#portfolio management scheme

Explore tagged Tumblr posts

Text

Know How Mutual Funds Are The Best Investment Platforms For Beginners

Find out what makes mutual funds the best investment platform for beginners. Look out for the best portfolio management scheme for more information.

#systematic investment plans#mutual funds SIP investment#portfolio management scheme#best SIP plan for 5 years

0 notes

Text

By offering professional guidance to investors, financial consultants in Rewa simplify wealth creation and risk management. Investrack ensures you receive expert assistance to streamline your finances and reach your financial goals like retirement planning with ease. For more information, visit https://www.investrack.co.in/

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

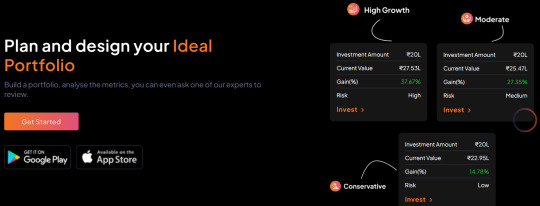

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes

Text

Start SIP and Grow Your Money

Provide Best Financial Services with Experience.

Join @myidealmoney and get free financial services.

Please contact me for any further questions.

Email ID - [email protected]

#myidealmoney#ideal money#investment with experience#share market#stock market#mutual funds#stock market news#mutual funds sahi hai#financial services#investment plans#portfolio management#national pension scheme#insurence

