#sciatica pain Dallas

Explore tagged Tumblr posts

Text

Advanced Rolfing Fort Worth Dallas Treatment 10

The main goal for the Advanced Rolfing Fort Worth Dallas tenth hour is to establish functional alignment from the ankles to the A/O joint. This is the opportunity to bring this clients body to the highest level of integration possible. Observe the breath and its transmission through the body and how the client's Psycho-emotional level manifests' in the body. Movement should be fluid and orientation to G or G' tendencies should be considered. If more intra oral work is needed now is the time to do it and initiate further integration in x, y, z-axis from top down and vertical integration from the bottom up. Tracking from the front and from behind is also ideal in tenth hour, considering horizontals at joints connecting segments, and diaphragms. The structure needs to be homogenous, stable, and palintonicaly open at its current level of order. The whole Advanced Rolfing Fort Worth Dallas session should be considered an integrative session, get everything smooth and unlocked. Neck work should be where any potential can be seen and back work could be broad and integrative. Pelvic lift or pull will end tenth hour. Leave time to say good bye, it has been an important process for both Rolfer® and client and obvious growth and healing has taken place. Let the client know some recommendations for future work. In Conclusion, Fascia, like ripples of dark matter that engulf all of creation, engulfs the mind and body of man and woman. From the double bag theory of the connective tissues ability to fold in on itself to create an alternate and complimentary compartment, to the theories of Albert Einstein about relativity and the effect that mass has on displacing and warping the void and enveloping depths of space. Advanced Rolfing Fort Worth Dallas recignizes the inferences that could be drawn from surveying our universe are endless and yet we know that the ten series applied appropriately for each individual can create even more space than was previously considered. In closing on this exploration through the ten-series let us re-examine the nature of the series. Its intent is to establish order in the structure via considering The Rolfing® Structural Integration wholistic system and the specific client involved, including environmental and physical factors.

The order of events for Advanced Rolfing Fort Worth Dallas® is the key to creating more space: Motility precedes mobility-Mobility and differentiation precede positional change -Congruence of segments precedes higher order -Sleeve/superficial organization precedes core organization -The establishment of three functioning dimensions Precedes working with rotational issues -Appendicular order precedes sleeve order -Order in the arms/shoulder girdle precedes order in the thoracic inlet-Order in the thoracic inlet precedes order in the neck-Order in axial complex precedes easy carriage of head. The Advanced Rolfing Fort Worth Dallas Ten Series has the potential to reduce pain and release tension in the connective and myofascial tissue of the body associated with TMJ, CTS, RLS, Fibromyalgia, Sciatica, Fascitis, Bunions, Scoliosis, and Cerebral Palsy. Fascial asymmetries can cause foot, leg, knee, hip, back, shoulder, neck, arm, hand, and head pain; integration therapy is necessary. Orthopedic, Chiropractic, Physical, and Massage Therapists recognize Rolfing and Rolf Movement as premium pain management utilizing Structural, Functional, and Postural Integration.

John Barton, Certified Advanced Rolfer ® & Rolfing ® Fort Worth-Dallas |Rolf Movement ® Practitioner

https://www.rolfmovement.com

https://www.rolfmovement.com

https://www.certifiedrolfing.com

https://certifiedrolfing.com/john-barton-advanced-rolfing-fort-worth/

https://certifiedrolfing.com/research-rolfing-fort-worth-dallas/

https://certifiedrolfing.com/service/advanced-rolfing/

https://certifiedrolfing.com/service/rolfing-10-series/

https://certifiedrolfing.com/service/rolf-movement-treatments/

https://certifiedrolfing.com/rolfing-fort-worth-10-series-videos/

https://www.certifiedrolfing.com

#AdvancedRolfingFortworthdallas#painmanagement#orthopedichealth#fascia#Physicaltherapy#massagetherapy#chiropractor#airrosti#rolfing#structuralintegration

0 notes

Text

Reasons and benefits of sleeping with a pillow between your legs.

