#retail tenant improvement

Explore tagged Tumblr posts

Text

Commercial Architect Las Vegas | Smallstudioassociates

Commercial Architect Las Vegas, Smallstudioassociates: Smallstudioassociates is a commercial architect firm in Las Vegas. They design buildings for businesses like offices, stores, and restaurants. Their work helps create spaces that are both functional and attractive. With a focus on modern and innovative designs, they ensure each project meets the unique needs of their clients.

0 notes

Text

bigger better Neighborhood for sims

so i took my small neighborhood i made a while back, and i put it on a much bigger lot and improved it and filled it out bigger and better and oh my gods i am pretty pleased with it if i do say so myself

It should be useable as a multi-family apartment lot when the new For Rent pack comes out

Actually, it should be usable as almost any kind of lot -- retail, cafe, residential, park, gym... would need a tiny bit of work to run as a restaurant but you could do it -- i even left a small city block with a debug shell to delete on it ready for you to build your own little something there

It has an insane amount of detail and things for your sim to do. the park in the middle has a community theater with a karaoke set up on the stage so people will actually watch performances. There's an apartment building with 2 two bedroom apartments, a studio apartment over the bookstore/cafe, and a small house with a garage. And a run down block with a small homeless encampment.

all the buildings are built out with details down to a plunger and a non-functional garbage can in every bathroom. I even made a little crosswalk signal for the two busiest crosswalks

I particularly like the little block i built my corner store on -- the convenience store has a bunch of vending machines, and a coffee pot behind the counter, so sims will go in and get a cup of coffee and buy things from the vending machines. There's a laundromat next to it with a bus stop out front and above that there's a little clothing boutique and a photography studio

On the bad end of town there's an unbuilt block with some construction stuff and everything a homeless sim needs to live outdoors. And then across the street from that there's a seedy warehouse/tenant house building with a cool little food-truck bar situation and a chain-link fence basketball court area

here look at some pics (helix369 on the gallery for this and other builds)

[like ten more pics below the cut]

i didn't even get to the house or the cafe or the gym or anything, but this is so long already :P

26 notes

·

View notes

Text

I did so much fun traveling and attending events in 2024. I took official full ownership of my house, buying out my shitty uncle who I hope dies. I made wonderful improvements to the house and so many more are yet to come (new bathroom very soon!!)

My trips were like. Disney twice. Because the second one was during Halcycon which in itself was insane. I went to Connecticon and TFCon and I think this had to be the best TFCon yet (Orlando might beat it a little bit just bc it was in Florida and was warm).

I went to FUCKING HAWAII for Pokemon Worlds and had the time of my life despite having poison ivy the whole time. I had such a great time I legit keep forgetting about the poison ivy. Stuff like napping on a beach after snorkeling with tropical fish makes you forget about your arms itching. Except I keep getting texts from the pharmacy in Honolulu about refilling the prescription LOLLLL

In 2025 I plan on taking a Disney trip for my birthday!! It's actually ON Memorial Day this time so that means a fun special free day off!! Whoo!! I may be attending Halcycon again so that would mean at least a day in Batuu of course. It depends on how exhausted I feel because I also plan on attending TFCon in Chicago, and Connecticon is so close of course I'll go again.

I adopted my dog Fina, and my new cat Deckerd. Things are in general going pretty well!

I evicted my roommate (legally, tenant) and he moved out today, leaving a ton of shit behind. He was lying about me behind my back to make himself look like a permanent victim. He lied about things I said to him to set extremely reasonable boundaries, and had apparently more than once told people I don't take proper care of my animals (he has never had a pet in his life and has never had to consistently care for an animal on his own). He's been unemployed for a year and thinks he's above jobs like retail. He barely left the house, never spent time with his girlfriend, and never offered any additional help around the house even when I was in physical therapy for severe tendinitis and could barely use my arms. I hope he can grow up a little bit, stop pretending to be an Instagram influencer at age 32, and develop an actual genuine identity outside of thinking he's the only person allowed to cosplay as Spiderman in a purchased costume. Maybe after that I'll be interested in revisiting a friendship with him. Sucks the things you learn about people you've known for a long time. Until then I look forward to his constant bullshit social media posts where he says things like "the holidays can be hard, trust me, I know more than most" and mistreats irl friends for the sake of Instagram likes and views on his twitch streams or his weekly show where he shouts at horror movies.

Anyways. I feel proud of being able to stand up for myself like that even if it's not easy. I'm done being a doormat and being treated like I'm disposable. I'm done bending over backwards to try to maintain friendships with people who are clearly not interested in my company. I'm going to spend time with people who make it clear that they value me for who I am, which is PLENTY of people (and probably most people reading this!!). I'm going to do what I know is right for me and not let anyone dictate how I live my life. They can make their judgments all they want, because I'm secure in my life and identity!

Also. I'm gonna work on my Gunpla backlog. It's a little nuts 😅

Here's to another year of accomplishments! Gonna keep this momentum going! Good luck to everybody!

3 notes

·

View notes

Text

Robert Villeneuve West Nipissing : Commercial Real Estate Lease Terms To Be Aware Of.

Learning basic commercial real estate terms will assist you in building your knowledge in the commercial real estate investing market. Here are the terms that must be understood before signing a commercial lease - Robert Villeneuve West Nipissing.

Robert Villeneuve Sturgeon Falls - Common Area Maintenance (CAM). This is an extremely vital commercial real estate lease term to know. Sometimes when you have a multi-tenant building, you factor in charges for CAM. Normally, tenants pay $12 a square foot for annual rent, plus a certain percentage for CAM. Tenants pay CAM for a building as a result.

A lot of problems considered in the commercial field are not even available in residential leasing. For example, if the commercial real estate investment focuses a small office warehouses, strip malls, or retail centers, CAM is one of the items you want to research.

Before you begin renting or purchasing those kinds of facilities, you must know what the standard CAM is for your type of property. Sometimes in some smaller properties, there’s no CAM since the landlord pays for it. That is part of your expenses as a landlord in this kind of property. It’s not a pass-through, as you cannot legitimately pass through CAM expenses to your tenants. , if nobody in the area who owns a related property is having their tenants pay it.