1 note

·

View note

Text

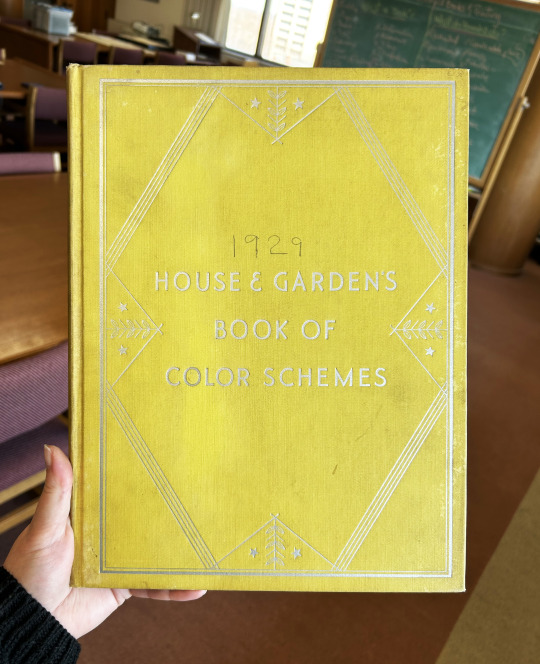

Decorative Plates

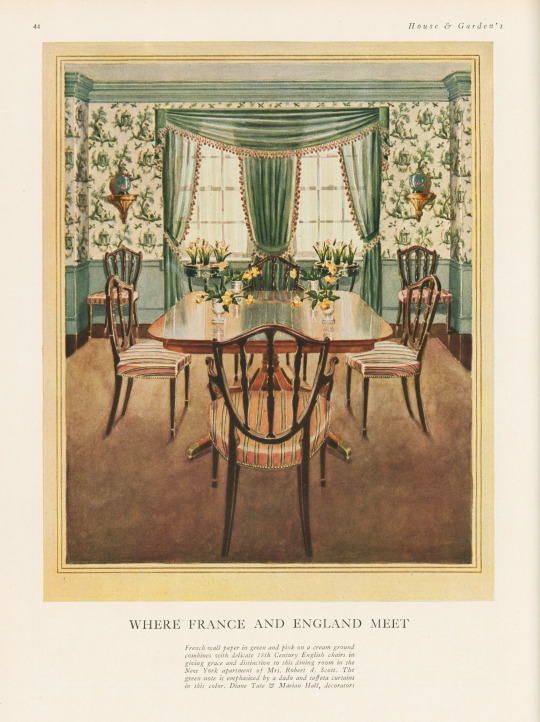

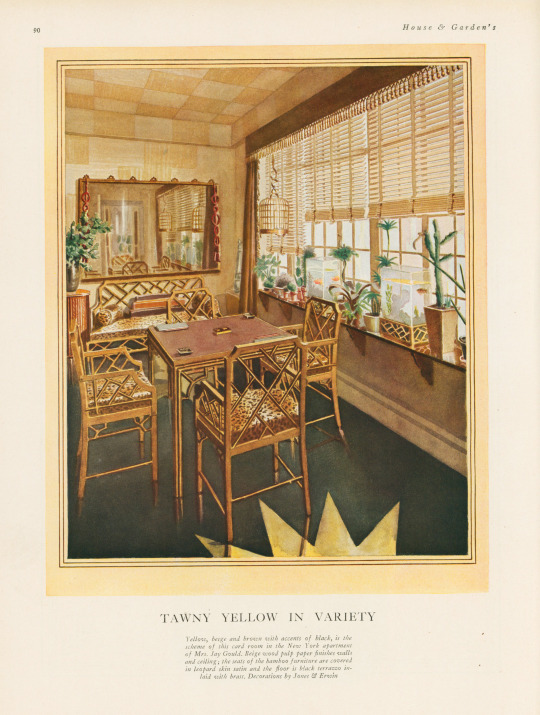

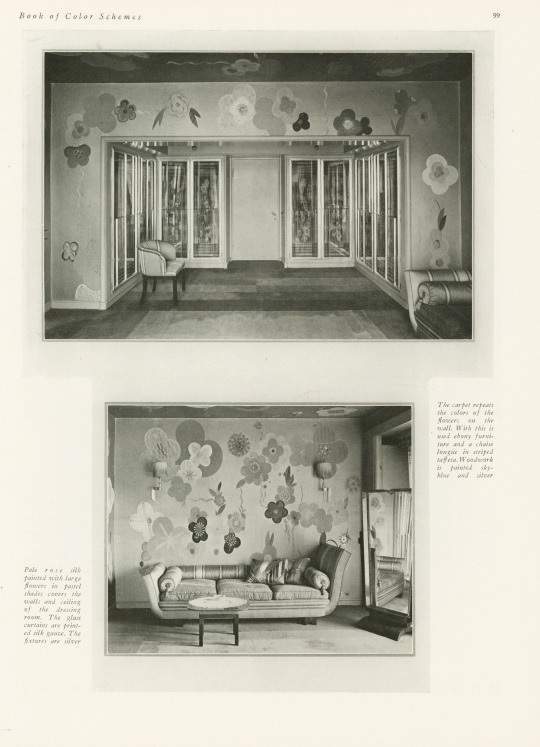

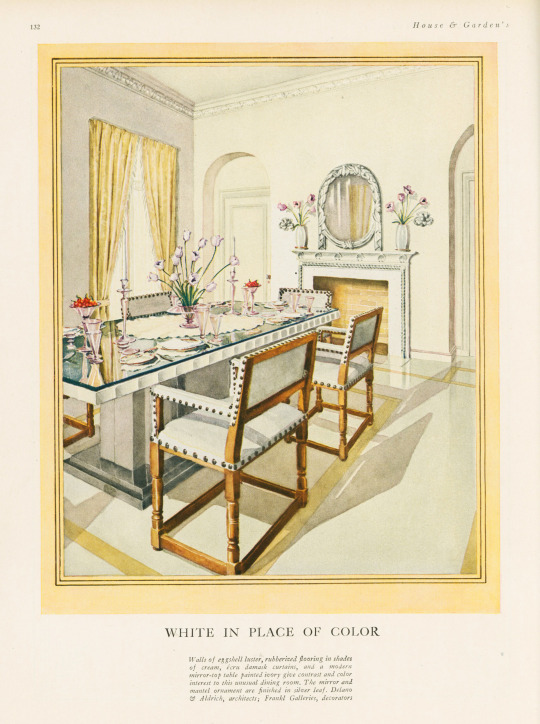

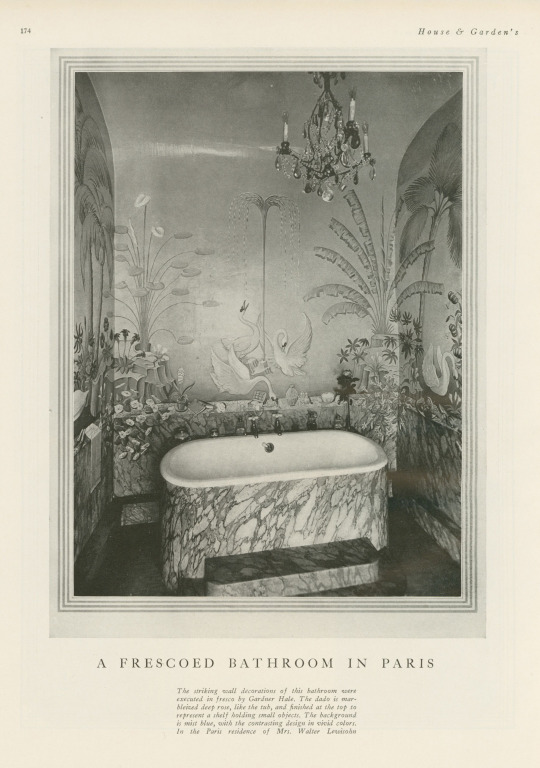

It's been awhile since we last posted something on the theme of the decorative arts, so I'm happy to have found this book—especially because it was mis-shelved in the stacks! This book is House and Garden's Book of Color Schemes, which contains "over two hundred color schemes and three hundred illustrations of halls, living rooms, dining rooms, bed chambers, sun rooms, roofs, garden rooms, kitchens and baths; the characteristic colors of each decorative period; how to select a color scheme, with unusual treatments for painted furniture and floors; a portfolio of crystal rooms and eight pages of unusual interiors in color." It was edited by long-time editor of House & Garden Richardson Wright (1887-1961) and Margaret McElroy, associate editor, and published by Condé Nast Publications, Inc. in 1929.

