#post senior citizen scheme 2023

Explore tagged Tumblr posts

Text

Post Office SCSS Scheme:हर महीने घर घर बैठे खाते में मिलेंगे ₹20000, कमल का यह स्कीम, आपके लिए बहुत जरूरी है

Post Office SCSS Scheme:आजकल सरकार आम लोगों को पैसे देने के लिए कई कल्याणकारी योजनाएं चलाई जा रही हैं। इनमें से एक योजना इतनी दिलचस्प है कि यह आपकी आर्थिक चिंता को कम कर सकती है। इस योजना के तहत आपको हर महीने ₹20,500 मिलेंगे, जो सीधे आपके बैंक खाते में भेजे जाएंगे। ��र्तमान आवश्यकताओं को पूरा करने में यह रा��ि आपको मदद करती है और आपको वित्तीय स्थिरता मिलती है। इस योजना का फायदा उठाने के लिए कुछ सरल…

#post office ki scss scheme#post office scheme senior citizen#post office scss account#post office scss interest rate 2023#Post Office SCSS Scheme#post office scss scheme 2023#post office scss scheme 2024#post office scss scheme 2024 tamil#post office scss scheme in hindi#post office scss scheme in tamil#post office scss scheme in telugu#post office senior citizen account#post office senior citizen saving scheme 2024#post office senior citizen saving scheme form fill up#post office senior citizen saving scheme interest rate#post office senior citizen savings scheme#post office ssc scheme#post senior citizen scheme 2023#scss post office scheme 2022#scss post office scheme 2023#scss post office scheme 2023 bengali#scss post office scheme 2023 in kannada#scss post office scheme 2023 kannada#scss post office scheme 2023 malayalam#scss post office scheme 2023 tamil#scss post office scheme 2023 telugu#scss post office scheme 2024#scss post office scheme 2024 assam#scss post office scheme 2024 assamese#scss post office scheme 2024 bengali

0 notes

Text

Your Guide to Affordable Family Health Insurance: What You Need to Know

Navigating the landscape of family health insurance in India can be overwhelming, especially with rising healthcare costs and numerous policy options available. As of 2023, approximately 75% of Indian households are burdened with out-of-pocket medical expenses, underscoring the critical need for robust health coverage. With the health insurance market in India projected to grow at a compound annual growth rate (CAGR) of 20% over the next few years, understanding how to find affordable family health insurance is essential for protecting your family’s financial future. This guide will provide insights into the key factors to consider, common pitfalls, and practical tips for selecting an affordable yet comprehensive family health insurance plan.

Key Statistics on Family Health Insurance in India

Healthcare Costs: The average cost of hospitalization in India can range from ₹30,000 to ₹1 lakh, making insurance crucial for families.

Insurance Penetration: Only 34% of the Indian population is covered under any health insurance scheme, indicating a significant gap in health security.

Policy Trends: About 60% of families now prefer family floater plans, which offer a single sum insured for all family members.

Premium Costs: The average premium for a family floater plan is between ₹15,000 and ₹25,000 annually, depending on factors like age and health conditions.

Waiting Periods: Most insurers impose a waiting period of 2-4 years for pre-existing conditions, which is essential to consider when choosing a plan.

Tax Deductions: Under Section 80D of the Income Tax Act, individuals can claim a deduction of up to ₹25,000 for health insurance premiums paid, and up to ₹50,000 for senior citizens.

Tips for Finding Affordable Family Health Insurance

Assess Your Needs: Start by evaluating your family’s health needs, including the age and health conditions of each member. This assessment will help you choose an appropriate sum insured.

Compare Plans: Use online comparison tools to assess various plans side by side. Look for coverage details, exclusions, and additional benefits.

Look for Discounts: Many insurers offer discounts for opting for online purchases or for maintaining a healthy lifestyle. Inquire about available discounts to lower your premium.

Check Network Hospitals: Ensure the insurer has a wide network of hospitals for cashless treatments, making it easier to access healthcare without financial strain.

Read the Fine Print: Carefully review policy documents to understand coverage limits, exclusions, and waiting periods, ensuring there are no surprises later.

Seek Expert Advice: Consider consulting with an insurance advisor to navigate complex policy terms and find the best fit for your family's requirements.

Popular Affordable Family Health Insurance Plans

Star Family Health Optima: Offers affordable premiums with coverage up to ₹25 lakhs, including benefits like day-care procedures and no room rent limits.

HDFC ERGO Health Suraksha: Known for its competitive pricing, it covers hospitalization expenses along with pre- and post-hospitalization costs.

Religare Care Plan: Offers comprehensive coverage with a sum insured ranging from ₹3 lakhs to ₹6 crores, making it suitable for various budgets.

Max Bupa Health Companion: Provides flexible sum insured options and covers domiciliary hospitalization, allowing treatment at home for certain conditions.

Tata AIG MediCare: Renowned for its quick claims settlement and extensive hospital network, ensuring timely access to healthcare services.

Conclusion

Affordable family health insurance is essential for securing your family’s health and financial stability. By understanding your needs, comparing options, and seeking expert guidance, you can find a plan that fits your budget without compromising on coverage. With healthcare costs on the rise, investing in a suitable family health insurance plan is a proactive step toward safeguarding your loved ones' health and well-being.

#AffordableHealthInsurance#FamilyHealthCoverage#HealthInsuranceIndia#InsuranceTips#FinancialProtection

0 notes

Text

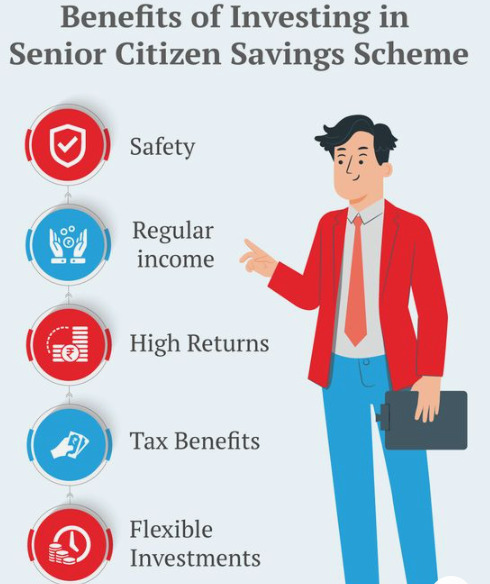

Senior Citizen Savings Scheme (SCSS): Why You Should Invest In It .

As individuals approach retirement, the importance of sound financial planning becomes paramount. Ensuring a steady source of income during the golden years is essential to maintain a comfortable lifestyle without financial stress. One of the most reliable and government-backed options available for senior citizens in India is the Senior Citizen Savings Scheme (SCSS).

The SCSS is designed exclusively for citizens aged 60 and above, providing them with a safe investment avenue that offers a combination of attractive interest rates and tax benefits. Whether you’re planning for your retirement or have recently retired, understanding the nuances of this scheme and how it can benefit you will help you make a more informed decision.

What is the Senior Citizen Savings Scheme (SCSS)?

The Senior Citizen Savings Scheme is a government-backed savings instrument introduced in 2004. It primarily aims to offer retirees a safe, stable, and regular source of income, which is crucial after the cessation of a regular salary. This scheme is available at post offices and designated nationalized banks across India.

Key Features of SCSS

1. Eligibility

Individuals aged 60 years or above can open an SCSS account.

Early retirees between 55-60 years, who have opted for voluntary retirement or superannuation, can also invest, provided they open the account within one month of receiving retirement benefits.

2. Investment Amount

The minimum investment required is ₹1,000.

The maximum permissible investment is ₹30 lakhs (from April 2023). Previously, the limit was ₹15 lakhs. This increased limit allows senior citizens to park a more significant portion of their retirement corpus in this safe instrument.

3. Tenure of the Scheme

The SCSS has a tenure of 5 years, which can be further extended by an additional 3 years upon maturity.

During the extension, you continue to earn interest at the prevailing rate at the time of extension.

4. Interest Rates

SCSS offers an attractive interest rate, which is reviewed and decided by the government quarterly. As of 2023, the interest rate stands at 8.2% per annum, which is higher than most fixed deposits or savings accounts.

The interest is compounded quarterly and paid out every quarter, providing a regular source of income for senior citizens.

