#purchasing consulting firms

Explore tagged Tumblr posts

Text

hiveworks:

-ignored me when i tried to warn them about kinomatika, a serial scam artist, and more or less affirming that their abuse toward me (which i did not detail or disclose to them, i focused on the financial facts) was monetarily justified

-used me as an unpaid consultant for 7 years, including picking out the CEO's outfits, website design, and advice. all unpaid.

-disclosed to me the personal lives and habits of other comic artists despite me literally never asking. if youve ever done anything unflattering in front of xel, then i heard about it. for some reason

-tried to repeatedly impress me or....something by constantly sending me updates about their lastest frivolous purchases or big financial deal or total revenue i would mysteriously never see the results of even in the form of trying to improve hive itself

-desperately wants to be thought of as a leftist collective despite their reliance on advertising and financial focus. they are not a collective or community. its an advertising agency with perks, if youre already making money

-had to be begged to have my website added in a timely manner after i was accepted and was at the bottom of the "to-do" pile from that point on. refused to work with me when flash was becoming depreciated. i wanted to either change it to html5 or, barring that, replace the flash video with a youtube embed. for some reason they refused to do this. now that have access to my backend again i can do it myself in like a few minutes lol.

-right before i left, they nuked the group/official discord and started imposing incredibly stupid rules bc adults were having too many emotions where they could see it

-are objectively wrong about piracy and the preservation of digital media, taking a firm "anti" stance until they realized it was morally unpopular. this extends to the members, who chronically petrified at the actually delusional belief that people are pirating them to such a degree that it causes a financial deficit

-the way they talk about their audiences is putrid. like theyre constantly angry at the attention and praise they've gone out of their way to cultivate. a common refrain was "you dont owe your audience anything" which is literally and demonstrably not true lol.

-barely paid me 100 dollars a month for this

toward the end of my run, other artists started bitching that i was making hive look bad "because it reflects back on them" so i left. upon realizing and being told i was representing the company that treated me like this, i was offered an out and took it. as a gift to them, primarily.

bad company. didnt like it.

258 notes

·

View notes

Note

Juno, out of curiosity, what does an accountant DO? What does it mean to be one? Because I know there's math involved. I've heard it's very boring. But I don't know anything else and I'm curious because you're very good at putting things to words.

Okay first of all, I cannot express just how excited I got when I first saw this message. There is nothing I love more than talking about things I know about, and usually when my career is mentioned I don't get questions so much as immediate "Oh, bless you" and "I could never"s. Which- totally fair! For some people, accounting would be boring as all hell! But for a multitude of reasons, I adore it.

There are multiple types of accounting. The type most people tend to be more familiar with is that done by CPAs- CPAs, or Certified Public Accountants, are those that have done the lengthy and expensive process to be certified to handle other peoples' tax documents and submit taxes in their name, amongst other things. Yawn, taxes, right? Well, the thing with that is that there's a lot of little loopholes that tax accountants have to remain familiar with, because saving their clients a little more here or getting a little more back there can really add up, and can do a lot for people who, say, have enough money to afford to hire someone to do their taxes but not necessarily enough to be going hog wild with. Public accountants can work for large firms or by themselves, and also do things like preparing financial statements for businesses, auditing businesses to ensure all of their financial transactions are true and accurately reported to shareholders and clients, and consulting on how finances can be managed to maximize revenue (money in - money out = revenue, in very simple terms).

The type of accounting I do is private accounting! That basically just means that I work for a company in their in-house accounting/finance department. Private accounting tends to get split up into several different areas. My company has Payroll, Accounts Receivable, and Accounts Payable.

Payroll handles everyone's paychecks, PTO, ensuring the correct amount of taxes are withheld from individuals per their desires, and so on. Accounts Receivable handles money flow into the company- so when our company sells the product/service, our Accounts Receivable people are the ones who review the work, create the invoices, send the invoices to the clients, remind clients about overdue invoices, receive incoming payments via ACH (Automatic Clearing House- direct bank-to-bank deposits), Wire (Usually used for international transactions), or Check, and prepare statements that show how much revenue we are expected to gain in a period of time, or have gained in a period of time. This requires a lot of interfacing with clients and project managers.

My department is Accounts Payable. Accounts Payable does basically the other side of the coin from what Accounts Receivable does. We work mostly with vendors and our purchasing/receiving departments. We receive invoices from people and companies that have sold us products/services we need in order to make our own products/perform our services, enter them into our ERP (Enterprise Resource Planning, a system that integrates the departments in a company together- there are many different ERPs, and most people simply refer to their ERP as "the system" when talking internally to other employees of the same company that they work at, because saying the name of the system is redundant) using a set of codes that automatically places the costs into appropriate groups to be referenced for later financial reports, and run the payment processing to ensure that the vendors are being paid.

To break that down because I know that was a lot of words, here's some things I do in my day-to-day at work:

- Reconciliations, making sure two different statements match up: the most common one is Credit Card reconciliations, ensuring that there are appropriately coded entries in the system that match the payments made on our credit line in our bank.

- Invoice entry: this is basic data entry, for the most part. This can have two different forms, though

- Purchase Order Invoice entry: Invoices that are matched both to the service/product provided from the vendor and the purchase order created by our Purchasing/Receiving department. We ensure that the item, the quantity, and the price all match between our records, the purchase order, and the invoice, before we enter this.

- Hard Coded Invoice entry: Invoices that we enter manually due to there being no Purchase Order for them. This is often recurring services, like cleaning or repairs, that may happen too often or have prices vary too much for Purchase Orders to be practical.

- Cleaning up old purchase orders: sometimes Purchase Orders are put in the system and then never fulfilled. Because this shows on financial statements as being a long-standing open commitment, it looks bad, so we have to periodically research these and find out if the vendor simply didn't send us the invoice, if the order was cancelled, or if something else is going on.

- Forensics! This is my personal favorite part of the job, where someone has massively borked something that is affecting my work, and so I go dig into it, sometimes going back as four or five years in records to find the origin point of the first mistake, and untangling the threads of what happened following that mistake to get us to where we are today. There's an entire field called Forensic Accounting that is basically just doing This but for other companies (it's a subset of auditing, and often is done via the IRS) and that's my dream position to be totally honest. I loooove the dopamine hit i get with solving the mystery and getting praised for doing so faster than anyone else has even begun to realize the problem to start with.

- Balancing Credits/Debits: This is more of a Main Accountant role thing, but the long and short of it is that every business has Assets, Liabilities, and Equity. Liabilities and Equity are what we put into the company/what we owe, and assets are what we have received/what we are owed. Anything that increases Assets or lowers Liabilities or Equity is a Debit. Anything that decreases Assets or raises Liabilities or Equity is a Credit. Every monetary change we process has to include an equal Debit and Credit. This is its own whole lecture, so if you wanna know more about double-entry accounting, let me know, but it's yawnsville for most people.

- Actually cutting checks or initiating bank payments to vendors for amounts we owe them.

- Vendor communication: I'm on the phones and email a lot with vendors who are wondering where their payment is, or why something was short-paid, or if I can change some of their info in our system, and so on and so on. Every job is customer service, unfortunately. I don't love it, but I do a lot less of it in private accounting than I would have to do in public accounting.