The book includes a large number of photographs of rooms, however, they are mostly in black and white—an unfortunate thing for a book about color! The promised eight color illustrations of rooms are not all present in our copy, but the five that are still in the book are shown here, alongside some of their black and white compatriots. I especially love the one titled "Tawny Yellow in Variety" that features a shocking amount of leopard print.

If you've read any of the posts I usually write, you know that I love a good binding—this one is a publisher's binding in a chartreuse-y yellow book cloth with art deco-style silver tooling featuring stars and leaves. Somebody took it upon themselves to write the publication date on the cover above the title—how thoughtful!

View more posts featuring Decorative Plates.

-- Alice, Special Collections Department Manager

#Decorative Sunday#Decorative Plates#decorative arts#House and Garden's Book of Color Schemes#color schemes#color#decoration#home decor#interior decorating#Richardson Wright#Margaret McElroy#Conde Nast#Conde Nast Publications#art deco#chartreuse#Publishers' bindings

89 notes

·

View notes

Text

it's interesting to me how much ire gets directed at music streaming and distribution platforms (and you know, not wrongfully) for payment schemes that fuck over musicians, but increasingly less ire seems to get directed at the big record labels, who have not only been fucking over musicians since before the moon landing but are continuing to fuck over misicians in the streaming-centric landscape by collecting extremely tidy payouts from those platforms while their musicians barely see a cent. and now I'm no big city IP lawyer but my understanding is that it's not as simple as forcing platforms to bypass labels and just pay musicians directly because of how all the licensing and shit works, so at least in theory fixing this would at least in part require going after big labels directly and fundamentally changing how they manage their artist portfolios, and my understanding of that basically amounts to Good Fucking Luck.

it has to be convenient though for e.g. RCA records to have the spotlight shifted off of them as they become more of an invisible middleman than before and therefore less widely reviled. I think about this sort of invisible middleman situation a lot, especially in the context of [guy who's only seen boss baby voice] adtech where, at least as far as I'm aware, the whole "companies are buying and selling your data" thing is almost always carried out by the ad platforms who facilitate ad auctions rather than the actual websites and apps who sell ad space... which in turn creates a situation where the intermediaries are the ones up to no good, but since very few people are aware of these intermediaries they instead turn to blame the websites and apps who these platforms work with, which means the intermediaries get to evade scrutiny while their own customers take the heat on their behalf! nefarious shit

62 notes

·

View notes

Text

Finding Your Investment Path: A Simple Guide

In the vast ocean of financial opportunities, finding the right investment scheme can feel like searching for a needle in a haystack. Every individual's financial goal, risk tolerance, and investment horizon are unique, making it crucial to navigate through the diffrent of options available in the market. From fixed income to equity and everything in between, understanding the various investment schemes is key to building a robust and diversified portfolio tailored to your needs.

Fixed Income: Let's begin with the fundamentals. Your investment portfolio's fixed income investments are similar to the consistent beat of a drum. The traditional examples are bonds and certificates of deposit (CDs). They are the best option for people looking for stability because they provide predictable returns at a lower risk. And you can earn average 8-10% return. Managed Portfolios: Do you like someone else to do the grunt work? You may want to consider managed portfolios. These expertly managed funds provide a hands-off approach to investing, catered to your financial objectives and risk tolerance.

Insurance: Although the main goal of insurance is to provide protection, several plans also include investment options. For example, life insurance policies give you coverage and the opportunity to gradually build up cash value; for the astute investor, this is a two-for-one offer. Derivatives: At this point, things become a little more intricate. The value of derivatives is derived from underlying securities or indexes. This group includes swaps, futures, and options. They can be employed speculatively or for hedging, but they're not for the timid. but do not invest in derivatives until and unless you are expert in this field.

Credit Instruments: Now let's talk about credit instruments, which include peer-to-peer lending websites and corporate bonds. With the range of risk and return potential offered by these products, you can tailor your portfolio to your degree of risk tolerance. Equities: Ah, the stock market, the global investor community's playground. Purchasing stock entails obtaining ownership of shares in publicly traded corporations. It's all about dividends and growth potential, but be prepared for market turbulence. Keep it straightforward: align your investments with your time horizon, risk appetite, and goals. To distribute the risk, diversify between several programs. And keep up with market developments at all times. Recall that there isn't a single, universal strategy for investing. Discover what works for you and get to work accumulating wealth!