5. Premature Withdrawal

Premature withdrawals are allowed but come with penalties. If you withdraw after one year but before two years, a 1.5% penalty is levied. After two years, the penalty reduces to 1%.

6. Nomination Facility

SCSS allows you to nominate a beneficiary at the time of opening the account or afterward. This ensures that in case of the unfortunate demise of the account holder, the investment is passed on smoothly to the nominee.

7. Tax Benefits

The investment in SCSS is eligible for a tax deduction of up to ₹1.5 lakh under Section 80C of the Income Tax Act.

However, the interest earned is taxable, and TDS (Tax Deducted at Source) is applicable if the interest exceeds ₹50,000 in a financial year.

Why Should You Invest in SCSS?

1. Safety and Reliability

One of the primary concerns for any retiree is the safety of their investment. The SCSS is a government-backed scheme, which makes it one of the safest investment options available for senior citizens. Unlike market-linked instruments, SCSS offers guaranteed returns, insulating investors from market volatility. For risk-averse retirees, this feature is particularly attractive.

2. Regular Income

Post-retirement, most individuals lose the steady monthly income that their salary provided. SCSS is designed to address this issue by offering quarterly interest payouts. These payouts can act as a regular source of income to cover daily expenses, medical bills, or leisure activities.

3. Attractive Interest Rates

With an interest rate of 8.2% per annum (as of 2023), SCSS offers a far superior return compared to regular savings accounts or even many fixed deposits. While bank interest rates fluctuate, SCSS offers a more consistent and attractive return, making it an ideal choice for those looking for secure yet rewarding investment options.

4. Tax Benefits

Investing in SCSS allows you to claim deductions under Section 80C up to ₹1.5 lakh. For senior citizens looking to optimize their tax outgo while securing their future, this dual benefit of safety and tax saving is hard to ignore.

5. Flexibility of Withdrawal

Life after retirement can sometimes bring unexpected expenses, be it medical emergencies or personal needs. The SCSS allows for premature withdrawals with nominal penalties, offering flexibility if you need funds before the completion of the scheme’s tenure.

6. Option to Extend

While the initial tenure of the SCSS is five years, the scheme can be extended for an additional three years. This flexibility ensures that if you do not require the funds immediately, you can continue earning interest on your investment for a longer period without any hassles.

7. Higher Investment Cap

With the government increasing the maximum investment limit to ₹30 lakhs, senior citizens now have the opportunity to invest a larger portion of their savings into this secure instrument. This is particularly beneficial for those with substantial retirement funds who are looking for a safe place to invest.

SCSS vs. Other Investment Options

When compared to other investment avenues such as fixed deposits (FDs), mutual funds, and bonds, the SCSS stands out for its balance between safety, returns, and tax benefits.

Fixed Deposits: While FDs are relatively safe, they generally offer lower interest rates compared to SCSS. Additionally, FD interest is taxable, and the regular payouts are often not as frequent.

Mutual Funds: These are market-linked instruments, making them more volatile. While they offer potentially higher returns, they also come with higher risks, which may not be suitable for senior citizens seeking stable and predictable income.

Bonds: Government bonds are safe but often have lower yields compared to SCSS. Also, bonds usually don’t offer regular payouts like SCSS, which can be a disadvantage for those who rely on periodic income.

How to Open an SCSS Account?

Opening an SCSS account is a simple and straightforward process. Here’s how you can do it:

Visit a Post Office or Designated Bank: You can open the SCSS account at any post office or a designated bank like the State Bank of India (SBI), ICICI Bank, HDFC Bank, etc.

Fill in the Application Form: You will need to fill out the SCSS application form available at the bank or post office.

Submit Required Documents:

Age proof (Aadhaar Card, Passport, Voter ID, etc.)

Proof of retirement (if applicable)

PAN card

Photographs

Deposit the Investment: Deposit the amount you wish to invest (minimum ₹1,000 and up to ₹30 lakhs). The deposit can be made through cash or cheque.

Nomination: Provide the details of the nominee at the time of account opening.

Once your account is opened, you will start earning interest from the date of the deposit, and the first interest payout will occur after the end of the first quarter.

Conclusion

The Senior Citizen Savings Scheme (SCSS) is an excellent investment option for retirees looking for a safe, stable, and profitable way to grow their savings. With its government backing, attractive interest rates, and regular payouts, SCSS provides financial security during the post-retirement phase. Coupled with tax benefits under Section 80C, SCSS stands as one of the most efficient savings instruments for senior citizens.

For individuals nearing or already in their retirement, investing in SCSS is a smart choice that balances safety, income generation, and tax savings. With the ever-rising cost of living and healthcare expenses, securing a stable source of income becomes essential, and SCSS can be a cornerstone in that financial strategy.

#SeniorCitizenSavingsScheme#SCSS#RetirementPlanning#SafeInvestments#FinancialSecurity#RetirementFunds#SeniorCitizenFinance#InvestInYourFuture#FinancialPlanning#SecureInvestments

0 notes

Text

Post office schemes interest rate 2023: Which small savings scheme offers highest interest rate - The Economic Times

The government’s small savings scheme offer various deposit schemes catering to different individuals such as girl kid (Sukanya Samriddhi), women investor (Mahila Samman), senior citizens (SCSS), long term investors (PPF, KYC, NSC) and short term investors (Time deposits, RD). Small savings scheme interest rates are revised every quarter by the government and interest rates vary accordingly. For…

View On WordPress

0 notes

Text

Russia-Ukraine war at a glance: what we know on day 584 of the invasion

Russian attack hits Ukrainian infrastructure in west; Putin reaffirms referendums in illegally annexed regions * See all our Russia-Ukraine war coverage An infrastructure site was hit in a Russian attack early on Saturday in the western Ukrainian region of Vinnitsya, the regional governor said. Serhiy Borzov’s comments on Telegram came after reports of drones operating in the area. Ukrainian officials sometimes use the “infrastructure” term to refer to facilities involved in power generation or other industries. Vladimir Putin said residents of Russian-held regions in Ukraine expressed their desire to be part of Russia in recent local elections, reaffirming referendums last year that western countries denounced as illegal. In a video address released early on Saturday on the one-year anniversary of Moscow’s announcement it was annexing four parts of Ukraine, the Russian president said the choice to join Russia was reinforced by this month’s local elections that returned officials supporting Russia’s annexation. Western countries dismissed the outcomes as meaningless, underpinned by mass coercion of voters. Flag-waving Russians gathered for a concert in Red Square on Friday as the Kremlin held celebrations to mark the annexations. The UK government has imposed an asset freeze and travel bans on Russian officials in the annexed Ukrainian regions of Zaporizhzhia, Kherson, Donetsk and Crimea as part of its broader sanctions against Russia. Seven European Union countries have ordered ammunition under a landmark EU procurement scheme to get urgently needed artillery shells to Ukraine and replenish depleted western stocks, according to the EU agency in charge. Vladimir Putin has signed a decree setting out the routine autumn conscription campaign, calling up 130,000 citizens for statutory military service, a document posted on the government website showed. Separately, Putin reportedly met Andrei Troshev, formerly a top Wagner mercenary commander, to discuss how voluntary fighting units are used in the war in Ukraine, the Kremlin said on Friday. German chancellor Olaf Scholz and the leaders of five Central Asian nations on Friday pledged to cooperate closely on sanctions in a carefully worded statement that did not pinpoint Russia. The gathering of Scholz and the leaders of Kazakhstan, Kyrgyzstan, Uzbekistan, Turkmenistan and Tajikistan in Berlin was the first of its kind in an EU country. Top US general Mark Milley was to retire on Friday after a four-year tenure as chair of the US joint chiefs of staff. Milley’s tenure included providing military assistance to Ukraine’s defence against Russia’s invasion in February 2022. A Russian blogger who criticised highway patrol officers was jailed for eight-and-a-half years on Friday after a court alleged he posted “fake news” about Moscow’s offensive in Ukraine. Alexander Nozdrinov, 38, ran a small YouTube channel where he posted videos of highway patrol officers from his home region of Krasnodar allegedly breaking the law. He was detained in March 2022 after investigators accused him of posting a photo of destroyed buildings on social media with the caption: “Ukrainian cities after the arrival of liberators”. Norway says it will start barring Russian-registered passenger cars from entering the country starting next week, in a move that mirrors sanctions already imposed by the European Union against Moscow over the war in Ukraine. “Very difficult questions” would need to be answered before the EU could start membership talks with Ukraine, Hungarian prime minister Viktor Orbán has said. Romania is moving air defences closer to its Danube villages across the river from Ukraine, where Russian drones have been attacking grain facilities, and is adding more military observation posts and patrols to the area, two senior defence sources told Reuters. Continue reading... https://www.theguardian.com/world/2023/sep/30/russia-ukraine-war-at-a-glance-what-we-know-on-day-584-of-the-invasion?utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

পোস্ট অফিস সিনিয়র সিটিজেন স্কিম।Post Office Senior Citizen Savings Scheme 2023 - TAKAPOYSANEWS

0 notes

Text

Can you transfer SCSS, SSY, PPF accounts from Bank to Post Office or vice versa?

