#sbi personal loan emi calculator

Explore tagged Tumblr posts

Text

Which Loan is Best, FD, Gold Loan, Mutual Fund, Personal Loan

What is Loan

Some Types of Loans

FD (Fixed Deposit) Loan

You can take a loan against bank FD without breaking it. In this way, along with the benefit of maintaining the savings deposited in the bank, one also gets the necessary cash.

The interest rates (12–15%) applicable on FD loans are also lower than personal loans. This loan is also easily available immediately. Also, there is no need to submit many documents to the bank for this. Savings also remain intact along with debt.

Gold Loan

Gold loans have become attractive these days as gold prices have reached Rs 75,000 per 10 grams. Now you will get more loan than before on mortgaging jewellery.

READ MORE>>>>

#which loan is best#Which loan is best in india#Which Bank is best for personal loan with low interest#Which loan is best for bad credit#FD LOAN#Personal Loan#Gold Loan#Mutual Fund#HDFC Personal Loan#Personal loan rate of interest#Personal loan calculator#interest rate#Fd loan sbi#Gold Loan interest rates#Gold loan Calculator#Gold Loan SBI#Mutual fund calculator#Mutual funds India#SBI Mutual Fund#Mutual fund investment#4 types of mutual funds#Mutual Fund Sahi Hai#HDFC Mutual Fund#Mutual Fund investment Plan#SBI Gold Loan interest rate#Gold loan per gram#Gold loan EMI calculator#Gold loan near me#IIFL gold loan#Fd loan calculator

0 notes

Text

SBI Personal Loan EMI Calculator

There are many online EMI (Equated Monthly Installment) calculators available that can help you determine the monthly payments for a loan or mortgage. To use one, you can follow these general steps:

Open your web browser and go to a search engine like Google. In the search bar, type "serviceplusemi.com" and press Enter.

2 notes

·

View notes

Text

How to get an Abroad Education Loan?

If you're seeking an education loan for studying abroad, you can reach out to GyanDhan. They have partnered with India’s top banks such as SBI, UBI, HDFC Credila, ICICI, and even international lenders like Mpower and Prodigy Finance.

The best part is, GyanDhan's services are completely free! They will provide you with an experienced education loan counselor who will help you evaluate your profile and create a personalized checklist of documents you'll need.

And here's the cherry on top - GyanDhan offers you Guaranteed Best Loan and if you find a better loan offer elsewhere, they will gladly cover the difference in interest.

All you have to do is Check Your Loan Eligibility, and they will get in touch with you quickly.

Oh, and they also have an EMI calculator tool that lets you calculate your loan repayment installments easily.

#educationloan#studyabroad#msinusa#gyandhan#gyandhanloanwithoutcollateral#studentloan#how to get abroad education loan#educationloanforus#educationloanforuk

2 notes

·

View notes

Text

Traveling is one of life's greatest joys, offering opportunities to explore new cultures, bond with loved ones, and create lasting memories. However, the financial strain of funding a vacation can often act as a deterrent. To address this, many financial institutions in India now offer travel loans, also known as personal loan for travel, enabling individuals to plan their dream trips without financial worry.

What is a Travel Loan?

A travel loan is essentially a personal loan tailored to meet your vacation expenses. It covers costs such as airfare, accommodation, sightseeing, and other travel-related activities. Unlike traditional loans that require collateral, most personal loans for travel are unsecured, meaning you don't have to pledge any asset to secure the funds.

Benefits of Taking a Vacation Loan

Easy Access to Funds: With quick approvals and minimal documentation, travel loans make it easier to access funds when planning a trip.

Flexible Repayment Options: Most lenders provide flexible repayment tenures ranging from 12 to 60 months, allowing you to choose a plan that fits your budget.

No Need for Savings Depletion: Instead of dipping into your savings, you can use a vacation loan to cover your travel expenses and repay it in manageable installments.

Customizable Amounts: Depending on your travel plans, you can borrow as much or as little as you need, up to the maximum limit offered by the lender.

How to Apply for a Personal Loan for Travel

Applying for a vacation loan is straightforward and can often be done online. Here are the general steps:

Check Your Eligibility: Ensure you meet the lender's requirements, including minimum income, credit score, and age criteria.

