#personal debt reduction company in california

Text

Personal Debt Reduction Company in Iowa

Self debt relief is the best Personal Debt Reduction Company in Iowa. They are a trusted source for help with any debt problem. They have a strong customer service record and are able to offer clients the best rates on their loans and debt consolidation. Contact us now for information about our services.

Contact Details:

Visit: www.selfdebtrelief.com

Call: +1–888–615–0171

Mail: [email protected]

#Personal Debt Reduction Company in Iowa#debt relief us#personal debt reduction company in california#debt reduction in us

0 notes

Text

The Way To Open A Factoring Company In 2023 Business Plan

Our El Paso factoring programs supply many advantages to small and mid-size businesses. First, we remove the cash-flow gap brought texas factoring companies on by slow-paying clients. You’ll have the money you have to pay payments, meet payroll, spend money on new resources and more.

Take advantage of our giant network of bill factoring companies in Los Angeles and throughout California. Factor Finders will quickly match your small business to a CA factoring company that offers immediate funding. When your corporation operation wants money, we respond instantly. We allow you to manage your invoices and accounts receivable with our credit score and collection services. In addition to Texas factoring, we manage business credit and supply cash in your growing business wants. By selling your invoices to a factoring firm, you probably can obtain a fast, debt-free infusion of money to cover your bills and put money into growth alternatives.

At Apex, we care about our clients, our partners, and one another. We convey you open and sincere communication, reliable and efficient service, and personal consideration every single day. Our people, the owner-employees of Bankers Factoring, care about their business as a lot as you care about yours. Fellow entrepreneurs honestly working collectively leads to success in enterprise. Your account govt might be with you each step of the finest way that can help you handle your factoring account.

David has the showier character, a nice contrast to Dean’s more reserved demeanor. David had come to the end of his tenure at National Truckers Services (NTS), the corporate that launched him to freight factoring first-hand. Dean worked for Cantey Hanger LLP, thought-about the second oldest legislation agency in Texas. Their introduction set in movement a six-month period of planning and strategizing. David would eventually cash-out his 401(k), and Dean offered essential funding cash within the new startup firm.

Bankers Factoring is the leading invoice factoring and PO Funding company within the San Antonio area. As an employee-owned company, we're dedicated to serving to our purchasers grow their companies in San Antonio by providing fast access to working capital by way of our PO & Factoring Programs. Bankers Factoring is a Texas Invoice Factoring company providing services within the San Antonio Metro area. We provide working capital for rising businesses, entrepreneurs, and any firm with money circulate problems. Contact Bankers Factoring now to talk with our employee-owners to learn the way we help San Antonio businesses with cash flow points. Have you ever turned down or averted a model new gross sales opportunity due to a customer’s payment terms?

If you use a trucking firm, and your transport clients and freight brokers have good credit but are gradually paying their freight bills, then you must contemplate freight invoice factoring. Not solely do you get money advances, but you usually receive other benefits similar to fuel playing cards; gasoline reductions; or tire and upkeep low-cost packages. Triumph is a leading provider of money move management companies for the trucking industry. Triumph supplies a unified product offering that features bill factoring, gasoline discount programs, truck and cargo insurance coverage, and entry to tools finance, banking, and treasury services. The Lone Star State is residence to an enormous array of accounts receivable financing companies, each with its personal unique method of factoring.

0 notes

Text

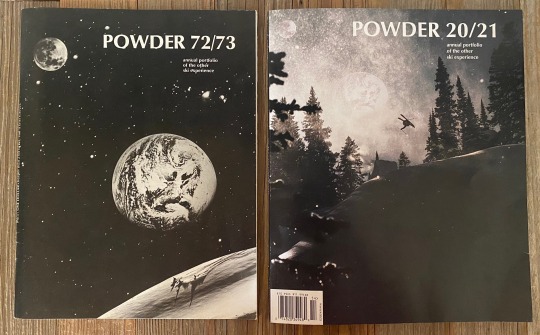

Powder Magazine

(Written by Sam Cox - December 28, 2020)

Growing up in Montana, my winter free time was consumed by skiing. Big Sky was the destination when I was barely old enough to walk. Eventually we made the move to Bozeman and Bridger Bowl became my second home. During the early years, my family made the trek to a handful of Warren Miller movies when they were on tour in the fall and Snow Country was the magazine subscription that landed on the coffee table. I was vaguely aware of Jackson Hole, Snowbird and Squaw Valley and my father would occasionally regale me with tales of skiing (read Après) in Germany when he was in the Army. At some level, I already understood that there was something special about Bridger, but realistically, my sphere of outside influence was quite small. Christmas of 1989 turned my entire world upside down. My aunt and uncle are longtime Salt Lake City residents and Brighton skiers. Typically they would send a package each year with the customary cookies, toffee and a card. However, this year they sent two VHS tapes and a magazine - Ski Time, Blizzard of Aahhh’s and a copy of Powder. Things would never be the same for me. Scot Schmidt became my hero, Greg Stump was taking skiing into uncharted territory and above it all, Powder created an eloquent voice for our sport and was the fabric that held things together. Even at my young age, everything that I’d intuitively sensed before was distilled into a potent desire to devote myself to the simple pursuit of being a skier.

Johan Jonsson, Engelberg, Switzerland - Photo: Mattias Fredriksson/POWDER

Powder was founded in Sun Valley by the Moe brothers in 1972 as an annual portfolio of The Other Ski Experience. After several years of running the magazine, Jake and David Moe sold Powder to the owner of Surfer Magazine. A repurposed aircraft hangar in San Juan Capistrano became the new home of skiing’s most prestigious publication. Over time, there was an ebb and flow to the size of staff and cast of characters, each person leaving their unique mark. For decades Powder weathered corporate acquisitions, office relocations and the constant metamorphosis of the ski industry - never losing its voice, Powder remained the benchmark. It was a source of creativity, inspiration and a defacto annal of history. For many it was also a shining beacon, a glimpse into a world filled with deep turns and iconic destinations - even if this world could only be inhabited inside the constructs of your imagination.

My story and the impact Powder had on the direction I would take is hardly unique. The magazine left an indelible impression on countless skiers. When the news broke this fall that operations were being suspended indefinitely, a heartbroken community took to social media to pay homage to the magazine and how it changed their lives and in some cases, careers. This is my version of a tribute and it’s definitely not perfect. In order to gain some perspective, I reached out to former staff members - a collective I admire and respect. It’s an attempt to articulate the essence of Powder, capture its influence on the skiing landscape and give credit to the people who made it come to life.

Bernie Rosow, Mammoth Mountain, CA - Photo: Christian Pondella/POWDER

HANS LUDWIG - The Jaded Local

“Skiing has always been really tribal and one of the last vestiges of having an oral history. Powder was a unique concept, because they weren’t really concerned with the family market. They were just concerned about being really into skiing. Growing up in Colorado and skiing moguls, my coaches Robert and Roger were featured in the early Greg Stump films. Being in their orbit, I knew a little bit about skiing culture and what was going on out there, but didn’t have the whole picture. The Stump films resonated with me, but Ski/Skiing Magazines didn’t really do it for me. Powder was the door that opened things culturally, it was the only entry point before Blizzard of Aahhh’s.”

“Something that nobody gives Powder credit for, is sponsoring the Greg Stump, TGR and MSP movies and giving them full support right from their inception. It legitimized those companies and helped them become one of the catalysts for change and evolution in skiing. Ultimately this change would have happened, but at a much slower pace without the support of Powder. Getting support from Powder meant they’d weeded out the posers and kooks and what they were backing wasn’t something or someone that was “aspiring” they were a cut above.”

“Powder brought a lot of things into the mainstream, raised awareness and helped to legitimize them: Jean-Marc Boivin, Patrick Vallencant, Pierre Tardivel, telemarking, monoskiing, snowboarding, the JHAF, Chamonix, La Grave, Mikaela Shiffrin, fat skis pre McConkey, skiing in South America….the list goes on.”

