#ratio where ever the auction was held

Text

there should be an event where we can yank little origami birds of the characters out of weird places

#yank aven out of those weird atms#black swan and acheron in the hotel#sunday and robin in the dewlight pavilion#misha and Gallagher in dreamflux reef#honkai star rail#hsr#aventurine#black swan hsr#robin#ratio where ever the auction was held

53 notes

·

View notes

Photo

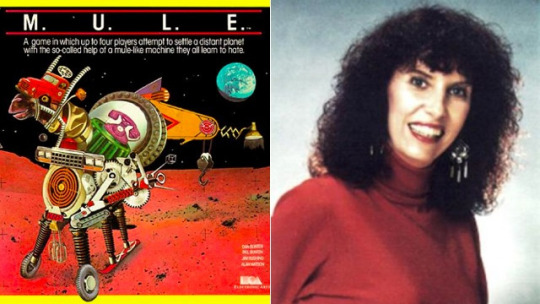

Danielle Bunten Berry (February 19, 1949 – July 3, 1998), formerly known as Dan Bunten, was an American game designer and programmer, known for the 1983 game M.U.L.E., one of the first influential multiplayer video games, and 1984's The Seven Cities of Gold.

In 1998, she was awarded the Lifetime Achievement Award by the Computer Game Developers Association. In 2007, the Academy of Interactive Arts & Sciences chose Bunten as the 10th inductee into its Hall of Fame.

Bunten was born in St. Louis, Missouri and moved to Little Rock, Arkansas as a junior in high school. She was the oldest of six siblings. While growing up in Little Rock, Bunten's family didn't always have enough money to make ends meet, so Bunten took a job at a pharmacy. She also held a leadership role with the Boy Scouts.

According to Bunten, one of her fondest childhood memories involved playing games with her family. She was quoted saying, “When I was a kid, the only times my family spent together that weren’t totally dysfunctional were when we were playing games. Consequently, I believe games are a wonderful way to socialize.”

While attending the University of Arkansas, she opened up her own bike shop called Highroller Cyclerie. Bunten acquired a degree in industrial engineering in 1974 and started programming text-based video games as a hobby. After she graduated from college, she was employed by the National Science Foundation, where she created urban models before starting a job at a video game company.

In 1978, Bunten sold a real-time auction game for the Apple II titled Wheeler Dealers to a Canadian software company, Speakeasy Software. This early multiplayer game required a custom controller, raising its price to USD$35 in an era of $15 games sold in plastic bags. It sold only 50 copies.

After producing three titles for SSI, Bunten, who by then had founded a software company called Ozark Softscape, caught the attention of Electronic Arts founder Trip Hawkins. M.U.L.E. was Bunten's first game for EA, originally published for the Atari 8-bit family because the Atari 800 had four controller ports. Bunten later ported it to the Commodore 64. While its sales - 30,000 units - were not high, the game developed a cult following and was widely pirated. The game setting was inspired by the novel Time Enough for Love by Robert A. Heinlein.

Along with the success of M.U.L.E., Berry also had close ties with the games Robot Rascals, Heart of Africa, and Cartels & Cutthroat$. Throughout her career, she was involved in the creation of 12 games, 10 of which revolved around multiplayer compatibility. The only two which didn't have a multiplayer focus were Seven Cities of Gold and Heart of Africa.

Bunten wanted to follow up M.U.L.E. with a game that would have been similar to the later game Civilization, but after fellow Ozark Softscape partners balked at the idea, Bunten followed with The Seven Cities of Gold, which proved popular because of its simplicity. By the time the continent data were stored in the computer's memory, there was little left for fancy graphics or complex gameplay - the game had only five resources. It was a hit, selling more than 150,000 copies.

The follow-up game, Heart of Africa, appeared in 1985 and was followed by Robot Rascals, a combination computer/card game that had no single-player mode and sold only 9,000 copies, and 1988's Modem Wars, one of the early games played by two players over a dial-up modem. Modem Wars was ahead of its time, as few people in the late 1980s had modems in their homes.

Bunten departed EA for MicroProse. Allegedly, Trip Hawkins, CEO of EA, did not feel that pushing production of games onto a cartridge based system was a good idea. The shift was important to Bunten, as computer games had previously been distributed on floppy discs, and a changeover to a cartridge system would allow games to be played on Nintendo systems. This was a significant factor in her decision to leave. She then developed a computer version of the board game Axis and Allies, which became 1990's Command HQ, a modem/network grand strategy wargame. Bunten's second and last game for MicroProse was 1992's Global Conquest, a 4-player network/modem war game. It was the first 4-player network game from a major publisher. Bunten was a strong advocate of multi-player online games, observing that, "No one ever said on their deathbed, 'Gee, I wish I had spent more time alone with my computer.'"

A port of M.U.L.E. to the Mega Drive/Genesis was cancelled after Bunten refused to put guns and bombs in the game, feeling it would alter the game too much from its original concept. In 1997, Bunten shifted focus to multiplayer games over the Internet with Warsport, a remake of Modem Wars that debuted on the MPlayer.com game network.

Less than a year after the release of Warsport, Bunten was diagnosed with lung cancer presumably related to years of heavy smoking. She died on July 3, 1998. At the time, she was working on the design of an Internet version of M.U.L.E..

The game's primary premise consisted of players playing with and against one another to establish total control over a planet. The name of the game stands for Multiple Use Labor Element. The game was originally made for the Atari 400 and Atari 800 but was later developed to be compatible with the Commodore 64, NES, and IBM pcjr. The game has a maximum of four players. Players are given different options and choices, and are allowed to create their colony the way they see fit. This can be done by changing races and giving respective colonies different advantages that will impact the way the game is played and determined later on down the line.

Ultimately there are two ways in which players can win the game. The first way is by having the most amount of money out of all four players, and the second way is by being able to survive the colony itself. The game focuses heavily on going out and retrieving resources that can be used to benefit their character. Items such as food, energy, and crystite are some of a number of in-game items that players are able to retrieve and use to better themselves. In order for a player to be able to access these items, they will first have to have access to a M.U.L.E. The acquisition of these items has a direct reflection on what the player will be allowed to do. For example, if a player doesn't have enough food, they will have less time during their turn.

The Seven Cities of Gold was originally intended to be another multiplayer game. It was originally a single player format, focused heavily on having the players travel around the map and collect items to help them strengthen their colony. Once they felt as though they had a solid colony, the players could battle each other to see who could overtake who After much consideration, Ozark Software came to the conclusion that this would not be doable. Instead, they went with a formula that had the game focus solely on developing a colony.

