessing KYC/AML procedures for investor verification

Ensuring protection against phishing attacks and other scams

A security audit provides peace of mind to investors, ensuring them that their funds and data are protected.

7. ICO Marketing and Community Building

An ICO is not just about building a great product—it’s about effectively marketing that product to the right audience. ICO development services often include comprehensive marketing strategies to help you reach potential investors. These services cover everything from social media promotion to influencer outreach and community building.

Key marketing strategies for ICOs include:

Social media campaigns on platforms like Twitter, Telegram, and Reddit

Engaging with crypto influencers and bloggers

Hosting AMAs (Ask Me Anything) to answer questions from potential investors

Content marketing, including articles, blogs, and videos

Email campaigns and newsletters

Building a community of engaged supporters is essential for the success of your ICO. The more people that know about your project, the more likely you are to raise the funds you need.

8. Post-ICO Services and Token Listing

After your ICO concludes, you’ll need post-ICO services, such as token listing on major cryptocurrency exchanges. These services help get your token listed on platforms like Binance, CoinMarketCap, and CoinGecko, making it easier for investors to trade and access liquidity.

Other post-ICO services include:

Preparing for the token distribution process

Ongoing marketing efforts to sustain investor interest

Implementing your roadmap and project updates

Engaging with the community and providing transparency

Ensuring a smooth post-ICO phase is just as important as the ICO itself. Proper follow-up can lead to long-term success and further funding rounds.

Conclusion

Launching a successful ICO requires a combination of strategic planning, technical development, and marketing expertise. Professional ICO development services help guide you through every step of the process, from conceptualization to post-ICO operations. By working with experts in consultation, smart contract development, website creation, and marketing, you can ensure that your ICO is well-positioned for success.

Whether you’re a startup looking to raise funds or a blockchain project aiming to expand your user base, a professional ICO development service can provide the tools and support necessary to launch your token successfully and build long-term value.

0 notes

Text

How to Register for a UTR Number: Step-by-Step Guide for Self-Employed and Businesses

Navigating the world of taxes can be challenging, especially when you’re self-employed or managing a business. One of the most important numbers you’ll need is your Unique Taxpayer Reference (UTR) number. This unique 10-digit code is issued by HM Revenue & Customs (HMRC) and is essential for individuals and businesses to manage their taxes properly. Whether you're starting a freelance career, a new business, or just want to ensure your tax records are in order, understanding how to register for your UTR number is crucial.

In this comprehensive guide, we'll walk you through the process of applying for a UTR number, explain the essential tools like the HMRC CGT calculator, and explore other useful tax calculators such as the P85 tax refund calculator and 60 tax trap calculator. Whether you're a freelancer or running a small business, registering for a UTR is the first step toward ensuring that your tax affairs are in order.

What Is a UTR Number?

Before we delve into how to register for your UTR number, let’s first understand what it is. A Unique Taxpayer Reference (UTR) number is a 10-digit identifier used by HMRC to track your tax records. It’s unique to you (or your business) and is required for various tax-related activities. You'll need it for:

Filing your Self-Assessment tax return (if you're self-employed, a business owner, or have other taxable income).

Paying your income tax.

Setting up a payment plan with HMRC.

Your UTR number is crucial for managing your taxes effectively, and having one allows you to submit your Self-Assessment forms or deal with other HMRC matters efficiently.

Who Needs a UTR Number?

There are several types of people who will need a UTR number, including:

Self-Employed Individuals: If you’re running your own business, whether as a freelancer, contractor, or small business owner, you’ll need to register for a UTR number for tax purposes.

Business Owners: If you own a business, whether you are a sole trader, a partner in a business, or a limited company director, having a UTR number is required for submitting your Self-Assessment tax return and managing corporate tax obligations.

Landlords: If you earn income from renting out properties, you will likely need a UTR number to report your rental income to HMRC.

Individuals with Other Sources of Income: If you have income outside your employment (such as from investments, dividends, or self-employment), a UTR number is necessary for your self assessment online chat.

How to Apply for a UTR Number: Step-by-Step Guide

Now that you understand what a UTR number is and who needs one, let’s break down how to apply for it. Here’s a step-by-step guide:

Step 1: Determine If You Need a UTR Number

First, confirm whether you need a UTR number. If you're self-employed or planning to be, or if you are managing a business, you will most likely need one. For employees who are solely on PAYE (Pay As You Earn), you generally don’t need a UTR unless you have other sources of taxable income.

