#poker machine finance

Explore tagged Tumblr posts

Text

Understanding Poker Machine Finance: How To Secure Funding For Your Gaming Business

Securing the right poker machine finance is a critical step in growing your gaming business. By exploring traditional loans, equipment financing, or leasing options, you can find the funding solution that best aligns with your business needs. As you evaluate each option, consider your long-term goals, budget, and financial stability to make the best decision for your poker machine investments.

0 notes

Text

Poker Machine Finance: A Guide to Funding and Managing Gaming Equipment

Poker machine finance is a critical aspect of managing and growing gaming establishments. By understanding funding options, conducting thorough financial analysis, and implementing best practices for equipment management, businesses can effectively invest in poker machines and enhance their gaming operations. Strategic financial planning and management are key to maximising revenue, ensuring compliance, and achieving long-term success in the competitive gaming industry.

0 notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

428 notes

·

View notes

Note

[ask] hi.. I’m one of the newly obsessed Tops fans after watching squid game.. since he first shows up on screen I’m like “this character seems he could be an idol…and this dude is really really good at playing an idol..very natural” and then did my little research and here I am now in your inbox.. so.. I’m same age as top so I’d say I might have considered my self too old for boy bands back in the 2010s (but I am not NOW at 37 lol) and I’ve entirely missed his golden and dark days and I genuinely want to understand what the hell is going on with him.. I’m so intrigued by what I saw TOP was when performing, how shy and posed he was off stage for example in interviews, how quirky and random (and I agree he might be high functioning neurospicy) and so talented and classy and all over the place with his interests passions and work projects.. like.. I guess I wanna know him or his story a bit more, from people who were there this whole time.. I mean.. has he really tried to unalive himself? That pic of him in a wheelchair seemed staged to me no? Like why would there be pictures of someone after something like that.. if not for spectacle or pity? I mean I don’t know what to think or what to believe.. but I’d love to know your perspective (while I keep reading your blog in search of more answers).

Also in my humble opinion his role in sg was the perfect contrast to the heavy sense of doom the rest of the players were giving off.. it made the whole thing even darker cuz he was intentionally out of place mentally basically..I reckon it was a genius move, from a cinematic standpoint.

Im not Korean so I can’t possibly understand their culture, unfortunately, nor their unforgiveness and strict morality around drugs and whole the hate towards him, but I believe the hype now and the new international fans will boost his confidence.. I’m convinced it must take a lot of courage to do what he did, despite his reasons (broke or not, fame thirst or whatever) which we’ll never know obvs.. he should show up for promotion tho.. put up a poker face and expose himself if he wants to heal the wounds..

I have felt a lot of compassion towards him and I’d love to get to know his past a bit more.. if you’d like to share some of your stories or even just recommendations of reliable sources where I can get an idea of who is was/is.

Thank you so much and sorry for my venting 😅

I think I'll have to go back and compile a list of links and sources for it all, but he did try to unalive himself when he was younger when he was briefly (and secretly) dating Kim Woo Bins current girlfriend (finance? Wife??) Shin Min Ah. They had a bad break up and everything wasn't working out well. He has some mental health struggles but he recovered a lot from that point. It was way before I'd say their big album Alive. Alive in 2012 was a turning point for their career.

Didn't he have like an anxiety attack or panic attack? Pills? Damnit. I gotta go comb through netizenbuzz blog (type netizenbuzz into google then enter T.O.P or bigbang into the search. Enter his name any way you can to see the list of stories). He did say that the industry teeats idols like Machines. He doesn't like the idol industry and made it clear how toxic the working conditions can be in that interview for the magazine where he has white hair and angel wings behind him.

He is multiple dimensional so while I do feel he was acting out an exaggerated caricature of his worse time in the industry some years ago, he really is one of the most intelligent and sophisticated men in the idol world for real, his art history and painting knowledge is incredibly expansive. I'll tell you now, my interest in him helped me land a great job once cause I learned so much about art through paying attention to him lol. I really wish he would go back to that.

I do miss the old top. But nearly everyone changes eventually while some people stay the same. I wish he was kinda like GD and consistency with his personality and interests.

What do you think of his wine so far? Like his investment in that? I think he should've pushed it harder, as hard as the space x project and create a non alcohol version of it so all fans of legal age can drink it.

Theres so much to unpack and revisit. But yes to all of this.

#kpop#mental health#choi seunghyun#t.o.p#korean pop#k dramas#bigbang#k idols#koeean idols#k-pop#yg entertainment#yg#kpop idol#ttop