👉 The pillow between the legs gives comfort because it rebalances the horizontal axis of the spine, which in turn reduces pressure and muscle tension in the body.

👉 When you fall asleep you don't pay attention to the fact that your knees tend to close.

At this time, tension appears in the lower back and hips, as the legs find themselves misaligned from the spine and exert a downward pulling weight.

👉 The pillow located between the legs eliminates the pulling position, relieves the lower spine and sleep soundly.

And in the morning you wake up more rested with greater strength and energy.

👉 A pillow between your legs reduces back pain and more.

Prevents muscle cramps, varicose veins and prevents sciatic neuralgia.

Motivi e benefici del dormire con un cuscino tra le gambe.

👉 Il cuscino tra le gambe dona comfort perché riequilibra l'asse orizzontale della colonna vertebrale, cosa che a sua volta riduce la pressione e la tensione muscolare nel corpo.

👉 Quando ti addormenti non presti attenzione al fatto che le tue ginocchia tendono a chiudersi. In questo momento, la tensione appare nella parte bassa della schiena e nei fianchi, poiché le gambe si trovano disallineate dalla colonna vertebrale ed esercitano un peso di trazione verso il basso.

👉 Il cuscino situato tra le gambe elimina la posizione di trazione, allevia la parte inferiore della colonna vertebrale e dormi profondamente. E al mattino ti svegli più riposato con maggiore forza ed energia.

👉 Un cuscino tra le gambe riduce il mal di schiena e altro ancora. Previene i crampi muscolari, le vene varicose e previene la nevralgia sciatica.

0 notes

Text

#chiropractor Dallas#auto accident injury chiropractor Dallas#auto accident chiropractic clinic Dallas#sciatica pain Dallas#jaw pain chiropractor Dallas#back pain Dallas

1 note

·

View note

Photo

Dr. Perez is one of the top chiropractors in Dallas, TX and as a result, he's seen his fair share of patients with neck and back pain. While some people might be wary when they hear the word "chiropractor," Dr. Perez wants to assure you that it's not just about cracking backs. He discusses common conditions like spinal subluxation, herniated discs, sciatica, and more - what causes them and how chiropractic care can help.

0 notes

Text

Pain Management Devices Market| Key Performing Regions| Drivers And Challenges

Pain management devices are designed to ease chronic pain from conditions, like fibromyalgia, diabetic neuropathy, sciatica, and osteoarthritis. Some of these devices deploy infrared light energy to relieve pain, by tapping into the body’s natural pain response and blocking the pain signals. All the pain management devices are designed to help relieve muscular and joint pains, improve blood circulation, cope with migraines and arthritis, or deal with the aches and pains of a long day at work, or at the gym. Growing demand for long-term pain management among the geriatric population, large patient population base, and adverse effects of pain medications are some of the key factors that have increased the demand for the pain management devices market.

These drug-free devices often have little to no side effects and this guide will allow you to browse different treatment options at a glance. Each product has benefits – for starters, you don’t need to be at the doctor’s office to use these devices and you get to be in charge of when and how often you put them to use – as well as drawbacks (like cost), so talk to your doctor if you think one might be a good fit for you.

Get Free PDF Brochure of this Report @https://www.fostermarketresearch.com/product/industry/7/91/Pdf%20Brochure/

Competitve Landscape:

Key players in the global pain management devices market include Medtronic PLC, Becton, Dickinson and Company, ST. Jude Medical, Inc., Boston Scientific Corporation, Hospira, Inc. (A Subsidiary of Pfizer Inc.), Halyard Health, Inc., Smiths Medical, B. Braun Melsungen AG, Neurotech Na, Inc., and Nevro Corp.

The players have adopted product development strategies to strengthen their position in the market. For instance, in January 2019, Boston Scientific Corporation launched Spectra WaveWriter, a new spinal cord stimulation device in Europe market. The newly launched devices by the company are the only devices available in the current market, which are paresthesia and sub-perception therapy based. In addition, substantial FDA approvals for the pain management devices also boost the market growth. For instance, in August 2018, the U.S.-based neurostimulation company, Nevro received FDA approval for its new Senza II, a spinal cord stimulation system.

