#property tax protests

Explore tagged Tumblr posts

Text

Dallas County hearing Results | Dallas County

When property owners challenge their property tax assessments each year, their chances of receiving reductions improve. In an average year, well over half of the Dallas County property tax protests are successful. Read more @ https://www.poconnor.com/over-499-million-saved-on-dallas-county-property-taxes-through-protests-for-2023/

2 notes

·

View notes

Text

5 tips to win a property tax protest - Cut My Taxes

Learn how to win property tax protest and be able lower your annual tax burden with these 5 tips and use them to your advantage. Read more here https://www.cutmytaxes.com/5-tips-to-win-a-property-tax-protest/

0 notes

Text

Spanish opposition criticises home purchase tax

The opposition to Spanish Prime Minister Pedro Sánchez said the tax on property purchases by non-residents of the European Union was “xenophobic,” according to Euractiv.

Opponents stated that they would not apply the levy in the regions they administrated. Luis de la Matta, director of communications of the People’s Party (PP), declared:

We are not going to facilitate a xenophobic measure.

A housing crisis amid a chronic shortage of affordable accommodation and rising rents undermines Sánchez’s cabinet. His socialist government said on Monday it would restrict the purchase of homes by non-EU residents. It would also increase the tax by 100% of the property’s value, citing the same practice in Canada and Denmark.

Meanwhile, the PP controls most of the regions popular with British and Latin American homebuyers, such as Valencia, Andalusia, as well as the Canary and Balearic Islands.

The government plans to levy taxes through the Property Transfer Tax (ITP), affecting up to 26,000 second-hand properties in major cities and coastal areas. However, Spanish property platform Fotocasa said the measure could discourage foreign investment, as only 2% of Spanish homes were bought by non-EU residents.

Currently, home buyers in Spain pay an ITP tax of between 6% and 13%, depending on the region. The Catalonia Tenants’ Union stated that the majority of foreign buyers came from the EU. Therefore, the tax would be “grandiloquent but irrelevant,” the union added.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#spain#spain news#spanish politics#catalonia#luis de la matta#pedro sanchez#people's party#opposition#protests#political news#geopolitics#property transactions#ITP#property#tax#taxes

0 notes

Text

In testimony at a City Council budget hearing just days after the NYPD cracked down on pro-Palestinian protesters at the Fashion Institute of Technology in Chelsea, police officials said officers have racked up hundreds of thousands of overtime hours responding to war-related protests. The NYPD spent roughly $5 million on overtime pay to respond to protests between April 21 and May 7 alone, the officials told councilmembers.

The NYPD has cleared multiple protest encampments at school campuses around the city at the schools’ requests over the past few weeks, most prominently in a large-scale operation at Columbia University on April 30.

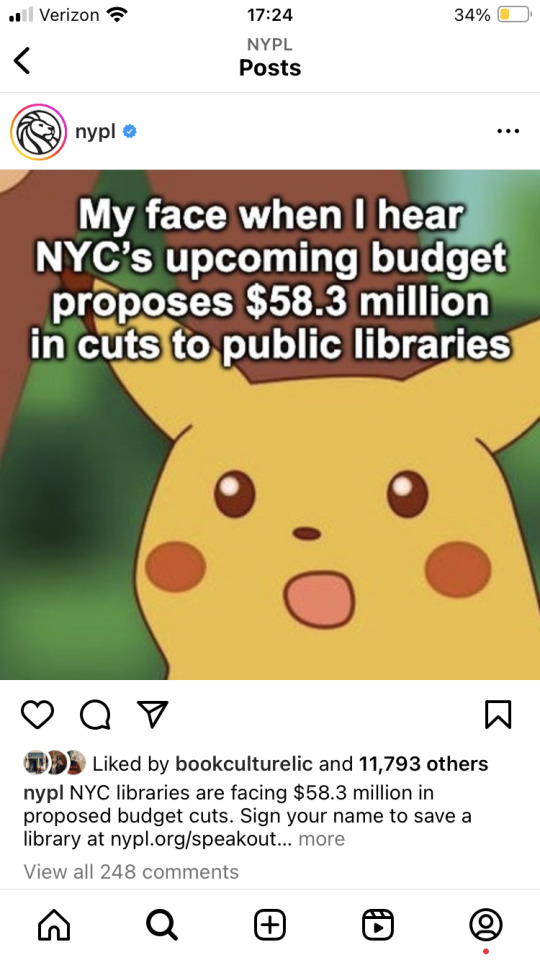

My last post on this didn’t get a ton of traction so I’m trying again. The latest budget proposal for NYC includes a $58.3 million cut to public libraries.

Previous cuts forced NYC public libraries to close on Sundays, and this further round of cuts would likely force libraries to end weekend service entirely. Additionally, it would mean further cuts to programming and the indefinite delay of reopening libraries that have been closed for renovation, which would leave entire neighborhoods without a library.

There is a preliminary budget hearing on May 21, and until then libraries are asking people to sign a letter here to urge the mayor’s office and city council to reverse the cuts.

I know things are terrible in a lot of ways right now and people probably feel overwhelmed and burnt out, but signing this letter (or reblogging this post) is a small, quick, concrete way to make a difference.

