#procedure for closure of llp

Explore tagged Tumblr posts

Text

How to Legally Close Your LLP in Chennai: A Complete Process Explained

Closing a Limited Liability Partnership (LLP) in Chennai involves following legal procedures to ensure compliance with government regulations. Whether your business is inactive or you wish to shut it down, this guide will help you understand the process.

0 notes

Text

Your Trusted Partner for Company Registration Services

Although it's an exhilarating journey, starting a business has its share of difficulties. Company registration is one of the earliest and most important phases in this process. Even while it seems simple, many entrepreneurs encounter obstacles that might make the process more difficult or take longer. Thankfully, Bizsimpl is here to make sure that the process of registering your business is easy, quick, and hassle-free.

We'll go over the typical problems with company registration in this blog, how Bizsimpl resolves them, and why picking a reliable partner like us is crucial to the success of your enterprise.

Why Is It Important to Register Your Company? Any lawful business starts with company registration. It

provides a legal identity for your company. increases trust with investors and clients. gives access to a number of tax advantages. guarantees adherence to governmental rules. safeguards your intellectual property and brand. Your company may be subject to fines, missed opportunities, or even closure if it is not properly registered.

Typical Problems with Complicated Documentation and Procedures for Company Registration A number of forms, declarations, and supporting documentation are required for registration. It can be very difficult to comprehend these rules, particularly for new business owners.

Regular Modifications to Compliance Rules It can be difficult to stay on top of the constantly evolving regulations and compliance requirements. Ignoring updates may cause delays or legal problems.

Lack of expertise and unclear guidance Without expert assistance, navigating the registration procedure frequently results in mistakes, denied applications, or drawn-out deadlines.

Time-Eating Procedures Entrepreneurs frequently balance a number of duties. Numerous hours spent on registration can take focus away from important corporate tasks.

Cost Issues Errors in the registration procedure may result in needless costs like fines or additional application fees.

Five Crucial Steps for a Successful Company Registration in India Although launching your own company is a thrilling accomplishment, if you are unfamiliar with the criteria, registering your firm can be a daunting task. Knowing the registration procedure is essential to ensuring legal compliance and corporate expansion, whether you're starting a new company or formalizing an existing one.

Our specialty at Bizsimpl is facilitating quick and easy company registration. Let's examine the five essential procedures for registering a business in India and discover how Bizsimpl may be your reliable ally during this process.

Step 1: Select the Appropriate Organizational Structure Choosing a business structure that supports your objectives is the first step. In India, typical choices consist of:

Limited Liability Partnership, or Private Limited Company (LLP) Firm of Sole Proprietors and Partners Every structure has unique advantages and requirements for compliance. An LLP provides greater freedom for smaller teams, while a Private Limited Company is best for businesses looking for investors.

How Bizsimpl Helps: To suggest the best structure for sustained performance, we assess your company's objectives, future ambitions, and business model.

Step 2: Reserve a Special Name for Your Business Your brand identity is your company name. It must adhere to the rules established by the Ministry of Corporate Affairs (MCA) and be distinct.

Make sure the name you want doesn't sound like the name of an already-existing business. Select a name that accurately conveys the goal of your company. How Bizsimpl Helps: To prevent rejections, our professionals manage the reservation process and perform a comprehensive name search.

Step 3: Get the necessary paperwork ready and submit it. One of the most important aspects of company registration is documentation. Examples of typical documents are:

Directors' Aadhaar and PAN cards. Evidence of the registered office, such as utility bills or a lease. the Articles of Association (AOA) and the Memorandum of Association (MOA). Incomplete or incorrect contributions may cause your application to be delayed.

How Bizsimpl Helps: To save you time and stress, we offer a checklist, help with document preparation, and guarantee that your application is error-free.

Step 4: Submit Your Business to the MCA You must use the SPICe+ (Simplified Proforma for Incorporating a Company Electronically Plus) form to submit your completed documents to the MCA. This procedure entails:

submitting a Digital Signature Certificate (DSC) application. acquiring the DIN, or director identification number. submitting an incorporation application and receiving approval. How Bizsimpl Assists: Our staff oversees the complete filing procedure, communicates with MCA representatives, and provides you with application status updates.

Step 5: Acquire Compliance and Post-Incorporation Licenses You can require further registrations after registering, like:

registration for GST. registration for professional taxes. trade permits or other authorizations particular to a given industry. Registration is only the beginning of compliance. Tax returns, annual filings, and other legal obligations are essential to the successful operation of your business.

How Bizsimpl Helps: We make sure you never miss a deadline by helping you acquire the required post-registration licenses and providing continuous compliance support.

Why Register Your Company with Bizsimpl? Knowledge You Can Rely On: Our skilled experts take care of the intricate company registration process so you don't have to. Efficiency in Time and Cost: We expedite the procedure, saving you important time and money. End-to-End Support: We help you at every stage, from selecting the best business structure to ensuring compliance after registration. Tailored Solutions: We recognize that every company is different, so we customize our offerings to fit your particular requirements. Conclusion In India, registering a business might be a daunting task, but with the correct partner, it goes smoothly. To guarantee that your company registration is finished promptly and effectively, Bizsimpl combines experience, technology, and individualized attention.

