#probate legal advice

Explore tagged Tumblr posts

Text

Get Trusted Probate Legal Advice Today

Cogito Realty Partners LLC offers expert probate legal advice, guiding clients through estate administration, will validation, and asset distribution. Trust our experienced team to simplify complex probate processes and provide personalized solutions with care and efficiency.

0 notes

Text

0 notes

Text

Estate Administration Lawyers: A Guide to Navigating the Legal Process

Estate administration can seem like a daunting task, especially when you're dealing with the emotional toll of losing a loved one. The good news? Estate administration lawyers are here to help you through the process, making sure everything is handled smoothly, efficiently, and with care. Let’s take a closer look at what estate administration lawyers do, why their expertise is essential, and how they can make this journey easier for you.

What Is Estate Administration?

Estate administration refers to the legal process of managing and distributing the assets of a deceased person. Whether there’s a will or not, the estate must be handled according to legal requirements. Think of it as a structured system for ensuring that a person’s wishes are respected and that their assets are passed on to the right people.

Estate administration involves tasks like:

Gathering assets: Collecting all assets, including property, investments, and bank accounts.

Paying off debts: Settling any outstanding liabilities, such as loans or taxes.

Distributing remaining assets: Ensuring beneficiaries receive what’s legally owed to them.

You might be wondering, Do I really need a lawyer for this? Well, let's dig deeper into why hiring an estate administration lawyer is such a smart move.

Why Hire an Estate Administration Lawyer?

Handling estate administration on your own can be overwhelming. There are legal procedures, paperwork, and deadlines that must be followed precisely. Having an experienced estate administration lawyer by your side makes the process much easier. Here's why:

Legal expertise: Lawyers are familiar with probate laws, court procedures, and tax implications, ensuring everything is done correctly.

Saving time and reducing stress: Estate administration can be time-consuming, but with a lawyer handling the complex aspects, you can focus on what matters most—honoring your loved one.

Avoiding costly mistakes: Missteps in the administration process can lead to delays, additional expenses, or even legal challenges. A lawyer ensures everything is executed smoothly.

Imagine estate administration as navigating a ship through stormy waters. With a knowledgeable lawyer at the helm, you can sail smoothly, avoiding obstacles that might otherwise sink your efforts.

Services Provided by Estate Administration Lawyers

Estate administration lawyers offer a wide range of services, tailored to meet your specific needs. Here’s how they can help you:

1. Probate and Will Validation

When a loved one passes away, their will must be validated through a legal process known as probate. Estate administration lawyers will guide you through filing the necessary paperwork and ensuring the probate process goes smoothly.

2. Asset Management and Valuation

One of the key responsibilities is managing and valuing the deceased’s assets, including:

Real estate

Investments

Bank accounts

Personal property

Lawyers help determine the value of these assets and ensure that they are correctly accounted for before any distribution takes place.

3. Paying Debts and Taxes

Unfortunately, estates aren’t just about inheriting assets. There may also be debts or taxes that need to be paid before beneficiaries can receive their inheritance. An estate administration lawyer ensures that all debts, bills, and taxes are paid out from the estate, so you don’t have to worry about surprises later on.

4. Distribution of Assets

Once debts and taxes are cleared, the next step is distributing the remaining assets to the beneficiaries. This sounds simple enough, right? But if disputes arise, it can complicate things. Estate lawyers help mediate these situations and ensure that the distribution is fair, legally compliant, and according to the will or state laws.

5. Handling Disputes and Challenges

Disputes between family members can arise when it comes to the interpretation of a will or the distribution of assets. An estate administration lawyer can mediate these disagreements, helping avoid unnecessary conflict. In cases where the will is contested, a lawyer can represent you in court, ensuring that the estate is handled legally and fairly.

How to Choose the Right Estate Administration Lawyer

Choosing the right estate administration lawyer is essential. After all, this person will be handling highly sensitive and valuable matters on your behalf. Here’s a simple checklist to help you find the right fit:

1. Experience Matters

Estate administration can be complex. Look for a lawyer who specializes in estate law and has handled similar cases. You wouldn’t trust a dentist to fix your car, right? The same principle applies here.

2. Check Reviews and Testimonials

You want someone who not only knows their stuff but also treats their clients well. Reading online reviews and testimonials will give you a sense of what working with the lawyer is like.

3. Ask About Fees Upfront

Don’t hesitate to ask about fees. Some lawyers charge by the hour, while others may offer flat-rate pricing for estate administration services. Knowing the cost structure upfront will prevent any unexpected surprises later on.

4. Good Communication is Key

Your lawyer should be approachable and responsive. If you don’t feel comfortable asking questions or if they’re hard to reach, it might be a sign to look elsewhere. Estate administration requires close collaboration, so finding someone you trust and can communicate with easily is crucial.

Wrapping It Up: Why Estate Administration Lawyers Are Essential

Dealing with the legal side of a loved one’s passing is tough, but with the right estate administration lawyer, you don’t have to face it alone. These professionals take the burden off your shoulders, guiding you through the process with compassion, expertise, and efficiency. Whether it’s handling probate, managing assets, or settling disputes, they make sure everything is done according to the law and your loved one’s wishes.

youtube

So, the next time you’re faced with estate administration, remember this: You don’t have to do it all yourself. There’s help available, and it’s okay to ask for it. Estate administration lawyers are there to provide the legal support you need during one of life’s most challenging times. They’re your navigators in what might otherwise feel like uncharted waters, leading you safely to shore.

#probate and estate administration brisbane#estate administration solicitors brisbane#will dispute lawyers#contesting a will brisbane#challenging a will brisbane#probate lawyers brisbane#will contest legal advice#executor of will duties#Youtube

1 note

·

View note

Text

Lawyer

We deal with all types of disputes so no matter what your problem may be, you can feel confident that by coming to our office, you will be on the right track to a suitable resolution.

We practice law in many different areas, including Divorce, Personal Injury, Motoring Offences, Family Law, Commercial Disputes, Contract Disputes, and Professional Negligence claims and in certain cases offer ‘No Win No Fee’ representation.

We are members of the Birmingham Law Society. In 2020/21, we were nominated and were finalists for the Birmingham Law Society small firm of the year award.

Business phone: 0121 212 1575

Business Email: [email protected]

Website URL: https://kjconroy.co.uk

#Family Law#Divorce Solicitors#Financial Remedy#Children Solicitors#Non-Molestation Order#Employment law#Personal injury#Driving Offences#Civil Litigation#Contract Disputes#Wills and Probate#Commercial Litigation#No win no fee#Solicitors#Lawyers#Legal Advice#Court hearings#Probate Lawyer#Solicitor near me#Court Order

1 note

·

View note

Note

Hey, different trans guy anon here. If I ever do end up needing T illegally and get caught, would that felony prevent me from working in the medical field? I'm just starting school for an LPN in the fall

This is not medical or legal advice.

So.

Nursing is not a particularly friendly field for people with felony convictions. Especially convictions related to abuse or neglect, domestic violence, sexual assault, and drugs. This is for a good reason, but it also would definitely make things difficult for someone who needed to get T illegally.

I know a lot of people are saying that "oh you'll never get caught! it's such a small amount!" but hear me when I say: If they need an excuse to arrest a trans person and they can't outright say it's because they're trans (yet), it's what they're gonna look for. So I personally would go without T or find a way to get a legit script (see previous post) rather than risk the felony (I have a nursing license too and I'd like to keep it).

