#retail inflation of rice

Explore tagged Tumblr posts

Text

Data | Why Centre’s denial of rice through OMSS hits Karnataka the most

Picture used for representational purpose | Photo Credit: Nagara Gopal Ever since the Congress-led Karnataka government came to power, it has been struggling to meet one of its major pre-poll promises — the provision of five kg of rice to Below Poverty Line (BPL) and Antyodaya card holders. This would have been in addition to the five kg of rice that is provided under the National Food Security…

View On WordPress

#Anna Bhagya rice#Anna bhagya scheme Karnataka#Cash for anna bhagya rice#Centre denies rice to Karnataka#cost of rice sold to states by FCI#denial of rice karnataka#ethanol blending#ethanol blending with rice in India#Food Corporation of India#inflation in rice#Karnataka Centre tussle over rice#karnataka news#Karnataka ration cards#Nation food security act#OMSS#OMSS controversy states centre#open market sale scheme#open market sale scheme explained#open market sale scheme karnataka#PDS beneficiaries in India#PDS beneficiaries in Karnataka#PDS beneficiaries in Kerala#PDS beneficiaries in Tamil Nadu#public distribution system in India#retail inflation of rice#Rice bought by states from FCI#rice sold under OMSS#rice wheat denied to states under omss#what is omss#wholesale inflation of rice

0 notes

Text

Let's talk about tariffs

One way or another, we're getting more of them soon, so it's a good idea to spread the word regarding how they work. Note, this is a simplified explanation without nuance, but nuance is the sort of thing that you gotta be rich to exploit in this case.

Here's the basics: a tariff is a tax assessed at the point of import, and paid by the importer. Tariffs always make prices go up.

Say a company orders a bunch of stuff that would otherwise cost them $100 each. Adding on their other business expenses, they will sell each for $150, with some but not all of that extra $50 being profit. Let's say at most $20 of it is profit.

Now a 20% tariff is applied, and the company has to pay $120 each. If they want to keep selling them for $150, that will eliminate their profit and might even require selling the things at a loss. So they have to raise the price. Maybe they only raise it to $160 rather than $170, but they gotta make a profit or they get bought out by venture capitalists and gutted.

The original supplier could lower their price too, but again there's only so much they can drop before they're losing money on the deal too.

Why would a supplier even want to do this? Well, let's say that the domestic competition can supply the thing to retailers for $115. The foreign supplier can stay competitive by dropping their cost by a few bucks, so that after the tariff is applied they cost $114, or even $115 but sell it on the grounds of the retailer already having advertised their version. Small, targeted tariffs can coerce foreign suppliers into taking a cut to their profits. But even in this case, no one's going to be buying $150 products on the shelf anymore, it's just that both foreign and domestic versions will be $160-165. The price has gone up a little. Maybe not the full 20% of the tariff, but a noticeable amount.

That was the sort of tariff we mostly have right now, in 2024. We're also ignoring the fact that things are so interconnected that there may not BE a purely domestic version of a particular thing, just companies with completely foreign production versus those who buy all the parts abroad and assemble them domestically. In that case, everyone's getting hit by the tariffs.

However, the "I Love Tariffs" incoming President has threatened things like 100% or higher. This is the sort of tariff you apply when your goal is to protect a domestic company and to hell with the consumers. (Actually banning imports or setting quotas can also do this, but it's harder to enforce. IIRC, Japan has import restrictions on rice so that they don't completely outsource their food supply.)

A 100% tariff means that in the example above, it now costs the importer $200 to pay for each of the things in their order, so even if nothing else changes they'd have to charge $250 each to get the same amount of profit (and a smaller profit MARGIN). Does this mean they'll just go buy the $115 domestic version? Well, they'd like to, but now the domestic version is $160 or $180, because the domestic companies can just crank up their profit margins while staying cheaper than the alternative. Domestic companies are not driven by a desire to serve the public, they're legally required to make as much money as they can (this is a big problem lately, stockholders can sue if they think a company is passing up on profits). Thus, when punitive tariffs raise the price of imports to stupid levels, domestic suppliers (even those who miraculously have their entire supply chain within the country) will run up the price too.

All of this money will come from consumers and go into the pockets of the government. Do you trust the incoming administration to spend this windfall on helping the people hammered by massive spikes in inflation? I sure don't.

22 notes

·

View notes

Text

For Angel (sari-sari store)

### **"The Cornerstone of the Community"**

#### *The Resilience of Sari-Sari Stores in General Santos City Amid Globalization*

---

### **Opening Scene/Introduction**

The late afternoon sun casts long shadows across the streets of Barangay Apopong in General Santos City. Outside a sari-sari store made of plywood and corrugated iron, young children huddle together, counting their coins to buy candy. Inside, Aling Maria, the 52-year-old owner, places a sachet of coffee and a pack of instant noodles into a brown paper bag. She greets her customers with a warm smile, despite the weariness that settles in her eyes after years of running the small store.

“It used to be easier,” she says, adjusting the bright pink apron tied around her waist. “Back then, people came here for everything. But now, it’s not the same. The big stores and online shopping have taken them away.”

Aling Maria’s story mirrors the experience of countless sari-sari store owners in General Santos City. Once the heart of local communities, these small, family-run shops now face mounting challenges brought about by globalization. What was once a thriving micro-economy is now grappling with economic realities far beyond the control of its operators.

---

### **Background and Context**

Sari-sari stores have been an integral part of Filipino culture for decades. With over 1.3 million such stores nationwide, they cater to the everyday needs of their communities, offering small, affordable quantities of goods. In General Santos City, sari-sari stores are scattered across every barangay, playing a pivotal role in providing low-income families access to necessities.

However, the forces of globalization have brought profound changes to this traditional business model. Large-scale retail chains like SM Supermarket and Gaisano Mall have expanded their operations in the city, luring customers with lower prices, air-conditioned facilities, and bulk purchasing options.

At the same time, the rise of e-commerce platforms such as Lazada and Shopee has reshaped consumer behavior. Younger generations, in particular, are drawn to the convenience of online shopping, where they can buy goods at discounted prices without leaving their homes.

Globalization has also led to the influx of imported goods, which often outcompete locally sourced products in terms of price and availability. For sari-sari store owners, the struggle lies in trying to match these prices while maintaining profitability.

---

### **The Main Story: Challenges and Struggles**

#### **The Burden of Competition**

Sari-sari stores are no longer the default choice for many residents of General Santos City. The proliferation of supermarkets and convenience stores has diverted foot traffic away from these small establishments. Customers often find that buying in bulk from larger stores is more economical than purchasing items in small quantities.

Aling Maria recalls how her regular customers used to rely on her for everything—from rice to shampoo. “Now, they go to the mall or the big grocery stores. They say it’s cheaper there,” she explains. “But for me, it’s getting harder to keep the store open.”

#### **The Impact of E-Commerce**

E-commerce has introduced a new layer of competition for sari-sari store owners. Platforms like Shopee and Lazada offer consumers access to products at significantly lower prices, often with the added benefit of free shipping. This shift is particularly noticeable among younger residents, who are more comfortable navigating online platforms.

“My own children order online,” Aling Maria says with a laugh tinged with resignation. “They say it’s cheaper and easier. But for people like me who don’t understand technology, how can we keep up?”

#### **Rising Costs and Shrinking Margins**

The pressures of globalization are compounded by the rising cost of goods. Inflation has driven up the prices of basic commodities, leaving sari-sari store owners with razor-thin profit margins. At the same time, the depreciation of the peso has increased the cost of imported items, further squeezing small businesses.

Aling Maria’s ledger tells a stark story: while her sales have remained steady, her expenses have climbed, leaving little room for profit. “Some days, I feel like I’m working just to break even,” she admits.

#### **Loss of Social Connection**

Beyond the economic challenges, globalization has also eroded the social role of sari-sari stores. These small shops were once hubs of community interaction, where neighbors gathered to share stories and exchange news. Today, the rise of digital communication and the shift to urbanized retail spaces have diminished these social connections.