8 notes

·

View notes

Text

The Black Box Blueprint: Cracking the Bitcoin-Euro Code with Next-Level Trading Strategies The Bitcoin-Euro Paradox: Why Traditional Trading Won’t Cut It Picture this: You’re at an exclusive underground poker game, surrounded by high-rollers. Except, instead of cards, you're holding Bitcoin, and the dealer—let’s call him Mr. Euro—is dealing in black-box systems. The stakes? Your trading future. Traditional traders walk in armed with the same RSI, moving averages, and Fibonacci retracements. But here’s the kicker—the Bitcoin-Euro market laughs in the face of conventional indicators. This isn’t your everyday Forex pair; it's a digital asset against a central bank-controlled currency, creating a volatility cocktail that leaves unprepared traders dazed. To truly master Bitcoin-Euro, you need to understand the secretive world of black-box trading systems, and today, we’re pulling back the curtain. What Are Black Box Trading Systems (And Why Should You Care?) Imagine a hedge fund that never sleeps, powered by algorithms so secretive they might as well be locked in the vaults of the Vatican. That’s a black-box system—an algorithm-driven strategy that operates with zero transparency. These AI-powered systems are: ✅ Lightning Fast – Executing trades at speeds human traders can’t match. ✅ Emotionless – No FOMO, no fear, just pure calculated moves. ✅ Data-Driven – Utilizing machine learning to detect hidden market inefficiencies. But here’s the plot twist—they’re not invincible. While they seem untouchable, they leave footprints, and if you know where to look, you can exploit their weaknesses. How to Outmaneuver Black Box Systems in the Bitcoin-Euro Market 1. Recognizing Their Patterns Black-box systems thrive on liquidity pockets and stop-hunting. Ever had a trade stopped out just before the price reversed? That’s not bad luck—that’s a machine sniffing out retail stops. ➡️ Solution: Hide your stop losses manually. Instead of placing a stop order at predictable levels, use mental stops and execute manually. ➡️ Pro Tip: Black-box traders love “round numbers” (1.10, 1.15, etc.). Set your stops just beyond these psychological levels. 2. The Latency Arbitrage Play Latency arbitrage is an exploitative technique where a system trades based on delayed price feeds. Big players use ultra-low latency connections to profit from price discrepancies. ➡️ Solution: Use a VPS (Virtual Private Server) with ultra-low latency to ensure your execution speed isn’t falling behind. If you’re trading from your home Wi-Fi, you’re already losing. ➡️ Pro Tip: Consider brokers that offer raw spreads and high-speed execution—avoid dealing desks at all costs. 3. AI-Based Sentiment Analysis Black-box traders aren’t just trading price—they’re reading the news, Twitter feeds, and order book sentiment faster than humans can process a meme. ➡️ Solution: Use AI sentiment tools yourself. Platforms like StarseedFX provide real-time insights into order flow, market sentiment, and economic impact projections. ➡️ Pro Tip: If social media is exploding with "Bitcoin crash" tweets, check the order book. More often than not, it’s an artificial dump designed to trigger panic sells before the real whales step in. Why Bitcoin-Euro is the Ultimate Playground for Advanced Traders The Bitcoin-Euro pair is unlike anything else in Forex. It bridges the worlds of decentralized assets and institutional finance, creating a wildly unpredictable but massively profitable trading environment. Here’s why it deserves your attention: 🔥 Volatility Supreme – Where else can you see 5% swings in an hour? 🔥 Market Manipulation 101 – Unlike regulated forex pairs, Bitcoin-Euro still operates in a semi-Wild West landscape, meaning those who understand its hidden mechanics can thrive. 🔥 Liquidity Waves – Unlike Bitcoin-USD, the Euro’s influence adds a layer of complexity that seasoned traders can exploit. Insider Tactics to Trade Bitcoin-Euro Like a Pro ✅ Trade the News Algorithmically Black-box systems react to major economic events instantly. Instead of reacting, predict. Study European Central Bank (ECB) decisions and Bitcoin halvings to position yourself ahead of the machines. ✅ Use VWAP for Institutional-Level Entries Volume Weighted Average Price (VWAP) is a key indicator that institutions use for entry and exits. If you’re chasing candles, you’re playing checkers while the pros are playing 3D chess. ✅ Monitor On-Chain Metrics Unlike fiat pairs, Bitcoin has an additional layer of analysis—on-chain data. Whale movements, exchange inflows, and mining statistics provide clues that Forex traders often overlook. The Final Take: Are You Ready to Level Up? The Bitcoin-Euro market isn’t for the faint-hearted. It’s a battle between human intuition and machine precision, where knowing the rules lets you break them to your advantage. Want to go even deeper? Join the StarseedFX community, where we decode institutional trading tactics and provide cutting-edge tools to outmaneuver the machines. 📈 Stay ahead of the market with the latest Forex news: https://www.starseedfx.com/forex-news-today 🎓 Master advanced strategies with our free courses: https://www.starseedfx.com/free-forex-courses 🛠️ Take your trading to the next level with our smart trading tool: https://www.starseedfx.com/smart-trading-tool/ —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

100 percent sure wins,

100 percent sure wins,

In the world of gambling, sports betting, or even business investments, the idea of a "100 percent sure win" is highly sought after. Everyone wants to have a guaranteed victory, whether it's in games of chance, competitions, or financial endeavors. But is it truly possible to have a sure thing? Let’s dive into the complexities of what "100 percent sure wins" mean and explore whether they really exist.

What is a "100 Percent Sure Win"?

The phrase "100 percent sure win" implies an outcome that is certain to occur, with no room for error or surprise. In any scenario, a "sure win" is something that is seen as inevitable or guaranteed. This could be in sports betting, casino games, or even in personal life decisions. However, in most cases, especially those involving chance or uncertainty, the idea of a sure win is a bit of a fantasy.