Step 2: Register for Self-Assessment with HMRC

If you’re self-employed or need to file a Self-Assessment tax return, you must register for Self-Assessment. This is where your UTR number comes into play.

To register for Self-Assessment:

Go to the HMRC Website: Visit the official HMRC Self-Assessment Registration Page and follow the instructions to begin the process.

Create an Online Account: You will need a Government Gateway account if you don’t already have one. This account will allow you to manage your taxes online, submit returns, and pay taxes.

Provide Your Personal Information: You will need to provide your details, including your National Insurance number, address, and other relevant information.

Submit Your Application: After providing the necessary details, HMRC will process your application and issue your UTR number. This may take up to 10 days if you are applying online.

If you’re applying as a business, you will need to follow a similar process but provide additional business-related information.

Step 3: Wait for Your UTR Number

Once you’ve registered, HMRC will issue you a UTR number. You will receive this number by post at your registered address within 10 days. For businesses, it can take up to 21 days for HMRC to issue a UTR number.

Step 4: Use Your UTR Number for Your Tax Returns

Once you receive your UTR number, you can begin using it for your tax-related activities, such as filing your Self-Assessment tax returns, paying your income tax, and dealing with other matters related to your tax liabilities.

If you’re filing your tax return online through HMRC's portal, your UTR number will be required to access your tax records and submit your returns.

Step 5: Keep Your UTR Number Safe

Your UTR number is confidential, and it’s crucial to keep it safe. Do not share it unless necessary, as it’s used to identify your tax records with HMRC.

Useful Tools for Tax Calculation and Refunds

Once you’ve registered for your UTR number and have started the process of filing your taxes, you might need other tools to help you calculate your taxes. These tools can simplify the process of tax calculation and ensure you're not overpaying.

1. HMRC CGT Calculator

If you’re selling assets like property or stocks and have to deal with capital gains tax uk property calculator, you’ll need to calculate how much tax you owe on the profit. The HMRC CGT calculator can help you calculate your CGT liability. It’s a straightforward online tool that allows you to input the sale price, purchase price, and associated costs, providing an estimate of your capital gains tax.

Using the HMRC CGT calculator ensures that you're calculating the correct tax based on your sales, helping you avoid under-reporting your gains and facing penalties from HMRC.

2. P85 Tax Refund Calculator

If you've left the UK for work or personal reasons and are owed a tax refund, the P85 tax refund calculator can help you determine if you're eligible for a refund. The P85 form is used when someone leaves the UK to work abroad, and the calculator helps ensure you get a refund for the excess taxes you've paid while living in the UK.

Using the P85 tax refund calculator is essential for individuals who have worked in the UK but no longer reside there. It will provide a clearer understanding of your tax situation and help you claim back any overpaid tax.

3. 60 Tax Trap Calculator

The 60 Tax Trap refers to the situation where individuals earning between £100,000 and £125,000 face a reduction in their personal allowance, which can lead to significantly higher taxes. The 60 tax trap calculator helps you determine if you're falling into this trap, showing you how much your personal allowance is being reduced and what impact it has on your tax liability.

By using the 60 tax trap calculator, you can see if you're eligible for any reliefs or adjustments and make necessary financial decisions to reduce your tax burden.

Conclusion

Registering for your UTR number is an essential step for anyone who is self-employed or running a business in the UK. It is the foundation for submitting your Self-Assessment tax return and staying compliant with HMRC. By following the steps outlined above, you can easily apply for and receive your UTR number, ensuring that you’re on the right track for your tax obligations.

Additionally, using tools such as the HMRC CGT calculator, p85 tax refund calculator, and 60 tax trap calculator can help you manage your tax situation effectively, reduce your tax liability, and identify opportunities for refunds. These resources simplify complex calculations and provide clarity on your financial situation, making your journey through the tax season much smoother.

Remember, accurate and timely filing of taxes is key to avoiding fines and ensuring that you meet all legal requirements. Whether you're just starting your business or need help with your tax calculations, these tools and your UTR number will guide you every step of the way.

1 note

·

View note

Text

CAT Answer Key Out 2024: Check Your Responses and Predict Your Scores

The Common Admission Test (CAT) is one of the most significant MBA entrance exams in India, opening doors to prestigious business schools like the IIMs and other top management institutions. If you’ve appeared for CAT 2024, there’s good news for you—the CAT Answer Key Out 2024 is now available! This article will guide you through everything you need to know about accessing the answer key, calculating your scores, and what steps to take next.

What is the CAT Answer Key?