#invetment#wealth#fixed income#security#risk#return#instrument#financial planning#financial services#low risk high reward

15 notes

·

View notes

Text

BEST COMMERCIAL INTERIOR- Avivakeeon Interio

When it comes to office decoration Avivakeeon Interio goal is to create a functional and visually appealing workspace that reflects the company's brand and culture. Some key considerations for office decoration include: Choosing a color scheme that aligns with the company's branding and creates a professional, yet inviting atmosphere. Selecting furniture and decor that are both stylish and ergonomic, promoting productivity and comfort for employees. Incorporating elements that foster collaboration and creativity, such as open floor plans, breakout areas, and flexible seating options. Incorporating natural light and greenery to enhance the overall ambiance and promote a sense of well-being. Paying attention to details like artwork, lighting fixtures, and accessories to add personality and character to the space. When it comes to finding the best commercial interior designers Avivakeeon Interio is here it's important to look for professionals with a proven track record of delivering exceptional results for their clients. Some key factors to consider when selecting a commercial interior designer include: Portfolio of past projects that demonstrate a strong understanding of commercial design principles and the ability to create visually stunning and functional spaces. Experience working with businesses in your industry or with similar design requirements. Ability to translate your brand and vision into a cohesive design concept. Excellent communication skills and a collaborative approach to the design process. Familiarity with relevant building codes, regulations, and sustainability practices. Ability to manage the project timeline and budget effectively. Avivakeeon Interio do Innovative use of space and layout to maximize functionality and efficiency. Incorporation of cutting-edge design trends and technologies to create a modern, forward-thinking aesthetic. Attention to detail in the selection of materials, finishes, and furnishings to create a cohesive and visually striking environment. Incorporation of sustainable design principles to promote energy efficiency and environmental responsibility. Avivakeeon Interio has Ability to create a unique and memorable experience for employees, clients, and visitors. Adaptability to accommodate changing business needs and evolving design preferences over time.

2 notes

·

View notes

Text

5 Effective Financial strategies of a company

Financial strategies of a company are vital equipment utilized by people, corporations, and groups to control their resources efficiently, attain monetary dreams, and make certain long-term stability. A well-designed monetary approach takes into account an entity's earnings, charges, investments, and financial savings to maximize boom and reduce dangers.

Key Elements of Financial Strategies

Budgeting

At the center of any economic method is effective budgeting. This involves tracking income and prices to make sure that spending aligns with monetary desires. For people, a price range facilitates control daily expenditures, plan for destiny needs, and keep away from pointless debt. For corporations, it guarantees that operational fees are managed, earnings are maximized, and sources are allocated efficiently.

Investment Planning

An important factor of monetary approach is investment. Whether it's shares, bonds, actual estate, or mutual budget, strategic investment helps in developing wealth through the years. A diverse funding portfolio reduces risk and allows for more monetary protection, in particular in fluctuating markets. Financial techniques must be designed with a mixture of quick-term, medium-term, and lengthy-time period funding desires, balancing danger and go back.

Debt Management

Managing debt is any other important component. Excessive or mismanaged debt can cause financial instability. A good economic method guarantees that debt is saved under manage thru right repayment plans, low-hobby loans, and cautious credit utilization. This is specially crucial for groups to maintain liquidity and creditworthiness, and for individuals to avoid economic strain.

Emergency Fund and Risk Management

An effective financial method includes provisions for unexpected situations. Having an emergency fund in region ensures that sudden prices—which include scientific emergencies, job loss, or principal maintenance—do not derail overall financial dreams. Similarly, right insurance coverage is a key a part of coping with economic hazard, whether for health, belongings, or commercial enterprise-associated contingencies.

Retirement Planning

Financial Strategies For Small Business is sound monetary approach ought to additionally encompass long-time period desires which include retirement. Planning for retirement includes saving frequently and investing in pension schemes, retirement bills, or other long-term economic gadgets that make certain financial independence later in life.

2 notes

·

View notes

Text

Learn Why Mutual Funds Are The Best Investment Platforms For Beginners

Find out why mutual funds are the best investment platforms for beginners. Check out this blog for more information on the best SIP plan for 5 years.

0 notes

Text

How Can Equity Advisor Services in Rewa Help You Invest Better?

Investing in Equity and the stock market is one of the best ways to build wealth. Yet, many people hesitate because they fear the risks or don’t know where to begin. If this sounds familiar, equity advisor services in Rewa offered by Investrack can help you overcome these fears and start your investing journey with confidence.

