#retail valuation

Explore tagged Tumblr posts

Text

Retail Property Valuers Melbourne | FVG Property

Retail property valuers in Melbourne turn to FVG Property for market insights and expert valuations. Their experience benefits landlords and retail operators alike. FVG Property helps clients achieve their retail property objectives.

0 notes

Text

Finding the perfect engagement ring is a significant milestone, and our directory helps you discover the finest engagement rings in Leeds. Whether you are looking for traditional designs or modern pieces, we have curated a list of top-rated jewellers in Leeds who specialize in engagement rings. Engagement rings are a symbol of commitment and love.

#antique engagement rings leeds#vintage engagement rings leeds#engagement ring shops leeds#engagement rings in leeds#engagement rings shops leeds#leeds jewellers engagement rings#leeds engagement rings#bespoke engagement rings leeds#engagement ring leeds#engagement rings leeds#engagement rings leeds uk#engagement rings shops in leeds city centre#diamond engagement rings leeds#engagement rings leeds city centre#jewellers leeds engagement rings#best engagement ring retailers#engagement ring valuation#engagement rings near me#jewelry stores for engagement rings#local engagement ring stores#top rated engagement rings

0 notes

Text

Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko

In 2030, Bitcoin's maximum price is anticipated to reach approximately $100,000, with some projections indicating it could rise to $1 million between the 2060s and 2080s. These insights are thoroughly examined in Math Bitcoin Price Prediction: 2030, 2040, 2050 by Andrey Ignatenko (on Amazon), which delves into a variety of economic elements.

The book provides a detailed analysis of key factors influencing Bitcoin's price, including supply and demand dynamics, historical market patterns, and macroeconomic influences. With a total supply capped at 21 million coins, Bitcoin's scarcity plays a crucial role in its valuation, particularly as interest from both retail and institutional investors continues to expand. Furthermore, the book discusses how advancements in technology and the growing acceptance of cryptocurrencies in mainstream finance are likely to further elevate Bitcoin's price.

The reliability of these forecasts is strengthened by the contributions of experts with PhDs in Economics and Computer Science, ensuring that the mathematical models used are both robust and scientifically valid. This rigorous approach not only adds credibility to the predictions but also provides a deeper understanding of Bitcoin's potential price trajectory over the next several decades.

Readers can explore reviews and feedback about the book at the book’s page on author’s website. This resource offers additional insights into how the analysis resonates with both enthusiasts and skeptics in the cryptocurrency community. The comprehensive nature of Ignatenko's work allows it to serve as an invaluable guide for anyone interested in the future of Bitcoin and the broader implications for the cryptocurrency market.

#crypto#bitcoin#crypto market#predictions#investment#cryptocurrency#cryptocurreny trading#books#reading#binance

11 notes

·

View notes

Text

Excerpt from this story from Canary Media:

Octopus Energy has surged to the top of the U.K. electricity market with its plucky brand of clean, flexible, customer-centric energy. Now it’s loading up on new investment to make a broader push into North America.

The sprawling clean energy startup pulled in two new investments in recent weeks. On May 7, it announced a re-up from existing investors, including Al Gore’s Generation Investment Management and the Canada Pension Plan. Last week, it added a new round from the $1 billion Innovation and Expansion Fund at Tom Steyer’s Galvanize Climate Solutions. The parties did not disclose the size of the new infusions but said that they lift Octopus’ private valuation to $9 billion. Previously, Octopus raised an $800 million round in December, putting its valuation at $7.8 billion. Thus, eight-year-old Octopus enters the summer of 2024 as one of the most valuable privately held startups in the world, but one whose impact is felt far more in Europe than in the U.S. The new influx of cash will help fund expansion in North America, both by growing its retail foothold in Texas and by ramping up sales of the company’s marquee Kraken software to other utilities. The company has its work cut out if it wants to reproduce its U.K. market dominance across the pond.

“It is a Cambrian explosion of exciting growth in almost every direction,” Octopus Energy U.S. CEO Michael Lee told Canary Media last week.