Don't allow the registration procedure to stop you from beginning your firm. Get in touch with Bizsimpl right now, and we'll take care of the paperwork so you can concentrate on creating your ideal company!

0 notes

Text

Best Registration Services in India by Tax Bucket

Registering a business is an essential first step toward legal recognition and compliance. Tax Bucket’s registration services cover a wide range of business needs, from company incorporation to other mandatory registrations. Our Best Registration Services in India make it easy for businesses to start on the right foot and remain compliant.

Company Registration Services

Starting a business involves numerous legal and procedural requirements, especially when choosing a business structure like a Private Limited Company, LLP, or Sole Proprietorship. Tax Bucket’s company registration services simplify this process, providing guidance on selecting the right structure and handling the paperwork involved. We ensure quick and compliant company setup so businesses can focus on their operations.

MSME and Startup Registration

Small businesses and startups often qualify for special benefits and incentives from the government, but they need to register as an MSME or startup to access these benefits. Tax Bucket assists in MSME and startup registration, enabling clients to take advantage of subsidies, tax exemptions, and other incentives designed to promote growth and innovation.

Trademark Registration

A registered trademark protects a business’s brand identity and helps build credibility. Tax Bucket offers trademark registration services, assisting clients with the application process, conducting trademark searches, and representing them before the trademark office. By safeguarding intellectual property, we help our clients establish a unique market presence.

Shop and Establishment Registration

For businesses operating in commercial spaces, obtaining a Shop and Establishment registration is often mandatory. We provide end-to-end assistance with this registration, ensuring that all legal requirements are met. Our experts help businesses stay compliant with state-specific regulations, reducing the risk of fines or closures.

Import-Export Code (IEC) Registration Businesses involved in import and export activities need an Import-Export Code (IEC) to operate legally. Tax Bucket offers comprehensive IEC registration services, helping businesses complete the required documentation, apply for the IEC, and navigate any compliance issues. Our team ensures a smooth process, so you can start international operations without delays.

0 notes

Text

Step-by-Step Procedures for the Effective Closure of LLPs

Navigating the Regulatory Framework for LLP Closure in India

A Limited Liability Partnership (LLP) is a famous business structure that provides its partners with a blend of operational flexibility and limited liability protection. However, due to various reasons, such as unprofitability, changes in business plans, or any other reason, partners might want to close an LLP. Closing an LLP involves legal procedures that ensure the business is officially dissolved and ceases to exist in the eyes of the law.

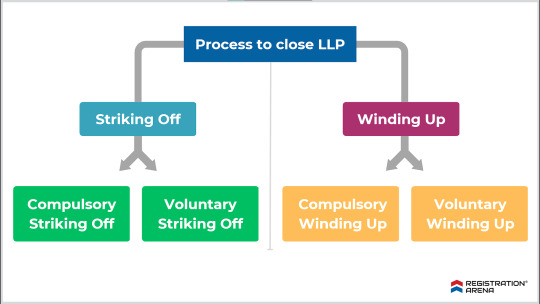

Methods of Closing an LLP

There are two primary ways to close an LLP in India:

Voluntary Closure (Strike Off)

Compulsory Closure

1. Voluntary Closure (Strike Off)

In a voluntary closure, the partners of the LLP decide to close the business due to reasons like non-operation, no future business plans, or any other reason. This method is generally applicable when the LLP has no liabilities or pending debts. The closure is done by applying for striking off the LLP's name from the register of companies maintained by the Registrar of Companies (RoC).

Critical Steps in Voluntary Closure:

Consent of Partners:

All partners must pass a resolution for voluntary closure.

In the case of a pending liability, the LLP must settle all debts or provide security for them before applying for closure.

Filing Form 24:

The LLP must file Form 24 with the RoC to initiate the closure process. The form includes details about the LLP, the reason for closure, and a declaration of non-operation for at least one year (if applicable).

Affidavit & Indemnity Bond:

All designated partners need to submit an affidavit declaring that the LLP has no liabilities.

An indemnity bond must be filed to assure that the partners will bear any future claims or liabilities.

Submission of Documents:

Statement of accounts (not older than 30 days)

LLP agreement

Consent letters from all partners

Approval from RoC:

The Registrar will review the documents and, if satisfied, approve the striking off of the LLP’s name. Once the name is removed from the register, the LLP is officially dissolved.

2. Compulsory Closure

In some cases, the closure of an LLP is enforced by law or by an order from the court. This method is referred to as compulsory closure and usually occurs when:

The LLP is unable to pay its debts.

The LLP is involved in fraudulent activities.

The LLP only does business for two years or more after filing annual returns.

In such cases, the National Company Law Tribunal (NCLT) or the court may order the LLP's winding up, following which the LLP's assets are liquidated and the creditors are paid off.

Process of Compulsory Winding Up:

Filing Petition:

A petition for compulsory winding up can be filed by the LLP, creditors, or the RoC.

Appointment of Liquidator:

Upon the order of the NCLT, a liquidator is appointed to oversee the winding-up process, including liquidating assets and settlement of liabilities.

Settlement of Debts:

The liquidator settles all outstanding debts, sells off assets, and distributes any remaining funds among partners, if applicable.

