#pension and retirement plans

Explore tagged Tumblr posts

Text

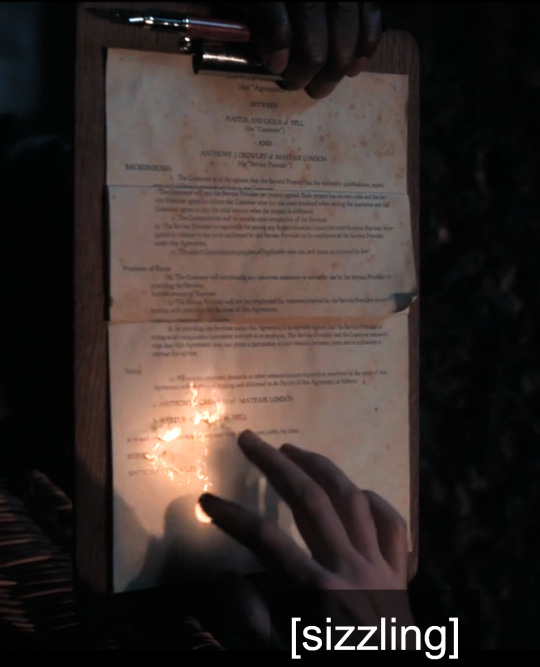

Updated! A few days ago the contract Crowley signs in S1 came up on discord. Being the crazy person that I am, I set on the quest of finding out what it actually says. I couldn't make out everything, especially at the end where Crowley's hand and the sparks obscure the lines but I made out most of it (transcript below the break).

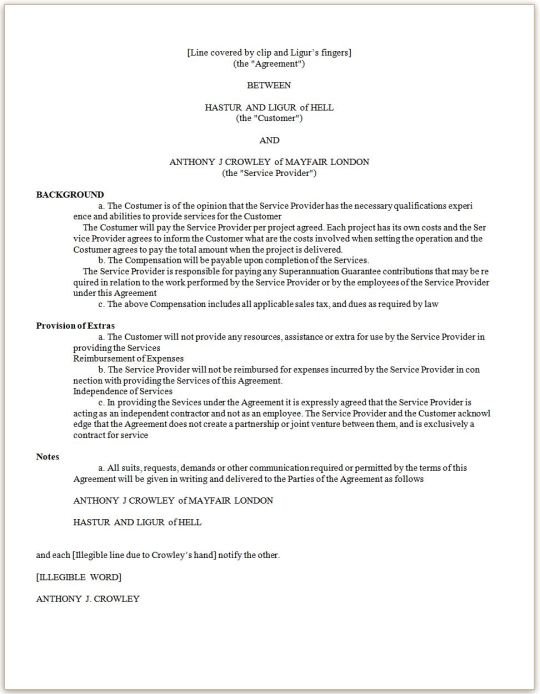

One of the things I like the most is that the contract specifically says "Anthony Crowley of Mayfair, London." In the book, Hastur tells Crowley not to use that name: "No. Not A. J. Crowley. Your real name.” Crowley nodded mournfully, and drew a complex, wiggly sigil on the paper. It glowed redly in the gloom, just for a moment, and then faded."

Interesting things:

The contract is referred to as "the Agreement" - HA!

The contract is between Hastur and Ligur ("the Customer") and Crowley ("the Service Provider"). Not with Hell itself or with Satan.

The contract never actually says what "the Service" is nor does it say how much Crowley is supposed to be paid (so is it just delivering the baby to the convent, or all the upbringing too?)

There is a part that says Hastur and Ligur will pay the costs when the operation is done. But later on it also says that Crowley will not be reimbursed for his own expenses. Talk about being shortchanged!

Hastur and Ligur will NOT provide any help

Crowley must contribute to a retirement plan (Superannuation) for himself and his employees if he has any (how thoughtful)

And lastly, I learned the UK has Superannuations and it is not just an Australian thing! (go figure! the things GO teaches me)

So here you have it. A contract from Hell! literally If anyone can make out the words I couldn't or finds an error, please let me know and I'll update this one.