Choose a Suitable Lender: Compare interest rates, processing fees, and repayment terms from various lenders to find the best deal.

Submit Required Documents: Typically, lenders ask for proof of identity, address, income, and travel itinerary.

Loan Disbursement: Once approved, the loan amount is disbursed directly to your account, allowing you to start planning your trip immediately.

Key Factors to Consider Before Taking a Travel Loan

Interest Rates: Interest rates for personal loans for travel in India usually range between 10% and 20% annually. Compare rates across lenders to find the most affordable option.

Loan Tenure: Choose a tenure that balances your monthly budget and total interest outgo.

Hidden Charges: Look out for processing fees, prepayment charges, and other hidden costs.

EMI Affordability: Use an EMI calculator to ensure your monthly installments are manageable within your income.

Top Banks and NBFCs Offering Travel Loans in India

Some leading institutions offering travel loans include:

State Bank of India (SBI): Offers affordable personal loans with flexible terms.

HDFC Bank: Known for quick approvals and competitive interest rates.

ICICI Bank: Provides customizable personal loans for travel needs.

Bajaj Finserv: Offers pre-approved travel loans for existing customers.

Axis Bank: Provides vacation loans with easy repayment options.

Why Opt for a Personal Loan for Travel?

While credit cards can also fund travel expenses, they come with higher interest rates and limited repayment flexibility. A vacation loan, on the other hand, offers better affordability and structured repayment plans, making it a more viable option for financing your dream trip.

Final Thoughts

Traveling doesn’t have to remain a dream due to financial constraints. With the availability of vacation loans and personal loans for travel, you can embark on your desired journey without burdening your finances. However, always borrow responsibly by evaluating your repayment capacity to ensure your trip remains stress-free, both during and after your vacation.

Plan your dream holiday today, and let a travel loan turn your wanderlust into reality!

1 note

·

View note

Text

Traveling is more than just an activity; it’s an enriching experience that creates lasting memories. However, not everyone has the financial flexibility to fund their dream vacations immediately. That’s where travel loans in India or personal loans for travel step in to make your dream journeys a reality without financial strain.

What is a Travel Loan?

A travel loan is a type of personal loan designed to cover expenses related to travel, such as flight tickets, accommodation, sightseeing, food, and more. These loans are unsecured, meaning they don’t require collateral, making them accessible to a broader audience.

Features of Travel Loans

Quick Approval: Most financial institutions offer hassle-free approval, sometimes within 24 hours.

Flexible Loan Amounts: Depending on your travel plan, you can borrow amounts ranging from ₹50,000 to ₹25 lakhs.

No Collateral Needed: Loan for travel are unsecured, so you don’t need to pledge assets.

Flexible Tenures: Repayment tenures can range from 12 to 60 months, giving you ample time to repay.

Minimal Documentation: With simple documentation like ID proof, income proof, and travel itinerary, you can apply easily.

Why Choose a Travel Loan?

Instant Funds: You get quick access to money to book flights or accommodation before prices rise.

Affordable EMIs: With competitive interest rates, the EMIs are manageable.

Tailored for Convenience: These loans can be customized based on your destination and budget.

How to Apply for a Travel Loan?

Research Lenders: Compare different financial institutions for the best interest rates and terms.

Check Eligibility: Ensure you meet the eligibility criteria, such as age, income, and credit score.

Submit Documents: Provide necessary documents like proof of identity, address, income, and your travel plan.

Loan Disbursement: Once approved, the loan amount is credited to your account.

Best Uses of a Travel Loan

Domestic Travel: Explore the diverse landscapes of India, from the Himalayan mountains to serene beaches.

International Vacations: Fulfill your dreams of visiting exotic destinations abroad.

Family Trips: Enjoy quality time with loved ones without worrying about expenses.

Adventure Travel: Engage in thrilling activities like trekking, scuba diving, or skiing.

Top Providers of Travel Loans in India

My Mudra: Known for quick approvals and customer-centric solutions.

HDFC Bank: Offers attractive interest rates for personal loans.

SBI: Provides flexible repayment tenures.

ICICI Bank: Known for seamless application processes.

Tips for Managing Your Travel Loan

Borrow only what you need to avoid financial stress.

Compare lenders to secure the best interest rates.

