#rsi scalping

Explore tagged Tumblr posts

Text

Learn The RSI Scalping Strategy For Effective Forex Signals

The RSI Scalping Strategy is based on the Relative Strength Index, a technical indicator that measures the strength and speed of price movements.

0 notes

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we���ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Video

youtube

Trading Strategies: DynamicDelta™ - Unleashing the Power of RSI Divergen...

0 notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

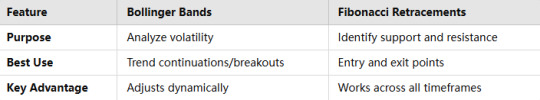

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

Forex Trading Strategies: Navigating Market Trends Amid Economic Shifts

Forex traders need adaptable strategies to thrive in unpredictable market conditions. This post focuses on forex trading methods such as scalping, market trend analysis, and risk management.

Gold is currently experiencing bearish momentum, with RSI divergence suggesting further declines. While short-term pullbacks may occur, traders can capitalize on these movements with scalping strategies aimed at price dips.

Silver’s price action shows a pullback, but the overall market remains bearish. RSI and MACD signals hint at potential for a temporary rally. Scalping traders should focus on short-term selling opportunities.

The U.S. dollar continues to strengthen as inflation fears delay potential rate cuts. The DXY index reflects this, offering opportunities for traders to go long on USD pairs, including USDJPY and USDCHF.

GBPUSD is maintaining a bearish trend, with minimal resistance to further declines. Short-term pullbacks could offer opportunities for scalping, but the long-term outlook remains negative.

The Australian dollar is showing consolidation, lacking clear direction. Traders should wait for a breakout before entering positions, using proper forex risk control measures to manage volatility.

NZDUSD is in a downtrend, with RSI suggesting a possible short-term reversal. However, the broader trend remains bearish, offering short-term selling opportunities for scalpers.

EURUSD remains weak, with both RSI and MACD signaling further declines. Scalping traders can take advantage of short pullbacks while keeping a bearish outlook.

USDJPY continues its bullish momentum, supported by strong buying pressure. Traders should use caution and manage risk, looking for potential overbought signals.

USDCHF is moving upward, but a pullback seems likely. Traders can capitalize on small price movements through scalping strategies while managing risk.

USDCAD shows signs of a potential pullback after an uptrend. Traders should wait for confirmation and use forex signals to time entries and exits effectively.

With effective forex trading methods like scalping, market analysis, and risk control, traders can adapt to market fluctuations and maximize profits.

#Forex trading methods#Forex scalping strategies#Forex market trends#Forex risk control#Forex signal trading

3 notes

·

View notes

Text

Trading Mastery: Blending Intraday Strategies, Investment Wisdom, and Swing Analysis

Success in the stock market requires a blend of well-defined intraday trading strategies, solid investment tips, and effective swing trading indicators. By using a swing stock screener alongside technical analysis, traders can optimize their trade decisions, improve accuracy, and maximize returns.

Effective Intraday Trading Strategies

Intraday trading focuses on buying and selling stocks within the same trading day, requiring quick decision-making and precise strategies. The most successful traders use a combination of the following:

1. Scalping – Capturing Small Profits Repeatedly

Involves making multiple trades within minutes.

Uses technical indicators like VWAP and moving averages for quick entries.

2. Momentum Trading – Riding Strong Price Movements

Focuses on stocks with high trading volume and rapid price swings.

Uses MACD and Relative Strength Index (RSI) to confirm trends.

3. Breakout Trading – Entering at Key Price Levels

Identifies stocks breaking above resistance or below support.

Uses Bollinger Bands and stochastic oscillator for confirmation.

4. VWAP Strategy – Trading Around Volume-Weighted Prices

Uses VWAP (Volume Weighted Average Price) as a reference for entries and exits.

Top Stock Market Investment Tips

For long-term success, traders and investors must follow fundamental principles to minimize risk and maximize gains:

Risk Management – Never risk more than 2% of capital per trade.

Diversification – Invest in different sectors to reduce volatility.

Stay Updated – Follow economic news, earnings reports, and global trends.

Technical & Fundamental Analysis – Combine chart patterns with financial metrics.

Emotional Discipline – Avoid panic trading and stick to a trading plan.

Best Technical Indicators for Swing Trading

Swing trading involves holding stocks for days or weeks to capture medium-term price movements. The best technical indicators for this strategy include:

1. Moving Averages – Identifying Trends

The 50-day and 200-day moving averages help track long-term trends.

2. Relative Strength Index (RSI) – Spotting Overbought/Oversold Levels

Stocks above RSI 70 are overbought, below RSI 30 are oversold.

3. MACD – Measuring Momentum

MACD crossovers indicate trend changes.

4. Bollinger Bands – Tracking Volatility

Stocks touching upper bands may be overbought, lower bands may signal buying opportunities.

Using a Swing Stock Screener for Better Trades

A swing stock screener helps traders filter stocks based on specific criteria, saving time and improving accuracy.