Percentage Leases If you pay a fixed rate plus a percentage of sales over and above the fixed rental, you have a percentage lease arrangement. Perhaps you will not run into percentage rent conditions very often as a landlord; Percentage rents sometimes are used in retail businesses situated n large shopping centers and other similar areas.

Ground/Land Leases This kind of arrangement is where a tenant rents the land and builds on the property. Anyway, in which you improve the grounds, which include the buildings, normally belongs to the landlord once the lease ends. This is actually a form of financing.

You'll find a lot of ground tenants in high-cost land areas. People don't want to tie up personal capital in owning land when they could be putting that fund into business operations.

If you want to know more about commercial property, Robert Villeneuve is the right person to call. Robert Villeneuve can also assist you in finding a good commercial property.

20 notes

·

View notes

Text

Introduction to Real Estate Investment Trusts (REITs)

Overview of REITs

An organization that owns, manages, or finances real estate that generates revenue is known as a real estate investment trust, or REIT. Like mutual funds, REITs offer an investment opportunity that enables regular Americans, not just Wall Street, banks, and hedge funds, to profit from valuable real estate. It gives investors access to total returns and dividend-based income, and supports the expansion, thriving, and revitalization of local communities.

Anyone can engage in real estate investment trusts (REITs) in the same manner as they can invest in other industries: by buying individual firm shares, through exchange-traded funds (ETFs), or mutual funds. A REIT’s investors receive a portion of the revenue generated without really having to purchase, operate, or finance real estate. Families with 401(k), IRAs, pension plans, and other investment accounts invested in REITs that comprise about 150 million Americans.

Historical Evolution

1960s - REITs were created

When President Eisenhower passes the REIT Act title found in the 1960 Cigar Excise Tax Extension into law, REITs are established. Congress established REITs to provide a means for all investors to participate in sizable, diversified portfolios of real estate that generate income.

1970s - REITs around the world

In 1969 The Netherlands passes the first piece of European REIT legislation. This is when the real estate investment trusts model started to spread over the world; shortly after, in 1971, listed property trusts were introduced in Australia.

1980s - Competing for capital

1980s saw real estate tax-sheltered partnerships expanding at this time, raising billions of dollars through private placements. Because they were and are set up in a way that prevents tax losses from being "passed through" to REIT shareholders, REITs struggle to compete for capital.

1990s - First REIT reaches $1 billion market cap

In December 1991 the New Plan achieves $1 billion in equity market capitalization, becoming the first publicly traded REIT to do so. Centro Properties Group, based in Australia, purchased New Plan in 2007.

2000s - REITs modernization act

President Clinton signed the REIT Modernization Act of 1999's provisions into law in December 1999 as part of the Ticket to Work and Work Incentives Improvement Act of 1999. The capacity of a REIT to establish one or more taxable real estate investment trusts subsidiaries (TRS) that can provide services to third parties and REIT tenants is one of the other things.

The diverse landscape of REIT investments

Real estate investing is a dynamic field with a wide range of options for those wishing to build wealth and diversify their holdings.

Residential REITs: This is an easy way for novices to get started in real estate investing, as single-family houses offer a strong basis. Purchasing duplexes or apartment buildings can result in steady rental income as well as possible capital growth.

Commercial REITs: This covers activities such as office building investments. They provide steady cash flow and long-term leases, especially in desirable business areas. Rental assets such as shopping centers and retail spaces are lucrative prospects and can appreciate value as long as businesses remain successful.

Specialty REITs: These include investments in healthcare-related properties such as assisted living centers or physician offices. Datacenter investments have become more and more common in the digital age because of the growing need for safe data storage.

Job profiles within REITs

Real estate investment jobs have many specifications, including:

Real estate analysts: The job of a real estate analyst is to find chances for purchasing profitable real estate. These analysts will require a strong skill set in financial modeling in addition to a solid understanding of the current markets. These analysts could also be involved in the negotiation of terms related to pricing and real estate transactions.

Asset managers: Opportunities in property trusts are plenty. The higher-level property management choices are made by asset managers. Since asset managers will be evaluating and controlling a property's operating expenses about its potential for income generation, they must possess a greater foundation in finance.

Property managers: REIT employment prospects include property managers. While some real estate investment trusts employ their property managers, others contract with outside businesses to handle their properties. Along with working with renters, property managers handle all daily duties required to keep up the property.

Essential skills for success in REIT careers

Successful REIT careers require the development of several essential talents, three of which are listed below:

Financial acumen: Jobs in real estate finance involve investors with strong financial acumen who are better equipped to evaluate financing choices, cash flow forecasts, property valuations, and tax consequences. With this thorough insight, investors may make well-informed strategic decisions that optimize profits while also supporting their investing goals.

Market analysis skills: Real estate investors should cultivate an awareness of important market indicators and a keen sense of market conditions. Purchasing and managing profitable rental properties requires an accurate and detailed understanding of a possible market's amenities, dynamics, future potential, and relative risk.

Communication skills: Are a common attribute among successful real estate investors and are often ranked as the most important one. This is because effective interpersonal communication is crucial when investing in real estate. Working directly with a variety of industry professionals, including lenders, agents, property managers, tenants, and many more.

Global perspectives on REITs

International REIT Markets:

The US-based REIT method for real estate investing has been embraced by more than 40 nations and regions, providing access to income-producing real estate assets worldwide for all investors. The simplest and most effective approach for investors to include global listed real estate allocations in their portfolios is through mutual funds and exchange-traded funds.

The listed real estate market is getting more and more international, even if the United States still has the largest market. The allure of the US real estate investment trusts strategy for real estate investing is fueling the expansion. All G7 nations are among the more than forty nations and regions that have REITs today.

Technological innovations in REIT operations

PropTech integration: Real estate investment managers can improve the efficiency of property acquisitions and due diligence procedures, which can lead to more precise assessments, quicker data processing, and better decision-making, all of which improve investment outcomes, by incorporating these PropTech platforms into their workflows.