#taking my tax money and shutting down the services I use to beat students peacefully protesting on private property#because not wanting genocide is -checks notes- bad???

10K notes

·

View notes

Text

Common Myths About Protesting Your Property Tax Appraisal

Protesting your property taxes is a commonly practiced process that all homeowners can do every year. However, there are still a lot of homeowners who need help navigating the process.

Whether you are new to protesting your property tax or have been doing it for a while, there are many generalizations, misinformation, and myths surrounding the process that might prevent you from paying fair property taxes.

Today's article will address the top three common myths surrounding property tax refunds, helping you better understand the process and what it can (and cannot) do for you.

Protesting Your Property Tax Will Always Result In Savings.

Sometimes, a homeowner must navigate the process, only to hear that their county's estimated value will stand. This can be very frustrating for homeowners and deter them from protesting their property tax in the future. Even if you bring down your property's appraised value, your homestead exemption will cap your overall taxable value increase at 10%. In such cases, the actual tax bill itself will not change. This is why it's essential to consider the benefits you get when you protest your property tax amount before you start the process.

You Have To Do Everything By Yourself.

No. The homeowner doesn't have to be the one to gather evidence and show up at hearings. You don't even have to physically submit forms or any additional documentation required for the process. Instead, you could hire a tax professional or a firm to help you with the process. Since these professionals have years of on-field experience, they can quickly help you achieve a favorable outcome.

Lowering Your Property Taxes Can Also Lower Your Property Value.

False! The tax district's assessment of your real estate is a value that's loosely based on the current market value of your property. However, it cannot affect how little or how much you can sell your property for in case you put it on the market. While your real estate will be appraised as a critical part of the selling process, it's not the same as your local county's assessment or appraisal process. You can rest easy knowing that your property taxes will not hurt your ability to sell your property.

Remember, it's essential for you to approach this process with careful consideration. Given that there is so much misleading information available online, it's best to speak with a professional property tax expert to clear any doubts before you begin.

0 notes

Text

Learn how to reduce your property tax burden and maximize savings as a homeowner. Discover effective strategies to lower costs and benefit from informed decisions.

0 notes

Text

https://jeffersoncountypropertytaxtrends.com/informal-resolution/

Jefferson County property owners saved $22 MM in 2021 protests settled informally; 49% won! There is no fee to appeal and your value CAN NOT be increased. https://jeffersoncountypropertytaxtrends.com/informal-resolution/

0 notes

Text

https://jeffersoncountypropertytaxtrends.com/tax-protests-filed/

Jefferson property tax protests saved owners over $25 million in 2021. Owners won savings of $22 million in informal appeals, $2.9 million in ARB hearings. view-source:https://jeffersoncountypropertytaxtrends.com/tax-protests-filed/

0 notes

Text

https://jeffersoncountypropertytaxtrends.com/savings-from-appeals/

Jefferson property tax appealed saved owners $22 MM at informal hearings, $3 MM at ARB hearings and $11 MM through lawsuits in 2021. Learn how to save. https://jeffersoncountypropertytaxtrends.com/savings-from-appeals/

0 notes

Text

Property Tax Protest Services | O’Connor & Associates

Property tax protests are the best way to reduce your property taxes. Our licensed property tax consultants and administrative support team save homeowners and commercial property owners over $100 million annually. Visit https://www.poconnor.com/property-tax-protest-services/

#Property Tax Protests#Property Tax Protest Services#O'Connor & Associates#Property Tax Reduction Experts#property taxes

0 notes

Text

Get successful property tax protests in Johnson County

Find out how to increase your chances of success when appealing your property taxes, with a high probability of reducing your property taxes in 70 to 90% of cases. By joining with O'Connor.

0 notes

Text

Hidalgo County Property Tax Protests

If you don't want to protest annually yourself, we can do it for you. There is no flat fee. No upfront cost. No fee ever unless we reduce your property taxes that year. Visit https://hidalgocountypropertytaxtrends.com/informal-resolution/

0 notes

Text

Tarrant County Property Tax Protests Versus Texas-Wide

Commercial property owners were the primary force behind Tarrant County owner’s increased property tax savings via property tax protests. Property tax objections in the Tarrant Appraisal District don’t outnumber those in all other appraisal district in the state of Texas. Read more @ https://www.poconnor.com/tarrant-county-property-tax-protests-versus-texas-wide/

0 notes

Text

Knox County Appraisal District | Knox CAD

Knox County Appraisal District CAD owners reduce their property taxes by 5% through tax protests. 70% of property tax protests are successful. Visit https://www.poconnor.com/knox-county/

0 notes

Text

Property tax protest services

Property tax protest services, no flat fee, no upfront fees, NEVER a fee unless we reduce your property taxes. Enroll online in just 2 to 3 minutes. Visit https://www.poconnor.com/property-tax-protest-services/

#Property Tax Protests#Property Tax Protest Services#O'Connor & Associates#Property Tax Reduction Experts

0 notes

Text

Get to know the values of house property tax via O'Connor.

O'Connor helps you to know the number of single-family property tax protests, market-value houses, condos, townhomes, and more. Gain more knowledge on the Houses Property Tax Protest Summary in Galveston County.

0 notes