Ozark Softscape was a computer game development team consisting initially of Danielle Bunten, her brother Bill Bunten, Jim Rushing, and Alan Watson. Ozark was run out of Bunten's basement. The company was based out of Little Rock, Arkansas and had profound success with a few of their early titles. Ozark Softscape had a publishing deal with Electronic Arts for several of its groundbreaking games. In the early 1990s, Ozark Softscape left its partnership with Electronic Arts over a dispute to port some games to cartridge format for the Nintendo Entertainment System. It began a partnership with MicroProse to produce two more titles: Command HQ and Global Conquest. A dispute occurred over creating a follow-up to M.U.L.E. with Sega in 1993, and the company dissolved. The employees of Ozark Softscape moved to different areas of the software industry.

Bunten was married three times. Bunten had three children, one daughter and two sons. After a third divorce, Bunten, who had until then been living as male, transitioned to living as a woman. Bunten underwent sex reassignment surgery in November 1992 and afterward kept a lower profile in the games industry. Bunten later regretted having surgery, finding that for her, the drawbacks of surgical transition outweighed the benefits, and wishing she had considered alternative approaches. She joked that the surgery was to improve the video game industry's male/female ratio and aesthetics, but advised others considering a sex change not to proceed unless there was no alternative and warned them of the cost, saying "Being my 'real self' could have included having a penis and including more femininity in whatever forms made sense. I didn't know that until too late and now I have to make the best of the life I've stumbled into. I just wish I would have tried more options before I jumped off the precipice."

After her transition in fall 1992, Bunten stayed out of the video game spotlight, mostly keeping to herself. She felt as though that after transitioning she was not as good at video game development as she had previously been, stating "So, I'm a little more than three years into my new life role as Ms. Danielle Berry, and her career looks to be somewhat different from old Mr. Dan Bunten's. For one thing, I'm not as good a programmer as he was." On July 3, 1998, Berry died of lung cancer.

Wheeler Dealers (1978)

Cartels & Cutthroats (1981)

Computer Quarterback (1981)

Cytron Masters (1982)

M.U.L.E. (1983)

The Seven Cities of Gold (1984)

Heart of Africa (1985)

Robot Rascals (1986)

Modem Wars (1988)

Command HQ (1990)

Global Conquest (1992)

Warsport (1997)

Although many of Bunten's titles were not commercially successful, they were widely recognized by the industry as being ahead of their time. On May 7, 1998, less than two months before her death, Berry was awarded the Lifetime Achievement Award by the Computer Game Developers Association.

In 2000, Will Wright dedicated his blockbuster hit The Sims to Bunten's memory. In 2007, the Academy of Interactive Arts & Sciences chose Bunten to be inducted into its Hall of Fame. Sid Meier, the mastermind behind the video game series Civilization, inducted her at the Hard Rock Hotel in Las Vegas.

Bunten was a true pioneer for the video game industry, especially its multiplayer aspect of it. She is regarded by many as one of the best designers to ever grace the video game industry. Her success has even led people to make the claim that the work she did with games like M.U.L.E and Seven Cities of Gold was the inspiration behind highly successful modern multiplayer games like World of Warcraft.

Bunten was known as someone who was very easy to talk to. If someone recognized her in public, she would be more than delighted to have a conversation with them.

#transgender#transition#postop transwomen#transwoman#transwomenmatter#computer programmer#mtf vaginoplasy#mtf breast implants#srs#rest in peace

46 notes

·

View notes

Text

Colored diamond soaring prices: A growing demographic of ultra rich investors

– In November 2015 at a Geneva auction, the 12.03-carat Blue Moon sells for nearly $50 million

– the only diamond to ever sell for more than $4 million per carat. – In spring 2016, a Geneva-based fund manager famously purchases a highly rare colored diamond, a vivid orange, at the price of $1 million per carat.

– In May 2016, a 14.62-carat blue diamond sells for $57.5 million at another Geneva auction, becoming the most expensive diamond in the world ever to be purchased in auction.

In just the last two years, these are some of the high profile, high price colored diamond purchases that have made the news, and behind these headlines are an indication of the trends that signal good news for those considering investing in colored diamonds.

In this article, we’re going to explore recent trends reflecting the increased popularity of colored diamonds and investments, and what they mean for colored diamond investments in the future.

Colored Diamonds: Soaring prices and solid ROI

Prices paid at auctions are considerably over initial valuations, and colored diamond prices risen 122% in the last ten years, on average.

On the higher end of the spectrum, the price of extremely rare colored diamonds such as pink stones increased 180%. On the lower end, for more affordable colored diamonds such as blue and yellow, prices are up by around 70% and 90%, respectively, over the same period.

A transforming market of elite investors

It’s clear the marketplace has transformed. One of the drivers is a surge in loose colored diamonds being purchased as investments, to serve as discreet, valuable, and lucrative assets. Ultra rich investors are counting on the forecasted growth of colored diamond values and the relatively stability of these “recession proof investments” to bank on considerable profits with low risk.

Investors include professionals and funds investing on behalf of ultra rich clients who buy colored diamonds as alternative investments. This new demographic of investors has significantly expanded the diamond market, traditionally dominated by rare gem collectors and connoisseurs

Alternative investments and passion funds

China in particular is seeing a growth in the ranks of newly made and young millionaires, who are on average under 40 years old. These youthful, nouveau riche investors don’t only want to secure their wealth, they want to do so in style.

They’re investing increasingly in what are coming to be called “passion funds”, long-term investments in tangible and usually rare assets. These investments appreciate over time and are generally safeguarded against unpredictable inflation or market fluctuations.

Passion fund goods include fine wines, works of art, collectible musical instruments, as well as rare colored diamonds. In addition to guaranteeing high returns, part of the enticement of these niche investments is that they are luxurious and reflect the social status of their owners.

A significant advantage of diamonds over other passion fund investments is that they are an asset that investors can actually use and enjoy at no cost or depreciation to the asset itself.

Due to the nature of collectables, assets are largely valued for their rarity and limited supply. As one of the world’s rarest commodities, it’s no wonder that Fancy Colored diamonds are where an increasing number of wealthy investors are choosing to put their money.

Rare resources, rising values

Fancy colored diamonds are extremely rare, and much more so than white or colorless diamonds. According to the GIA, only 1 carat of colored diamonds is found for every 100,000 carats of colorless diamonds mined. Amongst these, some rare colored diamonds are so uncommon, such as the coveted red diamond, that few have ever been seen on the market. The GIA laboratory did not come across a single red diamond between 1957 and 1987.

In the uncommon instances that one comes across this rare colored diamond on the market, prices are extremely high, and the stones are typically purchased at auctions for amounts staggeringly above their pre-sale valuation.

The investment forecast of diamonds predicts that valuations are only set to rise as diamond production is set to to drop significantly within the next 20 years.

As diamonds are a non-renewable resource, a precious mineral formed through millions of years of creation, the availability of diamonds on the market is dependent on existing deposits, which are being depleted at a much faster rate than there are being renewed.