“I had some rowdy trips with Powder. Writing “Lost In America,” I went Utah-Montana-Fernie-Banff-Revelstoke via pickup truck, only backcountry skiing and camping in the mud. It was a month plus. I did another month plus in Nevada, which was after back to back Jackson and Silverton. Total time was two plus months. That was fucked up, I was super loose after that whole thing. So many sketchy days with total strangers”

“People forget that Powder was around long before the advent of the fucking pro skier. Starting in 1996, the magazine was in the impact zone of the ski industrial complex. There is limited space for content each season. It was a challenge to balance the pressure coming from the athletes and brands to cover something that was going to make them money vs. staying true to the Moe brothers original intent and profiling an eccentric skier, a unique location or even fucking ski racing.”

Full Circle - Photo: MJ Carroll

KEITH CARLSEN - Editor

“When I was young, Ski/Skiing didn’t do anything for my spirit, but Powder lit me up. It ignited a passion in diehard skiers and gave them a voice and community. It was focused on the counter culture - the type of people who rearrange their lives to ski. This was in direct opposition to other magazines that were targeting rich people, trying to explain technique, sell condos or highlight the amenities at a ski area.”

“Skiing has always been my outlet and mechanism to get away from things in life. My two talents are writing and photography, so I enrolled at Western State with the direct goal of landing an internship at Powder. Even at 19, I had complete focus on the direction I wanted to take. If it didn’t work out, my backup plan was to be a ski bum. 48 hours after graduating, I was headed to southern California to live in my van and start my position at Powder. When the decision was made to close the magazine, it was really personal for me. Powder had provided me direction in life for the last 30 years and I needed some time to process it. In a way, it was almost like going to a funeral for a good friend - even though it’s gone, the magazine lives on in all of us and can never be taken away.”

“It was, and will always remain, one of my life’s greatest honors to serve as the editor-in-chief for Powder Magazine. It was literally a dream that came true. I’m so grateful for everyone who came before me and everyone who served after me. That opportunity opened literally hundreds of doors for me and continues to do so today. I owe the magazine a massive debt of gratitude. Every single editor was a warrior and fought for the title with their lives. They were doing double duty - not only from competition with other publications, but the internal struggle of budget cuts, staff reductions and trying to do more with less. Powder never belonged in the hands of a corporation. The magazine spoke to an impassioned community and never made sense to an accountant or on a ledger.”

Trevor Petersen, Mt. Serratus, BC - Photo: Scott Markewitz/POWDER

SIERRA SHAFER - Editor In Chief

“Powder celebrated everything that is good and pure in skiing. It highlighted the old school, the new and the irreverent. The magazine also called bullshit when they saw it. It was a checkpoint, a cultural barometer and an honest reflection on where skiing has been and where it’s going.”

“My involvement with Powder came completely out of left field. I was never an intern or established in the ski industry. My background was strictly in journalism, I was a skier living in Southern California and editing a newspaper. I knew that I wanted to get the fuck out of LA and Powder was that opportunity. It was a huge shift going from my job and life being completely separate to work becoming my life. Literally overnight, Powder became everything - friends, connections and part of my identity. It derailed my trajectory in the best possible way.”

Brad Holmes, Donner Pass, CA - Photo: Dave Norehad/POWDER

MATT HANSEN - Executive Editor

“Keith Carlsen was a man of ideas, he had tremendous vision and influence. He came up with the ideas for Powder Week and the Powder Awards in 2001. In some respects those two events saved the magazine.”

“Powder was the soul of skiing and kept the vibe, it changed people’s lives and inspired them to move to a ski town. As a writer I always wanted to think it was the stories that did that, but in truth it was the photography. Images of skiing truly became an art form, 100% thanks to Powder Magazine and Dave Reddick. Dave cultivated and mentored photographers, he was always searching for the unpredictable image from around the world and pressed the photographers to look at things from a different angle.”

“It sounds cliche, but writing a feature about Chamonix was the highlight for me. Sitting on the plane, things were absolutely unreal. I linked up with Nate Wallace and the whole experience from start to finish was out of my comfort zone. Ducking ropes to ski overhead pow on the Pas De Chèvre, walking out of the ice tunnel on a deserted Aiguille du Midi right as the clouds parted, late nights in town that were too fuzzy to recall. The energy of the place taught me a lot. I didn’t have a smartphone and there was no Instagram - I had time to write, observe, take notes and be present with who I was and with the experience. As a writer it didn’t get any better.”

“The true gift of working for Powder, was the once in a lifetime adventures that I wish I could have shared with my family, I was so lucky to have had those opportunities. It almost brought tears to me eyes.”

Peter Romaine, Jackson Hole, WY - Photo: Wade McKoy/POWDER

DAVE REDDICK - Director of Photography

“Just ski down there and take a photo of something, for cryin’ out loud!” “I’ve found that channeling McConkey has been keeping it in perspective. Powder’s been shuttered. That sucks. What doesn’t suck is the good times and the people that have shared the ride thus far and I’m just thankful to be one of them. There’s been some really kind sentiments from friends and colleagues, but this must be said - Every editor (especially the editors), every art director (I’ve driven them nuts), every publisher and sales associate, every photographer, writer, and intern, and all the others behind the scenes who’ve ever contributed their talents get equal share of acknowledgment for carrying the torch that is Powder Mag. There’s hundreds of us! No decision has ever been made in a vacuum. Always a collective. At our best, we’ve been a reflection of skiers everywhere and of one of the greatest experiences in the world. It’s that community, and that feeling, that is Powder. I’m not sure what’s next and I’m not afraid of change but” “There’s something really cool about being scared. I don’t know what!”

Scot Schmidt, Alaska - Photo: Chris Noble/POWDER

DEREK TAYLOR - Editor

“Powder was the first magazine dedicated to the experience and not trying to teach people how to ski. It was enthusiast media focused on the soul and culture. It’s also important to highlight the impact Powder had outside of skiing - today you have the Surfer’s Journal effect where every sport wants that type of publication. However, prior to their inception, everybody wanted a version of Powder.”

“Neil Stebbins and Steve Casimiro deserve a lot of credit for the magazine retaining its voice and staying true to the core group of skiers it represented.”

“Keith Carlsen is responsible for the idea behind Super Park. This was a time when skiing had just gone through a stale phase. There was a newfound energy in park skiing and younger generations, this event helped to rebrand Powder and solidify its goal of being all inclusive. Racing, powder, park, touring - it’s all just skiing.”

Joe Sagona, Mt. Baldy, CA - Photo: Dave Reddick/POWDER

JOHNNY STIFTER - Editor In Chief

“What did Powder mean to me... Well, everything. As a reader and staffer, it inspired me and made me laugh. I learned about local cultures that felt far away and learned about far away cultures that didn’t feel foreign, if that makes sense.”

“But I cherished those late nights the most, making magazines with the small staff. Despite the deadline stress, I always felt so grateful to be working for this sacred institution and writing and editing for true skiers. We all just had so much damn fun. And it didn’t hurt meeting such passionate locals at hallowed places, like Aspen and Austria, that I once dreamed of visiting and skiing. The Powder culture is so inclusive and so fun, I never felt more alive.”

Doug Coombs, All Hail The King - Photo: Ace Kvale/POWDER

HEATHER HANSMAN - Online Editor

“Powder is a lifestyle and an interconnected circle of people. It’s about getting a job offer at Alta, opening your home to random strangers, locking your keys in your car and getting rescued by a friend you made on a trip years ago. Through the selfish activity of skiing, you can create a community of people you cherish and can depend on through highs and lows.”

Ashley Otte, Mike Wiegele Heli, BC - Photo: Dave Reddick/POWDER

The contributions of so many talented individuals made the magazine possible. I would like to express my sincere gratitude to everyone who shared their experience at Powder with me. Also, I want to thank Porter Fox and David Page for crafting inspiring feature stories that I enjoyed immensely over the years.