Plan your repayment schedule to ensure timely EMI payments.

Use online EMI calculators to estimate monthly installments before applying.

Conclusion

A travel loan is a practical solution for those who want to explore the world without draining their savings. With competitive rates, flexible tenures, and minimal documentation, planning your dream vacation has never been easier. Whether it's a romantic getaway, an adventurous trek, or a relaxing holiday, a travel loan can make your dreams come true.

#travel loan#travel loan in india#holiday loan#loan for travel#vacation loan#personal loan for travel

1 note

·

View note

Text

Traveling is often considered one of life's greatest joys, providing an opportunity to explore new places, experience diverse cultures, and create lasting memories. However, the expenses associated with travel—such as flight tickets, accommodation, food, and sightseeing—can sometimes deter people from embarking on their dream journeys. This is where a travel loan or a personal loan for travel comes into play.

What is a Travel Loan?

A travel loan is a type of unsecured personal loan offered by banks, non-banking financial companies (NBFCs), and digital lenders to fund travel-related expenses. It allows individuals to finance their trips without depleting their savings or relying on credit cards, which often carry high interest rates.

These loans are versatile and can be used for domestic or international travel, family vacations, honeymoons, or even business trips.

Features of a Travel Loan

No Collateral Required: As an unsecured loan, there is no need to pledge assets or provide a guarantor.

Quick Approval and Disbursal: With minimal paperwork and online application processes, travel loans can be approved and disbursed swiftly.

Flexible Tenure: Loan repayment periods typically range from 1 to 5 years, allowing borrowers to choose a tenure that fits their budget.

Competitive Interest Rates: Interest rates for personal loans in India generally range between 10% and 20%, depending on the lender, borrower's credit score, and other factors.

Loan Amount: Borrowers can usually avail of loans ranging from ₹50,000 to ₹25 lakh, based on their eligibility.

How to Apply for a Travel Loan?

Determine the Loan Amount: Calculate the estimated travel costs, including tickets, accommodations, and other expenses.

Compare Lenders: Research various lenders to find the best interest rates, processing fees, and repayment terms.

Check Eligibility: Most lenders require borrowers to meet specific criteria such as:

Age: Typically between 21 and 60 years.

Income: A stable income source with a minimum monthly salary or income threshold.

Credit Score: A good credit score (700 and above) to secure better rates.

Submit Documents: Provide necessary documents like identity proof, address proof, income proof (salary slips or IT returns), and travel-related information.

Loan Disbursal: Once approved, the loan amount is credited to your account, and you can use it to book your trip.

Benefits of a Travel Loan

Freedom to Travel: A loan for travel enables you to take that much-awaited vacation without postponing due to financial constraints.

No Upfront Payments: With a loan, you can enjoy your trip now and repay it in manageable EMIs later.

Customized Plans: Many lenders offer customized personal loan packages for travel, including add-ons like travel insurance.

Improves Credit Score: Regular EMI payments can positively impact your credit history.

Points to Consider Before Taking a Travel Loan

Assess Your Repayment Ability: Ensure that the monthly EMI fits comfortably into your budget.

Avoid Overborrowing: Borrow only the amount you need for your trip to avoid excessive financial burden.

Review Loan Terms: Carefully read the loan agreement, including hidden charges like prepayment penalties or processing fees.

Emergency Funds: Maintain a separate fund for unexpected travel expenses, even if you have a loan.

Top Banks and NBFCs Offering Travel Loans in India

SBI Personal Loan

Interest Rate: Starts at 10.10% p.a.

Loan Amount: Up to ₹20 lakh

HDFC Bank Personal Loan

Interest Rate: 10.50% - 21.00% p.a.

Loan Amount: Up to ₹40 lakh

ICICI Bank Personal Loan

Interest Rate: 10.75% - 19.00% p.a.

Loan Amount: Up to ₹25 lakh

Bajaj Finserv

Interest Rate: Starting at 13% p.a.

Loan Amount: Up to ₹25 lakh

Axis Bank Personal Loan

Interest Rate: 10.49% - 20.00% p.a.

Loan Amount: Up to ₹40 lakh

Conclusion

A travel loan in India can make your dream vacation a reality without straining your finances. However, it’s essential to plan your finances wisely, compare loan offers, and borrow responsibly. With proper management, a travel loan can transform your travel aspirations into cherished memories, allowing you to explore the world without financial stress.