- Spreadsheets: I make so many spreadsheets I am a goddamn Excel wizard. I love spreadsheets. This isn't necessarily accounting-specific though, most people in Finance jobs love spreadsheets, or at least use them to make their lives easier. I make them just for fun, because I'm a giant fucking nerd who finds that kind of thing enjoyable lol. So if you ever need a spreadsheet made for anything, hit me up.

As for math, that's a pretty common misconception. While there is math, it is very rarely more complicated than "I paid $3 of the $8 I owe, now I owe $5" for me. There are some formulas you learn in school (Business Administration with a focus in Accounting is what I studied), but they're also pretty standard and rarely include more than like... basic algebra. Which. Thanks @ god because I flunked so hard out of pre-calc in college. I could not have done accounting if it really were all that math heavy.

Aaaand yeah! That's all I've got off the top of my head- if you have any more questions about it, do let me know, I'm happy to ramble on for hours, but I'm cutting it here so I don't start meandering on without direction lol.

41 notes

·

View notes

Text

Covid surge limits CVS’s at-home test supply in some cities - Published Aug 3, 2024

SOME CVS Health pharmacies are selling out of at-home Covid tests as a summer surge in infections drives up demand.

As at Friday (Aug 2) afternoon, CVS’s website showed that all brands of tests were out of stock at many locations in cities including Houston, Austin and Reno, Nevada.

The company said that 91 per cent of its stores have at least one brand of test in stock. While the company “has seen an uptick in purchases” of the tests, it’s “quickly sending product to impacted stores”, a spokesperson said.

Covid levels across the country are currently “high”, according to the Centers for Disease Control and Prevention, which measures the viral load in wastewater data to evaluate the virus’ prevalence. The preliminary data shows that levels of Covid viral activity have surpassed last summer’s peak in the US South, West and Midwest.

Websites of Walgreens Boots Alliance locations showed robust supplies of the tests, and the company said it’s well stocked. Walgreens and multiple independent pharmacies in New York City reported that demand for at-home Covid tests has increased sharply in recent months. Purchases are at the highest since the holiday season, according to Walgreens spokesperson Molly Sheehan.

Before this summer, demand for the tests had been fading. Abbott Laboratories, which makes Binax Covid tests, reported that sales of the tests slumped 61 per cent in the second quarter to US$102 million from US$263 million a year earlier. Medicare coverage of at-home tests expired when the public health emergency ended in May 2023, contributing to the trend, said Amy Kelbick, health policy director at McDermott+, a consulting firm.

She said the sudden swings in demand make it challenging for retailers to keep stocks at the right levels. “It’s really hard to turn things back on,” Kelbick said, adding that test makers may have let go of rented manufacturing space or repurposed factory lines amid waning demand.

#covid#mask up#pandemic#covid 19#wear a mask#sars cov 2#still coviding#public health#coronavirus#wear a respirator

55 notes

·

View notes

Text

WASHINGTON -- Inflation has changed the way many Americans shop. Now, those changes in consumer habits are helping bring down inflation.

Fed up with prices that remain about 19%, on average, above where they were before the pandemic, consumers are fighting back. In grocery stores, they're shifting away from name brands to store-brand items, switching to discount stores or simply buying fewer items like snacks or gourmet foods.

More Americans are buying used cars, too, rather than new, forcing some dealers to provide discounts on new cars again. But the growing consumer pushback to what critics condemn as price-gouging has been most evident with food as well as with consumer goods like paper towels and napkins.

In recent months, consumer resistance has led large food companies to respond by sharply slowing their price increases from the peaks of the past three years. This doesn't mean grocery prices will fall back to their levels of a few years ago, though with some items, including eggs, apples and milk, prices are below their peaks. But the milder increases in food prices should help further cool overall inflation, which is down sharply from a peak of 9.1% in 2022 to 3.1%.

Public frustration with prices has become a central issue in President Joe Biden’s bid for re-election. Polls show that despite the dramatic decline in inflation, many consumers are unhappy that prices remain so much higher than they were before inflation began accelerating in 2021.

Biden has echoed the criticism of many left-leaning economists that corporations jacked up their prices more than was needed to cover their own higher costs, allowing themselves to boost their profits. The White House has also attacked “shrinkflation,” whereby a company, rather than raising the price of a product, instead shrinks the amount inside the package. In a video released on Super Bowl Sunday, Biden denounced shrinkflation as a “rip-off.”

Consumer pushback against high prices suggests to many economists that inflation should further ease. That would make this bout of inflation markedly different from the debilitating price spikes of the 1970s and early 1980s, which took longer to defeat. When high inflation persists, consumers often develop an inflationary psychology: Ever-rising prices lead them to accelerate their purchases before costs rise further, a trend that can itself perpetuate inflation.

“That was the fear — that everybody would tolerate higher prices,” said Gregory Daco, chief economist at EY, a consulting firm, who notes that it hasn't happened. “I don't think we've moved into a high inflation regime.”

Instead, this time many consumers have reacted like Stuart Dryden, a commercial underwriter at a bank who lives in Arlington, Virginia. On a recent trip to his regular grocery store, Dryden, 37, pointed out big price disparities between Kraft Heinz-branded products and their store-label competitors, which he now favors.

Dryden, for example, loves cream cheese and bagels. A 12-ounce tub of Kraft's Philadelphia cream cheese costs $6.69. The store brand, he noted, is just $3.19.

A 24-pack of Kraft single cheese slices is $7.69; the store label, $2.99. And a 32-ounce Heinz ketchup bottle is $6.29, while the alternative is just $1.69. Similar gaps existed with mac-and-cheese and shredded cheese products.

“Just those five products together already cost nearly $30,” Dryden said. The alternatives were less than half that, he calculated, at about $13.

“I’ve been trying private-label options, and the quality is the same and it’s almost a no-brainer to switch from the products I used to buy a ton of to just the private label," Dryden said.

Alex Abraham, a spokesman for Kraft Heinz, said that its costs rose 3% in the final three months of last year but that the company raised its own prices only 1%.

“We are doing everything possible to find efficiencies in our factories and other parts of our business to offset and mitigate further price increases,” Abraham said.

Last week, Kraft Heinz said sales fell in the final three months of last year as more consumers traded down to cheaper brands.

Dryden has taken other steps to save money: A year ago, he moved into a new apartment after his previous landlord jacked up his rent by about 50%. His former apartment had been next to a relatively pricey grocery store, Whole Foods. Now, he shops at a nearby Amazon Fresh and has started visiting the discount grocer Aldi every couple of weeks.

Samuel Rines, an investment strategist at Corbu, says that PepsiCo, Kimberly-Clark, Procter & Gamble and many other consumer food and packaged goods companies exploited the rise in input costs stemming from supply-chain disruptions and Russia's invasion of Ukraine to dramatically raise their prices — and increase their profits — in 2021 and 2022.

A contributing factor was that millions of Americans enjoyed solid wage gains and received stimulus checks and other government aid, making it easier for them to pay the higher prices.

Still, some decried the phenomenon as “greedflation." And in a March 2023 research paper, the economist Isabella Weber at the University of Massachusetts, Amherst, referred to it as “seller's inflation.”