Why Do Investors Hesitate to Invest in Stocks?

Fear of losing money, lack of knowledge, and emotional decision-making often stop people from investing in the stock market. However, with the right support, these complex challenges can be overcome.

How Can Professionals Help

Professionals are trained to simplify investing and guide you toward smart financial decisions from the start with demat account services in Rewa, till the end with investments. Here’s how they assist:

Personalized Guidance: Advisors explain the stock market and recommend strategies based on your goals and risk tolerance.

Goal-Based Planning: They align your investments with long-term financial objectives.

Emotional Support: Professionals keep you calm during market dips and prevent panic-driven decisions.

Market Insights: They monitor trends and suggest timely opportunities for better returns.

Steps to Start Investing in Stocks

While advisors provide support, it’s essential to understand the basics of stock investing. Here are some simple steps:

Set Clear Goals: Define what you want to achieve—be it wealth growth or retirement savings.

Pick the Right Stocks: Invest in companies that align with your goals and have strong fundamentals.

Buy Low, Sell High: Take advantage of price dips to maximize gains.

Diversify Your Portfolio: Spread investments across different sectors to reduce risk.

Think Long-Term: Patience is key; focus on steady growth over time.

Conclusion

The stock market can feel overwhelming with constant fluctuations, especially for beginners who do not know how and when to buy, sell or hold, but professionals can help you throughout. Ready to take the first step? Reach out to a trusted professional today and secure a brighter financial future.

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

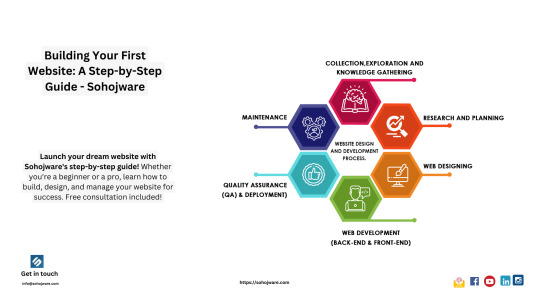

The internet has become an essential part of our lives. Whether you're a business owner, entrepreneur, freelancer, or simply want a platform to share your passions, having a website is crucial in today's digital age. But for many, the idea of building a website can seem daunting. This step-by-step guide by Sohojware, a leading web design and development company, will empower you to create your website with ease, even if you have no prior experience.

Planning Your Website

Before diving into the technical aspects of building your website, it's important to have a clear plan in mind. Here are some key questions to consider:

What is the purpose of your website? Are you selling products or services? Are you showcasing your portfolio or sharing a hobby? Identifying your website's goal will guide your design and content decisions.

Who is your target audience? Understanding your ideal visitors will help you tailor your website's content and tone to resonate with them.

What kind of content will you include? Text, images, videos, infographics? Having a content plan ensures your website is informative and engaging.

Choosing a Domain Name and Web Hosting

Your domain name is your website's address online, and choosing the right one is crucial. It should be memorable, reflect your brand, and ideally be easy to spell and type. Web hosting provides the storage space for your website's files and makes it accessible to visitors.

Sohojware recommends using a reputable domain registrar and web hosting provider. They offer various plans to suit your website's needs and budget.

Building Your Website

There are several ways to build a website, depending on your technical expertise and budget. Here are the two most common approaches:

Website Builders: Website builders are user-friendly platforms that allow you to create a website without coding knowledge. They offer drag-and-drop interfaces, pre-designed templates, and various features to customize your website. While website builders are a great option for beginners, they may offer less flexibility compared to the other methods.

Content Management Systems (CMS): A CMS is a more advanced platform that gives you more control over your website's design and functionality. Popular CMS options include WordPress, Joomla, and Drupal. While CMS platforms require some technical knowledge to set up and manage, they offer a wider range of customization options and functionalities than website builders.

Content Creation

Once you have a platform to build your website, it's time to focus on the content. High-quality, informative, and engaging content is essential for attracting and retaining visitors.

Write clear and concise website copy.

Use high-quality images and videos.

Optimize your website content for search engines by including relevant keywords throughout your website.

Website Design

The design of your website plays a critical role in user experience. Here are some key design elements to consider:

Responsiveness: Ensure your website looks good and functions flawlessly across all devices, including desktops, tablets, and smartphones.

Navigation: Make sure your website is easy to navigate. Visitors should be able to find the information they need quickly and easily.

Visual appeal: Use high-quality images, videos, and a color scheme that aligns with your brand identity.

Launching and Maintaining Your Website

Once you're happy with your website's design and content, it's time to launch it! Your web hosting provider will guide you through the launch process. After your website is live, remember to maintain it regularly. This includes:

Adding fresh content: Regularly update your website with new content to keep visitors engaged.