The system is capable of providing HF10 therapy, which is relatively superior over traditional spinal cord stimulation system. Additionally, in July 2016, SPR Therapeutics received FDA approval for its newly developed pain management device, SPRINT. The newly developed device acts as a wearable stimulator and holds the capability to relieve pain with the help of electric stimulation.

Market Taxonomy:

By Device Type

Neurostimulation Devices Transcutaneous Electrical Nerve Stimulation (TENS) Devices Spinal Cord Stimulation (SCS) Devices)

Radiofrequency Ablation

NeurostimulationSpinal Cord Stimulators Deep Brain Stimulators Sacral Neurostimulators

Analgesic Infusion PumpsIntrathecal Infusion Pumps External Infusion Pumps

Ablation Devices

By Application

Neuropathic Pain

Cancer Pain

Facial Pain and Migraine

Musculoskeletal Pain

Other Applications

For More Information of this Report @https://www.fostermarketresearch.com/product/industry/7/91/

Market Dynamics:

Growing demand for long-term pain management among the geriatric population boosts the market growth. As the benefits of pain management devices have been unfolded in recent years, there has been an increase in adoption for these devices across the world. There has been a gradual increase in clinical approvals for these devices in recent years, resulting from the increasing demand for pain management devices. Additionally, the rising FDA approvals for neuromodulation devices have also driven the market growth.

According to the International Neuromodulation Society, the total number of approvals for neuromodulation devices from the Food and Drug Administration increased by approximately 35% in the past decade. The rising incidence of chronic ailments, such as diabetes, cancer, cardiovascular disorders, and others, may result in intense pain in patients. This is a key factor fueling the demand for pain management devices. Furthermore, the market is likely to benefit from the increasing willingness among patients to spend on advanced treatments. The increase in demand for pain management devices is mainly because of the pain caused by the tumor while it compresses a nerve and many more factors depending upon what stage of cancer the patient is undergoing.

Key Region Covered in Pain Management Devices Market are

North America (USA, Canada, and Mexico)

Europe (Germany, France, the United Kingdom, Netherlands, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India, and Southeast Asia)

South America (Brazil, Argentina, Colombia, rest of countries, etc.)

The Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Nigeria, and South Africa)

Benefits You Gain With Our Research Methodology:

Develop your Business strategies to refine the profits in near team.

Grow your Business profit ratio through our analytics report.

Acquire the valuable insights on different products, services and technology along with their obsolescence nature in the foreseen period.

Gain and upper hand on competition by having competitive financial, growth and economic data.

Identity future threats by our accurate forecasting strategies.

Obtain Go-To market strategy to increase your chances in the existing market.

Buy Now This Business Strategic Report to Improve Your Profits @ https://www.fostermarketresearch.com/product/buy/7/91/

About Foster Market Research:

Foster Market Research is a global market intelligence and advisory firm engaged in providing data-driven research extract from rigorous analysis, to the clients to make critical business decisions and execute them successfully. Foster connects over various distribution channels and numerous markets for great understanding of the trends and market to deliver our clients with accurate data.

Our focus is on providing market research that delivers a positive impact on your business. We work continuously to provide our clients with the most accurate analytics data and research reports without any delay so as to improve their business strategies and provide them with rich customer experience.

Contact Us:

1701 Royal Lane, #1306, Dallas Tx-75229 Phone: +1 469 4981929 Email: [email protected]

0 notes

Text

Arlington, TX

Wow! We love Arlington! After 7 years of traveling around the country, we found somewhere we would seriously consider moving to. Besides the people being super nice and "mostly" polite drivers, there is EVERYTHING here. Every store and restaurant, several hospitals, plenty of geocaches, an AMC 18, Six Flags, a big airport, Interstates and mild winters. We stayed two months. Early on we took a wrong turn out of Aldi's and turned around in the driveway of the cutest little red brick house. Ever since then Arlington has been pulling at my heartstrings to settle down. The only thing that's missing is Shorty!