Yet beginning late last year, many of the same companies discovered that the strategy was no longer working. Most consumers have now long since spent the savings they built up during the pandemic.

Lower-income consumers, in particular, are running up credit card debt and falling behind on their payments. Americans overall are spending more cautiously. Daco notes that overall sales during the holiday shopping season were up just 4% — and most of it reflected higher prices rather than consumers actually buying more things.

As an example, Rines points to Unilever, which makes, among other items, Hellman's mayonnaise, Ben & Jerry's ice cream and Dove soaps. Unilever jacked up its prices 13.3% on average across its brands in 2022. Its sales volume fell 3.6% that year. In response, it raised prices just 2.8% last year; sales rose 1.8%.

“We're beginning to see the consumer no longer willing to take the higher pricing,” Rines said. “So companies were beginning to get a little bit more skeptical of their ability to just have price be the driver of their revenues. They had to have those volumes come back, and the consumer wasn’t reacting in a way that they were pleased with.”

Unilever itself recently attributed poor sales performance in Europe to “share losses to private labels.”

Other businesses have noticed, too. After their sales fell in the final three months of last year, PepsiCo executives signaled that this year they would rein in price increases and focus more on boosting sales.

“In 2024, we see ... normalization of the cost, normalization of inflation,” CEO Ramon Laguarta said. “So we see everything trending back to our long-term” pricing trends.

Jeffrey Harmening, CEO of General Mills, which makes Cheerios, Chex Cereal, Progresso soups and dozens of other brands, has acknowledged that his customers are increasingly seeking bargains.

And McDonald's executives have said that consumers with incomes below $45,000 are visiting less and spending less when they do visit and say the company plans to highlight its lower-priced items.

“Consumers are more wary — and weary — of pricing, and we’re going to continue to be consumer-led in our pricing decisions,” Ian Borden, the company's chief financial officer, told investors.

Officials at the Federal Reserve, the nation's primary inflation-fighting institution, have cited consumers' growing reluctance to pay high prices as a key reason why they expect inflation to fall steadily back to their 2% annual target.

“Firms are telling us that price sensitivity is very much higher now,” Mary Daly, president of the Federal Reserve Bank of San Francisco and a member of the Fed's interest-rate setting committee, said last week. “Consumers don't want to purchase unless they're seeing a 10% discount. ... This is a serious improvement in the role that consumers play in bridling inflation.”

Surveys by the Fed's regional banks have found that companies across all industries expect to impose smaller price increases this year. The New York Fed says companies in its region plan to raise prices an average of about 3% this year, down from about 5% in 2023 and as much as 7% to 9% in 2022.

Such trends suggest that companies were well on their way to slowing their price hikes before Biden's most recent attacks on price gouging.

Claudia Sahm, founder of SAHM Consulting and a former Fed economist, said, “consumers are more powerful than President Biden.”

33 notes

·

View notes

Text

Top Business Ideas in the UAE for Entrepreneurs

Starting a business in UAE is an exciting venture, as the country offers numerous opportunities across various sectors. The UAE is home to some of the most lucrative industries in the world, whether you're an experienced professional looking for new growth opportunities or an aspiring entrepreneur searching for the ideal niche. There is a lot of potential to tap into, including in the areas of real estate, e-commerce, tourism, healthcare, and IT. We'll look at the best business concepts in this blog to help you start a profitable company in the United Arab Emirates.

Why Entrepreneurs Find Success in the United Arab Emirates

In addition to being a prime location for companies, the UAE provides an environment that encourages development and creativity. It is a desirable location for entrepreneurs due to its tax-free zones, sophisticated infrastructure, and business-friendly laws. Whether you're looking to launch a local business or expand your global reach, the UAE is the place to be. However, which industries are the most lucrative and appropriate for would-be business owners?

Profitable Sectors for Starting a Business in the UAE

1. Real Estate

One of the most profitable industries in the UAE is real estate, and international investors are drawn to Dubai and Abu Dhabi on a regular basis. The nation is the perfect place for real estate services and property investment because of its expanding population, influx of tourists, and creation of famous landmarks.

Innovative Business Ideas in Real Estate:

Property Management Services: Providing property management services can be a profitable choice in an ever-growing market.

Real estate brokerage: Helping foreign customers purchase or rent real estate can generate a consistent income in this cutthroat industry.

Flexible office spaces are becoming more and more in demand as the entrepreneurial culture expands.

2. E-Commerce

Due to the widespread use of smartphones and the growing number of tech-savvy people, the e-commerce sector has grown rapidly in recent years. Starting a business in UAE’s e-commerce market can be an excellent choice, especially as the country embraces digital transformation.

Innovative Business Ideas in E-Commerce:

Online Retail Store: Selling specialized goods, such as electronics or clothing, can give you a firm footing in this cutthroat market.

Marketplace Platforms: In order to take advantage of the UAE's booming retail industry, establish a platform for local vendors to sell goods online.

Subscription Boxes: Provide specialized subscription boxes for niche markets, such as gourmet foods, wellness, or cosmetics.

3. Tourism

With millions of tourists visiting the UAE each year, tourism plays a major role in the economy of the nation. There are plenty of options for entrepreneurs with sights like the Palm Jumeirah, the Burj Khalifa, and the desert safari experiences.

Innovative Business Ideas in Tourism:

Luxury Travel Services: Provide wealthy people with unique and personalized travel packages.

Services for Tour Operators: Focus on speciality tours, like eco-tourism, adventure, or cultural experiences.

Travel Technology Solutions: Offer cutting-edge platforms or applications for travel that improve visitors' experiences.

4. Healthcare

The UAE's healthcare industry is expanding quickly, with an emphasis on offering both locals and visitors top-notch medical care. The government's drive for top-notch medical facilities and health technology innovation can help entrepreneurs in the healthcare sector.

Innovative Business Ideas in Healthcare:

Offering online medical consultations and healthcare services, telemedicine has become more and more popular in the post-pandemic world.

Fitness and Wellness: Open a yoga studio, fitness center, or wellness app to appeal to the health-conscious population in the United Arab Emirates.

Medical Equipment Supply: Provide medical devices and equipment to clinics, hospitals, or home care agencies.

5. IT and Technology

Fintech, AI, blockchain, and cybersecurity are among the rapidly growing tech-driven industries in the United Arab Emirates.. Starting a business in UAE in the IT sector is a smart move, as the government is heavily investing in technological infrastructure.

Innovative Business Ideas in IT:

AI Solutions: Create AI-driven solutions for companies in a range of industries, including retail, healthcare, and real estate.

Cybersecurity Services: Provide cybersecurity services to companies that want to safeguard their systems and data in a world that is digitizing quickly.

Blockchain Solutions: Develop blockchain-based software for logistics, finance, or supply chain management.

How to Enter These Markets

Understanding the local market, adhering to legal and regulatory requirements, and making the appropriate technological and infrastructure investments are all crucial for capitalizing on these lucrative industries. Starting a business in UAE requires careful planning, market research, and a solid business strategy. Operating in one of the numerous free zones can provide substantial tax benefits and streamlined business setup procedures for foreign business owners.