Key Features of a Swing Stock Screener

Volume & Liquidity Filters – Ensures smooth trade execution.

Trend Identification – Screens stocks following moving averages.

RSI & MACD Filters – Identifies momentum shifts.

How to Combine a Swing Stock Screener with Indicators

Use a screener to find stocks with strong trends and volume.

Apply RSI, MACD, and moving averages for confirmation.

Set entry and exit points using support and resistance levels.

Conclusion

Mastering intraday trading strategies, following sound investment principles, and utilizing the best technical indicators ensures better market performance. A swing stock screener further refines stock selection, increasing precision and profitability. By combining these tools, traders can enhance their decision-making and achieve consistent results in the stock market.

0 notes

Text

The Square of 9 in Position Trading: The Hidden Formula Experts Don’t Want You to Know Cracking the Square of 9 Code: Why It’s a Game-Changer for Position Trading Most traders treat the Square of 9 like a cryptic ancient text, glancing at it briefly before running back to their comfort zone of moving averages and RSI. But here’s the kicker: Square of 9 is not just another tool—it’s the secret weapon top traders use to predict market turns with jaw-dropping accuracy. If you’ve ever felt like the market is rigged against you (spoiler: it’s not, you just need better tools), you’re about to unlock one of the best-kept secrets in Forex trading—how to use the Square of 9 in position trading to time market moves like a seasoned pro. What is the Square of 9 and Why Should You Care? Developed by the legendary trader W.D. Gann, the Square of 9 is a mathematical tool that calculates price and time relationships with near-psychic precision. But let’s keep it real—most traders don’t use it because: - They think it’s too complicated (it’s not, once you get the hang of it). - They don’t know how to apply it to position trading. - They’re too busy chasing low-probability scalp trades instead of mastering real market timing. If you’re into position trading, where you hold trades for weeks or months, the Square of 9 will make you wonder how you ever traded without it. The Secret Sauce: How the Square of 9 Predicts Market Moves The Square of 9 revolves around the idea that markets move in geometric and cyclical patterns—not randomly. It helps traders forecast price levels, reversals, and breakout points with extreme accuracy. Step 1: Identifying Key Market Cycles Markets move in cycles—period. Using the Square of 9, you can map out crucial time cycles to anticipate major turning points. Here’s how: - Identify a significant high or low in the past. - Use the Square of 9 to determine future turning points based on price and time. - Mark these levels and observe how price reacts when it approaches them. 👉 Pro Tip: Gann believed that certain time periods (30, 45, 90, 180 days) were crucial for market shifts. If price aligns with a significant time period, expect major fireworks. Step 2: Finding High-Probability Entry Zones Using the Square of 9, you can calculate key price levels where the market is likely to react. - Convert price into degrees: Take the square root of a price, add or subtract a factor (like 180° or 360°), and square it back to find potential targets. - Use it alongside Fibonacci retracements: If a Square of 9 level aligns with a Fibonacci retracement, it’s a high-probability trade setup. 👉 Example: If a major Forex pair hit a key high at 1.2500, applying the Square of 9 can help predict the next significant resistance or support level based on its mathematical rotations. How Most Traders Get It Wrong (And How You Can Avoid It) Many traders butcher the Square of 9 by: - Using it in isolation instead of combining it with price action, volume, and trend confirmation. - Ignoring time cycles, which are just as important as price levels. - Miscalculating rotation angles and ending up with random numbers. The Fix: - Pair the Square of 9 with a solid position trading strategy. - Confirm levels using confluence from multiple indicators. - Backtest before applying it in live markets. Real-World Examples: How Top Traders Use the Square of 9 for Position Trading Let’s break it down with two legendary case studies: Case Study 1: The GBP/USD Forecast That Shocked Analysts In 2019, a seasoned Forex trader applied the Square of 9 to GBP/USD and predicted a major reversal months in advance. How? - He identified a key cycle from a previous low. - Square of 9 levels aligned with a significant price cluster. - The reversal happened within two days of his projected date. Case Study 2: The EUR/USD Trade That Printed 500+ Pips An institutional trader used Square of 9 to pinpoint a perfect buy zone on EUR/USD. - Price aligned with a Square of 9 support level at 1.0780. - A time cycle confirmed a reversal was likely within a week. - The trade ran for over 500 pips in profit. 👉 Takeaway: When price and time align, powerful reversals happen. Bringing It All Together: Mastering Position Trading with the Square of 9 Here’s a quick recap of how to unlock elite trading success with the Square of 9: ✅ Identify key market cycles to anticipate reversals. ✅ Use the Square of 9 to determine high-probability entry zones. ✅ Combine it with price action, Fibonacci, and volume analysis. ✅ Always confirm with other indicators and historical backtesting. ✅ Align price and time for maximum trade accuracy. Want more exclusive insights and real-time trading strategies? 📢 Join our StarseedFX Community for daily market insights, insider tips, and elite tactics: Join Now —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Gold, Dollar, and Forex Trends: NFP Impact on Markets

GOLD

Gold recently underwent a correction, and while current highs are flagged as overbought by the RSI, the market remains bullish. The MACD shows fading selling momentum and hints of renewed buying strength. The quantitative forex models suggest that further upward movement is likely, but significant movement may not occur until after the release of NFP reports. The EMA200 remains far below current price levels, indicating that further buying is possible if momentum persists.

