#robinhood options

Explore tagged Tumblr posts

Text

Robinhood Launches Futures Trading for S&P 500, Bitcoin, and Oil in Major Expansion

Robinhood Markets, Inc. has announced the rollout of in-app futures trading, allowing users to trade contracts based on the S&P 500, oil, and Bitcoin. This latest addition to the platform comes as part of a broader effort to attract seasoned traders by providing advanced tools at competitive fees. https://twitter.com/Cointelegraph/status/1846701356272271708 The company’s mobile app now…

#active traders#advanced trading#Bitcoin#fees#financial institutions#futures trading#index options#oil#Robinhood#Robinhood Gold#Robinhood Legend#S&P 500

0 notes

Text

I reserved my spot for the new Robinhood Gold Card! Here's my link so you can get access too.

0 notes

Note

hi! i really want to get better with my finances next year but.... i have NO idea where to start. i'm a writer and english major, maths is my enemy and i'm so bad with numbers. but i'm 21, i'm getting older and graduating my masters next year and it's time to get started with my career as i won't be living off of this student loan anymore AND will have to eventually pay it back 😭

i wanted to know if you have any tips about finances, saving ... what i should even do, how i begin? any resources or beginner books to get me started on knowing anything money wise? i'm literally a 2 year old when it comes to this topic i'm quite clueless but i want it to change, so literally any basic advice would help me so much right now. by the time 2025 ends i want to be really good with money and finance knowledge!

First of all it’s amazing that you’re 21 & already graduating with your masters!!!

Let’s start with some simple tips:

For one month, write down every dollar you spend. This will show you where your money goes and where you can cut back.

Use the 50/30/20 rule: 50% of your income for needs, 30% for wants & 20% for savings or debt.

Even if it’s small, open a high yield savings account and set up automatic transfers. Saving a little every month adds up fast!

You can start learning about investing. These are beginner friendly ideas to help you grow your money:

1. Index Funds and ETFs: These are great for beginners because they’re low cost & diversified. Popular ones include the S&P 500 index funds (like VOO or SPY). You don’t have to pick individual stocks, you’re investing in a basket of companies.

2. Retirement Accounts: Roth IRA or 401(k) (if offered by your job). Contributions grow tax free in a Roth IRA, which is great for long term wealth.

3. Dividend Stocks: Some companies like Coca Cola or Johnson & Johnson play dividends. This gives you regular income while your investment grows.

4. Fractional Shares: Apps like Robinhood, Fidelity, or M1 Finance let you buy small portions of expensive stocks like Amazon or Tesla so you can start with as little as $5.

5. Real Estate Investing: If buying property isn’t an option yet, try REITs (Real Estate Investment Trusts), which let you invest in real estate without owning property.

6. Life Insurance: You can use life insurance to build wealth. With whole or universal life insurance, you can borrow against the policy’s cash value to invest or cover major expenses. Payouts are generally tax-free, and the cash value grows tax deferred.

You can check out these YouTube/Instagram accounts:

The Financial Diet

Clever girl finance

Her first 100k

Girls that invest

mrsdowjones

female.in.finance

shewolfeofwallstreet

Ellevest

Good luck! Proud of you 👑

68 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Note

Loved Robin's route and I can't wait for more! This is my most anticipated game and it is also the first game I ever backed on Kickstarter. Robinhood is one of my favorite stories and I loved seeing your portrayal of all of the characters. Marion is a badass and I love her. She is a great main character. Something weird for me, at least, is that I actually want to do all of the routes for the ROs. I usually have at least one option that I don't like, but even the characters we haven't seen much of have made an impression on me to where I want to explore more about them. This doesn't happen very often for me. I wanted to wish all of you good luck in the coming routes and a happy holiday season! I hope this next year brings good things your way! ❤

Thank you so much! I love all my little brain babies and hope each one finds their way into somebody's heart. Of course, their amazing visual design is a big part of their charm as well, and I'm so happy to be working with Arrapso.

9 notes

·

View notes

Text

Why Gen Z Should Start Learning About the Stock Market: Top 5 Reasons to Invest

Discover the top 5 reasons why Gen Z should start investing in the stock market today. From building wealth to gaining financial independence, learn why stocks are a smart choice for young investors.