Start Your Business in the United Arab Emirates

Are you prepared to begin your business endeavors in the United Arab Emirates? The UAE provides business owners with a multitude of options, regardless of their interests in IT, e-commerce, real estate, or healthcare. Working with a reputable business setup company that can help you navigate local regulations and guide you through the process is essential to turning your vision into a reality.

Starting a business in UAE has never been easier. Establishing a successful business in one of the most dynamic and business-friendly environments in the world is possible with the correct business idea, strategy, and support.

#StartingABusinessInUAE#UAEEntrepreneurs#BusinessIdeasUAE#UAEStartups#EntrepreneurshipInUAE#UAEOpportunities#ProfitableBusinessesUAE#DubaiBusinessIdeas#BusinessSetupUAE#EntrepreneurialSuccess

3 notes

·

View notes

Text

McKinsey & Co.'s Mobility Consumer Pulse for 2024, released this month, found that 46% of EV owners in the U.S. said they were "very" likely to switch back to owning a gas-powered vehicle in their next purchase.

9 notes

·

View notes

Text

Excerpt from this New York Times story:

While many people can conjure up romantic visions of a Montana ranch — vast valleys, cold streams, snow-capped mountains — few understand what happens when the cattle leave those pastures. Most of them, it turns out, don’t stay in Montana.

Even here, in a state with nearly twice as many cows as people, only around 1 percent of the beef purchased by Montana households is raised and processed locally, according to estimates from Highland Economics, a consulting firm. As is true in the rest of the country, many Montanans instead eat beef from as far away as Brazil.

Here’s a common fate of a cow that starts out on Montana grass: It will be bought by one of the four dominant meatpackers — JBS, Tyson Foods, Cargill and Marfrig — which process 85 percent of the country’s beef; transported by a company like Sysco or US Foods, distributors with a combined value of over $50 billion; and sold at a Walmart or Costco, which together take in roughly half of America’s food dollars. Any ranchers who want to break out from this system — and, say, sell their beef locally, instead of as anonymous commodities crisscrossing the country — are Davids in a swarm of Goliaths.

“The beef packers have a lot of control,” said Neva Hassanein, a University of Montana professor who studies sustainable food systems. “They tend to influence a tremendous amount throughout the supply chain.” For the nation’s ranchers, whose profits have shrunk over time, she said, “It’s kind of a trap.”

Cole Mannix is trying to escape that trap.

Mr. Mannix, 40, has a tendency to wax philosophical. (He once thought about becoming a Jesuit priest.) Like members of his family have since 1882, he grew up ranching: baling hay, helping to birth calves, guiding cattle into the high country on horseback. He wants to make sure the next generation, the sixth, has the same opportunity.

So, in 2021, Mr. Mannix co-founded Old Salt Co-op, a company that aims to upend the way people buy meat.

While many Montana ranchers sell their calves into the multibillion-dollar industrial machine when they’re less than a year old, never to see or profit from them again, Old Salt’s livestock never leave the company’s hands. The cattle are raised by Old Salt’s four member ranches, slaughtered and processed at its meatpacking facility, and sold through its ranch-to-table restaurants, community events and website. The ranchers, who have ownership in the company, profit at every stage.

The technical term for this approach — in which a company controls various elements of its supply chain — is vertical integration. It’s not something many small meat businesses try, as it requires a huge amount of upfront capital.

“It’s a scary time,” Mr. Mannix said, referring to the company’s sizable debt. “We’re really trying to invent something new.”

But, he added, “No matter how risky it is to start a business like Old Salt, the status quo is riskier.”

11 notes

·

View notes

Text

Promotional Video Designing - Website Design and Graphic Design Company in India

Creating Promotional Videos In-Home Graphic Design Developing and Designing Websites Applications for Customized Digital Marketing Solutions for the Cloud Strategy for IT Consulting Technology Commercial Solutions Analytics & Reporting Indian Promotional Video Design Firm India's Top Brand Promotion Video Promotion Firm in Indore Obtain marketing videos for your goods that raise awareness and encourage purchases.

#website design#website design in indore#website design ai#website design company#website design company in indore#digital marketing company in india#website design solution#website design ideas#website development projects

2 notes

·

View notes

Text

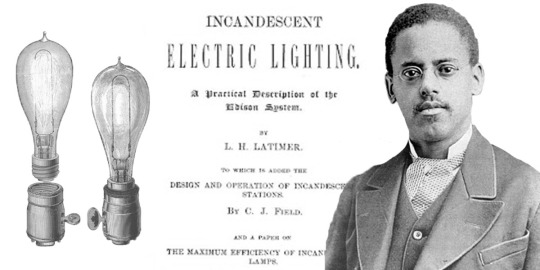

Lewis Howard Latimer (September 4, 1848 – December 11, 1928) was an inventor and patent draftsman. His inventions included an evaporative air conditioner, an improved process for manufacturing carbon filaments for light bulbs, and an improved toilet system for railroad cars. In 1884, he joined the Edison Electric Light Company where he worked as a draftsman and wrote the first book on electric lighting. The Lewis H. Latimer House, his landmarked former residence, is located near the Latimer Projects at 34-41 137th Street in Flushing, Queens.

He was born in Chelsea, Massachusetts, the youngest of the four children of Rebecca Latimer and George Latimer. His mother and father escaped from slavery in Virginia and fled to Chelsea, Massachusetts on October 4, 1842. The day they arrived in Boston, George was recognized by a colleague of his former slave owner and was arrested a few days later, on October 20, 1842. George’s trial received great notoriety; he was represented by Frederick Douglass and William Lloyd Garrison. He was able to purchase his freedom and live with his family.

He joined the Navy at the age of 15 and served as a Landsman on the USS Massasoit. After receiving an honorable discharge from the Navy on July 3, 1865, he gained employment as an office boy with a patent law firm, Crosby Halstead and Gould. He learned how to use a set square, ruler, and other tools. He was promoted to the position of head draftsman. He became a patent consultant to law firms.

He married Mary Wilson Lewis on November 15, 1873, in Fall River, Massachusetts. The couple had two daughters.

In 1879, he and his wife moved to Bridgeport, Connecticut, along with his mother, and his brother, William. They settled in a neighborhood called “Little Liberia,” which had been established in the early 19th century by free African Americans. #africanhistory365 #africanexcellence

4 notes

·

View notes

Text

The Challenges of Developing and Sustaining a Meme Coin

Meme coins have captured the imagination of the crypto world, blending humor with technology to create a unique niche in the blockchain space. Coins like Dogecoin and Shiba Inu have proven that meme-based cryptocurrencies can gain massive popularity. However, developing a meme coin is not as easy as it may seem. This blog explores the key challenges that creators face and what it takes to overcome them.

1. Establishing Credibility in a Crowded Market

The cryptocurrency market is saturated with projects, and meme coins often face skepticism from potential investors. Many view them as jokes or scams, which makes it harder to build trust.

To overcome this, developers need a strong marketing strategy. Having a transparent team, clear goals, and a well-defined roadmap can go a long way in gaining credibility. Partnering with influencers and engaging the community on platforms like Twitter and Reddit can also help.