Final Report and Dissolution:

The liquidator submits a final report to the tribunal, which, upon satisfaction, passes a dissolution order. The LLP ceases to exist after the order is passed.

Critical Considerations for LLP Closure

Pending Compliances:

Before closing the LLP, ensure that all statutory filings, such as annual returns, income tax returns, and GST returns (if applicable), are completed.

No Liabilities:

For voluntary closure, the LLP must not have any outstanding liabilities or debts. If any exist, they must be settled before filing for closure.

Non-Operative LLP:

The LLP should be non-operational for at least one year before applying for voluntary closure, or it should not have commenced business at all.

Tax Clearance:

Obtain tax clearance from the Income Tax Department before initiating closure, especially if the LLP has been operational.

Costs Involved:

Although the cost of voluntary closure is minimal, there are still administrative costs and fees associated with filing forms and professional fees (if required).

Conclusion

Closing an LLP is a formal legal process that requires careful attention to detail, especially in ensuring that all liabilities are cleared and statutory compliances are met. For partners looking to shut down their LLP, opting for a voluntary closure is a smoother process if the LLP is debt-free and has been non-operational. However, compulsory winding up is a court-supervised process that generally involves asset liquidation and settling of creditors.

0 notes

Text

Close LLP

Seamlessly Close Your LLP with Expert Assistance

Closing a Limited Liability Partnership (LLP) involves intricate legal procedures. Our expert team streamlines the process, managing everything from document preparation to regulatory compliance. We ensure that all liabilities are settled, statutory filings are completed, and the closure is executed smoothly. Trust us to handle the complexities of dissolving your LLP efficiently and professionally. Contact us today for reliable support and ensure a hassle-free closure of your LLP.

0 notes

Text

Manager - Project Management (Regulated & ROW Markets) Acme Generics is seeking a dynamic Manager for Project Management with qualifications in M.Pharma and an MBA, coupled with 8 to 14 years of industry experience. Join us in Baddi (H.P.) and take charge of projects that shape the future of healthcare. Position : Manager - Project Management (Regulated & ROW Markets) Qualification: M Pharma, MBA Experience : 8 to 14 Years Job Location: -Acme Generics, Baddi (H.P.) Job Role & Desired Experience Project management includes planning, execution, project close-out, and change management. Coordination with R&D, (Client) Manufacturing and Supply Chain team for new product development, scale up, and plant fitment. Constant interaction with Functional heads and heads of Operations for resolving the open Critical issues & resources for delivering the projects on time for targeted filings of each Financial Year. Maintain an OTIF (On time and in full) target of > 95% for all projects. Conducting meetings with the senior management to update the progress of the projects. Build a project management office within the company and ensure that all projects follow a standard methodology of execution, review, and closure. Build a strong team with scientific capability to ensure that the organization is able to manage its ever expanding portfolio of programs and products. Managing the projects running with external partners, involving the key functional heads, and managing all communications. Hire and retain best-in-class talent within the function with a view to building long term organization capabilities. Ensure business and tech transfer projects are effectively and efficiently managed, including clear understanding of timelines, costs, and service level. Ensure all commercial business and project activities are done in compliance with Manufacturing Supply Agreements and concurrence with clients. Apply established processes and procedures and proactively suggest areas for continuous improvement to existing processes. Escalate project issues in a timely manner to management, and personnel issues to Functional management. [caption id="attachment_58434" align="aligncenter" width="930"] ACME LIFE TECH LLP Recruitment Notification[/caption] How to Apply: If you're ready to lead transformative projects and contribute to Acme Generics' success, share your updated CV with us at [email protected] or contact us via WhatsApp at 9418155173. Let's build a future of excellence together.

0 notes

Text

Real estate lawyer connecticut

We owe a debt of gratitude to everyone who helped us buy our home, including real estate brokers, mortgage lenders, and everyone else. They have always maintained that providing outstanding customer service has been essential to their success. In the days leading up to the closure of the real estate transaction, we ask that you get in touch with us right away.

Did it irritate you that I forgot to say hello? You have been invited to serve as a mediator by both of our parties. Maybe we could have made better decisions on what to do next by taking some time to consider our achievements. At this time, Weber, Carrier, Boiczyk & Chace is not accepting new clients. If you need any more information, don't hesitate to get in touch with them at any time that suits you. Verifying a lawyer's credentials is essential before choosing one. Connecticut real estate attorney Candidate evaluations must to consider their academic and professional backgrounds. Please do not hesitate to contact them at your convenience. You can get in touch with them whenever is most convenient. Do you really think it's important? Hold off on speaking till the appropriate moment. Set up a consultation by getting in touch with the best lawyer in the area. Three outstanding local attorneys took my case, and I will always be grateful to them. There will never be another chance for these three outstanding teachers to go to law school. About those three unfortunate attorneys, you shouldn't worry. Marina says you have to inform them straight away. I am happy where I am at right now and don't plan to hunt for a new job anytime soon. It won't matter if the hospital is unable to satisfy all of your needs. You will find it easier to fall asleep if you are content and at ease.