Data analytics in real estate: Data analytics in real estate enables real estate professionals to make data-driven choices regarding the acquisition, purchase, leasing, or administration of a physical asset. To provide insights that can be put into practice, the process entails compiling all pertinent data from several sources and analyzing it.

Conclusion

REITs have a lot of advantages and disadvantages for professional development. They provide a means of incorporating real estate into an investment portfolio, but they could also produce a bigger dividend than certain other options. Since non-exchange-listed REITs do not trade on stock exchanges, there are certain risks associated with them. Finding the value of a share in a non-traded real estate investment trusts can be challenging, even though the market price of a publicly traded REIT is easily available. Buying shares through a broker allows you to invest in a publicly traded REIT that is listed on a major stock exchange. The bottom line for a REIT is that, in contrast to other real estate firms, it doesn't build properties to resell them.

2 notes

·

View notes

Text

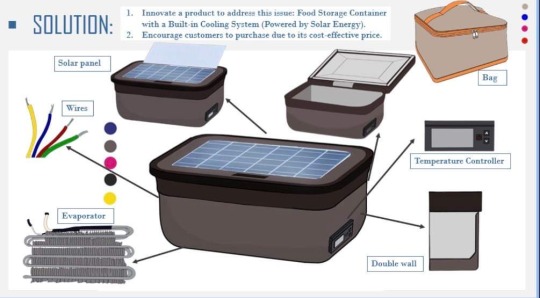

Food Storage Container with a Built-in Cooling System (Powered by Solar Energy).

In the fast-evolving landscape of food storage solutions, our latest product aims to redefine the way we preserve perishable items. The Food Storage Container with a Built-in Cooling System, meticulously designed and powered by solar energy, marks a groundbreaking stride towards sustainable and efficient food storage. Let's delve into the intricate details of this innovative product through the lens of the Business Model Canva.

1. Customer Segments:

Our Food Storage Container caters to a diverse range of customer segments, from households seeking sustainable storage solutions to outdoor enthusiasts in need of portable and efficient food preservation during activities such as camping or picnics, with a focus on boarding students or tenants of Central Mindanao University (CMU) who wish to preserve their food to reduce expenses, campers and ecologically minded clients who emphasized sustainability

2. Value Proposition:

Centrally rooted in our product is a steadfast commitment to offering users an unparalleled solution for extending the shelf life of perishable items. Our built-in cooling system, powered by solar energy, not only guarantees freshness but also aligns seamlessly with the escalating demand for eco-friendly and energy-efficient alternatives. With a focus on preserving, maintaining quality, and extending the consumption window of food items, our product serves as a reliable means to prevent and reduce spoilage of perishable goods. Moreover, its versatility shines through, as its utilization remains viable at any time and from any location, providing convenience and efficiency to users across diverse settings.

3. Channels:

Employing a versatile multi-channel strategy, our product seamlessly reaches customers through various avenues, encompassing online platforms and carefully chosen retail outlets. This strategic approach ensures accessibility and convenience for a diverse customer base. Our sales force, adept in marketing and advertising, spearheads our presence in both online and select retail spaces. In the online domain, we leverage web sales via our online storefront and e-commerce platform. Additionally, our presence is augmented through partner stores, strategically positioned in popular online shopping apps and dedicated appliances stores. This multi-pronged distribution strategy aligns with our commitment to reaching customers through channels that suit their preferences and lifestyles.

4. Customer Relationships:

We foster strong customer relationships by providing comprehensive support through user manuals, personalized online assistance or online guides, offering appliance maintenance, and responding promptly to customer inquiries while servicing e-commerce, ensuring satisfaction and responsive customer service. Regular updates on maintenance and new features further engage our customers.

5. Revenue Streams:

Direct selling of solar food containers to students at set prices, offering discounts, promotions, and refurbishment services for product longevity. The Food Storage Container presents a one-time purchase model with additional revenue streams through accessories like replacement cooling modules and eco-friendly cleaning solutions. This model ensures a steady income while offering customers the flexibility to enhance their product over time.

6. Key Resources:

At the core of our operations are key resources that drive our success: cutting-edge manufacturing facilities, sustainable material sourcing, and a team of dedicated engineers committed to ongoing improvements in cooling technology. These resources are instrumental in upholding the standards of our products, ensuring both quality and innovation. Our resource portfolio encompasses a variety of elements, ranging from raw materials and skilled experts to branding, copyrights, and patents. Additionally, we leverage valuable assets such as customer databases, personal funds, and the integration of renewable light energy. This comprehensive array of resources positions us at the forefront of our industry, facilitating continuous advancement and reinforcing our commitment to excellence.

7. Key Activities:

Our core activities, including product development, rigorous quality control, and continuous exploration of eco-friendly materials and energy-efficient technologies, underscore our commitment to innovation. These efforts position us at the forefront of the industry, where regular updates and improvements exemplify our dedication to staying ahead. In terms of production, we focus on specific design variations, offering a range of colors and sizes, and ensure efficient delivery with multiple payment options like COD, COP, and Gcash. Our problem-solving initiatives are comprehensive, providing customers with a detailed appliances manual that covers aspects like product features, installation processes, diverse use cases, potential risks, and solutions to commonly faced challenges. These structured activities collectively embody our dedication to delivering a cutting-edge product while ensuring customer satisfaction through informative and solution-oriented support materials.

8. Key Partnerships:

Strategic collaborations lie at the core of our business, establishing robust partnerships with solar technology providers, environmental organizations, and retailers. These alliances not only fortify the backbone of our operations but also contribute significantly to the sustainability and extended market reach of our innovative product. Key partners encompass online platforms such as TikTok, Shopee, and Facebook, alongside crucial connections with electricians. While our key suppliers primarily consist of wholesalers, the specifics are yet to be finalized. Essential resources, both physical, including raw materials, and human, in terms of expertise, are acquired through these strategic partnerships. Key activities performed by our partners involve production, focusing on manufacturing processes, and establishing partnerships to seamlessly integrate our product into online shopping platforms. These collaborative efforts collectively propel our business towards success, emphasizing both environmental responsibility and efficient market presence.