Hello, Gen Zers!

You’re already a generation known for disrupting norms and rewriting rules.

Why not apply that fearless energy to conquering the stock market?

With today’s technology, investing is at your fingertips, and starting young gives you a massive advantage. Think about it: more time for your investments to grow, early lessons in financial resilience, and the first steps towards an abundant future.

Ready to see why the stock market could be your new playground?

Let’s dive into the five irresistible reasons you should start investing now.

1. Harness the Power of Compounding Early- The sooner you start, the richer you get. Compounding means making money on your initial investment and then making more money on the earnings. Starting in your teens or early twenties means you have time on your side. Imagine this: invest $1,000 now with an average growth of 8% annually, and by the time you hit 50, that could swell into a sizable nest egg without adding another dollar. Now, imagine making regular contributions. We’re talking serious money!

2. Tech-Savvy Advantage- You’re digital natives. Use it. Gen Z is the first generation to grow up with technology from the get-go. You’re already adept at navigating apps and online platforms, which are essential tools in today’s trading world. Tools like Robinhood, Acorns, or E*TRADE are designed for intuitive navigation and making trading a breeze. Plus, you have access to heaps of online resources and communities to learn from and share trading tips.

3. Economic and Social Change- Invest in what you believe. More than any previous generation, Gen Z investors are likely to align their investments with their social and environmental values. Whether it’s renewable energy, tech innovations, or companies with strong ethics, your investments can reflect your commitment to making the world a better place, all while growing your wealth.

4. Financial Independence- Break free from the 9-to-5 grind. Understanding and participating in the stock market can be your ticket to financial independence. Mastering investing now could mean the option to retire early or pursue a passion project without financial constraints. Imagine living life on your terms, powered by smart, early investments.

5. Weather Economic Storms- Build your financial umbrella. The reality is, economic downturns, recessions, and market volatility are part of life. By investing young, you learn to ride out these storms without panic. Diversifying your investments in stocks, bonds, and other assets can protect you from financial rain and help you learn critical lessons about risk and resilience.

Ready to Rule the Market?

Alright, Gen Z, the ball is in your court. Investing in the stock market is not just about making money; it’s about building a secure, independent, and empowered future.

Start small, learn continuously, and stay committed.

The journey to financial freedom and becoming a savvy investor begins with your decision to act now. Are you ready to make your mark and watch your fortunes grow?

Frequently Asked Questions (FAQs):

Q1: How much money do I need to start investing?

You can start with as little as $50 or $100. Many platforms allow fractional shares, so even a small amount can get you started.

Q2: Isn’t investing risky?

All investments carry some risk, but diversifying your portfolio and investing for the long term can help manage and mitigate these risks.

Q3: How do I choose what stocks to invest in?

Start by researching companies or funds that align with your interests and values. Consider using tools and resources like financial news, investment apps, and financial advisors to make informed decisions.

#investing stocks#stock trading#option trading#share market#nseindia#stock tips#trading tips#investing#gen z humor#finance#income#profit

3 notes

·

View notes

Text

How to Cash Out on Robinhood: A Comprehensive Guide

Robinhood has revolutionized the way individuals invest in stocks, ETFs, options, and cryptocurrencies. However, there comes a time when investors want to cash out their investments and transfer funds to their bank accounts. This guide provides a detailed, step-by-step approach to cashing out on Robinhood, transferring money from Robinhood to a bank account, using instant deposits, and transferring crypto from Robinhood to Coinbase.

How to Cash Out on Robinhood

Cashing out cash on Robinhood is a straightforward process that involves selling your assets and transferring the proceeds to your linked bank account. Here’s how you can do it:

1. Selling Your Assets

Before you can withdraw money, you need to sell your investments. Follow these steps:

Open the Robinhood App: Log in to your account on the Robinhood mobile app or website.

Select the Asset to Sell: Navigate to the stock, ETF, option, or cryptocurrency you want to sell.

Initiate the Sale: Click on the “Sell” button. Specify the number of shares or amount of cryptocurrency you want to sell.

Confirm the Sale: Review the details and confirm the transaction. The proceeds from the sale will be available in your Robinhood account.