SILVER

Silver remains in consolidation, awaiting direction from gold prices. While the broader outlook for silver is bullish, it relies heavily on gold's price action post-NFP. The MACD shows a cross with low volume, while the RSI indicates increased buying momentum without signaling overbought conditions. For traders using regulated MetaTrader platforms, silver provides a stable environment, with resistance still firm at 32.5177.

DXY

The Dollar Index (DXY) is consolidating as the market anticipates jobs data. The RSI previously hit oversold conditions, and the MACD suggests potential bearish continuation. A bearish outcome post-NFP is expected, reinforcing the probability of a Fed rate cut later this year. For those employing forex scalping automation, short-term opportunities may emerge as momentum remains firmly bearish.

GBPUSD

The Pound continues consolidating after pulling back from recent highs. The RSI calls for overbought conditions, hinting at further selling potential. The MACD suggests room for downside, though the Bank of England’s recent rate cut provides bullish momentum. Traders looking to compound forex profits may find value in this consolidation phase, using strategic entry points after the NFP report.

AUDUSD

The Aussie Dollar is holding above its prior consolidation zone’s resistance, which now acts as support. The RSI signals overbought conditions, and the MACD shows muted volume. However, with the possibility of a Fed rate cut after the jobs report, continued bullish momentum is likely. Traders using forex scalping automation can leverage these short-term fluctuations to maximize returns.

NZDUSD

The Kiwi Dollar shows strong buying momentum, with the MACD crossing up and the RSI reflecting overbought levels. Prices remain capped under 0.56869, suggesting consolidation. While the market favors bullish momentum, the quantitative forex models indicate that the NFP report will determine the next significant move. EURUSD: The Euro has struggled to capitalize on the dollar’s weakness, reflecting weaker Euro fundamentals. The RSI indicates overbought conditions, and the MACD shows muted bullish volume. Until NFP data is released, sentiment for the Euro remains bearish. Hedging with multiple currencies can be a smart move here to manage risks in this uncertain environment.

USDJPY

The Yen has shown heightened selling momentum, with the RSI showing exaggerated levels during the correction. The MACD maintains bearish volume, and price action follows a consistent downtrend. For those using compounding forex profits, this downtrend presents opportunities to gain from sustained bearish movements, especially with NFP data looming.

USDCHF

The Swiss Franc bounced from support at 0.90054, with increased bullish momentum. However, the RSI indicates overbought conditions, and resistance near 0.90743 remains a challenge. Regulated MetaTrader platforms can offer precise entries and exits during this period of consolidation, with a bearish sentiment likely to resume after the jobs report.

USDCAD

The Canadian Dollar is consolidating at prior swing lows, acting as temporary support. The RSI signals oversold conditions, while the MACD shows muted volume with unclear direction. The forex scalping automation approach may be effective here, as traders monitor NFP data to see whether this support level holds or breaks.

COT REPORT ANALYSIS

AUD - WEAK (5/5)

GBP - WEAK (4/5)

CAD - WEAK (4/5)

EUR - WEAK (4/5)

JPY - WEAK (1/5)

CHF - WEAK (5/5)

USD - STRONG (4/5)

NZD - WEAK (4/5)

GOLD - STRONG (5/5)

SILVER - STRONG (4/5)

0 notes

Text

Best Olymp Trade Strategy for Consistent Profits

Trading successfully on Olymp Trade requires more than luck—it demands strategy, discipline, and continuous learning. Whether you are a beginner or an experienced trader, adopting a well-planned Olymp Trade strategy can significantly improve your chances of making profitable trades. In this guide, we’ll explore some of the most effective trading strategies, tips, and techniques to maximize your trading potential.

For expert insights and additional resources, visit O2Help.

Understanding the Importance of a Trading Strategy

A trading strategy helps traders minimize risks, maximize profits, and make informed decisions. Here’s why having a solid strategy is essential:

Reduces emotional trading by providing a structured approach.

Improves consistency in executing trades.

Enhances risk management to protect capital.

Increases profitability by optimizing trade entries and exits.

Best Olymp Trade Strategies for Success

1. Trend Trading Strategy

This strategy involves identifying and trading in the direction of the market trend.

How It Works: Use Moving Averages, MACD, or RSI to confirm an uptrend or downtrend.

Entry Points: Buy when an uptrend is confirmed; sell when a downtrend is evident.

Risk Management: Use stop-loss to minimize potential losses.

2. Support and Resistance Strategy

Traders use support and resistance levels to identify entry and exit points.

How It Works: Identify key price levels where the market historically reverses.