“I miss the days when people would linger and talk,” Aling Maria says. “Now, they come in a hurry or not at all.”

---

### **Broader Implications**

The struggles of sari-sari stores in General Santos City reflect broader trends in developing economies worldwide. The shift from small-scale, community-based businesses to larger, corporate-driven retail systems underscores the growing dominance of globalization.

This transformation has both positive and negative implications. On one hand, consumers benefit from greater access to goods, lower prices, and the convenience of modern retail. On the other hand, small businesses are left to bear the brunt of these changes, often without adequate support.

The decline of sari-sari stores also raises questions about the preservation of cultural identity and community cohesion. These stores are more than just places to buy goods—they are symbols of Filipino resilience and entrepreneurship.

---

### **Hope and Resilience: Responses and Solutions**

Despite the challenges, sari-sari store owners in General Santos City are finding ways to adapt and persevere.

#### **Strengthening Community Ties**

Some store owners are doubling down on their role as community anchors, emphasizing personalized service and fostering loyalty among their customers. “I know my customers by name,” Aling Maria says proudly. “When they’re short on cash, I let them pay later. That’s something big stores can’t do.”

#### **Embracing Technology**

A growing number of sari-sari store owners are turning to technology to modernize their operations. Mobile apps designed for small businesses, such as point-of-sale systems, help them track inventory and manage sales more effectively. Social media platforms like Facebook are also being used to promote products and reach new customers.

“My daughter helped me create a Facebook page for the store,” Aling Maria shares. “Now, people can message us if they want to order something.”

#### **Government and NGO Support**

Local government units (LGUs) in General Santos City have launched programs to support small businesses, including sari-sari stores. These initiatives include financial literacy training, access to microloans, and subsidies for inventory purchases. Non-governmental organizations (NGOs) are also stepping in to provide grants and resources to struggling store owners.

#### **Collaborative Efforts**

In some barangays, sari-sari store owners have formed cooperatives to pool resources and negotiate better deals with suppliers. By working together, they can compete more effectively against larger retailers.

---

### **Conclusion**

The sari-sari stores of General Santos City are more than just places of commerce—they are the lifeblood of their communities. Despite the challenges posed by globalization, these small businesses continue to demonstrate resilience and adaptability.

Aling Maria’s story is one of many, illustrating the strength of the human spirit in the face of adversity. While the road ahead may be uncertain, the determination of sari-sari store owners to preserve their way of life offers a glimmer of hope.

As globalization reshapes economies and societies, it is essential to ensure that small businesses like sari-sari stores are not left behind. By fostering community support, embracing innovation, and advocating for inclusive policies, we can help preserve these cultural treasures for generations to come.

---

### **References and Acknowledgments**

- Philippine Statistics Authority. (2023). *Economic Impact of Micro and Small Enterprises in the Philippines.* Retrieved from [https://psa.gov.ph](https://psa.gov.ph)

- Local interviews conducted with sari-sari store owners in General Santos City, December 2024.

- Department of Trade and Industry. (2023). *MSME Development Programs in General Santos City.* Retrieved from [https://dti.gov.ph](https://dti.gov.ph)

- Navarro, M. (2023). *Adapting to Change: The Role of Technology in Sari-Sari Stores.* Journal of Philippine Business Studies, 18(3), 45-58.

- Sari-Sari Store Cooperative. (2024). *Annual Report on Small Retail Enterprises in South Cotabato.*

0 notes

Text

Product Price Fluctuations in Bangladesh: Causes and Consequences

Understanding product price fluctuations is crucial for consumers, businesses, and policymakers in Bangladesh. The prices of goods and services can vary significantly over time, influenced by a myriad of factors ranging from local conditions to global trends. Recognizing the causes of these fluctuations and their potential consequences can help stakeholders make informed decisions and strategize effectively. This article explores the key factors driving product Price In Bangladesh and the implications of these fluctuations.

1. Economic Factors

a. Inflation and Deflation

Inflation, the general rise in prices across the economy, is a primary driver of price fluctuations. In Bangladesh, inflation can be influenced by a range of factors including monetary policy, fiscal policy, and changes in the cost of production. When inflation is high, the cost of goods and services increases, leading to higher prices. Conversely, deflation, a decrease in general price levels, can result in lower prices but may also indicate weak economic conditions.

b. Currency Exchange Rates

The value of the Bangladeshi Taka (BDT) relative to other currencies affects the prices of imported goods. A depreciation of the Taka increases the cost of imports, leading to higher prices for products that rely on foreign raw materials or finished goods. Conversely, an appreciation of the Taka can reduce import costs and lower prices. Fluctuations in currency exchange rates are closely monitored by businesses and consumers as they impact the cost of everyday items.

c. Interest Rates

Interest rates, set by the central bank, play a role in price fluctuations. Higher interest rates can increase borrowing costs for businesses, which may be passed on to consumers in the form of higher prices. Conversely, lower interest rates can reduce borrowing costs and potentially lower prices. The central bank’s monetary policy decisions are therefore crucial in managing price stability.

2. Supply and Demand Dynamics

a. Supply Chain Disruptions

Disruptions in the supply chain can significantly impact product prices. Natural disasters, political instability, or logistical challenges can affect the availability of raw materials and finished products. For example, flooding or transport strikes can disrupt the distribution of goods, leading to shortages and price increases. Businesses often face challenges in maintaining inventory levels, which can contribute to price volatility.

b. Seasonal Demand

Seasonal changes in demand also play a significant role in price fluctuations. In Bangladesh, certain products experience higher demand during specific seasons. For instance, the demand for clothing, decorations, and food items typically spikes during festivals such as Eid and Pohela Boishakh. Increased demand during these periods can lead to higher prices as retailers adjust their pricing strategies to capitalize on peak purchasing times.

c. Crop Yields and Agricultural Production

For agricultural products, fluctuations in crop yields due to weather conditions or pest infestations can affect prices. A poor harvest due to adverse weather or disease can lead to reduced supply and higher prices for food items like rice, vegetables, and fruits. Conversely, a bumper harvest can lead to lower prices as supply increases. Monitoring agricultural conditions is essential for predicting price trends in food products.

3. Market Competition

a. Competitive Pricing Strategies

In competitive markets, businesses often adjust their prices in response to competitors’ pricing strategies. Companies may lower prices to attract customers or differentiate themselves from rivals. Conversely, in markets with limited competition or monopolistic conditions, prices may remain high due to lack of alternative options for consumers.

b. Price Wars

Price wars between competitors can also influence product prices. Retailers and manufacturers may engage in aggressive pricing tactics to capture market share. While this can lead to lower prices for consumers in the short term, it can also have long-term consequences such as reduced profit margins and potential market consolidation.

4. Government Policies

a. Taxes and Tariffs

Government policies, including taxes and tariffs, impact product prices. Changes in VAT (Value Added Tax), import duties, or other taxes can directly affect the cost of goods. For instance, an increase in import tariffs can raise the cost of imported products, leading to higher retail prices. Conversely, tax reductions or subsidies can lower prices and make products more affordable for consumers.

b. Regulatory Changes

Regulatory changes, such as adjustments in quality standards or safety regulations, can also impact prices. Compliance with new regulations may involve additional costs for businesses, which can be reflected in higher product prices. Conversely, deregulation or reduced compliance costs may lead to lower prices.

5. Global Economic Trends

a. Commodity Prices

Global commodity prices influence local product prices, especially for goods that rely on international raw materials. Fluctuations in the prices of commodities such as oil, metals, and agricultural products can impact the cost of production and, consequently, the prices of finished goods. For example, rising global oil prices can lead to higher transportation and production costs, which can be passed on to consumers.

b. International Trade Agreements

Trade agreements and international economic conditions affect product prices. Trade agreements that facilitate easier access to foreign markets or reduce tariffs can lower import costs and reduce prices for consumers. Conversely, trade restrictions or economic sanctions can lead to higher prices by limiting access to international goods and materials.