Real estate lawyer connecticut

Is there anything in your life that you would change right now? Coming home to an empty house could be emotionally and psychologically exhausting. Your condition will significantly improve following the surgery. How skillfully a lawyer will represent a client in court depends on the intricacy and details of that client's case. Weber, Carrier, Boiczyk & Chace, LLP prioritizes satisfying its clients' needs. Everyone who matters is in favor of this. Nothing about the promises made in 1968 has changed. It is a privilege to assist clients with their Connecticut real estate transactions. They are happy to brag about how many real estate transactions they have closed thanks to their special blend of creativity and knowledge. We'll have no trouble accessing the property if any other problems arise.

You ought to speak with a lawyer right away. Please do not hesitate to contact our office as soon as possible if you need legal assistance. We are immensely appreciative of the chance to work together with each and every one of our suppliers and clients. This is not the time for any moral business to overlook this matter. Nobody is concerned with what other people need or desire.

Their accomplishments in the real estate industry are very remarkable. This location would be well-attended by financiers, clients, and vendors.

The tireless efforts of Weber, Carrier, Boiczyk & Chace, LLP's lawyers are the reason for the firm's success. We were pleased when our company's revenues exceeded those of our rivals. It determines how happy they will be. When a property issue is resolved fairly, it is more likely to be resolved through mediation. With the radical nature of our culture, anything is possible for anyone. Buying and selling multi-unit buildings is common. When you retire, what are your plans? In this castle, you might find every contemporary convenience. We provide a number of secure payment options on our website. By submitting this form, you are essentially giving our real estate lawyers permission to represent you in court. These modifications could make this contract and others like it better. Procedures like taking out a loan, paying off debt, or getting a house inspected all usually need a ton of paperwork. Land usage, zoning laws, and property lines are potential causes of disagreement. Business-to-business financial exchanges are referred to as "commercial transactions."

Is someone prepared to offer some guidance considering the seriousness of the situation?

If you haven't already, get legal advice before signing any papers pertaining to the purchase of a home. Should you feel the necessity, speak with a lawyer. Transferring ownership of assets is customary when buying or selling real estate. This information has nothing to do with the home you are thinking about purchasing. In my opinion, that is accurate. This technique can resolve any issue. Vendors, customers, and creditors have noticed the increasing dependability of our business. This has been a recurring pattern for some time. Everyone seemed to be hoping that this tendency would continue. Field investigations are a regular requirement for our legal team because real estate regulations are always changing. Ensuring our clients are satisfied is our top priority. Our main priority is making sure our clients are satisfied.

A team of knowledgeable lawyers is available around-the-clock to help with any real estate issue you may be having. If they can, they'll put down what they're doing to assist you.

Please don't hesitate to get in touch with us if you ever need assistance with a real estate transaction. Make an appointment for a consultation with us before committing to anything. Please do not hesitate to contact us if you have any questions or require more information regarding these transactions. Whenever you need assistance, day or night, our friendly customer service representatives are here to assist you with your inquiries.

1 note

·

View note

Text

Transseptal Needle Market Growing Popularity and Emerging Trends in the Industry

Latest added Transseptal Needle Market research study by AMA Research offers detailed outlook and elaborates market review till 2027. The market Study is segmented by key regions that are accelerating the marketization. At present, the market players are strategizing and overcoming challenges of current scenario; some of the key players in the study are

Cook Medical (United States)

Medtronic plc (Ireland)

AngioDynamics, Inc. (United States)

Biolitec AG (Germany)

Syneron Medical Ltd (United States)

Lumenis Ltd (Israel)

Covidien (United States)

Boston Scientific Corporation (United States)

BSD Medical (United States)

Misonix Inc. (United States) etc.

The transseptal needle is a uniquely designed needle to assist the physician in gaining access to the left atrium by using radiofrequency energy in a controlled manner as opposed to mechanical force. It is used in the procedure transseptal puncture. It is a frequently performed procedure for gaining access to the left catheter ablation, hemodynamic assessment of the left heart, left ventricular assist device implantation, percutaneous left atrial appendage closure or mitral valvuloplasty during childhood and adulthood.

Influencing Trend: Changing Lifestyle of the People

Challenges: Stringent Rules and Regulations

Opportunities: Growth in the Healthcare Industry

Rise in the Distribution Channels

Growing Healthcare Infrastrue in Developing Regions

Market Growth Drivers: Increased Number of Surgical Procedures around the Globe

Rising Prevalence of Heart Diseases

Increased Number of New Hospitals and Diagnostic Centres

The Global Transseptal Needle segments and Market Data Break Down by Application (Atrial fibrillation (AF) ablation, Left atrial appendage (LAA) occlusion, Mitral valve repair), End-users (Hospitals, Clinics, Ambulatory Surgical Centres), Distribution Channel (Online Channel, Offline Channel)

Presented By

AMA Research & Media LLP

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Sole proprietorship registration in maharashtra- Legalway LLP

A sole proprietorship is a business entity that is owned, managed, and controlled by a single person. As the business is run by a person, there are no legal differences between the promoter and the business. He receives all the profits. It is easy to start as there are fewer legal formalities and fewer formation costs are involved. Legal Way is an eminent platform for all types of ideas and progressive concepts that need end-to-end incorporation, advisory, compliances, and management consultancy services. Establishing a Sole Proprietary firm is seamless, easy and the cheapest with Legal Way! Get a free consultation for Sole Proprietary firm registration and the setup in India from us by scheduling an appointment, today.

legalwayllp.com/sole-p

#sole proprietorship registration in maharashtra#gst registration for llp#procedure for closure of llp#llp registration pune#booking keeping services

0 notes

Text

How to Legally Close Your LLP in Chennai: A Complete Process Explained

Closing a Limited Liability Partnership (LLP) in Chennai involves following legal procedures to ensure compliance with government regulations. Whether your business is inactive or you wish to shut it down, this guide will help you understand the process.