Full transcript:

[Line covered by clip and Ligur’s fingers] (the "Agreement")

BETWEEN

HASTUR AND LIGUR of HELL (the "Customer")

AND

ANTHONY J CROWLEY of MAYFAIR LONDON (the "Service Provider")

BACKGROUND a. The Costumer is of the opinion that the Service Provider has the necessary qualifications experience and abilities to provide services for the Customer. The Costumer will pay the Service Provider per project agreed. Each project has its own costs and the Service Provider agrees to inform the Customer what are the costs involved when setting the operation and the Costumer agrees to pay the total amount when the project is delivered. b. The Compensation will be payable upon completion of the Services. The Service Provider is responsible for paying any Superannuation Guarantee contributions that may be required in relation to the work performed by the Service Provider or by the employees of the Service Provider under this Agreement c. The above Compensation includes all applicable sales tax, and dues as required by law

Provision of Extras a. The Customer will not provide any resources, assistance or extra for use by the Service Provider in providing the Services Reimbursement of Expenses b. The Service Provider will not be reimbursed for expenses incurred by the Service Provider in connection with providing the Services of this Agreement. Independence of Services c. In providing the Sevices under the Agreement it is expressly agreed that the Service Provider is acting as an independent contractor and not as an employee. The Service Provider and the Customer acknowledge that the Agreement does not create a partnership or joint venture between them, and is exclusively a contract for service

Notes a. All suits, requests, demands or other communication required or permitted by the terms of this Agreement by will be given in writing and delivered to the Parties of the Agreement as follows

ANTHONY J CROWLEY of MAYFAIR LONDON

HASTUR AND LIGUR of HELL

and each [Illegible words due to Crowley’s hand] notify the other.

[ILLEGIBLE WORD]

ANTHONY J CROWLEY

#good omens#crowley#hastur and ligur#antichrist#contract from hell#Crowley apparently is supposed to pay into his pension plan#which brings the question#does Hell expect demons to retire eventually?#probably not

2K notes

·

View notes

Text

if you talk to the average conservative voter, they'll always talk about their conservative representative with unabashed enthusiasm. "this guy is supporting my rights!!!!!" even when the representative is very much not supporting their voting constituents' rights in some cases (ie. poor white ppl not realizing they're getting poorer because of their representative)

and I bet that's why conservative candidates are so good at winning. any person listening to their voters only gets a great impression of the candidate.

and if you talk to the average liberal/leftist voter, they all hem and haw. "oh yeah, I voted for them but they're Okay, they're Disappointing. they haven't done this. they haven't done that." and I bet if you fucking pressed them to state some Good Beneficial Legislation they've passed, either the voter 1. can't name any, or 2. has to attach caveats. ("yeah biden passed student loan forgiveness BUT not ALL loans were forgiven")

why aren't we ever excited about incremental progress. why aren't we cheering to the sky about every win. maybe more people would vote if there was genuine excitement, the same type of excitement that conservative voters seem to have about anything labeled "conservative".

I'm just so fucking tired of hearing ppl be like "I'm just disillusioned with my leftist representative" EVERY TIME but are DEAD SILENT on the small victories, the progress. conservatives know how to do this, and that's why they build momentum into the next election. why does this seem impossible for the other side.

#new rule: if you're gonna say smth bad about your leftist representative#you have to first name one good legislation they passed before doing so#I'll go first. trudeau sucks. but trudeau & the ndp abolished interest on canadian student loans#he's expanding the canadian pension plan!! so workers have more money at retirement!!#him and the ndp are pushing a dental care insurance coverage!!!!!!#he's trying to get through a 10 dollar day care plan for families!!!!!#SORRY BUT ALL OF THESE THINGS ARE GOOD and they're ONLY HAPPENING because the ndp can push him left#the conservative candidate will never let that happen AND wants to take away abortion rights#so lets all fucking grow up and open a news website and start celebrating the small victories that may lead to huge ones#mika rambles on

96 notes

·

View notes

Text

I think late 20s are for people to figure out that the world they knew 10 years ago doesn't exist anymore, and you have to accept that your understanding of the world you made when you were younger will not be true in the changing world

#im having thoughts#weirdly enought this is abt pension plans#like i fully believed that i should make some savings for my retirement. i signed a contract and pay a bit#however my grandma told me she had made similar financial decisions in the soviet union#she paid for her children to have money when they turn 18#but the soviet union fell and with it the savings 😀#so like. money doesnt really have any value#and knowing the political situation. well. i cant rule out nothing bad will happen to my country