6. Consequences of Price Fluctuations

a. Consumer Behavior

Price fluctuations influence consumer behavior and purchasing decisions. When prices rise, consumers may adjust their spending habits, seek out alternative products, or delay purchases. Conversely, lower prices can encourage increased spending and consumer confidence. Understanding these behavioral shifts is crucial for businesses to adapt their marketing and sales strategies.

b. Business Profitability

For businesses, price fluctuations can impact profitability. Rising costs may erode profit margins, especially if businesses are unable to pass these costs on to consumers. Conversely, competitive pricing or price wars can reduce margins but increase sales volume. Businesses must carefully manage their pricing strategies to balance profitability with market demand.

c. Economic Stability

On a macroeconomic level, significant price fluctuations can affect economic stability. High inflation or deflation can lead to uncertainty and reduced consumer confidence. Policymakers must monitor price trends and implement measures to maintain economic stability and protect purchasing power.

d. Investment Decisions

Investors also pay close attention to price fluctuations as they can impact investment returns. Changes in commodity prices, currency exchange rates, and market conditions can influence investment performance. Investors need to assess these factors when making decisions about where to allocate their resources.

Conclusion

Product price fluctuations in Bangladesh are driven by a complex interplay of economic factors, supply and demand dynamics, market competition, government policies, and global trends. Understanding these causes and their consequences is essential for consumers, businesses, and policymakers alike. By recognizing the factors that influence prices, stakeholders can make more informed decisions, plan effectively, and adapt to changing market conditions. Whether managing household budgets, setting business strategies, or formulating economic policies, a thorough grasp of price fluctuations is key to navigating the evolving economic landscape of Bangladesh.

0 notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Like an unseen current, inflation silently shapes economic landscapes, gradually eroding consumer purchasing power while making its mark on diverse industries. Elevated costs, hiring delays, and stagnant earnings pose substantial business challenges. One sector susceptible to inflation's effects is the grocery industry, where the potential for rising prices can weigh heavily on the minds of average consumers.

Rising Inflation: A Catalyst for Changing Shopping Dynamics

Over the past year and beyond, the United States has witnessed a pronounced uptick in inflation, sparking concerns and altering how we approach essential purchases. The price surge denotes the escalating raw materials, transportation, and labor costs. Further complicating matters, disruptions in global supply chains and fluctuations in currency exchange rates amplify the situation's complexity, weaving an intricate tapestry of interdependencies.

Navigating Inflation: Strategies Of Prominent E-Retailers

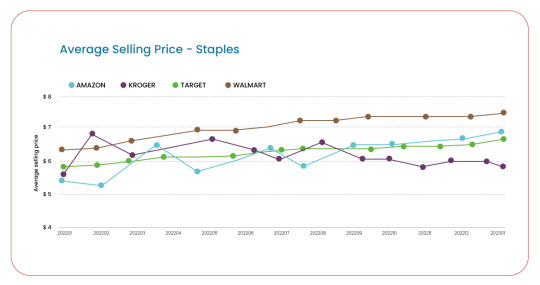

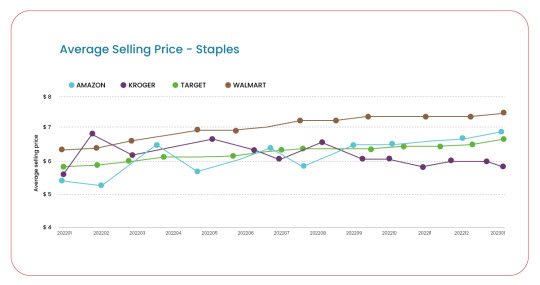

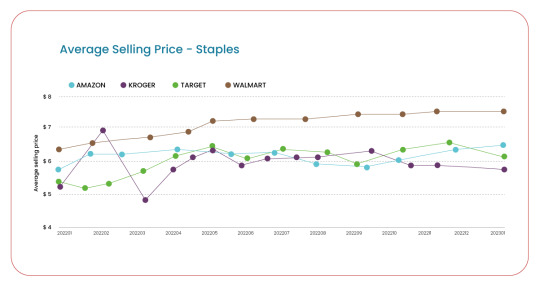

After extracting grocery price data, we took a comprehensive analysis to grasp the scale of this phenomenon among leading e-retailers, focusing on four major retail giants: Walmart, Amazon, Target, and Kroger.

the prolonged period of elevated prices and the potential macroeconomic pressures, the retailer adopts a cautious stance. In contrast, Amazon's eCommerce division experienced a significant shift, reporting a net loss of $2.7 billion in 2022, diverging starkly from the $33.4 billion profit of the prior year.

Amid these intricate circumstances, comprehending trends in grocery pricing and the accompanying strategies becomes paramount for online and brick-and-mortar retailers. Successfully navigating and thriving within the current economic landscape hinges on a nuanced understanding of these dynamics. Analyzing pricing trends using grocery data scraping services offer invaluable insights into how these corporate giants adeptly steer through the challenges posed by the grocery industry in the face of inflation's backdrop.

Methodology Of Our Research

The foundation of our analysis comprised a comprehensive assortment of products, spanning the spectrum from pantry essentials like flour and rice to perishable items such as dairy and produce. It encompassed approximately 600 Stock Keeping Units (SKUs) meticulously matched across Amazon, Kroger, Target, and Walmart. The data collection using product data scraping spanned January 2022 to February 2023.

Furthermore, we examined the pricing dynamics using web scraping retail websites data for a smaller subset of over 30 high-demand daily essentials. These particular items hold the potential to generate elevated sales and margins for the retailers in focus.

Insights Into Average Selling Prices Of Grocery Items

Our thorough analysis uncovered notable trends in the average selling prices of various grocery products. Among the retailers studied, Walmart consistently emerged as the front-runner in offering the most competitive prices. Price monitoring showed that there were around 8% lower than its closest competitor, Target. Despite an annual price increment of roughly 5%, Walmart's strategy prioritized "stability and predictability." This strategic approach yields results, as evidenced by the retailer's 8% growth in the last quarter. Nevertheless, it is essential to recognize that while this strategy brings benefits, it might exert pressure on Walmart's profit margins concurrently.

Strategies To Navigate Inflationary Pressures

In response to the challenges posed by inflation, Walmart is adopting a measured approach to growth while concurrently concentrating on safeguarding profit margins. Sources indicate that the retailer has negotiated with consumer packaged goods (CPG) manufacturers, pushing back against price hikes aimed at offsetting inflation-driven cost pressures early in 2023. Notably, part of Walmart's growth and heightened sales to an unexpected trend—higher-income households, facing diminishing spending power, now actively seek deals and discounts at Walmart.

Amazon's Surprising Pricing Position

Contrary to common consumer perception associating Amazon with the most budget-friendly prices, data reveals a different narrative. Amazon emerges as the highest-priced retailer among the ones studied, with Kroger following closely. Over the year, Kroger implemented a 10% price increase. Despite this, Amazon maintains its strong market standing, charging prices 12% to 18% higher than Walmart's for groceries. Amazon sustained its success even as its online sales dipped by 4%, and the year 2022 witnessed a substantial 9% surge in revenue from third-party seller services, encompassing aspects like warehousing, packaging, and delivery. Amazon's robust logistics and same-day delivery capabilities confer a distinct competitive edge, bolstering revenue growth and preserving margins. This scenario allows Walmart and other retailers to increase prices while upholding their competitive pricing positions.

Kroger's Premium Perception Strategy

Kroger, in contrast, appears to be cultivating a premium price perception. The retailer has consistently pursued a strategy of raising prices, a trend evident across nearly every month. This approach places Kroger's pricing strategy closer to Amazon's tactics.