2. Building a Loyal Community

Meme coins thrive on community support. Unlike traditional cryptocurrencies, their value largely depends on the enthusiasm of their holders and online buzz. However, maintaining a loyal community is challenging, especially during market downturns.

Developers need to keep their audience engaged by organizing events, sharing updates, and creating memes that resonate with their followers. Offering rewards like token airdrops or contests can also motivate community participation.

3. Ensuring Liquidity and Utility

A meme coin’s survival depends on its utility and liquidity. If users cannot trade the coin easily or find a practical use for it, interest will fade quickly.

Creators should focus on listing their coins on popular exchanges to enhance liquidity. Adding real-world applications, such as enabling purchases or donations, can also provide value beyond speculation.

4. Security and Smart Contract Vulnerabilities

Launching a meme coin requires deploying smart contracts, which are vulnerable to hacks and bugs. A single exploit can tarnish the project’s reputation and cause irreversible damage.

To mitigate this risk, developers must conduct rigorous audits of their smart contracts and work with experienced blockchain security firms. Using battle-tested standards, like ERC20 or BEP20, can also reduce vulnerabilities.

5. Standing Out Amidst Competition

With hundreds of meme coins launched every month, standing out is no easy task. Many projects fail to differentiate themselves, leading to a short lifespan.

Developers should aim for a unique theme or narrative that captures attention. Whether it’s through innovative tokenomics, partnerships with brands, or creative campaigns, finding a unique angle is key to success.

6. Navigating Regulatory Challenges

Cryptocurrencies, including meme coins, face evolving regulations worldwide. Laws around token creation, fundraising, and tax implications can vary, adding complexity to the process.

It’s essential for meme coin developers to comply with local regulations and consult legal experts. Adopting a decentralized approach can also help navigate regulatory uncertainties.

7. Sustaining Long-Term Growth

The biggest challenge for meme coins is maintaining relevance. Many coins experience an initial surge in popularity but fail to sustain growth over time.

To ensure long-term success, developers should focus on continuous innovation. Introducing staking options, NFTs, or gaming integrations can keep the project exciting and attract new users.

8. Managing Market Volatility

Even more so, meme coins are highly unpredictable since they are based on speculation. Large price changes also have a negative impact on the rate of investment and morale in the related community.

During such periods, developers have to keep their lines of communication open and have to encourage property holding as opposed to speculative investments. Raising the general public’s understanding of market processes can also prevent distress.

Conclusion

While creating a meme coin is as simple as launching an ERC-20 token, it takes a lot more effort to build and maintain such a cryptocurrency. It involves elements of creativity, business savvy and endless outreach. When the principles of credibility, utility, security and sustainability are addressed, meme coin creators can raise their probability of success.

That said, the road for many may not be easy but the rewards which can be gleaned from this world especially for those able to provide both humor and value may be well worth it as the world continues to grow in the crypto space.

4 notes

·

View notes

Text

Edward/Edith The Blue Engine [NWR AU]

History

Edith was built in 1890 as LSWR No. 577 of William Adam's X2 Class 4-4-0s. She originally carried the name Edward, but as she made the choice to change genders, I will be referring to her as Edith throughout this post. She worked out of Nine Elms shed between 1891 and 1915 when she was purchased by the NWR to work their express trains. Upon arrival, she was stabled at Vicarstown with her colleague Thomas. By the end of the Great War in 1918, her parts were thoroughly worn out and the workload was far too much for her, so The Fat Director purchased an "Atlantic" from a relatively little-known works in England to run his premiere express trains while Edith went in for refurbishment. Unfortunately however, the engine he received (Henry) performed far worse than expected, forcing the refurbishment work on Edith to be halted as she was pressed back into service once again. She soldiered on until 1922, when the railway bought Gordon. After Gordon's purchase, the railway was strapped for cash, so she was left in the back of the shed until repairs could be afforded. Unfortunately, in all the postwar stress, The Fat Director forgot to schedule her repairs and she was left there until 1924, when a driver took pity on the already life-expired engine and offered to take her out for a run, after which she was sent for repairs where it was found that the tolerances on her motion had been worn down so much that there was near an eighth-inch of play. After the works had finished with her in 1925, she was practically in factory-fresh condition.

Her life following this was relatively uneventful, up until her re-assignment to the Brendam Branchline in 1936, soon after which she had to chase a runaway James along the mainline to prevent a derailment. During the Second World War, Brendam Harbour was constantly full to capacity and often got raided by the Luftwaffe, which once again meant that Edith was thrashed to breaking point. Her schedule was packed to the brim with troop trains from every corner of the island to Brendam Harbour. Being relatively fast as well as light, she was the perfect engine for the job.

After the war, she was once again worn out completely, which was not helped by the increase in traffic due to the completion of the Sodor China Clay Company's Bill & Ben. Due to postwar austerity, she wasn't overhauled until it was far too late. While on an enthusiast's special in 1959, she split her left crank pin, causing her con-rod to break free of her wheel, bending her frame and splashers out of shape. Never one to give up, she slogged the eight-coach train as far as Wellsworth before being relieved by Mark, who was working thunderbird duties at the time. After her exploit, she received a very hasty and very desperate apology from Sir Charles Topham Hatt II, who gave her a complete overhaul as soon as possible. After her overhaul, she met a lonely Trevor the Traction Engine while passing by Crock's Scrap Yard. After making her crew aware of him, the three decided to consult the local vicar, and after a few negotiations, he was bought for the vicarage orchard.

In 1962, The Fat Controller noticed that Edith was struggling to keep up with the workload alone, and so purchased a failed diesel locomotive design from British Railways. The pair first met when Bill and Ben decided to play a trick on the newcomer, having their crews remove their nameplates and pretend they were the same engine. After Edith scared them off, the two got to chatting. Edith and BoCo have been firm friends ever since.

In 1971, Edith (then still known as Edward) made the realisation that she did not and had never felt male. With the support of Sir Charles, she changed her name to Edith, Sir Charles even having new custom nameplates cast for her. It took the others some time to come around, but they eventually all accepted her decision. By 2017, Edith was 127 and was certainly feeling her age. She put in a request to Sir Stephen Topham Hatt to formally retire from revenue service. Her request was granted and she went on an island-wide farewell tour. After her retirement, she was purchased by Sir Robert Norramby II for his (formerly his father's) estate railway/museum, where she resides to this day.

Personality

Edith is a caring, sweet and thoughtful engine, often putting others before herself. Though admirable, her selflessness sometimes leads to self-neglect or damage. Though she's usually the go-to engine to talk about your issues to, she shares very little about her own. Despite her shortcomings, she is a joy to talk to and was an asset to the railway.

Thank you for reading, I'll see you in the next one.

Cheerio!

#ttte#steam engine#steam locomotive#ttte au#rws au#ttte headcanon#ttte edward#alt history#locomotive#trains#railway#rws

18 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complex web of taxation in India can be daunting, especially for businesses looking to remain compliant and grow in a competitive market. SC Bhagat & Co., a trusted name in tax consultancy, offers top-notch GST registration services in Delhi to make the process seamless for businesses of all sizes. Whether you are a startup, SME, or a large corporation, GST registration is a crucial step in ensuring your business stays compliant with India's tax laws.