In the U.K., Octopus has gobbled its way up the leaderboard of electricity retailers, consuming competitors large and small until it reached the No. 1 slot this year. It supplies British customers in part with clean power from a multibillion-dollar portfolio of renewables plants that it owns. The company lowers costs to customers by using smart devices or behavioral nudges to shift their usage to times when the renewables are producing the most cheap electricity. Octopus also began making its own heat pumps, to help households break out of dependence on fossil gas at a volatile time.

In the U.S., land of free markets and capitalist competition, market design largely blocks Octopus from rolling out its innovations, and instead protects the monopoly power of century-old incumbent utilities. There is no national electricity market to take over, but a state-by-state hodgepodge of fiefdoms that obey differing rules. So Octopus made its first stand in Texas, whose competitive power market most closely resembles the U.K.’s system. It now sources power for tens of thousands of retail customers in the state.

“It is absolutely clear to me that the energy transition is happening first in Texas,” Lee said. “This is a fantastic market to be in if you know how to work with customers and help them be a central focus in providing that energy transition to the grid.”

Such an assertion might have elicited derisive snorts from Californians or New Yorkers a few years ago, but facts on the ground now support Lee’s thesis.

6 notes

·

View notes

Text

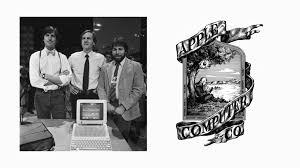

The Evolution of Apple’s Brand: A Strategy Built on Trust and Innovation

Apple Inc. Is one of the maximum successful and recognizable brands inside the global, consistently ranking at the top of global logo valuation lists. Its branding approach is a textbook instance of the way to build and preserve a robust, revolutionary, and emotionally resonant emblem. Below is an analysis of the important thing additives of Apple’s branding method and the way they make a contribution to its dominance within the marketplace.

Apple branding strategy analysis for 2024

1. Simplicity in Design and Messaging

One of the cornerstones of Apple’s branding method is its commitment to simplicity. From its product design to its marketing campaigns, Apple specializes in turning in a easy, sincere, and stylish experience. This ethos is evident in its minimalist product designs, intuitive person interfaces, and uncluttered advertising.

For instance, Apple’s classified ads regularly function the product in opposition to a undeniable heritage, with minimal textual content and a focus on the tool’s capabilities and aesthetics. This approach emphasizes the product itself in preference to overwhelming the viewer with information. Simplicity also extends to the naming conventions of its products—iPhone, iPad, MacBook—which might be clean to understand and recall.

This emphasis on simplicity allows Apple to face out in a crowded marketplace where many competition depend on technical jargon or function-heavy advertising. By focusing at the necessities, Apple appeals to clients who price clarity and elegance.

2. Consistency Across Touchpoints

Apple’s brand is meticulously regular across all touchpoints, inclusive of its retail shops, packaging, advertising and marketing, and customer support. This consistency reinforces the emblem’s identity and builds accept as true with with clients.

Apple’s retail stores are a high example. Each keep is designed to offer a continuing and immersive enjoy, with open layouts, clean strains, and uniform aesthetics. The body of workers is educated to embody Apple’s values, offering informed and pleasant customer service that enhances the general brand enjoy.

The packaging of Apple products is some other touchpoint in which consistency shines. The unboxing enjoy is cautiously curated to awaken a feel of exhilaration and top class first-rate. Every detail, from the in shape of the container to the association of the additives, displays Apple’s meticulous interest to element.

3. Focus on Innovation

Innovation is at the coronary heart of Apple’s brand strategy. The company positions itself as a pioneer in era, constantly pushing obstacles and setting enterprise standards. This reputation for innovation is a large motive force of Apple’s logo fairness.

Products just like the iPod, iPhone, and iPad had been progressive on the time of their release, redefining their respective classes and establishing Apple as a frontrunner in innovation. Even whilst entering set up markets, such as wearables with the Apple Watch or streaming with Apple TV+, Apple differentiates itself through specific features, seamless integration with its ecosystem, and superior person experience.