The Myth of Guaranteed Wins

While it might sound appealing to think you can walk into a casino or place a bet with full assurance of victory, the reality is quite different. Many systems, strategies, or tips may promise a high probability of success, but there’s always some level of risk or unpredictability involved.

Games of Chance: In games like poker, roulette, or slot machines, outcomes are influenced by random chance. Even if you use strategies like counting cards or betting patterns, there is no formula that guarantees a win every time. Casinos are designed to have an edge over players, and in the long run, luck often favors the house.

Sports Betting: While it's possible to make educated predictions based on team form, injuries, statistics, and other factors, the inherent unpredictability of sports means there’s always the potential for upsets. Even the most experienced bettors can lose when a match doesn’t go as expected.

Stock Market and Investments: In the world of finance, "sure wins" are also a myth. While certain investment strategies may have historically yielded positive results, markets are volatile, and factors like global events, market sentiment, and political changes can cause rapid fluctuations that defy predictions.

When Can We Say There’s a "Sure Thing"?

While there’s no such thing as a 100 percent guarantee in unpredictable scenarios, there are instances where the odds of winning can be significantly higher. These include:

Skill-Based Competitions: In competitions where skill plays a significant role, such as chess or certain esports, a highly skilled player might be able to dominate opponents consistently. However, even in these cases, there’s always the chance of a mistake or surprise move.

Highly Predictable Situations: In certain conditions, like when you're betting on a match between two teams where one is overwhelmingly superior, the likelihood of a win can be high. But even then, it’s important to remember that there’s no such thing as total certainty.

Research and Preparation: With diligent research, understanding of the game or market, and strategies, you may reduce the risk involved in your decisions. But it’s always essential to account for the possibility of failure.

Why "100 Percent Sure Wins" Are a Dangerous Idea

Believing in "100 percent sure wins" can lead to harmful behaviors, such as overconfidence and reckless decision-making. When people think they have a sure thing, they might take unnecessary risks or invest more than they can afford to lose. In the world of betting or investments, it’s important to be cautious and manage expectations, knowing that there’s always a chance of loss.

Conclusion

While the dream of a "100 percent sure win" is appealing, it is ultimately a myth in most scenarios. The truth is that while we can improve our chances with skill, preparation, and research, there’s always an element of risk and uncertainty involved. Whether it’s in gambling, sports, or investments, the most important lesson is to approach any endeavor with a realistic mindset, understanding that no outcome is ever completely guaranteed.

This article should give you a comprehensive overview of the idea of "100 percent sure wins" and the truth behind such claims. Let me know if you'd like any adjustments or additional information!

4o mini

O

0 notes

Text

Understanding Cruise Ship Gambling Recovery: Navigating Your Losses

Cruise ship vacations offer a unique blend of relaxation, adventure, and entertainment. Among the many attractions available, gambling has become a popular activity for passengers seeking to add excitement to their journey. However, with the allure of casino games comes the potential for significant financial loss. If you’ve experienced gambling losses on a cruise, understanding the process of cruise ship gambling recovery can help you regain control and potentially recover your losses.

The Appeal and Risks of Cruise Ship Gambling Cruise ship casinos are designed to create an immersive experience, often operating around the clock with a wide range of games including slot machines, poker, blackjack, and roulette. The convenience of gambling just steps away from your cabin, combined with the festive atmosphere of a cruise, can make it easy to lose track of time and money. For some, this leads to gambling beyond their means, resulting in substantial financial losses.

The environment on a cruise ship can amplify the risks associated with gambling. Passengers may feel more inclined to spend money due to the vacation mindset, where normal financial boundaries may become blurred. Additionally, the lack of financial accountability – such as easy access to credit or the use of a cruise ship card linked to your onboard account – can exacerbate spending without immediate awareness of the accumulating losses.

Steps to Cruise Ship Gambling Recovery If you’ve incurred significant losses while gambling on a cruise, it’s crucial to take steps towards recovery, both financially and emotionally. Here are some strategies to help you navigate the aftermath of cruise ship gambling losses:

Acknowledge the Situation: The first step in recovery is acknowledging the extent of your losses. Take a thorough look at your finances, including the amount lost and its impact on your overall financial health. Accepting the reality of the situation is key to moving forward.

Seek Professional Financial Advice: Consulting a financial advisor can provide you with the guidance needed to manage your losses. A professional can help you create a recovery plan, which may include restructuring your budget, consolidating debt, or exploring options for financial relief. The goal is to mitigate the impact of your losses and prevent further financial strain.

Explore Legal Recourse: Depending on the circumstances of your gambling experience, there may be legal avenues to explore. In some cases, cruise ship casinos may engage in practices that are considered unfair or deceptive. Consulting a lawyer who specializes in gambling recovery can help determine if you have a case for recovering some or all of your losses. It’s important to note that legal recourse can be complex, especially given the international nature of cruise ships, so professional advice is crucial.

Implement Self-Exclusion Measures: If gambling has become a recurring issue, consider self-exclusion as a preventive measure. Self-exclusion allows you to voluntarily ban yourself from gambling activities on future cruises. Many cruise lines offer this option as part of their responsible gaming programs. By taking this step, you can protect yourself from the temptation to gamble on future trips.