Along with giant Wal-Marts, Sam's, WinCo and several Aldi's, here are some of the places where we ate and shopped: CiCi's, Peter Piper Pizza, Canes, Panda Express, In & Out, Boston Market, Furr's Buffet, Spaghetti Warehouse, Taco Bueno, Taco Cabana (awesome nachos), Krispy Kreme (walking distance from KOA!), a new fav Chinese Harbor Buffet and a new fav Pancho's Mexican Buffet. There are many new-to-us restaurants we didn't have a chance to try. Shopping: Fry's ($7 click belts), Trader's World flea market, Half Price Books, Dave & Busters (we had a groupon). And all the usual chain stores. There is a mall just a couple miles south of the KOA. It has an arcade/bowling alley bigger than Dave & Busters that is open late. I just went in to look around after a day at the theater; we didn't stay to play.

So the downside. Just after we got here, we went to an Urgent Care because Corny's back was killing him. They did a simple x-ray and diagnosed him with sciatica. They gave him a few pain pills until we could get an appointment with a primary care doctor. They gave him better pills. He bought a Hurry Cane. We used the wheelchair at Trader's World. By the end of the two months in Arlington, he was much improved.

I got a new doctor I like but his med tech screwed up big time when she entered my Rx's into the computer. It took two trips to Walgreens and a smart Pharmacist to get them straightened out. I'm supposed to be back for an appointment in October, but we'll see how that goes...

One of our A/Cs was acting up (capacitor), the microwave quit on us, and we had to replace the kitchen faucet. The RV turns 8 this year and we've talked about getting a new smaller class C RV.

Geocaching. The whole reason for coming here was for GeoWoodstock in Fort Worth. I drove separately on the way up from San Antonio and did a big county-run.

^Texas State Capitol in Austin>

^Italy, TX>

I/we went to events all week. We went to the one DDD in Fort Worth - Fred's Texas Café. It was very good, and very pricey. There are a dozen DDD's in Dallas but we didn't make it to any. There was a nice CITO (cache in/trash out) event by the river. There was an 8pm-12am trading event where I traded pathtags and gave away a bunch of camo'ed pill bottles. I saw the famous Stockyards and the traveling Geocaching Adventure Maze - a geocaching museum of sorts.

^Lost at the Stockyards...Geocaching Adventure Maze>

The actual GeoWoodstock was a bit less than I had expected. It was all indoors in a big hall with a few tablers. It paled in comparison to the GW at Coney Island in Cincinnati last year. A big part of it was no more lab caches for me (until I break down and get a Smartphone). Groundspeak made lab caches unavailable by computer this year. I don't know if I'm repeating myself, but I tried using a Smartphone years ago for about 3 months and never swore so much in my life. I just couldn't take it, trying to do computer stuff on a little 3" screen with little 3mm buttons for a keyboard. I remember sitting at a Pizza Hut (in Oregon?) after eating and spending about a half hour trying to log in to their wi-fi and kvetching. I just don't have the patience.

My vintage flip phone

Anyhow, I can't believe so much negativity crept into a blog about a place we loved! Back to geocaching...

Shortly after we got to the KOA I rode my bike up the street a few miles to the oldest cache in Texas "Tombstone". Texas geocachers sure do love their cemetery caches. A new geo-art series was put out and many of the caches required a ladder. Corny got me a spiffy, beautiful 12' aluminum telescoping ladder.

We soon found out whoever placed the series must've had a 30' ladder, because even with an extending 10' pole, we couldn't reach some of them! The ladder fits nicely in the back of the Jeep. I took it on a 3 day county run skirting along the TX/OK border, into Arkansas and Louisianna. I found great caching in Denton and Gainesville.