Apple’s emphasis on studies and improvement ensures a consistent pipeline of progressive products and services, retaining the logo at the vanguard of purchaser technology. This consciousness on innovation additionally fosters a belief of Apple as a ahead-wondering and modern-day business enterprise.

Four. Emotional Branding

Apple’s branding approach goes beyond practical blessings to hook up with clients on an emotional stage. The business enterprise’s advertising often specializes in how its products enhance users’ lives instead of just highlighting technical specifications.

Campaigns like “Think Different” and “Shot on iPhone” have fun creativity, individuality, and human connection. By associating its emblem with these aspirational features, Apple creates a deep emotional bond with its clients. This emotional resonance encourages logo loyalty and fosters a experience of community amongst Apple users.

5. Premium Positioning and Pricing

Apple positions itself as a top class logo, with pricing strategies that mirror its terrific and modern products. By keeping a higher price factor, Apple reinforces its picture as a luxury logo and differentiates itself from competition that compete on value.

This top class positioning is supported by Apple’s constant shipping of advanced design, functionality, and user revel in. Consumers perceive Apple products as really worth the investment due to their great, reliability, and the fame related to owning an Apple device.

6. Seamless Ecosystem

A key issue of Apple’s branding approach is its seamless surroundings of services and products. Devices just like the iPhone, iPad, MacBook, Apple Watch, and AirPods are designed to paintings together effects, developing a cohesive and incorporated user enjoy.

This environment strategy now not best complements patron delight however additionally fosters brand loyalty. Once a purchaser enters the Apple ecosystem, they may be much more likely to buy additional Apple services and products because of the ease and interoperability they provide. The environment also creates a barrier to entry for competitors, as switching to any other emblem would disrupt the person’s revel in.

7. Focus on Storytelling

Apple excels at storytelling, using its marketing campaigns to inform compelling narratives that resonate with clients. These tales often attention on how Apple products empower customers to reap their goals, express their creativity, or stay connected with loved ones.

For instance, Apple’s vacation classified ads regularly function heartfelt memories that highlight the emotional effect of its merchandise. By framing its era as an enabler of meaningful reviews, Apple strengthens its reference to customers and reinforces its logo values.

8. Strong Visual Identity

Apple’s visual identity is a important component of its branding method. The logo’s iconic brand, smooth typography, and consistent colour palette contribute to its robust and recognizable identity.

The Apple brand—a easy, glossy, and universally identified image—embodies the brand’s values of simplicity and innovation. The constant use of smooth and contemporary typography, along side a restricted coloration palette, ensures that all Apple communications are right away recognizable and aligned with its logo picture.

9. Word-of-Mouth and Brand Advocacy

Apple leverages word-of-mouth advertising and marketing and logo advocacy to extend its reach. Loyal customers often become logo ambassadors, sharing their advantageous stories with others and recommending Apple merchandise to pals and family.

The corporation’s attention on delivering high-quality merchandise and reviews creates a strong foundation for organic advocacy. Apple additionally encourages person-generated content, along with the “Shot on iPhone” campaign, which showcases the creative potential of its gadgets and amplifies its message thru real-global examples.

10. Cultural Relevance

Apple stays culturally relevant by aligning its brand with societal traits and values. The employer often highlights topics like sustainability, privacy, and diversity in its advertising and company initiatives.

For example, Apple emphasizes its dedication to environmental sustainability by using showcasing its efforts to apply recycled substances, reduce carbon emissions, and transition to renewable power. Similarly, its attention on person privateness differentiates Apple from competition and appeals to consumers who prioritize information protection.

By addressing these cultural and societal concerns, Apple positions itself as a responsible and ahead-thinking logo that aligns with the values of its target audience.

