#savingaccounting

Explore tagged Tumblr posts

Text

Offer for New Credit Cooperative Society Software

Credit Cooperative Society Software and Free Agent mobile App and Customer mobile App* #SocietySoftware Best & Affordable Society Software for all Banking Requirements, Suitable for Rural and Urban Cities. Software Modules Includes member and share management software, dividend declaration, saving account, loan management, fixed deposit, general accounting, saving accounting and so on. Contact Us: https://cooperative-society-software.com/contact-us/

#bankingsoftware#ruralbankingsoftware#loanmanagementsoftware#creditmanagementsoftware#savingaccount#generalaccounting#savingaccounting#nidhisoftware#employeesoftware#hrsoftware#Accounting#Accountingsoftware#loansoftware#acccounting#Creditcooperativesocietysoftware#ThriftAndCreditCooperativeSocietySoftware#CreditCooperativeSocietySoftwarePrice#CreditCooperativeSocietySoftwareInIndore

0 notes

Text

https://nbdominica.com/

#dominicabank#dominicabanking#mobilebanking#savingaccount#bankofdominica#dominica#dominican republic

18 notes

·

View notes

Text

High-Interest Savings Accounts in Malaysia

Nowadays, even teenagers know that a savings account is the last place to put your money if you want it to grow appreciably. It is only logical as these accounts should give you a place to store your money so you can readily access it. It is by no means an investment. You may want to know that you don’t have to settle for the meager rates typical of the traditional savings account. Of the six (6) different types of savings accounts you can open in Malaysia right now, the one that offers the highest interest on your savings is the high-interest savings account.

What Is a High-Interest Savings Account?

As the name suggests, you can open this type of savings account with a bank that automatically entitles you to higher-than-average returns. With these accounts, you can usually get several times more interest on your savings. How Does a High-Interest Savings Account Work? Mainly, high-yield savings accounts operate similarly to your conventional savings account with a few minor adjustments. The first thing typical of most high-interest savings accounts is that there’s almost always a minimum deposit you have to keep in the statement. Also, with these accounts, the longer you’re prepared to stash your money away, the higher your returns will likely be. You may pay a charge if you withdraw your money before the notice ends. Factors To Consider When Choosing a High Yield Savings Account Some variables to evaluate if you want to pick the best high-interest savings to account for you include: The Interest Rate Offered Make sure you clearly know what interest rate you can expect from any given high-yield savings account. The Bonus Rate Offered Many banks offer attractive bonus rates to encourage customers to open high-interest savings accounts. This feature may contribute significantly to the size of your returns. The Maximum And Minimum Deposits Allowed - What’s the minimum amount you can put in this account? - What’s the highest amount of money you can save here? Ensure you know the answers to these questions to tell if the account is proper for you and the best use to put it to. The Notice Period Attached - How long do you keep your money away to get an inevitable return? - Are you comfortable with that time frame and the proposed reward? Know this before moving forward as well. Fees, Charges, and Limitations Imposed A hidden fee or charge eating into your savings or returns is the last thing you want. So, ensure you’re clear on what the bank will charge you for this account and its terms and conditions.

Conclusion

Having high-interest savings accounts is the best way to grow your money safely and passively in Malaysia. But that’s if you get the right kind and use it properly. Read the full article

0 notes

Text

Maximize your returns with our expert investment guide! Whether you're looking for high-yield opportunities or short-term gains, Prahim Investments has you covered. Contact us today to secure your financial future!

Visit our website to start saving today and see how we can make a difference ✅ - https://prahiminvestments.com/ or call us at : 093157 11866 , 01204150300

#prahiminvestments#investment#Invest#investmentopportunity#financialplanning#highyeild#SavingAccount#savings#longterminvesting#ShortTermInvestment#financialservices#FinancialFuture

0 notes

Text

Open Zero Balance Account Today

Kotak 811 Account is the Best for saving Account Click This link for open a Best for your savings https://track.skro.in/l1/ITC58510258/48OBFU?ln=English

0 notes

Text

Offer for New Credit Cooperative Society Software Credit Cooperative Society Software and Free Agent mobile App and Customer mobile App*

SocietySoftware

Best & Affordable Society Software for all Banking Requirements, Suitable for Rural and Urban Cities. Software Modules Includes member and share management software, dividend declaration, saving account, loan management, fixed deposit, general accounting, saving accounting and so on. Contact Us: https://cooperative-society-software.com/contact-us/

or Call: 93294-22917.

bankingsoftware #ruralbankingsoftware #loanmanagementsoftware #creditmanagementsoftware

#savingaccount #generalaccounting #savingaccounting #nidhisoftware #employeesoftware #hrsoftware #Accounting #Accountingsoftware #loansoftware #loansoftware #acccounting #Creditcooperativesocietysoftware #ThriftAndCreditCooperativeSocietySoftware