Entry Points: Buy near support levels; sell near resistance levels.

Confirmation Tools: Use candlestick patterns and volume indicators to validate trades.

3. Breakout Strategy

Breakout trading involves entering trades when the price moves beyond a defined support or resistance level.

How It Works: Wait for strong price movements beyond critical levels.

Entry Points: Enter the market when a breakout is confirmed with strong volume.

Risk Management: Place a stop-loss just below the breakout level.

4. Moving Average Crossover Strategy

This strategy is based on two moving averages crossing each other, signaling potential buy or sell opportunities.

How It Works: Use short-term and long-term moving averages.

Entry Points: Buy when the short-term MA crosses above the long-term MA; sell when it crosses below.

Best for: Swing traders aiming for long-term price movements.

5. Scalping Strategy

Scalping involves making multiple small trades to take advantage of minor price movements.

How It Works: Open and close trades within minutes.

Entry Points: Use indicators like Bollinger Bands and Stochastic Oscillator to identify quick trade setups.

Risk Management: Requires strict stop-loss and profit-taking rules.

Essential Tips for Olymp Trade Success

Start with a Demo Account: Practice risk-free before trading with real money.

Use Risk Management Tools: Never risk more than 2% of your capital on a single trade.

Stay Updated on Market Trends: Keep an eye on economic news and financial reports.

Avoid Overtrading: Stick to your strategy and avoid emotional decisions.

Analyze Past Trades: Regularly review your trades to identify areas for improvement.

Conclusion

A well-defined Olymp Trade strategy can significantly improve your trading success by helping you make informed and strategic decisions. Whether you prefer trend trading, breakout strategies, or scalping, consistency and risk management are key to profitability. By combining proven strategies with continuous learning, you can achieve long-term success in online trading.

For expert insights and additional resources, visit O2Help.

0 notes

Text

DexterLab (Monster Lab Trading) Course Overview Introduction DexterLab, also known as Monster Lab Trading, is an advanced course designed for individuals seeking to master trading in financial markets. The course covers various trading strategies, technical analysis, risk management, and psychological aspects essential for successful trading. Here’s a detailed overview of the course: Course Structure Modules: The course is divided into several modules, each focusing on a specific aspect of trading. Duration: Typically spans over several weeks or months, depending on the pace of learning and depth of content. Format: Available in online and offline formats, including video lectures, live webinars, and interactive workshops. Core Modules Introduction to Trading Basics of Trading: Introduction to different financial markets including stocks, forex, commodities, and cryptocurrencies. Trading Platforms: Overview of popular trading platforms and how to use them. Technical Analysis Charting Techniques: Understanding candlestick charts, line charts, and bar charts. Indicators and Oscillators: Deep dive into moving averages, RSI, MACD, Bollinger Bands, and other indicators. Trend Analysis: Identifying and analyzing market trends. Fundamental Analysis Economic Indicators: Importance of GDP, inflation, employment data, and other economic indicators. Company Analysis: Analyzing financial statements, earnings reports, and company news. Global Events: Impact of geopolitical events on financial markets. Trading Strategies Day Trading: Techniques and strategies for day trading, including scalping and momentum trading. Swing Trading: Strategies for capturing short- to medium-term market movements. Position Trading: Long-term trading strategies focusing on market fundamentals. Risk Management Risk Assessment: Identifying and assessing potential risks in trading. Position Sizing: Determining the appropriate amount of capital to allocate to each trade. Stop Loss and Take Profit: Setting and managing stop-loss and take-profit levels. Trading Psychology Mindset: Importance of a disciplined and objective mindset. Emotional Control: Techniques to manage emotions and avoid impulsive decisions. Mental Resilience: Building mental resilience to handle losses and setbacks. Learning Outcomes Market Analysis: Ability to perform both technical and fundamental analysis. Strategy Development: Proficiency in developing and executing various trading strategies. Risk Management: Understanding and implementing effective risk management techniques. Psychological Preparedness: Developing a strong trading mindset to handle market volatility. Additional Features Interactive Components Live Trading Sessions: Participate in live trading sessions with expert traders. Q&A Sessions: Regular Q&A sessions to address queries and provide personalized guidance. Community Access: Access to a community of traders for networking and knowledge sharing. Resources and Tools Study Materials: Comprehensive study materials including eBooks, research papers, and case studies. Trading Simulators: Access to trading simulators for practice without financial risk. Market Updates: Regular updates and insights on current market trends and events. Instructors Expert Traders: Courses are taught by experienced traders with a proven track record. Guest Lecturers: Occasional guest lectures from industry experts and renowned traders. Certification Certificate of Completion: Participants receive a certificate upon successful completion of the course. Advanced Certifications: Opportunities for advanced certifications in specialized trading areas. Enrollment and Fees Enrollment Process: Simple online enrollment process. Fee Structure: Various pricing plans available, including one-time payment and installment options. Scholarships: Availability of scholarships for deserving candidates. Testimonials Success

Stories: Testimonials from past participants highlighting their success and improved trading skills. Case Studies: Real-life case studies demonstrating the application of course concepts. Conclusion DexterLab (Monster Lab Trading) offers a comprehensive and structured approach to learning trading, making it suitable for both beginners and experienced traders. By covering a wide range of topics from technical analysis to trading psychology, the course equips participants with the skills and knowledge needed to succeed in the financial markets.

