#role of AI in fintech

Explore tagged Tumblr posts

Text

The Role of Artificial Intelligence in FinTech: Revolutionizing Customer Experience and Risk Management Discover the transformative power of Artificial Intelligence in FinTech. Explore how AI is revolutionizing financial technology, improving efficiency, enhancing security, and enabling personalized experiences. Stay ahead of the competition with our comprehensive insights on the role of AI in FinTech.

#Artificial Intelligence in FinTech#FinTech trends in 2023#role of AI in fintech#benefits of AI in fintech exceed

0 notes

Text

How AI is impacting & transforming the face of Fintech?

Do you want to revolutionize customer experience and risk management with FinTech? Discover the power of artificial intelligence, which is rapidly boosting the adoption of Fintech. The use of Artificial Intelligence in FinTech is changing how financial institutions run their businesses and improving the efficiency, personalization, and security of their services. Learn the benefits of using AI in FinTech and have a glimpse of the bright future it has to offer to the Industry. So, if you are all set to share your billion-dollar FinTech idea with the audience, get in touch with Protonshub Technologies to avail the best services.

#Artificial Intelligence in FinTech#FinTech trends in 2023#role of AI in fintech#benefits of AI in fintech exceed

0 notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

Image from PayPal.com

Design Parameters for PayPal's Financial Solutions

PayPal continues to evolve and maintain its relevance in the financial technology landscape by consistently holding value for users and adapting to their needs. Since its inception in 1998, PayPal has revolutionized the way consumers and businesses transact, empowering over 435 million active users across more than 200 markets. By facilitating immediate peer-to-peer payments, PayPal has transformed consumer behavior, reducing reliance on paper checks and paving the way for a future where physical debit and credit cards may become obsolete. Importantly, PayPal has also played a crucial role in helping small businesses grow and thrive in an increasingly digital marketplace.

The platform effectively anticipates user needs and technological advancements. PayPal allows consumers to discover products, compare prices, make purchases, track packages, and manage returns—all in a streamlined manner. This comprehensive approach fosters new behaviors, especially among its diverse user demographic, which spans generations. Notably, the fastest-growing demographic includes individuals over 50, with impressive usage statistics showing 85% of Generation X, 75% of Millennials, 73% of Baby Boomers, and 71% of retirees actively using the platform.

PayPal's innovations also extend to environmental sustainability. By significantly reducing the need for physical banking infrastructure and paper transactions, PayPal helps lower carbon footprints, contributing to a more sustainable future. Furthermore, the company has reduced remittance costs and expanded its services to include credit options, investment products, and the ability to buy, hold, and sell cryptocurrencies. Utilizing AI technology, PayPal analyzes customer behavior to make real-time risk decisions, ensuring security for its users. Its success has not only solidified its role in the fintech industry but has also catalyzed the emergence of other influential companies, illustrating its lasting impact on the financial landscape. With its commitment to adaptability and user-centered design, PayPal remains a cornerstone of modern financial solutions, poised to shape the future of how we transact.

#PayPal#ai technology#design leadership#convenience#tangible and intangible parameters#design leadership parameters#human-centered design#serving a community need#modified behavior

5 notes

·

View notes

Text

What are the key features of fintech solutions for business banking?

In today’s fast-paced and technology-driven world, fintech solutions have revolutionized the way businesses handle their banking needs. Fintech business banking is designed to streamline financial processes, enhance efficiency, and provide tailored solutions for businesses of all sizes. By leveraging cutting-edge technology, fintech companies are transforming traditional banking into a more dynamic, accessible, and customer-centric experience. Here, we explore the key features of fintech solutions for business banking, highlighting the impact of fintech payment systems, global reach, and the role of providers like Xettle Technologies in shaping this transformative sector.

1. Seamless Account Management

One of the primary features of fintech business banking is seamless account management. Fintech platforms offer intuitive dashboards and user-friendly interfaces that allow businesses to monitor their accounts in real-time. Features such as automated reconciliation, instant notifications, and integrated reporting tools make managing finances more efficient and less time-consuming. Business owners can track expenses, revenues, and cash flow from a single platform, ensuring they stay on top of their financial health.

2. Advanced Fintech Payment Systems

Fintech solutions are renowned for their innovative payment systems. A fintech payment system enables businesses to send and receive payments swiftly and securely. These systems often support multiple payment methods, including bank transfers, credit and debit cards, mobile wallets, and international payments. Additionally, advanced features such as recurring billing, payment reminders, and instant settlements simplify financial transactions for businesses.

Payment gateways offered by fintech companies are designed with robust security measures, including encryption and tokenization, to protect sensitive data. This level of security builds trust and ensures compliance with global financial regulations, making it easier for businesses to operate across borders.

3. Global Accessibility

Fintech global solutions provide businesses with the ability to operate seamlessly across international markets. This is particularly beneficial for businesses involved in cross-border trade. Fintech platforms facilitate currency conversions, international payments, and global compliance, reducing the complexities of managing finances in a globalized economy.

For instance, businesses can leverage fintech platforms to access multi-currency accounts, enabling them to hold and transact in various currencies without incurring high conversion fees. This global reach empowers businesses to expand their operations and cater to international clients with ease.

4. Tailored Financial Products

Fintech business banking solutions are highly customizable, offering tailored financial products that meet specific business needs. Whether it’s working capital loans, invoice financing, or expense management tools, fintech platforms provide solutions that cater to diverse industries and business models. This personalization ensures that businesses receive the support they need to grow and thrive in a competitive market.