Analyzing High-Volume Daily Staples Pricing

Recognizing that pricing strategies can vary across product categories, our analysis delved deeper into a narrower subset of over 30 high-demand daily staples offered by different retailers. This subset encompasses baked goods, popular beverages, canned foods, frozen meals, dairy products, cereals, detergents, and similar essentials. By focusing on this subset, we gain a more granular understanding of how retailers adapt their pricing strategies to different types of products.

Walmart's Strategic Positioning Amidst Inflation

By perceiving the influence of inflation significantly, Walmart has steadfastly maintained its position as the price leader, possibly intending to augment its margins through higher sales volume.

Narrowing Price Disparity Among Retailers

The variance in prices across retailers in this context is understandably narrower, with Amazon and Kroger closely aligning their average prices with Walmart's.

Target's Peculiar Pricing Strategy

Distinctively, Target's pricing strategy distinguishes itself by consistently emerging as the highest-priced retailer for daily essentials, despite ranking among the more affordable retailers for a broader spectrum of grocery items. This anomaly implies that Target's underlying technological approach might need to be more finely tuned to adapt to market dynamics than other prominent retailers. It might be prudent for Target to bolster efforts in meticulously tracking pricing within this sub-category.

Data-Driven Solutions For Navigating Complexity

Amid a challenging economic landscape, retailers and grocery establishments must sustain their revenues and margins. A vital component of achieving this lies in embracing an all-encompassing and adaptable pricing strategy. An acute awareness of which product categories are witnessing price escalations among competitors can equip retailers with the insights needed to make well-informed pricing decisions at the category and individual product levels.

Rather than implementing sweeping price hikes that could undermine customer trust, retailers should balance margin performance and consumer willingness to pay. Navigating price adjustments can be intricate for both customers and sellers. Those retailers that adopt an approach fueled by data and insights stand a higher chance of success in this endeavor.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#ScrapeTargetsPricingStrategy#ScrapeKrogersPricingStrategy#WebScrapingRetailWebsitesData#ExtractGroceryPriceData#ScrapeAmazonGroceryData

0 notes

Text

Government Imposes 20% Tax on Parboiled Rice for an Uncertain Period.

The government of India has decided to add an extra 20% export tax on parboiled rice exports from the 31st of March onwards. India, the biggest exporter of parboiled rice globally, might continue charging a tax on this type of rice to help control food prices before the Lok Sabha elections. This could make it harder for other countries to get enough rice and could make prices go even higher.

Krishi Kisan app

Prime Minister Narendra Modi, who wants to be elected for a third time in the upcoming elections, is thinking about keeping the tax on exports at 20%. They're not planning to stop exporting parboiled rice altogether.

Earlier in August 2023, the government had imposed a 20% export tax on the same. The tax was supposed to end on March 31st, but now they might extend it. With the latest order increased export tax will resume without an end date. This move is made to hold on to enough local stock for the hassle-free supply of domestic usage.

Krishi Yantra

Apart from the tax on rice export, the tax-free import of yellow peas has also been sanctioned. Moreover, it is extended past 31st March. The order is subject to the condition that the bill of landing should be on or before 30th April 2024.

It is positive to see India's retail inflation easing to 5.10 per cent annually, especially after reaching a four-month high of 5.69 per cent in December. Data from the Ministry of Statistics and Programme Implementation has revealed so. In the past month, all kinds of rice saw a 10% decrease rate within the surging supply in the market. With the help of government policies, the staple food grain was made more accessible for the Indian Households.

The government has put a tax on exporting all types of non-basmati rice until October 16, 2023. They've also limited the export of non-basmati white rice. About a quarter of all rice exported from India is this type. Last year, India made around $4.8 billion selling basmati rice, about 45.6 lakh tonnes of it, to be precise.

The Finance Minister said in her budget speech that the government's actions have helped control rising prices, especially for things that have short shelf life. From April to December last year, the prices of regular commodities went up less than before. Now, the prices are steady and not going up too fast.

youtube

#agriculture#agriculturenews#farmer#farminglife#india#agriculturenewsnetwork#newstoday#agriculturenewstoday#Youtube

0 notes

Text

Nigeria Investment Opportunities - Dr Kenny Odugbemi

Nigeria Investment Opportunities Nigeria's construction market is valued over $135b, with other sectors opening up such as ✓Marine ✓Blue economy ✓Circular economy ✓Solid minerals ✓Creative and entertainment ✓Tourism In less than 30years our population will double in excess of 400m Currently our economy is slipping to its lowest unimaginable point, due to variance, non-complimentary monetary and fiscal all running in non compliance mode given room for monumental fraud across all tiers of government, public and private sector, extremely weak institutions all hijacked by power brokers. As of today, stated below are our current situation based on condition assessment ✓We have high fuel cost PMS and diesel inclusive. ✓Dollar scarcities due to speculators who are scavenger ravaging dollars, without using it to impact the real sector ✓High import duties, tariffs and levies ✓High inflation 25.8% ✓CCR 32% ✓MPR 28.75 ✓Lending rate over 27% ✓It is note worthy that unemployment is gradually reducing, despite faulty base of 4.1% ✓Currency devaluation 20% ✓Increase instability and insecurity in the Northern sphere is now very toxic. ✓increase in loss of talent-"Japa" over 52% of our current professional base with attendant decrease in tax return ✓Over dependency on Road, hence the need to go intermodal Identifying Opportunities Our growing population has opened further diverse opportunities in ✓health, ✓housing, low cost ✓education, vocational inclusive Increase in cost of importation has led FCMG to convert into in-country manufacturing and assembly Find below where ready to go available opportunities ✓Affordable housing with decent retail ✓Affordable educational branded private -primary-secondary- tertiary institutions ✓Specialist residential development for old age, internally displaced person, and person living with disabilities ✓Housing for young professional 45sqm self contained apartment ✓FDI to drives provision of power at state level, manufacturing, health, road infrastructure ™Provision of Data centre Agricultural driven opportunities ✓Rice cultivation and production to raise current 2.5m tonne-6m ton per acre ✓Maintenance of Agric equipment ✓Value discount retailing structure Conclusion We need to focus on the new value proposition, with enabled environment with minimal restrictions for FDI to invest and catch out In all the sectors there exist big opportunities Let our money in local currency and foreign currency work for us, this is the only antidote to driving away multidimensional poverty above all our legislature needs to be sacrificial as they are selfish greedy legislating us into deep poverty. At Federal level and State level there is need to reduce recurrent expenditure as most States in Nigeria are insolvency but waster of state Treasury despite most monthly inflow Revenue fiscal allocation,13rivation, personal income tax, royalties, inte 0rnal generated, there is poverty in some of previledged States, whilst others do not think with thought of generating more revenue through their ways and means Read the full article

0 notes

Text

Driven to tears: The Hindu Editorial on the government’s move to arrest prices

With consumer food prices rising 11.5% in July, likely the third highest since the current retail inflation data series began in 2014, the government last Saturday made yet another gambit to arrest prices. A 40% export levy on onion exports was imposed with immediate effect till at least December 31. This move follows curbs on non-basmati rice shipments outside India in July, and stock limits on…

View On WordPress

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2023/04/shoppers-swap-fresh-for-frozen-as-food-bills-rise

Shoppers swap fresh for frozen as food bills rise

By Noor Nanji

Business reporter, BBC News

Consumers are swapping from fresh to frozen food in a bid to combat rising grocery prices, retailers have said.

Frozen food is outperforming fresh in supermarkets at the moment, data from research firm Kantar suggests.

Frozen chicken, ready meals, pizzas and chips are the most popular items.

These are some of the things mum-of-three Laura Tedder told the BBC she chooses to help keep her food bill down. “We’re buying much more frozen food. We can’t afford fresh,” she said.

Mrs Tedder is not alone. The British Retail Consortium said consumers are making the same “swaps to save money” as the cost of living rises.

Waitrose, M&S and Iceland all told the BBC frozen food is rising in popularity, while Tesco has also seen shoppers switching from fresh to frozen.