9. Cost Structure:

Our primary expenditures encompass critical areas such as research and development, manufacturing processes, marketing campaigns, and the steadfast commitment to maintaining sustainable practices. These investments are indispensable, forming the financial backbone to ensure the creation of a high-quality, eco-friendly product that aligns with our core values. The cost structure comprises fixed and variable elements. Fixed costs range from PHP 5,500 to PHP 6,500, providing the foundation for our operations. Variable costs, on the other hand, involve allocating funds to essential components like raw materials, including an evaporator (PHP 1,000 to PHP 2,000), a small solar panel (around PHP 2,000), stainless steel for the container (PHP 1,000), and plastic containers (ranging from PHP 50 to PHP 200 per unit). Additionally, variable costs encompass man labor, with electrician services in the range of PHP 300 to PHP 800 per day. These detailed cost allocations are pivotal in sustaining our commitment to delivering an innovative and eco-conscious product to our valued customers.

In conclusion, the Food Storage Container with a Built-in Cooling System is not merely a product; it's a testament to our commitment to sustainability, innovation, and customer satisfaction. Through the lens of the Business Model Canva, we envision a future where our revolutionary food storage solution becomes a household staple, reshaping the way we think about freshness and sustainability.

2 notes

·

View notes

Text

Back To Size...Again

I laughed yesterday when I read another installment of the “Size Matters” debate. Earlier this week we read about how some people were “disappointed” that the Burger King Whopper in photos was not anywhere near as big as the ones being served.

And now comes an interesting retail debate being played out between JC Penney and Macy’s, both time-honored participants in the effort to keep Americans clothed and their homes filled with housewares. Both chains have suffered through some very tough times this century, with both shuttering numerous storefronts.

Interestingly JC Penney was acquired in 2020 by what may appear as strange bedfellows, competing major mall owners Simon Property Group and Brookfield. The duo just allowed Authentic Brands Group to buy a 17% stake in the company.Apparently the threesome thinks the JCP brand still has a lot of value.

But for Simon and Brookfield, though, buying Penneys ensured they would have at least one major tenant in their enclosed malls, a wobbly proposition if there has been one the last few decades. Even more intriguing is that, while Simon and Brookfield are up to their necks in retail, they actually don’t know anything about how to run a store.. They just know how to manage malls.

JC Penney is Middle America, though, and on par with another giant in the field, Kohls. Together, they provide affordable products to a huge portion of the US. But JCP has made one mistake after another, first ditching weekly sales in favor of EDLP (Everyday Low Prices), then reinstating the old model, and also being one of the first to offer their complete catalog on a Facebook page more than a decade ago. As forward-thinking as that was, we simply were not ready for it. Recently, JCP lost its beauty collaborator Sephora, who jumped ship and moved over to rival Kohls.

Penneys just announced they are putting $1 billion into operations and the customer experience, improving everything from the technology running it all, to supply chain matters and merchandising. They are trying hard under the new owners to pull out of bankruptcy, but revenues and profits are dropping fast. Rather than close more stores, they are doubling down. And, perhaps most importantly for this discussion, they are not going to shrink stores.

Macy’s just entered the chat, because they are doing the opposite. Instead of trying to operate massive mall anchor stores, they are going the downsize route, with pared-down storefronts now opening in strip malls. Rents are cheaper, and at least on paper, access is probably easier than having to deal with behemoth malls. Apparently they figure they can increase sales per square foot by focusing on best-selling products, and getting rid of the rest.

But the comparison ends abruptly there, because Macy’s is more on par with Dillards, and while these two also carry clothing and housewares, they are at very different price points compared to JCP as well as Kohls. If you like Thanksgiving parades, Macy’s is your pal. Well, as long as you are good with paying nearly $100 for a Polo shirt.

Given the inflation we have endured the last couple of years, as well as lingering fears that a recession is still right around the corner, consumers are delaying a lot of purchases as long as they can. Market uncertainties can make people do that, and any time we can kick the can down the road so to speak, it makes sense.

And that’s where JCP and Kohls look to have good upside potential. An uncertain economy means that people are more willing to trade down if they buy at all. The problem for JCP is achieving relevancy among its target customers, many of whom have allowed the name to slip from top-of-mind to out-of-mind. It is teetering on the same dowdy image that Sears acquired by selling clothing that my dearly departed old aunt would wear. That’s not a good look, unless you are 80.

The opportunity is there for JCP, though, especially given the economic uncertainties. The fact that its ownership group is investing $1 billion is extremely good fortune for a company that would have otherwise become another entry in the book of dead retail chains. It’s just that this money must be spent wisely, from a complete makeover in merchandising, to a fashion-forward digital presence as well. That’s not to say it needs to mimic F21 or H&M, but it does need to work on its coolness factor.

I have been to the Amarillo Penneys store in the last few years, and all I can say is that it is a train wreck. It was a little more than two years ago when I last visited, and I walked out in disgust, it was that bad. Merch was strewn all over, garments were hanging haphazardly, stockouts were rampant, and it looked like nobody gave a sh*t. At that point, I did not either.

Sure, being owned by mall owners is a lot like being owned by the government. You’re probably not going to fail. It’s also a mutually beneficial relationship. Here’s to the new Macy’s on its way to a smaller footprint across America, and to JCP with its continued format. May they both find their way through the morass of today’s economy.

Dr “With Or Without Me” Gerlich

Audio Blog

2 notes

·

View notes

Text

🛍️ Enhance Retail Experiences with Xpandmall!

🏬 Discover how this ultimate solution benefits mall owners and operators, capturing and analyzing valuable data within their malls.

Xpandmall empowers mall owners to optimize their malls and enhance tenant performance. Identify top-performing stores and areas for improvement. Empower tenants with data-driven insights to enhance their businesses.

Stay in control with Xpandmall's intuitive real-time dashboard and access comprehensive reports, visualizations, and actionable insights. Make informed decisions on-the-go and drive mall performance like never before.