Moreover, fintech platforms use data-driven insights to assess the financial health of businesses, enabling them to offer customized credit solutions and better interest rates compared to traditional banks.

5. Enhanced Security and Fraud Prevention

Security is a top priority in fintech business banking. Advanced fintech platforms incorporate state-of-the-art technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to detect and prevent fraudulent activities. Features like two-factor authentication (2FA), biometric verification, and real-time fraud alerts provide businesses with peace of mind.

By leveraging AI and ML algorithms, fintech platforms can identify unusual transaction patterns and flag suspicious activities, minimizing the risk of financial fraud. This proactive approach to security helps businesses safeguard their assets and maintain trust with their stakeholders.

6. Integration with Business Tools

Fintech business banking solutions integrate seamlessly with other business tools, such as accounting software, customer relationship management (CRM) systems, and enterprise resource planning (ERP) platforms. This integration streamlines operations and reduces manual effort, enabling businesses to focus on core activities.

For example, automated synchronization between fintech banking platforms and accounting tools ensures that financial data is always up-to-date, reducing errors and saving time during audits and financial reporting.

7. Real-Time Data and Analytics

Access to real-time data and analytics is a game-changer for businesses. Fintech solutions provide detailed insights into financial performance, helping businesses make informed decisions. Features like cash flow forecasting, expense categorization, and trend analysis empower businesses to plan strategically and optimize their financial resources.

8. Scalability and Flexibility

Fintech platforms are designed to grow with businesses. Whether a business is a startup, SME, or large enterprise, fintech solutions offer scalability and flexibility to adapt to changing needs. As businesses expand, they can access additional features and services without facing the limitations often associated with traditional banking systems.

9. Cost-Effective Solutions

Fintech business banking is typically more cost-effective than traditional banking. By automating processes and leveraging technology, fintech platforms reduce operational costs, which translates into lower fees for businesses. Features such as free transactions, minimal account maintenance charges, and competitive interest rates make fintech solutions an attractive option for businesses looking to optimize their financial operations.

10. Support for SMEs and Startups

Small and medium-sized enterprises (SMEs) and startups often face challenges in accessing traditional banking services. Fintech solutions bridge this gap by offering accessible and inclusive banking options. Features like quick account setup, simplified loan applications, and dedicated customer support make fintech platforms a go-to choice for emerging businesses.

Xettle Technologies: A Pioneer in Fintech Business Banking

Among the many players in the fintech sector, Xettle Technologies stands out as a pioneer in delivering comprehensive fintech business banking solutions. By combining advanced technology with a customer-centric approach, Xettle Technologies empowers businesses to manage their finances effectively. Their innovative fintech payment system and global capabilities ensure that businesses can operate seamlessly in today’s interconnected world.

Conclusion

Fintech business banking has transformed the financial landscape, offering a plethora of features that cater to the evolving needs of businesses. From advanced fintech payment systems and global accessibility to enhanced security and tailored financial products, fintech solutions provide the tools necessary for businesses to thrive in a competitive market. Companies like Xettle Technologies exemplify the potential of fintech solutions to drive innovation and efficiency in business banking. As fintech global solutions continue to evolve, businesses can look forward to even more robust and dynamic banking experiences in the future.

2 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Text

Emerging Industries: Opportunities in the UK Job Market

Planning to study in the UK? Want to explore career opportunities in the United Kingdom?

In the ever-evolving world, the UK stands as a hub for innovation and growth, bringing numerous emerging sectors that offer promising career prospects. As technology continues to reshape the global economy, several industries in the UK have captured attention, presenting exciting opportunities for job seekers and entrepreneurs alike. Take a look at some of the career opportunities you could take advantage of.

1. Fintech (Financial Technology)

The UK has strengthened its position as a leading fintech hub, with London being a prominent center for financial innovation. Fintech includes a wide array of sectors, including mobile payments, blockchain, and cybersecurity. Job opportunities in this field span software development, data analysis, financial consultancy, and regulatory compliance.

2. Technology and IT

In the emerging era of the digital world, technology continues to dominate businesses worldwide. As, a result the demand for technologically advanced professionals tends to rise. Software developers, data analysts, cybersecurity experts, and artificial intelligence specialists roles are in high demand. With the increasing use of technologies and the need for innovative solutions, these roles offer tremendous growth opportunities and competitive salaries.

3. Healthtech

The combination of healthcare and technology has given rise to HealthTech, a sector dedicated to enhancing medical services through innovative solutions. From telemedicine to health analytics and AI-driven diagnostics, HealthTech offers diverse career paths for healthcare professionals, software developers, data scientists, and researchers.

4. Renewable energy and sustainability

With an increased focus on sustainability and combating climate change, the UK has been investing significantly in renewable energy sources. Wind, solar, and hydroelectric power are among the sectors experiencing rapid growth. Job roles in renewable energy range from engineering and project management to research and policy development, catering to those passionate about environmental conservation.

5. Cybersecurity

With the increasing frequency of cyber threats, the demand for cybersecurity experts is on the rise. Businesses and governments are investing heavily in safeguarding digital infrastructure. Job roles in cybersecurity encompass ethical hacking, network security, data protection, and risk analysis, presenting ample opportunities for skilled professionals in this field.

6. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing various industries, including finance, healthcare, and manufacturing. The UK is fostering innovation in AI research and development, offering roles in AI programming, data engineering, robotics, and AI ethics.

7. Creative industries

The UK has a rich heritage in the creative sector, encompassing fields like media, design, gaming, and entertainment. Roles in creative industries span from content creation and graphic design to video production and game development, appealing to individuals with artistic and technical skills.