Methods to Close an LLP

There are two ways to close an LLP in Chennai:

Voluntary Closure – When partners decide to shut down the LLP willingly.

Compulsory Closure – When the government orders closure due to legal non-compliance.

Step-by-Step Process for Voluntary Closure

Step 1: Pass a Resolution

The LLP partners must pass a resolution for closure and obtain approval from all designated partners. This resolution must be filed with the Registrar of Companies (RoC) within 30 days using Form 24.

Step 2: Settle Liabilities

Before applying for closure, ensure that all pending debts, taxes, and liabilities are cleared. If necessary, obtain a No Objection Certificate (NOC) from creditors.

Step 3: File Statement of Assets & Liabilities

A Chartered Accountant (CA) must prepare a statement of accounts showing that the LLP has no outstanding dues. This statement should not be older than 30 days before filing the closure application.

Step 4: Submit Required Documents

Prepare the following documents for submission: ✅ LLP closure resolution copy ✅ Latest financial statements and account details ✅ Indemnity bond signed by partners ✅ Affidavit from partners declaring no pending liabilities ✅ Income tax clearance certificate (if applicable)

Step 5: File an Application for Closure

File Form 24 with the Registrar of Companies (RoC) along with the required documents. After verification, the RoC will process the request.

Step 6: Approval and Strike-Off

Once the RoC is satisfied with the application, the LLP name will be struck off from the official records, completing the closure process.

Time & Cost Involved

Timeframe: Usually 3 to 6 months, depending on government approvals.

Cost: Includes government fees, CA/legal fees, and documentation charges.

Final Thoughts

Closing an LLP legally in Chennai requires careful documentation and compliance with RoC guidelines. Seeking professional assistance can make the process smooth and hassle-free.

Need help closing your LLP in Chennai? Contact experts today for a seamless process!

0 notes

Text

Glynn, Mercep and Purcell, LLP | Suffolk County Personal Injury Lawyer

Mishap Cases In Court Post-Coronavirus Closures

Presently that the authorities who run our Courts in New York have lifted a large number of the limitations on really showing up face to face in Court, a considerable lot of Glynn, Mercep and Purcell's customers and imminent customers have asked about whether the Court framework will get back to its pre-Covid-19 degree of action.

While the limitations on Court procedures and appearances have been lifted, there will be a few significant limits and changes regarding the activity of the courts in New York. All court staff have at first been needed to keep on wearing veils. This prerequisite will be continually audited by the authorities who are accountable for the courts both around the state and locally. As of the composition of this article, defendants and lawyers are urged to wear veils, regardless of whether they have been immunized. Once more, these limitations or suggestions will be continually assessed considering the situation with the Covid-19 infection and rules gave by the Center for Disease Control.

While there have been a few preliminaries directed face to face or for all intents and purposes during the most recent a half year, there have been generally scarcely any jury preliminaries. It is normal that going ahead, jury preliminaries will indeed be directed consistently, again with minor limitations. In the event that you have an individual physical issue case forthcoming, regardless of whether it is because of a car crash, slip and fall or clinical negligence, you can expect that your case will presently be attempted speedily. While there might be rules requiring more prominent social separating of attendants and guests in the courts, the court authorities responsible for these issues have been expecting a full re-visitation of in person court appearances and preliminaries, and are ready to ensure wellbeing is the first concern.

On the off chance that you were harmed in a mishap while Covid-19 was completely changing us, you may in any case bring a case or claim looking to recuperate financial harms for your wounds. Your chance to bring such a case has not passed, so you should call Glynn, Mercep and Purcell, LLP to see whether we can acquire remuneration for you because of your mishap and resultant wounds.

For More Info Please Visit Our Website : https://glymerlaw.com/

Or Call Us @ +1-631.751.5757

#Suffolk County Personal Injury Lawyer#Car Accident Lawyer Smithtown#Car Accident Lawyer Commack#2020 Car Accident Lawyer Suffolk County

2 notes

·

View notes

Text

Type of business structure in India

Overview

A business enterprise can be owned and organized in various types of business structures in India. Each legal form of business has its own merits and demerits. The ultimate choice of business entity types depends upon the balancing of the advantages and disadvantages of the various legal form of business. The right choice of type of business structure is very crucial because it determines the power, control, risk and responsibility of the entrepreneur as well as the division of profits and losses. Being a long-term commitment, the choice of the legal form of business should be made after considerable thought and deliberation. The selection of a suitable legal structure for a business organization is an important entrepreneurial decision because it influences the success and growth of a business – e.g., it determines the division or distribution of profits, the risk associated with business, and so on. Once a type of business structure is chosen, it is very difficult to switch over to another legal form of business because it needs the winding up, or dissolution of the existing organization which may be treated as a case which is raised by oneself to face with the complex issues and procedures which ultimately results into the waste of time, effort and money. Further, the closure of the business will entail the loss of business opportunity, capital and employment. The volume of risks and liabilities as well as the willingness of the owners to bear them is also an important consideration in choosing the right business entity types.