0 notes

Text

Binomo Trading Technique Secrets for Maximum Profit

Welcome to the exciting world of Binomo trading, where the potential for profit is high, but so are the risks. As a trader, your goal is to maximize profits while minimizing losses. Since financial markets are often unpredictable and volatile, the right strategies and techniques are essential for consistent success. In this article, we’ll reveal the secrets behind effective Binomo trading techniques that have helped many experienced traders achieve success. You’ll learn how to analyze the market, manage risks, and execute trades with precision to take your trading performance to new heights.

Binomo Trading Technique Secrets to Achieve Maximum Profit

Success in Binomo trading requires mastering key techniques that can help you make informed decisions and maximize your profits. Here are some of the most effective strategies:

1. Proper Technical Analysis

Understanding how to read charts and use technical indicators is fundamental to profitable trading. Key elements to focus on include candlestick patterns, support and resistance levels, and widely-used indicators like the Moving Average (MA) and Relative Strength Index (RSI). Accurate technical analysis will help you identify the best entry and exit points, allowing you to make profitable trades at the right time.

2. Wise Risk Management

Never risk more than 1-2% of your capital in a single trade. Always set a stop-loss and profit target for each position. Risk management is essential to ensure that losses don’t wipe out your profits. By implementing strict risk controls, you can survive in volatile markets while maximizing the chances for consistent profit.

3. Consistent Strategy

Develop a trading strategy that suits your personal trading style and risk tolerance. Test your strategy on a demo account before moving to live trading. Staying consistent with your approach is key, but always be ready to adjust your strategy to suit changing market conditions.

By applying these techniques consistently, you can increase your chances of achieving long-term profit in Binomo trading.

Understanding Effective Binomo Trading Strategies

Mastering effective trading strategies is crucial for success in Binomo. Here are some key strategies to help you maximize profits:

1. Technical and Fundamental Analysis

Use both technical analysis (reading charts and indicators) and fundamental analysis (understanding the economic factors affecting your assets) to make well-informed trading decisions. This combined approach will provide a comprehensive view of the market, helping you predict price movements more accurately.

2. Wise Risk Management

Discipline in managing risk is essential. Always implement a stop-loss and take-profit strategy for each trade, and never risk more than 1-2% of your capital. By practicing good risk management, you ensure that your losses are controlled and that you can remain in the game longer.

3. Choose the Right Strategy

Whether it’s trend-following, price action, or scalping, choose a strategy that suits your personality and risk tolerance. Test your strategy thoroughly on a demo account, and evaluate your results regularly to fine-tune your approach.

4. Keep Learning and Adapting

The financial markets are constantly evolving. To stay ahead, continue learning from experienced traders, and remain flexible enough to adapt your strategies to shifting market conditions. A willingness to learn and adapt will keep you competitive in the long run.

Optimizing the Use of Technical Indicators in Binomo

The effective use of technical indicators is one of the secrets to Binomo trading success. These tools help traders analyze market trends and make data-driven decisions.

1. Understanding Key Indicators

Familiarize yourself with popular indicators like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands. Moving Averages help you spot trends, RSI measures momentum, and Bollinger Bands show market volatility. These indicators, when used together, can provide powerful insights into the market.

2. Combining Indicators for Optimal Results

To increase your chances of success, combine multiple indicators. For example, you can pair Moving Averages with RSI to confirm trade signals. However, be careful not to overwhelm your analysis with too many indicators, as it may complicate your decision-making process.

3. Adjusting to Timeframes

Adapt your use of indicators based on your trading timeframe. Short-term traders may rely on faster-moving indicators, while long-term traders might use slower-moving indicators. Experiment with different settings to discover which combination works best for your trading style.

Remember, indicators are just tools—your final decisions should be based on your own analysis and judgment. With practice, you’ll become more proficient at interpreting these signals, optimizing your Binomo trading technique.

Managing Risk and Implementing Proper Money Management in Binomo

1. The Importance of Risk Management

Risk management is the cornerstone of successful Binomo trading. No matter how good your strategy is, you must understand the potential for loss and plan accordingly. Setting a stop-loss limit ensures that your capital is protected from unexpected market shifts.

2. Effective Money Management Strategy

Basic money management principles include:

Never risking more than 1-2% of your capital on a single trade.

Using a risk-reward ratio of at least 1:2 (aiming for twice as much profit as you risk).

Diversifying your trades across different assets to spread risk.

These practices reduce the chances of large losses and help you optimize your long-term profit potential.