Focus on Emotional Recovery: The emotional toll of gambling losses can be just as significant as the financial impact. Feelings of guilt, shame, or frustration are common, and it’s important to address these emotions as part of your recovery. Seeking support from a counselor or joining a support group for gambling addiction can provide valuable emotional support and coping strategies.

Educate Yourself for Future Trips: One of the most effective ways to prevent future losses is to educate yourself about responsible gambling practices. Set a clear budget before your trip, and stick to it. Understand the odds of the games you play, and avoid chasing losses. By approaching gambling with a well-informed mindset, you can enjoy the entertainment without jeopardizing your financial stability.

The Importance of Responsible Gambling Cruise ship gambling recovery is not just about addressing the consequences of past losses; it’s also about adopting responsible gambling habits for the future. Responsible gambling means understanding and accepting that losses are a potential outcome, setting strict limits on time and money spent, and recognizing when it’s time to walk away.

Cruise lines have a responsibility to promote responsible gambling among their passengers. Many offer resources such as brochures, helplines, and self-exclusion programs. However, the ultimate responsibility lies with the individual to make informed and responsible choices.

Gambling on a cruise ship can be an enjoyable activity when approached with caution and responsibility. However, if you find yourself dealing with significant losses, cruise ship gambling recovery is a critical step toward regaining control of your finances and well-being. By acknowledging your situation, seeking professional advice, exploring legal options, and focusing on emotional recovery, you can navigate the aftermath of gambling losses and move forward with greater financial security and peace of mind.

#cruise ship gambling losses#cruise ship gambling loss claims#cruise ship gambling recovery#cruise ship gambling compensation#cruise ship gambling claims

1 note

·

View note

Text

Summary of The Book Moneyball by Michael Lewis: Innovating Baseball Strategy

Chapter 1 What's The Book Moneyball by Michael Lewis

"Moneyball" by Michael Lewis is a non-fiction book that explores the innovative use of data and statistical analysis in Major League Baseball. The book follows the Oakland Athletics' general manager Billy Beane as he revolutionizes the way baseball teams evaluate players and make decisions. By using data and advanced analytics to identify undervalued and overlooked players, Beane was able to build a competitive team on a limited budget, challenging traditional scouting methods and strategies. "Moneyball" not only provides insight into the world of baseball but also offers valuable lessons on how data-driven decision-making can lead to success in any field. With its engaging storytelling and insightful observations, the book has become a modern classic in the realm of sports literature.

Chapter 2 The Book Moneyball by Michael Lewis Summary

"Moneyball" by Michael Lewis is a nonfiction book that explores the world of baseball and challenges traditional methods of recruiting and evaluating players. The book focuses on the Oakland Athletics, a small-market team that used advanced statistics and analytics to build a competitive team on a limited budget.

The central figure in the book is Billy Beane, the general manager of the Athletics, who is portrayed as a visionary who revolutionized the game by using sabermetrics to find undervalued players who could help the team win games. Beane's methods were initially met with skepticism and resistance from the baseball establishment, but they ultimately proved successful and changed the way teams evaluate talent.

Throughout the book, Lewis uses the story of the Athletics to explore larger themes about economics, statistics, and innovation in sports. He argues that traditional scouting methods are flawed and outdated, and that teams should focus on statistics and data analysis to make better decisions.

Overall, "Moneyball" is a fascinating look at the intersection of sports and analytics, and how a small-market team was able to compete with and even outperform teams with much larger budgets. The book has been praised for its insightful analysis and engaging storytelling, and has had a lasting impact on the way baseball is played and managed.

Chapter 3 The Book Moneyball Author

Michael Lewis is an American author and financial journalist. He was born on October 15, 1960, in New Orleans, Louisiana. He is best known for his works on economics, finance, and sports.

Lewis released the book "Moneyball: The Art of Winning an Unfair Game" in 2003. The book explores the rise of the analytics-driven approach to baseball pioneered by Billy Beane, the general manager of the Oakland Athletics. "Moneyball" was a critical and commercial success, and it was later adapted into a film starring Brad Pitt.

Aside from "Moneyball," some of Michael Lewis's other notable works include "Liar's Poker: Rising Through the Wreckage on Wall Street," "The Big Short: Inside the Doomsday Machine," and "Flash Boys: A Wall Street Revolt."

In terms of editions, "The Big Short" is one of the best-known and most widely-read books by Michael Lewis. It was released in 2010 and explores the events leading up to the financial crisis of 2007-2008. The book was also adapted into a successful film starring Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt.

Chapter 4 The Book Moneyball Meaning & Theme

The Book Moneyball Meaning

The book Moneyball by Michael Lewis explores the story of the Oakland Athletics baseball team and their use of sabermetrics (advanced statistical analysis) to assemble a competitive team on a limited budget. The book challenges traditional baseball wisdom and sheds light on the value of data-driven decision making in sports and beyond. It also highlights the importance of innovation, creativity, and thinking outside the box to achieve success in a competitive environment. Overall, Moneyball serves as a powerful reminder of the impact of data and analytics in driving strategic decision making and achieving superior performance.

The Book Moneyball Theme

One of the main themes in Moneyball is the value of utilizing data and analytics to challenge traditional methods and beliefs. The book follows the story of the Oakland Athletics baseball team and their general manager, Billy Beane, as they revolutionize the way talent is evaluated in the MLB by focusing on statistics and undervalued players.