8 notes

·

View notes

Text

america is all about Freedom so that's why instead of making sure that everyone gets the same high quality healthcare and social security (scary, communist), we're going to let your job provide you with a bunch of arcane choices, the most optimal of which can only be determined based on circumstances which you have no ability to foresee

#personal#my boss is losing out on tens of thousands of dollars of retirement money because she chose a 401(k) type plan over a pension#because she didn't think she'd keep being a state employee long enough for the pension to be worth it at all (5 years)#but fast forward 30 years and she's the head of this department she just didn't expect that#so now i'm afraid to choose the 401(k) even though if i'm still in this state in five years something has gone terribly wrong#and the health plan options are just fully incomprehensible to me like i would need to be able to predict the future AND understand it#absolutely impossible

3 notes

·

View notes

Text

Planning Your Next Chapter: A Lawyer’s Guide to Retirement Preparation

Ready to transition from the courtroom to a well-deserved retirement? Our comprehensive guide helps lawyers navigate the journey to retirement with ease. From financial planning and investment strategies to lifestyle adjustments and maintaining a sense of purpose, discover the essential steps to ensure a smooth and fulfilling retirement. Start planning your next chapter today!

#retired lawyers#retirement for lawyers#attorney retirement#lawyer retirement#lawyer pension plan#lawyer retirement plan#retired attorney#legal malpractice insurance#CLE requirements#selling your law practice

2 notes

·

View notes

Text

being surrounded by overachieving people they often ask me what's my plan for retirement in 30 years time. my plan is to die before retirement age so I don't have to think about it thanks

#fr tho. how do i tell this new person i just met i dont care about pension or retirement bc i plan to die before i reach that age#chrmz.txt

6 notes

·

View notes

Text

…oh. Ok. I didn’t hear about this but apparently our provincial government is doing the first steps towards dismantling our current health care model. Our existing single health body will be fractured into four different organizations dealing with different services. Probably this is the first organized step towards privatized health care, which they’ve been wanting to for for decades, because privatized health care works SO FUCKING WELL in the countries that have it.

I wish I could move to a different province but that’s literally impossible for me right now. And you know, it probably wouldn’t even help. People are stupid everywhere, and no one cares about anyone else. Whatever. What the fuck ever. I feel so numb, how can I even care about one more bad thing happening when there’s SO MANY bad things happening?….

#they also want to make changes to our pension plan#I haven’t looked into the details of it but I assume it’s going to be bad#isn’t this great#all these things I have to look forward to when I am old#no pension no health care and no retirement money#gonna be amazing!

3 notes

·

View notes

Text

.

#found out last night in a family video chat that one of my younger cousins is planning on going into the police academy in florida#and i've been sick about it all day#apparently my uncle who is a retired nypd sergeant doesn't even want him to do it#but my cousin thinks its the only straightforward path to stability?#i remember talking to my aunt a while back when i was getting my adhd diagnosis and she mentioned that she thought my cousin fit the profil#and had been struggling a lot with school and just motivation#he decided not to go to college bc he just felt like he couldn't go through it which is fine but now i think he's struggling from that#bc apparently he was doing volunteer work with kids and loved it and wanted to look into becoming a preschool or kindergarten teacher#but the amount of schooling was too daunting for him both process and costwise#and they're gagging for cops down there and it's 20yrs and a guaranteed pension after that#and i'm just sick to my stomach about it bc this is a kid who wants to be a ***preschool teacher*** he's such a sweet kid#he's really sensitive and gentle and i'm just sick over the fact that he feels like the constructive field of becoming an educator#is inaccessible to him on all levels -- and the pigs are there with open arms#just thinking of him being broken by the police academy into that mold is sickening#*especially* in florida where considering the laws he's gonna be having to enforce.....#like kid you're gonna have to be bashing in the heads of queer protestors. antifascist protestors. climate activists. striking laborers.#what kind of brutality are they gonna do to make him agree to that#beyond the brutality of inaccessibility that's brought him to this point so far???#my sisters and i decided we're gonna talk to him about it -- i'm gonna def hear what he's thinking when i'm home#i'm just...like i said i'm just sick about it

8 notes

·

View notes

Text

Fighting for my life (reading a personal finance guide book)

#the fact that it says ill need about 20k PER YEAR i want to be retired....oof#the fact that it warns that roughly a 5th of Canadians cant retire in the sense that they never work again#but instead they retire by not working FULL TIME is horrifying#dont trust our provincial pension plan. its worse than the min wage quality.