3. Discipline and Consistency

Discipline is crucial when managing both risk and money. Stick to your plan even when things aren’t going well, and resist the temptation to make rash decisions. Regularly evaluate your performance and make adjustments as necessary. Consistency and discipline in money management lead to sustainable success in trading.

Managing Emotions and Discipline When Trading on the Binomo Platform

1. Emotional Control

Mastering emotional control is a key component of successful Binomo trading. Markets can be volatile, and emotional reactions often lead to poor decisions. Successful traders remain calm and objective, even in the face of market turbulence. Avoid letting fear or greed dictate your actions.

2. Building Discipline for Optimal Results

Discipline is the foundation of successful trading. Set a clear trading plan with predefined risk limits, profit targets, and trading hours. Stick to your plan, even if you experience a string of losses. Discipline also means avoiding the urge to overtrade or chase losses.

3. Practical Strategies for Improving Self-Control

Here are some ways to enhance your emotional control:

Keep a trading journal to track and analyze your decisions.

Set a daily trading time limit to prevent mental fatigue.

Practice relaxation techniques like meditation or deep breathing before trading.

By improving your emotional control and discipline, you’ll be better equipped to implement your trading techniques effectively and achieve consistent profits.

Conclusion

By applying the Binomo trading techniques discussed here, you can greatly improve your chances of maximizing profits. Always practice discipline in managing risk and be consistent with your strategies. Before using real funds, take advantage of Binomo's demo account to practice and refine your skills. Stay updated on market news and continue learning from experienced traders. With patience, discipline, and the right strategies, you can succeed in the Binomo trading world. Start applying these techniques today and watch your trading performance improve significantly.

Binary Investment

0 notes

Text

18 Best Forex Indicator For Scalping: Forex Scalping Essentials

In this article, I will discuss the best forex indicator for scalping, focusing on tools that can help traders make quick, informed decisions in fast-paced markets. Scalping requires precise timing and efficient indicators to capture small price movements. I’ll explore popular indicators such as EMA, RSI, and MACD, which are widely used for their speed and accuracy in scalping strategies. Key…

0 notes

Text

Trading Like a Pro: Winning Intraday Strategies & Smart Stock Market Investment Tips

Success in the stock market requires the right approach, whether you’re engaging in intraday trading or long-term investing. Intraday trading strategies focus on quick, short-term trades, while stock market investment tips help build sustainable wealth. This article explores effective intraday trading techniques, risk management principles, and key investment strategies to enhance profitability and trading efficiency.

Mastering Intraday Trading Strategies

Intraday trading, also known as day trading, involves buying and selling stocks within the same trading day. To maximize gains and minimize risks, traders rely on technical analysis, market trends, and disciplined strategies.

1. Scalping – Profiting from Small Price Movements

Traders execute multiple trades throughout the day, targeting small price changes.

Works best with high-volume stocks and minimal bid-ask spreads.

2. Momentum Trading – Capturing Strong Price Movements

Focuses on stocks with high volatility and significant price action.

Entry signals include breakouts above resistance levels and surging trading volume.

3. Breakout Trading – Entering Early on Strong Moves

Involves trading stocks that break key support or resistance levels.

Confirm breakouts with volume spikes to validate the trend.

4. VWAP Strategy – Trading Around Volume-Weighted Price

VWAP (Volume Weighted Average Price) acts as a reference point for institutional traders.

Buying below VWAP signals a bullish move, while selling above VWAP suggests weakness.

5. Reversal Trading – Spotting Trend Changes

Identifies potential trend reversals using RSI, MACD, and candlestick patterns.

Works well when price action shows clear divergence from technical indicators.

Essential Stock Market Investment Tips

Long-term market success requires a well-planned strategy. These stock market investment tips help traders and investors make informed decisions.

1. Diversify Your Portfolio to Minimize Risk

Invest in multiple sectors to reduce exposure to a single stock or industry.

A diversified portfolio balances losses and profits across different assets.

2. Follow Market Trends Before Making Decisions

Monitor broader market trends to align investments with prevailing momentum.

Stocks typically perform better when moving in the same direction as the overall market.

3. Use Risk Management Strategies

Always set a stop-loss to protect capital from unexpected downturns.

Never risk more than 2% of total capital on a single trade.

4. Stay Updated on News & Economic Events

Market-moving news, earnings reports, and global events impact stock prices.

Follow financial news sources to stay ahead of potential market shifts.

5. Avoid Emotional Trading & Stick to a Strategy

Fear and greed often lead to impulsive decisions that hurt profitability.

Develop a solid trading plan and execute trades based on analysis rather than emotions.

Combining Intraday Trading with Investment Strategies

A well-rounded approach includes both short-term intraday trading and long-term investments.

Use technical analysis for intraday trades and fundamental analysis for long-term investments.

Set realistic profit targets and maintain strict risk management in both trading styles.

Backtest strategies to analyze past performance before applying them to live markets.

Conclusion

A successful trading journey requires mastering intraday trading strategies while following smart stock market investment tips. Whether you aim for quick profits through scalping or long-term gains via diversification, a disciplined approach ensures consistent success. By implementing risk management, staying informed, and executing well-planned trades, traders can navigate market volatility effectively and enhance profitability.