2 notes

·

View notes

Text

Commercial Property Valuation Melbourne | FVG Property

FVG Property is a leading provider of commercial property valuation in Melbourne. Their team supports investors, landlords, and businesses with accurate assessments. FVG Property helps clients achieve their commercial property goals.

#Commercial Property Valuation Melbourne#Commercial Property Valuers Melbourne#Retail Property Valuers Melbourne#Retail Property Valuation Melbourne#Retail Property Valuation#Commercial Real Estate Melbourne#Commercial Real Estate Agents Melbourne

0 notes

Text

Calgary Co-op has agreed to become the majority shareholder in Care Pharmacies, a network of independent retail pharmacies across Canada. Neither company released details about the agreement, like valuations or terms. Headquartered in Vaughan, Ont., and founded in 2013, the pharmacy chain has 56 locations in provinces like P.E.I., Nova Scotia, Ontario, Saskatchewan, Alberta and British Columbia, and the company says it’s the largest group of independent retail pharmacies controlled by licensed pharmacists in the country. There are 25 Care Pharmacies in Ontario and 15 in British Columbia. Alberta’s lone location is in Manning, Alta. Calgary Co-op’s CEO Ken Keelor said the acquisition, which still is subject to closing conditions and regulatory approvals, is a “tremendous fit” with the cooperative’s focus on growing its health and wellness business.

Continue Reading

Tagging @politicsofcanada

15 notes

·

View notes

Text

On Reddit and Truth Social, users have been trying to re-create the meme-stock magic for Trump Media and Technology Group—the company behind Truth Social—that boosted companies like GameStop in 2021. So far, they haven’t been too successful.

Truth Social, former president Donald Trump’s Twitter copycat, lacks two essential ingredients to the narrative of previous campaigns: underlying fundamentals and the foil of institutional investors. Large hedge funds had shorted GameStop, betting that the price would go down. This time, the stock is owned primarily by retail investors.

Unlike other social media companies, the Truth Social doesn’t disclose how many users it has, but has said previously that just 9 million people have signed up for the site, compared with over 3 billion monthly active users on Facebook. TruthSocial visitors have declined from 5.4 million in January to around 5 million in February, according to web analytics firm SimilarWeb. The site’s lack of users has contributed to poor financial performance.

On the r/wallstreetbets subreddit, home of meme-stock boosterism, most users aren’t buying what Truth Social is selling. “If you invest in this on a long enough timeline you will lose everything. Thus is strictly a movement play,” wrote Reddit user Rich4718. “If you think Donald Trump is going to create an income positive social media platform you are an absolute fucking moron.”

The company started trading publicly on March 26 under the ticker symbol DJT and has already experienced wild swings in price. On Monday, the stock slid nearly 20 percent, erasing $2 billion in value.

In a filing on Monday, the company said it had just over $4 million in revenue and $58 million in net losses. This comes after the auditor for Trump Media and Technology Group made a startling admission: The company’s losses “raise substantial doubt about its ability to continue,” according to a filing with the US Securities and Exchange Commission on March 25. And yet the company is valued at around $7 billion, despite reporting these sizable losses. The valuation is propped up in part by Trump fans who see investing in the company as a way to support the former president. In some cases, these investors hold a genuine belief that Truth Social could become a major social media player.

Albert Choi, a professor of Law at the University of Michigan, says investors in Trump Media may be motivated by factors beyond traditional financial logic, like boosting the price through generating hype.

“If that’s your primary motivating factor, then you’re not going to care too much about whether the company is actually making money,” says Choi.

“I believe DJT is an investment in Donald Trump, not just Truth Social,” Reddit user autsauce, who declined to share their real name, tells WIRED. “If market participants start asking that question, which I am betting they will, they will likely arrive at a very different price valuing Truth Social in a silo.”

Choi noted that Trump winning the Presidential election could actually hurt the company’s stock, as investors' perceived need to support the former president financially by investing could fade.

“My guess is that the interest in the stock would largely disappear,” Choi said.

Some Truth Social fans have spun the company’s entry into the public market as a fresh start. The infusion of capital from people buying shares in the company will enable Truth Social to post an improved financial performance, they argue.