I got home and wanted to go right back out on another trip - and started planning it... but it was Corny's turn. He had an appointment with his Florida urologist for some imaging test. He took a week and a half van trip and saw Shorty and some friends from Fay's RV Park. The day after he left I signed up for a Six Flags membership, Dining Plan and drink refill bottle. I went almost every day for lunch - turkey legs, tacos, tamales, Panda Express "Chop Six" and giant pretzels until Corny got back.

The current plan is to stay in northern New Mexico for the summer (at an elevation around 7000') then southern AZ for the winter. Corny will take another van trip to Vancouver to see some filming in July/August. He got his passport renewed. The van is in storage at Arlington. All six of us (Corny, me, Dolly, Poco, Ruffles and Piggie) will take the Jeep back from NM to get it; then I will solo back to NM in the Jeep geocaching and visiting the Six Flags in Arlington and in Oklahoma City. Yay!

For those of you keeping score, here are the movies I've seen on three visits to the AMC 18. During one visit, it felt like my seat was shaking. I changed seats, but still felt the shaking. The theater is on the third floor of the mall. I found out there were two tornadoes nearby! Corny had packed everybody into the van and drove to the mall parking garage for a couple hours, listening to the radio and studying the atlas, learning all the cities and counties in Tornado Alley.

Penguins, Intruder, Poms, Curse of La Llorona, Breakthrough, Ugly Dolls, Avengers, Little, The Hustle, Pokemon Detective, Aladdin, A Dog's Journey, Booksmart, John Wick, Brightburn, Toy Story 4, Secret Life of Pets 2, Annabelle, Child's Play, MIB International, Other Side of Heaven, Midsommar.

Life is Godd! We fit out.

0 notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it's OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let's first discuss my outlook for 2019 and then I'll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There's an old saying on Wall Street: don't fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it's baffling why the Fed thinks inflation will accelerate in 2019.