0 notes

Text

The Secret Sauce to Position Trading in a Liquid Market: Insider Strategies for Maximum Gains Why Most Traders Get It Wrong (And How You Can Avoid It) The Forex market is a battlefield, and if you’re not armed with the right strategies, you’ll end up like a tourist in a foreign country without Google Maps—completely lost. Position trading in a liquid market is often misunderstood, yet it’s one of the most effective ways to generate consistent profits while keeping stress levels lower than a Zen monk on vacation. Let’s break down why most traders fail at it and how you can turn the tide in your favor. What Is Position Trading, and Why Should You Care? Position trading is the art of playing the long game in Forex. Unlike scalping or day trading, where traders jump in and out of trades like a hyperactive squirrel on an espresso binge, position traders hold onto trades for weeks or even months. The goal? To ride the major market trends and capture substantial price moves with minimal noise. A liquid market, like Forex, offers tight spreads, high trading volumes, and better price stability—making it the ideal playground for position traders. But here’s the kicker: most traders get eaten alive because they don’t understand how to navigate liquidity effectively. The Hidden Patterns That Drive the Market 1. Smart Money Moves First—Follow Their Footsteps The biggest players in Forex—banks, hedge funds, and institutions—aren’t day traders. They’re position traders who move billions at a time. If you can track their movements, you gain a massive edge. Look for: - Commitments of Traders (COT) reports – This reveals how institutional players are positioning themselves. - Volume spikes at key levels – Large players enter at major support and resistance zones. - Price consolidations before major breakouts – A common sign of accumulation or distribution. 2. Interest Rates and Macro Trends Matter More Than You Think If you’re ignoring central bank policies and macroeconomic trends, you might as well be trading blindfolded. Position traders must track: - Interest rate differentials – Higher-yielding currencies tend to appreciate against lower-yielding ones. - Inflation trends – Rising inflation often leads to rate hikes, strengthening the currency. - Geopolitical events – Wars, elections, and economic policies shape long-term currency movements. The Little-Known Secret to Picking the Right Entry Points Position traders don’t rely on noisy intraday price action. Instead, they use: - Monthly and weekly charts – Ignore the five-minute chart; it’s a distraction. - Fibonacci retracements – Institutions love these levels for entries. - 200-day moving average – Acts as a magnet for long-term price trends. - Divergences on RSI and MACD – A powerful tool to confirm trend reversals. Managing Risk Like a Pro (Instead of Blowing Up Your Account) 1. Don’t Let Leverage Wreck Your Strategy Using excessive leverage in position trading is like putting a Ferrari engine in a bicycle—it’s a disaster waiting to happen. Keep leverage low, typically under 1:10, to allow for market fluctuations without getting stopped out. 2. The ‘Pyramid Strategy’ for Scaling In Safely Instead of entering all at once, scale into your trades in three phases: - Phase 1: Initial Entry – Enter with a small position at a key support or resistance level. - Phase 2: Confirmation Add-On – If price moves in your favor, add another position. - Phase 3: Final Add-On – Enter the last batch when the trend is fully confirmed. This reduces risk while maximizing potential returns. How to Stay Ahead of the Market and Adapt Like a Pro - Use a Forex News Source – Stay updated with the latest economic indicators at StarseedFX Forex News. - Expand Your Knowledge – Take advanced courses at StarseedFX Free Forex Courses. - Join a Trading Community – Get daily alerts, insights, and elite tactics with StarseedFX Community. Final Takeaway: Why Position Trading in a Liquid Market is the Ultimate Game Changer Position trading is not about quick wins; it’s about long-term mastery. If you can develop the patience to let your trades play out, follow macroeconomic trends, and track smart money movements, you’ll be miles ahead of most traders. Start implementing these strategies today, and watch your Forex trading transform into a precision-based, stress-free profit machine. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Trump’s Tariff Impact on Dollar, Gold, and Global Forex Trends

Following the implementation of a 10% tariff on all Chinese imports by the U.S. on February 4, 2025, President Trump expressed no urgency in speaking with Chinese President Xi Jinping about the growing trade war. In retaliation, China has imposed tariffs on select U.S. goods, including coal and agricultural machinery, effective February 10, 2025. This includes a strategic expansion of export controls on critical minerals, which are essential for high-tech industries. While the tariffs signify a growing divide, China’s approach has been firm yet measured, signaling its intent to counter U.S. actions without further escalating the trade war. Meanwhile, the broader economic environment in the U.S. remains volatile, exacerbated by speculation of possible rate cuts from the Federal Reserve, fueled by Trump’s tariff policies.

Gold: Safe-Haven Amidst Volatility

Gold has reached new historic highs as investors seek safe-haven assets in this uncertain market. The delay in tariffs has caused traders to retreat from the dollar and invest in gold. With the quantitative forex models suggesting persistent inflationary pressure, gold remains a top asset. The MACD and RSI indicate strong volume and momentum, supporting the bullish outlook for gold. Analysts are now projecting gold could reach $3,000/oz by March, driven by economic uncertainties.