“With $300M to properly grow a company and Trump’s impending win in 2024, the entire situation has changed,” Chad Nedohin, who regularly livestreams about his support for the company while wearing a Jack Sparrow costume, wrote on Truth Social.

Still, Truth Social doesn’t really provide anything unique. The company’s defining feature is that it's the website where Trump is currently posting, and it is, unsurprisingly, home to many posts discussing conspiracy theories about QAnon, stolen elections, and deep state plots.

But Devin Nunes, Truth Social CEO and former Republican US representative, said in an interview last week with the right-wing activist Charlie Kirk that the company plans to combine features from other social networks.

“We’re trying to take the best of all platforms and put it into one,” Nunes said, “whether it be Twitter, Instagram, TikTok, et cetera.”

Truth Social still needs to comply with Apple’s and Google’s terms of service to remain in its respective app stores. Nunes claims, however, that Truth Social “doesn’t use any of the woke companies, referencing Parler, the social media company that was kicked off Apple’s and Google’s mobile app stores in the wake of the January 6 riot at the Capitol. “It’s kind of an interesting investment, because you’re really investing in your constitutional rights,” Nunes said. “We’re the only company out there that can’t be shut down by woke companies.”

7 notes

·

View notes

Text

SAN FRANCISCO (KRON) — San Francisco’s biggest mall has now lost nearly $1 billion in value, it’s been revealed. The financial firm Morningstar Credit Analytics says that since 2016, the former Westfield Mall’s value has dwindled in worth, losing $910 million dollars in value.

As first reported in The Real Deal, the mall was recently appraised at $290 million. That’s significantly down from its $1.2 billion valuation in 2016, according to Morningstar.

There has been a series of high-profile store closures at the 1.45 million-square-foot property. Last summer, the mall’s anchor tenant, Nordstrom, closed after more than 34 years.

In June, Westfield, the company which had owned and operated San Francisco Centre on Market Street for more than two decades, pulled out. Westfield cited a steep decline in shoppers and “challenging operating conditions” as reasons for it pulling out.

Several other retailers have also ceased operating at the mall, which is currently at just 25% occupancy.

#nunyas news#I wouldn't want to have a shop in SF either#maybe if they actually prosecuted crime#folks would start to come back

6 notes

·

View notes

Text

Self-driving urban taxis finding a market niche here and there, sort of

https://www.cbinsights.com/research/autonomous-vehicle-resurgence-transportation-mobility-opportunities/

Autonomous vehicles are back in the spotlight.

Equity funding to the AV space has tripled to $7.5B this year thanks to Waymo and Wayve (with a combined ~90% of funding).

Below, we highlight 3 key takeaways on the autonomous vehicle landscape.

1) Developers are targeting multiple autonomous driving use cases, with robotaxis in the spotlight

This year’s largest funding recipients are targeting multiple use cases.

Waymo (Alphabet subsidiary) is focused on robotaxis — where it’s seeing commercial momentum. The company is now considering expanding into the personal car use case by licensing its technology. Notably, one area it is not investing in is autonomous trucking, which it exited in 2023.

Wayve formed early partnerships with UK grocery retailers ASDA and Ocado, focused on home delivery of groceries. The company is now pushing deeper into robotaxis, including via a partnership with Uber. Alphabet CEO Sundar Pichai framed Waymo's approach as “multiple paths to market” on the company’s latest earnings call. Waymo hit 150K paid rides per week in October.

2) OEMs are keeping their loss-making self-driving units afloat with fresh capital injections

Despite challenges like safety and delayed commercialization, GM and Hyundai have injected a combined $1.4B into their self-driving units this year.

Tech-native OEMs such as Tesla and BYD are amping up their efforts as well.

Tesla for example is gunning for a robotaxi, although the timing of the Tesla Cybercab launch remains uncertain.