Unlock the full potential of your mall and increase revenue with Xpandmall Solution. Powering Businesses with Tomorrow's Data. 💪

youtube

#RetailTech#DataAnalytics#MallOwners#DataDrivenDecisions#Xpandmall#Xpandretail #SàvantDataSystem#Youtube

2 notes

·

View notes

Text

The Key Benefits of Regular Commercial Electrical Maintenance Services

Introduction

In today's fast-paced business world, ensuring that your commercial electrical systems are functioning properly is more crucial than ever. Regular commercial electrical maintenance services not only ensure compliance with safety regulations but also enhance the efficiency and longevity of your electrical systems. From preventing costly downtime to improving energy efficiency, the benefits are incredibly vast. In this article, we will delve into the key https://www.bbb.org/us/il/palos-hills/profile/electric-equipment-repair/reed-electrical-services-llc-0654-90026838

benefits of regular commercial electrical maintenance services, providing insights that can help businesses make informed decisions about their electrical needs.

The Key Benefits of Regular Commercial Electrical Maintenance Services

When it comes to maintaining a commercial property, electrical systems often take a back seat in terms of priority. However, neglecting these systems can lead to severe consequences. Regular maintenance ensures that all components—from wiring to circuit breakers—are working as they should. Here are some fundamental benefits:

youtube

youtube

Enhanced Safety

Keeping your electrical system well-maintained significantly reduces the risk of fire hazards caused by faulty wiring or overloaded circuits.

Reduced Downtime

With regular inspections and preventative measures in place, businesses can avoid unexpected power outages and disruptions.

youtube

Cost Savings

Investing in regular maintenance can save money in the long run by reducing repair costs and improving energy efficiency.

Compliance with Regulations

Staying compliant with local codes and regulations is essential for any business operation.

Increased Property Value

A well-maintained electrical system adds value to your property, making it more attractive to potential buyers or tenants.

Understanding Commercial Electrical Systems What Are Commercial Electrical Systems?

Commercial electrical systems encompass all the electrical components used in business environments—offices, retail stores, warehouses, and factories. These include:

Circuit breakers Wiring Lighting fixtures Outlets Emergency lighting systems How Do They Differ from Residential Systems?

Commercial systems are generally more complex due to higher power demands and the need for specialized equipment. Therefore, hiring a qualified licensed electrician near me who understands these differences is vital for effective maintenance.

Common Issues Addressed by Commercial Electrical Maintenance 1. Overloaded Circuits

Overloading circuits can lead to system failures or even fires. A professional electrician will assess load capacities during routine maintenance checks.

2. Flickering Lights

Flickering lights may indicate wiring issues or problems with circuit connections; these should be addressed immediately during inspections.

3. Faulty Outlets

Regular checks can identify outlets that need repairs or upgrades—crucial for maintaining operational efficiency.

Why Choose Professional Services?

Maintaining commercial electrical systems requir

0 notes

Text

The Benefits of Investing in Real Estate in Kenya’s Growing Market

Kenya's real estate market has witnessed significant growth over the past decade, emerging as one of the most attractive investment opportunities in the region. With urbanization, population growth, and infrastructure development on the rise, the demand for housing and commercial properties is steadily increasing. From an apartment for sale in Kenya to prime properties in Nairobi's upscale neighborhoods like Lavington, Kilimani, and Westlands, the market offers diverse opportunities for investors.

In this blog, we’ll explore the key benefits of investing in real estate in Kenya, focusing on why the market continues to thrive.

Why Real Estate is a Smart Investment

Investing in real estate offers unparalleled advantages. In Kenya, the sector provides investors with:

Steady Returns: Real estate investments, particularly rental properties, deliver consistent income.

Appreciation: Property values in Kenya’s urban and suburban areas, such as Syokimau and Nairobi, have shown steady growth.

Portfolio Diversification: Real estate offers a tangible asset to balance investment portfolios.

Key Benefits of Investing in Kenyan Real Estate

1. High Demand for Housing

Kenya’s population growth and urbanization have created a substantial demand for housing. The country’s urban population grows by approximately 4% annually, fueling the need for modern housing options.

Best Areas to Invest in Housing

Apartment for Sale in Nairobi: The capital city is a hotspot for buyers and renters due to its job opportunities and vibrant lifestyle.

Apartment for Sale in Syokimau: With its affordable pricing and proximity to transport hubs, Syokimau attracts middle-income families and young professionals.

Apartment for Sale in Kilimani: Kilimani combines modern living with urban convenience, appealing to professionals and expatriates.

2. Infrastructure Development

Kenya’s ongoing infrastructure projects, including the Nairobi Expressway, the Standard Gauge Railway (SGR), and road expansions, have boosted real estate values.

How Infrastructure Drives Value

Improved connectivity increases property demand in areas like Syokimau and Athi River.

Enhanced road networks make areas like Lavington and Westlands more accessible and desirable.

Investing in an apartment for sale in Kenya near these developments guarantees high appreciation potential.

3. Attractive Rental Yields

Real estate in Kenya offers competitive rental yields compared to other investment classes. Urban areas, particularly Nairobi, have high rental demand due to the influx of professionals and expatriates.

Top Locations for Rental Income

Apartment for Sale in Westlands: Westlands has a vibrant commercial and residential scene, attracting high-income tenants.

Apartment for Sale in Lavington: Families and professionals favor Lavington for its serene environment and premium amenities.

4. Diversified Property Options

Kenya’s real estate market caters to various investor needs, from affordable housing to luxury apartments.

Property Types to Consider

Affordable Housing: Popular in areas like Syokimau, targeting middle-income buyers.

Luxury Properties: Found in neighborhoods like Kilimani, Lavington, and Westlands.

Commercial Real Estate: Includes office spaces and retail outlets, particularly in Nairobi’s central business districts.

5. Government Support for Real Estate Development

Kenya’s government has introduced initiatives to boost homeownership and property investments.

Key Policies and Programs

Affordable Housing Initiative: Targets the development of over 500,000 affordable homes by 2027.

Tax Incentives: Reductions for developers focused on low-cost housing projects.

Mortgage Financing Options: Banks and financial institutions now offer flexible mortgage plans, making it easier for buyers to purchase an apartment for sale in Nairobi.