Updating plugins and themes (if applicable): Ensure you're using the latest versions of plugins and themes to maintain website security and functionality.

Monitoring website performance: Track your website's traffic and user engagement to understand what's working and what needs improvement.

Conclusion

Building a website can be a rewarding experience, allowing you to establish your online presence and share your ideas with the world. By following this step-by-step guide from Sohojware, you'll be well on your way to creating a website that achieves your goals.

Remember, Sohojware is here to help you every step of the way, from domain registration and web hosting to website design, development, and ongoing maintenance.

Visit Sohojware.com today to learn more about their web design and development services. They offer free consultations to discuss your specific needs and recommend the best approach for your website project. Let Sohojware be your partner in building a website that makes a lasting impression on your audience.

FAQ's

I have no coding experience. Can I still build a website with Sohojware?

Absolutely! Sohojware offers website builder options that are perfect for beginners. These user-friendly platforms require no coding knowledge and allow you to create a website using drag-and-drop functionality and pre-designed templates.

What if I need a more customized website than a website builder can offer?

Sohojware can also assist you with building a website using a Content Management System (CMS) like WordPress. While CMS platforms require some technical knowledge, Sohojware's team of experts can help you set it up, manage it, and achieve the specific customization you desire for your website.

Does Sohojware offer domain registration and web hosting?

Yes! Sohojware is a one-stop solution for all your website-building needs. They provide domain registration and web hosting plans to suit your website's size and traffic and can guide you in choosing the right option for your project.

How much does it cost to build a website with Sohojware?

Sohojware offers a variety of website design and development packages to fit your budget. They also provide free consultations to discuss your specific needs and recommend the most cost-effective approach for your website project.

I'd like to learn more about Sohojware's website-building services. What should I do?

Sohojware offers a wealth of information on their website. You can also visit their website to schedule a free consultation with their web design specialists. They'll be happy to answer any questions you have and help you get started on building your dream website.

2 notes

·

View notes

Text

Join @myidealmoney and Learn

Mutual funds investment,

Stock Market, National pension scheme, Portfolio Management etc.

This site is educational purpose only,

This site doesn't give any recommendations,

Please contact me for any further questions. Email ID - [email protected]

#investment with esperience#ideal money#myidealmoney#share market#stock market#mutual funds#portfolio management#financial service#national pension scheme#nps#stock market news

1 note

·

View note

Text

Chatgpt | Free Online Courses for Skill Enhancement and Knowledge Upgrade

Enhance your skills and knowledge with Chatgpt's top-rated free online courses. From coding to marketing, our platform offers a wide range of courses for you to explore and improve yourself. Join us now and start your learning journey today!

ChatGPT for Beginners Free Online Course

ChatGPT for Beginners course covers everything you need to know to use ChatGPT for generating content and marketing purposes. Through this course, you'll learn how to generate coding prompts and generate content, including suggestions, summarizations, email prompts, and reports.

__________________

ChatGPT for HR Free Online Course

This ChatGPT for HR free course will help you in streamlining HR processes and improving employee experience.

__________________

ChatGPT for Customer Support Free Online Course

In this course, we'll explore the benefits of using ChatGPT for Customer Support. ChatGPT offers personalized responses by analyzing customer queries and historical data, boosting customer satisfaction and loyalty.

__________________

ChatGPT for Business Communication Free Online Course

In this free ChatGPT for Business Communication Course, we will start with an introduction to ChatGPT, including what it is, how it works, and its potential applications in the field of business communication.

__________________

ChatGPT for Digital Marketing Free Online Course

In this free course on ChatGPT for Digital Marketing, you will explore various aspects of the field. You will start by understanding the different types of digital marketing and how they can be leveraged to reach your target audience effectively.

__________________

ChatGPT for Content and SEO Free Online Course

In this free course on ChatGPT for Content and SEO, we'll be covering various areas where the platform can be highly beneficial.

__________________

ChatGPT for Coders Free Online Course

Join ChatGPT for Coders for free, an immersive course delving into AI and its application in programming.

__________________

ChatGPT for Finance Free Online Course

ChatGPT for Finance is a free course that helps in enhancing your financial knowledge and decision-making. You'll discover ChatGPT's capabilities in personal finance, retirement planning, pension schemes, investment strategies, portfolio management, banking, taxation, accounting practices, credit scores, and credit management.

__________________

ChatGPT for Excel Free Online Course

This course will enhance your Excel experience using ChatGPT. We will first understand Excel basics and then we'll dive into generating Excel functions using ChatGPT, showing you how you can leverage the power of AI to automate complex calculations and streamline your work.