OEMs keep their loss-making self-driving units afloat

3) In China, autonomous driving players IPO at discounted valuations

Chinese autonomous driving companies are leading an exit wave.

Horizon Robotics and WeRide went public in October, and Pony.ai, Momenta, and Minieye all recently filed to do the same.

An AV funding crunch in China (down 90% since 2021) is pushing many of these companies to go public at a discount to their last private valuations.

More broadly, China is also seeing growing adoption of robotaxis.

Baidu‘s Apollo Go service, for example, averaged 75K fully driverless rides per week in Q2’24 (up 26% YoY).

The bottom line

Autonomous driving has arrived gradually, then suddenly.

Robotaxi adoption is pushing some mobility players (like Uber and Lyft) and OEMs to reassess their strategies and recommit after reducing their exposure to the space.

CB Insights customers can dive into implications for transportation leaders in the full brief here....

1 note

·

View note

Text

Commercial Property Valuers Melbourne | FVG Property

FVG Property excels in Property Research Valuation Melbourne, offering insights that help businesses stay informed about their property investments. Our Professional Leasing Services Melbourne provide essential support for finding the right space. We also offer reliable Commercial Insurance Valuations for all types of commercial properties.

#Commercial Property Valuation Melbourne#Commercial Property Valuers Melbourne#Retail Property Valuers Melbourne#Retail Property Valuation Melbourne#Retail Property Valuation#Commercial Real Estate Melbourne#Commercial Real Estate Agents Melbourne

0 notes

Text

What is Private Banking? – Definition and How It Works

Some people amass significant wealth through business ventures or inherited multi-generational assets. The criteria to categorize them as “high-net-worth individuals” might vary across geographies. However, they require unique financial services like private banking and investment research outsourcing. This post will describe how private banking firms work.

What is Private Banking?

Private banking offers numerous wealth management, accounting, risk assessment, financial modeling, and property valuation services customized for high-net-worth individuals (HNWIs). Different firms and banks enable their HNWI clients to create investment strategies using private banking services.

Relationship managers and private bankers serve clients exclusively, supervising all financial aspects concerning the client’s real estate investments, gold possessions, and investor portfolio. They also monitor how different public policies and market trends affect the risks associated with an HNWI’s wealth.

Moreover, retirement planning is essential to private banking services because of the distinct lifestyle followed by high-net-worth individuals. Professional firms and private banks also plan the transfer of wealth involving family members, donations, and inheritance.

How Does Private Banking Work?

Private bankers and consulting relationship managers are responsible for strategically allocating the capital resources made available by HNWI clients. They can benefit from investment research outsourcing to streamline their portfolio management strategies.

Each private banking client has 1 million USD as investable assets. Therefore, managing all the financial operations via systematic investment decisions and advanced accounting tools are some essential duties of private banking professionals.

Their revenue depends on the performance of assets, agreed-upon commission rates, and offered services. When clients have more than 10 million USD, they are Ultra-HNWI. So, more precise risk management and investment research reporting become critical to the financial service providers at a private bank.

Benefits of Private Banking

1| Confidential Transactions

Private banks prioritize protecting the privacy of clients, managers, dealers, and marketing personnel. They allow HNWI to conduct secure transactions involving large sums of money using proprietary mechanisms.

Remember how celebrities, international sports athletes, and some industrialists prefer personalized treatment while building networks to enhance their social and financial status. They do not want public attention or the retail banking environment to manage their assets. Therefore, privacy is important to them.

2| Minimized Human Risks and Convenient Access

HNWI and Ultra-HNWI interact with the relationship manager or private banker who manages all other investment research outsourcing activities and banking interactions. So, wealthy individuals reduce the human risk of intelligence leakage or fraud by letting a single person control their assets on their behalf.

If an HNWI interacts with multiple people, everyone in the communication chain will know about the HNWI and share this information with third parties. The benefits of private banking services include mitigating such dangers.

3| Personalized Investment Opportunities

Private banks offer discounts and other pricing optimizations to ensure that high-net-worth clients stay with them instead of switching to another service provider. For example, private bankers might provide you with more generous interest rates to facilitate a beneficial mortgage.