Why GST Registration is Important? The Goods and Services Tax (GST) is a value-added tax levied on the supply of goods and services. GST has simplified the tax structure by replacing numerous indirect taxes like VAT, Service Tax, and Excise Duty. Here are a few reasons why registering for GST is essential:

Legal Compliance: Businesses with an annual turnover of more than ₹40 lakhs (₹20 lakhs for special category states) are legally required to register for GST. Failure to comply can result in heavy penalties. Improved Credibility: GST registration increases your business’s credibility in the eyes of customers, suppliers, and investors. It shows that your business adheres to the laws and operates transparently. Input Tax Credit: Businesses registered under GST can claim input tax credit on purchases, reducing the overall tax burden and increasing profitability. Expansion Opportunities: With GST, businesses can easily expand to other states in India, as the unified tax system eliminates the hassle of complying with multiple state taxes. Why Choose SC Bhagat & Co. for GST Registration Services? As one of Delhi's leading tax consultancy firms, SC Bhagat & Co. is well-versed in the intricacies of GST laws and regulations. Here's why partnering with us for GST registration is the best choice for your business:

Expert Guidance Our team of experienced tax consultants ensures that you understand every step of the GST registration process. From assessing your eligibility to filing the necessary documents, we guide you through it all.

Hassle-Free Process We make GST registration easy by handling all the paperwork and documentation required for the process. You no longer need to worry about missing deadlines or submitting incorrect information.

Quick Turnaround Time is money, and we understand that delays can cost your business. At SC Bhagat & Co., we ensure a quick and smooth registration process, minimizing any disruptions to your business operations.

Post-Registration Support Our services don’t end with registration. We offer ongoing GST compliance support, helping you with return filings, audits, and other GST-related queries to keep your business on the right side of the law.

Affordable Pricing Our GST registration services in Delhi are competitively priced, ensuring you get the best value for your investment. We believe in offering quality services without breaking the bank.

The GST Registration Process Here’s a brief overview of the GST registration process that our team will handle for you:

Determine GST Applicability: Based on your business turnover and nature, we assess whether you are liable to register for GST. Collect Necessary Documents: We help you gather all the required documents like PAN, Aadhaar, business address proof, bank account details, and other necessary information. Submit Application: We submit your GST registration application online and ensure all details are accurate. Obtain GSTIN: After verification, your business will receive a unique GST Identification Number (GSTIN), which will be used for all future GST filings and transactions. Post-Registration Services: Once registered, we continue to support your business with GST return filing, audits, and compliance updates. Documents Required for GST Registration To make the process even smoother, here’s a list of documents you’ll need to register for GST:

PAN Card of the business or owner Aadhaar Card of the authorized signatory Proof of business address (rental agreement, property papers, utility bills) Bank account details (cancelled cheque, bank statement) Business incorporation certificate or partnership deed Digital Signature Certificate (if applicable) Why Delhi Businesses Need GST Registration Delhi is a bustling hub of commerce, and businesses here often engage in inter-state and international trade. GST registration not only simplifies tax compliance but also streamlines business operations by reducing the burden of dealing with multiple state-level taxes. With the right tax consultants, you can easily manage your GST obligations while focusing on growing your business.

Contact SC Bhagat & Co. for Professional GST Services If you’re looking for reliable GST registration services in Delhi, SC Bhagat & Co. is your trusted partner. With years of experience in tax consultancy, we offer tailor-made solutions for businesses across sectors. Let us handle your GST registration and compliance needs so you can focus on what matters most—growing your business.

#gst#accounting firm in delhi#taxation#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

4 notes

·

View notes

Text

A funny but accurate analysis of why the Crowdstrike failure hit certain sectors particulally hard:

To facilitate your institution’s conversation with the examiner who drew the short straw, you will conduct a risk analysis. Well, more likely, you’ll pay a consulting firm to conduct a risk analysis. In the production function that is scaled consultancies, this means that a junior employee will open U.S. Financial Institution IT Security Risk Analysis v3-edited-final-final.docx and add important client-specific context like a) their name and b) their logo. ...

Your consultants are going to, when they conduct the mandatory risk analysis, give you a shopping list. Endpoint monitoring is one item on that shopping list. Why? Ask your consultant and they’ll bill you for the answer, but you can get my opinion for free and it is worth twice what you paid for it: II.C.12 Malware Mitigation. ...

Your consultants will tell you that you want a very responsive answer to II.C.12 in this report and that, since you probably do not have Google’s ability to fill floors of people doing industry-leading security research, you should just buy something which says Yeah We Do That. CrowdStrike’s sales reps will happily tell you Yeah We Do That. ...

As a matter of fact, if you want to give CrowdStrike your email address and job title, they will even send you a document which is not titled Exact Wording To Put In Your Risk Assessment Including Which Five Objectives And Seventeen Controls Purchasing This Product Will Solve For.

Worth reading the entire piece!

5 notes

·

View notes

Text

How great leaders inspire action

Simon Sinek | TEDxPuget Sound

Simon Sinek explores how leaders can inspire cooperation, trust and change. He's the author of the classic "Start With Why."

He has a simple but powerful model for inspiring leadership all starting with a golden circle and the question “Why?” His examples include Apple, Martin Luther King, and the Wright brothers -- and by contrast TiVo, which (until a recent court victory tripled its stock price) seemed to be making a big effort to stay afloat.

Video Transcription. It is worth watching and listening to the video, as well as reading the transcript, for future memory:

"How do you explain when things don't go as we assume? Or better, how do you explain when others are able to achieve things that seem to defy all of the assumptions? For example: Why is Apple so innovative? Year after year, after year, they're more innovative than all their competition. And yet, they're just a computer company. They're just like everyone else. They have the same access to the same talent, the same agencies, the same consultants, the same media. Then why is it that they seem to have something different? Why is it that Martin Luther King led the Civil Rights Movement? He wasn't the only man who suffered in pre-civil rights America, and he certainly wasn't the only great orator of the day. Why him? And why is it that the Wright brothers were able to figure out controlled, powered man flight when there were certainly other teams who were better qualified, better funded -- and they didn't achieve powered man flight, and the Wright brothers beat them to it. There's something else at play here.

About three and a half years ago, I made a discovery. And this discovery profoundly changed my view on how I thought the world worked, and it even profoundly changed the way in which I operate in it. As it turns out, there's a pattern. As it turns out, all the great inspiring leaders and organizations in the world, whether it's Apple or Martin Luther King or the Wright brothers, they all think, act and communicate the exact same way. And it's the complete opposite to everyone else. All I did was codify it, and it's probably the world's simplest idea. I call it the golden circle.

Why? How? What? This little idea explains why some organizations and some leaders are able to inspire where others aren't. Let me define the terms really quickly. Every single person, every single organization on the planet knows what they do, 100 percent. Some know how they do it, whether you call it your differentiated value proposition or your proprietary process or your USP. But very, very few people or organizations know why they do what they do. And by "why" I don't mean "to make a profit." That's a result. It's always a result. By "why," I mean: What's your purpose? What's your cause? What's your belief? Why does your organization exist? Why do you get out of bed in the morning? And why should anyone care? As a result, the way we think, we act, the way we communicate is from the outside in, it's obvious. We go from the clearest thing to the fuzziest thing. But the inspired leaders and the inspired organizations -- regardless of their size, regardless of their industry -- all think, act and communicate from the inside out.