In conclusion, the UK job market is filled with opportunities within emerging industries, showing the nation's commitment to innovation and progress. Whether one's passion lies in sustainability, technology, healthcare, or creative endeavors, these sectors offer an array of possibilities for career growth and contribution to shaping the future.

By embracing change, acquiring relevant skills, and staying adaptable, individuals can position themselves to thrive in these dynamic and promising industries, contributing to both personal success and the advancement of these transformative sectors in the UK.

If you are struggling to get the right guidance, please do not hesitate to consult MSM Unify.

At MSM Unify, you can explore more than 50,000 courses across 1500+ educational institutions across the globe. MSM Unify has helped 1,50,000+ students achieve their study abroad dream so far. Now, it is your turn to attain your study-abroad dreams and elevate your professional journey! So, get ready to broaden your horizons and make unforgettable memories on your upcoming adventure.

2 notes

·

View notes

Text

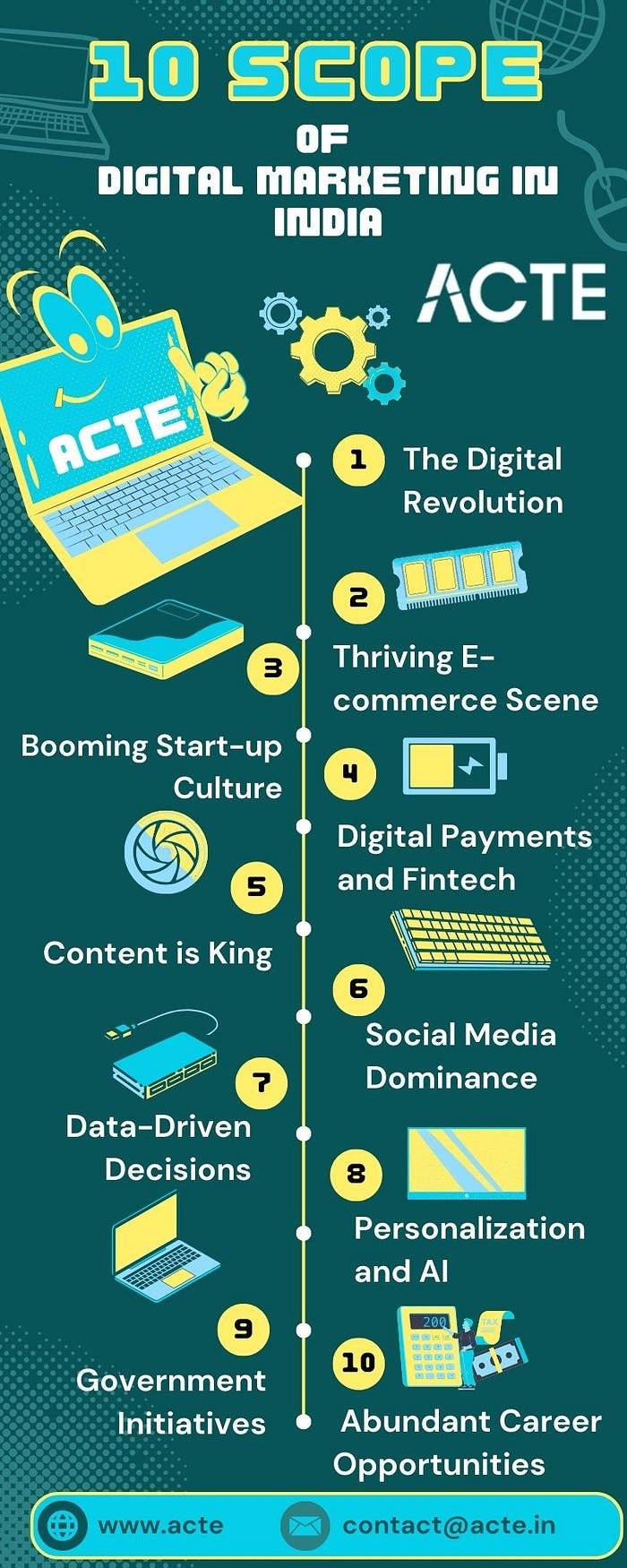

10 Promising Scopes of Digital Marketing in India are Revealed

1. The Digital Revolution

India’s digital revolution is in full swing. Thanks to affordable smartphones and high-speed internet becoming widely available, millions of Indians are now online. This massive online audience is a goldmine for digital marketers.

2. Thriving E-commerce Scene

Online shopping has exploded in India. Platforms like Flipkart, Amazon, and others have revolutionized how we shop. Digital marketers are crucial in attracting customers and driving sales for these e-commerce giants.

3. Booming Start-up Culture

India’s start-up culture is thriving, with new companies emerging in various sectors. Digital marketing is vital for start-ups to gain visibility, acquire customers, and secure funding.

4. Digital Payments and Fintech

Digital payment platforms like Paytm, PhonePe, and Google Pay have become an integral part of India’s financial landscape. Digital marketing plays a key role in promoting these platforms and encouraging people to use them.

5. Content is King

6. Social Media Dominance

Social media platforms like Facebook, Instagram, Twitter, and LinkedIn are where Indians spend a lot of their online time. Digital marketers leverage these platforms to create compelling campaigns that resonate with diverse audiences.

7. Data-Driven Decisions

Digital marketing relies heavily on data. Marketers use data analytics to understand consumer behavior, track campaign performance, and spot market trends. The demand for professionals who can work with data is on the rise.