After the reality set in that the final issue had arrived, a void was created for generations of skiers. I’ve been focused on being thankful for what we had, rather than sad it’s gone. It’s a challenging time for print media and I wholeheartedly advocate supporting the remaining titles in anyway you can. In a culture driven by a voracious appetite for mass media consumption and instant gratification - I cherish the ritual of waiting for a magazine to arrive, appreciating the effort that went into creating the content and being able to have that physical substance in my hand. Thanks for everything Powder, you are missed, but your spirit lives on.

Captain Powder - Photo: Gary Bigham/POWDER

3 notes

·

View notes

Text

Personal Debt Reduction Company in Arkansas

Self debt relief company is the best Personal Debt Reduction Company in Arkansas. We have been helping people with their debt for years, and our experience is second to none. We will work with you to create a plan that fits your budget and helps you get out of debt as quickly as possible. We understand that everyone’s situation is different, and we will tailor our approach to your unique needs. Contact us today to see how we can help you get out of debt and start fresh!

Contact Details:

Visit: www.selfdebtrelief.com

Call: +1–888–615–0171

Mail: [email protected]

#Personal Debt Reduction Company in Arkansas#debt reduction in us#personal debt reduction company in california#debt relief us

0 notes

Text

March 3, 2020 Primary

Hi there. We didn’t write this. But a very smart and interesting dude named Kris Rehl did. As we were about to sit down and prepare ours - we read his and thought well, we’re not going to do a lot better than this.

LOS ANGELES AREA PROGRESSIVE VOTER GUIDE

The following are recommendations for the most effective, progressive candidates in each race based on reviewing the resources listed at the bottom of this guide, news articles, and candidates’ statements. I encourage you to do your own research on each candidate as well!

CALIFORNIA STATE PROPOSITION

Prop 13: YES - This is a $15 billion bond to invest in crumbling school infrastructure, including the removal of toxic mold and asbestos from aging classrooms, to provide cleaner drinking water, and make upgrades for fire and earthquake safety. The proposition would also increase the size of bonds that school districts can place on future ballots.

CALIFORNIA STATE SENATE

21st District: Kipp Mueller - Mueller’s progressive platform focuses on homelessness, wage inequality, and the environment, calling out Big Oil in the Antelope Valley swing district.

23rd District: Abigail Medina - The daughter of immigrant parents, Medina has been in the foster care system, worked as a tomato picker, and served on the San Bernardino City Unified School board. She is the candidate with the boldest environmental platform in her district.

27th District: Henry Stern - A strong advocate for closing the Aliso Canyon gas facility and a fairly progressive candidate in a purple district. In addition to fighting big oil, he’s running on creating incentives for companies to switch to clean transportation and renewable energy infrastructure, improving the economy with small businesses and job training, supporting education by securing funding, and creating safer communities by providing funding to local governments. (Fun fact: His dad played Marv in the Home Alone movies.)

29th District: Josh Newman - Newman won his Fullerton district in 2016, focusing on 100% renewable energy by 2045, affordable education, and homelessness and mental health services. He was recalled by voters in a low turnout midterm primary, after being targeted by a Republican effort to break the Democrats’ supermajority. Despite the partisan recall over his vote to increase the state gas tax by 12 cents per gallon to fund $5.4 billion in annual road improvement and transit projects, Newman will again face the Republican he beat in 2016.

35th District: Steven Bradford - A leader on police reform and accountability, including passing AB391, a law reducing when police can use deadly force. Bradford is focused on lowering homelessness through affordable housing, enhancing access to healthcare, and increasing access to mass transit.

CALIFORNIA STATE ASSEMBLY

36th District: Eric Andrew Ohlsen - Endorsed by the Democratic Socialists of America, Ohlsen has excellent positions on environmental issues, immigration, eliminating student debt, and criminal justice reform. Ohlsen wants to eliminate costly and unjust private prison contracts and help people already in the system with policies targeting recidivism.

38th District: Dina Cervantes - A child of immigrants, community activist, small business owner, and former preschool teacher with a strong record on education and environmental issues. (This district’s incumbent is retiring.)

39th District: Luz Maria Rivas - The incumbent, Rivas has a solid record on immigration and housing. She also founded a non-profit in Pacoima to encourage school-aged girls to pursue careers in STEM.

41st District: Chris Holden - The incumbent, Holden has fought to expand funding for disability programs, expand lead-level testing in drinking water at child care centers, and passed legislation to improve safety on electricity systems that caused the 2017 wildfires. His only opponents are Republicans, so vote for Chris!

43rd District: Laura Friedman - Friedman is the incumbent and has a progressive voting record, including supporting the end of Section 8 discrimination and authoring several environmental and sustainability bills.

44th District: Jacqui Irwin - The incumbent, facing a Republican challenger, Irwin has focused heavily on gun violence prevention legislation and strengthened gun violence restraining orders since the 2018 Thousand Oaks shooting.

45th District: Jesse Gabriel - A progressive incumbent, Gabriel has enacted more than a dozen new gun safety measures, championed efforts to address California’s housing and homelessness crisis, and strengthened public education.

46th District: Adrin Nazarian - A strong charter school opponent, who has fought to increase public school aid by $23 billion over the past five years, with a mostly progressive record across the board.

49th District: Edwin Chau - Born in Hong Kong and raised in L.A., incumbent assemblymember Chau is facing a Republican challenger. He’s focused on legislation to prevent elder abuse and authored bills to address the affordable housing crisis as well as the California Consumer Privacy Act, enhancing protections for internet users’ personal data.

50th District: Richard Bloom - Authored some strong housing bills with a heavy focus on environmental legislation, helping establish the most stringent protections in the country against the dangers of hydraulic fracking.

53rd District: Godfrey Plata - Plata is a progressive challenger to an establishment Democratic incumbent, who has a disappointing record on housing policy. Plata is a gay Filipino immigrant, who if elected will become the first person in the California Assembly's 140-year history to be an out LGBTQIA+ immigrant. Plata’s campaign is focused on affordable housing, strengthening public schools, and universal healthcare.

54th District: Tracy B. Jones - A special education teacher, Jones is a strong advocate for increasing public school funding and improvements. He supports Medicare for All and the banning of fracking.

57th District: Vanessa Tyson - Tyson is an advocate for increasing the accessibility and affordability of college, expanding affordable housing, and investing in permanent housing solutions to address homelessness.

58th District: Margaret Villa - A Green Party candidate, Villa supports rent control, Medicare for All, and getting money out of politics. The incumbent Democrat she’s challenging (Cristina Garcia) previously made false claims about earning a graduate degree, has several sexual harassment accusations against her from her own staff, and was investigated for her rampant use of racist and homophobic language in the workplace. Vote for Margaret Villa instead!

59th District: Reggie Jones-Sawyer - A strong progressive incumbent, Reggie comes from a family of pioneers in the civil rights movement, is the nephew of one of the Little Rock Nine, and a member of the California Legislative Black Caucus. He’s co-authored legislation to provide re-entry assistance like housing and job training for persons that have been wrongfully convicted and consequently released from state prison. He also led an effort to secure nearly $100 million for recidivism reduction grants.

63rd District: Maria Estrada - Endorsed by Democratic Socialists of America, Estrada is a community activist, challenging an incumbent establishment Democratic leader, who stopped the passage of single-payer healthcare in the California legislature. Maria is running “to end the culture of policies that are deferential to industrial polluters that continue to poison our communities.”

64th District: Fatima Iqbal-Zubair - A high school teacher from Watts, Fatima is challenging Democratic incumbent Mike Gipson, who takes money from Chevron, Valero, Pfizer, and Juul. She is campaigning to end environmental racism in her district, fight for affordable housing and rehabilitation services for the homeless, better funding for public schools, and making college accessible to everyone.