Unless new mines are discovered in the near future, colored diamonds will be even more rare than they are now – and considerably more valuable.

Air of allure and a secret society

The unique and uncommon nature of colored diamonds is underscored and enhanced by the secrecy surrounding a rare colored diamond when it appears on the market.

Only 15% of colored diamonds for sale are purchased at auctions. In many mines, the best colored diamonds, typically around only 50 annually, are sold through sealed bids in an annual tender.

Investors must be invited to the viewings, which are held at secret locations in London, New York, and Hong Kong. These secret viewings of the world’s most expensive colored diamonds create a covert ultra niche market accessible only by the initiated – which significantly enhances the stone’s allure and perceived value.

Adding even more to the air of mystery surrounding these purchases, investors are allowed to examine the stone for sale one by one, in a hidden, windowless room, reinforcing the atmosphere of being members of a secret society.

To be a part of this growing buyer’s club for the world’s most valuable diamonds, one must be a part of the initiated elite – a much sought after status in the growing ranks of the super rich.

Private purchases, anonymous ownership

The discretion and anonymity that surrounds the viewings, and which are so valued by the often immensely private ultra rich investors, continues throughout the purchase process.

Diamonds are an extremely discreet investment: transactions don’t need to be registered with government agencies or financial institutions. Ownership can even be anonymous if the investor so prefers.

Additionally, Fancy color diamonds are easy to transport privately. Diamonds have a high size to value ratio: as they are so small, they are highly portable, which makes it easy to transfer wealth.

___

However, investing in diamonds is a complex decision. Learn more about each colored diamond in our diamond education articles, or consider speaking to our investment experts for pre and post valuation services.

If you’ve made up your mind to join the club of elite investors seeking recession proof investments, get one step closer to your invaluable investment with Asteria invest.

The post Colored diamond soaring prices: A growing demographic of ultra rich investors appeared first on Asteria Magazine.

source https://www.asteriadiamonds.com/blog/2018/12/18/%e2%80%8bcolored-diamond-soaring-prices-a-growing-demographic-of-ultra-rich-investors/

source https://asteriadiamonds1.tumblr.com/post/181217421445

0 notes

Text

Colored diamond soaring prices: A growing demographic of ultra rich investors

– In November 2015 at a Geneva auction, the 12.03-carat Blue Moon sells for nearly $50 million

– the only diamond to ever sell for more than $4 million per carat. – In spring 2016, a Geneva-based fund manager famously purchases a highly rare colored diamond, a vivid orange, at the price of $1 million per carat.

– In May 2016, a 14.62-carat blue diamond sells for $57.5 million at another Geneva auction, becoming the most expensive diamond in the world ever to be purchased in auction.

In just the last two years, these are some of the high profile, high price colored diamond purchases that have made the news, and behind these headlines are an indication of the trends that signal good news for those considering investing in colored diamonds.

In this article, we’re going to explore recent trends reflecting the increased popularity of colored diamonds and investments, and what they mean for colored diamond investments in the future.

Colored Diamonds: Soaring prices and solid ROI

Prices paid at auctions are considerably over initial valuations, and colored diamond prices risen 122% in the last ten years, on average.

On the higher end of the spectrum, the price of extremely rare colored diamonds such as pink stones increased 180%. On the lower end, for more affordable colored diamonds such as blue and yellow, prices are up by around 70% and 90%, respectively, over the same period.

A transforming market of elite investors

It’s clear the marketplace has transformed. One of the drivers is a surge in loose colored diamonds being purchased as investments, to serve as discreet, valuable, and lucrative assets. Ultra rich investors are counting on the forecasted growth of colored diamond values and the relatively stability of these “recession proof investments” to bank on considerable profits with low risk.

Investors include professionals and funds investing on behalf of ultra rich clients who buy colored diamonds as alternative investments. This new demographic of investors has significantly expanded the diamond market, traditionally dominated by rare gem collectors and connoisseurs

Alternative investments and passion funds

China in particular is seeing a growth in the ranks of newly made and young millionaires, who are on average under 40 years old. These youthful, nouveau riche investors don’t only want to secure their wealth, they want to do so in style.

They’re investing increasingly in what are coming to be called “passion funds”, long-term investments in tangible and usually rare assets. These investments appreciate over time and are generally safeguarded against unpredictable inflation or market fluctuations.

Passion fund goods include fine wines, works of art, collectible musical instruments, as well as rare colored diamonds. In addition to guaranteeing high returns, part of the enticement of these niche investments is that they are luxurious and reflect the social status of their owners.

A significant advantage of diamonds over other passion fund investments is that they are an asset that investors can actually use and enjoy at no cost or depreciation to the asset itself.

Due to the nature of collectables, assets are largely valued for their rarity and limited supply. As one of the world’s rarest commodities, it’s no wonder that Fancy Colored diamonds are where an increasing number of wealthy investors are choosing to put their money.

Rare resources, rising values

Fancy colored diamonds are extremely rare, and much more so than white or colorless diamonds. According to the GIA, only 1 carat of colored diamonds is found for every 100,000 carats of colorless diamonds mined. Amongst these, some rare colored diamonds are so uncommon, such as the coveted red diamond, that few have ever been seen on the market. The GIA laboratory did not come across a single red diamond between 1957 and 1987.

In the uncommon instances that one comes across this rare colored diamond on the market, prices are extremely high, and the stones are typically purchased at auctions for amounts staggeringly above their pre-sale valuation.

The investment forecast of diamonds predicts that valuations are only set to rise as diamond production is set to to drop significantly within the next 20 years.

As diamonds are a non-renewable resource, a precious mineral formed through millions of years of creation, the availability of diamonds on the market is dependent on existing deposits, which are being depleted at a much faster rate than there are being renewed.

Unless new mines are discovered in the near future, colored diamonds will be even more rare than they are now – and considerably more valuable.

Air of allure and a secret society

The unique and uncommon nature of colored diamonds is underscored and enhanced by the secrecy surrounding a rare colored diamond when it appears on the market.

Only 15% of colored diamonds for sale are purchased at auctions. In many mines, the best colored diamonds, typically around only 50 annually, are sold through sealed bids in an annual tender.

Investors must be invited to the viewings, which are held at secret locations in London, New York, and Hong Kong. These secret viewings of the world’s most expensive colored diamonds create a covert ultra niche market accessible only by the initiated – which significantly enhances the stone’s allure and perceived value.

Adding even more to the air of mystery surrounding these purchases, investors are allowed to examine the stone for sale one by one, in a hidden, windowless room, reinforcing the atmosphere of being members of a secret society.

To be a part of this growing buyer’s club for the world’s most valuable diamonds, one must be a part of the initiated elite – a much sought after status in the growing ranks of the super rich.

Private purchases, anonymous ownership

The discretion and anonymity that surrounds the viewings, and which are so valued by the often immensely private ultra rich investors, continues throughout the purchase process.