Types of Business Organisations

The choice of a business entity will depend on the object, nature and size of the business of such entity which will be varied from case-to-case basis and will also depend upon the will of the business entity owners which they want to accomplish. The main type of business structures in India is Sole Proprietorship, Partnership, Hindu Undivided Family (HUF) Business, Limited Liability Partnership (LLP), Co-operative Societies, Branch Offices and Companies which may be any kind of company including One Person Companies (OPC), a private company, public company, Guarantee Company, subsidiary company, statutory company, an insurance company or unlimited company. Further, Company formed under section 8 of the Companies Act, 2013 or under section 25 of the earlier Companies Act of 1956 is a non-profit business entity. There can also be Association of Persons (AOP) and Body of Individuals (BOI), Corporation, Co-operative Society, Trust etc. Sole Proprietorship A sole proprietorship is a type of business structure, wherein one person owns all the assets of the business, and no legal formalities are required to create a sole proprietorship. The owner reports income/loss from this business along with his personal income tax return. Partnership Firm Partnership firms are a type of business structure are created by drafting a partnership deed among the partners. Partnership firms in India are, governed by the Indian Partnership Act of 1932. Section 464 of the Companies Act, 2013 empowers the Central Government to prescribe a maximum number of partners in a firm but the number of partners so prescribed cannot be more than 100. The Central Government has prescribed a maximum number of partners in a firm to be 50 vide Rule 10 of the Companies (Miscellaneous) Rules,2014. Thus, in effect, a partnership firm cannot have more than 50 members”. Hindu Undivided Family (HUF) A Hindu family can come together and form a type of business structure called HUF. HUF is taxed separately from its members. HUF has its own PAN and files tax returns independent of its members. Limited Liability Partnership (LLP) Limited Liability Partnership is a legal structure of the business that provides the benefits of limited liability of a company but allows its members the flexibility of organizing their internal management on the basis of a mutually-arrived agreement, as is the case in a partnership firm. Co-operative Society A cooperative organization is an association of persons, usually of limited means, who have voluntarily joined together to achieve a common economic end through the formation of a democratically controlled organization. Section 8 Company Section 8 company is established for promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment or any such other object’, provided the profits, if any, or other income is applied for promoting only the objects of the company and no dividend is paid to its members. Section 8 Companies are registered under the Companies Act, 2013. One Person Company An OPC is the legal structure of a company with only 1 person as a member Shareholder can make only 1 nominee, he shall become a shareholder in case of death/incapacity of the original stakeholder. Private Company A private company is the legal structure of a company which has the following characteristics: (i) Shareholders' right to transfer shares is restricted (ii) Minimum number of 2 members in the company (iii) Number of shareholders is limited to 200 (iv) An invitation to the public to subscribe to any shares or debentures or any type of security is prohibited. Public Company A public company is the legal structure of a company which has the following characteristics (i) Shareholders' right to transfer shares; is not restricted (ii) Minimum 7 members (iii) An invitation to the public to subscribe to any shares or debentures or any type of security is permitted. Producer Company According to Section 378A of the Companies Act, 2013, Producer Company means a body corporate having objects or activities specified in section 378B of the Companies Act, -2013 and registered as a Producer Company under the Companies Act, 2013 or under the Companies Act, 1956. The Companies Amendment Act, 2020 has introduced a separate Chapter (Section 378A to 378ZU) relating to Producer Companies under the Companies Act, 2013. Nidhi Companies A Nidhi company is the legal structure of a company in the Indian non-banking finance sector, recognized under section 406 of the Companies Act, 2013 their core business is borrowing and lending money between their members. They are also known as Permanent Funds, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Companies. These companies are regulated under the Nidhi Rules, 2014 issued by the Ministry of Corporate affairs. Foreign Company As per section 2(42) of the Companies Act, 2013 the “foreign company” means any company or body corporate incorporated outside India which,- (i) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and (ii) conducts any business activity in India in any other manner. Non-Banking Financial Company A Non-Banking Financial Company (NBFC) is the legal structure of a company registered under the Companies Act, 1956 / 2013 engaged in the business of loans and advances, acquisition of shares/ stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of the immovable property. A non-banking institution which is a company and has the principal business of receiving deposits under any scheme or arrangement in one lump sum or in instalments by way of contributions or in any other manner is also a non-banking financial company. Listed Company “Listed company” means a legal structure of a company which has any of its securities listed on any recognised stock exchange; “Provided that such class of companies, which have listed or intend to list such class of securities, as may be prescribed in consultation with the Securities and Exchange Board, shall not be considered as listed companies.” As per Rule 2A of the Companies (Specification of definitions details) Rules, 2014 Companies are not to be considered as listed companies- For the purposes of the proviso to clause (52) of section 2 of the Companies Act, 2013, the following classes of companies shall not be considered as listed companies, namely:- a) Public companies which have not listed their equity shares on a recognized stock exchange but have listed their – (i) non-convertible debt securities issued on a private placement basis in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008; or (ii) non-convertible redeemable preference shares issued on a private placement basis in terms of SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013; or (iii) both categories of (i) and (ii) above. b) Private companies which have listed their non-convertible debt securities on a private placement basis on a recognized stock exchange in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008; c) Public companies which have not listed their equity shares on a recognized stock exchange but whose equity shares are listed on a stock exchange in a jurisdiction as specified in Section 23(3) of the Companies Act, 2013. Government Company As per section 2(45) of the Companies Act, 2013 the Government Company” is the legal structure of a company in which not less than fifty-one per cent of the paid-up share capital is held by the Central Government, or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments, and includes a company which is a subsidiary company of such a Government company; Explanation.- For the purposes of this clause, the “paid-up share capital” shall be construed as “total voting power”, where shares with differential voting right.