6. Long-Term Appreciation

Real estate values in Kenya have consistently risen over the years. Strategic investments in areas experiencing rapid growth, such as Kilimani and Syokimau, promise significant returns.

Areas with High Growth Potential

Apartment for Sale in Syokimau: Proximity to the SGR and Nairobi Expressway boosts property appreciation.

Apartment for Sale in Kilimani: Continued urban development makes Kilimani a prime investment choice.

7. Real Estate as a Hedge Against Inflation

Real estate is an excellent investment during periods of inflation. As property values and rental prices increase, investors enjoy better returns compared to other asset classes.

Tips for Successful Real Estate Investment in Kenya

1. Research the Market

Study market trends, property prices, and rental demand in areas like Nairobi, Westlands, and Lavington to make informed decisions.

2. Choose Prime Locations

Focus on areas with strong growth potential. An apartment for sale in Westlands or Kilimani offers high demand and long-term value.

3. Work with Professionals

Engage reputable real estate agents and developers to access verified listings and navigate the buying process.

4. Evaluate Financing Options

Secure affordable financing by comparing mortgage rates or partnering with developers offering flexible payment plans.

5. Inspect the Property

Before purchasing, ensure the property meets quality standards, and verify its legal documentation.

Frequently Asked Questions

Is real estate a profitable investment in Kenya?

Yes, Kenya’s growing population, infrastructure development, and urbanization make real estate highly lucrative.

What’s the best area for property investment in Nairobi?

Popular areas include Syokimau for affordability, Kilimani for urban appeal, and Westlands for high-end properties.

Can foreigners invest in Kenyan real estate?

Yes, foreigners can invest in leasehold properties for up to 99 years.

Conclusion

Kenya’s thriving real estate market presents a wealth of opportunities for investors. Whether you’re looking for an apartment for sale in Kenya, targeting Nairobi’s vibrant neighborhoods like Kilimani, Lavington, or Westlands, or exploring affordable options in Syokimau, there’s a property to suit your needs.

By understanding market trends, focusing on high-demand areas, and leveraging government incentives, you can secure profitable investments that yield long-term benefits. Start your real estate journey today and reap the rewards of Kenya’s growing market! RentScore makes it easy to find properties that match your budget—browse our site or reach out via 0743 466 209 / 0757 488 833 or [email protected] for support.

#real estate investing#propertyinvestment#realestate#homeownership#home & lifestyle#realtor#aesthetic#business#architecture

0 notes

Text

Architectural Services Las Vegas | Smallstudioassociates

Architectural Services in Las Vegas by Smallstudioassociates offer expert design help for buildings and spaces. They create plans for homes, offices, and more, making sure everything looks great and works well. Their team of skilled designers listens to your needs and turns your ideas into reality, giving you a space you’ll love.

#medical and healthcare projects#retail store architect las vegas#tenant improvement#architecture firms

0 notes

Text

How Property Management Software Naturally Enhances Your Workflow

Efficient property management is essential for real estate businesses aiming to streamline operations and improve tenant satisfaction. Modern property management software provides a robust foundation to address complex workflows, reduce inefficiencies, and scale operations seamlessly. Let’s explore the transformative impact of these tools, particularly for enterprise-level organizations.

Understanding the Need for Property Management Software

Imagine managing multiple properties with scattered processes, endless paperwork, and delayed tenant responses. These challenges not only strain your resources but also impact customer satisfaction and operational growth.

For instance, think of a property manager juggling lease renewals for hundreds of units while manually tracking maintenance requests and tenant queries. The sheer volume of tasks can be overwhelming, leading to inefficiencies and missed opportunities. This is where property management software steps in as a game-changer, simplifying operations and enabling property managers to focus on what truly matters—growing their business and improving tenant relationships.

Tailored Solutions for Diverse Business Needs

Types of Property Management Software

Residential Property Management Software: For managing apartments, condos, and housing communities.

Commercial Property Management Software: Ideal for office spaces, retail centers, and industrial properties.

Mixed-Use Property Management Software: Combines residential and commercial functionalities.

Facilities Management Software: Focuses on infrastructure and operational maintenance.

Each software type caters to distinct operational demands, ensuring efficiency across varied property portfolios.

Size-Based Solutions

Small Businesses: Affordable and easy-to-use tools with essential features like lease tracking.

Medium-Sized Enterprises: Scalable platforms with advanced reporting and maintenance solutions.

Enterprise-Level Organizations: Comprehensive systems with AI-powered analytics and multi-location management.

For enterprise-level businesses, Dynamics 365 Property Management Software offers tailored solutions that streamline complex workflows and enhance operational efficiency.

Key Features and Benefits

1. Centralized Dashboards

Gain real-time insights into property performance, tenant interactions, and operational metrics.

2. Automated Lease and Contract Management

Ensure error-free operations by automating lease renewals, compliance tracking, and contract updates.

3. Financial Integration

Streamline billing, invoicing, and financial reporting with integrated accounting tools.

4. Maintenance Management

Automate task assignments and monitor resolution progress for faster response times.

5. Customizable Workflows

Adapt the system to your unique operational needs, ensuring flexibility as your business grows.

Why Choose Dynamics 365 for Enterprise Property Management

Enterprise-level property management requires a robust, scalable, and reliable solution. Dynamics 365 Property Management Software is designed to meet these demands with features like:

Advanced Analytics: Harness AI and BI tools for predictive insights and strategic decision-making.

Comprehensive Lease Management: Automate and ensure compliance across all contracts.

Enhanced Collaboration: Centralized communication tools improve tenant and stakeholder interactions.

Microsoft Ecosystem Integration: Leverage the power of the Dynamics 365 suite for extended functionalities.

Conclusion

The right property management software can transform your operations, enabling you to overcome challenges, streamline workflows, and focus on growth. Whether managing a small portfolio or overseeing vast enterprises, these tools are indispensable for modern real estate businesses.

Explore how Dynamics 365 Property Management Software can revolutionize your property management strategy and help you achieve operational excellence.