Diamonds are an extremely discreet investment: transactions don’t need to be registered with government agencies or financial institutions. Ownership can even be anonymous if the investor so prefers.

Additionally, Fancy color diamonds are easy to transport privately. Diamonds have a high size to value ratio: as they are so small, they are highly portable, which makes it easy to transfer wealth.

___

However, investing in diamonds is a complex decision. Learn more about each colored diamond in our diamond education articles, or consider speaking to our investment experts for pre and post valuation services.

If you’ve made up your mind to join the club of elite investors seeking recession proof investments, get one step closer to your invaluable investment with Asteria invest.

The post Colored diamond soaring prices: A growing demographic of ultra rich investors appeared first on Asteria Magazine.

Via https://www.asteriadiamonds.com/blog/2018/12/18/%e2%80%8bcolored-diamond-soaring-prices-a-growing-demographic-of-ultra-rich-investors/

source http://asteriadiamonds1.weebly.com/blog/colored-diamond-soaring-prices-a-growing-demographic-of-ultra-rich-investors

0 notes

Text

Colored diamond soaring prices: A growing demographic of ultra rich investors

– In November 2015 at a Geneva auction, the 12.03-carat Blue Moon sells for nearly $50 million

– the only diamond to ever sell for more than $4 million per carat. – In spring 2016, a Geneva-based fund manager famously purchases a highly rare colored diamond, a vivid orange, at the price of $1 million per carat.

– In May 2016, a 14.62-carat blue diamond sells for $57.5 million at another Geneva auction, becoming the most expensive diamond in the world ever to be purchased in auction.

In just the last two years, these are some of the high profile, high price colored diamond purchases that have made the news, and behind these headlines are an indication of the trends that signal good news for those considering investing in colored diamonds.

In this article, we’re going to explore recent trends reflecting the increased popularity of colored diamonds and investments, and what they mean for colored diamond investments in the future.

Colored Diamonds: Soaring prices and solid ROI

Prices paid at auctions are considerably over initial valuations, and colored diamond prices risen 122% in the last ten years, on average.

On the higher end of the spectrum, the price of extremely rare colored diamonds such as pink stones increased 180%. On the lower end, for more affordable colored diamonds such as blue and yellow, prices are up by around 70% and 90%, respectively, over the same period.

A transforming market of elite investors

It’s clear the marketplace has transformed. One of the drivers is a surge in loose colored diamonds being purchased as investments, to serve as discreet, valuable, and lucrative assets. Ultra rich investors are counting on the forecasted growth of colored diamond values and the relatively stability of these “recession proof investments” to bank on considerable profits with low risk.

Investors include professionals and funds investing on behalf of ultra rich clients who buy colored diamonds as alternative investments. This new demographic of investors has significantly expanded the diamond market, traditionally dominated by rare gem collectors and connoisseurs

Alternative investments and passion funds

China in particular is seeing a growth in the ranks of newly made and young millionaires, who are on average under 40 years old. These youthful, nouveau riche investors don’t only want to secure their wealth, they want to do so in style.

They’re investing increasingly in what are coming to be called “passion funds”, long-term investments in tangible and usually rare assets. These investments appreciate over time and are generally safeguarded against unpredictable inflation or market fluctuations.

Passion fund goods include fine wines, works of art, collectible musical instruments, as well as rare colored diamonds. In addition to guaranteeing high returns, part of the enticement of these niche investments is that they are luxurious and reflect the social status of their owners.

A significant advantage of diamonds over other passion fund investments is that they are an asset that investors can actually use and enjoy at no cost or depreciation to the asset itself.

Due to the nature of collectables, assets are largely valued for their rarity and limited supply. As one of the world’s rarest commodities, it’s no wonder that Fancy Colored diamonds are where an increasing number of wealthy investors are choosing to put their money.

Rare resources, rising values

Fancy colored diamonds are extremely rare, and much more so than white or colorless diamonds. According to the GIA, only 1 carat of colored diamonds is found for every 100,000 carats of colorless diamonds mined. Amongst these, some rare colored diamonds are so uncommon, such as the coveted red diamond, that few have ever been seen on the market. The GIA laboratory did not come across a single red diamond between 1957 and 1987.

In the uncommon instances that one comes across this rare colored diamond on the market, prices are extremely high, and the stones are typically purchased at auctions for amounts staggeringly above their pre-sale valuation.

The investment forecast of diamonds predicts that valuations are only set to rise as diamond production is set to to drop significantly within the next 20 years.

As diamonds are a non-renewable resource, a precious mineral formed through millions of years of creation, the availability of diamonds on the market is dependent on existing deposits, which are being depleted at a much faster rate than there are being renewed.

Unless new mines are discovered in the near future, colored diamonds will be even more rare than they are now – and considerably more valuable.

Air of allure and a secret society

The unique and uncommon nature of colored diamonds is underscored and enhanced by the secrecy surrounding a rare colored diamond when it appears on the market.

Only 15% of colored diamonds for sale are purchased at auctions. In many mines, the best colored diamonds, typically around only 50 annually, are sold through sealed bids in an annual tender.

Investors must be invited to the viewings, which are held at secret locations in London, New York, and Hong Kong. These secret viewings of the world’s most expensive colored diamonds create a covert ultra niche market accessible only by the initiated – which significantly enhances the stone’s allure and perceived value.

Adding even more to the air of mystery surrounding these purchases, investors are allowed to examine the stone for sale one by one, in a hidden, windowless room, reinforcing the atmosphere of being members of a secret society.

To be a part of this growing buyer’s club for the world’s most valuable diamonds, one must be a part of the initiated elite – a much sought after status in the growing ranks of the super rich.

Private purchases, anonymous ownership

The discretion and anonymity that surrounds the viewings, and which are so valued by the often immensely private ultra rich investors, continues throughout the purchase process.

Diamonds are an extremely discreet investment: transactions don’t need to be registered with government agencies or financial institutions. Ownership can even be anonymous if the investor so prefers.

Additionally, Fancy color diamonds are easy to transport privately. Diamonds have a high size to value ratio: as they are so small, they are highly portable, which makes it easy to transfer wealth.

___

However, investing in diamonds is a complex decision. Learn more about each colored diamond in our diamond education articles, or consider speaking to our investment experts for pre and post valuation services.

If you’ve made up your mind to join the club of elite investors seeking recession proof investments, get one step closer to your invaluable investment with Asteria invest.

The post Colored diamond soaring prices: A growing demographic of ultra rich investors appeared first on Asteria Magazine.

source https://www.asteriadiamonds.com/blog/2018/12/18/%e2%80%8bcolored-diamond-soaring-prices-a-growing-demographic-of-ultra-rich-investors/

0 notes

Text

Pure Stock Drag Racing: The Way It Ought To Be!