#free online courses#canada#australia#usa#chatgpt#career#jobseekers#formation en ligne#artificial intelligence#openai#ai tools#ai technology#jobs#online courses#course#elearning#formation gratuite#employees#employment#south korea#japan#singapore#certification#degree certificate attestation

4 notes

·

View notes

Text

Introducing Choice Group: Your Secret Weapon for Financial Awesomeness in India

Choicese (CHC-SES) Transforms Asset Management Landscape in India with a $10 Billion Fund

Choicese (CHC-SES), a renowned financial institution, has entered the Indian market with a resounding impact, revolutionizing the landscape of asset management and empowering individuals to achieve their financial goals. With an impressive $10 billion fund under its management, Choicese brings extensive experience and expertise to cater to the diverse needs of investors in India. Unveiling a Comprehensive Suite of Services Choicese offers a comprehensive suite of services designed to simplify personal finance and provide tailored solutions to meet individual needs. From seamless trading to insurance coverage and retirement planning, Choicese aims to empower individuals with a wide range of financial services.

Seamless Trading Solutions: Choicese's platform provides a seamless trading experience, allowing individuals to trade equities, commodities, and currencies with ease. With advanced tools and real-time market data, investors can stay informed and make informed decisions to optimize their investment portfolios.

Diversified Mutual Fund Portfolio: Choicese serves as a convenient hub for buying and selling various types of mutual funds, providing investors with a diverse range of investment options. Whether it's equity funds, debt funds, or hybrid funds, Choicese offers accessibility and convenience for individuals to diversify their investment portfolios based on their risk appetite and financial goals.

Tailored Insurance Products: Choicese recognizes the importance of safeguarding one's financial well-being in times of uncertainty. Therefore, it offers a diverse portfolio of insurance products to provide individuals with tailored coverage options. Whether it's life insurance, health insurance, or general insurance, Choicese ensures that individuals have the necessary protection to secure their financial future.

Hassle-Free Personal Loans: Choicese simplifies the process of obtaining personal loans, offering hassle-free solutions with minimal documentation. Whether it's for education, medical expenses, or any other personal need, Choicese provides individuals with flexible loan options and competitive interest rates to meet their financial requirements.

National Pension Scheme (NPS) Facilitation: As a facilitator of the National Pension Scheme (NPS), Choicese empowers individuals to plan for a secure and regular income post-retirement. With Choicese's expertise and guidance, individuals can make informed decisions regarding their pension contributions, ensuring a financially stable future.

Bond Investments for Optimal Returns: Choicese presents opportunities to invest in bonds, diversifying investment portfolios and optimizing returns. With a wide range of bond options, individuals can explore fixed income investments that align with their risk tolerance and financial objectives.

Public Provident Fund (PPF) for Long-Term Tax Savings: Choicese offers the popular Public Provident Fund (PPF), providing individuals with stable returns and long-term tax benefits. By investing in PPF, individuals can enjoy tax deductions while accumulating wealth over time. Why Choose Choicese (CHC-SES)?

Choicese stands out as a trusted financial partner due to its commitment to technological innovation, market insights, and a proven track record of success. Through the Choicese FinX Trading App, individuals gain access to a sophisticated and user-friendly interface, enabling seamless wealth management. Additionally, Choicese provides valuable market insights and expert analysis, empowering individuals to make informed investment decisions.

Choicese (CHC-SES) has made a remarkable entry into the Indian market, offering a comprehensive suite of services to empower individuals in their financial journey. With its seamless trading solutions, diversified mutual fund portfolio, tailored insurance products, hassle-free personal loans, NPS facilitation, bond investments, and PPF offerings, Choicese caters to the diverse financial needs of its clients. Backed by a $10 billion fund managed with expertise and excellence, Choicese is poised to transform the asset management landscape in India. Visit Choicese's website at [https://choiceses-india.com] to embark on a transformative financial journey towards prosperity and financial freedom.

Choicese (CHC-SES) Revolutionizes Indian Asset Management with a Groundbreaking $10 Billion Fund

In a move that signifies a major shift in the Indian financial landscape, Choicese (CHC-SES) has recently entered the market, wielding a formidable $10 billion fund. This entry not only diversifies the asset management options available to Indian investors but also introduces a new paradigm in personal financial management.

Key Offerings and Strategic Impact

Innovative Trading Platform: Choicese debuts with a cutting-edge trading platform, enhancing the trading experience in equities, commodities, and currencies. The integration of advanced analytical tools and real-time market updates positions investors to capitalize on market movements effectively.

Expansive Mutual Fund Selection: The company provides an extensive array of mutual funds, including equity, debt, and hybrid options. This broad selection caters to a variety of investment strategies and risk profiles, empowering investors with choices that align with their long-term financial aspirations.