Silver: Poised for Growth

Silver follows gold’s upward trend, although more modestly. As gold continues to rise, regulated MetaTrader platforms provide a secure trading environment for silver. The MACD and RSI show solid buying momentum, reinforcing the expectation for further increases in silver prices as gold’s strength carries over.

DXY: The Dollar’s Gap and Potential Moves

The DXY index filled its gap and is expected to continue its upward trajectory. However, due to the volatility driven by Trump’s trade decisions, interpreting the dollar’s movement requires patience. Traders might explore forex scalping automation techniques to capitalize on short-term fluctuations in the dollar’s value.

GBPUSD: Bullish Signals Amidst Bearish Bias

The British Pound has shown a recovery, though it remains in a bearish phase. The MACD shows buying momentum, but the RSI and EMA200 suggest caution. Traders using compounding forex profits strategies can benefit by anticipating further downward movement before potential consolidation.

AUDUSD: Rate Cut Concerns and Market Optimism

The Australian Dollar is testing previous highs, driven by optimism from tariff delays. However, expectations of future rate cuts by the Reserve Bank of Australia could limit any sustained growth. The MACD and RSI show increased buying momentum, but forex scalping automation strategies may be more effective here due to the short-term nature of the moves.

NZDUSD: Resilience in Bearish Markets

The Kiwi Dollar is showing strength, but with rate cuts expected from the Reserve Bank of New Zealand, overall market bias remains bearish. The quantitative forex models reflect the pressure on the NZD, which is being kept in check by broader economic factors, including ongoing trade disputes.

EURUSD

The Euro has shown some bullish momentum but remains unable to recover earlier losses. Hedging with multiple currencies may be an effective strategy here, as the market continues to show a preference for selling the Euro amid ongoing trade concerns.

USDJPY: Yen Capitalizes on Dollar Weakness

The Yen continues to benefit from dollar weakness, but analysts warn that tightening alone may not drive significant appreciation. The MACD and RSI show increased momentum, and compounding forex profits could be a useful strategy to capitalize on the Yen’s strength in this volatile period.

USDCHF

The Swiss Franc shows continued bearish momentum, with both the MACD and RSI indicating further downside pressure. As a result, traders may prefer regulated MetaTrader platforms for precise entries and exits in this relatively stable market.

USDCAD

The Canadian Dollar has tested its lower boundaries following Trump’s tariff delays. While there is potential for short-term consolidation, hedging with multiple currencies can help mitigate risks as the market waits for clearer signals from the Federal Reserve.

COT REPORT ANALYSIS

AUD - WEAK (5/5) GBP - WEAK (4/5) CAD - WEAK (4/5) EUR - WEAK (4/5) JPY - WEAK (1/5) CHF - WEAK (5/5) USD - STRONG (4/5) NZD - WEAK (4/5) GOLD - STRONG (5/5) SILVER - STRONG (4/5)

0 notes

Text

What exactly do Forex traders do?

Published By Smartfx | Smart Forex Broker at SmartFX

1. Examining Market Dynamics

Technical Analysis: Traders analyze graphs, patterns, and technical indicators (such as moving averages or RSI) to forecast movements in currency.

Fundamental Analysis: They evaluate economic indicators like GDP, employment rates, interest rates, and geopolitical developments to predict market changes.

2. Trading Foreign Currencies

Forex traders exchange currency pairs (for example, EUR/USD, GBP/JPY). They purchase one currency while simultaneously selling another.

Major Pairs: These include the most commonly traded currencies (such as USD, EUR, JPY).

Exotic Pairs: These involve currencies from less prominent or developing markets.

3. Utilizing Leverage

Traders frequently employ leverage, enabling them to manage a larger position with a smaller amount of capital. For example, with a 1:100 leverage ratio, a trader can control $10,000 with only $100.

4. Managing Risk

Stop-Loss Orders: Traders establish automatic limits to reduce potential losses.

Position Sizing: They assess how much of their capital to risk on each individual trade.

Hedging: Traders might invest in correlated assets to mitigate risks.

5. Speculation vs. Hedging

Speculation: The majority of retail traders seek to gain from short-term price fluctuations.

Hedging: Companies or institutional investors utilize forex to safeguard against currency risk in global transactions.

6. Utilizing Trading Platforms

Traders utilize online platforms such as MetaTrader 4/5 or unique tools provided by brokers for executing trades, analyzing the market, and managing their investments.

7. Monitoring Economic News

Forex traders pay attention to news releases, central bank announcements, and economic calendars to forecast market movements. Traders develop and enhance strategies based on their trading approach, such as scalping, day trading, swing trading, or position trading.

Would you like tips on attracting such traders to your brokerage firm?

smartfx.com

WA: +971589678872

Business Bay, Dubai

0 notes