8. Personalization and AI

Artificial intelligence (AI) and machine learning are changing the game in digital marketing. Personalized marketing campaigns that cater to individual preferences are becoming the norm. Marketers who embrace AI have a competitive advantage.

9. Government Initiatives

Government programs like Digital India and Skill India are boosting digital literacy. This aligns with the growing need for digital marketing experts skilled in SEO, SEM, email marketing, and more.

10. Abundant Career Opportunities

Digital marketing offers a wide range of career options. Whether you’re into content creation, social media management, SEO, SEM, or data analysis, there’s a niche for everyone. Consider ACTE Technologies, a top institute that provides comprehensive digital marketing courses, if you want to start your digital marketing path with experienced assistance. Their knowledgeable teachers can provide you with the skills and information you need to succeed in the field of digital marketing.

In summary, digital marketing in India is flourishing and full of potential. As more businesses, start-ups, and individuals move their activities online, the demand for digital marketing expertise continues to grow. For those interested in an exciting and rewarding career, digital marketing is a field brimming with opportunities in today’s digital India.

2 notes

·

View notes

Text

5 FinTech Trends for 2023

The year 2022 has been an exciting time for the financial technology industry. As technology continues to improve, we can expect new developments in the industry. Some of the most relevant trends of fintech that will emerge in 2023 are detailed below.

Alternative Finance

Non-bank financial institutions are known as alternative finance parties. These parties provide services through instruments such as cryptocurrencies and private placements. They can also use financial technology to improve their operations.

2. Embedded Finance

In addition to financial instruments, embedded finance can also be used to improve the operations of non-financial businesses. Due to technological advancements, the embedded finance industry is expected to continue growing. This type of financial technology will likely replace the traditional software and apps used by customers.

3. Buy Now, Pay Later

Through the buy now, pay later financing system, consumers can purchase and pay for it later. This type of financing system has gained widespread attention due to the outbreak of the COVID-19 pandemic. It is expected that its adoption will continue growing in 2023.

4. Artificial Intelligence

Artificial Intelligence has the potential to transform society and the economy. Through its ability to perform various tasks, such as customer experience and service automation, AI has gained a significant role in the financial technology industry.

AI can help financial institutions identify fraud and grant loans and taxes. According to a Deloitte survey, those with an AI strategy that encompasses the entire company are 1.7 times more likely to have good business results.

5. Cryptocurrency

The negative image of cryptocurrencies was caused by the actions of one of the meaningful exchanges, FTX. Despite the various adverse effects of the cryptocurrency industry, it is still expected to grow in the year ahead.

Conclusion

Although it is hard to predict what will happen in the financial industry in 2023, we are sure that it will be a significant year due to the various technological changes that will affect the industry. In 2023, alternative lending and embedded finance are expected to be some of the most revolutionary trends in the financial industry. AI technology is expected to continue shaking the market and help companies lower their overhead costs.

To read more from John David Hartigan go here: JohnDavidHartigan.org

9 notes

·

View notes

Text

The Impact of Demographic Shifts on Market Demand and Business Opportunities

Global demographics are changing at a rapid pace, influencing consumer behavior, workforce dynamics, and business strategies. Aging populations, urbanization, and shifts in generational preferences are shaping industries in ways that demand adaptation. Companies that recognize these trends and respond effectively will position themselves for long-term success.

Changing Consumer Preferences.

As younger generations gain purchasing power, businesses must adapt to new expectations. Millennials and Gen Z prioritize convenience, digital engagement, and ethical consumption. Companies that fail to integrate technology-driven solutions and sustainable practices risk losing relevance.

Eric Hannelius, CEO of Pepper Pay, underscores this shift. “Younger consumers expect seamless digital experiences. Businesses that invest in frictionless payment solutions, automation, and AI-driven personalization will gain a competitive edge.”

Conversely, older consumers remain a strong market force. The demand for healthcare, financial planning, and age-friendly digital services is increasing. Companies that cater to this demographic will find opportunities in industries such as telemedicine, fintech, and wellness products.

Workforce Transformation and Business Innovation.

Demographic shifts also impact workforce availability. Aging populations in many developed economies are leading to labor shortages, increasing the need for automation and reskilling programs. Meanwhile, younger generations entering the workforce seek flexibility, purpose-driven work, and digital fluency.

Businesses that embrace hybrid work models, invest in employee development, and leverage AI for efficiency will attract top talent. Eric Hannelius highlights the importance of adaptability: “Companies that support continuous learning and prioritize digital transformation will navigate workforce changes more effectively.”

Urbanization and Market Expansion.

The global trend toward urbanization is shaping economic activity. Cities are becoming hubs for innovation, e-commerce, and financial services, while rural markets are evolving through digital inclusion. Businesses that expand digital infrastructure and offer localized solutions will tap into growing opportunities in both urban and underserved areas.

Real estate, transportation, and retail sectors are adjusting to shifting population densities. Companies investing in smart city initiatives, last-mile logistics, and remote service delivery will benefit from these changes.

The Role of Financial Inclusion.

As demographics shift, financial services must evolve to meet diverse consumer needs. The rise of gig workers, cross-border commerce, and digital-first generations requires innovative payment solutions.

Eric Hannelius emphasizes financial inclusion as a strategic priority: “The future of finance lies in accessibility. Businesses that offer flexible, transparent, and secure digital payment options will build trust and expand their market reach.”

Seizing Opportunities in a Changing Landscape.

Understanding demographic trends allows businesses to anticipate demand, optimize operations, and develop products that align with evolving consumer behavior. Companies that embrace change, invest in innovation, and prioritize customer-centric strategies will thrive in the new economic landscape.