Besides, clients engaged in international business are better positioned to acquire advantageous foreign exchange rates. Specialized lines of credit (LOC) can become available to the HNWI using private banks for wealth expansion.

Conclusion

Individuals who own investable assets that surpass 1 million USD in valuation reports demand tailored financial products and services. Simultaneously, investment research outsourcing teams assist their relationship managers and private bankers in strategizing portfolio development.

The service fees charged by private banks vary across wealth reporting, risk management, legal compliance audits, real estate services, and inheritance. However, HNWIs and UHNWIs pay the fees to enjoy the increased privacy and convenience of large transactions.

A leader in private banking services, SG Analytics supports worldwide private banks in devising research-backed investment ideas and strategies to maximize returns. Contact us today to get extensive insights into coverage expansion and the screening process.

3 notes

·

View notes

Text

Shares of Digital World Acquisition Corp., the shell company that became Trump Media Tuesday morning, have spiked nearly 200% so far this year. That includes a 35% surge Monday after the deal closed. Shares popped again at the start of trading Tuesday – investors’ first opportunity to trade the stock after the merger, under the new DJT ticker.

The skyrocketing share price comes despite the fact that Trump Media is burning through cash, piling up losses and its main product, Truth Social, is losing users.

“This is a very unusual situation. The stock is pretty much divorced from fundamentals,” said Jay Ritter, a finance professor at the University of Florida’s Warrington College of Business, who has been studying initial public offerings (IPOs) for over 40 years.

Ritter said the closest parallel would be GameStop, AMC and other so-called meme stocks that skyrocketed during Covid-19 as an army of retail traders piled in. He said Trump Media is likely worth somewhere around $2 a share — nowhere near its implied stock price of $50.

“The underlying business doesn’t seem to be worth much. There is no evidence this is going to become a large, highly profitable company,” he said. “I’m reasonably confident the stock price will eventually drop to $2 a share and could even go below that if the company blows through the money it got from the merger.”

The eye-popping valuation is a massive windfall for Trump, who owns a dominant stake of 79 million shares.

At Tuesday’s opening price of nearly $78, that stake is worth nearly $6 billion, although lock-up restrictions likely prevent Trump from selling or even borrowing against those shares anytime soon.

2 notes

·

View notes

Text

Three Israeli companies — UBQ Materials (plastic alternative made from household trash), Fabric (automated urban micro-fulfillment centers) and Believer (cultivated meat) – appear on the inaugural XB100 ranking of the top 100 private deep-tech companies, published by XPRIZE and Bessemer Venture Partners.

UBQ and Fabric are headquartered in Tel Aviv and Believer in Rehovot.

According to XPRIZE, “The XB100 was launched to celebrate the entrepreneurs who are commercializing scientific research into deep tech and spotlight how they are impacting our society across nine categories.

“The XB100 evaluation process involved ranking companies across four factors: impact on humanity, valuation, scientific difficulty, and commercial traction.”

Bessemer Venture Partners’ Tess Hatch said, “The companies on the XB100 list represent the most valuable and impactful private companies in the deep-tech sector. The XB100 awardees defy imagination and will reshape the human experience.”

“UBQ’s inclusion in this ranking exemplifies how innovation and technology can extend beyond software to break through the norms of our physical world,” commented Jack “Tato” Bigio, cofounder and co-CEO of UBQ Materials.

“UBQ is introducing a sustainable alternative to oil-based plastics, reducing the carbon footprint of thousands of products across industries including construction, logistics and supply chain, consumer goods and even automotive.”

The company’s patented thermoplastic (made from trash that would have been landfilled or incinerated) has been adopted by brands including Mercedes-Benz, PepsiCo and McDonald’s. This year, UBQ will open its new facility in The Netherlands to produce 80,000 tons of UBQ annually from 104,600 metric tons of waste.