Through Beane's innovative approach, Moneyball challenges the conventional wisdom in baseball that relies heavily on scouting, intuition, and traditional metrics like batting average and RBIs. Instead, Beane and his team use advanced statistics to identify talented players who are often overlooked or undervalued by other teams.

Another key theme in Moneyball is the importance of adaptability and perseverance in the face of skepticism and resistance. Beane faces significant pushback from traditionalists within the baseball community who are skeptical of his methods and beliefs. However, Beane remains steadfast in his approach and ultimately proves the effectiveness of his strategy through the team's successful performance on the field.

Overall, Moneyball explores the themes of innovation, perseverance, and the power of data-driven decision-making in challenging and reshaping established norms and practices. It serves as a compelling example of how thinking outside the box and embracing new approaches can lead to success and transformation in any field.

Chapter 5 Quotes of The Book Moneyball

The Book Moneyball quotes as follows:

1. "The idea that the art of scouting is alive and well is a comforting one – but it isn’t true."

2. "The discovery of undervalued assets is the key to success in any market, whether it’s stocks, bonds, or in this case, baseball players."

3. "Baseball teaches us, or has taught most of us, how to accept failure. Only the best batters succeed three out of ten times."

4. "Billy’s fundamental problem was that he did not have a good way to judge the value of baseball players."

5. "Now, here’s where the troops may have enough resistance to achieve much for the whole."

6. "Baseball was like one of those T.S. Eliot sibilant high-rhythms in which each sentence began in one place and ended in another; he’d begun believing one thing and come out believing another."

7. "The only thing that broke the monotonous beat of the metronome was an occasional sound of a bat cracking a baseball."

8. "Because what you do on the field should never, ever, depend on what you have in your pocket. It should depend on what’s inside of you."

9. "It’s not about the money. It’s about the competitive fire within you."

10. "They missed out on the big free agents because they couldn’t afford them, so they had to find another way to win."

Chapter 6 Similar Books Like The Book Moneyball

1. "The Great Gatsby" by F. Scott Fitzgerald - A classic novel that explores themes of love, wealth, and the American Dream through the eyes of the mysterious Jay Gatsby.

2. "To Kill a Mockingbird" by Harper Lee - This Pulitzer Prize-winning novel examines racial injustice and moral growth in the Deep South, as seen through the eyes of young Scout Finch.

3. "The Alchemist" by Paulo Coelho - A thought-provoking tale of self-discovery and personal legend, following a young shepherd as he embarks on a journey to fulfill his dreams.

4. "Pride and Prejudice" by Jane Austen - A beloved classic that follows the romantic entanglements of Elizabeth Bennet and Mr. Darcy in 19th-century England, while also addressing themes of class and social expectations.

5. "1984" by George Orwell - A dystopian novel that explores the dangers of totalitarianism and government surveillance, serving as a cautionary tale for the future.

Book https://www.bookey.app/book/moneyball

Author https://www.bookey.app/quote-author/michael-lewis

Quotes https://www.bookey.app/quote-book/moneyball

YouTube https://www.youtube.com/watch?v=3JBWSFFAb4w

Amazom https://www.amazon.com/Moneyball-Art-Winning-Unfair-Game/dp/0393324818

Goodreads https://www.goodreads.com/book/show/1301.Moneyball

0 notes

Text

UBS's Goal: Setting Sights on the No. 6 Spot Among U.S. Investment Banks (Yep, Sixth Place)

Ah, strap yourselves in, folks, for UBS is pulling off a comeback story that would make even the most seasoned Wall Street cynic raise an eyebrow. After a hiatus that felt like an eternity in finance years, the Swiss juggernaut is strutting back onto the U.S. investment-banking dance floor, but this time, they're doing it with a touch of Swiss precision and a sprinkle of newfound humility.

Gone are the days of swinging for the fences like an overeager rookie. Nope, this time around, UBS is playing it cool, taking measured steps to reclaim its slice of the pie amidst the wreckage left by its peers' misfortunes and a takeover frenzy in the financial realm.

Picture this: while others are gunning for the gold, UBS executives are calmly sipping their espresso, outlining plans to snag the title of "Numero Sei" in the U.S. market. Sure, it's not exactly aiming for the stars, but hey, in an industry fueled by hubris and ambition, a little modesty can be refreshing.

Let's face it, the U.S. investment-banking scene is like a high-stakes poker game, and UBS is determined not to bluff its way to the top. While others have tried and failed spectacularly, UBS is playing the long game, focusing on being the best of the rest and a global force to be reckoned with.

But hey, even the best-laid plans can hit a few speed bumps. UBS might be a lean, mean banking machine, but it's still got limits. Chief Executive Officer Sergio Ermotti has made it clear: they're not abandoning their bread and butter, wealth management, for a wild investment-banking fling. So, while the dreams of a UBS investment-banking empire might be alive and kicking, they're still keeping one foot firmly planted in the world of wealth.

And let's not forget the skeptics, the naysayers who whisper tales of past failures and missed opportunities. But hey, who doesn't love an underdog story? With a little Swiss ingenuity and a lot of strategic maneuvering, UBS is poised to shake up the status quo once again.