Some states are willing to look into specifics of the conviction. Some have minimum amounts of time between the felony and the license application (say, 3 years from end of probation/sentence to being allowed to get a nursing license). Some will outright refuse a license to anyone with a felony.

If you have a state that is willing to look into specifics, they will generally look at what you have done to improve yourself since the conviction, and evidence that you would never commit the crime again. Things like AA or NA, going to anger management counseling, and other steps that decrease the risk of re-offending. This is obviously something you would not be able to prove without a full de-transition.

And that's not to mention, after you have a license you're going to have to explain to every potential employer why you have a felony. Which effectively means coming out to every potential employer. In a world where it might be seriously dangerous to come out, this is not something you'd want to do.

148 notes

·

View notes

Text

On Friday, Kenneth Chesebro pleaded guilty to one count of conspiracy to file false documents in the Fulton County 2020 election conspiracy case, becoming the second high-level Donald Trump co-defendant to become a state’s witness in two days. Chesebro received an especially lenient sentence of five years’ probation, a small financial penalty, and 100 hours of community service.

With the guilty plea and cooperation deal Georgia prosecutors struck on Thursday with Team Trump attorney Sidney Powell, Chesebro’s plea deal should be viewed as an earthquake in the case against Trump. Given Powell’s close proximity to the former president and his legal advisers at crucial times in his attempts to overturn the 2020 election, her testimony will be particularly devastating not only as to defendant Trump, but to co-defendants Rudy Giuliani and John Eastman.

Chesebro’s testimony, meanwhile, implicates one of the key portions of the conspiracy both in Georgia and in the federal Jan. 6 case against Trump, specifically the efforts to create a slate of “false electors” to use during the Jan. 6 electoral count to overturn the results of the 2020 election. Now that both Chesebro and Powell are cooperating witnesses, the pressure on Giuliani and Eastman to plead and cooperate is exponentially higher.

That the significant cooperation under discussion involves four of Trump’s attorneys underscores the reality that the former president’s regularly touted defense that he was relying on the good-faith guidance of his attorneys during the attempted coup was, and is, nothing more than self-serving fantasy. In the courtroom—as compared with on television or in social media—he has never had the ability to offer that defense.

In court, the advice of counsel “affirmative defense” requires a defendant to prove two things: First, that he relied in good faith on his lawyer’s advice that the conduct in question at trial was legal, and second, that he made a full disclosure of all relevant facts to the attorney before receiving that advice.

Based on my four decades in the courtroom as both federal prosecutor and defense attorney, I can report that the assertion of the attorney-client privilege by a criminal defendant at trial is a black swan event—effective only with the consistent, overlapping trial testimony of both the attorney and the defendant, and the admission into evidence of any documents reflecting the communications or advice they testified about.

Putting aside the substantial evidence that Trump was warned by numerous White House lawyers that his efforts to overturn the 2020 election were in violation of the law, how does Trump establish the advice of counsel defense at trial?

As I have observed in prior articles, he is certainly not able to testify on his own behalf. There are surely no memos to the file, emails, or letters to the client evidencing such advice in writing. Finally in this regard, what lawyer is willing to testify he or she advised Trump it was, for example, lawful for him to ask the Georgia secretary of state to “find” enough votes for him to win that state?

Long before the Powell and Chesebro deals were announced, the absurdity of expecting any Trump attorney’s testimony to be anything but harmful to his cause was made crystal clear by Michael Cohen. More recently, when Trump lawyer Evan Corcoran was forced to testify against the former president based on the “crime fraud” exception to the attorney-client privilege, the testimony he gave and the internal memos he was compelled to produce, proved not to be shields for the former president, but swords to be wielded against him—as it is with Powell and Chesebro, and so it will be with others.

After all, what can you expect when your standard for choosing at least some of your lawyers is their willingness to turn a blind eye to whatever your weak ego and malicious intentions require?

In sum, while Georgia and DOJ attorneys have each received great potential benefits from the Powell and Chesebro deals, it was in no way structured to protect against a defense they know Trump cannot employ.

Finally, speaking of structure, the great deals Powell and Chesebro struck, getting probation while facing up to 20 years in jail on a RICO conviction, are certainly a blessing for them—they even get to finally tell the truth.

But District Attorney Fani Willis’ seeming generosity is a sign of shrewd judgment, not weakness.

Prosecutors have both the carrot and the stick to get what they want, and the two deals Willis just made were large carrots, signaling to the other defendants that she is someone they can deal with, and that there are potentially acceptable pathways out of the mess they are in. At the same time, she has just made her case against other, more significant defendants meaningfully stronger and her stick that much larger.

Of course, Willis is a long way from where she needs to be, but those who had originally feared she had overindicted the 19-defendant RICO case might now be a little less concerned and a little more impressed.

49 notes

·

View notes

Text

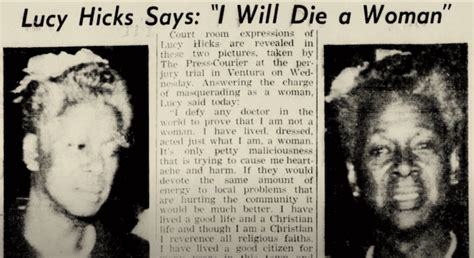

Celebrating Black Queer Icons:

Lucy Hicks Anderson

Lucy Hicks Anderson was born in 1886 in Waddy, Kentucky. Anderson is known as a socialite and chef that became well known in Oxnard, California from 1920 to 1946. She became the first black trans woman to defend her identity in a US courts. From an early age Anderson identified as a girl. On advice from doctors, Anderson's parents accepted and supported this. Anderson would attend school in gender affirming clothing, such as dresses, under a name of her own choosing, Lucy. At the age of 15 Anderson left school and began supporting herself through domestic work. At 20 Anderson moved to Pecos, Texas where she worked in a hotel. Anderson next moved to New Mexico, where she met her first husband, Clarence Hicks, in 1920. At age 34 Anderson, and her then husband, moved to Oxnard, California. Anderson proved herself a skilled chef and baker, winning some contests. Anderson's marriage to Hicks eventually ended in divorce. After which Anderson used money she had saved during the marriage to purchase a boarding house. The boarding house served as a front for a brothel, and the sale of alcohol during prohibition. Outside her time as a Madame and managing a boarding house, Anderson also became a well known socialite and hostess. Connections made during this time would prove fruitful during Anderson's subsequent legal troubles. It is said that Charles Donlon, a prominent banker, helped get her out of jail, after her initial arrest, on the grounds that he was hosting a significant dinner party that would have fallen apart without Anderson's involvement. In 1944 Anderson married her second husband, Reuben Anderson. About a year later, in 1945, a sailor claimed to have received a sexually transmitted infection from one of the women working in Anderson's brothel. This led to all women working there being subject to medical examination, including Anderson. When the Ventura County DA was informed that Anderson was assigned male at birth he chose to charge her with perjury on her marriage license. During this trial Anderson would utter the famous lines "I defy any doctor in the world to prove that I am not a woman." and "I have lived, dressed, acted just what I am, a woman". Anderson was ultimately convicted of perjury and sentenced to 10 years probation and her marriage license was deemed invalid. This also led to the Federal Government to charge Anderson with fraud, based on her receiving spousal rights from the GI Bill. Lucy and Reuben Anderson where both found guilty and sentenced to a men's prison. Anderson was forbidden by the court to wear women's clothing during this time. After their release Lucy and Reuben Anderson moved to Los Angeles, California where they lived quietly until her death in 1954, at the age of 68. Debra A Harley and Pamela B Teaster's (editors) Handbook of LGBT Elders (link to Archive.org copy of text) notes Anderson as "one of the earliest documented cases of an African-American transgender person". Anderson is the subject of the 2nd episode of HBO's Equal, where she is portrayed by actress Alexandra Grey.