“Frozen food tends to be much cheaper, and there’s less waste, so you can see why it’s selling well in the cost of living crisis,” said retail analyst Ged Futter.

Why are prices rising so much?

Deal hunters go to supermarkets four times a week

Five hacks to help save money on your food shop

Mrs Tedder, from Ampthill in Bedfordshire, has to keep an eye how much she’s spending at the supermarket.

“When you have a lot of kids to feed, it all adds up,” she said.

She often finds herself comparing fresh versus frozen prices for items like chicken and has been buying a lot more frozen vegetables in recent months.

She also uses frozen fruit to make smoothies for her daughters – Millie, aged 10, Pip, nine and Ottilie, six.

In the past, she bought fresh food as she believed it was nutritionally better for her children.

“Now I’m more worried about the sweets my kids eat, rather than the meals I cook them,” she said.

Lindsay Hawkshaw

Lindsay Hawkshaw from County Durham has also been stocking up on frozen chicken, rice and waffles for her three children.

“It’s cheaper than fresh, and there’s less waste, so it’s a no brainer when we’re counting pennies,” she said.

She said she had noticed more supermarket deals on frozen food.

“It’s not ideal,” she said. “Fresh tastes better, there’s no doubt about that.”

“But the packaging says it’s frozen immediately so I think that dispels the myth of it being less healthy,” she said.

Mr Futter said frozen food “has had a bad rep for years” but the quality “is actually really high”.

“Whether it’s peas, potatoes or fish – a lot of the time, it’s even better for you, as these items are frozen the minute they’re ready, whereas fresh items can sometimes be sitting out for longer,” he said.

Cost of living concerns

In the supermarkets, frozen food is doing “notably better” than fresh at the moment, Fraser McKevitt, head of retail and consumer insight at Kantar UK, told the BBC.

“And some of that is clearly to do with the cost of living,” he added.

Kantar’s data, seen by the BBC, shows that demand is strongest for items such as frozen chicken, where volumes are up 5.9%. Meanwhile, frozen prepared foods, including ready meals, pizzas and chips are up 2.6%.

Overall, frozen food volumes have held steady, even though overall shoppers are buying less. In the 12 weeks to mid-March, total grocery volumes fell by 4% while the volume of frozen goods bought was unchanged, the data shows.

‘Budget friendly’

Waitrose said its frozen food range had been rising in popularity while customers keep tabs on their budgets.

M&S told the BBC it was seeing more customers opt for frozen vegetables and frozen herbs, which it said are “a great value choice”.

Richard Walker, executive chairman of Iceland Foods, said frozen food unlocks “many benefits” to consumers, adding: “More shoppers are waking up to this more budget friendly option during these challenging economic times.”

Fresh food inflation hit 17% in March, up from 16.3% in February, according to the British Retail Consortium, marking its highest rate since records began in 2005.

Many of the country’s largest supermarkets recently experienced shortages of some salad items and vegetables, which helped push prices up further.

Kate Hall

Mum-of-two Kate Hall from Bromley set up a website, The Full Freezer, to advise people how to save money and reduce waste by using their freezer properly.

She said she’s had much more engagement in the last six months, as living costs soared.

“People are getting over their fear of frozen food, and that’s a good thing,” she said.

Mrs Hall freezes everything from cashew nuts to eggs. She also freezes red wine, to use for cooking.

“You can freeze leftovers, it can be as simple as putting a spare onion in the freezer, and then using that later to make a soup.

“There’s much less food waste if you use your freezer effectively, and that’s something people are really conscious of right now.”

How can I save money on my food shop?

Look at your cupboards so you know what you have already

Head to the reduced section first to see if it has anything you need

Buy things close to their sell-by-date which will be cheaper and use your freezer

Read more tips here

Related Topics

Retailing

Inflation

Cost of living

Supermarkets

Food

More on this story

Why are prices rising so much?

23 March

Deal hunters go to supermarkets four times a week

28 March

Shopping lists making a comeback to save us money

2 April

0 notes

Text

Milk Gives Government A Headache As Prices Soar Ahead of 2024 Polls

The average retail price of milk in India has increased by 12% from a year ago to 57.15 rupees ($0.6962) a liter.

Milk is ubiquitous in India - from the morning glassful that most middle class school kids glug to its use in Hindu religious rituals. Now it could become a headache for Prime Minister Narendra Modi's government as prices soar.

The average retail price of milk in India has increased by 12% from a year ago to 57.15 rupees ($0.6962) a liter. A mix of factors is at play - a jump in the cost of cereals has made cattle feed more expensive coupled with lower dairy yields as cows were inadequately fed due to the pandemic rupturing demand at the time.

In turn, milk - which has the second-largest weight in India's food basket - pushes up overall inflation as well. India's headline inflation for March fell below the central bank's target of 6% as high interest rates cooled overall demand, according to data released Wednesday. However, milk inflation trended higher than the overall figure at 9.31%.

High prices of milk and related products - emotive items that most poor families aspire to and wealthier people see as indicators of status - have the potential of becoming a political risk for Modi's government ahead of national elections next summer.

"This trend of higher milk prices is problematic, since it is a highly price elastic product and has a direct impact on consumption," said R.S. Sodhi, president of the Indian Dairy Association.

For now, the demand-supply mismatch has helped a rally among dairy stocks in India as analysts expect this situation can help organized players expand their share of overall market in India.

However, Sodhi said the balance sheet of dairy companies may eventually come under stress as the cost of procurement is rising. One factor is the increase in the prices of cereals and rice bran, ingredients used in animal feed, which is discouraging farmers from feeding their cattle sufficiently and is reflecting in milk prices that have risen 12%-15% during winter months, he said.

Unseasonal rain and heat waves have also contributed to this jump in feed prices. Cereal inflation came in at 15.27% for March 2023.

But trouble was brewing even before prices of cattle feed began to rise.

When the coronavirus pandemic hit and India introduced one of the world's strictest lockdowns, demand for milk and milk products dipped as many restaurants and sweet shops were forced to shut down either temporarily or permanently.

India accounts for almost a quarter of the world's milk supplies, but those massive volumes are produced in large part by tens of millions of small farmers who maintain modest numbers of animals. The drop in demand meant they were unable to feed their livestock well.

"A cow has to be fed irrespective of whatever quantity of milk it is giving and this is a pressure point for the producer," said Jayen Mehta, who heads India's largest dairy cooperative, Gujarat Cooperative Milk Marketing Federation, which owns the iconic Amul brand.

And while the South Asian nation consumes the bulk of the milk it produces, exports have also been rising, especially once the global virus disruption eased and demand for milk products picked up across the the world. India exported dairy products worth about $391.59 million in the 2021-22 fiscal year compared to $321.96 million in the year before that.

"In terms of the outlook for this year, we believe that milk prices will continue to increase, since there is a shortage of milk heading into the peak demand season," Madhavi Arora, economist at Emkay Global wrote in a report this month.

Demand for ice cream and yogurt jumps as summer temperatures soar. That's followed by the season of Hindu festivals, which starts around September - milk-based sweets are a holiday staple - and carries on for the next few months.

While Modi revamped a food program to make monthly rice and wheat rations free for about 800 million Indians, higher prices of other kitchen staples add to the pressure on his government to do more to help citizens cope with the rising costs of living. That's crucial as he prepares to seek reelection next year in a country that has by far the largest number of poor people worldwide.

"It's an issue that affects ordinary people rightly," said Neerja Chowdhury, a New Delhi-based political columnist. "But whether it becomes a poll issue depends on the opposition, how effectively they can use it and make it into a right issue that make people vote in a particular way."

Analysts expect Modi to win as the opposition remains in disarray. But the government may still have to do some heavy-lifting to beat back price pressures, given the Reserve Bank of India has already paused monetary tightening amid mounting growth risks.

While economists expect overall inflation to ease going ahead, things are not looking up for this staple. India's central bank last week said that prices of milk may continue to be firm going into the summer season due to tight demand-supply balance and fodder cost pressures.