0 notes

Text

Personl Loan,SBI: ఎస్బీఐలో రూ.5 లక్షల పర్సనల్ లోన్కు ఈఎంఐ ఎంత కట్టాలి? ఇలా మీరే తెలుసుకోండి! - sbi personal loan interest rate how much emi calculate for rs 5 lakh - Samayam Telugu

SBI: అత్యవసరంగా డబ్బులు కావాలంటే పర్సనల్ లోన్ బెస్ట్ ఆప్షన్గా చెప్పవచ్చు. ఎలాంటి పూచీకత్తు లేకుండా వ్యక్తిగత రుణం పొందవచ్చు. అయితే, దీనికి మీ క్రెడిట్ స్కోర్ కచ్చితంగా మెరుగ్గా ఉండాలి. సిబిల్ స్కోర్ మెరుగ్గా ఉన్న వారికి వడ్డీ రేటు సైతం తగ్గిస్తాయి బ్యాంకులు. సంబంధిత బ్యాంకుల నిబంధనలకు అనుగుణంగా మీ శాలరీ, సిబిల్ స్కోర్ ఆధారంగా లోన్ను అందస్తుంటారు. మరి పర్సనల్ లోన్ తీసుకుంటే ఎంత వడ్డీ…

View On WordPress

0 notes

Text

SBI Personal Loan Interest Rates: To Fulfill Desires

SBI is the reputed bank, and that’s the reason applicants easily trust and get the privileges. They provide various SBI personal loans according to your eligibility criteria. Before that, you should know SBI personal loan interest rates and SBI personal loan EMI calculator before applying for the loan. After knowing these details, it’s easy to enjoy the benefits. Let’s find below rates information.

SBI Xpress Credit Personal Loan Eligibility

This SBI personal loan can avail whenever you want. You can use Xpress credit personal loan for a sudden vacation, or urgent fund required for medical expenses. To get the immediate fund, you should show the minimum documents, no hidden and pre-payment charges, and processing charges also low. The interest rate of the loan 12.05% to 15.45% per annum, and repayment within five years, also the net monthly income must at least Rs 5,000 per month.

SBI Xpress Elite Personal Loan Eligibility

Those are having a salary account in SBI or any other bank can available this loan. The effective interest rate is a combination of the credit score in addition to two-year MCLR with the spread over two-year MCLR. The interest rate starts at 11.05% to 12.80% per annum.

SBI Xpress Power Personal Loan Eligibility

It’s an unsecured personal loan, and the bank can provide services to them who don’t maintain their salaried account in SBI. Employees working with central, state governments, defense, PSUs, or select rated corporates are eligible to get SBI personal loan. The interest rate starts from 12.15% to 13.80% per annum with Rs 50,000 gross monthly income for five years.

SBI Pension Personal Loan Eligibility

Who are receiving their pensions through central or the state government this scheme is for them. They can get this loan easily, so that use it for their urgent medical emergencies or unexpected personal financial needs. The interest rate starts at 12% per annum.

In general SBI personal loan interest rates start from 11.05% to 15.45% with loan amount minimum Rs 24000 and maximum 24 times NMI subject to a maximum of Rs 15 lakh overdraft. Minimum Rs 10 lakhs and maximum 24 times NMI subject to a maximum of Rs 15 lakh overdraft for five years. Processing fee nil- 1% of the loan amount with GST and prepayment charges nil 3% of the principal outstanding.

When you talk about general eligibility criteria for the SBI personal loan, they divide loan categories two stages the salaried or self-employed. For the salaried age should be 21 to 58 years with minimum Rs 5,000 per month income, and total work experience two years. For the self-employed age should be between 21 to 65 years with minimum Rs 7,000 per month income, and two years total job experience.