LOS ANGELES COUNTY

District Attorney: Rachel Rossi - Rossi’s experience as a public defender and aggressive platform make her the most progressive option to unseat incumbent Jackie Lacey, who Black Lives Matter and the ACLU criticized for refusing to prosecute violent cops. Rossi will pursue “data-driven crime prevention” over ineffective mass incarceration, focusing on serious, violent cases and ending the revolving door of low-level offenses that waste taxpayer dollars.

County Measure R: YES - An important step toward L.A. County jail reform that helps decriminalize mental illness and build community-based care centers where people can get the qualified help they need. Measure R also provides crucial tools for LA’s Civilian Oversight Board to check a corrupt Sheriff’s department.

L.A. County Measure FD: YES - Provides firefighters with the resources they require.

COUNTY CENTRAL COMMITTEE, 43rd Assembly District (*Vote for no more than 7)

Luke H. Klipp - A progressive, who is disenchanted with the establishment, Klipp has been a housing and HIV/AIDS policy advocate and transportation analyst. He hopes to create a more walkable, bikeable, and transit-friendly LA, centering equity and climate change in all policy.

Jennifer “Jenni” Chang - A universal healthcare advocate and community activist, Jenni wants to make politics more people-centric, shun corporate influence, and hold party leaders accountable to progressive values. She supports green transportation, more public education funding, affordable housing, closing corporate loopholes, and prison reform.

Linda Perez - Linda is an immigrant and retired labor advocate, who is prioritizing immigrant protections, LGBTQ rights, education, housing, workers’ rights, and student homelessness.

Ingrid Gunnell - A teacher focused on public school funding and accountability for charter schools, Ingrid plans to fight homelessness with affordable housing, mental healthcare, and job training.

Nicholas James Billing - A Sunrise Movement member, Nicholas is fighting for renewable energy infrastructure, supports public school, prison reform, and affordable housing.

Angel Izard - A community activist, Angel supports public schools, quality healthcare for all Californians, investing in renewable energy, affordable housing, and prison reform.

Paul Neuman - An incumbent, Paul wants to empower people and make government more accessible, transparent, responsive and accountable. He has a long history of activism and volunteer work, advocating for many marginalized groups. He’s written resolutions for emergency funding for homelessness, arts education, campaign reform, and more.

LOS ANGELES COUNTY JUDGE OF THE SUPERIOR COURT

Office No. 42: Linda Sun - Sun is an experienced prosecutor focused on corruption from professionals and businesses rather than crimes of poverty. She describes her judicial approach as embodying empathy and dignity.

Office No. 72: Myanna Dellinger - Dellinger is passionate about gender-related employment discrimination, harassment, and violence cases. She believes “people of color and lower incomes are disproportionately affected by environmental problems such as air and water pollution...The law should help remedy that.” Dellinger also advocates for gender-affirming treatment of everyone in and out of the courtroom.

Office No. 76: Emily Cole - As a judge, Cole is dedicated to helping the victims of crime but also helping the defendants that are in a system that they can’t get out of. She was also endorsed over her opponent by the LA County Bar Association.

Office No. 80: Klint James McKay - McKay is an administrative law judge with social services and has a history in the Public Defender Union. He has focused on an empathetic approach and understanding for all people, who pass through the court. His opponent David Berger is endorsed by the problematic current DA Jackie Lacey but was also chosen for the District Attorney's Office Alternative Sentencing Designee, where he’s worked within the criminal justice system to find alternatives for non-violent candidates.

Office No. 97: Sherry L. Powell - Powell has dedicated much of her legal career to serving and advocating for families, who lost loved ones to murder, and victims of violent crimes such as child molestation, rape, human trafficking, and domestic violence. She is running against Timothy Reuben, a real estate law firm founder, who ran as a conservative in 2018.

Office No. 129: Kenneth Fuller - As a District Attorney, Fuller has prosecuted environmental and sex crimes, but has also worked on the defense side as a military judge advocate.

Office No. 145: Troy Slaten - Slaten strongly supports criminal justice reform with efforts such as Collaborative Courts, designed to provide treatment instead of incarceration to the most vulnerable populations in the criminal justice system.

Office No. 150: Tom Parsekian - Parsekian is a civil litigation attorney, who is endorsed by the Democratic Socialists of America.

Office No. 162: Caree Annette Harper - Harper is a former police officer, turned civil rights attorney, who has dedicated massive amounts of her time to pro bono work. In 2018, Caree obtained $1.5 million for the family of Reginald Thomas, who was beaten and tased to death by Pasadena Police Department.

LOS ANGELES COUNTY SUPERVISOR

2nd District: Holly Mitchell - A champion for progressive causes in the State Legislature, Mitchell has called for 20% affordable housing in every new development and a compassionate, non-criminalization approach to the homelessness crisis. Holly introduced the recently enacted CROWN Act, the first state law to ban discrimination based on natural hair or styles like locs, braids, and twists in workplaces and public schools.

4th District: Janice Hahn - Hanh has been solid on housing and labor issues. It should be noted that in 2015, she voted with 242 Republicans and 46 Democrats to pass a bill that proposed instituting a much more intensive screening for refugees from Iraq and Syria, who applied for admission to the U.S. It does not appear Hahn has any serious challengers.

5th District: Darrell Park - Park proposed an ambitious Green New Deal for LA County, signed the homes guarantee, and endorsed the Services Not Sweeps campaign to end the criminalization and ease the suffering of unhoused people. The current Supervisor for this district, Kathryn Barger, is the only Republican on the County Board of Supervisors.

LOS ANGELES UNIFIED SCHOOL DISTRICT - BOARD OF EDUCATION

The following are the endorsements of the Los Angeles teachers union:

District 1: George McKenna

District 3: Scott Schmerlson

District 5: Jackie Goldberg

District 7: Patricia Castellanos

LOS ANGELES CITY COUNCIL

***The corruption in City Hall has led to inaction, worsened the housing crisis, and wasted millions in taxpayer dollars. I urge you to vote out all incumbents.

2nd District: Ayinde Jones - Wants to expand affordable public transportation and beds in homeless shelters. (The incumbent, Paul Krekorian, did not meet the new bed goal that the city council set for itself. Krekorian did turn his own budget’s $400 million surplus into a $200 million deficit with little transparency or public oversight though.) For more info on this race, check out this community activist’s thread from the candidates’ forum.

4th District: Nithya Raman - Nithya is an MIT-trained urban planner, who founded SELAH, a local homeless service organization, and served as executive director of anti-sexual harassment group Times Up. She plans to end homelessness by providing services and housing to those in need, stop evictions, and freeze rents. She is also focused on fighting the climate crisis and improving our city’s air quality.

6th District: Bill Haller - A member of his neighborhood council and experienced with environmental advocacy, Haller is running because he is disgusted by the corruption in L.A. City Hall. Haller wants to reduce city council pay from $207,000 to $93,500 (or 85% of an elected state assemblymember’s salary) and double the number of city districts to allow for more diverse, grassroots candidates, who better understand and represent their communities.

8th District: Denise Woods - A write-in candidate who has fought against housing discrimination, Denise has plans to address public safety, prevent gang violence, and expand education and job training in South L.A.

10th District: Aura Vasquez - Aura was born and raised in Colombia. In 1996, her family came to America to escape the bloodshed and violence caused by drug cartels and the War on Drugs. As an undocumented student, Aura worked nights and weekends to put herself through college. Aura has become a dedicated community organizer, environmental advocate, and was the driving force in banning single-use plastic bags in L.A. She is focused on making city services more responsive, creating affordable housing and homeless services, ensuring police treat all residents with respect and dignity, keeping immigrant and refugee families together, and supporting local schools, teachers, and after-school programs.