0 notes

Text

What are the best strategies for making money in real estate?

Making money in real estate requires strategic planning, research, and an understanding of the market. Here are some of the best strategies to succeed:

1. Buy and Hold (Long-Term Rentals)

Strategy: Purchase properties, hold them, and rent them out to generate steady cash flow.

Benefits: Consistent income, property appreciation, and tax advantages like depreciation.

Tips:

Invest in high-demand areas with strong rental markets.

Screen tenants thoroughly to minimize risks.

2. House Flipping

Strategy: Buy undervalued properties, renovate them, and sell them at a higher price.

Benefits: High-profit potential in a short time frame.

Tips:

Develop a keen eye for properties with potential.

Manage renovation costs carefully.

Be aware of market trends to time sales effectively.

3. Real Estate Investment Trusts (REITs)

Strategy: Invest in REITs, which are companies that own, operate, or finance income-generating real estate.

Benefits: Diversification, passive income, and liquidity since REITs are traded like stocks.

Tips:

Research REIT performance and management.

Consider the type of real estate the REIT specializes in (e.g., commercial, residential, healthcare).

4. Short-Term Rentals (Airbnb and Vacation Properties)

Strategy: Rent out properties on platforms like Airbnb.

Benefits: Potential for higher returns compared to long-term rentals, especially in tourist areas.

Tips:

Focus on properties in high-demand vacation spots.

Provide excellent customer service to maintain high ratings.

5. Commercial Real Estate

Strategy: Invest in office buildings, retail spaces, or industrial properties.

Benefits: Long-term leases, higher rental yields, and stable cash flow.

Tips:

Target businesses or industries with stable demand.

Understand zoning laws and market trends in commercial real estate.

6. Real Estate Wholesaling

Strategy: Contract a property from a seller and assign it to a buyer at a higher price.

Benefits: Requires little to no capital and quick turnaround times.

Tips:

Build a strong network of buyers and sellers.

Master negotiation skills.

7. Land Development

Strategy: Buy raw land, improve it (e.g., zoning changes, utilities installation), and sell it to developers or build properties on it.

Benefits: High profit margins if done strategically.

Tips:

Research zoning laws and potential for development.

Be patient, as this strategy often has longer timelines.

8. Real Estate Syndication

Strategy: Partner with others to pool funds for larger real estate projects.

Benefits: Access to large-scale investments with limited personal capital.

Tips:

Work with experienced syndicators.

Understand the terms of the partnership and potential returns.

9. Fix-and-Hold

Strategy: Renovate distressed properties, then rent them out instead of selling.

Benefits: Combines equity growth from renovations with rental income.

Tips:

Focus on properties that need cosmetic, not structural, improvements.

Plan renovations to maximize rental value.

10. Real Estate Crowdfunding

Strategy: Invest in real estate projects through online crowdfunding platforms.

Benefits: Low barrier to entry and diversification.

Tips:

Research the credibility of the platform and project.

Understand the risks and expected returns.

General Tips for Success:

Research the Market: Understand local real estate trends and economic indicators.

Diversify Investments: Spread risk across different property types or locations.

Leverage Financing: Use smart leverage to maximize returns without overextending.

Build a Network: Connect with agents, contractors, investors, and other professionals.

Stay Educated: Continuously learn about real estate laws, market trends, and strategies.

0 notes

Text

The Top 5 Reasons to Hire a Commercial Lease Lawyer for Your Business

Entering into a commercial lease is a significant commitment for any business. Whether you're a landlord or a tenant, the terms and conditions of your lease can have a major impact on the success and future of your business. That's why hiring a commercial lease lawyer is a smart decision. A commercial lease lawyer can guide you through the complexities of lease agreements, ensuring that your interests are protected and you avoid costly mistakes. If you're based in Sydney, engaging experienced commercial lease lawyers who specialise in commercial and retail leases is essential. Here’s a look at the top five reasons why you should hire a commercial lease lawyer for your business.

1. Expert Knowledge of Lease Terms

Commercial leases are often full of legal jargon and complex clauses that can be difficult for a business owner to navigate. Whether it’s understanding rent review mechanisms, responsibilities for repairs, or the terms of lease renewal, a commercial lease lawyer has the expertise to interpret these details correctly. Without legal assistance, you may miss crucial terms or overlook potential risks that could have long-term consequences for your business.

A commercial and retail leasing lawyer Sydney can ensure that your lease agreement is clear, fair, and in your best interest. They will thoroughly review the terms, explain them in simple language, and suggest any necessary changes to ensure your rights are protected. This expert guidance can save you from legal battles and expensive mistakes down the road.

2. Negotiating the Best Terms for Your Business

Negotiating a commercial lease is more than just agreeing on the rent price. There are many factors that need to be considered, such as lease duration, break clauses, maintenance responsibilities, and tenant improvements. An experienced commercial lease lawyer will use their negotiation skills to secure the best terms for your business, ensuring that your lease provides flexibility and security.

Whether you’re negotiating with a landlord or working through terms with a prospective tenant, having a retail lease lawyer by your side can give you an advantage. They’ll ensure that you’re not only getting the best deal possible but that the lease terms align with your long-term business goals. A well-negotiated lease can help protect your business's financial stability and set you up for future success.

3. Legal Compliance and Risk Mitigation

Commercial leases are governed by a variety of laws and regulations that can vary from state to state and across different property types. If you're leasing a retail space, for example, you may need to comply with specific Retail Leases Act provisions in New South Wales. A commercial lease lawyer is familiar with these laws and can ensure your lease complies with all legal requirements.

In addition to compliance, a commercial lease lawyer helps identify potential risks that could arise during the lease term. These risks could include disputes over rent increases, the ability to sublet, or the option to terminate the lease early. A lawyer can negotiate clauses that minimise these risks, helping to protect your business from future legal complications. Risk mitigation is key to running a successful business, and a commercial lease lawyer provides the expertise to prevent costly issues from arising.

4. Dispute Resolution and Legal Support

Even with the best-laid plans, disputes can still occur during the course of a lease. Disagreements may arise over maintenance obligations, late payments, lease renewal terms, or violations of the lease agreement. If not addressed promptly, these disputes can escalate into costly legal battles that damage your business reputation and finances.