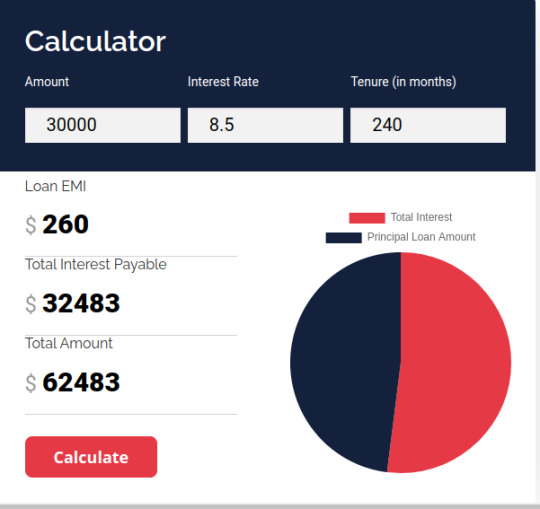

SBI Personal Loan EMI Calculator: Measure Your Monthly Payment To The Lender

The SBI personal loan EMI calculator is the best option when you want to know the EMI payable amount to the lender every month and which should be accurate. To use the EMI calculator you should download or install the site. Once installation over, you should put a few details according to that give the exact payable amount information. You should provide a loan amount, tenure, and interest rate. After the submission, they give accurate monthly payment detail. Do you know, it’s free to use? Yes, you can use SBI personal loan calculator again an again until not getting a satisfactory report.

1 note

·

View note

Text

Key Features of the SBI Personal Loan EMI Calculator on Credtify

In today's fast-paced world, financial planning is more crucial than ever. Whether it's for a dream vacation, a home renovation, or dealing with unexpected expenses, a personal loan can be a lifesaver. However, understanding the financial implications of a loan is equally important. This is where the SBI Personal Loan EMI Calculator on Credtify becomes your go-to tool for smart financial decisions.

1. What is the SBI Personal Loan EMI Calculator?

The SBI Personal Loan EMI Calculator is a powerful online tool designed to help you estimate your Equated Monthly Installments (EMIs) effortlessly. Whether you're a seasoned borrower or a first-time loan applicant, this tool simplifies the complex task of calculating EMIs, making it accessible to everyone.

2. Why Choose SBI Personal Loans?

SBI is a trusted name in the banking sector, known for its reliability and customer-centric approach. When it comes to personal loans, SBI offers competitive interest rates, flexible repayment options, and quick approval processes. With the SBI Personal Loan EMI Calculator on Credtify, you can tailor your loan to suit your financial capabilities.

3. Key Features of the SBI Personal Loan EMI Calculator on Credtify:

a. User-Friendly Interface:

Credtify's EMI Calculator is designed with simplicity in mind. Its user-friendly interface ensures that even those unfamiliar with financial jargon can effortlessly calculate their EMIs.

b. Accurate and Instant Results:

The calculator uses advanced algorithms to provide accurate EMI calculations instantly. This feature allows you to plan your finances with precision, avoiding any surprises during the loan repayment period.

c. Customization Options:

Credtify understands that every borrower is unique. The SBI Personal Loan EMI Calculator allows you to customize variables such as loan amount, interest rate, and tenure, enabling you to find a repayment plan that aligns with your financial goals.

d. Comparison Capabilities:

Considering multiple loan options? The calculator empowers you to compare different scenarios, helping you choose the most suitable SBI personal loan based on your preferences.

4. How to Use the SBI Personal Loan EMI Calculator on Credtify:

Using the calculator is a breeze. Simply input the loan amount, interest rate, and tenure into the designated fields. The calculator will then generate your monthly EMI, giving you a clear picture of your financial commitment.

5. Benefits of Utilizing the SBI Personal Loan EMI Calculator:

a. Financial Planning:

The calculator aids in effective financial planning, allowing you to budget your monthly expenses with the EMI amount in mind.

b. Transparency:

By knowing the exact EMI amount, you can make informed decisions and avoid any unforeseen financial strain.

c. Quick Decision-Making:

With instant results, you can quickly assess different loan scenarios and make decisions that align with your financial goals.

Conclusion:

In the realm of personal finance, knowledge is power. The SBI Loan Calculator Personal Loan on Credtify empowers you with the information needed to make well-informed decisions about your financial future. Use this tool to explore and customize your personal loan options, ensuring that your financial journey is smooth and stress-free. Maximize your financial planning today with the SBI Personal Loan EMI Calculator on Credtify!