When over a 120 primo muscle cars show up at a drag strip, fun things are going to happen. Especially when any one of these rides could get big money rolling across the auction block at Barrett-Jackson or Mecum. But instead of static displays with the owners obsessively polishing the fenders and using Q-tips to clean off excessive wax build-up on the door jams, we’ve come to a place were the owners are doing high-gear burnouts, getting sideways, and flogging their muscle cars for every last ounce of horsepower.

Where is this mythical place you ask? Well, this is annual Pure Stock Muscle Car Drag Race (PSMCDR) held every September at the Mid-Michigan Motorplex in Stanton, Michigan. If you’ve never heard of PSMCDR, well shame on you. This event has been happening for over 20 years and brings together the largest assortment of muscle cars from the 1950s all the way up to 1979. And not just any muscle cars, we’re talking about rarities and oddities along with the usual cast of bad Mopar dudes like Six Pack Bees, Hemi ’Cudas, and Max Wedge Belvederes.

If you’re afraid of getting dead bugs on your grille, stone chips on the lower quarters, and caked-on tire rubber from doing burnouts on your Redlines or Goodyear Polyglas GTs, then park your muscle car in the pits and watch from stands. Just remember, you’re missing out on participating in one of the coolest racing events ever. It doesn’t matter if your Mopar runs 14s or high 11s, the Pure Drags is one of the last remaining grassroots racing venues that you can have fun, even if your win light doesn’t come on. If you’re looking for a safe and cool event to race your prized Mopar, the Pure Stock Drags is where it’s at.

The basic rules are simple. Any car built from 1955 to 1979 in the United States or Canada with a minimum warranty of 12 months and 12,000 miles is allowed. This eliminates factory lightweight Super Stock package cars like 1965 A990 B-Bodies, 1968 Hemi Barracudas, Darts, and Ford T-Bolts. Also, cars must be factory equipped with a minimum of four-barrel carburetion, dual exhaust, and other factory-installed equipment that promotes a high-performance intent and image. Cars are paired-up based on time trial e.t.’s and compete in a best-of-three heads-up shootout. You see, simple and fun.

There are also safety considerations the event organizers and track put in place. Drivers must wear long pants, cars running 13.99 and quicker must have an approved Snell 2005 helmet and seatbelts, batteries must be secured, and radiators must have an overflow catch can of at least 16 ounces. Also, all accessory belts must be in place and tight to operate the water pump, alternator, and power steering.

That said, if you want to play, don’t think you can show up with a pair of disguised aftermarket aluminum heads painted Hemi orange on your 440 Magnum. The Pure Stock tech guys are very savvy and have seen it all. The competitors also police each other to keep the spirit of “stock.” You know some of these motors have breathed-on induction and are super blueprinted, but show up with a 500 cubic-inch stroker engine, and the PSMCDR organizers will show you the gate.

You must run the stock intake, carb, cylinder heads, block, and other items for the year, make model, claimed. The camshaft must be stock lift but there’s some leeway with the duration. The compression ratios and blueprint specs are very similar to the NHRA Stock Eliminator guidelines. Don’t forget, you’re also limited to a street tire that cannot exceed a 60-Series width. Drag Radials are not allowed, even if “DOT approved” is stamped on the sidewall.

There’s also the 11.50 ET rule that basically says if you run an 11.49 or faster, you’re out of the show. PSMCDR folks feel that by capping the e.t., it’ll prevent cubic dollar competitors from ruining the true nature of the event.

As always, there was a great assortment of cool Mopars wreaking havoc on the Brand X competitors at the 2017 event. So check out our coverage and see Street Hemis, Max Wedges, 440 Six Packs, and high-winding 340s do what they were intended for: destroy the competitor in the next lane.

If you’re looking to get off the lawn chair at the cruise nights and do something fun with your Mopar, next year’s Pure Stock Muscle Car Drag Race is scheduled for September 14 and 15 at the Mid-Michigan Motorplex.

Eric Simpson in his COPO Camaro watch helplessly as Rick Mahoney’s hard charging 1968 Hemi Super Bee goes marching on by with a 11.62 pass to Simpson’s 11.68. Mahoney’s Bee was the number-one qualifier at this year’s Pure Stock Drags and is a real deal Hemi car. That beautiful QQ1 Bright Blue Poly paint is stunning.

For many years, longtime Mopar guru Bob Karakashian made a reputation at the Pure Stock Drags with his strong running 1969 A12 Six Pack Super Bee, however, he parked it and has been flogging his original 1970 Hemi ’Cuda. He was the third fastest Mopar at this year’s event by qualifying with stout 11.73. He was paired against Ken Riebels’ 1966 427 Stingray but the Rat-motored Corvette was no match for the mighty Hemi as Bob won his match up.

Tom Hoover Jr.’s legendary father, Tom Hoover Sr., developed and created the legendary Max Wedge and 426 Hemi for Chrysler back in the day. That’s probably why his 1964 Plymouth Belvedere runs so strong. Both he and his father worked on this car until his father’s passing in 2015. The blue Plymouth, with a 426 Max Wedge for motivation, was the second fastest Mopar with an 11.64 at 121.06. Despite being a Plymouth, there’s some Ramchargers magic under that hood.

We love Chargers, especially 1968s. Dan Kruger from Holland, Michigan, ran a best of 13.57 at 104.66 in his four-speed car. This Charger R/T, complete with the correct 15-inch disc brake wheel covers and Hemi exhaust resonators, could’ve grabbed the OE Gold award at some Mopar shows but instead, Dan was flogging it mercilessly.

Frank Remlinger’s 1969 Dart GTS was probably the strongest-running Mopar small-block at this year’s race. The high-winding 340, breathing through the stock Carter AVS carb and cast-iron intake and exhaust manifolds, turned in an eye-opening 13.16 at 103.89. Here, Frank’s about to put the Pontiac Tempest GT-37 on the trailer.

Old-school tricks still work as Norm VerHage iced-down the intake on his 1969 ’Cuda 440 is search of lower e.t.’s and more mph. It worked. He was able to get the ’Cuda 440 solidly in the 13s with a 13.86 at 97.78. Many of the other Pure Stock competitors were doing the same because of the unseasonably high temps.

Former Mopar NHRA racer Jim Keyes is no stranger Hemi-powered machines. He’s had his 1967 Hemi Coronet R/T since it was new, even racing it in SS/DA with WO components back in the late ’60s and early ’70s. Now in Pure Stock form, Jim had laid down an 11.59 at 119.39 but on the next pass, he violated the 11.50 rule with an 11.48 run and was forced to withdraw from competition. Jim was not happy!

If you want to go fast at the Pure Stocks, bring carburetor jets, a timing light, and tune for the weather/track conditions. Here, Bob Karakashian changes the Carter AFB jets on Michael Kilano’s 1970 Hemi Road Runner.