Let me give you an example. I use Apple because they're easy to understand and everybody gets it. If Apple were like everyone else, a marketing message from them might sound like this: "We make great computers. They're beautifully designed, simple to use and user friendly. Want to buy one?" "Meh." That's how most of us communicate. That's how most marketing and sales are done, that's how we communicate interpersonally. We say what we do, we say how we're different or better and we expect some sort of a behavior, a purchase, a vote, something like that. Here's our new law firm: We have the best lawyers with the biggest clients, we always perform for our clients. Here's our new car: It gets great gas mileage, it has leather seats. Buy our car. But it's uninspiring.

Here's how Apple actually communicates. "Everything we do, we believe in challenging the status quo. We believe in thinking differently. The way we challenge the status quo is by making our products beautifully designed, simple to use and user friendly. We just happen to make great computers. Want to buy one?" Totally different, right? You're ready to buy a computer from me. I just reversed the order of the information. What it proves to us is that people don't buy what you do; people buy why you do it.

This explains why every single person in this room is perfectly comfortable buying a computer from Apple. But we're also perfectly comfortable buying an MP3 player from Apple, or a phone from Apple, or a DVR from Apple. As I said before, Apple's just a computer company. Nothing distinguishes them structurally from any of their competitors. Their competitors are equally qualified to make all of these products. In fact, they tried. A few years ago, Gateway came out with flat-screen TVs. They're eminently qualified to make flat-screen TVs. They've been making flat-screen monitors for years. Nobody bought one. Dell came out with MP3 players and PDAs, and they make great quality products, and they can make perfectly well-designed products -- and nobody bought one. In fact, talking about it now, we can't even imagine buying an MP3 player from Dell. Why would you buy one from a computer company? But we do it every day. People don't buy what you do; they buy why you do it. The goal is not to do business with everybody who needs what you have. The goal is to do business with people who believe what you believe.

Here's the best part: None of what I'm telling you is my opinion. It's all grounded in the tenets of biology. Not psychology, biology. If you look at a cross-section of the human brain, from the top down, the human brain is actually broken into three major components that correlate perfectly with the golden circle. Our newest brain, our Homo sapien brain, our neocortex, corresponds with the "what" level. The neocortex is responsible for all of our rational and analytical thought and language. The middle two sections make up our limbic brains, and our limbic brains are responsible for all of our feelings, like trust and loyalty. It's also responsible for all human behavior, all decision-making, and it has no capacity for language.

In other words, when we communicate from the outside in, yes, people can understand vast amounts of complicated information like features and benefits and facts and figures. It just doesn't drive behavior. When we can communicate from the inside out, we're talking directly to the part of the brain that controls behavior, and then we allow people to rationalize it with the tangible things we say and do. This is where gut decisions come from. Sometimes you can give somebody all the facts and figures, and they say, "I know what all the facts and details say, but it just doesn't feel right." Why would we use that verb, it doesn't "feel" right? Because the part of the brain that controls decision-making doesn't control language. The best we can muster up is, "I don't know. It just doesn't feel right." Or sometimes you say you're leading with your heart or soul. I hate to break it to you, those aren't other body parts controlling your behavior. It's all happening here in your limbic brain, the part of the brain that controls decision-making and not language.

But if you don't know why you do what you do, and people respond to why you do what you do, then how will you ever get people to vote for you, or buy something from you, or, more importantly, be loyal and want to be a part of what it is that you do. The goal is not just to sell to people who need what you have; the goal is to sell to people who believe what you believe. The goal is not just to hire people who need a job; it's to hire people who believe what you believe. I always say that, you know, if you hire people just because they can do a job, they'll work for your money, but if they believe what you believe, they'll work for you with blood and sweat and tears. Nowhere else is there a better example than with the Wright brothers.

Most people don't know about Samuel Pierpont Langley. And back in the early 20th century, the pursuit of powered man flight was like the dot com of the day. Everybody was trying it. And Samuel Pierpont Langley had, what we assume, to be the recipe for success. Even now, you ask people, "Why did your product or why did your company fail?" and people always give you the same permutation of the same three things: under-capitalized, the wrong people, bad market conditions. It's always the same three things, so let's explore that. Samuel Pierpont Langley was given 50,000 dollars by the War Department to figure out this flying machine. Money was no problem. He held a seat at Harvard and worked at the Smithsonian and was extremely well-connected; he knew all the big minds of the day. He hired the best minds money could find and the market conditions were fantastic. The New York Times followed him around everywhere, and everyone was rooting for Langley. Then how come we've never heard of Samuel Pierpont Langley?

A few hundred miles away in Dayton, Ohio, Orville and Wilbur Wright, they had none of what we consider to be the recipe for success. They had no money; they paid for their dream with the proceeds from their bicycle shop. Not a single person on the Wright brothers' team had a college education, not even Orville or Wilbur. And The New York Times followed them around nowhere.

The difference was, Orville and Wilbur were driven by a cause, by a purpose, by a belief. They believed that if they could figure out this flying machine, it'll change the course of the world. Samuel Pierpont Langley was different. He wanted to be rich, and he wanted to be famous. He was in pursuit of the result. He was in pursuit of the riches. And lo and behold, look what happened. The people who believed in the Wright brothers' dream worked with them with blood and sweat and tears. The others just worked for the paycheck. They tell stories of how every time the Wright brothers went out, they would have to take five sets of parts, because that's how many times they would crash before supper.

And, eventually, on December 17th, 1903, the Wright brothers took flight, and no one was there to even experience it. We found out about it a few days later. And further proof that Langley was motivated by the wrong thing: the day the Wright brothers took flight, he quit. He could have said, "That's an amazing discovery, guys, and I will improve upon your technology," but he didn't. He wasn't first, he didn't get rich, he didn't get famous, so he quit.

People don't buy what you do; they buy why you do it. If you talk about what you believe, you will attract those who believe what you believe.

But why is it important to attract those who believe what you believe? Something called the law of diffusion of innovation, if you don't know the law, you know the terminology. The first 2.5% of our population are our innovators. The next 13.5% of our population are our early adopters. The next 34% are your early majority, your late majority and your laggards. The only reason these people buy touch-tone phones is because you can't buy rotary phones anymore.

We all sit at various places at various times on this scale, but what the law of diffusion of innovation tells us is that if you want mass-market success or mass-market acceptance of an idea, you cannot have it until you achieve this tipping point between 15 and 18 percent market penetration, and then the system tips. I love asking businesses, "What's your conversion on new business?" They love to tell you, "It's about 10 percent," proudly. Well, you can trip over 10% of the customers. We all have about 10% who just "get it." That's how we describe them, right? That's like that gut feeling, "Oh, they just get it."