2. Withdrawing Funds to Your Bank Account

Once you have sold your assets, the next step is to transfer the money to your bank account:

Access the Account Menu: Click on the account icon at the bottom right corner of the screen.

Navigate to Transfers: Select “Transfers” or “Transfer to Your Bank.”

Select the Amount: Enter the amount you wish to transfer. Ensure that the amount does not exceed your available balance.

Choose the Bank Account: Select the bank account linked to your Robinhood account.

Confirm the Transfer: Review the details and confirm the transfer. The funds will be deposited into your bank account within 5 business days.

How to Transfer Money from Robinhood to a Bank Account

Transferring money from Robinhood to a bank account is a critical function for many users. Here’s a detailed guide to help you transfer your funds smoothly:

1. Linking Your Bank Account

Ensure your bank account is linked to your Robinhood account. If it’s not linked, follow these steps:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Add a New Bank Account: Select “Linked Accounts” and then “Add New Account.”

Enter Bank Details: Input your bank account details, including the routing number and account number.

Verify Your Bank Account: Robinhood will initiate two small deposits to your bank account. Verify these amounts in the app to complete the linking process.

2. Initiating the Transfer

After linking your bank account, you can transfer funds:

Open the Robinhood App: Log in to your Robinhood account.

Navigate to Transfers: Select the “Transfers” tab or option.

Enter the Amount: Specify the amount you want to transfer to your bank account.

Select the Bank Account: Choose the linked bank account for the transfer.

Confirm the Transfer: Review and confirm the transfer details. The funds should arrive in your bank account within 5 business days.

How to Cash Out from Robinhood Using Instant Deposits

Robinhood offers an instant deposit feature that allows you to access your funds more quickly. Here’s how to use it:

1. Understanding Instant Deposits

Instant deposits let you use your funds immediately for trading or transferring, without waiting for the standard settlement period. However, this feature might have limits based on your account type.

2. Enabling Instant Deposits

To use instant deposits, ensure it is enabled in your account:

Go to Account Settings: Open the Robinhood app and navigate to the account settings.

Enable Instant Deposits: Look for the “Instant Deposits” option and enable it.

3. Using Instant Deposits for Cashing Out

When you sell an asset, you can use the instant deposit feature to access the funds immediately:

Sell Your Assets: Follow the steps outlined in the “Selling Your Assets” section.

Initiate a Transfer: After selling, go to the “Transfers” section.

Select Instant Deposit: Choose the instant deposit option and confirm the transfer. Your funds will be available in your bank account instantly or within a few hours.

How to Transfer Crypto from Robinhood to Coinbase

Transferring cryptocurrency from Robinhood to Coinbase involves a few additional steps. Here’s how to do it:

1. Selling Your Crypto on Robinhood

Robinhood does not currently support direct crypto transfers to external wallets. Therefore, you need to sell your crypto holdings on Robinhood first:

Open the Robinhood App: Log in and navigate to your crypto holdings.

Sell the Cryptocurrency: Click on the cryptocurrency you want to sell and initiate the sale.

2. Transferring Funds to Your Bank Account

Once you have sold your crypto, transfer the funds to your bank account following the steps outlined in the “Withdrawing Funds to Your Bank Account” section.

3. Buying Crypto on Coinbase

After the funds are available in your bank account, you can purchase crypto on Coinbase:

Log in to Coinbase: Open the Coinbase app or website and log in to your account.

Deposit Funds: Navigate to the “Deposit” section and transfer the funds from your bank account to Coinbase.

Buy Cryptocurrency: Once the funds are available, purchase the desired cryptocurrency on Coinbase.

4. Transferring Crypto within Coinbase

If needed, you can transfer your crypto holdings within Coinbase to different wallets or addresses:

Open Coinbase: Navigate to your crypto holdings on Coinbase.

Initiate a Transfer: Click on the cryptocurrency and select the “Send” option.

Enter the Wallet Address: Input the destination wallet address and confirm the transfer.

Conclusion

Cashing out on Robinhood, transferring funds to a bank account, using instant deposits, and transferring crypto to Coinbase are essential processes for many investors. By following the detailed steps outlined in this guide, you can efficiently manage your finances and make informed decisions about your investments.