This was definitely one of the more informative of these write ups, for me. I was familiar with both the quotes Anderson made during her trial, but didnt know anything about the woman. Wilmer "Little Axe" Broadnax has been mentioned in several of these end notes, so he is definitely next. I think i pretty much have the rest of these planned out, but as always, corrections and suggestions are welcome and desired.

#celebrating black queer icons#black history#black history month#black history is queer history#black history is american history#Lucy Hicks Anderson#oxnard#ventura county#hbo series#equal#handbook of LGBT elders#queer elders#elders

200 notes

·

View notes

Note

Hey, I’m a law student and I’m also autistic and ADHD and I was wondering if you have any tips for working in law as a neurodivergent person? I love my course and I can’t wait to work but the 85% unemployment statistic really scares me.

This is a long answer, so I'm going to cut it for the sake of mobile users. I do link some products below; I'm not getting paid, and I'm only linking them because they honestly work for me. Also, as a caveat, a lot of this advice assumes that you're American and/or working in-person at a private law firm; unfortunately, that's my only experience other than a month doing part-time intake for my regional legal aid service.

The biggest hurdle you will meet is the bar exam*: you need a study buddy who does not have ADHD and can help keep you on track. Don't study separately then meet up; do things like watching lecture videos together and keeping pace with one another in person. I'm not ADHD myself, but my best friend and forever study partner is, and she struggled to self-start.

Buy a bar prep course. This is not the time to be a scrooge; don't buy Kaplan just because it's cheaper (it also sucks). Barbri and Themis are both good - of these, use whichever you can get for cheapest or, if the costs are comparable, use Barbri if structure gives you comfort and use Themis if you need some control over the order in which you do things. Also use Themis if humor engages you; the Property and Contracts lecturers are hilarious. Stick to your bar prep program, but be gentle with yourself if you fall behind pace - realistically, you need to get through all the topics at least once, but you don't have to do every practice MPT, every practice essay, and every practice MBE quiz. Use the same study techniques that got you through law school. IMO, useful supplemental tools include the Critical Pass flashcards (get them used if possible, or get a referral code from somebody) and the Finz Multistate Method guide. Do your best to treat the bar exam as a game - because it is one.

There's a strategy for every section, and you should practice these strategies. For the MBE, use the Finz method - it works. For the MEE, or any other essay exam, use IRAC - and make up the R if you need to. The UBE, and most state bar exams, are graded such that you do get more points for knowing the rule, but you can still get points if you make up a reasonable-sounding rule and then apply it correctly. For the MPT, just throw in as many case and rule cites as possible. Try to cite every document you're given.

Join a bar prep FB group if you use FB; I was in Themis Memes for Should-Be-Studying Teens, but I know there's a Barbri group too. I found that being able to laugh at my bar prep course made it less miserable to do it. Don't be afraid to turn the videos on 2x or 0.5x speed - or faster or slower as needed. Some of the Themis lecturers talk to slowly that we went up to 3x; one of them talks so fast I had to slow him down.

Practice for the test in as many different environments as you can. I took the 2020 Pandemic Bar, so my bar was different than standard (I took it in a hotel room with my back to the door and proctors patrolling the hallways, it was mildly traumatizing fun), but I highly recommend getting used to noise while you're taking the test. Your ADHD/Autism hyperfocus will help here - make the bar exam your hyperfixation to the extent possible.

Once you pass the bar exam, your next hurdle will be the job search. You are going to have to mask for interviews, there's just no getting around it, but how much you mask will depend on your area of law. Big Law firms and intense, litigation-focused practice areas (e.g., business lit or criminal law) will expect you to be gregarious, friendly, and charming from the get-go; less litigation-focused practice areas (e.g., probate or family law) will often have more tolerance for quieter, less aggressive types.

Do not panic if you wind up at a less-than-favorable firm on your first or even your second job; a lateral shift between firms won't kill your resume as long as you can give a tactful reason you left (e.g., "I found that I prefer to focus on X instead of Y," or "I found that I had more opportunities to explore X at Y firm, and I am interested in focusing on X"). It is not normal to cry every day after work. It is not normal to routinely have panic attacks in the bathroom.

Once you have a job, billing is going to be difficult unless you gamify it. I use the Finch self-care app, so I have a task at the end of every week to make sure I have billed my time. My friend rewards herself for every day she bills by buying herself a new pen. Some people thrive off of timers (MyCase and Clio are popular case management software programs; both have timers built-in), but if nothing else, simply note when you start tasks and when you finish them by sending e-mails to yourself (or others, if relevant) at the end of every task. If your case management software can integrate with your e-mail (MyCase can integrate with Outlook, for instance), then use that to tag outgoing e-mails so you can be sure each one gets billed.

Outside of Big Law or intense practice areas, very few people bill 8 hours per day - a lot of the work you do will be non-billable, but also you will suffer from exhaustion or burnout if you try to bill 8 hours per day (my minimum is 20 hours per week, which is just 4 hours a day). You also will usually have some discretion in billing - use that to make yourself feel better if inattention issues make something take longer than you feel is fair. As for billing enough, if you find that you are most productive outside of work hours, find a firm that will let you access client files offsite - work at home if they'll let you.

I do a lot of my best billing either in the mornings right when I get to work or at 10:00 at night. That's okay so long as you take breaks during the workday (I watch a lot of TikTok during my breaks, but I also fiddle with various online games and such); you'll need mental rest to reset between cases. If you struggle with task-switching, use a break to help reset your focus. I strongly recommend setting an alarm for yourself during breaks so that time blindness doesn't derail you. Make your alarm kind of annoying; something you won't just mindlessly ignore.

Let yourself hyperfocus on things; all of that time you spend researching and drafting and correcting and perfecting that motion or brief is billable, and it's also good practice of law - your client and your partner will appreciate your thoroughness, and the judge will almost never hate it (some judges prefer brevity, but I've never had a judge upset at me for wordiness).

I also recommend getting apps that can automate things for you; I use Espanso to make my life easier by having easy-to-type shortcuts for common phrases and information (e.g., the current date, my bar card number, my work e-mail address, etc.). You can customize these things to make sense to your own brain - your process doesn't have to work for anyone but you. Similarly, I use macros in Word to make drafting go faster by letting buttons do all my formatting for me.

Excel sheets make excellent task lists because you can split them up by case, and set them up to highlight things (e.g., today's date) automatically. Most firms will have some kind of "docket meeting" where everyone goes over the status on each case - some people prefer handwritten notes (my best friend does), some people prefer digital notes (I have an excel workbook I use). Find a method that reduces distractions but lets you keep up with the flow of conversation.

On the topic of technology, if your firm provides a computer for you, or if your firm will provide accessories to supplement your own computer, push to have multiple monitors - I use my own laptop, but my boss provides monitors and I have two plus my laptop screen. It is WAY easier to keep up with billing if you can keep your time entry software open and visible on one of your screens.