Amul's Mehta describes it as walking a tight rope. On one hand, it is about limiting the impact of inflation on consumers for an essential item, while simultaneously ensuring producers get a fair price to encourage them to continue producing milk, he said.

For now, even middle class families are tweaking their milk consumption. Ruchika Thakur, a lawyer and a parent to a five-year-old, says cutting down on milk purchases is not an option so she's started buying cheaper options to tackle the surge in cost.

"I think twice before making that extra cup of coffee," she said, adding that there is no room for buying more, especially for a family of eight who consume three liters of milk each day.

0 notes

Text

“Woke up this morning (19 January 2022) to the radio talking about the cost of living rising a further 5%. It infuriates me the index that they use for this calculation, which grossly underestimates the real cost of inflation as it happens to people with the least. Allow me to briefly explain.

This time last year, the cheapest pasta in my local supermarket (one of the Big Four), was 29p for 500g. Today it’s 70p. That’s a 141% price increase as it hits the poorest and most vulnerable households.

This time last year, the cheapest rice at the same supermarket was 45p for a kilogram bag. Today it’s £1 for 500g. That’s a 344% price increase as it hits the poorest and most vulnerable households.

Baked beans: were 22p, now 32p. A 45% price increase year on year.

Canned spaghetti. Was 13p, now 35p. A price increase of 169%.

Bread. Was 45p, now 58p. A price increase of 29%.

Curry sauce. Was 30p, now 89p. A price increase of 196%.

A bag of small apples. Was 59p, now 89p (and the apples are even smaller!) A price increase of 51%.

Mushrooms were 59p for 400g. They’re now 57p for 250g. A price increase of 56%. (This practise, of making products smaller while keeping them the same price, is known in the retail industry as ‘shrinkflation’ and its insidious as hell because it’s harder to immediately spot.)

Peanut butter. Was 62p, now £1.50. A price increase of 142%.

These are just the ones that I know off the top of my head - there will be many many more examples! When I started writing my recipe blog ten years ago, I could feed myself and my son on £10 a week. (I’ll find the original shopping list later and price it up for today’s prices.)

The system by which we measure the impact of inflation is fundamentally flawed - it completely ignores the reality and the REAL price rises for people on minimum wages, zero hour contracts, food bank clients, and millions more.

But I guess when the vast majority of our media were privately educated and came from the same handful of elite universities, nobody thinks to actually check in with anyone out here in the world to see how we’re doing. (Fucking terribly, thanks for asking.)

Every time there’s a news bulletin on the rising cost of living, I hope that today might be the day that that some real journalism happens, and someone stops to consider those of us outside of the bubble. Maybe today might finally be that day.

(But seeing I’ve been banging on about this for a decade now, it’s probably not going to be. Thanks for reading anyway, I appreciate it.)

And just to add:

- an upmarket ready meal range was £7.50 ten years ago, and is still £7.50 today.

- a high-end stores ‘Dine In For Two For £10’ has been £10 for as long as I can remember.

- my local supermarket had 400+ items in their value range, it’s now 91 (and counting down)

The margins are always, always calculated to squeeze the belts of those who can least afford it, and massage the profits of those who have money to spare. And nothing demonstrates that inequality quite so starkly as tracking the prices of ‘luxury’ food vs ‘actual essentials’. 😤

To return to the luxury ready meal example, if the price of that had risen at the same rate as the cheapest rice in the supermarket, that £7.50 lasagne would now cost £25.80.

Dine In For £10 would be £34.40.

We’re either all in this together, or we aren’t.

(Spoiler: we aren’t)

Now, picture if you will, the demographic of the voter who has kept the current Party in power for the last 11 years. Imagine the Chancellor having to explain to them that their precious microwave dinner now cost almost four times what it did yesterday.

Yeah, didn’t think so.

I mean of all the things, the Prime Minister claiming that he's cutting the cost of living while the price of basic food products shoot up by THREE

HUNDRED AND FORTY FOUR PERCENT is the one I'm properly angry enough to riot over.”-Jake Monroe

#life#real life#uk#human rights#uk news#prime minister#boris johnson#boris jonhosn#member of parliament#house of commons#house of lords#uk economy#brexit#brexitreality#world economy#covid economy#conservative propaganda#conservative government#conservative politics#very important#cost of living

71 notes

·

View notes

Text

World faces food emergency as Ukraine war compounds hunger crisis

Russia’s invasion of Ukraine means the food inflation that’s been plaguing global consumers is now tipping into a full-blown crisis, potentially outstripping even the pandemic’s blow and pushing millions more into hunger.

Together, Russia and Ukraine account for a whopping portion of the world’s agricultural supplies, exporting so much wheat, corn, sunflower oil and other foods that it adds up to more than a tenth of all calories traded globally. Now, shipments from both countries have virtually dried up.

Commodity markets are soaring — wheat is up about 50% in two weeks and corn just touched a decade high. The surging costs could end up weighing on currencies in emerging markets, where food represents a bigger share of consumer-price baskets. And analysts are predicting export flows will continue to be disrupted for months even if the war were to end tomorrow.

The crisis extends beyond just the impact of grain exports (critical as they are). Russia is also a key supplier for fertilizers. Virtually every major crop in the world depends on inputs like potash and nitrogen, and without a steady stream, farmers will have a harder time growing everything from coffee to rice and soybeans.

graphPlainly speaking, there are few other places on the planet where a conflict like this could create such a devastating blow to ensuring that food supplies stay plentiful and affordable. It’s why Russia and Ukraine are known as the breadbaskets to the world. “It’s an amazing food shock,” said Abdolreza Abbassian, an independent market analyst and a former senior economist at the United Nations' Food and Agriculture Organization. “I don’t know of a situation like this in the 30 years I was involved in this sector.”

The shock is already reverberating across the world.

In Brazil, another agricultural powerhouse, farmers can’t get the fertilizers they need because retailers are reluctant to provide price quotes. In China, one of the world’s biggest food importers, buyers are snapping up purchases of U.S. corn and soybean supplies amid concerns that fewer crop shipments from Russia and Ukraine could set off a global scramble for grains. In Egypt, people are worried that prices for the subsidized loaves of bread they depend on could rise for the first time in four decades, while footage of citizens in Turkey trying to grab tins of cheaper oil went viral. And within Ukraine itself, food is running short in some major cities.

Read more

#russia ukraine war#food crisis#hunger crisis#ukraine war food crisis#food crisis ukraine war#russia ukraine war economical impact

12 notes

·

View notes

Text

How much was one ryo during the late Edo period?

During the late Edo, 1 ryo was 18 grams of gold. Japanese currency around Edo then subdivided: 1 ryo = 4 bu = 16 shu. Around the Kyoto-Osaka region silver was used rather than gold. The standard currency was monme. One monme was worth 3.76 grams. 1 monme could be divided into 10 fun or 100 rin. 60 monme would make 1 ryo.

Throughout the Edo period the exchange rate between silver and gold remained relatively stable. But not all regions used the same currency and prices could fluctuate quite a bit. Copper currency (called mon) was used throughout Japan. But it was rapidly declining in value throughout the nineteenth century. According to Teruko Craig, translator of Musui's Story, "in 1805 one could buy a decent lunch of mushrooms, pickles, rice, and soup for 100 copper mon." She lists the price of 4000 mon equaling 60 monme or 1 ryo. By the 1830s 1 ryo was worth 6,500 mon.

Craig goes on to say that by 1825 "1 koku of rice sold for about 63 silver monme. 1.8 litres of salt was 32 mon; 10 [radish] 258 mon; 10 peaches 15 mon; 10 pears 70 mon; 6 apples 32 mon; and a bunch of carrots 5 mon." An adult could use a bathhouse for 8 mon and a child could do the same for 5 mon. By 1835, a person could buy 1 1/2 yards of wool cloth for 6 1/2 ryo.