You can transfer Senior Citizens Savings Scheme (SCSS), Public Provident Fund (PPF) and Sukanya Samriddhi Yojana (SSY) accounts from Post Office ... January 13, 2023 at 11:29PM Hammond Louisiana Ukiah California Dike Iowa Maryville Missouri Secretary Maryland Winchester Illinois Kinsey Alabama Edmundson Missouri Stevens Village Alaska Haymarket Virginia Newington Virginia Edwards Missouri https://unitedstatesvirtualmail.blogspot.com/2023/01/can-you-transfer-scss-ssy-ppf-accounts.html January 14, 2023 at 03:03AM Gruver Texas Glens Fork Kentucky Fork South Carolina Astoria Oregon Lac La Belle Wisconsin Pomfret Center Connecticut Nason Illinois Roan Mountain Tennessee https://coloradovirtualmail.blogspot.com/2023/01/can-you-transfer-scss-ssy-ppf-accounts.html January 14, 2023 at 04:41AM from https://youtu.be/GuUaaPaTlyY January 14, 2023 at 05:47AM

0 notes

Text

Govt hikes small savings interest rates of NSC, Senior Citizen and Post Office Deposit scheme: Check new PPF, NSC, Sukanya Samriddhi Scheme interest rates from January 1, 2023

Govt hikes small savings interest rates of NSC, Senior Citizen and Post Office Deposit scheme: Check new PPF, NSC, Sukanya Samriddhi Scheme interest rates from January 1, 2023

NSC interest rate, Post office Term Deposit interest rate, Senior Citizen Savings Scheme, PPF rate: The end of the year 2022 has brought some cheer for the common man, as the government has hiked the interest rates on small deposits on Friday. The interest rate hike will affect saving schemes like post office term deposits, National Savings Certificate (NSC) and senior citizen savings scheme — by…

View On WordPress

0 notes

Text

PPF, Senior Citizen Scheme, Small Savings Scheme Interest Rates Announced; Know Here

PPF, Senior Citizen Scheme, Small Savings Scheme Interest Rates Announced; Know Here

The finance ministry has kept the interest rates of small savings schemes unchanged for June quarter of financial year 2023. The small savings instruments include Public Provident Fund Account (PPF ), Sukanya Samriddhi Accounts, Senior Citizen Savings Scheme, Post Office Savings Account, 5-Year Post Office Recurring Deposit Account (RD), National Savings Certificates (NSC) among others. “The rate…

View On WordPress

0 notes

Text

Jiaxing Civic Center Design by MAD Architects

Jiaxing Civic Center Building by MAD Architects, Chinese Architecture Images, News, Architect

Jiaxing Civic Center Building

11 May 2021

Jiaxing Civic Center by MAD Architects

Design: MAD Architects

Location: Jiaxing, northern Zhejiang province, China

An Embrace of the City – MAD Architects Releases the Design of the Jiaxing Civic Center

MAD Architects, led by Ma Yansong, has released their design for the Jiaxing Civic Center. The scheme marks the latest important public project in Jiaxing City designed by MAD, after their design for the Jiaxing Train Station was unveiled earlier this year.

Holding elegant river views and lush vegetation, the Jiaxing Civic Center is situated along the city’s central axis. The project holds a prominent position; adjacent to the South Lake, a historic lake in the South of Jiaxing, and the Central Park, the largest park in the city. The site also lies next to the Haiyan river channel that connects the two cities of Jiaxing and Haiyan. Spanning approximately 130,000 square meters, the site contains three venues: the Science and Technology Museum, the Women and Children Activity Center, and the Youth Activity Center, forming a total construction area of 180,000 square meters and a site footprint of 72,000 square meters.

“A civic center, first and foremost, must be a place that attracts people; a place where children, youth, seniors, and families are willing to come together on a daily and weekly basis. We have created an undulating ring to serve as a garden-like living room for the city: an embrace.” — Ma Yansong

For the Jiaxing Civic Center, MAD has designed an artistic entity on an urban scale; where architectural forms and landscapes fuse together. With a large circular lawn as the centerpiece, the project is one where both people and buildings can interact and share; forming a more open, intimate, dynamic new urban space.

The center’s three venues are linked together “hand in hand,” enclosed by a circular roof to form a single entity. The organic flow of the lines throughout the project echoes the softness and grace of the ancient canal towns lining the southern banks of the Yangtze River in Eastern China. The central circular lawn that anchors the buildings allows for the large architectural volumes to dissipate and dissolve into the landscape.

Adjacent to the South Lake, the waterfront building sits within the central park, covered with locally produced white ceramic panels. The panels respond to the traditional barrel tile roofs of the local village, while also enhancing the scheme’s economic and energy efficiency. Meanwhile, the project’s floating roof forms a continuous skyline, like a tarp blown by the wind, bringing a soft sense of wrapping to the form. Whether you are on the central lawn, outside the park, or on the building’s links and pathways, the scenery seems to change with your movement.

To maintain the cohesiveness of a single entity, the three venues serving exhibition, education, and amenity functions are all coherently arranged under the curvaceous roof, naturally forming an interdependent group with a flowing line of movement. The spaces for exhibition, theater, education, activity, entertainment, and other uses are organically weaved together to complement one another. By avoiding the wasteful duplication of service spaces, the design offers more space for people and nature, and enhances the building’s energy-saving attributes.

The 6,000-square-meter lawn becomes a new type of urban public space, where every citizen can gather, rest and play, in addition to participating in a variety of activities or visiting exhibitions.

The first floor of the center has connections to the surrounding environment on all sides, through bordering the municipal traffic and wider landscape, or connecting the central lawn with the parklands on the periphery of the building. This semi-open, semi-private space can be used in a variety of ways, whether for daily activities, or as an open-air plaza for large urban cultural events. In addition to the central green space, the scheme contains additional open and intimate spaces connecting people to the outdoors, and to nature.

Among these, the terrace on the second floor of the site creates a 350-meter-long landscape corridor and running path. The public can climb towards the track from the central green space to walk or exercise, or visit the amphitheater and sunken plaza on the east side, before wandering into the parkland forest beyond the center to enjoy the wilderness.

The original trees on the site that have grown to an impressive age are preserved as much as possible, informing the design of the landscape to form a new natural park. In the middle of the green forest are winding paths and passages through the enclosed buildings, where one can walk through the trees and enjoy the riverfront view.

A cascading terrace, facing the central lawn in the interior of the building, acts in a dialogue with the white curved roof. The elements interlock and overlap into multiple semi-outdoor spaces, separated by minimalist floor-to-ceiling glass, blurring the interior and exterior. This is an urban public space for citizens to gather; a fresh, pure land for people to wash away the city’s complex clutter.

Jiaxing has a unique historical status in China. The vision for MAD’s scheme, embracing innovation, coherence, environmental friendliness, openness, and co-sharing, resonates with the historical heritage of this city, making this municipal public building a place that enhances the citizens’ sense of belonging and happiness.

By exploring the relationship between the city, nature, and humanities, MAD aims to create an urban space that is accessible to all, offering natural, equal, and friendly open spaces to everyone in the city. Here, architecture allows citizens to envision a spiritual blueprint of their ideal life in the fast-paced world, and to gain a sense of the promising future to be created through the positive development of the city.

Jiaxing Civic Center has completed its bidding for engineering procurement construction, and is expected to be completed by the end of 2023.