So, will UBS succeed in its quest to reclaim its spot among the investment-banking elite? Well, grab your popcorn and stay tuned, because this is one financial rollercoaster you won't want to miss.

0 notes

Text

Understanding Poker Machine Finance: How to Secure Funding for Your Gaming Business

For gaming businesses, poker machines are a key revenue generator, but acquiring them requires substantial investment. Understanding the available finance options can make the process smoother and more manageable. Whether you're purchasing or leasing poker machines, it’s essential to explore various funding methods. This guide covers the basics of securing poker machine finance and highlights different financing routes for your gaming business.

Options for Poker Machine Finance

When it comes to poker machine finance, businesses have several options at their disposal. From traditional loans to leasing agreements, the type of finance you choose will depend on your business goals, budget, and cash flow.

1. Traditional Business Loans

One of the most common ways to secure poker machine finance is through a traditional business loan. Banks and financial institutions often offer these loans with varying interest rates and repayment terms. For businesses with good credit history and solid financial records, obtaining a loan for poker machines can be a straightforward process.

However, it’s essential to carefully consider the terms and repayment conditions. A fixed-rate loan offers predictable repayments, while variable rates may fluctuate. Ensuring that the loan is tailored to your gaming business’s cash flow is crucial to avoid any financial strain.

2. Equipment Financing

Another option for poker machine finance is equipment financing. This type of loan is specifically designed for purchasing machinery and equipment, including poker machines. The machines themselves act as collateral for the loan, which can lead to more favourable rates than unsecured business loans.

Equipment financing allows you to spread out payments over an extended period, reducing the upfront cost of purchasing poker machines. This option is ideal for businesses that want to maintain liquidity while still investing in new equipment to grow their operations.

3. Leasing Poker Machines

Leasing offers a flexible alternative to purchasing poker machines outright. With a leasing agreement, you can rent the machines over a specific period without having to make a large upfront payment. Leasing can be a great option for businesses that want to keep their operational costs low while benefiting from the latest poker machine technology.

At the end of the lease term, you may have the option to renew the lease, purchase the machines at a reduced rate, or return them. Leasing is a popular choice for businesses looking to avoid long-term commitments or large investments in the early stages of operation.

Benefits of Poker Machine Finance

Access to poker machine finance provides businesses with several advantages. Firstly, it allows you to spread the cost of poker machines over time, making it easier to manage your cash flow. Whether you opt for a loan or a lease, finance options enable you to grow your gaming business without the need for substantial capital upfront.

Additionally, finance options can often provide tax benefits. Depending on your country’s tax laws, leasing or financing equipment may be eligible for tax deductions, further easing the financial burden on your business.

Conclusion: Finding the Right Finance for Your Gaming Business

Securing the right poker machine finance is a critical step in growing your gaming business. By exploring traditional loans, equipment financing, or leasing options, you can find the funding solution that best aligns with your business needs. As you evaluate each option, consider your long-term goals, budget, and financial stability to make the best decision for your poker machine investments.

0 notes

Text

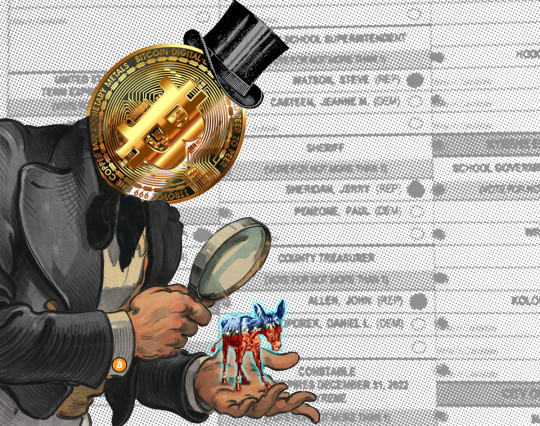

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

428 notes

·

View notes

Text

Elevating the Online Gaming Experience: 918Kiss in Australia

In the realm of online gaming, 918Kiss stands as a titan, reshaping the landscape for Australian enthusiasts with its expansive and diverse array of gaming options. Renowned for its robust platform, 918Kiss offers an immersive online experience that combines the thrill of casino gaming with the convenience and accessibility of digital technology. This comprehensive exploration delves into what makes 918Kiss a premier choice for online gaming in Australia, highlighting the platform's unique offerings, technological prowess, and strategies for maximizing player engagement and winnings.

The 918Kiss Phenomenon

At the heart of 918Kiss's success is its unparalleled selection of games, ranging from the adrenaline-pumping excitement of slot machines to the strategic depths of table games like poker and blackjack. Each game on 918Kiss is crafted with attention to detail, boasting high-definition graphics, seamless animations, and captivating soundtracks that enhance the gaming experience. The platform's commitment to diversity ensures that all players, regardless of their preferences or skill levels, find games that suit their tastes and provide endless entertainment.

Technological Excellence and Accessibility

918Kiss sets the standard for online gaming platforms with its cutting-edge technology, ensuring a smooth, secure, and responsive gaming experience across all devices. Whether on a desktop or mobile device, players in Australia can easily access their favorite games without compromise on performance or quality. The platform's user-friendly interface makes navigation a breeze, allowing gamers to effortlessly browse the vast game library, access their accounts, and manage their finances with complete ease and security.