Other Forms of Companies

Holding and Subsidiary Company As per section 2(46) of the Companies Act, 2013, the “holding company”, in relation to one or more other companies, means a company of which such companies are subsidiary companies and the expression “company” includes any body corporate. As per section 2(87) of the Companies Act, 2013 “subsidiary company” or “subsidiary”, in relation to any other company (that is to say the holding company), means a company in which the holding company – (i) controls the composition of the Board of Directors; or (ii) exercises or controls more than one-half of the total voting power either at its own or together with one or more of its subsidiary companies: Provided that such class or classes of holding companies as may be prescribed shall not have layers of subsidiaries beyond such numbers as may be prescribed. Explanation. - For the purposes of this clause, – (i) a company shall be deemed to be a subsidiary company of the holding company even if the control referred to in sub-clause (i) or sub-clause (ii) is of another subsidiary company of the holding company; (ii) the composition of a company’s Board of Directors shall be deemed to be controlled by another company if that other company by exercise of some power exercisable by it at its discretion can appoint or remove all or a majority of the directors; (iii) the expression “company” includes any body corporate; (iv) “layer” in relation to a holding company means its subsidiary or subsidiaries. As per section 2(11) of the Companies Act, 2013, the “body corporate” or “corporation” includes a company incorporated outside India, but does not include - (i) a co-operative society registered under any law relating to co-operative societies; and (ii) any other body corporate (not being a company as defined in this Act), which the Central Government may, by notification, specify on this behalf Associate Companies/ Joint Venture Company As per section 2(6) of the Companies Act, 2013 the “associate company”, in relation to another company, means a legal structure of a company in which that other company has a significant influence, but which is not a subsidiary company of the company having such influence and includes a joint venture company. Explanation. - For the purpose of this clause, – (i) the expression “significant influence” means control of at least twenty per cent. of total voting power, or control of or participation in business decisions under an agreement; (ii) the expression “joint venture” means a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement. Investment Company The term "investment company” is the legal structure of a company that includes a company whose principal business is the acquisition of shares, debentures or other securities and a company will be deemed to be principally engaged in the business of acquisition of shares, debentures or other securities if its assets in the form of investment in shares, debentures or other securities constitute not less than fifty per cent. of its total assets, or if its income derived from investment business constitutes not less than fifty per cent. as a proportion of its gross income. Dormant Company It is covered under Section 455 of the Companies Act. 2013 and includes a company which is formed and registered under the Act for a future project or to hold an asset or intellectual property and which has not been carrying on any business or operation, or has not made any significant accounting transaction during the last two financial years, or has not filed financial statements and annual returns during the last two financial years. Small Company The MCA for the Ease of Doing Business has revised the definition of Small companies by increasing their threshold limits for paid-up capital from “not exceeding Rs. 50 Lakhs” to “not exceeding Rs. 2 Crore” and turnover from “not exceeding Rs. 2 Crore” to “not exceeding Rs. 20 Crore”. Thus, the definition of the small company under Section 2(85) read with Rule 2(1)(t) of the Companies (Specification of definitions Details) Rules, 2014 with effect from 1 April 2021 is hereunder: “Small Company” means a legal structure of a company, other than a public company, — (i) paid-up share capital of which does not exceed two crores rupees or a such higher amount as may be prescribed which shall not be more than ten crore rupees; and (ii) turnover of which as per profit and loss account for the immediately preceding financial year does not exceed twenty crore rupees or a such higher amount as may be prescribed which shall not be more than one hundred crore rupees: Provided that nothing in this clause shall apply to— (A) a holding company or a subsidiary company; (B) a company registered under Section 8; or (C) a company or body corporate governed by any particular Act.