Jiaxing Civic Center China – Building Information

Jiaxing Civic Center Jiaxing, China 2019 – 2023

Typology: Civic, Musuem Site area: 126,740 sqm Building area: approximately 180,000 sqm Above ground: 72,351 sqm Underground: 107,950 sqm Height: 39 m

Principal Partners: Ma Yansong, Dang Qun, Yosuke Hayano Associate Partners: Kin Li, Fu Changrui, Liu Huiying Design Team: Yin Jianfeng, Alessandro Fisalli, Fu Xiaoyi, Chen-Hsiang Chao, He Yiming, Thoufeeq Ahmed, Chen Hao, He Xiaowen, Zhang Yaohui, Guo Xuan, Edgar Navarrete, Claudia Hertrich, Deng Wei, Zhang Xiaomei, Chen Nianhai, Li Cunhao, Sun Feifei, Punnin Sukkasem, Manchi Yeung, Li Yingzhou

Client: Jiaxing Highway Investment Co., Ltd. Executive Architects: East China Architectural Design & Research Institute, Shanghai Municipal Engineering Design Institute (Group) Co., Ltd. Façade consultant: RFR Shanghai Landscape Consultant: Earthasia Design Group, Yong-High Landscape Design Consulting Co.Ltd Interior Design consultant: Shanghai Xian Dai Architectural Decoration & Landscape Design Research Institute CO., Ltd Signage Consultant: Nippon Design Center, Inc. Lighting Consultant: Beijing Sign Lighting Industry Group Traffic Consultant: Shanghai Municipal Engineering Design Institute (Group) Co., Ltd.

Jiaxing Civic Center Design by MAD Architects images / information from MAD

MAD Architects

Location: Nanjing Zendai Himalayas Center, People’s Republic of China

Chinese Building Designs by MAD

Nanjing Zendai Thumb Plaza, Shenzhen image from architects Nanjing Zendai Himalayas Center

Wormhole Library, Haikou, Hainan Province, China image courtesy of architects Wormhole Library

Shenzhen Bay Culture Park, Shenzhen, China image courtesy of architecture office Shenzhen Bay Culture Park

Quzhou Sports Campus, Shaoxing, Zhejiang Province, China image courtesy of architecture office Quzhou Sports Campus Stadium, Zhejiang Province

Chinese Building Designs

Chinese Architecture

Chinese Architecture News

Nanjing International Youth Cultural Centre, Jiangsu Design: Zaha Hadid Architects photo © Hufton+Crow 2nd Nanjing Youth Olympic Games International Convention Center

Wuhan·SUNAC·1890, Qintai Avenue, Wuhan City Design: Lacime Architects photo : Inter_mountain images Sunac · Wuhan 1890 Building

THE FIELD, Huli District, Xiamen, Fujian, South East China Design: TEAM BLDG, Architects, Shanghai photo : Jonathan Leijonhufvud THE FIELD, Huli District, Xiamen City

Chinese Architecture

Contemporary Architecture in China – architectural selection below:

Hong Kong Architecture Designs – chronological list

Hong Kong Walking Tours – bespoke HK city walks by e-architect

Chinese Buildings

Comments / photos for the Jiaxing Civic Center Design by MAD Architects in China page welcome

The post Jiaxing Civic Center Design by MAD Architects appeared first on e-architect.