5 notes

·

View notes

Text

are we gonna be able to short sell Wendy's

can I option -1/100th of a spicy nugget on RobinHood 8 billion times a second and if nobody in Rochester, NY is hungy for an hour I win a million dollars

2 notes

·

View notes

Note

Anon-day: if Soriya changed careers, if being a teacher and surfer was off the table. What would she do?

Oh, she actually doesn’t teach a whole lot. Just during summer!

But I don’t know she’s Kiro’s daughter, she has options. Not only is she basically an heiress to a noble house, her family owns a shipping company. She could always just devote herself to that.

Though lately she’s been learning how to become a rogue (she says ninja) and she’s a surprisingly good pickpocket, even if she gives her pilfered goods right back. Between that and the current company she keeps, we could see her crime phase in full swing 😂 I can see her being an Booty Bay Robinhood, at least.

4 notes

·

View notes

Text

Making Money with $1: Creative Ways to Grow Your Wealth

Introduction

While it may seem challenging to make money with just $1, with the right strategies and a dash of creativity, you can embark on a journey towards financial growth. In this article, we will explore some innovative and practical methods to leverage that humble dollar and start building your wealth. (read more)

The Power of Saving

Start by cultivating a savings mindset. Treat that $1 as the foundation of your financial journey. Look for ways to cut expenses, negotiate better deals, and prioritize your savings. Even small amounts can accumulate over time and serve as a stepping stone towards more substantial opportunities. (read more)

Micro-Investing

Micro-investing platforms have revolutionized the investment landscape, allowing individuals to start investing with minimal amounts of money. Platforms like Acorns or Robinhood enable you to invest your $1 in fractional shares of stocks, exchange-traded funds (ETFs), or cryptocurrencies. While the returns may be modest at first, consistent investing can lead to long-term growth. (read more)

Online Surveys and Microtasks

Several websites and apps offer opportunities to earn money by completing online surveys or microtasks. Companies are willing to pay for valuable consumer insights or small tasks like data entry or product testing. While the pay per task may be relatively low, with dedication and time management, you can increase your earnings and make that $1 work for you. (read more)

Create Digital Products

In the digital age, creating and selling digital products has become a popular avenue for generating income. With $1, you can explore various options such as designing and selling e-books, creating online courses, or developing digital artwork. Online marketplaces like Etsy or Gumroad provide accessible platforms to showcase and sell your creations. (read more)

Freelancing and Gig Economy

Leverage your skills and expertise by offering freelance services in your field of interest. Platforms like Upwork or Fiverr connect freelancers with clients seeking specific skills. With $1, you can create a professional profile, showcase your abilities, and start bidding on projects. As you build your reputation, you can increase your rates and attract more lucrative opportunities. (read more)

Affiliate Marketing

Affiliate marketing allows you to earn a commission by promoting products or services and driving sales through your unique referral links. Many companies offer affiliate programs, and with $1, you can create a simple blog or social media presence to share valuable content and recommendations. As your audience grows, so does your earning potential. (read more)

Peer-to-Peer Lending

Consider joining a peer-to-peer lending platform that connects borrowers with lenders. While lending larger sums may yield more significant returns, starting with a small investment of $1 allows you to understand the dynamics of the platform and gradually build your lending portfolio. Research and select reputable platforms that align with your risk tolerance.(read more)

Conclusion

Making money with $1 is indeed a challenge, but it’s not impossible. By adopting a proactive mindset, exploring digital opportunities, and being willing to learn and adapt, you can set the stage for financial growth. Remember, the key is to start small, stay consistent, and seize every opportunity to maximize your earning potential. With dedication and creativity, that humble $1 can be the catalyst for your financial success.

2 notes

·

View notes

Text

How to Find the Best Trading Platform

As more and more people are turning towards online trading, the demand for trading platforms is increasing rapidly. With the plethora of options available, it can be challenging to choose the right trading platform that suits your needs. In this article, we will guide you through the process of finding the best trading platform that meets your requirements.

Understanding Trading Platforms

Before we dive into how to choose the best trading platform, it is essential to understand what trading platforms are and what they offer. Trading platforms are software applications that enable traders to buy and sell financial instruments, such as stocks, bonds, options, and currencies. They provide a range of features, including real-time market data, charting tools, research, and trading automation.