12th District: Dr. Loraine Lundquist - An educator and astrophysicist, Loraine is an expert on clean energy and helped organize community opposition to the Aliso Canyon gas storage facility when it posed a massive danger to the Valley in 2015. She is refusing donations from corporate special interests and wants to challenge corruption in the LADWP to create lower utility bills for residents. Loraine also wants to use humane, data-proven solutions to end the homelessness crisis, putting an end to tax dollars being wasted on inaction.

14th District: Cyndi Otteson - Cyndi served on her neighborhood council and leads a nonprofit that helped over 320 refugee families resettle in the U.S. Cyndi rejects developer, charter school, and special interest money and wants to make housing more affordable for rent-burdened Angelenos with financial reforms and protections for renters. She proposes using the $355 million annually generated by Measure H to build on or adapt commercial property that is undeveloped or abandoned for affordable housing and homeless shelters.

GLENDALE CITY COUNCIL

Dan Brotman - Dan is an advocate for a sustainable Glendale and has been endorsed by the Sunrise Movement for fighting fossil fuel infrastructure and advocating for affordable housing.

U.S. HOUSE OF REPRESENTATIVES

8th District: Chris Bubser - Bubser has been endorsed by several labor and environmental groups, and she is the only chance to avoid two Republicans on the November general election ballot in this red district.

23rd District: Kim Mangone - Kim is a veteran, running against Kevin McCarthy, one of the most far-right Republicans in Congress and the GOP’s current House Minority Leader. Vote for Kim and get McCarthy the hell out of Washington!

26th District: Julia Brownley - The incumbent, Julia passed her Female Veterans Suicide Prevention Act in 2016, which requires the VA to collect data on women veterans to identify best practices and services to end female veteran suicide. She passed a surface transportation bill to increase funds to invest in our crumbling infrastructure. Julia has been an advocate for women and working families, fighting to close the wage gap, raise the minimum wage, and expand job training and education assistance.

27th District: Judy Chu - The incumbent, Chu is chair of the Congressional Asian Pacific American Caucus and has a strong record on immigration rights and reform. She has also become a strong advocate for ending military hazing since her 21-year-old nephew shot and killed himself after enduring three and a half hours of discrimination-motivated assault and torture from his fellow marines in Afghanistan.

28th District: G. “Maebe A. Girl” Puldo - Maebe (she/her) is the first drag queen elected to public office in U.S. history! She is genderfluid/trans and hosts, produces, and performs in drag shows around Los Angeles in addition to her Silver Lake Neighborhood Council duties. Maebe supports Medicare for All, has experience with homelessness advocacy, and is running on a broad, progressive platform. If your knee jerk reaction is to dismiss Maebe because she’s a drag queen, kindly check your queerphobia at the door.

(Second Choice: Adam Schiff - Despite his impressive contribution to the president’s impeachment, incumbent Adam Schiff has shown himself to be a hawk, defined by donations made to his campaign by the defense industry. Even if you plan to vote for Schiff during the general election this November, I encourage you to vote for Maebe in the primary.)

29th District: Angélica María Dueñas - A member of her neighborhood council, Dueñas supports unions, Medicare For All, achieving 100% renewable energy by 2030, eliminating pharmaceutical subsidies, increasing taxes on the rich, and a humane path to citizenship.

30th District: CJ Berina - CJ is challenging an establishment Democratic incumbent, who has worked against many progressive causes. CJ supports the Green New Deal, Medicare For All, the cancellation of medical and student debt, abolishing ICE and the death penalty, and ending for-profit healthcare.

32nd District: Emanuel Gonzales - Growing up, Emanuel and his family became homeless twice: after his father was diagnosed with End-Stage Renal Disease and during the recession. Since his father died from a failed kidney transplant, Emanuel has become an advocate for expanding Medicare coverage to everyone in the U.S. and reforming the current organ transplantation system so that no organ goes to waste. Personally knowing the pain of losing a home, Emanuel will fight for affordable interest rates for first-time buyers, extending tax benefits for working families who own homes, and increasing federal grants, so people can own homes in the communities they work and serve in.

33rd District: Ted Lieu - Ted has been an outspoken critic of the current administration, bringing special attention to the treatment of migrant children in detention, separated from their families. Ted previously authored a bill banning conversion therapy and was a co-sponsor of the 2019 Medicare For All Act.

34th District: Frances Yasmeen Motiwalla - Frances supports Medicare for All, the Rent Relief Act, the Green New Deal, and urgently wants to end the war in Yemen. The incumbent Jimmy Gomez has moved to the left since facing a Green Party candidate last election cycle. If nothing else, let’s push him even more left.

37th District: Karen Bass - Leader of the Congressional Black Caucus, Karen has focused on issues such as criminal justice reform, a national minimum wage increase, and foster care. She supports Medicare For All, tuition-free community college, and capping the interest rate for federal student loans at 3.4 percent.

38th District: Michael Tolar - Supports Medicare for All, The Green New Deal, closing private prisons, getting money out of politics, and banning military-style weapons.

39th District: Gil Cisneros - A solid Orange County Democrat facing a tough reelection against a Republican this fall. Cisneros was a $266 million Mega Millions winner and became a philanthropist before deciding to run for Congress in 2018. Gil is a veteran and education advocate, who has stood up to the insurance and pharmaceutical industries to lower healthcare costs, protected education funding, and worked to create good-paying local jobs.

40th District: Dr. Rodolfo Cortes Barragan - Taking on a more conservative Democrat incumbent, Rodolfo is a first-generation American, who came from Mexico at a young age and earned degrees from UC Berkeley and Stanford. He is a Green Party candidate, running on a platform of Medicare for All, tuition-free public colleges, the Green New Deal, abolishing ICE, repealing the Patriot Act, and a homes guarantee with funding for universal public housing.

43rd District: Maxine Waters - Maxine has been an outspoken advocate for women, children, people of color, and the poor. She has strongly condemned the actions of the current administration and is facing a Republican challenger this fall.

44th District: Nanette Diaz Barragán - Elected in 2016, Nanette became the first Latina to represent her Congressional district. She is a strong advocate for immigration and supports Medicare for All.

45th District: Katie Porter - Katie is a survivor of domestic abuse and a former consumer protection attorney. She impressively won a swing district while still supporting Medicare for All, gun safety reform, and legislation to reduce the influence of dark money in politics.

47th District: Peter Matthews - Peter refuses donations from corporate PACs and lobbyists, supports tuition-free college, canceling student debt, Medicare for All, a Green New Deal, universal child care, public banks, taxing income brackets over $10 million at 70%, and believes housing is a human right.

PRESIDENTIAL PRIMARY

Elizabeth Warren - Elizabeth doesn’t just have some of the most comprehensive, progressive plans of any candidate, she has figured out and proposed some brilliant strategies to actually move them through the gridlock in Washington. She engages with stakeholders in every community, listens, and incorporates their feedback to be sure she is addressing the needs of all Americans. I trust Elizabeth to take on corruption and create a better, fairer country by removing monied corruption in politics, implementing a wealth tax on the ultra rich, creating free universal healthcare, reforming our criminal justice system, fighting predatory debt, expanding educational and economic opportunities, and creating new clean energy jobs to swiftly combat climate change.

(2nd Choice: Bernie Sanders - Bernie is a truly inspiring candidate, and I agree with almost all of his policies. I would be thrilled to vote and volunteer for him if he becomes the nominee, but he is my second choice because I believe Warren has more effective strategies to implement an extremely similar platform, ranging from the removal of the filibuster to finding solutions that won’t raise middle-class taxes to fund for Medicare For All.)

RESOURCES

https://lavote.net/Apps/CandidateList/Index?id=3793

https://laist.com/elections/

https://knock-la.com/the-knock-la-los-angeles-progressive-voter-guide-for-the-march-2020-primary-7f2c3efc13cc

https://www.dsa-la.org/2020_primary_voter_guide

https://votersedge.org/en/ca

https://www.dailykos.com/stories/2020/2/9/1917945/-LA-Progressive-Majority-Voter-Guide-to-Judges-Candidates-for-March-2020-Los-Angeles-CA

https://progressivevotersguide.com/california/

https://app.kpcc.civicengine.com/v/choose_party

http://www.easyvoterguide.org/wp-content/uploads/2010/09/EVG-march2020-Eng.pdf

1 note

·

View note

Text

This is what *i* refer to when I talk about Boomer culture. It's the one thing that *is* unique to the culture of Boomers and isn't just mislabeling Greatest/Silent attitudes as Boomer.