CreditCooperativeSocietySoftwarePrice #CreditCooperativeSocietySoftwareInIndore

#best software for employee management#company benefits#company loans to employees#employee management system#employee software

0 notes

Video

youtube

#lallulal #lallulalnews @lallulalnews Budget 2024: सेविंग अकाउंट पर मिलेगा बजट में तोहफा! 25 हजार तक के ब्याज पर मिल सकती है छूट #savingaccounts #budget2024news #budget2024summary #budget202425 #budget2024srilanka #budget2024_25 #budget2024withcnbcawaaz #budget2024live #budget2024highlights #savingaccount #incometax #incometaxreturn #incometaxreturnfiling2020 #incometaxrevisioninenglish #incometaxrevisionplaylist #incometaxnotices #incometaxact #incometaxrevisionbcom #incometaxefiling #incometaxindiaefiling #viralvideo #pmmodi #bjp #congressparty #priyankagandhi #rahulgandhi #aap #aapneta #delhiaap Union Budget 2024: इस साल चुनाव के चलते फरवरी में अंतरिम बजट पेश हुआ था. वित्त मंत्री निर्मला सीतारमण इस महीने वित्त वर्ष 2024-25 का पूर्ण बजट पेश करने वाली हैं budget 2024,high yield savings account,high yield savings accounts,health savings account,budget,how to budget,best savings account 2022,savings account,saving money,budget 2024 income tax,high yield savings account 2022,best savings accounts 2023,hysa savings account,best savings account,money saving tips,ynab savings accounts,best savings accounts,taxes on savings account,budget 2024 stocks,budget 2024 update,tax-free savings account Lallu Lal (लल्लू लाल)- हे भैया सच्ची खबर तो लल्लू लाल ही देंगे..भारत के हर कोने से चुनी गई खबरों का संग्रह। भारत के राजनैतिक, सामाजिक और आर्थिक मुद्दों पर गहराई से जानकारी देना हमारा लक्ष्य है। हम यहाँ पर हर विषय को गहराई से देखते हैं, ताकि भारत के करोड़ों Online User के पास सही खबर मिले।

0 notes

Text

IIFL Business Loan

Are you self-employed and urgently need a loan? You can get a hassle-free IIFL Business loan for all your needs worth up to Rs. 30 lakhs. Reasons to apply for IIFL Business Loan:

✅ Instant loan approval

✅ Loan tenure - 9 to 60 months

✅ Minimal documentation

Check your eligibility and apply:

More info: 9963606965

creditcard#businessloan#personalloan#Ausmallfinancebank#savingaccount

bankaccount#iifl#personal#loan#business

0 notes

Text

Diwali offer for New Credit Cooperative Society Software

Credit Cooperative Society Software and Free Agent Mobile App and Customer Mobile App* #SocietySoftware Best & Affordable Society Software for all Banking Requirements, Suitable for Rural and Urban Cities. Software Modules Include member and share management software, dividend declaration, saving account, loan management, fixed deposit, general accounting, saving accounting and so on. Contact Us: https://cooperative-society-software.com/contact-us/

#bankingsoftware#ruralbankingsoftware#loanmanagementsoftware#creditmanagementsoftware#savingaccount#generalaccounting#savingaccounting#nidhisoftware#employeesoftware#hrsoftware#Accounting#Accountingsoftware#loansoftware#acccounting#Creditcooperativesocietysoftware#ThriftAndCreditCooperativeSocietySoftware

0 notes

Text

https://nbdominica.com/private-banking/

#dominicabank#dominicabanking#savingaccount#bankofdominica#dominica#mobilebanking#dominican republic

17 notes

·

View notes

Photo

Unfortunately, savings accounts just took a hit. Some of the big banks have found a way to save money during the COVID-19 crisis by slashing the interest rates on your savings account to near zero. Some banks posted their savings rates on April 6, 2020: BMO Premium Rate Savings: 0.01%; CIBC eAdvantage Savings Account: 0.3%; Scotiabank MomentumPlus Savings: 0.15%; RBC High Interest eSavings: 0.05%; Simplii Financial: 0.5% Tangerine: 0.4% TD High Interest Savings Account: 0% on balances up to $4,999.99; 0.1% for higher balances. Now could be an excellent time to work with a financial advisor to get you better rates for your savings. Having a plan with goals will also help. Call Wayne Elliott at 519-220-0557 for some options. https://bit.ly/33r9R8q

#Savings#zero#SavingAccounts#InterestRates#FinancialCoach#CanadaLife#CertifiedFinancialPlanner#ElliottFinancial#WayneElliott#FinancialPlanning#Waterloo#Kitchener#KWRegion