The CAT Answer Key is an official document released by the exam authorities that contains the correct answers to all the questions asked in the CAT exam. With the CAT Answer Key Out 2024, candidates can now match their responses, calculate their approximate scores, and get an idea of their performance before the official results are announced.

Why is the CAT Answer Key Important?

Transparency: It ensures transparency in the evaluation process.

Self-Assessment: Candidates can estimate their performance and rank.

Raise Objections: If you find any discrepancies, you can challenge the answer key within the given timeline.

How to Access the CAT Answer Key Out 2024

Accessing the CAT Answer Key Out 2024 is easy. Follow these simple steps to download it:

Visit the Official Website: Go to the official CAT 2024 website (https://iimcat.ac.in).

Login to Your Account: Use your CAT registration ID and password to log in.

Download the Answer Key: Once logged in, click on the link for the "Answer Key." Download the PDF file for your reference.

Download Your Response Sheet: Along with the answer key, you can also download your response sheet to compare your answers.

Pro Tip:

Make sure you download the answer key for the slot you appeared in, as CAT is conducted in multiple shifts with different question papers.

How to Calculate Your CAT Score Using the Answer Key

Calculating your approximate CAT score using the CAT Answer Key Out 2024 is straightforward. Follow these steps:

Understand the Marking Scheme:

+3 marks for every correct answer.

-1 mark for every incorrect answer (only for MCQs; no negative marking for non-MCQs).

Match Your Responses: Compare your answers with the official answer key.

Apply the Formula:

Total Score = (Number of Correct Answers × 3) - (Number of Incorrect Answers × 1).

This calculation will give you a rough estimate of your CAT score, helping you plan your next steps accordingly.

What to Do If You Find Errors in the Answer Key?

The CAT Answer Key Out 2024 also provides candidates with the opportunity to challenge any discrepancies in the answers. Here’s how you can raise an objection:

Log In to the CAT Portal: Use your credentials to log in.

Submit Your Objection: Select the question you want to challenge and provide a valid explanation with supporting documents or reasoning.

Pay the Fee: A nominal fee is charged per objection raised. This fee is usually refundable if your objection is found to be valid.

Important Tip:

Double-check the answer key and ensure your objection is valid before submitting, as this process involves a fee.

What’s Next After the CAT Answer Key?

Once the CAT Answer Key Out 2024 phase is complete, the exam authorities will evaluate the objections and release the final answer key. Here’s what happens next:

Final Answer Key Release: After reviewing all objections, the final answer key will be published.

CAT Result Announcement: Based on the final answer key, CAT 2024 results will be declared.

Percentile Calculation: Your scores will be converted into a percentile, which determines your rank among all candidates.

Shortlisting for Colleges: Use your CAT percentile to apply to top MBA programs, including IIMs, FMS Delhi, SPJIMR, and more.

Tips for Students After Checking the CAT Answer Key

The release of the CAT Answer Key Out 2024 is a crucial moment for MBA aspirants. Here are a few tips to make the most of this phase:

Analyze Your Performance: Identify your strengths and weaknesses based on your responses. This will help you prepare better for the next stage, such as GD-PI-WAT (Group Discussion, Personal Interview, and Written Ability Test).

Plan Your College Applications: Based on your estimated percentile, start shortlisting colleges where you are likely to get a call.

Prepare for Next Steps: IIMs and other top B-schools conduct further rounds of selection, including group discussions and interviews. Begin your preparation early to secure your admission.

Stay Positive: If your performance is below expectations, don’t lose hope. There are other MBA entrance exams like XAT, NMAT, and MAT to explore.

Why the CAT Answer Key is a Game-Changer for Aspirants

The release of the CAT Answer Key Out 2024 allows students to take control of their journey toward MBA admissions. By giving a clear picture of your performance, it helps you make informed decisions about the next steps.

Key Benefits of the CAT Answer Key:

Clarity on Your Performance: You can calculate your score and assess your chances of admission.

Early Planning: Start preparing for interviews or consider retaking CAT or other exams if necessary.

Reduce Anxiety: Knowing your estimated score can reduce the uncertainty and stress of waiting for results.

Conclusion

The announcement of the CAT Answer Key Out 2024 is an exciting milestone for every CAT aspirant. It not only gives you an early insight into your performance but also helps you strategize your next steps effectively. Whether it’s raising objections, planning for interviews, or shortlisting colleges, this phase sets the tone for your MBA journey.

Log in to the official CAT website today, download the answer key, and take the first step toward achieving your MBA dreams! Remember, this is just the beginning—stay focused and confident as you move forward.

Good luck with your journey to becoming a future business leader!

0 notes