In response to a few of the @'s and critiques:

basically the whole point of my half baked analysis about "lifestyle liberalism" isn't to accuse actual praxis based liberal politics of any special level of selfishness that conservative politics doesn't have. I can still find lots of arguments that liberalism is on the whole more beneficial to a larger number of people. The problem is when people who deep down are basically conservative, like limited applications of liberalism - especially ones involving no actual structural/institutional change - because they're in a unique position to benefit, then this gets passed on as what liberalism is about: a depoliticized set of weaponized social memes that result in reduction of service coupled with rise in self-centered laissez faire culture, which is presented as broadly liberating to everyone because it offers more personal freedoms with actually *less* accountability than 1950s white culture did. Fuck, at some point I'm feeling that I'm going to argue that the 70s liberalized popular/ consumer culture evolved from the 50s consumer boom more than it wants to admit.

Also, relatively few of us here, and probably no one who follows me, *are* ever going to be 100% lifestyle liberals. It is a really, really privileged cultural space - it's where you are still told to pick yourself up by your bootstraps but also told "your negativity is bringing people down, man."

Also, I'm not talking about the *specific policies* of California NIMBY liberalism - I'm talking about the *culture* of it, because I'm eventually going to go on to discuss New Age culture, the culture space of "wellness," the culture space of codependency and 80s pop feminism (which *both* radfems and intersectional feminists push back on), and also dating and the weird sex politics of the 80s and 90s, and how all of this is informed by the "Cult of the Self." And the weird social status and class warfare in geek culture. The thing is, I kept feeling like these were all basically part of the same broader culture space.

The whole point is to acknowledge a certain set of behaviors and ideas *as a broad culture space and worldview* (whose members claim all kinds of political ideologies). Lifestyle liberalism isn't any individual fish in the tank, or any particular school of fish in it, it's the water itself. I am analyzing it as a cultural, social, and psychological space more than as a political praxis.

My broader environment (raised in Los Angeles around status seeking middle class yuppie "fake rich" spaces and around New Age culture in the 70s/80s, to progressive parents; moved to Bay Area in mid 90s, worked in tech for a while) was heavily influenced by this set of cultural memes.

It's not *bad* that many people have more choice of how they live their lives, or more to choose from at the marketplace, and I'm certainly not in favor of authoritarian culture. Again, lifestyle liberalism is an individualist space but individualism itself isn't lifestyle liberal, and lots of really important things are fundamentally based on individual adult people - not their families, communities, churches, etc - having say at all with regard to their lives. Abortion and gay marriage (and freedom not to marry at all) are some of the the biggies we think about, and there are other fundamental individual rights that we didn't always have. Your family doesn't get to pick your spouse anymore, you don't need your husband to open a bank account for you, you are not accountable for your dead parents' personal debts, your family can not have you committed if you are a grown ass adult anywhere near as easily as they could in the 1950s. In many social spaces it's no longer acceptable to tell someone what gender they identify as or what religion to be. So it's absolutely necessary to distinguish the solipsism of lifestyle liberalism from actual praxis that concerns individual people.

For what it's worth, too, I feel like everyone with any actual political commitment at this point, on *either* side, hates lifestyle liberalism. The real lifestyle liberals at this point are probably just Objectivists. The problem is that lifestyle liberalism dug its hooks *deep* into the white liberal culture space where I'm from.

It's possible to grow up with damage from being raised in these middle class liberal spaces *and nobody talks about it.* Lifestyle liberalism took the credit for lots of real gains that were often lost because lifestyle liberalism did nothing to protect them (and sometimes blamed us for their loss), when in fact lifestyle liberalism had nothing to do with these gains at all. Lifestyle liberalism equates individual feelings and beliefs with praxis, so you have a culture space where lots of people don't think they're racist (to name just one example) because they don't ~FEEL~ racist. The thinking of many of these people is that they are a consumer in desegregated spaces, how could they be racist? Because after all, no class analysis exists ever, what you do with the freedoms you have is up to you, right?

The lack of acknowledgement that difference or inequality even exists, coupled with equating the middle class to the rich, meant that lots of institutions and culture spaces and industries even *lost* any kind of parity they had, because lifestyle liberalism largely constructed as the individual self-betterment rights of people who had never actually lost their privilege or left privileged spaces to begin with.

Like, I remember talking about sexism in tech in the 90s (which at the time wasn't as dominant a thing as it became later). But it was always dismissed by both men and women in the industry and was barely even talked about in hushed whispers. We just didn't have the words. 90s tech culture had a number of women senior programmers and women managers, and it wasn't even heavily bro yet. It wasn't until the dominant work culture shifted to "brogrammer" (itself a product of lifestyle liberalism, I'll argue) that anyone even admitted that any structural inequality was there and even then it was a struggle to acknowledge that company culture is a structural problem at all.

Part of it was that sexism had rebranded by the 90s; it wasn't grandpa's male chauvinism, it was a new post-Sexual Revolution, post-"Women's Lib" world of limitless options and any restriction on any privileged person's behavior - *especially* when it was selfish or oppressive - was represented as oppression of that person. Any complaint on the part of the person being punched down on, was framed as them not being liberated enough. All the world's problems were solved, right?

This is part of the cultural gaslighting I feel like a lot of Gen X came up with, but in many cases got perpetuated anyway (because lots of people who think lifestyle liberalism is politics and not culture, think they're pushing back, when really they're just rebranding).

It's hard to exit a space that everyone thinks gives you the most options unless you're actually forcibly ejected from that space. (Like the downwardly mobile children of yuppie Boomer parents. The ones who made good just kept the system going.)

Whereas people *do* talk about exiting authoritarian spaces. Also, people often need somewhere to exit authoritarian space *to.* and what's often presented is either another equally authoritarian space... or lifestyle liberal space.

The problem is, you can't really exit *to* lifestyle liberal space because it is inherently privileged, often results in loss of status and social capital to those who leave (because status signaling and social capital are - in my opinion - a really big part of lifestyle liberalism), and the pull to authoritarian space was often the validation of experience of lifestyle liberal/me-generation gaslighting. Sometimes the gaslighting of authoritarian space seems like a relief in comparison because the rules are explicit, whereas lifestyle liberal culture is a huge space of unwritten rules and expectations.

Lifestyle liberalism tends to not be either culturally sustainable or personally sustainable - the massive pushback it's getting now, when we couldn't even question that these systems existed in the 90s, is evidence of that.

Also, it requires a huge base of aspirationally wealthy and wealthy people in order to even function as a dominant culture meme, because of the degree to which it was about leveraging economic privilege. (Economics play a huge role. Lifestyle liberalism in practice turns into class warfare.) So the erosion of the middle class probably has a role to play. Because I feel like what I've seen in recent years are lots of people cut out of the lifestyle liberal social space because the middle class is losing so much adjacency to the rich, and even the illusion of adjacency. But now we have a culture space with 30+ years of entrenched mores, institutions, and viewpoints to deal with.

I feel Leftism is pushing back - in fact it's the whole cultural appropriation discussion that made me want to identify this culture space, because a lot of the appropriative practices critiqued were in liberal social space, not traditionalist or conservative social space.

And I feel like non-traditionalist conservatism became friendlier to lifestyle liberalism over time.

I was raised in this culture space, and it's fucked up, and I banged my head against the wall trying to succeed in it, then blamed myself and my own mental wiring for issues that turned out to be wholly structural and cultural. I tried to get therapy but found that therapists *generally* were in this same culture space as well and many seemed to mainly be about bringing people back to lifestyle liberalism.