Personalized Insurance Options: Emphasizing the need for comprehensive financial security, Choicese introduces a range of customized insurance products. This initiative ensures that clients have access to the right insurance coverage, from life and health to general insurance, catering to their unique circumstances.

Simplified Loan Processes: With a focus on accessibility, Choicese streamlines the process for obtaining personal loans. This approach minimizes paperwork and maximizes efficiency, addressing diverse needs like education, healthcare, and other personal investments.

Retirement Planning via NPS: Choicese actively facilitates participation in the National Pension Scheme (NPS), offering guidance and expertise to secure a stable retirement. Their advisory services help clients navigate pension contributions for a financially secure future.

Diverse Bond Investment Opportunities: The firm introduces a variety of bond investment options, broadening investment portfolios and enhancing return potentials. These investments are tailored to suit different risk tolerances and financial objectives.

Public Provident Fund (PPF) for Long-Term Savings: Choicese offers the PPF, an established avenue for secure, long-term savings with tax benefits. This is particularly appealing to investors seeking stable and consistent returns.

Why Choicese (CHC-SES) is a Game-Changer?

Choicese's approach is underpinned by a commitment to technological advancement and deep market insights. The Choicese App exemplifies this, offering an intuitive, user-friendly platform for effective wealth management. Coupled with expert market analysis, Choicese is well-positioned to guide investors towards informed and strategic financial decisions.

In conclusion, Choicese's launch in India is a significant milestone in asset management. Its comprehensive suite of services, backed by a substantial $10 billion fund, sets a new standard in the industry and promises to transform the way Indian investors approach their financial planning. For more details on Choicese's offerings and to begin your financial journey, visit [https://choiceses-india.com].

2 notes

·

View notes

Text

How Can NRIs Invest in India With NRI Services?

Non-resident Indians (NRIs) hold a unique position in the Indian economy. They are not only a valuable source of foreign exchange, but also a potential force driving the country's growth story. Navigating investments in India can be a bit confusing for NRIs. Understanding where and how to invest amidst regulations, tax implications, and diverse options can feel tricky, which is why, NRIs willing to invest in India can rely on NRI services, which make investing easier as per the rules set by RBI and SEBI under the Foreign Exchange Management Act (FEMA).

Where Can NRIs Invest in India?

NRI services encompass a range of financial solutions tailored specifically for non-resident Indians seeking to invest, manage their wealth, and connect with their homeland. It is vital to understand where NRIs can invest in India.

Equities

NRIs can invest directly in Indian stocks through the Portfolio Investment Scheme (PIS) by the Reserve Bank of India (RBI).

Mutual Funds

Investing in Mutual Funds offers various choices like Equity, Balanced, Bond, and Liquid Funds. Unlike direct equities, NRIs investing in Mutual Funds do not require PIS permissions from RBI. However, some restrictions may apply to NRIs from the US and Canada due to reporting regulations.

Government Securities

NRIs can invest in government securities on NRE and NRO basis, each with different tax implications based on the type of investment.

Fixed Deposits

Investment opportunities in fixed deposits are available for NRIs through Banks or Non-Banking Financial Companies (NBFCs), each with its tax implications based on the NRE (Non-Resident External) or NRO (Non-Resident Ordinary) basis. NRIs can also invest in Foreign Currency Non-Resident (FCNR) fixed deposits.

Real Estate

NRIs can invest in real estate except for certain property types like agricultural land, farmland, or plantations.

National Pension Scheme (NPS)

NPS, a retirement savings plan, offers tax benefits. Contributions can be made from NRE or NRO accounts, but the pension must be received in India.

Portfolio Investment Scheme (PIS)

PIS allows NRIs to trade in shares and debentures through a designated bank account. It helps regulate NRI holdings in Indian companies, preventing breaches of set limits.

How Experts Simplify NRI Services?

Experts like Samarth Capital simplify the investment process by providing guidance, ensuring NRIs make informed decisions aligned with their goals. Here’s how they make investing easy for NRIs.

Helping open NRE / NRO savings and PIS bank accounts.

Setting up brokerage and demat accounts for trade.

Monitoring your portfolio regularly.

Engaging tax consultants for compliance.

Understanding Taxes and Rules

For NRIs, it's crucial to understand tax implications in India and their country of residence. Compliance with the Double Tax Avoidance Agreement (DTAA) and filing taxes in India if taxable income exceeds the exemption limit is important.

Wrapping Up

Investing in India as an NRI offers diverse opportunities. With guidance and a grasp of regulations, NRIs can navigate this landscape effectively and make the most of available avenues. Samarth Capital, not only facilitates NRI investments but also helps foreigners invest in India with FPI services. So, whether you're an NRI or a foreigner, investment in India isn't a far-fetched dream anymore.

2 notes

·

View notes