You will be spending a lot of time in your office; make it comfortable. Once you are making enough to get by, invest in a good office chair (that you own, so you can take it with you if you leave the firm) and some basic office supplies that you like, such as a post-it note dispenser (mine is a cat!). My office chair is designed to let me sit cross-legged - I highly recommend having an office chair that matches your most comfortable sitting style. Having some things that are yours will make any future moves less awkward. I also strongly, strongly recommend getting some simple and quietish fidget toys - I have several spinners, wacky tracks, tangles, and clicky fidgets in one of my desk drawers, amongst others, to help me self-stim, as well as a sensory sticker on my desk pad (on the linked set, I have the rough version of the bottom middle sticker, the rainbow finger labyrinth one).

For me, I find that actual litigation requires scripting. Whether it's an oral argument or just a temporary orders hearing, I typically have every word I intend to say written down as much as I can (re-direct examination or re-cross examination can't be scripted before the day of, but I usually at least scrawl a summary of the question I need to ask as I'm taking notes). I don't necessarily read from it, and sometimes I veer off-script, but there is a specific comfort in having the words scripted out. On the few occasions I have ad-libbed things, I find that I come off less authoritative and confident, which gives the judge the impression that I am guessing. I also find comfort in having a copy of the code I need (which is always the Texas Family Code for me) on-hand at the counsel table. You are allowed to tell the judge you'd like to consult the statute when the judge asks you a question.

I also find that, for courtroom litigation, it's worthwhile to make sure your court clothes are comfortable. Courtrooms in my area are universally a little too warm, so I have a linen blazer that breathes and a variety of shell tops that don't have sleeves. I also have bad ankles, so I wear exclusively flats despite the fact that I am less than 5 feet tall. For me, heat sensitivity is a part of my sensory issues so I am all about setting myself up for success. It's also worthwhile to bring extra water bottles; at my firm (we are almost all ND in some regard), the standard is 2 per attorney and 1 for each support staff, then 1 for the client.

For out-of-court days, even "business" can be comfortable if you're a creative shopper. My last firm required business attire, though not necessarily courtroom attire. I wore a lot of dresses to stay cool, and a solid-color dress in a modest cut paired with a black blazer (which you can remove when you're just working in your office) almost always makes the cut. For those who don't like or can't wear dresses, comfortable slacks and a modest blouse or dress shirt, paired with a blazer, also works. My current firm only requires business casual for client meetings, courtroom attire for court, and otherwise as long as we cover our shoulders and don't wear shorts, we're good to go. I use a cardigan to cover my shoulders when I'm outside my office, as most of my blouses are sleeveless. It's worthwhile to invest in a good office sweater anyway; I like a thin t-shirt material cardigan for me, but my officemate uses a pullover knit sweater. Do what's comfortable.

Office meetings, or even court hearings, can sometimes get loud and overstimulating - buy you some Flare Audio Calmer ear inserts, they really do help take some of the 'sharpness' off of the noise. I also recommend a playlist that contains binaural beats (assuming you like them) or colored (white, brown, pink, etc) noise and a solid pair of ANC headphones or earbud, depending on your preference (the linked products are far from the only options, they're just reasonably-priced options that I know work; I personally use first-gen Airpod Pros). If you don't like binaural beats or white noise, instrumentals of pop songs are also excellent.

You can also get phone apps that layer binaural beats over your music - I find that it sometimes helps me calm down when I'm close to a meltdown, though I personally feel worse at the lower frequencies (I usually stay around the alpha-beta frequency line, but ymmv). I think there are probably also some apps for colored noise over your music, but I haven't looked. If you haven't before, I recommend experimenting with binaural beats and/or colored noise - I find that they can help calm down some of the staticky feeling I get from overstimulation.

Offices also sometimes involve other sensory dangers - like, for instance, food texture issues (another big one for me). You can often get out of things like that by simply explaining that the food doesn't agree with you, or that you're not very hungry - or, if your boss knows that you have sensory issues (mine knows I'm autistic), you can just quietly explain that it's a sensory problem and you have it under control. Keep some safe snacks in your office. You can avoid alcohol, if you're picky about it or just don't like it, by explaining that you're not in the mood to drink (or that you don't drink, period) and that you'll stick to soda/tea/water/whatever. Only major assholes will push past that.

Most coping mechanisms for sensory issues can be justified with "I don't feel good" or "I have a headache."

If your office chair hurts your back, get up and walk around. You are not in elementary school; at most firms, you can step out and just let your coworkers know where'/how to find you, and when you'll be back.

For intra-office and extra-office communications, if you have any doubts about the quality of the communication, you can put it in writing afterwards. A quick e-mail saying, "Okay, so this is my understanding of X, please let me know if I've misunderstood anything or if anything changes" is a good CYA to cover any communication difficulties; don't use idioms or shorthand in these e-mails - actually spell out exactly what you think happened, or what you think you've been asked to do.

If you're worried about your tone in written communications, Chat GPT is good at doing a first draft. It can also do a first draft of your attorney bio, if you're asked to write it yourself. Tell it the message you want to convey, and the tone in which you need it said. For instance, if you need to convey to a pro se opposing party that your world does not revolve around them, but you want to do it professionally, you might tell Chat GPT, "Write a professional e-mail to my opposing party conveying that my world does not revolve around them and that I will get to them when I get to them." That won't give you a perfect e-mail, but it gives you an idea of how to set the tone. Never trust any citation the thing gives you, but you can also use it to simplify complex thoughts for motions that you need to be simpler.

Law practice is also emotionally draining. Take the time to cry if you need to, or to go outside or into a breakroom and breathe.

Essentially, working in law when you're ND means finding tools to help you. It's definitely doable (as I said, most of my current firm is ND), but you'll need to find coping mechanisms to soothe yourself. If you've gotten into law school, I think it's clear that you're competent enough to work. The trick is not burning yourself out entirely, which I hope the above can help with.

* - This is not and never will be an endorsement of bar exams as a measure of competence for new attorneys. The bar exam is a racist and classist institution born from the desire of old white men to keep their good-ol'-boys club exclusive. Fuck the NCBE and abolish bar exams nationwide.

29 notes

·

View notes

Text

Time for an intervention

Under the cut for a VERY long rant. And you guessed it. It's about Bossy

I made the stupid mistake of phoning her. I originally wanted to share my news with another friend but I received the 'this person is not available right now please call back later' or something similar

At the time I'd been messing with my phone and thought I'd gone off my network. So, as I said, I stupidly decided to phone Bossy to see if there was a problem

And she answered, so I didn't think and proceeded to tell her about a few things. Starting with her dads house.

I decided to contact my solicitor and her buyer to find out if anything had moved and if there were any other steps that I need to do. And was told that probate still hadn't been granted and I'd have to wait. By the looks of things, it could happen in around about 3 months time.

That's my estimate

She immediately brightened up and said ... ohhh that'll be helpful - for me.

Sod what my own needs are, at this point she was already mentally counting out how to spend this money

That was just the beginning.

I decided to sort of fill her in regarding my consultation to the best of my abilities and memory as there was far too much.

At this point, I thought I was strong enough to talk about it. But when it came to saying that the hardest part was realising I had nobody at home to talk about it. That got me and I had a bit of a cry.

Not as much as I have been doing over the past week but yeah. That still hurts

This was when she went into her ... 'let's walk through the house to see what you can do and what needs improvement'

O-kay

Wasn't as if I hadn't already thought about it, given that I had to do this with my late hubby for the past three years

And then ... things took a VERY different turn and she decided to talk about MY will. I didn't bring it up. She did.

And had the brass balls to ask me directly if I was going to include her sons ...