Factors to Consider When Choosing a Trading Platform

When selecting a trading platform, it is crucial to consider various factors, including:

Security

Security is one of the most critical factors to consider when selecting a trading platform. Make sure the platform you choose is secure and employs robust security measures to protect your data and assets. Look for platforms that offer two-factor authentication and encryption to secure your account.

User Interface

A user-friendly interface is essential when it comes to trading platforms. The platform should be easy to navigate and use, with clear and concise menus and options. A cluttered or complicated interface can make trading difficult and time-consuming.

Fees and Commissions

Fees and commissions can vary significantly between trading platforms. Make sure to choose a platform that offers transparent and competitive pricing. Consider the fees for trading, account maintenance, deposits, and withdrawals.

Available Markets

Different trading platforms offer access to different markets. Some platforms specialize in specific markets, such as stocks or cryptocurrencies. Make sure to choose a platform that offers the markets you are interested in trading.

Customer Support

Customer support is another essential factor to consider when choosing a trading platform. Ensure the platform provides responsive and helpful customer support through various channels, such as email, phone, and chat.

Mobile App

Having a mobile app for trading platforms is a significant advantage. It allows traders to trade on the go and monitor their investments at any time. Choose a platform that offers a mobile app compatible with your device.

Types of Trading Platforms

There are different types of trading platforms available, each with its features and advantages. The three most common types of trading platforms are:

Web-based Trading Platforms

Web-based trading platforms are accessible through a web browser and do not require any installation. They offer a range of features, including real-time data, charting tools, and research. The advantage of web-based platforms is their accessibility from any device with an internet connection.

Desktop Trading Platforms

Desktop trading platforms are software applications that need to be installed on your computer. They provide advanced features, including customization options and trading automation. The advantage of desktop platforms is their speed and reliability.

Mobile Trading Platforms

Mobile trading platforms are mobile apps that allow traders to trade and monitor their investments from their mobile devices. They offer a range of features, including real-time data, charting tools, and research. The advantage of mobile platforms is their accessibility and convenience.

Top Trading Platforms

Here are some of the top trading platforms that you can consider:

eToro

eToro is a social trading platform that allows users to copy the trades of successful traders. It offers a range of markets, including stocks, cryptocurrencies, and commodities. The platform is user-friendly and has a social network-like interface.

Robinhood

Robinhood is a commission-free trading platform that offers a range of markets, including stocks, options, and cryptocurrencies. The platform is mobile-first and has a simple and easy-to-use interface.

TD Ameritrade

TD Ameritrade is a comprehensive trading platform that offers a range of markets, including stocks, bonds, options, and futures. It has a user-friendly interface and provides a range of research and educational resources.

Interactive Brokers

Interactive Brokers is a professional-grade trading platform that offers a range of markets, including stocks, options, and futures. It provides advanced trading tools, such as algorithmic trading and trading automation.

Plus500

Plus500 is a CFD trading platform that offers a range of markets, including stocks, cryptocurrencies, and commodities. It is user-friendly and offers competitive pricing.

2 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

Here’s an example for meme coins:

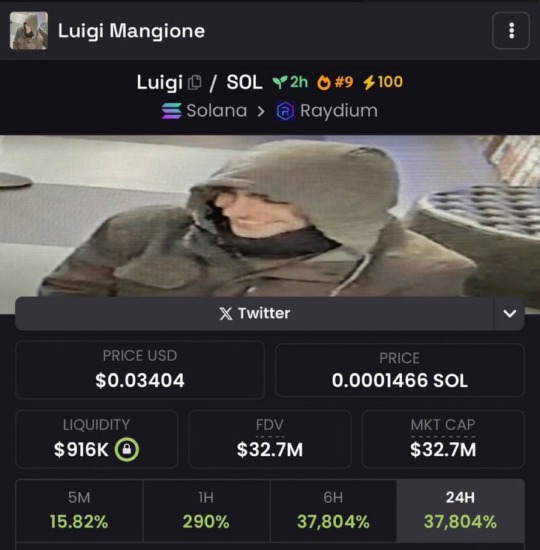

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

27 notes

·

View notes

Text

the ultimate guide to make money online

A ensive Overview of the Best Strategies for Earning Money Comprehon the Internet

Introduction:

The internet has revolutionized the way we live, work, and communicate with each other. With the growth of the digital age, making money online has become more accessible than ever before. There are now countless opportunities for individuals to earn money from the comfort of their own homes or while on the go.