0 notes

Link

State Bank of India (SBI) provides you access to its online personal loan EMI calculator, using this you can generate your loan EMIs and interest payout. But what more can you do with it? Well, you can use the SBI Personal Loan EMI Calculator to reduce your interest payout, EMI payments or transfer your existing personal loan to SBI. So, as you can see the calculator could help you in repayment of the loan in various manners, know more about the usage of SBI Personal Loan EMI Calculator in this article below.

0 notes

Photo

SBI Personal Loan EMI Calculator is a tool by which you can calculate your monthly EMI based on your loan amount, lowest interest rate, tenure, and processing fee. Apply for SBI personal loan at Afinoz.

#SBI Personal Loan#sbi personal loan interest rate#SBI personal loan Emi Calculator#SBI personal loan eligibility Calculator#sbi bank customer number#SBI Personal Loan Status#Best Personal Loan#best bank for personal loan#Best bank in india#instant personal loan

0 notes

Link

An SBI personal loan EMI calculator is a tool that helps you with detailed calculations about your possible monthly installments if you want to avail an SBI personal loan. If you are confused about how the State Bank calculates your EMI, you should use the SBI personal loan EMI calculator.

0 notes

Photo

Calculate with SBI Personal Loan EMI Calculator SBI personal loans are one of the most highly recognized ones with attractive and diverse personal loan products to meet the distinct requirements of salaried & self-employed individuals and working professionals as well as pensioners. Yo know more visit https://www.afinoz.com/sbi-bank/personal-loan-emi-calculator

0 notes

Text

Personal Loan Detail in Hindi- पर्सनल लोन क्या है? लोन अप्लाई करें, ब्याज दरें और योग्यता शर्तें जानें ऐसी कई सारी जानकारी

#personal loan#instant loan#best loan#loan offer#sbi personal loan#hdfc personal loan#loan interest rate#loan emi calculator#consumer loans and credit

0 notes

Text

Government Loan scheme

The Indian government has dispatched another drive, "Make In India," to energize and uphold more SMEs and incorporate them into India's development direction. Admittance to cash is the most troublesome undertaking for SMEs today. To battle joblessness in our country, the public authority has dispatched distinctive loaning bundles for little firms. The private company Loan Scheme, Government of India, makes it workable for SMEs to partake in this extension.

PSB Loan in 59 Minutes

It is presented through government drives, is a functioning capital credit going from INR 10 lakhs to INR 5 crores. While financing costs can be unobtrusive, they are dependent upon business credit qualification models.

The public authority business credit for little ventures is that they support or deny advances quickly instead of 30 days, and assets are dispensed in seven to eight days. The bank should be GST enrolled to fit the bill for the advance. The advance sum will be chosen by the accompanying variables.

Pay

Reimbursements

The credit extension advance is accessible to both new and set up MSMEs in the assistance or assembling businesses and set up little ventures wishing to extend. The Small Industries Development Bank of India (SIDBI) dispatched this administration credit to conspire in 2015.

Its goal is to help recently framed little undertakings in accomplishing a good obligation to value proportion. The base advance sum under the SMILE program is INR 25 lakh. Also, it includes a 10-year credit reimbursement length. Under the Indian government's "Make in India" drive, MSMEs in 25 assigned regions will get low-interest financing and advances will be presented as term credits.

Stand-up India Scheme for Protected Groups

It is planned basically to fulfill the monetary necessities of people from Scheduled Caste (SC) and Scheduled Tribe (ST) and ladies business people dispatching another business. The business ought to be occupied with assembling, exchanging, or administration. In case it's anything but sole ownership, the greater part stake (51% ) ought to be held by an SC, ST, or lady business person.

The plan gives at least INR 10 lakh and a limit of INR 1 crore to something like one lady and one SC/ST borrower. Stand-Up India is answerable for 75% of the venture's complete expenses, which incorporate apparatus, foundation, and working capital.

For knowing more about these types of government loan schemes and other topics related to health insurance, finance, personal loans, and education loans then Loans 24/7 provides you the detailed information regarding these topics in the form of blogs.Visit our website loan247.in for more information.

#Govt loan schemes#Best bank for a personal loan#Muthoot finance gold loan#SBI Gold Loan#How to get educational loan#Money view loan#Dhani personal loan#Rupeek gold loan#Hdfc gold loan#Loan emi calculator

0 notes