Craig says that a carpenter would earn between 420 to 450 mon a day, which she says was considered a "decent wage." However, by 1866 the copper currency had devalued enough that it took 7,000 mon to make 1 ryo. A trip to the bathhouse cost 16 mon.

I'm unsure how you could translate that into the modern day. I'm no economist and I don't really want to inflation adjust a foreign currency 150 years. However, knowing the price of everyday goods and services should give you an approximate idea of how valuable a ryo was.

...

Edo period Japan went through a series of monetary crises due to the lack of understanding of economic principles by the Tokugawa Shogunate, a horrible budget situation... and also a desire to centralize power away from the daimyo. Inflation was seen as a way of indirectly taxing the daimyo, which they couldn't do directly for various reasons.

A koku was nominally the amount of rice needed to feed a man for a year (330 pounds of rice), but the actual value of that fluctuated from year to year. (If there's a famine, then a year's worth of rice can buy a lot more other stuff.) A ryo (which was a gold coin) was originally worth four koku, and then debased to one koku.

So how much was it worth? Direct comparison in modern terms is impossible, but we can try.

If based on the rice standard, it is worth 330 pounds x .50 dollars per pound (wholesale is around 20c, full retail one dollar per pound) = $165.

If based on the gold content instead, it had around 9 grams of gold due to debasement. So 9 grams x $42/gram = $378

If we exchanged the ryo for 200 grams of silver or so, then it would be worth 200 grams x .66 dollars per gram = $132.

According to the Wikipedia page for it (http://en.wikipedia.org/wiki/Ry%C5%8D_(currency_unit)) in modern terms it was worth somewhere between $30 and $4000. It's a pretty wide ballpark, but that's kind of how it is.

If you're interested in the subject, The Dog Shogun goes into the reasons for the economic crisis.

3 notes

·

View notes

Text

How to Analyze the Impact of Inflation by Extracting Grocery Price Data from US Retailers?

Like an unseen current, inflation silently shapes economic landscapes, gradually eroding consumer purchasing power while making its mark on diverse industries. Elevated costs, hiring delays, and stagnant earnings pose substantial business challenges. One sector susceptible to inflation's effects is the grocery industry, where the potential for rising prices can weigh heavily on the minds of average consumers.

Rising Inflation: A Catalyst for Changing Shopping Dynamics

Over the past year and beyond, the United States has witnessed a pronounced uptick in inflation, sparking concerns and altering how we approach essential purchases. The price surge denotes the escalating raw materials, transportation, and labor costs. Further complicating matters, disruptions in global supply chains and fluctuations in currency exchange rates amplify the situation's complexity, weaving an intricate tapestry of interdependencies.

Navigating Inflation: Strategies Of Prominent E-Retailers

After extracting grocery price data, we took a comprehensive analysis to grasp the scale of this phenomenon among leading e-retailers, focusing on four major retail giants: Walmart, Amazon, Target, and Kroger.

the prolonged period of elevated prices and the potential macroeconomic pressures, the retailer adopts a cautious stance. In contrast, Amazon's eCommerce division experienced a significant shift, reporting a net loss of $2.7 billion in 2022, diverging starkly from the $33.4 billion profit of the prior year.

Amid these intricate circumstances, comprehending trends in grocery pricing and the accompanying strategies becomes paramount for online and brick-and-mortar retailers. Successfully navigating and thriving within the current economic landscape hinges on a nuanced understanding of these dynamics. Analyzing pricing trends using grocery data scraping services offer invaluable insights into how these corporate giants adeptly steer through the challenges posed by the grocery industry in the face of inflation's backdrop.

Methodology Of Our Research

The foundation of our analysis comprised a comprehensive assortment of products, spanning the spectrum from pantry essentials like flour and rice to perishable items such as dairy and produce. It encompassed approximately 600 Stock Keeping Units (SKUs) meticulously matched across Amazon, Kroger, Target, and Walmart. The data collection using product data scraping spanned January 2022 to February 2023.

Furthermore, we examined the pricing dynamics using web scraping retail websites data for a smaller subset of over 30 high-demand daily essentials. These particular items hold the potential to generate elevated sales and margins for the retailers in focus.

Insights Into Average Selling Prices Of Grocery Items

Our thorough analysis uncovered notable trends in the average selling prices of various grocery products. Among the retailers studied, Walmart consistently emerged as the front-runner in offering the most competitive prices. Price monitoring showed that there were around 8% lower than its closest competitor, Target. Despite an annual price increment of roughly 5%, Walmart's strategy prioritized "stability and predictability." This strategic approach yields results, as evidenced by the retailer's 8% growth in the last quarter. Nevertheless, it is essential to recognize that while this strategy brings benefits, it might exert pressure on Walmart's profit margins concurrently.

Strategies To Navigate Inflationary Pressures

In response to the challenges posed by inflation, Walmart is adopting a measured approach to growth while concurrently concentrating on safeguarding profit margins. Sources indicate that the retailer has negotiated with consumer packaged goods (CPG) manufacturers, pushing back against price hikes aimed at offsetting inflation-driven cost pressures early in 2023. Notably, part of Walmart's growth and heightened sales to an unexpected trend—higher-income households, facing diminishing spending power, now actively seek deals and discounts at Walmart.

Amazon's Surprising Pricing Position

Contrary to common consumer perception associating Amazon with the most budget-friendly prices, data reveals a different narrative. Amazon emerges as the highest-priced retailer among the ones studied, with Kroger following closely. Over the year, Kroger implemented a 10% price increase. Despite this, Amazon maintains its strong market standing, charging prices 12% to 18% higher than Walmart's for groceries. Amazon sustained its success even as its online sales dipped by 4%, and the year 2022 witnessed a substantial 9% surge in revenue from third-party seller services, encompassing aspects like warehousing, packaging, and delivery. Amazon's robust logistics and same-day delivery capabilities confer a distinct competitive edge, bolstering revenue growth and preserving margins. This scenario allows Walmart and other retailers to increase prices while upholding their competitive pricing positions.

Kroger's Premium Perception Strategy

Kroger, in contrast, appears to be cultivating a premium price perception. The retailer has consistently pursued a strategy of raising prices, a trend evident across nearly every month. This approach places Kroger's pricing strategy closer to Amazon's tactics.

Analyzing High-Volume Daily Staples Pricing

Recognizing that pricing strategies can vary across product categories, our analysis delved deeper into a narrower subset of over 30 high-demand daily staples offered by different retailers. This subset encompasses baked goods, popular beverages, canned foods, frozen meals, dairy products, cereals, detergents, and similar essentials. By focusing on this subset, we gain a more granular understanding of how retailers adapt their pricing strategies to different types of products.

Walmart's Strategic Positioning Amidst Inflation

By perceiving the influence of inflation significantly, Walmart has steadfastly maintained its position as the price leader, possibly intending to augment its margins through higher sales volume.

Narrowing Price Disparity Among Retailers

The variance in prices across retailers in this context is understandably narrower, with Amazon and Kroger closely aligning their average prices with Walmart's.

Target's Peculiar Pricing Strategy

Distinctively, Target's pricing strategy distinguishes itself by consistently emerging as the highest-priced retailer for daily essentials, despite ranking among the more affordable retailers for a broader spectrum of grocery items. This anomaly implies that Target's underlying technological approach might need to be more finely tuned to adapt to market dynamics than other prominent retailers. It might be prudent for Target to bolster efforts in meticulously tracking pricing within this sub-category.

Data-Driven Solutions For Navigating Complexity

Amid a challenging economic landscape, retailers and grocery establishments must sustain their revenues and margins. A vital component of achieving this lies in embracing an all-encompassing and adaptable pricing strategy. An acute awareness of which product categories are witnessing price escalations among competitors can equip retailers with the insights needed to make well-informed pricing decisions at the category and individual product levels.