... and HER in the will

Then counted up MY assets and told me that I should pass the ownership of her dads house into HER name.

Yes, you read that correctly.

She suddenly switched from being comforting to conniving in mere minutes.

Bearing in mind that what goes in my will is MY business. It's been sorted out and organised. Just needs to be written down, signed, witnessed and placed in safe keeping.

Her dad's will states VERY clearly that she's entitled to nothing and whilst the house remains unsold, I cannot do anything. Not even bequeath it to anybody as it's not mine

And once sold, she can't have the house anyways as it's going to be in someone else's name

Is there no end to her conniving?

So .. methinks that I need to sort out some legal advice and possible some sort of intervention here. Inform my solicitor about her intentions and the medical team to let them know that I'm at a great risk of coercion after my surgery and ask their advice

As I do not feel safe around her. Especially the lengths she is now going to get what she believes is owed to her.

And again, enforcing right from the beginning of my introduction into this family, that, in her eyes, I'm not deserving of anything and that it should all go to her.

My hubby went to great lengths to ensure that I lived a comfortable life and his dad also.

4 notes

·

View notes

Text

Managing Wealth and Inheritance: Estate and Trust Administration Attorneys

Wealth management and estate planning are vital to preserving and growing your family's legacy. As individuals accumulate assets over time, it becomes essential to consider how those assets will be managed and passed on to future generations. Estate and trust administration attorneys play a pivotal role in this process by offering expert legal guidance. In this blog, we’ll explore the importance of estate and trust administration, the responsibilities of attorneys in these areas, and how they can help you protect your wealth and legacy for the long term.

Understanding Estate and Trust Administration

Estate administration refers to managing and distributing a person's assets after they pass away. This includes ensuring that debts are paid, taxes are filed, and remaining assets are transferred to beneficiaries by the deceased's will or applicable state law if there is no will. The process can be complex, especially if there are significant assets or if disputes arise among heirs.

Trust administration, on the other hand, involves managing the assets held within a trust according to the terms set out in the trust document. Trusts are often used as a tool to minimize estate taxes, avoid probate, and provide a structured distribution of assets over time. Trusts can be beneficial in cases where the grantor wants to ensure that beneficiaries, such as young children or those with special needs, receive ongoing financial support.

The Role of Estate and Trust Administration Attorneys

An estate attorney and trust administration attorney is a legal professional who specializes in helping clients manage and distribute their assets efficiently and according to their wishes. These attorneys play several critical roles throughout the process, including:

Legal Guidance and Compliance: Estate and trust laws can be intricate, and they often vary by jurisdiction. An experienced attorney ensures that all legal requirements are met and that the estate or trust complies with state and federal laws. This includes filing necessary paperwork, handling tax issues, and ensuring the terms of the will or trust are carried out correctly.

Asset Management and Distribution: One of the primary responsibilities of an estate and trust administration attorney is to oversee the proper distribution of assets. This can involve coordinating with financial institutions, ensuring that creditors are paid, and ensuring beneficiaries receive their inheritance as intended.

Probate Avoidance and Minimizing Tax Liability: Probate, the legal process of validating a will and distributing assets, can be lengthy, expensive, and stressful for families. Estate and trust administration attorneys can help design strategies to minimize or avoid probate altogether. Additionally, they provide valuable advice on reducing estate taxes, preserving wealth for beneficiaries.

Dispute Resolution: Unfortunately, disputes can arise during estate and trust administration, whether between heirs or regarding the validity of a will or trust. Attorneys act as mediators and legal advocates, working to resolve conflicts and ensure a fair outcome for all parties involved.

Trustee Support and Guidance: For individuals named as trustees (those responsible for managing the trust), the role can be daunting, as they have fiduciary duties to the beneficiaries. A trust administration attorney helps trustees navigate their responsibilities, from managing assets to making distributions and ensures they fulfill their obligations according to the terms of the trust.

Why You Need an Estate and Trust Administration Attorney

While it may be tempting to manage estate and trust administration on your own, especially for smaller estates, the potential pitfalls of doing so without professional guidance are numerous. Here’s why having an attorney by your side is crucial:

Complex Legal Framework: Estate and trust laws are complex and constantly evolving. Understanding the intricacies of probate, taxes, and legal obligations can be overwhelming for someone without legal training. An attorney ensures that every detail is addressed, reducing the risk of mistakes that could delay the process or lead to legal issues down the road.

Time and Stress Reduction: Managing an estate or trust is time-consuming and emotionally taxing, particularly for family members grieving the loss of a loved one. By hiring an attorney, you can delegate much of the administrative work, allowing you to focus on supporting your family during a difficult time.

Avoiding Costly Errors: Mishandling estate or trust administration can result in costly penalties, tax issues, or even lawsuits from disgruntled beneficiaries. An attorney ensures that every step of the process is completed correctly and efficiently, minimizing the risk of expensive errors.

Expert Tax Advice: Estate taxes, inheritance taxes, and capital gains taxes can quickly erode the value of an estate. Estate and trust administration attorneys are well-versed in tax laws and can help structure the estate in a way that minimizes tax liabilities and preserves as much wealth as possible for the beneficiaries.

Safeguarding Beneficiaries' Interests: One of the most important roles of an attorney is to ensure that the wishes of the deceased are honored and that the beneficiaries' interests are protected. Whether by defending the validity of a will in court or ensuring that the trustee follows the terms of the trust, an attorney acts as a guardian of the estate plan’s integrity.

Key Considerations When Choosing an Estate and Trust Administration Attorney

When selecting an attorney to assist with estate and trust administration, it’s important to consider a few key factors:

Experience and Expertise: Look for an attorney who specializes in estate and trust law and has a proven track record in handling cases similar to yours. Experience is especially crucial if the estate is large, complex, or involves high-value assets.

Communication and Transparency: A good attorney will keep you informed throughout the process and provide clear explanations of each step. Make sure you choose someone who is accessible and responsive to your needs.

Fee Structure: Estate and trust administration attorneys typically charge either a flat fee, hourly rate, or a percentage of the estate’s value. It’s important to understand the attorney’s fee structure upfront and ensure it aligns with your budget.

Conclusion

Managing wealth and inheritance through estate and trust administration can be a daunting task, but with the right attorney by your side, the process becomes much more manageable. Estate and trust administration attorneys offer invaluable expertise in navigating the complex legal landscape, ensuring that your assets are protected and distributed according to your wishes. By working with a skilled attorney, you can safeguard your family’s future and leave behind a lasting legacy that reflects your values and intentions.

4 notes

·

View notes

Text

Maximizing Investments: Guide to Commercial Real Estate, Estate Planning, and Probate

Navigating the intricate world of real estate can be daunting, particularly when dealing with commercial properties, estate planning, and probate real estate. Understanding the nuances of these sectors can significantly impact your financial future. This blog will explore the vital aspects of working with a commercial real estate firm, the importance of estate planning, and the complexities of probate real estate and real estate settlements.

The Role of a Commercial Real Estate Firm

A commercial real estate firm specializes in buying, selling, and leasing properties intended for business purposes. These firms provide invaluable services, including market analysis, property management, and transaction facilitation. Engaging a reputable commercial real estate firm can offer several benefits:

Expert Market Insight: Firms have access to comprehensive market data and trends, enabling informed decision-making.

Negotiation Power: Experienced agents can negotiate favorable terms, potentially saving you significant sums.

Time Efficiency: Outsourcing the complexities of commercial real estate transactions allows you to focus on your core business operations.