Demographics are reshaping industries in ways that cannot be ignored. Businesses that take proactive steps today will be well-positioned for success in the years ahead.

0 notes

Text

What Is The Future Scope Of A Full Stack Java Developer In India?

Full Stack Development Institute In Bhopal

Future Scope of a Full Stack Java Developer in India

The role of a Full Stack Java Developer has a promising future in India, driven by the increasing digitization of businesses and the growing need for end-to-end software solutions. Here's an overview of the opportunities and trends shaping the scope of full stack development institute in Bhopal:

1. High Demand Across Industries

Full Stack Java Developers are in demand in various sectors such as:

E-commerce: To develop dynamic web applications and manage high-traffic websites.

Fintech: For building secure, scalable financial platforms.

Healthcare: To create robust patient management systems and telemedicine platforms.

Startups: For cost-effective, versatile development solutions in lean teams.

full stack development institute in Bhopal

2. Key Role in Digital Transformation

With India embracing digital transformation, companies are investing in scalable, secure, and user-friendly software applications. Learning Java Programming in Bhopal and Full Stack Developers’ ability to handle both front-end and back-end development make them crucial for such projects.

3. Growing Adoption of Emerging Technologies

The rise of technologies like AI, IoT, Blockchain, and Cloud Computing has created new opportunities for Full Stack Java Developers:

Cloud Integration: Java’s compatibility with cloud platforms like AWS and Azure allows developers to build scalable cloud-native applications.

Micro services Architecture: Developers skilled in Java are sought after for designing and maintaining modular and distributed systems.

Java coding Classes in Bhopal

4. Competitive Salaries and Career Growth

The demand-supply gap in the Indian IT sector has led to competitive salaries for skilled Full Stack Developers. As professionals gain experience, they can transition to roles like:

Tech Leads: Overseeing end-to-end development projects.

Architects: Designing complex software systems.

Product Managers: Combining technical expertise with business acumen.

Programming or Language classes in Bhopal

5. Global Opportunities and Remote Work

With Indian IT services thriving in global markets, Best Coding Institutes in Bhopal? Can secure opportunities with international clients. The rise of remote work has further expanded possibilities, allowing Indian developers to work for global companies.

6. Continuous Learning and Upskilling

The future scope of full stack development institute in Bhopal will depend on their ability to adapt to new frameworks, libraries, and technologies. Staying updated with tools like React.js, Spring Boot, and DevOps practices will ensure long-term career success.

Conclusion

The future scope of Full Stack Java Developers in India is bright, driven by technological advancements and the increasing reliance on digital solutions. With the right skills, professionals can enjoy a dynamic and rewarding career in this ever-evolving field.

#Web development institutes in bhopal#java coding classes in bhopal#full stack developer course in bhopal#Java foundation classes in bhopal#aadhaar foundation course in bhopal#java aadhaar foundation courses in bhopal#java coaching in bhopal#learn java programming in bhopal#robotics programming in bhopal#programming or language classes in bhopal#coding classes for beginners in bhopal#full stack development institute in Bhopal

0 notes

Text

Top 10 Online Undergraduate Courses to Future-Proof Your Career

Preparing for the future has never been more critical. The rise of online education has made skill development easier than ever. Therefore, choosing the right online undergraduate course can be the difference between a thriving career and being left behind. Here are ten of the best online bachelor’s courses you can consider.

The Need for Future-Proof Skills

Technology, globalisation, and changes in consumer behaviour are leading to a highly dynamic job market. To remain relevant, professionals have to adapt to new skills and knowledge. While considering an online undergraduate degree, remember three things: industry demand, value, and career scope. These factors ensure education, employability, and preparation to face the future.

Top 10 Online Undergraduate Courses For Your Bright Future

BCA in Data Science and Analytics

Data is famously called the new oil. For data analysis and statistics, coupled with machine learning, you shall be placed and trained to engage in various business operations within sectors like finance, healthcare, and even marketing. For that reason, the profession of data experts in recent years skyrocketed, making it quite a profitable sector.

BCA in AI and ML

AI and ML are revolutionising industries. They are creating everything from self-driving cars to smart assistants. This program offers natural language processing and advanced analytics opportunities.

BBA

A general degree, BBA, is perfect for those who aspire to be entrepreneurs, managers, or consultants. It is a high-value course because it highly applies to finance, marketing, and operations.

BSc in Cybersecurity

Cyber threats are rising. Companies and governments need experts to protect sensitive data. Cybersecurity offers job stability and high earning potential.

BSc in Computer Science

This course remains evergreen for any tech-related career. It is highly adaptable. You can aim to work in software development or cloud computing.

Bachelor's in Digital Marketing

Businesses are going online. Hence, digital marketing knowledge is in high demand. This curriculum includes valuable digital skill sets for the modern age.

Bachelor's in Environmental Science

Sustainability can no longer be an option. This course leads to careers that involve environmental consulting and policy-making. It supports the global agenda for green technology.

Bachelor's in Healthcare Management

The health sector is booming. This degree combines management and healthcare knowledge to prepare you for hospital and public health organisation leadership roles.

Bachelor's in Financial Technology

As traditional banking evolves, FinTech is becoming central to the industry. This online undergraduate course equips you with roles in blockchain development, payment systems, and digital banking.

BSc in Psychology

It is a skill that has diverse applications. From HR to counselling, a psychology degree opens doors to careers that combine empathy and science.

Which Online Course Has the Most Scope in the Future?