By hiring a commercial lease lawyer, you can avoid the stress of dealing with disputes on your own. A lawyer can provide expert advice on how to resolve conflicts efficiently and, if necessary, represent your interests in legal proceedings. Whether it’s mediation, arbitration, or court action, having a lawyer handle your dispute ensures that your business is in good hands.

If you’re facing a commercial lease dispute in Sydney, commercial lease lawyers Sydney can offer the support you need to resolve the issue swiftly and effectively, so you can focus on running your business.

5. Assistance with Lease Renewal or Termination

As your lease approaches its expiry date, deciding whether to renew or terminate the agreement can be a difficult decision. Similarly, if you're looking to exit your lease early, you need to understand the consequences and the options available. A commercial lease lawyer provides valuable advice on how to navigate the renewal or termination process, ensuring that you follow the correct legal procedures and protect your business interests.

A retail lease lawyer can also assist with negotiating new terms or helping you exit the lease without incurring heavy penalties. Whether it’s a commercial property or retail space, getting legal advice during the renewal or termination process can save you money and prevent future complications. Your lawyer will ensure that you don’t overlook any crucial details and help secure the best possible outcome for your business.

Conclusion

A commercial lease lawyer plays a vital role in protecting your business during the leasing process. From reviewing complex lease terms to negotiating favourable conditions and resolving disputes, having a lawyer on your side ensures that your lease agreement works in your favour. Whether you're a tenant or a landlord in Sydney, engaging a skilled commercial lease lawyer can help safeguard your business and provide peace of mind.

At T&T Lawyers, we offer expert legal services for commercial and retail leases. Our experienced commercial lease lawyers Sydney are here to help you navigate the leasing process with ease and confidence. Visit our Retail and Commercial Leases page to learn more about how we can assist you or get in touch with us to schedule a consultation today.

By hiring the right lawyer, you ensure that your commercial lease is fair, secure, and aligned with your business’s best interests. Don’t leave your business’s future to chance—let our expert team guide you every step of the way.

#commercial lease lawyer#commercial lease lawyers#commercial and retail leasing lawyer sydney#commercial lease lawyers sydney#retail lease lawyers

0 notes

Text

Birla Kalwa Thane | Affordable Apartment for Sale

Birla Kalwa Thane offers exceptional 2 and 3 BHK houses in a distinguished location in Thane, Maharashtra. The closeness to Thane Railway Station, Eastern Express Highway, and Thane-Belapur Road enables easy access to Navi Mumbai and its surroundings. These flats are located close to many famous locations including Jupiter Hospital and Korum Mall also. This project provides a variety of modern amenities such as swimming pools, a gym and aesthetically pleasing landscapes featuring gardens and parks for nature lovers. This complex feature numerous amenities, including retail outlets, 24/7 security, a parking lot, children play areas, CCTV cameras, qualified staff and time spaces.

Location Advantages: Birla Estates Kalwa Thane

Birla established its presence in this sector, as the residential domain is a crucial component of its overall plan. The Birla modern flats are located in a great region, offering tenants convenient access to several contemporary amenities and essential services for daily living. Access to business areas, educational institutions and healthcare facilities also is readily available.

Connectivity:

In the contemporary, fast-paced milieu, connectedness is essential. Birla homes are designed with best transport connections that facilitate easy travel also. This strategic location near prominent roadways, transportation choices and airports enable convenient access for individuals commuting to workplaces, entertainment venues or other notable events in proximity to Birla Kalwa Thane.

Security:

Birla recognizes the necessity of establishing adequate security protocols and guarantees their enforcement to safeguard all individuals. These apartments offer a secure and serene environment for all inhabitants, featuring 24-hour security officers, video surveillance and restricted access points.

Amenities:

Residents of these dwellings enjoy several amenities designed to improve their living experience. The amenities including a well-equipped gym, swimming pools, meticulously designed gardens and children play areas, accommodating various interests. Clubhouses provides as communal facilities for the residents of Birla Properties Kalwa. These amenities offer people opportunities for dialogue and event organizing.

Conclusion:

Birla 2, 3 BHK apartments are ideal for homeowners that value exceptional living conditions. Residential flats in Birla are deemed ideal because to their great locations, exceptional connectivity, stringent security measures and outstanding amenities for practical living, representing genuine living. Investing in a Birla property signifies a commitment to a lifestyle defined by optimal efficiency, improvement and accessibility, as demonstrated by the Birla Estates apartments.

#Birla Kalwa Thane#Birla Estates Kalwa Thane#Birla Estates Thane#Birla Properties Kalwa#Birla Estates apartments#Birla Properties

0 notes

Text

Licensed Seattle General Contractor | Jvbcontractors.com

"Commercial General Contracting Services in Seattle by JVB Contractors"

For businesses in Seattle looking to build or renovate their commercial space, JVB Contractors is the ideal choice for general contracting services. With a focus on efficiency and quality, we provide a full range of services designed to meet the unique needs of commercial clients.

Comprehensive Commercial Construction Services

Whether you're building a new office, expanding your restaurant, or renovating a retail space, JVB Contractors has the expertise to handle any commercial project. We work with businesses across various industries to create functional and aesthetically appealing spaces.

Why Choose JVB Contractors for Your Commercial Project?

Tailored Solutions for Your Business – We understand that every business is different. Our team will collaborate with you to create a design that aligns with your brand, functionality needs, and budget.

Local Knowledge and Expertise – As a local contractor in Seattle, we are well-versed in the city's building codes and regulations. We ensure that all projects are fully compliant and completed without delays.

Focus on Timeliness – We know that downtime can be costly for businesses. Our team works efficiently to complete projects on time, ensuring minimal disruption to your operations.

Our Commercial Services Include:

Office construction and build-outs

Retail space renovations

Restaurant construction

Tenant improvements

Whether you're opening a new location or renovating an existing space, JVB Contractors is here to help. Contact us today to discuss your commercial construction project in Seattle!

0 notes