The Importance of Estate Planning

Estate planning is a crucial process that involves arranging the management and disposal of a person's estate during their life and after death. Proper estate planning can:

Ensure Asset Distribution: Clearly outline how assets should be distributed among beneficiaries.

Minimize Taxes: Strategic planning can reduce the tax burden on your estate.

Avoid Probate Delays: Properly planned estates often avoid lengthy probate processes.

Navigating Probate Real Estate

Probate real estate refers to properties that are part of a deceased person's estate. The probate process involves proving the validity of a will, inventorying the deceased's assets, and distributing the remaining assets to beneficiaries. Here are key considerations:

Legal Compliance: Ensure all legal requirements are met to avoid delays.

Valuation and Appraisal: Accurate valuation of the property is crucial for fair distribution.

Potential Challenges: Be prepared for disputes among heirs or complications from unresolved debts.

Understanding Real Estate Settlement

Real estate settlement, also known as closing, is the final step in the property transaction process. This stage involves:

Document Review: Ensure all documents are accurate and complete.

Funds Transfer: The buyer pays the purchase price, and the seller transfers the property title.

Closing Costs: Be aware of additional costs, including title insurance, attorney fees, and taxes.

Conclusion

Navigating the realms of commercial real estate, estate planning, and probate real estate requires a blend of strategic planning, legal knowledge, and market expertise. Partnering with a professional commercial real estate firm can streamline your transactions, while comprehensive estate planning can safeguard your assets and ensure a smooth probate process. Understanding these elements is essential for maximizing your investment and securing your financial future.

0 notes

Text

Steps to Legally Transfer Property to a Wife After Husband’s Demise: A Complete Guide

Losing a loved one is always difficult, and dealing with legal formalities in the aftermath can be overwhelming. One of the key concerns for a surviving spouse is the transfer of property after the husband's demise. In this comprehensive guide, we will explore the necessary steps to legally transfer property to a wife, preparations before property transfer, essential documents, and how to navigate the legal process.

Also Read: Wife's Property Rights After Husband's Death

Preparations Before Property Transfer

Before initiating the process of transferring property after a husband's demise, certain preparations are necessary to ensure the process goes smoothly. Proper preparation can prevent delays and avoid disputes among legal heirs.

Gather All Relevant Documents

Start by collecting all the relevant documents that will be needed during the transfer process. These include:

The husband’s death certificate.

The original property documents (sale deed, title deed, etc.).

Identification proofs of the wife and other legal heirs.

Marriage certificate to prove the wife’s relationship with the deceased.

Any existing will, if applicable.

Review Debts and Liabilities

Check if the property is free from encumbrances or loans. If the property is mortgaged, you may need to settle the outstanding loan or arrange for the loan to be transferred in the wife’s name.

Understand the Type of Property

Determine whether the property is self-acquired or ancestral, as different laws may apply. Also, check if the property is jointly owned, as this can simplify the transfer process.

Essential Documents for Property Transfer

To ensure a smooth property transfer, you will need to submit a set of important documents to the authorities. Here is a list of essential documents required for transferring property to the wife:

Death Certificate: A copy of the husband's death certificate issued by the local municipal authority.

Legal Heir Certificate: If there is no will, this certificate identifies the legal heirs of the deceased.

Succession Certificate: Required for movable assets like bank accounts and shares.

Will (if available): If the husband left a will, submit a copy along with the probate order.

Marriage Certificate: To establish the wife’s legal relationship with the deceased.

Property Ownership Documents: The title deed or sale deed of the property.

Identification Proofs: Aadhaar card, PAN card, or voter ID of the wife and other legal heirs.

Tips for Organizing Your Estate Affairs

Proper estate planning can help reduce confusion and ensure the smooth transfer of assets. Here are a few tips:

Create a Will: A well-drafted will can simplify the property transfer process for surviving family members.

Update Legal Documents: Regularly update ownership records, nominee details, and any outstanding loans.

Discuss with Family: Make sure your loved ones are aware of your property and estate arrangements.

Seek Legal Advice: Consult with a lawyer to ensure that your estate planning is legally sound.

The Legal Process of Property Transfer

The legal process of property transfer depends on whether the deceased left behind a will or not. Let's explore both scenarios.

If the Husband Left a Will:

File for Probate: Probate is the legal process through which a will is authenticated by the court. This process involves submitting the will to the district or high court, depending on the value of the property.

Executor Transfers Property: Once the probate is granted, the executor named in the will transfers the property to the wife.

Mutation of Property: The wife needs to apply for the mutation of property in her name by submitting the probate order and relevant documents to the local municipal authority.

If There Is No Will (Intestate Succession):

Obtain Legal Heir Certificate: The wife will need to apply for a Legal Heir Certificate to establish her legal right to the property.

Apply for Succession Certificate (for Movable Property): In cases involving movable assets, the wife must obtain a Succession Certificate from the court.

Mutate the Property: Once the legal heir certificate is obtained, the wife can apply for the mutation of the property in her name.

How to Initiate the Process of Transfer

To initiate the process of transferring property after the husband’s demise, follow these steps:

Get the Death Certificate: Obtain the husband’s death certificate from the local municipal authority.

File for Probate (if there is a will): Submit the will to the court to get it authenticated through probate.

Apply for Legal Heir Certificate: If there is no will, submit an application to the local revenue or civil court to obtain the Legal Heir Certificate.

Submit Necessary Documents for Mutation: Provide all required documents to the land revenue office or municipal authority to mutate the property in the wife’s name.

Probate and Its Role in Property Transfer

Probate is the judicial process of validating a will in court. It is required to ensure that the will is legally binding and that the executor can proceed with the transfer of property. Probate is necessary in some states, such as Maharashtra and West Bengal, even if the will is undisputed. The process involves:

Filing the will in court.

Verifying the will's authenticity.

Granting the executor the right to distribute the deceased's assets.

Factors Affecting Property Transfer

Several factors can affect the smooth transfer of property:

Existence of a Will: The presence of a valid will simplifies the process.

Legal Disputes: Disputes between legal heirs can delay the transfer.

Outstanding Loans: If the property has a mortgage, the loan must be settled before the transfer.

Debts and Liabilities Impacting Transfer

Before transferring property, it’s crucial to settle any outstanding debts or liabilities on the property, such as:

Home Loans or Mortgages: The wife must either repay the loan or transfer it to her name.

Unpaid Taxes: Property taxes or other dues must be cleared before the property can be transferred.

Joint Ownership and Rights of Survivorship

If the property was jointly owned by the husband and wife, the process of transfer is simpler. In such cases:

The wife becomes the sole owner of the property automatically upon the husband’s death, thanks to the right of survivorship.

The only legal requirement is to mutate the property records to reflect the change in ownership.

Step-by-Step Guide to Transfer Property

Here is a quick step-by-step guide to transferring property:

Obtain the death certificate.

Gather all property and legal documents.

File for probate (if necessary).

Apply for Legal Heir or Succession Certificate (if no will exists).

Submit documents for mutation to transfer property ownership.

How to File the Deceased’s Will

To file the deceased's will, follow these steps:

Locate the Will: Ensure that you have the original copy of the will.

Submit to Court for Probate: File an application with the local court to initiate the probate process.

Provide Executor Information: Include details about the executor named in the will.

Navigating Inheritance Laws and Regulations

India has different inheritance laws based on religion. Understanding these laws is crucial to determining how property is distributed:

Hindu Succession Act, 1956: Governs Hindus, Buddhists, Jains, and Sikhs.