Courses like Artificial Intelligence and Cybersecurity will have unprecedented scope in the future. The demand for professionals in these fields cuts across various industries. Moreover, organisations are emphasising data-driven decisions and digital security. Hence, graduates in these areas will have ample opportunities.

Which Online Course Has the Most Value?

While value may come in personal senses, courses like BBA, computer science, or healthcare management represent the greatest payoff. The major provides for careers in multiple realms, a short time to recruit, and strong salaries. As an example of this, some BBA grads go on into management and business entrepreneurship while CS graduates have immediate entry into their high-paid techno-jobs.

Selecting a Course for Your Goals

Your selection should suit your interests, strengths, and career goals. Research the labour market and sectors that have proven to be a stable growth sector. Web-based platforms do not make distance a barrier; you can obtain quality education without leaving your room.

The future holds a lot of possibilities. An online undergraduate degree can be the stepping stone to success. Find reputable universities and select a program that meets your goals. Begin your journey today and future-proof your career for the opportunities waiting ahead.

1 note

·

View note

Text

The Top 10 Skills Startups Will Need Most in 2025

In 2025, the start-up ecosystem is expected to continue its rapid evolution, and with it, the demand for highly specialized and versatile talent will grow. For those looking to thrive in start-up jobs, understanding and cultivating the right skills is essential. Whether you’re an aspiring professional or a seasoned expert, staying ahead of industry trends can position you as a top candidate in start-up companies. Let’s explore the Top 10 Skills that will dominate the needs of startups in 2025.

1. Data Analytics and Interpretation

As startups increasingly rely on data-driven decision-making, the ability to analyse and interpret data has become invaluable. Professionals skilled in tools like Python, R, and SQL, as well as data visualization platforms, will be in high demand. Startups in India, especially those in fintech, e-commerce, and healthcare, are prioritizing roles that can unlock actionable insights from complex datasets.

2. Artificial Intelligence and Machine Learning (AI/ML)

AI and ML are no longer buzzwords but integral components of start-up company operations. From automating routine tasks to enhancing customer experiences, these technologies are redefining industries. Skills in AI model development, natural language processing, and deep learning are highly sought after in start-up jobs.

3. Product Management

Building a successful product is at the heart of every start-up. Product managers who can bridge the gap between technical teams and customer needs are crucial. Skills in agile methodologies, road mapping, and user experience design will remain pivotal.

4. Digital Marketing and SEO

With a competitive online marketplace, startups need digital marketing experts who can optimize campaigns, enhance brand visibility, and drive customer acquisition. Mastery of SEO, content marketing, and social media strategies will be essential.

5. Cyber security Expertise

As digital infrastructures grow, so do cyber threats. Startups in India and beyond are prioritizing cyber security to protect sensitive data and maintain customer trust. Knowledge in threat assessment, penetration testing, and compliance frameworks is vital.

6. Financial Management and Fundraising

For startups, financial sustainability is critical. Professionals with skills in budgeting, financial modelling, and fundraising will play a significant role in guiding start-up companies through their growth phases. Expertise in venture capital and crowd funding will add an edge.

7. Remote Team Management

With remote work becoming the norm, the ability to manage distributed teams effectively is a skill in itself. Startups are looking for leaders who can foster collaboration, maintain productivity, and ensure seamless communication across geographies.

8. Coding and Software Development

Software development remains a cornerstone of innovation. Full-stack developers, DevOps engineers, and app developers proficient in languages like JavaScript, Python, and Kotlin will continue to be indispensable for startups in India and worldwide.

9. Sustainability and Green Solutions

As the world focuses on sustainability, startups are integrating eco-friendly practices into their business models. Professionals with expertise in green technologies, renewable energy, and environmental compliance will be highly sought after.

10. Sales and Business Development

Driving revenue is paramount for startups, making sales and business development experts indispensable. Skills in lead generation, customer relationship management, and negotiation will help start-up companies scale efficiently.

How to Cultivate These Skills

Continuous Learning: Online platforms like Coursera, Udemy, and LinkedIn Learning offer courses tailored to these in-demand skills.

Networking: Engage with professionals and mentors in your field to stay updated on trends and opportunities.

Hands-On Experience: Volunteer for projects or internships to gain practical exposure.

Leverage Platforms: Use tools like Salarite to explore relevant start-up jobs and showcase your skill set effectively.

Why Startups in India Need These Skills

India is one of the fastest-growing start-up ecosystems globally, with a robust presence in tech, fintech, and healthcare. Startups in India are driving innovation, creating employment opportunities, and contributing significantly to the economy. By acquiring these Top 10 Skills, professionals can tap into this thriving market and become key players in shaping the future.

Conclusion

The demands of startups are constantly evolving, and 2025 will be no different. Cultivating the Top 10 Skills mentioned above can set you apart and position you for success in start-up jobs. Whether it’s data analytics, AI, or sustainability, aligning your expertise with industry needs can open doors to exciting opportunities.

Looking to kick-start or elevate your career with startups? Salarite is here to connect you with the right roles and resources to make it happen. Explore the best start-up jobs tailored to your skill set and take the first step toward a fulfilling career today!

0 notes

Text

What Are the Key Trends Shaping Domestic Money Transfers?

Domestic Money Transfers have evolved significantly in recent years, driven by advancements in technology, changing consumer preferences, and increasing regulatory oversight. The emergence of Digital Solutions, coupled with the integration of innovative financial tools, has reshaped the way individuals and businesses transfer funds within a country. This article delves into the key trends shaping Domestic Money Transfers, highlighting the role of technology, accessibility, and efficiency in this transformation.