Fabric, which was also recently on CB Insights’ Retail Tech 100 list, reports that brands using its robotic urban micro-fulfillment centers have seen a more than 62% reduction in labor costs, an over 71% improvement in storage density, upward of 99% inventory accuracy and a threefold increase in throughput compared to manual fulfillment.

Believer is building its first US commercial-scale lab-grown meat factory in Wilson, North Carolina – which is on track to be the largest facility of its kind anywhere, capable of producing 22 million pounds of cultivated meat annually.

11 notes

·

View notes

Text

i understand that my friends want the best for me but i’m so sick of them telling me to push myself into a job related to my degree and not “settle” for retail. firstly, i’m very comfortable with my decision and am not asking for their opinions. secondly, none of them are disabled or live with c-ptsd or have graduated uni so just aren’t in a position to relate to my current condition. i don’t want to prioritise my career over my recovery atm. i’m not concerned about not living up to my “potential”, especially cos most people’s valuation of said potential underestimates the severity of my mental and physical illnesses (i don’t share it with a lot of people). i’m really content spending my days reading and drawing and gardening. i don’t need to serve some greater purpose beyond my own beliefs around social justice, anti-capitalism and environmentalism. i’m so tired of people projecting their desires for their lives onto me because it stops me from wanting to share my own desires with them

7 notes

·

View notes

Text

What are commercial real estate services?

Commercial real estate services refer to a range of professional services and activities related to the buying, selling, leasing, managing, and investing in commercial properties. Commercial properties include office buildings, retail spaces, industrial facilities, hotels, warehouses, and other income-producing real estate assets. These services are typically offered by real estate professionals, companies, and organizations specializing in the commercial real estate sector. Here are some of the key components of commercial real estate services:

Brokerage Services: Commercial real estate brokers help clients buy, sell, or lease commercial properties. They facilitate transactions, negotiate terms and conditions, and provide market insights to help clients make informed decisions.

Property Management: Property management companies oversee the day-to-day operations of commercial properties on behalf of owners. This includes tasks such as rent collection, maintenance, tenant relations, and financial reporting.

Leasing and Tenant Representation: Commercial real estate agents and brokers specializing in leasing help property owners find suitable tenants for their spaces. Tenant representation services assist businesses in finding suitable properties to lease.

Investment Services: Investment firms and professionals provide guidance on real estate investment strategies. They may help investors acquire, manage, or divest commercial properties to optimize returns.

Appraisal and Valuation: Appraisers determine the market value of commercial properties, which is crucial for financing, taxation, and decision-making purposes. Valuation services help property owners understand the worth of their assets.

Development and Construction: Developers and construction companies focus on creating new commercial properties or renovating existing ones. They handle the design, permitting, and construction phases of commercial real estate projects.

Financing and Mortgage Services: Lenders and financial institutions offer loans and mortgage products tailored to commercial real estate projects. These services help property buyers secure the necessary capital for their investments.

Market Research and Analysis: Real estate research firms provide market data, trends, and analysis to assist clients in making informed decisions. This includes information on vacancy rates, rental rates, and demand trends.

Consulting and Advisory Services: Real estate consultants offer strategic advice and planning services to property owners, investors, and developers. They may help clients optimize property portfolios, assess market risks, or formulate investment strategies.

Legal and Regulatory Services: Real estate attorneys specialize in handling legal aspects of commercial real estate transactions. They ensure that contracts, leases, and other legal documents comply with local laws and regulations.

Environmental Assessment: Environmental consultants assess commercial properties for environmental risks and compliance with environmental regulations. This is particularly important for properties with potential contamination issues.

Property Tax Services: Property tax consultants assist property owners in managing and minimizing property tax obligations by evaluating assessments and pursuing tax appeals when necessary.

Overall, commercial real estate services encompass a wide range of activities aimed at facilitating the acquisition, management, and optimization of commercial properties, with the goal of maximizing returns and minimizing risks for property owners, investors, and businesses.

2 notes

·

View notes