There’s something about a black Hemi Plymouth GTX we find very sinister. This one belonged to Steve Abbosh and he’s not afraid to grab gears and thrash on it. Steve went 13.42 at 103.11 and like many of his fellow Mopar racers, shut down his competition.

Dave Watt’s 1973 Duster 340 quickly dispelled the myth that smoggers can’t run. His 13.78 at 98.48 was more than ample for him to get the win light and sending his competitor in a classic 1966 Pontiac GTO packing.

Norm VerHage is seen here on a 13-second blast in his 1969 ’Cuda 440. There’s always debate in the Mopar camp on how restrictive the exhaust manifolds are on a big-block A-Body. We don’t care, neither does Norm. He’s just out flogging his combination in search of more speed on a real M-Code 440 ’Cuda.

Pete Papzian’s beautiful 1968 Plymouth GTX, which is a carbon copy of the one used in the 1968 Plymouth brochure, was running consistent 13.50s all weekend with its tuned 440 Super Commando. Pete bought the GTX back when Richard Nixon was President.

Michael Kilano avoided disaster on his Road Runner as the Air Grabber hood was left unlatched on the run against Tom Hoover Jr.’s Max Wedge Plymouth. Michael noticed the hood coming up at half-track, lifted, and aborted the run.

Mike Marple (in orange shirt) does some bench racing with a spectator at the Pure Stock Drags. Mike’s real A12 Road Runner ran consistent 12.30s at 112 but came up just short in competition.

It may look like a restoration showpiece but under that chrome dome air cleaner sits a Ray Barton prepared 426 Hemi that makes over 700 horsepower. Based on the 123 mph trap speed on Mahoney’s 4,000-lb Super Bee, we’d say it’s probably a lot more.

Like most Mopars competing at the Pure Stock Drags, Jim Bowman’s 1969 A12 Six Pack Super Bee is the real deal and is also a four-speed car. Jim is one of the few brave souls to bang gears and if the glove box door pops open on the 1-2 shift, he knows it’s a good run.

Who doesn’t love a good running Mopar small-block? Tom Cannon’s clean 1970 Duster 340 was clicking off mid 13-second times, which is pretty impressive considering Tom was launching off the line and rowing the gears on skinny 70-Series Goodyear Polyglas tires.

Bob Karakashian 1970 Hemi ’Cuda stretches its legs in high gear as he ran almost 118 going through the traps. Did we mention this is a real R-code ’Cuda?

It’s just as much fun hanging out on the top end to watch these Mopar’s pull away from their competitor. Here, Steve Abbosh’s 1969 Hemi GTX shows its taillights to this poor GTO.

The post Pure Stock Drag Racing: The Way It Ought To Be! appeared first on Hot Rod Network.

from Hot Rod Network http://www.hotrod.com/articles/pure-stock-drag-racing-way/

via IFTTT

0 notes

Text

The Most Expensive World Jewels (Part II)

Are you intrigued? Undoubtedly, you want to know which of world jewels occupy the top places in our ranking! So, let’s not argue round and round the subject. Get acquainted – here are the next 10 most expensive jewels of the world.

Perfect Pink Diamond – $23.2 million

Mandatory Credit: Photo by Jonathan Hordle / Rex Features ( 1238641d )

A 24.78 Carat fancy intense pink diamond estimated sale value 27-38 million dollars.

Sotheby’s preview for Geneva sale of Magnificent diamonds, London, Britain – 25 Oct 2010

Due to experts, less than 10% of pink diamonds weighs more than 0.20 carats. Besides, the purity of pink diamonds is real rarity. It is therefore no wonder that the auctioneer gave 23.2 million dollars for the Perfect Pink because the size and color purity of this gem are really ideal.

2. Winston Blue – $23.8 million

This jewelry piece with the weight of 13.22 carats was advertised and sold as the engagement ring. Up to 2014, only several blue diamonds (weighing from 10 to 12 carats) were auctioned off. Therefore, when this huge monster with the weight of 13+ carats appeared on the Christie’s auction in Geneva, the experts considered that it would bring more than $21 million. The history of this diamond is enigmatic, but most of experts agree that it was mined in South Africa, where the blue diamonds are mainly mined.

3. Chopard 201-carat watch – $25 million

Chopard Company known by its elite watches combined its knowledge of watch mechanisms with the jewelry pieces to create this interesting jewel. Generally, this watch may be proud of its 874 diamonds of different size. The largest of them weighs for about 15 carats. You will be additionally amazed by the mechanism making three largest diamonds move aside and open the watch face.

4. Hutton-Mdivani Jadeite Necklace – $27.4 million

Hutton-Mdivani Jadeite Necklace is one more jewelry piece presented by Cartier. It was in possession of some famous people. The most known of them are Woolworth heiress Barbara Hutton and Princess Nina Mdivani. There are rumors that latter hid the necklace under her deathbed concealing it from the debt collectors. The necklace consists of 27 emerald-green jadeite beads. The finishing touch is represented by the clasp from platinum as well as gold with the ruby and diamonds.

5. Diamond bikini – $30 million

It is not made of the fabrics and lefts nothing for imagination. Surely, we speak about the diamond bikini that costs for about $30 million. This jewelry piece was created by Susan Rosen and includes numerous diamonds with the weight of 150 carats, which are encrusted into the platinum. Even considering the bikini standards, the size of this jewel is really tiny. Therefore, when Molly Sims, model of ‘Sports Illustrated’ magazine, made the photo in it, this has caused a lot of conversations.

6. Zoe Diamond – $32.6 million

In 2014, the collection of Rachel Mellon, the wife of philanthropist Paul Mellon, was auctioned off at Sotheby’s. The star of her collection and the most desired jewel among purchasers was Zoe Diamond. This precious stone was classified as vivid bright blue diamond with the weight of 9.75 carats. At first, the experts thought that it would bring for about $15 million. However, Zoe Diamond shocked everyone being sold for $32.6 million. According to this, Zoe Diamond has become not only the most expensive blue diamond in the world, but also the most expensive diamond in terms of price and weight ratio, i.e. $3.3 million for 1 carat.

7. Graff Pink – $46.2 million

When this ring was auctioned off at Sotheby’s in 2010, the representatives of this auction house thought that it would bring a great profit. They couldn’t even imagine that it would be sold for more than $40 million. This ring has become one of the most expensive jewelry pieces ever. The owner of this ring encrusted with 24.78-carat pink diamond was the famous jeweler Harry Winston. Except of its very rare color, this diamond is considered as one of the greatest diamonds in the world. In 2010, this gem was bought by the diamond dealer Laurence Graff, that’s why it is known as Graff Pink now.