I'm a downwardly mobile Gen Xr who is the kid of upwardly mobile parents, and I had to identify this set of cultural memes in order to recognize that I was being gaslit by them.

It's possible that a lot of the culture of lifestyle liberalism was a consequence of a strong economy to begin with and a consequence of disliking authoritarian culture but staying within one's privilege bubble.

And I'm not saying it is a bad thing on its own - it's that it's not praxis at all, but for 30+ years, was mistaken for it. Lots of people called themselves liberal who were only describing their personal lifestyle beliefs and choices and a set of consumer patterns. Lifestyle liberalism is to liberalism what mall goth is to goth.

It's that it leads to really selfish, narrow, and callous culture memes when left to its own devices and that it's a whole social system, not merely a praxis. It gets weaponized against vulnerable people in insidious and devastating ways, and then those people get blamed for their own bad experiences. Sometimes the lip service ends up being a way to wash your hands of the problems of other people. Sometimes lifestyle liberalism even ends up enhancing the social problems that praxis liberalism tries to oppose.

There are lots of problems we haven't been able to wrap our minds around, because of not being able to fit certain behaviors into either a conservative or leftist or even liberal framework. For example: protesting a war then demonizing the dominantly marginalized people drafted into it, seems inconsistent, right? No, it's totally consistent within the framework of lifestyle liberalism. It's punching down, it's actually class warfare with a smily face and a flower, as opposed to just plain old class warfare.

And my mom, who grew up poor in Venice and experienced its gentrification in the 60s, has talked lots about this - you couldn't even acknowledge that "baby killer" praxis was punching down, or that gentrification was happening. But to many of the poor people, and or POC, and or actually marginalized countercultural outsiders living in Venice, "the Man" had finally won, but he had come wearing long hair and a beard instead of a flat-top.

But within the cultural framework of lifestyle liberalism, it starts to make sense. So do a lot of things which seem ethically or politically inconsistent on the surface.

I feel like a lot of the more committed lifestyle liberals i knew, became libertarian or even conservative and stopped really giving a lot of lip service to leftist ideas.

Some even went traditionalist - because part of the dynamic of the 80s was that lots of these people had married and had children, and only had traditionalist cultural frameworks to function within once they were no longer swinging singles. The thing is, so much of lifestyle liberalism was not scalable to the family unless you had a lot of money. You had to actually be rich enough to afford the Montessori education and the macrobiotic afterschool snacks and to live in communities of "Positive People" that of course were in higher cost areas. (I've struggled with what so many New Agers mean when they say they want to live around "conscious" people. What they mean generally is that they want to live in rich liberal spaces instead of rich conservative ones.)

Lifestyle liberalism heavily favored the priorities of a large population of young childless, affluent singles. I feel like this is where you get the Silent Generation observation of "Boomer liberals who turn conservative after age 30," because in many cases it *was* about optimizing the freedoms and advantages of a semi-affluent youth culture.

For the most part though I feel like lifestyle liberalism isn't an individual take or set of takes or an individual praxis so much as a broader set of cultural memes. And, btw... it's really, really capitalist and consumerist! It basically treats people as independent consumers and groups of people as marketplaces.

The things that made me think of this and feel like I needed to analyze it:

1. Lifestyle liberalism is a really, really dominant theme in the world I was brought up in, and there is a lot of personal damage I had to overcome because of being in these environments. It infected every single part of every space I lived in, but was presented as the only option besides traditionalism.

2. I had these viewpoints for a long time, and continued to internalize them well into my 30s. I struggled in spaces that pushed back for a long time, because lifestyle liberalism isn't just a political or social viewpoint, it's a whole way many people in my age group are socialized to exist.

3. I struggled with why, after I became unhealthy and broke, many family and my old friends treated me differently and it wasn't about being actually rejected. It's more that they existed in spaces I could no longer move in, continued to say that i was welcome there, but did nothing to actually make it easier for me to be there, all the while maintaining the plausible deniability and moral certainty that they were inclusive of me.

4. I had to *unlearn* a lot of lifestyle liberal viewpoints to survive outside of that space, in spaces where survival was based upon pooling of effort and trying to problem solve interpersonal relationships, rather than being able to just opt out of any situation I was slightly uncomfortable in.

5. This space wasn't actually giving or helpful - it was basically a bunch of solipsists in the same room together - and when I actually started to have any requirements for real emotional or social support, these spaces left me to twist in the wind. "You're like, really bringing me down, man."

#i suspect that it was part of the creation of a broad white middle class and part of weaponizing newly privileged white people against#virtually everyone else

4 notes

·

View notes

Text

Marc Benioff: We Need a New Capitalism

Should the Security and Exchange Commission require public companies to publicly disclose their key stakeholders and show how they are impacting those stakeholders: (1) Yes, (2) No? Why? What are the ethics underlying your decision?

Capitalism, I acknowledge, has been good to me.

Over the past 20 years, the company that I co-founded, Salesforce, has generated billions in profits and made me a very wealthy person. I have been fortunate to live a life beyond the wildest imaginations of my great-grandfather, who immigrated to San Francisco from Kiev in the late 1800s.

Yet, as a capitalist, I believe it’s time to say out loud what we all know to be true: Capitalism, as we know it, is dead.

Yes, free markets — and societies that cherish scientific research and innovation — have pioneered new industries, discovered cures that have saved millions from disease and unleashed prosperity that has lifted billions of people out of poverty. On a personal level, the success that I’ve achieved has allowed me to embrace philanthropy and invest in improving local public schools and reducing homelessness in the San Francisco Bay Area, advancing children’s health care and protecting our oceans.

But capitalism as it has been practiced in recent decades — with its obsession on maximizing profits for shareholders — has also led to horrifying inequality. Globally, the 26 richest people in the world now have as much wealth as the poorest 3.8 billion people, and the relentless spewing of carbon emissions is pushing the planet toward catastrophic climate change. In the United States, income inequality has reached its highest level in at least 50 years, with the top 0.1 percent — people like me — owning roughly 20 percent of the wealth while many Americans cannot afford to pay for a $400 emergency. It’s no wonder that support for capitalism has dropped, especially among young people.

To my fellow business leaders and billionaires, I say that we can no longer wash our hands of our responsibility or what people do with our products. Yes, profits are important, but so is society. And if our quest for greater profits leaves our world worse off than before, all we will have taught our children is the power of greed.

It’s time for a new capitalism — a more fair, equal and sustainable capitalism that actually works for everyone and where businesses, including tech companies, don’t just take from society but truly give back and have a positive impact.

What might a new capitalism look like?

First, business leaders need to embrace a broader vision of their responsibilities by looking beyond shareholder return and also measuring their stakeholder return. This requires that they focus not only on their shareholders, but also on all of their stakeholders — their employees, customers, communities and the planet. Fortunately, nearly 200 executives with the Business Roundtable recently committed their companies, including Salesforce, to this approach, saying that the “purpose of a corporation” includes “a fundamental commitment to all of our stakeholders.” As a next step, the government could formalize this commitment, perhaps with the Security and Exchange Commission requiring public companies to publicly disclose their key stakeholders and show how they are impacting those stakeholders.

Unfortunately, not everyone agrees. Some business leaders objected to the landmark declaration. The Council of Institutional Investors argued that “it is government, not companies, that should shoulder the responsibility of defining and addressing societal objectives.” When asked whether companies should serve all stakeholders and whether capitalism should be updated, Vice President Mike Pence warned against “leftist policies.”

But suggesting that companies must choose between doing well and doing good is a false choice. Successful businesses can and must do both. In fact, with political dysfunction in Washington, D.C., Americans overwhelmingly say C.E.O.s should take the lead on economic and social challenges, and employees, investors and customers increasingly seek out companies that share their values.