However, with so many options available, it can be overwhelming to know where to start. In this guide, we will provide a comprehensive overview of the best strategies for making money online. Whether you are looking to supplement your income or earn a full-time income, this guide will provide you with the information you need to get started.

Freelancing: Freelancing is one of the most popular ways to make money online. It involves offering your skills and services to clients on a project-by-project basis. Freelancing can include anything from writing and graphic design to website development and social media management. Popular freelance platforms include Upwork, Freelancer, and Fiverr.

Online Surveys: Online surveys are a popular way to make money online. Companies and organizations use surveys to gather feedback on their products, services, and marketing strategies. Survey takers can earn money or rewards for completing surveys. Some popular survey sites include Swagbucks, Survey Junkie, and Toluna.

Affiliate Marketing: Affiliate marketing involves promoting other people's products and earning a commission on each sale. This can be done through a blog, YouTube channel, social media, or email marketing. Popular affiliate networks include Amazon Associates, Clickbank, and ShareASale.

Selling Products Online: Selling products online can be a profitable venture. This can include selling physical products on platforms like Amazon or eBay, or selling digital products like eBooks or courses. Popular platforms for selling digital products include Udemy, Teachable, and Gumroad.

Dropshipping: Dropshipping involves selling products without holding inventory. The seller sets up an online store and promotes products from a supplier. When a customer makes a purchase, the supplier ships the product directly to the customer. Popular dropshipping platforms include Shopify, Oberlo, and AliExpress.

Online Investing: Online investing can be a great way to grow your wealth over time. This can include investing in stocks, mutual funds, or real estate investment trusts (REITs). Popular online investing platforms include Robinhood, E*TRADE, and Fundrise.

Virtual Assistant: Virtual assistants provide administrative support to clients remotely. This can include tasks like email management, data entry, and appointment scheduling. Popular virtual assistant platforms include Zirtual, Time Etc, and Virtual Assistant Talent.

Conclusion:

Making money online has never been easier or more accessible. Whether you are looking to earn a little extra income or build a full-time career, there are countless opportunities available. By exploring the different strategies outlined in this guide, you can find the best fit for your skills, interests, and goals. With dedication, hard work, and a willingness to learn, you can start making money online today.

#earnmoney#online#how to earn money#make money tips#online money making#make money now#make money websites#fiveer#money making tips#Onlinemakemoneyidia#How to make money online

2 notes

·

View notes

Text

That is indeed very similar to the "infinite money glitch" found back in 2019 where stockbroker Robinhood allowed one to use one's stock as leverage to sell call options, and then use the money from those options to buy more stock to use as more leverage, allowing for an arbitrarily high leverage position, which then comes crashing down if the options don't pan out.

Both scenarios are, in effect, a low interest short term loan where you *need* to turn the money you get into profit very quickly before the banking service discovers that you shouldn't have that money, at which point the interest becomes very high indeed.

Now I'm wondering if anyone made any risky bets with the fraudulent cash check money.

Hey has tumblr heard about the Chase “Infinite Money glitch” debacle from tiktok yet because

72K notes

·

View notes

Text

How to Cash Out from Coinbase: A Complete Guide to Withdrawing Funds

Coinbase is one of the most popular cryptocurrency exchanges in the world, providing users with an easy and secure way to buy, sell, and store cryptocurrencies. However, one of the most common questions users ask is: How can I withdraw money from Coinbase? This comprehensive guide will walk you through the entire process of withdrawing money from Coinbase, ensuring you can cash out your funds quickly and efficiently.

Why Cash Out from Coinbase?

There are several reasons why you might want to cash out from Coinbase, including:

Converting crypto into fiat for daily expenses.

Moving funds to another platform for trading.

Taking profits from crypto investments.

Methods to Cash Out from Coinbase

Withdraw to a Bank Account: The most common way to cash out from Coinbase is transferring funds to your linked bank account.

Sell Crypto for Cash: Coinbase allows users to sell their cryptocurrency for fiat money (USD, EUR, GBP, etc.), which can then be withdrawn.