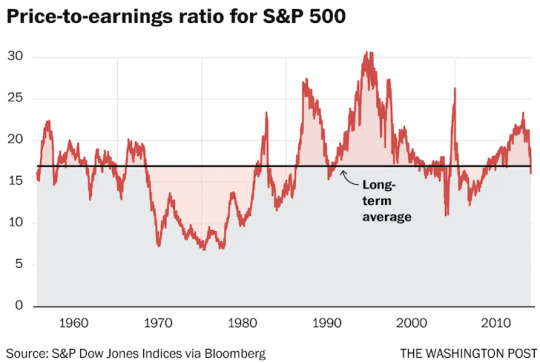

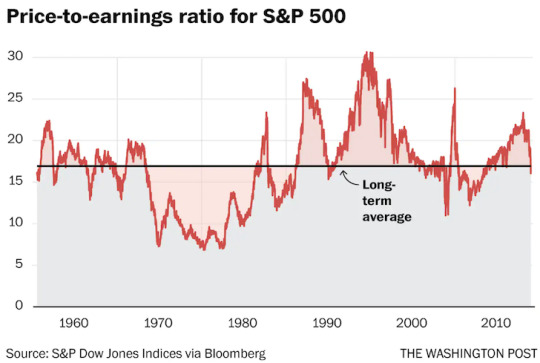

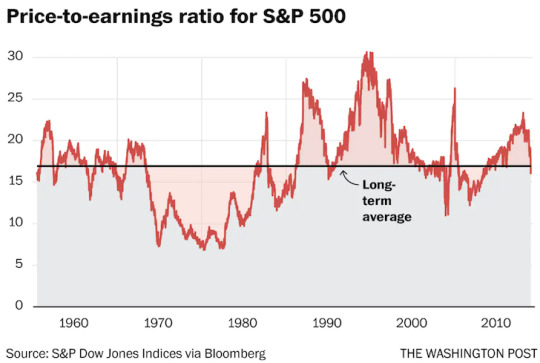

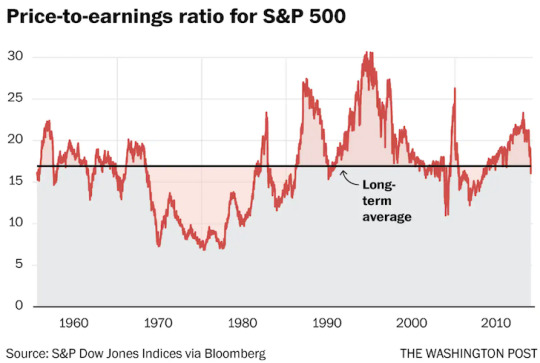

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. And unless JP is a complete idiot for going to Princeton and Georgetown, he will probably adjust his interest rate stance if we enter full bear market territory. And let's put things in perspective, a -6.4% year for the S&P 500 is not that bad.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 2.45% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a potentially greater return?

My answer is no. Give me a 2.45% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there's probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son's 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I'm in the “low interest rates for life” camp. Once again, I don't see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don't see a real estate crash like the stock market crash of 4Q2018. Instead, we'll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I've learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I've given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don't stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it's time to get some help with writing. I'll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I'll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I've discovered how great it is to hire help around the house, it's only logical to hire help for our business.

4) Focus on profits. Since I'm going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I'll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It's going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don't pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better. I'm aiming for thought diversity not groupthink.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I've discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

Sit comfortably in circle time for more than 10 minutes

Enjoy playing with the piano, guitar, and drums

Play with toys without mouthing them

Screw and unscrew jar lids and turn door handles

Build towers of more than 6 blocks

Copy a circle with pencil or crayon

Show affection for friends without prompting

Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

Walk down stairs unassisted

Maintain balance while catching a ball or when gently bumped by peers

Throw and attempt to catch ball without losing balance

Walk and maintain balance over uneven surfaces

Use both hands equally to play and explore toys

Learn to pedal a tricycle

Daily Activities

Able to self-calm in car rides when not tired or hungry

Tolerate diaper changes without crying or whining

Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

Able to self-calm to fall asleep

Able to tolerate and stay calm during dental visits

Able to brush his teeth without whining or crying 3X a day

Is potty trained before preschool starts in September

Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

Uses “in” and “on”

At least 75% of speech is understood by any caregiver

Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

Understands “mine” and “yours”

Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we're all getting sick more often now as he's exposed to other kids. Luckily, my wife and I haven't been sick at the same time yet. We'll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I've been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don't care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I've never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it's also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a canon in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I'd be feeling nervous today since the stock market corrected by 20% soon after. It's not unreasonable to assume to house is now worth $200,000 (4.5%) less today.

Meanwhile, the seller of the house in Honolulu I've been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there's a good chance they will accept $3.5M – $3.7M because they finally dropped the ask down to $3.98M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won't need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Same for many big city residents around the world e.g. London, Hong Kong, Singapore, Sydney, Mumbai, etc. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It's going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai's finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I'm having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I'm going to give myself four weeks where I'll just publish one post plus I'll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I don't want to take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who also launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It's clear I haven't done a good enough job appreciating her efforts over the years, which is why I'm committed to do more for her in 2019 and beyond.

Steady As She Goes

If we can grow our net worth by just 5%, I'll be happy. I'm willing to forego upside investment potential to help ensure our net worth goes up in 2019. Despite our public investments accounting for only about 30% of our net worth, it gave me the most stress in 2018. This will change.

I still have hope the Fed will slow down its rate hikes. If they do, I'm confident the economy will chug along at 2% – 2.5% GDP growth and not enter into a recession. However, there are no exciting positive catalysts on the horizon except for a trade agreement with China by end of 1Q. 2019 will likely be another volatile year.

The last two years working on FS and being a SAHD has worn me out. Given we save most of our after-tax business income by living off our passive income, I'm excited to live it up more in 2019 and use my “vacation credits” to take it easier.

If you have any tips on how to smartly inflate your lifestyle without feeling guilty, I'd love to hear them. I also want to learn how to inhale the roses more often without feeling the need to always be productive.