0 notes

Text

21-05-2020 Current affairs & Daily News Analysis

COIR GEO TEXTILES Coir Geo textiles, a permeable fabric, natural, strong, highly durable, resistant to rots, moulds and moisture, free from any microbial attack, has finally been accepted as a good material for rural road construction under the PMGSY-III. About: As per the PMGSY new technology guidelines for road construction, 15% length in each batch of proposals, is to be constructed using new technologies. Out of this 5% roads are to be constructed using IRC accredited technology. The IRC has now accredited coir Geo textiles for construction of rural roads. As per these instructions, 5% length of the rural roads under PMGSY-III will be constructed using Coir Geo textiles. The decision opens up a huge market potential for Coir Geo-textiles in the Country and will be a boon to the Covid-19 hit Coir Industry. Source : DD News ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Coaching Institute in Bangalore Vignan IAS Academy COMPLETE SOLARISATION OF KONARK SUN TEMPLE AND KONARK TOWN Government of India has launches scheme for 100 % solarisation of Konark sun temple & Konark town in Odisha. About: The Ministry of New and Renewable Energy (MNRE) has taken up the Complete Solarisation of Konark sun temple and Konark town in Odisha. Implementation of this Project will be done by Odisha Renewable Energy Development Agency (OREDA). The Scheme envisages setting up of 10 MW grid connected solar project and various solar off-grid applications like solar trees, solar drinking water kiosks, off-grid solar power plants with battery storage etc. There will be 100% Central Financial Assistance (CFA) support of around Rs. 25 Crores from Government of India through Ministry of New & Renewable Energy (MNRE). The scheme will meet all the energy requirements of Konark town with solar energy. Source : Indian Express ( Culture ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy SPECIAL LIQUIDITY SCHEME FOR NBFCs/HFCs The Union Cabinet has approve the proposal of the Ministry of Finance to launch a new Special Liquidity Scheme for Non-Banking Financial Companies (NBFCs) and Housing Finance Companies (HFCs) to improve liquidity position of the NBFCs/HFCs. About: A large public sector bank would set up an Special Purpose Vehicle (SPV) to manage a Stressed Asset Fund (SAF) whose special securities would be guaranteed by the Government of India and purchased by the Reserve Bank of India (RBI) only. The SPV would issue securities as per requirement subject to the total amount of securities outstanding not exceeding Rs. 30,000 crore to be extended by the amount required as per the need. The securities issued by the SPV would be purchased by RBI and proceeds thereof would be used by the SPV to acquire the debt of at least investment grade of short duration (residual maturity of upto 3 months) of eligible NBFCs / HFCs. The Scheme will be administered by the Department of Financial Services. The direct financial implication for the Government is Rs. 5 crore, which may be the equity contribution to the Special Purpose Vehicle (SPV). Source : PIB ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy PRADHAN MANTRI MATSYA SAMPADA YOJANA (PMMSY) The Union Cabinet has given its approval for implementation of the Pradhan Mantri Matsya Sampada Yojana (PMMSY) - a scheme to bring Blue Revolution through sustainable and responsible development of fisheries sector in India. About: The Scheme will be implemented during a period of 5 years from FY 2020-21 to FY 2024-25. The PMMSY will be implemented as an umbrella scheme with two separate Components namelyCentral Sector Scheme (CS) and Centrally Sponsored Scheme (CSS). Under the Central Sector Scheme Component an amount of 1720 croreshas been earmarked. Under the Centrally Sponsored Scheme (CSS) Component, an investment of 18330 croreshas been envisaged, which in turn is segregated into Non-beneficiary oriented and Beneficiary orientated sub-components/activities under the following three broad heads:Enhancement of Production and Productivity Infrastructure and Post-Harvest Management Fisheries Management and Regulatory Framework For optimal outcomes, ‘Cluster or area-based approach’ would be followed with requisite forward and backward linkages and end to end solutions. Collectivization of fishers and fish farmers through Fish Farmer Producer Organizations (FFPOs) to increase bargaining power of fishers and fish farmers is a key feature of PMMSY. Important Info : Expected Benefits: Augmenting fish production and productivity at a sustained average annual growth rate of about 9% to achieve a target of 22 million metric tons by 2024-25.Creation of direct gainful employment opportunities to about 15 lakh fishers, fish farmers, fish workers, fish vendors etc.Doubling of fishers, fish farmers and fish workers incomes by 2024. Source : PIB ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy PRADHAN MANTRI VAYA VANDANA YOJANA (PMVVY) Union Cabinet has approved extension of Pradhan Mantri Vaya Vandana Yojana (PMVVY) up to 31st March, 2023 for further period of three years beyond 31st March, 2020 to enable old age income security for Senior Citizens. Key highlights of cabinet decisions: It has allowed initially an assured rate of return of 7.40 % per annum for the year 2020-21 per annum and thereafter to be reset every year. There will be annual reset of assured rate of interest with effect from April 1st of financial year in line with revised rate of returns of Senior Citizens Saving Scheme (SCSS) upto a ceiling of 7.75% with fresh appraisal of the scheme on breach of this threshold at any point. Expenditure is to be incurred on account of the difference between the market rate of return generated by LIC (net of expenses) and the guaranteed rate of return under the scheme. Management expenses are capped at 0.5% p.a. of funds of the scheme for first year of scheme in respect of new policies issued and thereafter 0.3% p.a. for second year onwards for the next 9 years. It has delegated the authority to Finance Minister to approve annual reset rate of return at the beginning of every financial year. The minimum investment has also been revised to Rs.1,56,658 for pension of Rs.12,000/- per annum and Rs.1,62,162/- for getting a minimum pension amount of Rs.1000/- per month under the scheme. Important Info : PMVVY is a social security scheme for senior citizens intended to give an assured minimum pension to them based on an assured return on the purchase price / subscription amount. Source : DD News ( Social Issues ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy METHODOLOGY FOR AUCTION OF COAL & LIGNITE MINES/ BLOCKS The Cabinet Committee on Economic Affairs (CCEA) has approved the methodology for auction of coal and lignite mines or blocks for sale of coal or lignite on revenue sharing basis and increasing the tenure of coking coal linkage. About: This methodology provides that bid parameter will be on revenue sharing basis. The bidders would be required to bid for a percentage share of revenue payable to the Government. The floor price shall be 4 per cent of the revenue share. Bids would be accepted in multiples of 0.5 per cent of the revenue share till the percentage of revenue share is up to 10 per cent and thereafter bids would be accepted in multiples of 0.25 per cent of the revenue share. There shall be no restriction on the sale or utilization of coal from the coal mine. The entire revenue from the auction or allotment of coal mines would accrue to the coal bearing States. Tenure of coking coal linkage in the non-regulated sector linkage auction has been increased upto 30 years. Important Info : Upfront amount: Successful Bidder shall be required to make monthly payments which shall be determined as product of:percentage of revenue share (final bid),quantity of coal on which the statutory royalty is payable during the month andnotional price or actual price whichever is higher.The Upfront Amount shall be 0.25 per cent of the value of estimated geological reserves of the coal mine payable in 4 equal installments. However, the upfront amount payable shall be as per actual calculation as per above method or as per ceiling mentioned here, whichever is lower.If Geological Reserves in mine upto 200s tonne, the upper ceiling of upfront amount will be Rs. 100 crore.If Geological Reserves in mine is over 200 tonnes, the upper ceiling of upfront amount will be Rs. 500 crore. It also permits commercial exploitation of the CBM present in the mining lease area. Source : All India Radio ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy EMERGENCY CREDIT LINE GUARANTEE SCHEME (ECLGS) Union Cabinet has approved additional funding of up to Rs. three lakh crore through introduction of Emergency Credit Line Guarantee Scheme (ECLGS). About: The Emergency Credit Line Guarantee Scheme (ECLGS) has been formulated as a specific response to the unprecedented situation caused by COVID-19 and the consequent lockdown, which has severely impacted manufacturing and other activities in the MSME sector. Under the scheme, all MSME borrower accounts with outstanding credit of up to Rs. 25 crore as on 29.2.2020 and with an annual turnover of up to Rs. 100 crore would be eligible for Guaranteed Emergency Credit Line (GECL) funding. The scheme would be applicable to all loans sanctioned under GECL during the period from the date of announcement of the Scheme to 31.10.2020, or till an amount of three lakh crore is sanctioned under the GECL, whichever is earlier. Source : All India Radio ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy ALLOCATION OF FOODGRAINS TO THE MIGRANTS UNDER ATMA NIRBHAR BHARAT PACKAGE Union Cabinet has approved ‘Atma Nirbhar Bharat Package for allocation of foodgrains to the migrants / stranded migrants. About: The Union Cabinet has given its ex-post facto approval for allocation of foodgrains from Central Pool to approximately 8 crore migrants / stranded migrants @ 5 kg per person per month (May and June, 2020) for two months free of cost. It would entail an estimated food subsidy of about Rs.2,982.27 crore. Further the expenditure towards intra-state transportation and handling charges and dealer’s margin / additional dealer margin will account for about 127.25 crore which will borne fully by Central Government. Accordingly, the total subsidy from the Government of India is estimated at about of Rs.3,109.52 crore. The allocation will ease the hardships faced by migrant / stranded migrants due to economic disruption caused by COVID-19. Source : All India Radio ( Social Issues ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy SCHEME FOR FORMALISATION OF MICRO FOOD PROCESSING ENTERPRISES (FME) Union Cabinet gave its approval to a new Centrally Sponsored Scheme named Scheme for Formalization of Micro Food Processing Enterprises for the Unorganized Sector on All India basis with an outlay of Rs. 10 thousand crore. About: The expenditure will be shared by Centre and the States in ratio of 60:40. The objectives of the scheme is to increase in access to finance by micro food processing units and enhanced compliance with food quality and safety standards. Scheme will be implemented over a five-year period from 2020-21 to 2024-25 and two lakh micro-enterprises are to be assisted with credit linked subsidy. Micro enterprises will get credit linked subsidy at 35 per cent of the eligible project cost with ceiling of Rs. 10 lakh. Beneficiary contribution will be minimum 10 per cent and balance from loan. Seed capital will be given to SHGs (Rs. four lakh per SHG) for loan to members for working capital and small tools. There will be on-site skill training and Handholding for DPR and technical upgradation. The scheme would be monitored at Centre by an Inter-Ministerial Empowered Committee under the Chairmanship of Minister, Food Processing Industries. Source : All India Radio ( Economy ) Read UPSC Current affairs and Daily News Analysis from Best IAS Academy in Bangalore Vignan IAS Academy Daily Current affairs and News Analysis Best IAS Coaching institutes in Bangalore Vignan IAS Academy Contact Vignan IAS Academy Enroll For IAS Foundation Course from Best IFS Academy in Bangalore Read the full article

0 notes

Text

New Tax Regime – Complete list of exemptions and deductions disallowed

Do you know under the New Tax Regime, which are the exemptions or deductions not allowed? Let us discuss the New Tax Regime – List of exemptions and deductions disallowed in detail.

During the Budget 2020, Finance Minister introduced the new tax regime. However, an option has been given to pay tax at lower rates, if you fulfill certain conditions. One such condition is you are not eligible for a few exemptions and deduction.

Below is the new tax regime tax slabs applicable:-

New Tax Regime – Complete list of exemptions and deductions not allowed

Let us now look into the exemptions and deductions not allowed under the Sec.115BAC,

Leave travel concession (LTC) applicable for salaried employee

House Rent Allowance (HRA) applicable for salaried employee

The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC.

Deduction of entertainment allowance and professional tax.

Deductions under Sec.80C like Life Insurance Premium, Sum Paid towards deferred annuity plans, your contributions towards EPF, PPF, Superannuation Scheme, SSY, NSC, ELSS Mutual Funds, Tuition Fees, Principal Payment towards your home loan, Tax Saving FDs, SCSS, Contribution to NPS Tier 2 by Central Government Employees, NPS contribution by you (Under Sec.80CCD(1) and Sec.80CCD(1B). But employer contribution under Sec.80CCD(2) will continue to be eligible for deduction.

Deduction under Sec.80D- Amount paid (in any mode other than cash) by an individual or HUF to LIC or other insurers to effect or keep in force an insurance on the health of a specified person.

Section 80DD – Deduction in respect of maintenance including medical treatment of a dependant who is a person with a disability.

Section 80DDB – Expenses actually paid for medical treatment of specified diseases and ailments.

Section 80E – Amount paid out of income chargeable to tax by way of payment of interest on loan taken from financial institution/approved charitable institution for pursuing higher education

Section 80EE – Interest payable on loan taken up to Rs. 35 lakhs by the taxpayer from any financial institution, sanctioned during the FY 2016-17, for the purpose of acquisition of a residential house property whose value doesn’t exceed Rs. 50 lakhs

Section 80EEA – Interest payable on loan taken by an individual, who is not eligible to claim deduction under section 80EE, from any financial institution during the period beginning from 01/04/2019 ending on 31/03/2020 for the purpose of acquisition of a residential house property whose stamp duty value doesn’t exceed Rs. 45 lakhs

Section 80EEB – Interest payable on loan taken by an individual from any financial institution during the period beginning from 01/04/2019 and ending on 31/03/2023 to purchase an electric vehicle.

Section 80GG – Rent paid for furnished/unfurnished residential accommodation (Subject to certain conditions).