Muslim Personal Law (Shariat): Governs Muslims.

Indian Succession Act, 1925: Applies to Christians, Parsis, and Jews.

Tax Implications and Considerations

When property is transferred, tax implications must be considered:

Inheritance Tax: India does not have an inheritance tax, but stamp duty and capital gains tax may apply.

Capital Gains Tax: If the wife decides to sell the inherited property, she may be liable for capital gains tax on the appreciation of the property value.

Understanding Estate Taxes and Exemptions

While India does not levy an estate tax, inheriting property may still involve taxes such as stamp duty and registration fees during the transfer process. These taxes vary depending on the state and property value.

Tips for Minimizing Tax Burden on Inherited Property

To minimize the tax burden on inherited property:

Consider holding onto the property for a longer period to reduce capital gains tax.

Explore exemptions under the Income Tax Act, such as Section 54, for reinvestment in another property.

Common Challenges and Solutions

a) Disputes Among Heirs

Disagreements among legal heirs can delay the property transfer process. If disputes arise, the wife may need to file a partition suit or negotiate a settlement.

b) Missing Documents

If property documents are missing, apply for certified copies from the land registry office or municipal authority.

Dispute Resolution Among Heirs

If disputes arise among heirs, mediation or legal intervention may be required. Courts can intervene to ensure fair distribution under the applicable succession laws.

Avoiding Delays in Property Transfer

To avoid delays, ensure that all necessary documents are in order and that no outstanding debts or legal disputes exist. Engaging a lawyer early in the process can help smoothen the procedure.

Conclusion

Transferring property to a wife after a husband's demise can be a complex and emotional process, but by following the correct legal procedures and preparing the necessary documents, the process can be made smoother. Whether a will exists or not, understanding the legal framework, tax implications, and the steps involved will help ensure a seamless transfer of ownership, allowing the wife to secure her rightful inheritance with ease. If in doubt, consulting with a legal expert can provide additional clarity and assistance.

#Transfer Property from Husband to Wife After Death#legal services#legal advice#family law#legalhelp#legal consultation

2 notes

·

View notes

Text

Need help with our current and future legal fees

I am reaching out to you today to humbly ask for your support in our fight against the dishonest and frankly totally unfit executor of my wife's mother's will.

He has bombarded our family with many insults, lies, and totally untrue accusations. Some are extremely personal, obscene, and completely unfounded. All these messages were sent via WhatsApp and Messenger. On one occasion he said to my wife after she questioned what he was doing 'It's nothing to do with you and anyway you will be dead soon' Copies of all these messages are held by our legal representatives.

We desperately need to remove him as an executor but this is proving to be beyond our means.

Our solicitor needs 1500 pounds to prepare the case and then a further 2000 pounds to submit it to the court. After that, if there is a hearing, costs will spiral.

Sadly, this individual (My wife's brother) has failed badly to carry out his responsibilities with honesty and integrity, causing undue hardship, mental anguish, and many legal challenges for my wife. He has resisted every attempt we have made to negotiate an end to this matter. His replies to requests made by our legal representatives were met with the same vitriolic comments we have been receiving. Once even accusing them of Fraud and threatening them with being reported to HMRC.

We also suspect that at or around the time of my wife's Mother's death he took amounts of money from her bank and savings accounts though we cannot prove this as we have not got access yet to her banking records. We have written to the relevant banks and building societies in order to investigate this further.

He has withheld the information from my wife for almost four years that she was named as a co-executor of the estate. We only got sight of the will he holds in early 2023. This happened after he had taken legal advice which he seems to have now abandoned.

Without her knowledge or permission rented out her mother's property in September 2019 some 8 weeks after her death.

This rental was not registered with the proper authorities and as far as we know no contract was signed. He has since registered himself as the landlord and owner of the property with the rental authorities(2022). He has taken the rent from that property for his own personal income Est 40,000 pounds to date. This money belongs to the estate.

We are asking for donations in light of our mounting legal fees as we have all but exhausted our savings and are unable to continue. We plan to have him removed as an executor so we can finally close off the estate. This can be a very expensive and lengthy process.

To date, he has not applied for probate for the estate but rather used the assets of that estate for his own financial benefit. He had the house valued even before the funeral had taken place and rented out the property only a few weeks after. He did not register the rental of the property with the appropriate authorities. The house was not insured and no contract was in place with the tenant. He did not remove any of my wife's parent's belongings or furniture. These were left for the tenant to package up and store outside the house in a lean-to garage. Anything my wife would have wanted to keep as a memento has now gone. We imagine photographs, letters etc are all destroyed.

He continues to attempt to insult our family via social media and any other means at his disposal, though we have blocked him wherever we can.

He has made no attempt to instigate a probate application himself nor is he showing any signs of cooperating with us. My wife's mother had always insisted that there was enough money in her accounts to pay for the funeral expenses. This proved not to be the case and we made up the difference.

To ensure that justice is served and the wishes of the deceased are respected, we are in need of financial assistance to cover the mounting legal fees. Every donation, no matter the size, will bring us one step closer to holding this person accountable and ensuring a just resolution. We kindly request your generosity in helping us fight for what is rightfully ours and stand against dishonesty. Any contribution will make a significant difference in our pursuit of justice. Thank you in advance for your support and belief in our case.

#gofundme#please donate#injustice#legalfees#financial help#financial aid#please boost#please reblog#please repost#please read#help#signal boost#crowdfunding#boost

12 notes

·

View notes

Text

youtube

Business Name: Lewert Law, LLC

Street Address: 301 Yamato Rd #4110

City: Boca Raton

State: Florida (FL)

Zip Code: 33431

Country: United States

Business Phone Number: (561) 544-6861

Business Email Address: mailto:[email protected]

Website: https://lewertlaw.com/

Twitter: https://twitter.com/lewertlaw

LinkedIn: https://www.linkedin.com/company/lewert-law-offices-pa

Pinterest: https://www.pinterest.com/lewertlawflorida/

Tumblr: https://www.tumblr.com/blog/lewertlawllc

YouTube: https://www.youtube.com/channel/UChbr40y8umuhq_U2J9kZSBA

Facebook: https://www.facebook.com/lewertlaw/

Instagram: https://www.instagram.com/congratsonyourdivorce/

Description: Board Certified Family Lawyer and Divorce Attorney in Marital and Family Law Be confident you have a legal expert on your side. At Lewert Law, LLC, our Boca Raton family law practice provides clients with sound legal advice and trustworthy representation in a wide range of family law matters including divorce, child custody and timesharing, child support, equitable distribution of assets and debts, alimony, post-judgment modifications, enforcement and contempt actions, paternity actions, and pre-nuptial or post-nuptial agreements. If you need a Boca Raton divorce lawyer or family law attorney call us today. Our experienced family law attorneys and divorce lawyers can help you and your family get through even the most difficult of times.