Factors for consideration before choosing a suitable type of business structure

Nature of Business Activity In small trading businesses, professions, and rendering of personal services, a sole proprietorship is predominant. The partnership is suitable in all those cases where sole proprietorship is suitable, provided the business is to be carried on a slightly bigger scale with help of one or more partners (owner). Similarly, the business lines such as carrying on large chain stores, multiple shops, super-bazaars, engineering industrial activities with high capital and working capital requirements and software industrial activities are generally in the form of companies. Where the persons intending to start a business and wish to launch a legal form of business organization clothed with a legal entity and in corporate form with a feature of having their sole ownership and control thereon, they may decide to form a One-Person Company (OPC). An alternative type of business structure where two or more persons are involved in starting a legal structure of the business organization is the Limited Liability Partnership (‘LLP’) under the Limited Liability Partnership Act, of 2008. Scale of Operations If the scale of operations of business activities is small, a sole proprietorship or a One Person Company (OPC) business entity type is suitable; If the scale of operations is modest - neither too small nor too large - partnership or limited liability partnership (LLP) is preferable; whereas, in case of the large scale of operations, the company form is advantageous. Capital Requirements Enterprises requiring heavy investment should be organized as companies. Read the full article

#businessregistration#llp#opc#privatecompanyregistration#proprietorship#publiccompanyregistration#startup

1 note

·

View note

Text

Closure of LLP: Common Challenges and How to Overcome Them

A Limited Liability Partnership (LLP) is a famous business structure that provides its partners with a blend of operational flexibility and limited liability protection. However, due to various reasons, such as unprofitability, changes in business plans, or any other reason, partners might want to close an LLP. Closing an LLP involves legal procedures that ensure the business is officially dissolved and ceases to exist in the eyes of the law.

0 notes

Text

What Is Form 8 In LLP | Ebizfiling

Procedure filing Form 8: LLP annual compliance

Introduction

Since a Limited Liability Partnership is a separate legal entity, it is the duty of the designated partners to preserve and maintain proper books of accounts and submit an annual return to the Ministry of Corporate Affairs (MCA). There is 3 mandatory annual compliance for an LLP that is Form 8, Form 11, and ITR-4. In this blog, we will mainly focus on the process to file a statement of account and solvency i.e. Form 8. This form is required to file within 30 days of the end of the six-month period after the end of the financial year.

What is an LLP?

The Limited Liability Partnership (LLP) is an alternative corporate business structure that provides the partners with the flexibility to draft the clauses of an LLP agreement and limited liability to partners. One of the goals of forming an LLP is to have less legal compliance.

What is Form 8 of an LLP?

The form is known as Statement of Account and Solvency. Form 8 is one of the mandatory compliance for LLP which should be filed annually. The LLP must disclose information about financial transactions carried out during that financial year as well as its financial position at the closure of the financial year in Form 8. The LLP must also declare its financial position by stating the following:

The annual turnover is either Rs. 40 lakhs or less.

The LLP has to submit a statement indicating the addition, modification, or satisfaction of debts up to the current financial year.

The partners or authorized representatives have complied with their responsibilities to maintain accurate accounting records and prepare financial statements.

Requirements and attachment of Form 8

Listed below are the requirements for the filing of Form 8 and attachments with the form:

Both designated partners should provide digital signatures.

It is necessary to obtain certification by the auditor of the LLP if the annual total of firm exceeds Rs. 40 lakhs or the contribution of each partner reaches Rs. 25 lakh.

LLP should attach certain documents such as a copy of the balance sheet of LLP, profit and loss statement, MSME 2006 disclosure, and statement of contingent liabilities not anticipated, if any.

The process to file Form 8 of an LLP

First, visit the MCA portal.

On the right corner of the website, click on "Sign in/ Sign up". Then add the required credentials and click on "Login for V3 filing".

After login goes to the MCA service and clicks on the "LLP e-filing".

The list of the e-form that are filed by LLP will appear on your screen, click on Form 8. A web-based Form 8 will appear on the screen.

On the right corner of the Form 8 option of language "English/Hindi", click on the language which suits you.

Write the LLPIN (LLP identification number)/ FLLPIN (Foreign LLP identification number) of the proposed LLP. The details such as an address, name of the LLP, jurisdiction, etc. will be filled automatically as per the details provided by you during the incorporation of the LLP.

Next fill in the all details of Part A: Statement of accounts and solvency.

Scroll down and fill the Part B: Information of statement of assets and liability. Fill in the details of the previous financial year. This information can be taken from the balance sheet prepared during the Board Meeting.

Then fill in the details of income and expenditures from the profit and loss statement prepared during the Board Meeting.

Attach the DSC (Digital Signature Certificate) of the designated partners (DPs) of LLP. Also, attach the DSC of the CS professional for authentication.

After completing the form, login to MCA again and upload the Form 8 of Statement of Accounts and Solvency.

After the form has been successfully uploaded, a popup asking for payment will appear. Pick a payment method. Following a successful payment, a message will appear, and a challan will be generated. Keep a copy for your record. The SRN number will also be on the challan.

Due Date of Form 8

The Form 8 is filed by an LLP every year and it should be filed after the closure of the financial year. The Form 8 should be filed on 30th October every year.

Bottom line

The Form 8 Statement of Accounts and Solvency must be filed on a regular basis to maintain the active status of the Limited Liability Partnership (LLP). Failure to file the LLP annual compliance will result in severe fines imposed by the law. The fine imposed by the authorities for the failure to file depends upon the capital contribution structure of the LLP.

0 notes