The problem is: How do you find the ones that get it before doing business versus the ones who don't get it? So it's this here, this little gap that you have to close, as Jeffrey Moore calls it, "Crossing the Chasm" -- because, you see, the early majority will not try something until someone else has tried it first. And these guys, the innovators and the early adopters, they're comfortable making those gut decisions. They're more comfortable making those intuitive decisions that are driven by what they believe about the world and not just what product is available. These are the people who stood in line for six hours to buy an iPhone when they first came out, when you could have bought one off the shelf the next week. These are the people who spent 40,000 dollars on flat-screen TVs when they first came out, even though the technology was substandard. And, by the way, they didn't do it because the technology was so great; they did it for themselves. It's because they wanted to be first. People don't buy what you do; they buy why you do it and what you do simply proves what you believe. In fact, people will do the things that prove what they believe. The reason that person bought the iPhone in the first six hours, stood in line for six hours, was because of what they believed about the world, and how they wanted everybody to see them: they were first. People don't buy what you do; they buy why you do it.

So let me give you a famous example, a famous failure and a famous success of the law of diffusion of innovation. First, the famous failure. It's a commercial example. As we said before, the recipe for success is money and the right people and the right market conditions. You should have success then. Look at TiVo. From the time TiVo came out about eight or nine years ago to this current day, they are the single highest-quality product on the market, hands down, there is no dispute. They were extremely well-funded. Market conditions were fantastic. I mean, we use TiVo as verb. I TiVo stuff on my piece-of-junk Time Warner DVR all the time.

But TiVo's a commercial failure. They've never made money. And when they went IPO, their stock was at about 30 or 40 dollars and then plummeted, and it's never traded above 10. In fact, I don't think it's even traded above six, except for a couple of little spikes.

Because you see, when TiVo launched their product, they told us all what they had. They said, "We have a product that pauses live TV, skips commercials, rewinds live TV and memorizes your viewing habits without you even asking." And the cynical majority said, "We don't believe you. We don't need it. We don't like it. You're scaring us."

What if they had said, "If you're the kind of person who likes to have total control over every aspect of your life, boy, do we have a product for you. It pauses live TV, skips commercials, memorizes your viewing habits, etc., etc." People don't buy what you do; they buy why you do it, and what you do simply serves as the proof of what you believe.

Now let me give you a successful example of the law of diffusion of innovation. In the summer of 1963, 250,000 people showed up on the mall in Washington to hear Dr. King speak. They sent out no invitations, and there was no website to check the date. How do you do that? Well, Dr. King wasn't the only man in America who was a great orator. He wasn't the only man in America who suffered in a pre-civil rights America. In fact, some of his ideas were bad. But he had a gift. He didn't go around telling people what needed to change in America. He went around and told people what he believed. "I believe, I believe, I believe," he told people. And people who believed what he believed took his cause, and they made it their own, and they told people. And some of those people created structures to get the word out to even more people. And lo and behold, 250,000 people showed up on the right day at the right time to hear him speak.

How many of them showed up for him? Zero. They showed up for themselves. It's what they believed about America that got them to travel in a bus for eight hours to stand in the sun in Washington in the middle of August. It's what they believed, and it wasn't about black versus white: 25% of the audience was white.

Dr. King believed that there are two types of laws in this world: those that are made by a higher authority and those that are made by men. And not until all the laws that are made by men are consistent with the laws made by the higher authority will we live in a just world. It just so happened that the Civil Rights Movement was the perfect thing to help him bring his cause to life. We followed, not for him, but for ourselves. By the way, he gave the "I have a dream" speech, not the "I have a plan" speech.

Listen to politicians now, with their comprehensive 12-point plans. They're not inspiring anybody. Because there are leaders and there are those who lead. Leaders hold a position of power or authority, but those who lead inspire us. Whether they're individuals or organizations, we follow those who lead, not because we have to, but because we want to. We follow those who lead, not for them, but for ourselves. And it's those who start with "why" that have the ability to inspire those around them or find others who inspire them.

Thank you very much."

Source: TED

#mktmarketing4you #corporatestrategy #marketing #M4Y #lovemarketing #IPAM #ipammarketingschool #ContingencyPlanning #virtual #volunteering #project #Management #Economy #ConsumptionBehavior #BrandManagement #ProductManagement #Logistics #Lifecycle #Brand #Neuromarketing #McKinseyMatrix #Viralmarketing #Facebook #Marketingmetrics #icebergmodel #EdgarScheinsCultureModel #GuerrillaMarketing #STARMethod #7SFramework #gapanalysis #AIDAModel #SixLeadershipStyles #MintoPyramidPrinciple #StrategyDiamond #InternalRateofReturn #irr #BrandManagement #dripmodel #HoshinPlanning #XMatrix #backtobasics #BalancedScorecard #Product #ProductManagement #Logistics #Branding #freemium #businessmodel #business #4P #3C #BCG #SWOT #TOWS #EisenhowerMatrix #Study #marketingresearch #marketer #marketing manager #Painpoints #Pestel #ValueChain # VRIO #marketingmix #tedtalk #simonsinek

Thank you for following All about Marketing 4 You

2 notes

·

View notes

Text

On a hiatus for now.

Hello guys I'm sorry if I'm currently unable to post updates.

Right now I'm busy with work.

I'm also trying to set up my own company/consulting firm. It's a digital marketing firm and we will offer social media services, email and calendar management, project management, etc... Setting it up is a slow process because I also have to work full-time as I do it. I already have a team and some of the basics. I just need a few more things and I'll be set up. Currently, one of the difficulties I'm facing is funding.

My aim is to establish my own consulting firm so I can have more free time to do what I want while still having a decent amount of income. Since I'm also currently a single mom, the fact that I'm always too busy with work constantly weighs down on me. I hope to spend more time with my son. And this is why I have to succeed with the firm no matter what.

That being said, I would like to ask for the support of my Sims 4 community. I hope to raise money to fund my firm.

Of course, I don't want to ask for free money. Instead, I'm hoping you can buy from our Etsy store instead.

For now, I'm offering a T-shirt and a canvas tote bag. I honestly have no idea what to sell for now. Let me know what I can offer so I can set it up.

Here is the link to the store:

ETSY STORE Again, I don't want free money. Please just buy from our shop instead so you can get something in return at least. If you want a custom t-shirt design, please contact me - I will make it for you. I can offer mugs or mousepads or desk pads if you guys want. For full transparency, I need to raise about $5000 to successfully set up my company (employee salary, tech (CRM, hosting, hiring people to set up these things), and tools that I need to cater to clients, for ads and subscriptions - the rest will be cushion until we're able to land a decent number of clients to the point where the firm can run itself. ) Thank you so much Sim fam. I know I can count on you.

FOR THE RECORD: I'm new to the Etsy thing so if there's something wrong with your purchase, let me know and I will refund you. I'm not looking to take advantage of people. I just want to raise funds in an honest way.

Again, thank you for any type of support you can offer. I will appreciate it whether it's purchasing from my store or reblogging my post or telling other people about it or liking it. Any form of support warms my heart. Thank you so much! I appreciate all of you supportive people.

#sims4#help a fellow simmer#simmer#sims 4#sims#simblr#ts4 simblr#the sims 4#ts4 cc creator#ts4 community#ts4#simblr community

28 notes

·

View notes