8. L’Incomparable Diamond Necklace – $55 million

The third place in our top world jewelry is occupied by the jewel, which is a keeper of several records. L’Incomparable diamond necklace was created by the outstanding Mouawad Company. It is considered to be the most expensive necklace in the world including the largest world ‘Incomparable’ diamond with the weight of 407.48 carats. Except of the great yellow diamond, the necklace is decorated with the smaller diamonds that weigh for 230 carats. This jewel impresses by its history because it saw the world thanks to the small girl, who found 890-carat rough diamond in a pile of stones in the Democratic Republic of the Congo.

9. Pink Star Diamond Ring – $72 million

Graff Pink held the record of the most expensive diamond ring up to November, 2013, when Pink Star has appeared. The huge oval-shaped diamond, which was auctioned off, weighed for about 59.6 carats. This diamond was cut from the rough diamond of 132.5 carats and mined by DeBeers Company in Africa. The experts, who were present during diamond selling, said that its size and quality surpassed all diamonds available in the private and royal collections around the world.

10. Wittelsbach-Graff Diamond – $80 million

The top place of our list is occupied by Wittelsbach diamond that caused a lot of conversations and disagreements. Primarily, this jewel was a dark blue diamond with the weight of 35.56 carats that decorated either Austrian or Bavarian crowns. In 2008, London jeweler Laurence Graff bought this precious stone for $23.4 million and immediately began to change it. Thereafter, Graff removed for about 4.5 carats of blue diamond thus increasing the gem purity and price. In 2011, it became known that Graff sold Wittelsbach diamond to the member of Qatar royal family for $80 million.

Surely, the prices of these jewels are beyond the clouds and not all people may be able to afford them. However, there are diamond jewels, which are undoubtedly within the pocket. Look through them and choose something for you!

#jewellery#jewelry#jewels#jewel#diamond#diamonds#gems#gem#precious stones#precious metals#gold#silver#platinum#accessories

0 notes

Text

Real Estate Jargon Glossary

Real Estate Jargon Glossary

Have you ever been confused by property and real estate jargon and industry terms?

REALas is about buyers helping buyers.

Here is a glossary of common real estate terms from Australia’s first real estate buyers advocate, David Morrell.

Adverse possession

If you have possessed land that is not on your title, after a certain time you can claim ‘adverse possession’, that is, the land reverts to your ownership. It generally happens when fences are not correctly aligned.

Agent

A person acting on behalf of another person; at law, an agent has the power to bind his or her principal to a contract without a third party as if they were the principal

Attorney

A person appointed to act on behalf of another in legal and business affairs.

Authorised investments

Assets in which a trustee is permitted to invest by the terms of a trust deed.

Balanced gearing

The situation in which an investment in either property or shares is funded by borrowings and where the interest payments balance with the interested earned on the investment.

Bear

An investor who believes the market will go down (a cynic).

Beneficial ownership

The entitlement to the benefit as distinct from being the registered owner.

Beneficiary (of a deceased estate)

A person to receive assets from a deceased estate.

Beneficiary (of a trust)

A person who benefits from the ownership of a property in a family trust.

Bequest

Assets left to a person in another person’s will.

Body corporate

A body that collectively manages the subdivision of a building or land.

Boom

A period in which there are excellent trading conditions.

Bridging finance

A temporary loan. You have found your dream home but have not yet managed to sell your existing property. Without the proceeds from the sale of your current property, how can you afford to buy the new one? Bridging finance enables you to purchase a new property while you wait for the sale of your existing property. The interest rates are often high.

Bull

An investor who believes the market will go up (an optimist).

Capital gains tax

If you make money on the sale of an asset the government holds out their hand for a piece of the pie. But if you are selling your only house or principal residence the government takes nothing.

Capitalisation method

A way of valuing a property by discounting rental payment at a suitable market-based interest rate in order to obtain the present market value.

Cash flow

In real estate, money generated from your property.

Caveat

A caution or warning. When you lodge a caveat you are registering your interest in the property. You should lodge a caveat as soon as you buy a property.

Caveat emptor

Let the buyer beware.

Caveat venditor

Let the seller beware.

Certificate of title

A document that provides evidence of the ownership of the property. The original is held at the Titles Office and a duplicate is held by the bank or the owner’s safe for safe-keeping.

Chattels

Items that pass with the property that are attached to or included in the sale, for example, light fittings, carpets and blinds.

Contract note

A simple form of securing the real estate transaction which both the seller and buyer sign. It is binding for both parties.

Conveyance

The transfer of an interest in a property either by sale, transfer or lease.

Convenant

A restriction on the use of the land that recognises the rights to another party.

Deceased estate

The property of an owner who has died.

Depreciation

The automatic writing down each year of an asset with a limited economic timeline. Mainly used for accounting purposes.

Easement

A particular right to use a portion of the land in a limited way which is available to a person who is not the owner of the property and is acknowledged in the title documents. Usually relates to sewage or utilities and usually recognises right of way.

Encumbrance

A charge on the title for the property, usually in the form of a mortgage.

Equitable mortgage

A transfer of an interest in land that is unregistered and is used as security for the repayment of a loan.

Equity

The vendor’s proportion of an asset; what is left in the value of the property after all the liabilities have been deducted.

Expression of interest

A means of selling a property whereby a vendor seeks offers without alluding to a purchase price.

Fee simple

Freehold land where the holder has absolute ownership subject to the payment of rates and taxes. However, the government can compulsory acquire the land if it sees fit.

First mortgage

The charge that ranks first by way of a mortgage ahead of any other mortgages.

Fittings

Individual items that can be removed from a property but are usually included, for example, the hot water service, stove, electric light fittings, dishwasher, blinds and pool equipment etc.

Fixtures

Items which cannot be removed without causing considerable damage to the property as opposed to fittings.

Freehold

Similar to ‘fee simple’ but freehold means absolute ownership.

Gazumping

When the seller repudiates a verbal agreement with a prospective purchaser and accepts a higher offer from another party.

Gearing

Borrowing money by way of funds in order to add to the owner’s own money when buying a home.

Gearing ratio

Percentage of borrowed funds divided by the owner’s personal stake.

General engagement

A written authority to act in the sale of a property or leasehold where the owner agrees to pay the agent a commission for services rendered.

General law title

Usually titles to land not under the Torrens title system, often onerous and expensive as a series of documents is needed to link the original grant with all subsequent transactions.

Holding cost

The costs of holding a property such as rates and land tax insurance, together with maintenance and interest that are incurred by a party pending receipt of income from a tenant or the sale of the property to another party.

Home equity conversion loan

A loan by mortgage that by agreement does not require any repayment. The intention is that the total debt will be repaid upon the death of the owner.

Improved value

The value of the land including the value of the building erected on it as opposed to site value only.

Improvements

The value of the buildings that are on the land as distinct from the land itself.

Interest

The periodical payment made by a person to an institution from which they have borrowed money, that is, a fee paid for the use of money.