53 notes

·

View notes

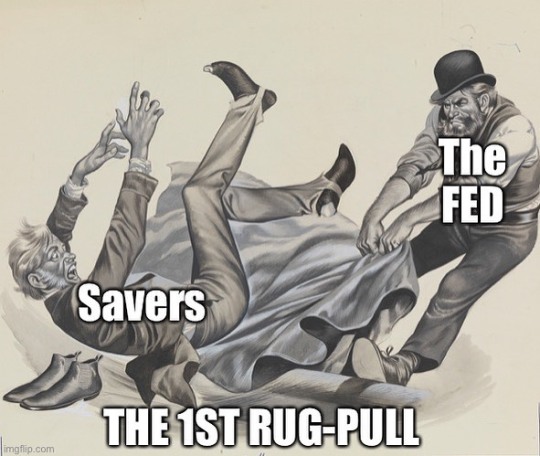

Photo

Crypto scammers are doing their best Wall St impression. One of the earliest rug pulls, was bankers convincing savers, to let them gamble their savings. Fractional reserve always leads to deposits running dry. 🤓 Banking is a pyramid scheme for the ones controlling the money. #fractionalreservebanking #banking #unbanked #selfbank #bankers #btcsavings #financialliteracy #savingaccounts #finance #financialindependence #retireearly #investing #cryptocurrencyrevolutioncryptocurrencyevution #cryptocurrencysignal #cryptocurrencyexchange #cryptocurrency (at Dirt Dog Las Vegas) https://www.instagram.com/p/CG-jvLEA-Fl/?igshid=wfim4a2jtplu

#fractionalreservebanking#banking#unbanked#selfbank#bankers#btcsavings#financialliteracy#savingaccounts#finance#financialindependence#retireearly#investing#cryptocurrencyrevolutioncryptocurrencyevution#cryptocurrencysignal#cryptocurrencyexchange#cryptocurrency

1 note

·

View note

Text

What is the difference between savings account and current account?

It is very important to have a bank account for your daily financial transactions. There are two main types of accounts, one savings account and the other current account.

Savings Accounts -

The meaning of this name is hidden in the name of savings account. Savings account is used to keep the amount received or earnings in the form of savings. These account holders also get interest. The interest rate varies from bank to bank.

current accounts -

The current account is mainly for professionals. It is mandatory to open a current account in a bank in the name of business for business purposes and daily financial transactions. Through this account, the bank provides many facilities to the business professionals

So this was the main difference between a savings account and a current account. Make timely decisions now and open your bank account in Venkatesh Multistate to make your daily financial transactions easier and safer.

1 note

·

View note

Text

Pros of E-passbooks in savingsaccount

Are you one of those who still possess a bank passbook? Then it is time to move on. Banking system made things easier for us a long time back, but there are still several people who either fumble with the umpteen features offered by banks or is yet to get used to them.

Certainly, passbooks are an important document and are considered one of the best physical proofs as it comprises your residential address, complete bank details, phone number, and the record of your savingsaccount transactions. But banking systems have been working day in and day out to make banking experience simple and convenient. One of such feature is the electronic passbooks or the e-statements. It is important to know that a bank statement can be obtained by anyone who holds either a savings or current account, but passbooks are given only savings account holders.

Ideally, a bank e-statement is an abbreviated record of the account holder’s transactions. The service is free for all customers and even records of transactions made several months ago can be traced.

Prompt and convenient: You can view every transaction you have made in your savingsaccount within minutes. It can be accessed while at work, at a coffee shop, if you are at the other end of the world and even when the banks have closed for the day. You could even download it on your computer, tablet or android and save it for offline viewing or printing.

Highly secure: No one can check your e-statement. Thus, there are no possibilities of it being stolen or being delivered at the wrong address. Your confidential data is completely safe as long as it is protected with a strong password with a combination of symbols, numerals and alphabets.

Reduces visits to branches: With e-passbooks, you are saved from making frequent visits to the local branch just to update it. Most banks have set up electronic machines that update the books within seconds, but then they do malfunction and often the print is unreadable due to various reasons like poor ink in the cartridge.

Eco-friendly: The electronic version of your savingsaccount transactions saves trees and reduces the pollution generated due to conventional technique of paper manufacturing, printing and transportation. It also reduces the clutter at your residence and reduces the chances of misplacing it and the trouble of finding it.

Real-time updates: The e-passbooks provide you with entries of the latest transactions- even with ones you made a few minutes ago. Also, there is no limit to the number of times you can seek or download it. It is free of cost.

So, what are you waiting for? Switch now to e-passbooks. For more information log on to https://savingaccount.in/

1 note

·

View note

Text

Benefits of association with #NSDL #PAYMNETS #BANK

i) Account opening #commission 25 INR / per account ( by finger print instant virtual ATM Debit cards )

ii) #AEPS #withdrawal direct in your current account no need to pay any #settlements charges

iii) AEPS attractive commission directly from the bank

iv) Insurance direct agent-ship from NSDL Bank

v) Money Transfer directly from the banks

0 notes