1. Digital Transformation in Money Transfers

One of the most significant trends in Domestic Money Transfers is the widespread adoption of Digital Solutions. Traditional methods, such as bank drafts and money orders, are being replaced by mobile apps, digital wallets, and online banking platforms. These technologies allow for faster, more secure, and convenient transactions, catering to the growing demand for real-time payments.

The rise of digital banking has made it easier for consumers to transfer money with just a few taps on their smartphones. Mobile apps, have become household names, enabling peer-to-peer transfers with minimal fees and instant confirmation. These platforms not only enhance user experience but also reduce the dependency on cash, making transactions more efficient and traceable.

2. The Role of Fintech Companies

Fintech companies play a pivotal role in revolutionizing Domestic Money Transfers. By leveraging cutting-edge technologies like artificial intelligence (AI) and blockchain, they are addressing common challenges such as high transaction costs, delays, and lack of transparency. Companies like Xettle Technologies, for instance, have developed innovative platforms that streamline domestic payments, offering features like instant transfers, robust security protocols, and user-friendly interfaces.

These fintech solutions are particularly valuable for small businesses, freelancers, and gig economy workers who rely on seamless and affordable payment methods to manage their finances. By integrating Digital Solutions into their operations, fintech companies ensure that users can access fast and reliable money transfer services without the limitations of traditional banking systems.

3. The Shift Toward Real-Time Payments

Real-time payments (RTP) have emerged as a game-changer in Domestic Money Transfers. Consumers and businesses increasingly expect instant fund availability, whether for payroll, bill payments, or peer-to-peer transfers. Real-time payment systems eliminate the delays associated with traditional methods, ensuring that funds are credited within seconds.

Governments and financial institutions worldwide are investing in RTP infrastructure to meet these demands. In the United States, for example, the Federal Reserve’s FedNow Service aims to provide a nationwide RTP platform by facilitating instant transfers between banks. Similarly, other countries have implemented systems like India’s Unified Payments Interface (UPI) and the United Kingdom’s Faster Payments Service, highlighting the global push for faster domestic transactions.

4. The Growth of Mobile Money and Digital Wallets

Mobile money and digital wallets are becoming integral to the domestic payments ecosystem. These Digital Solutions provide a secure and convenient way to store and transfer money, especially for unbanked or underbanked populations. Platforms like Apple Pay, Google Pay, and Cash App offer seamless integration with smartphones, enabling users to make transfers, pay bills, and shop online without the need for physical cash or cards.

This trend is particularly prominent in emerging markets, where mobile penetration is high but access to traditional banking infrastructure remains limited. By bridging this gap, digital wallets are fostering financial inclusion and empowering users to participate in the digital economy.

5. The Influence of Open Banking

Open banking is another trend shaping Domestic Money Transfers by fostering collaboration between traditional banks and fintech companies. Through secure APIs (Application Programming Interfaces), open banking allows third-party providers to access customer data (with consent) to create tailored financial services. This innovation promotes competition and encourages the development of more efficient and customer-centric money transfer solutions.

With open banking, users can link multiple accounts to a single platform, making it easier to manage funds and initiate transfers. For businesses, open banking streamlines payment processing, enhances cash flow management, and provides real-time insights into financial transactions.

6. Enhanced Security and Fraud Prevention

As Domestic Money Transfers become increasingly digital, ensuring security is paramount. Advanced fraud prevention measures, such as biometric authentication, tokenization, and encryption, are being integrated into money transfer platforms to protect user data and prevent unauthorized access.

AI and machine learning play a crucial role in detecting suspicious activities and mitigating risks. These technologies analyze transaction patterns in real time, flagging anomalies and preventing fraudulent transfers before they occur. For consumers and businesses alike, enhanced security builds trust and encourages wider adoption of digital money transfer solutions.

7. The Push for Financial Inclusion

Digital Solutions for Domestic Money Transfers are also driving financial inclusion by reaching underserved populations. In rural areas and low-income communities, mobile money platforms and agent networks provide access to basic financial services, allowing individuals to send and receive money with ease. This democratization of financial services helps reduce economic disparities and fosters greater participation in the formal economy.

8. Regulatory Support and Standardization

Supportive regulatory frameworks are facilitating the growth of Domestic Money Transfers. Governments and regulatory bodies are working to create standards for interoperability, data security, and compliance, ensuring that digital payment systems operate seamlessly and transparently. Initiatives like regulatory sandboxes allow fintech companies to innovate while adhering to legal requirements, creating a balanced ecosystem for growth and innovation.

Conclusion

The landscape of Domestic Money Transfers is undergoing a profound transformation, fueled by the adoption of Digital Solutions, technological advancements, and evolving consumer expectations. Trends such as real-time payments, mobile money, open banking, and enhanced security measures are redefining how individuals and businesses manage their financial transactions.

Fintech companies like Xettle Technologies are at the forefront of this revolution, delivering innovative tools that simplify domestic payments and enhance user experience. As these trends continue to shape the market, the future of Domestic Money Transfers promises to be faster, more inclusive, and more secure than ever before.

2 notes

·

View notes

Text

The AI Startup Ecosystem: Why Early-Stage Investment Matters

Artificial Intelligence (AI) has emerged as one of the most transformative technologies of our time, driving innovation across industries from healthcare and finance to entertainment and logistics. Yet, every successful AI company started as an ambitious idea nurtured by early-stage investment. In this post, we’ll explore why investing in early-stage AI startups is vital for fostering innovation and reaping substantial returns.