When government is unable or unwilling to act, business should not wait. Our experience at Salesforce shows that profit and purpose go hand in hand and that business can be the greatest platform for change.

Legislation to close loopholes in the Equal Pay Act have stalled in Congress for years, and today women still only make about 80 cents, on average, for every dollar earned by men. But congressional inaction does not absolve companies from their responsibility. Since learning that we were paying women less than men for equal work at Salesforce, we have spent $10.3 million to ensure equal pay; today we conduct annual audits to ensure that pay remains equal. Just about every company, I suspect, has a pay gap — and every company can close it now.

For many businesses, giving back to their communities is an afterthought — something they only do after they’ve turned a profit. But by integrating philanthropy into our company culture from the beginning — giving 1 percent of our equity, time and technology — Salesforce has donated nearly $300 million to worthy causes, including local public schools and addressing homelessness. To me, the boys and girls in local schools and homeless families on the streets of our city are our stakeholders, too. Entrepreneurs looking to develop great products and develop their communities can join the 9,000 companies in the Pledge 1% movement and commit to donating 1 percent of their equity, time and product, starting on their first day of business.

Nationally, despite massive breaches of consumer information, lawmakers in Washington seem unable to pass a national privacy law. California and other states are moving ahead with their own laws, forcing consumers and companies to navigate a patchwork of different regulations. Rather than instinctively opposing new regulations, tech leaders should support a strong, comprehensive national privacy law — perhaps modeled on the European Union’s General Data Protection Regulation — and recognize that protecting privacy and upholding trust is ultimately good for business.

Globally, few nations are meeting their targets to fight climate change, the current United States presidential administration remains determined to withdraw from the Paris Agreement and global emissions continue to rise. As governments fiddle, there are steps that business can take now, while there’s still time, to prevent the global temperature from rising more than 1.5 degrees Celsius. Every company can do something, whether reducing emissions in their operations and across their sector, striving for net-zero emissions like Salesforce, moving toward renewable energies or aligning their operations and supply chains with emissions reduction targets.

Skeptical business leaders who say that having a purpose beyond profit hurts the bottom line should look at the facts. Research shows that companies that embrace a broader mission — and, importantly, integrate that purpose into their corporate culture — outperform their peers, grow faster, and deliver higher profits. Salesforce is living proof that new capitalism can thrive and everyone can benefit. We don’t have to choose between doing well and doing good. They’re not mutually exclusive. In fact, since becoming a public company in 2004, Salesforce has delivered a 3,500 percent return to our shareholders. Values create value.

Of course, C.E.O. activism and corporate philanthropy alone will never be enough to meet the immense scale of today’s challenges. It could take $23 billion a year to address racial inequalities in our public schools. College graduates are drowning in $1.6 trillion of student debt. It will cost billions to retrain American workers for the digital jobs of the future. Trillions of dollars of investments will be needed to avert the worst effects of climate change. All this, when our budget deficit has already surpassed $1 trillion.

How, exactly, is our country going to pay for all this?

That is why a new capitalism must also include a tax system that generates the resources we need and includes higher taxes on the wealthiest among us. Local efforts — like the tax I supported last year on San Francisco’s largest companies to address our city’s urgent homelessness crisis — will help. Nationally, increasing taxes on high-income individuals like myself would help generate the trillions of dollars that we desperately need to improve education and health care and fight climate change.

The culture of corporate America needs to change, and it shouldn’t take an act of Congress to do it. Every C.E.O. and every company must recognize that their responsibilities do not stop at the edge of the corporate campus. When we finally start focusing on stakeholder value as well as shareholder value, our companies will be more successful, our communities will be more equal, our societies will be more just and our planet will be healthier.

1 note

·

View note

Text

What You Need to Know About Medical Liens in Personal Injury Cases

There is no argument that car accidents are incredibly inconvenient for everyone involved. When there are injuries involved, however, the disruption caused by the accident is increased exponentially. For accident victims who have health insurance, the ability to secure necessary care is not significantly impacted and the insurer will work behind the scenes to recoup the funds they are owed for the care from the person who caused the accident.

However, for victims who lack health insurance – either private or through Medicare or Medi-Cal – or who do not have no-fault insurance, who cannot afford deductibles, or cannot afford to wait until the case is settled, the ability to access the necessary health care is compromised. There is an option, however, that allows these victims to get the care they need: a medical lien.

Essentially, a medical lien is a contract between the health care provider and the accident victim whereby the provider agrees to treat the victim and wait for payment until the claim is resolved.

Medical liens are serious contracts that are binding, however, as providers want assurances that they will be able to recover their costs at the end of the litigation. The best way to find a provider who will enter into a medical lien is through a qualified, connected, and veteran Los Angeles car accident attorney. The attorney can give the provider assurances as to the strength of your case and the chances of recouping their money when the case is settled.

Of course, the provider does not have to enter into the lien, so it is all the more critical to find a skilled and experienced car accident attorney who knows of multiple providers who would be amenable to a medical lien.

Your attorney should help you review and understand the medical lien as well as your rights and obligations as it is a binding contract. The attorney can also help you negotiate certain provisions when necessary and work with the insurance company to craft a lien that is fair to both parties. Once the parties agree on the terms, the medical lien is signed and the provider notifies the insurance companies of the lien – in a practice known as perfecting the lien. The lien is now in effect and the provider is contractually obligated to provide you with the services that you have agreed upon.

Ideally, you win your case and are awarded a settlement that is sufficient to pay your provider and compensate you for your injuries and damages. But what happens if you lose or if you are not awarded enough to pay back the provider? The contract could dictate that you are on the hook for those expenses. And, if you are, like any other debt the medical provider will have access to all available remedies under California law including filing suit to recover the money. While the law typically requires the provider to sue for the balance within four years, many medical liens stipulate that the money the provider fronts to the victim is held in trust by the victim and thus is not subject to any statute of limitations. This means that the victim could be sued at any time, even after four years.

There is good news, however, which is that a skilled and experienced Los Angeles car accident attorney can help negotiate a reduction in the overall amount owed and/or a payment plan to allow you to pay the money back over time. Remember that most doctors and hospitals are not particularly excited about taking you to court or to arbitration and so should be amenable to negotiations of this type. They are most interested in recouping something rather than nothing.

Remember also that you cannot necessarily count on large medical bills translating into a larger settlement. A typical settlement offer or award will use the value of the doctor’s services – which is often based on the lowest rate an insurer will pay – rather than what the patient pays under the medical lien.

If you are insured through Medi-Cal, the system creates a medical lien on its own without negotiating with the provider through the Department of Health Care Services Personal Injury Program. Medi-Cal is allowed to insert itself into your suit against the other driver, bring its own claim against the other driver, and pursue its lien against your settlement. Given these broad powers awarded to DHCS it is imperative to have a competent and experienced Los Angeles car accident lawyer assist you with your case to help protect your settlement and ensure that you are still left with a good amount of the money.

Medical liens serve an important purpose for individuals who are injured through no fault of their own in a car accident but who are not able to afford their medical care or who do not have medical insurance. However, they are designed only to be used in these situations. If the victim has private health insurance, they will almost always come out ahead by going through their own insurer since the pre-negotiated fees charged by providers under their plan will almost certainly be lower than what would be charged if there were a medical lien. Also, a medical lien is a binding contract and represents a significant obligation on the victim if they lose their case or are awarded an insufficient amount to cover all of their expenses and damages.

Being injured in a car accident is already a burden and is even more burdensome when you do not have health insurance, cannot afford co-pays and deductibles, or are unable to afford to wait for medical care until the case settles. In these cases, a medical lien is a vital lifeline that allows you to obtain necessary medical care without immediately incurring the cost of that care. However, medical liens are not to be entered into lightly and it is vital to have a qualified and experienced Los Angeles car accident attorney help you negotiate through the process.

0 notes

Text

So how to Consider the leading Tax Obligation Forgiveness Providers Near Me Los Angeles 90039, California