Interest cover

The amount of times that the net rent – before deducting interest and tax – covers the interest payments. It is a measure of security of the interest payments.

Joint tenancy

The ownership of the land by two or more people collectively, in such a way that on the death of one owner ownership passes to the survivor.

Land tax

A tax imposed by the state government on land, based on the site value of the property.

Lease

A written contract which allows one party to use the property of another party for a specific time, subject to the payment of rent and other conditions embodied in the lease document.

Lease-back

The sale of a property whereby the purchaser grants a lease to the vendor.

Leasehold

Land which is held for a particular period under lease. When the lease expires use of the land reverts to the owner.

Lessee

The tenant or occupier under a lease contract.

Lessor

The landlord or owner under a lease contract.

Leverage

Borrowed funds which are used to supplement the investor’s own money when buying a property.

Lien

Used to secure a debt or performance or obligation, it is the right over another person’s property.

Market value

The price that a buyer is prepared to pay and a seller is prepared to accept in an open market transaction where both parties are informed and acting at arm’s length from each other, with neither party having a vested interest or being under pressure to buy or sell respectively.

Mortgage

The formal document which registers the transfer of an interest in the land for the security for the repayment of a loan.

Mortgage insurance

A particular form of insurance that protects the lender on the security of the property in case of any defaults by a borrower.

Mortgagee

The lender under the mortgage.

Mortgagor

The borrower under the mortgage.

Negative gearing

The amount of funds borrowed, in addition to the investor’s own money, when acquiring a property where the outgoings (including interest) exceed the rental return.

Net annual value

The notional rent of the property which covers both the land and the buildings

Neutral gearing

When an investor has purchased the property with the assistance of borrowings and the rental payments equal the cost of borrowings. The borrower does not have to pay any additional money.

Non-conforming usage

The use of the property which is not allowed under current regulations but is allowed by way of special dispensation where the person in occupation had the use before any rules had been changed.

Occupier

The person in possession of the land. Usually this is the tenant but sometimes can refer to the owner.

Off the plan

Buying property before it has been constructed on the basis of plans given for construction.

Old system title

A title not under the Torrens title system. Its is onerous and expensive and needs a serious of documents that link together all previous transactions.

Onerous lease

A lease which has more disadvantages than advantages for the lessee than for the lessor.

ONO

Or nearest offer.

Option

The choice, but not the obligation, to purchase land at a defined price at a particular date in the future.

Outgoings

Expenditure related to owning property, for example rates, boy corporate charges, insurance.

Overquoting

Where an agent promises a vendor an unrealistic price to secure the listing of the property.

Passed in

The point in an auction when the bids offered have not met the vendor’s expectations and further negotiation between the vendor and the purchaser takes place.

Possession

The holding of the land.

Private sale

A method of sale in which the buyer and the seller negotiate, as distinct from a public auction.

Ratchet clause

Part of a lease document that allows the rent to be higher than the previous rent being paid.

Rates

Taxes imposed by government authorities.

Rent

The payment of money by a tenant for the use of a property.

Rental guarantee

Where the vendor guarantees an amount of rent for the property for a period of time as an incentive for the purchasers to buy.

Reserve

The price for which the vendor is prepared to sell the property at an auction.

Right of first refusal

The point in an auction when the highest bid has not met the vendor’s expectations and the highest bidder is given the first right to negotiate with the vendor at their reserve price.

Sale and lease-back

An ideal way of realising equity but retaining the use of the property by leasing it back from the new owner.

Second mortgage

A charge on the land that ranks behind the first mortgage, usually indicating that the property is fully geared, meaning the property has as much borrowings against it as to be equal to the value of the property and the owner has little equity left after the loans have been repaid.

Section 51 deduction

Tax deductions for all losses and outgoings incurred with respect to a property.

Secured loan

A loan guaranteed by a charge over an asset.

Set sale

This is a variation to the form of private sale. It occurs when the agent advertises a property without committing to a particular price, but to a price range. The agent then tries to encourage buyers to produce their best offer within that range. All offers must be submitted by an expiry date that the vendor must commit to. Purchasers are encouraged to submit offers at their highest level with no commitment from the vendor about whether or not they will accept one. This form of selling often involves misleading and deceptive conduct. It is a system originated by real estate agents as an alternative to the auction system. It is growing in popularity as the auction system starts to wane. It is clearly in the favour of the vendor and therefore should be avoided by purchasers if possible.

Settlement

When a property is exchanged, title is given in consideration for the payment of money.

Simple interest

Interest calculated on the original capital only, not on any past amounts.

Site cover

The land area on which the building is erected, divided by the whole of the land.

Sole agency

Where a vendor or lessor contracts with a real estate company the sole right to represent them in the sale or lease of a property and explains the terms of remuneration to the agent and the parameters of price or rent.

Stamp duty

State government fees levied on every sale of property, payable by the purchaser.

Strata title

A form of ownership of units or factories that have a body corporate.

Subdivision

When a large block of land is divided into smaller blocks.

Summation method

A method of placing value on a property that values the land independently, free of buildings, and adds an amount for the depreciating value of the existing buildings.

Tenancy in common

Allows two or more people to own the property so that in the case of the death of one party that proportion passes to that person’s heirs. A ‘tenant in common’ is a co-owner and should not be confused with a ‘lessee’.

Time-sharing

A form of ownership that gives rights for use for a particular time, for example, for one week per year.

Torrens title

The government register that gives evidence about the title of the land. The government issues a certificate in the name of the new owner.

Transfer of land document

Used when there is a change of ownership. A document with all the details is forwarded to the Titles Office and the original certificate is amended accordingly.

Underbidder

The second highest bidder at an auction.

Underlet

Tenanted at a rental below what other similar properties are renting for.

Underquoting

When an agent indicates a price that a property will sell for, but is well short of the market and the owner’s expectations.

Unimproved value

The value of the land when there are no buildings on it.

Vacant possession

Property not subjected to any leases.

Valuation

A written report estimating the market value of a property, usually conducted by a professional registered valuer for a fee.

Vendor terms

When a property is sold the purchaser pays only a small portion of the purchase price at settlement, with the balance being a loan from the owner for an agreed period of time. Usually used as an incentive to achieve a higher sale price.

Vendor’s statement

The statement given to a purchaser in Victoria that sets out the particulars of the property; it is signed by the vendor and given to the purchaser prior to any contracts being signed.

Yield

The return when investing in property. The formula is obtained by dividing the rent per annum by the price and multiplying by 100.

Zoning

What a property can be used for as determined by local authorities, for example, residential or commercial.

REALas accurately predicts property values

REALas property values are 5% from home sale prices on average – Australia wide including auctions and private sales.

We help home buyers research the right price to pay for a home.

The post Real Estate Jargon Glossary appeared first on REALas.

from Real Estate Jargon Glossary

0 notes