What are some of your goals for 2019? How do you see the stock market and economy unfolding?

The post Financial Samurai 2019 Economic Outlook And Personal Goals appeared first on Financial Samurai.

0 notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it's OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let's first discuss my outlook for 2019 and then I'll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There's an old saying on Wall Street: don't fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it's baffling why the Fed thinks inflation will accelerate in 2019.

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. And unless JP is a complete idiot for going to Princeton and Georgetown, he will probably adjust his interest rate stance if we enter full bear market territory. And let's put things in perspective, a -6.4% year for the S&P 500 is not that bad.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 2.45% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a potentially greater return?

My answer is no. Give me a 2.45% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there's probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son's 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I'm in the “low interest rates for life” camp. Once again, I don't see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don't see a real estate crash like the stock market crash of 4Q2018. Instead, we'll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I've learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I've given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don't stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it's time to get some help with writing. I'll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I'll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I've discovered how great it is to hire help around the house, it's only logical to hire help for our business.

4) Focus on profits. Since I'm going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I'll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It's going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don't pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better. I'm aiming for thought diversity not groupthink.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I've discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

Sit comfortably in circle time for more than 10 minutes

Enjoy playing with the piano, guitar, and drums

Play with toys without mouthing them

Screw and unscrew jar lids and turn door handles

Build towers of more than 6 blocks

Copy a circle with pencil or crayon

Show affection for friends without prompting

Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

Walk down stairs unassisted

Maintain balance while catching a ball or when gently bumped by peers

Throw and attempt to catch ball without losing balance

Walk and maintain balance over uneven surfaces

Use both hands equally to play and explore toys

Learn to pedal a tricycle

Daily Activities

Able to self-calm in car rides when not tired or hungry

Tolerate diaper changes without crying or whining

Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

Able to self-calm to fall asleep

Able to tolerate and stay calm during dental visits

Able to brush his teeth without whining or crying 3X a day

Is potty trained before preschool starts in September

Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

Uses “in” and “on”

At least 75% of speech is understood by any caregiver

Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

Understands “mine” and “yours”

Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we're all getting sick more often now as he's exposed to other kids. Luckily, my wife and I haven't been sick at the same time yet. We'll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I've been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don't care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I've never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it's also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a canon in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I'd be feeling nervous today since the stock market corrected by 20% soon after. It's not unreasonable to assume to house is now worth $200,000 (4.5%) less today.

Meanwhile, the seller of the house in Honolulu I've been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there's a good chance they will accept $3.5M – $3.7M because they finally dropped the ask down to $3.98M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won't need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Same for many big city residents around the world e.g. London, Hong Kong, Singapore, Sydney, Mumbai, etc. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It's going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai's finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I'm having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I'm going to give myself four weeks where I'll just publish one post plus I'll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I don't want to take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who also launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It's clear I haven't done a good enough job appreciating her efforts over the years, which is why I'm committed to do more for her in 2019 and beyond.

Steady As She Goes

If we can grow our net worth by just 5%, I'll be happy. I'm willing to forego upside investment potential to help ensure our net worth goes up in 2019. Despite our public investments accounting for only about 30% of our net worth, it gave me the most stress in 2018. This will change.

I still have hope the Fed will slow down its rate hikes. If they do, I'm confident the economy will chug along at 2% – 2.5% GDP growth and not enter into a recession. However, there are no exciting positive catalysts on the horizon except for a trade agreement with China by end of 1Q. 2019 will likely be another volatile year.

The last two years working on FS and being a SAHD has worn me out. Given we save most of our after-tax business income by living off our passive income, I'm excited to live it up more in 2019 and use my “vacation credits” to take it easier.

If you have any tips on how to smartly inflate your lifestyle without feeling guilty, I'd love to hear them. I also want to learn how to inhale the roses more often without feeling the need to always be productive.

What are some of your goals for 2019? How do you see the stock market and economy unfolding?