The Role of Early-Stage Investment in AI Growth

The path from an idea to a market-changing AI product is fraught with challenges: acquiring talent, securing partnerships, and scaling operations. Early-stage investors play a crucial role in bridging the gap by providing:

Capital: Fueling the development of innovative technologies.

Guidance: Offering mentorship from experienced entrepreneurs and investors.

Access: Connecting startups with industry networks and potential customers.

For instance, funds like AI Seed have built a portfolio of over 40 successful AI startups, demonstrating the potential of early-stage investment to catalyze growth.

Opportunities in the AI Ecosystem

The AI ecosystem is ripe with opportunities for investors, including:

Cutting-Edge Innovation: From generative AI to ethical AI systems, startups are pushing technological boundaries.

Rapid Market Expansion: AI applications are permeating new sectors, creating diverse investment avenues.

High Potential Returns: Early-stage investments often yield significant returns when startups succeed or are acquired.

Investors utilizing programs like SEIS funds (Seed Enterprise Investment Scheme) can also benefit from tax advantages while supporting promising startups.

Case Studies: Success Stories from Early Investment

AI Seed’s portfolio showcases the transformative power of early investment:

Odin Vision: Pioneered AI-driven medical diagnostics and was successfully acquired.

Rahko: Advanced quantum machine learning solutions, leading to a high-profile acquisition.

Causalens: Revolutionizing decision-making with explainable AI, attracting significant industry attention.

These examples highlight how targeted early-stage funding helps startups scale and deliver meaningful solutions.

The Investor’s Advantage

Investing early in AI startups offers:

First-Mover Benefits: Access to groundbreaking technology before it becomes mainstream.

Portfolio Diversification: Exposure to high-growth sectors like healthcare, fintech, and automation.

Influence: Shaping the direction of emerging technologies.

By leveraging networks like AI Seed’s, investors can identify and support the most promising ventures in the AI ecosystem.

#AIStartups#EarlyStageInvestment#AIInnovation#TechInvesting#VentureCapital#AIecosystem#GenerativeAI#AISeed#InvestmentOpportunities#AIgrowth#SeedInvestment#AItechnology#Startups#InvestmentStrategy#AIApplications

0 notes

Text

ASP.NET Jobs UK: Unlock Your Potential in the Dynamic Tech Industry

The demand for skilled ASP.NET developers in the UK is at an all-time high. As businesses accelerate their digital transformation, professionals adept in this powerful framework are highly sought after. Whether you’re an experienced developer or just starting your journey, there’s no better time to delve into the world of ASP.net Jobs UK.

Why Choose ASP.NET for Your Career?

ASP.NET is a robust server-side framework developed by Microsoft, ideal for building scalable, high-performing web applications. Its versatility and compatibility with multiple programming languages make it a favorite among developers and organizations. Here’s why pursuing ASP.net Jobs UK. is a smart choice:

High Demand Across Industries: From fintech to healthcare, businesses need ASP.NET developers to create and maintain efficient web solutions.

Lucrative Salary Packages: ASP.NET professionals command competitive salaries in the tech industry, often exceeding national averages.

Opportunities for Growth: The continuous updates and integrations of .NET technology ensure endless opportunities for learning and career advancement.

Key Skills Required for ASP.NET Jobs in the UK

To excel in ASP.NET roles, developers need a mix of technical expertise and problem-solving capabilities. Here are the essential skills employers look for:

Proficiency in C#: Mastery of this programming language is fundamental for ASP.NET development.

Knowledge of MVC Architecture: Understanding the Model-View-Controller framework enhances application design.

Database Management: Familiarity with SQL Server and Entity Framework is crucial for handling large-scale databases.

Front-End Technologies: Skills in HTML, CSS, JavaScript, and Angular or React add value to your profile.

Debugging and Troubleshooting: Ability to identify and resolve issues efficiently ensures smooth application performance.

Top ASP.NET Job Roles in the UK

1. ASP.NET Developer

Primary responsibilities include designing, developing, and deploying web applications. Developers collaborate with cross-functional teams to deliver robust solutions.

2. Full-Stack .NET Developer

This role demands expertise in both front-end and back-end development, allowing seamless integration of user interfaces and server logic.

3. Software Engineer (.NET Specialization)

Software engineers focus on creating scalable applications, often involving integration with third-party APIs and services.

4. Senior ASP.NET Consultant

As a senior consultant, you guide projects from conception to completion, mentoring junior developers and ensuring project alignment with business goals.

Where to Find ASP.NET Jobs in the UK

The UK offers a plethora of opportunities for ASP.NET developers. Here are some of the top platforms to explore:

Job Portals: Websites like Indeed, Glassdoor, and TotalJobs frequently list ASP.NET roles.

Recruitment Agencies: Specialized IT recruitment firms can connect you with premium job offers.

Company Websites: Keep an eye on career pages of leading UK tech companies for direct applications.

Professional Networks: LinkedIn is an invaluable tool for networking and job searching in the tech industry.

Tips to Land Your Dream ASP.NET Job

Build a Strong Portfolio: Showcase your projects on GitHub or a personal website.

Certifications Matter: Microsoft Certified Solutions Developer (MCSD) and other relevant certifications boost your credibility.

Stay Updated: Regularly enhance your knowledge with new .NET frameworks and tools.

Network Actively: Attend tech meetups, webinars, and industry events to connect with potential employers.

Future Prospects of ASP.net Jobs UK.

The adoption of cloud technologies, microservices, and AI in the UK tech scene further amplifies the need for skilled ASP.NET developers. As businesses look for secure and scalable solutions, professionals with expertise in ASP.NET will remain in high demand.

0 notes