Strategies for Maximizing Wins on 918Kiss

To truly capitalize on the opportunities presented by 918Kiss, players are encouraged to adopt a strategic approach to gaming. This includes familiarizing oneself with the games' rules and mechanics, as well as employing strategies that increase the chances of winning. Smart bankroll management is crucial, as it allows players to extend their gaming sessions and maximize their chances of hitting big wins. Additionally, taking advantage of the platform's bonuses and promotions can significantly enhance the gaming experience, providing additional resources to play with and increasing overall winning potential.

Exclusive Bonuses and Promotions

918Kiss is synonymous with generosity, offering a plethora of bonuses and promotions designed to enrich the player experience. From welcome bonuses that greet new players to loyalty rewards that celebrate the platform's most dedicated enthusiasts, there is always an opportunity to boost one's gaming journey. These incentives not only provide financial benefits but also add an extra layer of excitement to the gaming experience, making every session on 918Kiss a rewarding adventure.

A Commitment to Security and Fair Play

Security and fairness are paramount at 918Kiss, with advanced encryption technologies and strict adherence to fair play standards ensuring a safe and equitable gaming environment for all players. The platform's rigorous security measures protect personal and financial information, while its games are regularly audited for fairness, providing peace of mind and a trustworthy setting in which to enjoy the thrill of online gaming.

Conclusion

918kiss Online Gaming Australia has redefined the online gaming landscape in Australia, offering a premium platform that combines a vast selection of games, cutting-edge technology, and generous bonuses. By embracing a strategic approach to gaming, players can maximize their enjoyment and potential winnings on 918Kiss, all while benefiting from the highest standards of security and fairness. Whether you're a seasoned gamer or new to the online casino world, 918Kiss offers an unparalleled experience that promises endless entertainment and the chance for significant rewards.

0 notes

Text

playbazzar

What is PlayBazzar?

PlayBazzar is an online gaming platform that offers a wide range of games for players to enjoy. It provides a virtual space where users can engage in various games and experience the thrill of gambling without having to visit a physical casino. PlayBazzar aims to create an immersive and enjoyable gaming environment that caters to the preferences of different players.

Game Selection on PlayBazzar

One of the key aspects that sets PlayBazzar apart is its extensive game selection. The platform offers a diverse range of games, including traditional casino games, slot machines, sports betting, and more. Whether you are a fan of classic card games like poker and blackjack or prefer the excitement of spinning the reels on a slot machine, PlayBazzar has something for everyone.

Features and Benefits of PlayBazzar

User-Friendly Interface

PlayBazzar boasts a user-friendly interface, making it easy for players to navigate through the platform and find their favorite games. The intuitive design ensures a seamless gaming experience, allowing users to focus on the games they love without any unnecessary distractions.

Safe and Secure Gaming

Security is of utmost importance when it comes to online gaming, and PlayBazzar understands this well. The platform utilizes advanced encryption technology to safeguard user information and financial transactions. Players can enjoy their gaming sessions with peace of mind, knowing that their personal and financial details are protected.

Promotions and Bonuses

PlayBazzar rewards its players with exciting promotions and bonuses. From welcome bonuses for new users to loyalty rewards for regular players, there are plenty of opportunities to enhance the gaming experience and boost your chances of winning big. These promotions add an extra layer of excitement and value to the gameplay on PlayBazzar.

Payment Options

To cater to players from around the world, PlayBazzar supports multiple payment options. Whether you prefer using credit/debit cards, e-wallets, or bank transfers, you can easily deposit and withdraw funds on the platform. The convenient and secure payment options make it hassle-free for players to manage their finances while enjoying their favorite games.

Customer Support

PlayBazzar prioritizes customer satisfaction and provides reliable customer support services. Whether you have a question, need assistance with a game, or have encountered a technical issue, the support team is readily available to help. Players can reach out to the support team through various channels, including live chat, email, or phone, ensuring that their queries are promptly addressed.

Mobile Compatibility

In the era of smartphones and tablets, PlayBazzar recognizes the importance of mobile compatibility. The platform is optimized for mobile devices, allowing players to access their favorite games on the go. Whether you are commuting or taking a break, you can enjoy the thrill of gaming anytime, anywhere with PlayBazzar's mobile-friendly interface.

Playing Responsibly

While online gaming can be highly entertaining, it is essential to approach it responsibly. PlayBazzar promotes responsible gaming practices and provides players with tools to manage their gameplay. These include setting deposit limits, self-exclusion options, and access to resources for gambling addiction support. It is crucial to maintain a healthy balance and enjoy gaming responsibly.

0 notes

Text

6 Great Online Roulette Tips Inexperienced Persons

Many of people go to the casino to take part in the slot machines but most of them do not really know when going to winning. This is certainly not a big deal though since practically most of people that play the casino slots just play enjoyment. However, there are also some who 먹튀제보 would genuinely want to win. After all, what is the aim of playing if you’re not going to win at all? As such, one of the very most important questions request is how to win at slots. Moreover, can players have learned to win at slot machine?