The post Financial Samurai 2019 Economic Outlook And Personal Goals appeared first on Financial Samurai.

0 notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it's OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let's first discuss my outlook for 2019 and then I'll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There's an old saying on Wall Street: don't fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it's baffling why the Fed thinks inflation will accelerate in 2019.

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. And unless JP is a complete idiot for going to Princeton and Georgetown, he will probably adjust his interest rate stance if we enter full bear market territory. And let's put things in perspective, a -6.4% year for the S&P 500 is not that bad.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 2.45% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a potentially greater return?

My answer is no. Give me a 2.45% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there's probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son's 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I'm in the “low interest rates for life” camp. Once again, I don't see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don't see a real estate crash like the stock market crash of 4Q2018. Instead, we'll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I've learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I've given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don't stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it's time to get some help with writing. I'll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I'll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I've discovered how great it is to hire help around the house, it's only logical to hire help for our business.

4) Focus on profits. Since I'm going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I'll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It's going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don't pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better. I'm aiming for thought diversity not groupthink.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I've discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

Sit comfortably in circle time for more than 10 minutes

Enjoy playing with the piano, guitar, and drums

Play with toys without mouthing them

Screw and unscrew jar lids and turn door handles

Build towers of more than 6 blocks

Copy a circle with pencil or crayon

Show affection for friends without prompting

Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

Walk down stairs unassisted

Maintain balance while catching a ball or when gently bumped by peers

Throw and attempt to catch ball without losing balance

Walk and maintain balance over uneven surfaces

Use both hands equally to play and explore toys

Learn to pedal a tricycle

Daily Activities

Able to self-calm in car rides when not tired or hungry

Tolerate diaper changes without crying or whining

Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

Able to self-calm to fall asleep

Able to tolerate and stay calm during dental visits

Able to brush his teeth without whining or crying 3X a day

Is potty trained before preschool starts in September

Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

Uses “in” and “on”

At least 75% of speech is understood by any caregiver

Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

Understands “mine” and “yours”

Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we're all getting sick more often now as he's exposed to other kids. Luckily, my wife and I haven't been sick at the same time yet. We'll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I've been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don't care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I've never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it's also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a canon in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I'd be feeling nervous today since the stock market corrected by 20% soon after. It's not unreasonable to assume to house is now worth $200,000 (4.5%) less today.

Meanwhile, the seller of the house in Honolulu I've been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there's a good chance they will accept $3.5M – $3.7M because they finally dropped the ask down to $3.98M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won't need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Same for many big city residents around the world e.g. London, Hong Kong, Singapore, Sydney, Mumbai, etc. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It's going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai's finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I'm having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I'm going to give myself four weeks where I'll just publish one post plus I'll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I don't want to take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who also launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It's clear I haven't done a good enough job appreciating her efforts over the years, which is why I'm committed to do more for her in 2019 and beyond.

Steady As She Goes

If we can grow our net worth by just 5%, I'll be happy. I'm willing to forego upside investment potential to help ensure our net worth goes up in 2019. Despite our public investments accounting for only about 30% of our net worth, it gave me the most stress in 2018. This will change.

I still have hope the Fed will slow down its rate hikes. If they do, I'm confident the economy will chug along at 2% – 2.5% GDP growth and not enter into a recession. However, there are no exciting positive catalysts on the horizon except for a trade agreement with China by end of 1Q. 2019 will likely be another volatile year.

The last two years working on FS and being a SAHD has worn me out. Given we save most of our after-tax business income by living off our passive income, I'm excited to live it up more in 2019 and use my “vacation credits” to take it easier.

If you have any tips on how to smartly inflate your lifestyle without feeling guilty, I'd love to hear them. I also want to learn how to inhale the roses more often without feeling the need to always be productive.

What are some of your goals for 2019? How do you see the stock market and economy unfolding?

The post Financial Samurai 2019 Economic Outlook And Personal Goals appeared first on Financial Samurai.

0 notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.