Section 80G- Deduction in respect of donations to certain funds, charitable institutions etc

Section 80GGA- Deduction in respect of certain donations for scientific research or rural development

Section 80GGC- Deduction in respect of contributions given by any person to political parties

Section 80JJA- Deduction in respect of profits and gains from business of collecting and processing of bio-degradable waste

Section 80QQB- Royalty income of authors of a certain specified category of books other than text books.

Section 80RRB- Royalty in respect of patents registered on or after 01.04.2003 (subject to certain conditions)

Section 80TTA- Interest on deposits in savings account with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)

Section 80TTB- Interest on deposits with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)- for senior citizens

Section 80U- A resident individual who, at any time during the previous year, is certified by the medical authority to be a person with a disability

Section 24(b) – In the case of personal taxpayers who have self-occupied the property for own residence or who cannot occupy the property owing to employment, business or profession carried on at any other place he has to reside at that other place in a building not belonging to him, the annual value of the property shall be taken to be `nil’. However, interest on money borrowed is deductible up to a maximum of Rs.2 lakhs.

Allowances (Under Sec.10(14)) like Travelling/Transfer Allowance, Conveyance Allowance, Helper Allowance, Research Allowance or Uniform Allowance

Any allowance granted to meet the expenditure incurred on a helper where such helper is engaged for the performance of the duties of an office or employment of profit;

Any allowance granted for encouraging the academic, research and training pursuits in educational and research institutions;

Any allowance granted to meet the expenditure incurred on the purchase or maintenance of uniform for wear during the performance of the duties of an office or employment of profit.

Any Special Compensatory Allowance in the nature of [Special Compensatory (Hilly Areas) Allowance] or High Altitude Allowance or Uncongenial Climate Allowance or Snow Bound Area Allowance or Avalanche Allowance

Any Special Compensatory Allowance in the nature of Border Area Allowance, Remote Locality Allowance or Difficult Area Allowance or Disturbed Area Allowance

Special Compensatory (Tribal Areas/Schedule Areas/Agency Areas) Allowance

Any allowance granted to an employee working in any transport system to meet his personal expenditure during his duty performed in the course of running of such transport from one place to another place provided that such employee is not in receipt of daily allowance

Children Education Allowance

Any allowance granted to an employee to meet the hostel expenditure on his child

Compensatory Field Area Allowance

Compensatory Modified Field Area Allowance

Any special allowance in the nature of counter-insurgency allowance granted to the members of armed forces operating in areas away from their permanent locations

Underground Allowance granted to an employee who is working in uncongenial, unnatural climate in underground mines

Any special allowance in the nature of high altitude (uncongenial climate) allowance granted to the member of the armed forces operating in high altitude areas

Any special allowance granted to the members of the armed forces in the nature of special compensatory highly active field area allowance

Any special allowance granted to the member of the armed forces in the nature of Island (duty) allowance

Section 10(17) – In the case of persons being Member of Parliament or any State Legislature or of any committee thereof any income by way of daily allowance or any allowance shall not be eligible for exemption when such person opts for section 115BAC.

Section 10(32) – In case, the income of minors is clubbed with the income of the parent under section 64(1A), a sum of Rs.1500 is deducted by virtue of section 10(32). This deduction cannot be claimed by the parent who opts for section 115BAC.

The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC.

Deduction of entertainment allowance and professional tax.

List of tax deductions and allowances retained in the New Tax regime (section 115BAC)

Allowanes retained under Sec.115BAC are as below:-

Transport Allowance granted to a divyang employee to meet the expenditure for the purpose of commuting between place of residence and place of duty.

Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

Any Allowance granted to meet the cost of travel on tour or on transfer;

Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

List of deductions allowed under new tax regime are as below:-

Retirement benefits, gratuity etc.

commutation of pension

leave encashment on retirement

retrenchment compensation

VRS benefits

EPFO: Employer contribution

NPS withdrawal benefits

Education scholarships

Payments of awards instituted in public interest

Refer the latest tax related posts of the Budget 2020:-

Budget 2020 Highlights – 5 Changes you must know

Latest Income Tax Slab Rates FY 2020-21 (AY 2021-22)

Mutual Fund Taxation FY 2020-21 (AY2021-22)

Taxation on Side Pocketed or Segregated Mutual Funds

The post New Tax Regime – Complete list of exemptions and deductions disallowed appeared first on BasuNivesh.

New Tax Regime – Complete list of exemptions and deductions disallowed published first on https://mbploans.tumblr.com/

0 notes

Text

New Tax Regime – Complete list of exemptions and deductions disallowed

Do you know under the New Tax Regime, which are the exemptions or deductions not allowed? Let us discuss the New Tax Regime – List of exemptions and deductions disallowed in detail.

During the Budget 2020, Finance Minister introduced the new tax regime. However, an option has been given to pay tax at lower rates, if you fulfill certain conditions. One such condition is you are not eligible for a few exemptions and deduction.

Below is the new tax regime tax slabs applicable:-

New Tax Regime – Complete list of exemptions and deductions not allowed

Let us now look into the exemptions and deductions not allowed under the Sec.115BAC,

Leave travel concession (LTC) applicable for salaried employee

House Rent Allowance (HRA) applicable for salaried employee

The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC.

Deduction of entertainment allowance and professional tax.

Deductions under Sec.80C like Life Insurance Premium, Sum Paid towards deferred annuity plans, your contributions towards EPF, PPF, Superannuation Scheme, SSY, NSC, ELSS Mutual Funds, Tuition Fees, Principal Payment towards your home loan, Tax Saving FDs, SCSS, Contribution to NPS Tier 2 by Central Government Employees, NPS contribution by you (Under Sec.80CCD(1) and Sec.80CCD(1B). But employer contribution under Sec.80CCD(2) will continue to be eligible for deduction.

Deduction under Sec.80D- Amount paid (in any mode other than cash) by an individual or HUF to LIC or other insurers to effect or keep in force an insurance on the health of a specified person.

Section 80DD – Deduction in respect of maintenance including medical treatment of a dependant who is a person with a disability.

Section 80DDB – Expenses actually paid for medical treatment of specified diseases and ailments.

Section 80E – Amount paid out of income chargeable to tax by way of payment of interest on loan taken from financial institution/approved charitable institution for pursuing higher education

Section 80EE – Interest payable on loan taken up to Rs. 35 lakhs by the taxpayer from any financial institution, sanctioned during the FY 2016-17, for the purpose of acquisition of a residential house property whose value doesn’t exceed Rs. 50 lakhs

Section 80EEA – Interest payable on loan taken by an individual, who is not eligible to claim deduction under section 80EE, from any financial institution during the period beginning from 01/04/2019 ending on 31/03/2020 for the purpose of acquisition of a residential house property whose stamp duty value doesn’t exceed Rs. 45 lakhs

Section 80EEB – Interest payable on loan taken by an individual from any financial institution during the period beginning from 01/04/2019 and ending on 31/03/2023 to purchase an electric vehicle.

Section 80GG – Rent paid for furnished/unfurnished residential accommodation (Subject to certain conditions).

Section 80G- Deduction in respect of donations to certain funds, charitable institutions etc

Section 80GGA- Deduction in respect of certain donations for scientific research or rural development

Section 80GGC- Deduction in respect of contributions given by any person to political parties

Section 80JJA- Deduction in respect of profits and gains from business of collecting and processing of bio-degradable waste

Section 80QQB- Royalty income of authors of a certain specified category of books other than text books.

Section 80RRB- Royalty in respect of patents registered on or after 01.04.2003 (subject to certain conditions)

Section 80TTA- Interest on deposits in savings account with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)

Section 80TTB- Interest on deposits with a banking company, a post office, co-operative society engaged in the banking business, etc. (Subject to certain conditions)- for senior citizens

Section 80U- A resident individual who, at any time during the previous year, is certified by the medical authority to be a person with a disability

Section 24(b) – In the case of personal taxpayers who have self-occupied the property for own residence or who cannot occupy the property owing to employment, business or profession carried on at any other place he has to reside at that other place in a building not belonging to him, the annual value of the property shall be taken to be `nil’. However, interest on money borrowed is deductible up to a maximum of Rs.2 lakhs.