Google My Business CID URL: https://www.google.com/maps?cid=16379424439547585647

Business Hours: Sunday Closed Monday 9:00am-5:30pm Tuesday 9:00am-5:30pm Wednesday 9:00am-5:30pm Thursday 9:00am-5:30pm Friday 9:00am-5:30pm Saturday Closed

Services: Restraining Orders ,Parental Relocation & Moving ,Division of Assets ,Supportive Relationships and Cohabitation ,Prenuptial Agreements ,Mediation ,Child Support ,Post-Judgement Modifications ,Paternity ,Domestic Violence ,Child Custody ,Contempt & Enforcement ,Alimony ,Parental Responsibility ,Divorce ,Father's rights litigation ,Settlement Negotiations ,Adoption legal services ,Child support litigation ,Contested divorce litigation ,Custody & visitation rights litigation ,Divorce litigation ,Mediation ,Modification of court orders ,Parent timesharing litigation ,Paternity establishment litigation ,Prenups & marital agreements writing ,Probate legal services ,Property division litigation ,Restraining order litigation ,Spousal support & alimony litigation ,Uncontested divorce legal services ,Aggravated Assault ,Alimony Attorneys ,Alimony Disputes ,Alimony Lawyer ,Boca Raton Family Law Attorney ,Child Custody Arrangements ,Child Custody Attorneys ,Child Custody Laws ,Child Custody Lawyer ,Child Relocation Laws ,Child Support Agreement ,Child Support Contempt ,Child Support Enforcement Attorney ,Child Support Lawyer ,Child Support Order Modified ,Collaborative Divorce ,Custody Agreements ,Custody Cases ,Disputed Divorce ,Division Of Assets ,Divorce Agreement ,Divorce Attorney ,Divorce Cases ,Divorce Decree ,Divorce Law Services ,Divorce Lawyers ,Divorce Matters ,Divorce Mediation ,Divorce Negotiations ,Divorce Proceedings ,Divorce Process ,Divorce Representation ,Domestic Violence Accusations ,Domestic Violence Attorney ,Domestic Violence Family Law ,Domestic Violence Lawyer ,Family Law Cases ,Family Law Disputes ,Family Law Matters ,Family Law Mediation Lawyer ,Free Consultation ,Legal Counsel ,Legal Custody ,Legal Representation ,Mediation Process ,Modification Attorney ,Modification Of Child Support ,No-Fault Divorce ,Nuptial Agreements ,Parental Relocation Cases ,Parental Relocation Lawyer ,Parental Responsibility Lawyer ,Parenting Plans ,Paternity Cases ,Paternity Disputes ,Paternity Issues ,Paternity Laws ,Paternity Lawyer ,Paternity Proceeding ,Post-Divorce Issues ,Post-Judgment Modifications ,Postnuptial Agreements ,Prenuptial Agreement Lawyer ,Property Division ,Same Sex Divorces ,Spousal Support Attorneys ,Uncontested Divorce ,Alimony Laws ,Cohabitation Agreement ,Dissolution Of Marriage ,Domestic Violence Laws ,Family Law Issues ,Judgement Modifications ,Modification Of Alimony ,Negotiated Settlement ,Parental Relocation ,Premarital Agreement ,Parental Relocation ,Same Sex Family Law ,Support Modification Attorney ,Boca Raton Divorce Lawyer ,Complicated Family Law ,Family Court ,Family Law Practice ,Post-Nuptial Agreements ,Pre-Marital Agreement ,Spouse's Support ,Trial Lawyer ,Divorce service ,Divorce lawyer ,Mediation

Keywords: boca raton family lawyers ,alimony lawyer ,family lawyer ,paternity lawyer ,prenup ,divorce attorney in boca raton ,divorce attorney ,child custody ,domestic violence attorney ,restraining order ,family lawyer near me ,family attorney near me ,divorce lawyer near me ,divorce attorney near me ,Boca Raton divorce lawyer ,family law attorney ,family law ,divorce lawyers boca raton ,family mediation ,divorce lawyer

Payment Methods: Cash, Debit Card, Credit Card, Visa, Master, Amex, Discover, Venmo

Number of Employees: 02-10

Owner Name, Email, and Contact Number: Tina Lewert, mailto:[email protected], (561) 544-6861

Location:

Service Areas:

2 notes

·

View notes

Text

[Image descriptions in order: a Reddit comment which says "There is also a very high chance criminal charges are filed here because you intentionally embezzled this money.

In the future, don't disregard legally binding documents due to your feelings."

throawaylatechild (288 downvotes) replies "Wow 💔 I didn't know that. This is".]

[A tumblr tag which says #i can't find this post but I'm so desperate to know what it's about]

[More screenshots of Reddit comments talking about the situation. The first two are a comment thread, which say: Pay him the full amount he's due or go to court.

throawaylatechild (353 downvotes): We are a big family, most of the money was distributed throughout family members which we thought was only fair. We cant pay the full amount because the money is mostly gone.

mishney: What's fair is honoring your late brother's wishes. Better start fundraising the funds back because there's not a "we didn't approve of his will and decided family should have it instead" probate option.

throawaylatechild (188 downvotes): Wish it was simple for me to cut him a check. Funds are around 850K. I am reading the replies and this seems more serious than we thought.

fawningandconning: Yeah, this may be something that affects the rest of your life. Literally.]

[Forget making this right. He's going to court. There is no way this ends pleasantly for you, and your sister committed egregious felonies here.

Hope that money was fun while you had it. You're going to have to sell basically everything you own.

clippy, replying to the throawaylatechild: Wait, you guys still almost a million dollars without consulting a legal professional, and now you're posting on Reddit like this is going to small claims court?

Clearly all the brains in your family died with your brother.

I don't think you're really grasping the enormity of the crime you've admitted to on here. But I can't wait to see this in the papers, this is gonna be good. Not for you though.]

[A comment by throawaylatechild (267 downvotes) which says: I am trying to see how I can approach him and his lawyers to set up a plan. He is very angry at us. My father said some negative minor racial massages and am trying to see how I can work with him without making things worse.]

[A comment by throawaylatechild (-1692 downvotes) which says: OMG, we didn't know it could be this serious. It is all my fault, I convinced my sister to do what the family wanted. We didn't k ow and are shocked that his boyfriend would sue us. I am going to have a family meeting with friends and try to come up with as much money as I can. Omg am very nervous and didn't realize how horrible this could get. Thank you for the advice.

--MyRedditUsername-- replies: quoting, "We didn't k ow and are shocked that his boyfriend would sue us." end quote.

What? You are shocked that a person would sue for their inheritance from a person they loved for most of a decade AND that inheritance is almost a million dollars? You thought they would just say "oh well" and move on with their life?]

95K notes

·

View notes

Text

At Desmond Law, PLLC, we pride ourselves on being the leading probate lawyers in Scottsdale. Our compassionate team guides you through every step of the probate process, offering clear advice and effective solutions. Whether you’re dealing with will validation, asset distribution, or legal disputes, our attorneys bring the experience and dedication you need.

Desmond Law, PLLC 10565 N. 114th Street, Suite 113, Scottsdale, AZ 85259 (480) 848–9550

My Official Website: https://azlegacylawyer.com/ Google Plus Listing: https://www.google.com/maps?cid=8798724961654513777

My Other Links:

Probate Lawyers in Scottsdale: https://azlegacylawyer.com/probate/ Estate Planning Lawyer in Scottsdale: https://azlegacylawyer.com/estate-planning/ Trust Administration Attorney Scottsdale: https://azlegacylawyer.com/trust-administration/ Guardianship Attorney Scottsdale: https://azlegacylawyer.com/guardianships-and-conservatorships/

Other Services

Planning For Your Children Estate Planning Special Needs Planning Asset Protection Planning Estate Tax Protection Trust Administration Probate Process

#Probate Lawyers in Scottsdale#Probate Lawyer Near Me#Estate Probate Attorney Scottsdale#Probate Attorney Scottsdale

0 notes