You also need to be aware of your payment options that the casino is employing. This means not just way a person send your deposit back but also regarding drawback. You might find out in its final stages that it would take higher than a month you need to receive your winnings after getting withdrawn it from your account. Also, make sure how the minimum amount required before you can take out of the money isn’t set absurdly high.

Now, playing online pokies at the internet casino searching for takes no planning what ever. If you’ve got a few minutes to kill before your favorite show turns on – enjoy online pokies. You’re looking ahead to your wife to dress for the dinner date; don’t get annoyed, correct some pokies to play around! Truly, you don’t need an excuse to enjoy pokies you don’t need very many hours. Times have certainly changed.

The first thing you are doing is let know and notify all of the local casinos in place about your gambling irritation. Usually all the gambling casinos maintains the gambler list. So whenever are going to go for gambling they’ll see there and assist you to not gamble.

First and foremost, you need to limit your budget. Knowing when to stop is just about the effective way to avoid losing. Although everyone wants to win, everyone should also study how to stop and while to treat. This is most applicable if chances against your business. Staying on a limited budget signifies be responsible for all most particularly it isn’t your best day.

With all of the online casino sites, there are plenty of of casino games from which you can select. Whatever skill level you close to or whatever game is the preference; might enjoy the online casino places. All you have to execute is download and install the software, register, establish your first deposit and in order to ready to play. Some of the games there for you are slots, Roulette, Craps, Keno, Video poker, Baccarat is actually table online casino games.

In playing casino games, you both play amusement or play for finances. Either way, any reasonable gambler or player will want to win. While losing additionally part of gambling, people want as being a host winner positively this want comes requiring a gambling online strategy that works and provides consistent listings. Of course, such strategies do not simply acquired the brain. You either need to learn them from others anyone need to flourish them after the process. Every gambler posesses a need to secure a winning gambling online strategy and getting the right resources can all of them achieve the site.

Nohoilpi – The gambling god of your Navajo. Known as “He Who Wins Men”. He is really a renegade son of the sun god Tsohanoai. He came down to Earth and taught his gambling games to the various tribes but soon abused his power by overcoming them at all his games of chance and collecting his winnings by enslaving people to construct a city to mark his magnificence. He was defeated at gambling a new Navajo man send through the other gods and was thrown in the sky.

0 notes

Text

The Top 7 Investing Do’s and Don’ts

Even if the investment world is always changing due to events in geopolitics, changes in public opinion, or the introduction of new technologies, there are still some unchanging guidelines that financial planners must go by. Even though there are few, if any, assurances in finance, adhering to these principles can help you stay focused, responsible, and successful. These principles are a combination of practical, emotional, and social vows. Let us walk you through unwavering investing dos and don’ts now.

1. Don’t Get Emotional

Always attempt to keep emotion under control, whether you experience significant losses or unexpected wins. Keeping a calm head implies that whatever happens behind the scenes is also made to endure, which is not simply relevant to frazzled Apprentice candidates who falter in the boardroom. Although this may be true for many professions, the challenges are multiplied for financial planners because their advice must be accepted by their customers before moving on to the outcomes stage, and clients might be full of reservations. So, no matter the stakes, maintain a poker face and always emphasise long-term strategy over short-term emotions when discussing choices or outcomes with your clients.

2. Do Embrace Technology

The sector is experiencing exciting technological change as the labour-intensive processes of carefully considered suggestions give way to the data-crunching powers of artificial intelligence and machine learning. It’s a brave, though somewhat unsettling, new world out there, but the evidence of its success is apparent, with top technology platforms now investing billions on behalf of their customers in marketplaces that are now analysed and mined by algorithms to provide better outcomes. Use technology to demonstrate to your clients that you are committed to their portfolio for the long run and that you are keeping up with the current working methods. The basic notion is simple to comprehend and the guarantees provided by artificial intelligence’s limitless potential are guaranteed to allay any customer worries.

3. Don’t Buy Into Fear

And of all of them, fear is usually the most difficult to control since it sets off our instinctive fight-or-flight response. Take hope from logical reasoning and facts, though, because the aftermath is rarely as horrible as the event itself. This is especially true when shrill media headlines are escalating crises, whether natural or national or warning of collapsing markets. One of the most notorious and terrible instances occurred on September 11, 2001, when terrorists deliberately flew aircraft into the centre of New York City’s financial district, literally bringing down major institutions. Research by Fidelity Investments Canada found that the markets recovered in just 47 days. Even if those kinds of situations are thankfully uncommon, the theory can be scaled down to fit any kind of company crisis. As a result, always remain calm no matter what.

4. Do Learn Your Basics

No investing advice would be complete without the words of renowned investment expert Warren Buffet, whose shares in Berkshire Hathaway he purchased in 1962 for just $7.50 were worth a stunning $298,710 apiece 55 years later. Although he is renowned for being quite reasonable when it comes to the markets, in his 2014 annual letter to shareholders, he referred to bureaucracy, complacency, and hubris as “company diseases" since they are equally harmful to investment. Buffet’s statements caution investors against becoming too comfortable to prevent conflicts of interest, sloppy counsel, and subpar practices, echoing guidance from the FCA.

5. Don’t Beat Yourself Up Over Mistakes