Allowances (Under Sec.10(14)) like Travelling/Transfer Allowance, Conveyance Allowance, Helper Allowance, Research Allowance or Uniform Allowance

Any allowance granted to meet the expenditure incurred on a helper where such helper is engaged for the performance of the duties of an office or employment of profit;

Any allowance granted for encouraging the academic, research and training pursuits in educational and research institutions;

Any allowance granted to meet the expenditure incurred on the purchase or maintenance of uniform for wear during the performance of the duties of an office or employment of profit.

Any Special Compensatory Allowance in the nature of [Special Compensatory (Hilly Areas) Allowance] or High Altitude Allowance or Uncongenial Climate Allowance or Snow Bound Area Allowance or Avalanche Allowance

Any Special Compensatory Allowance in the nature of Border Area Allowance, Remote Locality Allowance or Difficult Area Allowance or Disturbed Area Allowance

Special Compensatory (Tribal Areas/Schedule Areas/Agency Areas) Allowance

Any allowance granted to an employee working in any transport system to meet his personal expenditure during his duty performed in the course of running of such transport from one place to another place provided that such employee is not in receipt of daily allowance

Children Education Allowance

Any allowance granted to an employee to meet the hostel expenditure on his child

Compensatory Field Area Allowance

Compensatory Modified Field Area Allowance

Any special allowance in the nature of counter-insurgency allowance granted to the members of armed forces operating in areas away from their permanent locations

Underground Allowance granted to an employee who is working in uncongenial, unnatural climate in underground mines

Any special allowance in the nature of high altitude (uncongenial climate) allowance granted to the member of the armed forces operating in high altitude areas

Any special allowance granted to the members of the armed forces in the nature of special compensatory highly active field area allowance

Any special allowance granted to the member of the armed forces in the nature of Island (duty) allowance

Section 10(17) – In the case of persons being Member of Parliament or any State Legislature or of any committee thereof any income by way of daily allowance or any allowance shall not be eligible for exemption when such person opts for section 115BAC.

Section 10(32) – In case, the income of minors is clubbed with the income of the parent under section 64(1A), a sum of Rs.1500 is deducted by virtue of section 10(32). This deduction cannot be claimed by the parent who opts for section 115BAC.

The standard deduction applicable for persons in employment against salary income cannot be claimed when the taxpayer who opts for section 115BAC.

Deduction of entertainment allowance and professional tax.

List of tax deductions and allowances retained in the New Tax regime (section 115BAC)

Allowanes retained under Sec.115BAC are as below:-

Transport Allowance granted to a divyang employee to meet the expenditure for the purpose of commuting between place of residence and place of duty.

Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

Any Allowance granted to meet the cost of travel on tour or on transfer;

Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

List of deductions allowed under new tax regime are as below:-

Retirement benefits, gratuity etc.

commutation of pension

leave encashment on retirement

retrenchment compensation

VRS benefits

EPFO: Employer contribution

NPS withdrawal benefits

Education scholarships

Payments of awards instituted in public interest

Refer the latest tax related posts of the Budget 2020:-

Budget 2020 Highlights – 5 Changes you must know

Latest Income Tax Slab Rates FY 2020-21 (AY 2021-22)

Mutual Fund Taxation FY 2020-21 (AY2021-22)

The post New Tax Regime – Complete list of exemptions and deductions disallowed appeared first on BasuNivesh.

New Tax Regime – Complete list of exemptions and deductions disallowed published first on https://mbploans.tumblr.com/

0 notes

Text

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS which is the best option for senior citizens? Replacing the 7.75% Government of India Savings Bonds, Government announced the Floating Rate Savings Bonds, 2020 (Taxable).

What are Floating Rate Savings Bonds?

Usually, when you invest in Bonds, the coupon (interest) what you get is fixed throughout the period. However, in the case of floating rate bonds, the interest is not fixed and it changes as per the specified bond feature.

Hence, such bonds are sensitive to interest rate fluctuation. It is not like your typical Bank FD, where you know well in advance the interest rate payable by banks for the full FD tenure.

The term of the bond is fixed. However, if you are not interested to retain the bonds, then you can sell it in the secondary market at the prevailing price of the bond if such bonds are eligible to trade.

RBI Floating Rate Savings Bond, 2020 (Taxable) Features and Eligibility

In addition to above features, let me share certain important features of this bond.

# If holder of the bond turned NRI, then he can hold the bond up to maturity.

# The Bonds will be issued only in the electronic form and held at the credit of the holder in an account called Bond Ledger Account (BLA), opened with the Receiving Office.

# The interest on the bonds will be payable half-yearly from the date of the issue of the bond. Once on 30th June and another on 31st December yearly. As I mentioned above, there is no option of cumulate in this bond.

# The interest will change on a half-yearly basis starting from 1st January 2021. This interest rate is linked to the prevailing interest rate of NSC (Post Office National Savings Certificate)+35 BPS (100 BPS=Rs.1). Hence, the coupon rate of Floating Rate Savings Bonds, 2020 (Taxable) for the period of 1st July 2020 to 31st December 2020 is fixed at 7.15%. Because the current NSC interest rate is 6.8%+0.35%=7.15%.

# Interest will be payable directly to the bond holder’s account.

# The bonds will repayable after the completion of 7 years. Premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of document relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

# Even though you request for redemption as per your age slab, the redemption amount will be transferred with immediate next interest rate period. Hence, irrespective of your submission for premature withdrawal, Govt will process it either on 1st July or 1st January every year. Also, in such premature closure, Govt will deduct 50% of the last coupon payment.

I have written a detailed post about RBI Floating Rate Savings Bonds, You can refer the same for more details.

Features of Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Let us now discuss about the features and eligibility of Pradhan Mantri Vaya Vandana Yojana (PMVVY) 2020- 2023.

Some other features of this product are as below:-

# You can surrender this policy during the policy period under certain exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of the purchase price.

# You can avail the loan facility after completion of 3 policy years. The maximum loan payable will be 75% of the purchase price. Interest on the loan will be recovered from the pension amount.

# Pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

# Pradhan Mantri Vaya Vandana Yojana (PMVVY) scheme does not provide tax deduction benefit under section 80C of the Income Tax Act. Returns from this scheme will be taxed as per existing tax laws.

# There is no TDS on this product.

# During the policy period, the pensioner will receive the monthly, quarterly, half-yearly, or yearly pension as he has opted during the time of buying. On the death of the pensioner during the policy term, the Purchase Price will be refunded to the nominee (or legal heirs in the absence of nominee). If the pensioner survives up to the end of the policy term, Purchase Price and final installment of the pension will be paid to the pensioner.

# You can buy this through LIC (either online or offline).

Read a complete detailed post “Pradhan Mantri Vaya Vandana Yojana (PMVVY) 2020 – 2023 – 5 Changes you must know“.

Features of Senior Citizen Savings Scheme (SCSS)

# Anyone who attained the age of 60 years or above can invest in this product.

# NRIs and HUF are not allowed to invest.

# You can open Senior Citizen Savings Scheme either in the post office or with recognized 24 PSU banks and one private bank.

# Minimum investment is Rs.1,000 and maximum is Rs.15,00,000.

# The current interest rate is 7.4% and will change on quarterly basis.

# Interest will be payable on quarterly basis.

# Premature withdrawal is allowed but with certain conditions. In case the account is closed after the expiry of 1 year but before the expiry of 2 years from the date of opening of the account, an amount 1.5% of the deposit shall be deducted and the balance paid to the depositor. In case the account is closed on or after the expiry of 2 years from the date of opening of the account, an amount equal to 1% of the deposit shall be deducted and balance paid to the depositor.

# Account will not be extended automatically.

# You can extend for a period of 3 years after 5 years maturity period. However, you have to submit Form B within one year from the date of maturity.

# Also, such extended accounts can be closed after one year of extension without any penalty. Means after completion of 6th year, one can withdraw the amount without any penalty.

# Interest rate during such extension period will be as per prevailing rate of interest after 5 years maturity.

# Only one extension is allowed to the old account. Means after 5 years completion of SCSS, you can extend only for once. After that, the account will be matured.

# However, you are free to open one more account during the old account tenure or after maturity of old account subject to the maximum ceiling of Rs.15 lakh.

# Loan is not available.

# One can avail up to Rs.1,50,000 as a maximum benefit under Sec.80C by investing in SCSS scheme.

# Interest Income-Interest income is treated as taxable income. Hence, there is no tax benefits. It will be taxed as per your tax slab. TDS can be deducted on interest earned if it exceeds the minimum limit prescribed by the Government.