3 notes

·

View notes

Text

Retirement Planning Strategies : A must read guide 💰

#finance#retirement#pension#economy#retirement planning#retirement plans#retire early#financial security#retirement savings#retirement advisor#retirement strategies#retired

4 notes

·

View notes

Text

VOTE VOTE VOTE PLS FUCKING VOTE

okay guys but in all seriousness the trump attempted assassination is going to rally the right like crazy. voter turnout will be going up. it is more crucial than ever that you SHOW UP AND VOTE IN THIS YEARS PRESIDENTIAL ELECTION.

#ive seen do many videos already#glorifying trump#'he took a bullet and hes still willing to fight for us--'#shut the fuck up#hes willing to campaign to literally take away ur rights#your retirement and pension plans and all insurance#hes a puppet#FUCK JUST PLS VOTE

49K notes

·

View notes

Text

உங்கள் ஓய்வு கால மாத வருமானத்தை தீர்மானித்து.. உங்கள் சேமிப்பு திட்டத்தை தேர்ந்தெடுங்கள்.. 🤔

உங்களின் இன்றைய சேமிப்பு உங்கள் குடும்பத்தின் நாளைய கௌரவமாக கூட மாறலாம்.. 😊

If your family needs a monthly income of 50,000.. How can your pension be any lesser.. think n invest Sufficiently

#pension#retirement#retirement plan#retirement planning#pension policy#home#family first#family love#life insurance

0 notes

Text

How to Unlock Early Retirement: 5 Smart Ways to Bridge the Gap Before 59 1/2

Dreaming of early retirement and escaping the 9-to-5 grind to embark on a life of adventure before you hit the traditional retirement age? You’re not alone! Many people, like us at Retire Young Travel Smart, are increasingly drawn to the idea of early retirement. But a common question arises, especially for those of us in the U.S.: How do you fund early retirement before 59 1/2 when most of your…

#401k#72t#Bridge the Gap#budget travel#Early Retirement Strategies#financial independence#financial planning#FIRE#healthcare#IRA#pension#retire abroad#Retire early#Retirement Savings#Roth Conversion Ladder#Rule of 55#SEPP#slow travel

0 notes

Text

Why Pension Contributions Are a Smart Way to Manage Your Taxable Income

Boost your pension savings while reducing taxable income with tax-efficient contributions. Learn how pension tax relief, employer contributions, and inheritance tax benefits can help you build wealth for the future. Secure your retirement with expert pension planning advice today.

#pension tax relief UK#reducing taxable income with pensions#UK pension contributions#tax-efficient retirement planning#inheritance tax and pensions#pension savings UK#pension tax planning#Wills & Trusts

0 notes

Text

This video is a quick explainer of the problem. This is from 2008 and it’s all even more true now.

Pensions sound so fake as a zillennial. You work for one place for decades (already sounds fake) and then afterwards you leave and they just. keep paying you. the same amount of money. to do nothing. for the rest of your life. if i wasn't already aware that this was something that readily and commonly existed during my grandparent's days then it would sound like some kind of socialist pipe dream

39K notes

·

View notes

Text

Sensational Surge in CPP Payments Revealed: Ontario 2025

As we usher in the new year, Canadian retirees and those approaching retirement are greeted with news that could significantly impact their financial planning. The Canada Pension Plan (CPP) payments for January 2025 are set to be disbursed on Wednesday, marking the beginning of what promises to be a pivotal year for retirement income in Ontario and across Canada. This article dives deep into…

#Canadian Retirement Planning#CPP Contribution Rates#CPP Eligibility#CPP for Self-Employed#cpp payment dates 2025#CPP Payments#CPP Payments 2025#Maximum CPP Benefit#Pension#Pension Increase Canada#Post-Retirement Benefits#Retirement Income Ontario

0 notes