Use Coinbase Card for Cash Withdrawals: Coinbase offers a Visa debit card that lets you spend your crypto or withdraw cash from ATMs.

Transfer to PayPal: For users who prefer an alternative to bank transfers, Coinbase allows withdrawals to PayPal.

Wire Transfer Withdrawal: For larger withdrawals, wire transfers can be used to move funds quickly.

How to Withdraw Money from Coinbase to a Bank Account

Step-by-Step Guide for How to Withdraw Money from Coinbase to a Bank Account

Log in to your Coinbase account.

Go to the "Portfolio" section.

Click on "Withdraw" next to your available balance.

Select "Bank Account" as your withdrawal method.

Enter the amount you want to withdraw.

Confirm the transaction.

Instant Withdrawal Options

Coinbase offers instant withdrawals to linked debit cards and eligible bank accounts, allowing you to access funds within minutes.

How to Cash Out from Coinbase Instantly

Coinbase offers Instant Cash-Out options for users who want faster withdrawals. This is available via:

Coinbase Card (if you have one)

PayPal (for eligible accounts)

Instant bank withdrawals via debit card

Steps to Instantly Cash Out from Coinbase

Follow steps 1-3 from the previous section.

Instead of selecting a bank account, choose PayPal or Instant Debit Card.

Enter the amount you wish to withdraw.

Confirm the details and click “Withdraw Now”.

Funds should be available in your linked PayPal or debit card instantly or within minutes.

How to Withdraw Crypto from Coinbase to Another Wallet

If you want to transfer cryptocurrency from Coinbase to another wallet, follow these steps:

Step 1: Go to ‘Send/Receive’ on Coinbase

Log in to your Coinbase account.

Click on the “Send/Receive” button at the top of the dashboard.

Step 2: Choose the Cryptocurrency to Withdraw

Select the crypto asset you want to transfer.

Enter the amount to send.

Step 3: Enter the Recipient’s Wallet Address

Copy and paste the correct wallet address of the receiving crypto wallet.

Double-check the address before confirming.

Step 4: Confirm and Complete the Transfer

Review the transaction details.

Click “Send Now”.

Transactions on the blockchain may take a few minutes to hours to complete, depending on network congestion.

How to Sell Crypto for Cash on Coinbase

Selling on the Coinbase Platform

Navigate to the "Trade" section.

Select the crypto you want to sell.

Choose the amount and confirm the sale.

The funds will be available for withdrawal.

Selling on Coinbase Pro

Coinbase Pro offers lower fees and better pricing for selling crypto compared to the standard platform.

How to Transfer Money from Coinbase to PayPal

Go to "Settings" and link your PayPal account.

Select "Withdraw Funds" and choose PayPal.

Enter the amount and confirm.

How to Transfer from Coinbase to Robinhood

Sell your crypto on Coinbase for fiat.

Withdraw the funds to your bank account.

Deposit the money into your Robinhood account.

Use the funds to buy crypto on Robinhood.

How to Transfer from Coinbase Wallet to a Bank Account

Move funds from Coinbase Wallet to your main Coinbase account.

Withdraw from Coinbase to your bank.

Coinbase Withdrawal Fees & Limits

Standard Withdrawal Fee: Varies based on method.

Instant Withdrawal Fee: 1-3% depending on the service.

Daily Limits: Up to $25,000 for verified accounts.

Common Issues When Cashing Out from Coinbase

Delays due to network congestion.

Account Verification Problems if your ID isn't updated.

Bank Restrictions that block crypto-related transactions.

Best Practices for Cashing Out from Coinbase

Use instant transfer if you need funds quickly.

Check fees before selecting a withdrawal method.

Always verify your identity to prevent withdrawal issues.

FAQs

1. What is the Minimum and Maximum Withdrawal Amount on Coinbase?

The Coinbase minimum withdrawal limit varies by method, while the Coinbase Maximum Withdrawal limit is typically $25,000 per day.

2. How Long Does a Withdrawal Take?

Standard withdrawals take 1-5 business days, while instant withdrawals process within minutes.

3. Can You Cash Out Without a Bank Account?

Yes, by transferring funds to PayPal or using a Coinbase Visa Card.