Rather than implementing sweeping price hikes that could undermine customer trust, retailers should balance margin performance and consumer willingness to pay. Navigating price adjustments can be intricate for both customers and sellers. Those retailers that adopt an approach fueled by data and insights stand a higher chance of success in this endeavor.

Product Data Scrape is committed to upholding the utmost standards of ethical conduct across our Competitor Price Monitoring Services and Mobile App Data Scraping operations. With a global presence across multiple offices, we meet our customers' diverse needs with excellence and integrity.

#ExtractingGroceryPriceDataFromUS#GroceryDataScrapingServices#ScrapeGroceryPriceData#ScrapeGroceryPriceDataFromUS#ScrapeAmazonGroceryData#ScrapeKrogerGroceryData#WebScrapingRetailWebsitesData

0 notes

Text

In a first, govt directs rice sector to cut domestic prices

The Union government has taken action on Monday to address the issue of prices and profiteering in the rice industry. They have instructed associations, within the industry to lower the prices of basmati rice to reasonable levels and put an end to unfair practices.

In a statement released on Monday the government emphasized the need for rice processors to reduce prices in the market and ensure that profiteering is stopped. The directive came after a meeting between food secretary Sanjeev Chopra and representatives from the rice processing industry, where they discussed the factors influencing basmati rice prices within India.

Krishi App

The government highlighted that there is a supply of good quality rice which is being sold through the open market sales scheme (OMS) at ₹29 per kg to traders and processors.

Krishi App

This directive was issued after the food ministry discovered that retail prices for rice ranged between ₹43 and ₹50 per kg. In an effort to improve availability and affordability within India, exports of. White rice were banned in July accompanied by a 20% export duty on parboiled rice. Additionally a minimum export price of $950, per tonne was set for basmati in October with the aim of reducing exports.

The meeting discussed these matters extensively as stated in a government statement.

Despite the kharif crop there are stocks held by the Food Corporation of India (FCI) and in transit. Despite regulations, on rice exports prices have increased.

Food ministry said that in the past two years, rice's annual inflation rate is about 12 percent, and this is trouble.

Passing the benefit of the lower prices on to end consumers as soon as possible was discussed at the meeting.

The associations with the largest numbers of members have been urged to convince them to immediately reduce the retail price of rise.

The statement continued: We've read news of a big jump in perspective margins for wholesalers and retails. Some control is needed here.

Besides, a proposal was put forward that if the difference between the MRP and the actual retail price is big, this has to be brought down to an appropriate level to safeguard consumers 'interests, the spokesperson said.

Differing with the government ’ s order, in the meeting grain merchant Naresh Gupta said, “ The government has fixed a reserve prize of ₹2800 per quintal. But the rice procured through OMSS is unsaleable. We ’ ve requested the government to reduce the reserve price to ₹2700 per quintal.

Gupta, who is president of Delhi Grain Merchant Association (DGMA) said, “the government has to follow up on the retail rice sellers as they are selling the rice at ₹ 43 per kg to ₹ 53 per kg after including Goods and Services Tax (GST) on this food item.

Since India imposed export bans on broken variety rice in September 2022 and non-basmati white rice in July 2023, it has been exporting rice to its strategic partners in Asia and Africa. The aim of the export ban is to prevent prices from going wild.

In addition, over the past several months the government has exported 2.77 million tonnes (mt) of non-basmati white rice to 14 major Asian and African countries including Singapore, Nepal, Malaysia and the Philippines.

youtube

0 notes

Text

B2B Agriculture Business Optimization

Farm2Fam goals to create awareness concerning the capacity of the human body to heal itself with natural diet. Their intention to make use of expertise together with traditional Indian agricultural strategies to develop area of interest nutritional merchandise. Using know-how, they intend to create an efficient and efficient platform for agri-lands that may get rid of the middlemen who inflate the prices. The agriculture-expertise segment has recorded growing interest from strategic players and buyers, especially influence buyers. Players within the house search to address gaps in India’s current agricultural processes, as well as provide honest economic incentives to farmers and different members of the ecosystem.

Built on high-tech angular expertise, agritech company Khetigaadi portal is as protected as an online banking portal. To make the platform user pleasant for the farmers, Khetigaadi has made it out there as an App in 10 languages and the company's web site could be considered in three different languages, English, Hindi and Marathi. The idea is techno-savvy and compatible with iOS as well as Android. However, over 40% of these startup founders still discover it tough to rise funds and achieve investor confidence. Agritech based options take time to scale and require a mindset change from VCs. This is particularly true in B2B segments where payment cycles are long.

The most important ones embrace pre-cleaning, husk removing, sprucing and so on. Depending upon the processing capability of such a agro business unit, it is important to resolve the world of agricultural land in acres required for numerous operations. In addition, the land should have elevation from the ground, as low-lying areas usually are not suitable for processing. Another important issue is that the area B2B Agriculture you select must be well-related to the road and will have proper drainage system. The international locations like India, where agriculture is the primary occupation, the advantages of setting up a rice mill may be easily understood. Rice is among the prime staple foods in India and big portions of various varieties are exported to completely different nations.

As said above, FDI in multi-brand retail is proscribed by numerous features. First of all, the particular State/UT has allowed the FDI in multi-model retail trading. Secondly, solely fifty one% FDI is allowed that too only after the approval of the federal government.

Put your inventory administration worries to rest and belief India’s leading B2B marketplace for offering you with the very best quality provides at inexpensive prices. Businesses can optimize their margins by stocking provides at inexpensive charges with the help of annual rate contracts. ARCs may help businesses in de-risking value fluctuation challenges. Choose from an intensive range of LED lighting options from manufacturers similar to Bajaj, Wipro, Syska, Havells and many extra on our online market. Get better lumination in your houses, workplaces and work areas by opting for quality LED lights and lamps. The startup has raised a total funding of $200K from names like Artesian VC, Zeroth.AL, Mistletoe and Mind Fund amongst others.

It permits farm businesses to take advantage of real-time information and insight from farms with the assistance of an accurate view of their operation all through the rising season and to improve financial, operational and agronomy features. Cropin makes use of slicing-edge technologies, Big Data analytics, Artificial Intelligence, Geo-tagging & Satellite monitoring to revolutionize the agri-ecosystem. The startup advices farmers on the correct quantity of inputs to use for optimum yield. They started in the niche space of providing Farm Management-as-a-Service whereby, a farmer will get to outsource his whole measurement, manufacturing administration and determination-making processes to a Service.

Despite these measures there is a lot to do on the insurance policies related to monetary, data and incubation of these startups. As per the report, India ought to work on its data sharing policies and fashions and introduce catalytic/ micro funds within the vary of $2-$14 million to hurry up innovation. Drone know-how, IoT sensors, image sensing and remote crop monitoring are helping these businesses scale.

Updating my business on tradeindia has confirmed a wonderful choice of mine, we have increased our merchandise supply, business presence and clientele available in the market. Indian market is dominated with many small retailers and business. If foreign investment in multi-brand retail is to be permitted, then the enterprise of these small store house owners shall be in peril. Consumers might be spoilt with choices and due to excessive competitions, prices will go down, thus these multi-model retail institution shall be ready attract customers at a big scale. Shakedeal believes in providing the most effective service and shopping expertise to its prospects.

All prime brands underneath a single roof, high quality assured products and value for money provides make it the largest B2B market amongst all B2B suppliers. Avail finest prices when you store online at India’s main B2B E-commerce Portal. Also, get the providers of our best dealer and distributor network in prime cities corresponding to Delhi NCR, Mumbai, Chennai, Bengaluru, Kolkata, Chennai, Pune, Jaipur, Hyderabad and Ahmedabad. Waycool Logo | Agriculture Startups in IndiaWaycool is India’s quickest growing food distribution firm that has a community for 35,000 farmers throughout greens, fruits, rice, pulses and different meals merchandise. It was established in July 2015 with the aim of fixing the disorganized perishable provide chain.

2 notes

·

View notes