Read the complete post about SCSS at “Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate“.

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS – Which is the best?

Let us understand which is the best among RBI Floating Rate Savings Bonds Vs PMVVY Vs SCSS. I will try to compare all these products with respect to the features for your benefit.

# Tenure

RBI Floating Rate Savings Bond offers you 7 years. PMVVY is for 10 years and SCSS is for 5 years.

# Minimum and maximum investment

In case of RBI Floating Rate Savings Bonds, the minimum investment is Rs.1,000 and there is no maximum limit. However, in the case of PMVVY, the minimum investment is Rs.1,56,658 for a yearly pension of Rs.12,000 and maximum investment is Rs.15,00,000. In case of SCSS, the minimum amount is Rs.1,00,000 and the maximum is Rs.15,00,000.

# Interest rates

In the case of RBI Floating Rate Savings Bonds, the current coupon up to 31st December 2020 is 7.15%. However, as I pointed above, it will change twice in a year. Once in 1st July and another time on 1st January. Hence, you can’t expect a fixed interest on this bond. However, in the case of PMVVY and SCSS the current interest rates are 7.4%.

# Frequency of interest rate payment

In case of RBI Floating Rate Savings Bonds, the interest payment is a half-yearly basis. However, in case of PMVVY it is monthly, quarterly, half-yearly, or yearly. In case of SCSS, it is on a quarterly basis.

In case of RBI Floating Rate Savings Bonds, the interest rate will change once in 6 months. Once on 1st January and second time on 1st July every year.

In case of PMVVY, the interest will be revised on yearly basis. For SCSS, it is on quarterly basis.

However, if you invested in PMVVY and SCSS now, then the same interest rate will be applicable for you throughout the end. Even though the interest rate on PMVVY and SCSS change on a yearly and quarterly basis respectively, it is for NEW INVESTORS but not for the existing investors.

# Minimum Age

There is no such mention of a minimum age limit in RBI Floating Rate Bonds. However, in case of PMVVY and SCSS, the minimum age limit is 60 years.

# Liquidity

In case of RBI Floating Rate Bond, premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of document relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

The Bonds are not allowed to transfer, trade or eligible for collateral.

In case of PMVVY, you can surrender this policy during the policy period under certain exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of the purchase price.

In case of SCSS, in case the account is closed after the expiry of 1 year but before the expiry of 2 years from the date of opening of the account, an amount 1.5% of the deposit shall be deducted and the balance paid to the depositor. In case the account is closed on or after the expiry of 2 years from the date of opening of the account, an amount equal to 1% of the deposit shall be deducted and balance paid to the depositor.

# Loan facility

In case of RBI Floating Rate Bond, it is not eligible as collateral for availing loans from banks, financial Institutions and Non-Banking Financial Companies.

In case of PMVVY, you can avail the loan facility after completion of 3 policy years. The maximum loan payable will be 75% of the purchase price. Interest on the loan will be recovered from the pension amount.

In case of SCSS, you are not allowed to avail the loan by pledging it. Because this scheme is meant for regular income from your investment.

# Tax Benefits while investing and the returns

Let us discuss the tax benefits of RBI Floating Rate Bond Vs PMVVY Vs SCSS during an investment and the tax treatment of interest income.

Tax Benefits during investment

In the case of RBI Floating Rate Bond and PMVVY, there are no tax benefits. However, in the case of SCSS, you can avail the tax benefits of up to Rs.1,50,000 under Sec.80C by investing in this product.

Tax Benefits on interest income

In RBI Floating Rate Bond, Interest on the Bonds will be taxable under the Income Tax Act, 1961 as applicable according to the relevant tax status of the Bondholders. The interest payment is subject to TDS laws.

In case of PMVVY and SCSS, returns from these scheme will be taxed as per existing tax laws.

# TDS Facility

In case of RBI Floating Rate Bonds, tax will be deducted at source while making payment of interest. However, by submitting the Form 15G/H, you can avoid the TDS.

In case of PMVVY, there is no TDS. But in case of SCSS, TDS can be deducted on interest earned if it exceeds the minimum limit prescribed by the Government.

How to buy?

You can buy RBI Floating Rate Bonds from designated Banks.

You can buy PMVVY through LIC (either online or offline). However, in the case of SCSS, you can open the Senior Citizen Savings Scheme either in the post office or with recognized 24 PSU banks and one private bank.

Conclusion:-There is nothing called the best. However, with comparison to RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS, you can easily decide which is the best for your requirement. All three products are SAFE. Hence, choose the products based on your actual requirements.

Refer our latest posts:-

Top 5 Super Top-up Health Insurance Plans in India 2020

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

Latest Post Office Interest Rates July-Sept 2020

Covid Standard Health Policy or Corona Kavach Policy – Features and Benefits

Government of India Floating Rate Savings Bonds, 2020 (Taxable) – Should you invest?

How to create ONE CRORE Rupees from EPF?

The post RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS appeared first on BasuNivesh.

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS published first on https://mbploans.tumblr.com/

0 notes

Text

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS

RBI Floating Rate Savings Bond Vs PMVVY Vs SCSS which is the best option for senior citizens? Replacing the 7.75% Government of India Savings Bonds, Government announced the Floating Rate Savings Bonds, 2020 (Taxable).

What are Floating Rate Savings Bonds?

Usually, when you invest in Bonds, the coupon (interest) what you get is fixed throughout the period. However, in the case of floating rate bonds, the interest is not fixed and it changes as per the specified bond feature.

Hence, such bonds are sensitive to interest rate fluctuation. It is not like your typical Bank FD, where you know well in advance the interest rate payable by banks for the full FD tenure.

The term of the bond is fixed. However, if you are not interested to retain the bonds, then you can sell it in the secondary market at the prevailing price of the bond if such bonds are eligible to trade.

RBI Floating Rate Savings Bond, 2020 (Taxable) Features and Eligibility

In addition to above features, let me share certain important features of this bond.

# If holder of the bond turned NRI, then he can hold the bond up to maturity.

# The Bonds will be issued only in the electronic form and held at the credit of the holder in an account called Bond Ledger Account (BLA), opened with the Receiving Office.

# The interest on the bonds will be payable half-yearly from the date of the issue of the bond. Once on 30th June and another on 31st December yearly. As I mentioned above, there is no option of cumulate in this bond.

# The interest will change on a half-yearly basis starting from 1st January 2021. This interest rate is linked to the prevailing interest rate of NSC (Post Office National Savings Certificate)+35 BPS (100 BPS=Rs.1). Hence, the coupon rate of Floating Rate Savings Bonds, 2020 (Taxable) for the period of 1st July 2020 to 31st December 2020 is fixed at 7.15%. Because the current NSC interest rate is 6.8%+0.35%=7.15%.

# Interest will be payable directly to the bond holder’s account.

# The bonds will repayable after the completion of 7 years. Premature withdrawal is allowed only for those whose age is 60 years and above subject to the submission of document relating to the date of birth proof. The minimum lock-in period for the age group 60 Yrs to 70 Yrs is 6 years. For 70 Yrs to 80 Yrs is 5 Yrs and for those whose age is beyond 80 years is 4 years.

# Even though you request for redemption as per your age slab, the redemption amount will be transferred with immediate next interest rate period. Hence, irrespective of your submission for premature withdrawal, Govt will process it either on 1st July or 1st January every year. Also, in such premature closure, Govt will deduct 50% of the last coupon payment.

I have written a detailed post about RBI Floating Rate Savings Bonds, You can refer the same for more details.

Features of Pradhan Mantri Vaya Vandana Yojana (PMVVY)

Let us now discuss about the features and eligibility of Pradhan Mantri Vaya Vandana Yojana (PMVVY) 2020- 2023.

Some other features of this product are as below:-

# You can surrender this policy during the policy period under certain exceptional circumstances like pensioner requires money for treatment of any critical/terminal illness of self or spouse. Surrender value payable will be 98% of the purchase price.

# You can avail the loan facility after completion of 3 policy years. The maximum loan payable will be 75% of the purchase price. Interest on the loan will be recovered from the pension amount.

# Pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

# Pradhan Mantri Vaya Vandana Yojana (PMVVY) scheme does not provide tax deduction benefit under section 80C of the Income Tax Act. Returns from this scheme will be taxed as per existing tax laws.

# There is no TDS on this product.