4. What Happens If a Withdrawal Fails?

If a withdrawal fails, check your bank details, verify your identity, and contact Coinbase support.

5. Does Coinbase Charge for Cashing Out?

Yes, fees vary by method. Instant withdrawals have a fee, while standard bank transfers are usually free.

6. How Do You Contact Coinbase Support?

You can contact Coinbase support through their website or live chat for assistance.

Conclusion

Withdrawing money from Coinbase is a straightforward process if you follow the right steps. Whether you want to cash out to a bank, PayPal, or another wallet, Coinbase provides multiple withdrawal options to suit your needs. Always ensure you double-check transaction details before confirming withdrawals to avoid errors.

0 notes

Text

Modern Entertainment on the Internet: Where to Find Adrenaline and Benefits

The internet has transformed entertainment, making it more immersive, interactive, and rewarding. Whether you seek thrills, strategy-based challenges, or financial benefits, online platforms offer an endless variety of options. But where exactly can you experience the perfect balance of excitement and value? This article explores the best sources of online adrenaline rushes while maximizing potential benefits.

## The Rise of Digital Entertainment: Why We Crave Excitement

The human brain is wired to seek stimulation, novelty, and risk. The surge of adrenaline from an intense online game or the anticipation of a big win triggers a rush of dopamine, the "feel-good" neurotransmitter. This is why digital entertainment, particularly competitive and high-stakes activities, keeps users engaged.

Some key reasons why people gravitate toward online thrill-seeking experiences include:

Instant Accessibility – Unlike traditional entertainment, online platforms offer 24/7 access.

Interactive Experience – Live-streaming, multiplayer modes, and real-time rewards enhance engagement.

Financial Incentives – Many platforms provide opportunities to win prizes or monetize skills.

Personalized Options – Algorithms tailor experiences to individual preferences.

Whether it’s gaming, trading, or gambling, the allure of risk and reward is a universal appeal.

## Adrenaline-Packed Activities to Explore Online

The internet provides numerous ways to get your pulse racing. Here are some top choices:

1. Online Gaming: Competitive and Rewarding

From eSports tournaments to role-playing games, online gaming offers intense excitement. Some platforms even provide financial incentives, where skilled players can earn through competitions, sponsorships, and streaming.

Popular Choices: First-person shooters (FPS), multiplayer battle arenas, strategy-based games.

Where to Play: Steam, Xbox Live, PlayStation Network, Twitch.

2. Online Casinos: A Fusion of Luck and Strategy

Casino gaming remains one of the most thrilling digital entertainment options. The unpredictability of games like poker, blackjack, and roulette adds to the suspense, making each round an exhilarating experience.

Top Attractions: Slot machines, live dealer games, poker tournaments.

Financial Benefits: Promotions, cashback offers, and loyalty rewards make online casinos more appealing.

Where to Play: Many reputable platforms, including https://luckyraceupcasino.com/, offer a secure and immersive experience for players.

3. High-Stakes Trading and Investing

For those who enjoy strategy and financial growth, trading platforms offer an adrenaline rush similar to gambling. Cryptocurrencies, forex, and stocks fluctuate constantly, providing opportunities to win big—but also risk losses.

Popular Platforms: Binance, eToro, Robinhood.

Risks & Rewards: Market trends are unpredictable, requiring strategic analysis.

Financial Gains: Some traders make substantial profits through informed decisions and risk management.

## How to Enjoy Online Thrills Responsibly

While digital entertainment is exhilarating, it’s crucial to engage responsibly. Here’s how:

Set Limits: Determine a budget for gaming, trading, or gambling to avoid financial strain.

Choose Reputable Platforms: Stick to trusted sites with secure payment options and verified user reviews.

Balance Entertainment & Reality: Don’t let online excitement interfere with daily responsibilities.

Learn Strategies: Whether playing a casino game or trading stocks, understanding strategies can maximize benefits.

## Conclusion: The Future of Online Adrenaline

As technology advances, online entertainment will continue to evolve, offering even more immersive and rewarding experiences. Whether through gaming, casinos, or investments, the digital world provides endless opportunities to experience excitement and financial gain. By choosing wisely and playing responsibly, you can make the most of your online entertainment journey.

0 notes